U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

for the period ended December 31, 2010

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934 for the transition period from ___ to ____.

Commission file number: 333-163635

Wonder International Education & Investment Group Corporation

(Exact name of registrant as specified in its charter)

Arizona 26-2773442

(State of (I.R.S. Employer

Incorporation) I.D. Number)

8040 E. Morgan Trail, #18, Scottsdale, AZ 85258

(Address of principal executive offices) (Zip Code)

Issuer's telephone number: 480-966-2020

Securities registered under Section 12 (b) of the Act:

Title of each class Name of exchange on which

to be registered each class is to be registered

None None

Securities registered under Section 12(g) of the Act:

Common Stock

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[ ]Yes [X] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [ ] Yes [X] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) [ ] Yes [X] No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately as of June 30, 2010 cannot be calculated because there is no market for the issuer’s securities.

The number of shares issued and outstanding of issuer's common stock, $.001 par value, as of April 14, 2011 was 20,000,000.

DOCUMENTS INCORPORATED BY REFERENCE

None.

PART I.

Item 1. Description of Business.

As stated herein, unless otherwise specified, all monetary amounts are in U.S. dollars. All renminbi, or RMB, amounts have been translated into U.S. dollars at the December 31, 2010 noon buying rate in the City of New York for cable transfers of RMB as certified for customs purposes by the Federal Reserve Bank of New York, being US$1.00 = RMB6.5586.

Except where the context otherwise requires:

|

·

|

“We,” “us,” “our company,” “our,” and “Wonder” refer to the combined business of US Wonder and its consolidated subsidiaries and affiliates;

|

|

·

|

“US Wonder” refers to Wonder International Education & Investment Group Corporation, an Arizona corporation;

|

|

·

|

“China Wonder” refers to Anhui Wonder Education and Management Company, Ltd, a PRC company;

|

|

·

|

“China,” “Chinese” and “PRC,” refer to the People’s Republic of China;

|

|

·

|

“Renminbi” and “RMB” refer to the legal currency of China; and

|

|

·

|

“U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States.

|

Organizational History.

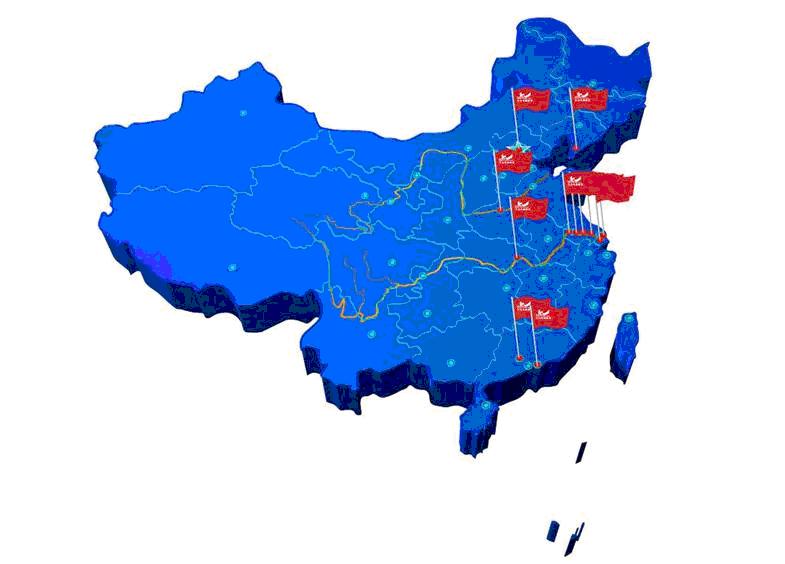

Wonder International Education & Investment Group Corporation (“US Wonder”) is a US holding company, incorporated in Arizona on April 21, 2008. On November 1, 2010, US Wonder acquired all of the outstanding capital stock of Anhui Lang Wen Tian Cheng Consulting & Management Co., Ltd., a PRC company (“WFOE”), pursuant to the terms of a share exchange agreement. As a result, WFOE became a wholly owned subsidiary of US Wonder. On November 3, 2010, WFOE entered into a series of agreements with Anhui Wonder Education and Management Company, Ltd, a PRC company (“China Wonder”), including a Voting Right Proxy Agreement, Option Agreement, Equity Pledge Agreement, Consulting Services Agreement and Operating Agreement. China Wonder owns and operates seven separate vocational training schools in seven provinces in China. These schools are now famous non-governmental vocational education institutions in China. Wonder’s core business is to provide IT education to students ranging in age from 18 to 30. China Wonder's seven vocational schools are in the following provinces of China: Anhui, Jiangsu, Zhejiang, Fujian, Henan, Hubei and Liaoning. Through our ownership of WFOE and the contractual arrangements between the WOFE and China Wonder, we control China Wonder and the schools and have the ability to control any income produced by China Wonder.

The Wholly-Foreign Owned Enterprise Law (1986), as amended, and The Wholly-Foreign Owned Enterprise Law Implementing Rules (1990), as amended and the Company Law of the PRC (2006), contain the principal regulations governing dividend distributions by wholly foreign owned enterprises. Under these regulations, wholly foreign owned enterprises may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. Additionally, such companies are required to set aside a certain amount of their accumulated profits each year, if any, to fund certain reserves. These reserves are not distributable as cash dividends except in the event of liquidation and cannot be used for working capital purposes. The PRC central government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. We may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from the Company’s profits. Furthermore, if our subsidiaries or affiliates in China incur debt on their own in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments. If we or our subsidiaries are unable to receive all of the revenues from our operations through these contractual or dividend arrangements, we may be unable to pay dividends on our Ordinary Shares.

Our United States offices are located at 8040 E. Morgan Trail, #18, Scottsdale, AZ 85258 and our phone number is 480-966-2020. Our PRC headquarters are located at 4-5/F, Xingke Building, 441 Huangshanlu, Hefei, Anhui, China and our phone number is 86-0551-3687892.

2

On January 6, 2001 our Form S-1 Registration Statement was declared effective by the Securities and Exchange Commission. The Registration Statement related to the distribution of 899,875 shares of our common stock held by one of our shareholders. This shareholder distributed, as a dividend, these registered shares to its own shareholders, however, the shares are restricted against resale for a period of one year.

Business Introduction.

China Wonder owns and operates seven separate vocational training schools located in seven provinces in China, namely Anhui, Jiangsu, Zhejiang, Fujian, Henan, Hubei and Liaoning. Its largest school is located in Anhui and consists of approximately 41,000 square meters. These schools are non-governmental vocational education institutions in China. Wonder’s core business is to provide IT education to students ranging in age from 18 to 30. It also provides job placement services to its students at no charge through its 12 employment centers located nationwide.

For fiscal year ended December 31, 2009, we had revenues of $11,261,812, gross profit of $6,336,576 and net income of $2,590,003. For fiscal year ended December 31, 2010, we had revenues of $12,714,429, gross profit of $8,308,782 and a net income of $3,286,872.

