Attached files

| file | filename |

|---|---|

| 8-K - WHITNEY HOLDING CORPORATION 1ST QTR 2011 8-K - WHITNEY HOLDING CORP | wtny1q20118k.htm |

WHITNEY HOLDING CORPORATION

228 ST. CHARLES AVENUE

NEW ORLEANS, LA 70130

www.whitneybank.com

NEWS RELEASE

|

CONTACT:

|

Thomas L. Callicutt, Jr., CFO

|

FOR IMMEDIATE RELEASE

|

|

|

Trisha Voltz Carlson, Investor Relations

|

April 21, 2011

|

||

|

504/299-5208

|

|||

|

tcarlson@whitneybank.com

|

WHITNEY REPORTS FIRST QUARTER 2011 PROFIT

New Orleans, Louisiana. Whitney Holding Corporation (NASDAQ—WTNY) (the “Company” or “Whitney”) reported net income of $17.2 million for the first quarter of 2011, compared to net losses of $88.5 million and $6.3 million in the fourth and first quarters of 2010, respectively. Including the $4.1 million dividend paid each quarter to the U.S. Treasury on the preferred stock issued under TARP, earnings per diluted common share for the first quarter of 2011 was $.13 compared to losses per common share of $.96 and $.11 for the fourth and first quarters of 2010, respectively.

During the first quarter of 2011, Whitney recovered $5.8 million on a charge-off related to Hurricane Katrina taken in 2006. Based on its current assessment of the impact of the BP oil spill on the Company’s loan customers in the first quarter of 2011, management reversed the $5.0 million allowance established in the second quarter of 2010 to cover estimated losses from this event.

“Late last year, the Company announced an expected return to core operating profitability in the first quarter of 2011”, said John C. Hope, III, Chairman and CEO. “I am proud of the continued hard work and dedication of our employees that allowed us to meet those expectations, even without the noncore items relating to Hurricane Katrina and the BP oil spill.”

In the fourth quarter of 2010, Whitney reclassified $303 million of problem loans as held for sale and recognized charge-offs of $139 million to record these loans at the lower of cost or fair value. The reclassification had a direct impact of approximately $112 million on the Company’s

-MORE-

2

provision for loan losses for the fourth quarter of 2010, reflecting the cost associated with aggressively dealing with problem credits through note sales versus individual resolutions. The carrying value of these problem loans at December 31, 2010 was $158 million. In the first quarter of 2011, Whitney sold approximately $95 million in carrying value of nonperforming loans held for sale, including the previously announced $83 million bulk sale completed in January 2011.

On December 21, 2010, Whitney entered into a definitive agreement with Hancock Holding Company ("Hancock"), headquartered in Gulfport, Mississippi, for the Company to merge with and into Hancock. The transaction is expected to be completed in the second quarter of 2011, subject to customary closing conditions and shareholder and regulatory approval.

HIGHLIGHTS OF FIRST QUARTER FINANCIAL RESULTS

Loans and Earning Assets

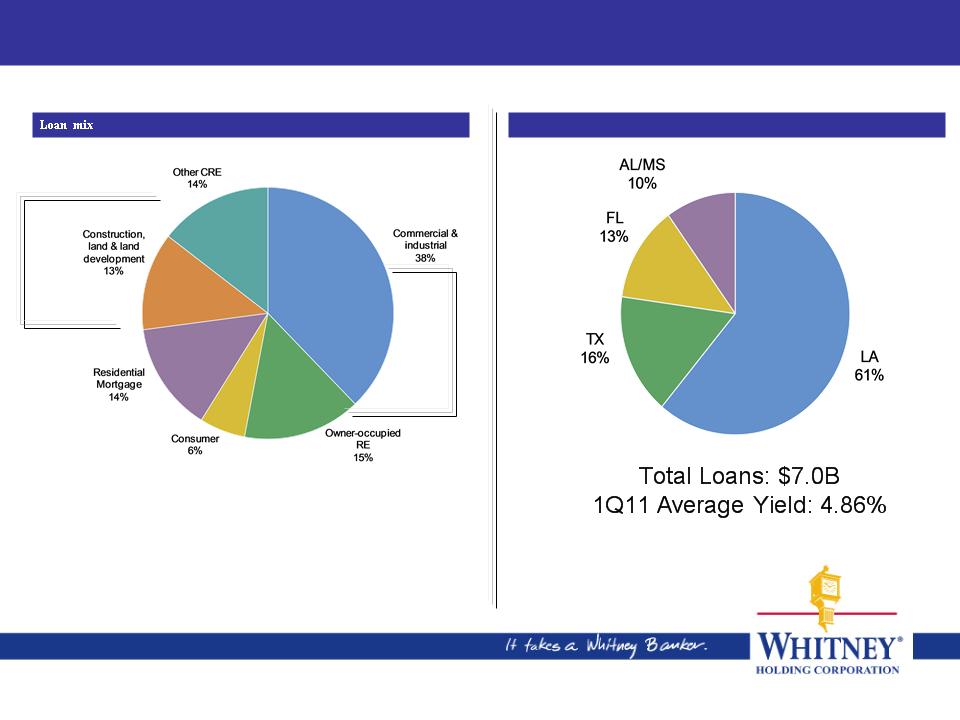

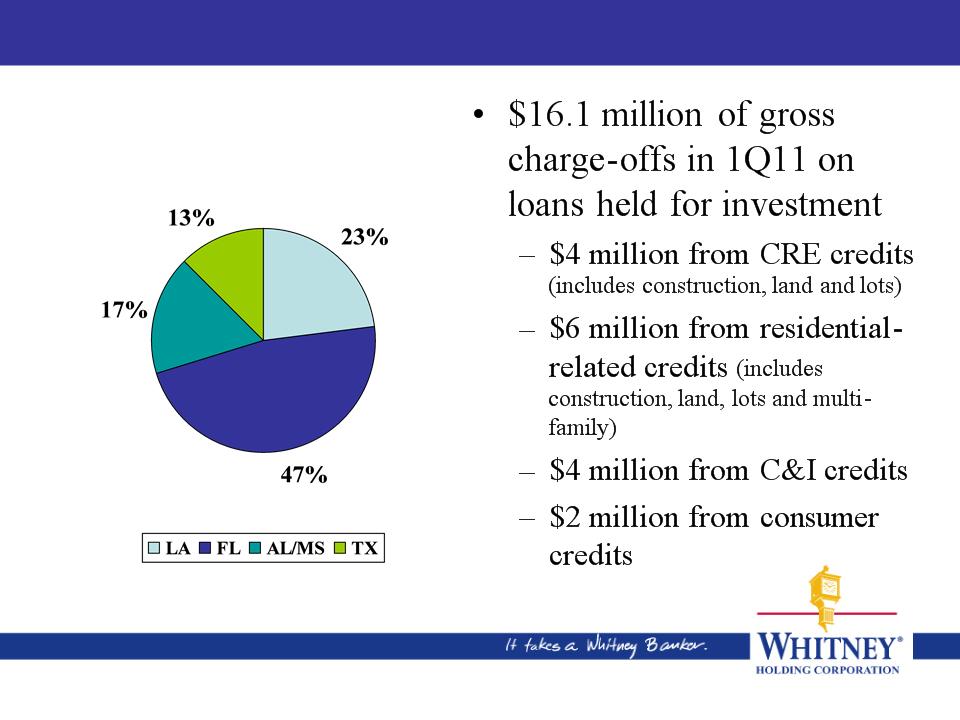

Total loans at the end of the first quarter of 2011 were $7.0 billion, down $241 million, or 3%, from December 31, 2010. The linked-quarter decline included $16.1 million in gross charge-offs and approximately $5.5 million in foreclosures. The remaining decrease reflected payoffs and paydowns during the quarter, including some larger oil and gas credits, several commercial real estate credits in Louisiana, Alabama and Texas and certain commercial and industrial (C&I) customers with seasonal borrowing patterns. Overall demand for credit remained limited during the first quarter.

Average loans for the first quarter of 2011 totaled $7.1 billion, down $508 million, or 7%, compared to the fourth quarter of 2010. The decline in average loans held for investment reflected in part a full quarter’s impact of the reclassification of problem loans as held for sale late in the fourth quarter of 2010.

Average earning assets of $10.2 billion in the first quarter of 2011 were down $244 million, or 2%, from the fourth quarter of 2010, including the impact of the bulk sale of problem loans in January 2011 and the significant charge-offs taken in the fourth quarter of 2010 on the loans reclassified as held for sale.

Deposits and Funding

Average deposits in the first quarter of 2011 were $9.2 billion, up $122 million, or 1%, from the fourth quarter of 2010. Total period-end deposits at March 31, 2011 of $9.2 billion were down $222 million, or 2%, compared to December 31, 2010. Deposits at year-end 2010 included seasonal public funds and year-end deposits of certain commercial relationships.

