Attached files

| file | filename |

|---|---|

| EX-31.1 - Quest Minerals & Mining Corp | v218771_ex31-1.htm |

| EX-23.1 - Quest Minerals & Mining Corp | v218771_ex23-1.htm |

| EX-32.1 - Quest Minerals & Mining Corp | v218771_ex32-1.htm |

U. S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ___________ to _____________

Commission File Number 000-32131

KENTUCKY ENERGY, INC.

(Name of small business issuer as specified in its charter)

|

Utah

|

87-0429950

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

18B East 5th Street

Paterson, NJ 07524

(Address of principal executive offices, including zip code)

|

|

Registrant’s telephone number, including area code: (973) 684-0075

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.0001 par value

___________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act: o Yes No x

Indicate by check mark whether the registrant(1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 day. x Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy ir information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 if the Exchange Act.

|

Large accelerated filter o

|

Accelerated filter o

|

|

|

Non-accelerated filter o

|

(Do not check if a smaller reporting company)

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes o No x

As of April 12, 2011, 178,219,904 shares of our common stock were issued and outstanding.

Documents Incorporated by Reference: None.

PART I

Kentucky Energy, Inc. (f/k/a Quest Minerals & Mining Corp.), including all its subsidiaries, are collectively referred to herein as “KI,” “the Company,” “us,” or “we.”

Item 1. DESCRIPTION OF BUSINESS

General

We acquire and operate energy and mineral related properties in the southeastern part of the United States. We focus our efforts on properties that produce quality compliance blend coal.

We are a holding company for Quest Minerals & Mining, Ltd., a Nevada corporation, or Quest (Nevada), which in turn is a holding company for Quest Energy, Ltd., a Kentucky corporation, or Quest Energy, and of Gwenco, Inc., a Kentucky corporation, or Gwenco.

Gwenco leases over 700 acres of coal mines, with approximately 9.8 million tons of proven/probable reserves tons of coal in place in six seams. At this time, we cannot readily define the difference of assurance between “proven” and “probable” reserves. In 2004, Gwenco had reopened Gwenco’s two former drift mines at Pond Creek and Lower Cedar Grove, and had begun production at the Pond Creek seam. This seam of high quality compliance coal is located at Slater’s Branch, South Williamson, Kentucky.

Fiscal 2010 and First Quarter 2011 Developments

SEC Settlement. On October 31, 2008, we received a Wells notice (the “Notice”) from the staff of the Salt Lake Regional Office of the Securities and Exchange Commission (the “Commission”) stating that they are recommending an enforcement action be filed against us based on our financial statements and other information contained in reports filed by us with the Commission by us for our 2004 year and thereafter. The Notice states that the Commission anticipates alleging that we have violated Sections 10(b), 13(a) and 13(b)(2) of the Securities Exchange Act of 1934, as amended and Rules 10b-5, 12b-20, 13a-1 and 13a-13 thereunder.

On April 8, 2011, the SEC announced that it has agreed to a settlement with us. We entered into the settlement without admitting or denying the allegations set forth in the Notice, as is consistent with standard SEC practice. Under the terms of the settlement, we consented to a cease and desist order from committing or causing any violations and any future violations of Section 13(a) and 13(b)(2)(A) and (B) of the Exchange Act and Rules 12b-20, 12a-1 and 13a-13 thereunder. In addition, we agreed to perform certain undertakings including (i) maintaining at least two independent director so that not less than 2/3 of our board will be independent directors (ii) employing a chief financial officer qualified to prepare financial statements in accordance with GAAP; (iii) notify the Division of Enforcement if our chief financial officer resigns or is terminated or if one or more board members leave such that the board as a whole is not independent and (iv) adopt a system of written internal controls and identify and implement actions to improve the effectiveness of our disclosure controls, including plans to enhance our resources and training with respect to financial reporting and disclosure responsibilities, and to review such actions with our independent auditors.

