Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - SVB FINANCIAL GROUP | d8k.htm |

JMP Securities

Research Conference May 9, 2011

Exhibit 99.1 |

| The presentations

made at today’s meeting contain projections or other forward- looking statements

regarding management’s expectations about the future events or the future financial

performance of the Company, as well as future economic, market and tax conditions.

Forward-looking statements are

statements that are not historical facts.

We wish to caution you that such

statements are just predictions and actual events or results may

differ materially,

due to changes in economic, business and regulatory factors and trends.

We refer you to the documents the Company files from time to time with the

Securities and Exchange Commission, specifically the company’s latest Annual

Report on Form 10-K for the year ended December 31, 2010, which was filed on

February 25, 2011, and quarterly report on form 10-Q, which was filed on May 6,

2011.

This document contains and identifies important risk factors that could

cause the Company’s actual results to differ materially from those contained in

our projections or other forward-looking statements.

All subsequent written or

oral forward-looking statements attributable to the company or persons acting

on

its behalf are expressly qualified in their entirety by these cautionary statements.

All forward-looking statements included in this presentation are made only as of

today’s date and the Company undertakes no obligation to update such

forward- looking statements.

Safe Harbor Disclosure

2 |

SVB’s

Unique Model

Strong Performance

Growth Initiatives

Outlook for 2011

Appendix

Overview

3

Overview |

A Unique

Financial Services Company Differentiated business model

•

Focus on “innovation”

markets

•

Balance sheet lender

•

Low cost funds from highly liquid clients

•

Diversified revenue streams

Leader

•

Leading market share

•

More than 550 venture firm clients

•

The bank for high-growth innovation companies

Established

(1)

•

26 U.S. and seven international offices

•

12,000+ clients and 1,350+ employees

•

$32.4 billion in total client funds

(2)

•

$18.6 billion in total assets

1) At 3/31/11

2) Total Client Funds includes deposits and off-balance sheet client investment

funds. 4

SVB’s

Unique Model |

Complete

Financial Services Platform 5

SVB’s

Unique Model |

Solid Q111

Performance 6

Strong Performance

Third straight

quarter of

loan growth

Fifth straight quarter

of credit quality

improvement

Improving net

interest

margin

Strong

warrant and

VC gains

Net interest

income at

record highs

Strong loan

pipeline

Outstanding

deposit

growth

Improving

markets for

our clients |

Strong Organic

Growth in Q111 7

7

Strong Performance

* From prior quarter

•

Diluted earnings per share of $0.76 vs.

street consensus of $0.48 •

Net income of $33 million •

Average loan growth of $305 million

(6.1%)*

•

Average deposit growth of $1.4 billion

(10.3%)*

•

Record net interest income of $120 million …underscored by outstanding credit quality

|

Net Interest

Income Remains Strong 8

8

Strong Performance |

An Expanded

Balance Sheet DRIVERS

•

Low interest rate environment

•

Solid client liquidity

•

New client acquisition

•

High-quality balance sheet

WE REMAIN FOCUSED ON MANAGING OUR BALANCE

SHEET

•

Ensuring clients are in the right deposit and

investment products

•

New client investment products

•

Recent debt repurchase of $313 million

•

Strong asset sensitivity

9

9

Strong Performance |

Our Growth

Initiatives 10

UK Branch

Application

India Branch

Application

China JV

Application

Israel Office

Correspondent

Banking

Network

Debit & Credit

Cards

New Products &

Services

Custom Credit

Products &

Programs

GLOBAL MARKETS & REACH

Global Core

Banking System

IT Backbone

Upgrade

Global Payment

Systems

Enhanced On-

line/Mobile

Systems

GLOBAL PLATFORM

PRODUCT LINES

Front-Line

Sales Staff

Private

Bank

Client

Segmentation

Client

Experience

CLIENT NEEDS

10

Growth Initiatives |

Our 2011 Outlook

Has Improved 1) See latest quarterly press release for more information

2) Excluding expenses related to non-controlling interests. Non-GAAP number.

