Attached files

| file | filename |

|---|---|

| 8-K - COMPUTER SCIENCES CORP | form8-k.htm |

*

INVESTOR CONFERENCE 2011

© 2011

May 11, 2011

Investor Conference

*

INVESTOR CONFERENCE 2011

© 2011

All written or oral statements made by CSC at this meeting or in these presentation materials

that do not directly and exclusively relate to historical facts constitute “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These

statements represent CSC’s expectations and beliefs, and no assurance can be given that

the results described in such statements will be achieved. These statements are subject to

risks, uncertainties, and other factors, many outside of CSC’s control, that could cause actual

results to differ materially from the results described in such statements. For a description of

these factors, please see CSC’s most recent Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q.

that do not directly and exclusively relate to historical facts constitute “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These

statements represent CSC’s expectations and beliefs, and no assurance can be given that

the results described in such statements will be achieved. These statements are subject to

risks, uncertainties, and other factors, many outside of CSC’s control, that could cause actual

results to differ materially from the results described in such statements. For a description of

these factors, please see CSC’s most recent Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q.

Fiscal Year 2011 information presented herein is based on CSC’s revised guidance issued on

May 2, 2011. Actual results for Fiscal Year 2011 are scheduled to be released on May 25,

2011. Actual Fiscal Year 2011 results could vary from such guidance information.

May 2, 2011. Actual results for Fiscal Year 2011 are scheduled to be released on May 25,

2011. Actual Fiscal Year 2011 results could vary from such guidance information.

*

INVESTOR CONFERENCE 2011

© 2011

This presentation includes certain non-GAAP financial measures, such as operating income,

operating margin, operating costs, free cash flow and free cash flow as a percentage of net income

attributable to CSC common shareholders. These non-GAAP financial measures are not meant to

be considered in isolation or as a substitute for results prepared in accordance with accounting

principles generally accepted in the United States (GAAP). A reconciliation of non-GAAP financial

measures included in this presentation to the most directly comparable financial measure calculated

and presented in accordance with GAAP is set forth elsewhere in this presentation and on our

website at www.csc.com. CSC management believes that these non-GAAP financial measures

provide useful information to investors regarding the Company’s financial condition and results of

operations as they provide another measure of the Company’s profitability and ability to service its

debt, and are considered important measures by financial analysts covering CSC and its peers.

operating margin, operating costs, free cash flow and free cash flow as a percentage of net income

attributable to CSC common shareholders. These non-GAAP financial measures are not meant to

be considered in isolation or as a substitute for results prepared in accordance with accounting

principles generally accepted in the United States (GAAP). A reconciliation of non-GAAP financial

measures included in this presentation to the most directly comparable financial measure calculated

and presented in accordance with GAAP is set forth elsewhere in this presentation and on our

website at www.csc.com. CSC management believes that these non-GAAP financial measures

provide useful information to investors regarding the Company’s financial condition and results of

operations as they provide another measure of the Company’s profitability and ability to service its

debt, and are considered important measures by financial analysts covering CSC and its peers.

*

INVESTOR CONFERENCE 2011

© 2011

$16.1B global IT services powerhouse

50+ year track record of client service excellence

CSC Business Profile

93,000 employees worldwide,

operating in more than 90 countries

2,500 clients

NYSE: CSC

Ranked 155 on the FORTUNE 500

On FORTUNE magazine’s list of World’s Most

Admired Companies

Admired Companies

*

INVESTOR CONFERENCE 2011

© 2011

FY11 Overview

|

|

Implemented dividend and stock repurchase programs

|

|

|

Underlying operational business performance

|

|

|

Commercial revenue growth, offset by uncertainty in Public Sector

|

|

|

NHS Program realigned for success

|

|

|

Invested in growth segments, both organically and through acquisition

|

*

INVESTOR CONFERENCE 2011

© 2011

IT Services — A Global Market in Transition

Sources: Forrester Research, Inc.; CSC Research

Outsourcing

Systems Integration

IT Consulting

Outsourcing

Systems Integration

IT Consulting

Infrastructure as a

Service

Service

Security as a Service

Implementation and

Consulting

Consulting

Vertical Software

Business Services

Business executives

depend less on CIO for

technology investments

depend less on CIO for

technology investments

Shift to “as a Service”

