Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Expedia Group, Inc. | d8k.htm |

| EX-99.1 - PRESS RELEASE OF EXPEDIA, INC. DATED APRIL 28, 2011 - Expedia Group, Inc. | dex991.htm |

Q111 Company Overview

Q1 2011

Company Overview

Exhibit 99.2 |

2

Q111 Company Overview

Forward-Looking Statements

This presentation contains "forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements are not guarantees of future

performance. These forward-looking statements are based on management’s expectations

as of April 28, 2011 and assumptions which are inherently subject to uncertainties, risks and

changes in circumstances that are difficult to predict. The use of words such as

"intends" and “expects,” among others, generally identify forward-looking statements. However, these words

are not the exclusive means of identifying such statements. In addition, any statements that refer to

expectations, projections or other characterizations of future events or circumstances are

forward-looking statements and may include statements relating to future revenues,

expenses, margins, profitability, net income / (loss), earnings per share and other measures of

results of operations and the prospects for future growth of Expedia, Inc.’s business.

Actual results and the timing and outcome of events may differ materially from those expressed

or implied in the forward-looking statements for a variety of reasons, including, among others:

declines or disruptions in the travel industry; changes in our relationships and contractual

agreements with travel suppliers or supplier intermediaries; risks relating to the announced

spin-off of our TripAdvisor business; increases in the costs of maintaining and enhancing

our brand awareness; changes in search engine algorithms and dynamics, or search engine

disintermediation; our inability to adapt to technological developments or to maintain our

existing technologies; our ability to expand successfully in international markets; changes in senior

management; volatility in our stock price; changing laws, rules and regulations and legal

uncertainties relating to our business; unfavorable new, or adverse application of existing,

tax laws, rules or regulations; adverse outcomes in legal proceedings to which we are party;

provisions in certain credit card processing agreements that could adversely impact our

liquidity and financial positions; fluctuations in our effective tax rate; our inability to

access the capital markets when necessary; risks related to our long term indebtedness; fluctuations in

foreign exchange rates; risks related to the failure of counterparties to perform on financial

obligations; potential liabilities resulting from our processing, storage, use and disclosure

of personal data; the integration of current and acquired businesses; the risk that our

intellectual property is not protected from copying or use by others, including competitors;

and other risks detailed in our public filings with the SEC, including our annual report on

Form 10-K for the year ended December 31, 2010. Except as required by law, we undertake no

obligation to update any forward-looking or other statements in this press release, whether

as a result of new information, future events or otherwise. Reconciliations

of non-GAAP measures included in this presentation to the most comparable GAAP measures are

included in Appendix B. |

3

Global Opportunity

Sizeable

markets

Higher growth

online

Penetration

tailwinds

OTA Share of

Online

Bookings

OTA share

stabilizing

CAGR

2008

2009

2010 (E)

2011 (E)

‘08 –

‘11

Travel Market Size:

U.S.

274

233

255

271

Flat

Europe

350

313

320

332

-1%

APAC

215

202

212

227

1%

LATAM

56

52

58

63

3%

4 Region Total

895

800

845

893

Flat

Online Bookings:

U.S.

143

132

139

145

Flat

Europe

107

107

118

129

5%

APAC

31

36

44

55

15%

LATAM

5

6

8

11

24%

4 Region Online

285

280

310

339

5%

Europe, APAC &

LATAM

142

148

171

195

8%

Online Penetration:

U.S.

52%

57%

54%

53%

Europe

30%

34%

37%

39%

APAC

14%

18%

21%

24%

LATAM

9%

11%

14%

18%

4 Region Online

Pen.

32%

35%

37%

38%

Figures in $billions

Sources: U.S. Online Travel Overview 10th Edition (November 2010); U.S. Online

Travel Overview 8th Edition Update: 2009 – 2010 (April 2009); U.S.

