Attached files

| file | filename |

|---|---|

| 8-K - Ally Financial Inc. | v219637_8-k.htm |

Ally Financial Inc. Annual Shareholders’ Meeting April 27, 2011 Contact Ally Investor Relations at (866) 710-4623 or investor.relations@ally.com

Forward-Looking Statements and Additional Information The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2010 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. In the presentation that follows and related comments by Ally Financial Inc. (“Ally”) management, the use of the words “expect,” “anticipate,” “estimate,” “forecast,” “initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “intend,” “evaluate,” “pursue,” “seek,” “may,” “would,” “could,” “should,” “believe,” “potential,” “continue,” or similar expressions is intended to identify forward-looking statements. All statements herein and in related management comments, other than statements of historical fact, including without limitation, statements about future events and financial performance, are forward-looking statements that involve certain risks and uncertainties. While these statements represent our current judgment on what the future may hold, and we believe these judgments are reasonable, these statements are not guarantees of any events or financial results, and Ally’s actual results may differ materially due to numerous important factors that are described in the most recent reports on SEC Forms 10-K and 10-Q for Ally, each of which may be revised or supplemented in subsequent reports on SEC Forms 10-Q and 8- K. Such factors include, among others, the following: maintaining the mutually beneficial relationship between Ally and General Motors (“GM”), and Ally and Chrysler; the profitability and financial condition of GM and Chrysler; securing low cost funding for us and Residential Capital, LLC (“ResCap”); our ability to realize the anticipated benefits associated with being a bank holding company, and the increased regulation and restrictions that we are now subject to; any impact resulting from delayed foreclosure sales or related matters; the potential for legal liability resulting from claims related to the sale of private-label mortgage-backed securities; risks related to potential repurchase obligations due to alleged breaches of representations and warranties in mortgage securitization transactions; changes in U.S. government-sponsored mortgage programs or disruptions in the markets in which our mortgage subsidiaries operate; continued challenges in the residential mortgage markets; the continuing negative impact on ResCap and our mortgage business generally due to the recent decline in the U.S. housing market; uncertainty of our ability to enter into transactions or execute strategic alternatives to realize the value of our ResCap operations; the potential for deterioration in the residual value of off-lease vehicles; disruptions in the market in which we fund our operations, with resulting negative impact on our liquidity; changes in our accounting assumptions that may require or that result from changes in the accounting rules or their application, which could result in an impact on earnings; changes in the credit ratings of Ally, ResCap, Chrysler, or GM; changes in economic conditions, currency exchange rates or political stability in the markets in which we operate; and changes in the existing or the adoption of new laws, regulations, policies or other activities of governments, agencies and similar organizations (including as a result of the Dodd-Frank Act). Investors are cautioned not to place undue reliance on forward-looking statements. Ally undertakes no obligation to update publicly or otherwise revise any forward-looking statements except where expressly required by law. Reconciliation of non-GAAP financial measures included within this presentation are provided in this presentation. Use of the term “loans” describes products associated with direct and indirect lending activities of Ally’s global operations. The specific products include retail installment sales contracts, loans, lines of credit, leases or other financing products. The term “originate” refers to Ally’s purchase, acquisition or direct origination of various “loan” products.

Meeting Re-established as the premier auto finance provider #1 U.S. auto lender with 72% year-over-year growth in consumer originations Diversified business mix as a market driven competitor Successfully implemented Ally Dealer Rewards cross-product sales strategy $36 billion of new secured and unsecured funding transactions MCP conversion bolstered capital with Tier 1 Common ratio increasing from 5.3% to 8.6% Exceeded expense reduction goal with $680 million of expense savings Sold 15 non-core operations in 2010 Demonstrated Ally Bank franchise strength with CD retention rate of 85% Total deposits grew $7.3 billion year-over-year and now comprise 29% of total funding Balance sheet has been streamlined and performance has stabilized Completed strategic review of mortgage business Reached important rep and warrant settlements with both Fannie Mae and Freddie Mac Premier Auto Finance Provider De-Risk Mortgage Business Grow Deposits Improve Cost Structure Access Capital Markets Bank Holding Company Transitioned to bank holding company model implementing best practices Successfully delivered on all strategic objectives in 2010 2010 Achievements 2011 Ally Annual Shareholders’ Meeting