Termination of Letter of Intent. On February 8, 2011, we announced the signing of a letter of intent to sell our coal mining operation. As of the date of this report, the purchaser under such letter of intent has not consummated the acquisition within the exclusivity period set forth in the letter of intent. As such, we intend to resume discussions with other prospective purchasers who have expressed an interest in acquiring our mining assets. In addition, we are currently seeking a larger credit facility that would allow us to make the necessary capital expenditures and provide sufficient working capital in order to accelerate our desired revenue growth.

Operations Overview. In the year ended 2010, we continued to conduct mining operations. We generated coal revenues of approximately $2.4 million for the year ended 2010, compared to approximately $1.6 million for the year ended 2009. Other than with respect to the West Virginia explosion discussed below, we did not have to shut down our operations during the year ended 2010. However, we did encounter temporary delays and stoppages, due to either breakdowns in equipment, a lack of necessary supplies, weather-related production issues, or regulatory inspections. We continue to encounter thicker coal seams as we advance further into the mine.

2

While certain general business conditions continue to improve, the continued effects of the recent recession, credit crisis, and related turmoil in the global financial system has had and may continue to have a negative impact on our business, financial condition, and liquidity. We may face significant future challenges if conditions in the financial markets do not continue to improve. Worldwide demand for coal has been adversely impacted by the global recession, but the steel industry and the global metallurgical coal markets have shown signs of improvement. If this trend continues, coal demand should increase and improve our opportunities to sell our coal products at higher prices.

West Virginia Explosion. On April 5, 2010, an explosion occurred at the Upper Big Branch mine in Montcoal, West Virginia, operated by Performance Coal Company, a subsidiary of Massey Energy, which resulted in 29 fatalities. In response to this tragedy, the Federal Mine Safety and Health Administration (“MSHA”) conducted inspections of most mines in the region, including Pond Creek. As a result of these inspections, MSHA issued an order to Gwenco to take certain precautionary measures, including upgrades to its ventilation system, CO system, and airlock system. In addition, MSHA conducted simulated evacuations and conducted underground training seminars. Gwenco ceased mining operations during this period in order to allow the inspections, implement the precautionary measures, and conduct the simulations and training. Gwenco reopened the mining operations approximately two weeks after the inspections commenced. However, as an ongoing result of the tragedy at UBB, MSHA significantly increased regulatory enforcement in our mines. The increased regulatory enforcement had a significant negative impact our productivity and operating results for the third quarter of 2010. We lost a significant number of shifts during the quarter due to regulatory issues, many of which were due to delays in MSHA’s approval process for ventilation or other mine plan changes. If MSHA continues to order our mines to be temporarily closed or permanently closes such mines, our ability to meet our customers’ demands could be adversely affected.

In September 2010, MSHA revised the federal standard for the incombustible content of coal dust, rock dust and other dust combined in coal mines. The revised standard is effective for new mining as of October 7, 2010, and for previously mined areas by November 22, 2010. We expect our cost of mining to increase as we comply with the revised standard for additional rock-dusting materials, equipment and labor.

Name Change. On June 10, 2010, we filed an amendment to our Articles of Incorporation to change corporate name from Quest Minerals & Mining Corp. to “Kentucky Energy, Inc.” The change in corporate name took effect on June 16, 2010.

Drilling Contract. On July 21, 2010, we entered into an agreement with an unrelated third party to obtain up to 100 drill sites and a 100% working interest of the oil and gas rights on approximately 3,000 acres of property located in Rockcastle County, Kentucky for $50,000. In addition, the unrelated third party will be retained for day to day management of the property, including drilling operations for additional consideration of $155,000 per well. This well will be used to test thoroughly the main oil and gas horizons. On January 15, 2011, we satisfied the initial deposit requirement pursuant to a lease agreement dated July 21, 2010, where we seeking to obtain the working interests for certain oil and gas properties in Rockcastle County, Kentucky. As part of the agreement, 75% net revenue interest representing a 100% working interest of said leases totaling 4,640 acres of oil and gas exploration property were assigned to the company by a third party leaseholder representative. We have not yet determined when initial drilling will commence.

