Attached files

| file | filename |

|---|---|

| 8-K - Vertro, Inc. | form8-knyssaconference.htm |

| EX-99.1 - Vertro, Inc. | vtroex9915162011.htm |

nyssaconfdeckfinal

NASDAQ:VTRO

© Vertro, Inc. 2011

© Vertro, Inc. 2011

2

Safe harbor and use of non-GAAP financial measures

This presentation contains certain forward-looking statements that are based upon current expectations and involve certain risks and uncertainties within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Words or expressions such as “plan,” “intend,” “believe,” or “expect” or variations of such words and similar expressions are intended to identify such forward-looking statements. Key risks are described in Vertro reports filed with the U.S. Securities and Exchange Commission. Readers should note that these statements may be impacted by several factors, including economic changes and changes in the Internet industry generally and, accordingly, Vertro actual performance and results may vary from those stated herein, and Vertro undertakes no obligation to update the information contained herein. This presentation contains GAAP financial measures and non-GAAP financial measures where management believes it to be helpful in understanding Vertro's results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in the current quarter earnings release, which can be found on Vertro's website at www.vertro.com.

Safe harbor and use of non-GAAP financial measures

This presentation contains certain forward-looking statements that are based upon current expectations and involve certain risks and uncertainties within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Words or expressions such as “plan,” “intend,” “believe,” or “expect” or variations of such words and similar expressions are intended to identify such forward-looking statements. Key risks are described in Vertro reports filed with the U.S. Securities and Exchange Commission. Readers should note that these statements may be impacted by several factors, including economic changes and changes in the Internet industry generally and, accordingly, Vertro actual performance and results may vary from those stated herein, and Vertro undertakes no obligation to update the information contained herein. This presentation contains GAAP financial measures and non-GAAP financial measures where management believes it to be helpful in understanding Vertro's results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in the current quarter earnings release, which can be found on Vertro's website at www.vertro.com.

3

Overview

Vertro owns and operates the alOt product portfolio Focus on App Strategy to provide additional future growth Headquartered in New York, 36 employees (2) Marketed in 20 countries world-wide Consistent EBITDA profitability for six quarters with adjusted EBITDA of $0.3 and revenues of $8.4 million in Q1 2011 $5.2 million in cash as at Q1 2011, no debt and an untapped credit line of up to $5mm with Bridge Bank NA

1. Current P/E is Calculated by earnings (ttm) / closing Price on May 13, 2011. 2. As of 5/1/11

Overview

Vertro owns and operates the alOt product portfolio Focus on App Strategy to provide additional future growth Headquartered in New York, 36 employees (2) Marketed in 20 countries world-wide Consistent EBITDA profitability for six quarters with adjusted EBITDA of $0.3 and revenues of $8.4 million in Q1 2011 $5.2 million in cash as at Q1 2011, no debt and an untapped credit line of up to $5mm with Bridge Bank NA

1. Current P/E is Calculated by earnings (ttm) / closing Price on May 13, 2011. 2. As of 5/1/11

4

Investment Highlights

Attractive valuation with a Current P/E of 14.0*, below the average for comparable peer companies Operating in Multiple High-Growth Markets: We make a market in search and display Internet growth: expanding worldwide in 20 countries App Focus Proprietary lifetime value model and online buying expertise

*Current P/E calculated by earnings (ttm) / closing price on May 13, 2011.

Investment Highlights

Attractive valuation with a Current P/E of 14.0*, below the average for comparable peer companies Operating in Multiple High-Growth Markets: We make a market in search and display Internet growth: expanding worldwide in 20 countries App Focus Proprietary lifetime value model and online buying expertise

*Current P/E calculated by earnings (ttm) / closing price on May 13, 2011.

5

Our Products: alOt Toolbar

Our Products: alOt Toolbar

6

Our Products: alOt Home

Our Products: alOt Home

7

Our Products Are Fully Customizable

Online and throughout digital media, users are turning to apps to customize their experiences, increase their productivity, create entertainment value, and realize the Internet’s potential.

