Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT312 - CONSTITUTION MINING CORP | exhibit312.htm |

| EX-32.1 - EXHIBIT321 - CONSTITUTION MINING CORP | exhibit321.htm |

| EX-32.2 - EXHIBIT322 - CONSTITUTION MINING CORP | exhibit322.htm |

| EX-31.1 - EXHIBIT311 - CONSTITUTION MINING CORP | exhibit311.htm |

| EX-21.1 - EXHIBIT211 - CONSTITUTION MINING CORP | exhibit211.htm |

| EX-24.1 - EXHIBIT241 - CONSTITUTION MINING CORP | exhibit241.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ý ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010.

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to _________.

Commission file number: 000-49725

Goldsands Development Company

(Exact name of registrant as specified in its charter)

|

Delaware

|

88-0455809

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

Calle Juan Fanning 219, Miraflores, Lima, Perú

|

||

|

(Address of principal executive offices) (Zip Code)

|

||

|

Registrant’s telephone, including area code: +54-1-446-6807

|

||

Securities registered under Section 12(b) of the Exchange Act: None.

Securities registered under Section 12(g) of the Exchange Act:

|

Common Stock, $0.001 par value

|

Not Applicable

|

|

|

(Title of class)

|

(Name of each exchange on which registered)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨

Non-accelerated filer ¨ (Do not check if a smaller reporting company) Smaller reporting company ý

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

As of June 30, 2010, the aggregate market value of the Company’s common equity held by non-affiliates computed by reference to the closing price ($0.70) was: $55,994,538

The number of shares of our common stock outstanding as of May 12, 2011 was: 187,517,618

Documents Incorporated by Reference: None

FORM 10-K

GOLDSANDS DEVELOPMENT COMPANY

DECEMBER 31, 2010

| Page | |

| PART I | |

|

Item 1. Business.

|

5

|

|

Item 1A. Risk Factors.

|

10

|

|

Item 1B. Unresolved Staff Comments.

|

19

|

|

Item 2. Properties.

|

19

|

|

Item 3. Legal Proceedings.

|

31

|

|

Item 4. (Removed and Reserved).

|

31

|

|

PART II

|

|

32

|

|

|

Item 6. Selected Financial Data.

|

34

|

|

35

|

|

|

41

|

|

|

41

|

|

|

41

|

|

|

Item 9A. Controls and Procedures.

|

41

|

|

Item 9B. Other Information.

|

43

|

|

PART III

|

|

44

|

||

|

Item 11. Executive Compensation.

|

48

|

|

|

54

|

||

|

55

|

||

|

56

|

||

|

PART IV

|

Cautionary Note Regarding Forward Looking Statements

This annual report contains forward-looking statements as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In some cases, you can identify forward-looking statements by terminology such as "may," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential," "continue," "intends," and other variations of these words or comparable words. In addition, any statements that refer to expectations, projections or other characterizations of events, circumstances or trends and that do not relate to historical matters are forward-looking statements. These forward-looking statements are based largely on our expectations or forecasts of future events, can be affected by inaccurate assumptions, and are subject to various business risks and known and unknown uncertainties, a number of which are beyond our control. Therefore, actual results could differ materially from the forward-looking statements contained in this document, and readers are cautioned not to place undue reliance on such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. A wide variety of factor could cause or contribute to such differences and could adversely impact revenues, profitability, cash flows and capital needs. There can be no assurance that the forward-looking statements contained in this document will, in fact, transpire or prove to be accurate. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Important factors that may cause the actual results to differ from the forward-looking statements, projections or other expectations include, but are not limited to, the following:

|

●

|

potential or pending investigations, proceedings or litigation that involves or affects us;

|

|

●

|

risk that we will not be able to remediate identified material weaknesses in our internal control over financial reporting and disclosure controls and procedures;

|

|

●

|

risks related to failure to obtain adequate financing on a timely basis and on acceptable terms for our planned exploration and development projects;

|

|

●

|

risk that we fail to fulfill the payment obligations set forth in the agreement we entered into with Temasek Investments Inc. ("Temasek"), a company incorporated under the laws of Panama, under which we acquired three separate options, each providing for the acquisition of an approximately one-third interest in certain mineral rights to certain properties in Peru that abut the other property interests we acquire, which could result in the loss of our right to exercise the options to acquire the mineral and mining rights underlying these properties;

|

|

●

|

risk that we cannot attract, retain and motivate qualified personnel, particularly employees, consultants and contractors for our operations in Peru;

|

|

●

|

risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits;

|

|

●

|

results of initial feasibility, pre-feasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with our expectations;

|

|

●

|

mining and development risks, including risks related to accidents, equipment breakdowns, labor disputes or other unanticipated difficulties with or interruptions in production;

|

|

●

|

the potential for delays in exploration or development activities or the completion of feasibility studies;

|

|

●

|

risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses;

|

|

●

|

risks related to commodity price fluctuations;

|

|

●

|

the uncertainty of profitability based upon our history of losses;

|

|

●

|

risks related to environmental regulation and liability;

|

|

●

|

risks that the amounts reserved or allocated for environmental compliance, reclamation, post-closure control measures, monitoring and on-going maintenance may not be sufficient to cover such costs;

|

|

●

|

risks related to tax assessments;

|

|

●

|

political and regulatory risks associated with mining development and exploration; and

|

|

●

|

other risks and uncertainties related to our prospects, properties and business strategy.

|

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this report. Except as required by law, we do not undertake to update or revise any of the forward-looking statements to conform these statements to actual results, whether as a result of new information, future events or otherwise.

As used in this annual report, “Goldsands Development,” the “Company,” “we,” “us,” or “our” refer to Goldsands Development Company, unless otherwise indicated.

If you are not familiar with the mineral exploration terms used in this report, please refer to the definitions of these terms under the caption “Glossary” at the end of Item 15 of this report.

PART I

ITEM 1. Business.

Corporate History

We were incorporated in the state of Nevada under the name Crafty Admiral Enterprises, Ltd. on March 6, 2000. Our original business plan was to sell classic auto parts to classic auto owners worldwide through an Internet site and online store; however, we were unsuccessful in implementing the online store and were unable to afford the cost of purchasing, warehousing and shipping the initial inventory required to get the business started. As a result, we ceased operations in approximately July 2002.