Organization Structure of Wonder:

Our organization is structured to abide by the laws of the PRC. Our corporate structure is depicted below:

Our Business.

|

o

|

China Wonder’s core business goal is to provide educated IT students to the business community of China. To meet this goal, Wonder has established an excellent vocational education system which includes two new education models, called the “1+3” educational and the “Double Certificate” models. Both education models have gained significant acceptance and reputation throughout China. The “1+3” educational model means through Wonder’s programs, “1” students obtain their IT diploma, and “3” they also obtain the skills to succeed, namely professionalism, industry skills, and foreign language. “Double Certificate” model means that students receive an industry recognized Wonder diploma, but also may receive, after additional testing, a more specific diploma which such as Microsoft MLC certification or Adobe’s graphics design certification, among others.

|

|

o

|

Our classes consist principally of IT subjects, including courses ranging from basic computer skills to higher level design courses. However, class durations can vary from a couple of weeks to two years. We have a substantially higher student population, approximately 40% in our short duration classes that range between two weeks to four weeks. The balance of our student population is comprised of classes ranging from three months to two years.

|

|

o

|

China Wonder’s market focus is in the vast rural areas of China and the students who are unable to pass the national high school exam or the entrance test for university acceptance. There are more than five million students each year that are candidates for China Wonder’s IT education. Wonder has established a strong marketing strategy to reach these students and to promote its IT education programs to its market. Wonder graduated 12,000 students in fiscal 2009 and 14,500 in fiscal 2010.

|

|

o

|

China Wonder has assembled a solid management team and a professional staff to execute their excellent business model and their plans to expand the business significantly. Wonder’s market strategies have been developed to take advantage of the large market potential in China.

|

3

AWARDS & QUALIFICATION

Wonder has achieved recognition for its IT education from various sources, including various ministries in the PRC. A list of these achievements is presented below:

|

|

●

|

|

Wonder was awarded the “Precursor of National Non-government Vocational Education institution” by the

|

|

|

ministry of labor of the People’s Republic of China.

|

|

|

●

|

|

Wonder was recognized as one of the “Top Ten IT Education Institutions” in China.

|

|

|

●

|

|

Wonder was assessed the “Excellent Training Center” by Macromedia in America.

|

|

|

●

|

|

Wonder was awarded the “Trustful Corporation”, “Reassurance Service Corporation”, “Full-satisfied

|

|

|

Corporation”, “Perfect Service Corporation”, “Zonta Club” by Consumer Association of Anhui Province.

|

|

|

●

|

|

Wonder was assessed the “Excellent Authorized Training Center” and “Excellent Regional Support Center for

|

|

|

ATC” by Microsoft.

|

|

|

●

|

|

Wonder was awarded the “Best Partner in Grand China” by Core in Canada.

|

|

|

●

|

|

Wonder was awarded the “Outstanding Achievement Award”, “Outstanding Corporation” and “Top Ten Corporation of Vocational Education Institution”

|

|

|

●

|

|

Wonder was assessed the “Top Ten Training Center” and “Best Partner in Five Years” by Adobe of America.

|

|

|

●

|

|

Wonder was awarded with “Outstanding Achievement Award” and as “Excellent Training Center in Grand China” by Autodesk of America

|

|

|

●

|

|

Wonder was awarded the “Excellent Training Center of NIT” by ministry of education of the People’s Republic of China.

|

4

EDUCATION MODEL AND CHARACTERISTICS

CURRICULUM SYSTEM

Wonder provides vocational training and employment service to its students. Wonder provides numerous IT classes in several different areas as noted below. Many of Wonder’s students come from rural areas of China. Therefore, Wonder provides a comprehensive employment orientation and helps its students to find employment after their IT program is complete. Wonder’s primary target market are students who have graduated from the high schools in China but are unable to advance to higher learning within the PRC school structure.

Classification of Curriculum System

Classification of Curriculum System of Wonder

|

Classification

|

Education Course

|

|

1. Basic

|

General Training of Computer Technology

|

|

2. Professional

|

Professional vocational education of computer application and design.

|

|

3. High-level

|

High-level training of Internet Technology, Cartoon and Games, Professional Programmer.

|

|

4. Expanded

|

IT education related vocational education such as Numerical Control Technology.

|

Training Curriculum Program

Training Curriculum Program

|

Department

|

Curriculum

|

Recruitment

|

|

IT-Application Department

|

Basics of Computer

|

Higher level than junior high school

|

|

Designer and Researcher

|

||

|

3-D advertisement Designer

|

||

|

Designer of Print Advertisement

|

||

|

Business Administration Assistant

|

||

|

Professional Secretary

|

||

|

E-Business & Marketing

|

||

|

Mechanics Department

|

Numerical Control Machine Tool

|

Students of high school or higher level than high school

|

|

Software Department

|

Professional programmer

|

|

|

Internet Department

|

Internet Engineer

|

|

|

Engineer of Information Security

|

||

|

Digital Art Department

|

E-Game Research Designer

|

|

|

Computer-art Designer

|

||

|

Environment-art Designer

|

||

|

Computer-based Costume Designer

|

||

|

Computer-based Movie & Cartoon Designer

|

5

Recruitment Target & Students Distribution

Students who are recruited with junior high school certificates and higher will be taught mainly basic knowledge of computer applications. Students with high school certificates and higher will learn about the professional use of a computer.

The percentage of students is shown by the type of IT program study in the above graph. Most students are in the Computer-based Art Design curriculum since this area has a large market demand and provides a significant employment opportunity for qualified students.

CHARACTERISTICS OF THE EDUCATION MODEL

1+3 Education Model

Wonder has created the “1+3” education model (“Training + Knowledge + Professionalism + Entrepreneurship”) which focuses its efforts on the students’ ability to put theory into practice and utilizing their entrepreneurship abilities, which are also taught by Wonder. By utilizing this very unique education model, Wonder has produced a significant number of talented students who are skilled in computer technology.

Market Oriented Course Program

Wonder also has focused its course development on what the market needs and what employers require. Wonder has established their course work to meet these needs in a timely and effective manner.

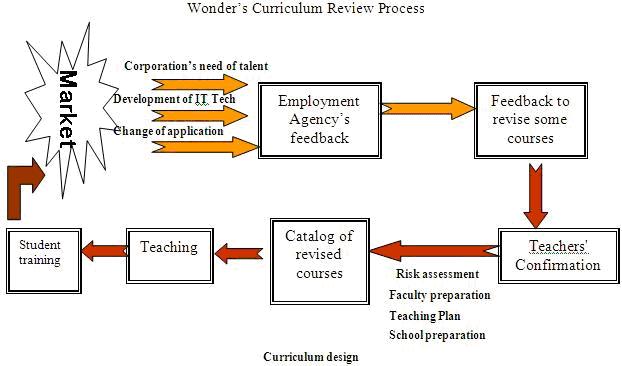

[Missing Graphic Reference]

Based on the needs of corporations and especially their need for talent and Wonder’s ability to look forward in IT technology, Wonder has created an excellent market oriented curriculum. Wonder revises its curriculum every six (6) months after receiving advice and feedback from employment agencies and their corporate partners. Wonder will revise the curriculum taking into account the feedback and also utilizing their 16 years of teaching experience, by applying key design factors, and considering the projected revenue and cost for the new curriculum. Wonder also will test the new curriculum by having its professors conduct the necessary tests with a view towards risk assessment. By utilizing this model, Wonder curriculum is the most up-to-date and market-driven system which management believes results in higher program and student success.

