Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - ARIBA INC | Financial_Report.xls |

| 10-Q - FORM 10-Q - ARIBA INC | d10q.htm |

| EX-31.1 - SECTION 302 CEO CERTIFICATION - ARIBA INC | dex311.htm |

| EX-32.1 - SECTION 906 CEO & CFO CERTIFICATION - ARIBA INC | dex321.htm |

| EX-31.2 - SECTION 302 CFO CERTIFICATION - ARIBA INC | dex312.htm |

| EX-10.51 - FOURTH AMENDMENT TO SUBLEASE - ARIBA INC | dex1051.htm |

Exhibit 10.50

LEASE AGREEMENT BETWEEN

W2005 RPS REALTY, L.L.C.,

AS LANDLORD, AND

ARIBA, INC.,

AS TENANT

DATED JANUARY 6, 2011

SUNNYVALE, CALIFORNIA

BASIC LEASE INFORMATION

| Lease Date: |

January 6, 2011 | |

| Landlord: |

W2005 RPS REALTY, L.L.C., a Delaware limited liability company | |

| Tenant: |

ARIBA, INC., a Delaware corporation | |

| Premises: |

That certain building containing 86,000 rentable square feet, whose street address is 910 Hermosa Court, Sunnyvale, California (the “Building”). The Premises are shown as cross-hatched on the plan attached to the Lease as Exhibit A. The land on which the Building is located (the “Land”) is described on Exhibit B. The term “Project” shall collectively refer to the Building, the Land and the driveways, parking facilities, and similar improvements and easements associated with the foregoing or the operation thereof. | |

| Term: |

126 full calendar months, plus any partial month from the Commencement Date to the end of the month in which the Commencement Date falls, starting on the Commencement Date and ending at 5:00 p.m. local time on the last day of the 126th full calendar month following the Commencement Date, subject to adjustment and earlier termination as provided in the Lease. | |

| Commencement Date: |

The earlier of (a) the date on which Tenant occupies any portion of the Premises and begins conducting business therein (it being acknowledged that Tenant’s mere performance of the Work (as defined in Exhibit D) shall not be deemed to be conducting business in the Premises), or (b) May 15, 2011. | |

| Basic Rent |

Basic Rent shall be the following amounts for the following periods of time: | |

| Lease Month |

Monthly Basic Rent Rate Per Rentable Square Foot |

Monthly Basic Rent | ||

| 1 - 6 |

$0 ($1.40 abated) | $0 (120,400.00 abated) | ||

| 7 - 12 |

$1.40 | $120,400.00 | ||

| 13 - 24 |

$1.45 | $124,700.00 | ||

| 25 - 36 |

$1.50 | $129,000.00 | ||

| 37 - 48 |

$1.55 | $133,300.00 | ||

| 49 - 60 |

$1.60 | $137,600.00 | ||

| 61 - 72 |

$1.65 | $141,900.00 | ||

| 73 - 84 |

$1.70 | $146,200.00 | ||

| 85 - 96 |

$1.75 | $150,500.00 | ||

| 97- 108 |

$1.80 | $154,800.00 | ||

| 109 - 120 |

$1.85 | $159,100.00 | ||

| 121 - 126 |

$1.90 | $163,400.00 |

-i-

| As used herein, the term “Lease Month” means each calendar month during the Term (and if the Commencement Date does not occur on the first day of a calendar month, the period from the Commencement Date to the first day of the next calendar month shall be included in the seventh Lease Month for purposes of determining the duration of the Term and the monthly Basic Rent rate applicable for such partial month).

The abatement of Basic Rent provided for in the Lease is conditioned upon Tenant’s full and timely performance of all of its obligations under the Lease. If at any time during the Term, the Lease is terminated by Landlord due to a default by Tenant under the Lease (after the expiration of any applicable notice and cure period), then the abatement of Basic Rent provided for in the Lease shall immediately become void, and Tenant shall promptly pay to Landlord, in addition to all other amounts due to Landlord under the Lease, an amount equal to the then unamortized portion of all Basic Rent herein abated, as amortized on a straight-line basis over the initial Term of the Lease. | ||||

| Security Deposit: |

$163,400.00. | |||

| Rent: |

Basic Rent, Tenant’s Proportionate Share of Taxes and Additional Rent, and all other sums that Tenant may owe to Landlord or otherwise be required to pay under the Lease. | |||

| Permitted Use: |

General office, research and development, laboratory, warehouse, sales and marketing, subject to and in conformity with all applicable governmental requirements. | |||

| Tenant’s Proportionate Share: |

100% of the Building. 18.34% of the Complex (as hereinafter defined), which is the percentage obtained by dividing (a) the number of rentable square feet in the Premises as stated above by (b) 468,953 rentable square feet in the Complex. Landlord and Tenant stipulate that the number of rentable square feet in the Premises and in the Complex set forth above is conclusive and shall be binding upon them. Notwithstanding the foregoing, if the number of buildings in the Complex is changed, then the number of rentable square feet in the Complex and Tenant’s Proportionate Share of the Complex shall be appropriately adjusted using the same calculation method used to calculate Tenant’s Proportionate Share above. Landlord shall provide written notice of the same along with the calculation for Tenant’s Proportionate Share of the Complex. | |||

| Initial Liability Insurance Amount: |

$3,000,000 | |||

| Tenant’s Address: |

Prior to Commencement Date:

Ariba, Inc. 807 11th Avenue Sunnyvale, California 94089 Attention: Legal Department Telephone: 650-390-1000 Telecopy: 650-390-1100

With a copy to:

Global Real Estate Manager Ariba, Inc. 610 Sixth Avenue Pittsburgh, Pennsylvania 15222 Telephone: 412-297-8310 Telecopy: 412-297-7989 |

Following Commencement Date:

Ariba, Inc. 910 Hermosa Court Sunnyvale, California 94085 Attention: Legal Department Telephone: 650-390-1000 Telecopy: 650-390-1100

With a copy to:

Global Real Estate Manager Ariba, Inc. 610 Sixth Avenue Pittsburgh, Pennsylvania 15222 Telephone: 412-297-8310 Telecopy: 412-297-7989 | ||

-ii-

| Landlord’s Address: | For all Notices:

W2005 RPS Realty, L.L.C. c/o CB Richard Ellis 225 W. Santa Clara Street, Suite 1050 San Jose, California 95113 Attention: Property Manager Telephone: 408-453-7437 Telecopy: 408-437-3170 |

With a copy to:

W2005 RPS Realty, L.L.C. c/o Archon Group, L.P. 6011 Connection Drive Irving, Texas 75039 Attention: General Counsel – Central Research Park Telephone: 972-368-2200 Telecopy: 972-368-3199 |

The foregoing Basic Lease Information is incorporated into and made a part of the Lease identified above. If any conflict exists between any Basic Lease Information and the Lease, then the Lease shall control.

| LANDLORD: | W2005 RPS Realty, L.L.C., a Delaware limited liability company | |||||

