Attached files

| file | filename |

|---|---|

| EX-32.1 - Bohai Pharmaceuticals Group, Inc. | v222146_ex32-1.htm |

| EX-32.2 - Bohai Pharmaceuticals Group, Inc. | v222146_ex32-2.htm |

| EX-31.2 - Bohai Pharmaceuticals Group, Inc. | v222146_ex31-2.htm |

| EX-31.1 - Bohai Pharmaceuticals Group, Inc. | v222146_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

x

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended March 31, 2011

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission File Number: 000-53401

Bohai Pharmaceuticals Group, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

98-0588402

|

|

(State or other jurisdiction of

|

(I.R.S. Employer Identification No.)

|

|

incorporation or organization)

|

|

c/o Yantai Bohai Pharmaceuticals Group Co. Ltd.

|

|

|

No. 9 Daxin Road, Zhifu District

|

|

|

Yantai, Shandong Province, China

|

264000

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number (including area code): +86(535)-685-7928

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

|

Non-accelerated filer ¨

|

Smaller reporting company x

|

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ Nox

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨

As of May 12, 2011, there were 17,821,085 shares of company common stock issued and outstanding.

Bohai Pharmaceuticals Group, Inc.

Quarterly Report on Form 10-Q

TABLE OF CONTENTS

|

PART I – FINANCIAL INFORMATION

|

||

|

Cautionary Note Regarding Forward-Looking Statements

|

||

|

Item 1.

|

Financial Statements (unaudited)

|

|

|

Condensed Consolidated Balance Sheets as of March 31, 2011 and June 30, 2010 (audited)

|

1 | |

|

Condensed Consolidated Statements of Income and Comprehensive Income for the Three and Nine Months ended March 31, 2011 and 2010

|

2 | |

|

Condensed Consolidated Statements of Changes in Stockholders’ Equity for the Nine Months Ended March 31, 2011

|

3 | |

|

Condensed Consolidated Statements of Cash Flows for the Nine Months ended March 31, 2011 and 2010

|

4 | |

|

Notes to Condensed Consolidated Financial Statements

|

5 | |

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

35 |

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk

|

49 |

|

Item 4(T).

|

Controls and Procedures

|

49 |

|

PART II – OTHER INFORMATION

|

||

|

Item 1.

|

Legal Proceedings

|

51 |

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

51 |

|

Item 3.

|

Defaults Upon Senior Securities

|

51 |

|

Item 4.

|

Removed and Reserved

|

51 |

|

Item 5.

|

Other Information

|

51 |

|

Item 6.

|

Exhibits

|

51 |

|

SIGNATURES

|

52 | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

In addition to historical information, this Quarterly Report on Form 10-Q contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those reflected in such forward-looking statements. We cannot give any guarantee that the plans, intentions or expectations described in the forward looking statements will be achieved. All forward-looking statements involve significant risks and uncertainties, and actual results may differ materially from those discussed in the forward-looking statements as a result of various factors, including those factors described in the “Risk Factors” section of our Annual Report for the fiscal year ended June 30, 2010 (the “2010 10-K”). Readers should carefully review such risk factors as well as factors described in other documents that we file from time to time with the Securities and Exchange Commission.

In some cases, you can identify forward-looking statements by terminology such as “guidance,” “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “projects,” “potential,” “proposed,” “intended,” or “continue” or the negative of these terms or other comparable terminology. You should read statements that contain these words carefully, because they discuss our expectations about our future operating results or our future financial condition or state other “forward-looking” information. There may be events in the future that we are not able to accurately predict or control. You should be aware that the occurrence of any of the events described in our risk factors and other disclosures could substantially harm our business, results of operations and financial condition, and that upon the occurrence of any of these events, the trading price of our securities could decline. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, growth rates, and levels of activity, performance or achievements. Factors that may cause actual results, our performance or achievements, or industry results, to differ materially from those contemplated by such forward-looking statements include, without limitation:

|

|

·

|

our ability to obtain sufficient working capital to support our business plans;

|

|

|

·

|

our ability to expand our product offerings and maintain the quality of our products;

|

|

|

·

|

the availability of Chinese government granted rights to exclusively manufacture or co-manufacture our products;

|

|

|

·

|

the availability of Chinese national healthcare reimbursement of our products;

|

|

|

·

|

our ability to manage our expanding operations and continue to fill customers’ orders on time;

|

|

|

·

|

our ability to maintain adequate control of our expenses allowing us to realize anticipated revenue growth;

|

|

|

·

|

our ability to maintain or protect our intellectual property;

|

|

|

·

|

our ability to maintain our proprietary technology;

|

|

|

·

|

the impact of government regulation in China and elsewhere, including the support provided by the Chinese government to the Traditional Chinese Medicine and healthcare sectors in China;

|

|

|

·

|

our ability to implement product development, marketing, sales and acquisition strategies and adapt and modify them as needed;

|

|

|

·

|

our ability to integrate any future acquisitions;

|

|

|

·

|

our implementation of required financial, accounting and disclosure controls and procedures and related corporate governance policies; and

|

|

|

·

|

our ability to anticipate and adapt to changing conditions in the Traditional Chinese Medicine and healthcare industries resulting from changes in government regulations, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics.

|

Readers are cautioned not to place undue reliance on our forward-looking statements, which reflect management’s opinions only as of the date thereof. We undertake no obligation to revise or publicly release the results of any revision of our forward-looking statements, except as required by law.

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

AS OF MARCH 31, 2011 AND JUNE 30, 2010

|

As of

|

As of

|

|||||||

|

March 31,

|

June 30,

|

|||||||

|

2011

|

2010

|

|||||||

|

(unaudited)

|

||||||||

|

ASSETS

|

||||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents

|

$ | 10,665,517 | $ | 17,149,082 | ||||

|

Restricted cash

|

220,043 | 576,019 | ||||||

|

Accounts receivable

|

14,798,323 | 10,409,527 | ||||||

|

Other receivables and prepayments

|

2,006,268 | 1,449,590 | ||||||

|

Amount due from equity holder

|

- | 40,160 | ||||||

|

Inventories

|

1,997,545 | 748,422 | ||||||

|

Total current assets

|

29,687,697 | 30,372,801 | ||||||

|

Non-current assets

|

||||||||

|

Property, plant and equipment, net

|

7,925,075 | 7,895,042 | ||||||

|

Prepayment for land use right

|

14,839,957 | 7,343,654 | ||||||

|

Intangible assets

|

25,278,154 | 17,342,772 | ||||||

|

Deferred fees on convertible notes

|

719,819 | 1,562,617 | ||||||

|

Total non-current assets

|

48,763,005 | 34,144,085 | ||||||

|

TOTAL ASSETS

|

$ | 78,450,702 | $ | 64,516,886 | ||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable

|

$ | 1,466,525 | $ | 741,621 | ||||

|

Other accrued liabilities

|

4,909,783 | 2,984,988 | ||||||

|

Amount due to equity holder

|

11,980 | - | ||||||

|

Income taxes payable

|

945,678 | 700,326 | ||||||

|

Short-term borrowings

|

905,618 | 4,398,849 | ||||||

|

Total current liabilities

|

8,239,584 | 8,825,784 | ||||||

|

Non-current liabilities

|

||||||||

|

Derivative liabilities - investor and agent warrants

|

2,300,325 | 5,481,928 | ||||||

|

Convertible notes, net of discount

|

438,743 | 124,820 | ||||||

|

Total non-current liabilities

|

2,739,068 | 5,606,748 | ||||||

|

TOTAL LIABILITIES

|

10,978,652 | 14,432,532 | ||||||

|

STOCKHOLDERS' EQUITY

|

||||||||

|

Common stock , $0.001 par value, 150,000,000 shares authorized, 17,821,085 and 16,500,000 shares issued and outstanding as of March 31, 2011 and June 30, 2010, respectively

|

17,821 | 16,500 | ||||||

|

Additional paid-in capital

|

18,320,431 | 15,317,621 | ||||||

|

Accumulated other comprehensive income

|

2,771,433 | 626,584 | ||||||

|

Statutory reserves

|

2,201,817 | 2,201,817 | ||||||

|

Retained earnings

|

44,160,548 | 31,921,832 | ||||||

|

Total stockholders’ equity

|

67,472,050 | 50,084,354 | ||||||

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

|

$ | 78,450,702 | $ | 64,516,886 | ||||

See accompanying notes to the unaudited condensed consolidated financial statements

