Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CADENCE PHARMACEUTICALS INC | d8k.htm |

Improving the lives of hospitalized patients

Cadence Pharmaceuticals, Inc.

Corporate Presentation

May 11, 2011

Exhibit 99.1 |

2

This presentation includes forward-looking statements, which are based on our

current beliefs and expectations. Such statements include, without

limitation, statements regarding: the anticipated U.S. market opportunity for OFIRMEV; our

projections regarding the number of formulary approvals of OFIRMEV; our belief that

we can rapidly accelerate sales of OFIRMEV; the potential for us to

ultimately acquire Incline Therapeutics, Inc. or other product candidates; and our strategy for

building a long-term hospital pain franchise.

You are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof. Our

actual

future

results

may

differ

materially

from

our

current

expectations

due

to

the

risks

and

uncertainties

inherent

in

our

business. These risks include our dependence on the successful commercialization of

OFIRMEV; the potential that delays in achieving formulary acceptance for

OFIRMEV at a substantial number of targeted accounts may decrease the market

potential for OFIRMEV; our ability to generate revenues from OFIRMEV; our ability

to ensure an adequate and continued supply of OFIRMEV; our ability to

successfully enforce our marketing exclusivities and intellectual property rights, and to

defend our patents; the potential product liability exposure associated with

OFIRMEV; the risk that we may not be able to raise

sufficient

capital

when

needed,

or

at

all;

and

other

risks

detailed

under

“Risk

Factors”

and

elsewhere

in

our

Annual

Report on Form 10-K for the period ended December 31, 2010, and our other

filings made with the Securities and Exchange Commission from time to time.

All forward-looking statements are qualified in their entirety by this

cautionary statement, which is made under the safe harbor provisions of

Section 21E of the Private Securities Litigation Reform Act of 1995 and we undertake no obligation to revise or

update this presentation to reflect events or circumstances after the date hereof.

Forward-looking statements

CADENCE®

and

OFIRMEV®

are

trademarks

of

Cadence

Pharmaceuticals,

Inc..

IONSYS™

is a trademark of Incline Therapeutics, Inc.

©

2011 Cadence Pharmaceuticals, Inc. All rights reserved.

|

3

Cadence:

investment highlights

Hospital-focused specialty pharmaceutical company

OFIRMEV

®

launched with broad pain and fever indication in

January 2011

–

Rapid formulary adoption demonstrated

–

Established hospital sales team provides a core platform for the

acquisition of additional products

–

Management team with significant hospital commercial experience

Option to acquire Incline Therapeutics

–

IONSYS™

transdermal PCA system

–

Opportunity to leverage OFIRMEV sales force

Strong balance sheet |

4

OFIRMEV

®

: product overview

OFIRMEV (acetaminophen) injection

–

Proprietary IV acetaminophen formulation

–

First and only IV formulation of acetaminophen

approved in the United States

–

New class of IV medication

•

non-narcotic / opioid

•

non-NSAID

–

Same formulation of IV acetaminophen marketed

by

BMS

in

Europe

since

2002

as

Perfalgan

™

U.S. Commercial launch : January 17, 2011

PERFALGAN™

is

a

trademark

of

Bristol

Myers

Squibb

Company. |

5

OFIRMEV

®

: indication supports message

Broad Indication

•

Mild to moderate pain

•

Moderate to severe pain with adjunctive opioids

•

Reduction of fever

•

Adults and children 2 and older

Message

•

Significant pain relief

•

Reduced opioid consumption*

•

Improved patient satisfaction

•

Established safety profile

* Clinical benefit of opioid reduction not demonstrated

|

6

OFIRMEV

®

:

