Attached files

The Hanover Insurance Group, Inc.

Chaucer: An Attractive

Opportunity to Advance Our Journey

April 20, 2011

To be used only in conjunction with the conference call to

be held at 9:00 a.m. ET on April 20, 2011

Not for release, publication or distribution, in whole or in part, directly or

indirectly, in, into or from any jurisdiction where to do so would

constitute a violation of the relevant laws or regulations of such jurisdiction.

Exhibit 99.2 |

Forward-Looking Statements; Non-GAAP

Financial Measures; and UK Responsibility Statement

2

Forward-Looking Statements/Non-Solicitation: This presentation (including

the conference call which this presentation accompanies) relates to a proposed acquisition of

Chaucer Holdings PLC (“Chaucer”) by The Hanover Insurance Group, Inc.

(“The Hanover” or “the company”). The

proposed acquisition is subject to a number of conditions,

including

approval

by

resolution

passed

at

a

Court-convened

meeting

of

Chaucer

shareholders

by

a

majority

in

number

of

shareholders

representing

75%

in

value of shareholders present and voting either in person or by proxy at the

meeting. The proposed acquisition is also subject to receipt of certain anti-trust clearances and

certain regulatory approvals and requires the sanction of the High Court in

England. There can be no assurances that the proposed acquisition will be consummated or if it

is, that The Hanover will realize the potential benefits of such

acquisition.

The proposed acquisition is to be effected by 440 Tessera Limited

(“Tessera”), a wholly-owned subsidiary of The Hanover, in accordance with the UK Takeover Code and

the terms and conduct of the proposed acquisition will be subject to the

jurisdiction of the UK Takeover Panel. The proposed acquisition will be recommended to Chaucer

shareholders

by

the

Board

of

Directors

of

Chaucer,

although

such

recommendation

may

in

certain

circumstances

be

withdrawn.

This

presentation

is

not

intended

to

and

does not constitute, or form part of, the solicitation of votes or approvals in any

jurisdiction. This presentation summarizes certain information contained in the formal

announcement relating to the proposed acquisition, and is qualified in its entirety

by that announcement. Certain statements in this presentation, including

responses to questions after our prepared remarks, constitute forward-looking statements for purposes of the safe harbor

provisions of the United States Private Securities Litigation Reform Act of

1995. These forward looking statements include statements about the likelihood of the

acquisition being consummated, the expected benefits of such acquisition and

comments regarding prior guidance of 2011 full-year expectations. In particular, statements

about the future economic performance, finances, earnings, profitability, premium

growth, strategic plans and prospects of The Hanover and Chaucer, both individually and

on a consolidated basis, future expected accretion to earnings or to return on

equity, consolidated premiums, the availability of products to The Hanover distribution

channel, product-

geographic-

and account-

based mix changes, estimates of first quarter catastrophe losses and segment

income after tax per share, future financial strength and credit ratings

(including anticipated actions of rating agencies in response to the proposed transaction), projections of combined ratios, loss ratios and

expense ratios, the ability to raise future capital or debt to fund the proposed

acquisition and the terms thereof, sufficiency and availability of capital and liquidity, future

management and the ability to retain personnel at The Hanover and at Chaucer,

reserve adequacy, the ability to increase the investment yield on the Chaucer investment

portfolio, financial leverage ratios and the ability to decrease

such leverage as a result of adding future earnings to our capital base, the

expectation of less volatile underwriting results in a combined entity, the

flexibility to more efficiently manage capital and the anticipation of ongoing regulatory approvals and licenses to conduct

business, are all forward-looking statements. In addition, use of the

words “would”, “believes,”

“anticipates,”

“expects,”

“projections,”

“outlook,”

“should,”

“could,”

“hope”,

“plan,”

“confident,”

“guidance,”

“on track to,”

“promise,”

“line of sight”

and similar expressions is intended to identify forward-looking

statements. Forward-looking statements are subject to certain risks and

uncertainties that could cause actual results to differ materially from those expressed in or suggested by such

statements. Any forward-looking statements are based on The Hanover’s and

Chaucer’s current plans, estimates, forecasts, projections and expectations. The company

cautions

investors

that

forward-looking

statements

are

not

guarantees

of

future

performance,

and

actual

results

could

differ

materially.

