Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x |

Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the quarterly period ended March 31, 2011. |

OR

| ¨ |

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to . |

Commission File Number: 001-33096

United States Natural Gas Fund, LP

(Exact name of registrant as specified in its charter)

| Delaware | 20-5576760 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

1320 Harbor Bay Parkway, Suite 145

Alameda, California 94502

(Address of principal executive offices) (Zip code)

(510) 522-9600

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

x |

Accelerated filer |

¨ | |||

| Non-accelerated filer |

¨ |

Smaller reporting company |

¨ | |||

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨ Yes x No

Table of Contents

UNITED STATES NATURAL GAS FUND, LP

Table of Contents

Table of Contents

| Condensed Financial Statements. |

Index to Condensed Financial Statements

1

Table of Contents

United States Natural Gas Fund, LP

Condensed Statements of Financial Condition

At March 31, 2011 (Unaudited) and December 31, 2010

| March 31, 2011 |

December 31, 2010 |

|||||||

| Assets |

||||||||

| Cash and cash equivalents (Note 5) |

$ | 1,978,523,029 | $ | 2,320,745,778 | ||||

| Equity in UBS Securities LLC trading accounts: |

||||||||

| Cash |

182,117,248 | 314,624,216 | ||||||

| Unrealized gain on open commodity futures and cleared swap contracts |

59,920,663 | 87,405,280 | ||||||

| Unrealized gain on open swap contracts |

22,587,540 | 27,200,226 | ||||||

| Receivable for units sold |

36,655,674 | - | ||||||

| Investment receivable |

30,103,852 | 16,538,472 | ||||||

| Dividend receivable |

32,465 | 54,186 | ||||||

| Other assets |

156,003 | 163,424 | ||||||

| Total assets |

$ | 2,310,096,474 | $ | 2,766,731,582 | ||||

| Liabilities and Partners’ Capital |

||||||||

| General Partner management fees payable (Note 3) |

$ | 1,082,934 | $ | 1,223,496 | ||||

| Payable for units redeemed |

- | 95,399,015 | ||||||

| Interest payable |

29,292 | - | ||||||

| Professional fees payable |

1,270,706 | 2,332,979 | ||||||

| Brokerage commissions payable |

216,250 | 236,250 | ||||||

| License fees payable |

142,681 | 158,697 | ||||||

| Directors’ fees payable |

20,066 | 24,308 | ||||||

| Total liabilities |

2,761,929 | 99,374,745 | ||||||

| Commitments and Contingencies (Notes 3, 4 and 5) |

||||||||

| Partners’ Capital |

||||||||

| General Partner |

- | - | ||||||

| Limited Partners |

2,307,334,545 | 2,667,356,837 | ||||||

| Total Partners’ Capital |

2,307,334,545 | 2,667,356,837 | ||||||

| Total liabilities and partners’ capital |

$ | 2,310,096,474 | $ | 2,766,731,582 | ||||

| Limited Partners’ units outstanding |

200,697,828 | 222,300,000 | * | |||||

| Net asset value per unit |

$ | 11.50 | $ | 12.00 | * | |||

| Market value per unit |

$ | 11.50 | $ | 11.98 | * | |||

| * |

On March 8, 2011, there was a 2-for-1 reverse unit split. Historical units outstanding, net asset value per unit and market value per unit have been adjusted to reflect the 2-for-1 reverse unit split on a retroactive basis. |

See accompanying notes to condensed financial statements

2

Table of Contents

United States Natural Gas Fund, LP

Condensed Schedule of Investments (Unaudited)

At March 31, 2011

| Number of Contracts |

Gain on Open Commodity Contracts |

% of Partners’ Capital |

||||||||||

| Open Cleared Swap Contracts - Long |

||||||||||||

| Foreign Contracts |

||||||||||||

| ICE Natural Gas Cleared Swap ICE LOT contracts, expiring May 2011 |

55,915 | $ | 36,835,513 | 1.59 | ||||||||

| Open Futures Contracts - Long |

||||||||||||

| United States Contracts |

||||||||||||

| NYMEX Natural Gas Futures NG contracts, expiring May 2011 |

6,606 | 8,250,100 | 0.36 | |||||||||

| NYMEX Natural Gas Futures NN contracts, expiring May 2011 |

22,520 | 14,835,050 | 0.64 | |||||||||

| 29,126 | 23,085,150 | 1.00 | ||||||||||

| Total Open Cleared Swap and Futures Contracts |

85,041 | $ | 59,920,663 | 2.59 | ||||||||

| |

Principal Amount |

|

|

Market Value |

|

|||||||

| Cash Equivalents |

||||||||||||

| United States Treasury Obligation |

||||||||||||

| U.S. Treasury Bill, 0.07%, 6/23/2011* |

$ | 250,000,000 | $ | 249,959,651 | 10.83 | |||||||

| United States - Money Market Funds |

||||||||||||

| Fidelity Institutional Government Portfolio – Class I |

476,565,164 | 476,565,164 | 20.65 | |||||||||

| Goldman Sachs Financial Square Funds – Government Fund – Class SL |

350,461,034 | 350,461,034 | 15.19 | |||||||||

| Morgan Stanley Institutional Liquidity Fund – Government Portfolio |

675,362,164 | 675,362,164 | 29.27 | |||||||||

| Total Money Market Funds |

1,502,388,362 | 65.11 | ||||||||||

| Total Cash Equivalents |

$ | 1,752,348,013 | 75.94 | |||||||||

| * |

Security or partial security segregated as collateral for open over-the-counter total return swap contracts. |

See accompanying notes to condensed financial statements.

3

Table of Contents

United States Natural Gas Fund, LP

Condensed Schedule of Investments (Unaudited) (Continued)

At March 31, 2011

Open Over-the-Counter Total Return Swap Contracts

| Notional Amount |

Market Value | Unrealized Gain (Loss) |

Range of Termination Dates |

|||||||||||||||

| Swap agreement to receive return on the Custom Natural Gas Index (UNG) – Excess Return |

$ | 245,450,029 | $ | 1,908,785 | $ | 1,908,785 | 4/20/2011 | |||||||||||

| Swap agreement to receive return on the Custom Natural Gas Index (UNG) – Excess Return |

98,941,589 | 769,844 | 769,844 | 6/08/2011 | ||||||||||||||

| Swap agreement to receive return on the eXtra US1 Excess Return Index |

282,889,080 | (104,756 | ) | (104,756 | ) | 4/29/2011 | ||||||||||||

| Swap agreement to receive return on the eXtra US1 Excess Return Index |

81,826,848 | (897 | ) | (897 | ) | 9/30/2011 | ||||||||||||

| Swap agreement to receive return on the eXtra US1 Excess Return Index |

110,485,530 | (36,368 | ) | (36,368 | ) | 8/17/2011 | ||||||||||||

| Swap agreement to receive return on the NYMEX Henry Hub Natural Gas Futures Contract |

314,673,610 | 20,050,932 | 20,050,932 | |

5/06/2011- 8/31/2011 |

| ||||||||||||

| Total unrealized gain on open swap contracts |

$ | 22,587,540 | ||||||||||||||||

See accompanying notes to condensed financial statements.

4

Table of Contents

United States Natural Gas Fund, LP

Condensed Statements of Operations (Unaudited)

For the three months ended March 31, 2011 and 2010

| Three months ended March 31, 2011 |

Three

months ended March 31, 2010 |

|||||||

| Income |

||||||||

| Gain (loss) on trading of commodity contracts: |

||||||||

| Realized gain (loss) on closed futures contracts |

$ | 2,603,815 | $ | (465,823,610 | ) | |||

| Realized loss on closed swaps contracts |

(28,899,684 | ) | (697,388,429 | ) | ||||

| Change in unrealized loss on open futures contracts |

(27,484,617 | ) | (101,594,860 | ) | ||||

| Change in unrealized loss on open swaps contracts |

(4,612,686 | ) | (18,732,581 | ) | ||||

| Dividend income |

114,922 | 136,183 | ||||||

| Interest income |

97,995 | 83,705 | ||||||

| Other income |

58,000 | 47,000 | ||||||

| Total loss |

(58,122,255 | ) | (1,283,272,592 | ) | ||||

| Expenses |

||||||||

| General Partner management fees (Note 3) |

3,184,351 | 5,044,409 | ||||||

| Brokerage commissions |

1,396,783 | 1,741,599 | ||||||

| Professional fees |

698,239 | 751,918 | ||||||

| Directors’ fees |

40,119 | 49,156 | ||||||

| Other expenses |

243,595 | 262,662 | ||||||

| Total expenses |

5,563,087 | 7,849,744 | ||||||

| Net loss |

$ | (63,685,342 | ) | $ | (1,291,122,336 | ) | ||

| Net loss per limited partnership unit |

$ | (0.50 | ) | $ | (6.33 | )* | ||

| Net loss per weighted average limited partnership unit |

$ | (0.30 | ) | $ | (6.09 | )* | ||

| Weighted average limited partnership units outstanding |

210,749,107 | 212,110,556 | * | |||||

| * |

On March 8, 2011, there was a 2-for-1 reverse unit split. The Condensed Statements of Operations (Unaudited) has been adjusted for the period shown to reflect the 2-for-1 reverse unit split on a retroactive basis. |

See accompanying notes to condensed financial statements.