Please see non-GAAP disclosures at end of presentation and our most recent financial

releases for more information 11

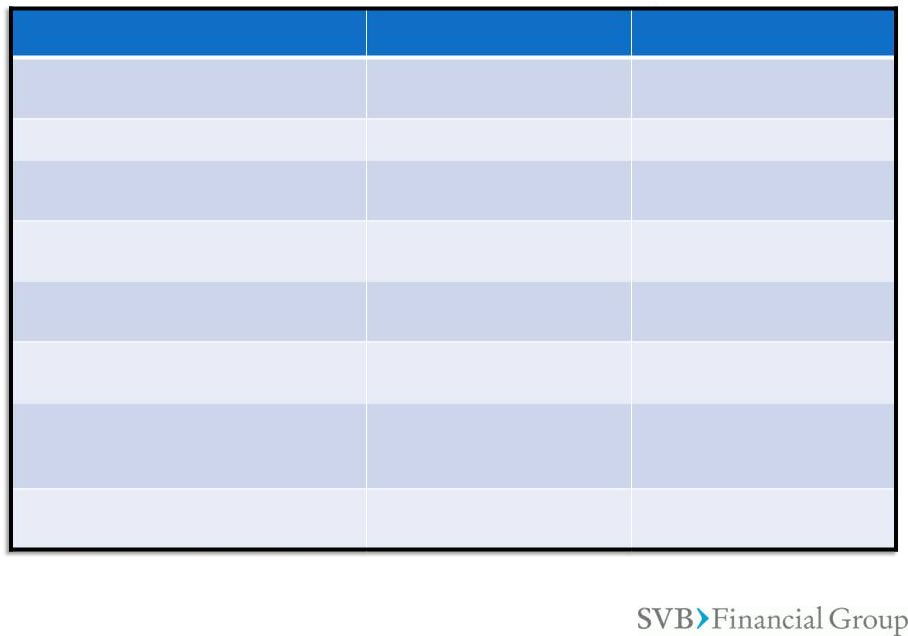

Outlook for 2011

Metric

2011 Outlook

(1)

Prior Outlook (1/20/11)

Deposits (average)

Low double-digit % growth

High-single digits %

increase

Net Interest

Income

Mid-twenties

% growth

High teens % increase

Allowance

for Loan Losses as % of

Total Performing Loans

Between 1.25% and 1.35%

Between 1.30% and 1.40%

Net Loan Charge-Offs

Lower than 0.50% of

average total gross loans

Comparable

to 2010

Non-performing Loans

Lower than 2010 levels of

0.71% of total

gross loans

Comparable

to 2010

Net gains on equity warrant

assets

Between $7

and $10

million

Comparable

to 2010

Net gains on investment

securities

(net of gains on sales of AFS securities

and non-controlling interests)

Between $13 and $16

million

$4 to $8 million

Non-interest

expense

(2)

Mid-teens

% increase

Low double-digits %

increase |

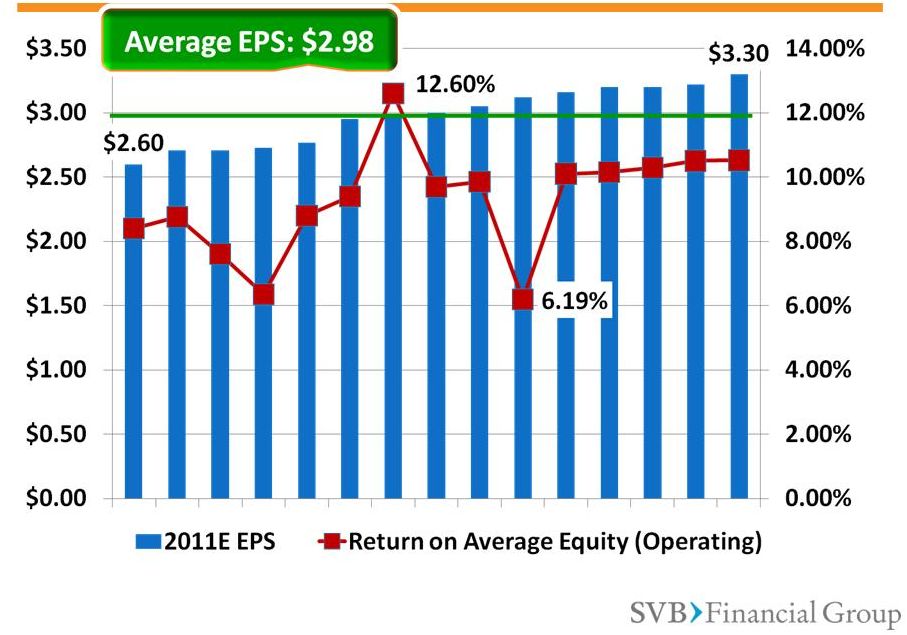

Street

Estimates: 2011 EPS and ROE* * Based on published reports as of 05/08/11. Certain