Our Products Are Fully Customizable

Online and throughout digital media, users are turning to apps to customize their experiences, increase their productivity, create entertainment value, and realize the Internet’s potential.

8

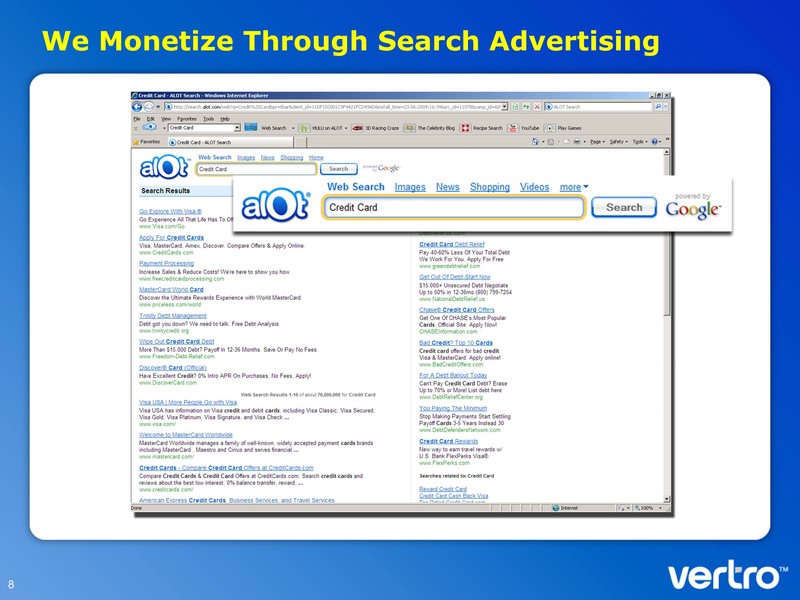

We Monetize Through Search Advertising

We Monetize Through Search Advertising

9

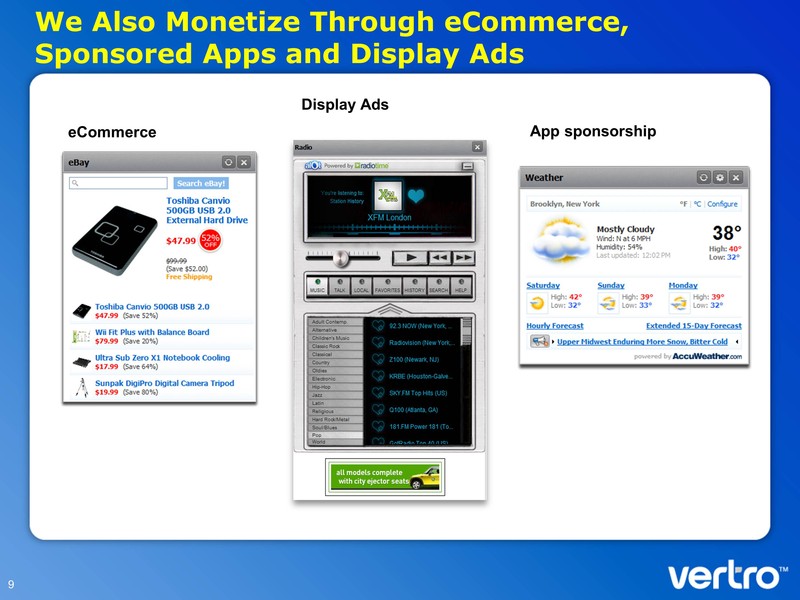

We Also Monetize Through eCommerce, Sponsored Apps and Display Ads

App sponsorship

eCommerce

Display Ads

We Also Monetize Through eCommerce, Sponsored Apps and Display Ads

App sponsorship

eCommerce

Display Ads

10

Our Go-To Market Strategy

1. We create micro-segmented versions of our Toolbars and Homepages

Our Go-To Market Strategy

1. We create micro-segmented versions of our Toolbars and Homepages

11

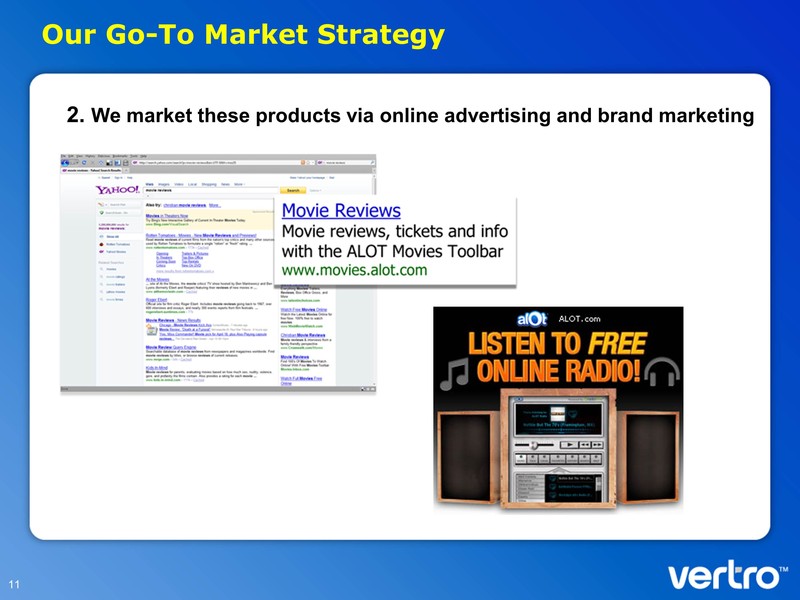

Our Go-To Market Strategy

2. We market these products via online advertising and brand marketing

Our Go-To Market Strategy