During our fiscal year ended December 31, 2006, we reorganized our operations to pursue the exploration, development, acquisition and operation of oil and gas properties. On June 27, 2006, we acquired a leasehold interest in a mineral, oil and gas property located in St. Francis County, Arkansas for a cash payment of $642,006, pursuant to an oil and gas agreement we entered into on April 29, 2006 (the “Tombaugh Lease”). Shortly after acquiring the Tombaugh Lease, we suspended our exploration efforts on the property covered by the Tombaugh Lease in order to pursue business opportunities developing nickel deposits in Finland, Norway and Western Russia. On January 18, 2008, we assigned all of our right, title and interest in and to the Tombaugh Lease to Fayetteville Oil and Gas, Inc., which agreed to assume all of our outstanding payment obligations on the Tombaugh Lease as consideration for the assignment. On March 9, 2007, we changed our name to better reflect our business to “Nordic Nickel Ltd.” pursuant to a parent/subsidiary merger with our wholly-owned non-operating subsidiary, Nordic Nickel Ltd., which was established for the purpose of giving effect to this name change. We were not successful pursuing business opportunities developing nickel deposits in Finland, Norway and Western Russia and again sought to reorganize our operations in November 2007.

In November 2007, we reorganized our operations and changed our name to “Constitution Mining Corp.” to better reflect our current focus, which is the acquisition, exploration, and potential development of mining properties. Since November 2007, we have entered into agreements to secure options to acquire the mineral and mining rights underlying properties located in the Salta and Mendoza provinces of Argentina (the “Argentinean Properties”) and in northeastern Peru. In 2009, we determined that it was in our best interest to dispose of our interests in the Argentinean Properties and we are now pursuing exploration and development exclusively on our properties in Peru.

On October 21, 2009, we completed a reincorporation merger from the State of Nevada to the State of Delaware.

On February 24, 2011, we filed a Certificate of Ownership and Merger with the Secretary of State of Delaware to effectuate a merger whereby we merged with our wholly-owned subsidiary, Goldsands Development Company, through a parent/subsidiary merger, with us as the surviving corporation. This merger, which became effective at 11:59 p.m. on March 31, 2011 (the “Effective Time”) is pursuant to Section 253 of the General Corporation Law of Delaware. Shareholder approval for this merger was not required under Section 253 of the General Corporation Law of Delaware. Upon the Effective Time of this merger, our name changed to “Goldsands Development Company”. We decided to change our corporate name in order to reflect management’s decision during the first quarter of 2011 to expand our business plan in order to pursue opportunities to consult on development projects in the same approximate geographical area as our property interest in Peru. As a result of our operations in Peru, we have gained significant experience and knowledge as to the local processes and procedures involved in the planning of development projects in Peru and we intend to leverage and market this expertise to other companies seeking to engage in development projects in Peru. It is our belief that changing our corporate name will minimize public perception in marketing this expertise that we are strictly a company engaged in mineral exploration.

Our common stock is quoted on the OTC Bulletin Board under the symbol “GSDC.” We conduct our business from Calle Juan Fanning 219, Miraflores, Lima, Peru. Our telephone number is +54-1-446-6807.

Exploration Stage Company

We are considered an exploration or exploratory stage company because we are involved in the examination and investigation of land that we believe may contain valuable minerals, for the purpose of discovering the presence of ore, if any, and its extent. There is no assurance that a commercially viable mineral deposit exists on any of the properties underlying our mineral property interests and a great deal of further exploration will be required before a final evaluation as to the economic and legal feasibility for our future exploration is determined. We have no known reserves of any type of mineral. For this reason, the proposed plan of exploration described below is exploratory in nature. To date, we have not discovered an economically viable mineral deposit on any of the properties underlying our mineral property interests, and there is no assurance that we will ever discover one. If we cannot acquire or locate mineral deposits, or if it is not economical to recover any mineral deposits that we do find, our business and operations will be materially and adversely affected and we may have to cease operations.

Previous Surplus Strategy

We previously disclosed that our business plan was to invest any surplus operating capital resulting from retained earnings into bullion accounts as opposed to holding retained earnings, if any, in cash or cash equivalents. Bullion accounts operate like traditional banking accounts with the exception that bullion account balances represent the ounces of gold and/or silver owned by the account holder instead of representing dollars or other national currencies. Bullion account holders may buy, hold or sell any amount of bullion from their account at any time, and may also take physical possession of some or all of their bullion. We have reconsidered this plan and have decided to no longer pursue this strategy due to recent significant fluctuations in the prices of precious metals which are completely unpredictable. In the event that commercially exploitable reserves of minerals exist on any of our property interests and we are able to make a profit, our business plan is to sell enough mineral reserves to satisfy all of our expenses and retain all earnings in cash or cash equivalents for use in financing our future operations.

Summary of our Mineral Property Interests

A description of each of our options to acquire the mineral and mining rights underlying properties located in Peru and the conditions that we must meet to exercise these options is set forth in Item 2 of this annual report.

Effect of Governmental Regulation on Our Business

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in Peru. The discussion that follows is a summary of the most significant government regulations which we anticipate will impact our operations.

Peru is located on the western coast of South America and has a population of approximately 28 million people. It covers a geographic area of approximately 1.3 million square kilometers and is bordered by Bolivia, Brazil, Chile, Colombia and Ecuador. Lima is the capital of Peru and its principal city with a population of approximately 7 million people.

Peru has become a leading country for mining activities. No special taxes or registration requirements are imposed on foreign-owned companies and foreign investment is treated as equal to domestic capital. Peruvian law allows for full repatriation of capital and profits and the country’s mining legislation provides access to mining concessions under an efficient registration system.

Peruvian Mining Law

According to the Peruvian Mining Act, the right to explore and/or exploit minerals is granted by the government by way of concessions. Under Peruvian regulations a mining concession is a property right, independent from the ownership of surface land on which it is located. There are no restrictions or special requirements applicable to foreign companies or individuals regarding the holding of mining concessions in Peru unless the concessions are within 50 kilometers of Peru's borders. The rights granted by a mining concession can be transferred, or sold and, in general, may be the subject of any transaction or contract. Mining concessions may be privately owned and no state participation is required.

The application for a mining concession involves the filing of certain documents before the mining administrative authority. The mining concession boundaries are specified in the application documents, with no requirement to mark the concession boundaries in the field since the boundaries are fixed by UTM coordinates. In order to conduct exploration or mining activities, the holder of a mining concession must purchase the surface land required for the project or reach an agreement with the owner for its temporary use. If any of this is not possible, a legal easement may be requested from the mining authorities, although these easements have been rarely granted.

Mining concessions are irrevocable as long as their holders pay an annual fee of US $3 per hectare and reach minimum production levels within the terms set forth by law or otherwise pay penalties, as applicable. Non-compliance with any of these mining obligations for two consecutive years will result in the cancellation of the mining concession.

