Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended March 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to

Commission File Number: 1-9728

EPOCH HOLDING CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 20-1938886 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

640 Fifth Avenue, New York, NY 10019

(Address of Principal Executive Offices)

(212) 303-7200

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer x | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not Check if Smaller Reporting Company) |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of May 3, 2011, there were 23,357,969 shares of the registrant’s common stock, $0.01 par value per share, issued and outstanding.

Table of Contents

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

QUARTERLY REPORT ON FORM 10-Q

FOR THE FISCAL QUARTER ENDED MARCH 31, 2011

| Form 10-Q Item No. |

Page No. | |||

| PART I. FINANCIAL INFORMATION | ||||||

| Item 1. |

1 | |||||

| Condensed Consolidated Balance Sheets - March 31, 2011 (Unaudited) and June 30, 2010 |

1 | |||||

| 2 | ||||||

| 3 | ||||||

| 4 | ||||||

| Notes to Condensed Consolidated Financial Statements (Unaudited) |

5 | |||||

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

13 | ||||

| Item 3. |

31 | |||||

| Item 4. |

33 | |||||

| PART II. OTHER INFORMATION | ||||||

| Item 1. |

34 | |||||

| Item 1a. |

34 | |||||

| Item 2. |

Unregistered Sales of Equity Securities and Use of Proceeds. |

34 | ||||

| Item 6. |

35 | |||||

| 36 | ||||||

Items other than those listed above have been omitted because they are not applicable.

i

Table of Contents

| Item 1. | Financial Statements. |

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

| March 31, 2011 |

June 30, 2010 |

|||||||

| (Unaudited) | ||||||||

| ASSETS |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 22,610 | $ | 36,447 | ||||

| Accounts receivable |

14,910 | 11,156 | ||||||

| Deferred income taxes, net - (Note 8) |

2,235 | 861 | ||||||

| Held-to-maturity securities, at amortized cost (fair value of $360) - (Note 5) |

358 | - | ||||||

| Security deposits |

- | 462 | ||||||

| Prepaid and other current assets |

1,911 | 1,011 | ||||||

| Total current assets |

42,024 | 49,937 | ||||||

| Property and equipment, net of accumulated depreciation of $3,022 and $2,454, respectively |

1,833 | 2,187 | ||||||

| Security deposits |

485 | 770 | ||||||

| Deferred income taxes, net - (Note 8) |

7,727 | 4,110 | ||||||

| Held-to-maturity securities, at amortized cost (fair value of $1,655 and $2,046, respectively) - (Note 5) |

1,613 | 2,001 | ||||||

| Other investments, at fair value (cost of $7,203 and $3,856, respectively) - (Note 6) |

7,786 | 3,698 | ||||||

| Total assets |

$ | 61,468 | $ | 62,703 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||||

| Current liabilities: |

||||||||

| Accounts payable and accrued liabilities |

$ | 1,031 | $ | 929 | ||||

| Accrued compensation and benefits |

3,363 | 5,041 | ||||||

| Subtenant security deposit |

- | 238 | ||||||

| Income taxes payable |

57 | 32 | ||||||

| Total current liabilities |

4,451 | 6,240 | ||||||

| Deferred rent |

736 | 848 | ||||||

| Total liabilities |

5,187 | 7,088 | ||||||

| Commitments and contingencies - (Note 7) |

||||||||

| Stockholders’ equity: |

||||||||

| Common stock, $0.01 par value per share, 60,000,000 shares authorized; 23,866,878 issued and 23,305,357 outstanding at March 31, 2011 and 23,269,262 issued and 22,786,861 outstanding at June 30, 2010, respectively |

238 | 233 | ||||||

| Additional paid-in capital |

62,876 | 56,893 | ||||||

| (Accumulated deficit)/Retained earnings |

(1,870 | ) | 2,668 | |||||

| Accumulated other comprehensive income/(loss), net of tax |

194 | (223) | ||||||

| Less: Treasury stock, at cost, 561,521 and 482,401 shares, respectively |

(5,157 | ) | (3,956) | |||||

| Total stockholders’ equity |

56,281 | 55,615 | ||||||

| Total liabilities and stockholders’ equity |

$ | 61,468 | $ | 62,703 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

1

Table of Contents

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

UNAUDITED

(in thousands, except per share data)

| Three Months Ended March 31, |

Nine Months Ended March 31, |

|||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| Operating Revenues: |

||||||||||||||||

| Investment advisory and management fees |

$ | 17,849 | $ | 14,494 | $ | 49,206 | $ | 38,525 | ||||||||

| Performance fees |

217 | 212 | 691 | 708 | ||||||||||||

| Total operating revenues |

18,066 | 14,706 | 49,897 | 39,233 | ||||||||||||

| Operating Expenses: |

||||||||||||||||

| Employee related costs (excluding share-based compensation) |

6,628 | 5,473 | 18,076 | 15,578 | ||||||||||||

| Share-based compensation |

2,149 | 1,864 | 4,629 | 3,795 | ||||||||||||

| General and administrative |

959 | 731 | 2,646 | 1,971 | ||||||||||||

| Professional fees and services |

986 | 770 | 2,544 | 2,041 | ||||||||||||

| Occupancy and technology |

621 | 785 | 2,441 | 2,865 | ||||||||||||

| Total operating expenses |

11,343 | 9,623 | 30,336 | 26,250 | ||||||||||||

| Operating Income |

6,723 | 5,083 | 19,561 | 12,983 | ||||||||||||

| Other income |

142 | 191 | 517 | 829 | ||||||||||||

| Income Before Income Taxes |

6,865 | 5,274 | 20,078 | 13,812 | ||||||||||||

| Provision for income taxes |

2,992 | 2,070 | 8,789 | 5,744 | ||||||||||||

| Income tax benefit from release of |

- | (99) | (4,964) | (261) | ||||||||||||

| Total provision for income taxes |

2,992 | 1,971 | 3,825 | 5,483 | ||||||||||||

| Net Income |

$ | 3,873 | $ | 3,303 | $ | 16,253 | $ | 8,329 | ||||||||

| Earnings Per Share: - (Note 9) |

||||||||||||||||

| Basic |

$ | 0.17 | $ | 0.15 | $ | 0.71 | $ | 0.37 | ||||||||

| Diluted |

$ | 0.17 | $ | 0.15 | $ | 0.70 | $ | 0.37 | ||||||||

| Weighted-Average Shares Outstanding: |

||||||||||||||||

| Basic |

23,073 | 22,448 | 22,894 | 22,269 | ||||||||||||

| Diluted |

23,262 | 22,601 | 23,069 | 22,403 | ||||||||||||

| Cash dividends declared and paid per share |

$ | 0.06 | $ | 0.05 | $ | 0.91 | $ | 0.41 | ||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

2

Table of Contents

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

FOR THE NINE MONTHS ENDED MARCH 31, 2011 AND THE YEAR ENDED JUNE 30, 2010

(dollars and shares in thousands)

| Common Stock | Additional Paid-in Capital |

(Accumulated Deficit)/ Retained Earnings |

Accumulated Other Comprehensive Income/(Loss) |

Treasury Stock | Total Stockholders’ Equity |

|||||||||||||||||||||||||||

| Shares | Par Value | Shares | Amount | |||||||||||||||||||||||||||||

| Balances at June 30, 2009 |

22,198 | $ | 225 | $ | 50,848 | $ | 1,256 | $ | (307 | ) | 304 | $ | (2,232) | $ | 49,790 | |||||||||||||||||

| Net income |

- | - | - | 11,645 | - | - | - | 11,645 | ||||||||||||||||||||||||

| Net unrealized gains on available-for-sale securities, net of tax |

- | - | - | - | 199 | - | - | 199 | ||||||||||||||||||||||||

| Reclassification of net realized gains included in net income, net of tax |

- | - | - | - | (115 | ) | - | - | (115 | ) | ||||||||||||||||||||||

| Comprehensive income |

11,729 | |||||||||||||||||||||||||||||||

| Issuance and forfeitures of restricted share awards |

702 | 7 | 821 | - | - | - | - | 828 | ||||||||||||||||||||||||

| Amortization of share-based compensation |

- | - | 4,309 | - | - | - | - | 4,309 | ||||||||||||||||||||||||

| Cash dividends |

- | - | - | (10,233) | - | - | - | (10,233 | ) | |||||||||||||||||||||||

| Income tax benefit from dividends paid on unvested shares |

- | - | 174 | - | - | - | - | 174 | ||||||||||||||||||||||||

| Exercise of employee stock options |

65 | 1 | 277 | - | - | - | - | 278 | ||||||||||||||||||||||||

| Net sales/purchases of shares for employee withholding |

31 | - | 25 | - | - | (31) | 207 | 232 | ||||||||||||||||||||||||

| Repurchase of common shares |

(209) | - | - | - | - | 209 | (1,931) | (1,931 | ) | |||||||||||||||||||||||

| Excess income tax benefit from share-based compensation |

- | - | 439 | - | - | - | - | 439 | ||||||||||||||||||||||||

| Balances at June 30, 2010 |

22,787 | 233 | 56,893 | 2,668 | (223 | ) | 482 | (3,956) | 55,615 | |||||||||||||||||||||||