Education Support/Description of Property

Faculty

Currently, Wonder has approximately 103 full time and 73 part time teachers who are sufficient to educate 20,000 students each year. Wonder graduates between 12,000 to 14,500 students per year so they have enough teacher capacity to grow the business during the next one to two years.

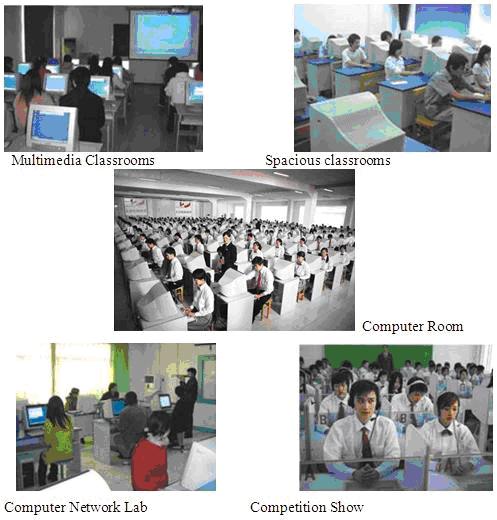

Hardware Facilities

There are over 8000 sets of computers in Wonder schools, and various types of laboratory classrooms are available, including: Auto-lectured labs, graphic design labs, in-house adorning and design labs, digital movie labs, television design labs, computer set-up and repair labs, internet labs, Cisco Network labs, program design labs and professional studios.

6

Excellent Education Certifications

As indicated below, the Company’s programs have been certified by industry leaders in the computer software and hardware industry and has been recommend by the PRC government.

|

Ø

|

Recommended institution by the PRC Ministries of Education, Labor, and Information.

|

|

Ø

|

Authorized training center for Microsoft, Adobe, Cisco, Autodesk, Discreet and Macromedia.

|

|

Ø

|

Authorized training center for Corel, Solid works, CIW, Sun, Linux in Canada.

|

|

Ø

|

The only authorized training institution, internet technology school, ATA software school in Anhui Province for Microsoft.

|

|

Ø

|

Authorized training institution for the Chinese Anti-Hacker & Computer Virus Research Center.

|

|

Ø

|

Authorized test center for Prometric, which is the largest computer test service corporation, providing over 60 famous IT tests worldwide.

|

PROPRIETARY BUSINESS MODELS

Double Certificates Education Model

China Wonder has launched the Double Certificates Education Model identified as “Ability + School Certificates”. This model provides assistance to students of China Wonder who are taking classes through the self-study program, the adult education program or through the off-campus program. China Wonder also will provide students, who pass the required tests, with certificates authorized by a foreign institution and the National Junior College Degree. This model has been recognized and accepted throughout China since it provides opportunities for many students who cannot take the traditional classes.

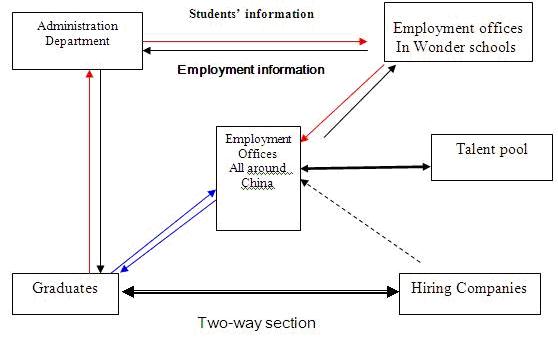

Employment Referral System

China Wonder’s Employment Referral System

With student employment as a key strategy, China Wonder has established employment centers through the PRC (see map below) which refer its student to prospective employers. After several years of development, China Wonder has established an excellent partnership with many corporations and is able to secure employment for almost all of its students. Of course, this is highly attractive to its students who are anxious to find employment.

China Wonder’s employment center distribution is depicted on the map below, with each red flag identifying the location of a China Wonder employment center.

7

MARKET ANALYSIS

CURRENT SITUATION OF FOREIGN VOCATIONAL EDUCATION

Current vocational education in several main developed countries

Vocational education plays an important role in many developed countries’ education system, providing significant contributions to promote economic development, solve the country’s employment problems and improve young people’s abilities throughout the country. In many countries, the vocational education is very popular, especially in Germany, the United States, and Australia. It is beginning to grow significantly in China as noted in the following paragraphs.

Forward-looking Review of vocational education in foreign countries

Vocational education tends to focus on the “fit” between the student’s talent and the corporate need. It also depends on predicting and forecasting corporate vocational needs.

Focusing on technology exploration,

Several countries and regions have already published documents or reports to promote technology ability development. According to several reports by the European Union, the number of people with lower level technology or no professional knowledge totals approximately 80 million and are in the 25 to 64 age group. The amount equals the population of the largest country in EU-Germany.

To have vocational training be more accurate, countries in the EU pay great attention to the predictability of technical abilities. For example, there are systems such as Great Britain’s Technology Database, the “Studying Monitor System” in Norway, Technology Ability Prediction Method in Finland, and the Technology Cooperation Program of the French.

People-Oriented Vocational Education

8

The People-Oriented Vocational Education focuses on people’s career development, the vocational education guide, and providing flexibility and openness in communication.

First, this system focuses on people’s career development. This important focus coupled with the openness of the education system is the distinguishing feature of the people-oriented education system with Australia’s middle level to senior level positions in corporations. They focus on building the skills of individuals. They emphasize the transformation from a general education to a vocational education to obtaining a university degree. For example, in Australia’s junior high school, students studying basic coursework can apply to study in the vocational education system. After obtaining the vocational education certificates, students can apply for study in a university. Several contracts have been signed between specific universities and some TAFE [?] institutions, which allow students to finish the TAFE course, and then continue to study in the associated university. Once both sets of coursework have been completed and the appropriate tests passed, the students are able to get both the TAFE vocational education certificate and a bachelor’s degree from the associated university.

Second, this system focuses on the employment guide. Many countries in Europe, America and Australia pay great attention to their employment guide. The career guide of America contains an introduction to the entire field of opportunities, details of related businesses, and information on the employment selection process and finally on how to prepare yourself for a specific field. In Australia, there’s professional training and teaching in TAFE institutions concerning employment opportunities.

The third part of this system is to set up a communication system between the university and vocational education systems. The system will include a credit transfer system, and a sharing of study and working experience between the university and vocational education systems. Look at the following systems for additional details: the “Unit system” in Australia, the “Separation System and the Credit Approval System” of Chinese Taiwan, and the “Credit Transform System” in Great Britain. All of these systems have excellent communication processes.

Professional Courses with professional Orientation

Several famous and popular education models in the world such as ability-based education, working career education and general knowledge education are all professionally-oriented.

GENERAL SUMMARY OF CHINESE VOCATIONAL EDUCATION

There are three levels in the vocational education system in China. Education starts with the Junior Vocational Education school followed by the Secondary Vocational Education school and finally one moves to the Senior Vocational Education school. The most popular is the Secondary Vocational Education school since it is directly linked to the development of China’s economy.

Statistically, the number of Secondary Vocational schools has increased 2.1 times versus the number of schools in 1978. The number of students also has increased. The number of students recruited for Secondary Vocational schools has increased 10.5 times while the number of in-school students increased 14.3 times.