-MORE-

3

Average and period-end noninterest-bearing deposits totaled $3.5 billion and $3.6 billion, respectively, in the first quarter of 2011, up 5% and 3%, respectively, compared to the fourth quarter of 2010. Noninterest-bearing demand deposits comprised 38% of total average deposits for the first quarter of 2011 and funded approximately 34% of average earning assets. The percentage of earning assets funded by all noninterest-bearing sources totaled 37% for the first quarter of 2011.

Net Interest Income

Net interest income (TE) for the first quarter of 2011 was $101 million, down $4.3 million, or 4%, from the fourth quarter of 2010, with fewer days in the current period accounting for approximately $1.6 million of the decrease. Average earning assets decreased 2% linked-quarter, while the net interest margin (TE) was basically stable, declining only 1 basis point to 3.98%. The stability of the margin reflected a continued unfavorable shift in the mix of earning assets and decline in investment portfolio yields, offset by a favorable shift in funding sources, further reductions in deposit rates and a decrease in nonaccrual loans included in earning asset totals.

Provision for Credit Losses and Credit Quality

As noted earlier, a significant portion of the nonperforming loan portfolio was reclassified as held for sale with significant charge-offs during the fourth quarter of 2010. These loans consisted primarily of the type of real estate-related credits from certain Whitney market areas that have been the main driver of the provision for loan losses over the past two years. These actions, the previously-mentioned large recovery on a Hurricane Katrina related charge-off and the reversal of the BP oil spill loss allowance in the first quarter of 2011 are reflected in management’s evaluation of the adequacy of the allowance for credit losses and decision to make no provision for credit losses in the current period. Whitney provided $148.5 million for credit losses in the fourth quarter of 2010 and $37.5 million in the first quarter of 2010. As noted earlier, the majority of the fourth quarter’s provision, $112 million, was a reflection of the impact of the reclassification of problem loans as held for sale.

Classified loans, excluding loans held for sale, increased $18 million, net, during the first quarter, and totaled $878 million at March 31, 2011. During the first quarter, classified loans from Whitney’s Texas market declined, mainly in commercial real estate credits. Classified C&I loans increased in total, mainly in Louisiana. Overall, there continued to be no significant industry concentrations in the classified total. Management continues to believe that the current portfolio of classified loans has lower loss potential compared to the level of losses that has been recognized on loans impacted by the significant real estate market issues in Florida.

-MORE-

4

Nonperforming loans totaled $239 million at March 31, 2011, a net decrease of $60 million from year-end 2010. Included in the total are $57 million of nonaccrual loans held for sale and $7 million for restructured problem loans that are accruing. Whitney’s Louisiana market accounted for $80 million of the $174 million total nonaccrual loans held for investment at March 31, 2011, with another $43 million from Florida, $27 million from Texas and $24 million from Alabama/Mississippi. Foreclosed assets totaled $78 million at March 31, 2011, down $10 million from year-end 2010.

Net loan charge-offs in the first quarter of 2011 were $2.7 million, or .15% of average loans on an annualized basis, compared to $155.4 million, or 8.14%, of average loans in the fourth quarter of 2010. Approximately half of the $16 million in gross charge-offs in the first quarter of 2011 were from Whitney’s Florida markets. Approximately $90 million of the gross charge-offs in the fourth quarter were related to loans included in the bulk sale, $49 million were charge-offs on additional loans transferred to held for sale and approximately $23 million were charge-offs on the remaining loan portfolio.

The allowance for loan losses represented 3.06% of total loans held for investment at March 31, 2011, compared to 3.00% at December 31, 2010 and 2.77% at March 31, 2010.

Noninterest Income

Noninterest income for the first quarter of 2011 totaled $30.4 million, a decrease of $1.4 million, or 4%, from the fourth quarter of 2010.

Certain recurring sources of income showed seasonal declines in the first quarter of 2011. Secondary mortgage market income was down $1.4 million on lower production levels related in part to less refinancing activity compared to prior periods.

Other noninterest income increased $.8 million. The first quarter of 2011 included $1.7 million of gains on sales of grandfathered assets and other revenue from these assets. The fourth quarter of 2010 included a $.6 million distribution from an investment in a local small business investment company and $.3 million from sales of grandfathered assets.

Noninterest Expense

Total noninterest expense of $108.1 million for the first quarter of 2011 was down $22.2 million from the fourth quarter of 2010. Expenses associated with the pending merger with Hancock totaled $1.2 million in the first quarter of 2011 and $4.1 million in the fourth quarter of 2010.

-MORE-

5

Loan collection costs, together with foreclosed asset management expenses, provisions for valuation losses on foreclosed assets and legal fees associated with problem credits totaled $8.8 million in the first quarter of 2011, down $11.7 million from the fourth quarter of 2010. As noted previously, problem loan resolution expenses were expected to be lower as the Company disposed of the loans held for sale.

Legal and professional fees, excluding those associated with problem credits, declined $1.7 million to a total of $5.3 million for the first quarter of 2011. This decrease was related mainly to costs associated with Whitney’s major technology upgrade project which has been suspended in anticipation of the merger with Hancock. Costs associated with regulatory matters totaled approximately $2.5 million for the first quarter of 2011.

Other noninterest expense decreased $4.4 million compared to the fourth quarter of 2010, including a reduction of approximately $1.0 million in training expenses related to the technology upgrade project.

Capital

The Company’s tangible common equity ratio was 7.22% at March 31, 2011, up from 6.90% at December 31, 2010. The Company’s leverage ratio at March 31, 2011 was 9.09% compared to 8.69% at December 31, 2010. Both the Company and Whitney National Bank remain in compliance with all regulatory capital requirements.

This earnings release, including additional financial tables and supplemental slides related to first quarter results, is posted in the Investor Relations section of the Company's website at http://investor.whitneybank.com/releases.cfm?ReleasesType=Earnings&Year=2011.

Whitney Holding Corporation, through its banking subsidiary Whitney National Bank, serves the five-state Gulf Coast region stretching from Houston, Texas; across southern Louisiana and the coastal region of Mississippi; to central and south Alabama; the panhandle of Florida; and the Tampa Bay metropolitan area of Florida.

-----

Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of section 27A of the Securities Act of 1933, as amended, and section 21E of the Securities Exchange Act of 1934,

6

as amended, and we intend such forward-looking statements to be covered by the safe harbor provisions therein and are including this statement for purposes of invoking these safe-harbor provisions. Forward-looking statements provide projections of results of operations or of financial condition or state other forward-looking information, such as expectations about future conditions and descriptions of plans and strategies for the future. The forward-looking statements made in this release include, but may not be limited to, expectations regarding credit quality metrics in the loan portfolio and specific industry and geographic segments within the loan portfolio, future profitability, the timing and strength of the economic recovery, the loss potential for currently classified credits, the overall capital strength of Whitney, its ability to dispose of, and the expense of disposing of, problem assets, the timing or actual results of such disposal on Whitney’s operations and the timing, completion and long-term success of the Hancock Holding Company/Whitney transaction.

Whitney’s ability to accurately project results or predict the effects of future plans or strategies is inherently limited. Although Whitney believes that the expectations reflected in its forward-looking statements are based on reasonable assumptions, actual results and performance could differ materially from those set forth in the forward-looking statements. Factors that could cause Whitney’s or the combined company’s actual results to differ from those expressed in Whitney’s forward-looking statements include, but are not limited to, those risk factors outlined in Whitney’s and Hancock’s public filings with the Securities and Exchange Commission, which are available at the SEC’s internet site (http://www.sec.gov), as well as the following factors, among others: the possibility that the proposed Hancock/Whitney transaction does not close when expected or at all because required regulatory, shareholder or other approvals and other conditions to closing are not received or satisfied on a timely basis or at all; the terms of the proposed transaction may need to be modified to satisfy such approvals or conditions; the anticipated benefits from the proposed transaction such as it being accretive to earnings, expanding our geographic presence and synergies are not realized in the time frame anticipated or at all as a result of changes in general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations (including changes to capital requirements) and their enforcement, and the degree of competition in the geographic and business areas in which the companies operate; the ability to promptly and effectively integrate the businesses of Whitney and Hancock; reputational risks and the reaction of the companies’ customers to the transaction; and diversion of management time on merger-related issues.

You are cautioned not to place undue reliance on these forward-looking statements. Whitney does not intend, and undertakes no obligation, to update or revise any forward-looking statements, whether as a result of differences in actual results, changes in assumptions or changes in other factors affecting such statements, except as required by law.

