Attached files

Exhibit 99.1

Citizens South Banking Corporation

FDIC-Assisted Acquisition of New Horizons Bank

NASDAQ / CSBC

April 2011

1

| ||

|

Forward Looking Statements

| ||

Statements contained in this presentation, which are not historical facts, are forward looking statements. The Company’s senior management or directors may from time to time make public forward looking statements concerning matters herein. Such forward looking statements are estimates reflecting best judgment of senior management or the directors based on current information. A number of factors that could affect the accuracy of such forward looking statements are identified in the public filings made by the Company with the Securities and Exchange Commission on Forms 10-Q and 10-K. There can be no assurance the such factors will not affect the accuracy of such forward looking statements. Additionally, there can be no assurance that the Company will realize the anticipated benefits related to New Horizons Bank acquisition. The Company undertakes no obligation to publicly revise any forward looking statements to reflect events and circumstances that may arise after the date hereof.

2

| ||

|

Transaction Summary

| ||

| • | Acquired $107.6 million in assets and assumed $106.0 million in liabilities of East Ellijay, Georgia-based New Horizons Bank |

| • | Loss sharing agreement covers substantially all acquired loans, reimburses 80% of all losses |

| • | Citizens South increases total assets to over $1.1 billion and expands footprint to 22 branches across three states |

3

| ||

|

Deposit Market Share

| ||

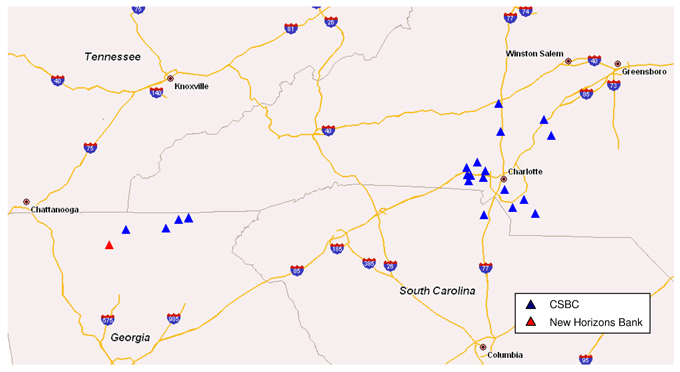

Tennessee Knoxville Chattanooga Georgia South Carolina Winston Salem Greensboro Charlotte CSBC New Horizons Bank Columbia