estimates and adjustments have been made where necessary. Please refer to analyst

reports before forming any conclusions. 12

Outlook

for

2011

–

vs.

Street

Estimates |

*

Based

on

published

providing

estimates

for

average

loan

growth

as

of

05/08/11.

Certain

estimates

and

adjustments

have

been

made

where

necessary. Please refer to analyst reports before forming any conclusions.

Street Estimates: Average Loans*

13

Outlook for 2011 –

vs. Street Estimates

SVB 2011 Outlook:

Mid-20s % Growth

Upside Drivers

•

Strong economic growth

•

Strong IPO/M&A markets

•

VC investment returns to

pre-recession levels

Downside Drivers

•

Lethargic economic recovery

•

Deleveraging by clients

•Adverse

global events Our Assumptions

•

Modest economic

growth in 2011

•

Stabilizing IPO/M&A

markets

•

Stabilizing VC

investment |

Street

Estimates: Average Deposits* 14

Outlook for 2011 –

vs. Street Estimates

Higher Deposit Drivers

•

Strong economic growth

•

Increased VC Fundraising

•

Increased IPO activity

•

Continued low interest rates

•

New client acquisition

Lower Deposit Drivers

•

Client adoption of off-balance

sheet products

•

Continued economic malaise

or downturn

•

Decrease in tech spending

•

Increased interest rates

Our Assumptions

•

Modest economic growth

•

VC Investment improves

but remains low

•

Strong tech spending

•

Success of target initiatives to

increase off-balance sheet funds

* Based on published reports providing estimates for average deposit growth as of

05/08/11. Certain estimates and adjustments have been made where necessary.

Please refer to analyst reports before forming any conclusions.

SVB 2011

Outlook:

Low Double Digit

% Growth |

Street Estimates:

Net Interest Income* 15

Outlook for 2011 –

vs. Street Estimates

Upside Drivers

•

Rising rate environment

•

Continued strong

demand deposit growth

•

Strong loan growth

Downside Drivers

•

Higher interest bearing

deposits in low rate

environment

•

Increase in Fed Funds rate

•

Declining loan balances

* Based on published reports providing estimates for net interest income as of 05/08/11.

Certain estimates and adjustments have been made where necessary. Please refer to

analyst reports before forming any conclusions.

SVB 2011 Outlook:

Mid-20s % Growth

Our Assumptions

•

No increase in Fed Funds

rate in 2011

•

Slower deposit growth

•

Steady investment rates

•

Mid-20s% loan growth

•

Success in moving funds

off the balance sheet |

Solid Momentum

For Growth in 2011 •

Improving business environment

•

Growing client revenues due to increasing

technology spending

•

Improving venture-backed exit markets

•

Beginning to see results from growth

initiatives

16

16

Outlook for 2011 |

|

Appendix

1)

First Quarter 2011 Review

19

•

Highlights

20

•

Loans & Credit Quality

21-24

•

Assets and Client Liquidity

25-26

•

Balance Sheet

27

•

Sensitivity Charts

28-29

•

Capital Ratios

30

•

2011 Outlook

31

2)

Annual Metrics

32-33

3)

Growth Initiatives

34-37

4)

Venture Capital Markets

38-39

6)

Non-GAAP Reconciliations

40-44 |

First Quarter

2011 Review 19

Appendix

–

First

Quarter

2011

Review |

Quarterly

Financial Highlights Q111

Q410

Q310

Q210

Q110

Diluted Earnings Per Share

$0.76

$0.41

$0.89

(1)

$0.50

$0.44

Net Income Available to

Common Stockholders

$33.0M

$17.5M

$37.8M

(1)

