Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OLIN Corp | form8kwellsslides050911.htm |

1

Wells Fargo Securities

Industrial & Construction Conference

May 10, 2011

Industrial & Construction Conference

May 10, 2011

Exhibit 99.1

2

Olin Representatives

John E. Fischer

Senior Vice President & Chief Financial Officer

Larry P. Kromidas

Assistant Treasurer & Director, Investor Relations

lpkromidas@olin.com

(314) 480 - 1452

3

Company Overview

All financial data are for the quarter ending March 31, 2011 and the year ending December 31, 2010, and are presented in millions of

U.S. dollars except for earnings per share. Additional information is available on Olin’s website www.olin.com in the Investors section.

U.S. dollars except for earnings per share. Additional information is available on Olin’s website www.olin.com in the Investors section.

Winchester

Chlor Alkali

Third Largest North American

Producer of Chlorine and Caustic Soda

Producer of Chlorine and Caustic Soda

Q1 2011 FY 2010

Revenue: $ 299 $ 1,037

Income: $ 45 $ 117

A Leading North American Producer

of Small Caliber Ammunition

of Small Caliber Ammunition

Q1 2011 FY 2010

Revenue: $ 137 $ 549

Income: $ 13 $ 63

Revenue: $ 436 $ 1,586

EBITDA: $ 69 $ 188

Pretax Operating Inc.: $ 220 $ 77

EPS (Diluted): $ 1.66 $ .81

Q1 2011 FY 2010

Olin

4

Investment Rationale

• Leading North American producer of Chlor-Alkali

• Strategically positioned facilities

• Diverse end customer base

• Favorable industry dynamics

• Leading producer of industrial bleach with additional

growth opportunities

growth opportunities

• Pioneer and SunBelt acquisition synergies improved chlor-

alkali price structure

alkali price structure

• Winchester’s leading industry position

5

Acquisition of PolyOne’s

Interest in SunBelt

Interest in SunBelt

• On February 28, 2011, Olin purchased PolyOne’s 50%

interest in SunBelt for $132.3 million in cash plus the

assumption of a PolyOne guarantee related to the SunBelt

Partnership debt

interest in SunBelt for $132.3 million in cash plus the

assumption of a PolyOne guarantee related to the SunBelt

Partnership debt

• Olin and PolyOne agreed to a three-year earn out based on

the performance of SunBelt

the performance of SunBelt

• The SunBelt 352,000 ton membrane plant located within

Olin’s McIntosh, AL facility, which has been operated by

Olin since 1997, is now 100% owned by Olin

Olin’s McIntosh, AL facility, which has been operated by

Olin since 1997, is now 100% owned by Olin

• Olin recorded a pretax gain of approximately $181 million

and a deferred tax expense of $76 million as a result of an

accounting remeasurement associated with the value of its

original 50% interest in the SunBelt Partnership

and a deferred tax expense of $76 million as a result of an

accounting remeasurement associated with the value of its

original 50% interest in the SunBelt Partnership

6

SunBelt Acquisition Benefits

• Olin expects the acquisition to be accretive to

both EBITDA and earnings in 2011

both EBITDA and earnings in 2011

• SunBelt currently has the lowest cash

manufacturing costs in the Olin system

manufacturing costs in the Olin system

• SunBelt has a long-term contract for 250,000

tons of chlorine per year

tons of chlorine per year

• Expected annual synergies of $5-10 million

associated with increased use of low cost

capacity and increased sales of membrane grade

caustic soda

associated with increased use of low cost

capacity and increased sales of membrane grade

caustic soda

7

Chlor Alkali Segment

ECU = Electrochemical Unit; a unit of measure reflecting the chlor alkali process outputs

of 1 ton of chlorine, 1.13 tons of 100% caustic soda and 0.3 tons of hydrogen.

of 1 ton of chlorine, 1.13 tons of 100% caustic soda and 0.3 tons of hydrogen.