More than 80 million students from the Secondary Vocational Education schools and more than 20 million students from the Senior Vocational schools have graduated in the past 30 years. At the same time, over 150 million people are taking part in various kinds of vocational education in China. In 2008, the Secondary Vocational Education program represented approximately 50% of the entire High School Education system in China and it continues to grow annually.

FORWARD-LOOKING REVIEW OF CHINESE VOCATIONAL EDUCATION

Chinese Government Encouraging Private Vocational Education

There are four kinds of Vocational Education schools currently in China divided by the different management systems. They are: Nationally financed Vocational Education schools, Vocational Education schools managed by social organizations, Vocational schools managed by corporations, and finally, the privately owned Vocational schools. The Private Vocational Schools are the most popular in China. Since capital is very scarce, the Chinese government is encouraging the founding of non-government owned or privately owned institutions for Vocational Education.

Market-oriented establishment of professions in vocational education school

9

The professions in a Vocational School are established by a combination of market demand and what is taught in that specific school. Currently, almost all of the professions offered by Vocational Education schools are established by utilizing the principles of market orientation of local economies. The market is based on demand and only those professions that meet this demand survive.

Focusing on practical training methods

Chinese education has changed from an elite education system to a more popular education focused on vocational training. With the optimization of the industry structure and with more specialization required, a vocational education has become more important in the PRC Practical skills are needed in the work place. The vocational education system requires students to practice what they learn by putting into practice what they studied in the classroom. Many of the students will seek more than one educational degree to meet the needs of the industry in their areas.

Setting up the training courses based on a company’s need to secure a talented workforce.

Vocational education schools usually set up the training courses based on a talent need in the workplace. As many employers request new staff with related working experience, the local vocational schools build a strong relationship with the employers; if necessary, the students will be taught specific skills to meet the needs of the employer.

There is a surplus of students from the rural parts of China.

During the past few years, there have been tens of thousands of laborers from rural areas transferred to cities to obtain jobs. However, most of them have very little education or practical training. Since the cost to study in a vocational education school is much lower than any other education school, it is very economical for students from rural areas to choose a vocational education. To obtain a vocational education, students from the rural areas of China can have access to professional classes and have the possibility of working in large cities after graduation. Accordingly, the vocational-specific technologies education school plays an important role in the Chinese urbanization process.

THE POTENTIAL OF “INFORMATION TECHNOLOGY (“IT”) EDUCATION” IN THE CHINESE MARKET

According to the Ministry of Education in China, there are 1,816,878 graduates of IT departments and 1,710,832 in-school students studying IT at vocational education schools in 2006. As the IT industry develops, this will require that IT education have a rapid development as well.

The IT industry has grown in size to 51.9 billion dollars and is now 0.8% of China’s GDP. Many IT companies and Research Centers have been created in China during the past few years. Therefore the demand for IT talent also has grown significantly and individuals with IT skills are in great demand. Please note the Demand versus Capacity table and the IT Supply and Demand graphs below.

IT Demand vs. Capacity in China

|

Market size

|

Annual growth rate

|

IT Demand/year

|

Current Capacity

|

|

|

Interchange

|

250,000/year

|

4,000

|

||

|

Information preservation

|

5.6 billion RMB

|

10%~20%

|

30,000/year

|

500

|

|

e-business

|

100%

|

200,000/year

|

||

|

Information security

|

4,000

|

|||

|

Network game

|

5 billion RMB

|

20,000/year

|

3,000

|

|

|

Software industry

|

35%

|

10

TARGET MARKET ANALYSIS

China Wonder has significant advantages since their primary recruitment area is from Junior High Schools and High Schools from the rural areas of China. Also, China Wonder has the resources to provide employment and career placement services once the student graduates from their vocational school.

Great market demand of vocational education after high school in China

In recent years, the quality of the high school curriculum in the PRC has improved dramatically, and at the same time, demand has increased due in part to the heavy population migration to urban areas. Unfortunately, post graduate educational opportunities (ie universities) have not grown symmetrically. As a result, there’s great market demand for vocational education. According to statistics from the Ministry of Education in China, 8.8 million students had been recruited by universities with the average enrollment ratio of 60.23 per cent of total possible students in 2006, in 2007 the quantity increased to 10.1 million while the ratio decreased to 54 per cent; in 2008 the quantity reached a culminating point of 10.5 million students and the ratio was 57.04 per cent. Therefore, there is only a small improvement of Chinese Universities’ total capacity. Accordingly, there is great market demand for vocational education.

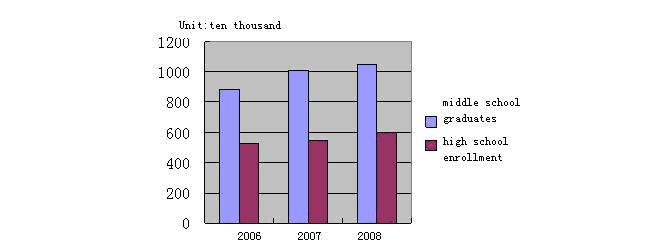

China Junior High and High School Enrollment

(Source: 2007-2009 China Vocational Education Industry Report)

Great market demand of vocational education due to the transfer of rural labor

The Chinese government is faced with the task of moving a significant amount of rural labor to China’s larger cities as the country moves toward urbanization. It is predicted that 15 to 20 million people from the rural areas of China will need to be transferred to the cities to meet the demands of the economy during the next 5 to 10 years. Poor education throughout the country has hindered the realization of this process. However, many believe that the expanding vocational education system will provide the necessary skills needed to meet the economic demands and will accelerate the urbanization of China.

The comparison between developed countries and China

|

Developed countries

|

China

|

|

|

Agriculture occupation

|

3%—10%

|

49%

|

|

Tertiary occupation

|

50%—70%

|

14.5%

|

|

Urbanization

|

More than 80%

|

44.9%

|

|

Surplus labor in rural area

|

46.1%

|

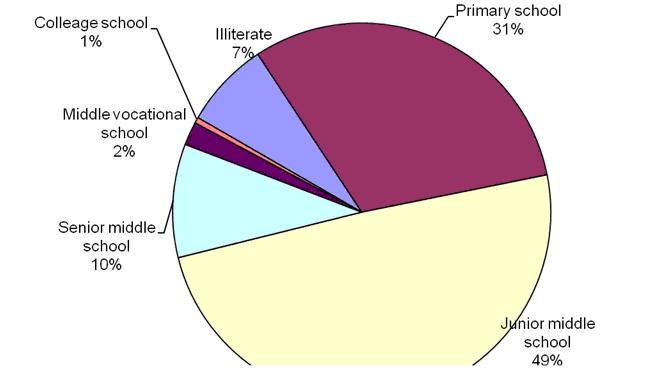

The two charts below depict the current status of rural education in China.

The education condition of rural labor in China

(Source: 2007-2009 China Vocational Education Industry Report)

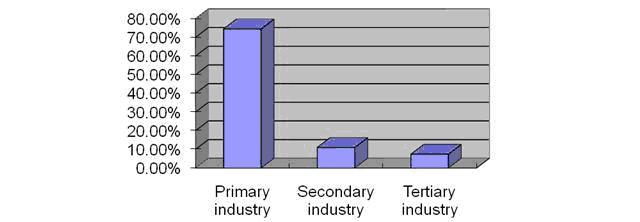

The industry condition of rural labor

11

(Source: 2007-2009 China Vocational Education Industry Report)

There is great opportunity for the vocational education industry as the Chinese develop and build new villages and complete the urbanization process.