5

Table of Contents

United States Natural Gas Fund, LP

Condensed Statement of Changes in Partners’ Capital (Unaudited)

For the three months ended March 31, 2011

| General Partner | Limited Partners | Total | ||||||||||

| Balances, at December 31, 2010 |

$ | - | $ | 2,667,356,837 | $ | 2,667,356,837 | ||||||

| Addition of 90,600,000 partnership units |

- | 551,537,522 | 551,537,522 | |||||||||

| Redemption of 334,502,172 partnership units* |

- | (847,874,472 | ) | (847,874,472 | ) | |||||||

| Net loss |

- | (63,685,342 | ) | (63,685,342 | ) | |||||||

| Balances, at March 31, 2011 |

$ | - | $ | 2,307,334,545 | $ | 2,307,334,545 | ||||||

| Net Asset Value Per Unit: |

||||||||||||

| At December 31, 2010 |

$ | 12.00 | * | |||||||||

| At March 31, 2011 |

$ | 11.50 | ||||||||||

| * |

On March 8, 2011, there was a 2-for-1 reverse unit split. The Condensed Statement of Changes in Partners’ Capital (Unaudited) has been adjusted for the period reflected to reflect the 2-for-1 reverse unit split on a retroactive basis. |

See accompanying notes to condensed financial statements.

6

Table of Contents

United States Natural Gas Fund, LP

Condensed Statements of Cash Flows (Unaudited)

For the three months ended March 31, 2011 and 2010

| Three months ended March 31, 2011 |

Three months ended March 31, 2010 |

|||||||

| Cash Flows from Operating Activities: |

||||||||

| Net loss |

$ | (63,685,342 | ) | $ | (1,291,122,336 | ) | ||

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: |

||||||||

| Decrease in commodity futures trading account – cash |

132,506,968 | 263,375,209 | ||||||

| Unrealized loss on open futures contracts |

27,484,617 | 101,594,860 | ||||||

| Unrealized loss on open swap contracts |

4,612,686 | 18,732,581 | ||||||

| Increase in investment receivable |

(13,565,380 | ) | (109,657,245 | ) | ||||

| (Increase) decrease in dividend receivable and other assets |

29,142 | (46,183 | ) | |||||

| Decrease in General Partner management fees payable |

(140,562 | ) | (469,466 | ) | ||||

| Decrease in investment payable |

- | (19,112,096 | ) | |||||

| Increase in swap premiums received |

- | 230,574,218 | ||||||

| Increase (decrease) in interest payable |

29,292 | (20,751 | ) | |||||

| Decrease in professional fees payable |

(1,062,273 | ) | (56,359 | ) | ||||

| Decrease in brokerage commissions payable |

(20,000 | ) | (16,000 | ) | ||||

| Decrease in license fees payable |

(16,016 | ) | (8,737 | ) | ||||

| Decrease in directors’ fees payable |

(4,242 | ) | (943 | ) | ||||

| Net cash provided by (used in) operating activities |

86,168,890 | (806,233,248 | ) | |||||

| Cash Flows from Financing Activities: |

||||||||

| Addition of partnership units |

514,881,848 | 195,674,968 | ||||||

| Redemption of partnership units |

(943,273,487 | ) | (637,766,682 | ) | ||||

| Net cash used in financing activities |

(428,391,639 | ) | (442,091,714 | ) | ||||

| Net Decrease in Cash and Cash Equivalents |

(342,222,749 | ) | (1,248,324,962 | ) | ||||

| Cash and Cash Equivalents, beginning of period |

2,320,745,778 | 3,896,493,193 | ||||||

| Cash and Cash Equivalents, end of period |

$ | 1,978,523,029 | $ | 2,648,168,231 | ||||

See accompanying notes to condensed financial statements.

7

Table of Contents

United States Natural Gas Fund, LP

Notes to Condensed Financial Statements

For the period ended March 31, 2011 (Unaudited)

NOTE 1 - ORGANIZATION AND BUSINESS

The United States Natural Gas Fund, LP (“USNG”) was organized as a limited partnership under the laws of the state of Delaware on September 11, 2006. USNG is a commodity pool that issues limited partnership units (“units”) that may be purchased and sold on the NYSE Arca, Inc. (the “NYSE Arca”). Prior to November 25, 2008, USNG’s units traded on the American Stock Exchange (the “AMEX”). USNG will continue in perpetuity, unless terminated sooner upon the occurrence of one or more events as described in its Third Amended and Restated Agreement of Limited Partnership dated as of December 31, 2010 (the “LP Agreement”). The investment objective of USNG is for the daily changes in percentage terms of its units’ net asset value to reflect the daily changes in percentage terms of the spot price of natural gas delivered at the Henry Hub, Louisiana as measured by the changes in the price of the futures contract on natural gas as traded on the New York Mercantile Exchange (the “NYMEX”) that is the near month contract to expire, except when the near month contract is within two weeks of expiration, in which case the futures contract will be the next month contract to expire, less USNG’s expenses. It is not the intent of USNG to be operated in a fashion such that the NAV will equal, in dollar terms, the spot price of natural gas or any particular futures contract based on natural gas. USNG accomplishes its objective through investments in futures contracts for natural gas, crude oil, heating oil, gasoline and other petroleum-based fuels that are traded on the NYMEX, ICE Futures or other U.S. and foreign exchanges (collectively, “Futures Contracts”) and other natural gas-related investments such as cash-settled options on Futures Contracts, forward contracts for natural gas, cleared swap contracts and over-the-counter transactions that are based on the price of natural gas, crude oil and other petroleum-based fuels, Futures Contracts and indices based on the foregoing (collectively, “Other Natural Gas-Related Investments”). As of March 31, 2011, USNG held 6,606 NG Futures Contracts and 22,520 NN Financially Settled Futures Contracts traded on the NYMEX, 55,915 cleared swap contracts traded on the ICE Futures, and over-the-counter swap transactions with four counterparties.

USNG commenced investment operations on April 18, 2007 and has a fiscal year ending on December 31. United States Commodity Funds LLC (“USCF”) is responsible for the management of USNG. USCF is a member of the National Futures Association (the “NFA”) and became a commodity pool operator registered with the Commodity Futures Trading Commission (the “CFTC”) effective December 1, 2005. USCF is also the general partner of the United States Oil Fund, LP (“USOF”), the United States 12 Month Oil Fund, LP (“US12OF”), the United States Gasoline Fund, LP (“UGA”) and the United States Heating Oil Fund, LP (“USHO”), which listed their limited partnership units on the AMEX under the ticker symbols “USO” on April 10, 2006, “USL” on December 6, 2007, “UGA” on February 26, 2008 and “UHN” on April 9, 2008, respectively. As a result of the acquisition of the AMEX by NYSE Euronext, each of USOF’s, US12OF’s, UGA’s and USHO’s units commenced trading on the NYSE Arca on November 25, 2008. USCF is also the general partner of the United States Short Oil Fund, LP (“USSO”), the United States 12 Month Natural Gas Fund, LP (“US12NG”) and the United States Brent Oil Fund, LP (“USBO”), which listed their limited partnership units on the NYSE Arca under the ticker symbols “DNO” on September 24, 2009, “UNL” on November 18, 2009 and “BNO” on June 2, 2010, respectively. USCF is also the sponsor of the United States Commodity Index Fund (“USCI”), a series of the United States Commodity Index Funds Trust (the “Trust”) which listed its units on the NYSE Arca under the ticker symbol “USCI” on August 10, 2010. USCF has also filed a registration statement to register units of the United States Metals Index Fund, the United States Agriculture Index Fund and the United States Copper Index Fund, three additional series of the Trust.

USNG issues units to certain authorized purchasers (“Authorized Purchasers”) by offering baskets consisting of 100,000 units (“Creation Baskets”) through ALPS Distributors, Inc., as the marketing agent (the “Marketing Agent”). The purchase price for a Creation Basket is based upon the net asset value of a unit calculated shortly after the close of the core trading session on the NYSE Arca on the day the order to create the basket is properly received.

