Attached files

| file | filename |

|---|---|

| 8-K - UNITY BANCORP FORM 8-K: 2011 SHAREHOLDERS' MEETING - UNITY BANCORP INC /NJ/ | form8k.htm |

Exhibit 99.1

UNITY’S Accomplishments!

® Despite this challenging environment, Unity’s

performance in 2010 included the following

accomplishments:

performance in 2010 included the following

accomplishments:

vStrategic reduction in certain products

v SBA loans down 11.50%

v Time deposits down 38%

v14% Increase in non-interest bearing deposits

vNet interest margin - 3.67% from 3.22%

vImprovement in total capital - 14.30% from 13.01%

vFurther development of sales culture

vContinued improvements in infrastructure

How the Economy Affected

UNITY

UNITY

® Unity’s 2010 results were affected by:

vHigh provision for loan losses

vElevated level of past due accounts

vElevated level of collection costs

vElevated level of FDIC insurance

vWeak loan demand

vLow yielding investments

UNITY’S Strategic Direction

® Focus on relationship-based business banking

® Reaffirm lending footprint

® Improve net interest margin

® Stabilize credit quality

® Effective cost control

® Branch realignment

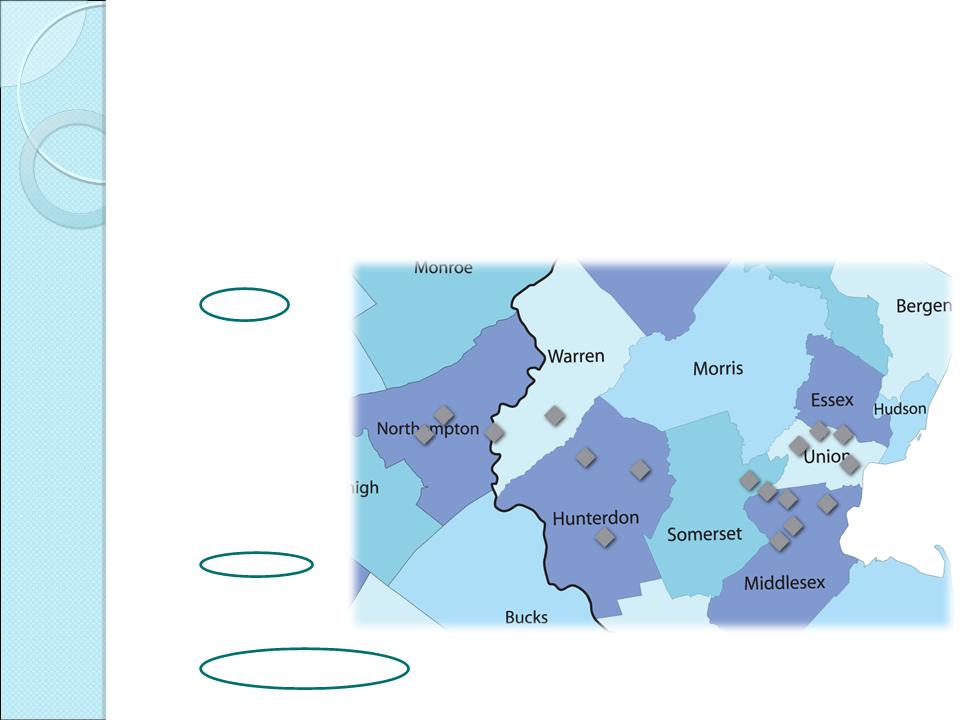

UNITY’S Branch Network

New Jersey

® Hunterdon County

v Clinton

v Flemington

v Whitehouse

® Middlesex County

v Colonia

v Edison

v Highland Park

v Middlesex

v South Plainfield

® Somerset County

v North Plainfield

® Union/Essex County

v Linden

v Scotch Plains

v Springfield

v Union

® Warren County

v Phillipsburg

v Washington (In Progress)