$21.1M

$18.6M

Average Loans (Change)

$5.3B

(+6.1%)

$5.0B

(+11.3%)

$4.5B

(+9.4%)

$4.1B

(-0.1%)

$4.1B

(-5.8%)

Average Deposits (Change)

$14.7B

(+10.3%)

$13.3B

(+11.6%)

$11.9B

(+0.1%)

$11.9B

(+8.6%)

$11.0B

(+11.0%)

Net Interest Margin

2.96%

2.74%

3.14%

3.20%

3.30%

Net Interest Income

$120.3M

$104.5M

$106.3M

$106.4M

$100.8M

Non-Interest Income

$90.0M

$71.9M

$86.2M

(1)

$40.2M

$49.3M

Net (Recoveries) Charge-

Offs/Total Average Gross

Loans

(0.19%)

(2)

0.57%

0.73%

0.38%

1.46%

Non-Interest Expense

$117.4M

$115.9M

$104.2M

$104.2M

$98.6M

1)

Includes $23.6 million in pre-tax gains from sale of AFS securities

2)

Represents net recovery of $2.5 million

20

Appendix

–

First

Quarter

2011

Review |

Loans Are At an

All-Time High 21

21

Appendix

–

First

Quarter

2011

Review

$5.65 |

A Focused,

High-Quality Loan Portfolio Risk Composition of Technology

and Life Science Lending

Total Loan Portfolio (3/31/11)

$5.7 Billion

22

Appendix

–

First

Quarter

2011

Review |

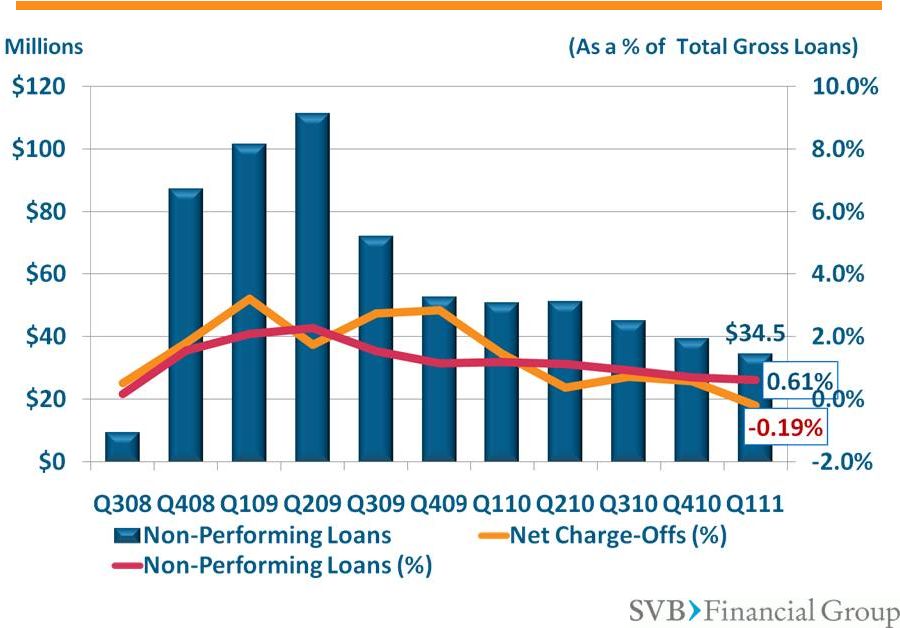

Credit Quality

Has Improved 23

Appendix

–

First

Quarter

2011

Review |

Credit Quality

Has Improved 24

Appendix

–

First

Quarter

2011

Review |

Solid Franchise

With Consistent Growth 25

Billions

25

Appendix

–

First

Quarter

2011

Review |

Our Clients Have

Ample Liquidity 26

Billions

26

Appendix –

First Quarter 2011 Review |

A Liquid Balance

Sheet (1)

1)

At 3/31/11

2)

Net of non-controlling interests, non-marketable securities were $310.1 million.

Non-GAAP number. Please see non-GAAP reconciliation at end of

presentation

and

our

most

recent

financial

releases

for

more

information.