Gilmer County, GA

| Rank |

Intsitution |

Total Deposits ($mm) |

Market Share (%) |

Branches | ||||||||

| 1 | Community & Southern Hldgs Inc (GA) | $ | 465.7 | 59.15 | 4 | |||||||

| 2 | United Community Banks Inc. (GA) | 117.4 | 14.91 | 1 | ||||||||

| 3 | CSBC Pro Forma | 111.8 | 14.2 | 1 | ||||||||

| 4 | BB&T Corp. (NC) | 68.3 | 8.67 | 1 | ||||||||

| 5 | Regions Financial Corp. (AL) | 24.2 | 3.07 | 1 | ||||||||

| Market Total | $ | 787.3 | 8 | |||||||||

Source: SNL Financial

Includes deposit market share data for New Horizons Banks county of operation

Date as of 6/30/2010

4

| ||

|

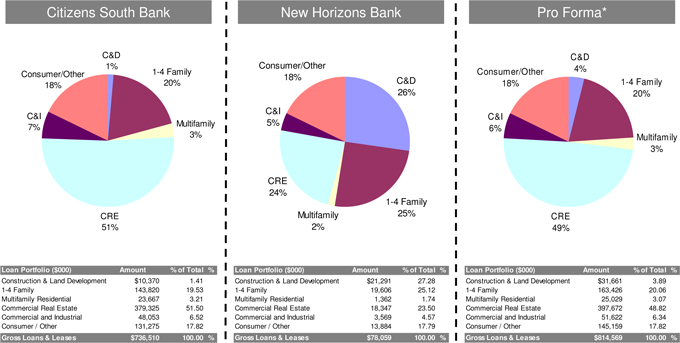

Loan Portfolio – 12/31/2010

| ||

Citizens South Bank C&D 1% Consumer/Other 1-4 Family 18% 20% C&I Multifamily 7% 3% CRE 51% Loan Portfolio ($000) Amount % of Total % Construction & Land Development $10,370 1.41 1-4 Family 143,820 19.53 Multifamily Residential 23,667 3.21 Commercial Real Estate 379,325 51.50 Commercial and Industrial 48,053 6.52 Consumer / Other 131,275 17.82 Gross Loans & Leases $736,510 100.00 % New Horizons Bank Consumer/Other 18% C&D 26% C&I 5% CRE 24% 1-4 Family Multifamily 25% 2% Loan Portfolio ($000) Amount % of Total % Construction & Land Development $21,291 27.28 1-4 Family 19,606 25.12 Multifamily Residential 1,362 1.74 Commercial Real Estate 18,347 23.50 Commercial and Industrial 3,569 4.57 Consumer / Other 13,884 17.79 Gross Loans & Leases $78,059 100.00 % Pro Forma* C&D Consumer/Other 4% 18% 1-4 Family 20% C&I 6% Multifamily 3% CRE 49% Loan Portfolio ($000) Amount % of Total % Construction & Land Development $31,661 3.89 1-4 Family 163,426 20.06 Multifamily Residential 25,029 3.07 Commercial Real Estate 397,672 48.82 Commercial and Industrial 51,622 6.34 Consumer / Other 145,159 17.82 Gross Loans & Leases $814,569 100.00 %

Source: SNL Financial

Data holding company level as of 12/31/2010

| * | Estimated pro forma does not include purchase accounting marks of possible exclusion of select loans |

5

| ||

|

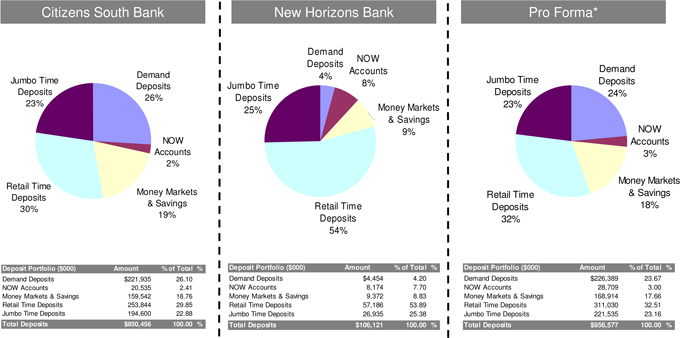

Deposit Composition – 12/31/2010

| ||

Citizens South Bank Demand Jumbo Time Deposits Deposits 26% 23% NOW Accounts 2% Retail Time Money Markets Deposits & Savings 30% 19% Deposit Portfolio ($000) Amount % of Total % Demand Deposits $221,935 26.10 NOW Accounts 20,535 2.41 Money Markets & Savings 159,542 18.76 Retail Time Deposits 253,844 29.85 Jumbo Time Deposits 194,600 22.88 Total Deposits $850,456 100.00 % New Horizons Bank Demand NOW Deposits Accounts 4% 8% Jumbo Time Deposits 25% Money Markets & Savings 9% Retail Time Deposits 54% Deposit Portfolio ($000) Amount % of Total % Demand Deposits $4,454 4.20 NOW Accounts 8,174 7.70 Money Markets & Savings 9,372 8.83 Retail Time Deposits 57,186 53.89 Jumbo Time Deposits 26,935 25.38 Total Deposits $106,121 100.00 % Pro Forma* Demand Jumbo Time Deposits Deposits 24% 23% NOW Accounts 3% Money Markets Retail Time & Savings Deposits 18% 32% Deposit Portfolio ($000) Amount % of Total % Demand Deposits $226,389 23.67 NOW Accounts 28,709 3.00 Money Markets & Savings 168,914 17.66 Retail Time Deposits 311,030 32.51 Jumbo Time Deposits 221,535 23.16 Total Deposits $956,577 100.00 %

Source: SNL Financial

Data holding company level as of 12/31/2010

| * | Estimated pro forma does not include possible exclusion of select deposits |

6

| ||

|

Summary

| ||

| • | Estimated after-tax gain on bargain purchase option of approximately $2.9 million |

| • | Based on preliminary analysis and subject to significant modification, the Company currently estimates the transaction will contribute approximately $0.4 to $0.5 to earnings per share for each of the next few years |

| • | Slightly accretive to tangible book value ( “TBV”) per share at closing increasing TBV per share by 3.2% to $6.38 |

| • | Strong pro forma capital ratios; pro forma total equity and tangible equity ratios of 8.2% and 8.0% respectively |

| • | Loan loss protection on substantially all acquired loans |

7

Citizens South Banking Corporation

FDIC-Assisted Acquisition of New Horizons Bank

NASDAQ / CSBC

April 2011

8