| SECURITIES AND EXCHANGE COMMISSION | |||

| Washington, D.C. 20549 | |||

| _________________________ | |||

| FORM 8-K | |||

| CURRENT REPORT | |||

| Pursuant to Section 13 or 15(d) of the | |||

| Securities Exchange Act of 1934 | |||

| Date of Report: May 2, 2011 | |||

| (Date of earliest event reported) | |||

| PRINCIPAL FINANCIAL GROUP, INC. | |||

| (Exact name of registrant as specified in its charter) | |||

| Delaware | 1-16725 42-1520346 | ||

| (State or other jurisdiction | (Commission file number) (I.R.S. Employer | ||

| of incorporation) | Identification Number) | ||

| 711 High Street, Des Moines, Iowa 50392 | |||

| (Address of principal executive offices) | |||

| (515) 247-5111 | |||

| (Registrant’s telephone number, including area code) | |||

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the | |||

| registrant under any of the following provisions: | |||

| [ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR | ||

| 240.14d-2(b)) | |||

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR | ||

| 240.13e-4(c)) | |||

| _________________________ | |||

| Page 2 | |

| Item 2.02. Results of Operations and Financial Condition | |

| On May 2, 2011, Principal Financial Group, Inc. publicly announced information regarding its | |

| results of operations and financial condition for the quarter ended March 31, 2011. The text of the | |

| announcement is included herewith as Exhibit 99. | |

| Item 9.01 Financial Statements and Exhibits | |

| 99 First Quarter 2011 Earnings Release | |

| SIGNATURE | |

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly | |

| caused this report to be signed on its behalf by the undersigned thereunto duly authorized. | |

| PRINCIPAL FINANCIAL GROUP, INC. | |

| By: /s/ Terrance J. Lillis | |

| Name: Terrance J. Lillis | |

| Title: Senior Vice President and Chief Financial | |

| Officer | |

| Date: May 3, 2011 | |

| Page 3 | |

| EXHIBIT 99 | |

| Release: On receipt, May 2, 2011 | |

| Media contact: Susan Houser, 515-248-2268, houser.susan@principal.com | |

| Investor contact: John Egan, 515-235-9500, egan.john@principal.com | |

| Principal Financial Group, Inc. Announces First Quarter 2011 Results | |

| Record assets under management of $327.4 billion at the end of first quarter 2011, an increase | |