strong foundation for commercial success

Effective Pain

Control

•

Sales force average >10 years hospital selling experience

•

Extensive relationships, significant overlap with prior

territory

•

Substantial hospital commercial experience throughout

management

–

CEO > 25 years, CCO > 15 years, VP of Sales > 25 years

•

$10.75/ vial

•

General Surgery DRG $23,000

•

OFIRMEV may help reduce post surgical ambulation

time, and time to extubation in the ICU

•

Significant pain relief

•

Reduced opioid consumption*

•

Improved patient satisfaction

Experienced

Hospital Sales

Force

Economic

Value

* Clinical benefit of opioid reduction not demonstrated

|

7

OFIRMEV

®

:

strong early launch indicators*

Rapid formulary adoption

–

On formulary in 675 hospitals in first 15 weeks of launch

–

Mix of formulary wins is representative of overall target market

–

Includes major academic medical centers and large community

healthcare systems

Most hospitals approved OFIRMEV without restriction

–

Allows access across the hospital by range of physicians

Physician support and early experience positive

–

Physician support strong driver of formulary success

–

Physician feedback:

•

Significant pain relief

•

Utilization of less opioids

•

Improved patient experience

* Launch through April 30, 2011 |

8

OFIRMEV

®

: vial sales off to strong start

Vial* Sales of Comparable New Hospital Product Launches Over Last 5 Years

0

20,000

40,000

60,000

80,000

100,000

120,000

1

2

3

4

5

6

7

8

9

10

11

12

Month Post Launch

OFIRMEV

(1-11)

TEFLARO

(1-11)

DORIBAX

(10-07)

CLEVIPREX

(9-08)

VAPRISOL

(3-06)

VIBATIV

(10-09)

LUSEDRA

(11-09)

ENTEREG (doses)

(06-08)

CALDOLOR

(9-09)

Average

(Excl OFIRMEV)

* # of doses are shown for Entereg, which is an oral product

OFIRMEV vs Avg:

546%

OFIRMEV Rank:

1

Source: Wolters Kluwer Pharma Solutions, Source® PHAST Institution. Based on Cadence comparison

to other selected product launches in hospital market over period March 2006 – March 2011

|

9

Limitations of other IV pain therapies

Sedation

Nausea

Vomiting

Constipation

Headache

Cognitive impairment

Respiratory depression

Opioids

NSAIDs

Black Box Warning

Bleeding

GI complications

Kidney complications

Cardiovascular risks

Prolonged recovery

Increased length of stay

Higher costs to the institution

Limited use |

10

Pain Intensity

Current US Approach

Current EU Approach

Severe

Opioids

IV

acetaminophen

+ opioids

Moderate

Opioids

IV

acetaminophen

+/-

opioids*

Mild

Opioids

IV

acetaminophen

Multi-modal analgesia: the norms

* First post operative analgesic drug, then add opioids if necessary

|

11

Sinatra, et al. Anesthesiology, V 102, No. 4, April 2005.

IV acetaminophen

placebo

p-value

Weighted sums of pain relief over 6hrs

6.6

2.2

<0.05

Patient

Satisfaction

(Good/excellent

–

24

hrs)

41%

23%

<0.01

Morphine consumption over 24 hrs**

38.3 mg (33%

)

57.4 mg

<0.001

Safety

placebo

IV acetaminophen

Placebo-controlled, total hip or total knee replacement

(n=49/52)

p<0.001

.

.

Sinatra Study: pivotal acute pain clinical

trial IV acetaminophen

placebo

p-value

Sum of pain intensity differences over 24hrs*

-.28

-242.3

<0.001

6.6

2.2

<0.05

41%

23%

<0.01

38.3 mg (33%

)

57.4 mg

IV acetaminophen comparable to placebo

* Post hoc analysis based on currently acceptable regulatory

endpoint ** Clinical benefit of opioid reduction was not demonstrated

|

12

OFIRMEV

®

: established safety profile

% of adult patients with AST/ALT elevations

in five repeat-dose clinical trials

IV APAP (n=402)

Placebo (n=379)

ALT

>

3x ULN

>

5x ULN

1.1% (n=4)

0.3% (n=1)

1.7% (n=6)

0.6% (n=2)

