Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - China Biologic Products Holdings, Inc. | cbpo081309exh311.htm |

| EX-32.1 - EXHIBIT 32.1 - China Biologic Products Holdings, Inc. | cbpo081309exh321.htm |

| EX-31.2 - EXHIBIT 31.2 - China Biologic Products Holdings, Inc. | cbpo081309exh312.htm |

| EX-32.2 - EXHIBIT 32.2 - China Biologic Products Holdings, Inc. | cbpo081309exh322.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 10−Q/A

(Amendment No. 1)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: June 30,

2009

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________

to _____________

Commission File No. 000-52807

|

|

|

CHINA BIOLOGIC PRODUCTS, INC. |

|

(Name of Small Business Issuer in Its Charter) |

|

|

|

|

|

DELAWARE |

|

75-2308816 |

|

|

||

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

No. 14 East Hushan Road |

|

Taian City, Shandong |

|

People's Republic of China 271000 |

|

(Address of principal executive offices) |

|

|

|

(+86) 538-620-2306 |

|

(Registrant's telephone number, including area code) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

Large accelerated filer o |

Accelerated filer o |

|

Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The number of shares outstanding of each of the issuer's classes of common stock, as of August 10, 2009 is as follows:

|

|

|

|

|

Class of Securities |

|

Shares Outstanding |

|

|

||

|

Common Stock, $0.0001 par value |

|

21,474,942 |

EXPLANATORY NOTE

China Biologic Products, Inc. (the "Company") is filing this Amendment No. 1 to its Quarterly Report on Form 10-Q (the "Amendment") to restate its consolidated financial statements for the three months and six months ended June 30, 2009, previously filed with the Securities and Exchange Commission on August 14, 2009 (the "the Original Filing"). This Amendment is being filed to amend the recognition of fair value of the callable feature for the warrants issued in 2006 and recognition of deferred tax liabilities in connection with business combination of Guiyang Dalin Biologic Technologies Co., Ltd. (“Dalin”).

Recognition of fair value of the callable feature for the warrants issued in 2006

In 2006, the Company issued 1,070,000 warrants (the "2006 Warrants") to certain accredited investors. According to the terms of the 2006 Warrants, the Company may, in its sole discretion, elect to require the 2006 Warrants holders to exercise up to all of the unexercised portion of the 2006 Warrants ("Callable Feature"). The Company inadvertently omitted the fair value of the Callable Features embedded in the 2006 Warrants when reclassifying the fair value of 2006 Warrants from equity to derivative liabilities as of January 1, 2009 in adopting EITF 07-5, "

Determining Whether an Instrument (or Embedded Feature) Is Indexed to an Entity's Own Stock" (FASB ASC 815-40-15-5) ("EITF 07-05"). As a result, the retained earnings and additional paid-in capital should have been increased by $535,615 and $138,160, respectively, and the derivative liabilities should have been decreased by $673,775 as of January 1, 2009. As a result, the loss of change in fair value of derivative liabilities during the three months and six months ended June 30, 2009 should have been decreased by $862,843 and $846,574, respectively. The derivative liabilities, retained earnings and additional paid-in capital should have been decreased by $1,492,941 and increased by $1,382,189 and $110,752, respectively, as of June 30, 2009.Recognition of deferred tax liabilities in connection with the business combination of Dalin

In connection with the business combination of Dalin in 2009, the Company misinterpreted the US GAAP regarding the accounting for the business combination. As a result, the Company did not recognize deferred tax liabilities for differences between the assigned values and the tax bases of the intangible assets and certain property, plant and equipment acquired in the business combination as in accordance with ASC Topic 740,

Income Taxes. As of January 1, 2009, deferred tax liabilities of $4,749,099 should have been recognized with a corresponding increase in goodwill of $4,749,099. During the six months ended June 30, 2009, the Company also should have recorded deferred tax benefit representing the tax effect of the amortization of intangible assets and the depreciation of property, plant and equipment for the six months ended June 30, 2009. As a result, the goodwill and deferred tax liabilities of the Company should have been increased by $4,769,979 and $4,520,397, respectively, as of June 30, 2009. The retained earnings and noncontrolling interest of the Company should have been increased $49,406 and $75,436 for the three months ended June 30, 2009, respectively, $116,153 and $133,484 for the six months ended June 30, 2009, respectively. Accumulated other comprehensive income decreased by $51 and $55 for the three months ended June 30, 2009 and the six months ended June 30, 2009, respectively.For purposes of the Amendment, and in accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended, each item of the Original Filing that was affected by the restatement has been amended and restated in its entirety. Unless otherwise indicated, this report speaks only as of the date that the Original Filing was filed. No attempt has been made in this Amendment to update other disclosures presented in the Original Filing. This Amendment does not reflect events occurring after the filing of the Original Filing or modify or update those disclosures, including the exhibits to the Original Filing affected by subsequent events, except that this Amendment includes as exhibits 31.1, 31.2, 32.1 and 32.2 new certifications by the Company’s Chief Executive Officer and Chief Financial Officer as required by Rule 12b-15.

| Quarterly Report on FORM 10-Q | ||

| Three and Six Months Ended June 30, 2009 | ||

| TABLE OF CONTENTS | ||

| PART I | ||

| FINANCIAL INFORMATION | ||

| Item 1. | Financial Statements | - 1 - |

| Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations | - 36 - |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | - 54 - |

| Item 4. | Controls and Procedures | - 54 - |

| PART II | ||

| OTHER INFORMATION | ||

| Item 1. | Legal Proceedings | - 55 - |

| Item 1A. | Risk Factors | - 55 - |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | - 55 - |

| Item 3. | Defaults Upon Senior Securities | - 55 - |

| Item 4. | Submission of Matters to a Vote of Security Holders | - 56 - |

| Item 5. | Other Information | - 56 - |

| Item 6. | Exhibits | - 56 - |

i

PART I

FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

|

CHINA BIOLOGIC PRODUCTS, INC.

|

||

| Contents | Page(s) | |

| Consolidated Balance Sheets (unaudited) | 1 | |

| Consolidated Statements of Income and Other Comprehensive Income (unaudited) | 2 | |

| Consolidated Statements of Changes in Equity (unaudited) | 3 | |

| Consolidated Statements of Cash Flows (unaudited) | 4 | |

| Notes to the Consolidated Financial Statements (unaudited) | 5 - 36 | |

ii

CHINA BIOLOGIC PRODUCTS, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS AS OF JUNE 30, 2009 AND DECEMBER 31, 2008 |

||||||

| ASSETS | ||||||

| June 30, | December 31, | |||||

| 2009 | 2008 | |||||

|

|

(Unaudited) | |||||

| (As Restated - Note 2) | ||||||

|

CURRENT ASSETS: |

||||||

|

Cash and cash equivalents |

$ | 49,479,021 | $ | 8,814,616 | ||

|

Accounts receivable, net of allowance for doubtful accounts of $1,274,001 and $1,268,052 as of June 30, 2009 and December 31, 2008, respectively |

980,696 | 313,087 | ||||

|

Accounts receivable - related party |

795,080 | - | ||||

|

Dividend receivable |

147,055 | 147,256 | ||||

|

Other receivables |

473,975 | 356,957 | ||||

|

Other receivables - related parties |

797,138 | - | ||||

|

Inventories |

27,316,217 | 14,949,196 | ||||

|

Prepayments and deferred expense |

1,928,553 | 614,704 | ||||

|

Total current assets |

81,917,735 | 25,195,816 | ||||

|

|

||||||

|

PLANT AND EQUIPMENT, net |

27,631,919 | 19,299,364 | ||||

|

|

||||||

|

OTHER ASSETS: |

||||||

|

Investment in unconsolidated affiliate |

6,474,950 | 6,533,977 | ||||

|

Refundable deposit for potential acquisition |

- | 14,181,800 | ||||

|

Prepayments - non-current |

4,362,343 | 955,874 | ||||

|

Intangible assets, net |

21,977,205 | 1,002,561 | ||||

|

Goodwill |

17,195,568 | - | ||||

|

Total other assets |

50,010,066 | 22,674,212 | ||||

|

|

||||||

|

Total assets |

$ | 159,559,720 | $ | 67,169,392 | ||

|

|

||||||

| LIABILITIES AND EQUITY | ||||||

|

|

||||||

|

CURRENT LIABILITIES: |

||||||

|

Accounts payable |

$ | 3,704,482 | $ | 2,481,889 | ||

|

Notes payable |

- | 29,340 | ||||

|

Short term loans - bank |

13,580,550 | - | ||||

|

Short term loans - holder of noncontrolling interest |

4,424,723 | 773,277 | ||||

|

Other payables and accrued liabilities |

15,722,686 | 3,962,931 | ||||

|

Other payable - land use right |

29,265 | 1,683 | ||||

|

Other payable - related parties |

3,082,731 | - | ||||

|

Accrued interest - holder of noncontrolling interest |

911,084 | - | ||||

|

Distribution payable to holder of noncontrolling interest |

447,821 | 3,252,354 | ||||

|

Customer deposits |

7,838,187 | 1,091,792 | ||||

|

Taxes payable |

5,567,794 | 4,060,010 | ||||

|

Long term loan - bank, current maturities |

3,369,500 | - | ||||

|

Investment payable |

6,139,984 | 3,275,501 | ||||

|

Total current liabilities |

64,818,807 | 18,928,777 | ||||

|

|

||||||

|

OTHER LIABILITIES: |

||||||

|

Non-current other payable - land use right |

324,141 | 323,707 | ||||

|

Notes payable, net of discount of $9,533,784 (including accrued interest of $21,178) as of June 30, 2009 |