Corporate Travel Distribution 4th Edition (July 2009); US Online figure for 2011 assumes ~$40 million in online

corporate travel bookings; European Online Travel Overview 6th Edition (November

2010); European Online Travel Overview 5th Edition (October 2009);

European figures assume Euro/USD exchange rate in each period of $1.45; APAC data - PhoCusWright

Asia Pacific Online Travel Overview – Third Edition (August 2009) & EyeForTravel APAC Overview

(April 2007). APAC data excludes managed travel. LATAM data – PhoCusWright Latin

America: Navigating the Emerging Online Travel Marketplace (April 2011). LATAM data

excludes managed travel. Q111 Company Overview |

4

Q111 Company Overview

World’s Largest and Most Intelligent Travel Marketplace

Suppliers

Customers

Hotels

Airlines

Car rental companies

Cruise lines

Global distribution

system (GDS) partners

Advertisers

Leisure travelers

Corporate travelers

Travel service providers

(“white label”)

Offline retail travel

agents

Secure superior quality supply & maintain price competitiveness

Intelligently match supply & demand

Empower and inspire travelers to find and build the right trip

Enable suppliers to reach travelers in a unique & value-additive

way Aggressively expand our global presence & demand

footprint Achieve excellence in technology, people and processes to

make quality, consistency & efficiency the foundation of our

marketplace Travel

products

Travel info

Technology |

5

Q111 Company Overview

Expedia -

the Travel Sector Leader

Sources: comScore

MediaMetrix, March 2011 & company data; ² See Appendix B for

reconciliation of non-GAAP to GAAP numbers. Adjusted EBITDA is

calculated as operating income plus depreciation, restructuring charges,

intangibles amortization, stock-based compensation, any impairments, and

certain legal reserves and occupancy tax charges. Adj. EBITDA includes

realized gains/(losses) from revenue hedges.

Global presence & portfolio of category leading brands

Premier

Brand

Portfolio

#1

Online

Travel

Agency

(OTA)

globally,

with

presence

in

22 countries

Leading

hotel

specialist

globally,

with

over

75

localized sites

Leading value-based travel provider

#1

online

travel

community,

operating

in

North

America,

Europe & APAC

Key Statistics

•

Traffic (March 2011 unique visitors):

75mm

•

TTM 3.31.11 number of transactions:

67mm

TTM 3.31.11

•Gross bookings:

$ 26.6b

•Revenue:

$ 3.5b

•OIBA

²

:

$817mm

•Adjusted EBITDA

$944mm

•

$6.5b market cap (April 15, 2011)

•

Member of S&P 500 & NASDAQ 100

stock indices

2

1

1 |

6

Q111 Company Overview

Largest Worldwide Audience

Source: comScore MediaMetrix, March 2011

1

Denotes Expedia’s percentage difference over next largest

competitor +157%

1

+136%

1

+108%

1

+80%

1

+136%

1

+104%

1

Orbitz

Yahoo Travel

Priceline

Travelocity

U.S.

Worldwide

0

100

200

300

400

500

600

700

Min Spent Online

Page Views

UV’s

Min

Spent

Online

Page

Views

UV’s |

7

Q111 Company Overview

Expedia’s Virtuous Cycle

Scale drives opportunity to enhance supplier, traveler &

advertiser value propositions, reward stakeholders

Growth/

Scale

Compelling

supplier &

advertising

channel

Better

supplier

economics

More

travelers

Improved

traveler

experience

User-

generated

content

Cash flow

to invest in

More ad

revenue |

8

Q111 Company Overview

Revenue by Product & Geography

Hotel

63%

Revenue

Air

11%

* Hotel & Advertising –

>75% of revenue base

and key revenue / profitability drivers

* Europe & other international markets benefit

from earlier stage online penetration

* Significant international growth anticipated,

with a target of 50+% of total revenue from

international

Domestic

61%

Revenue

International

39%

Advertising

& Media

13%

Car, Cruise & Other

13%

Business mix shifting to hotel & advertising, increasingly global

Source: Company financial reports; some numbers may not add due to

rounding. Geographic Split (TTM 3.31.2011)