Pennsylvania

® Northampton County

v Forks Township

v William Penn

UNITY’S Recent and Future

Highlights

Highlights

® Expand Residential Mortgage Division

® Streamlined Loan Payment Processing

® Online Banking Product

® Mobile Money Smart Phone Banking

® Digital Signature Cards & Document Storage

® New Unity Bank Credit Card Program

® In-house electronic check presentments

® Enhanced Customer Call Center Phone System

® Upgrade of ATM Machines

eStatements

® Over 2600 Accounts on eStatements

® Reduced Cost in paper & postage

® Convenient & Secure

® Environmentally Friendly

® View, download and print the last 15 months of statements

UNITY’S Marketing Initiatives

Ucare Charitable Giving Program

® Launched in April 2011

® 25 Partners by Year-End

Key Bank Ratios

|

For the year ended 12/31/2010

|

||

|

|

Unity

|

Public Companies

$300 million - $2.5 billion |

|

Return on Average Assets

|

0.26%

|

-0.13%

|

|

Return on Average Equity

|

3.24%

|

-5.25%

|

|

Net Interest Margin

|

3.67%

|

3.71%

|

|

Total Nonperforming Assets to

Total Assets

|

2.93%

|

4.27%

|

|

Net Charge-offs to

Average Loans

|

1.05%

|

1.50%

|

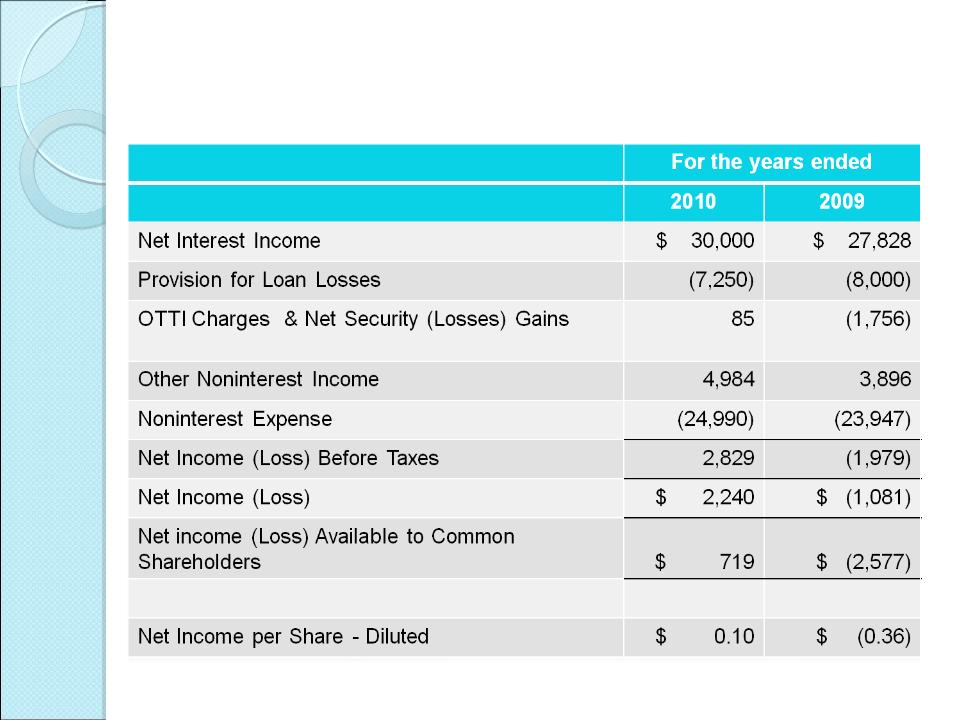

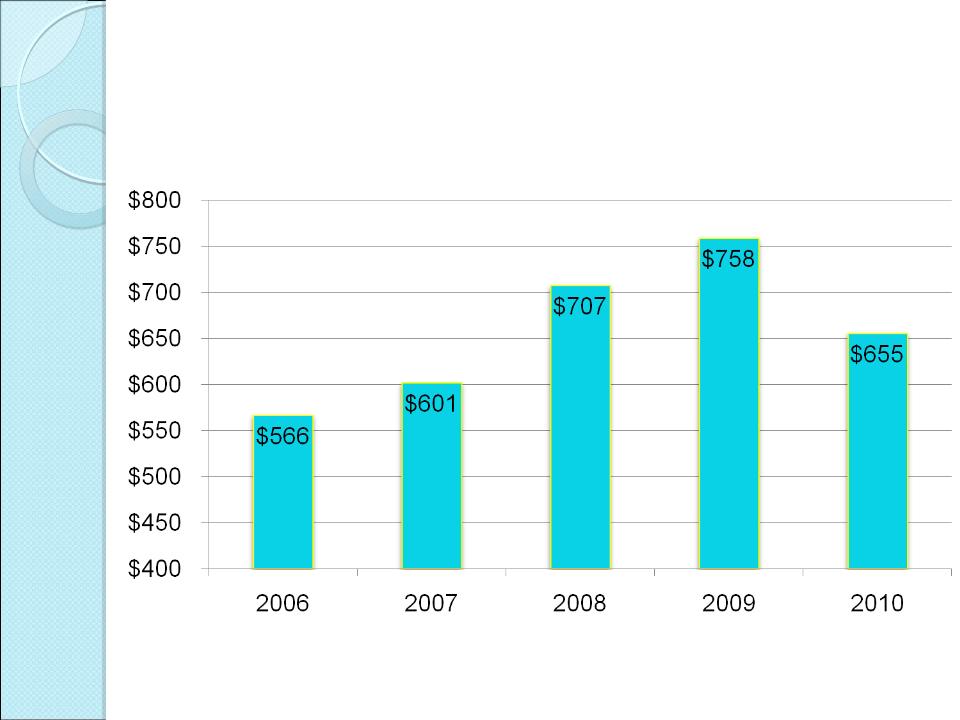

Income Statement

(dollars in thousands)

(dollars in thousands)

