Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EASYLINK SERVICES INTERNATIONAL CORP | v219823_8k.htm |

Investor Presentation April 27-29, 2011 Tom Stallings, Chief Executive Officer Glen Shipley, Chief Financial Officer

Safe Harbor: Safe Harbor Statements included that are not historical facts (including any statements concerning plans and objectives of management for future operations or economic performance, or assumptions or forecasts related thereto), are forward-looking statements . These statements can be identified by the use of forward-looking terminology including “forecast,” “may,” “believe,” “will,” “expect,” “anticipate,” “estimate,” “continue” or other similar words. These statements discuss future expectations, contain projections of results of operations or of financial condition or state other “forward-looking” information . We and our representatives may from time to time make other oral or written statements that are also forward-looking statements . These forward-looking statements are made based upon management’s current plans, expectations, estimates, assumptions and beliefs concerning future events impacting us and therefore involve a number of risks and uncertainties . We caution that forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied in the forward-looking statements . Because these forward-looking statements involve risks and uncertainties, actual results could differ materially from those expressed or implied by these forward-looking statements for a number of important reasons . EasyLink Services International Corporation expressly disclaims any intention or obligation to revise or update any forward-looking statements whether as a result of new information, future events, or otherwise . Except for the historical information and discussion contained herein, statements contained in this presentation may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those indicated by such forward-looking statements . These and other risk factors are set forth under the caption "Risk Factors" in the Company's Annual Report on Form 10-K, the Company's quarterly reports on Form 10-Q and the Company's other filings with the Securities and Exchange Commission . These filings are available on a website maintained by the Securities and Exchange Commission at www.sec.gov. 2

Agenda: Agenda Overview EasyLink Services International Corporation (Nasdaq: ESIC) The Opportunity Delivering Enterprise Communications Applications Over the Cloud Solutions, Customers, and Growth Strategy Team Financials Summary Questions and Answers 3

Overview: EasyLink Services A leading provider of communications applications that enable enterprises of all sizes to communicate easily, securely and profitably 4

Overview (continued): Investor Snapshot Exchange: NASDAQ Ticker: ESIC Headquarters: Atlanta, GA International Headquarters: London, UK Employees: 550+ Shares Outstanding: 30.1 M Market Cap 1: $125M Enterprise Value 2: $219M Operating Cash Flow 3: $25.8M Investor Snapshot as of April 25, 2011 1 Shares outstanding is taken from the most recently filed quarterly or annual report and Market Cap is calculated using shares outstanding 2 Data derived from multiple sources or calculated by Yahoo! Finance 3 Trailing Twelve Months (as of Jan 31, 2011) 4 Please see GAAP to non-GAAP reconciliation at http://ir .easylink .com/releases .cfm 5

Overview (continued): EasyLink Services Rich history of moving complex business applications to the cloud Cloud Delivered Applications Highly-profitable “Application-as-a-Service” (AaaS) business model built on cloud delivered services including Electronic Fax, Multimodal Electronic Notification and Supply-chain Messaging AaaS >97% recurring revenue Number one global market position in enterprise fax Established worldwide footprint Managing over 5 million transactions a day Strong business momentum • $47.4 million in record Q2 revenues • $29.9 million in record Q2 gross profit • $12.1 million in record Q2 adjusted EBITDA 6

