Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Wendy's Co | form8-k_05102011slides.htm |

First Quarter 2011

Earnings Call

Earnings Call

May 10, 2011

Opening

Comments

Comments

John Barker

SVP and Chief Communications Officer

3

Agenda

|

Business Highlights

•Update on Arby’s strategic alternatives

•Key first quarter 2011 results

|

Roland Smith

|

|

Financial Results and Outlook

•First quarter 2011 financial overview

•Cash flow and debt capitalization

•Dividends and share repurchases

•2011 Outlook

|

Steve Hare

|

|

Wendy’s Key Initiatives and Global Expansion

|

Roland Smith

|

|

Q&A

|

|

4

Forward-Looking Statements and Regulation G

This presentation, and certain information that management may discuss in connection with this

presentation, may contain statements that are not historical facts, including, importantly,

information concerning possible or assumed future results of our operations. Those statements

constitute “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995 (the “Reform Act”). For all our forward-looking statements, we claim the

protection of the safe harbor for forward-looking statements contained in the Reform Act.

presentation, may contain statements that are not historical facts, including, importantly,

information concerning possible or assumed future results of our operations. Those statements

constitute “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995 (the “Reform Act”). For all our forward-looking statements, we claim the

protection of the safe harbor for forward-looking statements contained in the Reform Act.

Many important factors could affect our future results and could cause those results to differ

materially from those expressed in or implied by our forward-looking statements. Such factors,

all of which are difficult or impossible to predict accurately, and many of which are beyond our

control, include but are not limited to those identified under the caption “Forward-Looking

Statements” in our most recent earnings press release and in the “Special Note Regarding

Forward-Looking Statements and Projections” and “Risk Factors” sections of our most recent

Form 10-K and subsequent Form 10-Qs.

materially from those expressed in or implied by our forward-looking statements. Such factors,

all of which are difficult or impossible to predict accurately, and many of which are beyond our

control, include but are not limited to those identified under the caption “Forward-Looking

Statements” in our most recent earnings press release and in the “Special Note Regarding

Forward-Looking Statements and Projections” and “Risk Factors” sections of our most recent

Form 10-K and subsequent Form 10-Qs.

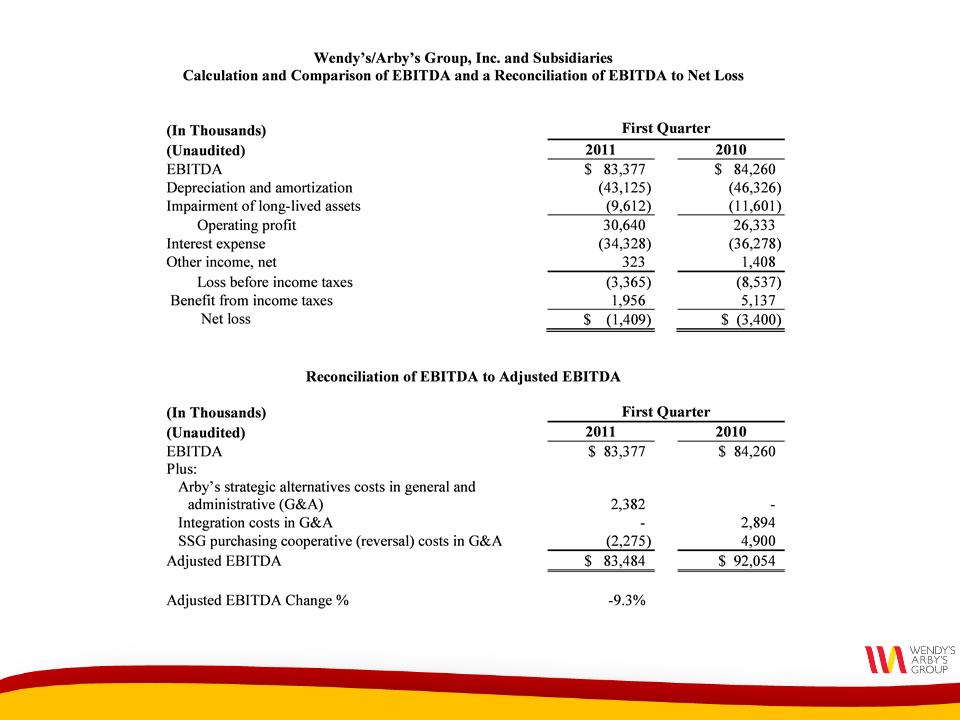

In addition, this presentation and certain information management may discuss in connection

with this presentation reference non-GAAP financial measures, such as earnings before interest,

taxes, depreciation and amortization, or EBITDA. Reconciliations of non-GAAP financial measures

to the most directly comparable GAAP financial measure are in the Appendix to this

presentation, and are included in the earnings release and posted on the Investor Relations

section of our website.

with this presentation reference non-GAAP financial measures, such as earnings before interest,

taxes, depreciation and amortization, or EBITDA. Reconciliations of non-GAAP financial measures

to the most directly comparable GAAP financial measure are in the Appendix to this

presentation, and are included in the earnings release and posted on the Investor Relations

section of our website.