In addition, Authorized Purchasers pay USNG a $1,000 fee for each order placed to create one or more Creation Baskets or to redeem one or more baskets consisting of 100,000 units (“Redemption Baskets”). Units may be purchased or sold on a nationally recognized securities exchange in smaller increments than a Creation Basket or Redemption Basket. Units purchased or sold on a nationally recognized securities exchange are not purchased or sold at the net asset value of USNG but rather at market prices quoted on such exchange.

8

Table of Contents

In April 2007, USNG initially registered 30,000,000 units on Form S-1 with the U.S. Securities and Exchange Commission (the “SEC”). On April 18, 2007, USNG listed its units on the AMEX under the ticker symbol “UNG”. On that day, USNG established its initial net asset value by setting the price at $50.00 per unit and issued 200,000 units in exchange for $10,001,000. USNG also commenced investment operations on April 18, 2007, by purchasing Futures Contracts traded on the NYMEX based on natural gas. As of March 31, 2011, USNG had registered a total of 1,480,000,000 units.

On March 8, 2011, after the close of trading on the NYSE Arca, USNG effected a 2-for-1 reverse unit split and post-split units of USNG began trading on March 9, 2011. As a result of the reverse unit split, every two pre-split units of USNG were automatically exchanged for one post-split unit. Immediately prior to the reverse split, there were 447,200,000 units of USNG issued and outstanding, each representing a net asset value of $5.16. Immediately after the reverse unit split, the number of issued and outstanding units of USNG decreased to 223,600,000, not accounting for fractional units, and the net asset value relating to each unit increased to $10.31. In connection with the reverse unit split, the CUSIP number of USNG’s units changed to 912318110. USNG’s ticker symbol, “UNG,” remains the same.

The accompanying unaudited condensed financial statements have been prepared in accordance with Rule 10-01 of Regulation S-X promulgated by the SEC and, therefore, do not include all information and footnote disclosure required under accounting principles generally accepted in the United States of America (“GAAP”). The financial information included herein is unaudited; however, such financial information reflects all adjustments, which are, in the opinion of management, necessary for the fair presentation of the condensed financial statements for the interim period.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Revenue Recognition

Commodity futures contracts, forward contracts, physical commodities and related options are recorded on the trade date. All such transactions are recorded on the identified cost basis and marked to market daily. Unrealized gains or losses on open contracts are reflected in the condensed statement of financial condition and represent the difference between the original contract amount and the market value (as determined by exchange settlement prices for futures contracts and related options and cash dealer prices at a predetermined time for forward contracts, physical commodities, and their related options) as of the last business day of the year or as of the last date of the condensed financial statements. Changes in the unrealized gains or losses between periods are reflected in the condensed statement of operations. USNG earns interest on its assets denominated in U.S. dollars on deposit with the futures commission merchant at the overnight Federal Funds Rate less 32 basis points. In addition, USNG earns income on funds held at the custodian at prevailing market rates earned on such investments.

Investments in over-the-counter total return swap contracts (see Note 5) are arrangements to exchange a periodic payment for a market-linked return, each based on a notional amount. To the extent that the total return of the commodity future, security or index underlying the transaction exceeds or falls short of the offsetting periodic payment obligation, USNG receives a payment from, or makes a payment to, the swap counterparty. The over-the-counter swap contracts are valued daily based upon the appreciation or depreciation of the underlying securities subsequent to the effective date of the contract. Changes in the value of the swaps are reported as unrealized gains and losses and periodic payments are recorded as realized gains or losses in the accompanying Condensed Statements of Operations.

Brokerage Commissions

Brokerage commissions on all open commodity futures contracts are accrued on a full-turn basis.

Swap Premiums

Upfront fees paid by USNG for over-the-counter swap contracts are reflected on the Condensed Statements of Financial Condition and represent payments made upon entering into a swap agreement to compensate for differences between the stated terms of the agreement and prevailing market conditions. The fees are amortized daily over the term of the swap agreement.

9

Table of Contents

Income Taxes

USNG is not subject to federal income taxes; each partner reports his/her allocable share of income, gain, loss deductions or credits on his/her own income tax return.

In accordance with GAAP, USNG is required to determine whether a tax position is more likely than not to be sustained upon examination by the applicable taxing authority, including resolution of any tax related appeals or litigation processes, based on the technical merits of the position. USNG files an income tax return in the U.S. federal jurisdiction, and may file income tax returns in various U.S. states. USNG is not subject to income tax return examinations by major taxing authorities for years before 2007 (year of inception). The tax benefit recognized is measured as the largest amount of benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement. De-recognition of a tax benefit previously recognized results in USNG recording a tax liability that reduces net assets. However, USNG’s conclusions regarding this policy may be subject to review and adjustment at a later date based on factors including, but not limited to, on-going analyses of and changes to tax laws, regulations and interpretations thereof. USNG recognizes interest accrued related to unrecognized tax benefits and penalties related to unrecognized tax benefits in income tax fees payable, if assessed. No interest expense or penalties have been recognized as of and for the period ended March 31, 2011.

Creations and Redemptions

Authorized Purchasers may purchase Creation Baskets or redeem Redemption Baskets only in blocks of 100,000 units at a price equal to the net asset value of the units calculated shortly after the close of the core trading session on the NYSE Arca on the day the order is placed.

USNG receives or pays the proceeds from units sold or redeemed within three business days after the trade date of the purchase or redemption. The amounts due from Authorized Purchasers are reflected in USNG’s condensed statement of financial condition as receivable for units sold, and amounts payable to Authorized Purchasers upon redemption are reflected as payable for units redeemed.

Partnership Capital and Allocation of Partnership Income and Losses

Profit or loss shall be allocated among the partners of USNG in proportion to the number of units each partner holds as of the close of each month. USCF may revise, alter or otherwise modify this method of allocation as described in the LP Agreement.

Calculation of Net Asset Value

USNG’s net asset value is calculated on each NYSE Arca trading day by taking the current market value of its total assets, subtracting any liabilities and dividing the amount by the total number of units issued and outstanding. USNG uses the closing price for the contracts on the relevant exchange on that day to determine the value of contracts held on such exchange.

Net Income (Loss) per Unit

Net income (loss) per unit is the difference between the net asset value per unit at the beginning of each period and at the end of each period. The weighted average number of units outstanding was computed for purposes of disclosing net income (loss) per weighted average unit. The weighted average units are equal to the number of units outstanding at the end of the period, adjusted proportionately for units redeemed based on the amount of time the units were outstanding during such period. There were no units held by USCF at March 31, 2011.

10

Table of Contents

Offering Costs

Offering costs incurred in connection with the registration of additional units after the initial registration of units are borne by USNG. These costs include registration fees paid to regulatory agencies and all legal, accounting, printing and other expenses associated with such offerings. These costs are accounted for as a deferred charge and thereafter amortized to expense over twelve months on a straight-line basis or a shorter period if warranted.

Cash Equivalents

Cash equivalents include money market funds and overnight deposits or time deposits with original maturity dates of three months or less.

Reclassification

Certain amounts in the accompanying condensed financial statements were reclassified to conform with the current presentation.

Use of Estimates

The preparation of condensed financial statements in conformity with GAAP requires USNG’s management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the condensed financial statements, and the reported amounts of the revenue and expenses during the reporting period. Actual results may differ from those estimates and assumptions.

Other

On March 8, 2011, after the close of the NYSE Arca, Inc., USNG effected a 2-for-1 reverse unit split and post-split units of USNG began trading on March 9, 2011. The unaudited condensed financial information reported in this quarterly report on Form 10-Q gives effect to the reverse split and the post-split of units as if they had been completed on January 1, 2010.

The unaudited condensed financial information and pro forma financial information, as well as the historical combined financial information as of and for the year ended December 31, 2010 was derived from USNG’s historical financial statements and has been audited by Spicer Jeffries LLP. The historical financial information as of and for the three months ended March 31, 2011 is unaudited. The condensed financial statements in this quarterly report on Form 10-Q are presented in accordance with Accounting Standards Codification 260 for purposes of presenting the 2-for-1 reverse split on a historical basis for all periods reported.