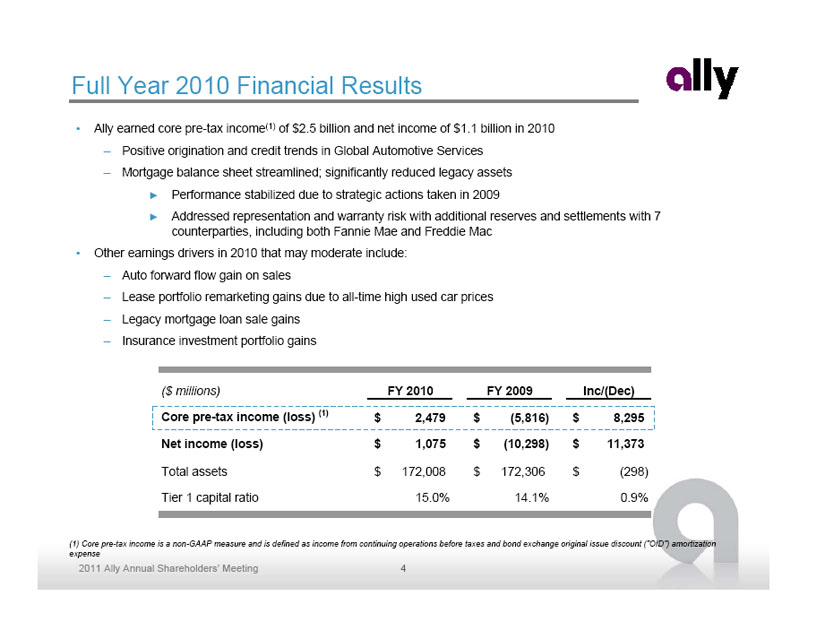

Full Year 2010 Financial Results (1) Core pre-tax income is a non-GAAP measure and is defined as income from continuing operations before taxes and bond exchange original issue discount ("OID") amortization expense • Ally earned core pre-tax income(1) of $2.5 billion and net income of $1.1 billion in 2010 – Positive origination and credit trends in Global Automotive Services – Mortgage balance sheet streamlined; significantly reduced legacy assets Performance stabilized due to strategic actions taken in 2009 Addressed representation and warranty risk with additional reserves and settlements with 7 counterparties, including both Fannie Mae and Freddie Mac • Other earnings drivers in 2010 that may moderate include: – Auto forward flow gain on sales – Lease portfolio remarketing gains due to all-time high used car prices – Legacy mortgage loan sale gains – Insurance investment portfolio gains ($ millions) FY 2010 FY 2009 Inc/(Dec) Core pre-tax income (loss) (1) 2,479 $ (5,816) $ 8,295 $ Net income (loss) 1,075 $ (10,298) $ 11,373 $ Total assets 172,008 $ 172,306 $ (298) $ Tier 1 capital ratio 15.0% 14.1% 0.9% 2011 Ally Annual Shareholders’ Meeting

($ millions) FY 2010 FY 2009 Inc/(Dec) North American Automotive Finance 2,344 $ 1,624 $ 720 $ International Automotive Finance 228 (157) 385 Insurance 569 329 240 Global Automotive Services 3,141 $ 1,796 $ 1,345 $ Mortgage Origination and Servicing 917 39 878 Legacy Portfolio and Other (1) (254) (6,304) 6,050 Mortgage Operations 663 $ (6,265) $ 6,928 $ Corporate and Other (ex. OID) (2) (1,325) (1,347) 22 Core pre-tax income (loss) 2,479 $ (5,816) $ 8,295 $ OID amortization expense 1,300 1,143 157 Income tax expense (benefit) 153 74 79 Income (loss) from discontinued operations 49 (3,265) 3,314 Net income (loss) 1,075 $ (10,298) $ 11,373 $ Results by Segment (1) Legacy Portfolio and Other segment primarily consists of loans originated prior to Jan. 1, 2009, and includes non-core business activities including portfolios in run-off. (2) Corporate and Other as presented includes Commercial Finance Group (“CFG”), certain equity investments and treasury activities including the residual impacts from the corporate funds transfer pricing and asset liability management (“ALM”) activities • Global Automotive Services profitability improved, driven by results in North American Operations • Ally will begin reporting Mortgage Origination and Servicing separately from the Legacy Portfolio • Both Ally Bank and ResCap legal entities were profitable in each quarter of 2010