Product Categories (TTM 3.31.2011) |

9

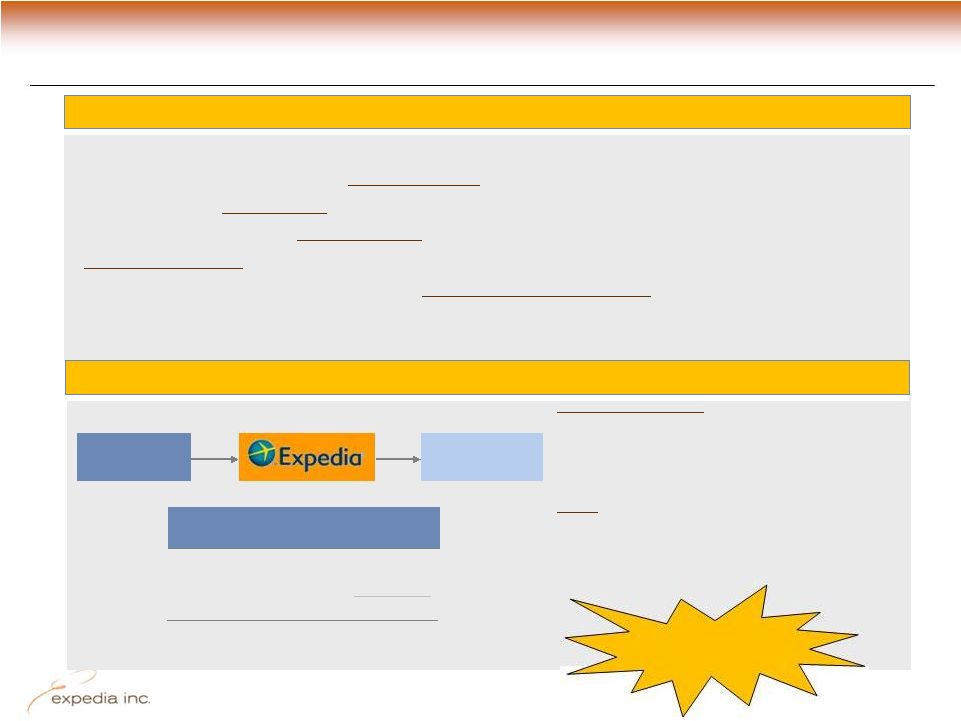

Q111 Company Overview

Product Category -

Hotel

Merchant Model / Illustrative Transaction

Hotels

(Supplier)

Travelers

Revenues to Expedia:

•Spread between the discounted rate provided

by suppliers and sales price paid by travelers

•Service fees from travelers

Other:

•Cash received on booking, revenue recognized

at stay

•Revenue margin higher than the agency model

Sample Expedia Revenue:

$350 night stay at luxury hotel

Cost to Traveler

Cost to Expedia

$350

$280

Revenue to Expedia

$70

1

Includes service fee and spread

•Merchant hotel

—Expedia merchant of record with no inventory risk

—Expedia receives cash upfront from travelers, pays hoteliers several

weeks later —Some control over pricing, higher margins &

ability to package with other products —1 -

3 year contracts with major chain lodging properties

—Consultative account management brings industry leading intelligence to

hoteliers •

Agency hotel small but growing in importance with acquisition of Venere &

launch of Expedia Easy Manage

Business Overview

1

Reduced E.com service

fees beginning Apr-09 |

10

Q111 Company Overview

Trended Worldwide Hotel Growth Statistics (y/y)

Source: Company financial reports . 2005 – 2007 data is for merchant

hotel only; 2008 – 2011 data is for both agency and merchant hotel. |

11

Q111 Company Overview

Travel supplier advertising on Expedia’s ww sites

Reviews with social networking

Search tool for fares

Travel blogs

European holiday reviews

Destination services, hotels & vacation rentals

Editorial info and deals

Cruise reviews & community

UGC seat maps and airline info

Guides and bargains

Vacation rental

Product Category -

Advertising & Media

•Two primary businesses –

•TripAdvisor Media Group

(leading global collection of

user-generated content sites)

•Expedia Media (monetizing global Expedia, Hotels &

Hotwire sites beyond transactions)

