Attached files

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 5, 2011

SKY DIGITAL STORES CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

000-52293

|

83-0463005

|

|

(State of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

#1801 Building B, Hai Song Da Sha

Che Gong Miao, Fu Tian Qu

Shenzen, China 518041

(Address of principal executive offices) (Zip code)

86 755 82718088

(Registrant's telephone number, including area code)

Former name or former address, if changed since last report)

______________________

Copies to:

Gregory Sichenzia, Esq.

Lijia Sanchez, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32nd Floor

New York, NY 10006

(212) 930-9700

______________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

1

TABLE OF CONTENTS

|

Item No.

|

Description of Item

|

PageNo.

|

||

|

Item 1.01

|

Entry Into a Material Definitive Agreement

|

3 | ||

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets

|

4 | ||

|

Item 3.02

|

Unregistered Sales of Equity Securities

|

44 | ||

|

Item 4.01

|

Changes in Registrant’s Certifying Accountant

|

44 | ||

|

Item 5.01

|

Changes in Control of Registrant

|

45 | ||

|

Item 5.02

|

Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers.

|

45 | ||

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

|

46 | ||

|

Item 5.06

|

Change in Shell Company Status

|

46 | ||

|

Item 9.01

|

Financial Statements and Exhibits

|

47 |

2

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

The Current Report on Form 8-K contains forward looking statements that involve risks and uncertainties, principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” All statements other than statements of historical fact contained in this Current Report on Form 8-K, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Although we do not make forward looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this Current Report on Form 8-K, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short term and long term business operations, and financial needs. These forward-looking statements are subject to certain risks and uncertainties that could cause our actual results to differ materially from those reflected in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this Current Report on Form 8-K, and in particular, the risks discussed below and under the heading “Risk Factors” and those discussed in other documents we file with the Securities and Exchange Commission that are incorporated into this Current Report on Form 8-K by reference. The following discussion should be read in conjunction with our annual report on Form 10-K and our quarterly reports on Form 10-Q incorporated into this Current Report on Form 8-K by reference, and the consolidated financial statements and notes thereto included in our annual and quarterly reports. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Current Report on Form 8-K may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statement.

You should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this Current Report on Form 8-K. Before you invest in our common stock, you should be aware that the occurrence of the events described in the section entitled “Risk Factors” and elsewhere in this Current Report on Form 8-K could negatively affect our business, operating results, financial condition and stock price. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this Current Report on Form 8-K to conform our statements to actual results or changed expectations.

Item 1.01 Entry Into A Material Definitive Agreement.

As more fully described in Item 2.01 below, on May 5, 2011, SKY Digital Store Corp, formerly known as Yellowcake Mining, Inc. (the “Company”, “we” or “SKYC”), completed the acquisition of HongKong First Digital Holding Limited (“FDH”), a company that is in the business of designing, manufacturing and selling of mobile communication and digital products, by means of a share exchange.

3

On May 5, 2011, we entered into a Share Exchange Agreement (“Exchange Agreement”) by and among SKYC, FDH, and the shareholders of FDH (the “FDH Shareholders”). The closing of the transaction (the “Closing”) took place on May 5, 2011 (the “Closing Date”). On the Closing Date, pursuant to the terms of the Exchange Agreement, we acquired all of the outstanding shares (the “Shares”) of FDH from the FDH Shareholders; and FDH Shareholders transferred and contributed all of their Shares to us. In exchange, we issued to the FDH Shareholders, their designees or assigns, an aggregate of 23,716,035 shares (the “Shares Component”) or 97.56% of the shares of common stock of the Company issued and outstanding after the Closing (the “Share Exchange”), at $0.20 per share. The parties understand and acknowledge that such exchange is based upon an acquisition value of FDH at $4,743,207, which is agreed and acceptable by all parties.

A copy of the Exchange Agreement is included as Exhibit 2.1 to this Current Report and is hereby incorporated by reference. All references to the Exchange Agreement and other exhibits to this Current Report are qualified, in their entirety, by the text of such exhibits.

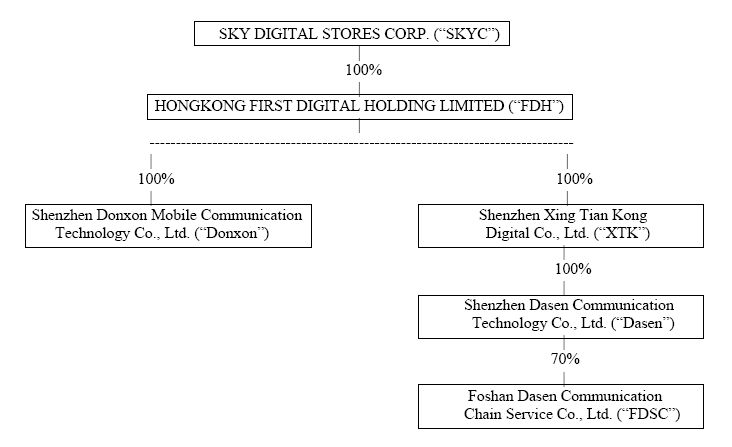

FDH owns (i) 100% of the issued and outstanding capital stock of Shenzhen Dong Sen Mobile Communication Technology Co., Ltd (also known and do business as Shenzhen Donxon Mobile Communication Technology Co., Ltd, “Donxon”), a company organized under the laws of the People’s Republic of China (“China” or the “PRC”); and (ii) 100% of the issued and outstanding capital stock of Shenzhen Xing Tian Kong Digital Company Limited (“XTK”), a PRC company. XTK is the holder of 100% of the issued and outstanding capital stock of Shenzhen Da Sheng Communication Technology Company Limited (also known and do business as Shenzhen Dasen Communication Technology Company Limited, “Dasen”), a PRC company. Dasen is the holder of 70% of the issued and outstanding capital stock of Foshan Da Sheng Communication Chain Service Company Limited (also known and do business as Foshan Dasen Communication Chain Service Co. Ltd, “FDSC”), a PRC company. Pursuant to the Exchange Agreement, FDH became a wholly-owned subsidiary of the Company, and the Company will own 100% of Donxon, 100% of XKT, 100% of Dasen and 70% of FDSC indirectly through FDH.

The directors of the Company have approved the Exchange Agreement and the transactions contemplated under the Exchange Agreement. The directors and majority stockholders of FDH have approved the Exchange Agreement and the transactions contemplated thereunder. Mr. Lin Xianfeng, the sole officer and chairman of the Company, is also the sole officer and chairman of FDH. As a further condition of the Share Exchange, Johnny C.W. Chan and Xiuhong Tian were appointed as the new officers of the Company, effective immediately at the Closing.

The Share Exchange transaction is discussed more fully in Section 2.01 of this Current Report. The information therein is hereby incorporated in this Section 1.01 by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets.

CLOSING OF EXCHANGE AGREEMENT

As described in Item 1.01 above, on May 5, 2011, in accordance with the Exchange Agreement, we acquired FDH, which is the parent holding company of operating subsidiaries engaging in the business of designing, manufacturing and selling of mobile communication and digital products in the PRC. The closing of the transaction took place on May 5, 2011. On the Closing Date, pursuant to the terms of the Exchange Agreement, we acquired all the Shares of FDH from the FDH Shareholders; and the FDH Shareholders transferred and contributed all of their Shares to us. In exchange, we issued to the FDH Shareholders, their designees or assigns, an aggregate of 23,716,035 shares or 97.56% of the shares of common stock of the Company issued and outstanding, at $0.20 per share, on a fully-diluted basis as of and immediately after the Closing. A copy of the Share Exchange Agreement is filed as Exhibit 2.1 to this Current Report. The parties understand and acknowledge that such exchange is based upon an acquisition value of FDH at $4,743,207 which is agreed and accepted by all parties. Following the Share Exchange, there are 24,309,066 shares of common stock issued and outstanding.