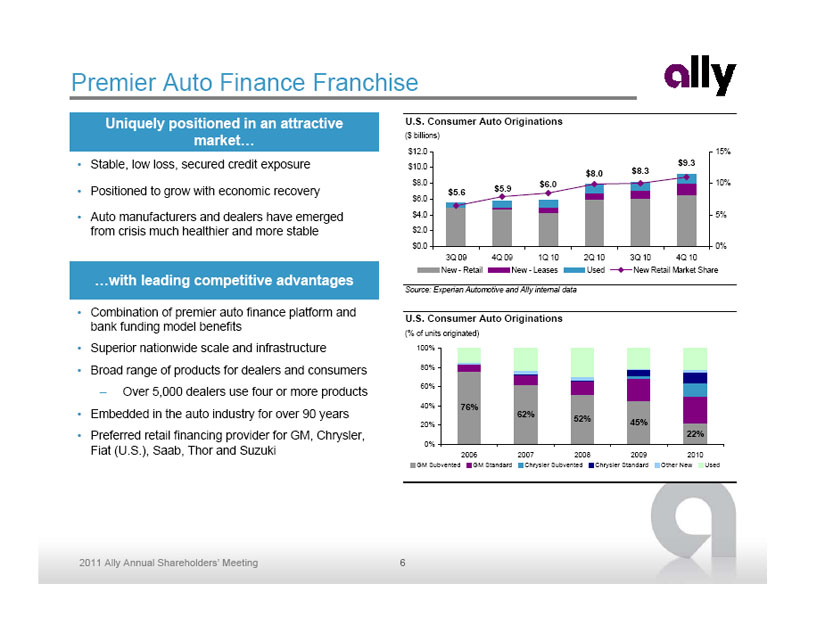

Premier Auto Finance Franchise • Stable, low loss, secured credit exposure • Positioned to grow with economic recovery • Auto manufacturers and dealers have emerged from crisis much healthier and more stable Uniquely positioned in an attractive market… …with leading competitive advantages • Combination of premier auto finance platform and bank funding model benefits • Superior nationwide scale and infrastructure • Broad range of products for dealers and consumers – Over 5,000 dealers use four or more products • Embedded in the auto industry for over 90 years • Preferred retail financing provider for GM, Chrysler, Fiat (U.S.), Saab, Thor and Suzuki U.S. Consumer Auto Originations (% of units originated) Trick Trick 76% 62% 52% 45% 22% 0% 20% 40% 60% 80% 100% 2006 2007 2008 2009 2010 GM Subvented GM Standard Chrysler Subvented Chrysler Standard Other New Used U.S. Consumer Auto Originations ($ billions) Source: Experian Automotive and Ally internal data $8.0 $8.3 $9.3 $6.0 $5.9 $5.6 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 4Q 10 0% 5% 10% 15% New - Retail New - Leases Used New Retail Market Share