Business

Highlights

Highlights

Roland Smith

President & Chief Executive Officer

6

Strategic Alternatives Update

• In January 2011, announced exploring strategic

alternatives for Arby’s, including a sale of the brand

alternatives for Arby’s, including a sale of the brand

• Potential bidders interested and active

• Focused on completing process as quickly as possible

• Benefits of the potential sale

– Focus resources on Wendy’s

– Deleverage the balance sheet

7

Q1 2011 Business Overview

• Revenues grew 1.2% to $848 million

• Adjusted EBITDA*, including Arby’s, was $83.5 million

– Performance met Company’s expectations

– Includes significant increase in commodities versus

prior year

prior year

– Includes incremental advertising for Wendy’s breakfast

expansion in new markets

expansion in new markets

* See Appendix

8

Q1 2011 N.A. Same-Store Sales

Systemwide* 0.0%

Company-owned -0.9%

Franchise +0.3%

Company Restaurant Margin

Q1 2011 13.4%

Q1 2010 15.4%

-200 bps

Margin Variances

-110 bps New breakfast advertising

-80 bps Increased commodities

March

February

January

99¢ Everyday

99¢ Everyday

Value Menu

Value Menu

Asiago Ranch

Asiago Ranch

Chicken Club

Chicken Club

Fish & Chips

Fish & Chips

* Q1 2011 U.S. Systemwide same-store sales were +0.3%

9

Q1 2011 N.A. Same-Store Sales

Systemwide +5.5%

Company-owned +6.8%

Franchise +4.8%

Company Restaurant Margin

Q1 2011 10.6%

Q1 2010 10.8%

March

February

January

Margin Variances

-160 bps Increased commodities

-20 bps

Q1 2011 Results

and

Full-Year Outlook

and

Full-Year Outlook

Steve Hare

Chief Financial Officer

11

Q1 2011 Results

*See Appendix.

12

Pro Forma Adjusted EBITDA

*See Appendix.

• Q1 2011 pro forma adjusted EBITDA* was

$75 million

$75 million

− Excludes Arby’s adjusted EBITDA* of $8.5 million

• Arby’s adjusted EBITDA includes brand G&A and an

allocation of corporate G&A

allocation of corporate G&A

− Arby’s portion of the allocation of corporate G&A in Q1

2011 was $8.8 million, which is equivalent to the

expected pro forma amount of corporate G&A savings

2011 was $8.8 million, which is equivalent to the

expected pro forma amount of corporate G&A savings

13

Cash Flow Q1 2011

14

Consolidated Debt

*See Appendix.

15

• Quarterly Cash Dividend

− $0.02 per share

− Payable on June 15, 2011 to stockholders of record as

of June 1, 2011

of June 1, 2011

• Stock Repurchases

− Total amount authorized and available is $250 million

− No repurchases during the first quarter due to Arby’s

strategic alternatives process

strategic alternatives process

Dividends and Stock Repurchases

16

Commodity Prices Increasing Significantly in 2011

17

Revised 2011 Outlook

• Expect $330-340 million pro forma adjusted EBITDA1

• Key Assumptions:

– Wendy’s same-store sales growth +1% to +3%

– Flat to slightly negative Wendy’s company-operated

restaurant margin2

restaurant margin2

– Capital expenditures of $145 million

1 Assumes sale of Arby’s and related G&A reductions occurred as of the beginning of 2011.

2 Includes incremental new breakfast advertising expense in 2010 and 2011.

Wendy’s Initiatives

& Global Expansion

& Global Expansion

Roland Smith

President & Chief Executive Officer

19

Value

Hamburgers

Salads

Fries

20

Wendy’s Q2 2011 Marketing Calendar

June

May

April

Natural-Cut Fries

with Sea Salt

with Sea Salt

Natural-Cut Fries

with Sea Salt

with Sea Salt

Flavor

Flavor

Dipped

Dipped

Chicken

Chicken

Bacon

Bacon

Mushroom

Mushroom

Melt

Melt

Coming in July:

Fresh Berry Frosty

21

Wendy’s #1 in Salad Category

Share of QSR/Fast Casual Entrée Salads

Share of QSR/Fast Casual Entrée Salads

Source: Third Party Research, for 3 month period ended January 2011

1st

2nd

3rd

22

Dave’s Hot ‘N Juicy Cheeseburgers

23

Enhanced Chicken Menu

Asiago Ranch Q1 2011

Gold Chicken Q4 2011

Enhanced Filet Q3 2010

24

Strategic Pricing

• Strategic pricing model provides information on

demand elasticity for pricing actions

demand elasticity for pricing actions

• Wendy’s implementing selective price increases in

2011

2011

• Objective is to partially offset commodity increases

while protecting transactions and market share

while protecting transactions and market share

25

Wendy’s Facility Remodels

Artist rendering of a Wendy’s facility remodel.