Industry Overview

Coal accounted for 24% of the energy consumed (excluding certain alternative fuels including wind, geothermal and solar power generators) by the United States and 29% of energy consumed globally in 2007, according to the BP Statistical Review of World Energy (“BP”). In 2007, coal was the fuel source of 49% of the electricity generated nationwide, as reported by the Energy Information Administration (“EIA”), a statistical agency of the United States Department of Energy.

According to BP, in 2007, the United States was the second largest coal producer in the world, exceeded only by China. Other leading coal producers include Australia, India, South Africa, the Russian Federation and Indonesia. According to BP, the United States has the largest coal reserves in the world, with proved reserves totaling 243 billion tons. The Russian Federation ranks second in proved coal reserves with 157 billion tons, followed by China with 115 billion tons, according to BP.

3

United States coal reserves are more plentiful than oil or natural gas with 234 years of supply at current production rates. Proved United States reserves of oil amount to 12 years of supply at current production rates and proved United States reserves of natural gas amount to 11 years of supply at current levels of consumption, as reported by BP.

United States coal production has more than doubled over the last 40 years. In 2008, total United States coal production, as estimated by the EIA, was 1.2 billion tons.

Coal is used in the United States by utilities to generate electricity, by steel companies to make steel products, and by a variety of industrial users to produce heat and to power foundries, cement plants, paper mills, chemical plants and other manufacturing and processing facilities. Significant quantities of coal are also exported from both East and Gulf Coast terminals. The breakdown of United States coal consumption for the first ten months of 2008 as estimated by the EIA, is as follows:

|

End Use

|

% of Total

|

|

|

Electric Power

|

93%

|

|

|

Other Industrial

|

5%

|

|

|

Coke

|

2%

|

|

|

Residential and Commercial

|

<1%

|

|

|

Total

|

100%

|

|

Coal has long been favored as an electricity generating fuel because of its basic economic advantage. The largest cost component in electricity generation is fuel. This fuel cost is typically lower for coal than competing fuels such as oil and natural gas on a Btu-comparable basis. The EIA estimates the average cost of various fossil fuels for generating electricity in the first 11 months of 2008 was as follows:

|

Electricity Generation Source

|

Average Cost per

million BTU

|

|||

|

Petroleum Liquids

|

$ | 16.56 | ||

|

Natural Gas

|

$ | 9.34 | ||

|

Coal

|

$ | 2.06 | ||

|

Petroleum Coke

|

$ | 1.85 | ||

There are factors other than fuel cost that influence each utility’s choice of electricity generation mode, including facility construction cost, access to fuel transportation infrastructure, environmental restrictions, and other factors. The breakdown of United States electricity generation by fuel source in 2007, as estimated by EIA, is as follows:

|

Electricity Generation Source

|

% of Total

Electricity Generation

|

|

|

Coal

|

49%

|

|

|

Natural Gas

|

21%

|

|

|

Nuclear

|

19%

|

|

|

Hydroelectric

|

6%

|

|

|

Oil and other (solar, wind, etc.)

|

5%

|

|

|

Total

|

100%

|

|

Demand for electricity has historically been driven by United States economic growth but it can fluctuate from year to year depending on weather patterns. In 2008, electricity consumption in the United States decreased 0.4% from 2007, but the average growth rate in the past decade was approximately 1.3% per year according to EIA estimates. Because coal-fired generation is used in most cases to meet base load requirements, coal consumption has generally grown at the pace of electricity demand growth.

4

According to the World Coal Institute (“WCI”), in 2007 the United States ranked seventh among worldwide exporters of coal. Australia was the largest exporter, with other major exporters including Indonesia, the Russian Federation, Columbia, South Africa and China. According to EVA, United States exports increased by 37% from 2007 to 2008. The usage breakdown for 2008 United States coal exports of 80 million tons was 47% for electricity generation and 53% for steel production. In 2008, United States coal exports were shipped to more than 30 countries. The largest purchaser of United States exported utility coal in 2008 continued to be Canada, which took 19.1 million tons or 50% of total utility coal exports. This was up 31% compared to the 14.6 million tons exported to Canada in 2007. Overall steam coal exports increased 43% in 2008 compared to 2007. The largest purchasers of United States exported metallurgical coal were Brazil, which imported approximately 5.9 million tons, or 14%, and Canada, which imported 3.7 million tons, or 9%. In total, metallurgical coal exports increased 31% in 2008 compared to 2007.