2. We market these products via online advertising and brand marketing

Vibrant App Strategy: In House Developed and Third Party Apps

Third Party Apps

In House Apps

12

AccuWeather.com

Web Snapshots

Maps

Say It

Calculator

Email Notifier

Third Party Apps

In House Apps

12

AccuWeather.com

Web Snapshots

Maps

Say It

Calculator

Email Notifier

13

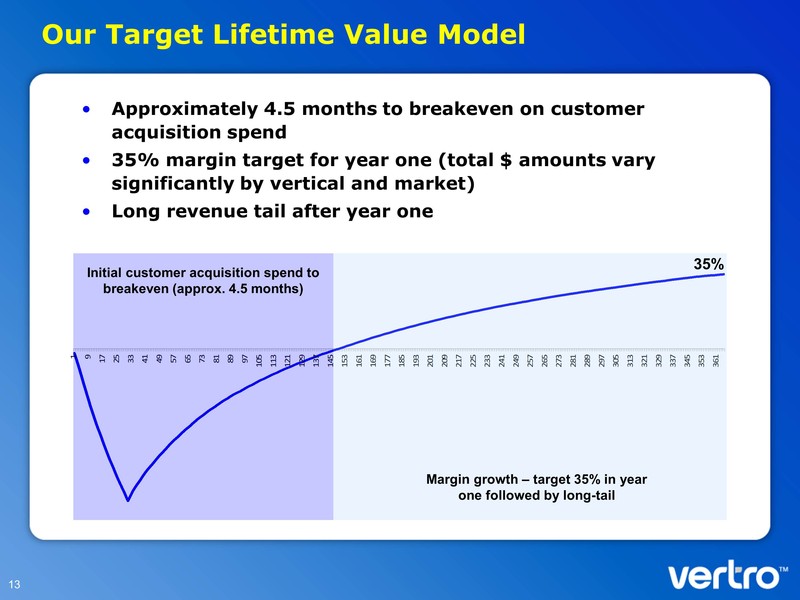

Our Target Lifetime Value Model

Approximately 4.5 months to breakeven on customer acquisition spend 35% margin target for year one (total $ amounts vary significantly by vertical and market) Long revenue tail after year one

Initial customer acquisition spend to breakeven (approx. 4.5 months)

Margin growth – target 35% in year one followed by long-tail

35%

Our Target Lifetime Value Model

Approximately 4.5 months to breakeven on customer acquisition spend 35% margin target for year one (total $ amounts vary significantly by vertical and market) Long revenue tail after year one