4

FDH, through its subsidiaries Donxon and XTK, primarily engages in the business of designing, manufacturing and selling of mobile communication and digital products in China. FDH was incorporated with limited liability under the laws of Hong Kong and owns 100% of the issued and outstanding capital stock of Donxon and XTK, both organized under the PRC laws. Pursuant to the Exchange Agreement, FDH became a wholly-owned subsidiary of the Company, and through FDH, the Company owns 100% of Donxon and XTK.

The Company was a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) immediately before the completion of the Share Exchange. Accordingly, pursuant to the requirements of Item 2.01(f) of Form 8-K, set forth below is the information that would be required if the Company were filing a general form for registration of securities on Form 10 under the Exchange Act, reflecting the Company’s common stock, which is the only class of its securities subject to the reporting requirements of Section 13 or Section 15(d) of the Exchange Act upon consummation of the Share Exchange, with such information reflecting the Company and its securities upon consummation of the Share Exchange.

BUSINESS

Overview

FDH, through its direct operating subsidiaries Donxon and XTK, primarily engages in the business of designing, manufacturing and selling of mobile communication and digital products in China. FDH owns 100% of the issued and outstanding capital stock of Donxon and XTK. XTK is the holder of 100% of the issued and outstanding capital stock of Dasen. Dasen is the holder of 70% of the issued and outstanding capital stock of FDSC.

Historical Sales and Income Summary

FDH generates revenues solely from the sales of mobile communication and digital products. Our net sales revenues for the fiscal year ended December 31, 2010 which was $34,993,500 represented a 583% growth from the fiscal year ended December 31, 2009 with net sales revenues of $5,123,871. Our fiscal year 2010 net income was $2,040,222; an increase of 737% compared with our fiscal year 2009 net income of $243,730. The post-merger assets of the Company and its subsidiaries on a consolidated basis include cash, accounts receivable from customers, inventories, trade deposit, prepaid expenses, equipment and other receivables.

|

Fiscal Year Ended

December 31,

|

||||||||||||

|

Summary Consolidated

|

2010

|

2009

|

Growth

|

|||||||||

|

Statement of Operations:

|

(audited)

|

(audited)

|

%

|

|||||||||

|

Sales, Net

|

$ | 34,993,500 | $ | 5,123,871 | 583 | % | ||||||

|

Gross Profit

|

3,703,336 | 320,165 | 1057 | % | ||||||||

|

Net Income

|

2,040,222 | 243,730 | 737 | % | ||||||||

5

Organization & Subsidiaries

FDH’s organizational structure was developed to permit the infusion of foreign capital under the laws of the PRC and to maintain an efficient tax structure, as well as to foster internal organizational efficiencies. FDH was established on September 30, 2010 in Hong Kong. FDH entered into a share exchange agreement with the shareholders of Donxon on November 3, 2010, and as a result of the transaction, Donxon became a wholly-owned subsidiary of FDH. XTK was established by FDH on February 28, 2011 in Shenzhen, PRC. XTK completed a 100% ownership acquisition transaction with Dasen on April 7, 2011 and has an indirect interest ownership of 70% of FDSC through Dasen. Dasen was established on November 26, 2007 in Shenzhen, PRC. FDSC was established on January 19, 2007 in Foshan, PRC. 70% interest ownership of FDSC was acquired by Dasen on January 7, 2008. The Company’s organization structure post-Share Exchange is summarized in the figure below:

Donxon:

Donxon is a company committed to research and development (“R&D”), production and sales of mobile communication and digital products. Donxon has acquired Network Access Licenses from the Ministry of Industry and Information Technology in all available telecommunication standards, including GSM, CDMA, TD-SCDMA, EVDO, and WCDMA. The main products of Donxon currently include CDMA phones, 3rd Generation (hereinafter ‘3G’) phones, and projectors. New products which include projector phones and tablet computers are scheduled to be launched into market between mid and late year 2011. Its network of sales and after sales services extends to every province in the nation.

Donxon was established on April 9, 2003 and entered into the telecommunication market and related fields by establishing regional dealerships with certain international brands such as TCL, Philips and Capitel and has achieved excellent success. After years of experiences and resources accumulation in the sector, Donxon acquired Network Access Licenses for mobile phones in all available standards, including GSM, CDMA, TD-SCDMA, EVDO, and WCDMA from the Ministry of Industry and Information Technology in Year 2008, and officially entered into the business of mobile phone development and sales. Furthermore, Donxon invested working capital in the R&D of mobile phones in Year 2009 and underwent government inspections, in which a total of 21 models of its mobile phones passed. Starting from Year 2010, Donxon has begun producing its own line of mobile phones under its own brand names “Donxon” and “EMI”. Donxon owns one trademark rights currently, which is “Donxon”, and two pending trademark rights, which are “EMI” and “  ” (Dong Sen in Chinese characters).

” (Dong Sen in Chinese characters).

” (Dong Sen in Chinese characters).

” (Dong Sen in Chinese characters).6

|

|

Donxon has developed its comprehensive management system in R&D, production and sales. Donxon’s R&D department has its own proprietary research capabilities of upgrading mobile phone products to launch 30 new mobile phone products each year. With a strong foundation in manufacturing and successful sales channels while maintaining independent R&D as its core strategy, Donxon believes that it is on the right track and stage to develop branded products.

Donxon’s registered and headquarter Shenzhen office address is Suite #1801, Building B, Hai Song Da Sha, Tairan 9 Lu, Che Gong Miao, Fu Tian Qu, Shenzhen, China 518041. The Shenzhen office area is approximately 349.43 square meters, and the monthly rental fee is RMB 31,410. Donxon has also set up a branch office in Beijing, and the address is Suite #1609-1610, 16th Floor, Jin Yu Da Sha, Xi Da Jie Jia # 129, Xuanwu Men, Xi Cheng Qu, Beijing, China 100031. The Beijing office area is approximately 71 square meters, and the monthly rental fee is RMB 7,861.83. Donxon’s Shenzhen factory is located at Floor 6, Block C5, Fuyuan Industrial Zone, No. 111 Zhoushi Lu, Xixiang Jie Dao, Bao’an Qu, Shenzhen, China 518033. The Shenzhen factory, which has easy access to main highways, is approximately 935 square meters in total rental area, and the monthly rental fee is RMB 11,687.50.

Donxon is equipped with two complete mobile phone production lines, including one 32 meters’ assembly with a packaging line, and another 23 meters’ assembly line. Furthermore, it is also equipped with five different mobile phone test instruments, including one CMU200 integrated test instrument; one 8960 integrated test instrument; one CMD55 integrated test instrument; one CMD80 integrated test instrument; and one torque tester. To ensure product quality, Donxon has acquired certain International Standard certifications, such as ISO9001:2000 Quality Management System, ISO14001:2004 Environmental Management System, and GB/T28001:2001 Occupational Health and Safety Management System.

Currently the production capacity of Donxon is between 60, 000 to 90, 000 units per month and it has a total of 127 employees, including81 assembly workers, 20 operating and management personnel, and 26 sales personnel. Among its employees, 30 hold Bachelor degrees; 26 hold Associate degrees and the rest of 71 have high school education or lower. All 127 current employees are full time.

With the growth of consumers in the electronics sector, the changes and expansion of the market, Donxon pushes further for innovation while maintaining sales efforts in existing products (such as GSM phones and CDMA phones through its channels). It has also entered into the 3G mobile phone market by co-operating with top domestic plan providers. It has established close business relationships with Chinese mobile carriers, such as China Telecom, China Mobile and China Unicom. Aiming for expansion in both the Chinese and the international markets, Donxon is continuously searching for business opportunities and is prepared to accept new challenges.

