Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CYTEC INDUSTRIES INC/DE/ | d8k.htm |

Shane Fleming

– Chairman, President and CEO

Dave Drillock –

Vice President and CFO

First Quarter 2011 Earnings Review

April 25, 2011

Exhibit 99.1 |

2

Forward Looking Statement

During the course of this meeting we may make forward-looking statements. All statements

that address expectations or projections about the future are forward-looking

statements.

Some of these statements include words such as “expects”, “anticipates,”

“plans,” “intends,” “projects,” and “outlook.”

Although they reflect our current expectations, these statements are not guarantees of future

performance because they involve a number of risks, uncertainties, and assumptions.

Included in this presentation are estimates for full year 2011 sales and earnings. These

were included in our April 21, 2011 press release, which was also furnished as an

exhibit to a current report on Form 8-K. These estimates set forth the

Company’s assumptions and management’s best estimate of the full year 2011 sales

and earnings at that time based on various assumptions set forth in the press release.

There can be no assurance that sales or earnings will develop in the manner then

projected or that the results for the year will be consistent with the results then

projected. Actual results may differ materially.

We recommend that you review Cytec’s SEC filings for a discussion of some of the factors

which could cause actual results to differ materially from its expectations and

projections. This and other Cytec information may be accessed at

www.cytec.com.

In sections of this presentation certain “non-GAAP” measures are provided and

identified as such. We believe that the “non-GAAP” measures can more

accurately reflect comparisons of year to year trends and is consistent with how we

review the information. A reconciliation of “non-GAAP” measures to the applicable

GAAP measure is provided in the appendix at the end of this presentation. |

3

Results Overview

•

Overall sales up 18% year on year

•

Volume growth across all segments and regions indicating

stronger demand from continued global economic improvement

•

Selling prices cover raw material cost increases

•

Overall as-adjusted diluted per share earnings up 34% year on year

•

Improved earnings across all segments

•

Sale of Building Block Chemicals completed

1

Quarter

2011:

Sales of $766 million

Net Earnings of $0.78

per diluted share

(Continuing operations attributable

to Cytec, excluding special items)