ADDITIONAL INFORMATION ABOUT THE HANCOCK HOLDING COMPANY/WHITNEY HOLDING CORPORATION TRANSACTION

In connection with the proposed merger, Whitney filed a definitive proxy statement with the Securities and Exchange Commission (SEC) on April 4, 2011, which was included in the registration statement on Form S-4, as amended, filed by Hancock with the SEC on March 31, 2011 (Registration No. 333-171882). This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. WE URGE INVESTORS TO READ THE DEFINITIVE PROXY STATEMENT AND THE REGISTRATION STATEMENT AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN

7

CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE DEFINITIVE PROXY STATEMENT AND THE REGISTRATION STATEMENT, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THOSE DOCUMENTS DO AND WILL CONTAIN IMPORTANT INFORMATION.

Free copies of the proxy statement, as well as other documents relating to this transaction that Whitney and/or Hancock file with the SEC, are and will be available at:

|

·

|

The SEC's website at www.sec.gov.

|

|

·

|

Whitney's website at www.whitneybank.com, in the Investor Relations section and then under the “SEC Filings” heading.

|

|

·

|

Hancock's website at www.hancockbank.com, in the Investor Relations section and then under the “SEC Filings” heading.

|

In addition, documents filed with the SEC by Hancock will be available free of charge from Paul D. Guichet, Investor Relations at (228) 563-6559. Documents filed with the SEC by Whitney will be available free of charge from Whitney by contacting Trisha Voltz Carlson, Investor Relations at (504) 299-5208.

Under SEC rules, the directors, executive officers, other members of management, and employees of Whitney and Hancock may be deemed to be participants in the solicitation of proxies of Whitney's shareholders in connection with the proposed merger. Information regarding the persons who may be considered participants under SEC rules in the solicitation of shareholders in connection with the merger is contained in the proxy statement. Information about Whitney's executive officers and directors is in its Form 10-K/A filed with the SEC on April 18, 2011. Information about Hancock's executive officers and directors is in its Form 10-K filed with the SEC on February 28, 2011. Free copies of these documents are available on the websites listed above.

(WTNY-E)

-MORE-

| 8 | |||||||||||||||||||||||

|

WHITNEY HOLDING CORPORATION AND SUBSIDIARIES

|

|||||||||||||||||||||||

| QUARTERLY HIGHLIGHTS | |||||||||||||||||||||||

|

First

|

Fourth

|

Third

|

Second

|

First

|

|||||||||||||||||||

|

Quarter

|

Quarter

|

Quarter

|

Quarter

|

Quarter

|

|||||||||||||||||||

|

(dollars in thousands, except per share data)

|

2011 | 2010 | 2010 | 2010 | 2010 | ||||||||||||||||||

|

INCOME DATA

|

|||||||||||||||||||||||

|

Net interest income

|

$ | 99,872 | $ | 104,101 | $ | 104,246 | $ | 105,869 | $ | 106,629 | |||||||||||||

|

Net interest income (tax-equivalent)

|

100,868 | 105,166 | 105,186 | 106,810 | 107,584 | ||||||||||||||||||

|

Provision for credit losses

|

- | 148,500 | 70,000 | 59,000 | 37,500 | ||||||||||||||||||

|

Noninterest income

|

30,438 | 31,847 | 28,651 | 31,761 | 28,247 | ||||||||||||||||||

|

Net securities gains in noninterest income

|

- | - | - | - | - | ||||||||||||||||||

|

Noninterest expense

|

108,128 | 130,358 | 113,118 | 110,147 | 109,706 | ||||||||||||||||||

|

Net income (loss)

|

17,155 | (88,489 | ) | (29,004 | ) | (17,993 | ) | (6,280 | ) | ||||||||||||||

|

Net income (loss) to common shareholders

|

13,088 | (92,556 | ) | (33,071 | ) | (22,060 | ) | (10,347 | ) | ||||||||||||||

|

QUARTER-END BALANCE SHEET DATA

|

|||||||||||||||||||||||

|

Loans

|

$ | 6,993,353 | $ | 7,234,726 | $ | 7,733,932 | $ | 7,979,371 | $ | 8,073,498 | |||||||||||||

|

Investment securities

|

2,685,792 | 2,609,602 | 2,297,338 | 2,076,313 | 2,042,307 | ||||||||||||||||||

|

Earning assets

|

10,180,576 | 10,488,071 | 10,246,178 | 10,214,267 | 10,395,252 | ||||||||||||||||||

|

Total assets

|

11,496,074 | 11,798,779 | 11,517,194 | 11,416,761 | 11,580,806 | ||||||||||||||||||

|

Noninterest-bearing deposits

|

3,625,043 | 3,523,518 | 3,245,123 | 3,229,244 | 3,298,095 | ||||||||||||||||||

|

Total deposits

|

9,181,820 | 9,403,403 | 8,865,916 | 8,819,051 | 8,961,957 | ||||||||||||||||||

|

Shareholders' equity

|

1,538,613 | 1,524,334 | 1,638,661 | 1,674,166 | 1,676,240 | ||||||||||||||||||

|

AVERAGE BALANCE SHEET DATA

|

|||||||||||||||||||||||

|

Loans

|

$ | 7,130,806 | $ | 7,638,375 | $ | 7,881,160 | $ | 8,051,668 | $ | 8,210,283 | |||||||||||||

|

Investment securities

|

2,672,697 | 2,344,312 | 2,115,549 | 2,021,359 | 2,008,095 | ||||||||||||||||||

|

Earning assets

|

10,237,174 | 10,481,277 | 10,331,541 | 10,314,161 | 10,482,211 | ||||||||||||||||||

|

Total assets

|

11,585,440 | 11,774,859 | 11,563,331 | 11,503,150 | 11,656,777 | ||||||||||||||||||

|

Noninterest-bearing deposits

|

3,519,240 | 3,354,893 | 3,224,881 | 3,255,019 | 3,260,794 | ||||||||||||||||||

|

Total deposits

|

9,200,238 | 9,078,371 | 8,884,439 | 8,895,731 | 9,026,703 | ||||||||||||||||||

|

Shareholders' equity

|

1,529,831 | 1,649,829 | 1,670,244 | 1,676,468 | 1,684,537 | ||||||||||||||||||

|

COMMON SHARE DATA

|

|||||||||||||||||||||||

|

Earnings (loss) per share

|

|||||||||||||||||||||||

|

Basic

|

$ | .13 | $ | ( .96 | ) | $ | ( .34 | ) | $ | ( .23 | ) | $ | ( .11 | ) | |||||||||

|

Diluted

|

$ | .13 | ( .96 | ) | ( .34 | ) | ( .23 | ) | ( .11 | ) | |||||||||||||

|

Cash dividends per share

|

$ | .01 | $ | .01 | $ | .01 | $ | .01 | $ | .01 | |||||||||||||

|

Book value per share

|

$ | 12.85 | $ | 12.71 | $ | 13.89 | $ | 14.29 | $ | 14.32 | |||||||||||||

|

Tangible book value per share

|

$ | 8.26 | $ | 8.11 | $ | 9.28 | $ | 9.65 | $ | 9.67 | |||||||||||||

|

Trading data

|

|||||||||||||||||||||||

|

High sales price

|

$ | 14.50 | $ | 14.43 | $ | 10.04 | $ | 15.29 | $ | 14.53 | |||||||||||||

|

Low sales price

|

12.47 | 7.84 | 7.04 | 9.25 | 9.05 | ||||||||||||||||||

|

End-of-period closing price

|

13.62 | 14.15 | 8.17 | 9.25 | 13.79 | ||||||||||||||||||

|

Trading volume

|

54,125,200 | 64,981,238 | 67,483,532 | 75,477,402 | 67,377,896 | ||||||||||||||||||

|

RATIOS

|

|||||||||||||||||||||||

|

Return on average assets

|

.60 | % | (2.98 | )% | (1.00 | )% | (.63 | )% | (.22 | )% | |||||||||||||

|

Return on average common shareholders' equity

|

4.30 | (27.13 | ) | (9.55 | ) | (6.41 | ) | (3.02 | ) | ||||||||||||||

|

Net interest margin (TE)

|

3.98 | 3.99 | 4.05 | 4.15 | 4.15 | ||||||||||||||||||

|

Average loans to average deposits

|

77.51 | 84.14 | 88.71 | 90.51 | 90.96 | ||||||||||||||||||

|

Efficiency ratio

|

82.35 | 95.14 | 84.52 | 79.49 | 80.77 | ||||||||||||||||||

|

Annualized expenses to average assets

|

3.73 | 4.43 | 3.91 | 3.83 | 3.76 | ||||||||||||||||||

|

Allowance for loan losses to loans

|

3.06 | 3.00 | 2.89 | 2.88 | 2.77 | ||||||||||||||||||

|

Annualized net charge-offs to average loans

|

.15 | 8.14 | 3.89 | 2.65 | 1.81 | ||||||||||||||||||

|

Nonperforming assets to loans (including nonaccrual

|

|||||||||||||||||||||||

|

loans held for sale) plus foreclosed assets

|

|||||||||||||||||||||||

|

and surplus property

|

4.45 | 5.16 | 6.64 | 6.73 | 6.12 | ||||||||||||||||||

|

Average shareholders' equity to average total assets

|

13.20 | 14.01 | 14.44 | 14.57 | 14.45 | ||||||||||||||||||

|

Tangible common equity to tangible assets

|

7.22 | 6.90 | 8.10 | 8.49 | 8.38 | ||||||||||||||||||

|

Leverage ratio

|

9.09 | 8.69 | 10.09 | 10.48 | 10.61 | ||||||||||||||||||

|

Tax-equivalent (TE) amounts are calculated using a federal income tax rate of 35%.