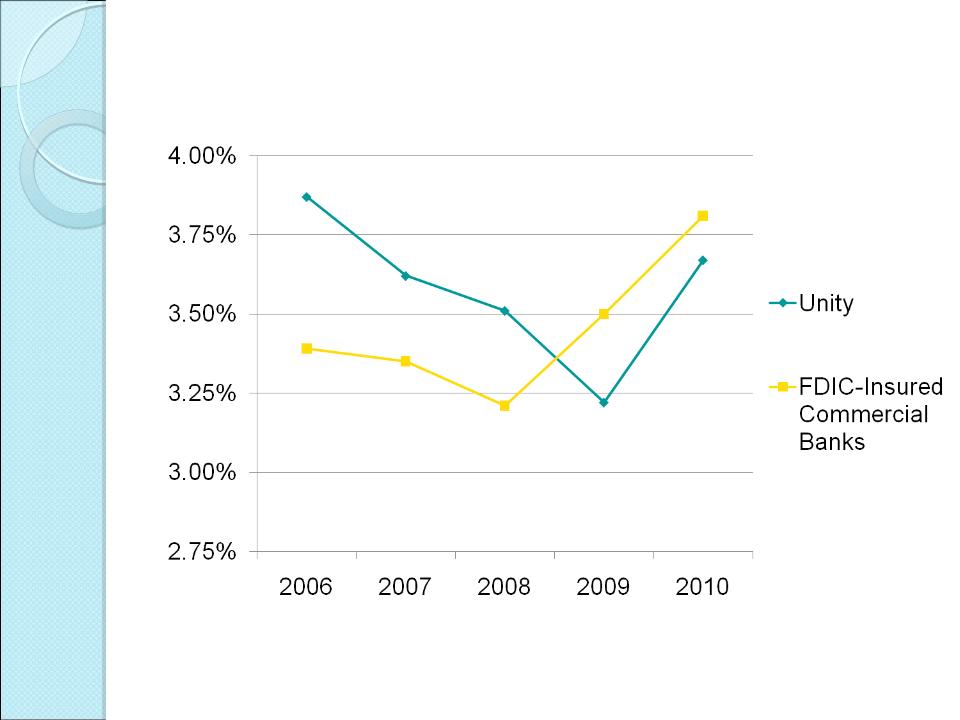

Net Interest Margin

|

Prime Rate

|

7.25%

|

8.25%

|

7.25%

|

3.25%

|

3.25%

|

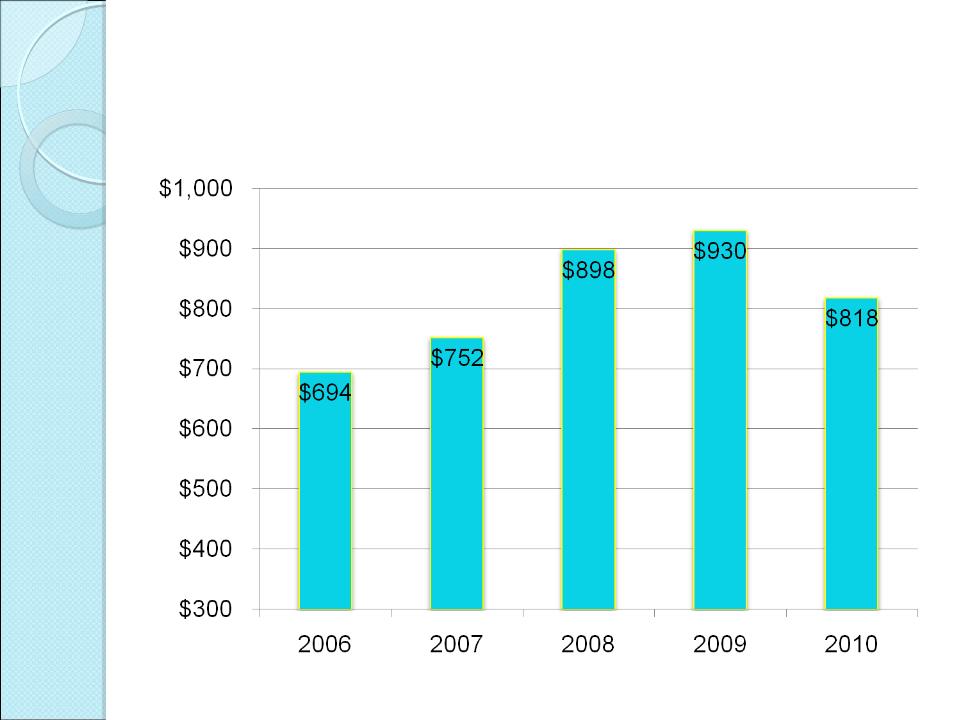

Total Assets

(dollars in millions)

(dollars in millions)