| of 12 percent compared to first quarter 2010. | |

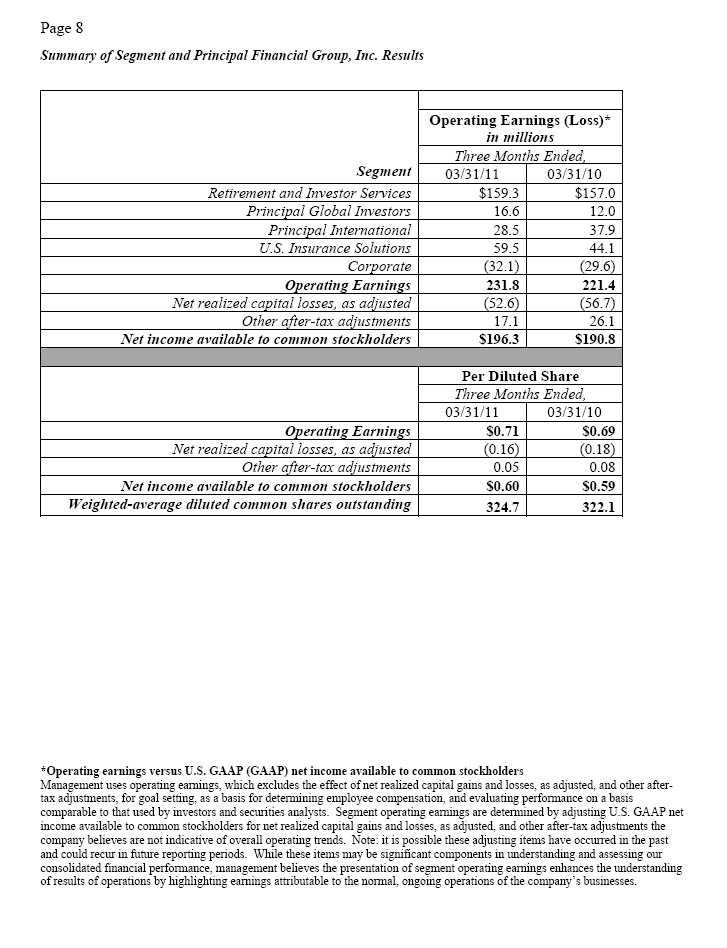

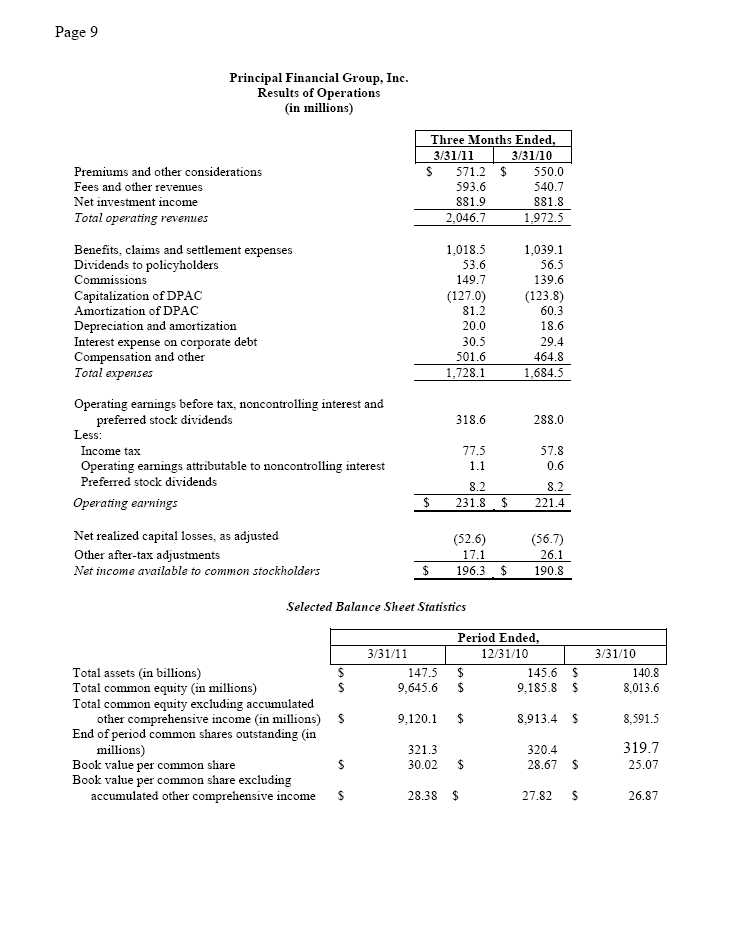

| (Des Moines, Iowa) – Principal Financial Group, Inc. (NYSE: PFG) today announced results for first quarter | |

| 2011. The company reported operating earnings1 of $231.8 million for first quarter 2011, compared to $221.4 | |

| million for first quarter 2010. Operating earnings per diluted share (EPS) were $0.71 for first quarter 2011, | |

| compared to $0.69 for first quarter 2010. The company reported net income available to common stockholders | |

| of $196.3 million, or $0.60 per diluted share for first quarter 2011, compared to $190.8 million, or $0.59 per | |

| diluted share for first quarter 2010. Operating revenues for first quarter 2011 were $2,046.7 million compared to | |

| $1,972.5 million for the same period last year. | |

| “The Principal® had a very solid start to 2011, including record total company assets under | |

| management, record Principal Funds sales and strong net cash flows from Principal International, Full Service | |

| Accumulation and Principal Funds,” said Larry D. Zimpleman, chairman, president and chief executive | |

| officer of Principal Financial Group, Inc. “With the continued successful execution of our strategy and signs | |

| of a recovering economy, we expect growth across our businesses to accelerate in the quarters ahead.” | |

| “Because of our strong financial position and flexibility going into the year, we have the | |

| opportunity to further increase shareholder value through capital deployment,” said Zimpleman. “Since year | |

| end, we’ve announced two acquisitions, the HSBC AFORE and Finisterre Capital. These businesses | |

| complement our strategy, provide additional scale and fit nicely within our existing infrastructure, which gives us | |

| potential for substantial synergies. We’re also excited about additional opportunities in 2011 to deploy capital as we | |

| continue to execute our strategy.” | |

| “In the first quarter we delivered strong operating results on double-digit earnings growth from Principal | |

| Global Investors, Principal Funds, Individual Annuities and U.S. Insurance Solutions,” said Terry Lillis, senior vice | |

| president and chief financial officer. “Across our business lines we’re seeing momentum continue to build, | |

| reflecting demand for our unique solutions and success of our multi-product, multi-channel distribution platform.” | |

| “Our investment portfolio continues to perform better than expected,” added Lillis. “In addition, we are | |

| encouraged by the demand for many of the investment strategies where Principal Global Investors has a proven | |

