Attached files

| file | filename |

|---|---|

| 8-K - INDEPENDENT BANK CORP /MI/ | ibc8k_042611.htm |

Annual Shareholders Meeting

Today’s Agenda

- Introductions

- Voting upon the matters listed in the Company’s 2011 Proxy Statement

- Presentation by IBC CEO and CFO

- Question and answer session

| 2 | IndependentBank.com | April 26, 2011 |

Annual Shareholders Meeting

IBC Board of Directors

Jeffrey A. Bratsburg, Chairman

Donna J. Banks, Ph.D.

Stephen L. Gulis Jr.

Terry L. Haske

Robert L. Hetzler

Michael M. Magee Jr.

James E. McCarty

Charles A. Palmer

Charles C. Van Loan

Note: Clarke B. Maxson retired from the Board of Directors at the end of 2010.

| 3 | IndependentBank.com | April 26, 2011 |

Annual Shareholders Meeting

IBC Executive Management

Michael M. Magee Jr. – Chief Executive Officer

William B. Kessel – President and Chief Operating Officer

Robert N. Shuster – EVP/Chief Financial Officer

Mark L. Collins – EVP/General Counsel

Stefanie M. Kimball – EVP/Chief Lending Officer

David C. Reglin – EVP/Retail Banking

| 4 | IndependentBank.com | April 26, 2011 |

Annual Shareholders Meeting

2011 Annual Meeting of Shareholders

- Secretary for the meeting (Robert Shuster)

- Inspectors of election (Charles Schadler/David Edwards)

- Record date: February 28, 2011

- Approximate mailing date of Proxy Statement: March 22, 2011

- Shares entitled to vote: 7,860,849

- Determination of quorum

- Voting on proposals

| 5 | IndependentBank.com | April 26, 2011 |

Annual Shareholders Meeting

Proposal #1

Election of Directors

Charles A. Palmer Terry L. Haske Stephen L. Gulis Jr.

| 6 | IndependentBank.com | April 26, 2011 |

Annual Shareholders Meeting

Proposal #2

Ratification of Auditors

- Crowe Horwath LLP has served as IBC’s independent registered public accounting firm since 2005

- Crowe Horwath was founded in 1942 and is one of the ten largest accounting and consulting firms in the U.S.

- IBC is served by Crowe Horwath’s Grand Rapids, Michigan, and South Bend, Indiana, offices

| 7 | IndependentBank.com | April 26, 2011 |

Annual Shareholders Meeting

Proposal #3

Advisory Vote on Executive Compensation

The Board has solicited a non-binding advisory vote from our shareholders to approve the compensation of our executives as described in our proxy materials.

| 8 | IndependentBank.com | April 26, 2011 |

Annual Shareholders Meeting

Proposal #4

Amend Long-term Incentive Plan

Our shareholders are being asked to approve an amendment to the Company’s Long-term Incentive Plan to:

- Extend the Plan for an additional 10 years; and

- Make an additional 750,000 shares of our common stock available for issuance under the Plan

| 9 | IndependentBank.com | April 26, 2011 |

Annual Shareholders Meeting

Proposal #5

Authorize Additional Shares Under an Equity Line Facility

Our shareholders are being asked to approve a proposal to authorize the Company to sell 2,500,000 additional shares under an equity line facility.

- Equity line facility of up to $15 million was established in July 2010 with Dutchess Opportunity Fund, II, LP

- This facility provides a contingent source of liquidity for the holding company that is particularly important since Independent Bank cannot currently pay dividends to the parent company

| 10 | IndependentBank.com | April 26, 2011 |

Annual Shareholders Meeting

Management Transition Plan

On February 15, 2011, the Company publicly announced a management transition plan.

- Brad Kessel appointed as President and Chief Operating Officer effective April 1, 2011, and adding Chief Executive Officer role on January 1, 2013

- Michael M. Magee Jr. remains as Chief Executive Officer until his retirement at the end of 2012

- Michael M. Magee Jr. becomes Chairman of the Board effective April 27, 2011

- Jim McCarty becomes Lead Director effective April 27, 2011

| 11 | IndependentBank.com | April 26, 2011 |

Annual Shareholders Meeting

Safe Harbor Statement

This presentation may contain certain forward-looking statements within the meaning of the Private Securities Reform Act of 1995. Forward-looking statements include expressions such as “expects,” “intends,” “believes” and “should” which are statements of belief as to expected outcomes of future events. Actual results could materially differ from those contained in, or implied by such statements. Independent Bank Corporation undertakes no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this presentation.