1

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME AND COMPREHENSIVE INCOME

FOR THE THREE AND NINE MONTHS ENDED MARCH 31, 2011 AND 2010

(UNAUDITED)

|

For The Three Months Ended

|

For The Nine Months Ended

|

|||||||||||||||

|

March 31,

|

March 31,

|

|||||||||||||||

|

2011

|

2010

|

2011

|

2010

|

|||||||||||||

|

Net revenues

|

$ | 22,153,412 | $ | 15,323,878 | $ | 61,289,991 | $ | 46,072,455 | ||||||||

|

Cost of revenues

|

5,213,548 | 2,841,385 | 13,341,860 | 8,205,715 | ||||||||||||

|

Gross profit

|

16,939,864 | 12,482,493 | 47,948,132 | 37,866,740 | ||||||||||||

|

Selling, general and administrative expenses

|

12,845,962 | 9,202,873 | 32,565,981 | 28,208,753 | ||||||||||||

|

Income from operations

|

4,093,901 | 3,279,620 | 15,382,151 | 9,657,987 | ||||||||||||

|

Other income (expenses)

|

||||||||||||||||

|

Other income

|

1,783 | - | 99,901 | 18,864 | ||||||||||||

|

Interest income

|

11,176 | - | 40,673 | - | ||||||||||||

|

Amortization of deferred financing fees

|

(232,200 | ) | (253,577 | ) | (736,224 | ) | (253,577 | ) | ||||||||

|

Interest expenses

|

(554,428 | ) | (381,700 | ) | (2,203,775 | ) | (538,008 | ) | ||||||||

|

Other expenses

|

(546 | ) | - | (2,468 | ) | (22,092 | ) | |||||||||

|

Change in fair value of derivative liabilities

|

263,118 | 1,083,350 | 3,181,603 | 1,083,350 | ||||||||||||

|

Total other income (expenses)

|

(511,097 | ) | 448,073 | 379,710 | 288,537 | |||||||||||

|

Income before provision for income taxes

|

3,582,804 | 3,727,693 | 15,761,860 | 9,946,524 | ||||||||||||

|

Provision for income taxes

|

(897,458 | ) | (585,135 | ) | (3,523,145 | ) | (2,193,931 | ) | ||||||||

|

Net income

|

$ | 2,685,346 | $ | 3,142,558 | $ | 12,238,716 | $ | 7,752,593 | ||||||||

|

Comprehensive income:

|

||||||||||||||||

|

Net income

|

2,685,346 | 3,142,558 | 12,238,716 | 7,752,593 | ||||||||||||

|

Other comprehensive income

|

||||||||||||||||

|

Unrealized foreign currency translation gain

|

415,307 | (157,384 | ) | 2,144,849 | (108,823 | ) | ||||||||||

|

Comprehensive income

|

$ | 3,100,653 | $ | 2,985,174 | $ | 14,383,564 | $ | 7,643,770 | ||||||||

|

Earnings per common share

|

||||||||||||||||

|

Basic

|

$ | 0.15 | $ | 0.20 | $ | 0.72 | $ | 0.48 | ||||||||

|

Diluted

|

$ | 0.14 | $ | 0.16 | $ | 0.59 | $ | 0.37 | ||||||||

|

Weighted average common shares outstanding

|

||||||||||||||||

|

Basic

|

17,544,163 | 16,078,472 | 16,988,489 | 16,193,659 | ||||||||||||

|

Diluted

|

22,808,885 | 21,745,139 | 22,439,202 | 22,084,170 | ||||||||||||

See accompanying notes to the unaudited condensed consolidated financial statements

2

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

CHANGES IN STOCKHOLDERS’ EQUITY

FOR THE NINE MONTHS ENDED MARCH 31, 2011

(UNAUDITED)

|

Common stock

|

Additional

|

Accumulated

other

|

Total

|

|||||||||||||||||||||||||

|

Shares

outstanding

|

Amount

|

paid-in

capital

|

comprehensive

income

|

Statutory

reserves

|

Retained

Earnings

|

Stockholders’

Equity

|

||||||||||||||||||||||

|

Balance at June 30, 2010

|

16,500,000 | $ | 16,500 | $ | 15,317,622 | $ | 626,584 | $ | 2,201,817 | $ | 31,921,832 | $ | 50,084,354 | |||||||||||||||

|

Net income for the period

|

- | - | - | - | - | 12,238,716 | 12,238,716 | |||||||||||||||||||||

|

Stock based compensation

|

45,000 | 45 | 160,455 | - | - | - | 160,500 | |||||||||||||||||||||

|

Option based compensation

|

- | - | 23,844 | - | - | - | 23,844 | |||||||||||||||||||||

|

Conversion of convertible notes

|

527,703 | 528 | 948,304 | - | - | - | 948,832 | |||||||||||||||||||||

|

Sale of common stock

|

748,382 | 748 | 1,870,207 | 1,870,955 | ||||||||||||||||||||||||

|

Foreign currency translation difference

|

- | - | - | 2,144,849 | - | - | 2,144,849 | |||||||||||||||||||||

|

Balance at March 31, 2011

|

17,821,085 | $ | 17,821 | $ | 18,320,431 | $ | 2,771,433 | $ | 2,201,817 | $ | 44,160,548 | $ | 67,472,050 | |||||||||||||||

See accompanying notes to the unaudited condensed consolidated financial statements

3

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE NINE MONTHS ENDED MARCH 31, 2011 AND 2010

(UNAUDITED)

|

For the Nine Months Ended

|

||||||||

|

March 31,

|

||||||||

|

2011

|

2010

|

|||||||

|

Cash flows from operating activities

|

||||||||

|

Net income

|

$ | 12,238,716 | $ | 7,752,593 | ||||

|

Adjustments to reconcile net income to net cash used in operating activities:

|

||||||||

|

Depreciation

|

260,577 | 224,656 | ||||||

|

Loss on disposal of property, plant and equipment

|

1,908 | 10,942 | ||||||

|

Accretion of beneficial conversion feature

|

1,029,487 | - | ||||||

|

Amortization of deferred fees on convertible notes

|

736,224 | 253,577 | ||||||

|

Interest expense on convertible notes

|

339,842 | 121,126 | ||||||

|

Change in fair value of warrants

|

(3,181,603 | ) | (1,083,350 | ) | ||||

|

Stock and option based compensation

|

184,344 | - | ||||||

|

Changes in operating assets and liabilities:

