Attached files

| file | filename |

|---|---|

| 8-K - ARMSTRONG WORLD INDUSTRIES INC | awi8k.htm |

| EX-99.1 - PRESS RELEASE DATED MAY 2, 2011 - ARMSTRONG WORLD INDUSTRIES INC | exhibit.htm |

Armstrong World Industries

Earnings Call Presentation

First Quarter 2011

May 2, 2011

2

Safe Harbor Statement

This presentation contains “forward-looking statements” related to Armstrong

World Industries, Inc.’s, future financial performance. Our results could differ

materially from the results discussed in these forward-looking statements due to

known and unknown risks and uncertainties. A more detailed discussion of the

risks and uncertainties that may affect our ability to achieve the projected

performance is included in the “Risk Factors” and “Management’s Discussion

and Analysis” sections of our recent reports on Forms 10-K and 10-Q filed with

the SEC. We undertake no obligation to update any forward-looking statement

beyond what is required by applicable securities law.

World Industries, Inc.’s, future financial performance. Our results could differ

materially from the results discussed in these forward-looking statements due to

known and unknown risks and uncertainties. A more detailed discussion of the

risks and uncertainties that may affect our ability to achieve the projected

performance is included in the “Risk Factors” and “Management’s Discussion

and Analysis” sections of our recent reports on Forms 10-K and 10-Q filed with

the SEC. We undertake no obligation to update any forward-looking statement

beyond what is required by applicable securities law.

In addition, we will be referring to non-GAAP financial measures within the

meaning of SEC Regulation G. A reconciliation of the differences between these

measures with the most directly comparable financial measures calculated in

accordance with GAAP is available on the Investor Relations page of our

website at www.armstrong.com.

meaning of SEC Regulation G. A reconciliation of the differences between these

measures with the most directly comparable financial measures calculated in

accordance with GAAP is available on the Investor Relations page of our

website at www.armstrong.com.

3

Key Metrics - First Quarter 2011 Adjusted (1)

Financial Overview

(1) Figures exclude non-recurring items such as charges for cost reduction initiatives, restructuring, etc. Figures also exclude the impact of foreign exchange

movements.

movements.

(2) As reported Net Sales: $685 million in 2011 and $659 million in 2010.

(3) As reported Operating Income: $52 million in 2011 and $13 million in 2010

(4) As reported EPS: $0.23 in 2011 and ($0.34) in 2010.

(5) Earnings per share reflect an adjusted tax rate of 42% for both 2011 and 2010.

(6) Total cash in 2011 of $244 million was comprised of $133 million in domestic cash and $111 million in foreign cash. Total cash in 2010 of $526 million

was comprised of $308 million in domestic cash and $218 million in foreign cash. Total debt was $849 million in 2011 and $467 million in 2010.

was comprised of $308 million in domestic cash and $218 million in foreign cash. Total debt was $849 million in 2011 and $467 million in 2010.

All figures in $ millions unless otherwise noted. Figures may not add due to rounding.

|

|

2011

Actual

|

2010

Actual

|

Variance

|

|

Net Sales (2)

|

$681

|

$659

|

3.3%

|

|

Operating Income (3)

|

66

|

27

|

144.4%

|

|

% of Sales

|

9.7%

|

4.1%

|

560 bps

|

|

EBITDA

|

93

|

55

|

69.1%

|

|

% of Sales

|

13.7%

|

8.3%

|

530 bps

|

|

Earnings Per Share (4), (5)

|

$0.51

|

$0.24

|

$0.27

|

|

Free Cash Flow

|

(44)

|

(30)

|

(14)

|

|

Net (Cash) Debt (6)

|

604

|

(59)

|

663

|

4

Q1 2011 - Adjusted EBITDA to

Reported Net Income

Reported Net Income

Financial Overview

All figures in $ millions unless otherwise noted. Figures may not add due to rounding.