3) Includes A) Premises and Equipment Net of Accumulated Depreciation and

Amortization, and B) Accrued Interest Receivable and Other Assets 27

Appendix

–

First

Quarter

2011

Review |

Rising Rates

Will Benefit Us Significantly Each 25 bps increase in the Fed Funds rate contributes

approximately $4 –

$8 million to Net Interest Income**

**Tax-effected, estimates are based on static balance sheet and assumptions as of

3/31/11 Changes in

Fed Funds

Rate (basis

points)

Changes in

Net Interest

Income (tax

effected)

Incremental

EPS Effect

Incremental

ROE Effect

Net Interest

Margin Effect

+75

+14.3 million

$0.34

+0.8%

+0.14%

+100

+$23.4 million

$0.55

+1.3%

+0.22%

+200

+$57.7 million

$1.36

+3.1%

+0.56%

+300

+$93.7 million

$2.21

+4.8%

+0.90%

28

Appendix

–

First

Quarter

2011

Review |

Higher Loan

Balances Will Benefit Us **Estimates

are

based

on

static

balance

sheet

and

assumptions

as

of

3/31/11

Each $250 million increase in loan volume contributes

approximately $0.22 to EPS**

29

Appendix

–

First

Quarter

2011

Review

Growth in

Overall Loan

Balances

($$)

Changes in

Net Interest

Income (tax

effected)

Incremental

EPS Effect

Incremental

ROE Effect

Net Interest

Margin

Effect

+250 million

+9.5 million

$0.22

+0.5%

+0.09%

+500 million

+$18.9 million

$0.45

+1.0%

+0.18%

+750 million

+$28.4 million

$0.67

+1.5%

+0.27%

+1 billion

+$37.9 million

$0.89

+2.0%

+0.37% |

We Are Well

Capitalized *TCE/TA and TCE/RWA are non-GAAP Numbers; please Refer to Non-GAAP

reconciliations at end of presentation for more information. 30

Appendix

–

First

Quarter

Review |

Full Year

Outlook: 2011 vs. 2010 Metric

2010 Actual

2011 Outlook

(3)

as of 4/21/11

Loans (average)

$4.4 Billion

Mid-20s % growth

Deposits (average)

$12.0 Billion

Low double-digit % growth

Net Interest Income

$418.1 Million

Mid-twenties % growth

Net Interest Margin

3.08%

Between 3.30% and 3.40%

Allowance for loan losses for performing loans

/period end gross performing loans

1.37%

Between 1.25% and 1.35%

Net Loan Charge-Offs

$34.5 million

Lower than 0.50% of average total gross

loans

Non-Performing Loans/Total Loans

0.71%

Lower than 2010 levels

“Core”

Fee Income

(1)

$109.0 million

High single-digit % increase

Net gains on equity warrant assets

$6.6 million

Between $7 and $10 million

Net gains on investment securities (net of gains

on sales of available-for-sale securities and

non-controlling interests)

$16.1 million

Between $13 and $16 million

Non-interest expense

(excluding expenses

related to non-controlling interests)

$410.5 million

(2)

Mid-teens % increase

1)

“Core”

is defined as fees for deposit services, letters of credit, business credit card, client

investment, and foreign exchange, in aggregate 2)

Non-GAAP

number.

Please

see

non-GAAP

reconciliations

at

end

of

presentation

and

our

most

recent

financial

releases

for

more

information.

3)

See latest financial press release for more information.

31

Appendix

–

First

Quarter

Review |

Annual

Metrics 32

Appendix –

Annual Metrics |

Financial

Highlights: 2008 -2010 2008

2009

2010

Diluted Earnings Per Share

$2.16

$0.66

$2.24

Net Income Available to

Common Stockholders

$73.6M

$22.7M

$95.0M

Average Loans (Change)

$4.6B (+31.5%)

$4.7B (+1.4%)

$4.4B (-5.6%)

Average Deposits (Change)

$4.9B (+23.6%)

$8.8B (+79.6%)

$12.0B (+36.8%)

Average AFS Securities

$1.3B

$2.3B

$5.3B

Net Interest Margin

5.72%

3.73%

3.08%

Net Interest Income

(Change)

$368.6M

$382.2M

$418.1M (+9.4%)