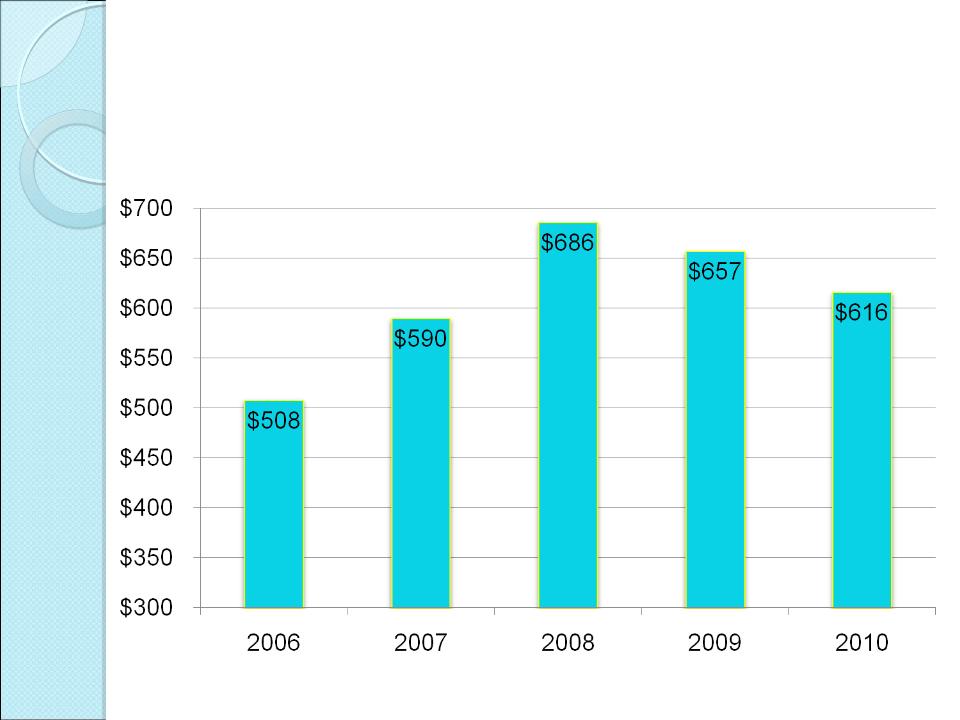

Total Loans Outstanding

(dollars in millions)

(dollars in millions)

Nonperforming Assets by Category

(dollars in thousands)

(dollars in thousands)

|

|

12/31/2010

|

12/31/2009

|

||

|

Category

|

$ Value

|

# of Loans

|

$ Value

|

# of Loans

|

|

SBA 7(a)

|

8,162

|

76

|

6,559

|

75

|

|

SBA 504

|

2,714

|

4

|

5,575

|

2

|

|

Commercial

|

5,452

|

19

|

7,397

|

21

|

|

Residential Mortgage

|

5,085

|

16

|

5,578

|

13

|

|

Consumer

|

249

|

3

|

387

|

6

|

|

OREO

|

2,346

|

7

|

1,530

|

5

|

|

Total

|

24,008

|

125

|

27,026

|

122

|

|

Selected Ratios

|

12/31/2010

|

12/31/2009

|

||

|

Nonperforming Assets to Total

Loans |

2.93%

|

2.90%

|

||

|

Allowance for Loan Losses to

Total Loans |

2.33%

|

2.11%

|

||

Total Deposits

(dollars in millions)

(dollars in millions)