| Net income |

- | - | - | 16,253 | - | - | - | 16,253 | ||||||||||||||||||||||||

| Net unrealized gains on available-for-sale securities, net of tax |

- | - | - | - | 528 | - | - | 528 | ||||||||||||||||||||||||

| Reclassification of net realized gain included in net income, net of tax |

- | - | - | - | (111 | ) | - | - | (111 | ) | ||||||||||||||||||||||

| Comprehensive income |

16,670 | |||||||||||||||||||||||||||||||

| Issuance and forfeitures of restricted share awards |

510 | 5 | 799 | - | - | - | - | 804 | ||||||||||||||||||||||||

| Amortization of share-based compensation |

- | - | 3,825 | - | - | - | - | 3,825 | ||||||||||||||||||||||||

| Cash dividends - (Notes 12 and 13) |

- | - | - | (20,791) | - | - | - | (20,791 | ) | |||||||||||||||||||||||

| Income tax benefit from dividends paid on unvested shares |

- | - | 425 | - | - | - | - | 425 | ||||||||||||||||||||||||

| Exercise of employee stock options |

87 | - | 537 | - | - | - | - | 537 | ||||||||||||||||||||||||

| Net sales/purchases of shares for employee withholding |

(79) | - | 88 | - | - | 79 | (1,201) | (1,113 | ) | |||||||||||||||||||||||

| Excess income tax benefit from share-based compensation |

- | - | 309 | - | - | - | - | 309 | ||||||||||||||||||||||||

| Balances at March 31, 2011 (Unaudited) |

23,305 | $ | 238 | $ | 62,876 | $ | (1,870) | $ | 194 | 561 | $ | (5,157) | $ | 56,281 | ||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

Table of Contents

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

UNAUDITED

(in thousands)

| Nine Months Ended March 31, |

||||||||

| 2011 | 2010 | |||||||

| Cash flows from operating activities: |

||||||||

| Net income |

$ | 16,253 | $ | 8,329 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||

| Benefit from deferred income taxes - (Note 8) |

(5,315) | (738) | ||||||

| Share-based compensation |

4,629 | 3,795 | ||||||

| Depreciation and amortization |

568 | 485 | ||||||

| Net realized gain on investments |

(198) | (180) | ||||||

| Equity in net income from limited liability company |

(91) | (96) | ||||||

| Amortization of bond premiums |

31 | 24 | ||||||

| Income tax benefit from dividends paid on unvested shares |

(425) | (436) | ||||||

| Excess income tax benefit from share-based compensation |

(309) | (148) | ||||||

| (Increase)/decrease in operating assets: |

||||||||

| Accounts receivable |

(3,754) | (4,773) | ||||||

| Prepaid and other current assets |

(900) | (266) | ||||||

| Increase/(decrease) in operating liabilities: |

||||||||

| Accounts payable and accrued liabilities |

102 | 465 | ||||||

| Accrued compensation and benefits |

(1,678) | (701) | ||||||

| Income taxes payable |

759 | 538 | ||||||

| Deferred rent |

(112) | 153 | ||||||

| Net cash provided by operating activities |

9,560 | 6,451 | ||||||

| Cash flows from investing activities: |

||||||||

| Investments in Company-sponsored products and other investments, net |

(3,059) | (41) | ||||||

| Security deposits, net |

509 | (107) | ||||||

| Capital expenditures |

(214) | (1,473) | ||||||

| Purchases of held-to-maturity securities |

- | (2,434) | ||||||

| Proceeds from redemption of held-to-maturity securities |

- | 400 | ||||||

| Proceeds from other transactions |

- | 6 | ||||||

| Net cash used in investing activities |

(2,764) | (3,649) | ||||||

| Cash flows from financing activities: |

||||||||

| Cash dividends |

(20,791) | (9,094) | ||||||

| Purchase of common shares, net |

(1,201) | (1,724) | ||||||

| Income tax benefit from dividends paid on unvested shares |

425 | 436 | ||||||

| Excess income tax benefit from restricted share-based compensation |

309 | 148 | ||||||

| Proceeds from stock option exercises |

537 | 274 | ||||||

| Net gain on sale of shares for employee withholding |

88 | 25 | ||||||

| Net cash used in financing activities |

(20,633) | (9,935) | ||||||

| Net decrease in cash and cash equivalents during period |

(13,837) | (7,133) | ||||||

| Cash and cash equivalents at beginning of period |

36,447 | 37,055 | ||||||

| Cash and cash equivalents at end of period |

$ | 22,610 | $ | 29,922 | ||||

| Supplemental disclosure of cash flow information: |

||||||||

| Cash paid for income taxes |

$ | 9,055 | $ | 5,792 | ||||

| Supplemental disclosures of non-cash investing activities: |

||||||||

| Net change in unrealized gains on available-for-sale securities, net of tax |

$ | 417 | $ | 308 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

Table of Contents

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED MARCH 31, 2011 AND 2010

(Unaudited)

Note 1—Organization

Business

Epoch Holding Corporation (“Epoch” or the “Company”), a Delaware corporation, is a holding company whose sole line of business is investment advisory and investment management services. The operations of the Company are conducted through its wholly-owned subsidiary, Epoch Investment Partners, Inc. (“EIP”). EIP is a registered investment adviser under the Investment Advisers Act of 1940, as amended. EIP provides investment advisory and investment management services to clients including corporations, mutual funds, endowments, foundations and high net worth individuals. Headquartered in New York City, the Company’s current investment strategies include U.S. Value, U.S. All Cap Value, Global Equity Shareholder Yield, Global Absolute Return, Global Choice, U.S. Choice, U.S. Smid Cap (small/mid) Value, International Small Cap, U.S. Small Cap Value, Global Small Cap, and Balanced.

Note 2—Summary of Significant Accounting Policies

Basis of Presentation

The unaudited condensed consolidated financial statements of the Company included herein have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”), and in accordance with the instructions to Form 10-Q pursuant to the rules and regulations of the United States Securities and Exchange Commission (“SEC”). Certain information and note disclosures normally included in annual financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to those rules and regulations, although the Company believes that the disclosures made are adequate to make the information not misleading. The fiscal year-end Condensed Consolidated Balance Sheet was derived from audited financial statements and, in accordance with interim financial statement standards, does not include all disclosures required by GAAP for annual financial statements.

These financial statements rely, in part, on estimates. Actual results could differ from these estimates. In the opinion of management, these unaudited condensed consolidated financial statements reflect all adjustments, including normal recurring adjustments, necessary for a fair presentation of the Company’s financial position, interim results of operations and cash flows. All material intercompany accounts and transactions have been eliminated in consolidation. The results for the interim periods are not necessarily indicative of the results to be obtained for a full fiscal year. The Company’s unaudited condensed consolidated financial statements and the related notes should be read in conjunction with the consolidated financial statements and the related notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2010.

Prior year amounts related to depreciation expense have been reclassified and presented as part of general and administrative expenses in the Condensed Consolidated Statements of Income to conform to the current year presentation. Prior year amounts for the income tax benefit from the release of valuation allowances on certain deferred tax assets are shown as a separate component of the provision for income taxes in the Condensed Consolidated Statements of Income to conform to the current year presentation. Such reclassifications had no impact on net income.

There have been no changes in significant accounting policies during the three and nine months ended March 31, 2011. For a complete listing of the Company’s significant accounting policies, please refer to the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2010.

5

Table of Contents

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED MARCH 31, 2011 AND 2010

(Unaudited)

Recently Issued Accounting Pronouncements

Management has considered all new accounting pronouncements issued subsequent to the fiscal year ended June 30, 2010 applicable to the Company’s operations and the preparation of its condensed consolidated financial statements. Such recently issued accounting pronouncements have no effect on the Company’s financial position or results of operations.