| track record such as real estate, emerging markets and high yield.” | |

| _________________________ | |

| 1 Use of non-GAAP financial measures is discussed in this release after Segment Highlights | |

| Page 4 | |

| Key Highlights | |

| • | Excellent sales in the company’s three key U.S. Retirement and Investor Services products in the first |

| quarter, with $2.0 billion for Full Service Accumulation, $2.9 billion for Principal Funds and $345 | |

| million for Individual Annuities. | |

| • | Net cash flows of $870 million for Full Service Accumulation and $620 million for Principal Funds. |

| • | Continued strong operating leverage in Principal Global Investors with 38 percent growth in first quarter |

| 2011 operating earnings over first quarter 2010 on 6 percent growth in average assets under management. | |

| • | Principal International reported record assets under management of $48.5 billion, excluding China, as of |

| March 31, 2011, and net cash flows of $1.3 billion for the quarter. | |

| • | Record Specialty Benefits sales of $113 million for the quarter and a 35 percent increase in Individual |

| Life sales over the prior year quarter. | |

| • | Strong capital position with an estimated risk based capital ratio of 425 percent at quarter end and |

| approximately $1.9 billion of excess capital.2 | |

| • | Book value per share, excluding AOCI3 increased to a record high of $28.38, up 6 percent over first |

| quarter 2010. | |

| • | Named by Barron’s as the #3 rated Fund Family for investment performance across all asset categories in |

| 2010 and #7 for the last decade. | |

| • | Named Investment Brand of The Year in the 2011 Harris Poll EquiTrend® Study.* |

| Net Income | |

| Net income available to common stockholders of $196.3 million for first quarter 2011 reflects net realized | |

| capital losses of $52.6 million, which include: | |

| • | $32.7 million of losses related to credit gains and losses on sales and permanent impairments of fixed |

| maturity securities, including $21.3 million of losses on commercial mortgage backed securities; and | |

| • | $5.1 million of losses on commercial mortgage whole loans. |

| Segment Highlights | |

| Retirement and Investor Services | |

| Segment operating earnings for first quarter 2011 were $159.3 million, compared to $157.0 million for | |

| the same period in 2010. Full Service Accumulation earnings were $76.0 million for first quarter 2011 as | |

| compared to $76.3 million for first quarter 2010. A 13 percent increase in average account values was | |

| substantially offset by a lower dividends received deduction accrual true-up than a year ago quarter and higher | |

| deferred policy acquisition cost (DPAC) amortization expense. Principal Funds earnings increased 18 percent | |

| from a year ago to $12.0 million, primarily due to a 19 percent increase in average account values. Individual | |

| Annuities earnings were $37.3 million compared to $30.8 million for first quarter 2010. The variance primarily | |

| reflects favorable investment income in the quarter and record account values. The accumulation businesses4 had | |

| record account values of $166.6 billion at March 31, 2011. | |

| _________________________ | |

| 2 Excess capital includes cash at the holding company and capital at the life company above that needed to maintain a | |

| 350 percent NAIC risk based capital ratio for the life company. | |

| 3 Accumulated Other Comprehensive Income | |

| 4 Full Service Accumulation, Principal Funds, Individual Annuities and Bank and Trust Services | |

| Page 5 |

| Operating revenues for first quarter 2011 were $1,017.8 million compared to $1,012.7 million for |

| the same period in 2010, primarily due to higher revenues for the accumulation businesses, which improved |

| $51.7 million, or 7 percent, from a year ago. |

| Segment assets under management were $181.5 billion as of March 31, 2011, compared to $165.9 |

| billion as of March 31, 2010. |

| Principal Global Investors |

| Segment operating earnings for first quarter 2011 were $16.6 million, compared to $12.0 million in |

| the prior year quarter, primarily due to an increase in assets under management. |

| Operating revenues for first quarter were $125.3 million, compared to $113.8 million for the same |

| period in 2010, primarily due to higher management fees and transaction fees. |

| Unaffiliated assets under management were $78.1 billion as of March 31, 2011, compared to $74.9 |

| billion as of March 31, 2010. |

| Principal International |

| Segment operating earnings were $28.5 million in first quarter 2011, compared to $37.9 million in |

| the prior year quarter, reflecting a reduced economic interest in our Brazilian joint venture. |

| Operating revenues were $206.2 million for first quarter 2011, compared to $181.1 million for the same |

| period last year, primarily due to growth in assets under management. |

| Segment assets under management were a record $48.5 billion as of March 31, 2011 ($7.7 billion |

| of assets in our joint venture in China are not included in reported assets under management), up from $35.7 |