•TTM revenue of $446mm, +32% y/y

•Offer advertisers targeted audiences

•CPC, CPM & subscription based ad models

•TripAdvisor leverages industry-leading SEM & SEO

capabilities

•Robust user-generated content and selection draws in users

Sources: Company reports

Business Overview

Ad & Media Brand Portfolio

Revenue Drivers

Growth in TTM Net Advertising Revenues

1

TripAdvisor Reviews and Opinions -

Robust Growth |

12

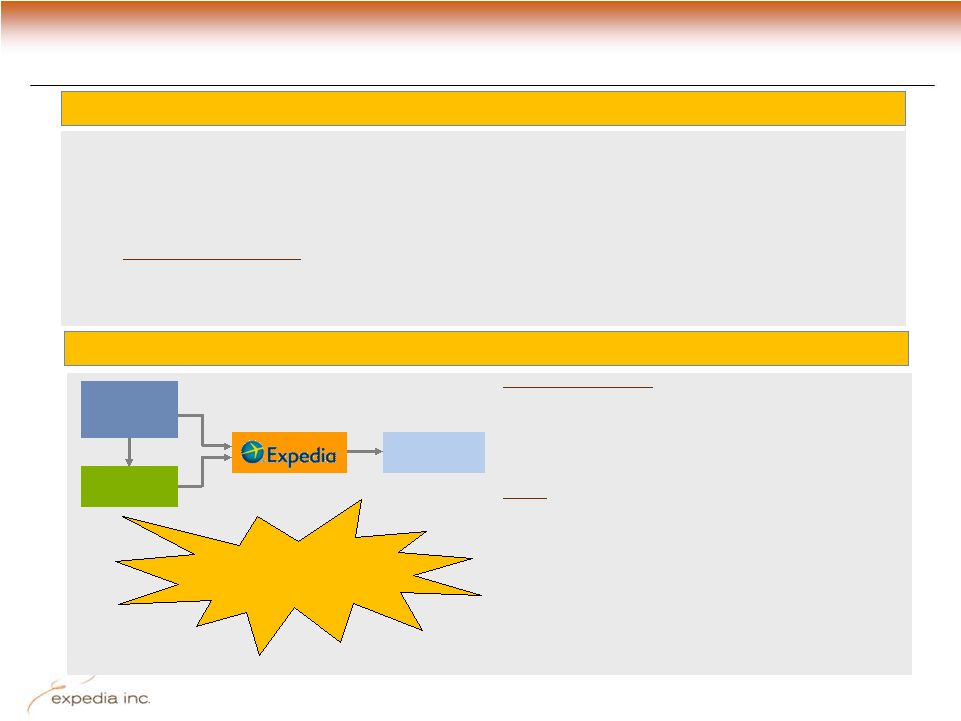

Q111 Company Overview

Product Category -

Air

•

Air revenue = 11% of Expedia’s worldwide trailing twelve months

revenue -

~95% of airplane tickets sold over Expedia’s online properties are

agency transactions, in which Expedia acts as an agent on behalf of a

supplier and collects a commission -

Customer pays supplier directly, Expedia collects its remuneration after

travel -

Lower

revenue

margin

business

vs.

hotel

transactions

•

OTAs in U.S. eliminated most consumer booking fees for air tickets in spring

2009, resulting in reduced revenue per ticket while taking share from

offline & supplier direct Airlines

(Supplier)

GDS

Travelers

Revenue to Expedia:

•Largely unit / volume driven and includes:

•Portion of GDS fee

•Commissions & incentives from carriers

•Booking fees (some sites)

Other:

•Supplier is merchant of record

•Expedia bears no inventory risk

•Revenue recognized at booking, cash received

within weeks

•Agency model is used in other product categories,

including hotel

•Multi-GDS strategy

No online booking

fees on E.com air tickets

Agency Model / Illustrative Transaction

Business Overview |

13

Q111 Company Overview

Trended Worldwide Air Growth Statistics (y/y)

Source: Company financial reports |

14

Q111 Company Overview

12.5%

12.5%

12.6%

12.6%

12.4%

12.1%

11.6%

11.3%

11.2%

11.3%

11.3%

13.7%

13.8%

14.0%

14.1%

13.9%

13.6%

13.1%

12.8%

12.8%

12.9%

13.0%

3Q08

4Q08

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

Stable Supplier Relationships & Economics

Trended Revenue Margin (TTM)

Stable supplier margins indicate healthy supplier relationships

Reductions driven by traveler fee cuts & rising air ticket prices

Supplier margins largely stable driven by:

Long-term agreements with airlines and GDS providers

Better hotel relationships through PSG investment

Growth in advertising business helping offset fee cut impact

Excluding ad & media revenue

Including ad & media revenue

Source: Company financial reports |

15

Q111 Company Overview

Q111 Results

Figures in $mm unless otherwise noted

* Excludes stock-based compensation. ** OIBA includes realized

gain/(loss) from revenue hedges *** Adjusted EBITDA is

calculated as operating income plus depreciation, restructuring charges, intangibles

amortization, stock-based compensation, any impairments and certain legal

reserves and occupancy tax charges. Adj. EBITDA includes

realized gains/(losses) from revenue hedges. ¹ See Appendix B for reconciliation

of non-GAAP to GAAP numbers.