AST

>

3x ULN

>

5x ULN

1.0% (n=4)

0.5% (n=2)

1.1% (n=4)

0.8% (n=3)

* Data from a pooled analysis of 5 multiple –dose clinical studies involving

adult patients. P value is based on Fisher’s Exact

Test. Established safety profile; well tolerated in clinical trials

|

13

Pain Intensity

Opioid Reduction*

Time

p Value

Severe

33%

24h

<0.01

61%

24h

<0.05

Moderate

53%

0-6h

0.016

Mild

86%

24h

<0.001

78%

24h

<0.01

Consistent opioid reduction across studies

*Reduction

in

number

of

patients

requiring

analgesic

rescue

with

ketorolac

and

fentanyl

1)

Sinatra, et al, 2005;

2)

Memis, et al, 2005;

3)

Viscusi, et al, 2005;

4)

Hong, et al, 2005;

5)

Atef, Fawaz, 2007

1

2

3

4

5 |

14

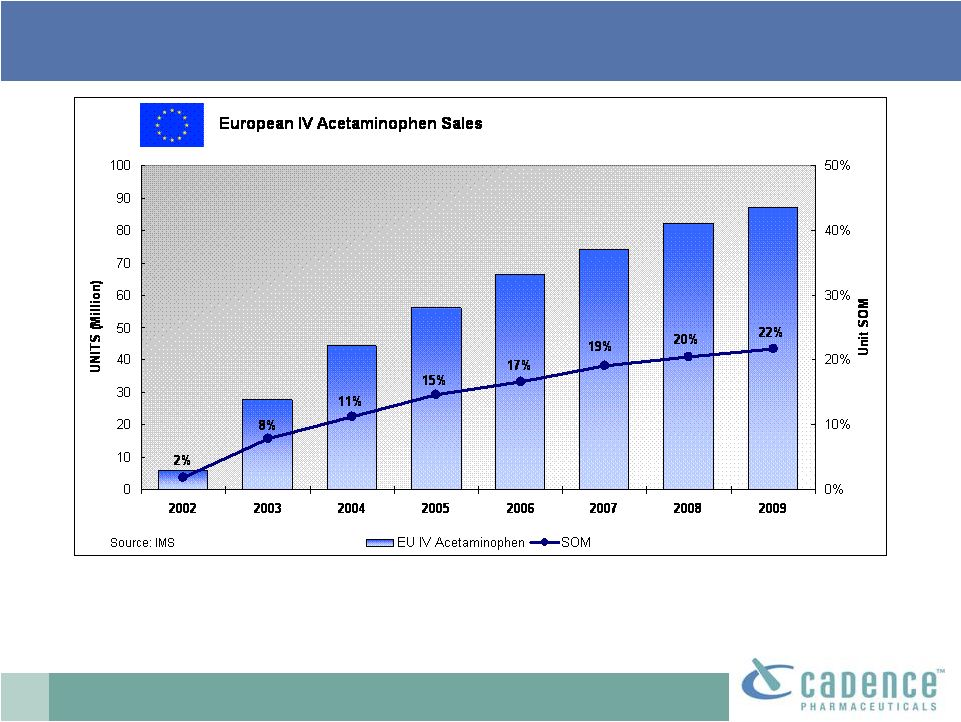

Source: IMS Data

*(SOM –

Share of market)