Main Products and Product Positioning

1. Specifications, Functions and Patents of Main Product Series

a) CDMA1X, EVDO mobile phones are customized strictly according to China Telecom’s customization requirements, supporting all applications required by China Telecom. They have passed the tests held by Guangzhou Research Institute of China Telecom Co., Ltd. and are listed in the customization product lines of China Telecom.

7

b) CDMA1X M808, D1, M88 mobile phones have obtained Network Access Licenses from the Ministry of Industry and Information Technology, participating in the first bid organized by China Telecom.

c) EVDO 3G mobile phone products, including E189, E289, E389, E153, and E180 have obtained Network Access Licenses from the Ministry of Industry and Information Technology, and E189 is the first launched EVDO mobile phone model that is priced above RMB 1,000 by China Telecom.

d) TD-SCDMA 3G mobile phones developed and produced by Donxon are customized strictly according to China Mobile’s customization requirements, supporting all applications required by China Mobile. They have passed the tests held by Research Institute of China Mobile, and are listed in the customization product lines of China Mobile. TD-SCDMA products, including D66, and D108 have obtained Network Access Licenses from the Ministry of Industry and Information Technology, and D66 have obtained a good grade from Research Institute of China Mobile.

e) Donxon owns one trademark currently, which is “Donxon”, the duration of which lasts until March 6, 2021. It has two pending trademarks, which are “EMI” and “  ” (Dong Sen in Chinese characters). It also owns three patents and has four pending patents. The three patents owned are a) Appearance Patent of E189 EVDO 3G mobile phone, the duration of which lasts until April 28, 2010; b) Appearance Patent of E389 EVDO 3G mobile phone, the duration of which lasts until April 28, 2010; and c) Appearance Patent of G1 projector mobile phone, the duration of which lasts until January 6, 2021. The four pending patents are a) Appearance Patent of E66 EVDO 3G network card; b) Appearance Patent of E289 EVDO 3G mobile phone; c) Appearance Patent of E153 EVDO 3G mobile phone; and d) Appearance Patent of E180 EVDO 3G mobile phone. Moreover, Donxon has obtained four chip-set licenses for R&D, which are a) Chip-set License of CDMA2000 2G CBP5.0, CBP5.1, CBP5.5, and CBP5.6 by VIA Technologies; b) Chip-set License of CDMA2000 3G CBP7.0, CBP7.1 by VIA Technologies; c) Chip-set License of GSM SC6600L, SC6600LS by Spreadtrum Communications; and d) Chip-set License of TD-SCDMA SC8800H by Spreadtrum Communications.

” (Dong Sen in Chinese characters). It also owns three patents and has four pending patents. The three patents owned are a) Appearance Patent of E189 EVDO 3G mobile phone, the duration of which lasts until April 28, 2010; b) Appearance Patent of E389 EVDO 3G mobile phone, the duration of which lasts until April 28, 2010; and c) Appearance Patent of G1 projector mobile phone, the duration of which lasts until January 6, 2021. The four pending patents are a) Appearance Patent of E66 EVDO 3G network card; b) Appearance Patent of E289 EVDO 3G mobile phone; c) Appearance Patent of E153 EVDO 3G mobile phone; and d) Appearance Patent of E180 EVDO 3G mobile phone. Moreover, Donxon has obtained four chip-set licenses for R&D, which are a) Chip-set License of CDMA2000 2G CBP5.0, CBP5.1, CBP5.5, and CBP5.6 by VIA Technologies; b) Chip-set License of CDMA2000 3G CBP7.0, CBP7.1 by VIA Technologies; c) Chip-set License of GSM SC6600L, SC6600LS by Spreadtrum Communications; and d) Chip-set License of TD-SCDMA SC8800H by Spreadtrum Communications.

” (Dong Sen in Chinese characters). It also owns three patents and has four pending patents. The three patents owned are a) Appearance Patent of E189 EVDO 3G mobile phone, the duration of which lasts until April 28, 2010; b) Appearance Patent of E389 EVDO 3G mobile phone, the duration of which lasts until April 28, 2010; and c) Appearance Patent of G1 projector mobile phone, the duration of which lasts until January 6, 2021. The four pending patents are a) Appearance Patent of E66 EVDO 3G network card; b) Appearance Patent of E289 EVDO 3G mobile phone; c) Appearance Patent of E153 EVDO 3G mobile phone; and d) Appearance Patent of E180 EVDO 3G mobile phone. Moreover, Donxon has obtained four chip-set licenses for R&D, which are a) Chip-set License of CDMA2000 2G CBP5.0, CBP5.1, CBP5.5, and CBP5.6 by VIA Technologies; b) Chip-set License of CDMA2000 3G CBP7.0, CBP7.1 by VIA Technologies; c) Chip-set License of GSM SC6600L, SC6600LS by Spreadtrum Communications; and d) Chip-set License of TD-SCDMA SC8800H by Spreadtrum Communications.

” (Dong Sen in Chinese characters). It also owns three patents and has four pending patents. The three patents owned are a) Appearance Patent of E189 EVDO 3G mobile phone, the duration of which lasts until April 28, 2010; b) Appearance Patent of E389 EVDO 3G mobile phone, the duration of which lasts until April 28, 2010; and c) Appearance Patent of G1 projector mobile phone, the duration of which lasts until January 6, 2021. The four pending patents are a) Appearance Patent of E66 EVDO 3G network card; b) Appearance Patent of E289 EVDO 3G mobile phone; c) Appearance Patent of E153 EVDO 3G mobile phone; and d) Appearance Patent of E180 EVDO 3G mobile phone. Moreover, Donxon has obtained four chip-set licenses for R&D, which are a) Chip-set License of CDMA2000 2G CBP5.0, CBP5.1, CBP5.5, and CBP5.6 by VIA Technologies; b) Chip-set License of CDMA2000 3G CBP7.0, CBP7.1 by VIA Technologies; c) Chip-set License of GSM SC6600L, SC6600LS by Spreadtrum Communications; and d) Chip-set License of TD-SCDMA SC8800H by Spreadtrum Communications.2. Product Positioning

a) Customized mobile phone supplier for China Telecom: CDMA single mode and GSM/CDMA dual mode mobile phones, 2G and 3G Smartphones made by Donxon are customized strictly according to China Telecom’s customization requirements, supporting all applications required by China Telecom. They have passed the tests held by Guangzhou Research Institute of China Telecom Co., Ltd. and listed in the customization product lines of China Telecom.

b) CDMA mobile phone mass marketer: Donxon plans to produce CDMA single mode and GSM/CDMA dual mode mobile phones and 2G and 3G Smartphones to cover the low, middle, and high end markets.

c) Customized mobile phone supplier for China Mobile: TD-SCDMA 3G mobile phones developed and produced by Donxon are customized strictly according to China Mobile’s customization requirements, supporting all applications required by China Mobile. They have passed tests held by Research Institute of China Mobile, and listed in customization product lines of China Mobile.

d) GSM mobile phone mass marketer: Donxon plans to produce TD-SCDMA mobile phones to cover the low, middle, and high end markets. Donxon has a reasonable price system for its products. The average price range of its phones is from RMB 500 to RMB 900. Products with low margins account for the most sales revenues but products with high margins are in short supply, which shows that Donxon has enormous room for growth.

3. New Products

a) Besides expansion in the production in 3G communication products, Donxon will capture the growth opportunity of tablet PC. The research, production and sales of tablet PC will be the main business focus and growth engine of Donxon in the future.

