Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - 3D SYSTEMS CORP | f8k_042811.htm |

| EX-99 - EXHIBIT 99.1 - 3D SYSTEMS CORP | exh_991.htm |

Conference Call and Webcast

First Quarter 2011

www.3dsystems.com NASDAQ:TDSC

Company Confidential

2

Participants

Company Confidential

3

Welcome Webcast Viewers

Company Confidential

4

Forward Looking Statements

This presentation contains forward-looking statements, as defined by federal and state securities laws. Forward-looking statements include

statements concerning plans, objectives, goals, strategies, expectations, intentions, projections, developments, future events, performance

or products, underlying assumptions, and other statements which are other than statements of historical facts. In some cases, you can

identify forward-looking statements by terminology such as ''may,'' ''will,'' ''should,'' “hope,'' "expects,'' ''intends,'' ''plans,'' ''anticipates,''

"contemplates," ''believes,'' ''estimates,'' ''predicts,'' ''projects,'' ''potential,'' ''continue,'' and other similar terminology or the negative of

these terms. From time to time, we may publish or otherwise make available forward-looking statements of this nature. All such forward-

looking statements, whether written or oral, and whether made by us or on our behalf, are expressly qualified by the cautionary statements

described on this message including those set forth below. In addition, we undertake no obligation to update or revise any forward-looking

statements to reflect events, circumstances, or new information after the date of the information or to reflect the occurrence or likelihood of

unanticipated events, and we disclaim any such obligation.

statements concerning plans, objectives, goals, strategies, expectations, intentions, projections, developments, future events, performance

or products, underlying assumptions, and other statements which are other than statements of historical facts. In some cases, you can

identify forward-looking statements by terminology such as ''may,'' ''will,'' ''should,'' “hope,'' "expects,'' ''intends,'' ''plans,'' ''anticipates,''

"contemplates," ''believes,'' ''estimates,'' ''predicts,'' ''projects,'' ''potential,'' ''continue,'' and other similar terminology or the negative of

these terms. From time to time, we may publish or otherwise make available forward-looking statements of this nature. All such forward-

looking statements, whether written or oral, and whether made by us or on our behalf, are expressly qualified by the cautionary statements

described on this message including those set forth below. In addition, we undertake no obligation to update or revise any forward-looking

statements to reflect events, circumstances, or new information after the date of the information or to reflect the occurrence or likelihood of

unanticipated events, and we disclaim any such obligation.

Forward-looking statements are only predictions that relate to future events or our future performance and are subject to known and

unknown risks, uncertainties, assumptions, and other factors, many of which are beyond our control, that may cause actual results,

outcomes, levels of activity, performance, developments, or achievements to be materially different from any future results, outcomes,

levels of activity, performance, developments, or achievements expressed, anticipated, or implied by these forward-looking statements. As a

result, we cannot guarantee future results, outcomes, levels of activity, performance, developments, or achievements, and there can be no

assurance that our expectations, intentions, anticipations, beliefs, or projections will result or be achieved or accomplished. These forward-

looking statements are made as of the date hereof and are based on current expectations, estimates, forecasts and projections as well as the

beliefs and assumptions of management. 3D System’s actual results could differ materially from those stated or implied in forward-looking

statements. Past performance is not necessarily indicative of future results. We do not intend to update these forward looking statements

even though our situation may change in the future. Further, we encourage you to review the risks that we face and other information

about us in our filings with the SEC, including our Annual Report on Form 10-K which was filed on February 17, 2011. These are available at

www.SEC.gov.