| billion as of March 31, 2010. This includes a record $5.6 billion of net cash flows over the trailing twelve |

| months, or 16 percent of beginning of period assets under management. |

| U.S. Insurance Solutions |

| Segment operating earnings for first quarter 2011 were $59.5 million, compared to $44.1 million |

| for the same period in 2010. Individual Life earnings were $36.5 million in the first quarter, compared to |

| $30.5 million in first quarter 2010, primarily due to improved mortality experience. Specialty Benefits earnings |

| were $23.0 million in first quarter 2011, up from $13.6 million in the same period a year ago, primarily due to |

| improved claims experience and investment performance. |

| Segment operating revenues for first quarter 2011 were $731.2 million compared to $692.1 million |

| for the same period a year ago, with stronger non-qualified life insurance sales and positive trends in sales, |

| lapses and employment in Specialty Benefits. |

| Corporate |

| Operating losses for first quarter 2011 were $32.1 million compared to operating losses of $29.6 |

| million in first quarter 2010. |

| Page 6 | |

| Forward looking and cautionary statements | |

| This press release contains forward-looking statements, including, without limitation, statements as to | |

| operating earnings, net income available to common stockholders, net cash flows, realized and unrealized | |

| gains and losses, capital and liquidity positions, sales and earnings trends, and management's beliefs, | |

| expectations, goals and opinions. The company does not undertake to update these statements, which are | |

| based on a number of assumptions concerning future conditions that may ultimately prove to be inaccurate. | |

| Future events and their effects on the company may not be those anticipated, and actual results may differ | |

| materially from the results anticipated in these forward-looking statements. The risks, uncertainties and | |

| factors that could cause or contribute to such material differences are discussed in the company's annual report | |

| on Form 10-K for the year ended Dec. 31, 2010, filed by the company with the Securities and Exchange | |

| Commission, as updated or supplemented from time to time in subsequent filings. These risks and | |

| uncertainties include, without limitation: adverse capital and credit market conditions that may significantly | |

| affect the company’s ability to meet liquidity needs, access to capital and cost of capital; a continuation of | |

| difficult conditions in the global capital markets and the general economy that may materially adversely affect | |

| the company’s business and results of operations; the risk from acquiring new businesses, which could result | |

| in the impairment of goodwill and/or intangible assets recognized at the time of acquisition; impairment of | |

| other financial institutions that could adversely affect the company; investment risks which may diminish the | |

| value of the company’s invested assets and the investment returns credited to customers, which could reduce | |

| sales, revenues, assets under management and net income; requirements to post collateral or make payments | |

| related to declines in market value of specified assets may adversely affect company liquidity and expose the | |

| company to counterparty credit risk; changes in laws, regulations or accounting standards that may reduce | |

| company profitability; fluctuations in foreign currency exchange rates that could reduce company | |

| profitability; Principal Financial Group, Inc.’s primary reliance, as a holding company, on dividends from its | |

| subsidiaries to meet debt payment obligations and regulatory restrictions on the ability of subsidiaries to pay | |

| such dividends; competitive factors; volatility of financial markets; decrease in ratings; interest rate changes; | |

| inability to attract and retain sales representatives; international business risks; a pandemic, terrorist attack or | |