41,534 | - | ||||

|

Deferred tax liabilities |

4,520,397 | - | ||||

|

Long term loan - bank, net of current maturities |

- | 5,868,000 | ||||

|

Derivative liability - conversion option |

5,796,562 | - | ||||

|

Fair value of derivative instruments |

5,784,023 | - | ||||

|

Total other liabilities |

16,466,657 | 6,191,707 | ||||

|

|

||||||

|

Total liabilities |

81,285,464 | 25,120,484 | ||||

|

|

||||||

|

COMMITMENTS AND CONTINGENCIES |

||||||

|

|

||||||

|

EQUITY: |

||||||

|

Common stock, $0.0001 par value, 100,000,000 shares authorized, 21,474,942 and 21,434,942 shares issued and outstanding at June 30, 2009 and December 31, 2008, respectively |

2,147 | 2,143 | ||||

|

Paid-in-capital |

10,366,007 | 10,700,032 | ||||

|

Statutory reserves |

11,738,002 | 6,989,801 | ||||

|

Retained earnings |

22,441,880 | 15,392,253 | ||||

|

Accumulated other comprehensive income |

4,176,630 | 4,159,298 | ||||

|

Total shareholders' equity |

48,724,666 | 37,243,527 | ||||

|

|

||||||

|

NONCONTROLLING INTEREST |

29,549,590 | 4,805,381 | ||||

|

|

||||||

|

Total equity |

78,274,256 | 42,048,908 | ||||

|

|

||||||

|

Total liabilities and equity |

$ | 159,559,720 | $ | 67,169,392 | ||

The accompanying notes are an integral part of these consolidated statements.

- 1 -

| CHINA BIOLOGIC PRODUCTS, INC. AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME AND OTHER COMPREHENSIVE INCOME FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2009 AND 2008 (Unaudited) |

||||||||||||

| Three months ended | Six months ended | |||||||||||

| June 30, | June 30, | |||||||||||

|

|

2009 | 2008 | 2009 | 2008 | ||||||||

| (As Restated - Note 2) | (As Restated - Note 2) | |||||||||||

|

|

||||||||||||

|

REVENUES |

$ | 33,181,545 | $ | 11,925,842 | $ | 54,330,143 | $ | 19,774,849 | ||||

|

|

||||||||||||

|

COST OF REVENUES |

9,161,765 | 3,638,128 | 15,376,695 | 5,587,026 | ||||||||

|

|

||||||||||||

|

GROSS PROFIT |

24,019,780 | 8,287,714 | 38,953,448 | 14,187,823 | ||||||||

|

|

||||||||||||

|

OPERATING EXPENSES: |

||||||||||||

|

Selling expenses |

1,114,614 | 510,565 | 1,694,110 | 1,005,094 | ||||||||

|

General and administrative expenses |

6,004,802 | 2,529,780 | 9,827,709 | 4,121,854 | ||||||||

|

Research and development expenses |

367,856 | 279,833 | 835,583 | 463,615 | ||||||||

|

Total operating expenses |

7,487,272 | 3,320,178 | 12,357,402 | 5,590,563 | ||||||||

|

|

||||||||||||

|

INCOME FROM OPERATIONS |

16,532,508 | 4,967,536 | 26,596,046 | 8,597,260 | ||||||||

|

|

||||||||||||

|

OTHER EXPENSES (INCOME): |

||||||||||||

|

Equity in loss of unconsolidated affiliate |

90,390 | - | 50,143 | - | ||||||||

|

Change in fair value of derivative liabilities |

432,889 | - | 842,181 | - | ||||||||

|

Interest expense (income), net |

883,914 | (846 | ) | 1,254,767 | 14,182 | |||||||

|

Other expense (income), net |

(16,005 | ) | 52,041 | 35,310 | 52,452 | |||||||

|

Total other expenses, net |

1,391,188 | 51,195 | 2,182,401 | 66,634 | ||||||||

|

|

||||||||||||

|

INCOME BEFORE PROVISION FOR INCOME TAXES AND NONCONTROLLING INTEREST |

15,141,320 | 4,916,341 | 24,413,645 | 8,530,626 | ||||||||

|

|

||||||||||||

|

PROVISION FOR INCOME TAXES |

2,857,199 | 2,123,843 | 4,762,594 | 2,864,325 | ||||||||

|

|

||||||||||||

|

NET INCOME BEFORE NONCONTROLLING INTEREST |

12,284,121 | 2,792,498 | 19,651,051 | 5,666,301 | ||||||||

|

|

||||||||||||

|

Less: Net income attributable to noncontrolling interest |

4,401,127 | 758,344 | 7,459,261 | 1,364,347 | ||||||||

|

|

||||||||||||

|

NET INCOME ATTRIBUTABLE TO CONTROLLING INTEREST |

7,882,994 | 2,034,154 | 12,191,790 | 4,301,954 | ||||||||

|

|

||||||||||||

|

OTHER COMPREHENSIVE INCOME: |

||||||||||||

|

Foreign currency translation adjustments |

(1,301 | ) | 632,130 | 17,332 | 1,574,829 | |||||||

|

Comprehensive income (loss) attributable to noncontrolling interest |

(33,422 | ) | 116,824 | 393,876 | 301,291 | |||||||

|

|

||||||||||||

|

COMPREHENSIVE INCOME |

$ | 7,848,271 | $ | 2,783,108 | $ | 12,602,998 | $ | 6,178,074 | ||||

|

|

||||||||||||

|

BASIC EARNINGS PER SHARE: |

||||||||||||

|

Weighted average number of shares |

21,442,909 | 21,434,942 | 21,438,948 | 21,434,942 | ||||||||

|

Earnings per share |

$ | 0.37 | $ | 0.09 | $ | 0.57 | $ | 0.20 | ||||

|

|

||||||||||||

|

DILUTED EARNINGS PER SHARE: |

||||||||||||

|

Weighted average number of shares |

21,442,909 | 21,664,429 | 21,438,948 | 21,808,852 | ||||||||

|

Earnings per share |

$ | 0.37 | $ | 0.09 | $ | 0.57 | $ | 0.20 | ||||

The accompanying notes are an integral part of these

consolidated statements.