| By: | Archon Group, L.P., as Asset Manager | |||||

| By: | /s/ Nancy M. Haag | |||||

| Name: | Nancy M. Haag | |||||

| Title: | Vice-President | |||||

| TENANT: | Ariba, Inc., a Delaware corporation | |||||

| By: | /s/ Chris Cavanaugh | |||||

| Name: | Chris Cavanaugh | |||||

| Title: | VP & Corporate Controller | |||||

-iii-

TABLE OF CONTENTS

| Page No. | ||||||

| 1. | DEFINITIONS AND BASIC PROVISIONS | 1 | ||||

| 2. | LEASE GRANT | 1 | ||||

| 3. | TENDER OF POSSESSION | 1 | ||||

| 4. | RENT | 2 | ||||

| (a) Payment |

2 | |||||

| (b) Operating Costs; Taxes |

2 | |||||

| 5. | Delinquent Payment; Handling Charges | 5 | ||||

| 6. | Security Deposit | 6 | ||||

| 7. | Landlord’s Obligations | 6 | ||||

| (a) Landlord’s Maintenance Obligations |

6 | |||||

| (b) Landlord’s Right to Perform Tenant’s Obligations |

6 | |||||

| 8. | Improvements; Alterations; Repairs; Maintenance | 6 | ||||

| (a) Improvements; Alterations |

6 | |||||

| (b) Repairs; Maintenance |

7 | |||||

| (c) Performance of Work |

7 | |||||

| (d) Mechanic’s Liens |

8 | |||||

| (e) Utilities |

8 | |||||

| 9. | Use | 9 | ||||

| 10. | Assignment and Subletting | 9 | ||||

| (a) Transfers |

9 | |||||

| (b) Consent Standards |

9 | |||||

| (c) Request for Consent |

9 | |||||

| (d) Conditions to Consent |

10 | |||||

| (e) Attornment by Subtenants |

10 | |||||

| (f) Intentionally Omitted |

10 | |||||

| (g) Additional Compensation |

10 | |||||

| (h) Permitted Transfers |

10 | |||||

| 11. | Insurance; Waivers; Subrogation; Indemnity | 11 | ||||

| (a) Tenant’s Insurance |

11 | |||||

| (b) Landlord’s Insurance |

12 | |||||

| (c) No Subrogation; Waiver of Property Claims |

12 | |||||

| (d) Indemnity |

12 | |||||

| 12. | Subordination; Attornment; Notice to Landlord’s Mortgagee | 13 | ||||

| (a) Subordination |

13 | |||||

| (b) Attornment |

13 | |||||

| (c) Notice to Landlord’s Mortgagee |

13 | |||||

| (d) Landlord’s Mortgagee’s Protection Provisions |

13 | |||||

| 13. | Rules and Regulations | 13 | ||||

| 14. | Condemnation | 14 | ||||

| (a) Total Taking |

14 | |||||

| (b) Partial Taking - Tenant’s Rights |

14 | |||||

| (c) Partial Taking - Landlord’s Rights |

14 | |||||

| (d) Temporary Taking |

14 | |||||

| (e) Award |

14 | |||||

-iv-

| 15. | Fire or Other Casualty | 14 | ||||

| (a) Repair Estimate |

14 | |||||

| (b) Tenant’s Rights |

14 | |||||

| (c) Landlord’s Rights |

15 | |||||

| (d) Repair Obligation |

15 | |||||

| (e) Waiver of Statutory Provisions |

15 | |||||

| (f) Abatement of Rent |

15 | |||||

| 16. |

Personal Property Taxes | 15 | ||||

| 17. |

Events of Default | 16 | ||||

| (a) Payment Default |

16 | |||||

| (b) Abandonment |

16 | |||||

| (c) Estoppel |

16 | |||||

| (d) Insurance |

16 | |||||

| (e) Mechanic’s Liens |

16 | |||||

| (f) Other Defaults |

16 | |||||

| (g) Insolvency |

16 | |||||

| 18. |

Remedies | 16 | ||||

| (a) Termination of Lease |

16 | |||||

| (b) Enforcement of Lease |

17 | |||||

| (c) Sublessees of Tenant |

17 | |||||

| (d) Efforts to Relet |

17 | |||||

| 19. |

Payment by Tenant; Non-Waiver; Cumulative Remedies | 17 | ||||

| (a) Payment by Tenant |

17 | |||||

| (b) No Waiver |

18 | |||||

| (c) Cumulative Remedies |

18 | |||||

| 20. |

Landlord Default | 18 | ||||

| 21. |

Surrender of Premises | 18 | ||||

| 22. |

Holding Over | 19 | ||||

| 23. |

Certain Rights Reserved by Landlord | 19 | ||||

| (a) Building Operations |

19 | |||||

| (b) Security |

19 | |||||

| (c) Prospective Purchasers and Lenders |

19 | |||||

| (d) Prospective Tenants |

19 | |||||

| 24. |

Intentionally Omitted | 19 | ||||

| 25. |

Miscellaneous | 19 | ||||

| (a) Landlord Transfer |

19 | |||||

| (b) Landlord’s Liability |

19 | |||||

| (c) Force Majeure |

20 | |||||

| (d) Brokerage |

20 | |||||

| (e) Estoppel Certificates |

20 | |||||

| (f) Notices |

20 | |||||

| (g) Separability |

20 | |||||

| (h) Amendments; Binding Effect; No Electronic Records |

20 | |||||

| (i) Quiet Enjoyment |

21 | |||||

| (j) No Merger |

21 | |||||

| (k) No Offer |

21 | |||||

| (l) Entire Agreement |

21 | |||||

| (m) Waiver of Jury Trial |

21 | |||||

| (n) Governing Law |

21 | |||||

| (o) Recording |

21 | |||||

| (p) Water or Mold Notification |

21 | |||||

-v-

| (q) Joint and Several Liability |

21 | |||||

| (r) Financial Reports |

21 | |||||

| (s) Landlord’s Fees |

22 | |||||

| (t) Attorneys’ Fees |

22 | |||||

| (u) Telecommunications |

22 | |||||

| (v) Confidentiality |

22 | |||||

| (w) Authority |

22 | |||||

| (x) Hazardous Materials |

22 | |||||

| (y) List of Exhibits |

23 | |||||

| (z) Prohibited Persons and Transactions |

23 | |||||

| (aa) Parking |

23 | |||||

| (bb) Reasonableness |

24 | |||||

| 26. |

Renewal Option | 24 | ||||

| 27. |

Right to Terminate | 25 | ||||

| 28. |

Generator | 25 | ||||

| 29. |

Existing Improvements | 26 | ||||

-vi-

LIST OF DEFINED TERMS

| Page No. | ||||

| Additional Rent |

2 | |||

| Affiliate |

1 | |||

| Basic Lease Information |

1 | |||

| Basic Rent |

i | |||

| Building |

i | |||

| Building’s Structure |

1 | |||

| Building’s Systems |

1 | |||

| Casualty |

14 | |||

| Commencement Date |

i | |||

| Complex |

3 | |||

| Controllable Excess |

5 | |||

| Controllable Operating Costs |

5 | |||

| Damage Notice |

14 | |||

| Default Rate |

5 | |||

| Delivery Date |

1 | |||

| Delivery Obligation |

1 | |||

| Event of Default |

16 | |||

| GAAP |

11 | |||

| Generator Installation |

25 | |||

| Hazardous Materials |

22 | |||

| including |

1 | |||

| Initial Liability Insurance Amount |

ii | |||

| Land |

i | |||

| Landlord |

1 | |||

| Landlord Default |

18 | |||

| Landlord’s Mortgagee |

13 | |||

| Law |

1 | |||

| Laws |

1 | |||

| Lease |

1 | |||

| Lease Month |

ii | |||

| Loss |

12 | |||

| Monthly Amortization Rent |

2 | |||

| Mortgage |

13 | |||

| OFAC |

23 | |||

| Operating Costs |

2 | |||

| Operating Costs and Tax Statement |

4 | |||

| Outside Execution Date |

1 | |||

| Parking Area |

23 | |||

| Permitted Transfer |

10 | |||

| Permitted Transferee |

10 | |||

| Permitted Use |

ii | |||

| Premises |

i | |||

| Prevailing Rental Rate |

24 | |||

| Primary Lease |

13 | |||

| Project |

i | |||

| Rent |

ii | |||

| Repair Period |

14 | |||

| Security Deposit |

ii | |||

| Taking |

14 | |||

| Tangible Net Worth |

11 | |||

| Taxes |

4 | |||

| Telecommunications Services |

22 | |||

-vii-

| Tenant |

1 | |||

| Tenant Party |

1 | |||

| Tenant’s Off-Premises Equipment |

1 | |||

| Tenant’s Proportionate Share |

ii | |||

| Term |

i | |||

| Termination Date |

25 | |||

| Termination Delivery Date |

1 | |||

| Termination Fee |

25 | |||

| Termination Notice |

25 | |||

| Termination Outside Date |

1 | |||

| Transfer |

9 |

-viii-

LEASE

This Lease Agreement (this “Lease”) is entered into as of January 6, 2011, between W2005 RPS REALTY, L.L.C., a Delaware limited liability company (“Landlord”), and ARIBA, INC., a Delaware corporation (“Tenant”).

1. Definitions and Basic Provisions. The definitions and basic provisions set forth in the Basic Lease Information (the “Basic Lease Information”) executed by Landlord and Tenant contemporaneously herewith are incorporated herein by reference for all purposes. Additionally, the following terms shall have the following meanings when used in this Lease: “Affiliate” means any person or entity which, directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with the party in question; “Building’s Structure” means the Building’s exterior walls, roof structure, elevator shafts, footings, foundations, structural portions of load-bearing walls, structural floors and subfloors, and structural columns and beams; “Building’s Systems” means the Building’s HVAC, life-safety, plumbing, electrical, and mechanical systems (including any elevators); “including” means including, without limitation; “Laws” means all federal, state, and local laws, ordinances, rules and regulations, all court orders, governmental directives, and governmental orders and all interpretations of the foregoing, and all restrictive covenants affecting the Project, and “Law” means any of the foregoing; “Tenant’s Off-Premises Equipment” means any of Tenant’s equipment or other property that may be located on or about the Project (other than inside the Premises); and “Tenant Party” means any of the following persons: Tenant; any assignees claiming by, through, or under Tenant; any subtenants claiming by, through, or under Tenant; and any of their respective agents, contractors, employees, licensees, guests and invitees.