|

|||||||||||||||||||||||

|

The efficiency ratio is noninterest expense to total net interest (TE) and noninterest income (excluding securities gains and losses).

|

|||||||||||||||||||||||

|

The tangible common equity to tangible assets ratio is total shareholders' equity less preferred stock and intangible assets divided by

|

|||||||||||||||||||||||

|

total assets less intangible assets.

|

|||||||||||||||||||||||

| 9 | |||||||||||||||||||||||

| WHITNEY HOLDING CORPORATION AND SUBSIDIARIES | |||||||||||||||||||||||

| DAILY AVERAGE CONSOLIDATED BALANCE SHEETS | |||||||||||||||||||||||

|

First

|

Fourth

|

Third

|

Second

|

First

|

|||||||||||||||||||

|

Quarter

|

Quarter

|

Quarter

|

Quarter

|

Quarter

|

|||||||||||||||||||

|

(dollars in thousands)

|

2011 | 2010 | 2010 | 2010 | 2010 | ||||||||||||||||||

|

ASSETS

|

|||||||||||||||||||||||

|

EARNING ASSETS

|

|||||||||||||||||||||||

|

Loans

|

$ | 7,130,806 | $ | 7,638,375 | $ | 7,881,160 | $ | 8,051,668 | $ | 8,210,283 | |||||||||||||

|

Investment securities

|

|||||||||||||||||||||||

|

Securities available for sale

|

2,001,587 | 2,047,483 | 1,957,481 | 1,858,996 | 1,838,179 | ||||||||||||||||||

|

Securities held to maturity

|

671,110 | 296,829 | 158,068 | 162,363 | 169,916 | ||||||||||||||||||

|

Total investment securities

|

2,672,697 | 2,344,312 | 2,115,549 | 2,021,359 | 2,008,095 | ||||||||||||||||||

|

Federal funds sold and short-term investments

|

337,452 | 447,555 | 296,485 | 213,031 | 243,123 | ||||||||||||||||||

|

Loans held for sale

|

96,219 | 51,035 | 38,347 | 28,103 | 20,710 | ||||||||||||||||||

|

Total earning assets

|

10,237,174 | 10,481,277 | 10,331,541 | 10,314,161 | 10,482,211 | ||||||||||||||||||

|

NONEARNING ASSETS

|

|||||||||||||||||||||||

|

Goodwill and other intangible assets

|

444,113 | 445,095 | 446,308 | 447,596 | 449,009 | ||||||||||||||||||

|

Accrued interest receivable

|

31,868 | 32,798 | 32,764 | 34,791 | 36,086 | ||||||||||||||||||

|

Other assets

|

1,092,371 | 1,044,410 | 983,823 | 941,391 | 925,851 | ||||||||||||||||||

|

Allowance for loan losses

|

(220,086 | ) | (228,721 | ) | (231,105 | ) | (234,789 | ) | (236,380 | ) | |||||||||||||

|

Total assets

|

$ | 11,585,440 | $ | 11,774,859 | $ | 11,563,331 | $ | 11,503,150 | $ | 11,656,777 | |||||||||||||

|

LIABILITIES

|

|||||||||||||||||||||||

|

INTEREST-BEARING LIABILITIES

|

|||||||||||||||||||||||

|

Interest-bearing deposits

|

|||||||||||||||||||||||

|

NOW account deposits

|

$ | 1,208,317 | $ | 1,163,000 | $ | 1,128,756 | $ | 1,148,590 | $ | 1,247,118 | |||||||||||||

|

Money market investment deposits

|

1,823,639 | 1,834,234 | 1,811,326 | 1,765,839 | 1,794,820 | ||||||||||||||||||

|

Savings deposits

|

916,749 | 887,331 | 865,229 | 868,829 | 849,006 | ||||||||||||||||||

|

Other time deposits

|

673,057 | 703,277 | 716,245 | 728,121 | 781,806 | ||||||||||||||||||

|

Time deposits $100,000 and over

|

1,059,236 | 1,135,636 | 1,138,002 | 1,129,333 | 1,093,159 | ||||||||||||||||||

|

Total interest-bearing deposits

|

5,680,998 | 5,723,478 | 5,659,558 | 5,640,712 | 5,765,909 | ||||||||||||||||||

|

Short-term borrowings

|

531,037 | 732,669 | 707,892 | 624,931 | 644,838 | ||||||||||||||||||

|

Long-term debt

|

219,596 | 218,499 | 199,731 | 199,751 | 199,711 | ||||||||||||||||||

|

Total interest-bearing liabilities

|

6,431,631 | 6,674,646 | 6,567,181 | 6,465,394 | 6,610,458 | ||||||||||||||||||

|

NONINTEREST-BEARING LIABILITIES

|

|||||||||||||||||||||||

|

Noninterest-bearing deposits

|

3,519,240 | 3,354,893 | 3,224,881 | 3,255,019 | 3,260,794 | ||||||||||||||||||

|

Accrued interest payable

|

10,073 | 8,835 | 11,543 | 8,910 | 12,554 | ||||||||||||||||||

|

Other liabilities

|

94,665 | 86,656 | 89,482 | 97,359 | 88,434 | ||||||||||||||||||

|

Total liabilities

|

10,055,609 | 10,125,030 | 9,893,087 | 9,826,682 | 9,972,240 | ||||||||||||||||||

|

SHAREHOLDERS' EQUITY

|

|||||||||||||||||||||||

|

Preferred

|

296,404 | 296,088 | 295,770 | 295,454 | 295,140 | ||||||||||||||||||

|

Common

|

1,233,427 | 1,353,741 | 1,374,474 | 1,381,014 | 1,389,397 | ||||||||||||||||||

|

Total shareholders' equity

|

1,529,831 | 1,649,829 | 1,670,244 | 1,676,468 | 1,684,537 | ||||||||||||||||||

|

Total liabilities and shareholders' equity

|

$ | 11,585,440 | $ | 11,774,859 | $ | 11,563,331 | $ | 11,503,150 | $ | 11,656,777 | |||||||||||||

|

EARNING ASSETS LESS

|

|||||||||||||||||||||||

|

INTEREST-BEARING LIABILITIES

|

$ | 3,805,543 | $ | 3,806,631 | $ | 3,764,360 | $ | 3,848,767 | $ | 3,871,753 | |||||||||||||

| 10 | |||||||||||||||||||||||

|

WHITNEY HOLDING CORPORATION AND SUBSIDIARIES

|

|||||||||||||||||||||||

|

CONSOLIDATED BALANCE SHEETS

|

|||||||||||||||||||||||

|

March 31

|

December 31

|

September 30

|

June 30

|

March 31

|

|||||||||||||||||||

|

(dollars in thousands)

|

2011 | 2010 | 2010 | 2010 | 2010 | ||||||||||||||||||

|

ASSETS

|

|||||||||||||||||||||||

|

Cash and due from financial institutions

|

$ | 264,233 | $ | 210,368 | $ | 244,331 | $ | 200,075 | $ | 198,912 | |||||||||||||

|

Federal funds sold and short-term investments

|

432,432 | 445,392 | 165,746 | 130,113 | 256,505 | ||||||||||||||||||

|

Loans held for sale

|

68,999 | 198,351 | 49,162 | 28,470 | 22,942 | ||||||||||||||||||

|

Investment securities

|

|||||||||||||||||||||||

|

Securities available for sale

|

2,008,911 | 1,968,245 | 2,140,882 | 1,915,587 | 1,877,653 | ||||||||||||||||||

|

Securities held to maturity

|

676,881 | 641,357 | 156,456 | 160,726 | 164,654 | ||||||||||||||||||

|

Total investment securities

|

2,685,792 | 2,609,602 | 2,297,338 | 2,076,313 | 2,042,307 | ||||||||||||||||||

|

Loans

|

6,993,353 | 7,234,726 | 7,733,932 | 7,979,371 | 8,073,498 | ||||||||||||||||||

|

Allowance for loan losses

|

(214,186 | ) | (216,843 | ) | (223,254 | ) | (229,884 | ) | (223,890 | ) | |||||||||||||