- 2 -

| CHINA BIOLOGIC PRODUCTS, INC. AND SUBSIDIARIES | ||||||||||||||||||||||||

| CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY | ||||||||||||||||||||||||

| China Biologic Products. Inc.'s shareholders | ||||||||||||||||||||||||

| Retained earnings | Accumulated other | |||||||||||||||||||||||

| Common stock | Additional | Statutory | comprehensive | Noncontrolling | ||||||||||||||||||||

|

|

Shares | Par value | paid in capital | reserves | Unrestricted | income | interest | Total | ||||||||||||||||

|

BALANCE, December 31, 2007 |

21,434,942 | $ | 2,143 | $ | 9,388,305 | $ | 3,934,703 | $ | 6,461,680 | $ | 2,313,348 | $ | 4,181,338 | $ | 26,281,517 | |||||||||

|

|

||||||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

Stock based compensation |

1,263,188 | 1,263,188 | ||||||||||||||||||||||

|

Net income |

4,301,954 | 1,364,347 | 5,666,301 | |||||||||||||||||||||

|

Dividend declared to noncontrolling interest shareholders |

(385,084 | ) | (385,084 | ) | ||||||||||||||||||||

|

Adjustment to statutory reserve |

821,443 | (821,443 | ) | - | ||||||||||||||||||||

|

Foreign currency translation adjustments |

1,574,829 | 301,291 | 1,876,120 | |||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

BALANCE, June 30, 2008 (unaudited) |

21,434,942 | $ | 2,143 | $ | 10,651,493 | $ | 4,756,146 | $ | 9,942,191 | $ | 3,888,177 | $ | 5,461,892 | $ | 34,702,042 | |||||||||

|

|

||||||||||||||||||||||||

|

Stock based compensation |

48,539 | 48,539 | ||||||||||||||||||||||

|

Net income |

7,683,717 | 1,939,494 | 9,623,211 | |||||||||||||||||||||

|

Dividend declared to noncontrolling interest shareholders |

(2,596,961 | ) | (2,596,961 | ) | ||||||||||||||||||||

|

Adjustment to statutory reserve |

2,233,655 | (2,233,655 | ) | - | ||||||||||||||||||||

|

Foreign currency translation adjustments |

271,121 | 956 | 272,077 | |||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

BALANCE, December 31, 2008 |

21,434,942 | $ | 2,143 | $ | 10,700,032 | $ | 6,989,801 | $ | 15,392,253 | $ | 4,159,298 | $ | 4,805,381 | $ | 42,048,908 | |||||||||

|

|

||||||||||||||||||||||||

|

Cumulative effect of reclassification of warrants, as restated (Note 2) |

(600,289 | ) | (393,962 | ) | (994,251 | ) | ||||||||||||||||||

|

Stock based compensation |

54,967 | 54,967 | ||||||||||||||||||||||

|

Warrants exercised, as restated (Note 2) |

40,000 | 4 | 211,297 | 211,301 | ||||||||||||||||||||

|

Net income, as restated (Note 2) |

12,191,790 | 7,459,261 | 19,651,051 | |||||||||||||||||||||

|

Dividend declared to noncontrolling interest shareholders |

(4,633,987 | ) | (4,633,987 | ) | ||||||||||||||||||||

|

Noncontrolling interest acquired from acquisition |

21,525,059 | 21,525,059 | ||||||||||||||||||||||

|

Adjustment to statutory reserve |

4,748,201 | (4,748,201 | ) | - | ||||||||||||||||||||

|

Foreign currency translation adjustments, as restated (Note 2) |

17,332 | 393,876 | 411,208 | |||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

BALANCE, June 30, 2009 (unaudited), as restated (Note 2) |

21,474,942 | $ | 2,147 | $ | 10,366,007 | $ | 11,738,002 | $ | 22,441,880 | $ | 4,176,630 | $ | 29,549,590 | $ | 78,274,256 | |||||||||

The accompanying notes are an integral part of these

consolidated statements.

- 3 -

| CHINA BIOLOGIC PRODUCTS, INC. AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE SIX MONTHS ENDED JUNE 30, 2009 AND 2008 (Unaudited) | ||||||

|

|

2009 | 2008 | ||||

| (As Restated - Note 2) | ||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

||||||

|

Net income attributable to controlling interest |

$ | 12,191,790 | $ | 4,301,954 | ||

|

Net income attributable to noncontrolling interest |

7,459,261 | 1,364,347 | ||||

|

Consolidated net income |

19,651,051 | 5,666,301 | ||||

|

Adjustments to reconcile net income to cash provided by operating activities: |

||||||

|

Depreciation |

1,589,625 | 579,754 | ||||

|

Amortization |

1,704,248 | 53,192 | ||||

|

(Gain) loss on disposal of equipment |

(506 | ) | 1,900 | |||

|

Recovery of bad debt previously reserved |

(22,311 | ) | (107,583 | ) | ||

|

Allowance for bad debt - accounts receivables |

9,635 | - | ||||

|

Allowance for bad debt - other receivables |

397,101 | - | ||||

| Deferred tax benefit, net | (249,701 | ) | - | |||

|

Stock based compensation |

54,967 | 1,263,188 | ||||

|

Change in fair value of warrant liabilities |

842,181 | - | ||||

|

Amortization of deferred note issuance cost |

25,323 | - | ||||

|

Amortization of discount on convertible notes |

20,356 | - | ||||

|

Equity in loss of unconsolidated affiliate |

50,143 | - | ||||

|

Change in operating assets and liabilities: |

||||||

|

Notes receivable |

- | (23,694 | ) | |||

|

Accounts receivable |

(676,036 | ) | (477,858 | ) | ||

|

Accounts receivable - related party |

(375,810 | ) | - | |||

|

Other receivables |

(23,082 | ) | (201,576 | ) | ||

|

Other receivables - shareholders |

- | 1,419 | ||||

|

Inventories |

(4,130,960 | ) | (2,571,137 | ) | ||

|

Prepayments and deferred expenses |

(750,937 | ) | (241,377 | ) | ||

|

Accounts payable |

(50,767 | ) | (294,290 | ) | ||

|

Other payables and accrued liabilities |

4,573,201 | 683,527 | ||||

|

Accrued interest |

21,178 | - | ||||

|

Accrued interest - holder of noncontrolling interest |

911,084 | - | ||||

|

Customer deposits |

4,251,476 | 264,990 | ||||

|

Taxes payable |

608,063 | 2,134,302 | ||||

|

Contingent liability |

- | (107,273 | ) | |||

|

Net cash provided by operating activities |

28,429,522 | 6,623,785 | ||||

|

|

||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

||||||

|

Cash acquired through acquisition |

11,943,673 | - | ||||

|

Payments made for acquisition |

(10,373,854 | ) | - | |||

|

Purchase of plant and equipment |

(1,865,746 | ) | (2,245,627 | ) | ||

|

Additions to intangible assets |

(1,014,766 | ) | (10,269 | ) | ||

|

Proceeds from sale of equipment |

- | 3,546 | ||||

|

Advances on non-current assets |

(590,428 | ) | (32,945 | ) | ||

|

Net cash used in investing activities |

(1,901,121 | ) | (2,285,295 | ) | ||

|

|

||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

||||||

|

Proceeds from warrants conversion |

113,700 | - | ||||

|

Proceeds from issuance of convertible notes |

8,971,337 | - | ||||

|

Repayments of former shareholders loan in acquiring company |

(2,652,737 | ) | - | |||

|

Proceeds from short term bank loans |

13,513,754 | - | ||||

|

Payments on short term loans - bank |

- | (709,200 | ) | |||

|

Payments on long term loan - bank |

(5,862,800 | ) | - | |||

|

Dividends paid to noncontrolling interest shareholders |

- | (283,680 | ) | |||

|

Net cash provided by (used in) financing activities |

14,083,254 | (992,880 | ) | |||

|

|

||||||

|

EFFECTS OF EXCHANGE RATE CHANGE IN CASH |

52,750 | 419,599 | ||||

|

|

||||||

|

INCREASE IN CASH |

40,664,405 | 3,765,209 | ||||

|

CASH and CASH EQUIVALENTS, beginning of period |

8,814,616 | 5,010,033 | ||||

|

|

||||||

|

CASH and CASH EQUIVALENTS, end of period |

$ | 49,479,021 | $ | 8,775,242 | ||

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION |

|

|||||

|

Income taxes paid |

$ |

4,351,056 | $ | 850,605 | ||

|

Interest paid (net of capitalized interest) |

$ |

715,158 | $ | 29,901 | ||

|

Non-cash investing and financing activities: |

|

|||||

|

Reclassification of warrant liability to paid-in capital upon warrants conversion |

$ |

97,601 | $ | - | ||

|

Dividend paid in exchange of holder of noncontrolling interest loan |

$ |

3,736,773 | $ | - | ||

|

Dividend paid by offsetting loan due from holder of noncontrolling interest |

$ |

3,720,649 | $ | - | ||

|

Net assets acquired with prepayments made in prior periods |

$ |

14,159,124 | $ | - | ||

|

Net assets acquired with unpaid investment |

$ |

2,849,321 | $ | - | ||

|

Land use right acquired with prepayments made in prior periods |

$ |

131,103 | $ | - |

The accompanying notes are an integral part of these consolidated statements.