•

>20% unit share of injectable analgesic market

IV acetaminophen: EU market leader

|

15

Europe: 78% receive IV acetaminophen post-op % of

Inpatients Given Each of the Following Treatments Post-operatively

PharmaSavvy market research 2009. n=60 anesthetists (commissioned by Cadence

Pharmaceuticals) |

16

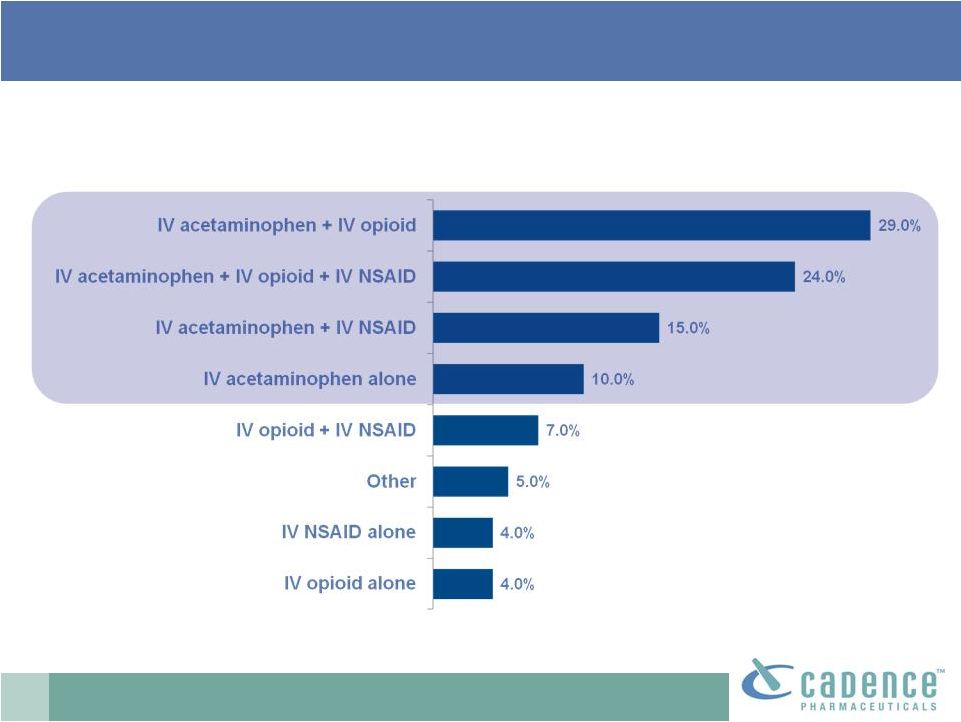

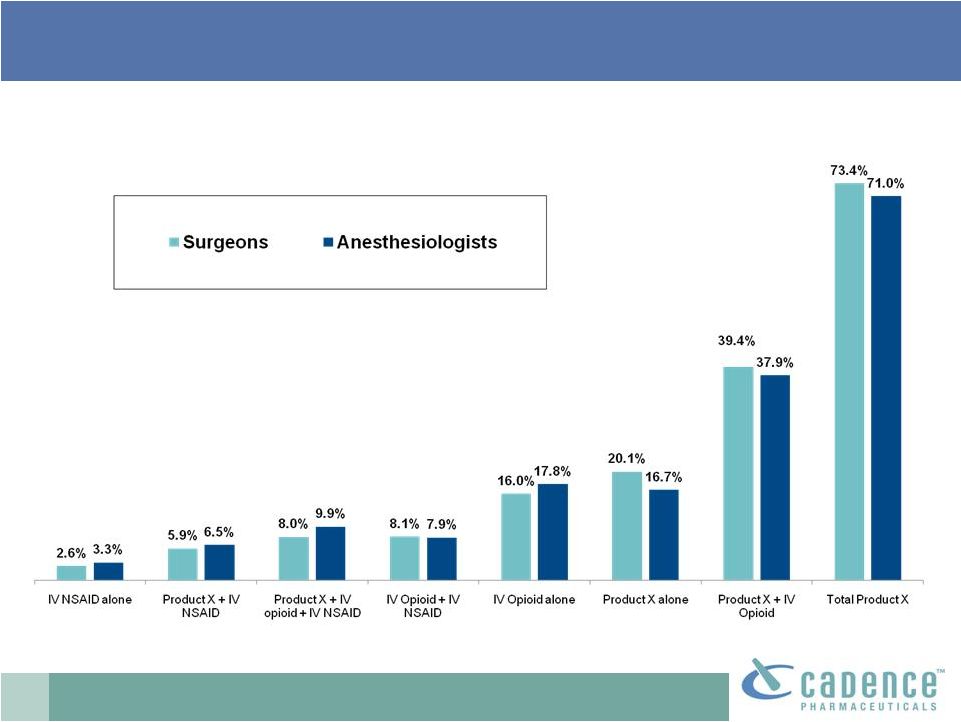

US: >70% may receive IV acetaminophen

post-op

Post-op inpatient treatment assignments assuming

availability of IV acetaminophen* (Product X)