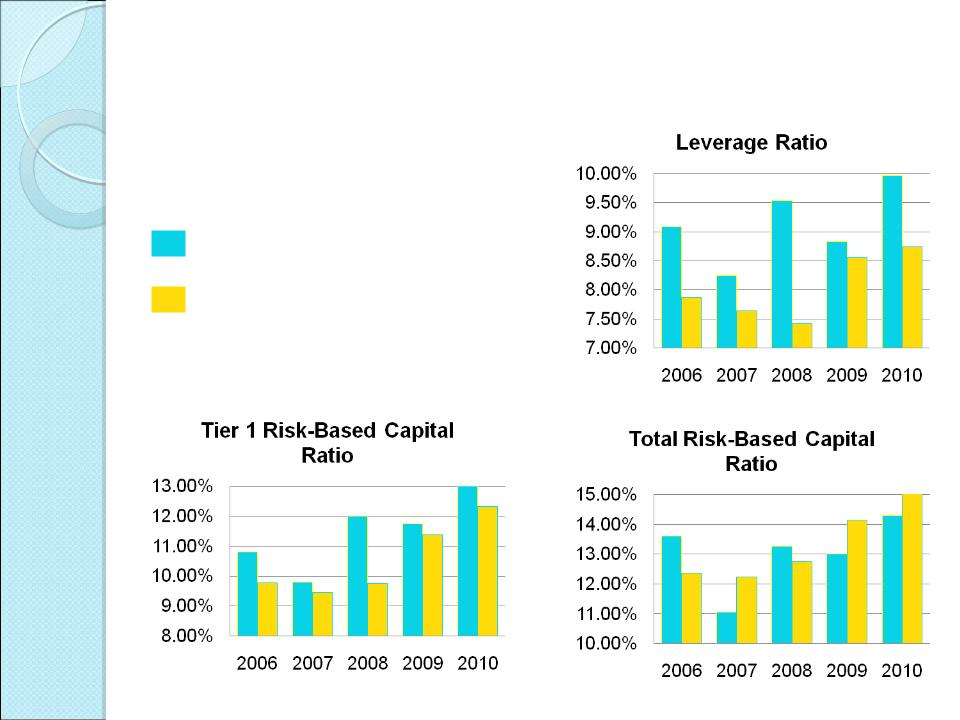

Capital Ratios

Unity Bancorp, Inc.

FDIC-Insured Commercial

Banks

Banks

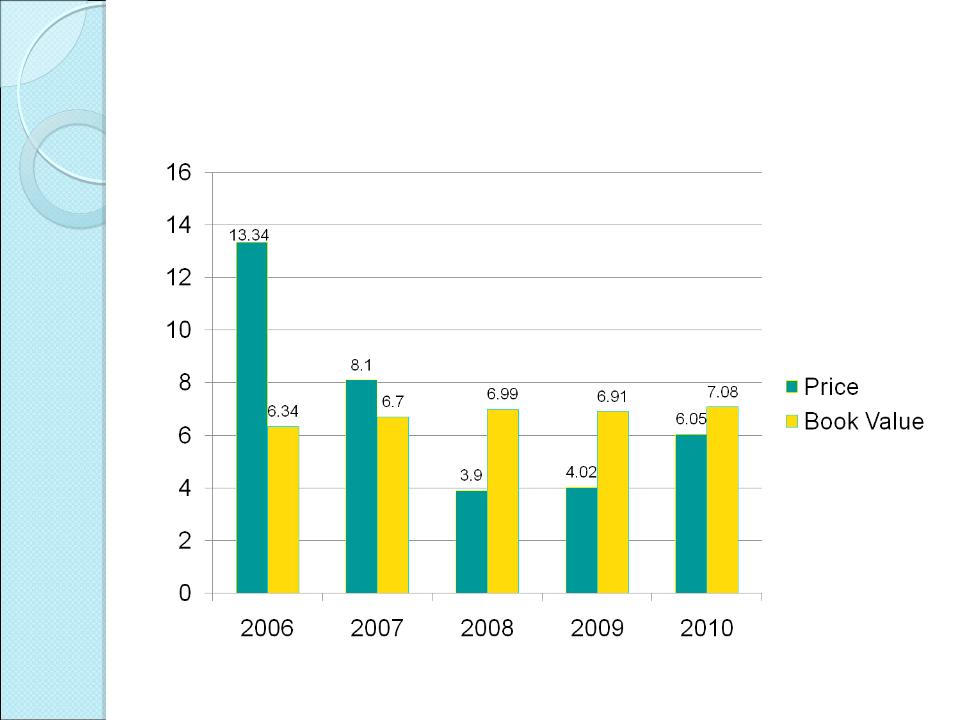

Compelling Investment

Considerations

® Discount to book

® Knowledgeable and experienced management

team

team

® Attractive branch franchise

® Improving bank fundamentals

® Positioned for economic rebound

® Insider ownership

UNITY’S Stock Price to Book

The previous slides contained data from the following sources:

® FDIC-Insured Commercial Banks:

v Obtained from FDIC.gov Quarterly Banking Profile

® SNL