Attached files

| file | filename |

|---|---|

| 8-K - UIL FORM 8-K DATED MAY 3, 2011 - UIL HOLDINGS CORP | uil_form8kdated05032011.htm |

| EX-99 - UIL EXHIBIT 99 - EARNINGS RELEASE - UIL HOLDINGS CORP | uil_exh99.htm |

1

1Q ’11 Earnings

1Q 2011 Earnings Conference Call

May 4, 2011

Exhibit 99.1

2

1Q ’11 Earnings

James P. Torgerson

President and Chief Executive Officer

Richard J. Nicholas

Executive Vice President and Chief Financial Officer

Safe Harbor Provision

Certain statements contained herein, regarding matters that are not historical facts, are forward-looking statements (as defined in the

Private Securities Litigation Reform Act of 1995). These include statements regarding management’s intentions, plans, beliefs,

expectations or forecasts for the future. Such forward-looking statements are based on UIL Holdings’ expectations and involve risks and

uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements. Such risks and

uncertainties include, but are not limited to, general economic conditions, legislative and regulatory changes, changes in demand for

electricity, gas and other products and services, unanticipated weather conditions, changes in accounting principles, policies or guidelines,

and other economic, competitive, governmental, and technological factors affecting the operations, markets, products and services of UIL

Holdings’ subsidiaries, The United Illuminating Company, The Southern Connecticut Gas Company, Connecticut Natural Gas

Corporation and The Berkshire Gas Company. Such risks and uncertainties with respect to UIL Holdings’ recent acquisition of The

Southern Connecticut Gas Company, Connecticut Natural Gas Corporation and The Berkshire Gas Company include, but are not limited

to, the possibility that the expected benefits will not be realized, or will not be realized within the expected time period. The foregoing and

other factors are discussed and should be reviewed in UIL Holdings’ most recent Annual Report on Form 10-K and other subsequent

periodic filings with the Securities and Exchange Commission. Forward-looking statements included herein speak only as of the date hereof

and UIL Holdings undertakes no obligation to revise or update such statements to reflect events or circumstances after the date hereof or to

reflect the occurrence of unanticipated events or circumstances.

Note to Investors

3

1Q ’11 Earnings

Highlights

Solid 1Q Net Income

Ø Growth in Electric Operations, including GenConn

Ø First full quarter of Gas Operations

Projected savings from the gas acquisitions are identified

Exit from transition services agreement on schedule

Implementing plans for growth in gas conversions

Executing on capital expenditure plan - realizing rate base growth

GenConn Middletown expected to be operational in June 2011

4

1Q ’11 Earnings

Expected $11.6M of Identified Savings

Ø Integration is on schedule

Ø Incurring one-time O&M

implementation costs of $3.5M (pre-tax)

implementation costs of $3.5M (pre-tax)

Ø Approximately $18M IT-related

capital costs associated with

implementation

capital costs associated with

implementation

($M)