|

Net loans

|

6,779,167 | 7,017,883 | 7,510,678 | 7,749,487 | 7,849,608 | ||||||||||||||||||

|

Bank premises and equipment

|

232,591 | 232,475 | 228,696 | 227,620 | 226,105 | ||||||||||||||||||

|

Goodwill

|

435,678 | 435,678 | 435,678 | 435,678 | 435,678 | ||||||||||||||||||

|

Other intangible assets

|

7,976 | 8,922 | 10,009 | 11,284 | 12,621 | ||||||||||||||||||

|

Accrued interest receivable

|

29,022 | 29,078 | 30,161 | 29,783 | 33,277 | ||||||||||||||||||

|

Other assets

|

560,184 | 611,030 | 545,395 | 527,938 | 502,851 | ||||||||||||||||||

|

Total assets

|

$ | 11,496,074 | $ | 11,798,779 | $ | 11,517,194 | $ | 11,416,761 | $ | 11,580,806 | |||||||||||||

|

LIABILITIES

|

|||||||||||||||||||||||

|

Noninterest-bearing demand deposits

|

$ | 3,625,043 | $ | 3,523,518 | $ | 3,245,123 | $ | 3,229,244 | $ | 3,298,095 | |||||||||||||

|

Interest-bearing deposits

|

5,556,777 | 5,879,885 | 5,620,793 | 5,589,807 | 5,663,862 | ||||||||||||||||||

|

Total deposits

|

9,181,820 | 9,403,403 | 8,865,916 | 8,819,051 | 8,961,957 | ||||||||||||||||||

|

Short-term borrowings

|

468,628 | 543,492 | 681,152 | 599,106 | 610,344 | ||||||||||||||||||

|

Long-term debt

|

219,612 | 219,571 | 199,755 | 199,764 | 199,722 | ||||||||||||||||||

|

Accrued interest payable

|

10,372 | 9,722 | 11,600 | 9,794 | 12,598 | ||||||||||||||||||

|

Other liabilities

|

77,029 | 98,257 | 120,110 | 114,880 | 119,945 | ||||||||||||||||||

|

Total liabilities

|

9,957,461 | 10,274,445 | 9,878,533 | 9,742,595 | 9,904,566 | ||||||||||||||||||

|

SHAREHOLDERS' EQUITY

|

|||||||||||||||||||||||

|

Preferred stock

|

296,559 | 296,242 | 295,925 | 295,608 | 295,291 | ||||||||||||||||||

|

Common stock

|

2,800 | 2,800 | 2,800 | 2,800 | 2,800 | ||||||||||||||||||

|

Capital surplus

|

621,803 | 620,547 | 618,475 | 620,111 | 618,392 | ||||||||||||||||||

|

Retained earnings

|

640,654 | 628,546 | 722,081 | 756,127 | 779,158 | ||||||||||||||||||

|

Accumulated other comprehensive income (loss)

|

(10,506 | ) | (11,104 | ) | 12,077 | 12,217 | (6,704 | ) | |||||||||||||||

|

Treasury stock at cost

|

(12,697 | ) | (12,697 | ) | (12,697 | ) | (12,697 | ) | (12,697 | ) | |||||||||||||

|

Total shareholders' equity

|

1,538,613 | 1,524,334 | 1,638,661 | 1,674,166 | 1,676,240 | ||||||||||||||||||

|

Total liabilities and shareholders' equity

|

$ | 11,496,074 | $ | 11,798,779 | $ | 11,517,194 | $ | 11,416,761 | $ | 11,580,806 | |||||||||||||

| 11 | ||||||||||||||||||||||

|

WHITNEY HOLDING CORPORATION AND SUBSIDIARIES

|

||||||||||||||||||||||

|

CONSOLIDATED STATEMENTS OF INCOME

|

||||||||||||||||||||||

|

First

|

Fourth

|

Third

|

Second

|

First

|

||||||||||||||||||

|

Quarter

|

Quarter

|

Quarter

|

Quarter

|

Quarter

|

||||||||||||||||||

|

(dollars in thousands, except per share data)

|

2011 | 2010 | 2010 | 2010 | 2010 | |||||||||||||||||

|

INTEREST INCOME

|

||||||||||||||||||||||

|

Interest and fees on loans

|

$ | 86,446 | $ | 95,379 | $ | 96,836 | $ | 98,778 | $ | 100,130 | ||||||||||||

|

Interest and dividends on investments

|

22,886 | 20,473 | 20,002 | 20,076 | 20,502 | |||||||||||||||||

|

Interest on federal funds sold and

|

||||||||||||||||||||||

|

short-term investments

|

233 | 302 | 195 | 157 | 179 | |||||||||||||||||

|

Total interest income

|

109,565 | 116,154 | 117,033 | 119,011 | 120,811 | |||||||||||||||||

|

INTEREST EXPENSE

|

||||||||||||||||||||||

|

Interest on deposits

|

6,759 | 9,071 | 9,998 | 10,398 | 11,420 | |||||||||||||||||

|

Interest on short-term borrowings

|

173 | 273 | 294 | 255 | 276 | |||||||||||||||||

|

Interest on long-term debt

|

2,761 | 2,709 | 2,495 | 2,489 | 2,486 | |||||||||||||||||

|

Total interest expense

|

9,693 | 12,053 | 12,787 | 13,142 | 14,182 | |||||||||||||||||

|

NET INTEREST INCOME

|

99,872 | 104,101 | 104,246 | 105,869 | 106,629 | |||||||||||||||||

|

PROVISION FOR CREDIT LOSSES

|

- | 148,500 | 70,000 | 59,000 | 37,500 | |||||||||||||||||

|

NET INTEREST INCOME AFTER PROVISION

|

||||||||||||||||||||||

|

FOR CREDIT LOSSES

|

99,872 | (44,399 | ) | 34,246 | 46,869 | 69,129 | ||||||||||||||||

|

NONINTEREST INCOME

|

||||||||||||||||||||||

|

Service charges on deposit accounts

|

7,962 | 8,568 | 8,208 | 8,662 | 8,482 | |||||||||||||||||

|

Bank card fees

|

6,553 | 6,738 | 6,305 | 6,217 | 5,674 | |||||||||||||||||

|

Trust service fees

|

3,055 | 3,080 | 2,804 | 3,076 | 2,908 | |||||||||||||||||

|

Secondary mortgage market operations

|

1,882 | 3,317 | 2,600 | 2,050 | 1,882 | |||||||||||||||||

|

Other noninterest income

|

10,986 | 10,144 | 8,734 | 11,756 | 9,301 | |||||||||||||||||

|

Securities transactions

|

- | - | - | - | - | |||||||||||||||||

|

Total noninterest income

|

30,438 | 31,847 | 28,651 | 31,761 | 28,247 | |||||||||||||||||

|

NONINTEREST EXPENSE

|

||||||||||||||||||||||

|

Employee compensation

|

40,930 | 43,171 | 40,277 | 40,719 | 39,044 | |||||||||||||||||

|

Employee benefits

|

10,493 | 9,325 | 9,344 | 9,004 | 11,051 | |||||||||||||||||

|

Total personnel

|

51,423 | 52,496 | 49,621 | 49,723 | 50,095 | |||||||||||||||||

|

Net occupancy

|

9,424 | 9,685 | 9,922 | 9,706 | 9,945 | |||||||||||||||||

|

Equipment and data processing

|

7,433 | 8,064 | 7,448 | 6,923 | 6,594 | |||||||||||||||||

|

Legal and other professional services

|

7,140 | 9,986 | 9,643 | 9,329 | 5,232 | |||||||||||||||||

|

Deposit insurance and regulatory fees

|

5,658 | 5,523 | 5,385 | 6,491 | 6,013 | |||||||||||||||||

|

Telecommunication and postage

|

2,808 | 2,304 | 3,024 | 3,022 | 3,085 | |||||||||||||||||

|

Corporate value and franchise taxes

|

1,404 | 1,439 | 1,720 | 1,588 | 1,698 | |||||||||||||||||

|

Amortization of intangibles

|

946 | 1,087 | 1,275 | 1,337 | 1,495 | |||||||||||||||||

|

Provision for valuation losses on foreclosed assets

|

5,631 | 14,189 | 4,372 | 3,479 | 3,088 | |||||||||||||||||

|

Nonlegal loan collection and other foreclosed asset costs

|

1,329 | 3,342 | 4,150 | 2,560 | 3,173 | |||||||||||||||||

|

Merger-related expense

|

1,166 | 4,086 | - | - | - | |||||||||||||||||

|

Other noninterest expense

|

13,766 | 18,157 | 16,558 | 15,989 | 19,288 | |||||||||||||||||

|

Total noninterest expense

|

108,128 | 130,358 | 113,118 | 110,147 | 109,706 | |||||||||||||||||

|

Income (loss) before income taxes

|

22,182 | (142,910 | ) | (50,221 | ) | (31,517 | ) | (12,330 | ) | |||||||||||||

|

Income tax expense

|

5,027 | (54,421 | ) | (21,217 | ) | (13,524 | ) | (6,050 | ) | |||||||||||||

|

Net income (loss)