Apple has made a breakthrough in innovation of consumer electronics with its iPad’s launch. Similar products were launched in the market. However, there is no real competitor to threaten iPad’s market dominance. Tablets adopting Window CE operating system and resistive-touch screen have had poorer performance in touch and text input experiences than tablets using capacitive-touch screen which supports multi-touch technology. In addition to the screen difference, another key factor in which most tablets are less competitive than iPad is the support for Apps. When Apple developed iPad, it collaborated with thousands of App developers. With strong support from developers, iPad has gained an edge against its competitors. Apps on iPad run smoothly with perfect graphics, response quickly to multi-touch gestures and gravity screen, which are usual problems for Apps running on Android operating system. There are many Apps from Android too but most of the Android Apps cannot display properly with larger resolutions as Android OS is usually used for smartphone category of below 5 inches. However, we believe that the current issue will be solved and the demand for other tablets PC besides iPad will increase. Donxon will work closely with strategic partner software developers on R&D in developing tablets PC and plan to launch our brand of tablets PC in 2011.

8

b) Micro projector products are another new business focus of Donxon, which include projector phones with projection function. Donxon has basically solved certain technical difficulty of the product and is collaborating with partners to launch a new series of products in 2011.

Price will be the first obstacle to Donxon’s projector phones. Even with the low price acceptance level of mobile phones among consumers, projector phones’ costs and price still remain at a high level. High price of optical engine is the key factor behind it. Take Ongine Technology (the only Chinese proprietary optic engine supplier) as an example. Even though Ongine owns its proprietary factory, has more than 10 years of experiences in optical production, and low cost in management, its optic engine for mobile projector phones still cost more than $20 per unit. However, price of the optic engine for mobile projector phones will decrease as competitions remain tense among upstream panel suppliers that have adopted the LCOS panel technology, including Taiwan Himax, American Displaytech and Aurora. These companies will compete with each other’s technology in the growing market and hence bringing down the cost.

Cooling or heat elimination is another obstacle. The shell temperature of mobile phones or other equipment should remain at 40 to 42 degree Celsius. If it exceeds 45 degree Celsius, the heat would cause harm to the skins. The first projector mobile phone model of Shengtai Communication in 2008 did not gain popularity in the market mainly due to its cooling problem. On the other hand, as cooling requirements are loose in traditional mobile phone productions, most of Chinese mobile phone manufacturers have not accumulated sufficient knowledge in this area. In order to solve the temperature cooling problem, some projector mobile phone manufacturers have begun cooling module design and provided cooling solutions to mobile phone design companies. For instance, the power consumption of Ongine Technology’s 5 lumen optic engine is only 1W, it could solve perfectly the heat problem to control shell temperature under 42 degree Celsius without using fans. It is believed that more and more optic engine manufactures and mobile phone designing companies will accumulate sufficient knowledge in cooling technologies, and projector mobile phones will reach its mature stage.

Raw Materials and Suppliers

Printed Circuit Board Assembly (PCBA), LCD screen, camera, T-Flash memory card, electronic materials, shell materials, packaging materials, and other basic components are our main raw materials in the production of mobile communication and digital products. Donxon purchases all of its raw materials and component parts from a variety of sources, none of which is believed to be a dominant supplier. Alternative sources of supply are to be available to Donxon. Our top raw material suppliers are listed as below:

Top Major Suppliers in 2009

|

Suppliers/ Materials

|

Percentage

|

|

Henan Postel Mobile Communications Equipment Co., Ltd./ Mobile Phones

|

24.84%

|

|

Jiangsu Yingtai Electronics Co., Ltd./ Mobile Phones

|

33.29%

|

|

Synnex (China) Zhengzhou/ Mobile Phones

|

41.87%

|

9

Top Major Suppliers in 2010

|

Suppliers/ Materials

|

Percentage

|

|

Shenzhen Wefly Technology Co., Ltd./ PCBA

|

23.94%

|

|

Simware Telecom Co., Ltd. Guangzhou/ PCBA

|

18.00%

|

|

Shenzhen Concox Information Technology Co., Ltd./ PCBA and projector components

|

15.34%

|

|

Shenzhen Dijing Shi Ye Co., Ltd./ LCD screen

|

4.66%

|

|

Shenzhen Xin Zhi Ji Digital Co., Ltd./ T-Flash memory card

|

4.60%

|

Marketing/Sales Strategies and Customers

Sales breakdown: The sales of our mobile communication products counted for 100% of sales in our fiscal year ended December 31, 2009. The sales of mobile communication products accounted for 93.85% and the sales of projectors accounted for 6.15% of the total sales in our fiscal years ended December 31, 2010.

Donxon’s marketing and sales strategies include:

a. Enter the market at a low cost;

b. Lower costs by proprietary product design;

c. Outsource certain productions to buy more marketing time;

d. Adopt a low pricing sales strategy; and

e. Establish an extensive sales and after-sales channel.

Donxon’s advertising promotion strategies include:

a. Give-away advertising promotion;

b. Entertaining advertising promotion;

c. Price winning advertising promotion; and

d. Non-commercial advertising promotion.

Five Major Customers in 2009

|

Customers

|

Percentage

|

|

Chengdu Ying Pu Rui Sheng Communication Equipment Co., Ltd.

|

25.70%

|

|

Shenyang Ba Fang Li Da Electronics Co., Ltd.

|

25.31%

|

|

Zhejiang Tian Ya Communication Technology Co., Ltd.

|

25.16%

|

|

Jinan Xin Jin Wang Information & Communication Co., Ltd.

|

12.40%

|

|

Fujian Yun Jin Digital Technology Co., Ltd.

|

11.43%

|

10

Top Five Customers in 2010

|

Customers

|

Percentage

|

|

Shenzhen Hong Run Da Digital Technology Co., Ltd.

|

8.64%

|

|

Fujian Nan Kai Dian Zi Ji Shu Kai Fa Co., Ltd.

|

7.61%

|

|

Shenyang Ba Fang Li Da Electronics Co., Ltd.

|

7.33%

|

|

Shenzhen Yang Guang Xing Ye Trade Co., Ltd.

|

6.10%

|

|

Shenzhen Shijitianyuan Communication Technology Co., Ltd.

|

5.87%

|

Market Shares and Competitors

Our analysis and comparison on local competitors:

|

PRC’s Local Manufacturers

|

Overall Industry Market Share

|

Strengths

|

Weaknesses

|

|

Lenovo

|

4.5%

|

Lenovo Mobile Communications is the top brand in China, one of the core members of TD-SCDMA alliance and has been a leader in 3G and smart phones. In 2005, American Business Week granted the Award for Industrial Design Excellence to its ET960. In August 2009, Lenovo Mobile Communications’ market share reached 4.5%, just behind international manufacturers Nokia and Samsung.

|

High operating costs, low price to performance ratio.

|

|

Tianyu

|

3.6%

|

Tianyu is one of the few companies which have obtained manufacturing licenses for GSM / GPRS, and CDMA mobile phones. Tianyu is also one of the market leaders in Chinese market and has had a rapid growth. In 2008, it sold a total of 21 million phones. In August 2009, its market share reached 3.6%, as high as LG Electronics (China).

|

High operating costs, low price to performance ratio.

|

|

Huawei

|

3.2%

|

Huawei is the largest networking and telecommunication equipment supplier in the world, specializing in production and marketing of communication equipment. Huawei Technologies was included in the World's Most Respected 200 Companies list compiled by the Forbes magazine in May 2007. Huawei also manufactures mobile phones and is reputable in CDMA and 3G phones industry.

|

High operating costs, low price to performance ratio.

|

|

Gionee

|

2.4%

|

Gionee specializes in Chinese domestic market and overseas sales. It obtained manufacturing license of GSM and CDMA mobile phones in 2005.

|

High operating costs, low price to performance ratio.