Operating Results

Abe Reichental, President & CEO

www.3dsystems.com NASDAQ:TDSC

Company Confidential

6

First Quarter 2011 Highlights

Financial Review

Damon Gregoire, Senior Vice President & CFO

www.3dsystems.com NASDAQ:TDSC

Company Confidential

8

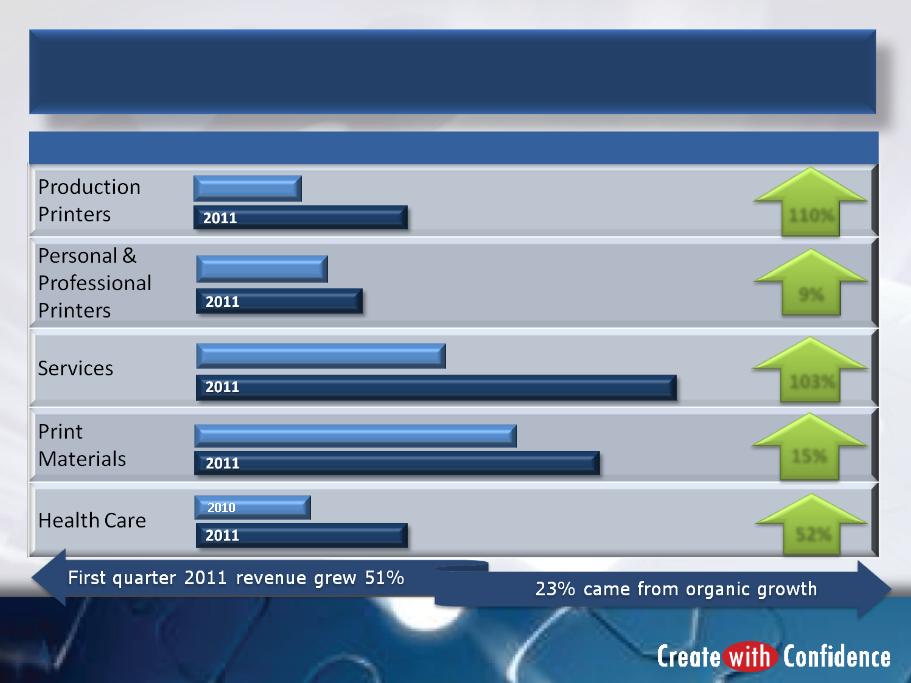

First Quarter 2011

2010

2010

2010

110%

Across-The-Board Revenue Growth

$ in millions

52%

103%

15%

9%

$ 4.0

$ 8.4

$ 4.7

$ 5.1

$ 9.2

$ 18.8

$ 13.6

$ 15.6

$ 4.1

$ 6.2

2010

Company Confidential

9

|

First Quarter

|

||||||

|

|

|

|

|

|

|

|

|

Drivers

|

|

2011

|

|

2010

|

|

% Change

Favorable/(Unfavorable)

|

|

Revenue

|

|

$ 47.9

|

|

$ 31.6

|

|

51%

|

|

Gross Profit

|

|

$ 23.2

|

|

$ 14.3

|

|

62%

|

|

% of Revenue

|

|

48%

|

|

45%

|

|

|

|

Operating Expenses

|

|

$15.8

|

|

$11.7

|

|

(35%)

|

|

% of Revenue

|

|

33%

|

|

37%

|

|

|

|

Net Income

|

|

$6.8

|

|

$2.0

|

|

238%

|

|

% of Revenue

|

|

14%

|

|

6%

|

|

|

|

Depreciation & Amortization

|

|

$2.4

|

|

$1.5

|

|

(60%)

|

|

% of Revenue

|

|

5%

|

|

5%

|

|

|

|

Diluted Earnings Per Share

|

|

$0.28

|

|

$0.09

|

|

211%

|

$ in millions, except earnings per share

-Percents are rounded to nearest whole number

First Quarter 2011 Operating Results

Company Confidential

10

Factors Affecting Earnings Per Share

• Legal costs reduced EPS by 7 cents per share for the quarter

• As anticipated, the negative impact from V-Flash® activity decreased

and did not affect our reported EPS for the quarter

and did not affect our reported EPS for the quarter

Future performance may result in release of portions of our valuation

allowance on deferred tax assets. We expect to periodically evaluate

the timing and amounts of future releases of valuation allowances as

required.

allowance on deferred tax assets. We expect to periodically evaluate

the timing and amounts of future releases of valuation allowances as

required.