(1) Figures exclude non-recurring items such as charges for cost reduction initiatives, restructuring, etc. Figures also exclude the impact of foreign

exchange movements.

exchange movements.

|

|

2011

|

2010

|

V

|

|

EBITDA- Adjusted (1)

|

$93

|

$55

|

$38

|

|

Depreciation and Amortization

|

(27)

|

(28)

|

1

|

|

Operating Income - Adjusted (1)

|

$66

|

$27

|

$39

|

|

Foreign Exchange Movements

|

1

|

(1)

|

2

|

|

Cost Reduction Initiatives

|

(5)

|

(2)

|

(3)

|

|

Accelerated Depreciation (not included above)

|

(5)

|

-

|

(5)

|

|

Restructuring

|

(5)

|

-

|

(5)

|

|

Executive Transition

|

-

|

(11)

|

11

|

|

Operating Income - As Reported

|

$52

|

$13

|

$39

|

|

Interest (Expense) Income

|

(14)

|

(3)

|

(11)

|

|

EBT

|

$38

|

$10

|

$28

|

|

Healthcare Reform- Medicare Subsidy Elimination

|

-

|

(22)

|

22

|

|

Tax (Expense) Benefit

|

(24)

|

(7)

|

(17)

|

|

Net Income

|

$14

|

($19)

|

$33

|

5

Q1 Sales and Adjusted EBITDA (1) by

Segment - 2011 vs. 2010

Segment - 2011 vs. 2010

Financial Overview

All figures in $ millions unless otherwise noted. Figures may not add due to rounding.

(1) Figures exclude non-recurring items such as charges for cost reduction initiatives, restructuring, etc. Figures also exclude the impact of foreign

exchange movements.

exchange movements.

6

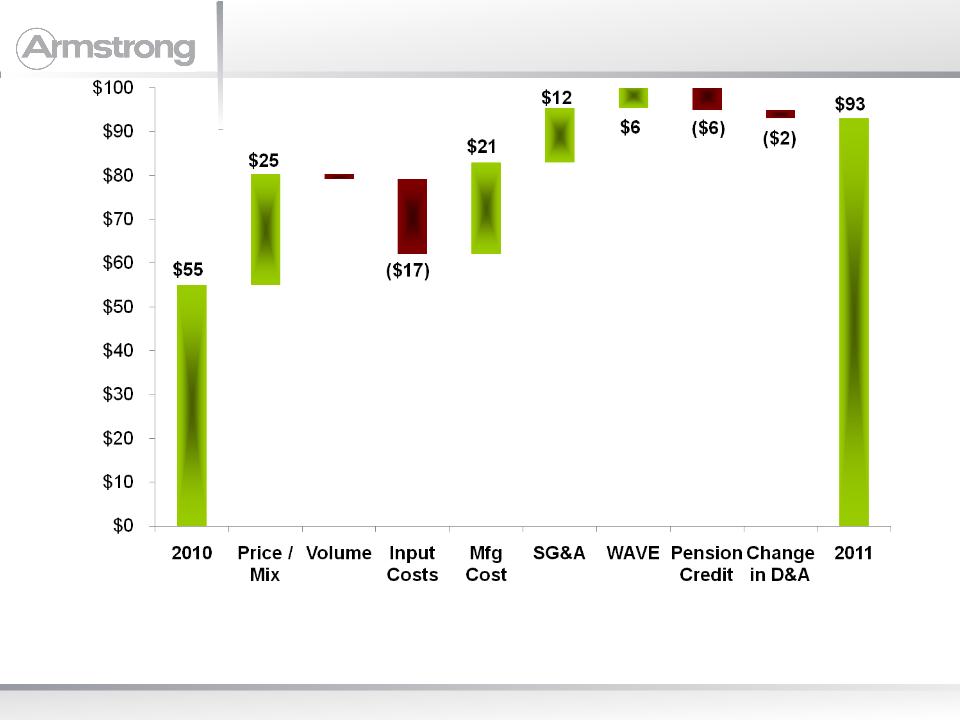

Adjusted EBITDA(1) Bridge -

Q1 2011 versus Prior Year

Q1 2011 versus Prior Year

Financial Overview

All figures in $ millions unless otherwise noted. Figures may not add due to rounding.