Investors

are

directed

to

consider

the risks and uncertainties in our business and in Chaucer’s business that may

affect future performance and that are discussed in readily available documents, including,

with respect to The Hanover, the company’s Annual Report to Shareholders on

Form 10-K and other documents filed by The Hanover with the Securities and Exchange

Commission(“SEC”), which are available at

www.hanover.com under “Investors”,

and with respect to Chaucer, the documents available at www.chaucerplc.com

under

“Investors”

and the documents regarding Chaucer which are available for public inspection via

the UK National Storage Mechanism. Except where it is required by law, we

undertake no obligation to update publicly or revise any forward-looking

statement, whether as a result of new information, future developments or otherwise.

Risks and uncertainties relating to the proposed acquisition include risks that the

parties will not obtain the requisite shareholder, court, regulatory and other approvals for

the transaction or that other conditions to which the transaction is subject may

not be satisfied, or that the parties will otherwise fail to consummate the transaction; The

Hanover is unable to obtain financing for the transaction or on the terms expected;

the anticipated benefits of the transaction will not be realized; financial strength or debt

credit rating services will reduce their outlooks or ratings for

The Hanover or Chaucer; The Hanover will not be able to retain key personnel from

Chaucer; the possibility of adverse catastrophe experience (including

terrorism) and severe weather; the uncertainties in estimating man-made and natural catastrophe losses (including with respect

to recent catastrophe losses in Australia, Chile, New Zealand and Japan which have

affected Chaucer, and winter storm-related losses which have affected The Hanover);

(cont’d on next slide)

2 |

3

risks relating to the application and interpretation of insurance and reinsurance

contracts, particularly with respect to a complex international event such as the unfolding

problems at the Fukushima Dai-ichi nuclear power complex in Japan and the

impact on Lloyd’s Syndicate 1176; risks relating to the collectability of reinsurance; risks of

operating internationally; unknown liabilities at the company or Chaucer;

significant transaction costs; the uncertainties in estimating property and casualty losses and

therefore the difficulty of ensuring adequacy of reserves for past periods,

particularly with respect to longer-tail products, which are written by both The Hanover and

Chaucer, and with respect to assumed reinsurance liabilities, such as are

written by Chaucer; the ability to increase or maintain certain property and casualty insurance

rates (including with respect to UK motor business); the impact of new product

introductions; adverse loss development; changes in frequency and loss trends; the ability to

improve renewal rates and increase new property and casualty policy counts;

underwriting capacity; adverse selection in underwriting activities; investment impairments;

heightened competition (including rate pressure); adverse and evolving state,

federal and, with respect to Chaucer or the proposed combined companies, foreign, legislation

or regulation; adverse regulatory or litigation actions; exchange rate fluctuations

which could affect the cost of the proposed purchase to The Hanover or the reported results

of the proposed combined company, as measured in United States dollars; interest

rate, credit market and other investment-related fluctuations; the impact on Chaucer of

capital requirements under European Union Solvency II regulations; and general

macro risks of the uncertain economic environment and various other

factors. Readers are cautioned not to place undue reliance on

forward-looking statements, which speak only as of the date on which they are made.

As a specialist Lloyd’s insurance group, Chaucer is subject to a number of

specific risk factors and uncertainties, including without limitation: its reliance on insurance and

reinsurance brokers and distribution channels to distribute and market its

products; its exposure to currency risks and fluctuations as a significant proportion of Chaucer’s

business is conducted in various currencies; its obligations to maintain funds at

Lloyd’s to support its underwriting activities; its risk-based capital requirement being assessed

periodically by Lloyd’s and being subject to variation; its reliance on

ongoing approvals from Lloyd’s, the Financial Services Authority and other regulators to conduct its

business; its obligations to contribute to the Lloyd’s New Central Fund and

pay levies to Lloyd’s; its ongoing ability to benefit from the overall Lloyd’s credit rating; its ongoing

ability to utilize Lloyd’s trading licenses in order to underwrite business

outside the United Kingdom; its ongoing exposure to levies and charges in order to underwrite at

Lloyd’s;

and

the

requirement

for

it

to

maintain

deposits

in

the

United

States

for

US

site

risks

it

underwrites.