| other catastrophic event; and default of the company’s re-insurers. | |

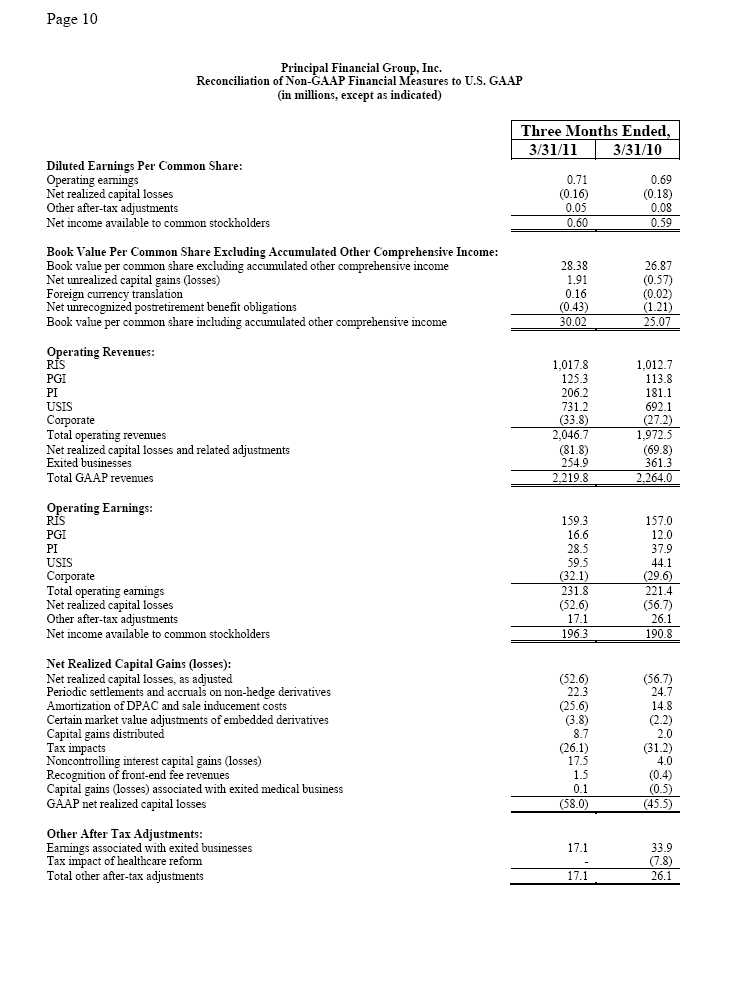

| Use of Non-GAAP Financial Measures | |

| The company uses a number of non-GAAP financial measures that management believes are useful to investors | |

| because they illustrate the performance of normal, ongoing operations, which is important in understanding and | |

| evaluating the company’s financial condition and results of operations. They are not, however, a substitute for | |

| U.S. GAAP financial measures. Therefore, the company has provided reconciliations of the non-GAAP | |

| measures to the most directly comparable U.S. GAAP measure at the end of the release. The company adjusts | |

| U.S. GAAP measures for items not directly related to ongoing operations. However, it is possible these | |

| adjusting items have occurred in the past and could recur in the future reporting periods. Management also uses | |

| non-GAAP measures for goal setting, as a basis for determining employee and senior management | |

| awards and compensation, and evaluating performance on a basis comparable to that used by investors | |

| and securities analysts. | |

| Earnings Conference Call | |

| On Tuesday, May 3, 2011 at 10:00 a.m. (ET), Chairman, President and Chief Executive Officer Larry | |

| Zimpleman and Senior Vice President and Chief Financial Officer Terry Lillis will lead a discussion of | |

| results, asset quality and capital adequacy during a live conference call, which can be accessed as follows: | |

| • | Via live Internet webcast. Please go to www.principal.com/investor at least 10-15 minutes prior to the |

| start of the call to register, and to download and install any necessary audio software. | |

| • | Via telephone by dialing 800-374-1609 (U.S. and Canadian callers) or 706-643-7701 (International |

| callers) approximately 10 minutes prior to the start of the call. The access code is 54521548. | |

| Page 7 | |

| • | Replay of the earnings call via telephone is available by dialing 800-642-1687 (U.S. and Canadian |

| callers) or 706-645-9291 (International callers). The access code is 54521548. This replay will be | |

| available approximately two hours after the completion of the live earnings call through the end of day | |

| May 10, 2011. | |

| • | Replay of the earnings call via webcast as well as a transcript of the call will be available after the call at: |

| www.principal.com/investor. | |

| The company's financial supplement and additional investment portfolio detail for first quarter 2011 is | |

| currently available at www.principal.com/investor, and may be referred to during the call. | |

| About the Principal Financial Group | |

| The Principal Financial Group® (The Principal ® )5 is a leader in offering businesses, individuals and | |

| institutional clients a wide range of financial products and services, including retirement and investment | |

| services, insurance, and banking through its diverse family of financial services companies. A member of the | |

| Fortune 500, the Principal Financial Group has $327.4 billion in assets under management6 and serves some | |

| 16.4 million customers worldwide from offices in Asia, Australia, Europe, Latin America and the United | |

| States. Principal Financial Group, Inc. is traded on the New York Stock Exchange under the ticker symbol | |

| PFG. For more information, visit www.principal.com. | |

| *The Principal Financial Group received the highest numerical Equity Score among Investment | |

| brands included in the 2011 Harris Poll EquiTrend® Study, which is based on opinions of 25,099 U.S. | |

| consumers ages 15 and over surveyed online between January 11 and 27, 2011. Your opinion may | |

| differ. “Highest Ranked” was determined by a pure ranking of a sample of Investment brands. | |

| ### | |

| _______________________ | |

| 5 “The Principal Financial Group” and “The Principal” are registered service marks of Principal Financial Services, | |

| Inc., a member of the Principal Financial Group. | |

| 6 As of March 31, 2011 | |