2. Lease Grant. Subject to the terms of this Lease, Landlord leases to Tenant, and Tenant leases from Landlord, the Premises.

3. Tender of Possession. Landlord and Tenant presently anticipate that possession of the Premises will be tendered to Tenant in its current “as-is” condition following full execution and delivery of this Lease by Landlord and Tenant and Tenant’s delivery to Landlord of evidence of all insurance required by this Lease and Tenant’s payment to Landlord of the Security Deposit and Rent required to paid concurrently with execution of this Lease (the date of such tender of possession being referred to as the “Delivery Date”). Notwithstanding the foregoing, Landlord shall tender possession of the Premises with the Building Systems and the loading dock roll-up door in good working order and the roof in watertight condition (the “Delivery Obligation”). Within forty-five (45) days following the Delivery Date, Tenant shall inspect the Premises and shall deliver written notice (the “Non-Compliance Report”) to Landlord of any items which are not in compliance with the Delivery Obligation. If Tenant does not timely deliver the Non-Compliance Report, Tenant shall be deemed to have accepted the Premises in their “as-is” condition as of the date of such tender of possession. If Tenant timely delivers the Non-Compliance Report, then Landlord shall diligently commence and pursue the correction of any such items that are not in compliance with the Delivery Obligation. If (i) Landlord is unable to tender possession of the Premises to Tenant on or before the date (“Outside Execution Date”) which is ten (10) business days following Tenant’s execution and delivery of this Lease for reasons not caused by Tenant or force majeure, the date “May 15, 2011” in the definition of “Commencement Date” in the Basic Lease Information above shall be extended by one (1) day for each business day beyond the Outside Execution Date until possession of the Premises is tendered to Tenant provided that Tenant has executed and delivered this Lease to Landlord by January 24, 2011, and (ii) Landlord is unable to tender possession of the Premises to Tenant on or before February 28, 2011 (such date referred to as the “Termination Delivery Date”) for reasons not caused by Tenant or force majeure (with the provisions of Section 15 below to apply in the event of a Casualty), Tenant shall have the right, exercisable only within ten (10) days following such Termination Delivery Date, to terminate this Lease effective as of the date which is thirty (30) days following such Termination Delivery Date (the “Termination Outside Date”), by giving written notice of such termination to Landlord, provided however, if Tenant fails to timely give such termination notice or if Landlord tenders possession of the Premises on or before the Termination Outside Date, Tenant’s election to terminate shall be null and void and this Lease shall continue in full force and effect. Except as expressly set forth in this Lease, Landlord shall have no obligation to perform any work in the Premises or in connection therewith, and Landlord shall not be obligated to reimburse Tenant or provide an allowance for any costs related to the improvement of the Premises contemplated by this Lease except as expressly provided in Exhibit D attached hereto. Prior to occupying the Premises for the conduct of its business, Tenant shall execute and deliver to Landlord a letter substantially in the form of Exhibit E

-1-

hereto confirming (1) the Commencement Date and the expiration date of the initial Term, (2) that Tenant has accepted the Premises, and (3) that Landlord has performed all of its obligations, if any, with respect to the Premises; however, the failure of the parties to execute such letter shall not defer the Commencement Date or otherwise invalidate this Lease. Notwithstanding the foregoing, Landlord shall correct any latent defects in the Premises existing as of the Delivery Date which are not readily discernable, but are discovered and reported in writing to Landlord within two (2) months after the Commencement Date. Possession of the Premises by Tenant prior to the Commencement Date shall be subject to all of the provisions of this Lease excepting only those requiring the payment of Basic Rent, Additional Rent and Taxes (each as defined herein).

4. Rent.

(a) Payment. Tenant shall timely pay to Landlord Rent, without notice, demand, deduction or set off (except as otherwise expressly provided herein), by good and sufficient check drawn on a national banking association at Landlord’s address provided for in this Lease or as otherwise specified by Landlord. The obligations of Tenant to pay Basic Rent and other sums to Landlord and the obligations of Landlord under this Lease are independent obligations. Basic Rent, adjusted as herein provided, shall be payable monthly in advance. Basic Rent for the seventh full calendar month of the Term shall be payable contemporaneously with the execution of this Lease; thereafter, Basic Rent shall be payable on the first day of each month beginning on the first day of the eighth full calendar month of the Term. The monthly Basic Rent for any partial month at the beginning of the Term shall equal the product of 1/365 of the annual Basic Rent in effect during the partial month and the number of days in the partial month and shall be due on the Commencement Date. Payments of Basic Rent for any fractional calendar month at the end of the Term shall be similarly prorated. Tenant shall pay Additional Rent at the same time and in the same manner as Basic Rent. If Tenant elects to receive the “Additional Allowance” (as defined in Exhibit D), then commencing on the Commencement Date (or on the first day of the first full calendar month of the Term if the Commencement Date is other than the first day of a calendar month) and continuing on the first day of each calendar month through the Term of this Lease, Tenant shall also pay Monthly Amortization Rent (as hereinafter defined). As used herein, “Monthly Amortization Rent” shall mean the amount determined by amortizing the “Additional Allowance” (as defined in Exhibit D), if any, advanced by Landlord pursuant to the provisions of Exhibit D, with interest thereon at the rate of eight percent (8%) per annum, on a straight-line basis over the initial Term of this Lease. Additional Rent shall include Monthly Amortization Rent, provided however and notwithstanding anything to the contrary contained in this Lease, in no event shall there be any abatement of Monthly Amortization Rent notwithstanding any provision for the abatement of Basic Rent or Additional Rent. This Lease shall be a net Lease and Basic Rent shall be paid to Landlord absolutely net of all costs and expenses, provided that the foregoing language shall not affect the obligations of Landlord expressly set forth in this Lease.

(b) Operating Costs; Taxes

(1) During each calendar year or partial calendar year of the Term, Tenant shall pay to Landlord as “Additional Rent” Tenant’s Proportionate Share of Operating Costs (defined below). Landlord may make a good faith estimate of the Additional Rent to be due by Tenant for any calendar year or part thereof during the Term and contemporaneously with the execution of this Lease, Tenant shall pay to Landlord the estimated Additional Rent for the first calendar month of the Term, and Tenant shall pay to Landlord in advance on the first day of each calendar month following the Commencement Date an amount equal to the estimated Additional Rent for such calendar year or part thereof divided by the number of months therein. From time to time (but not more than two (2) times during any calendar year), Landlord may estimate and re-estimate the Additional Rent to be due by Tenant and deliver a copy of the estimate or re-estimate to Tenant. Thereafter, the monthly installments of Additional Rent payable by Tenant shall be appropriately adjusted in accordance with the estimations so that, by the end of the calendar year in question, Tenant shall have paid all of the Additional Rent as estimated by Landlord. Any amounts paid based on such an estimate shall be subject to adjustment as herein provided when actual Operating Costs are available for each calendar year.

(2) The term “Operating Costs” means all expenses and disbursements (subject to the limitations set forth below) that Landlord incurs in connection with the ownership, operation, and maintenance of the Project, determined in accordance with sound accounting principles consistently applied, including the following costs: (A) wages and salaries of all on-site employees at or below the