This presentation is provided for informational purposes only. It does not

constitute a solicitation or an offer to sell any debt or other securities of The Hanover or of Chaucer.

Non-GAAP Financial Measures: The discussion in this presentation regarding the

proposed acquisition of Chaucer and of The Hanover’s financial performance or estimates

include references to certain financial measures that are derived from generally

accepted accounting principles, or GAAP, such as segment income after tax per share.

Segment income after tax per share is defined as income from continuing operations,

excluding the after-tax impact of net realized investment gains (losses) and

gains(losses) on the retirement of debt for a period divided by the average number

of shares outstanding for that period. The definition of other financial measures and terms

can be found in the Annual Report in Form 10-K on pages 77-79.

The Hanover believes that measures of segment income after tax per share and other

metrics provide investors with valuable measures of the performance of the company’s

ongoing business because they highlight income from continuing operations

attributable to the core operations of the business. Income from continuing

operations (per share) is the most directly comparable GAAP measure for segment income after tax per share. Non-GAAP measures should not be

construed as substitutes for income from continuing operations per share, net

income or other GAAP measures. See company’s Form 8-K filed with the SEC on April 20,

2011 for a reconciliation of estimated segment income after tax per share to

estimated income from continuing operations per share. Information relating

to Chaucer is derived from its publicly available information. Unless otherwise indicated, financial information regarding Chaucer is prepared in

accordance with International Financial Reporting Standards (IFRS) as adopted by

the European Union (EU). IFRS comprises standards issued by the International

Accounting Standards Board (IASB) and interpretations issued by International

Financial Reporting Interpretations Committee (IFRIC). Responsibility

Statement Under United Kingdom Rules of the Takeover Panel: The Hanover Directors and the Tessera Directors (all of whose names will be set out in the

Scheme Circular filed under rules of the UK Takeover Panel) accept responsibility

for the information contained in this announcement relating to Hanover, The Hanover

Group and themselves and their immediate families, related trusts and connected

persons. To the best of the knowledge and belief of The Hanover Directors

and the Tessera Directors (who have taken all reasonable care to ensure that

such is the case), such information for which they are responsible is in accordance with the facts and

does not omit anything likely to affect the import of such information.

Forward-Looking Statements; Non-GAAP

Financial Measures and UK Responsibility Statement

|

4

Chaucer: An Attractive Opportunity to

Advance Our Journey

•

Acquisition of Chaucer is an important step forward in our journey to build a

world-class property and casualty company

•

Chaucer

is

an

attractive

acquisition

opportunity

which

we

regard

as

one

of

the

best-run

franchises

at Lloyd’s:

–

Strong, consistent track record of underwriting profitability

–

Balanced business mix

–

Significant market opportunities

–

Highly-experienced management and underwriting team

•

Strategic benefits of the Chaucer acquisition:

–

Scale, geographic and earnings diversification; a broadened market position

–

Enhanced product and underwriting capabilities which will further our stated

specialty strategy –

Chaucer’s product suite will advance our partner agent strategy by

strengthening our position with sophisticated retail distributors

•

The Lloyd’s platform further supports our strategic objectives by providing

international licenses, sophisticated non-admitted business and the

ability to syndicate risk •

Attractive financial benefits:

•

Expected to be accretive to earnings and ROE

•

Diversification

•

Strong balance sheet

4 |

Deep

Partnerships

with

Winning

Agents

World Class

Product and

Underwriting

Capability

Responsive

Service Delivery

via Cost –

Effective

Operating

Model

World Class

World Class

Property and Casualty

Property and Casualty

Company

Company

World Class People

Strong Culture of Execution

Strong Financial Position

Our Goal Remains The Same –

Creating

A World Class Property and Casualty Company

•

More balanced product and geographic mix

–

Targeting one-third Personal Lines, one-third

core Commercial Lines and one-third Specialty

business

•

Profitable growth through property and

casualty pricing cycle

(target 11-13% enterprise ROE through cycle)