Initial customer acquisition spend to breakeven (approx. 4.5 months)

Margin growth – target 35% in year one followed by long-tail

35%

14

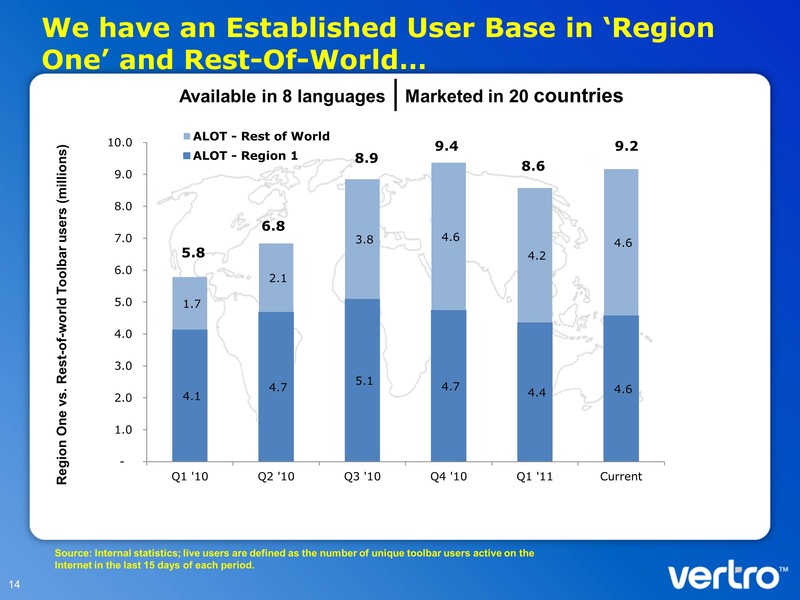

We have an Established User Base in ‘Region One’ and Rest-Of-World…

Available in 8 languages Marketed in 20 countries

Region One vs. Rest-of-world Toolbar users (millions)

8.6

9.4

Source: Internal statistics; live users are defined as the number of unique toolbar users active on the Internet in the last 15 days of each period.

We have an Established User Base in ‘Region One’ and Rest-Of-World…

Available in 8 languages Marketed in 20 countries

Region One vs. Rest-of-world Toolbar users (millions)

8.6

9.4

Source: Internal statistics; live users are defined as the number of unique toolbar users active on the Internet in the last 15 days of each period.