is underway

is underway

Undifferentiated traditional

services are being

commoditized

services are being

commoditized

Traditional IT Services

Business Solutions

Traditional IT Services

*

INVESTOR CONFERENCE 2011

© 2011

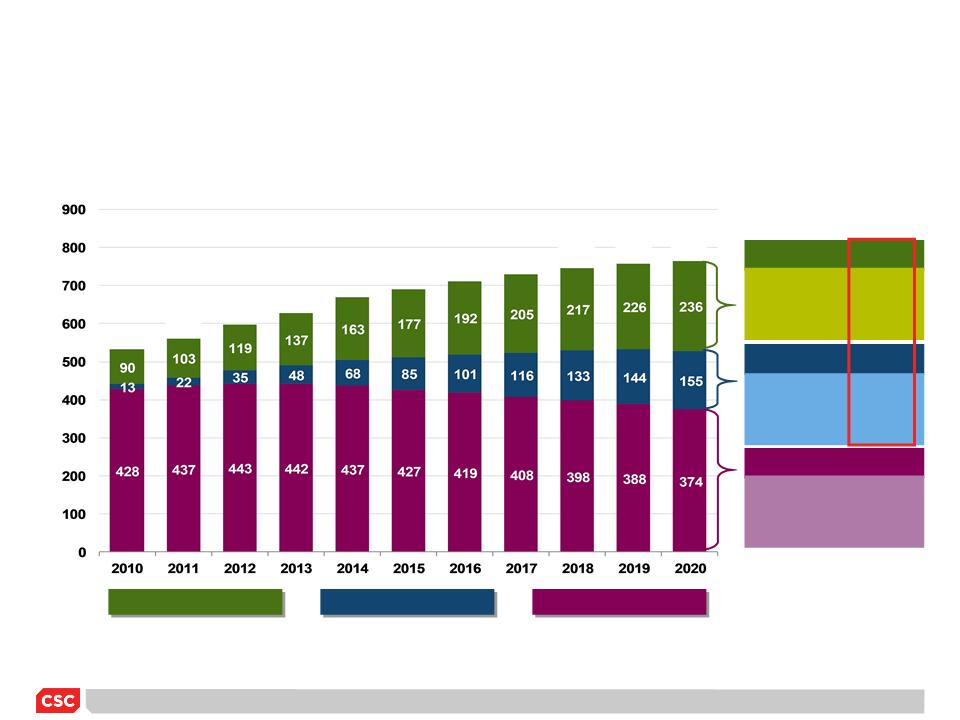

Market Offers Opportunities for Growth

$532

$562

$597

$627

$669

$689

$711

$729

$748

$758

$765

Business CAGR

Emerging CAGR

Traditional CAGR

3-yr. 14.7%

5-yr. 14.4%

10-yr. 10.1%

3-yr. 53.8%

5-yr. 45.2%

10-yr. 27.8%

3-yr. 1.1%

5-yr. 0.0%

10-yr. -1.3%

Business Solutions

Emerging Services

Traditional Services

$B

(U.S.)

(U.S.)

Sources: Forrester Research, Inc.; CSC Research

*

INVESTOR CONFERENCE 2011

© 2011

• Protect and expand our

core markets

core markets

• Focus on high-growth

horizontal segments

horizontal segments

• Expand our global

presence

presence

• Lead in the “as a Service”

cloud-based economy

cloud-based economy

• Capture market share in

cybersecurity services

cybersecurity services

• Expand our market with

Infrastructure as a Service

offerings

Infrastructure as a Service

offerings

Our Strategic Direction — Aligned with Market Opportunities

for Growth

for Growth

BUSINESS

• Be a leader in our chosen

verticals

verticals

• Use industry-leading,

IP-based solutions to

drive growth

IP-based solutions to

drive growth

• Focus on business

outcomes

outcomes

Fueling Clients’

Growth and

Performance

Growth and

Performance

TRADITIONAL

Enabling Clients

to Focus on

Their Business

to Focus on

Their Business

EMERGING

Enhancing Clients’

Agility and Security

Agility and Security

*

INVESTOR CONFERENCE 2011

© 2011

NPS Opportunities — High Growth Vectors

Building on Our Strengths

Building on Our Strengths

Current Revenue Composition

Future Revenue Composition

NPS Core

Health

Cybersecurity

Identity

Management

NPS Core

Health

Identity

Management

Data Center

Consolidation

and Cloud

and Cloud

Data Center

Consolidation

and Cloud

and Cloud

*

INVESTOR CONFERENCE 2011

© 2011

Six Potential Billion-Dollar Growth Platforms

|

I

|

Grow Financial Services business from $3 billion to $4 billion

|

|

II

|

Be recognized by our clients as the world’s leader in healthcare IT services

|

|

III

|

Be a leader in cloud and emerging services

|

|

IV

|

Achieve global recognition as the “go to” developer and provider of cybersecurity

|

|

V

|

Double our high-margin applications development and management business

|

|

VI

|

Focus intensely on cross-sell/up-sell to leverage our portfolio

|

Underpinning our strategy is a shift to a proactive

sales culture and increased brand promotion

sales culture and increased brand promotion

*

INVESTOR CONFERENCE 2011

© 2011

Our Plan Is Aligned with the Market’s Transition

Revenue Outlook by Strategic Growth Vector

Business Solutions

Emerging Services

Traditional Services

*Based on Revised Guidance issued May 2, 2011

Percents Are of Total (Mix)