•

Distinctive product mix delivered to winning

agents and brokers:

–

Much more “specialty-oriented”

product mix

–

Focus on product innovation to give agents and

brokers direct access to most sophisticated

insurance offerings

–

Preferred shelf space with winning agents and

brokers; those who are consolidating markets

Strategic and Financial Priorities:

5

5 |

Personal

Lines

66%

Specialty

3%

Commercial

Lines

31%

2010

Highest-ever book value per share (at December 31, 2010)

Industry-leading growth; ex-cat reported accident year loss ratios best in

four years Strong balance sheet

Significantly improved cost of capital

Dramatically improved product portfolio

More distinctive and diversified product offering

Significant specialty capabilities

Position with winning agents and brokers strong and growing significantly

Responsiveness and expertise aligned to improve agency economics

National footprint established

We Made Important Progress

on All Critical Strategic Levers

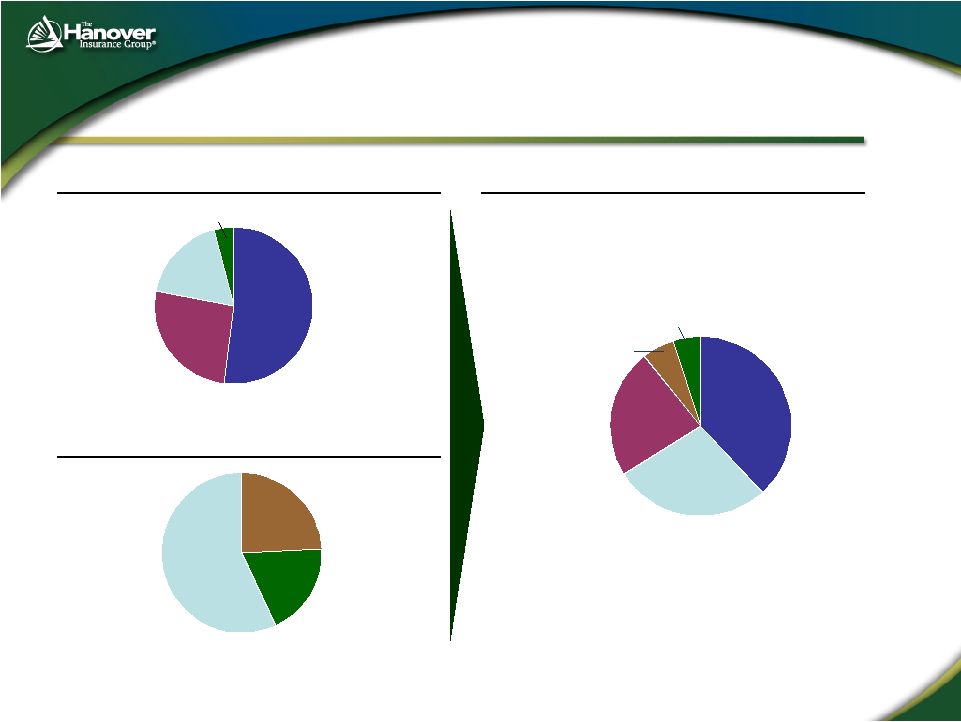

Hanover Business Mix Evolution 2010

6

2004

NWP: $3,048

NWP: $2,236

($NWP in millions)

Personal

Lines

48%

Specialty

19%

Niches

5%

Commercial

Lines

28%

Improved financial

strength

Enhanced Product Mix

And Distinctiveness

Built Strong

Position With Partners

6

Note:

For

information

on

sources

of

all

information

on

this

page

and

in

the

remainder

of

this

presentation,

please

refer

to

Appendix. |

•

Specialist Lloyd’s based insurance company founded in 1922 and top ten

managing agent at Lloyd’s •

Core strategy is founded upon:

–

Underwriting excellence

–

International growth through access to local markets

–

Maintenance of capital strength

•

Over $900 million in net premiums earned in 2010

•

Writes business in all major insurance and reinsurance classes

•

Leading provider of Lloyd’s “turn-key”

solutions for new syndicate start-ups

•

Headquartered in London, with operations in Whitstable (England), Copenhagen,

Houston, Buenos Aires and Singapore Note: Chaucer data here and further in the

presentation is converted from GBP to USD at year end 2010 exchange rate of 1.57 unless noted otherwise.