-2-

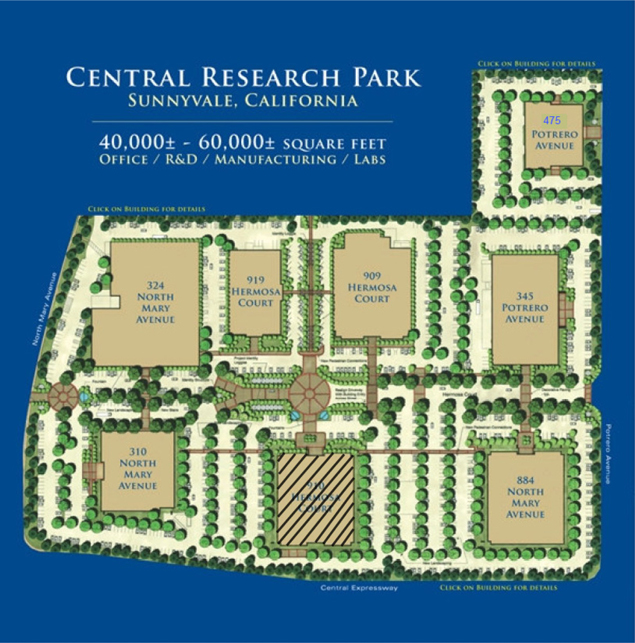

grade of senior building manager engaged in the operation, maintenance or security of the Project (together with Landlord’s reasonable allocation of expenses of off-site employees at or below the grade of senior building manager who perform a portion of their services in connection with the operation, maintenance or security of the Project), including taxes, insurance and benefits relating thereto; (B) all supplies and materials used in the operation, maintenance, repair, replacement, and security of the Project; (C) costs for improvements made to the Project which, although capital in nature, are expected to reduce the normal operating costs (including all utility costs) of the Project, as amortized using a commercially reasonable interest rate over the time period reasonably estimated by Landlord to recover the costs thereof taking into consideration the anticipated cost savings, as determined by Landlord using its good faith, commercially reasonable judgment, as well as capital improvements made in order to comply with any Law hereafter promulgated by any governmental authority or any interpretation hereafter rendered with respect to any existing Law, as amortized using a commercially reasonable interest rate over the useful economic life of such improvements as determined by Landlord in its good faith, commercially reasonable discretion; (D) cost of all utilities, except the cost of utilities reimbursable to Landlord by the Project’s tenants other than pursuant to a provision similar to this Section 4(b); (E) insurance expenses; (F) repairs, replacements, and general maintenance of the Project as reasonably necessary; and (G) service, maintenance and management contracts for the operation, maintenance, management, repair, replacement, or security of the Project. If Tenant’s Proportionate Share of the cost incurred in connection with any parking area repair exceeds $100,000, such cost shall be amortized using a commercially reasonable interest rate over the useful economic life of such repair as determined by Landlord in its good faith, commercially reasonable discretion. The Project is part of a multi-building complex (the “Complex”), the term Operating Costs shall include Complex-wide Operating Costs for the Complex (e.g., insurance expenses for the Complex and Complex common area costs), and Tenant shall pay Tenant’s Proportionate Share of Operating Costs and Taxes for the Building and for the Complex, as applicable. The Complex currently consists of the following buildings: 884, 909, 910 and 919 Hermosa Court, 310 and 324 North Mary Avenue, and 345 and 475 Potrero Avenue (as depicted on the site plan attached hereto as Exhibit A-1). Operating Costs shall also include any costs, taxes or other charges allocated to the Project, as reasonably determined by Landlord, pursuant to or in connection with any covenants, conditions, restrictions and/or easements applicable to the Project and other property, provided however, no such covenants, conditions, restrictions and/or easements entered into by Landlord shall materially increase Tenant’s obligations under this Lease.

Operating Costs shall not include costs for (i) capital improvements made to the Building, other than capital improvements described in Section 4(b)(2)(C) and except for items which are generally considered maintenance and repair items, such as painting of common areas and the like (it being acknowledged that common areas shall not refer to any areas within a building); (ii) repair, replacements and general maintenance paid by proceeds of insurance or by Tenant or other third parties; (iii) interest, amortization or other payments on loans to Landlord; (iv) depreciation; (v) leasing commissions; (vi) legal expenses for services, other than those that benefit the Project tenants generally (e.g., tax disputes); (vii) renovating or otherwise improving space for occupants of the Project or vacant space in the Project; (viii) Taxes; (ix) federal income taxes imposed on or measured by the income of Landlord from the operation of the Project; (x) marketing costs, legal fees, space planners’ fees, advertising and promotional expenses, and brokerage fees incurred in connection with the original construction or development, or original or future leasing of the Project, and costs, including permit, license and inspection costs, incurred with respect to the installation of tenant improvements made for new tenants initially occupying space in the Project after the Commencement Date or incurred in renovating or otherwise improving, decorating, painting or redecorating vacant space for tenants or other occupants of the Project (excluding, however, such costs relating to any common areas or parking facilities); (xi) bad debt loss, rent loss, or reserves for bad debts or rent loss; (xii) amounts paid by Landlord as ground rental for the Project; (xiii) costs, other than those incurred in ordinary maintenance and repair, for sculpture, paintings, fountains or other objects of art; (xiv) all items and services for which Tenant or any other tenant in the Project reimburses Landlord other than pursuant to a provision similar to this Section 4(b) or which Landlord provides selectively to one or more tenants (other than Tenant) without reimbursement; (xv) costs incurred to comply with laws relating to the removal of Hazardous Materials (as defined below) (other than costs expended as part of the ordinary and customary operation and maintenance of the Project) which were in existence in the Building or on the Project prior to the date hereof and were of such a nature that a federal, state or municipal governmental authority, if it then had knowledge of the presence of such Hazardous Materials, in the state, and under the

-3-

conditions that they then existed in the Building or on the Project, would have then required the removal of such Hazardous Materials or other remedial or containment action with respect thereto; (xvi) costs arising from Landlord’s charitable or political contributions; (xvii) any gifts provided to any entity whatsoever, including, but not limited to, Tenant, other tenants, employees, vendors, contractors, prospective tenants and agents; (xviii) the cost of any magazine, newspaper, trade or other subscriptions; (xix) electric power costs for which any tenant directly contracts with the local public service company; (xx) costs or expenses of leasing any item if the purchase price of such item is not properly chargeable as Operating Costs; (xxi) fees payable by Landlord for management of the Project in excess of two percent (2%) of Landlord’s gross rental revenues, excluding any revenue for any after-hours utility charges; (xxii) any costs expressly excluded from Operating Costs elsewhere in this Lease; (xxiii) except for a Project management fee to the extent allowed pursuant to item (xxi) above, any amount paid to Landlord or to subsidiaries or affiliates of Landlord for services in the Project to the extent the same exceeds the costs of such services rendered by qualified, first-class unaffiliated third parties on a competitive basis; (xxv) rent for any office space occupied by Project management personnel to the extent the size or rental rate of such office space exceeds the size or fair market rental value of office space occupied by management personnel of comparable projects in the vicinity of the Project, with adjustment where appropriate for the size of the applicable project; (xxvi) expenses directly resulting from the gross negligence or willful misconduct of Landlord or its agents or employees; (xxvii) Landlord’s entertainment expenses and travel expenses, except for those expenses that are necessary, reasonable and incurred in connection with Landlord’s operation of the Project; (xxviii) costs arising from Landlord’s violation of any applicable governmental laws or regulations as of the date hereof; and (xxix) repair of the Building’s Structure. The foregoing exclusions from Operating Costs shall apply to any Operating Costs assessed in connection with the Complex.

(3) Tenant shall also pay Tenant’s Proportionate Share of Taxes for each year and partial year falling within the Term in the same manner as provided above for Tenant’s Proportionate Share of Operating Costs. “Taxes” means taxes, assessments, and governmental charges or fees whether federal, state, county or municipal, and whether they be by taxing districts or authorities presently taxing or by others, subsequently created or otherwise, and any other taxes and assessments (including non-governmental assessments for common charges under a restrictive covenant or other private agreement that are not treated as part of Operating Costs) now or hereafter attributable to the Project (or its operation), excluding, however, penalties and interest thereon and federal and state taxes on income (if the present method of taxation changes so that in lieu of or in addition to the whole or any part of any Taxes, there is levied on Landlord a capital tax directly on the rents received therefrom or a franchise tax, assessment, or charge based, in whole or in part, upon such rents for the Project, then all such taxes, assessments, or charges, or the part thereof so based, shall be deemed to be included within the term “Taxes” for purposes hereof). Taxes shall include the costs of consultants retained in an effort to lower taxes and all costs incurred in disputing any taxes or in seeking to lower the tax valuation of the Project. For property tax purposes, Tenant waives all rights to protest or appeal the appraised value of the Premises, as well as the Project, and all rights to receive notices of reappraisement, provided however, if Landlord and Tenant, each acting reasonably and in good faith, agree that an appeal of the appraised value of the Premises will result in the reduction of the tax valuation, then Landlord will pursue such appeal.

(4) By April 1 of each calendar year, or as soon thereafter as practicable, Landlord shall furnish to Tenant a statement of Operating Costs for the previous year, in each case adjusted as provided in Section 4(b)(5), and of the Taxes for the previous year (the “Operating Costs and Tax Statement”). If Tenant’s estimated payments of Operating Costs or Taxes under this Section 4(b) for the year covered by the Operating Costs and Tax Statement exceed Tenant’s Proportionate Share of such items as indicated in the Operating Costs and Tax Statement, then Landlord shall promptly credit or reimburse Tenant for such excess; likewise, if Tenant’s estimated payments of Operating Costs or Taxes under this Section 4(b) for such year are less than Tenant’s Proportionate Share of such items as indicated in the Operating Costs and Tax Statement, then Tenant shall promptly pay Landlord such deficiency.