(1) Figures exclude non-recurring items such as charges for cost reduction initiatives, restructuring, etc. Figures also exclude the impact of foreign

exchange movements.

exchange movements.

($1)

7

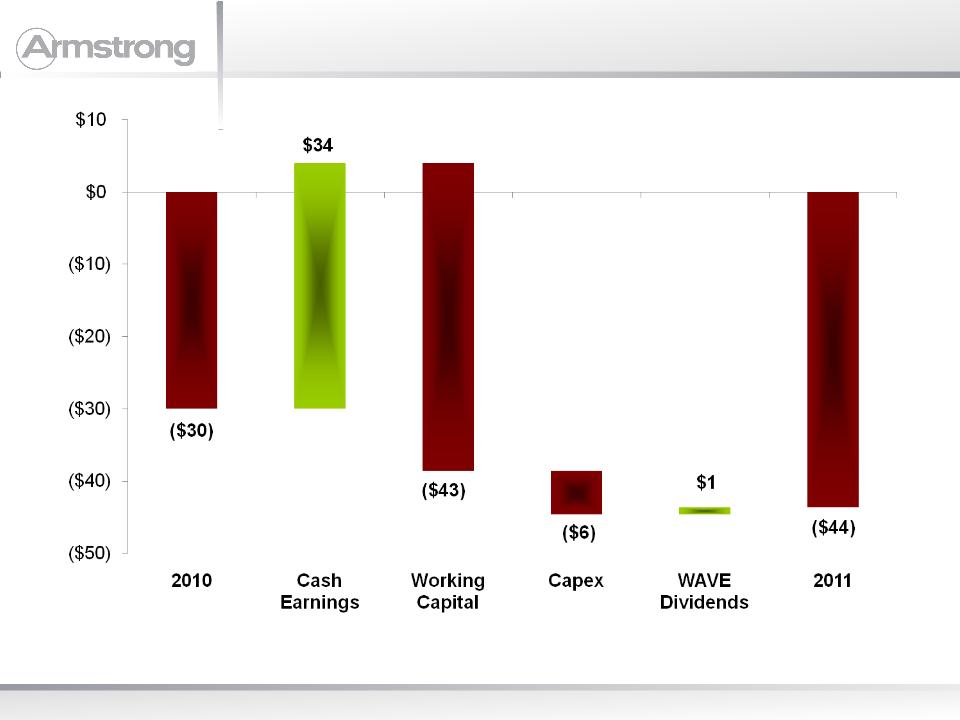

Free Cash Flow - First Quarter 2011

versus Prior Year

versus Prior Year

Financial Overview

All figures in $ millions unless otherwise noted. Figures may not add due to rounding.

8

Key Metrics (1) - Guidance

2011

2011

Financial Overview

All figures in $ millions unless otherwise noted.

|

|

2011

Estimate Range

|

|

2010

|

|

Variance

|

||||

|

Net Sales

|

2,800

|

to

|

3,000

|

|

2,766

|

|

1%

|

to

|

8%

|

|

Operating Income(2)

|

270

|

to

|

310

|

|

189

|

|

43%

|

to

|

64%

|

|

EBITDA

|

375

|

to

|

415

|

|

303

|

|

24%

|

to

|

37%

|

|

Earnings Per Share(3),(4)

|

$2.17

|

to

|

$2.57

|

|

$1.73

|

|

25%

|

to

|

49%

|

|

Free Cash Flow

|

80

|

to

|

120

|

|

180

|

|

(56%)

|

to

|

(33%)

|

(1) Figures exclude non-recurring items such as charges for cost reduction initiatives, restructuring, etc.

(2) As reported Operating Income: $240- 280 million in 2011 and $81 million 2010.

(3) Earnings per share reflect an adjusted tax rate of 42% for both 2011 and 2010.

(4) As reported earnings per share: $1.83 - $2.25 in 2011 and $0.19 in 2010.