1

Refers

to

2011

year

of

account

Lloyd’s

stamp

capacity.

Equals

gross

premiums

written

less

acquisition

costs.

2

Liability includes all the specialist lines at Chaucer including E&O / Direct

Casualty, A&H, Medical, Financial Institutions and International Treaty.

7

Chaucer: a Leading Specialist Lloyd’s

Insurance Group

Syndicate Structure

Business Overview

Business Mix

7 |

8

Dynamic Business

with Proven Underwriting Record

Established Operating Performance

Combined Ratio¹

•

5-year average combined ratio of 90.6%

•

Solid underwriting results despite elevated

catastrophe activity in recent years

•

5-year average ROE of 15.8%

•

Consistent track record of positive

reserve development

•

Conservative investment portfolio

•

Conservative financial leverage

Solid Balance Sheet

8

29.6 %

29.8 %

24.2 %

32.7 %

29.4 %

55.4 %

52.3 %

66.6 %

64.3 %

68.2 %

0.0 %

20.0 %

40.0 %

60.0 %

80.0 %

100.0 %

120.0 %

2006

2007

2008

2009

2010

Loss Ratio

Expense Ratio

85.0%

82.1%

90.8%

97.0%

97.6% |

Chaucer’s Management Has Extensive

Underwriting Expertise

9

•

Chaucer has a strong underwriting culture:

–

Track

record

of

strong

underwriting

results

–

5-year

average

loss

ratio

of

61.3%

–

Conservative approach to risk retention and limits

–

Lead underwriter in attractive industry classes

–

Turn-key solutions provider

•

Senior underwriting team brings an average of 32 years industry experience and

15 years at Chaucer with recognized expertise in numerous business

classes •

Robust risk management culture

•

The Hanover intends to support and develop Chaucer’s longstanding leadership

and proven underwriting team

9 |

10

Pro Forma

Chaucer²

1

Hanover

specialty

includes

other

commercial,

including

coverages

such

as

program

business,

inland

marine,

bonds

and

professional

liability .

2

Chaucer reinsurance includes property, marine and liability treaty. Specialty

includes property, liability, aviation, marine, energy and nuclear.

Chaucer Further Diversifies

Our Business Mix and…

($ in millions)

Hanover¹

Specialty

57%

UK

Motor

24%

Reinsurance

19%

US

Personal

Lines

52%

US

Commercial

26%

Specialty

18%

US

Personal

Lines

38%

US

Commercial

23%

Specialty

28%

UK Motor

6%

Reinsurance

5%

Niches 4%

2010 NEP: $2,841

2010 NEP: $925

2010 NEP: $3,766

10 |

11

2010 NPE

Geographic Mix²

2010 Total Assets¹

Hanover

Chaucer³

Pro Forma

1

Excludes purchase accounting adjustments.

2

Based on 2010 Net Earned Premium.

($ in millions)