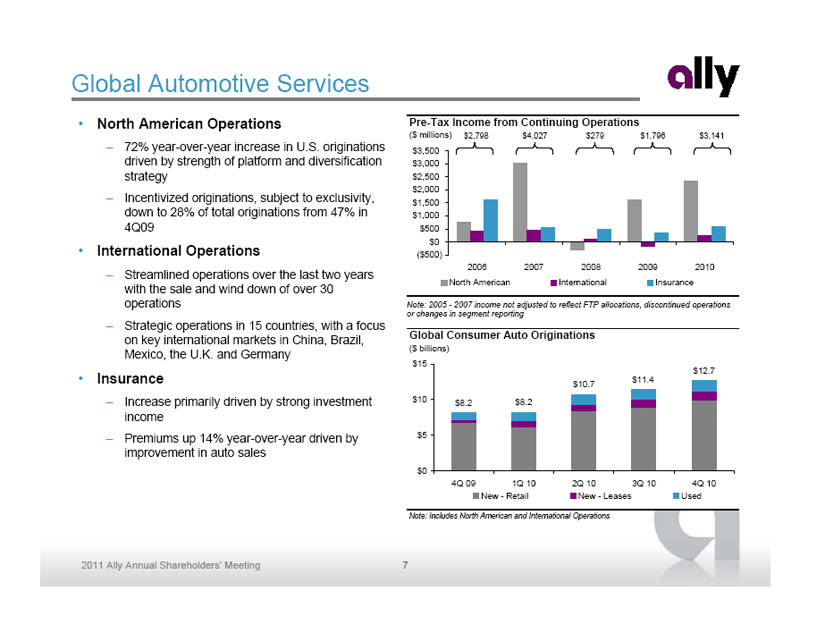

7 2011 Ally Annual Shareholders’ Meeting Pre-Tax Income from Continuing Operations ($ millions) Trick ($500) $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 2006 2007 2008 2009 2010 North American International Insurance Global Automotive Services $2,798 $279 $1,796 $3,141 Note: 2005 - 2007 income not adjusted to reflect FTP allocations, discontinued operations or changes in segment reporting • North American Operations – 72% year-over-year increase in U.S. originations driven by strength of platform and diversification strategy – Incentivized originations, subject to exclusivity, down to 28% of total originations from 47% in 4Q09 • International Operations – Streamlined operations over the last two years with the sale and wind down of over 30 operations – Strategic operations in 15 countries, with a focus on key international markets in China, Brazil, Mexico, the U.K. and Germany • Insurance – Increase primarily driven by strong investment income – Premiums up 14% year-over-year driven by improvement in auto sales $4,027 Global Consumer Auto Originations ($ billions) Note: Includes North American and International Operations $12.7 $11.4 $10.7 $8.2 $8.2 $0 $5 $10 $15 4Q 09 1Q 10 2Q 10 3Q 10 4Q 10 New - Retail New - Leases Used