Depending on the relative strength of the United States dollar versus currencies in other coal producing regions of the world, United States producers may export more or less coal into foreign countries as they compete on price with other foreign coal producing sources. Likewise, the domestic coal market may be impacted due to the relative strength of the United States dollar to other currencies, as foreign sources could be cost-advantaged based on a coal producing region’s relative currency position.

Since 2003, the global marketplace for coal has experienced swings in the demand/supply balance. In periods of supply shortfall, as occurred from 2003 to early 2006 and again in late 2007 through late 2008, the prices for coal reached record highs in the United States. The increased worldwide demand was primarily driven by higher prices for oil and natural gas and economic expansion, particularly in China, India, and elsewhere in Asia. At the same time, infrastructure and regulatory limitations in China contributed to a tightening of worldwide coal supply, affecting global prices of coal. The growth in China and India caused an increase in worldwide demand for raw materials and a disruption of expected coal exports from China to Japan, Korea and other countries. Since mid-2008, the United States and world economies have been in an economic recession and financial credit crisis, significantly reducing the demand for coal.

Metallurgical grade coal is distinguished by special quality characteristics that include high carbon content, volatile matter, low expansion pressure, low sulfur content, and various other chemical attributes. High vol met coal is also high in heat content (as measured in Btus), and therefore is desirable to utilities as fuel for electricity generation. Consequently, high vol met coal producers have the ongoing opportunity to select the market that provides maximum revenue and profitability. The premium price offered by steel makers for the metallurgical quality attributes is typically higher than the price offered by utility coal buyers that value only the heat content. The primary concentration of United States metallurgical coal reserves is located in the Central Appalachian region. EVA estimates that the Central Appalachian region supplied 89% of domestic metallurgical coal and 76% of United States exported metallurgical coal during 2007.

For utility coal buyers, the primary goal is to maximize heat content, with other specifications like ash content, sulfur content, and size varying considerably among different customers. Low sulfur coals, such as those produced in the western United States and in Central Appalachia, generally demand a higher price due to restrictions on sulfur emissions imposed by the Federal Clean Air Act, as amended, and implementing regulations (“Clean Air Act”) and the volatility in sulfur dioxide (“SO2”) allowance prices that occurred in recent years when the demand for all specifications of coal increased. SO2 allowances permit utilities to emit a higher level of SO2 than otherwise required under the Clean Air Act regulations. The demand and premium price for low sulfur coal is expected to diminish as more utilities install scrubbers at their coal-fired plants.

Coal shipped for North American consumption is typically sold at the mine loading facility with transportation costs being borne by the purchaser. Offshore export shipments are normally sold at the ship-loading terminal, with the purchaser paying the ocean freight. According to the National Mining Association (“NMA”), approximately two-thirds of United States coal shipments in recent years were transported via railroads. Final delivery to consumers often involves more than one transportation mode. A significant portion of United States production is delivered to customers via barges on the inland waterway system and ships loaded at Great Lakes ports.

5

Gwenco Mines

Gwenco holds approximately 30 coal leases, covering an estimated 700 acres, with approximately 9.8 million proven/probable reserves. At this time we cannot readily define the difference of assurance between “proven” and “probable” tons of coal in place in six seams. The primary reserves are in the Pond Creek, Lower Cedar Grove, and Taylor seams. Both the Pond Creek and Lower Cedars Grove seams are permitted and bonded and have been mined to a limited extent. The coal in the Pond Creek seam is low-sulfur, compliance coal, running at an average of 12,000 to 12,500 BTUs when mined clean. The coal in the Lower Cedar Grove seam has a shale parting and must be washed to be commercial. When cleaned it is a high BTU coal with certain metallurgical coal qualities.