|

|

Oppo

|

2.3%

|

Oppo used to produce MP3 and MP4 players, has built its brand image and its sales network.

|

High operating costs, low price to performance ratio.

|

|

Donxon/EMI

|

0.24%

|

Focus on the three main companies - China Telecom, China Mobile and China Unicom’s customized mobile communication products; has independent R&D capabilities of mobile phones with integrated micro-projection machine, independent R&D with a cluster calling features (PTT) mobile terminal industry applications.

|

New brands, need to work on building brand image.

|

11

Business Model

Donxon’s goal is to become a competitive leader in the development and manufacturing of consumer digital and mobile communication products. We will try to achieve this goal through our development strategies and business model:

1. Management Strength

Donxon has an efficient management team equipped with comprehensive sector knowledge. Most of the team members hold bachelor’s degrees or higher, and one half of them hold master’s degrees. 40% of the management team has years of management experiences in Chinese listed companies. Hence the management is more efficient and this is the core competitiveness of Donxon. Moreover, Donxon is a qualified customization mobile phone brand supplier of China Telecom, participating in discussion and finalization of mobile phone customization standards of China Telecom; a qualified customization mobile phone brand supplier of China Mobile, participating in discussion and finalization of mobile phone customization standards of China Mobile; and an approved mobile phone brand manufacturer by the Ministry of Industry and Information Technology of China, participating in discussion and finalization of headset jack and charger jack standards.

2. Quality Strength

The employees of Donxon have comprehensive industry knowledge and quality control experience. After years of operation, it has accumulated rich experiences and data in field control and technical management. By strict quality control measures and equipment, Donxon ensures high quality of its production and has gained trust from many top clients.

3. Efficiency Strength

Donxon has a clear corporate governance structure. Major shareholders participate in the operation of Donxon. Anticipating customer demands and responding to the market, the management team has full decision making power and responds to market conditions efficiently.

4. Cost Strength

Cost control remains one of the most important management tasks of Donxon and the cost control concept is shared by all Donxon employees. By scientific and detailed management in technical development, technical improvement, purchase control, procedure optimization, inventory management, sales and overhead cost target control, Donxon is able to operate at low cost and high efficiency and to produce more competitive products.

5. Technology Strength

5.1 Technology development

In order to improve product competitiveness, Donxon commits to R&D of mobile phone technologies.

a. R&D of main 3G (EVDO, TD-SCDMA) mobile phone products;

b. R&D of new products, such as projector mobile phones;

c. R&D of more different categories of mobile phone products, in which mobile phones are going smart and multimedia as multi-touch smartphones are gaining popularity, the gap between mobile phone and the internet are getting narrower.

d. R&D of user friendly interface, which is key factor to improve mobile internet user experience.

e. Integration of various functions under costs control, in which traditional functions of mobile phone will be fully utilized. The hardware design develops toward multi-modes, intelligent, and opened platform, and integrates with high storage, high performance processor, high memory, high resolution touch screen, battery longevity and high resolution camera.

f. Integrates elements of ultra-thin, full touch wide screen, narrow edge LCD design, to improve user vision/sensual experiences.

12

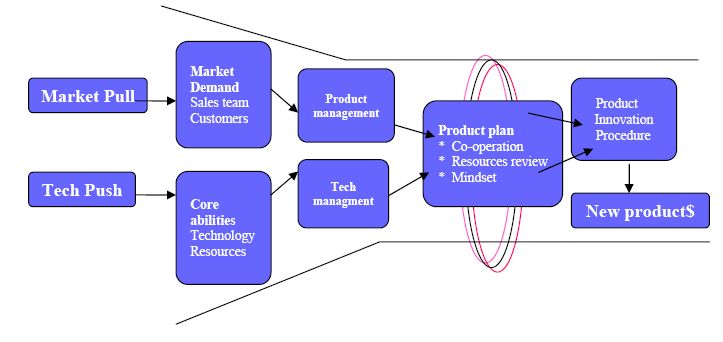

5.2 R&D Strategy

a. To search for overseas strategy alliance and import advanced technology from all over the world;

b. Collaborating with Chinese domestic universities, link up research and development with production;

c. Co-found research and development center with Shenzhen Government.

5.3 Donxon’s Research and Development Procedure Chart

13

Environmental Protection

Compliance with national, provincial or local rules and regulations on the discharge of materials into the environment, or otherwise relating to the protection of the environment have not had, nor are they expected to have, any material effect on the capital expenditures, earnings or competitive position of Donxon. The Company uses and generates certain substances and wastes that can be regulated or may be deemed hazardous under certain national, provincial or local regulations with respect to the environment. However, there is currently no cost generated in compliance with the current environment laws in the PRC.

XTK and its subsidiaries, Dasen and FDSC:

XTK was established by FDH on February 28, 2011 in Shenzhen, PRC. It was a newly established management company set to focus on the management and future merger or acquisition of franchisee chain stores that sell mobile communication and digital products and provide after-sales services. XTK completed a 100% ownership acquisition transaction with Dasen on April 7, 2011 and has an indirect interest ownership of 70% of FDSC through Dasen. Dasen was established on November 26, 2007 in Shenzhen, PRC. FDSC was established on January 19, 2007 in Foshan, PRC. A 70% interest ownership of FDSC was acquired by Dasen on January 7, 2008. Except as otherwise disclosed herein or incorporated herein by reference, there have been no bankruptcy and no other reclassification, merger or purchase or sale of assets from XTK and its subsidiaries.

XTK is established as a management and holding company. Its operating subsidiaries, Dasen and FDSC, engage in the retail business of selling mobile communication products and accessories in PRC. Dasen and FDSC operate the retailing business through its retail website (http://www.dasen.com.cn/) and three branch chain stores located within Guangdong Province. They offer customers a broad selection of mobile phones from international brands such as Nokia, Motorola, Samsung, Sony Ericsson, LG, HTC to PRC domestic brands such as Lenovo, OPPO, Gionee and others. XTK, Dasen and FDSC do not own any patents or trademarks.

XTK, Dasen and FDSC did not spend any funds during the last two years on research and development as they are only engaging in retailing business and not manufacturing. XTK, Dasen and FDSC’s retailing business does not require them to comply with any local or national environment laws currently.

XTK’s registered Shenzhen office address is #2-98 Nan Shi, Block B 2nd Floor, Lan Guang Building, No. 56 Zhen Hua Road, Fu Tian Qu, Shenzhen, China 518031. XTK’s Shenzhen office area is approximately 19.5 square meters, and the monthly rent expense is RMB 1365. Dasen’s registered Shenzhen office address is #11C2-B Tian Xiang Building, Che Gong Miao, Fu Tian Qu, Shenzhen, China 518040. Dasen’s Shenzhen office area is approximately 439.5 square meters, and the monthly rent expense is RMB 35160. FDSC’s registered Foshan office address is Dong A Qu, #2-3, Huang Qi Business Central, Nan Hai Qu, Foshan, China 528248. FDSC’s Foshan office area is approximately 101.5 square meters, and the monthly rent expense is RMB 20101. The three branch chain stores are located at: (i) Ground Floor, Xing Da Building, Ren He Zhen, Bai Yun Qu, Guangzhou, China 510470, with an area of approximately 210 square meters and monthly rent expense of RMB 31,000; (ii) #130 Cang Jiang Lu, He Cheng Jie Dao, Gao Ming Qu, Foshan, China 528500, with an area of approximately 176.05 square meters and monthly rent expense of RMB 66,371; and (iii) #18-#19 Jin Hai Da Lou, Jin Cheng Lu, Le Liu Zhen, Shun De Qu, Foshan, China 528322, with an area of approximately 101.5 square meters and monthly rent expense of RMB 11,000.