Currently, China is actively developing and implementing the New Village Construction program. This program is intended to accelerate the training of rural laborers who are transferring from their rural homes to the larger cities where many of the new jobs are located.

During this urbanization process, more highly educated rural laborers are needed. However, amongst the rural laborers younger than 35 years old, less than 9.1 per cent have been professionally trained and less than 5 percent have taken part in the rural vocational education system. The lack of education is hindering the progress of the urbanization process and the New Village Construction program.

The Chinese government has published several policies to promote the development of vocational education. The Chinese government believes vocational education is a key program for speeding up the New Village Construction program and the urbanization process. Vocational education is one of the most effective programs to improve the skills of the rural laborers as they transfer to critical jobs in the larger cities of China.

Training institutions that focus their attention on providing rural vocational education will see significant opportunities during the New Village Construction projects. The size of this market is very significant for those who take advantage of the urbanization process in China. The Chinese government has initiated a series of policies to supply incentives to organizations to provide rural vocational education. The State Department’s decision “to energetically develop vocational education” affirms the great opportunity that exists for those who devote themselves to the rural vocational education market.

COMPETITION

The vocational school market in China is very fragmented and there are many smaller players. The market is furthered fragmented into specialized sectors. There are vocational schools for the junior high school, high school and university graduates; there are vocational schools for learning foreign languages, industrial skills, service providers and computer technology technicians. China Wonder is in the computer IT technology sector. We mainly target our recruitment efforts at the junior and high school graduates who want to gain a set of pragmatic computer IT technology knowledge for their immediate employment needs. In the sector we are in, there are many competitors locally and nationally. Many of them are smaller in scale compared to ours. There are many factors a typical student would consider before choosing a vocation school; besides the curricula offered, the history, size and brand name of the institution are also among the considerations. China Wonder is one of the better known vocational schools in the cities it now operates.

COMPETITIVE ADVANTAGES

China Wonder's core marketing competence lies in their existing channels to recruit new students. They rely heavily on their various recruitment centers and employment agencies to contact new students.

Wonder's Competitive Edge

12

Management Team Advantage

China Wonder is the leader and main driver of improving China’s IT vocational education system. China Wonder has been developing its programs for 15 years and has developed a strong management team and staff structure.

Marketing Advantage

China Wonder’s target market is the rural population of China. As noted above, the rural areas of China has large number of people who are looking for jobs in the larger cities but lack the skills needed for such job positions. The market focus is the senior high school graduates located in the enormously populated rural areas of China. China Wonder has a strong regional influence in these areas of China and places a larger emphasis on reaching the individuals who are looking to transfer to the Chinese cities and looking for jobs to improve their lives. China Wonder’s Employment Referral System guarantees the rural laborers an education and jobs after graduation. This is a major factor in increasing China Wonder’s market position.

Product research Advantage

China Wonder can control and guarantee the education quality of their programs due to the Corporate Chain Management system that they employ in each branch school. After 15 years of development, China Wonder has accumulated large numbers of competent teachers, which helps them create market demand and provides research capabilities. The qualifications and experiences of the staff ensure that the training courses will be improved constantly to meet the changing student learning needs and social manpower demands.

Enrollment Network Advantage

The substantial enrollment advertisements result in multi-level and high-impact media coverage toward the target market. China Wonder also has a strong sales team, including enrollment teams in all provinces of China and enrollment offices in all China Wonder schools.

Student's Employment Security Advantage

With 15 years of vocational education, China Wonder has gained many experiences in brand consciousness, management and market orientation. The employment offices which are located in the major cities and IT-developed regions and the standard training model which is a great fit for the market demand have together ensured the 100% employment rate.

Item 1A. Risk Factors.

Disclosure Regarding Forward Looking and Cautionary Statements.

Forward Looking Statements. Certain of the statements contained in this Annual Report on Form 10-K include "forward looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended ("Exchange Act"). All statements other than statements of historical facts included in this Form 10-K regarding the Company's financial position, business strategy, and plans and objectives of management for future operations and capital expenditures, and other matters, are forward looking statements. These forward-looking statements are based upon management's expectations of future events. Although the Company believes the expectations reflected in such forward looking statements are reasonable, there can be no assurances that such expectations will prove to be correct. Additional statements concerning important factors that could cause actual results to differ materially from the Company's expectations ("Cautionary Statements") are disclosed below in the Cautionary Statements section and elsewhere in this Form 10-K. All written and oral forward looking statements attributable to the Company or persons acting on behalf of the Company subsequent to the date of this Form 10-K are expressly qualified in their entirety by the Cautionary Statements.

Cautionary Statements. Certain risks and uncertainties are inherent in the Company's business. In addition to other information contained in this Form 10-K, the following Cautionary Statements should be considered when evaluating the forward looking statements contained in this Form 10-K:

13

Risks Related to Our Business

Although our Chinese subsidiary has been in operation for several years, US Wonder was incorporated on April 17, 2008 and has a limited operating history.

There is no way to evaluate the likelihood of whether we will be able to operate our proposed business successfully.If our business fails to develop in the manner we have anticipated, you will lose your investment in the shares. If our business develops, management may be unable to effectively or efficiently operate our business unless we are able to employ sufficient and trained professional personnel to assist us in the operation of our business, in which event you will lose your investment in the shares.

The Chinese market for educational services is still emerging and evolving rapidly. If market acceptance of our products and services declines or fails to grow, our revenue growth may slow or we may experience a decrease in revenues.

As the Chinese market for educational services is still emerging, our success will depend to a large extent on our ability to convince our clients that our technologies and services are valuable. If demand for educational services does not grow to the extent we anticipate, our revenue growth may slow or we may experience a decrease in revenues.

If we need to raise additional funds, the funds may not be available when we need them. We may be required to provide rights senior to the rights of our shareholders in order to attract additional funds and if we use equity securities to raise additional funds dilution to our shareholders will occur.

To the extent that we require additional funds, we cannot assure you that additional financing will be available when needed on favorable terms or at all, and if the funds are not available when we need them, we may be forced to terminate our business. If additional funds are raised through the issuance of equity securities, the percentage ownership of our existing stockholders will be reduced; and those equity securities issued to raise additional funds may have rights, preferences or privileges senior to those of the rights of the holders of our common stock.

Compliance with rules and requirements applicable to public companies will be difficult due to our PRC operations and cause us to incur increased costs,

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. In addition, the Sarbanes-Oxley Act, as well as rules subsequently implemented by the SEC and Nasdaq, have required changes in corporate governance practices of public companies. We expect these rules and regulations to increase our legal, accounting and financial compliance costs and to make certain corporate activities more time-consuming and costly. Complying with these rules and requirements may be especially difficult and costly for us because we may have difficulty locating sufficient personnel in China with experience and expertise relating to U.S. GAAP and U.S. public-company reporting requirements, and such personnel may command high salaries relative to what similarly experienced personnel would command in the United States. If we cannot employ sufficient personnel to ensure compliance with these rules and regulations, we may need to rely more on outside legal, accounting and financial experts, which may be very costly. In addition, we will incur additional costs associated with our public company reporting requirements. We cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

Some of our competition will be from larger, more established and better financed companies, and if we are unable to successfully compete with other companies our business will fail.