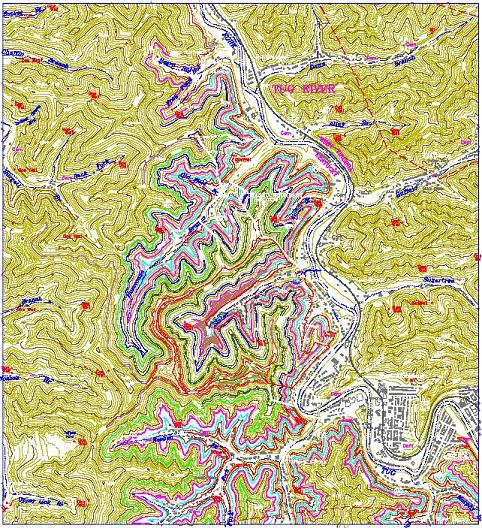

The following map provides the location of our operations within the Central Appalachian region:

Each seam has road access and can be reached by truck.

The following table provides key operational information on our Seams in 2010:

|

Seam

|

Active/

Inactive

|

Mine

Type

|

Active

Mine

Count (1)

|

Transportation

|

2010

Production

|

Year

Established

or

Acquired

|

|||||||||||||||

|

Winifrede

|

I | U | 0 |

Truck

|

0 | 2004 | |||||||||||||||

|

Taylor

|

I | U | 0 |

Truck

|

0 | 0 | 2004 | ||||||||||||||

|

Cedar Grove

|

I | U | 0 |

Truck

|

0 | 2004 | |||||||||||||||

|

Pond Creek

|

A | U | 1 |

Truck

|

32,898 | 2004 | |||||||||||||||

|

(1)

|

Active mine count as of March 31, 2011.

|

|

(1)

|

Active mine count as of March 31, 2011.

|

|

S

|

– surface mine

|

|

U

|

– underground mine

|

Mining Techniques

There are several basis techniques for mining drift or adit mines. We have used, and intend to use, a continuous miner on the Pond Creek seam at its Gwenco facility. We have used, and intend to use, a Joy 14-9 continuous miner at the Gwenco mines. In this technique, the miner has a cutting head that tears the coal from it natural deposit and transfers the coal to a gather head and then to shuttle cars that can carry from 3 to 10 tons depending on the size. This method can create higher volume mining than the conventional method, but may mine the coal with a higher content of ash.

Expansion Strategy

We seek to acquire new mines and contracting to produce and market additional coal in its geographic focus area. We intend to acquire and operate high quality coal properties with established field personnel, primarily in the eastern Kentucky coalfields, with additional properties in southwestern West Virginia and western Virginia. This region has an excellent infrastructure of workers, truckers, rail sidings on the CSX and N&W rail lines and low cost access to the Big Sandy barge docks near Ashland, KY, for effective coal distribution. We intend to use its local knowledge to pursue high returns on investment from re-opening profitable properties in this region. It intends to grow by additional accretive acquisitions, contract mining, and internal development of owned properties.

6

We are also seeking to diversify its operations into other sectors of the energy industry, including the oil and gas sector. Our coal miners collectively have over 50 years of mining experience. We may also engage key industry experts to assist in the analysis and funding of these properties. Our management believes that a successful diversification into the oil and gas field would provide us with an opportunity to improve its results of operations while hedging on coal production and prices.

Customers

We had 3 primary customers in the year ended December 31, 2010, which routinely purchase all the coal we can produce at spot market rates. To the extent that we are able to produce coal beyond the demands of these two customers, it intends to sell its remaining coal to other purchasers or on the spot market to coal brokers. We may seek to enter into long-term contracts (exceeding one year in duration) with customers if economic circumstances indicate that such arrangements would maximize profitability. These arrangements would allow customers to secure a supply for their future needs and provide us with greater predictability of sales volume and sales prices.