|

||||||||

|

(Increase) in accounts receivable

|

(3,946,124 | ) | (433,728 | ) | ||||

|

(Increase)/decrease in other receivables and prepayments

|

(496,515 | ) | 4,127,297 | |||||

|

Decrease in amount due from equity holder

|

- | 1,465,000 | ||||||

|

(Increase) in inventories

|

(1,201,923 | ) | (662,830 | ) | ||||

|

Increase (decrease) in accrued liabilities

|

158,949 | (10,407,917 | ) | |||||

|

Increase/ (decrease) in accounts payable

|

686,541 | (128,858 | ) | |||||

|

Increase in other payable

|

1,633,817 | - | ||||||

|

Increase in income taxes payable

|

216,325 | 2,905,998 | ||||||

|

Increase in restricted cash

|

355,976 | - | ||||||

|

Net cash provided by operating activities

|

9,016,541 | 4,144,506 | ||||||

|

Cash flows used in investing activities

|

||||||||

|

Purchases of property, plant and equipment

|

(14,619 | ) | (280,804 | ) | ||||

|

Proceeds from disposal of property, plant and equipment

|

4,491 | - | ||||||

|

Purchase of leased land use rights

|

(7,111,204 | ) | - | |||||

|

Purchase of intangible assets

|

(7,186,059 | ) | - | |||||

|

Net cash used in investing activities

|

(14,307,391 | ) | (280,804 | ) | ||||

|

Cash flows from financing activities

|

||||||||

|

Proceeds from borrowings

|

890,772 | 4,381,153 | ||||||

|

Repayment of borrowings

|

(4,483,801 | ) | (5,860,000 | ) | ||||

|

Repayment from related party

|

53,147 | - | ||||||

|

Cash fees on placement agent and other financing costs

|

- | (1,570,000 | ) | |||||

|

Proceeds from issuance of convertible promissory notes

|

- | 12,000,000 | ||||||

|

Proceeds from sale of common stock

|

1,870,955 | - | ||||||

|

Net cash flows (used in) provided by financing activities

|

(1,668,927 | ) | 8,951,153 | |||||

|

Effect of foreign currency translation on cash and cash equivalents

|

476,212 | 266,544 | ||||||

|

Net (decrease) increase in cash and cash equivalents

|

(6,483,565 | ) | 13,081,399 | |||||

|

Cash and cash equivalents at beginning of period

|

17,149,082 | 2,493,510 | ||||||

|

Cash and cash equivalents at end of period

|

$ | 10,665,517 | $ | 15,574,909 | ||||

|

Cash paid during the period for:

|

||||||||

|

Interest paid

|

$ | 811,582 | $ | 466,135 | ||||

|

Income taxes paid

|

$ | 3,306,820 | $ | 2,305,073 | ||||

|

Supplemental cash flow information

|

||||||||

|

Non-cash investing and financing activities:

|

||||||||

|

Common stock issued upon conversion of convertible notes and accrued interest

|

$ | 948,832 | $ | - | ||||

|

Placement agent warrants issued

|

$ | - | $ | 582,454 | ||||

See accompanying notes to the unaudited condensed consolidated financial statements

4

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED MARCH 31, 2011 AND 2010

|

1.

|

ORGANIZATION AND PRINCIPAL ACTIVITIES

|

Bohai Pharmaceuticals Group, Inc., or the Company (formerly known as Link Resources, Inc.), was incorporated under the laws of the State of Nevada on January 9, 2008. Until January 5, 2010, our principal office was located in Calgary, Alberta, Canada. Prior to January 5, 2010, we were a public “shell” company in the exploration stage since our formation had not yet realized any revenues from our planned operations.

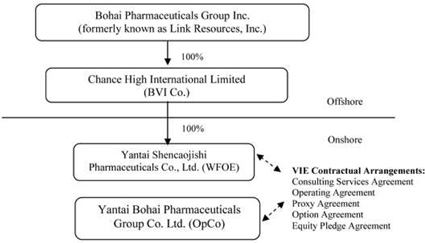

Pursuant to a Share Exchange Agreement, dated January 5, 2010 (the “Share Exchange Agreement” and the transactions contemplated thereby, the “Share Exchange”), the Company acquired Chance High International Limited, a British Virgin Islands company, or Chance High, from Chance High’s shareholders, or the Chance High shareholders, and, as a result, acquired Chance High’s indirect, controlled affiliate, Yantai Bohai Pharmaceuticals Group Co., Ltd., or Bohai, a Chinese company engaged the production, manufacturing and distribution in the People’s Republic of China (“China” or the “PRC”) of herbal medicines, including capsules and other products, based on traditional Chinese medicine.

The closing of the Share Exchange, or the Closing, took place on January 5, 2010, or the Closing Date. On the Closing Date, pursuant to the terms of the Share Exchange Agreement, the Company acquired all of the outstanding equity securities, or the Chance High shares, of Chance High from the Chance High Shareholders, and the Chance High Shareholders transferred and contributed all of their Chance High Shares to the Company. In exchange, we issued to Chance High Shareholders an aggregate of 13,162,500 newly issued shares of common stock, par value $0.001 per share, or the Common Stock. In addition, pursuant to the terms of the Share Exchange Agreement, Anthony Zaradic, the former President and Chief Executive Officer of the Company, cancelled a total of 1,500,000 shares of Common Stock.

Chance High owns 100% of the issued and outstanding capital stock of a Chinese wholly-foreign owned enterprise, Yantai Shencaojishi Pharmaceuticals Co., Ltd., or the WFOE. On December 7, 2009, the WFOE entered into a series of variable interest entity contractual agreements, or the VIE Agreements, with Bohai and its three shareholders, including Mr. Hongwei Qu, currently the Company’s Chairman, Chief Executive Officer and President, pursuant to which WFOE effectively assumed management of the business activities of Bohai and has the right to appoint all executives and senior management and the members of the board of directors of Bohai.

Chance High, WFOE and Bohai are referred to herein collectively and on a consolidated basis as the “Company” or “we”, “us” or “our” or similar terminology.

The VIE Agreements are comprised of a series of agreements, including a Consulting Services Agreement, Operating Agreement and Proxy Agreement, through which WFOE has the right to advise, consult, manage and operate Bohai for an annual fee in the amount of Bohai’s yearly net profits after tax. Additionally, Bohai’s shareholders pledged their rights, titles and equity interest in Bohai as security for WFOE to collect consulting and services fees provided to Bohai through an equity pledge agreement. In order to further reinforce WFOE’s rights to control and operate Bohai, Bohai’s shareholders granted WFOE an exclusive right and option to acquire all of their equity interests in Bohai through an option agreement.

5

|

1.

|

ORGANIZATION AND PRINCIPAL ACTIVITIES - Continued

|

On January 29, 2010, we entered into an agreement and plan of merger, the sole purpose of which was to effect a change of our corporate name from Link Resources Inc. to Bohai Pharmaceuticals Group, Inc.

We are engaged in the production, manufacturing and distribution of herbal pharmaceuticals based on traditional Chinese medicine, or TCM, in the People’s Republic of China. We are based in the city of Yantai, Shandong Province, China, and our operations are exclusively in China.

|

2.

|

BASIS OF PREPARATION

|

The accompanying unaudited condensed consolidated financial statements of our company and our subsidiaries at March 31, 2011 and for the three and nine months ended March 31, 2011 and 2010 reflect all adjustments (consisting only of normal recurring adjustments) that, in the opinion of management, are necessary to present fairly our consolidated financial position and results of operations for the periods presented. Operating results for the three and nine months ended March 31, 2011 are not necessarily indicative of the results that may be expected for the year ending June 30, 2011. The accompanying condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and the notes thereto included in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on September 28, 2010.