Pursuant to the original legal framework in force since 1992, holders of mining concessions are obliged to achieve a minimum production of US $100 per hectare per year within six years following the year in which the respective mining concession title is granted. If this minimum production is not reached, as of the first six months of the seventh year, the holder of the concession shall pay a US $6 penalty per hectare per year until such production is reached and penalties increase to US $20 in the twelfth year. Likewise, it is possible to avoid payment of the penalty if evidence is submitted to the mining authorities that an amount ten times the applicable penalty or more had been invested.

However, this regime has been recently and partially amended providing for, among other matters, increased minimum production levels, new terms for obtaining such minimum production, increased penalties in case such minimum production is not reached, and even the cancellation of mining concessions if minimum production is not reached within certain terms. Pursuant to this new regime, the holder of the mining concession should achieve a minimum production of at least one tax unit (S/. 3,600.00 approximately US$ 1,309) per hectare per year, within a ten-year term following the year in which the mining concession title is granted. If such minimum production is not reached within the referred term, the holder of the concession shall pay penalties equivalent to 10% of the tax unit.

If the minimum production is not reached within a fifteen-year term following the granting of the concession title, the mining concession shall be cancelled by the mining authority, unless (i) a qualified force majeure event is evidenced to and approved by the mining authority, or (ii) by paying the applicable penalties and concurrently evidencing minimum investments of at least ten times the amount of the applicable penalties; in which cases the concession may not be cancelled up to a maximum term of five additional years. If minimum production is not reached within a twenty-year term following the granting of the concession title, the concession shall inevitably be cancelled.

This amended regime is currently applicable to all new mining concessions granted since October 11, 2008. Regarding those mining concessions existing prior to such date, the new term for obtaining the increased minimum production level or otherwise being required to pay the increased penalties pursuant to the amended regime shall be counted as from the first business day of 2009. Nevertheless, until such new term for obtaining the increased minimum production level does not expire, the minimum production level, the term for obtaining such minimum production, the amount of the penalties and the causes for cancellation of the mining concessions shall continue to be those provided in the original legal framework existing since 1992.

The amended regime shall not be applicable to those concessions handed by the Peruvian State through private investment promotion procedures, which shall maintain the production and investment obligations contained in their respective agreements, or to titleholders of concessions with mining stability agreements in force.

Environmental Laws

The Peruvian Ministry of Energy and Mines (“MEM”) regulates environmental affairs in the mining sector, including establishing an environmental protection regulations while the Environmental Assessment and Supervisory Bureau (“OEFA”), which forms part of the Ministry of the Environment, is in charge of supervising compliance with, and sanctioning any violation of, environmental regulations.

Each stage of exploration or mining requires some type of authorization or permit, beginning with an application for an environmental permit for initial exploration and continuing with an Environmental Impact Assessment (“EIA”) for mining, which includes public hearings.

For permitting purposes, exploration activities in Peru are classified in two categories:

|

·

|

Category I projects: Mining exploration activities that comprise any of the following: (i) a maximum of twenty drilling platforms; (ii) a disturbed area of less than ten hectares considering drilling platforms, trenches, auxiliary facilities and access means; and, (iii) the construction of tunnels with a total maximum length of fifty meters. Holders of these projects must submit an Environmental Impact Statement (“EIS”) before the MEM, which in principle, is subject to automatic approval upon its filing, and subject to subsequent (ex post) review by the latter. Nevertheless, in any of the following cases, the project shall not be subject to automatic approval and shall necessarily obtain an express prior approval by MEM, which should be granted, in principle, within a term of two months since filing the EIS: (i) the project is located in a protected natural area or its buffer zone; (ii) the project is oriented to determining the existence of radioactive minerals; (iii) the platforms, drill holes, trenches, tunnels or other components would be located within certain specially environmental sensitive areas specified in the applicable regulations (e.g., glaciers, springs, water wells, groundwater wells, protection lands, primary woods, etc.); (iv) the project covers areas where mining environmental contingencies or non-environmental rehabilitated previous mining works, already exist.

|

|

·

|

Category II projects: Mining exploration activities that comprise any of the following: (i) more than twenty drilling platforms; (ii) a disturbed area of more than 10 hectares considering drilling plants, trenches, auxiliary facilities and access means; and, (iii) the construction of tunnels over a total length of fifty meters.

|

Before initiating construction or exploitation activities and before the expansion of existing operations, an EIA approval should be obtained. This process of authorization involves public hearings in the place where the project is located and, in general, should conclude within a term of 120 calendar days, although such process can require between eight months and one year.

Holders of mining activities performing mining exploration are required to conduct remediation works of disturbed areas, as part of the progressive closure of the project. Likewise, they are required to undertake the final closure and post closure actions as set forth in the terms and conditions in the approved environmental instrument.

If the holder carries out mining exploration activities involving the removal of more than 10,000 tonnes of material, or more than 1,000 tonnes of material with a potential neutralization (“PN”) over potential acidity (“PA”) relation lower than 3 (PN/PA<3), then they shall be required to file a Mine Closure Plan along with the corresponding environmental instrument, as well as to establish a financial guarantee to secure compliance with such Mine Closure Plan.

Holders of mining exploitation activities must file a Mine Closure Plan with before the MEM within one year of the approval of their EIA. The Mine Closure Plan must be implemented from the beginning of the mining operation. Semi-annual reports must be filed evidencing compliance with the Mine Closure Plan. An environmental guarantee covering the Mine Closure Plan 's estimated costs is also required to be granted.

Mining Royalties

Peruvian law requires that concession holders pay a mining royalty as consideration for the extraction of mineral resources. The mining royalty is payable monthly on a variable cumulative rate of 1% to 3% of the value of the ore concentrate or equivalent, calculated in accordance with price quotations in international markets, subject to certain deductions such as indirect taxes, insurance, freight and other specified expenses. The mining royalty payable is determined based on the following schedule: (i) under US $60 million of annual sales of concentrates: 1% royalty; (ii) in excess of US $60 million and up to US $120 million of annual sales: 2% royalty; and (iii) in excess of US $120 million of annual sales: 3% royalty.

Competition

We are an exploration stage mineral resource exploration company that competes with other mineral resource exploration companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact on our ability to achieve the financing necessary for us to conduct further exploration of our mineral properties. We will also compete with other mineral exploration companies for financing from a limited number of investors that are prepared to make investments in mineral exploration companies. The presence of competing mineral exploration companies may impact on our ability to raise additional capital in order to fund our exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors. We will also be compete with other mineral companies for available resources, including, but not limited to, professional geologists, camp staff, mineral exploration supplies and drill rigs.