(5) If Tenant is not leasing the entire Building, then with respect to any calendar year or partial calendar year in which the Building is not occupied to the extent of 100% of the rentable area thereof, or Landlord is not supplying services to 100% of the rentable area thereof, the Operating Costs for such period which vary with the occupancy of the Building shall, for the purposes hereof, be increased to the amount which would have been incurred had the Building been occupied to the extent of 100% of the rentable area thereof and Landlord had been supplying services to 100% of the rentable area thereof.

-4-

(6) Provided no Event of Default then exists, after receiving an annual Operating Costs and Tax Statement and giving Landlord 30 days’ prior written notice thereof, Tenant may inspect Landlord’s records relating to Operating Costs and Taxes for the period of time covered by such Operating Costs and Tax Statement in accordance with the following provisions. If Tenant fails to object to the calculation of Operating Costs and Taxes on an annual Operating Costs and Tax Statement within 60 days after the statement has been delivered to Tenant, or if Tenant fails to conclude its inspection within 90 days after the date of Tenant’s objection, then Tenant shall have waived its right to object to the calculation of Operating Costs and Taxes for the year in question and the calculation of Operating Costs and Taxes set forth on such statement shall be final. Tenant’s inspection shall be conducted at the office of Project’s property manager in the San Francisco Bay Area, shall not unreasonably interfere with the conduct of Landlord’s business, and shall be conducted only during business hours reasonably designated by Landlord. Tenant shall pay the cost of such inspection, unless the total Operating Costs and Taxes for the period in question is determined to be overstated by more than 5% in the aggregate, in which case Landlord shall pay the inspection cost (not to exceed the amount Tenant was overcharged for the period in question). Tenant may not conduct an inspection more than once during any calendar year. Tenant or the accounting firm conducting such inspection shall, at no charge to Landlord, submit its report in draft form to Landlord for Landlord’s review and comments before the final approved report is submitted to Landlord, and any reasonable comments by Landlord shall be incorporated into the final report. If such inspection reveals that an error was made in the Operating Costs or Taxes previously charged to Tenant, then Landlord shall refund to Tenant any overpayment of any such costs, or Tenant shall pay to Landlord any underpayment of any such costs, as the case may be, within 30 days after notification thereof. Provided Landlord’s accounting for Operating Costs and Taxes is consistent with the terms of this Lease, Landlord’s good faith judgment regarding the proper interpretation of this Lease and the proper accounting for Operating Costs and Taxes shall be binding on Tenant in connection with any such inspection. Tenant shall maintain the results of each such inspection confidential and shall not be permitted to use any third party to perform such inspections, other than an independent firm of certified public accountants (1) reasonably acceptable to Landlord, (2) which is not compensated on a contingency fee basis or in any other manner which is dependent upon the results of such inspection (and Tenant shall deliver the fee agreement or other similar evidence of such fee arrangement to Landlord upon request), and (3) which agrees with Landlord in writing to maintain the results of such inspection confidential. Nothing in this Section 4(b)(6) shall be construed to limit, suspend or abate Tenant’s obligation to pay Rent when due, including Additional Rent.

(7) If Landlord fails to give Tenant notice by June 30 of any calendar year during the Term that Controllable Operating Costs (as defined below) for such calendar year will increase by more than five percent (5%) over the amount of Controllable Operating Costs for the immediately preceding calendar year (the amount of such increase in excess of 5% of Controllable Operating Costs for the immediately preceding year referred to as the “Controllable Excess”), then Tenant shall have the right to pay the Controllable Excess to Landlord in equal monthly installments during the following calendar year. As used here, “Controllable Operating Costs” shall mean all Operating Costs other than Taxes, insurance, utilities, common area maintenance and landscaping.

5. Delinquent Payment; Handling Charges. All past due payments required of Tenant hereunder shall bear interest from the date which is five (5) days after the date due until paid at the lesser of eight percent per annum or the maximum lawful rate of interest (such lesser amount is referred to herein as the “Default Rate”). Additionally, Landlord, in addition to all other rights and remedies available to it, may charge Tenant a fee equal to five percent of the delinquent payment to reimburse Landlord for its cost and inconvenience incurred as a consequence of Tenant’s delinquency. In no event, however, shall the charges permitted under this Section 5 or elsewhere in this Lease, to the extent they are considered to be interest under applicable Law, exceed the maximum lawful rate of interest. Notwithstanding the foregoing, the late fee referenced above shall not be charged with respect to the first occurrence (but not any subsequent occurrence) during any 12-month period that Tenant fails to make payment when due, until five days after Landlord delivers written notice of such delinquency to Tenant.

-5-

6. Security Deposit. Contemporaneously with the execution of this Lease, Tenant shall pay to Landlord the Security Deposit, which shall be held by Landlord to secure Tenant’s performance of its obligations under this Lease. The Security Deposit is not an advance payment of Rent or a measure or limit of Landlord’s damages upon an Event of Default (as defined herein). Landlord may, from time to time following an Event of Default and without prejudice to any other remedy, use all or a part of the Security Deposit to perform any obligation Tenant fails to perform hereunder. Following any such application of the Security Deposit, Tenant shall pay to Landlord on demand the amount so applied in order to restore the Security Deposit to its original amount. Provided that Tenant has performed all of its obligations hereunder, Landlord shall, within 30 days after the Term ends, return to Tenant the portion of the Security Deposit which was not applied to satisfy Tenant’s obligations. The Security Deposit may be commingled with other funds, and no interest shall be paid thereon. If Landlord transfers its interest in the Premises and the transferee assumes Landlord’s obligations under this Lease, then Landlord may assign the Security Deposit to the transferee and Landlord thereafter shall have no further liability for the return of the Security Deposit. Tenant hereby waives and releases all rights with regard to the Security Deposit set forth in Section 1950.7 of the California Civil Code or under any similar law, statute or ordinance now or hereafter in effect.

7. Landlord’s Obligations.

(a) Landlord’s Maintenance Obligations. This Lease is intended to be a net lease; accordingly, subject to Tenant’s payment obligations pursuant to the provisions of Section 4(b) and Landlord’s obligations expressly set forth in Section 8(b), Landlord’s maintenance obligations are limited to the repair and replacement of the Building’s Structure and any Building’s Systems not exclusively serving the Premises and maintenance and repair of the common areas of the Complex. Landlord shall not be responsible for (1) any such work until Tenant notifies Landlord of the need therefor in writing, (2) alterations to the Building’s Structure required by applicable law because of alterations and improvements made by or on behalf of Tenant or the specific nature of Tenant’s use of the Premises (which alterations shall be Tenant’s responsibility), or (3) any such work that is the responsibility of Tenant pursuant to Section 8. The Building’s Structure does not include skylights, windows, glass or plate glass, doors, special fronts, or entries, all of which shall be the responsibility of Tenant. Subject to Tenant’s payment obligations pursuant to the provisions of Section 4(b), Landlord’s liability for any defects, repairs, replacement or maintenance for which Landlord is specifically responsible under this Lease shall be limited to the cost of performing the work.

(b) Landlord’s Right to Perform Tenant’s Obligations. Landlord may perform Tenant’s maintenance, repair, and replacement obligations and any other items that are Tenant’s obligation pursuant to Section 8 in accordance with the provisions of Section 8. Tenant shall reimburse Landlord for the reasonable cost incurred in so doing within 30 days after being invoiced therefor.