Non-Interest Income

$152.4M

$97.7M

$247.5M

Net Charge-Offs/Total

Average Gross Loans

0.87%

2.64%

0.77%

Non-Interest Expense

$312.9M

$343.9M

$422.8M

33

Appendix –

Annual Metrics |

Growth

Initiatives 34

Appendix

–

Growth

Initiatives |

We’re

Supporting Clients At All Stages 50%

Market Share

10% –

12%

Market Share

< 10%

Market Share

35

Appendix

–

Growth

Initiatives |

Prior to

2011

2011 -

2012

Long Term

Financial

Impact

-

Rep office

-

LPO

Branch and

full product

set

Subsidiary bank +

Europe;

expansion and

growth

0-2 years

-

Rep Office

-

Funds

JV Bank and

related

activities

Subsidiary

Branch;

expansion and

growth

3-5 years

-

Rep Office

-

LPO

Expansion and

growth

0-2 years

-

NBFC

-

Fund

Branch or

subsidiary

with full

product set

Subsidiary

3-5 years

We Are Extending Our Platform Globally

36

36

Appendix –

Growth Initiatives |

Private

Bank •

Expanded private banking services

•

Tailored lending for influencers in the SVB

ecosystem

•

An advanced, easy-to-use, online platform

•

Support for clients’

success in all arenas:

business, family, life

37

Appendix

–

Growth

Initiatives |

Venture Capital

Markets 38

Appendix

–

Venture

Capital

Markets |

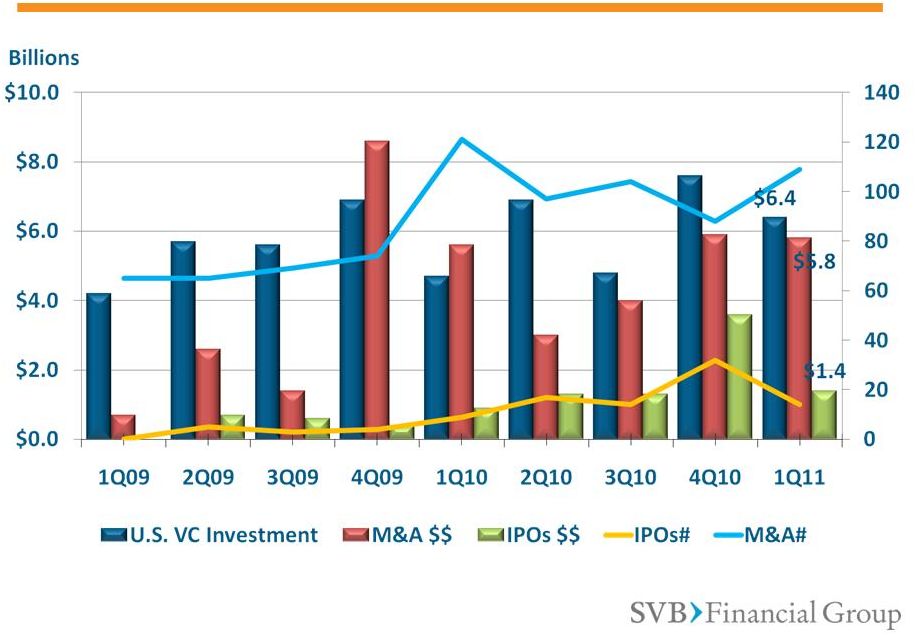

VC Markets Are

Stabilizing Source: Thomson Reuters, National Venture Capital Association, Dow

Jones 39

Appendix –

Venture Capital Markets |

Non-GAAP

Reconciliations 40

Appendix

–

Non-GAAP

Reconciliations |

Non-GAAP

TCE/TA and TCE/RWA Reconciliation

Non-GAAP tangible common equity and

tangible assets

(dollars in thousands, except ratios)