NOTE 3 - FEES PAID BY THE FUND AND RELATED PARTY TRANSACTIONS

USCF Management Fee

Under the LP Agreement, USCF is responsible for investing the assets of USNG in accordance with the objectives and policies of USNG. In addition, USCF has arranged for one or more third parties to provide administrative, custody, accounting, transfer agency and other necessary services to USNG. For these services, USNG is contractually obligated to pay USCF a fee, which is paid monthly, that is equal to 0.60% per annum of average daily net assets of $1,000,000,000 or less and 0.50% per annum of average daily net assets that are greater than $1,000,000,000.

Ongoing Registration Fees and Other Offering Expenses

USNG pays all costs and expenses associated with the ongoing registration of its units subsequent to the initial offering. These costs include registration or other fees paid to regulatory agencies in connection with the offer and sale of units, and all legal, accounting, printing and other expenses associated with such offer and sale. For the three months ended March 31, 2011 and 2010, USNG incurred $27,900 and $34,200, respectively, in registration fees and other offering expenses.

11

Table of Contents

Directors’ Fees and Expenses

USNG is responsible for paying its portion of the directors’ and officers’ liability insurance of all affiliated funds for which USCF serves as general partner or sponsor (all affiliated funds including USCI) and the fees and expenses of the independent directors who also serve as audit committee members of those affiliated USCF funds organized as limited partnerships (all affiliated funds, excluding USCI). Effective as of April 1, 2010, USNG became responsible for paying its portion of any payments that may become due to the independent directors pursuant to the deferred compensation agreements entered into between the independent directors, USCF and each of the affiliated funds, except USCI. USNG shares all director fees and expenses, including any that may become due pursuant to the deferred compensation agreements, with all the affiliated funds, except USCI, based on the relative assets of each fund, computed on a daily basis. These fees and expenses for the affiliated funds, as described above, for the year ending December 31, 2011, are estimated to be a total of $540,000.

Licensing Fees

As discussed in Note 4 below, USNG entered into a licensing agreement with the NYMEX on May 30, 2007. Pursuant to the agreement, USNG and the affiliated funds managed by USCF, other than USBO and USCI, pay a licensing fee that is equal to 0.04% for the first $1,000,000,000 of combined assets of the funds and 0.02% for combined assets above $1,000,000,000. During the three months ended March 31, 2011 and 2010, USNG incurred $142,709 and $222,636, respectively, under this arrangement.

Investor Tax Reporting Cost

The fees and expenses associated with USNG’s audit expenses and tax accounting and reporting requirements are paid by USNG. These costs are estimated to be $2,500,000 for the year ending December 31, 2011.

Other Expenses and Fees

In addition to the fees described above, USNG pays all brokerage fees, transaction costs for over-the-counter swaps and other expenses in connection with the operation of USNG, including the costs incurred with the preparation and execution of the reverse split, but excluding costs and expenses paid by USCF as outlined in Note 4 below.

NOTE 4 - CONTRACTS AND AGREEMENTS

USNG is party to a marketing agent agreement, dated as of April 17, 2007, as amended from time to time, with the Marketing Agent and USCF, whereby the Marketing Agent provides certain marketing services for USNG as outlined in the agreement. The fee of the Marketing Agent, which is borne by USCF, is equal to 0.06% on USNG’s assets up to $3 billion and 0.04% on USNG’s assets in excess of $3 billion.

The above fee does not include the following expenses, which are also borne by USCF: the cost of placing advertisements in various periodicals; web construction and development; or the printing and production of various marketing materials.

USNG is also party to a custodian agreement, dated March 5, 2007, as amended from time to time, with Brown Brothers Harriman & Co. (“BBH&Co.”) and USCF, whereby BBH&Co. holds investments on behalf of USNG. USCF pays the fees of the custodian, which are determined by the parties from time to time. In addition, USNG is party to an administrative agency agreement, dated March 5, 2007, as amended from time to time, with USCF and BBH&Co., whereby BBH&Co. acts as the administrative agent, transfer agent and registrar for USNG. USCF also pays the fees of BBH&Co. for its services under such agreement and such fees are determined by the parties from time to time.

Currently, USCF pays BBH&Co. for its services, in the foregoing capacities, a minimum amount of $75,000 annually for its custody, fund accounting and fund administration services rendered to USNG and each of the affiliated funds managed by USCF, as well as a $20,000 annual fee for its transfer agency services. In addition, USCF pays BBH&Co. an asset-based charge of (a) 0.06% for the first $500 million of USNG’s, USOF’s, US12OF’s, UGA’s, USHO’s, USSO’s, US12NG’s, USBO’s and USCI’s combined net assets, (b) 0.0465% for USNG’s, USOF’s, US12OF’s, UGA’s, USHO’s, USSO’s, US12NG’s, USBO’s and USCI’s combined net

12

Table of Contents

assets greater than $500 million but less than $1 billion, and (c) 0.035% once USNG’s, USOF’s, US12OF’s, UGA’s, USHO’s, USSO’s, US12NG’s, USBO’s and USCI’s combined net assets exceed $1 billion. The annual minimum amount will not apply if the asset-based charge for all accounts in the aggregate exceeds $75,000. USCF also pays transaction fees ranging from $7 to $15 per transaction.

USNG has entered into a brokerage agreement with UBS Securities LLC (“UBS Securities”). The agreement requires UBS Securities to provide services to USNG in connection with the purchase and sale of Futures Contracts and Other Natural Gas-Related Investments that may be purchased and sold by or through UBS Securities for USNG’s account. In accordance with the agreement, UBS Securities charges USNG commissions of approximately $7 to $15 per round-turn trade, including applicable exchange and NFA fees for Futures Contracts and options on Futures Contracts.

On May 30, 2007, USNG and the NYMEX entered into a licensing agreement whereby USNG was granted a non-exclusive license to use certain of the NYMEX’s settlement prices and service marks. Under the licensing agreement, USNG and the affiliated funds managed by USCF, other than USBO and USCI, pay the NYMEX an asset-based fee for the license, the terms of which are described in Note 3.

USNG expressly disclaims any association with the NYMEX or endorsement of USNG by the NYMEX and acknowledges that “NYMEX” and “New York Mercantile Exchange” are registered trademarks of the NYMEX.

NOTE 5 - FINANCIAL INSTRUMENTS, OFF-BALANCE SHEET RISKS AND CONTINGENCIES

USNG engages in the trading of futures contracts, options on futures contracts, cleared swaps and over-the-counter swaps (collectively, “derivatives”). USNG is exposed to both market risk, which is the risk arising from changes in the market value of the contracts, and credit risk, which is the risk of failure by another party to perform according to the terms of a contract.

USNG may enter into futures contracts, options on futures contracts, cleared swaps and over-the-counter swaps to gain exposure to changes in the value of an underlying commodity. A futures contract obligates the seller to deliver (and the purchaser to accept) the future delivery of a specified quantity and type of a commodity at a specified time and place. Some futures contracts may call for physical delivery of the asset, while others are settled in cash. The contractual obligations of a buyer or seller may generally be satisfied by taking or making physical delivery of the underlying commodity or by making an offsetting sale or purchase of an identical futures contract on the same or linked exchange before the designated date of delivery. Cleared swaps are over-the-counter agreements that are eligible to be cleared by a clearinghouse, e.g., ICE Clear Europe, but which are not traded on an exchange. A cleared swap is created when the parties to an off-exchange over-the-counter transaction agree to extinguish their over-the-counter contract and replace it with a cleared swap. Cleared swaps are intended to provide the efficiencies and benefits that centralized clearing on an exchange offers to traders of futures contracts, including credit risk intermediation and the ability to offset positions initiated with different counterparties.

The purchase and sale of futures contracts, options on futures contracts and cleared swaps require margin deposits with a futures commission merchant. Additional deposits may be necessary for any loss on contract value. The Commodity Exchange Act requires a futures commission merchant to segregate all customer transactions and assets from the futures commission merchant’s proprietary activities.

Futures contracts and cleared swaps involve, to varying degrees, elements of market risk (specifically commodity price risk) and exposure to loss in excess of the amount of variation margin. The face or contract amounts reflect the extent of the total exposure USNG has in the particular classes of instruments. Additional risks associated with the use of futures contracts are an imperfect correlation between movements in the price of the futures contracts and the market value of the underlying securities and the possibility of an illiquid market for a futures contract.