Source: Company financial reports

Q111

Q110

y/y

Transactions (mm)

17.1

15.8

8%

Gross Bookings

$7,294

$6,632

10%

Revenue

822

718

15%

Cost of Revenue *

177

157

13%

Selling & Marketing *

337

277

22%

Tech & Content *

98

82

19%

General & Administrative *

75

62

22%

Total Costs and Expenses *

688

578

19%

OIBA **

129

143

-9%

OIBA Margin

16%

20%

(413bps)

Adjusted EBITDA ***

163

168

-3%

Adj. EBITDA Margin

20%

23%

(365bps)

Free Cash Flow

678

590

15%

Unit Growth

•

Q111 worldwide room night growth of 15%

•

Q111 worldwide air tickets declined 10%

1

1

1

1

1

1

1

1

1

1 |

Trended Free Cash Flow

(TTM) $millions

‘08 cash flows down due

to taxes, slowing

merchant hotel & one-

time cap ex

Approximately $1.7B in free cash flow* generated in past 3 years

‘09 cash flows improved

due to higher earnings,

merchant hotel recovery

& normalized cap ex

Source: Company financial reports

‘10 cash flows improved

due to higher earnings,

lower occupancy tax

assessment payments

and lower cash tax

payments

16

Q111 Company Overview

*

Free cash flow is a non-GAAP measure calculated by adding capital

expenditures to net cash provided by or used in operating activities. See Appendix B for reconciliation of non-GAAP to

GAAP numbers |

17

Q111 Company Overview

Efficiently Managing Dilution

15% reduction in share base since Q107

millions of adjusted diluted shares

Source: Company financial reports

2007 repurchased 55mm

shares for $1.4b

2010 repurchased 20.6mm

shares for $489mm |

18

Q111 Company Overview

Capitalization

3/31/11

Cash and Cash Equivalents

$953

Revolving Credit Facility

--

5.950% Notes due 2020

750

7.456% Notes due 2018

500

8.500% Notes due 2016

395

Total Debt

$1,645

Net Debt

692

Market Value of Equity

$6,468

Total Capitalization

$7,160

Adjusted EBITDA TTM

$944

Total Debt / Adj. EBITDA

1.7

Net Debt / Adj. EBITDA

0.7

Source: Company financial reports. Some numbers may not add due to

rounding. Modest leverage;

minimal net debt

3 debt issues with long-

term maturities

(2018 Notes have 2013

investor put)

1

Does not include restricted cash, short-term investments and corporate bond investments that are

included in long-term assets.

2

Total size of revolving credit facility closed in February 2010 is $750 million; available capacity

reduced by $27mm in outstanding letters of credit as of March 31, 2011.

3

Based on 273mm outstanding shares and April 15, 2011 closing share price of $23.66. 4

Adjusted EBITDA is calculated as operating income plus depreciation, intangibles expense,

restructuring charges, stock-based compensation, any impairments, certain legal reserves

and occupancy tax charges. Adjusted EBITDA includes any realized gains/(losses) from revenue hedges. See Appendix B for reconciliation of non-GAAP to GAAP

numbers.

1

2

3

4

4

4 |

19

Q111 Company Overview

12.31.07

12.31.08

12.31.09

12.31.10

TTM

3.31.11

Leverage Measures

Total Debt / TTM Adjusted EBITDA

¹

1.5

2.0

1.0

1.7

1.7

Net Debt / TTM Adjusted EBITDA

¹

0.6

1.1

0.3

1.0

0.7

Coverage Measures

TTM Adj. EBITDA / TTM Interest

Expense

¹

13.8

10.8

10.3

9.4

8.5

TTM Free Cash Flow / TTM Int.

Expense

¹

11.8

5.0

6.9

6.1

6.4

Trended Credit Metrics

Demonstrated strong credit metrics, consistent with investment grade rating

See Appendix B for reconciliation of non-GAAP to GAAP numbers.

Source: Company financial reports

1 |

20

Q111 Company Overview

Rating Agency Snapshot

S&P (Analyst: Andy Liu)

Rating ‘BBB-’

on CreditWatch with negative implications

April 7, 2011 Research Update:

“The CreditWatch placement is based on the company’s plan to split off

its TripAdvisor unit…we believe it will reduce Expedia’s growth

rate, EBITDA margin, and discretionary cash flow going forward.”