March 31,

December 31,

March 31,

2011

2010

2010

GAAP SVBFG stockholders' equity

$ 1,313,574

$ 1,274,350

$ 1,173,480

Less: intangible assets

749

847

979

Tangible common equity

$ 1,312,825

$ 1,273,503

$ 1,172,501

GAAP total assets

$ 18,618,266

$ 17,527,761

$ 14,125,249

Less: intangible assets

749

847

979

Tangible assets

$ 18,617,517

$ 17,526,914

$ 14,124,270

Risk-weighted assets

$ 10,000,214

$ 9,406,677

$ 7,324,526

Tangible common equity to tangible assets

7.05 %

7.27

%

8.30 %

Tangible common equity to risk-weighted

assets

13.13 %

13.54 %

16.01 %

For additional Non-GAAP disclosures, please refer to our regularly filed Forms 10-Q and

10-K, as well as our quarterly earnings releases. 41

Appendix

–

Non-GAAP

Reconciliations |

Non-GAAP

Non-Interest Income Reconciliation Three

months

ended

Year

ended

Non-GAAP noninterest

income, net of

noncontrolling interests

(dollars in thousands)

March 31,

December 31,

March 31,

December 31,

December 31,

2011

2010

2010

2010

2009

GAAP noninterest income

$ 89,954

$ 71,864

$ 49,273

$ 247,530

$ 97,743

Less: income (losses)

attributable to

noncontrolling interests,

including carried interest

43,562

19,785

13,891

54,186

(24,901)

Less: gains on sales of

available-for-sale securities

-

-

-

24,699

-

Non-GAAP noninterest

income, net of

noncontrolling interests

$ 46,392

$ 52,079

$ 35,382

$ 168,645

$ 122,644

42

Appendix

–

Non-GAAP

Reconciliations

For additional Non-GAAP disclosures, please refer to our regularly filed Forms 10-Q and

10-K, as well as our quarterly earnings releases. |

Non-GAAP

Non-Interest Expense Reconciliation

43

Appendix –

Non-GAAP Reconciliations

Three

months

ended

Year

ended

Non-GAAP operating efficiency ratio,

net of noncontrolling interests

(dollars in thousands, except ratios)

March 31,

December 31,

March 31,

December 31,

December 31,

2011

2010

2010

2010

2009

GAAP noninterest expense

$ 117,435

$ 115,891

$ 98,576

$ 422,818

$ 343,866

Less: amounts attributable to

noncontrolling interests

3,481

3,298

3,231

12,348

12,451

Less: impairment of goodwill

-

-

-

-

4,092

Non-GAAP noninterest expense, net of

noncontrolling interests

$ 113,954

$ 112,593

$ 95,345

$ 410,470

$ 327,323

GAAP taxable equivalent net interest

income

$ 120,806

$ 105,025

$ 101,362

$ 420,186

$ 384,354

Less: income (losses) attributable to

noncontrolling interests

7

8

(7)

28

(18)

Non-GAAP taxable equivalent net

interest income, net of noncontrolling

interests

120,799

105,017

101,369

420,158

384,372

Non-GAAP noninterest income, net of

noncontrolling interests

46,392

52,079

35,382

168,645

122,644

Non-GAAP taxable equivalent revenue,

net of noncontrolling interests

$ 167,191

$ 157,096

$ 136,751

$ 588,803

$ 507,016

Non-GAAP

operating

efficiency

ratio

(1)

68.16

%

71.67

%

69.72

%

69.71

%

64.56 %

(1) The non-GAAP operating efficiency ratio is calculated by dividing non-GAAP

noninterest expense, net of noncontrolling interests by non-GAAP taxable equivalent

revenue, net of noncontrolling interests. For additional GAAP to Non-GAAP reconciliation information, please refer to our regularly filed Forms 10-Q

and 10-K, as well as our quarterly earnings releases. |

Non-GAAP

Non-Marketable

Securities

Reconciliation

For additional GAAP to Non-GAAP reconciliation information, please refer to our regularly

filed forms 10-Q and 10-K, as well as our quarterly earnings releases. 44

Appendix –

Non-GAAP Reconciliations

Non-GAAP non-marketable

securities, net of

noncontrolling interests

(dollars in thousands)

March 31,

December 31,

March 31,

2011

2010

2010

GAAP non-marketable

securities

$ 798,064

$ 721,520

$ 591,692

Less: noncontrolling interests

in non-marketable securities

488,013

423,400

344,890

Non-GAAP non-marketable

securities, net of

noncontrolling interests

$ 310,051

$ 298,120

$ 246,802 |