Note 3—Fair Value Measurements

Fair value is defined as the price in a transaction to sell an asset or paid to transfer a liability (i.e. the “exit price”) in an orderly transaction between market participants at the measurement date.

The Company established a three-level valuation hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of an asset or liability as of the reported date. The three levels are defined as follows:

| • | Level 1—quoted prices in active markets that are available for identical assets or liabilities as of the reported date. |

| • | Level 2—quoted prices in markets that are not active or other pricing inputs that are either directly or indirectly observable as of the reported date. |

| • | Level 3—prices or valuation techniques that are both significant to the fair value measurement and unobservable as of the reported date. These financial instruments do not have active markets and are measured using management’s best estimate of fair value, where the inputs into the determination of fair value require significant management judgment or estimation. |

An asset’s or liability’s categorization within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement. The fair value hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3).

Other Investments

Other investments primarily consist of investments in Company-sponsored investment vehicles, including mutual funds, an investment strategy separate account, and a limited liability company. Other investments also include an investment in a non-affiliated investment limited partnership.

The investments in the mutual funds and in the separate account are accounted for as available-for-sale investments and valued under the market approach through the use of unadjusted quoted market prices available in an active market, and are classified within Level 1 of the valuation hierarchy. The fair value of these investments at March 31, 2011 was $4.2 million.

During the nine months ended March 31, 2011, the Company invested $3.0 million in a non-affiliated investment limited partnership. At March 31, 2011, the Company held less than a 2% interest in this limited partnership. This investment is accounted for as available-for-sale and is valued based upon an ownership interest in partners’ capital to which a proportionate share of net assets is attributed. The value of net assets is based on the underlying assets and liabilities of the limited partnership, which primarily include exchange-listed common stocks and money market funds. This investment seeks to generate capital appreciation. The Company’s investment may be redeemed as of the end of the partnership’s fiscal year, provided that 30 days prior written notice is given to the general partner. Redemptions may be more frequent at the option of the general partner. There is no lock-up and the Company has no unfunded commitments. The investment limited partnership is classified within Level 2 of the valuation hierarchy. The fair value of this investment at March 31, 2011 was $3.1 million.

6

Table of Contents

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED MARCH 31, 2011 AND 2010

(Unaudited)

The following table presents, for each of the hierarchy levels previously described, the Company’s assets that are measured at fair value on a recurring basis as of March 31, 2011 and June 30, 2010, respectively (in thousands):

| March 31, 2011 Fair Value Measurements Using |

June 30, 2010 Fair Value Measurements Using |

|||||||||||||||||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | Level 1 | Level 2 | Level 3 | Total | |||||||||||||||||||||||||

| Other investments: |

||||||||||||||||||||||||||||||||

| Available-for-sale |

$ | 4,155 | $ | 3,113 | $ | - | $ | 7,268 | $ | 3,272 | $ | - | $ | - | $ | 3,272 | ||||||||||||||||

There were no transfers between Level 1, 2 and 3 categories in the fair value measurement hierarchy for the periods presented.

The investment in the limited liability company is accounted for under the equity method, whereby the Company records its percentage of realized and unrealized earnings or losses in the Condensed Consolidated Statement of Income. Consequently, this investment is not recorded at, but approximates fair value. The total carrying value of this investment was $0.5 million at March 31, 2011 and $0.4 million at June 30, 2010.

The Company did not hold any financial liabilities measured at fair value at March 31, 2011 or June 30, 2010.

Note 4—Accounts Receivable

The Company’s accounts receivable balances do not include an allowance for doubtful accounts for the periods presented and there have been no bad debt expenses recognized during the three and nine months ended March 31, 2011 and 2010, respectively. Management believes the March 31, 2011 accounts receivable balances are fully collectible.

Significant Customers

For the three months and nine months ended March 31, 2011, New York Life Investment Management, through the MainStay Epoch Funds and other funds sub-advised by EIP, accounted for approximately 19% of consolidated operating revenues, while CI Investments Inc, (“CI”), a Canadian-owned investment management company, accounted for approximately 7% of consolidated operating revenues.

For the three months ended March 31, 2010, New York Life Investment Management accounted for approximately 19% of consolidated operating revenues, while CI accounted for approximately 8% of consolidated operating revenues. For the nine months ended March 31, 2010, New York Life Investment Management accounted for approximately 14% of consolidated operating revenues, while CI accounted for approximately 9% of consolidated operating revenues.

Note 5—Held-to-Maturity Securities

The Company’s investment securities classified as held-to-maturity consist of high-grade debt securities. These investments are carried at amortized cost. Gross unrecognized gains and losses, and fair value of these securities at March 31, 2011 and June 30, 2010 are as follows (in thousands):

| March 31, 2011 | June 30, 2010 | |||||||||||||||||||||||||||||

| Amortized Cost |

Gross Unrecognized | Aggregate Fair Value |

Amortized Cost |

Gross Unrecognized | Aggregate Fair Value |

|||||||||||||||||||||||||

| Gains | Losses | Gains | Losses | |||||||||||||||||||||||||||

| $ 1,971 | $ | 44 | $ | - | $ | 2,015 | $ | 2,001 | $ | 45 | $ | - | $ | 2,046 | ||||||||||||||||

The fair value of investments in held-to-maturity securities is valued under the market approach through the use of quoted prices for similar investments in active markets.

7

Table of Contents

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED MARCH 31, 2011 AND 2010

(Unaudited)

The contractual maturities of the investment securities classified as held-to-maturity at March 31, 2011 are as follows (in thousands):

| Contractual Maturities |

Amortized Cost |

Aggregate Fair Value |

||||||

| Less than 1 year |

$ | 358 | $ | 360 | ||||

| Due after 1 year through 3 years |

1,350 | 1,383 | ||||||

| Due after 3 years through 5 years |

263 | 272 | ||||||

| Total |

$ | 1,971 | $ | 2,015 | ||||

Note 6—Other Investments

The Company’s other investments at March 31, 2011 and June 30, 2010 are summarized as follows (in thousands):

| March 31, 2011 | June 30, 2010 | |||||||||||||||||||||||||||||||

| Cost Basis |

Gross Unrealized | Aggregate Fair Value |

Cost Basis |

Gross Unrealized | Aggregate Fair Value |

|||||||||||||||||||||||||||

| Gains | Losses | Gains | Losses | |||||||||||||||||||||||||||||

| Available-for-sale securities: |

||||||||||||||||||||||||||||||||

| Epoch Global All Cap separate account |

$ | 2,504 | $ | 520 | $ | (33) | $ | 2,991 | $ | 2,297 | $ | 185 | $ | (105) | $ | 2,377 | ||||||||||||||||

| Investment in limited partnership |

3,000 | 113 | - | 3,113 | - | - | - | - | ||||||||||||||||||||||||

| Company-sponsored mutual funds |

1,181 | 89 | (106) | 1,164 | 1,133 | 34 | (272) | 895 | ||||||||||||||||||||||||

| Total available-for-sale securities |

6,685 | 722 | (139) | 7,268 | 3,430 | 219 | (377) | 3,272 | ||||||||||||||||||||||||

| Equity method investment: |

||||||||||||||||||||||||||||||||

| Epoch Global Absolute Return Fund, LLC |

518 | - | - | 518 | 426 | - | - | 426 | ||||||||||||||||||||||||

| Total Other Investments |

$ | 7,203 | $ | 722 | $ | (139) | $ | 7,786 | $ | 3,856 | $ | 219 | $ | (377) | $ | 3,698 | ||||||||||||||||

The unrealized losses for each period presented have been unrealized for twelve months or more. Management has reviewed its investment securities for other-than-temporary impairment in accordance with its accounting policy outlined in Note 2 of the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2010. When evaluating whether an unrealized loss on an available-for-sale investment is other than temporary, management reviews such factors as extent and duration of the loss, deterioration in the issuer’s credit quality, reduction or cessation of dividend payments, and overall financial strength of the issuer.

Based on management’s assessment, the Company does not believe that the declines are other-than-temporary for all periods presented. The gross unrealized losses from available-for-sale securities were primarily caused by overall weakness in the financial markets and world economy. The securities are expected to recover their value over time, and management has the intent and ability to hold these investments until such recovery occurs. Unrealized gains or losses from available-for-sale securities are recorded in accumulated other comprehensive income/(loss), net of tax, as a separate component of stockholders’ equity until realized.