Intellectual Property

We do not own, either legally or beneficially, any patent or trademark.

Employees

We have no full-time employees at the present time. Our executive officers do not devote their services full time to our operations. We engage contractors from time to time to consult with us on specific corporate affairs or to perform specific tasks in connection with our exploration programs. As of December 31, 2010, we engaged approximately 21 contractors that provided work to us on a recurring basis.

Research and Development Expenditures

We have not incurred any research or development expenditures since our incorporation.

Subsidiaries

Constitution Mining Argentina SA is a subsidiary entity which was registered with the General Inspection of Corporations in Argentina on March 4, 2008 that is in the process of being dissolved because of our decision to not pursue opportunities within Argentina.

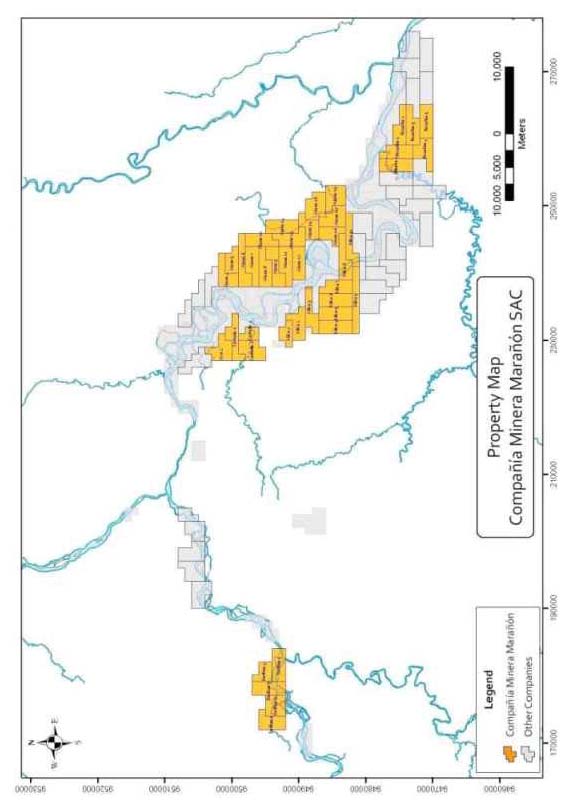

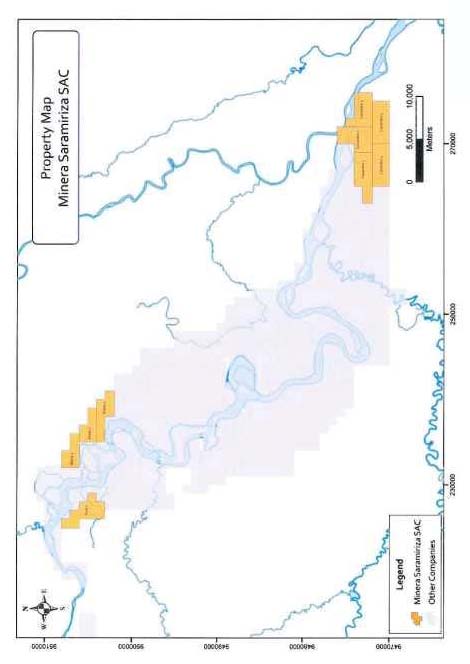

We own a 100% interest in the issued and outstanding stock of Bacon Hill Invest Inc. (“Bacon Hill”), a corporation incorporated under the laws of Panama. Bacon Hill indirectly owns the mineral and mineral rights to certain properties located in Peru held by its subsidiary, Compañía Minera Marañón S.A.C.

You should carefully consider the following risk factors in evaluating our business and us. The factors listed below represent certain important factors that we believe could cause our business results to differ. These factors are not intended to represent a complete list of the general or specific risks that may affect us. It should be recognized that other risks may be significant, presently or in the future, and the risks set forth below may affect us to a greater extent than indicated. If any of the following risks occur, our business, financial condition or results of operations could be materially and adversely affected. You should also consider the other information included in this annual report and subsequent quarterly reports filed with the SEC.

Risk Factors

Risks Associated With Our Business

Our accountants have raised substantial doubt with respect to our ability to continue as a going concern.

As noted in our consolidated financial statements, we have incurred a net loss of $43,877,689 for the period from inception on March 6, 2000 to December 31, 2010 and we have no present source of revenue. At December 31, 2010, we had a working capital deficiency of $3,165,504. As of December 31, 2010, we had cash and cash equivalents in the amount of US $4,181. We will have to raise additional funds to meet our currently budgeted operating requirements for the next twelve months. No assurance can be given that sources of debt or equity financing will be available to the Company to fund these operating requirements.

The audit report of James Stafford, Inc., Chartered Accountants, for the fiscal year ended December 31, 2010 and 2009 contained a paragraph that emphasizes the substantial doubt as to our continuance as a going concern. This is a significant risk that we may not be able to generate and/or raise enough resources to remain operational for an indefinite period of time.

A pending SEC investigation may subject us to significant costs and could divert management’s attention.

On March 30, 2011, we received a copy of a formal order of investigation issued by the United States Securities and Exchange Commission (“SEC”) regarding possible violations of the securities laws including securities registration requirements, financial reporting and/or market manipulation believed to have been committed by us, our officers, directors, employees, partners, subsidiaries, affiliates and/or other persons. We received a subpoena requesting the delivery of certain documents to the SEC. We have been cooperating fully, and intend to continue to cooperate fully, with the SEC in regards to this investigation. At this time, it is not possible to predict the outcome of the investigation or its impact on us. In the event the SEC investigation leads to action against any of our current or former directors or officers, or the Company itself, the trading price of our common stock may be adversely impacted. In addition, the SEC investigation may result in the incurrence of significant legal expense, both directly and as the result of any indemnification obligations. This investigation may also divert management’s attention from our operations or limit our ability to obtain financing to fund our on-going operating requirements, which could cause our business to suffer. If we are subject to any adverse findings, we could be required to pay damages or penalties or have other remedies imposed on us which could have a material adverse effect on our business. We have no insurance coverage to cover any portion of our defense cost or any amounts that we may be required to pay in connection with the resolution of this investigation.

In preparing our consolidated financial statements for fiscal 2010, our management identified material weaknesses in our internal control over financial reporting, and our failure to remedy these or other material weaknesses could result in material misstatements in our consolidated financial statements and the loss of investor confidence in our reported financial information.