Through March 31, 2011, all of USNG’s investment contracts were exchange-traded futures contracts, cleared swaps or fully-collateralized over-the-counter swaps. The liquidity and credit risks associated with exchange-traded contracts and cleared swaps are generally perceived to be less than those associated with over-the-counter transactions since, in over-the-counter transactions, a party must rely solely on the credit of its respective individual counterparties. At March 31, 2011, USNG maintained over-the-counter

13

Table of Contents

transactions with four counterparties. Over-the-counter transactions subject USNG to the credit risk associated with counterparty non-performance. The credit risk from counterparty non-performance associated with such instruments is the net unrealized gain, if any, on the transaction. USNG has credit risk under its futures contracts since the sole counterparty to all domestic and foreign futures contracts is the clearinghouse for the exchange on which the relevant contracts are traded. However, as compared to its over-the-counter transactions, it may more easily realize value by reselling its futures contracts. In addition, USNG bears the risk of financial failure by the clearing broker.

At March 31, 2011, USNG’s counterparties posted $33,802,279 in cash and $0 in securities as collateral with USNG’s custodian, as compared with $10,260,000 in cash and $0 securities at March 31, 2010. Under these agreements, USNG posted collateral with respect to its obligations of $140,534,883 in cash and $64,799,038 in securities, such as U.S. Treasuries, at March 31, 2011, as compared with $259,652,889 in cash and $86,584,859 in securities at March 31, 2010.

USNG’s cash and other property, such as U.S. Treasuries, deposited with a futures commission merchant are considered commingled with all other customer funds, subject to the futures commission merchant’s segregation requirements. In the event of a futures commission merchant’s insolvency, recovery may be limited to a pro rata share of segregated funds available. It is possible that the recovered amount could be less than the total of cash and other property deposited. The insolvency of a futures commission merchant could result in the complete loss of USNG’s assets posted with that futures commission merchant; however, the vast majority of USNG’s assets are held in U.S. Treasuries, cash and/or cash equivalents with USNG’s custodian and would not be impacted by the insolvency of a futures commission merchant. Also, the failure or insolvency of USNG’s custodian could result in a substantial loss of USNG’s assets.

USCF invests a portion of USNG’s cash in money market funds that seek to maintain a stable net asset value. USNG is exposed to any risk of loss associated with an investment in these money market funds. As of March 31, 2011 and December 31, 2010, USNG had deposits in domestic and foreign financial institutions, including cash investments in money market funds, in the amounts of $2,160,640,277 and $2,635,369,994, respectively. This amount is subject to loss should these institutions cease operations.

For derivatives, risks arise from changes in the market value of the contracts. Theoretically, USNG is exposed to market risk equal to the value of futures contracts purchased and unlimited liability on such contracts sold short. As both a buyer and a seller of options, USNG pays or receives a premium at the outset and then bears the risk of unfavorable changes in the price of the contract underlying the option.

USNG’s policy is to continuously monitor its exposure to market and counterparty risk through the use of a variety of financial, position and credit exposure reporting controls and procedures. In addition, USNG has a policy of requiring review of the credit standing of each broker or counterparty with which it conducts business.

The financial instruments held by USNG are reported in its condensed statement of financial condition at market or fair value, or at carrying amounts that approximate fair value, because of their highly liquid nature and short-term maturity.

14

Table of Contents

NOTE 6 - FINANCIAL HIGHLIGHTS

The following table presents per unit performance data and other supplemental financial data for the three months ended March 31, 2011 and 2010 for the unitholders. This information has been derived from information presented in the condensed financial statements.

| For the three months ended March 31, 2011 (Unaudited) |

For the three months ended March 31, 2010 (Unaudited) |

|||||||||||

| Per Unit Operating Performance: |

||||||||||||

| Net asset value, beginning of period |

$ | 12.00 | * | $ | 20.14 | * | ||||||

| Total loss |

(0.47 | ) | (6.30 | )* | ||||||||

| Total expenses |

(0.03 | ) | (0.04 | )* | ||||||||

| Net decrease in net asset value |

(0.50 | ) | (6.34 | )* | ||||||||

| Net asset value, end of period |

$ | 11.50 | $ | 13.80 | * | |||||||

| Total Return |

(4.17 | )% | (31.48 | )% | ||||||||

| Ratios to Average Net Assets |

||||||||||||

| Total loss |

(2.44 | )% | (32.98 | )% | ||||||||

| Expenses excluding management fees** |

0.41 | % | 0.29 | % | ||||||||

| Management fees** |

0.54 | % | 0.53 | % | ||||||||

| Net loss |

(2.67 | )% | (33.18 | )% | ||||||||

| * |

On March 8, 2011, there was a 2-for-1 reverse unit split. The Financial Highlights (Unaudited) have been adjusted for the periods shown to reflect the 2-for-1 reverse unit split on a retroactive basis. |

| ** |

Annualized |

Total returns are calculated based on the change in value during the period. An individual unitholder’s total return and ratio may vary from the above total returns and ratios based on the timing of contributions to and withdrawals from USNG.

NOTE 7 - FAIR VALUE OF FINANCIAL INSTRUMENTS

USNG values its investments in accordance with Accounting Standards Codification 820 – Fair Value Measurements and Disclosures (“ASC 820”). ASC 820 defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles, and expands disclosures about fair value measurement. The changes to past practice resulting from the application of ASC 820 relate to the definition of fair value, the methods used to measure fair value, and the expanded disclosures about fair value measurement. ASC 820 establishes a fair value hierarchy that distinguishes between: (1) market participant assumptions developed based on market data obtained from sources independent of USNG (observable inputs) and (2) USNG’s own assumptions about market participant assumptions developed based on the best information available under the circumstances (unobservable inputs). The three levels defined by the ASC 820 hierarchy are as follows:

Level I – Quoted prices (unadjusted) in active markets for identical assets or liabilities that the reporting entity has the ability to access at the measurement date.

Level II – Inputs other than quoted prices included within Level I that are observable for the asset or liability, either directly or indirectly. Level II assets include the following: quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the asset or liability, and inputs that are derived principally from or corroborated by observable market data by correlation or other means (market-corroborated inputs).

Level III – Unobservable pricing input at the measurement date for the asset or liability. Unobservable inputs shall be used to measure fair value to the extent that observable inputs are not available.

15

Table of Contents

In some instances, the inputs used to measure fair value might fall within different levels of the fair value hierarchy. The level in the fair value hierarchy within which the fair value measurement in its entirety falls shall be determined based on the lowest input level that is significant to the fair value measurement in its entirety.

The following table summarizes the valuation of USNG’s securities at December 31, 2010 using the fair value hierarchy:

| At December 31, 2010 |

Total | Level I | Level II | Level III | ||||||||||||

| Short-Term Investments |

$ | 1,902,183,385 | $ | 1,902,183,385 | $ | - | $ | - | ||||||||

| Exchange-Traded Futures Contracts |

56,023,955 | 56,023,955 | - | - | ||||||||||||

| Exchange-Traded Cleared Swap Contracts |

31,381,325 | 31,381,325 | - | - | ||||||||||||

| Over-the-Counter Total Return Swap Contracts |

27,200,226 | - | - | 27,200,226 | ||||||||||||

During the year ended December 31, 2010, there were no significant transfers between Level I and Level II.

Following is a reconciliation of assets in which significant observable inputs (Level III) were used in determining fair value:

| Total Return Swap Contracts |

||||

| Beginning balance as of 12/31/09 |

$ | (39,408,688 | ) | |

| Realized gain (loss)* |

- | |||

| Change in unrealized gain (loss) |

66,608,914 | |||

| Ending balance as of 12/31/10 |

$ | 27,200,226 | ||

| * |

The realized gain (loss) incurred during the fiscal year ended December 31, 2010 for total return swaps was $(905,660,856). |

The following table summarizes the valuation of USNG’s securities at March 31, 2011 using the fair value hierarchy:

| At March 31, 2011 |

Total | Level I | Level II | Level III | ||||||||||||

| Short-Term Investments |

$ | 1,752,348,013 | $ | 1,752,348,013 | $ | - | $ | - | ||||||||

| Exchange-Traded Futures Contracts |

23,085,150 | 23,085,150 | - | - | ||||||||||||

| Exchange-Traded Cleared Swap Contracts |

36,835,513 | 36,853,513 | - | - | ||||||||||||

| Over-the-Counter Total Return Swap Contracts |

22,587,540 | - | - | 22,587,540 | ||||||||||||

During the three months ended March 31, 2011, there were no significant transfers between Level I and Level II.

16

Table of Contents

Following is a reconciliation of assets in which significant observable inputs (Level III) were used in determining fair value:

| Total Return Swap Contracts |

||||

| Beginning balance as of 12/31/10 |

$ | 27,200,226 | ||

| Realized gain (loss)* |

- | |||

| Change in unrealized gain (loss) |

(4,612,686 | ) | ||

| Ending balance as of 03/31/11 |

$ | 22,587,540 | ||

| * |

The realized gain (loss) incurred during the three months ended March 31, 2011 for total return swaps was $(28,899,684). |

Effective January 1, 2009, USNG adopted the provisions of Accounting Standards Codification 815 — Derivatives and Hedging, which require presentation of qualitative disclosures about objectives and strategies for using derivatives, quantitative disclosures about fair value amounts and gains and losses on derivatives.