8

Table of Contents

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED MARCH 31, 2011 AND 2010

(Unaudited)

Proceeds as well as realized gains and losses recognized from investments classified as available-for-sale are as follows (in thousands):

| For the Three Months Ended March 31, |

||||||||||||||||||||||||||||

| 2011 | 2010 | |||||||||||||||||||||||||||

| Proceeds | Gross Realized | Proceeds | Gross Realized | |||||||||||||||||||||||||

| Gains | Losses | Gains | Losses | |||||||||||||||||||||||||

| Investments: |

||||||||||||||||||||||||||||

| Available-for-sale securities: |

||||||||||||||||||||||||||||

| Epoch Global All Cap separate account |

$ | 700 | $ | 103 | $ | (17) | $ | 394 | $ | 36 | $ | (20) | ||||||||||||||||

| For the Nine Months Ended March 31, |

||||||||||||||||||||||||||||

| 2011 | 2010 | |||||||||||||||||||||||||||

| Proceeds | Gross Realized | Proceeds | Gross Realized | |||||||||||||||||||||||||

| Gains | Losses | Gains | Losses | |||||||||||||||||||||||||

| Investments: |

||||||||||||||||||||||||||||

| Available-for-sale securities: |

||||||||||||||||||||||||||||

| Epoch Global All Cap separate account |

$ | 1,734 | $ | 234 | $ | (71) | $ | 2,182 | $ | 276 | $ | (124) | ||||||||||||||||

| Company-sponsored mutual funds |

35 | 35 | - | 28 | 28 | - | ||||||||||||||||||||||

| $ | 1,769 | $ | 269 | $ | (71) | $ | 2,210 | $ | 304 | $ | (124) | |||||||||||||||||

Realized gains and losses from available-for-sale securities are included in other income in the Condensed Consolidated Statements of Income using the specific identification method.

Note 7—Commitments and Contingencies

Employment Agreements

The Company renewed its employment agreement with its Chief Executive Officer in December 2010, effective January 1, 2011. The term of the agreement is for two years, with automatic two year renewals thereafter. Both the Company and the Chief Executive Officer have the option not to renew the term of the agreement within forty-five days of the end of the term or renewal term. The agreement calls for a minimum base salary of $375 thousand per annum, and bonus compensation in accordance with the Company’s bonus and incentive compensation plans. The agreement also calls for certain payments in the event of termination. The payments could vary depending on the cause of termination and whether or not the Board of Directors elects to enforce a non-compete agreement. The agreement was reviewed and approved by the Company’s Compensation Committee and the Board of Directors.

There are no employment contracts with any other officer or employee of the Company. There are written agreements with certain employees, which provide for sales commissions or bonuses, subject to the attainment of certain performance criteria or continuation of employment. Such commitments under the various agreements total approximately $1.4 million at March 31, 2011. Of this amount, approximately $0.5 million is included in accrued compensation and benefits in the Condensed Consolidated Balance Sheet at March 31, 2011. An additional $0.5 million will be accrued during the remainder of the fiscal year ending June 30, 2011 and shortly thereafter. Approximately $0.4 million represents restricted stock awards to be issued during the remainder of the fiscal year ending June 30, 2011 and shortly thereafter.

Strategic Relationship

On July 9, 2009, EIP entered into a strategic relationship with New York Life Investment Management, whereby the MainStay Group of Funds adopted the Company’s family of mutual funds (the “Epoch Funds”). EIP continues to be responsible for the day-to-day investment management of the funds through a sub-advisory relationship, while MainStay Investments (“MainStay”), the retail distribution arm of New York Life Investments, is responsible for the distribution and administration of the funds. Each former Epoch Fund is now co-branded as a “MainStay Epoch” Fund.

9

Table of Contents

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED MARCH 31, 2011 AND 2010

(Unaudited)

In addition to an existing sub-advisory relationship between EIP and New York Life Investments for certain funds, and the adoption of the Epoch Funds indicated above, EIP and New York Life Investments have entered into an arrangement wherein, among other things, EIP and an affiliate of New York Life Investments have established a distribution and administration relationship with respect to certain separately managed account and unified managed account strategies, and for a period of three years commencing November 2009 New York Life Investments agrees to pay certain additional base fees and meet minimum distribution targets.

Legal Matters

From time to time, the Company or its subsidiaries may become parties to claims, legal actions and complaints arising in the ordinary course of business. Management is not aware of any claims which would have a material effect on its condensed consolidated financial position, results of operations, or cash flows.

Note 8—Provision For/(Benefit From) Income Taxes

The Company accounts for income taxes under the asset and liability method. Deferred tax assets and liabilities arise from temporary differences between book and tax basis using the enacted statutory tax rates and laws that will be in effect when such differences are expected to reverse. Deferred tax assets are recognized for temporary differences that will result in deductible amounts in future years. Deferred tax liabilities are recognized for temporary differences that will result in taxable income in future years. The Company must assess the likelihood that its deferred tax assets will be realized based upon the consideration of all available evidence, using a “more likely than not” standard. To the extent the Company believes that recovery is not likely, it must establish a valuation allowance. To the extent the Company establishes a valuation allowance or changes this allowance in a reporting period, the Company must include an expense or a benefit within the tax provision of its condensed consolidated statement of income.

Prior to December 31, 2010, the Company maintained a valuation allowance on certain deferred tax assets, relating to acquired net operating losses and alternative minimum tax credits, since the likelihood of the realization of those assets was not “more likely than not”. The Company has continuously evaluated additional facts representing positive and negative evidence in the determination of the realizability of those deferred tax assets. As of December 31, 2010, the Company concluded that sufficient positive evidence existed from recent earnings history, pre-tax income growth rates, current operating income levels, and the outlook for sustained profitability, to conclude that it is more likely than not that these assets will be fully realized in future operating periods. Therefore, the Company released a valuation allowance of $5.0 million as a discrete benefit from income taxes during the quarter ended December 31, 2010. If future operating and business conditions were to differ significantly, the Company will reassess the ability to realize the deferred tax assets. If it is more likely than not that the Company would not realize the deferred tax assets, then all or a portion of the valuation allowance may need to be re-established, which would result in a charge to tax expense.

The release of the above valuation allowance resulted in a non-recurring increase in the Company’s basic earnings per share of $0.22 and diluted earnings per share of $0.21 for the nine months ended March 31, 2011. The release also resulted in an increase in deferred tax assets on the Condensed Consolidated Balance Sheet, but had no effect on cash flows.

Note 9—Earnings Per Share

Basic earnings per share (“EPS”) is computed by dividing net income by the weighted-average number of common shares outstanding during the period.

Diluted EPS is computed by dividing net income, adjusted for the effect of dilutive securities, by the weighted-average number of common and common equivalent shares outstanding during the period. The Company uses the treasury stock method to reflect the dilutive effect of outstanding stock options.

The Company had 485,331 and 1,082,448 issued and outstanding stock options at March 31, 2011 and 2010, respectively. The calculation of diluted EPS included all of the issued and outstanding stock options for the three and nine months ended March 31, 2011. The calculation of diluted EPS excluded 510,000 issued and outstanding stock options for the three and nine months ended March 31, 2010, respectively, as the exercise price of those options was higher than the average market price of the common stock for the respective periods. The conversion of those particular options, whose exercise price was higher than the average market price of the common stock during the respective period, would have had an anti-dilutive effect.