- 4 -

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2009

(Unaudited)

Note 1 – Organization background and principal activities

Principal Activities and Reorganization

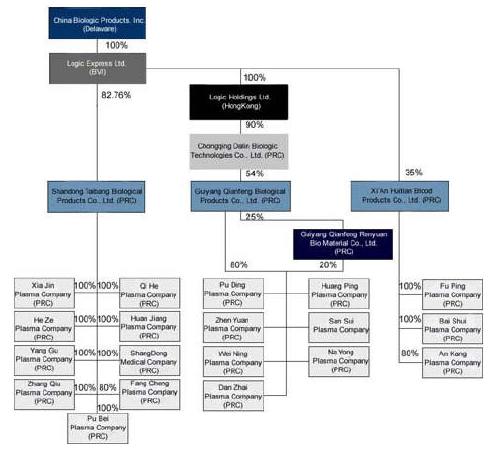

China Biologic Products, Inc. (the “Company” or “CBP”) was originally incorporated in 1992 under the laws of the state of Texas. After it completed the reverse acquisition with Logic Express Limited, it converted to a Delaware corporation. The Company through its direct and indirect subsidiaries is principally engaged in the research, development, commercialization, manufacture and sale of human blood products to customers in the People's Republic of China (the “PRC”) and to some extent in India.

Current Development

Dalin Acquisition and Entrustment Agreement

Logic Express Ltd. (“Logic Express”), CBP's wholly owned subsidiary, through Logic Holdings Ltd. (“Logic Holdings”) completed the acquisition of 90% interest in Chongqing Dalin Biologic Technologies Co. Ltd. (“Dalin”) in April 2009 upon payment of 90% of the total purchase price of approximately RMB 194,400,000 ($28,479,600). The Company is obligated to pay the remaining 10% of the purchase price, RMB 19,440,000 (approximately $2,847,960), on or before April 9, 2010, the one-year anniversary of the local Administration for Industry and Commerce's approval of the equity transfer. Guiyang Qianfeng Biological Products Co., Ltd. (“Qianfeng”), Dalin's 54% owned subsidiary, is one of the largest plasma-based biopharmaceutical companies in China and is the only manufacturer currently operating in Guizhou Province. Qianfeng is in compliance with Good Manufacturing Practices, or GMP, standards, and has been approved by the PRC's State Food and Drug Administration or the SFDA to produce six types of plasma-based products including Human Albumin, Human Immunoglobulin, Human Intravenous Immunoglobulin, Human Hepatitis B Immunoglobulin, Human Tetanus Immunoglobulin and Human Rabies Immune Globulin.

In accordance with the terms of the equity transfer agreement, Logic Holdings effectively became a 90% shareholder in Dalin, including the right to receive its pro rata share of the profits on January 1, 2009.

On April 6, 2009, Logic Express entered into an equity transfer and entrustment agreement, or Entrustment Agreement, among Logic Express, Shandong Taibang Biological Products Co. Ltd (“Shandong Taibang”), and the Shandong Institute of Biological Products (“the Shandong Institute”), the holder of the minority interests in Shandong Taibang, pursuant to which, Logic Express agreed to permit Shandong Taibang and the Shandong Institute to participate in the indirect purchase of Qianfeng's equity interests. Under the terms of the Entrustment Agreement, Shandong Taibang agreed to contribute 18% or RMB 35,000,000 (approximately $5,116,184) of the Dalin purchase price and the Shandong Institute agreed to contribute 12.86% or RMB 25,000,000 (approximately $3,654,917) of the Dalin purchase price. Logic Express is obligated to repay to Shandong Taibang and the Shandong Institute their respective investment amounts on or before April 6th, 2010, along with their pro rata share, based on their percentage of the Dalin purchase price contributed, of any distribution on the indirect equity investment in Qianfeng payable to Logic Express during 2009. Logic Express has agreed that if these investment amounts are not repaid within five days of the payment due date, then Logic Express is obligated to pay Shandong Taibang and the Shandong Institute liquidated damages equal to 0.03% of the overdue portion of the amount due until such time as it is paid. Logic Express has also agreed to pledge 30% of its ownership in Shandong Taibang to the Shandong Institute as security for nonpayment. If failure to repay continues for longer than 3 months after the payment due date, then the Shandong Institute will be entitled to any rights associated with the pledged interests, including but not limited to rights of disposition and profit distribution, until such time as the investment amount has been repaid. Logic Express also provided a guarantee that Shandong Taibang and the Shandong Institute will receive no less than a 6% return based on their original investment amount.

Huitian Acquisition

Shandong Taibang purchased a 35% interest in Xi'an Huitian Blood Products Co. Ltd (“Huitian”) at a purchase price of RMB 44,000,000 (approximately $6,446,000) on October 10, 2008 and paid the final installment on July 16, 2009. Huitian is a manufacturer of plasma-based biopharmaceutical products in Shaanxi Province and is one of only 32 such manufacturers in China who are government approved. Huitian is in compliance with GMP standards and it is also approved by the SFDA for the production of Human Albumin, Human Immunoglobulin, Human Immunoglobulin for Intravenous Injection, and Human Hepatitis B Immunoglobulin products.

Formation of Logic Holding

On December 12, 2008, the Company established Logic Holding, the Company's wholly-owned Hong Kong subsidiary of Logic Express, for the purpose of being a holding company for the majority interest in Dalin.

- 5-

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2009

(Unaudited)

Note 2 – Restatement of June 30, 2009 consolidated financial statements

This financial statements contain restatements related to the recognition of fair value of the callable feature for the warrants issued in 2006 and recognition of deferred tax liabilities in connection with business combination of Dalin for the three months and six months ended and as of June 30, 2009.

Recognition of fair value of the callable feature for the warrants issued in 2006

In 2006, the Company issued 1,070,000 warrants (the “2006 Warrants”) to certain accredited investors, see Note 16. As a result of adopting EITF 07-5, “Determining Whether an Instrument (or Embedded Feature) Is Indexed to an Entity's Own Stock” (FASB ASC 815-40-15-5) (“EITF 07-05”), effective January 1, 2009, both of the 2006 Warrants and Placement Agent Warrants (as defined in Note 16 below) previously treated as equity pursuant to the derivative treatment exemption are no longer afforded equity treatment because the strike price of these warrants are denominated in US dollar, a currency other than the Company’s functional currency, Renminbi. As a result, these warrants are not considered indexed to the Company’s own stock, and as such, all future changes in the fair value of these warrants will be recognized in earnings until such time as the warrants are exercised or expired.

According to the terms of the 2006 Warrants, the Company may, in its sole discretion, elect to require the 2006 Warrants holders to exercise up to all of the unexercised portion of the 2006 Warrants (“Callable Feature”). The Company inadvertently omitted the fair value of the Callable Features embedded in the 2006 Warrants when reclassifying the fair value of 2006 Warrants from equity to derivative liabilities as of January 1, 2009. As a result, the retained earnings and additional paid-in capital should have been increased by $535,615 and $138,160, respectively, and the derivative liabilities should have been decreased by $673,775 as of January 1, 2009. As a result, the loss of change in fair value of derivative liabilities during the three months and six months ended June 30, 2009 should have been decreased by $862,843 and $846,574, respectively. The derivative liabilities, retained earnings and additional paid-in capital should have been decreased by $1,492,941 and increased by $1,382,189 and $110,752, respectively, as of June 30, 2009.

Recognition of deferred tax liabilities in connection with the business combination of Dalin

In connection with the business combination of Dalin in 2009 (see note 1), the Company misinterpreted US GAAP regarding the accounting for the business combination. As a result, the Company did not recognize deferred tax liabilities for differences between the assigned values and the tax bases of the intangible assets and certain property, plant and equipment acquired in the business combination as in accordance with ASC Topic 740, Income Taxes. As of January 1, 2009, deferred tax liabilities of $4,749,099 should have been recognized with a corresponding increase in goodwill of $4,749,099. During the six months ended June 30, 2009, the Company also should have recorded deferred tax benefit representing the tax effect of the amortization of intangible assets and the depreciation of property, plant and equipment for the six months ended June 30, 2009. As a result, the goodwill and deferred tax liabilities should have been increased by $4,769,979 and $4,520,397, respectively, as of June 30, 2009. Retained earnings and noncontrolling interest of the Company should have been increased by $49,406 and $75,436 respectively, for the three months ended June 30, 2009 and $116,153 and $133,484, respectively, for the six months ended June 30, 2009. Accumulated other comprehensive income decreased by $51 and $55 for the three months ended June 30, 2009 and the six months ended June 30, 2009, respectively.

