Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PUBLIC MEDIA WORKS INC | d8k.htm |

Public

Media Works, Inc. dab

SpotTM

The difference

Executive Summary

April 2011

Exhibit 99.1 |

SPECIAL NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This Executive Summary contains statements that involve expectations,

plans or intentions (such as those relating to future business

or financial results, new features or services, or management

strategies). These statements are forward-looking and are

subject to risks and uncertainties, so actual results may vary

materially. You can identify these forward-looking

statements by words such as “may,” “should,” “expect,”

“anticipate,” “believe,” “estimate,”

“intend,” “plan” and other similar expressions. Our

actual results could differ materially from those anticipated in these

forward-looking statements as a result of certain factors,

including but not limited to those set forth under “Risk

Factors” and elsewhere in the company’s Quarterly Reports on Form 10Q and

Annual Report on Form 10-K and other reports are filed with the SEC

and may be reviewed at www.sec.gov. The company cautions readers not to place undue reliance on

any such forward-looking statements, which speak only as of the

date made. The company disclaims any obligation subsequently to

revise any forward-looking statements to reflect events or

circumstances after the date of such statements or to reflect the

occurrence of anticipated or unanticipated

events. |

Current kiosk model

|

Market –

U.S.

•Over 40,000 video kiosks in US

•Kiosk rentals approaching 50% market share

•Brick & Mortar (i.e. Blockbuster)

rapidly

closing = expanding kiosk market share

•Video kiosk saturation point approximately

80,000 |

Market -

Canada

•

Underserved kiosk market

•

approximately 500 kiosks

•

No major player

•

Market is brick and mortar

•

Highly vulnerable as was U.S. market

•

Netflix is not available

•

Retail price points very high

•

Conclusion

•

Strong opportunity to rapidly grow to be

the “redbox”

of Canada |

Competition

•

Main kiosk players:

•

redbox (Coinstar) 27,000 kiosks

•

Blockbuster Express (NCR) 11,000 kiosks

•

Focus: on large national chains (Walmart, CVS,

Walgreens)

•

Largely ignore middle/small markets

•

We believe a lot of AAA locations exist with smaller

chains and in smaller markets

•

Netflix –

different business model |

Competitive

Advantage •

Rental and sale of movies at kiosks grows

while brick and mortar share shrinks

•

Competitors concentrate on mega-chains; we

concentrate on next tier high volume retailers

•

Large parts of U.S. still underserved

•

Initiative to enter Canada

•

95% of rentals still brick & mortar at high price

points.

•

We would enter the market with aggressively low

price points.

•

Targeting Vancouver, Calgary, Toronto, Montreal |

Opportunity

Our kiosk is the “gold standard”

in the market

•

Faster rental and return times

•

Largest capacity in the industry

•

Two transaction points in kiosk vs. one at redbox and

Blockbuster Express

•

32 inch monitor for promotion and advertising

•

First 25 kiosks all outdoor

•

Planning 90% outdoor at scale

•

Outdoor kiosks significantly out perform indoor

•

Ability to change advertising and promotions remotely

•

Enabled for digital distribution |

Marketing and sales

strategy •

Aggressively lower rental prices

•

Unlike competitors –

we release all DVD titles on

original street date

•

Higher capacity kiosks means more titles, greater

customer selection

•

First video membership program in

development

•

Focusing on high traffic outdoor locations at

convenience stores, groceries and pharmacies |

Marketing and sales

strategy •

Proprietary

kiosk

design

–

Meets

American

Disability Act (ADA)

•

Opportunity for future advertising revenue using

32”

monitor

•

Introduction of DVD sales from kiosks by summer

2011 |

Operations

Strategy Leveraging

•

Management focus (our skillsets):

•

Scientific model to find new sites

•

Rapid deployment of kiosks

•

Continue to negotiate favorable pricing for content

•

Managing financial reporting model

•

Sub-contract (outside skillsets):

•

Outside merchandiser for weekly placement of new

inventory and maintenance

•

Remote monitoring in real-time:

•

Sales, inventory, etc.

•

Third party call center

•

Third party installation services |

Current operations

•

Began installation of kiosks March 2011

•

25 kiosks in Riverside CA area

•

Undergoing beta test on initial 25

•

Estimating first full month of operation, after beta test,

will exceed industry average

•

Targeting and negotiating site locations throughout

Western U.S. and Canada including:

•

Selective expansion in Riverside area

•

Northern California

•

Vancouver

•

Southern Nevada |

Management team

Strong industry experience and Hollywood

connections:

•

Martin W. Greenwald, CEO –

Founder of Image

Entertainment

•

Greg Waring, President

and

COO

–

Canadian Co-

Founder and former CMO of redbox.

