Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SPARTON CORP | d8k.htm |

| EX-99.1 - SCRIPT - SPARTON CORP | dex991.htm |

Exhibit 99.2

sparton

Empowering your Vision

Fiscal 2011 Third Quarter Financial Results Conference Call

May 12, 2011

Safe Harbor Statement

sparton

Empowering your Vision

Certain statements herein constitute forward-looking statements within the meaning of the Securities Act of 1933, as amended and the Securities Exchange Act of 1934, as amended. When used herein, words such as “believe,” “expect,” “anticipate,” “project,” “plan,” “estimate,” “will” or “intend” and similar words or expressions as they relate to the Company or its management constitute forward-looking statements. These forward-looking statements reflect our current views with respect to future events and are based on currently available financial, economic and competitive data and our current business plans. The Company is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements whether as a result of such changes, new information, subsequent events or otherwise. Actual results could vary materially depending on risks and uncertainties that may affect our operations, markets, prices and other factors. Important factors that could cause actual results to differ materially from those forward-looking statements include those contained under the heading of risk factors and in the management’s discussion and analysis contained from time-to-time in the Company’s filings with the Securities and Exchange Commission.

2

Today’s Agenda

sparton

Empowering your Vision

Fiscal 2011 3rd Quarter Consolidated Results

3rd Quarter Segmented Operating Results

Liquidity & Capital Resources

SMS Colorado 3rd Quarter Financial Results

Outlook

Q & A

3

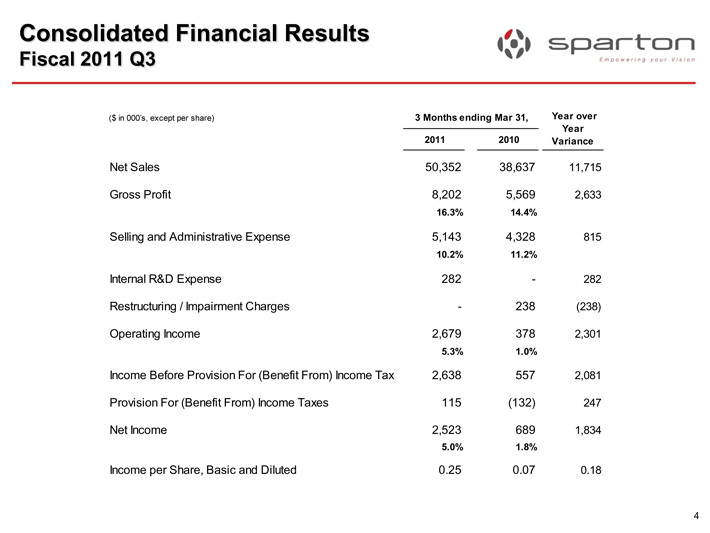

Consolidated Financial Results

Fiscal 2011 Q3

sparton

Empowering your Vision

($ in 000’s, except per share) 3 Months ending Mar 31,

2011 2010 Year over Year Variance

Net Sales 50,352 38,637 11,715

Gross Profit 8,202 5,569 2,633

16.3% 14.4%

Selling and Administrative Expense 5,143 4,328 815

10.2% 11.2%

Internal R&D Expense 282 - 282

Restructuring / Impairment Charges - 238 (238)