| 13 | IndependentBank.com | April 26, 2011 |

Annual Shareholders Meeting

2010 Summary – Our Focus on Asset Quality, Core Deposit Growth and Capital

|

|

Substantial improvement in asset quality metrics | |

| Continued progress in restructuring the balance sheet and reducing higher risk loans | ||

| Core deposit growth with focus on building relationships | ||

| Emphasis on enhancing franchise value with investment in: | ||

|

|

Staff training (online learning management and live meeting technology) | |

| Security technology and fraud prevention | ||

| Treasury management services | ||

| Social media marketing | ||

| Significant reduction in net loss | ||

| Achieved several goals in our Capital Plan | ||

| 14 | IndependentBank.com | April 26, 2011 |

Annual Shareholders Meeting

Improvement in Asset Quality

- Improving asset quality is our number one priority

- Reduced non-performing loans by nearly 40% in 2010

- Loan net charge-offs reduced by nearly 25% in 2010

- Reduced loan delinquency rates at year-end 2010

- Participating in programs, such as MSHDA’s Hardest Hit, to assist homeowners and help them avoid foreclosure

| 15 | IndependentBank.com | April 26, 2011 |

Annual Shareholders Meeting

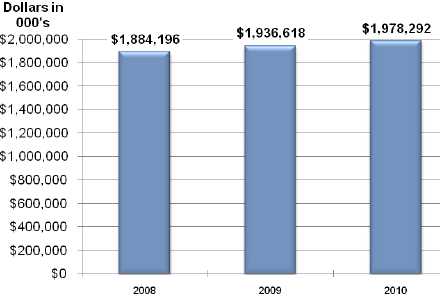

Core Deposits*

- Core deposits have grown by $94 million or 5% since the end of 2008

- Checking, savings and money market accounts have grown by 19% since 2008

- For two consecutive years, we have earned a perfect “five” Power Circle™ Rating for customer service in J.D. Power and Associates Retail Banking Satisfaction Survey

- Company wide focus on our service mission to: “Impress every customer every day, every time”

*Excludes brokered certificates of deposit.

| 16 | IndependentBank.com | April 26, 2011 |

Annual Shareholders Meeting

J.D. Power and Associates

2011 U.S. Retail Banking Satisfaction StudySM

The publisher of this graph is J.D. Power and Associates and the source is J.D. Power and Associates 2011 U.S. Retail Banking Satisfaction StudySM. Rankings are based on numerical scores, and not necessarily on statistical significance. JDPower.com Power Circle RatingsTM are derived from consumer ratings in J.D. Power studies.

| 17 | IndependentBank.com | April 26, 2011 |

Annual Shareholders Meeting

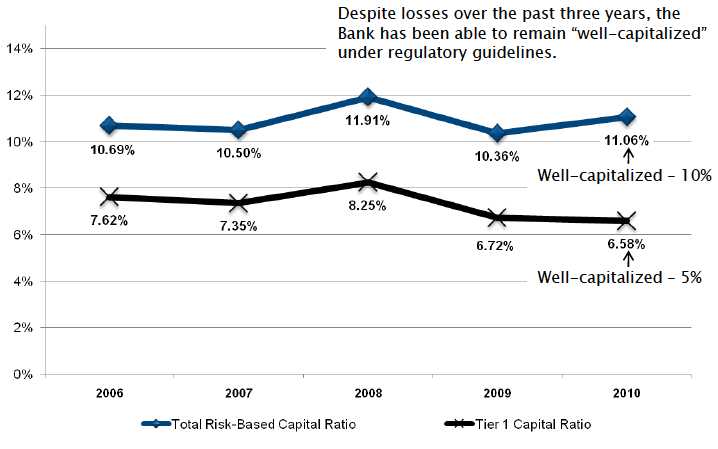

Bank Regulatory Capital Ratios

| 18 | IndependentBank.com | April 26, 2011 |

Annual Shareholders Meeting

Capital Plan Update

Major accomplishments in 2010:

- April 2010 – completed an exchange agreement with U.S. Treasury to exchange 72,000 shares of Series A preferred stock and $2.4 million of accrued and unpaid dividends into 74,426 shares of Series B cumulative mandatorily convertible preferred stock

- June 2010 – completed an exchange of $41.4 million of trust preferred securities and $2.3 million of accrued and unpaid interest into 5.1 million shares of common stock

- July 2010 – established $15 million equity line facility as a contingent source of liquidity at parent holding company

Goals for 2011:

- Revise terms for early conversion of Series B preferred stock to allow for a smaller common equity offering