|

$ | 17,155 | $ | (88,489 | ) | $ | (29,004 | ) | $ | (17,993 | ) | $ | (6,280 | ) | ||||||||

|

Preferred stock dividends

|

4,067 | 4,067 | 4,067 | 4,067 | 4,067 | |||||||||||||||||

|

Net income (loss) to common shareholders

|

$ | 13,088 | $ | (92,556 | ) | $ | (33,071 | ) | $ | (22,060 | ) | $ | (10,347 | ) | ||||||||

|

EARNINGS (LOSS) PER COMMON SHARE

|

||||||||||||||||||||||

|

Basic

|

$ | .13 | $ | (.96 | ) | $ | (.34 | ) | $ | (.23 | ) | $ | (.11 | ) | ||||||||

|

Diluted

|

.13 | (.96 | ) | (.34 | ) | (.23 | ) | (.11 | ) | |||||||||||||

|

WEIGHTED-AVERAGE COMMON

|

||||||||||||||||||||||

|

SHARES OUTSTANDING

|

||||||||||||||||||||||

|

Basic

|

96,728,115 | 96,724,267 | 96,707,562 | 96,538,261 | 96,534,425 | |||||||||||||||||

|

Diluted

|

96,728,115 | 96,724,267 | 96,707,562 | 96,538,261 | 96,534,425 | |||||||||||||||||

|

CASH DIVIDENDS PER COMMON SHARE

|

$ | .01 | $ | .01 | $ | .01 | $ | .01 | $ | .01 | ||||||||||||

| 12 | ||||||||||||||||||||||

|

WHITNEY HOLDING CORPORATION AND SUBSIDIARIES

|

||||||||||||||||||||||

|

SUMMARY OF INTEREST RATES (TAX-EQUIVALENT)*

|

||||||||||||||||||||||

|

First

|

Fourth

|

Third

|

Second

|

First

|

||||||||||||||||||

|

Quarter

|

Quarter

|

Quarter

|

Quarter

|

Quarter

|

||||||||||||||||||

| 2011 | 2010 | 2010 | 2010 | 2010 | ||||||||||||||||||

|

EARNING ASSETS

|

||||||||||||||||||||||

|

Loans**

|

4.86 | % | 4.94 | % | 4.86 | % | 4.91 | % | 4.93 | % | ||||||||||||

|

Investment securities

|

3.54 | 3.64 | 3.94 | 4.15 | 4.26 | |||||||||||||||||

|

Federal funds sold and short-term investments

|

.28 | .27 | .26 | .30 | .30 | |||||||||||||||||

|

Total interest-earning assets

|

4.36 | % | 4.45 | % | 4.54 | % | 4.66 | % | 4.70 | % | ||||||||||||

|

INTEREST-BEARING LIABILITIES

|

||||||||||||||||||||||

|

Interest-bearing deposits

|

||||||||||||||||||||||

|

NOW account deposits

|

.22 | % | .27 | % | .30 | % | .35 | % | .36 | % | ||||||||||||

|

Money market investment deposits

|

.36 | .59 | .69 | .74 | .82 | |||||||||||||||||

|

Savings deposits

|

.09 | .12 | .15 | .15 | .15 | |||||||||||||||||

|

Other time deposits

|

1.04 | 1.18 | 1.26 | 1.31 | 1.39 | |||||||||||||||||

|

Time deposits $100,000 and over

|

.99 | 1.11 | 1.18 | 1.22 | 1.37 | |||||||||||||||||

|

Total interest-bearing deposits

|

.48 | % | .63 | % | .70 | % | .74 | % | .80 | % | ||||||||||||

|

Short-term borrowings

|

.13 | .15 | .16 | .16 | .17 | |||||||||||||||||

|

Long-term debt

|

5.03 | 4.96 | 5.00 | 4.98 | 4.98 | |||||||||||||||||

|

Total interest-bearing liabilities

|

.61 | % | .72 | % | .77 | % | .81 | % | .87 | % | ||||||||||||

|

NET INTEREST SPREAD (tax-equivalent)

|

||||||||||||||||||||||

|

Yield on earning assets less cost of interest-

|

||||||||||||||||||||||

|

bearing liabilities

|

3.75 | % | 3.73 | % | 3.77 | % | 3.85 | % | 3.83 | % | ||||||||||||

|

NET INTEREST MARGIN (tax-equivalent)

|

||||||||||||||||||||||

|

Net interest income (tax equivalent) as a

|

||||||||||||||||||||||

|

percentage of average earning assets

|

3.98 | % | 3.99 | % | 4.05 | % | 4.15 | % | 4.15 | % | ||||||||||||

|

COST OF FUNDS

|

||||||||||||||||||||||

|

Interest expense as a percentage of average interest-

|

||||||||||||||||||||||

|

bearing liabilities plus interest-free funds

|

.38 | % | .46 | % | .49 | % | .51 | % | .55 | % | ||||||||||||

|

* Based on a 35% tax rate.

|

||||||||||||||||||||||

|

** Net of unearned income, before deducting the allowance for loan losses and including loans held for sale and loans accounted for

|

||||||||||||||||||||||

|

on a nonaccrual basis.

|

||||||||||||||||||||||

| 13 | ||||||||||||||||||||||

|

WHITNEY HOLDING CORPORATION AND SUBSIDIARIES

|

||||||||||||||||||||||

|

LOAN QUALITY

|

||||||||||||||||||||||

|

First

|

Fourth

|

Third

|

Second

|

First

|

||||||||||||||||||

|

Quarter

|

Quarter

|

Quarter

|

Quarter

|

Quarter

|

||||||||||||||||||

|

(dollars in thousands)

|

2011 | 2010 | 2010 | 2010 | 2010 | |||||||||||||||||

|

ALLOWANCE FOR LOAN LOSSES

|

||||||||||||||||||||||

|

Allowance at beginning of period

|

$ | 216,843 | $ | 223,254 | $ | 229,884 | $ | 223,890 | $ | 223,671 | ||||||||||||

|

Provision for credit losses

|

- | 149,000 | 70,000 | 59,300 | 37,300 | |||||||||||||||||

|

Loans charged off

|

(16,107 | ) | (161,466 | ) | (80,062 | ) | (57,948 | ) | (39,987 | ) | ||||||||||||

|

Recoveries on loans previously charged off

|

13,450 | 6,055 | 3,432 | 4,642 | 2,906 | |||||||||||||||||

|

Net loans charged off

|

(2,657 | ) | (155,411 | ) | (76,630 | ) | (53,306 | ) | (37,081 | ) | ||||||||||||

|

Allowance at end of period

|

$ | 214,186 | $ | 216,843 | $ | 223,254 | $ | 229,884 | $ | 223,890 | ||||||||||||

|

Allowance for loan losses to loans

|

3.06 | % | 3.00 | % | 2.89 | % | 2.88 | % | 2.77 | % | ||||||||||||

|

Annualized net charge-offs to average loans

|

.15 | 8.14 | 3.89 | 2.65 | 1.81 | |||||||||||||||||

|

Annualized gross charge-offs to average loans

|

.90 | 8.46 | 4.06 | 2.88 | 1.95 | |||||||||||||||||

|

Recoveries to gross charge-offs

|

83.50 | 3.75 | 4.29 | 8.01 | 7.27 | |||||||||||||||||

|

RESERVE FOR LOSSES ON

|

||||||||||||||||||||||

|

UNFUNDED CREDIT COMMITMENTS

|

||||||||||||||||||||||

|

Reserve at beginning of period

|

$ | 1,600 | $ | 2,100 | $ | 2,100 | $ | 2,400 | $ | 2,200 | ||||||||||||

|

Provision for credit losses

|

- | (500 | ) | - | (300 | ) | 200 | |||||||||||||||

|

Reserve at end of period

|

$ | 1,600 | $ | 1,600 | $ | 2,100 | $ | 2,100 | $ | 2,400 | ||||||||||||

|

March 31

|

December 31

|

September 30

|

June 30

|

March 31

|

||||||||||||||||||

|

(dollars in thousands)