Gas Operations

5

1Q ’11 Earnings

Gas Operations

Ø Capitalize on the competitive advantage of natural gas as the economical,

abundant and environmentally friendly fuel of choice for customers

abundant and environmentally friendly fuel of choice for customers

Ø Aggressively pursue new gas heating customers

Ø Generate incremental revenue sufficient to support expanding infrastructure

Ø 2011 multi-media campaign - launched in April

› Cost savings associated with natural gas use compared to other energy sources

Ø Historical customer additions(1) 2009 2010

Heating conversions 5,535 5,728

New construction 901 1,071

Total 6,436 6,799

Ø Targeting 30,000-35,000 additional gas heating customers over the next 3 years

› ’11 - 25% increase over ‘10 levels

› ’12 - 50% increase over ’10 levels

Ø New customers are anticipated to generate approximately $280-$315 dollars of

distribution net operating income per customer

distribution net operating income per customer

(1) Businesses & households

6

1Q ’11 Earnings

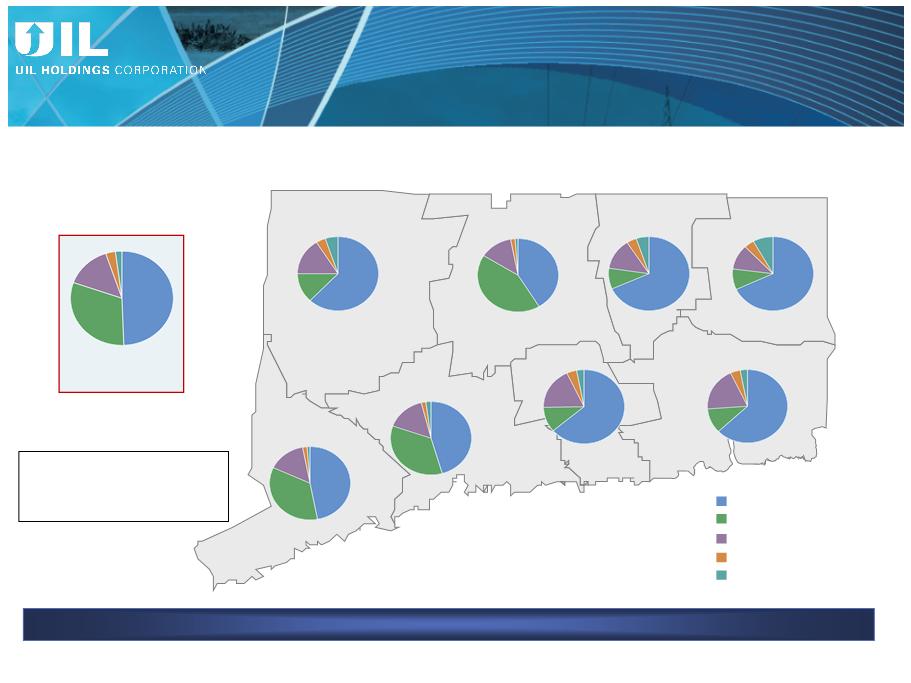

American Community Survey’s selected housing characteristics estimates show a large percentage of

households in Connecticut do not use natural gas for heating

households in Connecticut do not use natural gas for heating

Potential for Gas Heating in CT

Litchfield

62%

13%

16%

4%

5%

Fairfield

47%

35%

15%

2%

1%

Connecticut

50%

31%

15%

2%

1%

New Haven

46%

35%

16%

2%

2%

Middlesex

63%

11%

18%

4%

3%

New London

63%

11%

19%

3%

4%

Windham

68%

9%

11%

8%

4%

Tolland

67%

9%

13%

5%

4%

Hartford

41%

42%

13%

1%

2%

Fuel oil, kerosene

Electricity

Utility gas

Bottled, tank or LP gas

Other¹

Source: U.S. Census Bureau; Average data for 2005-2009

1 Other includes coal or coke, wood, solar, no fuel used and other

# Occupied

housing units:

1,327,482

housing units:

1,327,482

73,704

339,516

52,993

42,653

104,468

65,476

322,752

325,920

(0)

(20)

(6)

(13)

(0)

(3)

(11)

(9)

The # in parentheses represents

the number of cities or towns in

that county that are served by a

UIL Gas Company.

UIL Gas Company.

Approximately 37% of businesses & households on UIL gas mains are not currently natural gas customers