N. American

Position

Position

% 2010

Revenue

Revenue

#2

#3

#1

Industrial

Industrial

#1

Merchant

Merchant

#1

Burner

Grade

Burner

Grade

42%

10%

4%

11%

32%

1%

Chlor Alkali Manufacturing Process

BRINE + ELECTROLYSIS = OUTPUTS

Caustic Soda - 1.13 Tons

(Sodium Hydroxide)

(Potassium Hydroxide)

Bleach

(Sodium Hypochlorite)

Chlorine - 1 Ton

Potassium Chloride

or

Sodium Chloride

KOH - 1.59 Tons

HCl

(Hydrochloric Acid)

Hydrogen Gas - 0.3 Tons

KOH

or

Caustic Soda

Chlorine

Hydrogen

1.8 Tons Salt &

.5 Tons Water

2.8 Megawatts Electricity

8

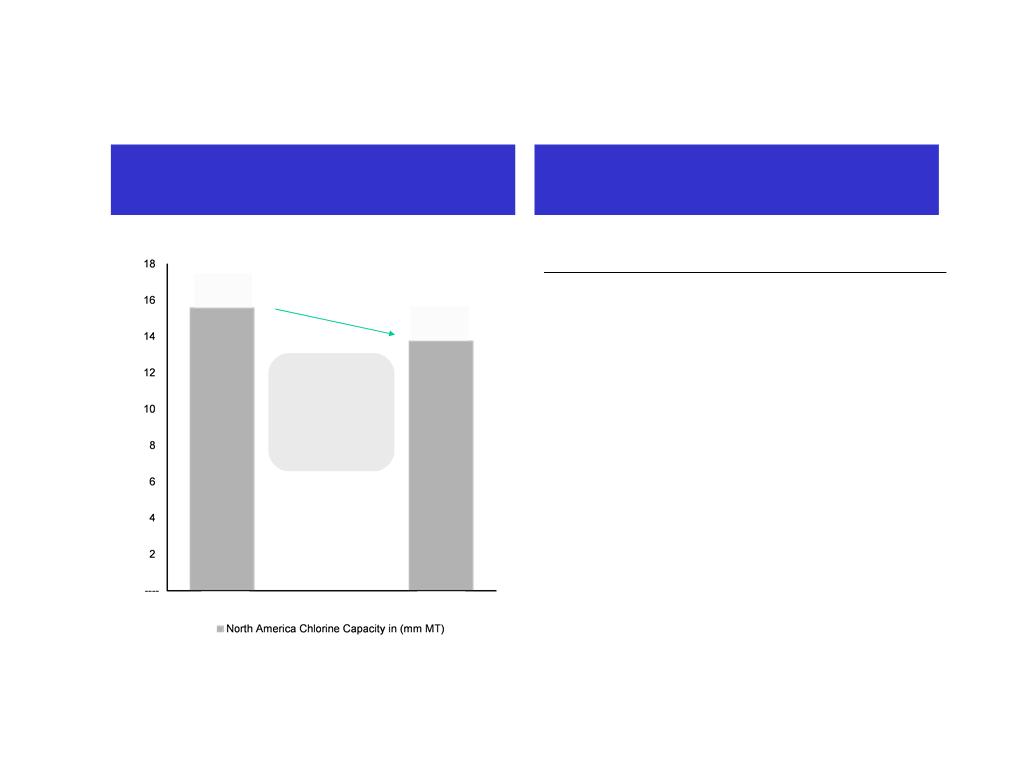

Olin is #3 Chlor-alkali Producer

Source: CMAI/Olin - 2010 year-end figures

Oxy includes OxyVinyls, PPG excludes Equa-Chlor and Olin includes 100% of SunBelt.

9

Mercury Transition Plan

• The North American Chlor Alkali industry has been moving

away from manufacturing chlorine and caustic soda using

mercury cell technology due to customer product de-selection

and threats of potential legislation

away from manufacturing chlorine and caustic soda using

mercury cell technology due to customer product de-selection

and threats of potential legislation

• Olin currently operates 2 mercury cell plants representing

approximately 360,000 ECUs or 17% of our total capacity

approximately 360,000 ECUs or 17% of our total capacity

• By the end of 2012, Olin expects to convert 200,000 ECUs

of mercury cell technology to membrane technology and will

shutdown the remaining 160,000 ECUs

of mercury cell technology to membrane technology and will

shutdown the remaining 160,000 ECUs

• Estimated cost is $160 million over 2 years, aided by $41

million of low-cost Tennessee-sponsored tax-exempt debt

million of low-cost Tennessee-sponsored tax-exempt debt

10

Capacity Rationalization

Favorable Industry Dynamics

Target

Acquisition

Date

Date

Position

2007

2004

• Acquired by Olin

• 725,000 Short Tons ECU Capacity

• 4.7% of North American capacity

• Acquired by OxyChem

• 859,000 Short Tons ECU Capacity

• 5.5% of North American capacity

Source: CMAI.