Our management is responsible for establishing and maintaining adequate internal control over our financial reporting, as defined in Rule 13a-15(f) under the Exchange Act. Our management identified material weaknesses in our internal control over financial reporting as of December 31, 2010. A material weakness is defined as a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim consolidated financial statements will not be prevented or detected on a timely basis.

The material weaknesses identified by management as of December 31, 2010 consisted of ineffective controls over the period-end financial close and reporting process and oversight and monitoring of certain international locations as of December 31, 2010 and lack of resources to manage the financial close process. As a result of these material weaknesses, our management concluded that as of December 31, 2010, our internal control over financial reporting was not effective based on criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission in Internal Control—An Integrated Framework.

As a result of management’s assessment of internal control over financial reporting, our Chief Executive Officer and Chief Financial Officer have concluded that our disclosure controls and procedures were not effective to ensure that the information required to be disclosed by us in the reports that we file or submit under the Exchange Act was recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms and that such information required to be disclosed is accumulated and communicated to management, including our Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosure.

We are in the process of considering the appropriate remedial measures to be taken to address these material weaknesses. We cannot be certain that the measures we take will be effective or will ensure that restatements will not occur in the future. If remedial measures are insufficient to address these material weaknesses, or if additional material weaknesses or significant deficiencies in our internal control are discovered or occur in the future, our consolidated financial statements may contain material misstatements and we could be required to restate our financial results. Any future restatement of consolidated financial statements could place a significant strain on our internal resources and harm our operating results. Further, any additional or unremedied material weakness may preclude us from meeting our reporting obligations on a timely basis. As a result of our inability to timely file our annual report on Form 10-K for the year ended December 31, 2010, we were not in compliance with SEC reporting requirements.

Any failure to address the identified material weaknesses or any additional material weaknesses in our internal control could also adversely affect the results of the periodic management evaluations regarding the effectiveness of our internal control over financial reporting that are required to be included in our annual reports on Form 10-K. Internal control deficiencies could also cause investors to lose confidence in our reported financial information. We can give no assurance that the measures we may take in the future will remediate the material weaknesses identified or that any additional material weaknesses or restatements of financial results will not arise in the future due to a failure to implement and maintain adequate internal control over financial reporting or circumvention of these controls. In addition, even if we are successful in strengthening our controls and procedures, in the future those controls and procedures may not be adequate to prevent or identify irregularities or errors or to facilitate the fair presentation of our consolidated financial statements.

We own the options to acquire the mining and mineral rights underlying certain properties and if we fail to perform the obligations necessary to exercise these options we will lose our options and may cease operations.

We hold options to acquire the mineral and mining rights underlying properties located in northeastern Peru, subject to certain conditions. If we fail to meet the requirements of the agreement under which we acquired such options, including any payments and/or any exploration obligations that we have regarding these properties, we may lose our right to exercise the options to acquire the mineral and mining rights underlying these properties. If we do not fulfill these conditions, then our ability to commence or continue operations could be materially limited. In addition, substantially all of our assets will be put into commercializing our rights to the areas covered by these options. Accordingly, any adverse circumstances that affect the areas covered by these option agreements and our rights thereto would affect us and your entire investment in shares of our common stock. If any of these situations were to arise, we would need to consider alternatives, both in terms of our prospective operations and for the financing of our activities. Management cannot provide assurance that we will ultimately achieve profitable operations or become cash-flow positive, or raise additional debt and/or equity capital. If we are unable to raise additional capital in the near future, we will experience liquidity problems and management expects that we will need to curtail operations, liquidate assets, seek additional capital on less favorable terms and/or pursue other remedial measures, including ceasing operations.

We have a limited operating history and have incurred losses that we expect to continue into the future.

We have not yet located any mineral reserve, nor are there any proven reserves on any of the properties for which we hold options, and we have never had any revenues from our operations. In addition, we have a very limited operating history upon which an evaluation of our future success or failure can be made. We have only recently taken steps in a plan to engage in the acquisition of interests in exploration and development properties, and it is too early to determine whether such steps will prove successful. Our business plan is in its early stages and faces numerous regulatory, practical, legal and other obstacles. At this early stage of our operation, we also expect to face the risks, uncertainties, expenses and difficulties frequently encountered by companies at the start-up stage of their business development. We cannot be sure that we will be successful in addressing these risks and uncertainties, and our failure to do so could have a materially adverse effect on our financial condition.

No assurances can be given that we will be able to successfully complete the purchase of mining rights to any properties, including the ones for which we currently hold options. Our ability to achieve and maintain profitability and positive cash flow over time will be dependent upon, among other things, our ability to (i) identify and acquire properties or interests therein that ultimately have probable or proven mineral reserves, (ii) sell such mining properties or interests to strategic partners or third parties or commence the production of a mineral deposit, (iii) produce and sell minerals at profitable margins and (iv) raise the necessary capital to operate during this possible extended period of time. At this stage in our development, it cannot be predicted how much financing will be required to accomplish these objectives.

We do not have enough money to complete our exploration and consequently may have to cease or suspend our operations unless we are able to raise additional financing.

We presently do not have sufficient capital to exercise our options to acquire the mineral and mining rights underlying property located in northeastern Peru and complete our planned exploration programs on our property interests. No assurance can be given that sources of financing are available to complete the acquisition of these property interests. Other forms of financing, if available, may be on terms that are unfavorable to our stockholders.

As we cannot assure a lender that we will be able to successfully explore and develop our mineral properties, we may find it difficult to raise debt financing from traditional lending sources. We have traditionally raised our operating capital from sales of equity and debt securities, but there can be no assurance that we will continue to be able to do so. If we cannot raise the money that we need to continue exploration of our mineral properties, we may be forced to delay, scale back, or eliminate our exploration activities. If any of these were to occur, there is a substantial risk that our business would fail.

In order to raise any financing from the sale of equity securities, we need to increase our authorized capital stock.

We are presently authorized to issue 300,000,000 shares of common stock, of which approximately 187,517,618 shares were issued and outstanding as of May 12, 2011 and approximately all of our remaining unissued shares are reserved for issuance to cover issuance obligations and the potential exercise of outstanding options, warrants and conversion of notes. We presently do not have sufficient available authorized capital to make securing additional financing from the sale of our common stock a viable option. We intend to submit a proposal to our shareholders to amend our Certificate of Incorporation for the purpose of increasing the authorized shares of our common stock, but have not done so yet and can provide no assurance that such proposal would be supported by our shareholders. Accordingly, we may not have sufficient authorized capital available to raise the funds necessary to execute our business plan beyond the short term.

We have no known reserves and we may not find any mineral reserves or, if we find mineral reserves, the deposits may be uneconomic or production from those deposits may not be profitable.