…Provides Greater Geographic

Reach and Scale

US

100%

11

$2,841

$2,841

$925

Standalone

Pro Forma

Hanover

Chaucer

$3,766

$8,570

$8,570

$0

$3,674

Standalone

Pro Forma

Hanover

Chaucer

$12,244

Worldwide

38%

Europe

28%

Middle East, Africa

& Asia Pacific

11%

US

81%

Worldwide

9%

Europe

7%

Middle East,

Africa &

Asia Pacific

3%

US

23% |

12

Additive Product and Underwriting

Capabilities for Our Agents and Brokers

Business Class

Examples

Energy

Full spectrum of smaller energy exposures covering upstream,

midstream, downstream, services and renewables

Aviation

Property

&

liability

in

smaller

private

aviation

/

fleets

and

in

aviation

services

Ocean Marine

Hull and marine liability coverage for specialist craft with some

potential in cargo

Other Marine

Protection against trade credit losses and political violence

Specie

Fine art, excess armored car, precious metal and vault risk

12 |

Reinsurance

37%

Property

22%

Casualty

20%

Marine

7%

Energy

6%

Motor

5%

Aviation

3%

2010 Lloyd’s Geography Mix

2010 Lloyd’s Business Mix

13

Strategic Benefits of Lloyd’s

•

Lloyd’s is a large, highly-diversified and well-regarded

insurance marketplace

–

Leading specialist insurance market: 52 managing agents, 85

syndicates and ~£23 billion of premium in 2010

–

Strong presence to generate direct and syndicated business

across a broadly diversified mix of global risks

•

Attractive ratings from key agencies: A, A+ and A+ by

A.M. Best, S&P and Fitch, respectively

–

Lloyd’s capital strength is broadly recognized by all buyers of

insurance

•

Syndication of risk throughout Lloyd’s market enables

capital efficient operating platform

–

Lloyd’s “chain of security”

–

provides three layers of capital

backing claims

–

Lloyd’s governing bodies assess risks and capital of the overall

market; large risks are commonly shared

–

Exposure of any single Lloyd’s participant is expressly limited

to assessed capital held within Lloyd’s

–

Highly efficient capital model -

individual syndicates may

require less capital than standalone insurers due to the

mutuality of the Lloyd’s capital structure

US &

Canada

43%

Other Americas

7%

UK

20%

Europe

16%

Central & Asia

Pacific

10%

Others

4%

13 |

Attractive Financial Profile

•

100% cash consideration

•

56p per share, including the 2.7p per share dividend announced by Chaucer on March

7, 2011 •

Total

cash

consideration

of

£313

million

($510

million)

1

Price and

Consideration

Key Multiples

Financing

(Combination

of Cash and

Debt)

Pro Forma

Impact

Anticipated

Steps / Timing

to Close

•

Cash

of

$235

million,

including

$99

million

of

ordinary

dividend

from

The

Hanover

Insurance

Company

•

Anticipated new senior unsecured debt of $250 million

•

Transaction

is

expected

to

be

approximately

10%

accretive

to

The

Hanover’s

2012

EPS

and

ROE

•

Transaction expected to be consummated via a UK approved “Scheme of

Arrangement” •

Transaction

closing

anticipated

in

the

earlier

part

of

the

third

quarter

•

Transaction subject to regulatory and court approvals

•

Transaction requires approval at a Chaucer shareholder meeting from a majority in

number of shareholders who represent 75% of the Chaucer shares voted at the

meeting, in person or by proxy 1

Assumes USD /GBP exchange rate of 1.63 on April 19, 2011.

2

Adjusted for Chaucer’s recently announced estimated catastrophe activity in

press releases dated March 14, March 18, and April 18, 2011. 14

As of Year-End 2010

As Reported

Adjusted

for

Catastrophes

Price to Tangible Book

Value Per Share (Net

Tangible Assets)

1.09x

1.26x

14

2 |

Conservative and Liquid

Investment Portfolio

15

Hanover

Pro Forma

Chaucer

($ in millions, as of December 31, 2010)

$5,376

$2,284

$7,660

Pro Forma Year-end 2010:

•

Cash and equivalents provides significant liquidity cushion

•

Fixed income portfolio represents 80% of total investments

–

94% investment grade

–

Average rating of AA-

–

Weighted average duration of ~3.6 years

Corporate

43%

MBS /

CMBS

17%

Municipals

13%

Govt.

/

Agency

7%

Equity and

Other

2%

Cash

&

Equivalents

18%

Corporate

36%

MBS / CMBS

5%

Govt. / Agency 9%

Cash

&

Equivalents

49%

Equity and Other 1%

Corporate

47%

MBS /

CMBS/

ABS

22%

Municipals

18%

Govt./

Agency

5%

Equity and Other

3%

Cash

& Equivalents

5%

15 |

16

Robust Pro Forma Capitalization

•

The consideration will be a mix of existing cash and new senior debt expected to

be issued prior to closing

•

We have obtained a financing commitment in the form of a bridge loan, which

together with escrowed

assets,

meet

UK

Takeover

Code

requirements

of

“Funds

Certain”

at

announcement

1

Pro

forma

for

subordinated

debt

repurchase

in

February

(see

“Recent

Developments”

in

2010

Annual

Report)

and

an

additional

committed

drawdown

of

$37

million

from

the

FHLB by January 2012.