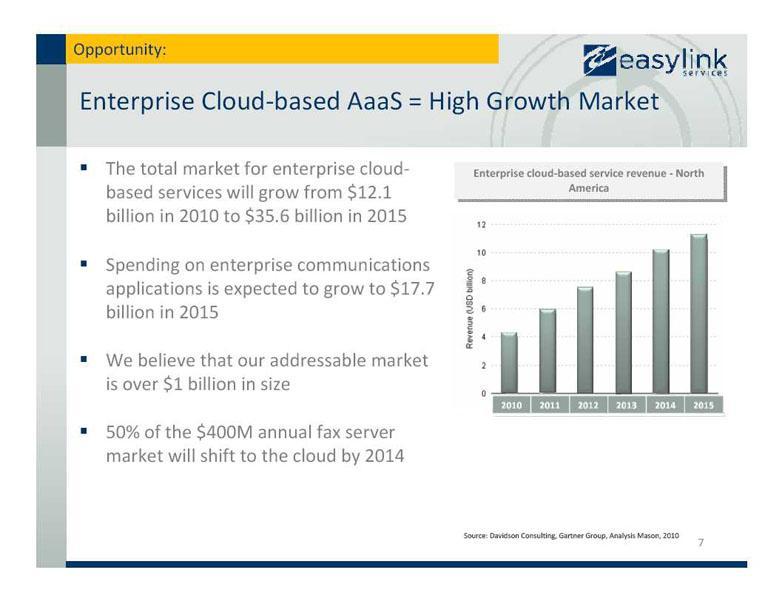

Opportunity: Enterprise Cloud-based AaaS = High Growth Market The total market for enterprise cloud-Enterprise cloud-based service revenue-North Enterprise cloud-based service revenue-North based services will grow from $12.1 America America billion in 2010 to $35.6 billion in 2015 Spending on enterprise communications applications is expected to grow to $17.7 billion in 2015 We believe that our addressable market is over $1 billion in size 50% of the $400M annual fax server market will shift to the cloud by 2014 Source: Davidson Consulting, Gartner Group, Analysis Mason, 2010 7

Solutions: Competitive Differentiators 100% outsourced and managed risk Global scale and leadership Broader portfolio of applications Complex integration experience Low total cost of ownership 8

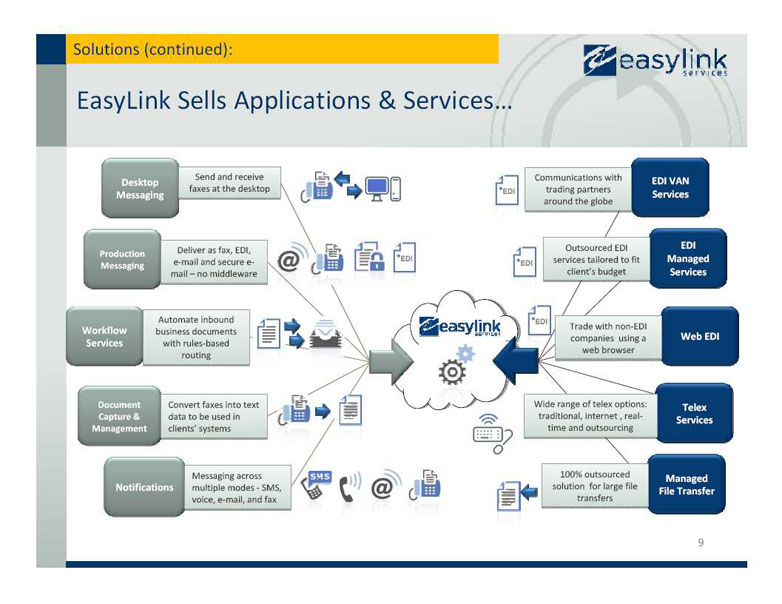

Solutions (continued): EasyLink Sells Applications & Services … Send and receive Communications with Desktop EDI VAN faxes at the desktop trading partners Messaging Services around the globe Outsourced EDI EDI Production Deliver as fax, EDI, e-mail and secure e-services tailored to fit Managed Messaging mail – no middleware client’s budget Services Automate inbound Trade with non-EDI Workflow business documents companies using a Web EDI Services with rules-based web browser routing Document Convert faxes into text Wide range of telex options: Telex Capture & data to be used in traditional, internet , real- Services Management clients’ systems time and outsourcing Messaging across 100% outsourced Managed Notifications multiple modes-SMS, solution for large file File Transfer voice, e-mail, and fax transfers 9