XTK has 5 employees and they are all full time employees. Dasen has 31 employees and they are all full time employees. FDSC has 10 employees and they are all full time employees.

14

Suppliers and Materials

Dasen’s 2010 Top Suppliers and Materials supplied:

|

Supplier

|

Material Supplied

|

Percentage

|

|

Guangzhou Yong Ji Electronics Technology Company Limited

|

Mobile Phones

|

54%

|

|

Guangzhou Wu Zhong Jin Shu Company Limited

|

Mobile Phones

|

29%

|

|

Guangzhou Hai Tuo Information Technology Company Limited

|

Mobile Phones

|

3%

|

|

Shenzhen You Li Tong Electronics Company Limited

|

Mobile Phones

|

3%

|

|

Guangzhou Duo Mao Tong Technology Company Limited

|

Mobile Phones

|

3%

|

FDSC’s 2010 Top Suppliers and Materials supplied:

|

Supplier

|

Material Supplied

|

Percentage

|

|

Shenzhen Dasen Communication Technology Company Limited

|

Mobile Phones

|

100%

|

XTK does not have any supplier.

Customers and Product Positioning

Dasen’s 2010 Top Customers and Percentage:

|

Customers

|

Products Sold

|

Percentage

|

|

Foshan Da Sheng Communication Chain Service Company Limited

|

Mobile Phones

|

66%

|

|

Foshan San Shui District Xi Nan Road Dong Tian Communication Products Store

|

Mobile Phones

|

5%

|

|

Foshan San Shui District Xi Nan Road Ji Cheng Bao Cell Phones Store

|

Mobile Phones

|

5%

|

|

Guangzhou Bai Yun District Tai He Yin Sheng Communication Store

|

Mobile Phones

|

3%

|

|

Foshan Shun De District Le Liu Ji Sheng Jia Telecommunication Store

|

Mobile Phones

|

3%

|

FDSC’s 2010 Top Customers and Percentage:

|

Customers

|

Products Sold

|

Percentage

|

|

Foshan Nan Hai Da Qi Communication Product Store

|

Mobile Phones

|

24%

|

|

Foshan San Shui District Xi Nan Road Dong Tian Communication Products Store

|

Mobile Phones

|

13%

|

|

Foshan Da Sheng Communication Chain Service Company Limited – Gao Ming Qu Branch Chain Stores

|

Mobile Phones

|

8%

|

|

Conghua Jie Kou Yan Guo Communication Product - Operating Store

|

Mobile Phones

|

5%

|

|

Yingde Ying Cheng Da Sheng Communication Company – 2nd Operating Store

|

Mobile Phones

|

5%

|

The positioning of our products is also mainly focused on middle-level products, with lower price compared to high-end products. Moderately priced products are easier to be accepted by consumers in smaller markets. We will also utilize our resources and network to sell our Donxon and EMI brand products. We will also focus on providing consumers with a superior shopping experience through our highly trained sales staff and a broad selection of mobile devices, accessories, data storage products, and after-sales services. We believe a one-stop shop approach is the key factor that differentiates our offering from our competitors. Our knowledgeable staff utilizes a consultative and informative sales approach targeting consumers that are keen to the hands-on experimentations of new mobile technologies or other digital products before making a purchase decision. Dasen and FDSC also provide a direct-to-consumer sales channel through our e-commerce website platform (http://www.dasen.com.cn/) that provides consumers with our latest product offerings, promotions and access to customer service, complementing our physical retail operations and increasing the scope of our marketing and branding efforts to the immense internet consumer population.

15

Business Model

XTK and its subsidiaries’ business model is to develop a network of digital products and mobile phone retail chains in third and fourth-tier cities throughout China. Third and fourth-tier cities are less developed and less populated compared to first and second-tier cities. First-tier cities such as Beijing, Shanghai and Guangzhou are cities that are more developed and more populated with a higher average salary. The market within first and second- tier cities is extremely competitive and the cost of business operation is also higher compared to third and fourth-tier cities. Therefore, we believe targeting third and fourth-tier cities for growth is faster and easier.

Business Strategies

XTK and its subsidiaries’ goal is to become a dominant specialty retailer for consumer digital and mobile communication products and services in China. The principal components of the growth and business strategies we plan to implement to attain our goal include the following:

•Expand the coverage of our retail network. We plan to continue expanding our retail chain stores network in PRC’s third and fourth-tier cities in order to expand the market availability of our products in China.

•Deepen and solidify our cooperative relationships with mobile carriers. We intend to develop, deepen and solidify our cooperative relationships with mobile carriers in order to provide better services and more selections for our customers.

•Efficiently integrate acquired retail chains. We intend to integrate newly acquired or newly joined franchisee chain stores in a cost and time efficient way.

•Enhance store and product brand awareness. We continue to devote our efforts towards brand development and utilize marketing concepts in an attempt to strengthen the marketability of our products.

▪Significantly increase value-added service offerings to customers. We also plan to strengthen the performance of our after sales services and introduce different value-added service offerings to our customers.

MARKET SUMMARY

1. Mobile Phone Market in China

1.1 History & Trend in CDMA Mobile Phone Market

China Unicom began its operation of CDMA network in Year 2002. Then China Telecom acquired the CDMA network and its related assets and businesses from China Unicom in June 2008 for a value of RMB110 billion. China Telecom has now replaced China Unicom and became the third largest CDMA network operator in the global market. However, the major problems faced by the CDMA network are limited supply of CDMA phones and higher than average price. But the company believes that China Telecom is the game changer as China Telecom’s current 200 million customers are potential CDMA subscribers.

16

CDMA phones are mobile phones used within the CDMA network. CDMA stands for Code Division Multiple Access, it is a more advanced digital interface technology, which is characterized by a high frequency of utilization, low power consumption, and good quality voice calls.

Compared to GSM phones, CDMA phones possess the following advantages:

First of all, it has low usage of transmission power; hence it has extremely low radiation and extends the battery life of the mobile phone. Secondly, it has a lower dropout rate than GSM phones for it adapts to a more advanced soft-switching technology. Thirdly, it provides better voice call quality of and offers noise-free communication, even in a noisy background. Lastly, it offers a higher Call Completion Ratio. As the CDMA technology developed from military anti-jamming communication system and its signal processing capacity is seven times higher than narrowband modulation. Therefore, for a same bandwidth, the CDMA system offers five times more capacity than GSM system, hence the network traffic drops and the Call Completion Ratio increases.

Moreover, CDMA phones are called “green phones”. The operating power of GSM phones and analog phones are usually 600 MW, while the maximum operating power of CDMA phones are only 200 MW. Furthermore, CDMA phones’ transmission power is less than 0.2W. It has extremely low radiation and extremely low impacts on human health. As the transmit power of stations and mobile phones decrease, the calling time increases and the battery and phone life extend.

As China Telecom enters the market, mobile services are segmented into three categories. First comes the business segment, in which government and enterprise clients are targeted; second comes the ‘My E Home’ brand, in which China Telecom packages CDMA services with Wi-Fi services together and offers it to household subscribers; third comes the individual subscribers. China Telecom strategically plans to upgrade its CDMA network to 3G, and to deploy its 4G network with LTE technology.

CDMA is an advanced digital interface technology itself. It is adopted by Verizon (US), SK Telecom (South Korea), and KDDI (Japan) and has showed positive performance. As waiting the deployment of LTE system to its maturity, China Telecom could gain an edge over China Mobile by offering EV-DORev, a mobile broadband service.