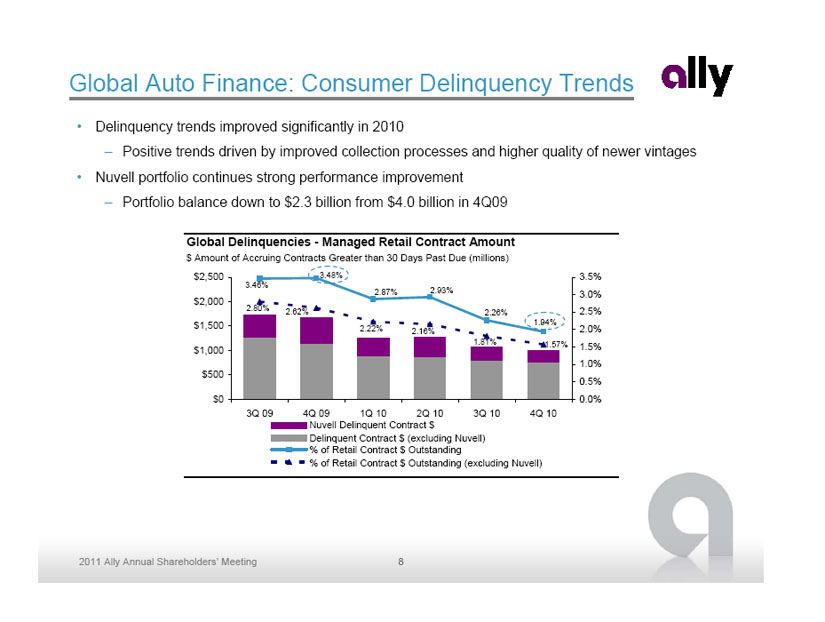

8 2011 Ally Annual Shareholders’ Meeting Global Auto Finance: Consumer Delinquency Trends • Delinquency trends improved significantly in 2010 – Positive trends driven by improved collection processes and higher quality of newer vintages • Nuvell portfolio continues strong performance improvement – Portfolio balance down to $2.3 billion from $4.0 billion in 4Q09 Global Delinquencies - Managed Retail Contract Amount $ Amount of Accruing Contracts Greater than 30 Days Past Due (millions) 2.80% 2.62% 2.22% 2.16% 1.81% 1.57% 1.94% 2.26% 2.93% 2.87% 3.48% 3.46% $0 $500 $1,000 $1,500 $2,000 $2,500 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 4Q 10 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% Nuvell Delinquent Contract $ Delinquent Contract $ (excluding Nuvell) % of Retail Contract $ Outstanding % of Retail Contract $ Outstanding (excluding Nuvell)

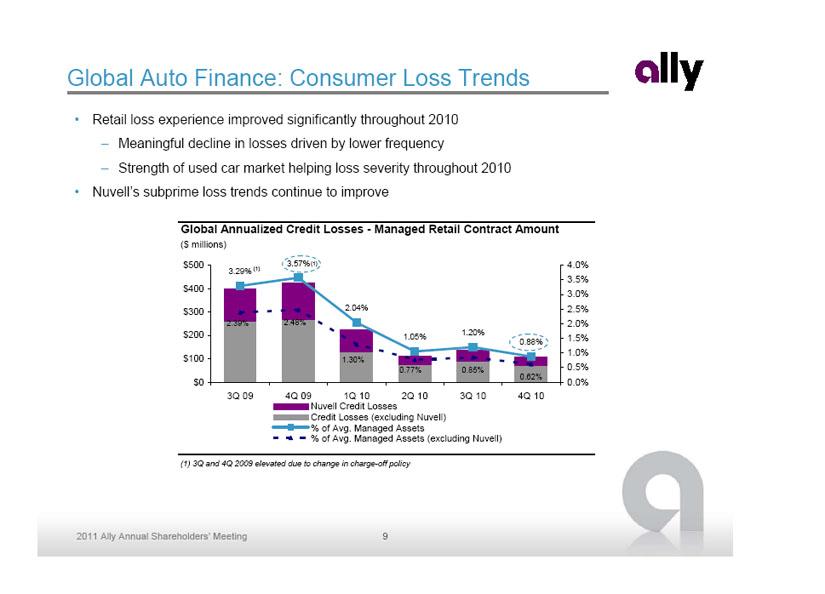

9 2011 Ally Annual Shareholders’ Meeting Global Annualized Credit Losses - Managed Retail Contract Amount ($ millions) (1) 3Q and 4Q 2009 elevated due to change in charge-off policy 3.29% 3.57% 2.04% 1.05% 1.20% 0.88% 0.62% 0.85% 0.77% 1.30% 2.48% 2.39% $0 $100 $200 $300 $400 $500 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 4Q 10 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% Nuvell Credit Losses Credit Losses (excluding Nuvell) % of Avg. Managed Assets % of Avg. Managed Assets (excluding Nuvell) (1) (1) Global Auto Finance: Consumer Loss Trends • Retail loss experience improved significantly throughout 2010 – Meaningful decline in losses driven by lower frequency – Strength of used car market helping loss severity throughout 2010 • Nuvell’s subprime loss trends continue to improve