91%

$16.1B

$19B

80%

$20B

74%

26%

20%

9%

($B)

*

INVESTOR CONFERENCE 2011

© 2011

Organic Growth Plan

|

Business Segment

|

Portfolio Share

|

3-Year Outlook

|

|

NPS

|

40%

|

0% - 5%

|

|

Commercial

|

60%

|

5% - 8%

|

|

Composite Total

|

100%

|

3% - 7%

|

*

INVESTOR CONFERENCE 2011

© 2011

Looking Forward

Our markets are in transition — providing exciting growth opportunities

Our go-to-market capabilities are realigned and energized

Proven Business Services model

A strong Tier One provider in our public sector and traditional

commercial markets

commercial markets

The financial strength to deliver top-line growth

Gaining recognition as a market leader in Cloud and Cybersecurity

*

INVESTOR CONFERENCE 2011

© 2011

Key Questions

Can margins improve?

Is cash generation sustainable?

Can the capital structure

support CSC’s strategy?

support CSC’s strategy?

Can CSC grow the top line?

*

INVESTOR CONFERENCE 2011

© 2011

Where We Have Been …

*

INVESTOR CONFERENCE 2011

© 2011

Historical Revenue Profile

$M

*Revised Guidance issued May 2, 2011

CSC FY

*

Global

Economic

Economic

Crisis

*

INVESTOR CONFERENCE 2011

© 2011

Historical Operating Income Margin Profile

*

CSC FY

%

*Revised Guidance issued May 2, 2011

*

INVESTOR CONFERENCE 2011

© 2011

Historical EPS Profile

CSC FY

$

Normalized for

IRS settlement

IRS settlement

*

7

*Revised Guidance issued May 2, 2011

*

INVESTOR CONFERENCE 2011

© 2011

Historical FCF % of NI Profile

*

CSC FY

Normalized for

timing distortion

timing distortion

-600%

-300%

Net Income attributable to

CSC Common Shareholders

150%

*Revised Guidance issued May 2, 2011

*

INVESTOR CONFERENCE 2011

© 2011

Share

Repurchase +

Covansys and

FCG

Acquisitions

Repurchase +

Covansys and

FCG

Acquisitions

DynCorp

Acquisition

Mynd +

Outsourcing

Assets

Capital

($M)

($M)

Debt-to-Cap

(%)

(%)