The accompanying unaudited condensed consolidated financial statements for our company, our subsidiaries and our variable interest entity (Bohai) have been prepared in accordance with accounting principles generally accepted in the United States of America, or the US, for interim financial information and with the instructions to Form 10-Q and Article 8-03 of Regulation S-X. Operating results for interim periods are not necessarily indicative of results that may be expected for the fiscal year as a whole.

The Share Exchange was accounted for as a reverse recapitalization effected as of January 5, 2010. Although we legally acquired Chance High and its controlled subsidiary Bohai, for accounting purposes, Chance High and Bohai are considered to be the accounting acquirers and Link Resources, Inc. as the accounting acquiree. As a result, the historical consolidated financial statements for periods prior to January 5, 2010 are those of Chance High and Bohai and the operating results, financial position and cash flows of our company (formerly known as Link Resources, Inc.) are consolidated only from its acquisition on January 5, 2010. As the transaction between our company and Chance High and its subsidiaries is treated as reverse acquisition, no goodwill was recorded. Intercompany transactions and balances are eliminated in consolidation.

|

3.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

|

Basis of Presentation and Consolidation

We adopted FAS ASC 810-10-15-14 and also ASC 810-10-05-8, which requires that a Variable Interest Entity, or VIE, to be consolidated by a company if that company is entitled to receive a majority of the VIE’s residual returns and has the direct ability to make decisions on all operating activities of the voting right of the VIE. We controls Bohai through the VIE Agreements described in Note 1 and accordingly it is consolidated for all periods presented.

The Operating Agreement provides that the WFOE has the direct ability to make decisions on all the operating activities and exercise all voting rights of Bohai, the Company’s VIE.

6

|

3.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Continued

|

Under Consultant Service Agreement entered between WFOE and Bohai on December 7, 2009, Bohai agreed to pay all of its net income to WOFE quarterly as a consulting fee. Accordingly, WOFE has the right to receive the expected residual returns of Bohai.

Under the above mentioned contractual arrangement, our company qualifies as the primary beneficiary of such controlling financial interest in Bohai as operating under ASC 810-10-15-14, an Interpretation of Accounting Research Bulletin No. 51. The results of subsidiaries or VIEs acquired prior to the date of Share Exchange Agreement on January 5, 2010 are included in the consolidated financial statements.

As of March 31, 2011, the particulars of our company’s subsidiaries and VIE are as follows:

|

Name of Company

|

Place of

incorporation

|

Date of

incorporation

|

Attributable

equity interest

|

Issued Capital

(US Dollars)

|

||||||||

|

Chance High International Limited

|

British Virgin Islands

|

July 2, 2009

|

100% | $ | 50,000 | |||||||

|

Yantai Shencaojishi

Pharmaceuticals Co., Ltd.

|

People’s Republic of China

|

November 25, 2009

|

100% | $ | 10,000,000 | |||||||

|

Yantai Bohai Pharmaceuticals Group Co., Ltd.

|

People’s Republic of China

|

July 8, 2004

|

* | $ |

2,918,000

|

|||||||

|

*

|

We have an indirect controlling interest in Bohai under the VIE Agreements entered on December 7, 2009, which are described in Note 1 above.

|

Initial measurement of VIE: we initially measured the assets, liabilities, and non-controlling interests of the VIEs at their carrying amount as of the date of the acquisition.

Accounting after initial measurement of VIE: subsequent accounting for the assets, liabilities, and non- controlling interest of a consolidated VIE are accounted for as if the entity were consolidated based on voting interests and the usual accounting rules for which the VIE operates are applied as they would to a consolidated subsidiary as follows:

|

·

|

Carrying amounts of the VIE are consolidated into the financial statements of the Company as the primary beneficiary, or Primary Beneficiary, or PB; and

|

|

·

|

Inter-company transactions and balances, such as revenues and costs, receivables and payables between or among the Primary Beneficiary and the VIE(s) are eliminated in their entirety.

|

7

|

3.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Continued

|

The carrying amount and classification of Yantai Bohai’s assets and liabilities included in the Consolidated Balance Sheets are as follows:

|

March 31, 2011

|

June 30, 2010

|

|||||||

|

(unaudited)

|

||||||||

|

Total current assets*

|

$

|

45,056,495

|

$

|

28,177,777

|

||||

|

Total assets*

|

78,259,724

|

53,415,591

|

||||||

|

Total current liabilities**

|

19,654,445

|

9,005,735

|

||||||

|

Total liabilities**

|

$

|

19,654,445

|

$

|

9,005,735

|

||||

* Including intercompany accounts of $1,627,814 and $394,821 as at March 31, 2011 and June 30, 2010 be eliminated in consolidation.

** Including intercompany accounts of $11,471,035 and $457,004 as at March 31, 2011 and June 30, 2010 be eliminated in consolidation

Economic and Political Risks

Our operations are conducted solely in the PRC. There are significant risks associated with doing business in the PRC, among others, political, economic, legal and foreign currency exchange risks. Our results may be adversely affected by changes in the political and social conditions in the PRC, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion, remittances abroad, and rates and methods of taxation, among other things.

Use of Estimates

In preparing the condensed consolidated financial statements in conformity with US GAAP, management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the dates of the financial statements, as well as the reported amounts of revenues and expenses during the reporting periods. These accounts and estimates include, but are not limited to, the valuation of accounts receivable, inventories, deferred income taxes, the estimation on useful lives of plant and machinery, and the fair value of derivative liabilities. Actual results could differ from those estimates.

Fair Value Measurements and Fair Value of Financial Instruments

We adopted the guidance of Accounting Standards Codification, or ASC, 820 for fair value measurements, which clarifies the definition of fair value, prescribes methods for measuring fair value, and establishes a fair value hierarchy to classify the inputs used in measuring fair value as follows:

Level 1 - Inputs are unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date.

Level 2 - Inputs are unadjusted quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other then quoted prices that are observable, and inputs derived from or corroborated by observable market data.

8

|

3.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Continued

|

Level 3 - Inputs are unobservable inputs which reflect the reporting entity’s own assumptions on what assumptions the market participants would use in pricing the asset or liability based on the best available information.

The carrying amounts reported in the balance sheets for cash, accounts receivable, other receivables, short-term borrowings, accounts payable and accrued expenses, customer advances, and amounts due from related parties approximate their fair market value based on the short-term maturity of these instruments.

ASC 825-10 “Financial Instruments,” allows entities to voluntarily choose to measure certain financial assets and liabilities at fair value (fair value option). The fair value option may be elected on an instrument-by-instrument basis and is irrevocable, unless a new election date occurs. If the fair value option is elected for an instrument, unrealized gains and losses for that instrument should be reported in earnings at each subsequent reporting date. We use Level 3 inputs to value our derivative liabilities.

The following table reflects gains and losses for the three and nine months ended March 31, 2011 for all financial assets and liabilities categorized as Level 3 as of March 31, 2011.

|

Liabilities:

|

||||

|

Balance of derivative liabilities as of December 31, 2010

|

$

|

2,563,443

|

||

|

Change in the fair value of derivative liabilities

|

(263,118)

|

|||

|

Balance of derivative liabilities as of March 31, 2011

|

$

|

2,300,325

|

||

|

Liabilities:

|

||||

|

Balance of derivative liabilities as of June 30, 2010

|

$

|

5,481,928

|

||

|

Change in the fair value of derivative liabilities

|

(3,181,603)

|

|||

|

Balance of derivative liabilities as of March 31, 2011

|

$

|

2,300,325

|

||

Estimating fair values of derivative financial instruments require the development of significant and subjective estimates that may, and are likely to, change over the duration of the instrument with related changes in internal and external market factors. In addition, valuation techniques are sensitive to changes in the trading market price of our Common Stock and its estimated volatility. Because derivative financial instruments are initially and subsequently carried at fair values, our net income may include significant charges or credits as these estimates and assumptions change.