8. Improvements; Alterations; Repairs; Maintenance.

(a) Improvements; Alterations. Improvements to the Premises shall be installed at Tenant’s expense only in accordance with plans and specifications which have been previously submitted to and approved in writing by Landlord, which approval shall be governed by the provisions set forth in this Section 8(a). No alterations or physical additions in or to the Premises may be made without Landlord’s prior written consent, which shall not be unreasonably withheld or delayed; however, Landlord may withhold its consent to any alteration or addition that would adversely affect (in the reasonable discretion of Landlord) the (1) Building’s Structure or the Building’s Systems (including the Building’s restrooms or mechanical rooms), (2) exterior appearance of the Building, (3) appearance of the Building’s common areas, if any, or (4) provision of services to any other occupants of the Building. Provided Tenant gives Landlord at least 10 days’ prior notice, Landlord’s consent shall not be required for non-structural, interior cosmetic improvements costing less than $20,000 in the aggregate that do not affect the exterior appearance of the Building and do not require any permit or for interior painting or carpeting, provided however, at the expiration or earlier termination of this Lease, Tenant shall, at Landlord’s election, remove any such improvements and restore the Premises to its prior condition. Tenant shall not paint or install lighting or decorations, signs, window or door lettering, or advertising media of any type visible from the exterior of the Premises without the prior written consent of Landlord, which consent may be withheld in Landlord’s sole and absolute discretion. Notwithstanding the foregoing and provided Tenant is not in default under this Lease, Tenant shall have the right, at its sole cost and expense and subject to obtaining all governmental permits and approvals therefor, to install Tenant’s name (i) on the monument sign located in front of the Building, and (ii) on the Central

-6-

Expressway and Hermosa Court sides of the Building at locations to be mutually agreed upon by Landlord and Tenant, subject to obtaining all permits and approvals therefor and otherwise in accordance with all Laws and the provisions of this Lease. The size, shape, content, general appearance, design, materials, coloring and lettering of said signage shall be subject to Landlord’s prior approval, which approval shall not be unreasonably withheld. Tenant shall be responsible for the fabrication, installation, maintenance and repair of such signage in good condition at Tenant’s sole cost and expense. At the expiration or earlier termination of this Lease, or if Tenant is in default under this Lease, Tenant shall, at Tenant’s sole expense, remove Tenant’s signage and restore the Building and/or the Project to its original condition in connection with the removal of such signage. All of the provisions of this Lease with respect to Tenant’s Premises shall apply to Tenant’s installation, use, maintenance and removal of such signage, including without limitation, provisions relating to compliance with requirements as to insurance, indemnity, repairs and maintenance, and compliance with applicable Laws. The signage rights granted to Tenant are personal to the original Tenant signing this Lease and shall not inure to the benefit of any assignee, subtenant or other occupant, other than a Permitted Assignee. All alterations, additions, and improvements shall be constructed, maintained, and used by Tenant, at its risk and expense, in accordance with all Laws; Landlord’s consent to or approval of any alterations, additions or improvements (or the plans therefor) shall not constitute a representation or warranty by Landlord, nor Landlord’s acceptance, that the same comply with sound architectural and/or engineering practices or with all applicable Laws, and Tenant shall be solely responsible for ensuring all such compliance.

(b) Repairs; Maintenance. Tenant shall maintain the Premises in a clean, safe, and operable condition, and shall not permit or allow to remain any waste or damage to any portion of the Premises. Except to the extent caused by Landlord’s or its agent’s gross negligence or willful misconduct, Tenant, at its sole expense, shall repair, replace and maintain in good condition and in accordance with all Laws and the equipment manufacturer’s suggested service programs, all portions of the Premises, Tenant’s Off-Premises Equipment and all areas, improvements and Building’s Systems exclusively serving the Premises. Tenant shall repair or replace, subject to Landlord’s direction and supervision, any damage to the Building caused by a Tenant Party. If Tenant fails to make such repairs or replacements within 15 days after the occurrence of such damage or if such repairs or replacements cannot reasonably be completed within 15 days after the occurrence of such damage and Tenant fails to promptly commence and diligently pursue completion of such repairs or replacements, then Landlord may make the same at Tenant’s cost. If any damage caused by a Tenant Party occurs outside of the Premises, then Landlord may elect to repair such damage at Tenant’s expense, rather than having Tenant repair such damage. The cost of all maintenance, repair or replacement work performed by Landlord under this Section 8 shall be paid by Tenant to Landlord within 30 days after Landlord has invoiced Tenant therefor. Tenant hereby waives and releases its right to make repairs at Landlord’s expense under Sections 1941 and 1942 of the California Civil Code or under any similar law, statute or ordinance now or hereafter in effect. Notwithstanding anything herein to the contrary, if, in the good faith, commercially reasonable discretion of Landlord, the HVAC system serving the Premises needs to be replaced, the cost of such replacement is in excess of $15,000, the need for such replacement is not due to Tenant’s failure to maintain such system, and the useful economic life of such replacement extends beyond the expiration of the Term of this Lease, then Landlord shall perform such work and Tenant shall pay to Landlord as part of Operating Costs for the Building, the cost of such replacement, as amortized using a commercially reasonable interest rate over the useful economic life as so determined by Landlord. Further, if, in the good faith, commercially reasonable discretion of Landlord, the roof of the Building needs to be replaced, then Landlord shall perform such work and Tenant shall pay to Landlord as part of Operating Costs for the Building, the cost of such replacement, as amortized using a commercially reasonable interest rate over the useful economic life of such replacement as determined by Landlord in its good faith, commercially reasonable discretion.

(c) Performance of Work. All work described in this Section 8 shall be performed only by Landlord if so expressly provided or by contractors and subcontractors reasonably approved in writing by Landlord. Tenant shall cause all contractors and subcontractors to procure and maintain insurance coverage naming Landlord, Landlord’s property management company and Landlord’s asset management company as additional insureds against such risks, in such amounts, and with such companies as Landlord may reasonably require. Tenant shall provide Landlord with the identities, mailing addresses and telephone numbers of all persons performing work or supplying materials prior to beginning such construction and Landlord may post on and about the Premises notices of non-responsibility pursuant to applicable Laws. All such work shall be performed in accordance with all Laws and in a good and workmanlike manner so as not to damage the Building (including the Premises, the Building’s Structure and the Building’s Systems). All such work which may affect the Building’s Structure or the Building’s Systems must be approved by the Building’s engineer of record, at Tenant’s expense and, at Landlord’s election,

-7-

must be performed by Landlord’s usual contractor for such work. All work affecting the roof of the Building must be performed by Landlord’s roofing contractor and no such work will be permitted if it would void or reduce the warranty on the roof.

(d) Mechanic’s Liens. All work performed, materials furnished, or obligations incurred by or at the request of a Tenant Party shall be deemed authorized and ordered by Tenant only, and Tenant shall not permit any mechanic’s liens to be filed against the Premises or the Project in connection therewith. Upon completion of any such work, Tenant shall deliver to Landlord final lien waivers from all contractors, subcontractors and materialmen who performed such work. If such a lien is filed, then Tenant shall, within ten days after Landlord has delivered notice of the filing thereof to Tenant (or such earlier time period as may be necessary to prevent the forfeiture of the Premises, the Project or any interest of Landlord therein or the imposition of a civil or criminal fine with respect thereto), either (1) pay the amount of the lien and cause the lien to be released of record, or (2) deliver to Landlord evidence of the recordation and service of a mechanic’s lien release bond in accordance with the provisions of the California Civil Code. If Tenant fails to timely take either such action, then Landlord may pay the lien claim, and any amounts so paid, including expenses and interest, shall be paid by Tenant to Landlord within ten days after Landlord has invoiced Tenant therefor. Landlord and Tenant acknowledge and agree that their relationship is and shall be solely that of “landlord-tenant” (thereby excluding a relationship of “owner-contractor,” “owner-agent” or other similar relationships). Accordingly, all materialmen, contractors, artisans, mechanics, laborers and any other persons now or hereafter contracting with Tenant, any contractor or subcontractor of Tenant or any other Tenant Party for the furnishing of any labor, services, materials, supplies or equipment with respect to any portion of the Premises, at any time from the date hereof until the end of the Term, are hereby charged with notice that they look exclusively to Tenant to obtain payment for same. Landlord may record, at its election, notices of non-responsibility pursuant to California Civil Code Section 3094 in connection with any work performed by Tenant. Nothing herein shall be deemed a consent by Landlord to any liens being placed upon the Premises, the Project or Landlord’s interest therein due to any work performed by or for Tenant or deemed to give any contractor or subcontractor or materialman any right or interest in any funds held by Landlord to reimburse Tenant for any portion of the cost of such work. Tenant shall defend, indemnify and hold harmless Landlord and its agents and representatives from and against all claims, demands, causes of action, suits, judgments, damages and expenses (including attorneys’ fees) in any way arising from or relating to the failure by any Tenant Party to pay for any work performed, materials furnished, or obligations incurred by or at the request of a Tenant Party. This indemnity provision shall survive termination or expiration of this Lease.