10 2011 Ally Annual Shareholders’ Meeting Pre-Tax Income from Continuing Operations ($ millions) Note: 2005-2007 results were not adjusted to reflect current segment split ($7,500) ($5,000) ($2,500) $0 $2,500 2005 2006 2007 2008 2009 2010 Mortgage Operations • Ally is the 4th largest originator and 5th largest servicer in the U.S. – ResCap platform supports business – More consistent profitability – Minimal balance sheet usage • Announced plan to split mortgage operations into two segments – Origination & Servicing – Legacy Portfolio & Other • Strong year of originations driven by refinancings – Originated $69.5 billion in residential mortgages – Expect volumes to moderate as rates rise • Demonstrated leader in loan workouts and modifications • Action taken to review, remediate and re-execute over 25,000 potentially affected foreclosure affidavits $1,627 $(4,131) $(6,265) $663 $416 $(2,608) Mortgage Operations O&S Legacy Mortgage Operations Total Assets ($ billions) Note: 2006-2009 assets adjusted to reflect the FAS 166/167 gross-up $147 $101 $70 $50 $37 $- $25 $50 $75 $100 $125 $150 $175 2006 2007 2008 2009 2010 ResCap, LLC Other Mortgage Operations

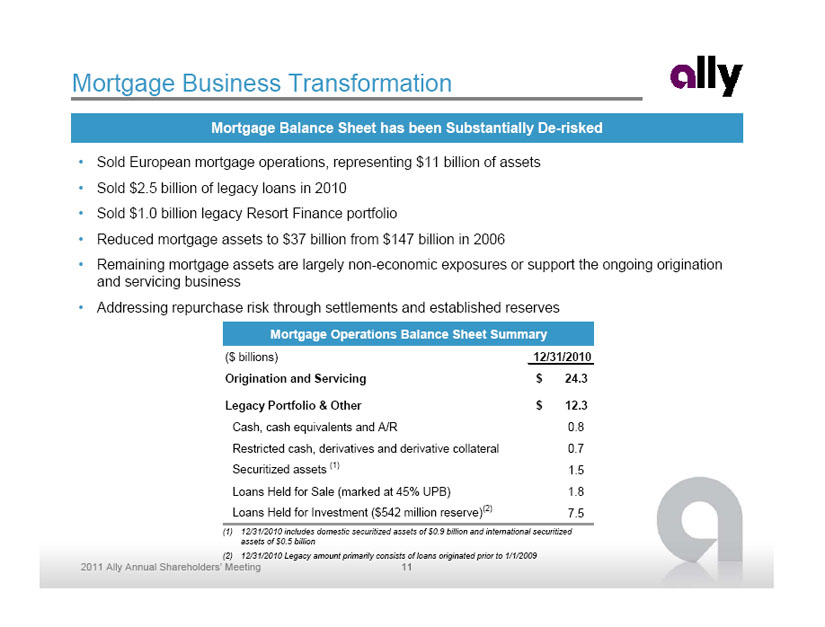

11 2011 Ally Annual Shareholders’ Meeting Mortgage Business Transformation • Sold European mortgage operations, representing $11 billion of assets • Sold $2.5 billion of legacy loans in 2010 • Sold $1.0 billion legacy Resort Finance portfolio • Reduced mortgage assets to $37 billion from $147 billion in 2006 • Remaining mortgage assets are largely non-economic exposures or support the ongoing origination and servicing business • Addressing repurchase risk through settlements and established reserves Mortgage Balance Sheet has been Substantially De-risked (1) 12/31/2010 includes domestic securitized assets of $0.9 billion and international securitized assets of $0.5 billion (2) 12/31/2010 Legacy amount primarily consists of loans originated prior to 1/1/2009 ($ billions) 12/31/2010 Origination and Servicing 24.3 $ Legacy Portfolio & Other 12.3 $ Cash, cash equivalents and A/R 0.8 Restricted cash, derivatives and derivative collateral 0.7 Securitized assets (1) 1.5 Loans Held for Sale (marked at 45% UPB) 1.8 Loans Held for Investment ($542 million reserve)(2) 7.5 Mortgage Operations Balance Sheet Summary

