Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PUBLIC SERVICE ELECTRIC & GAS CO | d8k.htm |

2

Forward-Looking Statement

EXHIBIT 99

Readers are cautioned that statements contained in this presentation about our and our

subsidiaries' future performance, including future revenues, earnings, strategies, prospects, consequences

and all other statements that are not purely historical, are forward-looking

statements for purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. When

used herein, the words “anticipate”, “intend”,

“estimate”, “believe”, “expect”, “plan”, “should”, “hypothetical”, “potential”, “forecast”, “project”, variations of such words and similar expressions are

intended to identify forward-looking statements. Although we believe

that our expectations are based on reasonable assumptions, they are subject to risks and uncertainties and we can give no

assurance they will be achieved. The results or developments projected or

predicted in these statements may differ materially from what may actually occur. Factors which could cause results or

events to differ from current expectations include, but are not limited to:

• adverse changes in energy industry law, policies and regulation, including

market structures and a potential shift away from competitive markets toward subsidized market mechanisms,

transmission planning and cost allocation rules, including

rules regarding how transmission is planned and who is permitted to build transmission going forward, and reliability standards,

• any inability of our transmission and distribution businesses to obtain adequate

and timely rate relief and regulatory approvals from federal and state regulators,

• changes in federal and state environmental regulations that could increase our

costs or limit operations of our generating units, • changes in nuclear

regulation and/or general developments in the nuclear power industry, including various impacts from any accidents or incidents experienced at our facilities or by others in the

industry that could limit operations of our nuclear

generating units, • actions or activities at one of our nuclear units

located on a multi-unit site that might adversely affect our ability to continue to operate that unit or other units located at the same site,

• any inability to balance our energy obligations, available supply and trading

risks, • any deterioration in our credit quality, or the credit quality of

our counterparties, • availability of capital and credit at commercially

reasonable terms and conditions and our ability to meet cash needs, • any

inability to realize anticipated tax benefits or retain tax credits, •

changes in the cost of, or interruption in the supply of, fuel and other commodities necessary to the operation of our generating units,

• delays in receipt of necessary permits and approvals for our construction and

development activities, • delays or unforeseen cost escalations in our

construction and development activities, • adverse changes in the demand

for or price of the capacity and energy that we sell into wholesale electricity markets,

• increase in competition in energy markets in which we compete,

• challenges associated with retention of a qualified workforce,

• adverse performance of our decommissioning and defined benefit plan trust fund

investments and changes in discount rates and funding requirements, and •

changes in technology and customer usage patterns. For further information, please refer to our Annual Report on Form 10-K, including

Item 1A. Risk Factors, and subsequent reports on Form 10-Q and Form 8-K filed with the Securities and Exchange

Commission. These documents address in further detail our business, industry

issues and other factors that could cause actual results to differ materially from those indicated in this presentation. In

addition, any forward-looking statements included herein represent our

estimates only as of today and should not be relied upon as representing our estimates as of any subsequent date. While we

may elect to update forward-looking statements from time to time, we specifically

disclaim any obligation to do so, even if our internal estimates change, unless otherwise required by applicable

securities laws. |

3

GAAP Disclaimer

PSEG presents Operating Earnings in addition to its Net Income reported in

accordance with accounting principles generally accepted in the United States

(GAAP). Operating Earnings is a non-GAAP financial measure that differs from

Net Income because it excludes gains or losses associated with Nuclear

Decommissioning Trust (NDT), Mark-to-Market (MTM) accounting, and other

material one-time items. PSEG presents Operating Earnings because

management believes that it is appropriate for investors to consider results

excluding these items in addition to the results reported in accordance with

GAAP. PSEG believes that the non-GAAP financial measure of Operating

Earnings provides a consistent and comparable measure of performance of its

businesses to help shareholders understand performance trends.

This

information is not

intended to be viewed as an alternative to GAAP information.