If we are unable to implement our business expansions, some of our competitors will have greater financial resources, technical expertise and managerial capabilities than we do. If we are unable to overcome some of the competitive disadvantages, we will be forced to cease our business operations.

Market factors are out of our control. As a result, we may not be able to market any of our educational products which may be developed.

The education industry, in general, is intensively competitive, and we are unable to provide any assurance that a ready market will exist of the sale of our products. Numerous factors beyond our control may affect the marketability of any products developed. The factors include market fluctuations, government regulations, including regulations relating to prices and taxes. The exact effect of these factors cannot be accurately predicted, but the impact or any one or a combination thereof may result in our inability to generate any revenue, in which event you will lose your entire investment in the shares.

Risks Related to Our Common Stock

We are not listed or quoted on any exchange and we may never obtain such a listing or quotation.

There may never be a market for stock and stock held by our shareholders may have little or no value. There is presently no public market in our shares. While we intend to contact a market maker for sponsorship of our securities, we cannot guarantee that such sponsorship will be approved and our stock listed and quoted for sale. Even if our shares are quoted for sale, buyers may be insufficient in numbers to allow for a robust market, it may prove impossible to sell your shares.

Even if we obtain a listing on an exchange and a market for our shares develops, sales of a substantial number of shares of our common stock into the public market by certain stockholders may result in significant downward pressure on the price of our common stock and could affect your ability to realize the current trading price of our common stock.

Our shareholders positions may be diluted through the issuance of additional shares.

Currently, we have issued a total of 20,000,000 shares of common stock. Additional issuances of equity securities may result in dilution to our existing stockholders. Our Articles of Incorporation authorize the issuance of up to 100,000,000 shares of common stock.

14

Our common stock is subject to the "penny stock" rules of the SEC.

Our common stock is subject to the "penny stock" rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock. Because our stock may not be traded on a stock exchange or on the NASDAQ National Market or the NASDAQ Small Cap Market and because the market price of the common stock may be less than $5.00 per share, the common stock is classified as a "penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve a person's account for transactions in penny stocks, and the broker or dealer receives from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In order to approve a person's account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives of the person and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, which sets forth the basis on which the broker or dealer made the suitability determination; and the broker or dealer has received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

A decline in the future price of our common stock could affect our ability to raise further working capital and adversely impact our operations.

Even if we are able to successfully list our stock for trading on the Nasdaq, AMEX or OTC Bulletin Board, we can have no assurances that a market will ever develop and if a market does develop we will have no control over the market price of our common stock. Any market price that does develop is likely to be highly volatile. Factors, including regulatory matters, concerns about our financial condition, operating results, litigation, government regulation, developments or disputes relating to current or future agreements or title to our claims may have a significant impact on the market price of our stock, causing the market price to decline. In addition, potential dilutive effects of future sales of shares of common stock by shareholders and by us could also have an adverse effect on the price of our securities. Such a decline would seriously hinder our ability to raise additional capital and prevent us from fully implementing our business plan and operations.

Control by our Founder and Chairman.

Mr. Chungui Xie, our Founder and Chairman, owns and controls approximately 83% of our total issued and outstanding shares of our common stock. Such ownership by the Company's principal shareholder, executive officer and director may have the effect of delaying, deferring, preventing or facilitating a sale of the Company or a business combination with a third party.

Even taking into account the limitations of Rule 144, the future sales of restricted shares could have a depressive effect on the market price of the Company’s securities in any market, which may develop.

The 20,000,000 shares of Common Stock presently issued are “restricted securities” as that term is defined under the Securities Act of 1933, as amended, (the “Securities Act”) or have other re-sale restrictions as set forth in our recent Form S-1 Registration Statement. In the future, these shares may be sold in compliance with Rule 144 of the Securities Act, pursuant to the terms of our recent Form S-1 Registration Statement, or pursuant to another Registration Statement filed under the Securities Act. Rule 144 provides, in essence, that a person, who has not been an affiliate of the issuer for the past 90 days and has held restricted securities for six months of an issuer that has been reporting for a period of at least 90 days, may sell those securities so long as the Company is current in its reporting obligations. After one year, non-affiliates are permitted to sell their restricted securities freely without being subject to any other Rule 144 condition. Sales of restricted shares by our affiliates who have held the shares for six months are limited to an amount equal to one percent (1%) of the Company’s outstanding Common stock that may be sold in any three-month period. Additionally, Rule 144 requires that an issuer of securities make available adequate current public information with respect to the issuer. Such information is deemed available if the issuer satisfies the reporting requirements of sections 13 or 15(d) of the Securities and Exchange Act of 1934 (the “Securities Exchange Act”) or of Rule 15c2-11 there under. There is no limitation on such sales and there is no requirement regarding adequate current public information. Sales under Rule 144 or pursuant to a Registration Statement filed under the Act, may have a depressive effect on the market price of our securities in any market, which may develop for such shares. However, these rules apply only to shares in a company that is not considered a “shell” entity. In the event that the issuer is a “shell” entity, as we are, all shares must be held for one year from the date of distribution in order to be sold in compliance with Rule 144.

If shareholders sell a large number of shares all at once or in blocks, the value of our shares would most likely decline.

The Company has 20,000,000 shares of Common Stock outstanding as of the date of this prospectus. When these shares become freely tradeable, either through a future registration or exemption (such as that provided by Rule 144 which will be available one year after approval of this Registration Statement), the availability for sale of a large amount of shares may depress the market price for our Common Stock and impair our ability to raise additional capital through the public sale of Common Stock. The Company has no arrangement with any of the holders of our shares to address the possible effect on the price of the Company's Common Stock of the sale by them of their shares.

15

Risks Relating to Regulation of Our Business

|

Changes to preferential policies adopted by the Chinese government related to vocational education may

negatively affect our business and results of operations.

|

The Chinese government has adopted preferential policies for the development of vocational schools in China, including “The Decision to Enhance the Promotion of the Reform and Development of Vocational Education” and “The Decision to Enhance the Development of Vocational Education” published by the State Council in September 2002 and October 2005, respectively. These decisions require all levels of government in China to intensify their support for vocational education and to gradually increase the financial resources that local and provincial governments allocate to vocational education. The influx of government run schools would represent competition to us and potentially may reduce our student enrollment. Accordingly, if these preferential policies were to be enhanced, it may negatively affect our business and results of operations.

We have limited recourse against our subsidiaries if anyone of them violates our contractual arrangements.