(e) Utilities. Tenant shall pay for all water, gas, electricity, heat, telephone, sewer, sprinkler charges and other utilities and services used at the Premises, together with all taxes, penalties, surcharges, and maintenance charges pertaining thereto pursuant to the terms and conditions of this Lease. Water, gas and electricity servicing the Premises are separately metered and Tenant shall pay directly to the utility provider for same. Except as otherwise expressly set forth herein, Landlord shall not be liable for any interruption or failure of utility service to the Premises, and in no event shall the unavailability of such services or any other services (or any diminution in the quality thereof) render Landlord liable to Tenant or any entity claiming through Tenant for any damages caused thereby, constitute a constructive eviction of Tenant, constitute a breach of any implied warranty by Landlord, or entitle Tenant to any abatement of Tenant’s obligations hereunder. If Tenant is prevented from using, and does not use, the Premises because of the unavailability of utility service to the Premises for a period of 10 consecutive business days or 15 non-consecutive days in any 12 month period following Landlord’s receipt from Tenant of a written notice regarding such unavailability, the cure of which is within Landlord’s reasonable control, and such unavailability was not caused by a Tenant Party, a governmental directive or cause beyond Landlord’s control, then Tenant shall, as its exclusive remedy be entitled to a reasonable abatement of Rent for each consecutive day (after such 10 business day period or 15 non-consecutive day period, as applicable) that Tenant is so prevented from using, and does not use, the Premises. Any amounts payable by Tenant under this Section shall be due within 10 days after Landlord has invoiced Tenant therefor. Tenant shall not install any electrical equipment requiring special wiring or requiring voltage in excess of 110 volts unless approved in advance by Landlord, which approval shall not be unreasonably withheld, conditioned or delayed. Tenant shall not install any electrical equipment requiring voltage in excess of Building capacity unless approved in advance by Landlord, which approval will not be unreasonably withheld if Tenant increases the Building capacity in compliance with all Laws and the terms of this Lease. The use of electricity in the Premises shall not exceed the capacity of existing feeders and risers to or wiring in the Premises. Any risers or wiring required to meet Tenant’s electrical requirements shall, upon Tenant’s written request, be installed by Landlord, at Tenant’s cost, if, in Landlord’s judgment, the same are necessary and shall not cause

-8-

permanent damage to the Building or the Premises, cause or create a dangerous or hazardous condition, entail excessive or unreasonable alterations, repairs, or expenses, or interfere with or disturb any other tenants of the Building. If Tenant uses machines or equipment in the Premises which affect the temperature otherwise maintained by the air conditioning system or otherwise overload any utility, Landlord may install supplemental air conditioning units or other supplemental equipment in the Premises, and the cost thereof, including the cost of installation, operation, use, and maintenance, shall be paid by Tenant to Landlord within 30 days after Landlord has delivered to Tenant an invoice therefor.

9. Use. Tenant shall use the Premises only for the Permitted Use and shall comply with all Laws relating to the use, condition, access to, and occupancy of the Premises and will not commit waste, overload the Building’s Structure or the Building’s Systems or subject the Premises to use that would damage the Premises. The population density within the Premises shall not adversely impact the Building’s Systems. The Premises shall not be used for any use which is disreputable, creates extraordinary fire hazards, or results in an increased rate of insurance on the Building or its contents, or for the storage of any Hazardous Materials (other than typical office supplies [e.g., photocopier toner] and then only in customary quantities and in compliance with all Laws). Tenant shall not use any substantial portion of the Premises for a “call center,” any other telemarketing use, or any credit processing use, provided that Tenant may use up to 20% of the Premises for customer support (as opposed to “call center”) purposes. If, because of a Tenant Party’s acts or because Tenant vacates the Premises, the rate of insurance on the Building or its contents increases, Tenant shall pay to Landlord the amount of such increase on demand, and acceptance of such payment shall not waive any of Landlord’s other rights. Tenant shall conduct its business and control each other Tenant Party so as not to create any nuisance or unreasonably interfere with other tenants or Landlord in its management of the Building or Complex.

10. Assignment and Subletting.

(a) Transfers. Except as provided in Section 10(h), Tenant shall not, without the prior written consent of Landlord, (1) assign, transfer, or encumber this Lease or any estate or interest herein, whether directly or by operation of law, (2) permit any other entity to become Tenant hereunder by merger, consolidation, or other reorganization, (3) if Tenant is an entity other than a corporation whose stock is publicly traded, permit the transfer of an ownership interest in Tenant so as to result in a change in the current control of Tenant, (4) sublet any portion of the Premises, (5) grant any license, concession, or other right of occupancy of any portion of the Premises, or (6) permit the use of the Premises by any parties other than Tenant (any of the events listed in Section 10(a)(1) through 10(a)(6) being a “Transfer”).

(b) Consent Standards. Landlord shall not unreasonably withhold or delay its consent to any assignment or subletting of the Premises, provided that the proposed transferee (1) is creditworthy, (2) has a good reputation in the business community, (3) will use the Premises for the Permitted Use (thus, excluding, without limitation, uses for credit processing and telemarketing) and will not use the Premises in any manner that would conflict with any exclusive use agreement or other similar agreement entered into by Landlord with any other tenant of the Building or Complex, (4) will not use the Premises, Building or Project in a manner that would materially increase the pedestrian or vehicular traffic to the Premises, Building or Project, (5) is not a governmental entity, or subdivision or agency thereof whose operations would create high visitation to the Premises or which is of a character inconsistent with other occupants of the Complex, (6) is not another occupant of the Building or Complex so long as Landlord has comparable space available for lease in the Complex, and (7) is not a person or entity with whom Landlord is then, or has been within the six-month period prior to the time Tenant seeks to enter into such assignment or subletting, negotiating to lease space in the Building or Complex or any Affiliate of any such person or entity; otherwise, Landlord may withhold its consent in its sole discretion and, in connection therewith, Tenant hereby waives and releases its rights under Section 1995.310 of the California Civil Code or under any similar law, statute or ordinance now or hereafter in effect. Additionally, Landlord may withhold its consent in its sole discretion to any proposed Transfer if any Event of Default by Tenant then exists.

(c) Request for Consent. If Tenant requests Landlord’s consent to a Transfer, then, at least 15 business days prior to the effective date of the proposed Transfer, Tenant shall provide Landlord with a written description of all terms and conditions of the proposed Transfer, copies of the proposed documentation, and the following information about the proposed transferee: name and address; reasonably satisfactory information about its business and business history; its proposed use of the Premises; and financial information reasonably sufficient to

-9-

enable Landlord to determine the proposed transferee’s creditworthiness. Concurrently with Tenant’s notice of any request for consent to a Transfer, Tenant shall pay to Landlord a fee of $1,000 to defray Landlord’s expenses in reviewing such request, and Tenant shall also reimburse Landlord immediately upon request for its reasonable attorneys’ fees incurred in connection with considering any request for consent to a Transfer.

(d) Conditions to Consent. If Landlord consents to a proposed Transfer, then the proposed transferee shall deliver to Landlord a written agreement whereby it expressly assumes Tenant’s obligations hereunder; however, any transferee of less than all of the space in the Premises shall be liable only for obligations under this Lease that are properly allocable to the space subject to the Transfer for the period of the Transfer. No Transfer shall release Tenant from its obligations under this Lease, but rather Tenant and its transferee shall be jointly and severally liable therefor. Landlord’s consent to any Transfer shall not waive Landlord’s rights as to any subsequent Transfers. If an Event of Default occurs while the Premises or any part thereof are subject to a Transfer, then Landlord, in addition to its other remedies, may collect directly from such transferee all rents becoming due to Tenant and apply such rents against Rent. Tenant authorizes its transferees to make payments of rent directly to Landlord upon receipt of notice from Landlord to do so following the occurrence of an Event of Default hereunder. Tenant shall pay for the cost of any demising walls or other improvements necessitated by a proposed subletting or assignment.

(e) Attornment by Subtenants. Each sublease by Tenant hereunder shall be subject and subordinate to this Lease and to the matters to which this Lease is or shall be subordinate, and each subtenant by entering into a sublease is deemed to have agreed that in the event of termination, re-entry or dispossession by Landlord under this Lease, Landlord may, at its option, take over all of the right, title and interest of Tenant, as sublandlord, under such sublease, and such subtenant shall, at Landlord’s option, attorn to Landlord pursuant to the then executory provisions of such sublease, except that Landlord shall not be (1) liable for any previous act or omission of Tenant under such sublease, (2) subject to any counterclaim, offset or defense that such subtenant might have against Tenant, (3) bound by any previous modification of such sublease not approved by Landlord in writing or by any rent or additional rent or advance rent which such subtenant might have paid for more than the current month to Tenant, and all such rent shall remain due and owing, notwithstanding such advance payment, (4) bound by any security or advance rental deposit made by such subtenant which is not delivered or paid over to Landlord and with respect to which such subtenant shall look solely to Tenant for refund or reimbursement, or (5) obligated to perform any work in the subleased space or to prepare it for occupancy, and in connection with such attornment, the subtenant shall execute and deliver to Landlord any instruments Landlord may reasonably request to evidence and confirm such attornment. Each subtenant or licensee of Tenant shall be deemed, automatically upon and as a condition of its occupying or using the Premises or any part thereof, to have agreed to be bound by the terms and conditions set forth in this Section 10(e). The provisions of this Section 10(e) shall be self-operative, and no further instrument shall be required to give effect to this provision.