The impact of these restatements on the June 30, 2009 financial statements is reflected in the following tables:

| As | |||||||||

| Previously | As | ||||||||

| Balance Sheet Amounts | Reported | Restatement | Restated | ||||||

| Goodwill (note 22) | $ | 12,425,589 | $ | 4,769,979 | $ | 17,195,568 |

| Total assets | 154,789,741 | 4,769,979 | 159,559,720 | ||||||

| Deferred tax liabilities (note 14) | - | 4,520,397 | 4,520,397 | ||||||

| Derivative liabilities (note 3 and 16) | 7,276,964 | (1,492,941 | ) | 5,784,023 | |||||

| Total liabilities | 78,258,008 | 3,027,456 | 81,285,464 | ||||||

| Additional paid-in capital | 10,255,255 | 110,752 | 10,366,007 | ||||||

| Retained earnings | 20,943,538 | 1,498,342 | 22,441,880 | ||||||

| Noncontrolling interest (note 21) | 29,416,106 | 133,484 | 29,549,590 | ||||||

| Total stockholders' equity | 76,531,733 | 1,742,523 | 78,274,256 |

-6-

| For the three months ended June 30, 2009 | For the six months ended June 30, 2009 | |||||||||||||||||

| Statement of Operations and Other | As | As | ||||||||||||||||

| Comprehensive Income Amounts | Previously | As | Previously | As | ||||||||||||||

| Reported | Restatement | Restated | Reported | Restatement | Restated | |||||||||||||

| Change in fair value of derivative liabilities (note 17) | $ | 1,295,732 | $ | (862,843 | ) | $ | 432,889 | $ | 1,688,755 | $ | (846,574 | ) | $ | 842,181 | ||||

| Net other expense | 2,254,031 | (862,843 | ) | 1,391,188 | 3,028,975 | (846,574 | ) | 2,182,401 | ||||||||||

| Income before income taxes | 14,278,477 | 862,843 | 15,141,320 | 23,567,071 | 846,574 | 24,413,645 | ||||||||||||

| Provision for income taxes (note 14) | 2,982,101 | (124,902 | ) | 2,857,199 | 5,012,295 | (249,701 | ) | 4,762,594 | ||||||||||

| Net income | 11,296,376 | 987,745 | 12,284,121 | 18,554,776 | 1,096,275 | 19,651,051 | ||||||||||||

| Net income attributable to noncontrolling interest (note 21) | 4,325,631 | 75,496 | 4,401,127 | 7,325,713 | 133,548 | 7,459,261 | ||||||||||||

| Other comprehensive income | (1,250 | ) | (51 | ) | (1,301 | ) | 17,387 | (55 | ) | 17,332 | ||||||||

| Comprehensive income attributed to controlling interest | 6,969,495 | 912,198 | 7,881,693 | 11,246,450 | 962,672 | 12,209,122 | ||||||||||||

| Basic earnings per share (note 13) | $ | 0.33 | $ | 0.04 | $ | 0.37 | $ | 0.52 | $ | 0.05 | $ | 0.57 | ||||||

| Diluted earnings per share (note 13) | $ | 0.32 | $ | 0.05 | $ | 0.37 | $ | 0.52 | $ | 0.05 | $ | 0.57 | ||||||

| As | |||||||||

| Previously | As | ||||||||

| Statement of Cash Flow | Reported | Restatement | Restated | ||||||

| Net income | $ | 18,554,776 | $ | 1,096,275 | $ | 19,651,051 | |||

| Change in fair value of derivative liabilities | 1,688,755 | (846,574 | ) | 842,181 | |||||

| Deferred tax benefit, net | - | (249,701 | ) | (249,701 | ) | ||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | |||||||||

| Non-cash investing and financing activities: | |||||||||

| Reclassification of warrant liability to paid-in capital upon warrants conversion | 125,009 | (27,408 | ) | 97,601 |

Note 3 – Summary of significant accounting policies

Basis of Presentation

The accompanying consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America. The Company's functional currency is the Chinese Renminbi (“RMB”); however, the Company's reporting currency is the United States Dollar (“USD”); therefore, the accompanying consolidated financial statements have been translated and presented in USD. All material inter-company transactions and balances have been eliminated in the consolidation.

While management has included all normal recurring adjustments considered necessary to give a fair presentation of the operating results for the periods presented, interim results are not necessarily indicative of results for a full year. The information included in this Form 10-Q should be read in conjunction with information included in the 2008 annual report filed on Form 10-K.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. For example, management estimates the fair value of stock based compensation as well as potential losses on outstanding receivables. Management believes that the estimates utilized in preparing its financial statements are reasonable and prudent. Actual results could differ from these estimates.

- 7 -

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2009

(Unaudited)

Foreign Currency Translation

The reporting currency of the Company is the US dollar. The Company's functional currency is the Chinese Renminbi (“RMB”), also the local currency of the Company's principal operating subsidiaries. Results of operations and cash flows are translated at average exchange rates during the period. Assets and liabilities are translated at the unified exchange rate as quoted by the People's Bank of China at the end of the period. Translation adjustments resulting from this process are included in accumulated other comprehensive income in the statements of stockholders' equity. Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

In accordance with FAS 95, "Statement of Cash Flows," cash flows from the Company's operations is calculated based upon the local currencies. As a result, amounts related to assets and liabilities reported on the statement of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheet.

The consolidated balance sheet amounts, with the exception of equity at June 30 2009 and December 31, 2008 were translated at RMB6.83 to $1.00 and RMB6.82 to $1.00, respectively. The equity accounts were stated at their historical rate. The average translation rates applied to consolidated statements of income and cash flow for the six months ended June 30, 2009 and 2008 were RMB6.82 and RMB7.05, respectively.

Revenue Recognition

The Company recognizes revenue when products are delivered and the customer takes ownership and assumes risk of loss, collection of the relevant receivable is probable, persuasive evidence of an arrangement exists and the sales price is fixed or determinable, which are generally considered to be met upon delivery and acceptance of products at the customer site. Sales are presented net of any discounts given to customers. As a policy, the Company does not accept any product returns and based on the Company's records, product returns, if any, are immaterial. Sales revenue represents the invoiced value of goods, net of a value-added tax (“VAT”). All products produced by the Company and sold in the PRC are subject to a Chinese VAT at a rate of 6% of the gross sales price or at a rate approved by the Chinese local government. Products distributed by Shandong Medical and plasma raw material inter-company sales from Puding Plasma Company to Qianfeng are subjected to a 17% VAT.

Shipping and Handling

Shipping and handling costs related to costs of goods sold are included in selling expenses and totaled $79,611 and $14,288 for the three months ended June 30, 2009 and 2008, respectively. For the six months ended June 30, 2009 and 2008, costs totaled $123,791 and $21,536, respectively.

Financial Instruments

FAS 107, “Disclosures about Fair Value of Financial Instruments” requires disclosure of the fair value of financial instruments held by the Company. FAS 107 defines financial instruments and requires fair value disclosures about those instruments. FAS 157, “Fair Value Measurements”, adopted January 1. 2008, defines fair value, establishes a three-level valuation hierarchy for disclosures of fair value measurement and enhances disclosures requirements for fair value measures. Receivables, payables, short and long term loans, and derivative liabilities qualify as financial instruments. Management concluded the carrying values of the receivables, payables and short term loans approximate their fair values because of the short period of time between the origination of such instruments and their expected realization, and if applicable, their stated rates of interest are equivalent to interest rates currently available. The fair values of the long term debt and derivative liabilities are measured pursuant to FAS 157. The three levels are defined as follow:

-

Level 1: inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets.

-

Level 2: inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liability, either directly or indirectly, for substantially the full term of the financial instruments.

-

Level 3: inputs to the valuation methodology are unobservable and significant to the fair value.

The Company analyzes all financial instruments with features of both liabilities and equity under FAS 150, “Accounting for Certain Financial Instruments with Characteristics of Both Liabilities and Equity,” FAS 133, “Accounting for Derivative Instruments and Hedging Activities”, EITF 00-19, “Accounting for Derivative Financial Instruments Indexed to, and Potentially Settled in, a Company's Own Stock” and EITF 07-5, “Determining Whether an Instrument (or Embedded Feature) Is Indexed to an Entity's Own Stock.”