We have limited direct recourse against our China subsidiaries if anyone of them violates these contractual arrangements. For example, they could refuse to operate the educational institutions in our group in an acceptable manner or pay the service fees due under our contractual arrangements. Because our contractual arrangements are governed by PRC law and provide for the resolution of disputes through either arbitration or litigation in China, if a subsidiary fails to perform its obligations under our contractual arrangements, we will have to rely on remedies under PRC law, including seeking specific performance and claiming damages. In addition, generally the PRC has substantially less experience related to the enforcement of contractual rights through its judiciary or the arbitration process as compared to the United States. This inexperience presents the risk that the judiciary or arbitrators in the PRC may be reluctant to enforce contractual rights, interpret these rights and remedies differently than what was intended by the parties to the agreements, or find that such contractual agreements do not comply with restrictions in current PRC laws. A PRC court may also set aside an arbitration award by reason of any defect the court considers to be present in the arbitration proceeding, remedies at law may not be adequate and a PRC court may not order specific performance. Additionally, contract interpretation and enforcement is not as developed as that in the United States and a contract dispute could be subject to uncertainties. In addition, any legal proceeding may result in substantial costs, disruptions to our business, damage to our reputation and diversion of our resources.

Risks Related to Doing Business in China

PRC economic, political and social conditions, as well as changes in any government policies, laws and regulations, could adversely affect the overall economy in China or the prospects of the education market, which in turn could adversely affect our business.

Substantially all of our operations are conducted in China, and substantially all of our revenues are derived from China. Accordingly, our business, financial condition, results of operations, prospects and certain transactions we may undertake are subject, to a significant extent, to economic, political and legal developments in China.

The PRC economy differs from the economies of most developed countries in many respects, including the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. While the PRC economy has experienced significant growth in the past two to three decades, growth has been uneven, both geographically and among various sectors of the economy. Demand for our products and services depend, in large part, on economic conditions in China. Any slowdown in China’s economic growth may cause our potential customers to delay or cancel their plans to participate in our educational services, which in turn could reduce our net revenues.

Although the PRC economy has been transitioning from a planned economy to a more market-oriented economy since the late 1970s, the PRC government continues to play a significant role in regulating industry development by imposing industrial policies. The PRC government also exercises significant control over China’s economic growth through the allocation of resources, controlling the incurrence and payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Changes in any of these policies, laws and regulations could adversely affect the overall economy in China or the prospects of the education market, which could harm our business.

The PRC government has implemented various measures to encourage foreign investment and sustainable economic growth and to guide the allocation of financial and other resources, which have for the most part had a positive effect on our business and growth. However, we cannot assure you that the PRC government will not repeal or alter these measures or introduce new measures that will have a negative effect on us.

China’s social and political conditions are also not as stable as those of the United States and other developed countries. Any sudden changes to China’s political system or the occurrence of widespread social unrest could have negative effects on our business and results of operations. In addition, China has tumultuous relations with some of its neighbors and a significant further deterioration in such relations could have negative effects on the PRC economy and lead to changes in governmental policies that would be adverse to our business interests.

The PRC legal system embodies uncertainties that could limit the legal protections available to you and us.

Unlike common law systems, the PRC legal system is based on written statutes and decided legal cases have little precedential value. In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters in general. The overall effect of legislation since then has been to significantly enhance the protections afforded to various forms of foreign investment in China. Our PRC operating subsidiaries are subject to laws and regulations applicable to foreign investment in China in general and laws and regulations applicable to foreign invested enterprises in particular. Our PRC subsidiaries are subject to laws and regulations governing the formation and conduct of domestic PRC companies. Relevant PRC laws, regulations and legal requirements may change frequently, and their interpretation and enforcement involve uncertainties. For example, we may have to resort to administrative and court proceedings to enforce the legal protection that we enjoy either by law or contract.

16

However, since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory and contractual terms, it may be more difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy than under more developed legal systems. Such uncertainties, including the inability to enforce our contracts and intellectual property rights, could materially and adversely affect our business and operations. In addition, confidentiality protections in China may not be as effective as in the United States or other countries. Accordingly, we cannot predict the effect of future developments in the PRC legal system, particularly with respect to the privatization of the education industry, including the promulgation of new laws, changes to existing laws or the interpretation or enforcement thereof, or the preemption of local regulations by national laws. These uncertainties could limit the legal protections available to us and other foreign investors, including you.

The accredited education sector is subject to extensive regulation in China, and the educational institutions’ ability to conduct operation is highly dependent on their compliance with these regulatory frameworks.

We are a private vocational school and are not subject to the same regulations and restrictions as imposed on the regular accredited schools in China.

We are required to hold a variety of permits, licenses and certificates to conduct our business in China. We may not possess or update all the permits, licenses and certificates required for our business and may have to apply for permits, licenses and certificates in addition to the currently secured ones from time to time. In addition, there may be circumstances under which the approvals, permits, licenses or certificates granted by the governmental agencies are subject to change without substantial advance notice, and it is possible that we could fail to obtain the approvals, permits, licenses or certificates that are required to expand our business as we intend. If we fail to obtain or to maintain such permits, licenses or certificates or renewals are granted with onerous conditions, we could be subject to fines and other penalties and be limited in the number or the quality of the products or services that we would be able to offer. As a result, our business, result of operations and financial condition could be materially and adversely affected.

You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing original actions in China based on United States or other foreign laws against us, our management or the experts named in the prospectus.

We conduct substantially all of our operations in China and substantially all of our assets are located in China. In addition, all of our senior executive officers reside within China. As a result, it may not be possible to affect service of process within the United States or elsewhere outside China upon our senior executive officers, including with respect to matters arising under U.S. federal securities laws or applicable state securities laws.

We have been advised by our PRC counsel that because the PRC does not have treaties with the United States providing for the reciprocal recognition and enforcement of court judgments, it is uncertain with regard to whether courts of China would recognize or enforce judgments of U.S. courts against us or our directors or officers pursuant to civil liability provisions of the securities laws of the United States or any state in the United States; or exercise jurisdiction over actions brought against us or our directors or officers pursuant to the securities laws of the United States or any state in the United States.

Governmental control of currency conversion may affect the value of your investment.

The PRC government imposes controls on the convertibility of the RMB into foreign currencies and, in certain cases, the remittance of currency out of China. We receive substantially all of our revenues in RMB. Under our current corporate structure, our income at the parent level will be primarily derived from dividend payments from our PRC subsidiary which in turn, derives its revenues from management fees from the Management Company. Shortages in the availability of foreign currency may restrict the ability of our PRC subsidiary and affiliate to remit sufficient foreign currency to pay dividends or other payments to us, or otherwise satisfy their foreign currency denominated obligations. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions, can be made in foreign currencies without prior approval from the PRC State Administration of Foreign Exchange, or SAFE, by complying with certain procedural requirements. However, approval from appropriate government authorities, such as SAFE, is required where RMB is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay dividends in foreign currencies to our shareholders, including holders of our ordinary shares.

PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident shareholders to personal liability and limit our ability to inject capital into our PRC subsidiary, limit our PRC subsidiary’s ability to distribute profits to us, or otherwise adversely affect us.