10

Table of Contents

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED MARCH 31, 2011 AND 2010

(Unaudited)

The table that follows presents the computation of basic and diluted EPS for the three and nine months ended March 31, 2011 and 2010, respectively (in thousands, except per share data):

| Three Months Ended March 31, |

Nine Months Ended March 31, |

|||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| Numerator: |

||||||||||||||||

| Net income |

$ | 3,873 | $ | 3,303 | $ | 16,253 | $ | 8,329 | ||||||||

| Denominator: |

||||||||||||||||

| Weighted-average common shares outstanding |

23,073 | 22,448 | 22,894 | 22,269 | ||||||||||||

| Net common stock equivalents assuming the exercise of in-the-money stock options |

189 | 153 | 175 | 134 | ||||||||||||

| Weighted-average common and common equivalent shares outstanding assuming dilution |

23,262 | 22,601 | 23,069 | 22,403 | ||||||||||||

| Earnings per share: |

||||||||||||||||

| Basic |

$ | 0.17 | $ | 0.15 | $ | 0.71 | $ | 0.37 | ||||||||

| Diluted |

$ | 0.17 | $ | 0.15 | $ | 0.70 | $ | 0.37 | ||||||||

Note 10—Comprehensive Income

A summary of comprehensive income is as follows (in thousands):

| Three Months Ended March 31, |

Nine Months Ended March 31, |

|||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| Net income |

$ | 3,873 | $ | 3,303 | $ | 16,253 | $ | 8,329 | ||||||||

| Other comprehensive income, before tax: |

||||||||||||||||

| Unrealized gains on available-for-sale securities: |

||||||||||||||||

| Unrealized holding gains |

196 | 119 | 939 | 713 | ||||||||||||

| Reclassification of net realized gains to net income |

(87) | (16) | (198) | (174) | ||||||||||||

| Other Comprehensive income, before tax |

109 | 103 | 741 | 539 | ||||||||||||

| Income tax expense related to other comprehensive income |

(47) | (44) | (324) | (231) | ||||||||||||

| Other comprehensive income, net of tax |

62 | 59 | 417 | 308 | ||||||||||||

| Comprehensive income |

$ | 3,935 | $ | 3,362 | $ | 16,670 | $ | 8,637 | ||||||||

11

Table of Contents

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED MARCH 31, 2011 AND 2010

(Unaudited)

Note 11—Geographic Area Information

The Company operates under one business segment, investment management. Geographical information pertaining to the Company’s operating revenues is presented below. The amounts are aggregated by the client’s domicile (in thousands):

| Three Months Ended March 31, |

Nine Months Ended March 31, |

|||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| United States |

$ | 12,696 | $ | 10,228 | $ | 34,722 | $ | 27,532 | ||||||||

| Canada |

2,189 | 1,790 | 6,026 | 5,276 | ||||||||||||

| Asia/Australia |

1,709 | 1,367 | 4,789 | 2,614 | ||||||||||||

| Europe/Africa |

1,472 | 1,321 | 4,360 | 3,811 | ||||||||||||

| Total |

$ | 18,066 | $ | 14,706 | $ | 49,897 | $ | 39,233 | ||||||||

Note 12—Quarterly Dividends on Common Stock

On January 7, 2011, the Board of Directors increased the Company’s quarterly cash dividend from $0.05 per share to $0.06 per share. This dividend was paid in February 2011. The aggregate dividend payment totaled approximately $1.4 million.

The Company expects regular quarterly cash dividends to be paid in February, May, August and November of each fiscal year. However, the actual declaration of future cash dividends, and the establishment of record and payment dates, is subject to determination by the Board of Directors each quarter after its review of our financial performance, as well as general business conditions. The Company may change its dividend policy at any time.

Note 13—Special Dividends

On November 17, 2010, the Board of Directors declared a special cash dividend of $0.75 per share on the Company’s common stock. The dividend was paid in December 2010. The aggregate dividend payment totaled approximately $17.1 million.

On November 13, 2009, the Board of Directors declared a special cash dividend of $0.30 per share on the Company’s common stock. The dividend was paid in December 2009. The aggregate dividend payment totaled approximately $6.7 million.

Note 14—Purchase of Common Shares

Common Stock Repurchase Plan

During the three and nine months ended March 31, 2011 the Company did not purchase any common shares pursuant to the share repurchase plan. As of March 31, 2011, a total of 317,599 shares remain available for purchase under the existing repurchase plan.

Employee Tax Withholding

To satisfy statutory employee tax withholding requirements related to the vesting of common shares, employees may elect to have the Company withhold shares and remit the necessary tax withholding on their behalf. The Company may promptly sell these shares in the open market on behalf of the employee or include them as part of the shares repurchased under the stock repurchase plan. Any resulting gain or loss on sale is accounted for as an adjustment to additional paid-in capital. At March 31, 2011, there were 79,120 shares so withheld related to employee tax withholdings.

All shares purchased are shown as treasury stock, at cost, in the stockholders’ equity section of the Condensed Consolidated Balance Sheets.

*****

12

Table of Contents

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Set forth on the following pages is management’s discussion and analysis of our financial condition and results of operations for the three and nine months ended March 31, 2011 and 2010. Such information should be read in conjunction with our unaudited condensed consolidated financial statements together with the notes to the unaudited condensed consolidated financial statements. When we use the terms “Company,” “Firm,” “management,” “we,” “us,” and “our,” we mean Epoch Holding Corporation, a Delaware corporation, and its consolidated subsidiaries.

Forward-Looking Statements

Certain information included or incorporated by reference in this Quarterly Report on Form 10-Q and other materials filed or to be filed by Epoch Holding Corporation (“Epoch” or the “Company”) with the United States Securities and Exchange Commission (“SEC”) contain statements that may be considered forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or “continue,” and the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to known and unknown risks, uncertainties and assumptions about our Company, may include projections of our future financial performance based on our anticipated growth strategies and trends in our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by our forward-looking statements. In particular, you should consider the risks and uncertainties outlined in “Factors Which May Affect Future Results.”

These risks and uncertainties are not exhaustive. Other sections of this Quarterly Report on Form 10-Q may include additional factors which could adversely impact our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. We are under no duty to update any of these forward-looking statements after the date of this Quarterly Report on Form 10-Q, nor to conform our prior statements to actual results or revised expectations, and we do not intend to do so.

Forward-looking statements include, but are not limited to, statements about our:

| • | business environment, |

| • | expectations with respect to the economy, securities markets, the market for mergers and acquisitions activity, the market for asset management activity and other industry trends, |

| • | competitive position, |

| • | possible or assumed future results of operations, operating cash flows, and working capital, |

| • | realization of deferred tax assets, |

| • | business strategies and investment policies, |

| • | potential operating performance, achievements, efficiency and cost reduction efforts, |

| • | growth strategy, |

| • | expected tax rates, |

| • | strategic relationships, |

| • | investment strategy development, and |

| • | the effect of future legislation and regulation on our Company. |

13

Table of Contents

Available Information

Reports we file electronically with the SEC via the SEC’s Electronic Data Gathering, Analysis and Retrieval system (“EDGAR”) may be accessed through the internet. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, at www.sec.gov.

We maintain a website which contains current information on operations and other matters. The website address is www.eipny.com. Through the Investor Relations section of our website, and the “Financial Information” tab therein, we make available, free of charge, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statement, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

Also available free of charge on our website within the Investors Relations section, and the “Corporate Governance” tab therein, is our Code of Ethics and Business Conduct and charters for the Audit, Nominating/Corporate Governance, and the Compensation Committees of our Board of Directors.

Factors Which May Affect Future Results

There are numerous factors which may affect our results of operations. These include, but are not limited to, the ability to attract and retain clients, performance of the financial markets and invested assets we manage, retention of key employees and members of management, and significant changes in regulations.

In addition, our ability to expand or alter our investment strategy offerings and distribution network, whether through acquisitions or internal development, is critical to our long-term success and has inherent risks. This success is dependent on the ability to identify and fund those developments or acquisitions on terms which are favorable to us. There can be no assurance that any of these operating factors or acquisitions can be achieved or, if undertaken, will be successful.

Other risks and uncertainties that we do not presently consider to be material or of which we are not presently aware may become important factors that affect us in the future.

These and other risks related to our Company are discussed in detail under Part I, Item 1A. “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended June 30, 2010.

Critical Accounting Estimates

Our significant accounting estimates are described in Note 2 of the Notes to the Consolidated Financial Statements, as well as Management’s Discussion and Analysis of Financial Condition and Results of Operations, in our Annual Report on Form 10-K for the fiscal year ended June 30, 2010, and have not changed from those described therein.

Overview

We are a global asset management firm with accomplished and experienced professionals. Our professional staff averages over 20 years of industry experience. Our Company was formed with the specific goal of responding to paradigm shifts occurring within the sources of global equity investment returns and within the structure of the investment management business as a whole.

Headquartered in New York City, we had approximately $15.6 billion in assets under management (“AUM”) as of March 31, 2011. We remain debt-free and continue to have substantial capital resources available to fund current operations and implement our long-term growth strategy.