26

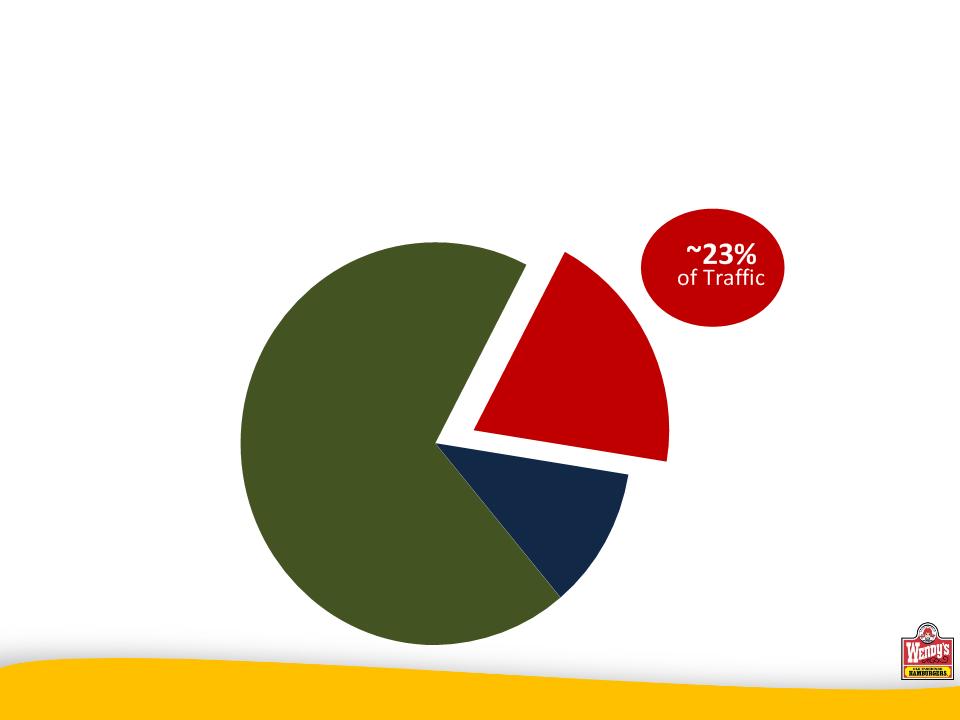

QSR Annual Sales:

Hamburger Category

Hamburger Category

Source: industry reports

QSR Breakfast Opportunity

$7 bil

Late Night

$42 bil

Core

$13 bil

Breakfast

27

Wendy’s Breakfast Update

• Awareness, trial and repeat rates improving

• Sales trends growing

• Annualized average weekly sales meeting incremental

breakfast sales target of $150,000

breakfast sales target of $150,000

– 10% sales lift to $1.4 million average unit volumes

28

Breakfast Products Score High with Consumers

Artisan Egg Sandwich

9.2 out of 10.0

Mornin’ Melt Panini

9.1 out of 10.0

Biscuit Sandwich

9.1 out of 10.0

Fire Roasted Burrito

9.0 out of 10.0

All Top-2 Box scores of 95% or higher

Average Attribute Score:

29

2011 Breakfast Expansion Timeline

Q4

2011

2011

Q2

2011

2011

Q3

2011

2011

Q1

2011

2011

2010

1,000

STORES

YE

2011

2011

CONVERT 300 OLD MENU

STORES

STORES

NEW

MENU

LAUNCH

MENU

LAUNCH

LOUISVILLE &

SAN ANTONIO

SAN ANTONIO

ADDITIONAL

MARKETS

MARKETS

• Kansas City

• Phoenix

• Pittsburgh

• Shreveport

30

Wendy’s/Arby’s International

Development Since the Merger

Development Since the Merger

Singapore

35 restaurants

Middle East

79 restaurants

Turkey

100 restaurants

Russia

180 restaurants

Eastern Caribbean

24 restaurants

Argentina

50 restaurants

Japan

joint venture

• Six long-term development agreements covering 23 countries

• Joint venture agreement with Higa Industries Co., Ltd. to develop

restaurants in Japan

restaurants in Japan

31

Russia Restaurant Openings

• First two restaurants in Moscow to open this month

– Mall food court at Capitoly Vernadskogo

– Arbat area of Moscow

• Openings part of the development agreement

announced in August 2010 with Wenrus Restaurant

Group Limited

announced in August 2010 with Wenrus Restaurant

Group Limited

– 180 restaurants in Russia over the next 10 years

32

• Working on the strategic alternatives process for

Arby’s, including a potential sale

Arby’s, including a potential sale

• Focusing our resources on the Wendy’s brand for

future growth

future growth

2011: Transition Year

33

Wendy’s Growth Initiatives - Summary

• Deliver “Real” brand positioning

• Improve core menu

• Introduce exciting, new products

• Expand breakfast

• Modernize our facilities

• Pursue global expansion

Average annual EBITDA growth of 10-15%, beginning in 2012

Q&A

Appendix

36

37