- 8 -

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2009

(Unaudited)

As required by FAS 157, financial assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. Depending on the product and the terms of the transaction, the fair value of the derivative liabilities were modeled using a series of techniques, including closed-form analytic formula, such as the Black-Scholes Option Pricing Model, which does not entail material subjectivity because the methodology employed does not necessitate significant judgment, and the pricing inputs are observed from actively quoted markets.

Derivative liabilities related to warrants issued by the Company and the liability related to derivative instruments (including the conversion option) embedded in the Company's Senior Secured Convertible Notes are carried at fair value, with changes in the fair value charged or credited to income. The fair values are determined using the Black-Scholes Model or a binomial model, defined in SFAS 157 as level 2 inputs.

| Carrying Value as of

June 30, 2009 |

Fair Value Measurements at June 30,

2009 |

|||||||||||

| Level 1 | Level 2 | Level 3 | ||||||||||

| Derivative liabilities - | ||||||||||||

| Conversion option | $ | 5,796,562 | $ | - | $ | 5,796,562 | $ | - | ||||

| Warrants liabilities - restated | $ | 5,784,023 | $ | - | $ | 5,784,023 | $ | - | ||||

The Company did not identify any assets or liabilities that are required to be presented on the balance sheet at fair value in accordance with FAS 157.

Concentration Risks

The Company's operations are carried out in the PRC and are subject to specific considerations and significant risks not typically associated with companies in North America and Western Europe. Accordingly, the Company's business, financial condition and results of operations may be influenced by the political, economic and legal environments in the PRC, and by the general state of the PRC economy. The Company's results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

The Company maintains balances at financial institutions which, from time to time, may exceed Federal Deposit Insurance Corporation insured limits for the banks located in the United States or may exceed Hong Kong Deposit Protection Board insured limits for the banks located in Hong Kong. Balances at financial institutions or state-owned banks within the PRC are not covered by insurance. Total cash in banks as of June 30, 2009 and December 31, 2008 amounted to $49,312,772 and $8,689,414, respectively, $8,749,249 and $47,865 of which are covered by insurance, respectively. The Company has not experienced any losses in such accounts and believes it is not exposed to any risks on its cash in bank accounts.

The Company's major product, human albumin: - 20%/10ml, 20%/25ml and 20%/50ml, accounted for 47.4% and 57.5% of total revenues, for the three months ended June 30, 2009 and 2008, respectively. 51.7% and 57.7% of total revenues, for the six months ended June 30, 2009 and 2008, respectively. If the market demands for human albumin cannot be sustained in the future or if the price of human albumin decreases, it would adversely affect the Company's operating results.

All of the Company's customers are located in the PRC and India. As of June 30, 2009 and 2008, the Company had no significant concentration of credit risk, except for the amounts due from related parties. There were no customers that individually comprised 10% or more of the revenue during the three and six months ended June 30, 2009 and 2008. No individual customer represented more than 10% of trade receivables at June 30, 2009 and December 31, 2008. The Company performs ongoing credit evaluations of its customers' financial condition and, generally, requires no collateral from its customers.

There were no vendors that individually comprised 10% or more of the purchase during the three and six months ended June 30, 2009. No individual vendors represented more than 10% of accounts payables at June 30, 2009 and December 31, 2008. The Company's top three vendors comprised 51.8% and 40.6% of the Company's purchases for the three and six months ended June 30, 2008, respectively.

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand and demand deposits in accounts maintained with state-owned banks within the PRC, Hong Kong and the United States. The Company considers all highly liquid investments with original maturities of three months or less at the time of purchase to be cash equivalents.

Accounts Receivable

During the normal course of business, the Company extends unsecured credit to its customers. Management reviews its accounts receivable on a regular basis to determine if the allowance for doubtful accounts is adequate. An estimate for doubtful accounts is made when collection of the full amount is no longer probable. Account balances are written-off after management has exhausted all efforts of collection.

Inventories

Inventories are stated at the lower of cost or market using the

weighted average method. The cost of finished goods included direct costs of raw

materials as well as direct labor used in production. Indirect production costs

such as utilities and indirect labor related to production such as assembling,

shipping and handling for raw material costs are also included in the cost of

inventories.

- 9 -

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2009

(Unaudited)

The Company reviews its inventory periodically for possible obsolete goods and cost in excess of net realizable value to determine if any reserves are necessary. As of June 30, 2009 and December 31, 2008, the Company has determined that no reserve is necessary.

Plant and Equipment

Plant and equipment are stated at cost less accumulated depreciation. Depreciation is computed using the straight-line method over the estimated useful lives of the assets with 5% residual value.

| Estimated useful lives of the assets are as follows: | |

| Estimated Useful Life | |

| Buildings and improvement | 30 years |

| Machinery and equipment | 10 years |

| Furniture, fixtures and office equipment | 5-10 years |

Construction in progress represents the costs incurred in connection with the construction of buildings, new additions, and capitalized interest incurred in connection with the Company's plant facilities. In accordance with the provisions of FAS 34, “Capitalization of Interest Cost”, interest incurred on borrowings is capitalized to the extent that borrowings do not exceed construction in progress. The credit is a reduction of interest expense. No depreciation is provided for construction in progress until such time as the assets are completed and placed into service. Maintenance, repairs and minor renewals are charged directly to expenses as incurred. Major additions and betterment to property and equipment are capitalized.

The Company periodically evaluates the carrying value of long-lived assets in accordance with FAS 144. “Accounting for the Impairment or Disposal of Long-Lived Assets.” When estimated cash flows generated by those assets are less than the carrying amounts of the asset, the Company recognizes an impairment loss. Based on its review, the Company believes that, as of June 30, 2009 and December 31, 2008, there were no impairments of its long-lived assets.

Investment in Unconsolidated Affiliate

Equity method investments are recorded at original cost and adjusted to recognize the Company's proportionate share of the investee's net income or losses and additional contributions made and distributions received. The Company recognizes a loss if it is determined that other than temporary decline in the value of the investment exists. Subsidiaries in which the Company has the ability to exercise significant influence, but does not have a controlling interest is accounted for using the equity method. Significant influence is generally considered to exist when the Company has an ownership interest in the voting stock between 20% and 50%, and other factors, such as representation on the Board of Directors, voting rights and the impact of commercial arrangements, are considered in determining whether the equity method of accounting is appropriate. The Company accounts for investments with ownership less than 20% using cost method.

Intangible Assets

Intangible assets are stated at cost (estimated fair value upon contribution or acquisition), less accumulated amortization. Amortization expense is recognized on the straight-line basis over the estimated useful lives of the assets as follows:

| Intangible assets | Estimated useful lives | |

| Land use rights | 50 years | |

| Permits and licenses | 5-10 years | |

| Blood donor network | 10 years | |

| Software | 3.8 years | |

| Good Manufacturing Practice certificate | 5-10 years | |

| Long-term customer-relationship intangible assets | 4 years |

- 10 -

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2009

(Unaudited)

All land in the PRC is owned by the government; however, the government grants “land use rights.” The Company has obtained rights to use various parcels of land for 50 years. The Company amortizes the cost of the land use rights over their useful life using the straight-line method.

Other intangible assets represent permits, licenses, blood donor network, software, Good Manufacturing Practice (“GMP”) certificate and long-term customer-relationship intangible assets. The Company amortized the cost of these intangible assets over their useful life using the straight-line method.

Intangible assets of the Company are reviewed at least annually or more often if circumstances dictate, to determine whether their carrying value has become impaired. The Company considers assets to be impaired if the carrying value exceeds the future projected cash flows from related operations. The Company also re-evaluates the years of amortization to determine whether subsequent events and circumstances warrant revised estimates of useful lives. As of June 30, 2009, the Company expects these assets to be fully recoverable.

Revenues

The Company's revenues are primarily derived from the manufacture and sale of human blood products. The Company's revenues by significant types of product for the three months and six months ended June 30, 2009 and 2008 are as follows:

| Three months ended | Six months ended | |||||||||||

| June 30, | June 30, | |||||||||||

| (Unaudited) | (Unaudited) | |||||||||||

| 2009 | 2008 | 2009 | 2008 | |||||||||

| Human Albumin – 20%/10ml, 20%/25ml and 20%/50ml | $ | 15,741,932 | $ | 6,888,417 | $ | 28,093,631 | $ | 11,413,320 | ||||

| Human Hepatitis B Immunoglobulin | 1,234,060 | 1,379,582 | 1,294,159 | 1,587,537 | ||||||||

| Human Immunoglobulin for Intravenous | 14,163,778 | 2,071,618 | 19,536,280 | 3,721,627 | ||||||||

| Human Rabies Immunoglobulin | 926,240 | 428,468 | 2,555,251 | 1,643,392 | ||||||||

| Human Tetanus Immunoglobulin | 342,924 | 1,025,079 | 1,372,610 | 1,137,328 | ||||||||

| Human Immunoglobulin | 322,063 | - | 535,940 |

- |

||||||||

| Others | 450,548 | 132,678 | 942,272 | 271,645 | ||||||||

| Totals | $ | 33,181,545 | $ | 11,925,842 | $ | 54,330,143 | $ | 19,774,849 | ||||

The Company is engaged in sale of human blood products to customers in China and India. The amount sold in India was less than 10% of total sales for the three and six months ended June 30, 2009.