|

2011 | 2010 | 2010 | 2010 | 2010 | |||||||||||||||||

|

NONPERFORMING ASSETS

|

||||||||||||||||||||||

|

Nonaccrual loans:

|

||||||||||||||||||||||

|

Held for investment

|

$ | 174,484 | $ | 140,519 | $ | 428,012 | $ | 451,405 | $ | 436,680 | ||||||||||||

|

Held for sale

|

57,218 | 158,044 | - | - | - | |||||||||||||||||

|

Restructured loans accruing

|

7,330 | - | - | - | - | |||||||||||||||||

|

Total nonperforming loans

|

239,032 | 298,563 | 428,012 | 451,405 | 436,680 | |||||||||||||||||

|

Foreclosed assets and surplus property

|

78,155 | 87,696 | 91,770 | 91,506 | 60,879 | |||||||||||||||||

|

Total nonperforming assets

|

$ | 317,187 | $ | 386,259 | $ | 519,782 | $ | 542,911 | $ | 497,559 | ||||||||||||

|

Loans 90 days past due still accruing

|

$ | 10,235 | $ | 14,283 | $ | 28,518 | $ | 10,539 | $ | 17,591 | ||||||||||||

|

Nonperforming assets to loans (including

|

||||||||||||||||||||||

|

nonaccrual loans held for sale) plus foreclosed

|

||||||||||||||||||||||

|

assets and surplus property

|

4.45 | % | 5.16 | % | 6.64 | % | 6.73 | % | 6.12 | % | ||||||||||||

|

Nonaccrual loans held for investment to loans

|

||||||||||||||||||||||

|

(excluding nonaccrual loans held for sale)

|

2.49 | 1.94 | 5.53 | 5.66 | 5.41 | |||||||||||||||||

|

Allowance for loan losses to nonperforming loans

|

||||||||||||||||||||||

|

(excluding nonaccrual loans held for sale)

|

117.81 | 154.32 | 52.16 | 50.93 | 51.27 | |||||||||||||||||

|

Loans 90 days past due still accruing to loans

|

.15 | .20 | .37 | .13 | .22 | |||||||||||||||||

| 14 | |||||||||||

|

WHITNEY HOLDING CORPORATION AND SUBSIDIARIES

|

|||||||||||

|

LOAN PORTFOLIO DETAIL

|

|||||||||||

|

LOAN PORTFOLIO AT QUARTER-END

|

|||||||||||

|

2011

|

2010

|

||||||||||

|

(dollars in millions)

|

March

|

December

|

September

|

June

|

March

|

||||||

|

Commercial & industrial

|

$2,644

|

$2,789

|

$2,846

|

$2,895

|

$2,869

|

||||||

|

Owner-occupied real estate

|

1,062

|

1,003

|

1,070

|

1,053

|

1,069

|

||||||

|

Total commercial & industrial

|

3,706

|

3,792

|

3,916

|

3,948

|

3,938

|

||||||

|

Construction, land & land development

|

879

|

946

|

1,175

|

1,396

|

1,479

|

||||||

|

Other commercial real estate

|

1,017

|

1,123

|

1,223

|

1,197

|

1,217

|

||||||

|

Total commercial real estate

|

1,896

|

2,069

|

2,398

|

2,593

|

2,696

|

||||||

|

Residential mortgage

|

979

|

953

|

994

|

1,007

|

1,015

|

||||||

|

Consumer

|

412

|

421

|

426

|

431

|

424

|

||||||

|

Total loans

|

$6,993

|

$7,235

|

$7,734

|

$7,979

|

$8,073

|

||||||

|

|

|

|

|

|

|||||||

|

GEOGRAPHIC DISTRIBUTION OF LOAN PORTFOLIO AT MARCH 31, 2011

|

|||||||||||

|

Alabama/

|

Percent

|

||||||||||

|

(dollars in millions)

|

Louisiana

|

Texas

|

Florida

|

Mississippi

|

Total

|

of total

|

|||||

|

Commercial & industrial

|

$1,930

|

$382

|

$124

|

$208

|

$2,644

|

38%

|

|||||

|

Owner-occupied real estate

|

681

|

125

|

174

|

82

|

1,062

|

15%

|

|||||

|

Total commercial & industrial

|

2,611

|

507

|

298

|

290

|

3,706

|

53%

|

|||||

|

Construction, land & land development

|

295

|

312

|

157

|

115

|

879

|

13%

|

|||||

|

Other commercial real estate

|

552

|

120

|

219

|

126

|

1,017

|

14%

|

|||||

|

Total commercial real estate

|

847

|

432

|

376

|

241

|

1,896

|

27%

|

|||||

|

Residential mortgage

|

530

|

167

|

160

|

122

|

979

|

14%

|

|||||

|

Consumer

|

282

|

25

|

64

|

41

|

412

|

6%

|

|||||

|

Total loans

|

$4,270

|

$1,131

|

$898

|

$694

|

$6,993

|

100%

|

|||||

|

Percent of total

|

61%

|

16%

|

13%

|

10%

|

100%

|

||||||

|

|

|

|

|

|

|||||||

|

CLASSIFIED LOANS AT MARCH 31, 2011

|

|||||||||||

|

Percent

|

|||||||||||

|

of loan

|

|||||||||||

|

Alabama/

|

category

|

||||||||||

|

(dollars in millions)

|

Louisiana

|

Texas

|

Florida

|

Mississippi

|

Total

|

total

|

|||||

|

Commercial & industrial

|

$ 108

|

$ 64

|

$ 8

|

$ 35

|

$ 215

|

8%

|

|||||

|

Owner-occupied real estate

|

63

|

25

|

28

|

29

|

145

|

14%

|

|||||

|

Total commercial & industrial

|

171

|

89

|

36

|

64

|

360

|

10%

|

|||||

|

Construction, land & land development

|

47

|

144

|

56

|

31

|

278

|

32%

|

|||||

|

Other commercial real estate

|

38

|

28

|

40

|

29

|

135

|

13%

|

|||||

|

Total commercial real estate

|

85

|

172

|

96

|

60

|

413

|

22%

|

|||||

|

Residential mortgage

|

43

|

13

|

27

|

13

|

96

|

10%

|

|||||

|

Consumer

|

2

|

1

|

5

|

1

|

9

|

2%

|

|||||

|

Total loans

|

$ 301

|

$275

|

$164

|

$138

|

$ 878

|

13%

|

|||||

|

Percent of regional loan total

|

7%

|

24%

|

18%

|

20%

|

13%

|

||||||

1Q11 Supplemental Data

April 21, 2011

April 21, 2011

2

Commercial and Business Banking Focus

Note: Financial data as of March 31, 2011

Geographic Distribution

C&I

CRE

3

Nonperforming Loans Held For Sale

Note: Financial data as of March 31, 2011

|

($s in millions)

|

Louisiana

|

Texas

|

Florida

|

Alabama/

Mississippi |

Total

|

|

Commercial & industrial

|

$ 1

|

$ 1

|

$ 1

|

$ --

|

$ 3

|

|

Owner-occupied real estate

|

10

|

1

|

3

|

3

|

17

|

|

CRE: Construction, land, land

development |

7

|

3

|

7

|

6

|

23

|

|

CRE - Other

|

3

|

1

|

3

|

--

|

7

|

|

Residential Mortgage

|

2

|

--

|

4

|

1

|

7

|

|

Consumer

|

--

|

--

|

--

|

--

|

--

|

|

|

|

|

|

|

|

|

Total

|

$ 23

|

$ 6

|

$ 18

|

$ 10

|

$ 57

|

4

CRE: Construction, Land & Land Development Loans

Note: Financial data as of March 31, 2011

Excludes loans held for sale

*Includes agricultural land.