Operating Income 2,679 378 2,301

5.3% 1.0%

Income Before Provision For (Benefit From) Income Tax 2,638 557 2,081

Provision For (Benefit From) Income Taxes 115 (132) 247

Net Income 2,523 689 1,834

5.0% 1.8%

Income per Share, Basic and Diluted 0.25 0.07 0.18

4

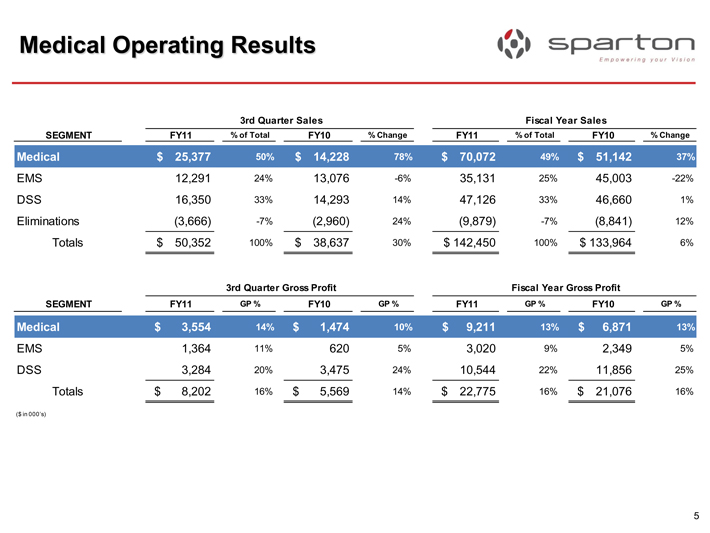

Medical Operating Results

sparton

Empowering your Vision

3rd Quarter Sales Fiscal Year Sales

SEGMENT FY11 % of Total FY10 % Change FY11 % of Total FY10 % Change

Medical $ 25,377 50% $ 14,228 78% $ 70,072 49% $ 51,142 37%

EMS 12,291 24% 13,076 -6% 35,131 25% 45,003 -22%

DSS 16,350 33% 14,293 14% 47,126 33% 46,660 1%

Eliminations (3,666) -7% (2,960) 24% (9,879) -7% (8,841) 12%

Totals $ 50,352 100% $ 38,637 30% $ 142,450 100% $ 133,964 6%

3rd Quarter Gross Profit Fiscal Year Gross Profit

SEGMENT FY11 GP % FY10 GP % FY11 GP % FY10 GP %

Medical $ 3,554 14% $ 1,474 10% $ 9,211 13% $ 6,871 13%

EMS 1,364 11% 620 5% 3,020 9% 2,349 5%

DSS 3,284 20% 3,475 24% 10,544 22% 11,856 25%

Totals $ 8,202 16% $ 5,569 14% $ 22,775 16% $ 21,076 16%

($ in 000’s)

5

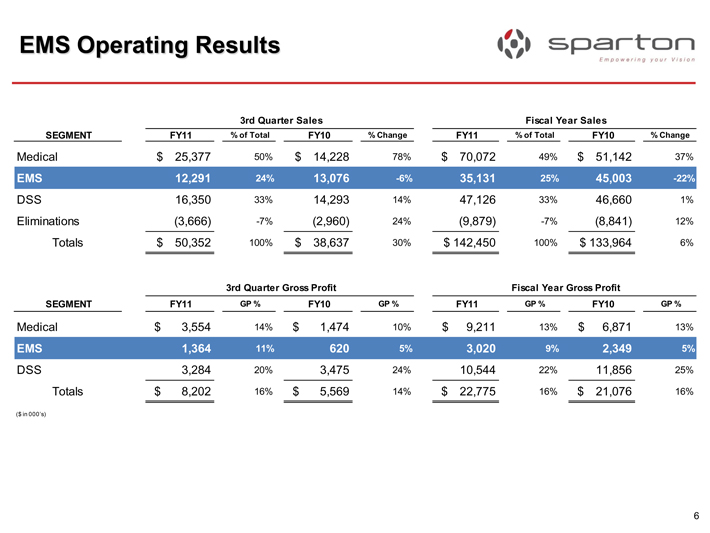

EMS Operating Results

sparton

Empowering your Vision

3rd Quarter Sales Fiscal Year Sales

SEGMENT FY11 % of Total FY10 % Change FY11 % of Total FY10 % Change

Medical $ 25,377 50% $ 14,228 78% $ 70,072 49% $ 51,142 37%

EMS 12,291 24% 13,076 -6% 35,131 25% 45,003 -22%

DSS 16,350 33% 14,293 14% 47,126 33% 46,660 1%

Eliminations (3,666) -7% (2,960) 24% (9,879) -7% (8,841) 12%

Totals $ 50,352 100% $ 38,637 30% $ 142,450 100% $ 133,964 6%

3rd Quarter Gross Profit Fiscal Year Gross Profit

SEGMENT FY11 GP % FY10 GP % FY11 GP % FY10 GP %

Medical $ 3,554 14% $ 1,474 10% $ 9,211 13% $ 6,871 13%

EMS 1,364 11% 620 5% 3,020 9% 2,349 5%

DSS 3,284 20% 3,475 24% 10,544 22% 11,856 25%

Totals $ 8,202 16% $ 5,569 14% $ 22,775 16% $ 21,076 16%

($ in 000’s)