15

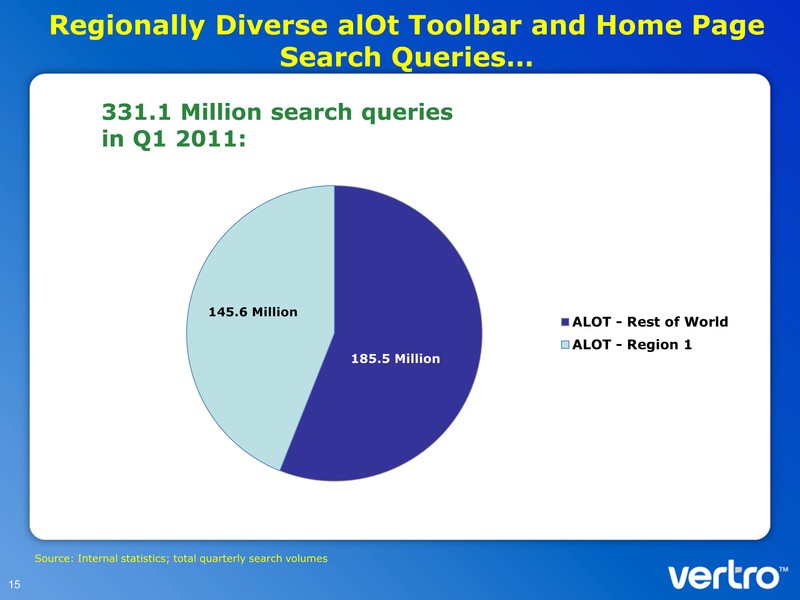

Regionally Diverse alOt Toolbar and Home Page Search Queries…

331.1 Million search queries in Q1 2011:

Source: Internal statistics; total quarterly search volumes

Regionally Diverse alOt Toolbar and Home Page Search Queries…

331.1 Million search queries in Q1 2011:

Source: Internal statistics; total quarterly search volumes

16

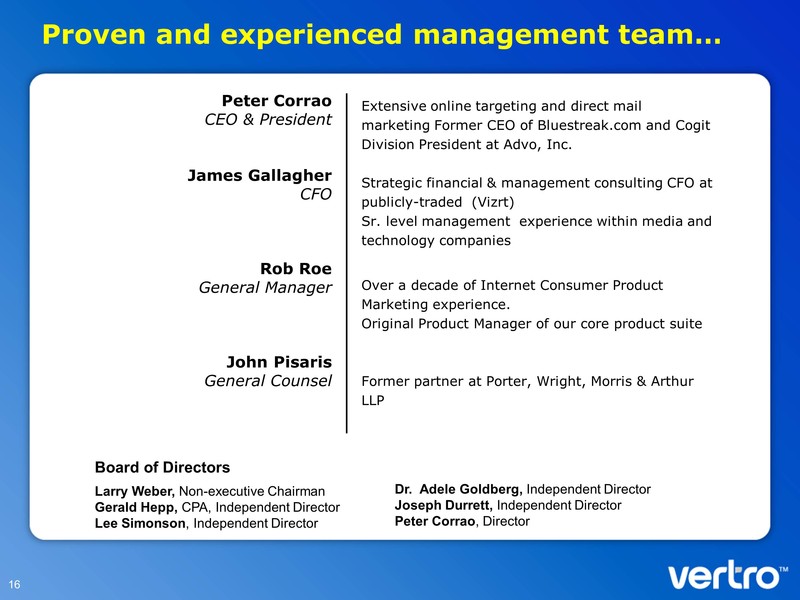

Proven and experienced management team…

Extensive online targeting and direct mail marketing Former CEO of Bluestreak.com and Cogit Division President at Advo, Inc. Strategic financial & management consulting CFO at publicly-traded (Vizrt) Sr. level management experience within media and technology companies Over a decade of Internet Consumer Product Marketing experience. Original Product Manager of our core product suite Former partner at Porter, Wright, Morris & Arthur LLP

Peter Corrao CEO & President James Gallagher CFO Rob Roe General Manager John Pisaris General Counsel

Larry Weber, Non-executive Chairman Gerald Hepp, CPA, Independent Director Lee Simonson, Independent Director

Dr. Adele Goldberg, Independent Director Joseph Durrett, Independent Director Peter Corrao, Director

Board of Directors

Proven and experienced management team…

Extensive online targeting and direct mail marketing Former CEO of Bluestreak.com and Cogit Division President at Advo, Inc. Strategic financial & management consulting CFO at publicly-traded (Vizrt) Sr. level management experience within media and technology companies Over a decade of Internet Consumer Product Marketing experience. Original Product Manager of our core product suite Former partner at Porter, Wright, Morris & Arthur LLP

Peter Corrao CEO & President James Gallagher CFO Rob Roe General Manager John Pisaris General Counsel

Larry Weber, Non-executive Chairman Gerald Hepp, CPA, Independent Director Lee Simonson, Independent Director

Dr. Adele Goldberg, Independent Director Joseph Durrett, Independent Director Peter Corrao, Director