Company Confidential

11

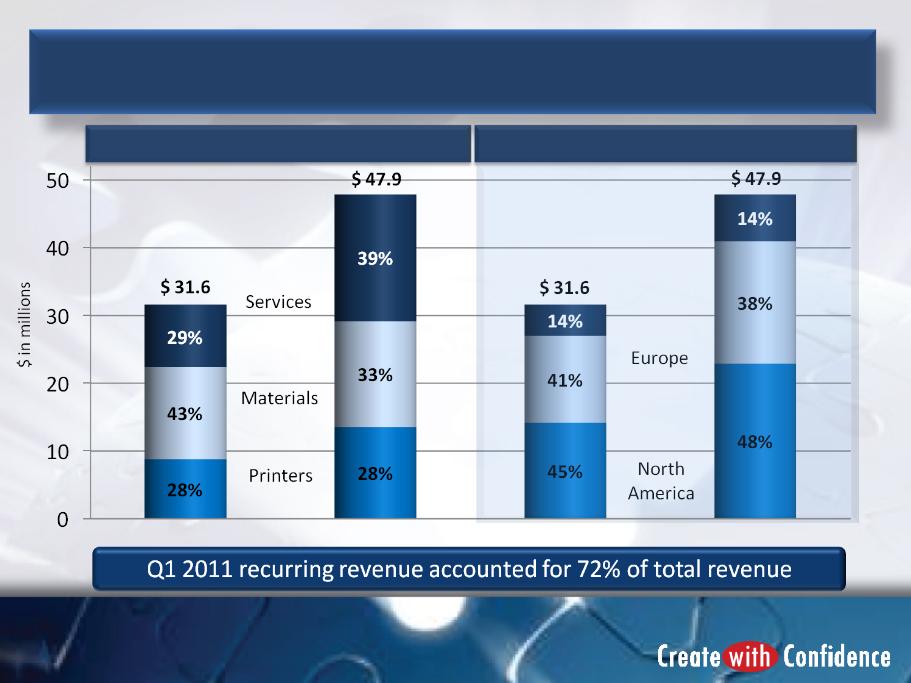

Revenue Categories

Geography

First Quarter Revenue by Category & Geography

Asia Pacific

2010

2010

2011

2011

Company Confidential

12

|

First Quarter

|

||||||

|

|

|

|

|

|

|

|

|

Category

|

2011

|

2010

|

Yr-Yr%

|

|||

|

$ Millions

|

Gross Profit

Margin |

$ Millions

|

Gross Profit

Margin |

$

|

Margin

|

|

|

Printers

|

$5.5

|

41%

|

$ 3.1

|

36%

|

75%

|

13%

|

|

Print materials

|

$9.9

|

63%

|

$ 8.3

|

61%

|

20%

|

5%

|

|

Services(1)

|

$7.8

|

42%

|

$ 2.9

|

32%

|

167%

|

31%

|

|

Total

|

$23.2

|

48%

|

$ 14.3

|

45%

|

62%

|

7%

|

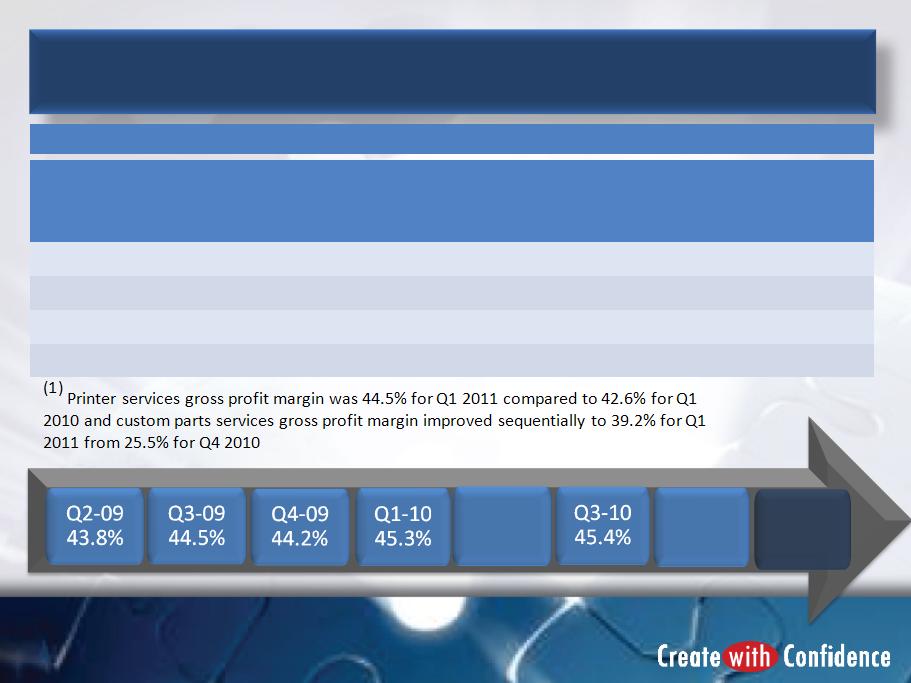

Q210

45.4%

45.4%

Q4-10

48.2%

48.2%

Q1-11

48.4%

48.4%

First Quarter Gross Profit and Margin

Company Confidential

13

|

First Quarter

|

|||

|

|

|

|

|

|

Category

|

2011

|

2010

|

% Change Favorable

(Unfavorable) |

|

Selling, general & administrative

|

$13.0

|

$ 9.2

|

(42%)

|

|

Research and development

|

$2.8

|

$ 2.5

|

(13%)

|

|

Total Operating Expenses

|

$15.8

|

$ 11.7

|

(35%)

|

|

% of Revenue

|

33%

|

37%

|

11%

|

- Columns may not foot due to rounding

• Total operating expenses increased primarily due to:

• Higher commissions from increased revenue

• Cost from additional acquisitions made during the quarter

• Legal expenses of $1.7 million primarily due to litigation concentration and timing

• Selling, general & administrative expenses decreased to 27% of revenue for the quarter from 29% in the first

quarter of 2010

quarter of 2010

• Research & development expenses decreased to 6% of revenue in 2011 from 8% of revenue in the 2010

quarter

quarter

($ in millions)

First Quarter Operating Expenses

Company Confidential

14

|

|

|

|

|

|

|

March 31, 2011

|

December 31, 2010

|

% Change

Favorable (Unfavorable)

|

|

Cash

|

$70.8

|

$ 37.3

|

90%

|

|

Inventory

|

$ 26.6

|

$23.8

|

(12%)

|

|

Accounts Receivable

|

$ 39.3

|

$ 35.8

|

10%

|

|

Accounts Payable

|

$ 23.4

|

$ 26.6

|

12%

|

|

Working Capital

|

$ 76.5

|

$ 42.5

|

80%

|

• Cash increased $33.5 million from the fourth quarter of 2010, primarily reflecting $54.0

million proceeds from our equity raise and $22.1 million paid in cash for acquisitions during the

quarter

million proceeds from our equity raise and $22.1 million paid in cash for acquisitions during the

quarter

• Working capital increased $34.0 million compared to the end of 2010, including a $3.5 million

increase in accounts receivable and a $7.5 million decrease in trade accounts payable

increase in accounts receivable and a $7.5 million decrease in trade accounts payable

• Inventory increased $2.8 million primarily related to timing of inventory purchases and

customer deliveries

customer deliveries

($ in millions)

Working Capital

Company Confidential

15

Drivers

Model Ranges

Q1 Actual Results

Revenue

$200.0

$300.0

$ 47.9

Gross Profit

56%

62%

48%

SG&A

23%

20%

27%

R&D

7%

5%

6%

Operating Income

26%

37%

15%

Net Income After Tax*

18%

22%

14%

Depreciation & Amortization

4%

3%

5%

Capital Expenditures

2%

1%

1%

Recurring Revenue

70%

75%

72%

($ millions)

* Net income is inclusive of the estimated fully-burdened tax rate.

- The Company’s current NOLs reduce the cash taxes to the portion relating to the Non-U.S. obligations.

This target model is not intended to constitute financial guidance related to the company’s expected performance. It is based upon management’s current

expectations concerning future events and trends and is necessarily subject to uncertainties.

expectations concerning future events and trends and is necessarily subject to uncertainties.

Progress Towards Operating Model

Outlook and Progress

Abe Reichental, President & CEO

www.3dsystems.com NASDAQ:TDSC

Company Confidential

17

Recent Developments

We continued to expand our custom parts services by:

• Acquiring Quickparts® in Atlanta, GA and ATI in Austin, TX

• Refining operations and optimizing capabilities as required

We expanded our reseller channel and grew personal and professional printer unit shipments and revenues

over the comparable 2010 quarter

over the comparable 2010 quarter

We announced plans to bring additional printer and print material production to Rock Hill and purchased

expansion land adjacent to our headquarters

expansion land adjacent to our headquarters

We grew our healthcare solutions revenue and installed base year over year and remain optimistic about our

growth prospects

growth prospects

We acquired Sycode, a software company in India as a step towards building 3D professional and consumer

content tools and as part of our expansion into India. We also acquired Print3D, a startup desktop tools and

utilities custom parts services company.

content tools and as part of our expansion into India. We also acquired Print3D, a startup desktop tools and

utilities custom parts services company.

We strengthened our printer services offerings through the acquisition of NRP

Company Confidential

18

Revenue Outlook

Company Confidential

19

Gross Profit and Operating Expenses Outlook

Company Confidential

20

Bottom Line

Company Confidential

21

Q&A Session

Thank You For Participating

Replay available at www.3dsystems.com/ir

www.3dsystems.com NASDAQ:TDSC