6

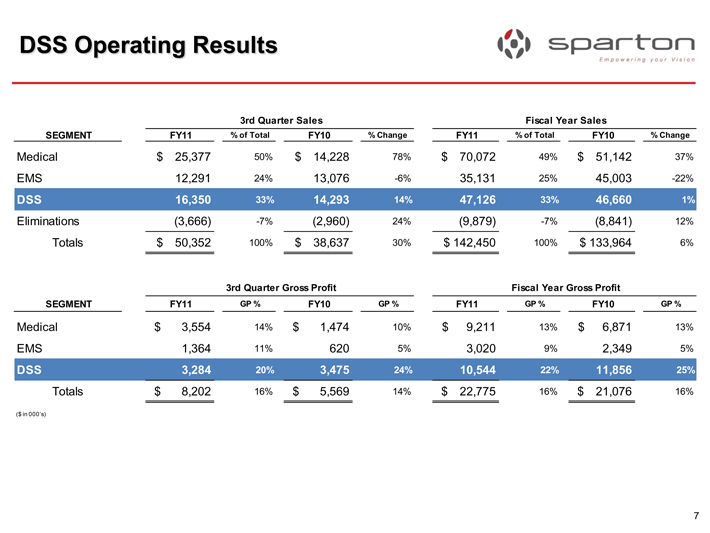

DSS Operating Results

sparton

Empowering your Vision

3rd Quarter Sales Fiscal Year Sales

SEGMENT FY11 % of Total FY10 % Change FY11 % of Total FY10 % Change

Medical $ 25,377 50% $ 14,228 78% $ 70,072 49% $ 51,142 37%

EMS 12,291 24% 13,076 -6% 35,131 25% 45,003 -22%

DSS 16,350 33% 14,293 14% 47,126 33% 46,660 1%

Eliminations (3,666) -7% (2,960) 24% (9,879) -7% (8,841) 12%

Totals $ 50,352 100% $ 38,637 30% $ 142,450 100% $ 133,964 6%

3rd Quarter Gross Profit Fiscal Year Gross Profit

SEGMENT FY11 GP % FY10 GP % FY11 GP % FY10 GP %

Medical $ 3,554 14% $ 1,474 10% $ 9,211 13% $ 6,871 13%

EMS 1,364 11% 620 5% 3,020 9% 2,349 5%

DSS 3,284 20% 3,475 24% 10,544 22% 11,856 25%

Totals $ 8,202 16% $ 5,569 14% $ 22,775 16% $ 21,076 16%

($ in 000’s)

7

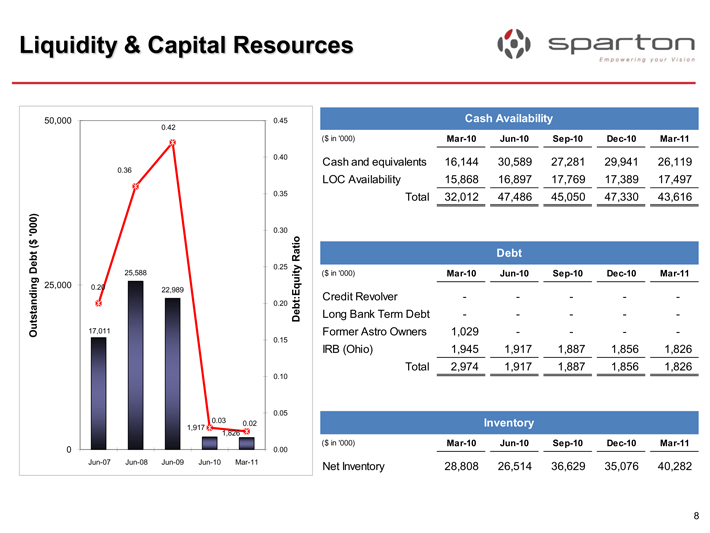

Liquidity & Capital Resources

sparton

Empowering your Vision

Outstanding Debt ($ ’000)