SAFE issued a public notice in October 2005 requiring PRC residents to register with the local SAFE branch before establishing or controlling any company outside of China for the purpose of capital financing with assets or equities of PRC companies, referred to in the notice as an “offshore special purpose company.” PRC residents that are shareholders and/or beneficial owners of offshore special purpose companies established before November 1, 2005 are required to register with the local SAFE branch before March 31, 2006. In addition, any PRC resident that is the shareholder of an offshore special purpose company is required to file, update and modify his or her SAFE registration with the SAFE or its competent local branch, with respect to that offshore special purpose company in connection with any of its increase or decrease of capital, transfer of shares, merger, split, equity investment or creation of any security interest over any assets located in China. The SAFE regulations require retroactive approval and registration of direct or indirect investments previously made by PRC residents in offshore special purpose companies. To further clarify the implementation of Circular 75, SAFE issued Circular 106 in May, 2007. Under Circular 106, PRC subsidiaries of an offshore special purpose company are required to coordinate and supervise the filing of SAFE registrations by the offshore holding company’s shareholders who are PRC residents in a timely manner. We have requested our current shareholders and/or beneficial owners to disclose whether they or their shareholders or beneficial owners fall within the ambit of the SAFE notice and urge those who are PRC residents to register with the local SAFE branch as required under the SAFE notice. The failure of these shareholders and/or beneficial owners to timely amend their SAFE registrations pursuant to the SAFE notice or the failure of future shareholders and/or beneficial owners of our company who are PRC residents to comply with the registration procedures set forth in the SAFE notice may subject such shareholders and/or beneficial owners to fines and legal sanctions and may also limit our ability to contribute additional capital into our PRC subsidiary, limit our PRC subsidiary’s ability to distribute dividends to our company or otherwise adversely affect our business.

We have been advised by our PRC counsel that while neither the Company nor any of its subsidiaries has registered with SAFE, Circular 75 allows for registration at a later date.

17

If the China Securities Regulatory Commission, or CSRC, or another PRC regulatory agency determines that its approval is required in connection with this offering, this offering may be delayed or cancelled, or we may become subject to penalties.

On August 8, 2006, PRC regulatory agencies, including the CSRC, promulgated the Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors, or the M&A Rule, which became effective on September 8, 2006. On June 22, 2009, the MOFCOM promulgated the amended Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (the “Order 6”, together with M&A rule, the “New M&A Rules”), which became effective immediately. The M&A Rule, among other things, has certain provisions that require offshore special purpose vehicles, or SPVs, newly formed for the purpose of acquiring PRC domestic companies and controlled by PRC companies or individuals, to obtain the approval of the CSRC prior to listing their securities on an overseas stock exchange. On September 21, 2006, pursuant to the New M&A Rules and other PRC Laws and regulations, the CSRC, in its official website, promulgated relevant guidance with respect to the issues of listing and trading of domestic enterprises’ securities on overseas stock exchanges, including a list of application materials with respect to the listing on overseas stock exchanges by SPVs. We believe that the M&A Regulations only apply to transactions involving "mergers and acquisitions of domestic enterprises by foreign investors," we believe that (i) the M&A Regulations are not applicable to our corporate structure based on control by contractual methods and (ii) CSRC approval is not required in the context of this offering, for the following reasons: (a) we established our PRC subsidiary, China WFOE, by means of direct investment, not through merger or acquisition of any PRC domestic companies and (b) we control our VIE and its subsidiaries through contractual arrangements, not through "mergers and acquisitions of domestic enterprises by foreign investors" as defined under the M&A Regulations. If the CSRC or another PRC regulatory agency subsequently determines that its approval is required for this offering, we may face sanctions by the CSRC or another PRC regulatory agency. If this happens, these regulatory agencies may impose fines and penalties on our operations in the PRC, limit our operating privileges in the PRC, restrict or prohibit payment or remittance of dividends by our PRC subsidiary to us or take other actions that could have a material adverse effect on our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our ordinary shares. The CSRC or other PRC regulatory agencies may also take actions requiring us, or making it advisable for us, to delay or cancel this offering before settlement and delivery of the ordinary shares being offered by us. However, the Law Office of Anhui Antai Da Mei Hua, our counsel as to PRC law, has advised us, as indicated in paragraph number 7 of counsel’s opinion letter (attached hereto as Exhibit 5.2), that the Company has all necessary licenses and approval to conduct it business and there is no reason to believe that any regulatory authority is “considering modifying, suspending, or revoking and such licenses, consents, authorizations, approvals, orders, certificates or permits…”.

The M&A Rule establishes more complex procedures for some acquisitions of PRC companies by foreign entities, which could make it more difficult for us to pursue growth through acquisitions in China.

The M&A Rule establishes additional procedures and requirements that could make some acquisitions of PRC companies by foreign entities, such as ours, more time-consuming and complex, including requirements in some instances that the Ministry of Commerce be notified in advance of any change-of-control transaction in which a foreign entity takes control of a PRC domestic enterprise. In the future, we may grow our business in part by acquiring complementary businesses. Complying with the requirements of the M&A Rule to complete such transactions could be time-consuming, and any required approval processes, including obtaining approval from the Ministry of Commerce, may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business or maintain our market share.

PRC regulation of loans and direct investment by offshore holding companies to PRC entities may delay or prevent us from making loans to our PRC subsidiary and PRC affiliated entity or to make additional capital contributions to our PRC subsidiary, which could materially and adversely affect our liquidity and our ability to fund and expand our business.

We are an offshore holding company conducting our operations in China through our PRC subsidiaries. We plan to make loans to our PRC subsidiary, whether currently in existence or to be formed in the future, and to the Management Company [?] or other PRC affiliated entities formed in the future, or make additional capital contributions to our PRC subsidiary.

Any loans we make to our PRC subsidiary cannot exceed statutory limits and must be registered with the State Administration of Foreign Exchange, or SAFE, or its local counterparts. Under applicable PRC law, the government authorities must approve a foreign-invested enterprise’s registered capital amount, which represents the total amount of capital contributions made by the shareholders that have registered with the registration authorities. In addition, the authorities must also approve the foreign-invested enterprise’s total investment, which represents the total statutory capitalization of the company, equal to the company’s registered capital plus the amount of loans it is permitted to borrow under the law. The ratio of registered capital to total investment cannot be lower than the minimum statutory requirement and the excess of the total investment over the registered capital represents the maximum amount of borrowings that a foreign invested enterprise is permitted to have under PRC law. The various applications could be time-consuming and their outcomes may be uncertain. Concurrently with the loans, we might have to make capital contributions to these subsidiaries to maintain the statutory minimum registered capital and total investment ratio, and such capital contributions involve uncertainties of their own, as discussed below. Furthermore, even if we make loans to our PRC subsidiary that do not exceed their current maximum amount of borrowings, we will have to register each loan with SAFE or its local counterpart for the issuance of a registration certificate of foreign debts. In practice, it could be time-consuming to complete such SAFE registration process.

Any loans we make to our PRC affiliated entity, which is treated as a PRC domestic company rather than a foreign-invested enterprise under PRC law, are also subject to various PRC regulations and approvals. Under applicable PRC regulations, international commercial loans to PRC domestic companies are subject to various government approvals.

We cannot assure you that we will be able to complete the necessary government registrations or obtain the necessary government approvals on a timely basis, if at all, with respect to future loans by us to our PRC subsidiary or PRC affiliated entity or with respect to future capital contributions by us to our PRC subsidiary. If we fail to complete such registrations or obtain such approvals, our ability to capitalize or otherwise fund our PRC operations may be negatively affected, which could adversely and materially affect our liquidity and our ability to fund and expand our business.

Restrictions on currency exchange may limit our ability to utilize our revenues effectively and the ability of our PRC subsidiary to obtain financing.