Our due diligence activities have been limited, and to a great extent, have relied upon information provided to us by third parties. We have not established that any of the properties for which we own or hold options contain adequate amounts of gold or other mineral reserves to make mining any of the properties economically feasible to recover that gold or other mineral reserves, or to make a profit in doing so. If we do not, our business will fail. If we cannot find economic mineral resources or if it is not economic to recover the mineral resources, we will have to cease operations.

We may not have access to all of the supplies and materials we need to begin exploration that could cause us to delay or suspend operations.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, such as explosives, and certain equipment, such as bulldozers and excavators, that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. We will attempt to locate products, equipment and materials. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

Our success is dependent upon a limited number of people.

The ability to identify, negotiate and consummate transactions that will benefit us is dependent upon the efforts of our management team. The loss of the services of any member of our management could have a material adverse effect on us.

Our business will be harmed if we are unable to manage growth.

Our business may experience periods of rapid growth that will place significant demands on our managerial, operational and financial resources. In order to manage this possible growth, we must continue to improve and expand our management, operational and financial systems and controls, particularly those related to subsidiaries that will be doing business in Peru. We will need to expand, train and manage our employee base and/or retain qualified contractors. We must carefully manage our mining exploration activities. No assurances can be given that we will be able to timely and effectively meet such demands.

We may not be able to attract and retain qualified personnel necessary for the implementation of our business strategy and mineral exploration programs.

Our future success depends largely upon the continued service of board members, executive officers and other key personnel. Our success also depends on our ability to continue to attract, retain and motivate qualified personnel, particularly employees, consultants and contractors for our operations in Peru. Personnel represents a significant asset, and the competition for such personnel is intense in the mineral exploration industry. We may have particular difficulty attracting and retaining key personnel in the initial phases of our operations, particularly in Peru.

Our officers and directors do not devote full time to the our operations.

Our officers do not devote full time to our operations. Until such time that we can afford executive compensation commensurate with that being paid in the marketplace, our officers will not devote their full time and attention to our operations. No assurances can be given as to when we will be financially able to engage our officers on a full-time basis.

As some of our officers and directors are located outside of the United States, you may have no effective recourse against our us or our management for misconduct and may not be able to enforce judgment and civil liabilities against our officers, directors, experts and agents.

Some of our directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof.

Indemnification of officers and directors.

Our Certificate of Incorporation and Bylaws contain broad indemnification and liability limiting provisions regarding our officers, directors and employees, including the limitation of liability for certain violations of fiduciary duties. Our stockholders therefore will have only limited recourse against the individuals.

Risks Associated With Mining

All of our properties are in the exploration stage. There is no assurance that we can establish the existence of any mineral reserve on any of our properties in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from operations and if we do not do so we will lose all of the funds that we expend on exploration. If we do not discover any mineral resource in a commercially exploitable quantity, our business will fail.

We have not established that any of our properties contain any commercially exploitable mineral reserve, nor can there be any assurance that we will be able to do so. If we do not, our business will fail. A mineral reserve is defined by the SEC in its Industry Guide 7 (which can be viewed over the Internet at http://www.sec.gov/divisions/corpfin/forms/industry.htm#secguide7) as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. The probability of an individual prospect ever having a “reserve” that meets the requirements of the SEC’s Industry Guide 7 is extremely remote; in all probability, our mineral resource property does not contain any ‘reserve’ and any funds that we spend on exploration will probably be lost.

Even if we do eventually discover a mineral reserve on one or more of our properties, there can be no assurance that we will be able to develop our properties into producing mines and extract those reserves. Both mineral exploration and development involve a high degree of risk and few properties that are explored are ultimately developed into producing mines. If we do discover mineral reserves in commercially exploitable quantities on any of our properties, we will be required to expend substantial sums of money to establish the extent of the reserve, develop processes to extract it and develop extraction and processing facilities and infrastructure.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the reserve to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral deposit unprofitable.

Mineral operations are subject to applicable law and government regulation. Even if we discover a mineral reserve in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of that mineral deposit. If we cannot exploit any mineral deposit that we might discover on our properties, our business may fail.

Both mineral exploration and extraction require permits from various foreign, federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration of our mineral properties or for the construction and operation of a mine on our properties at economically viable costs. If we cannot accomplish these objectives, our business could fail.

We believe that we are in compliance with all material laws and regulations that currently apply to our activities, but there can be no assurance that we can continue to do so. Current laws and regulations could be amended and we might not be able to comply with them, as amended. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our mineral properties.

If we establish the existence of a mineral reserve on any of our properties, we will require additional capital in order to develop the property into a producing mine. If we cannot raise this additional capital, we will not be able to exploit the reserve and our business could fail.

If we do discover a mineral reserve on any of our properties, we will be required to expend substantial sums of money to establish the extent of the reserve, develop processes to extract it and develop extraction and processing facilities and infrastructure. Although we may derive substantial benefits from the discovery of a reserve, there can be no assurance that it will be large enough to justify commercial operations, nor can there be any assurance that we will be able to raise the funds required for development on a timely basis. If we cannot raise the necessary capital or complete the necessary facilities and infrastructure, our business may fail.

Because our property interest and exploration activities in Peru are subject to political, economic and other uncertainties, situations may arise that could have a significantly adverse material impact on us.

Our activities in Peru are subject to political, economic and other uncertainties, including the risk of expropriation, nationalization, renegotiation or nullification of existing contracts, mining licenses and permits or other agreements, changes in laws or taxation policies, currency exchange restrictions, changing political conditions and international monetary fluctuations. Future government actions concerning the economy, taxation, or the operation and regulation of nationally important facilities such as mines could have a significant effect on our plans and on our ability to operate. No assurances can be given that our plans and operations will not be adversely affected by future developments in those jurisdictions where we hold property interests.

Because we presently do not carry title insurance and do not plan to secure any in the future, we are vulnerable to loss of title.

We do not maintain insurance against title. Title on mineral properties and mining rights involves certain inherent risks due to the difficulties of determining the validity of certain claims as well as the potential for problems arising from the frequently ambiguous conveyance history characteristic of many mining properties. Disputes over land ownership are common, especially in the context of resource developments. We cannot give any assurance that title to such properties will not be challenged or impugned and cannot be certain that we will have or acquire valid title to these mining properties. The possibility also exists that title to existing properties or future prospective properties may be lost due to an omission in the claim of title. As a result, any claims against us may result in liabilities we will not be able to afford, resulting in the failure of our business.

Because we are subject to various governmental regulations and environmental risks, we may incur substantial costs to remain in compliance.