Fair Value of Derivative Instruments

| Derivatives not Accounted for as Hedging Instruments |

Condensed Statement of Financial Condition Location |

Fair Value At March 31, 2011 |

Fair Value At December 31, 2010 |

|||||||

| Futures - Commodity Contracts |

Assets | $ | 59,920,663 | $ | 87,405,280 | |||||

| Swaps - Commodity Contracts |

Assets - | 22,587,540 | 27,200,226 | |||||||

| Unrealized | ||||||||||

| Appreciation | ||||||||||

The Effect of Derivative Instruments on the Condensed Statements of Operations

| For the three months ended March 31, 2011 |

For the three months ended March 31, 2010 |

|||||||||||||||||

| Derivatives not Accounted for as Hedging Instruments |

Location of Gain or (Loss) |

Realized Gain or (Loss) on Derivatives Recognized in Income |

Change in Unrealized Gain or (Loss) Recognized in Income |

Realized Gain or (Loss) on Derivatives Recognized in Income |

Change in Unrealized Gain or (Loss) Recognized in Income |

|||||||||||||

| Futures - |

Realized gain (loss) on closed futures positions |

$ | 2,603,815 | $ | (465,823,610 | ) | ||||||||||||

| Change in unrealized loss on open futures positions |

$ | (27,484,617 | ) | $ | (101,594,860 | ) | ||||||||||||

| Swaps - |

Realized loss on closed swap contracts |

(28,899,684 | ) | (697,388,429 | ) | |||||||||||||

| Change in unrealized loss on open swap contracts |

(4,612,686 | ) | (18,732,581 | ) | ||||||||||||||

NOTE 8 - RECENT ACCOUNTING PRONOUNCEMENTS

In January 2010, the Financial Accounting Standards Board issued Accounting Standards Update (“ASU”) No. 2010-06 “Improving Disclosures about Fair Value Measurements.” ASU No. 2010-06 clarifies existing disclosure and requires additional disclosures regarding fair value measurements. Effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years, entities will need to disclose information about purchases, sales, issuances and settlements of Level 3 securities on

17

Table of Contents

a gross basis, rather than as a net number as currently required. The implementation of ASU No. 2010-06 is not expected to have a material impact on USNG’s financial statement disclosures.

NOTE 9 - SUBSEQUENT EVENTS

USNG has performed an evaluation of subsequent events through the date the financial statements were issued. This evaluation did not result in any subsequent events that necessitated disclosures and/or adjustments.

18

Table of Contents

| Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

The following discussion should be read in conjunction with the condensed financial statements and the notes thereto of the United States Natural Gas Fund, LP (“USNG”) included elsewhere in this quarterly report on Form 10-Q.

Forward-Looking Information

This quarterly report on Form 10-Q, including this “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains forward-looking statements regarding the plans and objectives of management for future operations. This information may involve known and unknown risks, uncertainties and other factors that may cause USNG’s actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements, which involve assumptions and describe USNG’s future plans, strategies and expectations, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend” or “project,” the negative of these words, other variations on these words or comparable terminology. These forward-looking statements are based on assumptions that may be incorrect, and USNG cannot assure investors that the projections included in these forward-looking statements will come to pass. USNG’s actual results could differ materially from those expressed or implied by the forward-looking statements as a result of various factors.

USNG has based the forward-looking statements included in this quarterly report on Form 10-Q on information available to it on the date of this quarterly report on Form 10-Q, and USNG assumes no obligation to update any such forward-looking statements. Although USNG undertakes no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, investors are advised to consult any additional disclosures that USNG may make directly to them or through reports that USNG in the future files with the U.S. Securities and Exchange Commission (the “SEC”), including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K.

Introduction

USNG, a Delaware limited partnership, is a commodity pool that issues units that may be purchased and sold on the NYSE Arca, Inc. (the “NYSE Arca”). The investment objective of USNG is for the daily changes in percentage terms of its units’ net asset value (“NAV”) to reflect the daily changes in percentage terms of the spot price of natural gas delivered at the Henry Hub, Louisiana, as measured by the changes in the price of the futures contract for natural gas traded on the New York Mercantile Exchange (the “NYMEX”) that is the near month contract to expire, except when the near month contract is within two weeks of expiration, in which case it will be measured by the futures contract that is the next month contract to expire, less USNG’s expenses. It is not the intent of USNG to be operated in a fashion such that the NAV will equal, in dollar terms, the spot price of natural gas or any particular futures contract based on natural gas.

USNG invests in futures contracts for natural gas, crude oil, heating oil, gasoline and other petroleum-based fuels that are traded on the NYMEX, ICE Futures or other U.S. and foreign exchanges (collectively, “Futures Contracts”) and other natural gas-related investments such as cash-settled options on Futures Contracts, forward contracts for natural gas, cleared swap contracts and over-the-counter transactions that are based on the price of natural gas, crude oil and other petroleum-based fuels, Futures Contracts and indices based on the foregoing (collectively, “Other Natural Gas-Related Investments”). For convenience and unless otherwise specified, Futures Contracts and Other Natural Gas-Related Investments collectively are referred to as “Natural Gas Interests” in this quarterly report on Form 10-Q. Due, in part, to USNG’s obligation to comply with current and potential regulatory limits, it has invested in, and may continue to invest in, Other Natural Gas-Related Investments in order to fulfill its investment objective.

USNG seeks to achieve its investment objective by investing in a combination of Futures Contracts and Other Natural Gas-Related Investments such that changes in its NAV, measured in percentage terms, will closely track the changes in the price of the Benchmark Futures Contract, also measured in percentage terms. USNG’s general partner believes the changes in the price of the Benchmark Futures Contract have historically exhibited a close correlation with the changes in the spot price of natural gas. The general partner of USNG, United States Commodity Funds LLC (“USCF”), believes that it is not practical to manage the portfolio to achieve such an investment goal when investing in Futures Contracts and Other Natural Gas-Related Investments.

19

Table of Contents

In addition, due to potential regulatory limitations, USNG may determine to hold greater amounts of cash and cash equivalents and lesser amounts of Natural Gas Interests, or greater amounts of Other Natural Gas-Related Investments if it determines that this will most appropriately satisfy USNG’s investment objective. Holding more cash and cash equivalents and fewer Natural Gas Interests, or more Other Natural Gas-Related Investments for some period of time may result in increased tracking error. Increasing USNG’s investments in Other Natural Gas-Related Investments, such as through increased investments in over-the-counter swaps, may result in increased tracking error due to the fact that transaction costs for over-the-counter swaps are significantly higher as compared to those for exchange-traded Natural Gas Interests, which to date are the principal investment of USNG. In the event that USNG determines that suitable Other Natural Gas-Related Investments are not obtainable, USNG will need to consider other actions to protect its unitholders and to permit USNG to achieve its investment objective.

On any valuation day, the Benchmark Futures Contract is the near month futures contract for natural gas traded on the NYMEX unless the near month contract is within two weeks of expiration, in which case the Benchmark Futures Contract becomes, over a 4-day period, the next month contract for natural gas traded on the NYMEX. “Near month contract” means the next contract traded on the NYMEX due to expire. “Next month contract” means the first contract traded on the NYMEX due to expire after the near month contract.

The regulation of commodity interests in the United States is a rapidly changing area of law and is subject to ongoing modification by governmental and judicial action. On July 21, 2010, a broad financial regulatory reform bill, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), was signed into law that includes provisions altering the regulation of commodity interests. Provisions in the new law include the requirement that position limits be established on a wide range of commodity interests including energy-based and other commodity futures contracts, certain cleared commodity swaps and certain over-the-counter commodity contracts; new registration, recordkeeping, capital and margin requirements for “swap dealers” and “major swap participants” as determined by the new law and applicable regulations; and the forced use of clearinghouse mechanisms for most swap transactions that are currently entered into in the over-the-counter market. The new law and the rules that are currently being and are expected to be promulgated thereunder may negatively impact USNG’s ability to meet its investment objective either through limits or requirements imposed on it or upon its counterparties. Further, increased regulation of, and the imposition of additional costs on, swap transactions under the new legislation and implementing regulations could cause a reduction in the swap market and the overall derivatives markets, which could restrict liquidity and adversely affect USNG. In particular, new position limits imposed on USNG or its counterparties may impact USNG’s ability to invest in a manner that most efficiently meets its investment objective, and new requirements, including capital and mandatory clearing, may increase the cost of USNG’s investments and doing business, which could adversely affect USNG’s investors.