The potential credit risk to our company is mainly attributable to its accounts receivable and bank balances. We have policies in place to ensure that we will only accept customers from countries which are politically stable and customers with an appropriate credit history. In addition, all bank balances are on deposit with financial institutions with high-credit quality. Accordingly, we do not consider that we are subject to significant credit risk.

Our interest rate risk is primarily attributable to our borrowings, all of which have fixed interest rates. We do not use interest rate swaps to hedge our exposure to interest rate risk.

Cash and Cash Equivalents

We consider all highly liquid investments purchased with original maturities of three months or less to be cash equivalents. We maintain bank accounts in the PRC and restricted cash accounts and a checking account in the United States of America. The restricted cash accounts were created for interest payments due to convertible note holders and payments for investor relations activities in the US.

9

|

3.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Continued

|

Concentrations of Credit Risk

Financial instruments which potentially subject us to concentrations of credit risk consist principally of cash and trade accounts receivable. Substantially all of our cash is maintained with state-owned banks within the PRC, and no deposits are covered by insurance. We have not experienced any losses in such accounts and believe we are not exposed to any risks on our cash in bank accounts. A significant portion of our sales are credit sales which are primarily to customers whose ability to pay is dependent upon the industry economics prevailing in these areas; however, concentrations of credit risk with respect to trade accounts receivables is limited due to generally short payment terms. We also perform ongoing credit evaluations of our customers to help further reduce credit risk.

At March 31, 2011 and June 30, 2010, our cash balances by geographic area were as follows:

|

|

|

March 31, 2011

|

June 30, 2010

|

|

||||||||||||

|

|

|

(unaudited)

|

|

|||||||||||||

|

Country:

|

||||||||||||||||

|

United States

|

$

|

31,829

|

0.3

|

%

|

$

|

-

|

-

|

%

|

||||||||

|

China

|

10,633,688

|

99.7

|

%

|

17,149,082

|

100.0

|

%

|

||||||||||

|

Total cash and cash equivalents

|

$

|

10,665,517

|

100.0

|

%

|

$

|

17,149,082

|

100.0

|

%

|

||||||||

Accounts Receivable

Accounts receivable consists of amounts due from customers. We extend unsecured credit to our customers in the ordinary course of business but mitigate the associated risks by performing credit checks and actively pursuing past due accounts. An allowance for doubtful accounts is established and determined based on management’s assessment of known requirements, aging of receivables, payment history, the customer’s current credit worthiness and the economic environment. As of March 31, 2011 and June 30, 2010, no allowance for doubtful accounts was deemed necessary based on management’s assessment.

Inventories

Inventories are valued at the lower of cost or market with cost is determined using the weighted average method. Finished goods inventories consist of raw materials, direct labor and overhead associated with the manufacturing process. In assessing the ultimate realization of inventories, management makes judgments as to future demand requirements compared to current or committed inventory levels. Our reserve requirements generally increase/decrease due to management’s projected demand requirements, market conditions and product life cycle changes. As of March 31, 2011 and June 30, 2010, we did not make any allowance for slow-moving or defective inventories.

Intangible Assets

Intangible assets consist of “Pharmaceutical Formulas”, which were acquired with indefinite useful lives. These intangible assets are measured initially at cost and not subject to amortization and will be tested for impairment annually or more frequently if there is indication of impairment. If the carrying amount exceeds fair value, an impairment loss would be recognized. Subsequently reversal of a recognized impairment loss is prohibited. There was no impairment of the intangible assets as of March 31, 2011 and June 30, 2010.

10

|

3.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Continued

|

Property, Plant and Equipment

Property, plant and equipment are carried at cost and are depreciated on a straight-line basis over the estimated useful lives of the assets. The cost of repairs and maintenance is expensed as incurred; major replacements and improvements are capitalized. When assets are retired or disposed of, the cost and accumulated depreciation are removed from the accounts, and any resulting gains or losses are included in income in the year of disposition. We examine the possibility of decreases in the value of fixed assets when events or changes in circumstances reflect the fact that their recorded value may not be recoverable.

Included in property and equipment was construction-in-progress which consisted of factories and office buildings under construction and machinery pending installation and includes the costs of construction, machinery and equipment, and any interest charges arising from borrowings used to finance these assets during the period of construction or installation. No provision for depreciation is made on construction-in-progress until such time as the relevant assets are completed and ready for their intended use. The principal annual rates are as follows:

|

Leasehold land and buildings

|

30 to 40 years

|

|

|

Motor vehicles

|

10 years

|

|

|

Plant and machinery

|

10 years

|

|

|

Office equipment

|

5 years

|

Accounting for the Impairment of Long-Lived Assets

We use ASC Topic 360, which addresses financial accounting and reporting for the impairment or disposal of long-lived assets. We periodically evaluate the carrying value of long-lived assets to be held and used in accordance with ASC Topic 360. ASC Topic 360 requires impairment losses to be recorded on long-lived assets used in operations when indicators of impairment are present and the undiscounted cash flows estimated to be generated by those assets are less than the assets’ carrying amounts. In that event, a loss is recognized based on the amount by which the carrying amount exceeds the fair market value of the long-lived assets. Loss on long-lived assets to be disposed of is determined in a similar manner, except that fair market values are reduced for the cost of disposal. Based on our review, we believe that, as of March 31, 2011 and June 30, 2010, there were no impairments of our long-lived asset.

Foreign Currency Translation

Our reporting currency is the U.S. dollar. We maintain our consolidated financial statements in the functional currency. Our functional currency is the Chinese Renminbi, or RMB. For our subsidiaries and affiliates whose functional currencies are the RMB, results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the unified exchange rate at the end of the period, and equity is translated at historical exchange rates. As a result, amounts relating to assets and liabilities reported on the statements of cash flows may not necessarily agree with the changes in the corresponding balances on the balance sheets. Translation adjustments resulting from the process of translating the local currency financial statements into U.S. dollars are included in determining comprehensive income. Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchanges rates prevailing at the dates of the transaction. Exchange gains or losses arising from foreign currency transactions are included in the determination of net income for the respective periods. All of our revenue transactions are transacted in the functional currency. We do not enter any material transaction in foreign currencies and, accordingly, transaction gains or losses have not had, and are not expected to have a material effect on our results of operations.

11

|

3.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Continued

|

Assets and liabilities are translated at the exchange rates at the balance sheet dates and revenue and expenses are translated at the average exchange rates using the following exchange rates:

|

|

Nine months ended

March 31, 2011

|

Year ended

June 30, 2010

|

Nine months ended

March 31, 2010

|

||||||

|

Period end US$: RMB exchange rate

|

6.57010

|

6.80860

|

6.84560

|

||||||

|

Average periodic US$: RMB exchange rate

|

6.67960

|

6.83667

|

6.85094

|

||||||

RMB is not freely convertible into foreign currency and all foreign exchange transactions must take place through authorized institutions. No representation is made that the RMB amounts could have been, or could be, converted into US dollar at the rates used in translation.