12 2011 Ally Annual Shareholders’ Meeting Ally Bank Franchise Strategy Brand and Marketing Strategy • Do Right – Advocate, strive for customer satisfaction • Be Obviously Better – Intelligent experience, win-win, be a challenger • Operate in a safe and sound manner at all times Differentiate the Customer Experience Compelling Value Proposition • Full spectrum of product offerings • Products designed to address customer needs • Online banking now the preferred banking channel by consumers • Voted “Best Savings Account” by Money Magazine in 2010 Competitive Pricing • Access to customer representatives 24/7 • Ease of Use – Streamlined account opening process, easy navigation on website • No hidden fees, rules or penalties • Ally Bank offers an attractive alternative to traditional money center banks • Competitive pricing but not a price leader • 100% of recent deposit growth has been from non-brokered products

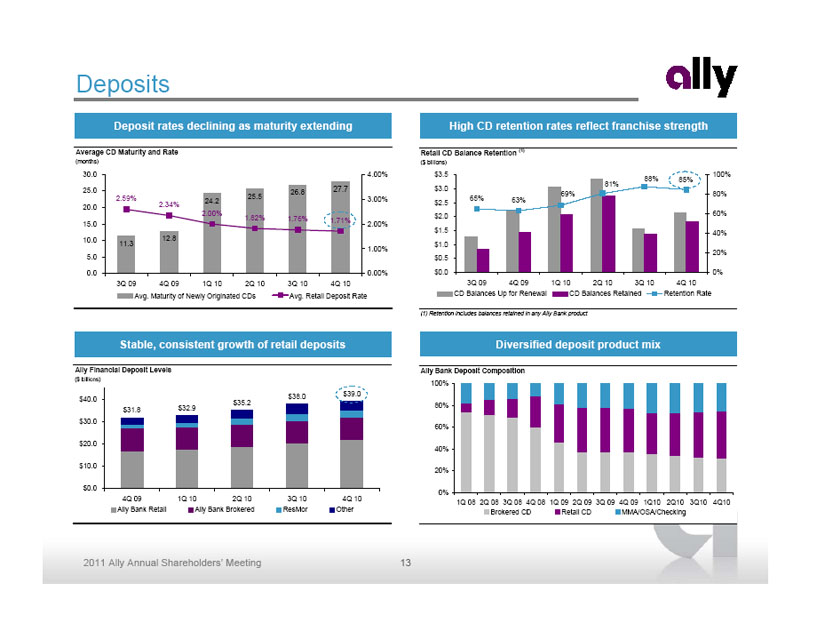

13 2011 Ally Annual Shareholders’ Meeting Ally Financial Deposit Levels ($ billions) $31.8 $32.9 $35.2 $38.0 $39.0 $0.0 $10.0 $20.0 $30.0 $40.0 4Q 09 1Q 10 2Q 10 3Q 10 4Q 10 Ally Bank Retail Ally Bank Brokered ResMor Other Average CD Maturity and Rate (months) Trick 11.3 12.8 24.2 25.5 26.8 27.7 2.59% 2.34% 2.00% 1.82% 1.76% 1.71% 0.0 5.0 10.0 15.0 20.0 25.0 30.0 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 4Q 10 0.00% 1.00% 2.00% 3.00% 4.00% Avg. Maturity of Newly Originated CDs Avg. Retail Deposit Rate Deposits Deposit rates declining as maturity extending High CD retention rates reflect franchise strength Stable, consistent growth of retail deposits Diversified deposit product mix Ally Bank Deposit Composition 0% 20% 40% 60% 80% 100% 1Q 08 2Q 08 3Q 08 4Q 08 1Q 09 2Q 09 3Q 09 4Q 09 1Q10 2Q10 3Q10 4Q10 Brokered CD Retail CD MMA/OSA/Checking Retail CD Balance Retention (1) ($ billions) (1) Retention includes balances retained in any Ally Bank product 65% 63% 81% 69% 85% 88% $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 4Q 10 0% 20% 40% 60% 80% 100% CD Balances Up for Renewal CD Balances Retained Retention Rate