Research and Development Costs

Research and

development costs are expensed as incurred.

Retirement and Other Post

Retirement Benefits

Contributions to retirement schemes (which are defined contribution plans) are charged to the statement of operations as and when the related employee service is provided.

Product Liability

The Company's products are covered by product liability insurance of approximately $2,930,000 (RMB 20,000,000). As of June 30, 2009 and December 31, 2008, no claim on the insurance policy was filed. However, there are two pre-existing potential claims against Qianfeng's products, which are still in the court proceedings as explained in the legal proceeding section below.

- 11 -

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2009

(Unaudited)

Government Grants

The Company's subsidiary, Shandong Taibang, is entitled to receive grants from the Tai'an municipal government due to its operation in the high and new technology business sector. For the three and six months ended June 30, 2009 and 2008, no non-refundable grants were received from the Tai'an municipal government. Grants received from the Tai'an municipal government can be used for enterprise development and technology innovation purposes.

Income Taxes

The Company accounts for income taxes under FAS 109, “Accounting for Income Taxes” and FIN 48, “Accounting for Uncertainty in Income Taxes – an interpretation of FASB Statement No. 109”, FAS 109 requires the recognition of deferred income tax liabilities and assets for the expected future tax consequences of temporary differences between income tax basis and financial reporting basis of assets and liabilities. Provision for income taxes consist of taxes currently due plus deferred taxes. Since the Company had no operations within the United States there is no provision for US taxes and there are no deferred tax amounts at June 30, 2009 and 2008. FIN 48 clarifies the accounting for uncertainty in tax positions taken or expected to be taken in a return. FIN 48 provides guidance on the measurement, recognition, classification and disclosure of tax positions, along with accounting for the related interest and penalties.

The charge for taxation is based on the results for the year as adjusted for items, which are non-assessable or disallowed. It is calculated using tax rates that have been enacted or substantively enacted by the balance sheet date.

Deferred tax is accounted for using the balance sheet liability method in respect of temporary differences arising from differences between the carrying amount of assets and liabilities in the financial statements and the corresponding tax basis used in the computation of assessable tax profit. In principle, deferred tax liabilities are recognized for all taxable temporary differences, and deferred tax assets are recognized to the extent that it is probably that taxable profit will be available against which deductible temporary differences can be utilized.

Deferred tax is calculated using tax rates that are expected to apply to the period when the asset is realized or the liability is settled. Deferred tax is charged or credited in the income statement, except when it is related to items credited or charged directly to equity, in which case the deferred tax is also dealt with in equity.

Deferred tax assets and liabilities are offset when they related to income taxes levied by the same taxation authority and the Company intends to settle its current tax assets and liabilities on a net basis.

Value Added Tax

Enterprises or individuals, who sell products, engage in repair and maintenance or import and export goods in the PRC are subject to a VAT in accordance with Chinese laws. The VAT rate applicable to the Company is 6% of the gross sales price. Products distributed by Shandong Medical and plasma raw material inter-company sales from Puding Plasma Company to Qianfeng are subjected to a 17% VAT. No credit is available for VAT paid on purchases.

Stock-based Compensation

The Company accounts and reports stock-based compensation pursuant to FAS 123R “Accounting for Stock-Based Compensation”, which defines a fair-value-based method of accounting for stock based employee compensation and transactions in which an entity issues its equity instruments to acquire goods and services from non-employees. Stock compensation for stock granted to non-employees has been determined in accordance with FAS 123R and the EITF 96-18, "Accounting for Equity Instruments that are issued to Other than Employees for Acquiring, or in Conjunction with Selling Goods or Services", as the fair value of the consideration received or the fair value of equity instruments issued, whichever is more reliably measured.

Noncontrolling Interest

Effective January 1, 2009, the Company adopted FAS 160, “Noncontrolling Interests in Consolidated Financial Statements - an amendment of Accounting Research Bulletin No. 51” Certain provisions of this statement are required to be adopted

retrospectively for all periods presented. Such provisions include a requirement that the carrying value of noncontrolling interests (previously referred to as minority interests) be removed from the mezzanine section of the balance sheet and

reclassified as equity. Further, as a result of adoption on FAS 160, net income attributable to noncontrolling interests is now excluded from the determination of consolidated net income. In addition, foreign currency translation adjustment is

allocated between controlling and noncontrolling interests.

- 12 -

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2009

(Unaudited)

Recently Issued Accounting Pronouncements

In January 2009, the FASB issued FSP EITF 99-20-1, “Amendments to the Impairment Guidance of EITF Issue No. 99-20, and EITF 99-20, Recognition of Interest Income and Impairment on Purchased and Retained Beneficial Interests in Securitized Financial Assets”. FSP EITF 99-20-1 changes the impairment model included within EITF 99-20 to be more consistent with the impairment model of SFAS 115. FSP EITF 99-20-1 achieves this by amending the impairment model in EITF 99-20 to remove its exclusive reliance on “market participant” estimates of future cash flows used in determining fair value. Changing the cash flows used to analyze other-than-temporary impairment from the “market participant” view to a holder's estimate of whether there has been a “probable” adverse change in estimated cash flows allows companies to apply reasonable judgment in assessing whether an other-than-temporary impairment has occurred. The adoption of FSP EITF 99-20-1 did not have a material impact on the Company's consolidated financial statements because all of the Company's investments in debt securities are classified as trading securities.

In April 2009, the FASB issued FSP FAS 157-4, “Determining Fair Value When the Volume and Level of Activity for the Asset or Liability Have Significantly Decreased and Identifying Transactions That Are Not Orderly”. FSP FAS 157-4 amends FAS 157 and provides additional guidance for estimating fair value in accordance with SFAS 157 when the volume and level of activity for the asset or liability have significantly decreased and also includes guidance on identifying circumstances that indicate a transaction is not orderly for fair value measurements. This FSP shall be applied prospectively with retrospective application not permitted. The adoption of FSP FAS 157-4 did not have a material impact on the Company's consolidated financial statements.

In April 2009, the FASB issued FSP FAS 115-2 and FAS 124-2. This FSP amends FAS 115, “Accounting for Certain Investments in Debt and Equity Securities,” FAS 124, “Accounting for Certain Investments Held by Not-for-Profit Organizations,” and EITF 99-20, “Recognition of Interest Income and Impairment on Purchased Beneficial Interests and Beneficial Interests That Continue to Be Held by a Transferor in Securitized Financial Assets,” to make the other-than-temporary impairments guidance more operational and to improve the presentation of other-than-temporary impairments in the financial statements. This FSP will replace the existing requirement that the entity's management assert it has both the intent and ability to hold an impaired debt security until recovery with a requirement that management assert it does not have the intent to sell the security, and it is more likely than not it will not have to sell the security before recovery of its cost basis. This FSP provides increased disclosure about the credit and noncredit components of impaired debt securities that are not expected to be sold and also requires increased and more frequent disclosures regarding expected cash flows, credit losses, and an aging of securities with unrealized losses. Although this FSP does not result in a change in the carrying amount of debt securities, it does require that the portion of an other-than-temporary impairment not related to a credit loss for a held-to-maturity security be recognized in a new category of other comprehensive income and be amortized over the remaining life of the debt security as an increase in the carrying value of the security. The adoption of FSP FAS 115-2 and FAS 124-2 did not have a material impact on the Company's consolidated financial statements.

In April 2009, the FASB issued FSP FAS 107-1 and APB 28-1. This FSP amends SFAS 107 to require disclosures about fair value of financial instruments not measured on the balance sheet at fair value in interim financial statements as well as in annual financial statements. Prior to this FSP, fair values for these assets and liabilities were only disclosed annually. This FSP applies to all financial instruments within the scope of SFAS 107 and requires all entities to disclose the method(s) and significant assumptions used to estimate the fair value of financial instruments. The adoption of FSP FAS 107-1 and APB 28-1 did not have a material impact on the Company's consolidated financial statements.