Moody’s (Analyst: Stephen Sohn)

Rating Affirmed at Ba1 / Outlook Stable

April 7, 2011 and April 11, 2011 Credit Opinions:

“The revised stable outlook for Expedia reflects our view that a near term

upgrade is unlikely until there is more clarity regarding the capital

structure post spin-off of TripAdvisor.” “Expedia’s Ba1

rating is supported by the company’s leading position in the consumer online travel agency

market, moderate leverage, solid profitability, and steady cash flow

generation.” Although

Expedia

is

a

globally

recognized

brand,

the

company

may

have

to

pursue

opportunistic

acquisitions

to

maintain its leadership position while achieving its growth

objectives.” Fitch Rates Expedia, Inc.'s 'BBB-'; Outlook Stable

Issuer Default Rating (IDR) 'BBB-‘; Senior unsecured notes

'BBB-'; Senior unsecured bank credit facility 'BBB-’; Rating

Outlook is Stable February 14, 2011 Research Update:

“Results should benefit from a continued strengthening of industry travel

trends and be positively impacted by continued share gains at Expedia as

consumers increasingly utilize online travel agents (OTAs).”

“Advertising revenue, which is growing significantly faster than airline and

hotel revenue and now represents over 10% of total revenue, represents a

strong source of revenue diversification and positively impacts overall

profitability.”

Solid execution & adequate liquidity |

21

Q111 Company Overview

Summary

•

Attractive macro tailwind as travel industry shifts online

•

World’s #1 online provider of travel-related services

Leading traffic, supply, scale, bookings, revenue & cash flows

Strong and complementary portfolio of brands and products

Important partner to airlines, hotels and other travel suppliers

Diversified brands, business models and geographic reach

•

Compelling platforms for travel suppliers, travelers & advertisers

•

Strong business model, execution & credit metrics

Substantial free cash flow

1

(TTM 3.31.11: $710mm)

Modest leverage (1.7x)

Strong interest coverage (8.5x)

High operating margins

Roughly 55% variable / 45% fixed cost base

•

Proven management

1

See Appendix B for reconciliation of non-GAAP to GAAP numbers.

|

22

Q410 Company Overview

Appendix A |

23

Q111 Company Overview

Business Model –

Income Statement (FY 2010)

Source: Company financial reports

1

Excludes stock-based compensation. See Appendix B for reconciliation of

non-GAAP to GAAP numbers. $ in millions

Gross bookings

$25,962

Revenue

3,348

Cost of revenue

1

690

Selling and marketing

1

1,190

General and administrative

1

285

Technology and content

1

348

“OIBA”

1

831

OIBA

margin

1

25%

Stock-based compensation

60

Amortization of intangibles

37

Legal reserves, occupancy tax & restructuring

6

Operating income (GAAP)

732

Customer books travel product or

service; total retail value (incl taxes

and fees) constitutes “Gross

Bookings.”

Expedia’s portion of the gross

booking gets recorded as revenue

(inc. commissions, fees, etc.). Also

includes advertising & media

revenue. Revenue = 12.9% of ‘10

bookings.

(1) Personnel–related costs,

including executive leadership,

finance, legal, tax and HR

functions. (2) Fees for professional

services typically related to legal,

tax and accounting engagements.

Annual employee awards granted

each Q1; company switched to

options from RSUs in 2009.

Amortization of M&A activity

•

Customer operations

•

Credit card & fraud expense

•

Data center & other costs

Consists of direct (73%)

advertising expenses (search

engine marketing & other online

advertising, TV, etc.) and

indirect, personnel-related costs

(27%), including our supplier

relationship function (PSG).

Principally relates to payroll and

related expenses, hardware &

software, licensing &

maintenance and software

development cost amortization. |

24

Q111 Company Overview

Growth

2006

2007

2008

2009

2010

2007

2008

2009

2010

Gross Bookings

$16,882

$19,632

$21,269

$21,811

$25,962

16%

8%

3%

19%

Revenue

2,238

2,665

2,937

2,955

3,348

19%

10%

1%

13%

Cost & Expenses *

1,639

1,996

2,239

2,183

2,514

22%

12%

(3%)

15%

OIBA***

599

670

698

762

831

12%

4%

9%

9%

OIBA Margin***

27%

25%

24%

26%

25%

(165bps)

(136bps)

201bps

(96bps)

Adj. EBITDA**

648

729

775

864

949

13%

6%

12%

10%

EBITDA Margin***

29%

27%

26%

29%

28%

(160bps)

(98bps)

287bps

(90bps)

Free Cash Flow***

525

625

361

584

622

19%

(42%)

62%

7%

Trended Historical Results

•

Positive top-line growth

•

Investing in business to drive accelerated transaction growth.