14 2011 Ally Annual Shareholders’ Meeting Liquidity Unsecured ABS Credit Facilities Issued over $8 billion of unsecured debt in 2010 Maintaining robust liquidity in light of upcoming maturities Refinancing flexibility with manageable issuance to address 2012 maturities Raised over $9 billion in the domestic ABS market in 2010 Completed an additional $6 billion of international ABS transactions Strong demand both domestically and internationally for retail and floorplan transactions New revolving facilities with capacity of $12.5 billion Diverse funding covering auto and mortgage assets at Ally Bank, ResCap and international subsidiaries of Ally Financial • Ally maintains a conservative liquidity posture with total parent company available liquidity of $23.8 billion • Manageable upcoming debt maturities with limited required unsecured issuance

15 2011 Ally Annual Shareholders’ Meeting Capital Ratios • Ally’s capital structure now in line with investment grade banks – Improvement in Tier 1 Common Capital primarily driven by U.S. Treasury conversion of MCP into common equity – Tier 1 and Total Capital ratios up as change in balance sheet mix resulted in lower risk-weighted assets ($ billions) 12/31/2010 12/31/2009 Tier 1 Capital 22.2 $ 22.4 $ Tier 1 Common Capital 12.7 $ 7.7 $ Total Risk-Based Capital 24.2 $ 24.6 $ Tangible Common Equity 13.0 $ 8.1 $ Tangible Assets 171.5 $ 171.8 $ Risk-Weighted Assets 147.7 $ 158.4 $ Tier 1 Capital Ratio 15.0% 14.2% Tier 1 Common Capital Ratio 8.6% 4.9% Total Risk-Based Capital Ratio 16.4% 15.6% Tangible Common Equity / Tangible Assets 7.6% 4.7% Tangible Common Equity / Risk-Weighted Assets 8.8% 5.1%

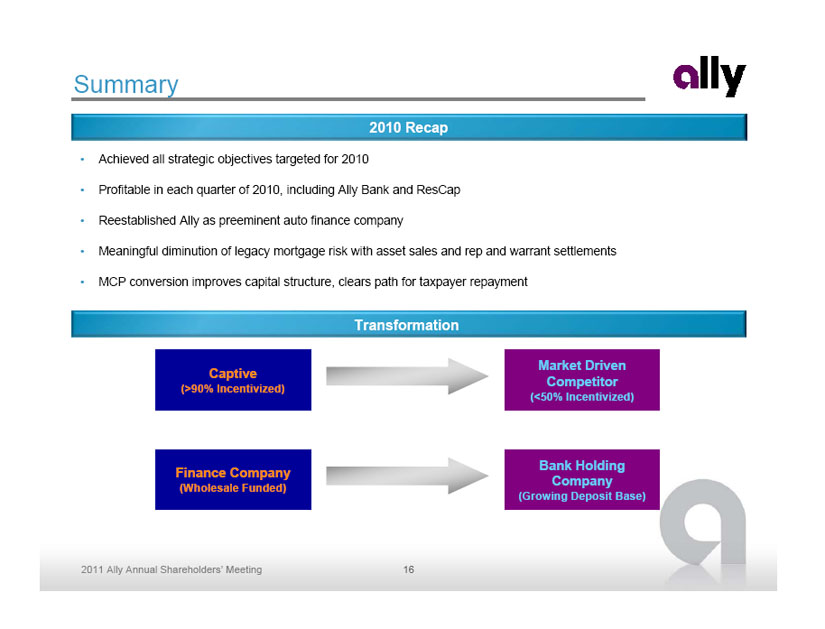

16 2011 Ally Annual Shareholders’ Meeting Summary • Achieved all strategic objectives targeted for 2010 • Profitable in each quarter of 2010, including Ally Bank and ResCap • Reestablished Ally as preeminent auto finance company • Meaningful diminution of legacy mortgage risk with asset sales and rep and warrant settlements • MCP conversion improves capital structure, clears path for taxpayer repayment 2010 Recap Captive (>90% Incentivized) Finance Company (Wholesale Funded) Market Driven Competitor (<50% Incentivized) Bank Holding Company (Growing Deposit Base) Transformation