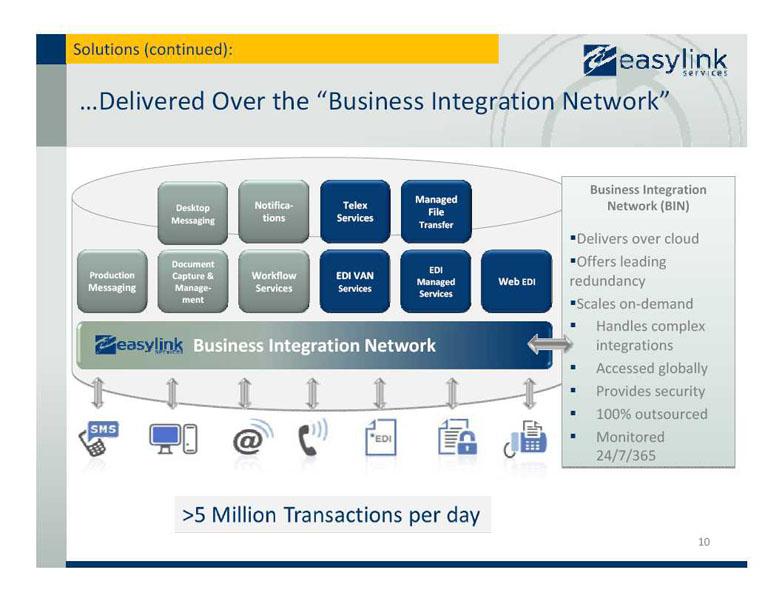

Solutions (continued): …Delivered Over the “Business Integration Network” Business Integration Managed Desktop Notifica-Telex Network (BIN) File Messaging tions Services Transfer Delivers over cloud Document Offers leading EDI Production Capture & Workflow EDI VAN Managed Web EDI redundancy Messaging Manage-Services Services Services ment Scales on-demand Handles complex Business Integration Network integrations Accessed globally Provides security 100% outsourced Monitored 24/7/365 10

Solutions (continued) : Real World Example: Healthcare The BIN notifies the pharmacy’s client that their prescription is ready for pick up via sms, email, voice, or fax A physician submits a prescription to a local pharmacy over EasyLink’s BIN after evaluating a patient EDI Mana Deskt Notifi Servi Telex ged op ca-ce Servi File Mess tions Burea ces Trans aging u fer Docu Prod ment EDI Work EDI uctio Captu Mana flow VAN Web n re & ged Servi Servi EDI Mess Mana Servi The BIN converts the submission into actionable ces ces aging ge-ces ment data and determines the format, routing the Business Information Network prescription via the cloud 11

Customers: Global Blue Chip & Diverse Customer Base 30,000 enterprise customer accounts Serving 70 of Fortune 100 with a presence in 95 countries Processing >5 million transactions a day Selling multi-year contracts Diverse industry coverage • Financial Services • Insurance • Healthcare • Retail • Manufacturing • Transportation and Logistics • Oil & Gas • Technology 12

Growth Strategy: Organic and Through M&A Enterprise Fax is growing double digits Capture new enterprise accounts transitioning to the cloud Cross-sell broader portfolio of applications into existing 30,000 customer accounts maximizing the number of services per customer Expand global sales and marketing investments M&A • Add additional applications to sell over the business integration network • Acquire new revenues and customer accounts • Extend global reach 13

Growth Strategy (continued): Proven Ability to Drive EBITDA Through M&A Six acquisitions in six years Strong integration track record with focus on driving synergies Acquired Xpedite in late 2010 • Significant financial contribution on an annualized run rate • >$111 Revenue • >$27 Adjusted EBITDA* • Accretive to basic earnings per share $0.35-$0.40 • More diverse industry base • Expanded application portfolio • Increased geographic, customer and integration scale • More viable partnership network *Please see GAAP to non-GAAP reconciliation at http://ir.easylink.com/releasedetail .cfm?ReleaseID=556882 14

Team: Strong, Experienced Leadership Team *Includes experience at newly acquired Xpedite 15

Financial Overview: Financial Overview Glen Shipley, Chief Financial Officer 16

Financial Overview (continued): Investor Highlights Highly predictable, recurring revenue model Leverageable business model Synergies from Xpedite acquisition taking effect Record revenues forecasted Record cash flow from operations and adjusted EBITDA Trending toward generating $45M+ in adjusted EBITDA *Please see GAAP to non-GAAP reconciliation at http://ir.easylink.com/releasedetail.cfm?ReleaseID=556882 17

Financial Overview (continued): Financials Q2 Highlights For Period Ended January 31 Q2 Q2 FY 2010 FY 2011 Y/Y % Revenue $20.4M $47.4M +132% Gross Profit $14.7M $29.9M +103% Operating Income $3.1m $6.3M +103% Adjusted EBITDA $5.3M $12.1M +128% Non-GAAP Basic income $0.07 $0.19 +171% per share 18

Financial Overview (continued): P&L Highlights in thousands for fiscal years ending July 31 2009 2010 Six Mo’s * Ended 1/31/2011 Revenues $85,366 $81,443 $70,160 Gross Profit 59,794 58,894 46,075 Operating Expenses 54,571 47,657 37,632 Non-Operating Expenses 17,023 1,346 2,077 Taxes (621) (7,202) 2,460 Net Income (Loss) $(11,179) $17,093 $3,906 Adjusted EBITDA $19,026 $20,497 $18,765 *Reflects *Reflectsapproximately approximately four fourmonths monthsof ofcontribution contribution from fromthe theXpedite Xpediteacquisition acquisition *Please see GAAP to non-GAAP reconciliation at http://ir.easylink.com/releasedetail .cfm?ReleaseID=556882 19