The last two slides in this presentation include a list of items

excluded from

Income from Continuing Operations to reconcile to Operating Earnings, with a

reference to that slide included on each of the slides where the

non-GAAP

information appears. |

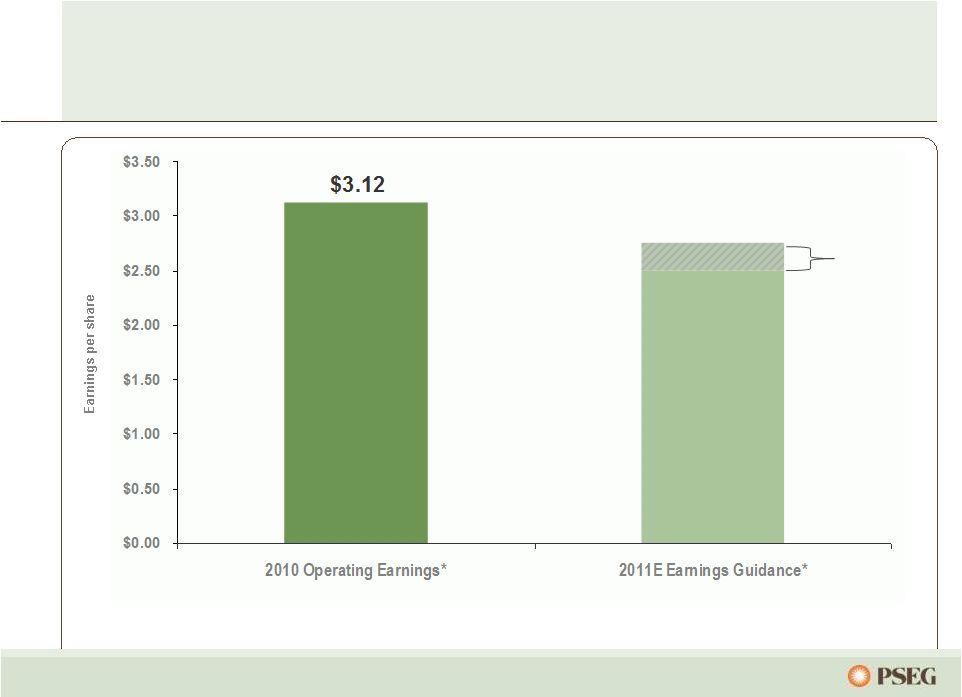

11

PSEG’s 2011 earnings guidance reflects

continued improvement at PSE&G…

–

Network transmission service revenue increase

= ~ $0.05 per share

–

Full year of E&G Rate Relief = ~ $0.05 per share

–

Each 1% change in Load = ~ $0.02 per share

–

Each 1% change in O&M = ~ $0.01 per share

–

2010 Utility ROE 9.9%; Each 10 bp = $0.01 per share

Revenue/Margin

–

Decline in average Hedge Price/Volume = ~ ($0.25-$0.30)

per share

–

Decline in Capacity revenues = ~ ($0.15-$0.20) per share

–

Improvement in WPT/BGSS = ~ $0.03-$0.05 per share

Other Expense

–

Higher O&M = ~ ($0.03) per share

–

Increase in Depreciation rate = ~ ($0.05) per share

–

Absence of LILO/SILO termination gains = ~ ($0.05) per share

–

Loss of Income from Asset Sales = ~ ($0.05) per share

Guidance

$2.75

$2.50

2011 Drivers

…offset by a decline in margins at Power and Holdings.

Earnings Per Share

* See page 64 for Items excluded from Income from Continuing Operations to reconcile

to Operating Earnings. E Estimate. |

12

Outlook for 2011 Operating Earnings

Maintained

* See page 64 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. $2.75E

$2.50E |

33

…

with sites in the eastern part of PJM.

With nearly 1/3 of its capacity in PS North and nearly 2/3 of its capacity in EMAAC, Power’s

assets in congested locations received higher pricing.

•

Locational

value of Power’s

fleet recognized.

•

Bid for 89 MW of new

capacity accepted for

2013/2014 auction;

in-service June 2012.

•

On schedule to complete

178 MW of previously

cleared peaking capacity

by June 2012.

•

Latest auction influenced

by updated demand

forecast and transfer

capabilities.

$/MW-day

PJM Zones

2009 / 2010

2010 / 2011

2011 / 2012

2012 / 2013

2013/2014

2014/2015

Eastern MAAC

$191.32

$174.29

$110.00

$139.73

$245.00

$136.50

MAAC

$191.32

$174.29

$110.00

$133.37

$226.15

$136.50

PSEG

$245.00

PSEG North Zone

$185.00

$245.00

$225.00

Rest of Pool

$102.04

$174.29

$110.00

$16.46

$27.73

$125.99

Reliability Pricing Model –

locational

value

of Power’s generating fleet recognized…

PJM Capacity Available to Receive Auction Pricing

0

2,000

4,000

6,000

8,000

10,000

12,000

09/10

10/11

11/12

12/13

13/14

14/15 |

47

PSEG’s long-term outlook is influenced by

Power’s hedge position…

2012

2013

Each $1/mcf Change in Natural Gas

Each $2/Mwh Change in Spark Spread

Each $2/Mwh Change in Dark Spread

Each 1% Change in Nuclear Capacity Factor

Each 1% Change in Depreciation Rate

$0.06 -

$0.08

$0.03

$0.02

$0.01

$0.01

$0.15 -

$0.20

$0.03

$0.03

$0.01

$0.01

Segment EPS Drivers

Each $100 Million of Incremental Investment

Each 1% Change in Sales:

Electric

Gas

Each 1% Change in O&M

Each 10 bp Change in ROE

$0.01

$0.01

$0.01

$0.01

$0.01

$0.02

$0.01

$0.01

$0.01

$0.01

…and increased investment at PSE&G. |

57

PSEG 2011 Operating Earnings Guidance

-

by Subsidiary

$ millions (except EPS)

2011E

2010A

PSEG Power

$ 765 –

$ 855

$ 1,091

PSE&G

$ 495 –

$ 520

$ 430

PSEG Energy Holdings

$ 0 –

$ 5

$ 49

Enterprise

$ 5 –

$ 15

$ 14

Operating Earnings*

$ 1,265 –

$ 1,395

$ 1,584

Earnings per Share

$ 2.50 –

$ 2.75

$ 3.12

* See Page 64 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

59

Operated by PSEG Nuclear

PSEG Ownership: 100%

Technology: Boiling Water Reactor

Total Capacity: 1,197MW

Owned Capacity: 1,197MW

License Expiration: 2026

Filed for license extension,

August 2009

Next Refueling 2012

Operated by PSEG Nuclear

Ownership: PSEG –

57%

Exelon –

43%

Technology: Pressurized Water Reactor

Total Capacity: 2,337MW

Owned Capacity: 1,342MW

License Expiration: 2016 and 2020

Filed for license extension,

August 2009

Next Refueling

Unit 1 –

Fall 2011

Unit 2 –

Fall 2012

Operated by Exelon

PSEG Ownership: 50%

Technology: Boiling Water Reactor

Total Capacity: 2,245MW

Owned Capacity: 1,122MW

License Expiration: 2033 and 2034

Next Refueling

Unit 2 –

2012

Unit 3 –

Fall 2011

Hope Creek

Salem Units 1 and 2

Peach Bottom Units 2 and 3

Our five unit nuclear fleet…

…

is a critical element of Power’s success. |

64

Pro-forma Adjustments, net of tax

2010

2009

2008

Gain (Loss) on Nuclear Decommissioning Trust (NDT)

Fund Related Activity (PSEG Power)

46

$

9

$

(71)

$

Gain (Loss) on Mark-to-Market (MTM) (PSEG Power)

(1)

(11)

14

Market Transition Charge Refund (PSE&G)

(72)

-

-

Net Reversal of Lease Transaction Reserves (Energy Holdings)

-

29

-

Lease Transaction Reserves (Energy Holdings)

-

-

(490)

Asset Impairments

-

-

(13)

Premium on Bond Redemption

-

-

(1)

Total Pro-forma adjustments

(27)

$

27

$

(561)

$

Fully Diluted Average Shares Outstanding (in Millions)

507

507

508

Gain (Loss) on Nuclear Decommissioning Trust (NDT)

Fund Related Activity (PSEG Power)

0.09

$

0.02

$

(0.14)

$

Gain (Loss) on Mark-to-Market (MTM) (PSEG Power)

-

(0.02)

0.03

Market Transition Charge Refund (PSE&G)

(0.14)

-

-

Net Reversal of Lease Transaction Reserves (Energy Holdings)

-

0.05

-

Lease Transaction Reserves (Energy Holdings)

-

-

(0.96)

Asset Impairments

-

-

(0.03)

Premium on Bond Redemption

-

-

-

Total Pro-forma adjustments

(0.05)

$

0.05

$

(1.10)

$

December 31,

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Reconciling Items Excluded from Continuing Operations to Compute Operating Earnings

(Unaudited)

For the Twelve Months Ended

Items Excluded from Income from Continuing

Operations to Reconcile to Operating Earnings

Earnings Impact ($ Millions)

Per Share Impact (Diluted)

Please see Page 3 for an explanation of PSEG’s use of Operating Earnings as a non-GAAP financial measure and how it differs from Net Income. |