Additionally, the Dodd-Frank Act requires the U.S. Commodity Futures Trading Commission (the “CFTC”) to promulgate rules establishing position limits for futures and options contracts on commodities, as well as for swaps that are economically equivalent to futures or options. On January 13, 2011, the CFTC proposed new rules, which if implemented in their proposed form, would establish position limits and limit formulas for certain physical commodity futures, including Futures Contracts and options on Futures Contracts, executed pursuant to the rules of designated contract markets (i.e., certain regulated exchanges) and commodity swaps that are economically equivalent to such futures and options contracts. The CFTC has also proposed aggregate position limits that would apply across different trading venues to contracts based on the same underlying commodity. At this time, it is unknown precisely when such position limits would take effect. The CFTC’s position limits for futures contracts held during the last few days of trading in the near month contract to expire, which, under the CFTC’s proposed rule would be substantially similar to the position limits currently set by the exchanges, could take effect as early as Spring 2011. Based on the CFTC’s current proposal, other position limits would not take effect until March 2012 or later.

On April 12, 2011, the Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, the Farm Credit System and the Federal Housing Finance Agency (collectively, the “Prudential Regulators”) and the CFTC issued proposed rules establishing minimum initial and variation margin collection requirements for certain swap dealers and major swap participants (collectively, “Covered Swap Entities”), which if adopted, would require Covered Swap Entities to collect minimum initial and variation margin amounts from swap counterparties. The Prudential Regulators’ proposed rules would apply to those Covered Swap Entities that are regulated by the Prudential Regulators and the CFTC’s proposed rules would apply to Covered Swap Entities that are not regulated by the Prudential Regulators.

The amount of initial and variation margin that Covered Swap Entities would be required to collect under the proposed rules varies based on whether their counterparty to a particular swap is (1) a Covered Swap Entity, (2) a “high-risk” financial entity end-user, (3) a “low-risk” financial entity end-user (e.g., financial entities subject to capital requirements imposed by bank or insurance regulators, that predominantly use swaps to hedge and that do not have significant swap exposure) or (4) a non-financial end-user. With certain exceptions not applicable to USNG and the affiliated funds managed by USCF, Covered Swap Entities would not be required to post initial or variation margin to any of their counterparties except for other Covered Swap Entities.

Covered Swap Entities and all financial entity end-users would be required to post initial margin and variation margin when they enter into swaps with Covered Swap Entities. Margin posted by “low-risk” financial entity end-users could be subject to thresholds under the proposed rules. As commodity pools, USNG and the affiliated funds managed by USCF would be “high-risk” financial entity end-users and would therefore have to post margin without thresholds.

On April 27, 2011, the CFTC and the SEC proposed joint rules defining “swaps” and “security-based swaps,” thus providing more clarity regarding which transactions will be regulated as such under the Dodd-Frank Act. The rules proposed in April 2011 are currently open to the public for comment at the time of the filing of this quarterly report on Form 10-Q. The CFTC has now issued proposed versions of all of the rules it is required to promulgate under the Dodd-Frank Act but, with one exception not applicable to USNG and the affiliated funds managed by USCF, the CFTC has not promulgated any final rules or indicated when such final rules would take effect. The effect of the future regulatory change on USNG is impossible to predict, but it could be substantial and adverse.

20

Table of Contents

USCF, which is registered as a commodity pool operator (“CPO”) with the CFTC, is authorized by the Third Amended and Restated Agreement of Limited Partnership of USNG (the “LP Agreement”) to manage USNG. USCF is authorized by USNG in its sole judgment to employ and establish the terms of employment for, and termination of, commodity trading advisors or futures commission merchants.

Price Movements

Natural gas futures prices exhibited a general downtrend during the three months ended March 31, 2011. The price of the Benchmark Futures Contract started the period at $4.405. It hit a peak on January 21, 2011 of $4.743 and then fell during the course of the period. The low price of the period was on March 3, 2011, when the Benchmark Futures Contract was $3.778. The Benchmark Futures Contract on March 31, 2011 was $4.389, for a return of approximately -0.36% over the period. USNG’s NAV initially rose during the period, taking into account the reverse split, from a starting level of $12.00* per unit to a high on January 21, 2011 of $12.87* per unit. USNG’s NAV reached its low for the period on March 3, 2011 at $10.09* per unit. The NAV on March 31, 2011 was $11.50, down approximately 4.17% over the period. The Benchmark Futures Contract prices listed above began with the February 2011 contract and ended with the May 2011 contract. The return of approximately -0.36% on the Benchmark Futures Contract listed above is a hypothetical return only and could not actually be achieved by an investor holding Futures Contracts. An investment in natural gas Futures Contracts would need to be rolled forward during the time period described in order to achieve such a result. Furthermore, the change in the nominal price of these differing natural gas Futures Contracts, measured from the start of the period to the end of the period, does not represent the actual benchmark results that USNG seeks to track, which are more fully described below in the section titled “Tracking USNG’s Benchmark.”

During the three months ended March 31, 2011, the natural gas futures market was primarily in a state of contango, meaning that the price of the near month natural gas Futures Contract was typically lower than the price of the next month natural gas Futures Contract, or contracts further away from expiration. A contango market is one in which the price of the near month natural gas Futures Contract is less than the price of the next month natural gas Futures Contract, or contracts further away from expiration. As a result of contango or backwardation, as the case may be, the return of approximately -0.36% on the Benchmark Futures Contract listed above is a hypothetical return only and could not actually be achieved by an investor holding futures contracts. For a discussion of the impact of backwardation and contango on total returns, see “Term Structure of Natural Gas Futures Prices and the Impact on Total Returns” below.

| * |

Adjusted to give effect to the reverse unit split of 2-for-1 executed on March 8, 2011. |

Valuation of Futures Contracts and the Computation of the NAV

The NAV of USNG’s units is calculated once each NYSE Arca trading day. The NAV for a particular trading day is released after 4:00 p.m. New York time. Trading during the core trading session on the NYSE Arca typically closes at 4:00 p.m. New York time. USNG’s administrator uses the NYMEX closing price (determined at the earlier of the close of the NYMEX or 2:30 p.m. New York time) for the contracts held on the NYMEX, but calculates or determines the value of all other USNG investments, including cleared swaps or other futures contracts, as of the earlier of the close of the NYSE Arca or 4:00 p.m. New York time.

21

Table of Contents

Results of Operations and the Natural Gas Market

Results of Operations. On April 18, 2007, USNG listed its units on the American Stock Exchange (the “AMEX”) under the ticker symbol “UNG.” On that day, USNG established its initial offering price at $50.00 per unit and issued 200,000 units to the initial authorized purchaser, Merrill Lynch Professional Clearing Corp., in exchange for $10,001,000 in cash. As a result of the acquisition of the AMEX by NYSE Euronext, USNG’s units no longer trade on the AMEX and commenced trading on the NYSE Arca on November 25, 2008.

Since its initial offering of 30,000,000 units, USNG has registered four subsequent offerings of its units: 50,000,000 units which were registered with the SEC on November 21, 2007, 100,000,000 units which were registered with the SEC on August 28, 2008, 300,000,000 units which were registered with the SEC on May 6, 2009 and 1,000,000,000 units which were registered with the SEC on August 12, 2009. Units offered by USNG in the subsequent offerings were sold by it for cash at the units’ NAV as described in the applicable prospectus. On March 8, 2011, after the close of trading on the NYSE Arca, USNG effected a 2-for-1 reverse unit split and post-split units of USNG began trading on March 9, 2011. As a result of the reverse unit split, every two pre-split units of USNG were automatically exchanged for one post-split unit. Immediately prior to the reverse unit split, there were 447,200,000 units of USNG issued and outstanding, each representing a NAV of $5.16. Immediately after the reverse unit split, the number of issued and outstanding units of USNG decreased to 223,600,000, not accounting for fractional units, and the NAV relating to each unit increased to $10.31. As of March 31, 2011, USNG had issued 980,000,000 units, 200,697,828 of which were outstanding. As of March 31, 2011, there were 500,000,000 units registered but not yet issued.

More units may have been issued by USNG than are outstanding due to the redemption of units. Unlike funds that are registered under the Investment Company Act of 1940, as amended, units that have been redeemed by USNG cannot be resold by USNG. As a result, USNG contemplates that additional offerings of its units will be registered with the SEC in the future in anticipation of additional issuances and redemptions.