Our activities in Peru are subject to Peruvian and local laws and regulations regarding environmental matters, the abstraction of water, and the discharge of mining wastes and materials. Any significant mining operations will have some environmental impact, including land and habitat impact, arising from the use of land for mining and related activities, and certain impact on water resources near the project sites, resulting from water use, rock disposal and drainage run-off. No assurances can be given that such environmental issues will not cause our operations in the future to fail.

The Peruvian and/or local government in the jurisdictions where we currently hold property interests could require us to remedy any negative environmental impact. The costs of such remediation could cause us to fail. Future environmental laws and regulations could impose increased capital or operating costs on us and could restrict the development or operation of any mines.

We have, and will in the future, engage consultants to assist us with respect to our operations in Peru. We are beginning to address the various regulatory and governmental agencies, and the rules and regulations of such agencies, in connection with the options for the properties in Peru. No assurances can be given that we will be successful in our efforts. Further, in order for us to operate and grow our business in Peru, we need to continually conform to the laws, rules and regulations of such country and local jurisdiction where we operate. It is possible that the legal and regulatory environment pertaining to the exploration and development of mining properties will change. Uncertainty and new regulations and rules could dramatically increase our cost of doing business, or prevent us from conducting our business; both situations could cause us to fail.

Mineral exploration and development is subject to extraordinary operating risks. We do not currently insure against these risks. In the event of a cave-in or similar occurrence, our liabilities may exceed our resources, which could cause our business to fail.

Mineral exploration, development and production involves many risks which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Our operations will be subject to all the hazards and risks inherent in the exploration, development and production of reserves, including liability for pollution, cave-ins or similar hazards against which we cannot insure or against which we may elect not to insure. Any such event could result in work stoppages and damage to property, including damage to the environment. We do not currently maintain any insurance coverage against these operating hazards. The payment of any liabilities that arise from any such occurrence could cause us to fail.

Mineral prices are subject to dramatic and unpredictable fluctuations.

We expect to derive revenues, if any, from the extraction and sale of precious and base metals such as gold and silver. The price of those commodities has fluctuated widely in recent years, and is affected by numerous factors beyond our control including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors on the price of base and precious metals, and, therefore, the economic viability of any of our exploration projects, cannot accurately be predicted.

The mining industry is highly competitive and there is no assurance that we will continue to be successful in acquiring property interests. If we cannot continue to acquire interests in properties to explore for mineral reserves, we may be required to reduce or cease operations.

The mineral exploration, development, and production industry is largely unintegrated. We compete with other exploration companies looking for mineral resource properties. While we compete with other exploration companies in the effort to locate and license mineral resource properties, we will not compete with them for the removal or sales of mineral products from our properties if we should eventually discover the presence of them in quantities sufficient to make production economically feasible. Readily available markets exist worldwide for the sale of gold and other mineral products. Therefore, we will likely be able to sell any gold or mineral products that we identify and produce.

We compete with many companies possessing greater financial resources and technical facilities. This competition could adversely affect our ability to acquire suitable prospects for exploration in the future as well as our ability to recruit and retain qualified personnel. Accordingly, there can be no assurance that we will acquire any interest in additional mineral resource properties that might yield reserves or result in commercial mining operations.

Risks Associated With Our Common Stock

Trading on the over-the-counter bulletin board may be volatile and sporadic, which could depress the market price of our common stock and make it difficult for our stockholders to resell their shares.

Our common stock is quoted on the over-the-counter bulletin board service of the Financial Industry Regulatory Authority (the “OTCBB”). Trading in stock quoted on the OTCBB is often thin and characterized by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects. This volatility could depress the market price of our common stock for reasons unrelated to operating performance. Moreover, the OTCBB is not a stock exchange, and trading of securities on the OTCBB is often more sporadic than the trading of securities listed on a quotation system like Nasdaq or a stock exchange like Amex. These factors may result in investors having difficulty reselling any shares of our common stock.

Because our common stock is quoted and traded on the OTCBB, short selling could increase the volatility of our stock price.

Short selling occurs when a person sells shares of stock which the person does not yet own and promises to buy stock in the future to cover the sale. The general objective of the person selling the shares short is to make a profit by buying the shares later, at a lower price, to cover the sale. Significant amounts of short selling, or the perception that a significant amount of short sales could occur, could depress the market price of our common stock. In contrast, purchases to cover a short position may have the effect of preventing or retarding a decline in the market price of our common stock, and together with the imposition of the penalty bid, may stabilize, maintain or otherwise affect the market price of our common stock. As a result, the price of our common stock may be higher than the price that otherwise might exist in the open market. If these activities are commenced, they may be discontinued at any time. These transactions may be effected on the OTCBB or any other available markets or exchanges. Such short selling if it were to occur could impact the value of our stock in an extreme and volatile manner to the detriment of our shareholders.

Our stock price is likely to be highly volatile because of several factors, including a limited public float.

The market price of our common stock is likely to be highly volatile because there has been a relatively thin trading market for our stock, which causes trades of small blocks of stock to have a significant impact on our stock price. You may not be able to resell shares of our common stock following periods of volatility because of the market’s adverse reaction to volatility.

Other factors that could cause such volatility may include, among other things:

|

·

|

potential or pending investigations, proceedings or litigation that involves or affects us;

|

|

·

|

risk that we will not be able to remediate identified material weaknesses in our internal control over financial reporting and disclosure controls and procedures;

|

|

·

|

risks related to failure to obtain adequate financing on a timely basis and on acceptable terms for our planned exploration and development projects;

|

|

·

|

actual or anticipated fluctuations in our operating results;

|

|

·

|

the absence of securities analysts covering us and distributing research and recommendations about us;

|

|

·

|

we expect our actual operating results to continue to fluctuate;

|

|

·

|

we may have a low trading volume for a number of reasons, including that a large amount of our stock is closely held;

|

|

·

|

overall stock market fluctuations;

|

|

·

|

economic conditions generally and in the mining industries in particular;

|

|

·

|

announcements concerning our business or those of our competitors or vendors;

|

|

·

|

our ability to raise capital when we require it, and to raise such capital on favorable terms;

|

|

·

|

changes in financial estimates by securities analysts or our failure to perform as anticipated by the analysts;

|

|

·

|

conditions or trends in the industry;

|

|

·

|

litigation;

|

|

·

|

changes in market valuations of other similar companies;

|

|

·

|

announcements by us or our competitors of significant contracts, acquisitions, strategic partnerships or joint ventures;

|

|

·

|

future sales of common stock;

|

|

·

|

actions initiated by the SEC or other regulatory bodies;

|

|

·

|

existence or lack of patents or proprietary rights;

|

|

·

|

departure of key personnel or failure to hire key personnel; and

|

|

·

|

general market conditions.

|

Any of these factors could have a significant and adverse impact on the market price of our common stock. In addition, the stock market in general has at times experienced extreme volatility and rapid decline that has often been unrelated or disproportionate to the operating performance of particular companies. These broad market fluctuations may adversely affect the trading price of our common stock, regardless of our actual operating performance.