- Size of common equity offering will be designed to preserve the Company’s $66 million net deferred tax asset

| 19 | IndependentBank.com | April 26, 2011 |

Annual Shareholders Meeting

Michigan Economy

- Showing signs of stabilization as we moved though 2010

- Unemployment rate has fallen to 10.4% in February 2011 vs. 13.5% a year earlier and vs. a peak of 14.5% in December 2009

- As of February 2011, 3.9 million people were employed in Michigan, which is an increase of 71,000 jobs since February 2010

- Rebound in manufacturing

- Housing affordability measures in several Michigan markets among the best in the country

- Stability of housing prices and level of foreclosures remains a challenge

| 20 | IndependentBank.com | April 26, 2011 |

Annual Shareholders Meeting

2011 – Our Commitment to Future Profitability

- Although we expect to incur a net loss in 2011 (primarily reflecting still elevated credit related costs), we also expect to see continued improvement in asset quality

- Expect the Bank to remain “well-capitalized”

- Optimistic for a return to profitability in 2012 with continued progress in improving asset quality metrics and a further reduction in credit related costs

- Completion of Capital Plan during 2011

| 21 | IndependentBank.com | April 26, 2011 |

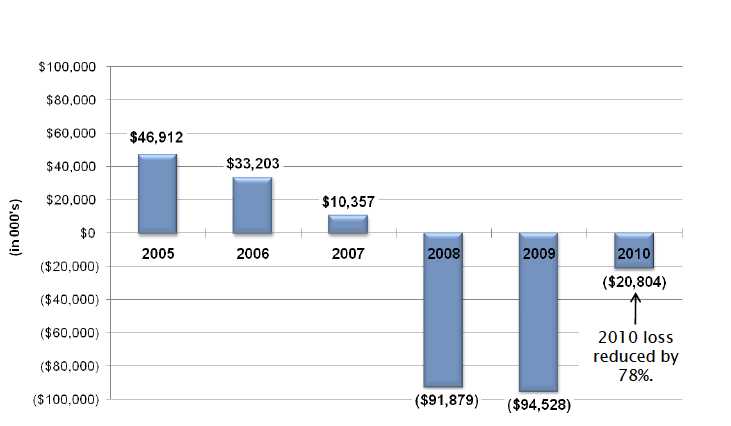

Annual Shareholders Meeting

Net Income (Loss) Applicable

to Common Stock

| 23 | IndependentBank.com | April 26, 2011 |

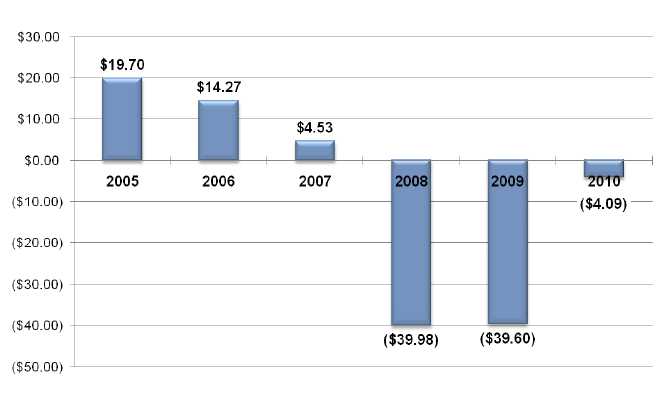

Annual Shareholders Meeting

Net Income (Loss) Per Share Applicable

to Common Stock

| 24 | IndependentBank.com | April 26, 2011 |

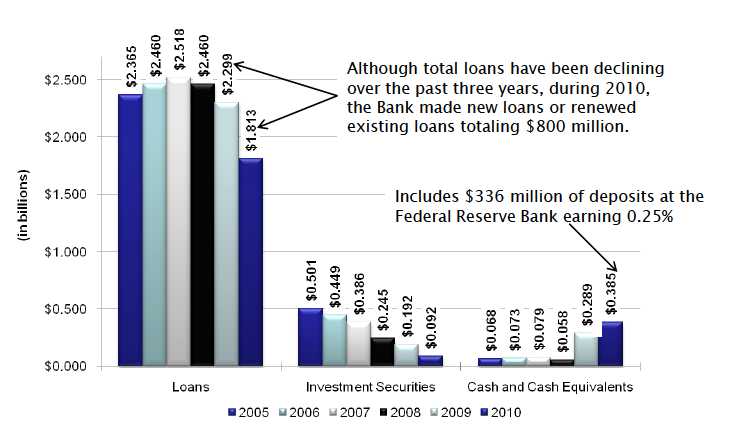

Annual Shareholders Meeting

Select Components of Total Assets

| 25 | IndependentBank.com | April 26, 2011 |

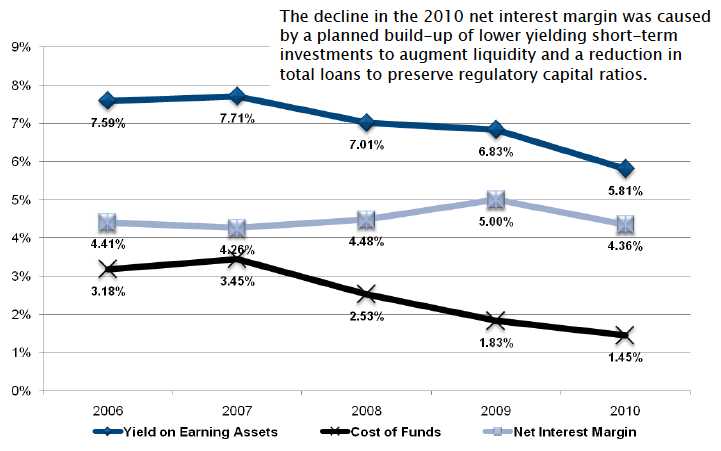

Annual Shareholders Meeting

Net Interest Margin

Note: 2007 and 2006 data is presented on a tax equivalent basis.

| 26 | IndependentBank.com | April 26, 2011 |

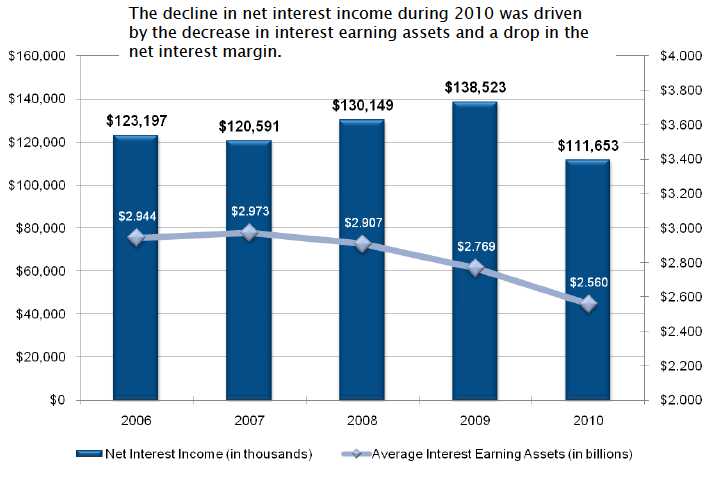

Annual Shareholders Meeting

Analysis of Net Interest Income

| 27 | IndependentBank.com | April 26, 2011 |

Annual Shareholders Meeting

Non-Performing Loans*

*Excludes loans classified as “troubled debt restructurings” that are still performing.