According to a market research, total CDMA phone sales exceeded 30 million in Year 2009. There were 600 models of CDMA phones available in the market in Year 2009, compared to 150 models in Year 2008 as China Telecom began its CDMA network deployment. As for 3G phones, based on statistics compiled by marketing consultant firms within the sector, 3G subscribers exceeded 10 million in Year 2009 in China and 3G (EVDO) subscribers of China Telecom exceeded 4.81 million. The increase in CDMA mobile phone sales signifies efficiency and performance of China Telecom in its mobile phone business segment. In terms of competition in mobile communication sector, mobile phone sales are one of the key factors, by which the maturity of mobile phone sector and efficiency of the mobile phone channel determine the ups and downs of each mobile phone carriers. Especially in the 3G era, mobile phone sales are an important part of marketing strategy of mobile phone carriers.

1.2 Current Situation of TD-SCDMA and Development Trend

Currently there are a total of three main 3G mobile telecommunication standards available in the global market, WCDMA, CDMA2000 and TD-SCDMA. The former two standards are gaining popularity rapidly in both the European and the American markets. TD-SCDMA standard is a self-proprietary 3G standards developed by China and almost reaches its maturity after years of development. Although TD-SCDMA network develops at a fast pace in China, international mobile phone brands still reluctant to produce TD-SCDMA phones as most international mobile phone brands are patent holders of WCDMA and CDMA2000 technologies. Therefore, most of the available TD-SCDMA phones in the market are made by Chinese firms and TD-SCDMA phone market develops at a slow pace. If the international mobile phone brands want to tap into the huge Chinese mobile phone market, these brands will need to come up with TD-SCDMA phone sales strategies. First of all, Chinese government had shown its support in the TD-SCDMA standard deployment and announced specific policies supporting the TD-SCDMA standard in the sector. Secondly, China Mobile has a huge mobiles phone subscriber base and accounts for the largest market shares in the Chinese market. China Mobile has a compensation plan to support TD-SCDMA phone development to attract suppliers. As China Mobile’s launch its compensation plan, more and more international mobile phone brands have joined TD-SCDMA mobile phones R&D. Models of TD-SCDMA mobile phones in the market are increasing, but the majority of the available models are middle to high end products. China Mobile is adjusting its policies to encourage suppliers to produce affordable middle to low end phones in order to acquire a bigger market share.

17

In the first half of Year 2008, rumors of the “death of TD-SCDMA” were spreading among the Chinese telecommunication industry, which caused serious concerns. Then the Ministry of Industry and Information Technology, the Ministry of Science and Technology, National Development and Reform Commission of China restated their support of the TD-SCDMA deployment. In the beginning of Year 2009, the Ministry of Industry and Information Technology, National Development and Reform Commission, Ministry of Finance, State-owned Assets Supervision and Administration Commission (‘SASAC’), and Ministry of Science and Technology of China jointly announced certain specific policies to support the TD-SCDMA standards. China Mobile also expressed its commitment to the development of TD-SCDMA several times in public, which had significant meanings to the development of the Chinese telecommunication industry. China Mobile had deployed around 16,000 TD-SCDMA stations within one year, as much as in ten years of GSM station deployments in the same area. Furthermore, China Mobile insisted on its three ‘No’ policy (No change phone number, No change Sim card and No registration), which not only provided a smooth transition to its current 0.5 billion subscribers from GSM standard to TD-SCDMA standard, but also laid down a solid foundation for future development of TD-SCDMA.

TD-SCDMA will transit towards TD-LTE technology in the future. The transition costs will account 60% of China Mobile’s future investment. China Mobile has given specific requirements to TD-SCDMA equipment suppliers, in which all Phase II TD-SCDMA equipment are required to be capable of transiting to LTE. TD-SCDMA stations will share the same platform with LTD according to the plan. Therefore, the transition of TD-SCDMA will be smooth and economical, which is comparable to the transition of WCDMA to FDD LTE. As for CDMA, the world has abandoned its transition path to UMB, by which operators of CDMA networks has to turn to LTE (FDD or TDD), which requires large sum of funds and enormous network implementations. Hence, as long as TD-SCDMA industrial chain develops positively, suppliers’ investment in TD-SCDMA will earn a positive return and contribute to its research in TD-LTE technology, and China Mobile will gain practical advantages along the transition from TD-SCDMA to TD-LTE.

2. Sector Barriers and Regulations

CDMA technology is exclusively owned by Qualcomm, an American company. The core of its business model is to develop intellectual property portfolio based on CDMA technology and to build up technological barriers by setting up industry standards. Moreover, by vertical management and universal licensing, Qualcomm accelerates adoption of its technology and makes strategically alliance with authorized suppliers through cross-license and royalty.

Since Qualcomm owns the intellectual property of both CDMA and WCDMA technologies, Qualcomm is the largest patent beneficiary. If any enterprises want to enter the market of CDMA mobile phone research and sales, it must pay up to $5 million of chip license fee to Qualcomm and certain software license fees for adopting each platform. Furthermore, after purchasing the chips, both solution companies and manufacturers have to pay 6% of patent fees per product of total sales amounts. As Qualcomm monopolizes such technologies, the barrier will remain stiff in the industry for a long time. Mobile operators are the biggest bulk buyers of CDMA phones while others cannot get access to the products easily. In China, the manufacturing application procedure for CDMA mobile phones is the same as GSM phones. The manufacturer shall obtain Network Access License first, then proceed to China Type Approval (CDMA phone test) and finally submit test application to Guangzhou Research Institute of China Telecom Co., Ltd. Therefore, each CDMA mobile phone’s product life cycle is longer than GSM phone’s. However, if CDMA mobile phone products cannot be launched successfully within the scheduled time, it will cause huge economic losses to manufacturers if it misses the scheduled purchase order made by China Telecom.

18

Before the manufacturers are allowed to sell their finished communication products in the PRC, the PRC government requires the sample manufactured products to be submitted to (i) the PRC Ministry of Industry and Information Technology for detection, in order to obtain “Network Access License” and “Radio Transmission Equipment Type Approval Certificate”; and (ii) the PRC Quality Certification Center for detection, in order to obtain “The PRC Mandatory Products Certificate”. Retailers are only allowed to sell products that possess the above mentioned license and certificates. Donxon has spent an estimate of RMB 9,199,451 during the last two years to obtain the certificates and network access licenses for all models of mobile phones we manufacture.

3. Industry’s Future

The mobile phone market in China has experienced rapid growth in recent years. Because of limited fixed line infrastructure, wireless mobile communication has become an increasingly important medium of communication in China. In 2009, the number of mobile phone subscribers increased by 16.6% to 747.4 million, compared to 641.2 million in 2008, according to the PRC Ministry of Industry and Information Technology, or the MIIT. Mobile phone sales in China exceeded 171 million units in 2009, and are expected to grow to 210 million units in 2012, representing a CAGR (Compound Annual Growth Rate) of 7.1%, according to the 2009 China Mobile Phones Market and Industry Survey by Sino, a subsidiary of the worldwide market research company, GFK Group.

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated herein that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, you may lose all or part of your investment.

Risks Relating to Our Business

The effects of recent global economic slowdown may continue to have a negative impact on our business, results of operations or financial condition.

The recent global economic slowdown has caused disruptions and extreme volatility in global financial markets, increased rates of default and bankruptcy, and declining consumer and business confidence, which has led to the decreased levels of consumer spending. These macroeconomic developments have and could continue to negatively impact our business, which depends on the general economic environment and levels of consumer spending in the PRC and other parts of the world that affect not only the ultimate consumers, but also wholesalers, who are our primary direct customers. As a result, we may not be able to maintain or increase our sales to existing customers, make sales to new customers, or maintain or improve our earnings from operations as a percentage of net sales. If the global economic slowdown continues for a significant period or continues to worsen, our results of operations, financial condition, and cash flows could be materially adversely affected.