Financial Overview (continued): Balance Sheet Highlights in thousands for fiscal years ending July 31 *Reflects *Reflects approximately approximately four fourmonths months of ofcontribution contribution from fromthe theXpedite Xpedite acquisition acquisition 20

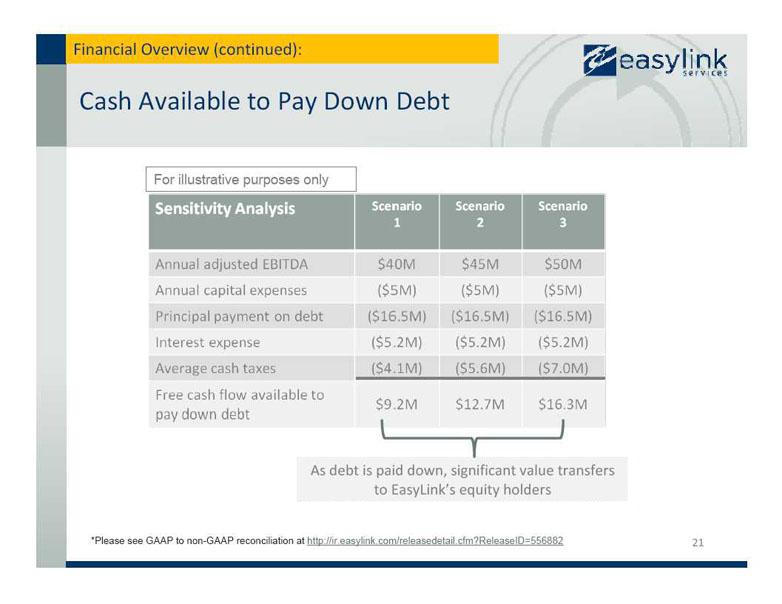

Financial Overview (continued): Cash Available to Pay Down Debt For illustrative purposes only As Asdebt debtis ispaid paiddown, down, significant value value transfers to toEasyLink’s equity equity holders holders *Please see GAAP to non-GAAP reconciliation at http://ir .easylink .com/releasedetail .cfm?ReleaseID=556882 21

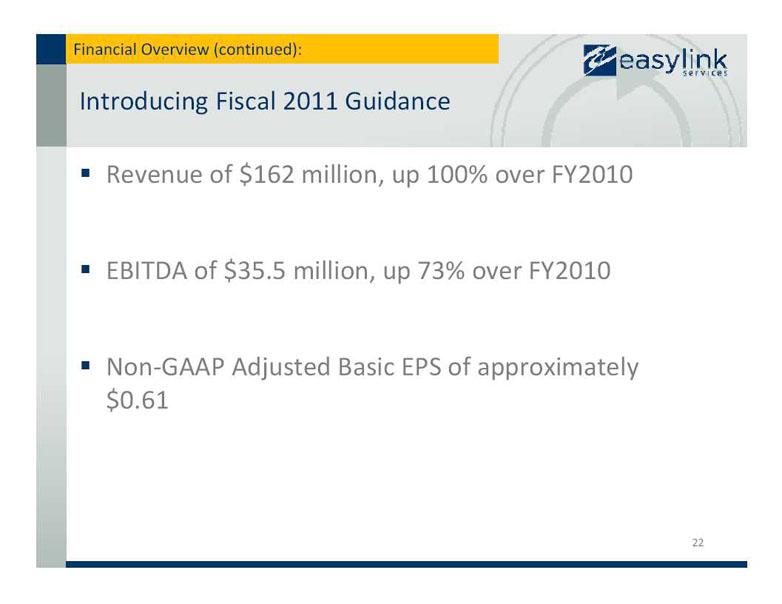

Financial Overview (continued): Introducing Fiscal 2011 Guidance Revenue of $162 million, up 100% over FY2010 EBITDA of $35.5 million, up 73% over FY2010 Non-GAAP Adjusted Basic EPS of approximately $0.61 22