•

$3.6B in cumulative OIBA & $2.7B in cumulative free cash flow

(Figures in $millions)

*

Excludes stock-based compensation. See reconciliation of non-GAAP to GAAP numbers in Appendix

B.

**

Adjusted EBITDA is calculated as operating income plus depreciation, intangibles expense,

restructuring charges, stock-based compensation, any impairments and certain legal reserves

and occupancy tax charges. Adjusted EBITDA includes any gains/(losses) from revenue hedges. See Appendix B for reconciliation of non-GAAP to GAAP numbers.

*** See Appendix B for reconciliation of non-GAAP to GAAP numbers. |

25

Q111 Company Overview

Appendix B |

26

Q111 Company Overview

Tabular Reconciliations For Non-GAAP Data

Operating Income Before Amortization

3 Months

Ended

3 Months

Ended

(figures in $000s)

Mar 31,

2010

Mar 31,

2011

OIBA

$ 142,544

$ 129,258

Amortization of intangible assets

(9,028)

(7,951)

Stock-based compensation

(18,892)

(17,272)

Legal reserves and occupancy tax

assessments

-

(1,100)

Restructuring charges

-

-

Realized (gain) loss on revenue hedges

(2,450)

5,306

Operating income

112,174

108,241

Operating income margin

16%

13%

Interest expense, net

(20,608)

(27,839)

Other, net

568

(6,217)

Provision for income taxes

(31,535)

(21,976)

Net income attributable to noncontrolling

interests

(1,204)

(170)

Net income attributable to Expedia, Inc.

$ 59,395

$

52,039 |

27

Q111 Company Overview

Tabular Reconciliations For Non-GAAP Data

Operating Income Before Amortization

(figures in $000s)

Year Ended

Dec. 31,

2006

Year Ended

Dec. 31,

2007

Year Ended

Dec. 31,

2008

Year Ended

Dec. 31,

2009

Year Ended

Dec. 31,

2010

OIBA

$ 599,018

$ 669,487

$ 697,774

$ 761,532

$ 830,721

OIBA margin

27%

25%

24%

26%

25%

Amortization of intangible assets

(110,766)

(77,569)

(69,436)

(37,681)

(37,123)

Amortization of non-cash distribution and

marketing

(9,638)

-

-

-

-

Stock-based compensation

(80,285)

(62,849)

(61,291)

(61,661)

(59,690)

Restructuring charges

-

-

-

(34,168)

-

Legal reserves and occupancy tax assessments

-

-

-

(67,658)

(5,542)

Impairment of goodwill

-

-

(2,762,100)

-

-

Impairment of intangible & other long-lived assets

(47,000)

-

(233,900)

-

-

Realized loss on revenue hedges

-

-

-

11,050

3,549

Operating income / (loss)

351,329

529,069

(2,428,953)

571,414

731,915

Operating income margin

16%

20%

n/a

19%

22%

Interest income (expense), net

14,799

(13,478)

(41,573)

(78,027)

(94,131)

Other, net

18,770

(18,607)

(44,178)

(35,364)

(17,216)

Provision for income taxes

(139,451)

(203,114)

(5,966)

(154,400)

Net (income) loss attributable to noncontrolling

interests

(513)

1,994

2,907

(4,097)

(4,060) Net

income / (loss) attributable to Expedia, Inc. $ 244,934

$ 295,864

$(2,517,763)

$ 299,526

$ 421,500

Source:

Company financial reports

(195,008) |

28

Q111 Company Overview

Tabular Reconciliations For Non-GAAP Data

Costs & Expenses

(figures in $000s)

Year Ended

Dec. 31, 2006

Year Ended

Dec. 31, 2007

Year Ended

Dec. 31, 2008

Year Ended

Dec. 31, 2009

Year Ended

Dec. 31, 2010

Total costs and expenses*

$ 1,718,853

$ 2,058,694

$ 2,300,530

$ 2,244,505

$ 2,573,529

Less: stock-based compensation

(80,285)

(62,849)

(61,291)

(61,661)

(59,690)

Costs and expenses excluding stock-based

compensation

1,638,568

1,995,845

2,239,239

2,182,844

2,513,839

* Includes cost of revenue, selling and marketing, general and administrative and

technology and content expenses. Source:

Company financial reports

(figures in $000s)

Quarter Ended

Mar 31, 2010

Quarter Ended

Mar 31, 2011

Total costs and expenses*

596,717

704,885

Less: stock-based compensation

(18,892)

(17,272)

Costs and expenses excluding stock-based

compensation

577,825

687,613 |

29

Q111 Company Overview

Tabular Reconciliations For Non-GAAP Data

Adjusted Earnings Before Interest, Taxes, Depreciation & Amortization

(figures in $000s)

Year Ended

Dec. 31,

2006

Year Ended

Dec. 31,

2007

Year Ended

Dec. 31,

2008

Year Ended

Dec. 31,

2009

Year Ended

Dec. 31,

2010

Adjusted EBITDA

647,797

729,013

774,574

864,314

949,123

Adjusted EBITDA margin

29%

27%

26%

29%

28%

Depreciation

(48,779)

(59,526)

(76,800)

(102,782)

(118,402)

OIBA

599,018

669,487

697,774

761,532

830,721

Source:

Company financial reports

(figures in $000s)

Qtr

Ended

Mar 31,

2010

Qtr

Ended

Mar 31,

2011

TTM

3.31.11

Adjusted EBITDA

168,159

162,545

943,509

Adjusted EBITDA margin

23%

20%

27%

Depreciation

(25,615)

(33,287)

(126,074)

OIBA

142,544

129,258

817,435 |

30

Q111 Company Overview

Tabular Reconciliations For Non-GAAP Data

Costs & Expenses

12 Months

Ended

12 Months

Ended

3 Months

Ended

3 Months

Ended

(figures in $000s)

12.31.09

12.31.10

3.31.10

3.31.11

Cost of revenue

607,251

692,832

158,030

177,842

Less: stock-based compensation

(2,285)

(2,401)

(789)

(810)

Cost of revenue excluding stock-based

compensation

604,966

690,431

157,241

177,032

Selling and marketing

1,027,062

1,204,141

280,838

341,158

Less: stock-based compensation

(12,440)

(13,867)

(4,317)

(4,314)

Selling and marketing excluding stock-based

compensation

1,014,622

1,190,274

276,521

336,844

Technology and content

319,708

362,447

86,791

103,184

Less: stock-based compensation

(15,700)

(14,326)

(4,381)

(4,751)

Technology and content excluding stock-

based compensation

304,008

348,121

82,410

98,433

General and administrative

290,484

314,109

71,058

82,701

Less: stock-based compensation

(31,236)

(29,096)

(9,405)

(7,397)

General and administrative excluding stock-

based compensation

259,248

285,013

61,653

75,304

Source:

Company financial reports |

31

Q111 Company Overview

Tabular Reconciliations For Non-GAAP Data

Free Cash Flow

(figures in $000s)

3 months

ended

Mar 31, 2010

3 months

ended

Mar 31, 2011

Net cash used in operating

activities

619,527

729,090

Less: capital expenditures

(29,675)

(51,079)

Free cash flow

589,852

678,011 |

32

Q111 Company Overview

Tabular Reconciliations For Non-GAAP Data

Free Cash Flow

TTM = Trailing Twelve Month periods ended

(figures in $000s)

TTM 6.07

TTM 9.07

TTM 12.07

TTM 3.08

TTM 6.08

TTM 9.08

TTM 12.08

TTM 3.09

Net cash provided by operating

activities

831,140

859,228

712,069

737,792

660,510

514,242

520,688

458,913

Less: capital expenditures

(97,576)

(82,671)

(86,658)

(101,514)

(118,417)

(148,022)

(159,827)

(150,025)

Free cash flow

733,564

776,557

625,411

636,278

542,093

366,220

360,861

308,888

TTM 6.09

TTM 9.09

TTM 12.09

TTM 3.10

TTM 6.10

TTM 9.10

TTM 12.10

TTM 3.11

Net cash provided by operating

activities

494,184

573,491

676,004

793,527

764,787

793,389

777,483

887,046

Less: capital expenditures

(131,146)

(103,775)

(92,017)

(98,306)

(123,093)

(142,409)

(155,189)

(176,593)

Free cash flow

363,038

469,715

583,987

695,221

641,694

650,980

622,294

710,453

Source:

Company financial reports. Numbers may not add due to rounding.

|