Our results of operations are cyclical and could be adversely affected by fluctuations in the raw material.

We are largely dependent on the cost and supply of raw materials such as electronic accessories and the selling price of our products, which are determined by constantly changing and volatile market forces of supply and demand as well as other factors over which we have little or no control. These other factors include:

|

•

|

competing demand for the raw materials,

|

|

•

|

environmental and conservation regulations, and

|

|

•

|

economic conditions.

|

We cannot assure you that all or part of any increased costs experienced by us from time to time can be passed along to consumers of our products in a timely manner, or at all.

19

Substantially all of our business, assets and operations are located in the PRC.

Substantially all of our business, assets and operations are located in the PRC. The economy of the PRC differs from the economies of most developed countries in many respects. The economy of the PRC has been transitioning from a planned economy to a market-oriented economy. Although in recent years the PRC government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of productive assets in the PRC is still owned by the PRC government. In addition, the PRC government continues to play a significant role in regulating industries by imposing industrial policies. It also exercises significant control over the PRC’s economic growth through allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Some of these measures benefit the overall economy of the PRC, but may have a negative effect on us.

Our management has no experience in managing and operating a public company. Any failure to comply or adequately comply with federal securities laws, rules or regulations could subject us to fines or regulatory actions, which may materially adversely affect our business, results of operations and financial condition.

Our current management has no experience managing and operating a public company and relies in many instances on the professional experience and advice of third parties including our attorneys and accountants. Failure to comply or adequately comply with any laws, rules, or regulations applicable to our business may result in fines or regulatory actions, which may materially adversely affect our business, results of operation, or financial conditions and could result in delays in achieving the development of an active and liquid trading market for our stock.

Our business and the success of our products could be harmed if we are unable to maintain our brand image.

Our success to date has been due in large part to the strength of our “Donxon” and “EMI” brands, and to a lesser degree, the reputation of our brands. If we are unable to timely and appropriately respond to changing consumer demand, our brand names and brand images may be impaired. Even if we react appropriately to changes in consumer preferences, consumers may still consider our brand image to be outdated and affect our business.

We need to manage growth in operations to maximize our potential growth and achieve our expected revenues and our failure to do so will cause a disruption of our operations resulting in the failure to generate revenue at levels we expect.

In order to maximize potential growth in our current and potential markets, we believe that we must expand our production operations. This expansion will place a significant strain on our management and our operational, accounting, and information systems. We expect that we will need to continue to improve our financial controls, operating procedures, and management information systems. We will also need to effectively train, motivate, and manage our employees. Our failure to manage our growth could disrupt our operations and ultimately prevent us from generating the revenues we expect. In addition, as we introduce new products or enter into new markets, we may face additional market, technological and operational risks and challenges. As a result, our business, results of operations and financial condition could be materially and adversely affected.

We cannot assure you that our growth strategy will be successful and will not result in a negative impact on our growth, financial condition, results of operations and cash flow.

Many market obstacles might prevent us from implementing our growth strategy. We cannot, therefore, assure you that we will be able to successfully overcome such obstacles and establish our products in any new markets. Our inability to implement this organic growth strategy successfully may have a negative impact on our growth, future financial condition, results of operations or cash flows.

20

We may need additional capital to fund our growing operations and we may not be able to obtain sufficient capital and may be forced to limit the scope of our operations.

If adequate additional financing is not available on reasonable terms, we may not be able to expand our production lines and we would have to modify our business plans accordingly. There is no assurance that additional financing will be available to us.

In connection with our growth strategies, we may experience increased capital needs and accordingly, we may not have sufficient capital to fund our future operations without additional capital investments. Our capital needs will depend on numerous factors, including (i) our profitability; (ii) the release of competitive products by our competition; (iii) the level of our investment in research and development; and (iv) the amount of our capital expenditures, including acquisitions. We cannot assure you that we will be able to obtain capital in the future to meet our needs.

In recent years, the securities market in the United States have experienced a high level of price and volume volatility, and the market prices of securities of many companies have experienced wide fluctuations that are not necessarily related to the operations, performances, underlying asset values or prospects of such companies. For these reasons, our securities can also be subject to volatility resulting purely from market forces over which we have no control. If we need additional funding we will, most likely, seek such funding in the United States (although we may be able to obtain funding in the PRC) and the market fluctuations’ affect on our stock price could limit our ability to obtain equity financing.

If we cannot obtain additional funding, we may be required to: (i) limit our expansion; (ii) limit our marketing efforts; and (iii) decrease or eliminate capital expenditures. Such reductions could materially adversely affect our business and our ability to compete.

Even if we do find a source of additional capital, we may not be able to negotiate terms and conditions for such additional capital that are favorable to us. Any future capital investments could dilute or otherwise materially and adversely affect the holdings or rights of our existing shareholders. In addition, new equity or convertible debt securities issued by us to obtain financing could have rights, preferences and privileges senior to our common stock. We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us.

Need for additional employees.

The Company’s future success also depends on its ability to continuously attract and retain highly qualified personnel. Expansion of the Company’s business, the management and operation of the Company will require additional managers and employees with industry experiences, and the success of the Company will be highly dependent on the Company’s ability to attract and retain skilled management personnel and other employees. There can be no assurance that the Company will be able to attract or retain highly qualified personnel. Competition for skilled personnel in our industry is significant. This competition may make it more difficult and expensive to attract, hire and retain qualified managers and employees.

Our ability to compete could be jeopardized if we are unable to protect our intellectual property rights or if we are sued for intellectual property infringement.

We believe that our product brands, trademarks, and other proprietary rights are important to our success and our competitive position. We use trademarks on our products and believe that having distinctive marks that are readily identifiable is an important factor in creating a market for our goods, identifying us and distinguishing our goods from the goods of others. We consider our trademarks to be among our most valuable assets. We believe that our trademarks are generally sufficient to permit us to carry on our business as presently conducted. While we vigorously protect our trademarks against infringement, we cannot assure you that we will be able to secure patents or trademark protection for our intellectual property in the future or that protection will be adequate for future products.

21

In addition, the laws of foreign countries where we might distribute our products may not protect intellectual property rights to the same extent as do the laws of the PRC. We cannot assure you that the actions we have taken to establish and protect our trademarks and other intellectual property rights outside the PRC will be adequate to prevent imitation of our products by others or, if necessary, successfully challenge another party’s counterfeit products or products that otherwise infringe on our intellectual property rights. Continued sales of these products could adversely affect our sales and our brand and result in the shift of consumer preference away from our products. We may face significant expenses and liabilities in connection with the protection of our intellectual property rights outside the PRC, and if we are unable to successfully protect our rights or resolve intellectual property conflicts with others, our business or financial condition could be adversely affected.

Our failure to comply with increasingly stringent environmental regulations and related litigation could result in significant penalties, damages and adverse publicity for our business.

In recent years, the government of China has become increasingly concerned with the degradation of China’s environment that has accompanied the country’s rapid economic growth. In the future, we expect that our operations and properties will be subject to extensive and increasingly stringent laws and regulations pertaining to, among other things, the discharge of materials into the environment and the handling and disposition of wastes (including solid and hazardous wastes) or otherwise relating to protection of the environment. Failure to comply with any laws and regulations and future changes to them may result in significant consequences to us, including civil and criminal penalties, liability for damages and negative publicity. We cannot assure you that additional environmental issues will not require currently unanticipated investigations, assessments or expenditures, or that requirements applicable to us will not be altered in ways that will require us to incur significant additional costs.

We will incur significant costs to ensure compliance with United States corporate governance and accounting requirements.

We will incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

We may not be able to meet the filing and internal control reporting requirements imposed by the Securities and Exchange Commission resulting in a possible decline in the price of our common stock and our inability to obtain future financing.