50,000

25,000

0

0.20

17,011

0.36

25,588

0.42

22,989

0.03

0.02

1,917

1,826

0.45

0.40

0.35

0.30

0.25

0.20

0.15

0.10

0.05

0.00

Debt:Equity Ratio

Jun-07 Jun-08 Jun-09 Jun-10 Mar-11

Cash Availability

($ in ’000) Mar-10 Jun-10 Sep-10 Dec-10 Mar-11

Cash and equivalents 16,144 30,589 27,281 29,941 26,119

LOC Availability 15,868 16,897 17,769 17,389 17,497

Total 32,012 47,486 45,050 47,330 43,616

Debt

($ in ’000) Mar-10 Jun-10 Sep-10 Dec-10 Mar-11

Credit Revolver - - - -

Long Bank Term Debt - - - -

Former Astro Owners 1,029 - - -

IRB (Ohio) 1,945 1,917 1,887 1,856 1,826

Total 2,974 1,917 1,887 1,856 1,826

Inventory

($ in ’000) Mar-10 Jun-10 Sep-10 Dec-10 Mar-11

Net Inventory 28,808 26,514 36,629 35,076 40,282

8

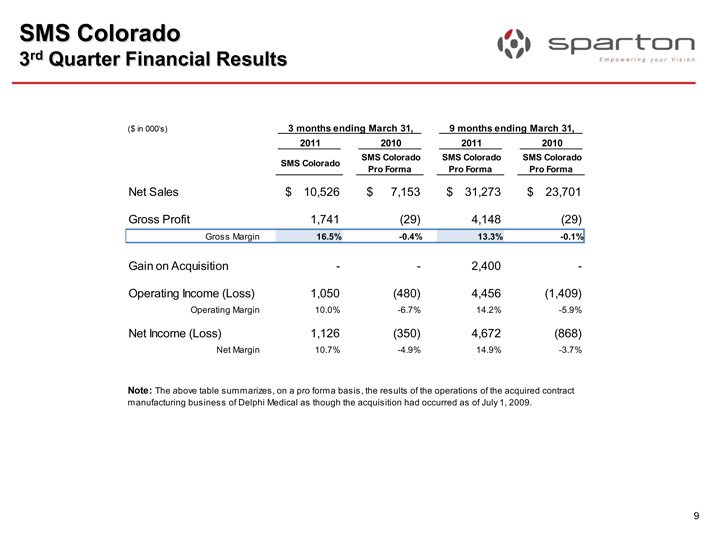

SMS Colorado

3rd Quarter Financial Results

sparton

Empowering your Vision

($ in 000’s) 3 months ending March 31, 9 months ending March 31,

2011 2010 2011 2010

SMS Colorado SMS Colorado Pro Forma SMS Colorado Pro Forma SMS Colorado Pro Forma

Net Sales $ 10,526 $ 7,153 $ 31,273 $ 23,701

Gross Profit 1,741 (29) 4,148 (29)

Gross Margin 16.5% -0.4% 13.3% -0.1%

Gain on Acquisition - - 2,400 -

Operating Income (Loss) 1,050 (480) 4,456 (1,409)

Operating Margin 10.0% -6.7% 14.2% -5.9%

Net Income (Loss) 1,126 (350) 4,672 (868)

Net Margin 10.7% -4.9% 14.9% -3.7%

Note: The above table summarizes, on a pro forma basis, the results of the operations of the acquired contract manufacturing business of Delphi Medical as though the acquisition had occurred as of July 1, 2009.

9

Acquisition

Byers Peak

sparton

Empowering your Vision

Acquired assets of Byers Peak for $4.35 million in March 2011

Estimated annual revenue of approximately $10 million with a new and diversified customer base is immediately accretive

Continues the expansion into the high growth Therapeutic Devices market and adds field service to Sparton’s list of capabilities

Customers are interested in Sparton’s capabilities such as internal CCA, low cost country manufacturing, engineering support, and rapid prototyping

Continues the growth of Sparton’s western geographic footprint

Enhances the Medical segment’s leadership

Solid business development funnel in place

Synergistic operational opportunities have been identified and will be implemented as part of the 100-day integration plan

10

Fiscal 2011 Outlook

sparton

Empowering your Vision

Focus on sustained profitability

Continue margin improvements in EMS

Maintain the successful operating performance at the Frederick facility

Further improvements in operating performance through lean and quality efforts

Implement the strategic growth plan

Enhance the Business Development organization

Leverage the new marketing strategy

Invest in new product development

Win more new business

Complete the integration of Byers Peak

Continue to look at complementary and compatible acquisitions

11

Q & A

sparton

Empowering your Vision

WELCOME TO A NEW ERA

12