st |

4

Business Segment Results

Coating Resins

•

Demand improvement led by powder and

waterborne resins with strongest growth in

Asia and Europe

•

Strong sales in March reflecting robust

underlying and seasonal demand

•

$36 million in higher raw material

costs

Sales Growth

18%

Volume

5%

Price

12%

Currency

1%

Sales Comparison Q1 YOY

$MM USD

Q1 11

Q1 10

% chg

Sales

403.6

341.4

18%

Operating Earnings

18.8

16.8

12%

% Sales

5%

5% |

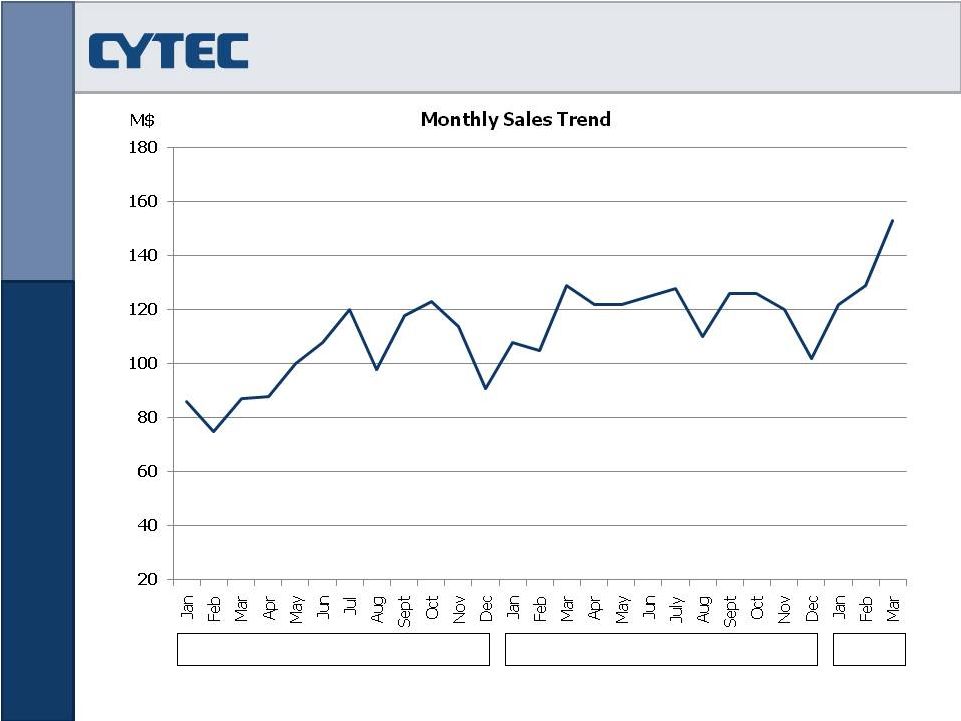

Coating

Resins 5

2009

2010

2011 |

6

Business Segment Results

Additive Technologies

Sales Growth

8%

Volume

3%

Price

4%

Currency

1%

Sales Comparison Q1 YOY

•

Volume growth lead by specialty

additives across most regions

•

Lower polymer additives volume due

to capacity constraints

•

Operating earnings slightly down in the

quarter due to higher manufacturing

costs related to maintenance

$MM USD

Q1 11

Q1 10

% chg

Sales

67.4

62.3

8%

Operating Earnings

8.0

8.4

-5%

% Sales

12%

13% |

7

Business Segment Results

In Process Separation

Sales Growth

20%

Volume

16%

Price

3%

Currency

1%

Sales Comparison Q1 YOY

•

Volume growth of 16% led by strong

demand in mining chemicals

reflecting higher production rates

from base metal customers as well

as new product commercializations

$MM USD

Q1 11

Q1 10

% chg

Sales

78.4

65.1

20%

Operating Earnings

16.4

14.9

10%

% Sales

21%

23% |

8

Business Segment Results

Engineered Materials

•

Robust volume growth lead by higher

build rates in large commercial

transport, business jet, and rotorcraft

markets

•

Higher raw material costs of $6 million

primarily due to carbon fiber cost

escalation as a result of tight global

market supply

•

Continued positive outlook and trends

for aerospace markets

Sales Growth

22%

Volume

21%

Price

1%

Currency

0%

Sales Comparison Q1 YOY

$MM USD

Q1 11

Q1 10

% chg

Sales

216.6

177.7

22%

Operating Earnings

26.7

21.0

27%

% Sales

12%

12% |

9

Financial Results

First

Quarter

2011

•

Special Items:

–

Pre-tax net restructuring credit of $0.7M

–

Pre-tax charge of $3.2Mrelated to an increase in environmental liability

at an inactive site

–

Pre-tax gain of $3.3M related to a sale of land at our manufacturing

site

in Colombia which was shutdown in the second half of 2009

•

Discontinued Operations:

–

Completed divestiture of Building Block Chemicals in February 2011 with

proceeds of $145M after-tax ($36.8M gain after-tax); greater focus on

core growth platforms

–

Earnings from two months of operations of $6.8M after-tax |

10

Financial Results

First

Quarter

2011

•

As-Adjusted Comments:

–

Gross margin of 23.5% down slightly vs. prior year due to cost escalations

–

Lower Corporate and Unallocated vs. prior year due to reduced consulting

costs. Also includes $1.0 and $1.4M of costs previously allocated to Building

Block Chemicals for Q1 2011 and 2010, respectively.

–

Operating Expenses (as % of sales) are down 1% year on year

–

Estimated annual underlying income tax rate was 31.25%, down 1.25% vs.

Q1 ‘10 |

11

Cash Flow

Cash flow from continuing operations was $22M in Q1’11 vs. $32M in Q1’10

Continued Focus on Working Capital

Working Capital Days |

Balance

Sheet Capital

Expenditures

•

Q1’11 capital expenditures of $26M vs. Q1’10 of $28M

•

Outlook for Full Year 2011 is estimated to be $170 to $190M

Maintaining

Liquidity

and

Returning

Excess

Cash

to

Shareholders

•

Cash balance is $522M, up by $139M from year-end 2010

•

Pension contribution of $16.3M in the quarter vs. $16.0M in prior

year quarter

•

Purchased 440 thousand shares of our common stock for $24M

•

Cash dividend of $6M

12 |

13

2011 Outlook

We reiterate our outlook for 2011 full year adjusted continuing EPS of $3.15 to

$3.50.

Business Segment

Net Sales

Operating Earnings Guidance

Coating Resins

$1,500 to $1,520

$70 to $80

Additive Technologies

$260 to $280

$37 to $40

In Process Separation

$320 to $330

$60 to $70

Engineered Materials

$825 to $845

$130 to $140

Total

$2,905 to $2,975

$297 to $330

Outlook table in Millions

Net sales and operating earnings guidance for all business segments

remains unchanged |

CYT : NYSE |

15

Appendix

Reconciliation of “Non-GAAP”

Measures to GAAP Measures

Management believes that net after

-

tax earnings and diluted earnings per share before special items, and gross margins

adjusted for special items, which are non

-

GAAP measures, are meaningful to investors because they provide a view of

the Company with respect to ongoing operations. Special items represent significant charges

or credits that are important to an understanding of the Company’s overall

operating results in the periods presented. Such measurements are not recognized in

accordance with generally accepted accounting principles (GAAP) and should not be viewed as an

alternative to GAAP measures of performance. The following table

summarizes the net special items used to adjust

reported net earnings and diluted earnings per share and gross margins for the quarters ended

March 31, 2011 and 2010. Period

Reported Net

Earnings from

Continuing

Operations less

Earnings

Attributable to

Noncontrolling

Interests

Net Special

Items

Non-GAAP Net

Earnings from

Continuing

Operations

Attributable to

Cytec

Reported Diluted

Continuing

Earnings Per Share

less Diluted

Earnings Per Share

Attributable to

Noncontrolling

Interests

Net Special

Items

Non-GAAP

Diluted

Earnings per

Share

Q1’11

$ 39.6

$ (0.5)

$ 39.1

$ 0.79

$ (0.01)

$ 0.78

Q1’10

$ 21.0

$ 7.9

$ 28.9

$ 0.42

$ 0.16

$ 0.58

Period

Reported Cost of

Sales

Net Special

Items

Adjusted Cost of

Sales

GAAP Gross

Margin

Net Special

Items

Adjusted Gross

Margin

Q1’11

$ 585.6

$ (0.1)

$ 585.7

$ 180.4

$ (0.1)

$ 180.3

Q1’10

$ 488.7

$ (0.3)

$ 489.0

$ 157.8

$ (0.3)

$ 157.5 |