Board of Directors

FINANCIAL HIGHLIGHTS

18

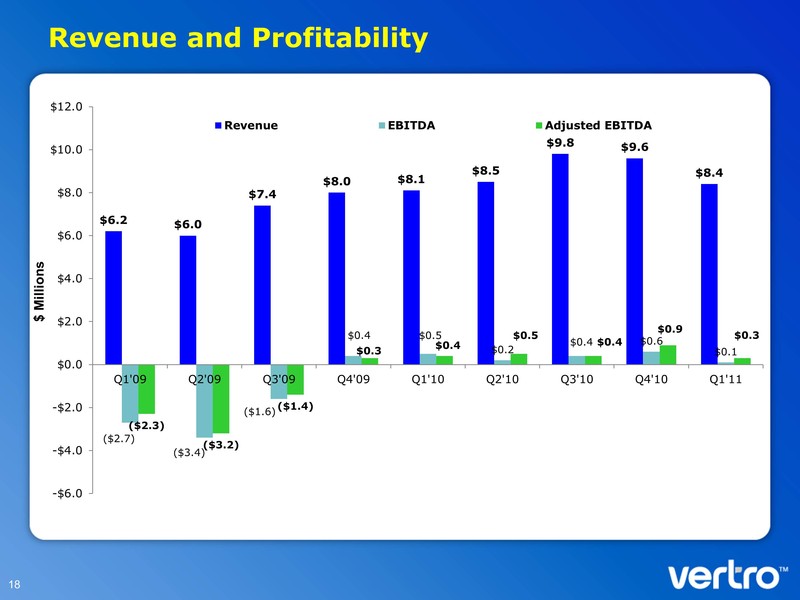

Revenue and Profitability

$ Millions

Revenue and Profitability

$ Millions

19

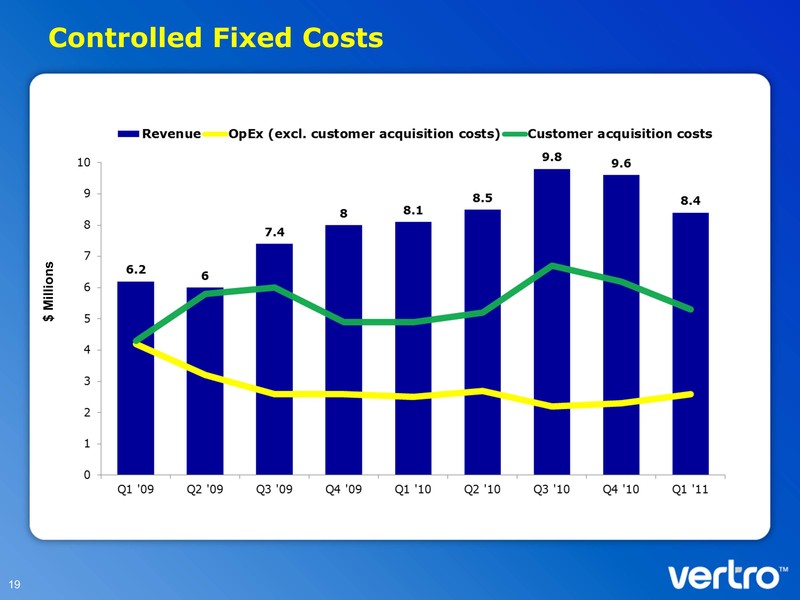

Controlled Fixed Costs

$ Millions

Controlled Fixed Costs

$ Millions

20

Investment Summary

Attractive Valuation with a Current P/E of 14.0, below the average for comparable peer companies Vibrant App Strategy with players like eBay, Amazon.com, Kazaa, AccuWeather.com, eMusic, Inuvo, Groupon, PeopleString and others, will help drive future growth Marketed in 20 countries around the world $5.2mm in cash as at Q1 2011, no debt and an untapped credit line of up to $5mm with Bridge Bank NA

1. Current P/E is Calculated by earnings (ttm) / closing Price on May 13, 2011.

(1)

Investment Summary

Attractive Valuation with a Current P/E of 14.0, below the average for comparable peer companies Vibrant App Strategy with players like eBay, Amazon.com, Kazaa, AccuWeather.com, eMusic, Inuvo, Groupon, PeopleString and others, will help drive future growth Marketed in 20 countries around the world $5.2mm in cash as at Q1 2011, no debt and an untapped credit line of up to $5mm with Bridge Bank NA

1. Current P/E is Calculated by earnings (ttm) / closing Price on May 13, 2011.

(1)

NASDAQ:VTRO

© Vertro, Inc. 2011

© Vertro, Inc. 2011