| 28 | IndependentBank.com | April 26, 2011 |

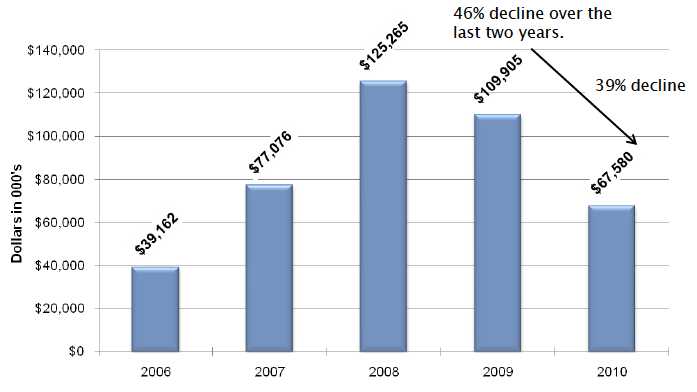

Annual Shareholders Meeting

Provision for Loan Losses

| 29 | IndependentBank.com | April 26, 2011 |

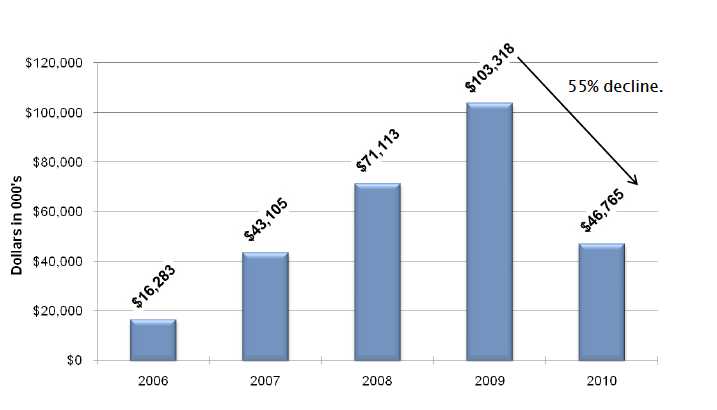

Annual Shareholders Meeting

Net Loan Charge-Offs

| 30 | IndependentBank.com | April 26, 2011 |

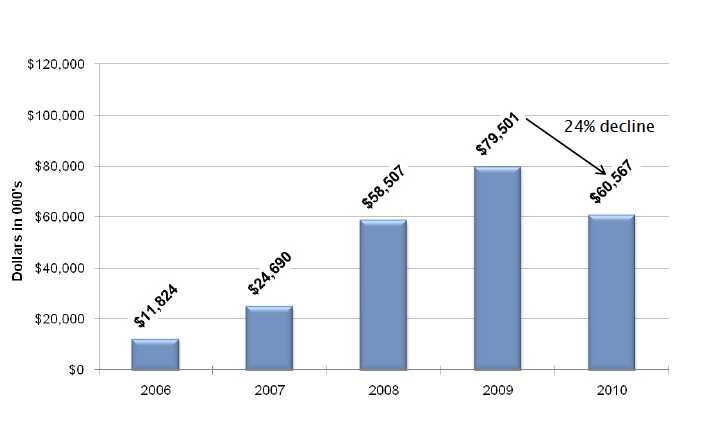

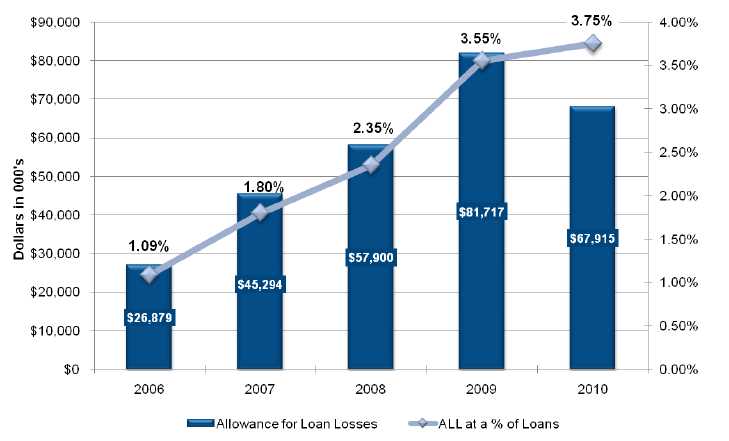

Annual Shareholders Meeting

Allowance for Loan Losses

| 31 | IndependentBank.com | April 26, 2011 |

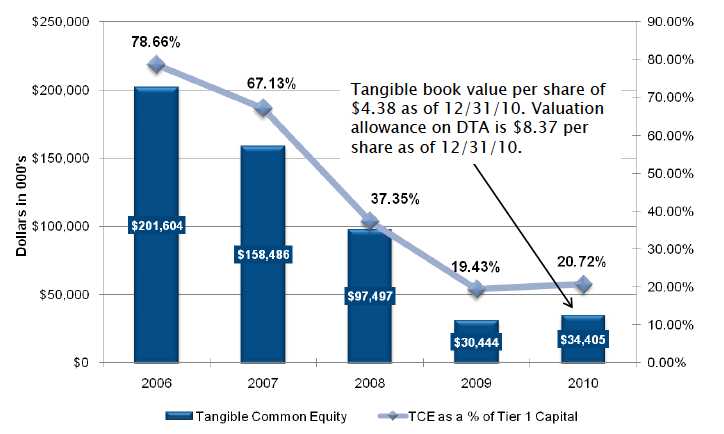

Annual Shareholders Meeting

Tangible Common Equity

| 32 | IndependentBank.com | April 26, 2011 |

Annual Shareholders Meeting

Voting Results

- Shares entitled to vote: 7,860,849

- Proposal #1 – Election of Directors

- Proposal #2 – Ratification of Auditors

- Proposal #3 – Advisory (Non-Binding) Vote on Executive Compensation

- Proposal #4 – Amendment of Long-term Incentive Plan

- Proposal #5 – Authorize 2,500,000 Additional Shares of Common Stock Under an Equity Line Facility

| 34 | IndependentBank.com | April 26, 2011 |