For the Three Months Ended March 31, 2011 Compared to the Three Months Ended March 31, 2010

As of March 31, 2011, the total unrealized gain on Futures Contracts, cleared swap contracts and over-the-counter swap contracts owned or held on that day was $82,508,203 and USNG established cash deposits, including cash investments in money market funds that were equal to $2,160,640,277. USNG held 91.57% of its cash assets in overnight deposits and money market funds at its custodian bank, while 8.43% of the cash balance was held as margin deposits for the Futures Contracts purchased. The ending per unit NAV on March 31, 2011 was $11.50.

By comparison, as of March 31, 2010, the total unrealized loss on Futures Contracts, cleared swap contracts and over-the-counter swap contracts owned or held on that day was $201,513,394 and USNG established cash deposits, including cash investments in money market funds, that were equal to $3,118,486,686. USNG held 84.92% of its cash assets in overnight deposits and money market funds at its custodian bank, while 15.08% of the cash balance was held as margin deposits for the Futures Contracts purchased. The decrease in cash assets in overnight deposits and money market funds for March 31, 2011 as compared to March 31, 2010 was the result of USNG’s greater size in the prior period as measured by total net assets. The ending per unit NAV on March 31, 2010 was $13.80*. The decrease in the per unit NAV from March 31, 2011 as compared to March 31, 2010 was primarily a result of lower prices for natural gas and the related decline in the value of the Futures Contracts, cleared swap contracts, and over-the-counter swap contracts that USNG had invested in between the period ended March 31, 2010 and the period ended March 31, 2011.

| * |

Adjusted to give effect to the reverse unit split of 2-for-1 executed on March 8, 2011. |

Portfolio Expenses. USNG’s expenses consist of investment management fees, brokerage fees and commissions, certain offering costs, licensing fees, the fees and expenses of the independent directors of USCF and expenses relating to tax accounting and reporting requirements. The management fee that USNG pays to USCF is calculated as a percentage of the total net assets of USNG. For total net assets of up to $1 billion, the management fee is 0.60%. For total net assets over $1 billion, the management fee is 0.50% on the incremental amount of assets. The fee is accrued daily and paid monthly.

22

Table of Contents

During the three months ended March 31, 2011, the daily average total net assets of USNG were $2,382,862,199. The management fee incurred by USNG during the period amounted to $3,184,351, which was calculated at the 0.60% rate on total net assets up to and including $1 billion and at the rate of 0.50% on total net assets over $1 billion, and accrued daily. Management fees as a percentage of average net assets averaged 0.54% over the course of this three month period. By comparison, during the three months ended March 31, 2010, the daily average total net assets of USNG were $3,891,576,206. The management fee paid by USNG during this three month period amounted to $5,044,409, which was calculated at the 0.60% rate for total net assets up to and including $1 billion and at the rate of 0.50% on total net assets over $1 billion, and accrued daily. Management fees as a percentage of average net assets averaged 0.53% over the course of this three month period. USNG’s management fees as a percentage of total net assets were higher for the three months ended March 31, 2011 compared to the three months ended March 31, 2010 due to USNG having a smaller percentage of total net assets in excess of $1 billion that were therefore charged the lower rate of 0.50%.

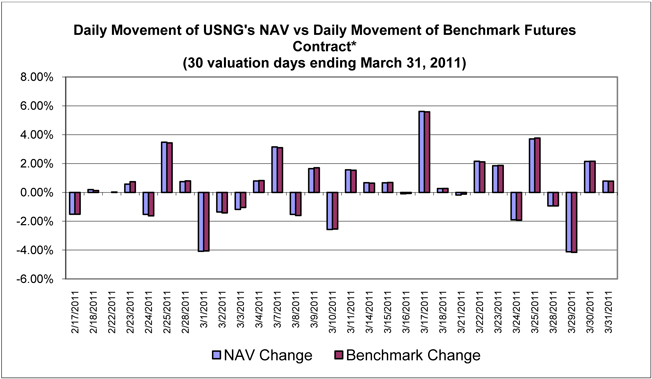

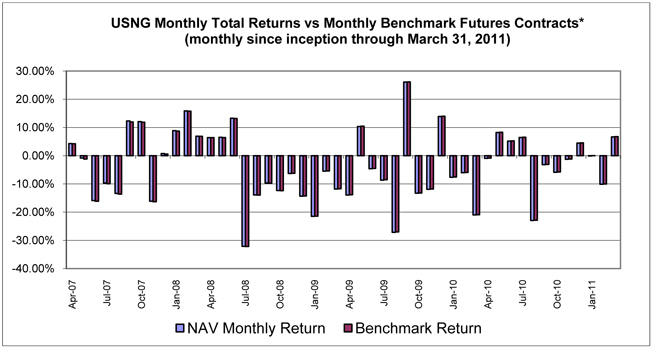

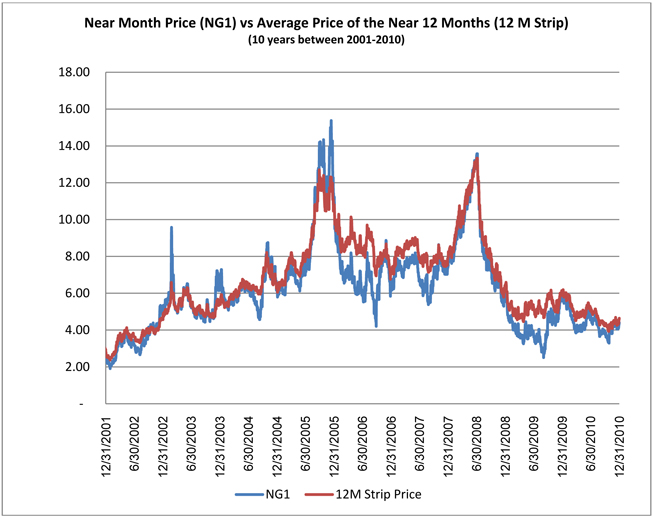

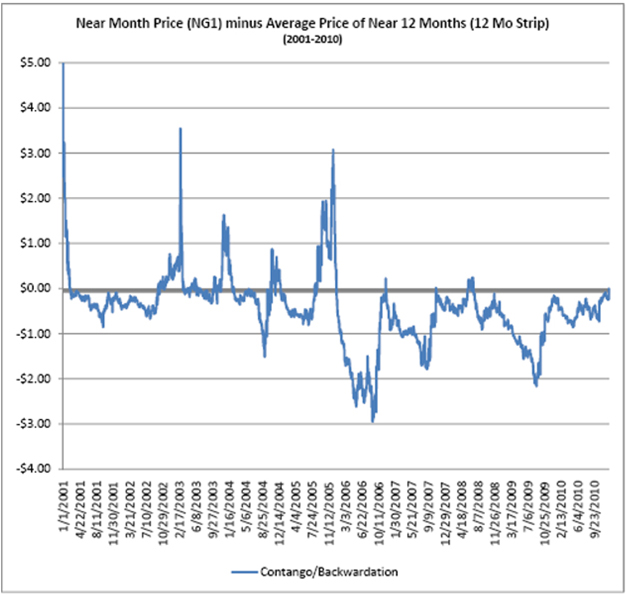

In addition to the management fee, USNG pays all brokerage fees, transaction costs for over-the-counter swaps and other expenses, including certain tax reporting costs, licensing fees for the use of intellectual property, ongoing registration or other fees paid to the SEC, the Financial Industry Regulatory Authority (“FINRA”) and any other regulatory agency in connection with offers and sales of its units subsequent to the initial offering and all legal, accounting, printing and other expenses associated therewith. The total of these fees and expenses for the three months ended March 31, 2011 was $2,378,736, which included $27,900 for the costs incurred for the preparation and execution of the reverse split, as well as in registration fees paid to the SEC, as compared to $2,805,335 for the three months ended March 31, 2010. The decrease in expenses for the three months ended March 31, 2011 as compared to the three months ended March 31, 2010 was the result of USNG’s greater size in the prior period as measured by total net assets. For the three months ended March 31, 2011, USNG incurred $27,900 in ongoing registration fees and other expenses relating to the registration and offering of additional units. By comparison, for the three months ended March 31, 2010, USNG incurred $34,200 in ongoing registration fees and other expenses relating to the registration and offering of additional units. The decrease in registration fees and expenses incurred by USNG for the three months ended March 31, 2011 as compared to the three months ended March 31, 2010 was primarily due to a slower amortization of prepaid registration costs, which were matched to the faster rate of unit creations during the three months ended March 31, 2011.