- 13 -

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2009

(Unaudited)

In May 2009, the FASB issued Statement of Financial Accounting Standards No. 165, “Subsequent Events,” (FAS 165, Subsequent Events [ASC 855-10-05], which provides guidance to establish general standards of accounting for and disclosures of events that occur after the balance sheet date but before financial statements are issued or are available to be issued. FAS 165 also requires entities to disclose the date through which subsequent events were evaluated as well as the rationale for why that date was selected. FAS 165 is effective for interim and annual periods ending after June 15, 2009, and accordingly, the Company adopted this Standard during the second quarter of 2009. FAS 165 requires that public entities evaluate subsequent events through the date that the financial statements are issued. The Company has evaluated subsequent events through the time of filing these consolidated financial statements with the SEC on August 14, 2009.

In June 2009, the FASB issued Statement No. 166, Accounting for Transfers of Financial Assets – an amendment of FASB No. 140 (“FAS 140”), Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities (“FAS 166”) [ASC 860]. FAS 166 amends the criteria for a transfer of a financial asset to be accounted for as a sale, redefines a participating interest for transfers of portions of financial assets, eliminates the qualifying special-purpose entity concept and provides for new disclosures. FAS 166 is effective for the Company beginning in 2010. Should the Company's accounts receivable securitization programs not qualify for sale treatment under the revised rules, future securitization transactions entered into on or after January 1, 2010 would be classified as debt and the related cash flows would be reflected as a financing activity. The Company is currently assessing the impact of the standard on its securitization programs.

In June 2009, the FASB issued Statement of Financial Accounting Standards No. 167, Amendments to FASB Interpretation No. 46(R) (“FAS 167”) [ASC 810-10], which modifies how a company determines when an entity that is insufficiently capitalized or is not controlled through voting (or similar rights) should be consolidated. FAS 167 clarifies that the determination of whether a company is required to consolidate an entity is based on, among other things, an entity's purpose and design and a company's ability to direct the activities of the entity that most significantly impact the entity's economic performance. FAS 167 requires an ongoing reassessment of whether a company is the primary beneficiary of a variable interest entity. FAS 167 also requires additional disclosures about a company's involvement in variable interest entities and any significant changes in risk exposure due to that involvement. FAS 167 is effective for fiscal years beginning after November 15, 2009. The Company is currently assessing the impact of the standard on its securitization programs.

In June 2009, the FASB issued Statement of Financial Accounting Standards No. 168, The FASB Accounting Standards Codification™ and the Hierarchy of Generally Accepted Accounting Principles a Replacement of FASB Statement No. 162 (“FAS 168”). This Standard establishes the FASB Accounting Standards Codification™ (the “Codification”) as the source of authoritative accounting principles recognized by the FASB to be applied by nongovernmental entities in the preparation of financial statements in conformity with U.S. GAAP. The Codification does not change current U.S. GAAP, but is intended to simplify user access to all authoritative U.S. GAAP by providing all the authoritative literature related to a particular topic in one place. The Codification is effective for interim and annual periods ending after September 15, 2009, and as of the effective date, all existing accounting standard documents will be superseded. The Codification is effective for the Company in the third quarter of 2009, and accordingly, the Company's Quarterly Report on Form 10-Q for the quarter ending September 30, 2009 and all subsequent public filings will reference the Codification as the sole source of authoritative literature.

Reclassifications

Certain prior period amounts have been reclassified to conform to the current period presentation. These reclassifications have no effect on net income or cash flows.

Note 4 – Related party transactions

The material related party transactions undertaken by the Company with related parties as of June 30, 2009 and December 31, 2008 are presented as follows:

- 14 -

| CHINA BIOLOGIC PRODUCTS INC. AND

SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS June 30, 2009 (Unaudited) | ||||||||||

| June 30, 2009 | December 31, | |||||||||

| Assets | Purpose | (unaudited) | 2008 | |||||||

| Accounts receivable – related party(1) | Processing fees | $ | 795,080 | $ | - | |||||

| Other receivable – related parties(2) | Advances | 797,138 | - | |||||||

| June 30, 2009 | December 31, | |||||||||

| Liabilities | Purpose | (unaudited) | 2008 | |||||||

| Short term loans – holder of noncontrolling interest(3) | Loan | $ | 4,424,723 | $ | 773,277 | |||||

| Other payable – related parties(4) | Loan & contribution | 3,082,731 | - | |||||||

| Accrued interest – holder of noncontrolling interest(3) | Interest payable | 911,084 | - | |||||||

(1) Qianfeng provides processing services for Guizhou Eakan, one of the Qianfeng's non-controlling shareholders. As of June 30, 2009, Guizhou Eakan owes Qianfeng processing fees in an amount of $795,080. This balance will be paid in form of cash during the third quarter of 2009 or offset with future dividends declaration and distribution. However, the next dividend declaration date has not been set.

(2) On November 13, 2008, Qianfeng advanced its noncontrolling shareholders Guizhou Eakan and Guizhou Jie'an approximately $1,172,000 (RMB 8,000,000) and $1,391,750 (RMB 9,500,000), respectively, as shareholders loans according to the shareholders resolution of November 10, 2008. The loans bear interest at the prevailing bank lending rate in PRC and payable each calendar quarterly, which is 5.31% and matures in one year. The loans were partially offset with the dividends declared on March 10, 2009 with outstanding balances of $199,426 and $597,712 due from Guizhou Eakan and Guizhou Jie'an, respectively. These balances will be offset with future dividends declaration and distribution. However, the next dividend declaration date has not been set.

(3) As of June 30, 2009 and December 31, 2008, the Company borrowed an aggregate of $772,223 and $773,277, respectively, from its noncontrolling interest shareholder, Shandong Institute, for working capital purposes. The Company is required to repay the loan in cash due by August 2009, with an annual interest rate of 6%.

On April 6, 2009, Logic Express entered into an equity transfer and entrustment agreement, or Entrustment Agreement, among Logic Express, Shandong Taibang, and the Shandong Institute of Biological Products, or the Shandong Institute, the holder of the noncontrolling interests in Shandong Taibang, pursuant to which, Logic Express agreed to permit Shandong Taibang and the Shandong Institute to participate in the indirect purchase of Qianfeng's equity interests. Under the terms of the Entrustment Agreement, Shandong Institute agreed to contribute 12.86% or $3,652,500 (RMB 25,000,000) of the Dalin purchase price. Logic express is obligated to repay to the Shandong Institute their investment amount on or before April 6th, 2010, along with their pro rata share, based on their percentage of the Dalin purchase price contributed, of any distribution on the indirect equity investment in Qianfeng payable to Logic Express during 2009. The accrued interest – holder of noncontrolling interest amounted to $911,084 represents the pro rata share of equity investment income pursuant of Entrustment Agreement for the six month period ended June 30, 2009.

(4) Qianfeng has payables to Guizhou Eakan Investing Corp. in the amount of approximately $2,119,878 (RMB14,470,160). Guizhou Eakan Investing Corp. is one of the shareholders of Guizhou Eakan, one of the Qianfeng's minority shareholders. The Company borrowed the amount for working capital purposes. The balance is due on demand in the form of cash.

Qianfeng has payables to Guizhou Jie'an, a holder of noncontrolling interest, in amount of approximately $962,853 (RMB 6,569,840). In 2007, Qianfeng received additional contributions from Guizhou Jie'an in the amount of $962,853 to maintain Jie'an ownership interest in the Company at 9%. However, due to legal dispute among Shareholders over Raising Additional Capital as stated in legal proceeding section, commitment and contingent liabilities, the money may be returned to Jie'an.

- 15 -

| CHINA BIOLOGIC PRODUCTS INC. AND

SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS June 30, 2009 (Unaudited) | ||||||

| Note 5 – Accounts receivable | ||||||

| Trade accounts receivable consist of the following: | ||||||

| June 30, 2009 | December 31, 2008 | |||||

| (unaudited) | ||||||

| Trade accounts receivable | $ | 2,254,697 | $ | 1,581,139 | ||

| Less: Allowance for doubtful accounts | (1,274,001 | ) | (1,268,052 | ) | ||

| Total | $ | 980,696 | $ | 313,087 | ||