Revenue Recognition

Revenue represents the invoiced value of goods sold recognized upon the delivery of goods to distributors. Pursuant to the guidance of ASC Topic 605 and ASC Topic 36, revenue is recognized when all of the following criteria are met:

|

·

|

Persuasive evidence of an arrangement exists;

|

|

·

|

Delivery has occurred or services have been rendered;

|

|

·

|

The seller’s price to the buyer is fixed or determinable; and

|

|

·

|

Collectability is reasonably assured.

|

We account for sales returns by establishing an accrual in an amount equal to our estimate of sales recorded for which the related products are expected to be returned. We determine the estimate of the sales return accrual primarily based on our historical experience regarding sales returns, but also by considering other factors that could impact sales returns. These factors include levels of inventory in the distribution channel, estimated shelf life, product discontinuances, and price changes of competitive products, introductions of generic products and introductions of competitive new products. For the three and nine months ended March 31, 2011 and 2010, our sales return rate is low and deemed immaterial and accordingly, no provision for sales returns was recorded.

Cost of Revenue

Cost of revenue consists primarily of raw material costs, labor cost, overhead costs associated with the manufacturing process and related expenses which are directly attributable to our revenues.

12

|

3.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Continued

|

Stock-based Compensation

Stock based compensation is accounted for based on the requirements of the Share-Based Payment topic of ASC 718 which requires recognition in the financial statements of the cost of employee and director services received in exchange for an award of equity instruments over the employee or director’s requisite service period (presumptively, the vesting period). The FASB Accounting Standards Codification also requires measurement of the cost of employee and director services received in exchange for an award based on the grant-date fair value of the award.

Pursuant to ASC Topic 505-50, for share-based payments to consultants and other third-parties, compensation expense is determined at the “measurement date.” The expense is recognized over the vesting period of the award. Until the measurement date is reached, the total amount of compensation expense remains uncertain. We record compensation expense based on the fair value of the award at the reporting date. The awards to consultants and other third-parties are then revalued, or the total compensation is recalculated based on the then current fair value, at each subsequent reporting date.

Research and Development Costs

Research and development costs are charged as an expense when incurred and included in operating expenses. Research and development costs totaled $190,440 and $146,640 for the three months ended March 31, 2011 and 2010, respectively. Research and development costs totaled $562,261 and $442,046 for the nine months ended March 31, 2011 and 2010, respectively.

Shipping Costs

Shipping costs are included in selling, general and administrative expens and totaled $230,938 and $326,097 for the three months ended March 31, 2011 and 2010, respectively, and totaled $598,525 and $608,500 for the nine months ended March 31, 2011 and 2010, respectively,

Advertising and Promotion

Advertising and promotion is expensed as incurred. Advertising and promotion expenses were included in selling, general and administrative expenses and amounted to $3,962,454 and $2,767,549 for the three months ended March 31, 2011 and 2010, respectively, and amounted to $10,461,435 and $8,732,252 for the nine months ended March 31, 2011 and 2010, respectively.

Income Taxes

We are governed by the Income Tax Law of the People’s Republic of China and the Internal Revenue Code of the United States. Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carry-forwards. Deferred tax assets are reduced by a valuation allowance to the extent management concludes it is more likely than not that the assets will not be realized. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the statements of income and comprehensive income in the periods that includes the enactment date.

13

|

3.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Continued

|

Comprehensive Income

Comprehensive income is defined to include all changes in equity except those resulting from investments by owners and distributions to owners. Among other disclosures, all items that are required to be recognized under current accounting standards as components of comprehensive income are required to be reported in a financial statement that is presented with the same prominence as other financial statements. Our current components of other comprehensive income are the foreign currency translation adjustment.

Commitments and Contingencies

Liabilities for loss contingencies arising from claims, assessments, litigation, fines and penalties and other sources are recorded when it is probable that a liability has been incurred and the amount of the assessment can be reasonably estimated.

Earnings Per Share

We report basic earnings per share in accordance with ASC Topic 260, “Earnings Per Share”. Basic earnings/ (loss) per share is computed by dividing net income/ (loss) by weighted average number of shares of Common Stock outstanding during the period. Diluted earnings per share is computed by dividing net income by the weighted average number of shares of Common Stock, Common Stock equivalents and potentially dilutive securities outstanding during the period. Common equivalent shares are excluded from the computation in periods for which they have an anti-dilutive effect. Stock options for which the exercise price exceeds the average market price over the period are anti-dilutive and, accordingly, are excluded from the calculation. At March 31, 2011, we had 5,225,000 Common Stock equivalents from convertible notes and stock options to purchase 26,000 shares of Common Stock that could potentially dilute future earnings per share. Warrants to purchase 6,600,000 shares of Common Stock were outstanding during the three and nine months ended March 31, 2011, but were excluded from the computation of diluted earnings per share as their effect would have been anti-dilutive.

Reclassification

Sales tax of $231,870 and $729,975 for the three and nine months ended March 31, 2010, respectively, have been reclassified from net revenue to cost of revenue to confirm with the current presentation. The reclassification has no impact on the net income for the three and nine months ended March 31, 2010.

Recent Accounting Pronouncements Not Yet Adopted

In April 2010, the FASB issued ASU 2010-13, Compensation-Stock Compensation (Topic 718): Effect of Denominating the Exercise Price of a Share-Based Payment Award in the Currency of the Market in Which the Underlying Equity Security Trades - a consensus of the FASB Emerging Issues Task Force. The amendments in this Update are effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2010. Earlier application is permitted. We do not expect the provisions of ASU 2010-13 to have a material effect on our position, results of operations or cash flows.

14

|

3.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Continued

|

In December 2010, FASB issued ASU No. 2010-28, Intangibles - Goodwill and Other (ASC Topic 350). Under Topic 350 on goodwill and other intangible assets, testing for goodwill impairment is a two-step test. When a goodwill impairment test is performed (either on an annual or interim basis), an entity must assess whether the carrying amount of a reporting unit exceeds its fair value (Step 1). If it does, an entity must perform an additional test to determine whether goodwill has been impaired and to calculate the amount of that impairment (Step 2). The amendments in this update modify Step 1 of the goodwill impairment test for reporting units with zero or negative carrying amounts. For those reporting units, an entity is required to perform Step 2 of the goodwill impairment test if it is more likely than not that a goodwill impairment exists. In determining whether it is more likely than not that a goodwill impairment exists, an entity should consider whether there are any adverse qualitative factors indicating that an impairment may exist. The qualitative factors require that goodwill of a reporting unit be tested for impairment between annual tests if an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying amount. The amendments in this update are effective for fiscal years, and interim periods within those years, beginning after December 15, 2010. Early adoption is not permitted. As we do not have any significant intangible assets, we believe that the impact of adopting this update will not be material on our consolidated results of operations and financial position.

In December 2010, FASB issued Accounting Standards Update (ASU) No. 2010-29, Business Combinations (ASC Topic 805). The amendments in this update specify that if a public entity presents comparative financial statements, the entity should disclose revenue and earnings of the combined entity as though the business combination(s) that occurred during the current year had occurred as of the beginning of the comparable prior annual reporting period only. The amendments also improve the usefulness of the pro forma revenue and earnings disclosures by requiring a description of the nature and amount of material, nonrecurring pro forma adjustments that are directly attributable to the business combination(s). The amendments in this update are effective for fiscal years, and interim periods within those years, beginning after December 15, 2010. Early adoption is permitted. As we did not enter into any business combinations in fiscal year 2010, we believe that the adoption this update will not have any material impact on our financial statement disclosures. However, if we enter into material business combinations in the future, the adoption of this update may have significant impact on our financial statement disclosures.