•

Ed Roffman, 25 years, early stage and public

companies

•

Several former redbox employees on

management team

•

Vancouver based experienced marketing team |

Board of Directors

•

Martin W. Greenwald, CEO –

Founder of Image

Entertainment

•

Bryan Subotnick, attorney with strong industry focus

on digital distribution

•

Ed Frumkes, Former senior executive at Warner

•

Joe Merhi, 30+ years in movie production and

executive production

•

Special

advisor

–

Joe

Abrams-

serial

entrepreneur

(Software Toolworks, Myspace, etc.) |

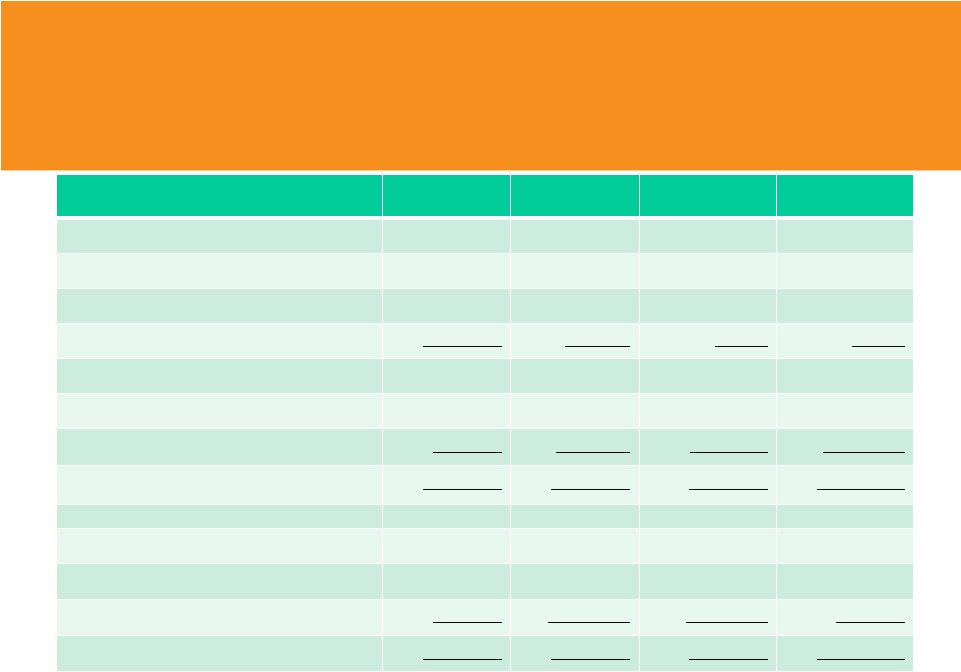

Financial forecast

Income Statement

Average revenue per kiosk

•

Test period -

$ 400

•

Month 1 -

$1,200

•

Month 2 -

$2,200

•

Month 3 -

$3,200

Three months ended

5-31-11

8-31-11

11-30-11

2-28-12

Full year

Kiosks Installed End of Period

25

105

330

630

Average # of Kiosks in Quarter

8

53

210

480

Revenue

$ 49,600

$ 372,600

$1,369,900

$3,687,400

$ 5,479,500

Operating costs (excl. product)

44,707

128,902

459,196

1,103,868

1,736,672

Gross profit (loss)

4,893

243,698

910,704

2,583,532

3,742,828

Overhead

353,548

378,099

480,716

585,714

1,798,077

EBITDA

(348,655)

(134,401)

429,988

1,997,818

1,944,751

Depreciation/amortization

59,398

157,443

607,385

1,457,141

2,281,366

Stock compensation

1,443,021

684,042

173,661

0

2,300,724

Interest expense

19,386

110,502

124,257

208,263

462,408

Net income (loss)

$(1,870,460)

$(1,086,388)

$(475,315)

$ 332,414

$(3,099,748)

Average monthly operating cost

$1,550

$1,560

$1,640

Gross Profit %

NA

65%

66%

70%

70%

Average monthly operating costs include software

license, technical support, internet, monitoring, credit

card fees and weekly loading of new content. |

Financial forecast

Balance Sheet

5-31-11

8-31-11

11-30-11

2-28-12

Cash

$ 3,521,519

$ 2,143,993

$ 1,727,786

$ 774,644

Inventory (DVD’s)

131,553

262,500

799,871

1,597,200

Kiosk deposits

180,000

305,377

525,000

525,000

Prepaid expenses

156,728

30,063

30,063

30,063

Total current assets

3,989,800

2,741,933

3,082,720

2,926,907

Fixed assets (Kiosks)

614,032

2,228,080

5,935,611

11,332,226

Other assets

9,448

9,448

9,448

9,448

Total assets

$4,613,280

$4,979,461

$9,027,779

$14,268,581

Current liabilities

$ 318,353

$1,103,043

$1,976,258

$3,126,383

Long-term debt

4,874,571

4,985,074

8,109,331

11,817,594

Equity

(579,644)

(1,108,656)

(1,057,810)

(675,396)

Total liabilities & equity

$4,613,280

$4,979,461

$9,027,779

$14,268,581 |

Note Regarding Use of Financial Projections:

The future operating and financial information contained in the company’s financial

projections above, and elsewhere in this Executive Summary (the “Projections”), are for

illustrative purposes only and are based upon hypothetical assumptions and events over

which the company has only partial or no control. The Projections were developed by the

company’s management and are based upon a variety of assumptions without benefit of a

significant operating history. The Projections are included solely to provide information

concerning the company’s estimates of future operating results based on these

assumptions and, although the company believes that these assumptions are reasonable,

they may be incomplete or incorrect, and unanticipated events and circumstances may

occur. Actual results will vary from the Projections, and these variations may be material

and adverse. The Projections should be read in conjunction with the assumptions upon

which the Projections are based. NO REPRESENTATION OR WARRANTY OF ANY KIND

IS OR CAN BE MADE WITH RESPECT TO THE ACCURACY OR COMPLETENESS OF,

AND NO REPRESENTATION OR WARRANTY SHOULD BE INFERRED FROM OUR

PROJECTIONS OR THE ASSUMPTIONS UNDERLYING THEM. |

For

more information Visit us at

Spotrentals.com

Public Media Works, Inc. |