Pioneer

Vulcan

Industry Consolidation

1.4 mm MT

net capacity

net capacity

reduction; or

9% of 2000

capacity

mmMT

14.2

15.6

2010

2000

2010

• Acquired by Cydsa/Iquisa

• 45,000 Short Tons ECU Capacity

Mexichem

2011

• Olin acquired SunBelt interest

• 176,000 Short Tons ECU Capacity

PolyOne

Olin announced capacity reductions expected to be in place by 12/31/2012

2011

• Acquired by PPG

• 70,000 Short Tons ECU Capacity

Equa-Chlor

11

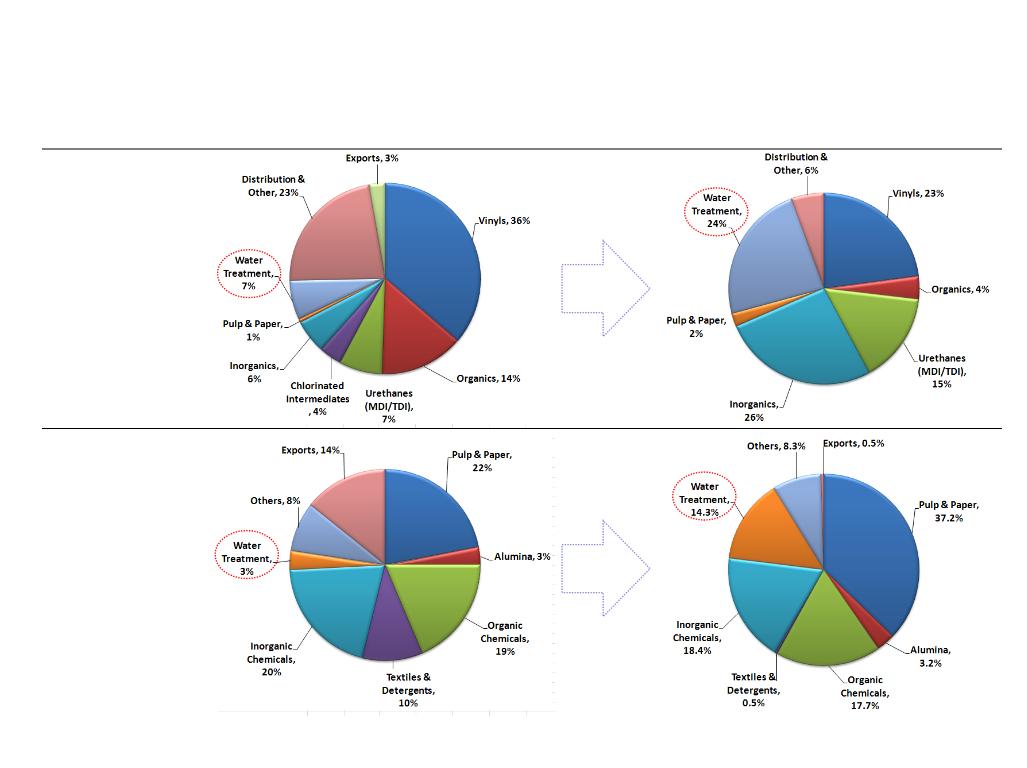

Diverse Customer Base

Chlorine

Caustic Soda

North American Industry

Olin Corporation

Source: CMAI and Olin 2010 demand. Includes sales of SunBelt.

Chlorine: “Organics” includes: Propylene oxide, epichlorohydrin, MDI, TDI, polycarbonates. “Inorganics” includes: Titanium dioxide and bromine.

Caustic Soda: “Organics” includes: MDI, TDI, polycarbonates, synthetic glycerin, sodium formate, monosodium glutamate. “Inorganics” includes: titanium dioxide, sodium silicates, sodium cyanide.