Other accounting standards that have been issued or proposed by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a material impact on our consolidated financial statements upon adoption.

|

4.

|

OTHER RECEIVABLES AND PREPAYMENTS

|

Other receivables and prepayments consist of the following:

15

4. OTHER RECEIVABLES AND PREPAYMENTS - Continued

|

|

As of

|

As of

|

||||

|

March 31, 2011

|

June 30, 2010

|

|||||

|

(unaudited)

|

||||||

|

Prepayment for advertising and promotion

|

$ | 1,749,349 | $ | 1,198,484 | ||

|

Prepayment for director and office insurance

|

5,417 | 29,792 | ||||

|

Advance to suppliers

|

8,048 | - | ||||

|

Other receivables

|

243,454 | 221,314 | ||||

|

Total other receivables and prepayments

|

$ | 2,006,268 | $ | 1,449,590 | ||

|

5.

|

AMOUNT DUE FROM EQUITY HOLDER

|

Amount due from equity holder consists of the following:

|

|

As of

|

As of

|

||||||

|

March 31, 2011

|

June 30, 2010

|

|||||||

|

(unaudited)

|

||||||||

|

Mr. Hongwei Qu

|

$ | - | $ | 40,160 | ||||

The amount due from an equity holder (the Company’s Chairman, President and Chief Executive Officer) as of June 30, 2010 is unsecured, non-interest bearing. The balance of $40,160 was repaid in July 2010.

|

6.

|

INVENTORIES

|

Inventories consist of the following:

|

As of

|

As of

|

|||||||

|

March 31, 2011

|

June 30, 2010

|

|||||||

|

(unaudited)

|

||||||||

|

Raw materials

|

$ | 973,043 | $ | 445,693 | ||||

|

Finished goods

|

1,024,503 | 302,729 | ||||||

|

Total inventories

|

$ | 1,997,545 | $ | 748,422 | ||||

16

|

7.

|

INTANGIBLE ASSETS

|

Intangible assets consist of the following:

|

|

As of

|

As of

|

||||||

|

March 31, 2011

|

June 30, 2010

|

|||||||

|

(unaudited)

|

||||||||

|

Pharmaceuticals formulas, at cost

|

$ | 25,278,154 | $ | 17,342,772 | ||||

On December 9, 2010, we entered into an Intangible Assets Transfer Agreement with Shandong Daxin Microbiology Pharmaceutical Industry Co., Ltd. (“Daxin”), an unrelated party, pursuant to which Daxin transferred to us all rights and title for 14 State Food and Drug Administration previously approved traditional Chinese medicine formulas. The aggregate purchase price of approximately $7,186,100 (RMB 48,000,000) has been paid by March 31, 2011. The 14 new formulas consist of two new product categories, powder and pellet formulations, which are the most popular product formulations under Chinese government’s Essential Drug List (EDL). Additionally, 4 of the 14 formulas are included in the EDL and an additional 5 medicines are included in the National Drug Reimbursement List (NDRL). Inclusion on EDL or NDRL allows for up to 100% insurance coverage by the Chinese government.

|

8.

|

PROPERTY, PLANT AND EQUIPMENT, NET

|

Property, plant and equipment consisted of the following:

|

|

As of

|

As of

|

||||||

|

March 31, 2011

|

June 30, 2010

|

|||||||

|

(unaudited)

|

||||||||

|

Leasehold land and buildings

|

$ | 7,906,455 | $ | 7,629,498 | ||||

|

Plant equipment

|

1,279,825 | 1,238,343 | ||||||

|

Office equipment

|

103,129 | 81,799 | ||||||

|

Motor vehicles

|

421,947 | 414,648 | ||||||

|

Total

|

9,711,355 | 9,364,288 | ||||||

|

Less: accumulated depreciation

|

1,786,280 | 1,469,246 | ||||||

|

Property, plant and equipment, net

|

$ | 7,925,075 | $ | 7,895,042 | ||||

Depreciation expense for the three months ended March 31, 2011 and 2010 amounted to $87,847 and $84,518, respectively. Depreciation expense for the nine months ended March 31, 2011 and 2010 amounted to $260,577 and $224,656, respectively.

As of March 31, 2011 and June 30, 2010, we have pledged plant machinery having a carrying amount of $457,565 and $534,102, respectively to secure a bank loan of Bohai.

17

|

9.

|

SHORT-TERM BORROWINGS

|

Bohai obtained several short-term loan facilities from financial institution in the PRC. Short-term borrowings as of March 31, 2011 consisted of the following:

|

Loan from

financial

institution

|

Loan period

|

Annual

interest rate

|

Secured by

|

Amount

|

|||||||

|

Yantai Laishan Rural Credit Union

|

September 21, 2010 to September 20, 2011

|

9.03 | % |

Bohai’s machinery and vehicles

|

$ | 608,819 | |||||

|

Yantai Laishan Rural Credit Union

|

September 21, 2010 to September 20, 2011

|

6.90 | % |

Yantai Jiahua Medical Equipment Co. Ltd

|

296,799 | ||||||

| $ | 905,618 | ||||||||||

Short-term borrowings as of June 30, 2010 consisted of the following:

|

Loan from

financial

institution

|

Loan period

|

Annual

interest rate

|

Secured by

|

Amount

|

|||||||

|

China Construction Bank

|

February 24, 2010 to February 23, 2011

|

5.84 | % |

Shandong Dai Xin Heavy Industries Co. Ltd.

|

$ | 3,524,954 | |||||

|

Yantai Laishan Rural Credit Union

|

September 28, 2009 to September 26, 2010

|

9.03 | % |

Bohai’s machinery and vehicles

|

587,492 | ||||||

|

Yantai Laishan Rural Credit Union

|

September 28, 2009 to September 26, 2010

|

6.90 | % |

Yantai Jiahua Medical Equipment Co. Ltd

|

286,403 | ||||||

| $ | 4,398,849 | ||||||||||

|

10.

|

COMMON STOCK

|

We are authorized to issue 150 million shares of Common Stock, par value $0.001 per share. Holders of Common Stock are entitled to one vote for each share held of record on each matter submitted to a vote of shareholders. Holders of Common Stock do not have a cumulative voting right, which means that the holders of more than one half of our outstanding shares of Common Stock, subject to the rights of the holders of preferred stock, if any, can elect all of our directors, if they choose to do so. In this event, the holders of the remaining shares of Common Stock would not be able to elect any directors. Subject to the prior rights of any class or series of preferred stock which may from time to time be outstanding, if any, holders of Common Stock are entitled to receive ratably, dividends when, as, and if declared by our Board of Directors out of funds legally available for that purpose and, upon our liquidation, dissolution, or winding up, are entitled to share ratably in all assets remaining after payment of liabilities and payment of accrued dividends and liquidation preferences on the preferred stock, if any. Holders of Common Stock have no preemptive rights and have no rights to convert their Common Stock into any other securities. The outstanding Common Stock is duly authorized and validly issued, fully-paid, and non-assessable. Except as required or permitted by law or our charter documents, all stockholder action is taken by the vote of a majority of the outstanding shares of Common Stock present at a meeting of stockholders at which a quorum consisting of a majority of the outstanding shares of Common Stock is present in person or by proxy.

18

|

10.

|

COMMON STOCK - Continued

|

On January 21, 2011, we closed a financing transaction under which we sold an aggregate of 748,382 shares of Common Stock to a total of 42 individual investors at $2.50 per share, for total gross proceeds of $1,870,955. The shares were sold pursuant to separate subscription agreements between us and each investor. All investors are domiciled in and citizens of the People's Republic of China.