Summary: Summary Growing market and opportunity pipeline Predictable, recurring revenue model Diverse customer base Top incumbent market position Large geographical footprint Growth via an expanding portfolio of applications Profitable “AaaS” cloud computing business model Experienced and dedicated management team Excellent operational and execution track record 23

Questions and Answers: Questions and Answers 24

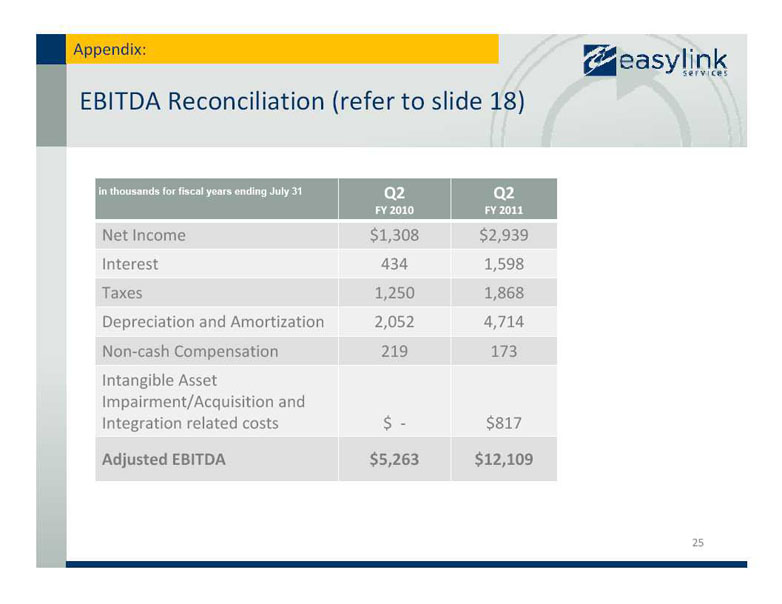

Appendix: EBITDA Reconciliation (refer to slide 18) in thousands for fiscal years ending July 31 Q2 Q2 FY 2010 FY 2011 Net Income $1,308 $2,939 Interest 434 1,598 Taxes 1,250 1,868 Depreciation and Amortization 2,052 4,714 Non-cash Compensation 219 173 Intangible Asset Impairment/Acquisition and Integration related costs $ -$817 Adjusted EBITDA $5,263 $12,109 25

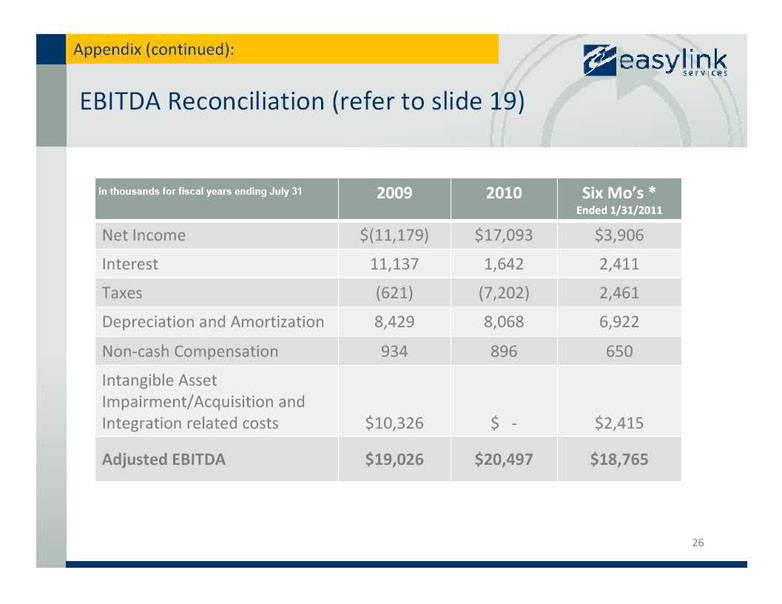

Appendix (continued): EBITDA Reconciliation (refer to slide 19) in thousands for fiscal years ending July 31 2009 2010 Six Mo’s * Ended 1/31/2011 Net Income $(11,179) $17,093 $3,906 Interest 11,137 1,642 2,411 Taxes (621) (7,202) 2,461 Depreciation and Amortization 8,429 8,068 6,922 Non-cash Compensation 934 896 650 Intangible Asset Impairment/Acquisition and Integration related costs $10,326 $ -$2,415 Adjusted EBITDA $19,026 $20,497 $18,765 26