Our operating subsidiary, Epoch Investment Partners, Inc. (“EIP”), is a registered investment adviser under the Investment Advisers Act of 1940, as amended. EIP’s sole line of business is to provide investment advisory and investment management services to clients including corporations, mutual funds, endowments, foundations, and high net worth individuals. These services are provided through both separately managed accounts and commingled vehicles, such as private investment funds and mutual funds.

14

Table of Contents

Revenues are generally derived as a percentage of AUM. Therefore, among other factors, our revenues are dependent upon:

| • | performance of financial markets, |

| • | performance of our investment strategies, |

| • | our ability to retain existing clients and attract new ones, and |

| • | changes in the composition of AUM. |

Our most significant operating expense is employee related costs, comprising fixed salaries, variable incentive compensation, and related employee benefits. Variable incentive compensation is primarily based upon management fee revenue, operating income, and relative risk-adjusted investment performance.

AUM Fair Value Measurement

AUM consists of actively traded securities. The fair value of these securities is determined by an independent pricing service, which uses publicly available, unadjusted, quoted market prices for measurement. We substantiate the values obtained with another independent pricing service to confirm that all prices are valid. There is no judgment involved in the calculation of AUM in a manner that would directly impact our revenue recognition.

Financial and Business Highlights

During the three months ended March 31, 2011, favorable market conditions impacted our AUM through both market performance and AUM inflows. Some highlights during the period ended March 31, 2011 were as follows:

| • | Our AUM increased to $15.6 billion at March 31, 2011, an increase of 24% from $12.6 billion at March 31, 2010. |

| • | Nearly all of our investment strategies have outperformed their respective benchmarks for the past three and five years as well as since investment strategy inception. |

| • | Operating revenues increased 23%, or $3.4 million, from the same period a year ago. |

| • | Operating expenses increased by 18%, or $1.7 million, from the same period a year ago. Increased employee compensation, in conjunction with increases in our investment and client relations teams, as well as an increase in incentive compensation, was a primary reason for the increase. |

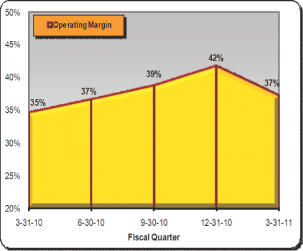

| • | Operating margin was approximately 37% for the three months ended March 31, 2011 compared with 35% for the same period a year ago. |

| • | Basic earnings per share increased to $0.17 for the three months ended March 31, 2011 compared to $0.15 for the same period a year ago. |

| • | Our financial position remains strong, with working capital of $37.6 million. The Company expects its working capital to increase during the next quarter as a result of its current operating margin. |

| • | In January 2011, our Board approved an increase in the quarterly dividend from $0.05 to $0.06 per share. |

| • | Committed but unfunded mandates at March 31, 2011 of $0.8 billion were funded during April 2011. |

15

Table of Contents

The table below presents key operating and financial indicators for the three and nine months ended March 31, 2011 and 2010, respectively:

| Three Months Ended March 31, |

’11 vs ’10 Change | Nine Months Ended March 31, |

’11 vs ’10 Change | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 2011 | 2010 | Amt | % | 2011 | 2010 | Amt | % | |||||||||||||||||||||||||||||||||||||||||||||||

|

Operating Indicators ($ in millions): |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AUM at end of period |

$ | 15,606 | $ | 12,616 | $ | 2,990 | 24% | $ | 15,606 | $ | 12,616 | $ | 2,990 | 24% | ||||||||||||||||||||||||||||||||||||||||

| Average AUM for the period |

$ | 15,060 | $ | 11,875 | $ | 3,185 | 27% | $ | 13,672 | $ | 10,382 | $ | 3,290 | 32% | ||||||||||||||||||||||||||||||||||||||||

| Net AUM flows |

$ | 327 | $ | 711 | $ | (384 | ) | (54%) | $ | 584 | $ | 2,468 | $ | (1,884 | ) | (76%) | ||||||||||||||||||||||||||||||||||||||

| Financial

Indicators |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Operating Revenue |

$ | 18,066 | $ | 14,706 | $ | 3,360 | 23% | $ | 49,897 | $ | 39,233 | $ | 10,664 | 27% | ||||||||||||||||||||||||||||||||||||||||

| Operating Income |

$ | 6,723 | $ | 5,083 | $ | 1,640 | 32% | $ | 19,561 | $ | 12,983 | $ | 6,578 | 51% | ||||||||||||||||||||||||||||||||||||||||

| Net Income |

$ | 3,873 | $ | 3,303 | $ | 570 | 17% | $ | 16,253 | $ | 8,329 | $ | 7,924 | 95% | ||||||||||||||||||||||||||||||||||||||||

| Earnings Per Share: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Basic |

$ | 0.17 | $ | 0.15 | $ | 0.02 | 13% | $ | 0.71 | $ | 0.37 | $ | 0.34 | 92% | ||||||||||||||||||||||||||||||||||||||||

| Diluted |

$ | 0.17 | $ | 0.15 | $ | 0.02 | 13% | $ | 0.70 | $ | 0.37 | $ | 0.33 | 89% | ||||||||||||||||||||||||||||||||||||||||

|

Operating Margin (1) |

37% | 35% | NM | NM | 39% | 33% | NM | NM | ||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted Financial Indicators* ($ in thousands): |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Income |

Same as above | $ | 11,289 | $ | 8,329 | $ | 2,960 | 36% | ||||||||||||||||||||||||||||||||||||||||||||||

| Earnings Per Share: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Basic |

Same as above | $ | 0.49 | $ | 0.37 | $ | 0.12 | 32% | ||||||||||||||||||||||||||||||||||||||||||||||

|

Diluted |

Same as above | $ | 0.49 | $ | 0.37 | $ | 0.12 | 32% | ||||||||||||||||||||||||||||||||||||||||||||||

*—The effect of the release of a valuation allowance on certain deferred tax assets during the quarter ended December 31, 2010 was removed from the calculations for the nine months ended March 31, 2011 to make the financial indicators comparable to the prior year period presented. This release caused the following increases: net income by approximately $5.0 million, basic earnings per share by $0.22 and diluted earnings per share by $0.21 in the nine months ended March 31 2011.

NM—not meaningful

(1) Defined as operating income divided by total operating revenues.

Investment Philosophy

We are global equity investors with a long-term perspective on the drivers of shareholder return. Our investment philosophy is focused on achieving superior long-term, risk-adjusted returns by investing in companies that generate increasing levels of free cash flow, appropriately allocate capital to create returns for shareholders, have understandable business models, possess transparent financial statements, and are undervalued relative to our investment team’s value determinations. Security selection and portfolio construction processes are designed to reduce the likelihood of significant capital losses in declining markets while participating in returns from rising markets.

Business Environment

As an investment management and advisory firm, our results are impacted by the prevailing global economic climate, including such items as corporate profitability, investor confidence, unemployment, and interest rates. These factors can directly affect investor sentiment and global equity markets.

Domestic

The U.S. stock market posted a solid gain during the three months ended March 31, 2011, advancing for the third consecutive quarter. Evidence of an uneven but promising economic recovery and continued strength in corporate earnings fueled a sharp equity market rally in January and most of February. Stocks slumped in late February and early March in response to growing political unrest in North Africa and the Middle East, and a devastating earthquake and tsunami in Japan. However, renewed optimism about the economy helped the market recover significantly during the latter part of March. Overall, U.S. equities posted strong results across all market-cap segments in the quarter. For the quarter, the S&P 500 Index increased 5.9%. All S&P 500 sectors produced strong quarterly results, although energy stocks were particularly robust with gains due in part to rising oil prices.

International

International stocks also advanced, but generally trailed the domestic equity market. In tandem with the domestic market, international stocks rallied early in the quarter supported by improving economic conditions and strong corporate profits, but fell in

16

Table of Contents

late February and early March due to the turmoil in North Africa and the Middle East, and the natural disaster in Japan. After reversing the quarter to date gains following these events, international equities recovered during the last two weeks of the quarter. The MSCI World Index, a broad measure of international stock performance, increased 4.8% in the quarter. For the first time in more than two years, developed markets outperformed emerging markets. European bourses generated the best returns, even as the European debt crisis led to the downgrade of sovereign debt in several countries. Markets along the Pacific Rim performed in line with the broad index, while Japan was one of the few global markets to decline for the quarter due to the devastating events in that country.