Notes with an aggregate face amount of $1,050,000 and interest of $5,406 on the $1,050,000 Notes were converted into 527,703 shares of Common Stock during the nine months ended March 31, 2011.

Restricted Stock Awards

On June 4, 2010, we issued 120,000 shares of restricted Common Stock to our Chief Financial Officer for three years of service. The restricted stock vests in three equal annual installments over the term of employment. For the three and nine months ended March 31, 2011, the Company recognized $22,000 and $73,000 of the restricted stock as compensation expenses.

On November 10, 2010, we issued 25,000 shares of restricted Common Stock to a third party to create investor awareness programs, which shares vested immediately. For the three and nine months ended March 31, 2011, the Company recognized $24,000 and $52,500 of the restricted stock as general and administrative expenses.

On January 5, 2011, we issued 20,000 shares of restricted Common Stock to a third party to create investor awareness programs, which shares vested immediately. For the three and nine months ended March 31, 2011, the Company recognized $35,000 of the restricted stock as general and administrative expenses.

|

11.

|

EARNINGS PER SHARE

|

Basic earnings per share are computed on the basis of the weighted average number of shares of Common Stock outstanding during the period. Diluted earnings per share is computed on the basis of the weighted average number of shares of Common Stock plus the effect of dilutive potential common shares outstanding during the period using the if-converted method for the convertible notes and the treasury stock method for warrants. The following table sets forth the computation of basic and diluted net income per common share:

19

|

11.

|

EARNINGS PER SHARE - Continued

|

|

Three

months

ended

|

Three

months

ended

|

Nine months

ended

|

Nine months

ended

|

|||||||||||||

|

March 31,

2011

|

March 31,

2010

|

March 31,

2011

|

March 31,

2010

|

|||||||||||||

|

(unaudited)

|

(unaudited)

|

(unaudited)

|

(unaudited)

|

|||||||||||||

|

Net income available for common shareholders

|

$ | 2,685,346 | $ | 3,142,558 | $ | 12,238,716 | $ | 7,752,593 | ||||||||

|

Effective interest charge on convertible note

|

438,376 | 347,793 | 986,842 | 347,793 | ||||||||||||

|

Net income for diluted earnings per common share

|

$ | 3,123,722 | $ | 3,490,351 | $ | 13,225,558 | $ | 8,100,386 | ||||||||

|

Three

months

ended

|

Three

months

ended

|

Nine months

ended

|

Nine months

ended

|

|||||||||||||

|

March 31,

2011

|

March 31,

2010

|

March 31,

2011

|

March 31,

2010

|

|||||||||||||

|

(unaudited)

|

(unaudited)

|

(unaudited)

|

(unaudited)

|

|||||||||||||

|

Basic weighted average common stocks outstanding

|

17,544,163 | 16,078,472 | 16,988,489 | 16,193,659 | ||||||||||||

|

Effect of dilutive securities:

|

||||||||||||||||

|

Warrants - incremental shares based on assumed proceeds & repurchases

|

- | - | - | - | ||||||||||||

|

Options - incremental shares based on assumed proceeds & repurchases

|

- | - | 75 | - | ||||||||||||

|

Restricted stock

|

14,722 | - | 9,398 | - | ||||||||||||

|

Common shares if converted from Convertible Notes

|

5,250,000 | 5,666,667 | 5,441,240 | 5,890,511 | ||||||||||||

|

Diluted weighted average for common stocks outstanding

|

22,808,885 | 21,745,139 | 22,439,202 | 22,084,170 | ||||||||||||

|

Earnings per share:

|

||||||||||||||||

|

Basic

|

$ | 0.15 | $ | 0.20 | $ | 0.72 | $ | 0.48 | ||||||||

|

Diluted

|

$ | 0.14 | $ | 0.16 | $ | 0.59 | $ | 0.37 | ||||||||

20

|

11.

|

EARNINGS PER SHARE - Continued

|

Warrants to purchase 6,600,000 shares of Common Stock and stock options to purchase 26,000 shares of Common Stock were outstanding during the three and nine months ended March 31, 2011 but were excluded from the computation of diluted earnings per share as their effect would have been anti-dilutive.

Warrants to purchase 6,600,000 shares of Common Stock were outstanding during the three and nine months ended March 31, 2010 but were excluded from the computation of diluted earnings per share as their effect would have been anti-dilutive

|

12.

|

OTHER ACCRUED LIABILITIES

|

Other accrued liabilities as of March 31, 2011 and June 30, 2010 are consisted of the following:

|

|

As of

|

As of

|

||||||

|

March 31, 2011

|

June 30, 2010

|

|||||||

|

(unaudited)

|

||||||||

|

Accrued selling expenses

|

$ | 3,233,082 | $ | 1,541,383 | ||||

|

Accrued staff costs

|

259,220 | 221,810 | ||||||

|

Value added tax payable

|

998,700 | 686,478 | ||||||

|

Other taxes payable

|

150,509 | 78,370 | ||||||

|

Other accrued expenses

|

268,272 | 456,947 | ||||||

|

Total other accrued liabilities

|

$ | 4,909,783 | $ | 2,984,988 | ||||

|

13.

|

CONVERTIBLE PROMISSORY NOTES AND WARRANTS

|

On January 5, 2010, pursuant to a Securities Purchase Agreement, or securities purchase agreement, with 128 accredited investors, or the Investors, we sold 6,000,000 units for aggregate gross proceeds of $12,000,000, each unit consisting of an 8% senior convertible promissory note, or Notes, in the principal amount of $2 and one Common Stock purchase warrant, or Warrant. By agreement with the Investors, each investor received: (i) a single Note representing the aggregate number of Notes purchased by them as part of the units (each, a “Note” and collectively, the “Notes”) and (ii) a single Investor Warrant representing the aggregate number of Investor Warrants purchased by them as part of the units.

The Notes bear interest at 8% per annum, payable quarterly in arrears on the last day of each fiscal quarter of our company. No principal payments are required until maturity of the Notes on January 5, 2012. Each Note, plus all accrued but unpaid interest thereon, is convertible, in whole but not in part, at any time at the option of the holder, into shares of Common Stock at a conversion price of $2.00 per share, subject to adjustment as set forth in the Note. The Notes issued have face amounts that range from $43,200 to $500,000.

21

|

13.

|

CONVERTIBLE PROMISSORY NOTES AND WARRANTS - Continued

|

The conversion price of the Notes is subject to standard anti-dilution adjustments for stock splits and similar events. In addition, if we issue or sell any additional shares of Common Stock or instruments convertible or exchangeable for Common Stock at a price per share less than the conversion price then in effect or without consideration, then the conversion price upon each such issuance will be adjusted to that price determined by multiplying the conversion price then in effect by a fraction: (1) the numerator of which is the sum of (x) the number of shares of Common Stock outstanding immediately prior to the issuance of such additional shares of Common Stock plus (y) the number of shares of Common Stock which the aggregate consideration for the total number of such additional shares of Common Stock so issued would purchase at a price per share equal to the conversion price then in effect, and (2) the denominator of which is the number of shares of Common Stock outstanding immediately after the issuance of such additional shares of Common Stock. Notwithstanding any provision of the Note to the contrary, no adjustment will cause the conversion price to be less than $1.00, as adjusted for any stock dividend, stock split, stock combination, reclassification or similar transaction.