Capital Structure

$1B Term Debt

Redemption +

Dyn Int’l Sale

Debt

Equity

Debt-to-Cap

CSC FY

*

*Third quarter ending

*

INVESTOR CONFERENCE 2011

© 2011

Where We Are Going …

*

INVESTOR CONFERENCE 2011

© 2011

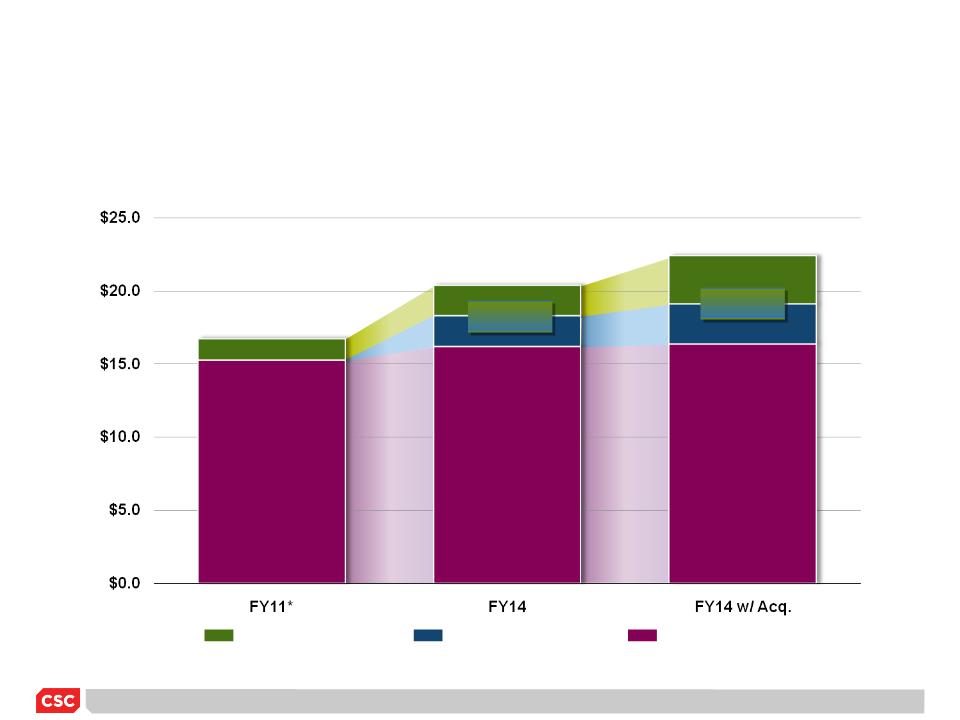

CAGR 2% - 3%

Revenue Drivers

Opportunities for growth

FY11*

FY14

Outlook

Outlook

$19B

Organic

Drivers

Cybersecurity

Cloud

Financial

Services

Services

Healthcare

$16.1B

*Revised Guidance issued May 2, 2011

Applications

Virtualization

Strategic

Acquisitions

Acquisitions

Foundation

*

INVESTOR CONFERENCE 2011

© 2011

Operating Income Margin Drivers

Drivers

• Portfolio mix

– Growth engines (financial services,

cybersecurity, healthcare, cloud)

cybersecurity, healthcare, cloud)

– Intellectual property

– Reduced capital intensity

– Low-cost centers

• Cost containment

– Facility/square footage

– Benefit management

– Supply chain management

– Travel

25 - 50

Basis Point

Improvement

Annually

*

INVESTOR CONFERENCE 2011

© 2011

*Revised Guidance issued May 2, 2011

Free Cash Flow (FCF) Drivers

• DSO improvements

• Lower pension

contributions

contributions

• Reduced capital

intensity

intensity

• NHS investment

amortization

amortization

• Claims resolution

FCF Drivers/Opportunities

FY11*

> 90% of NI

FY14 Outlook

80% of

Net Income

(NI)

(NI)

*

INVESTOR CONFERENCE 2011

© 2011

Cash Profile

|

$B

|

FY 2011

|

FY 2012w

|

FY 2013w

|

FY 2014w

|

|

Beginning Cash

|

$2.8

|

$2.0

|

$2.8

|

$2.7

|

|

FCF

|

0.6

|

.8

|

.9

|

.9

|

|

Debt repayment

|

(1.4)

|

|

(1.0)

|

|

|

Available Balance

|

$2.0

|

$2.8

|

$2.7

|

$3.6

|

**Estimated

wOutlook

Uses of Cash

Dividends

Share

Repurchase

Repurchase

Acquisitions

Investments

**

*

*Revised Guidance issued May 2, 2011

*

INVESTOR CONFERENCE 2011

© 2011

Financial Performance Plan Summary

FY12 - FY14 Outlook

FY12 - FY14 Outlook

Deliver top-line growth:

3% - 7% organic

2% - 3% acquisitions

(CAGR)

Improve

OI margin

by 25 - 50 BPS

annually

Grow EPS

at rate exceeding

top-line growth

Sustain cash

Performance > 90%

of Net Income

*

INVESTOR CONFERENCE 2011

© 2011

Can margins improve?

Is cash generation sustainable?

Can the capital structure support

CSC’s strategy?

CSC’s strategy?

Answers to Key Questions

Can CSC grow the top line?

ü

ü

ü

ü

*

INVESTOR CONFERENCE 2011

© 2011

CSC Investment Case

|

Financial Plan

|

|

|

Revenue

Growth |

3% to 7% organic,

2% to 3% acquisition |

|

Operating

Margin |

25 to 50 BPS

improvement to 10% |

|

EPS Growth

|

At a rate greater

than top line |

|

Free Cash

Flow |

> 90% Net Income

|

|

Shareholder Return

|

|

|

EPS Growth

|

|

|

Dividends

|

|

|

Share Repurchase

Program |

|

|

TSR Range

|

|

|

Plus, multiple expansion as we

deliver on our commitments |

|

8.5% to 14%

*

INVESTOR CONFERENCE 2011

© 2011

Non-GAAP Reconciliation

Proceeds from the sale of Property & Equipment (included in investing activities) are included in the calculation of Free

Cash Flow for all periods. Capital lease payments are included in the calculation of free cash flow from Fiscal 2004 -

Fiscal 2010.

Cash Flow for all periods. Capital lease payments are included in the calculation of free cash flow from Fiscal 2004 -

Fiscal 2010.

Operating Income Margin is Operating Income as a percentage of Revenue

*

**