PharmaSavvy market research 2009. n=102 (52 surgeons, 50 anesthesiologists)

* Based

on

target

product

profile

similar

to

OFIRMEV™

approved

indications |

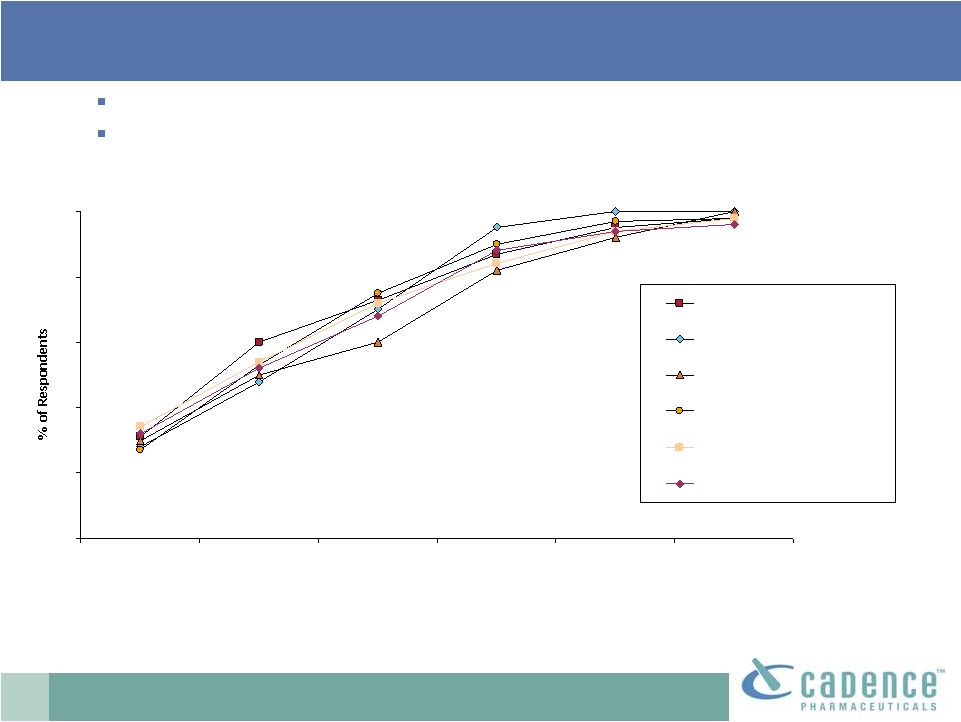

17

ATU Research 10/2010

Base: Anesthesiologists and surgeons

Q55. How soon after FDA approval would you expect to first use Product X (IV

acetaminophen)? Virtually all respondents expect to use OFIRMEV at some

point. About half of respondents across specialties would expect to

try OFIRMEV within one month after it is approved.

0

20

40

60

80

100

As soon as it is

available

1 month

3 months

6 months

Within one year

After more than

1 year

Anesthesiologist

General Surgeon

Orthopedic Surgeon

OB-GYN

Cardiothoracic Surgeon

Neurosurgeon

OFIRMEV

®

: early adoption |

18

The UK experience:

an appropriate model

UK treatment paradigms for moderate

and acute pain are similar to those in

the US

–

Higher opioid than NSAID usage

–

Multimodal pain therapy

Perfalgan, BMY’s IV acetaminophen

–

Launched in 2004

–

Has taken approximately 35% market

share

–

Most share taken from opioids, some

from NSAIDS

Used alone and in combination

with opioids

–

Multimodal therapy provides broader

market opportunity

UK Injectable Analgesics

Source: IMS data, 2009

2004

2009

Opioids

Perfalgan

NSAIDS

89%

2%

35%

1%

9%

63% |

19

Oral

opioids:

acetaminophen

combinations

dominate

Opioid-acetaminophen combinations

Opioid-only products

Opioid-NSAID combinations

73%

25%

1%

Source: IMS data, 2008.