12

Bleach Plants

39

Tacoma, WA

Tracy, CA

Santa Fe Springs, CA

Henderson, NV

St. Gabriel, LA

Augusta, GA

Charleston, TN

Niagara Falls, NY

Becancour,

Quebec

Olin’s Geographic Advantage

|

Location

|

Chlorine Capacity

(000s Short Tons)

|

|

McIntosh, AL

|

426 Diaphragm

|

|

McIntosh, AL - SunBelt

|

352 Membrane

|

|

Becancour, Quebec

|

252 Diaphragm

65 Membrane

|

|

Niagara Falls, NY

|

300 Membrane

|

|

Charleston, TN (1)

|

260 Mercury

|

|

St. Gabriel, LA

|

246 Membrane

|

|

Henderson, NV

|

153 Diaphragm

|

|

Augusta, GA (1)

|

100 Mercury

|

|

Total

|

2,154

|

• Access to regional customers including bleach and water treatment

• Access to alternative energy sources

– Coal, hydroelectric, nuclear, natural gas

(1) Announced the conversion of 200,000 tons of mercury cell technology to membrane cell technology at the Charleston, TN facility

and the closure of the mercury cell facility in Augusta, GA, both are expected to be completed by 12/31/12.

13

Why Industrial Bleach?

• Olin is the leading North American bleach producer with 18% market

share and current installed capacity to service 25% of the market with

low-cost expansion opportunities

share and current installed capacity to service 25% of the market with

low-cost expansion opportunities

• Bleach utilizes both chlorine and caustic soda in an ECU ratio

• Bleach commands a premium price over an ECU

• Demand is not materially impacted by economic cycles

• Regional nature of the bleach business benefits Olin’s geographic

diversity, further enhanced by Olin’s proprietary railcar technology to

reach distant customers

diversity, further enhanced by Olin’s proprietary railcar technology to

reach distant customers

• Low salt, high strength bleach investment will lower freight costs

• Bleach volumes accounted for almost 10% of total 2010 ECUs

produced; these volumes are expected to grow to 15% to 20% in 2011

produced; these volumes are expected to grow to 15% to 20% in 2011

14

Chlor-Alkali Outlook

• Q1 2011 ECU netbacks of $525 are up $85 over Q1 2010;

we expect netbacks and volumes to continue to improve

we expect netbacks and volumes to continue to improve

• Positive price momentum from 2010 has continued in 2011:

Chlorine Caustic Soda

2010 Increases $50 $300

January 2011 $ 40

March 2011 $60 $ 60

April 2011 $ 50

• Q1 2011 operating rates improved to 80% from 75% in Q1

2010 and are expected to increase in the second and third

quarters of 2011

2010 and are expected to increase in the second and third

quarters of 2011

• Q1 EBIT is the highest level since the Q2 2009 and is

expected to improve

expected to improve

15

Winchester Segment

Winchester Strategy

• Leverage existing strengths

– Seek new opportunities

to leverage the

legendary Winchester®

brand name

to leverage the

legendary Winchester®

brand name

– Investments that

maintain Winchester as

the retail brand of

choice, and lower costs

maintain Winchester as

the retail brand of

choice, and lower costs

• Focus on product line

growth

growth

– Continue to develop

new product offerings

new product offerings

• Provide returns in excess of

cost of capital

cost of capital

|

|

Hunters & Recreational Shooters

|

|

|

|

||

|

Products

|

Retail

|

Distributors

|

Mass

Merchants |

Law

Enforcement |

Military

|

Industrial

|

|

Rifle

|

ü

|

ü

|

ü

|

ü

|

ü

|

|

|

Handgun

|

ü

|

ü

|

ü

|

ü

|

ü

|

|

|

Rimfire

|

ü

|

ü

|

ü

|

ü

|

ü

|

ü

|

|

Shotshell

|

ü

|

ü

|

ü

|

ü

|

ü

|

ü

|

|

Components

|

ü

|

ü

|

ü

|

ü

|

ü

|

ü

|

Brands

16

Favorable Industry Dynamics

Commercial

• Economic environment leading to personal security concerns

• Fears of increased gun/ammunition control due to change in administration

• New gun and ammunition products

• Strong hunting activity in weak economy, driven by cost/benefit of hunting

for food and increased discretionary time

for food and increased discretionary time

Law

Enforcement

Enforcement

• Significant new federal agency contracts and solid federal law enforcement

funding

funding

• Higher numbers of law enforcement officers and increase in federal agency

hiring

hiring

• Increased firearms training requirements among state and local law

enforcement agencies

enforcement agencies

Military

• Sustained high demand for small caliber ammunition due to wars in Iraq and

Afghanistan

Afghanistan

• Commitment to maintaining the “Second-Source Program” to mitigate the

risk of a sole-source small caliber ammunition contract

risk of a sole-source small caliber ammunition contract

17

Winchester

• Q1 2011 segment earnings of $12.5 million are $7 million lower

than Q1 2010 earnings due to higher commodity costs

than Q1 2010 earnings due to higher commodity costs

• Olin and the other two North American ammunition producers

have announced price increases to be effective by June 1st

have announced price increases to be effective by June 1st

• Q1 2011 commercial backlog has declined by 50% from Q1 2010

levels reflecting the demand decline from the 2008 - 2010 surge

levels; while Q1 2011 law enforcement and military backlog is

comparable to Q1 2010 levels

levels reflecting the demand decline from the 2008 - 2010 surge

levels; while Q1 2011 law enforcement and military backlog is

comparable to Q1 2010 levels

• Winchester was recently awarded a 5 year contract to make 9mm

rounds with a potential sales value of approximately $85 million

rounds with a potential sales value of approximately $85 million

• We expect current year and future segment earnings to be in

excess of earnings generated by the business prior to the most

recent surge that began late 2008 and ended H2 2010.

excess of earnings generated by the business prior to the most

recent surge that began late 2008 and ended H2 2010.

18

Centerfire Relocation

• The decision to relocate Winchester’s centerfire operations,

including 1,000 jobs, was made on November 3, 2010

including 1,000 jobs, was made on November 3, 2010

• The controlled relocation process is expected to take up to 5

years to complete assuring that high quality product is

available for our customers

years to complete assuring that high quality product is

available for our customers

• In 2011, we expect a $4 to $5 million negative pretax impact

on earnings associated with the relocation project

on earnings associated with the relocation project

• Annual operating costs are forecast to be reduced by $30

million once the move is complete

million once the move is complete

• The net project cost is estimated to be $80 million, of which

approximately $50 million is related to capital expenditures

approximately $50 million is related to capital expenditures

• $42 million of low-cost Mississippi-sponsored tax-exempt

debt has been made available to the company

debt has been made available to the company

19

Financial Highlights

• Strong Balance Sheet

– The Q1 2011 cash balance of $380 million reflects the use

of $132 million to acquire PolyOne’s 50% interest in

SunBelt and normal seasonal working capital needs

of $132 million to acquire PolyOne’s 50% interest in

SunBelt and normal seasonal working capital needs

– Pension plans remain fully funded with no contributions

expected until at least 2013

expected until at least 2013

– 2011 CAPEX is forecast to be $235-$255 million reflecting

the mercury conversion and Oxford relocation costs

the mercury conversion and Oxford relocation costs

• Profit Outlook

– ECU pricing and volume trends are positive

– Higher margin bleach business is growing

– Acquisition of PolyOne’s interest in SunBelt is expected to

be accretive to EBITDA and earnings in 2011

be accretive to EBITDA and earnings in 2011

– Opportunity for highest level of EBITDA since Arch spin

20

Forward-Looking Statements

This presentation contains estimates of future

performance, which are forward-looking

statements and actual results could differ

materially from those anticipated in the forward-

looking statements. Some of the factors that could

cause actual results to differ are described in the

business and outlook sections of Olin’s Form 10-K

for the year ended December 31, 2010 and in

Olin’s First Quarter 2011 Form 10-Q. These

reports are filed with the U.S. Securities and

Exchange Commission.

performance, which are forward-looking

statements and actual results could differ

materially from those anticipated in the forward-

looking statements. Some of the factors that could

cause actual results to differ are described in the

business and outlook sections of Olin’s Form 10-K

for the year ended December 31, 2010 and in

Olin’s First Quarter 2011 Form 10-Q. These

reports are filed with the U.S. Securities and

Exchange Commission.