Broad Market Indices

| Period Ended March 31, 2011 | ||||||||||||

| Broad Market Index* | Three Months | Nine Months | Twelve Months | |||||||||

| Dow Jones Industrial Average (1) |

7.1 | % | 28.6 | % | 16.5 | % | ||||||

| NASDAQ Composite (2) |

5.0 | % | 32.9 | % | 17.2 | % | ||||||

| S&P 500 (3) |

5.9 | % | 30.6 | % | 15.6 | % | ||||||

| MSCI World (Net) (4) |

4.8 | % | 29.9 | % | 13.4 | % | ||||||

| * | — assumes dividend re-investment |

| (1) | Dow Jones Industrial Average is a trademark of Dow Jones & Company, which is not affiliated with Epoch. |

| (2) | NASDAQ is a trademark of the NASDAQ Stock Market, Inc., which is not affiliated with Epoch. |

(3) S&P is a trademark of Standard & Poor’s, a division of the McGraw-Hill Companies, Inc., which is not affiliated with Epoch.

| (4) | MSCI World Index is a trademark of MSCI Inc., which is not affiliated with Epoch. |

Business Outlook

We believe the U.S. economy will continue to recover, although the rate of growth will be low. Corporate profit margins appear to be peaking. The employment growth rate has been slow for an economic recovery, and still has a lot of ground to make up. Rising inflation is a primary concern with energy, food, and commodities prices putting pressure on consumer spending. Interest rates are still extremely low, but at some point in the next few months the Federal Reserve may begin to move away from its accommodative monetary policy.

We believe that equities are likely to generate single-digit positive results in 2011, although returns could be uneven due to higher oil prices, rising food prices, geopolitical events, the economic drag and supply chain disruptions from the natural disaster in Japan, and uncertainty about monetary policy choices in several emerging markets.

Despite economic uncertainties, we believe equities are far more attractive in this business environment than fixed income securities. However, stock selection will be crucial. The key to successful investing will be finding those companies with end-demand for their products, which generate consistent free cash flow, and whose management teams have a history of allocating capital to generate shareholder value. We continue to seek companies that return capital to the business owners through cash dividends, stock buybacks, and debt pay downs, particularly in those instances when internal projects and acquisition opportunities offer returns that are less than a firm’s cost of capital. Alternatively, we also look for those companies that appropriately reinvest their cash flow internally or make acquisitions that are accretive to shareholder value.

17

Table of Contents

AUM and Flows

The following table sets forth the changes in our AUM for the periods presented (dollars in millions):

| Three Months Ended March 31, |

Nine Months Ended March 31, |

|||||||||||||||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||||||||||||||

| Beginning of period AUM |

$ | 14,326 | $ | 11,354 | $ | 11,344 | $ | 7,891 | ||||||||||||||||||||

| Client flows: |

||||||||||||||||||||||||||||

| Inflows/new accounts |

662 | 1,160 | 1,672 | 3,596 | ||||||||||||||||||||||||

| Outflows/closed accounts |

(335) | (449) | (1,088) | (1,128) | ||||||||||||||||||||||||

| Net inflows |

327 | 711 | 584 | 2,468 | ||||||||||||||||||||||||

| Market performance |

953 | 551 | 3,678 | 2,257 | ||||||||||||||||||||||||

| Net change |

1,280 | 1,262 | 4,262 | 4,725 | ||||||||||||||||||||||||

| End of period AUM |

$ | 15,606 | $ | 12,616 | $ | 15,606 | $ | 12,616 | ||||||||||||||||||||

| Percent change in total AUM |

8.9% | 11.1% | 37.6% | 59.9% | ||||||||||||||||||||||||

| Organic growth percentage (1) |

2.3% | 6.3% | 5.1% | 31.3% | ||||||||||||||||||||||||

(1) Net inflows divided by beginning of period AUM.

For each of the three and nine months ended March 31, 2011 and 2010, approximately 48% of investment advisory and management fees were earned from services to funds under advisory and sub-advisory contracts whose fees are calculated based upon daily net asset values, and approximately 52% of fees were earned from services provided for separate accounts whose fees are calculated based upon asset values at the end of the period.

18

Table of Contents

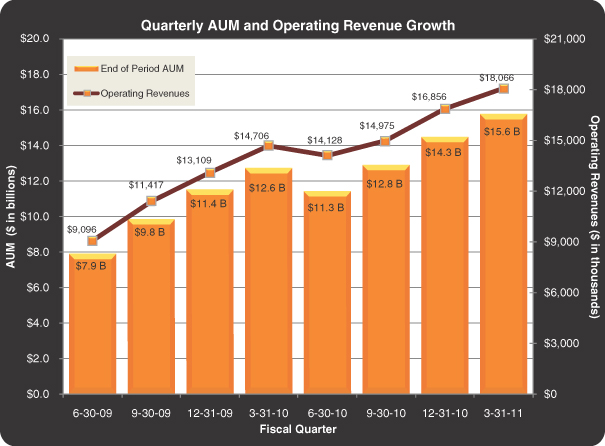

The chart that follows highlights the quarterly growth in AUM and operating revenues over the past eight quarters:

19

Table of Contents

Investment Strategies

The table that follows presents our AUM by investment strategy as of March 31, 2011, December 31, 2010 and March 31, 2010, respectively, as well as the three-month and one-year changes (dollars in millions):

| Strategy | March 31, 2011 |

December 31, 2010 |

March 31, 2010 |

3-Month Change | 1-Year Change | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Amt | % | Amt | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Value |

$ | 4,650 | $ | 4,204 | $ | 3,915 | $ | 446 | 11 | % | $ | 735 | 19 | % | ||||||||||||||||||||||||||||||||||||||||||

| U.S. All Cap Value/ Balanced |

3,899 | 3,592 | 2,929 | 307 | 9 | % | 970 | 33 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Global Equity Shareholder Yield |

2,640 | 2,446 | 2,158 | 194 | 8 | % | 482 | 22 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Global Absolute Return/Choice |

1,878 | 1,777 | 1,577 | 101 | 6 | % | 301 | 19 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Smid Cap Value |

1,125 | 1,014 | 924 | 111 | 11 | % | 201 | 22 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| International/Int’l Small Cap |

660 | 623 | 459 | 37 | 6 | % | 201 | 44 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Small Cap Value (1) |

396 | 378 | 415 | 18 | 5 | % | (19 | ) | (5 | %) | ||||||||||||||||||||||||||||||||||||||||||||||

| Global Small Cap |

358 | 292 | 239 | 66 | 23 | % | 119 | 50 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Total AUM |

$ | 15,606 | $ | 14,326 | $ | 12,616 | $ | 1,280 | 9 | % | $ | 2,990 | 24 | % | ||||||||||||||||||||||||||||||||||||||||||

| (1) | During the quarter ended December 31, 2010, approximately $50 million transferred from the U.S. Small Cap Value strategy to the U.S. All Cap strategy. |

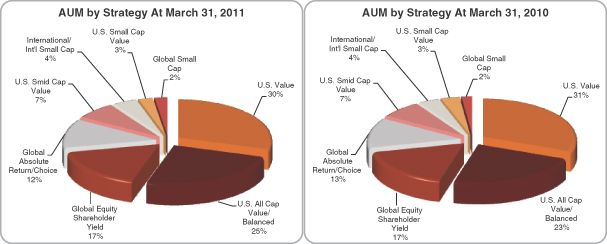

The charts that follow show our investment strategies as a percentage of AUM as of March 31, 2011 and 2010, respectively:

|

20

Table of Contents

Investment Strategy Performance

The following table displays each of our investment strategies’ composite returns, net of management fees, for the period ended March 31, 2011, as measured against their respective benchmarks:

| Returns (%) (2),(3) | ||||||||||||||||||||||||

| Strategy | Inception Date (1) |

3 Months |

1 Year |

3 Years |

5 Years |

Since Inception |

||||||||||||||||||

| U.S. Value |

7/31/01 | 7.1 | 15.2 | 3.7 | 5.3 | 6.1 | ||||||||||||||||||

| Russell 1000 |

6.2 | 16.7 | 3.0 | 2.9 | 3.5 | |||||||||||||||||||

| Russell 1000 Value

|

6.5 | 15.2 | 0.6 | 1.4 | 4.2 | |||||||||||||||||||

| U.S. All Cap Value |

7/31/94 | 7.9 | 17.8 | 4.0 | 4.5 | 11.1 | ||||||||||||||||||

| Russell 3000 |

6.4 | 17.4 | 3.4 | 2.9 | 8.8 | |||||||||||||||||||

| Russell 3000 Value

|

6.5 | 15.6 | 1.1 | 1.4 | 9.3 | |||||||||||||||||||

| Global Equity Shareholder Yield |

12/31/05 | 5.5 | 17.6 | 3.6 | 5.4 | 6.5 | ||||||||||||||||||

| MSCI World (Net)