9

2011 Financial Outlook

Financial Overview

¾ Raw Material & Energy Inflation* $40 - $50 million increase

¾ Manufacturing Productivity* Gross Margin +125 to +225 bps vs. 2010

¾ U.S. Pension Credit ~$25 million, down ~$25 million vs. 2010

60% manufacturing, 40% SG&A

60% manufacturing, 40% SG&A

¾ Earnings from WAVE $5 - $10 million vs. 2010

¾ Cash Taxes/ETR ~$15 million. Adjusted ETR of 42%

¾ Q2 Sales $740 - $790 million

EBITDA $105 - $120 million

EBITDA $105 - $120 million

¾ Capital Spending ~$180-$200 million

¾ Exclusions from EBITDA ~$18 - 27 million associated with already

announced actions

announced actions

* Changed from February Outlook

10

Appendix

11

Adjusted Operating Income to Free Cash Flow

Financial Overview Appendix

All figures in $ millions unless otherwise noted.

|

|

2011

Estimate Range

|

||

|

Adjusted Operating Income

|

270

|

to

|

310

|

|

D&A

|

105

|

||

|

Adjusted EBITDA

|

375

|

to

|

415

|

|

Changes in Working Capital

|

5

|

to

|

25

|

|

Capex

|

(180)

|

to

|

(200)

|

|

Pension Credit

|

(25)

|

||

|

Interest Expense

|

(50)

|

||

|

Cash Taxes

|

(15)

|

||

|

Other, including cash payments for

restructuring and one-time items |

(30)

|

||

|

Free Cash Flow

|

80

|

to

|

120

|

12

Consolidated Results

Financial Overview Appendix

All figures in $ millions unless otherwise noted. Figures may not add due to rounding.

(1) See earnings press release and 10-Qfor additional detail on comparability adjustments

(2) Eliminates impact of foreign exchange movements

|

First Quarter

|

||||||||

|

|

2011

Reported |

Comparability(1)

Adjustments

|

FX(2) Adj

|

2011

Adjusted |

2010

Reported |

Comparability(1)

Adjustments

|

FX(2) Adj

|

2010

Adjusted |

|

Net Sales

|

685

|

-

|

(4)

|

681

|

659

|

-

|

-

|

659

|

|

Operating Income

|

52

|

15

|

(1)

|

66

|

13

|

14

|

-

|

27

|

|

EPS

|

$0.23

|

$0.30

|

($0.02)

|

$0.51

|

($0.34)

|

$0.58

|

$ -

|

$0.24

|

13

Segment Operating Income (Loss)

Financial Overview Appendix

All figures in $ millions unless otherwise noted. Figures may not add due to rounding.

(1) Eliminates impact of foreign exchange movements and non-recurring items; see earnings press release and 10-Q for additional detail.

|

First Quarter

|

||||||

|

|

2011

Reported |

Comparability(1)

Adjustments |

2011 Adjusted

|

2010

Reported |

Comparability(1)

Adjustments |

2010 Adjusted

|

|

Resilient Flooring

|

(1)

|

8

|

7

|

(5)

|

-

|

(5)

|

|

Wood Flooring

|

3

|

-

|

3

|

(2)

|

-

|

(2)

|

|

Building Products

|

61

|

7

|

68

|

43

|

(1)

|

42

|

|

Cabinets

|

(1)

|

-

|

(1)

|

(4)

|

-

|

(4)

|

|

Unallocated Corporate

(Expense) Income |

(10)

|

(1)

|

(11)

|

(19)

|

15

|

(4)

|

|

|

||||||

14

Cash Flow

Financial Overview Appendix

All figures in $ millions unless otherwise noted. Figures may not add due to rounding.

|

|

First Quarter

|

|

|

($-millions)

|

2011

|

2010

|

|

Net Cash From Operations

|

(36)

|

(28)

|

|

Plus / (Minus) Net Cash from Investing

|

(8)

|

(2)

|

|

Equals Free Cash Flow

|

(44)

|

(30)

|