Because the SEC imposes additional sales practice requirements on brokers who deal in our shares that are penny stocks, some brokers may be unwilling to trade them. This means that you may have difficulty in reselling your shares and may cause the price of the shares to decline.

Our stock is a penny stock. The SEC has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations and the broker-dealer and salesperson compensation information must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in, and limit the marketability of, our common stock.

In addition to the “penny stock” rules promulgated by the SEC, Financial Industry Regulatory Authority (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative, low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock.

ITEM 1B.Unresolved Staff Comments.

None.

ITEM 2. Properties.

Description of our Mineral Property Interests

The Peru Property

Our property interests located in Peru are in the exploration stage and we refer to these properties as the "Peru Property." These properties are without known reserves and the proposed plan of exploration detailed below is exploratory in nature. These properties are described below.

We entered into a Mineral Right Option Agreement with Temasek Investments Inc. (“Temasek”), a company incorporated under the laws of Panama, on September 29, 2008 (the “Effective Date”), as amended and supplemented by Amendment No. 1, dated May 12, 2009 (“Amendment No. 1”), Amendment No. 2, dated October 29, 2009 (“Amendment No. 2”), and Amendment No. 3, dated April 8, 2010 (“Amendment No. 3” and collectively, the “Option Agreement”), in order to acquire four separate options from Temasek, each providing for the acquisition of a twenty-five percent interest in certain mineral rights (the “Mineral Rights”) in certain properties in Peru, that after each of the options were exercised would result in our acquisition of an aggregate one hundred percent of the Mineral Rights.

A description of the Mineral Rights is set forth below:

|

Name

|

Area

(hectares)

|

Dept.

|

Province

|

District

|

Observation

|

|

Aixa 2

|

1000

|

Loreto

|

Datem del Marañon

|

Manseriche

|

|

|

Alana 10

|

900

|

Loreto

|

Datem del Marañon

|

Manseriche

|

Fully overlap Zona de Amortiguamiento ANP

|

|

Alana 11

|

1000

|

Loreto

|

Datem del Marañon

|

Manseriche

|

Fully overlap Zona de Amortiguamiento ANP

|

|

Alana 12

|

1000

|

Loreto

|

Datem del Marañon

|

Manseriche

|

Fully overlap Zona de Amortiguamiento ANP

|

|

Alana 13

|

1000

|

Loreto

|

Datem del Marañon

|

Manseriche

|

Fully overlap Zona de Amortiguamiento ANP

|

|

Alana 14

|

1000

|

Loreto

|

Datem del Marañon

|

Manseriche

|

Fully overlap Zona de Amortiguamiento ANP

|

|

Alana 15

|

800

|

Loreto

|

Datem del Marañon

|

Manseriche

|

Fully overlap Zona de Amortiguamiento ANP

|

|

Alana 16

|

800

|

Loreto

|

Datem del Marañon

|

Manseriche

|

Fully overlap Zona de Amortiguamiento ANP

|

|

Alana 17

|

1000

|

Loreto

|

Datem del Marañon

|

Manseriche

|

Fully overlap Zona de Amortiguamiento ANP

|

|

Alana 18

|

1000

|

Loreto

|

Datem del Marañon

|

Manseriche

|

Fully overlap Zona de Amortiguamiento ANP

|

|

Alana 19

|

1000

|

Loreto

|

Datem del Marañon

|

Manseriche

|

Fully overlap Zona de Amortiguamiento ANP

|

|

Alana 4

|

900

|

Loreto

|

Datem del Marañon

|

Manseriche

|

Fully overlap Zona de Amortiguamiento ANP

|

|

Alana 5

|

700

|

Loreto

|

Datem del Marañon

|

Manseriche

|

Fully overlap Zona de Amortiguamiento ANP

|

|

Alana 6

|

1000

|

Loreto

|

Datem del Marañon

|

Manseriche

|

Fully overlap Zona de Amortiguamiento ANP

|

|

Alana 7

|

1000

|

Loreto

|

Datem del Marañon

|

Manseriche

|

Fully overlap Zona de Amortiguamiento ANP

|

|

Alana 8

|

1000

|

Loreto

|

Datem del Marañon

|

Manseriche

|

Fully overlap Zona de Amortiguamiento ANP

|

|

Alana 9

|

1000

|

Loreto

|

Datem del Marañon

|

Manseriche

|

Fully overlap Zona de Amortiguamiento ANP

|

|

Bianka 5

|

1000

|

Loreto

|

Datem del Marañon

|

Manseriche

|

|

|

Castalia 1

|

1000

|

Loreto

|

Datem del Marañon

|

Manseriche

|

|

|

Castalia 2

|

1000

|

Loreto

|

Datem del Marañon

|

Manseriche

|

|

|

Castalia 3

|

500

|

Loreto

|

Datem del Marañon

|

Manseriche

|

|

|

Delfina 1

|

900

|

Amazonas

|

Condorcanqui

|

Nieva

|

Partially overlap Zona de Amortiguamiento ANP

|

|

Delfina 2

|

900

|

Amazonas

|

Condorcanqui

|

Nieva

|

Partially overlap Zona de Amortiguamiento ANP

|

|

Delfina 3

|

1000

|

Amazonas

|

Condorcanqui

|

Nieva

|

Partially overlap Zona de Amortiguamiento ANP

|

|

Delfina 4

|

700

|

Amazonas

|

Condorcanqui

|

Nieva

|

Partially overlap Zona de Amortiguamiento ANP

|

|

Delfina 5

|

1000

|

Amazonas

|

Condorcanqui

|

Nieva

|

Partially overlap Zona de Amortiguamiento ANP

|

|

Mika 1

|

600

|

Loreto

|

Datem del Marañon

|

Manseriche

|

|

Mika 10

|

900

|

Loreto

|

Datem del Marañon

|

Manseriche

|

Partially overlap Zona de Amortiguamiento ANP

|

|

Mika 2

|

1000

|

Loreto

|

Datem del Marañon

|

Manseriche

|

|

|

Mika 3

|

900

|

Loreto

|

Datem del Marañon

|

Manseriche

|

|

|