|

($s in millions)

|

Louisiana

|

Texas

|

Florida

|

Alabama/

Mississippi |

Total

|

|

Residential

construction |

$ 61

|

$ 47

|

$ 24

|

$ 11

|

$ 143

|

|

Land & Lots:

|

|

|

|

|

|

|

Residential

|

96

|

13

|

53

|

36

|

198

|

|

Commercial

|

82

|

87

|

35

|

40

|

244

|

|

Retail

|

15

|

86

|

2

|

4

|

107

|

|

Office Buildings

|

4

|

6

|

17

|

1

|

28

|

|

Hotel/motel

|

--

|

--

|

15

|

--

|

15

|

|

Multifamily

|

1

|

51

|

--

|

--

|

52

|

|

Industrial/

warehouse |

14

|

3

|

2

|

2

|

21

|

|

Other*

|

22

|

19

|

9

|

21

|

71

|

|

Total

|

$ 295

|

$ 312

|

$ 157

|

$ 115

|

$ 879

|

5

CRE: Other Commercial Real Estate Loans

Note: Financial data as of March 31, 2011

Excludes loans held for sale

|

($s in millions)

|

Louisiana

|

Texas

|

Florida

|

Alabama/

Mississippi |

Total

|

|

Retail

|

$ 199

|

$ 66

|

$ 62

|

$ 30

|

$ 357

|

|

Office Buildings

|

109

|

24

|

51

|

20

|

204

|

|

Hotel/motel

|

97

|

3

|

43

|

20

|

163

|

|

Multifamily

|

66

|

14

|

19

|

42

|

141

|

|

Industrial/

warehouse |

62

|

11

|

29

|

10

|

112

|

|

Other

|

19

|

2

|

15

|

4

|

40

|

|

Total

|

$ 552

|

$ 120

|

$ 219

|

$ 126

|

$ 1,017

|

C&I: Oil & Gas Portfolio

• Oil and gas

portfolio 9% of

total loans

portfolio 9% of

total loans

• Approximately

$50 million in

classified

$50 million in

classified

• Nonaccruals

total less than

$1 million

total less than

$1 million

|

Sector

|

$ Outstanding

|

% of

Total |

|

Exploration &

Production |

$217

|

34%

|

|

Drilling & pre-drilling

|

156

|

24%

|

|

Transportation

|

134

|

21%

|

|

Service & Supply

|

113

|

18%

|

|

Other

|

19

|

3%

|

|

Total

|

$639

|

100%

|

$s in millions

Note: Financial data as of March 31, 2011

6

7

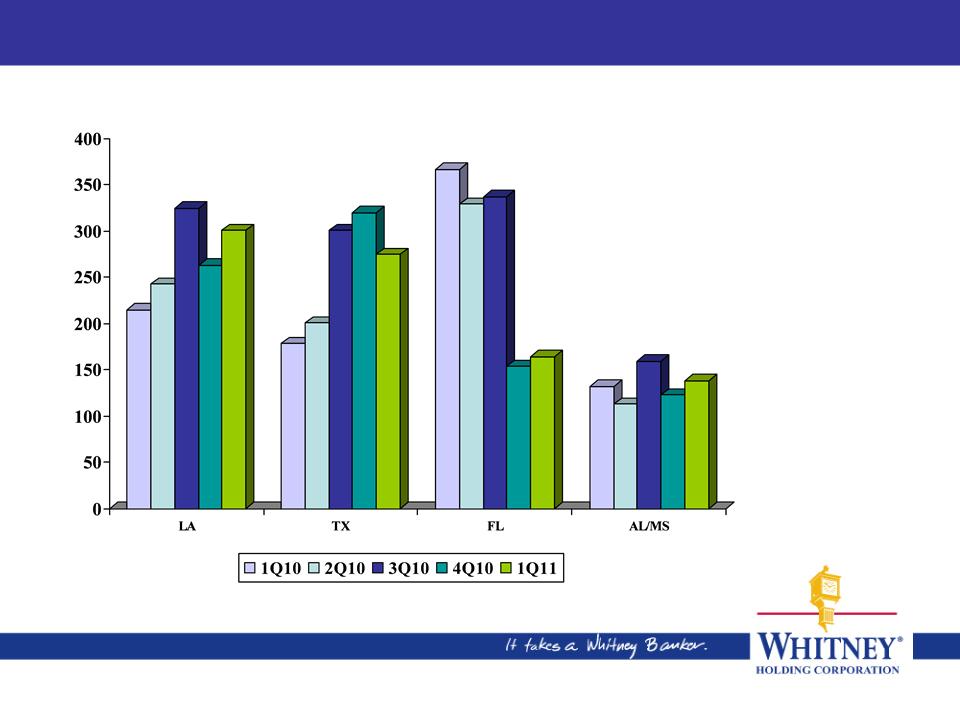

Classified Portfolio By Geography

Nonperforming loans are included in total classified portfolio

Excludes loans held for sale

Excludes loans held for sale

Note: Financial data as of March 31, 2011

8

Construction, Land & Land Development Classified Loans

|

($s in millions)

|

Louisiana

|

Texas

|

Florida

|

Alabama/

Mississippi |

Total

|

% of

Portfolio Total |

|

Residential

construction |

$ 4

|

$ 4

|

$ 5

|

$ 1

|

$ 14

|

10%

|

|

Land & Lots:

|

|

|

|

|

|

|

|

Residential

|

17

|

4

|

25

|

11

|

57

|

29%

|

|

Commercial

|

20

|

60

|

13

|

4

|

97

|

40%

|

|

Retail

|

--

|

39

|

--

|

--

|

39

|

36%

|

|

Office

Buildings |

--

|

--

|

12

|

--

|

12

|

43%

|

|

Multifamily

|

--

|

23

|

--

|

--

|

23

|

44%

|

|

Other*

|

6

|

14

|

1

|

15

|

36

|

51%

|

|

Total

|

$ 47

|

$ 144

|

$ 56

|

$ 31

|

$ 278

|

32%

|

Note: Financial data as of March 31, 2011

Excludes loans held for sale

*Includes agricultural land.

9

Other Commercial Real Estate Classified Loans

|

($s in millions)

|

Louisiana

|

Texas

|

Florida

|

Alabama/

Mississippi |

Total

|

% of

Portfolio Total |

|

Retail

|

$ 5

|

$ 18

|

$ 5

|

$ 7

|

$ 35

|

10%

|

|

Office

Buildings |

11

|

7

|

11

|

1

|

30

|

15%

|

|

Hotel/motel

|

3

|

3

|

7

|

--

|

13

|

8%

|

|

Multifamily

|

11

|

--

|

3

|

20

|

34

|

24%

|

|

Industrial/

warehouse |

6

|

--

|

10

|

1

|

17

|

15%

|

|

Other

|

2

|

--

|

4

|

--

|

6

|

15%

|

|

Total

|

$ 38

|

$ 28

|

$ 40

|

$ 29

|

$ 135

|

13%

|

Note: Financial data as of March 31, 2011

Excludes loans held for sale

10

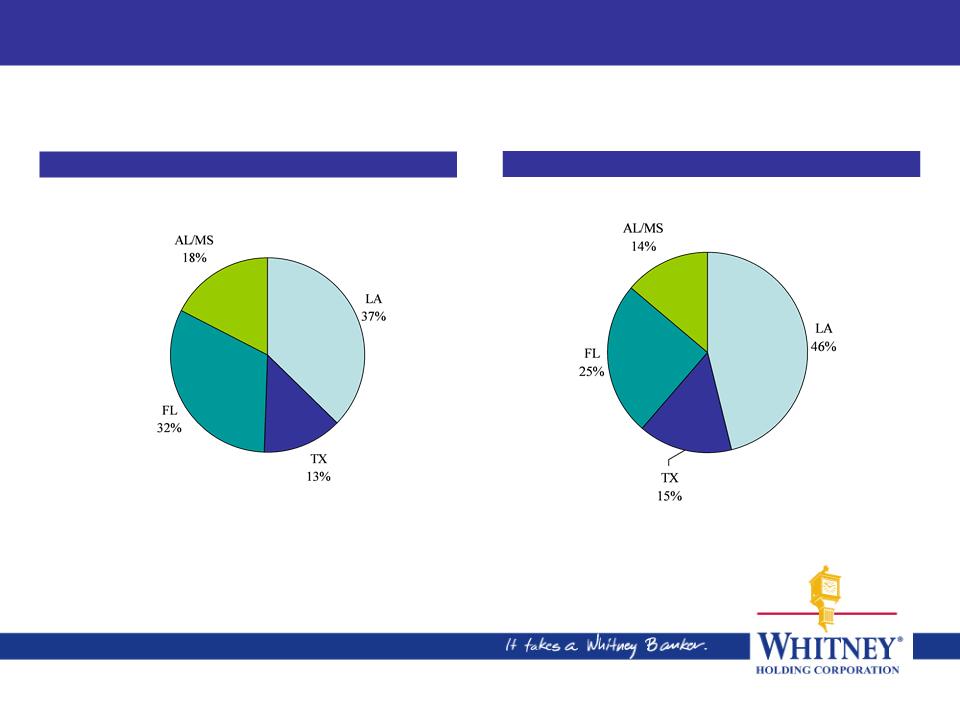

Geographic Distribution Of Allowance, Nonperforming Loans

Geographic distribution of allowance for loan losses

Geographic distribution of NPLs (held for investment)

Note: Financial data as of March 31, 2011

NPLs exclude nonaccrual loans held for sale and restructured loans accruing

11

Charge-Offs On Loans

Gross Charge-offs by

Geography: 1Q11

Geography: 1Q11

Note: Financial data as of March 31, 2011

1Q11 Supplemental Data

April 21, 2011

April 21, 2011