$ in millions

16

Hanover

Chaucer

Acquisition of Chaucer

Hanover Pro Forma

Debt at Dec. 31, 2010

$594

$64

$658

New Senior Debt

$250

$250

Total Debt

$594

$64

$250

$908

Equity at Dec. 31, 2010

$2,458

$499

$(499)

$2,458

Total Capitalization

$3,052

$563

$(249)

$3,366

Debt/Total Capital

19.5%

11.5%

NM

27.0%

1

1 |

17

Strategically and Financially Attractive

Chaucer is an attractive acquisition opportunity, which we regard as one of the

best-run franchises at Lloyd’s. It is expected to provide us with

earnings diversification and give access to additional product

capabilities Acquisition of Chaucer is an important step forward in our

journey to build a world-class property and casualty company, enhancing

our product mix, advancing our specialty strategy and strengthening our

position with our distinctive partner agents The Lloyd’s platform is

an ideal vehicle to achieve our strategic objectives through access to

international licenses, sophisticated non-admitted business and a capital

efficient operating model

The

transaction

is

attractive

financially

given

earnings

and

ROE

accretion,

diversification

and

the strengths of the combined balance sheet

17 |

18

APPENDIX |

19

Data Sources

Slide #

Graph title

Source

6

Hanover Business Mix Evolution 2010

Hanover 2010 Annual Report, p. 6 and internal systems reporting

7

Syndicate Structure

Chaucer 2010 Annual Report pgs. 23 and 118

Syndicate 1301 web site:

http://www.broadgateinsurance.co.uk/about.htm

Syndicate 4242 web site:

http://www.lloyds.com/Lloyds/Investor-Relations/Financial-performance/Syndicate-reports-and-accounts/2008/06/4242

7

Business Mix

Chaucer 2010 Annual Report p. 11

8

Chaucer Combined Ratio

Chaucer Annual Report 2010 p. 93-94; 2008 p. 101; 2006 p. 92

8

Chaucer ROE

Chaucer 2010 Annual Report pgs 67, 70 and 96; 2008 pgs. 78, 80 and 104; 2006 pgs.

74, 76 and 99 8

Chaucer Reserve Release Development

Chaucer 2010 Annual Report p. 26, 108, 2008 Annual Report p. 117, 2006 Annual

Report p. 113 10

Hanover Business Mix

Chaucer Business Mix

Hanover 2010 Annual Report, p. 6

Chaucer 2010 Annual Report, pgs. 11 and 27

11

Hanover NPE

Chaucer NPE

Hanover 2010 Annual Report, p. 6

Chaucer 2010 Annual Report, p. 93

11

Hanover Total Assets

Chaucer Total Assets

Hanover 2010 Annual Report, p. 81

Chaucer 2010 Annual Report, p. 95

11

Chaucer Geographic Mix

Chaucer 2010 Annual Report, p. 95

13

Lloyd’s Managing Agents and Syndicates

Lloyd’s 2010 Premium

Lloyd’s 2010 Annual Report , “Lloyd’s Vision”

p. 7

Lloyd’s 2010 Annual Report “Lloyd’s Vision”

p. 3

13

Lloyd’s Business Mix

Lloyd’s 2010 Annual Report, p. 3

13

Lloyd’s Geographic Mix

Lloyd’s 2010 Annual Report, p. 2

15

Hanover Investment Portfolio

Hanover 2010 Annual Report, p. 55

15

Chaucer Investment Portfolio

Chaucer 2010 Annual Report, p. 31

16

Hanover Debt

Hanover Equity

Hanover Total Capitalization

Hanover Debt/Total Capital

Hanover 2010 Annual Report, p. 81

16

Chaucer Debt

Chaucer Equity

Chaucer Total Capitalization

Chaucer Debt/Total Capital

Chaucer 2010 Annual Report, p. 70

Chaucer 2010 Annual Report, p. 69

Chaucer 2010 Annual Report, p. 70 |