73% of oral opioid doses sold in U.S. contain acetaminophen

Approximately 14.4 billion total doses sold in 2008

Acetaminophen + hydrocodone is the most frequently dispensed Rx

drug in the US (FDA, 2009) |

20

OFIRMEV

®

: US market opportunity

US and EU injectable analgesics markets are similarly sized

Approximately 87 million IV acetaminophen units sold in

Europe in 2009

Continued EU market expansion after introduction of IV

acetaminophen

List price $10.75 per vial; net price approximately $10.05 per

vial

Sources: IMS data, company estimates |

21

Hospital products:

multi-step launch process

Regulatory

Approval

Doctor

Access

Formulary

Access |

22

Injectable analgesic market: highly

concentrated Source: WoltersKluwer Non-Retail Outlet Data,

June 2009 MAT *Injectable analgesics consist of USCs 02221, 02211, 02131,

02231 0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

0

1,000

2,000

3,000

4,000

5,000

6,000

Number of Hospitals

The top 1,874 (28%)

hospitals generated

80% of the total

market volume

Less than 750 (11%)

hospitals generated

50% of the total

market volume |

23

Experienced, Seasoned, Tested Sales Organization

147 Hospital Sales Specialists

–

>10 years hospital selling experience

–

90% resigned to join Cadence

–

Extensive relationships, 70% overlap with prior territory

Deep hospital commercial experience

–

CEO > 25 years

–

CCO > 15 years

–

VP Sales > 25 years

–

Regional Business Directors > 20 years

–

District Sales Managers > 9 years |

24

OFIRMEV

®

: economic value

Placebo-controlled studies using IV acetaminophen demonstrated

results that may be associated with possible hospital cost savings:

–

Decreased opioid consumption *

•

Total hip/knee replacement

(1)

•

Total hip replacement

(2, 3)

•

Adult tonsillectomy

(4)

•

Endoscopic thyroidectomy

(5)

–

Decreased

time

in

PACU

(post-anesthesia

care

unit)

(6)

–

Decreased time to ambulation

(7)

–

Decreased

time

to

extubation

in

ICU

(8)

* Note: (1-5) Clinical benefit

of opioid reduction was not demonstrated References: (1) Sinatra, 2005; (2)

Viscusi, 2008; (3) Gimbel, 2008; (4) Atef, 2007; (5) Hong, 2010a; (6) Salihoglu, 2009; (7) Ohnesorge, 2009;

(8) Memis, 2010 |

25

Cadence: financial position

12 Months

Ended

12/31/10

(MM)

3 Months

Ended

3/31/11

(MM)

Operating expenses

$ 54.9

$ 22.7

Cash, cash equivalents &

short-term investments

$134.1

$109.0

(1)

Shares outstanding

63.1

63.3

(1)

Does not include a $5.3 million upfront payment received in April 2011 under a data

license agreement with Terumo |

26

OFIRMEV

®

: product overview

OFIRMEV (acetaminophen) injection

–

Proprietary IV acetaminophen formulation

–

First and only IV formulation of acetaminophen

approved in the United States

–

New Class of IV Analgesic

OFIRMEV launched with broad pain and fever

indication in January 2011

–

Rapid formulary adoption demonstrated; 675

approvals by April 30

–

Management team with significant hospital

commercial experience

–

Established hospital sales team provides a core

platform for the acquisition of additional products |