|

4.8 | 13.4 | (0.2 | ) | 2.1 | 3.2 | ||||||||||||||||||

| Global Absolute Return |

12/31/01 | 4.5 | 7.8 | 3.8 | 4.7 | 10.0 | ||||||||||||||||||

| MSCI World (Net)

|

4.8 | 13.4 | (0.2 | ) | 2.1 | 5.1 | ||||||||||||||||||

| Global Choice |

9/30/05 | 4.8 | 7.6 | 1.7 | 5.3 | 8.1 | ||||||||||||||||||

| MSCI World (Net)

|

4.8 | 13.4 | (0.2 | ) | 2.1 | 3.6 | ||||||||||||||||||

| U.S. Choice |

4/30/05 | 6.7 | 15.5 | 5.2 | 4.6 | 6.5 | ||||||||||||||||||

| Russell 3000

|

6.4 | 17.4 | 3.4 | 2.9 | 5.2 | |||||||||||||||||||

| U.S. Smid Cap Value |

8/31/06 | 6.0 | 22.8 | 8.9 | N/A | 5.9 | ||||||||||||||||||

| Russell 2500 |

8.7 | 26.1 | 8.9 | N/A | 6.0 | |||||||||||||||||||

| Russell 2500 Value

|

7.7 | 22.7 | 7.9 | N/A | 3.9 | |||||||||||||||||||

| International Small Cap |

1/31/05 | 1.7 | 27.2 | 2.2 | 5.8 | 11.0 | ||||||||||||||||||

| MSCI World ex USA Small Cap (Net)

|

3.3 | 22.0 | 2.5 | 2.3 | 7.2 | |||||||||||||||||||

| U.S. Small Cap Value |

12/31/02 | 6.1 | 23.1 | 8.5 | 4.5 | 10.1 | ||||||||||||||||||

| Russell 2000 |

7.9 | 25.8 | 8.6 | 3.3 | 11.5 | |||||||||||||||||||

| Russell 2000 Value

|

6.6 | 20.6 | 6.8 | 2.2 | 11.0 | |||||||||||||||||||

| Global Small Cap |

12/31/02 | 4.1 | 27.9 | 7.2 | 7.2 | 13.6 | ||||||||||||||||||

| MSCI World Small Cap (Net) |

6.2 | 24.6 | 6.9 | 3.5 | 14.3 | |||||||||||||||||||

| (1) | Epoch Investment Partners, Inc. became a registered investment adviser under the Investment Advisers Act of 1940 in June 2004. Performance from April 2001 through May 2004 is for Epoch’s investment team and accounts while at Steinberg Priest & Sloane Capital Management, LLC. For the period from July 1994 through March 2001, Co-Chief Investment Officer and Chief Executive Officer William W. Priest managed the accounts while at Credit Suisse Asset Management and was the only individual responsible for selecting the securities to buy and sell. |

| (2) | Index and investment strategy returns assume dividend re-investment. Investment strategy returns are net of management fees. |

| (3) | Past performance is not indicative of future results. |

21

Table of Contents

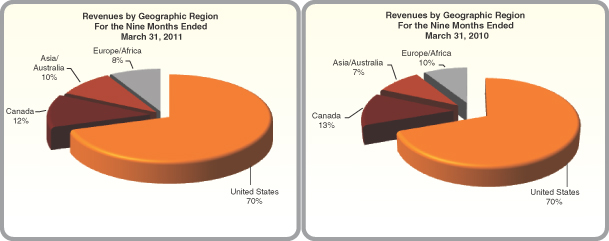

Domestic vs. International

The charts that follow show our operating revenue by geographic region as a percentage of total operating revenue for the nine months ended March 31, 2011 and 2010, respectively.

|

Distribution Channels

The table that follows presents our AUM by distribution channel as of March 31, 2011, December 31, 2010 and March 31, 2010, respectively (dollars in millions):

| Distribution Channel |

March 31, 2011 | December 31, 2010 | March 31, 2010 | |||||||||||||||||||||||||||||||||||||||||||||

| Amount | % of AUM | Amount | % of AUM | Amount | % of AUM | |||||||||||||||||||||||||||||||||||||||||||

| Sub-advisory |

$ | 8,302 | 53% | $ | 7,653 | 53% | $ | 6,848 | 54% | |||||||||||||||||||||||||||||||||||||||

| Institutional |

7,048 | 45% | 6,404 | 45% | 5,511 | 44% | ||||||||||||||||||||||||||||||||||||||||||

| High net worth |

256 | 2% | 269 | 2% | 257 | 2% | ||||||||||||||||||||||||||||||||||||||||||

| Total AUM |

$ | 15,606 | 100% | $ | 14,326 | 100% | $ | 12,616 | 100% | |||||||||||||||||||||||||||||||||||||||

22

Table of Contents

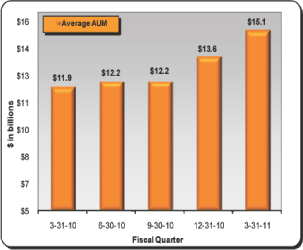

Key Performance Indicators

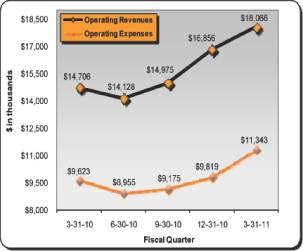

The charts that follow depict our quarterly performance for the past five quarters in certain key financial measures:

| (1) | AUM – End of quarter |

| (2) | AUM – Average |

| (3) | Operating revenues vs. Operating expenses |

| (4) | Operating margin (1) |

| (1) | defined as operating income divided by operating revenue |

|

| |

|

| |

23

Table of Contents

Results of Operations

Three Months Ended March 31, 2011 and 2010

For the three months ended March 31, 2011, net income was $3.9 million, compared to $3.3 million for the same period a year ago. Basic earnings per share were $0.17 compared to $0.15 per share for the same period a year ago.

Drivers for the change in net income were as follows:

| • | Total operating revenues increased by 23%, as AUM increased approximately 24% from the same period a year ago. Average AUM increased by 27%. |

| • | Operating margin increased to 37% for the three months ended March 31, 2011 compared to 35% for the three months ended March 31, 2010, as revenue growth drove higher profitability as a result of our operating leverage. |

Nine Months Ended March 31, 2011 and 2010

For the nine months ended March 31, 2011, net income was $16.3 million, compared to $8.3 million for the same period a year ago. Basic earnings per share were $0.71 compared to $0.37 per share. Excluding the release of the tax valuation allowance, net income for the period would have been $11.3 million and basic earnings per share would have been $0.49.

Other drivers for the change in net income were as follows:

| • | Total operating revenues increased by 27% as a result of higher AUM levels. Average AUM increased by 32%. |

| • | Operating margin increased to 39% compared to 33%. |

Operating Revenues:

|

Three Months Ended March 31, |

’11 vs ’10 Change |

Nine Months Ended March 31, |

’11 vs ’10 Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) |

2011 | 2010 | $ | % | 2011 | 2010 | $ | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment advisory and |

$17,849 | $ 14,494 | $ 3,355 | 23% | $49,206 | $ 38,525 | $ 10,681 | 28% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The increase in revenues for the periods presented above were attributable to the increase in AUM levels, as a result of net inflows from new and existing clients during the past twelve months, as well as market performance. More than half of our investment strategies realized double-digit returns during the past year, with significant growth across nearly all investment strategies.

For both the three and nine months ended March 31, 2011, New York Life Investment Management accounted for approximately 19% of consolidated operating revenues, while CI accounted for approximately 7%.

For the three and nine months ended March 31, 2010, New York Life accounted for approximately 19% and 14% of consolidated operating revenues, respectively, while CI accounted for 8% and 9%, respectively.

24

Table of Contents

Operating Expenses:

| (Dollars in |

Three Months Ended March 31, |

’11 vs ’10 Change |

Nine Months Ended March 31, |

’11 vs ’10 Change | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2011 | 2010 | $ | % | 2011 | 2010 | $ | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Employee related costs (excluding

share- |