7

1Q ’11 Earnings

Electric Operations

Ø On course with aggressive $2.1B UI base capital expenditure plan for 2010-2019

› Distribution - $1.4B

› Transmission - $0.6B

› GenConn equity investment - $0.1B

Ø Investing in Connecticut portion of New England East West Solution projects,

with an investment floor of $60M

with an investment floor of $60M

Ø Continue to seek out other Transmission opportunities in our service territory

and beyond

and beyond

8

1Q ’11 Earnings

Devon Facility

Ø Operating

Ø Contractual requirements met on

9/10/10

9/10/10

Middletown Facility

Ø 98% complete as of 4/30/11

Ø Expected to be operational in June 2011

50/50 Joint Venture between UI and NRG

Picture as of 3/31/11

GenConn Energy

9

1Q ’11 Earnings

Ø On 3/24/11, CNG, SCG & the OCC filed a motion with

the DPUC to reopen the CNG & SCG rate cases for the

purposes of reviewing and approving a settlement

agreement

the DPUC to reopen the CNG & SCG rate cases for the

purposes of reviewing and approving a settlement

agreement

Ø On 4/13/11, the DPUC reopened the rate cases

Ø If approved by DPUC, the settlement would, among

other things

other things

› resolve all pending issues related to the rate case

appeals

appeals

› terminate the SCG potential overearnings

investigation

investigation

Ø DPUC schedule as of 4/27/11

› Hearings 5/26/11 & 6/9/11

› Draft decision expected 7/20/11, final 8/3/11

|

|

|

|

|

|

SCG Potential Overearnings

Generic ROE Proceeding

UI Electric Decoupling

SCG/CNG Rate Case Appeals

DPUC schedule has not been updated

Ø Filed results of decoupling rider for 2010-2011 on 4/5/11

› Resulted in an over-collection of allowed revenues of

$1.3M

$1.3M

› Company requested continuation of decoupling

mechanism until next rate case decision

mechanism until next rate case decision

Ø Potential for UI to file distribution rate case for rates in effect in 2012 to reflect significant investments

in distribution infrastructure

in distribution infrastructure

Regulatory Update

10

1Q ’11 Earnings

Legislative Highlights

Session ends June 8th

Members of the state House and Senate in CT introduced ~ 100 energy- and

technology-related bills

technology-related bills

Ø UIL is actively engaged in legislative process

Proposals include:

Ø New Department that combines Department of Environmental Protection and

Department of Public Utility Control

Department of Public Utility Control

Ø Senate Bill One - reintroduction of legislation from the last legislative session that

has multiple components

has multiple components

11

1Q ’11 Earnings

Economic Update

Non-seasonally adjusted unemployment rate as of 3/11

Ø MA - 8.2%

Ø National - 9.2%

Ø CT - 9.3%

Major cities in service territory trailing national average

Ø Hartford - 9.3%

Ø New Haven - 13.6%

Ø Bridgeport - 14.5%

12

1Q ’11 Earnings

Net Income ($M)

1Q 2011 vs. 1Q 2010 Net Income

13

1Q ’11 Earnings

1Q 2011 Financial - Details

Electric distribution, CTA, GenConn & other

Ø 8% increase in 1Q 2011 net income compared to 1Q 2010

› Favorable variance primarily attributable to income from the investment in GenConn, partially

offset by increased operating expenses and lower CTA rate base

offset by increased operating expenses and lower CTA rate base

› Earnings of $2.1M from UI’s equity investment in GenConn

Ø Average D & CTA ROE as of 3/31/11; 9.62% including sharing

Ø GenConn ROE - 9.75%

Electric transmission

Ø 15% increase in 1Q 2011 net income compared to 1Q 2010

› Increase in AFUDC coupled with higher rate base

Gas distribution

Ø Net income of $37.4M

› Colder than normal winter weather in New England

Ø Preliminary average adjusted ROEs as of 3/31/11; SCG - 9.65%, CNG - 11.63%

Corporate

Ø After tax cost in 1Q 2011 of $3.8M compared to $0.7M in 1Q 2010

› Predominately attributable to interest expense of $3.2M on the $450M public debt issued to partially

fund the gas acquisitions

fund the gas acquisitions

EPS dilution from Sept. 2010 equity issuance - $0.24 per share

14

1Q ’11 Earnings

UI Pollution Control Revenue Bonds

UI Equity Bridge Loan

UIL Debt retired 2/15/11

SCG, CNG & Berkshire

Liquidity Overview (3/31/11)

Near-Term Debt Maturities

($M)

*

* To be remarketed

Amounts may not add due to rounding.