(f) Intentionally Omitted.

(g) Additional Compensation. Tenant shall pay to Landlord, immediately upon receipt thereof, one-half of the excess of (1) all compensation received by Tenant for a Transfer less the actual out-of-pocket costs reasonably incurred by Tenant with unaffiliated third parties (i.e., brokerage commissions and tenant finish work) in connection with such Transfer (such costs shall be amortized on a straight-line basis over the term of the Transfer in question) over (2) the Rent allocable to the portion of the Premises covered thereby.

(h) Permitted Transfers. Notwithstanding Section 10(a), Tenant may Transfer all or part of its interest in this Lease or all or part of the Premises (a “Permitted Transfer”) to the following types of entities (a “Permitted Transferee”) without the written consent of Landlord, so long as (A) Tenant’s obligations hereunder are assumed by such entity in the case of a Transfer which is an assignment of this Lease; and (B) in the case of subparagraphs (2) and (3) below, the Tangible Net Worth of such entity is not less than the Tangible Net Worth of Tenant as of the date hereof:

(1) an Affiliate of Tenant;

(2) any corporation, limited partnership, limited liability partnership, limited liability company or other business entity in which or with which Tenant, or its corporate successors or assigns, is merged or consolidated, in accordance with applicable statutory provisions governing merger and consolidation of business entities; or

-10-

(3) any corporation, limited partnership, limited liability partnership, limited liability company or other business entity acquiring all or substantially all of Tenant’s assets.

Tenant shall promptly notify Landlord of any such Permitted Transfer. Tenant shall remain liable for the performance of all of the obligations of Tenant hereunder, or if Tenant no longer exists because of a merger, consolidation, or acquisition, the surviving or acquiring entity shall expressly assume in writing the obligations of Tenant hereunder. Additionally, the Permitted Transferee shall comply with all of the terms and conditions of this Lease, including the Permitted Use, and the use of the Premises by the Permitted Transferee may not violate any other agreements affecting the Premises, the Building or the Complex, Landlord or other tenants of the Building or the Complex. No later than 30 days after the effective date of any Permitted Transfer, Tenant agrees to furnish Landlord with (A) copies of the instrument effecting any of the foregoing Transfers, (B) documentation establishing Tenant’s satisfaction of the requirements set forth above applicable to any such Transfer, and (C) evidence of insurance as required under this Lease with respect to the Permitted Transferee. The occurrence of a Permitted Transfer shall not waive Landlord’s rights as to any subsequent Transfers. “Tangible Net Worth” means the excess of total assets over total liabilities, in each case as determined in accordance with generally accepted accounting principles consistently applied (“GAAP”), excluding, however, from the determination of total assets all assets which would be classified as intangible assets under GAAP including goodwill, licenses, patents, trademarks, trade names, copyrights, and franchises. Any subsequent Transfer by a Permitted Transferee shall be subject to the terms of this Section 10.

11. Insurance; Waivers; Subrogation; Indemnity.

(a) Tenant’s Insurance. Effective as of the earlier of (1) the date Tenant enters or occupies the Premises, or (2) the Commencement Date, and continuing throughout the Term, Tenant shall maintain the following insurance policies: (A) commercial general liability insurance in amounts of $3,000,000 per occurrence or, following the expiration of the initial Term, such other amounts as Landlord may from time to time reasonably require and as is customarily required by landlords of comparable buildings (and, if the use and occupancy of the Premises include any activity or matter that is or may be excluded from coverage under a commercial general liability policy [e.g., the sale, service or consumption of alcoholic beverages], Tenant shall obtain such endorsements to the commercial general liability policy or otherwise obtain insurance to insure all liability arising from such activity or matter [including liquor liability, if applicable] in such amounts as Landlord may reasonably require), insuring Tenant, Landlord, Landlord’s property management company, Landlord’s asset management company and, if requested in writing by Landlord, Landlord’s Mortgagee, against all liability for injury to or death of a person or persons or damage to property arising from the use and occupancy of the Premises and (without implying any consent by Landlord to the installation thereof) the installation, operation, maintenance, repair or removal of Tenant’s Off-Premises Equipment, (B) insurance covering the full value of all alterations and improvements and betterments in the Premises, naming Landlord and Landlord’s Mortgagee as additional loss payees as their interests may appear, (C) insurance covering the full value of all furniture, trade fixtures and personal property (including property of Tenant or others) in the Premises or otherwise placed in the Project by or on behalf of a Tenant Party (including Tenant’s Off-Premises Equipment), (D) contractual liability insurance sufficient to cover Tenant’s indemnity obligations hereunder (but only if such contractual liability insurance is not already included in Tenant’s commercial general liability insurance policy), (E) worker’s compensation insurance, and (F) business interruption insurance. The limit of liability specified in subpart (A) above can be satisfied through a combination of primary, umbrella or excess liability policies, provided that the coverage under such umbrella or excess liability policies is at least as broad as the primary coverage and applies on a “following form” basis. Tenant’s insurance shall provide primary coverage to Landlord when any policy issued to Landlord provides duplicate or similar coverage, and in such circumstance Landlord’s policy will be excess over Tenant’s policy. Tenant shall furnish to Landlord certificates of such insurance and such other evidence satisfactory to Landlord of the maintenance of all insurance coverages required hereunder prior to the date Landlord tenders possession of the Premises to Tenant, and upon each renewal of said insurance, and Tenant shall endeavor to notify Landlord at least 30 days before cancellation or a material change of any such insurance policies. All such insurance policies shall be issued by companies with an A.M. Best rating of A+:VII or better, and shall be in form reasonably satisfactory to Landlord. If Tenant fails to comply with the foregoing insurance requirements or to deliver to Landlord the

-11-

certificates or evidence of coverage required herein, Landlord, in addition to any other remedy available pursuant to this Lease or otherwise, may, but shall not be obligated to, obtain such insurance and Tenant shall pay to Landlord on demand the premium costs thereof, plus an administrative fee of 2% of such cost.

(b) Landlord’s Insurance. Throughout the Term of this Lease, Landlord shall maintain, as a minimum, the following insurance policies: (1) property insurance for the Building’s replacement value (excluding property required to be insured by Tenant), less a commercially-reasonable deductible if Landlord so chooses (which deductible is currently $25,000), and (2) commercial general liability insurance in an amount of not less than $3,000,000. Landlord may, but is not obligated to, maintain such other insurance and additional coverages as it may deem necessary. The cost of the insurance coverage specified in subparts (1) and (2) and the cost of other and additional coverages carried by Landlord with respect to the Project so long as carried by comparable landlords of comparable buildings shall be included in Operating Costs. The foregoing insurance policies and any other insurance carried by Landlord shall be for the sole benefit of Landlord and under Landlord’s sole control, and Tenant shall have no right or claim to any proceeds thereof or any other rights thereunder.

(c) No Subrogation; Waiver of Property Claims. Notwithstanding anything to the contrary contained herein, Landlord and Tenant each waives any claim it might have against the other for any damage to or theft, destruction, loss, or loss of use of any property, to the extent the same is insured against under any insurance policy of the types described in this Section 11 that covers the Project, the Premises, Landlord’s or Tenant’s fixtures, personal property, leasehold improvements, or business, or is required to be insured against under the terms hereof, regardless of whether the negligence of the other party caused such Loss (defined below). Additionally, Tenant waives any claim it may have against Landlord for any Loss to the extent such Loss is caused by a terrorist act. Each party shall cause its insurance carrier to endorse all applicable policies waiving the carrier’s rights of recovery under subrogation or otherwise against the other party. Notwithstanding any provision in this Lease to the contrary, Landlord, its agents, employees and contractors shall not be liable to Tenant or to any party claiming by, through or under Tenant for (and Tenant hereby releases Landlord and its servants, agents, contractors, employees and invitees from any claim or responsibility for) any damage to or destruction, loss, or loss of use, or theft of any property of any Tenant Party located in or about the Project, caused by casualty, theft, fire, third parties or any other matter or cause, regardless of whether the negligence of any party caused such loss in whole or in part. Tenant acknowledges that Landlord shall not carry insurance on, and shall not be responsible for damage to, any property of any Tenant Party located in or about the Project.