Based on current plans - expect no need for external equity for at least the next 3 years

($M)

Debt Maturity & Liquidity Profile

15

1Q ’11 Earnings

Assumptions

› Regulated businesses are expected to earn the allowed return

on an aggregate basis

on an aggregate basis

› GenConn expected to be fully operational by 6/11 and earn

$0.12-$0.14 per share

$0.12-$0.14 per share

› CTA earnings are expected to decline by $0.07-$0.09 per share

from 2010 as rate base continues to be amortized

from 2010 as rate base continues to be amortized

› Incorporates full year of gas distribution earnings

› Bonus depreciation is expected to have a net impact of ($0.03)-

($0.05) per share

($0.05) per share

› Includes one-time costs for the transition of the gas

distribution business support services from IUSA, as well as

the on-going integration costs

distribution business support services from IUSA, as well as

the on-going integration costs

,

2011

› Integration of all of the regulated businesses with an emphasis on process integration initiatives and best practices

› Exiting the TSA by year-end for vast majority of services

› Positioned to realize half of IUSA’s ‘09 allocated corporate charges of $23M à expected savings of $11.6M in 2012

› Implementing plans for growth in gas conversions

› Execution of capital expenditure plan at each of our regulated businesses

› Continued focus on management of O&M expenses at each of our regulated businesses

16

1Q ’11 Earnings

Highlights

Solid 1Q Net Income

Ø Growth in Electric Operations, including GenConn

Ø First full quarter of Gas Operations

Projected savings from the gas acquisitions are identified

Exit from transition services agreement on schedule

Implementing plans for growth in gas conversions

Executing on capital expenditure plan - realizing rate base growth

GenConn Middletown expected to be operational in June 2011

17

1Q ’11 Earnings

Q&A

18

1Q ’11 Earnings

Appendix

19

1Q ’11 Earnings

* 2010 Gas distribution capex reflects the full year amount; UIL ownership was for 6 weeks effective with the closing on the acquisition. Does not reflect capital for gas conversions growth

plan.

plan.

** Updated - February 23, 2011

*** Information as of 2010 Fall EEI conference

Amounts may not add due to rounding.

The annual long-term capital spending update will be presented at the Fall EEI conference

UIL CapEx Profile

20

1Q ’11 Earnings

20

Near-Term Average Rate Base Profile

28%

23%

7%

30%

22%

5%

35%

3%

40%

1%

23%

38%

37%

39%

43%

22%

38%

24%

36%

40%

24%

Electric distribution

CTA

Gas distribution*

Electric transmission

UI’s 50% Share ($M): 2010A 2011P 2012P 2013P 2014P 2015P

Avg. GenConn RB Equivalent: $ 51 $ 140 $ 164 $ 156 $ 149 $ 142

Avg. Gen Conn Equity “Rate Base” $ 25 $ 70 $ 82 $ 78 $ 75 $ 71

Rate Base (Excluding GenConn Equity Investments):

GenConn Equity Investments:

Notes: *2010 Gas distribution average rate base reflects the full year; UIL ownership was for 6 weeks effective with the closing on the acquisition. For comparability purposes, Gas distribution excludes the impacts

of 338(h)(10) election.

of 338(h)(10) election.

Amounts may not add due to rounding.

42%

21

1Q ’11 Earnings

* Based on current expectations

** Related to the tax year

Efficient use of cash benefits from

bonus depreciation

bonus depreciation

Ø Expected pension contributions of

approximately $73M to the electric &

gas pension plans in 2011

approximately $73M to the electric &

gas pension plans in 2011

› $52.2M already contributed during

1Q ‘11

1Q ‘11

Ø Reduces pension costs and increases

rate base

rate base

Based on current plans, expect no

need for external equity for at least

the next 3 years

need for external equity for at least

the next 3 years

Expected Impacts of Bonus Depreciation - ‘10 & ‘11

Based on Current Expectations

Based on Current Expectations

22

1Q ’11 Earnings

Final 338(h)(10) Cash Value ($M)