Competition

The coal industry in the United States is highly competitive. We compete with many large producers and other small coal producers. We also compete with other producers primarily on the basis of price, coal quality, transportation cost and reliability of supply. Many of our competitors are more viable, are better capitalized, and have greater financial resources than us. Continued demand for coal is also dependent on factors outside of our control, including demand for electricity, environmental and governmental regulations, weather, technological developments, and the availability and cost of alternative fuel sources.

The price at which our production can be sold is dependent upon a variety of factors, many of which are beyond our control. We sell coal on the spot-market and seek to sell coal under long-term contracts. Generally, the relative competitiveness of coal vis-a-vis other fuels or other coals is evaluated on a delivered cost per heating value unit basis. In addition to competition from other fuels, coal quality, the marginal cost of producing coal in various regions of the country and transportation costs are major determinants of the price for which our production can be sold. Factors that directly influence production cost include geological characteristics (including seam thickness), overburden ratios, depth of underground reserves, transportation costs and labor availability and cost. Underground mining has higher labor (including reserves for future costs associated with labor benefits and health care) and capital (including modern mining equipment and construction of extensive ventilation systems) costs than those of surface mining. In recent years, increased development of large surface mining operations, particularly in the western United States, and more efficient mining equipment and techniques, have contributed to excess coal production capacity in the United States. Competition resulting from excess capacity has encouraged producers to reduce prices and to pass productivity gains through to customers. Demand for our low sulfur coal and the prices that we will be able to obtain for it will also be affected by the price and availability of high sulfur coal, which can be marketed in tandem with emissions allowances.

Transportation costs are another fundamental factor affecting coal industry competition. Coordination of the many eastern loadouts, the large number of small shipments, terrain and labor issues all combine to make shipments originating in the eastern United States inherently more expensive on a per-mile basis than shipments originating in the western United States. Historically, coal transportation rates from the western coal producing areas into Central Appalachian markets limited the use of western coal in those markets. More recently, however, lower rail rates from the western coal producing areas to markets served by eastern producers have created major competitive challenges for eastern producers. Barge transportation is the lowest cost method of transporting coal long distances in the eastern United States, and the large numbers of eastern producers with river access keep coal prices competitive. We believe that many utilities with plants located on the Ohio River system are well positioned for deregulation as competition for river shipments should remain high for Central Appalachian coal. We also believes that with close proximity to competitively-priced Central Appalachian coal, utilities with plants located on the Ohio River system will become price setters in a deregulated environment.

Although undergoing significant consolidation, the coal industry in the United States remains highly fragmented. It is possible that our costs will not permit it to compete effectively with other producers seeking to provide coal to a customer; however, it is our goal to maintain low production costs, offer a variety of products and have develop access to multiple transportation systems that will enable it to compete effectively with other producers.

7

Environmental, Safety and Health Laws and Regulations

The coal mining industry is subject to regulation by federal, state and local authorities on matters such as the discharge of materials into the environment, employee health and safety, permitting and other licensing requirements, reclamation and restoration of mining properties after mining is completed, management of materials generated by mining operations, surface subsidence from underground mining, water pollution, water appropriation, and legislatively mandated benefits for current and retired coal miners, air quality standards, protection of wetlands, endangered plant and wildlife protection, limitations on land use, and storage of petroleum products and substances that are regarded as hazardous under applicable laws. The possibility exists that new legislation or regulations may be adopted that could have a significant impact on our mining operations or on our customers’ ability to use coal.

Numerous governmental permits and approvals are required for mining operations. Regulations provide that a mining permit or modification can be delayed, refused or revoked if an officer, director or a stockholder with a 10% or greater interest in the entity is affiliated with or is in a position to control another entity that has outstanding permit violations. Thus, past or ongoing violations of federal and state mining laws by individuals or companies no longer affiliated with us could provide a basis to revoke existing permits and to deny the issuance of addition permits. We are required to prepare and present to federal, state, or local authorities data and/or analysis pertaining to the effect or impact that any proposed exploration for or production of coal may have upon the environment, public and employee health and safety. All requirements imposed by such authorities may be costly and time-consuming and may delay commencement or continuation of exploration or production operations. Accordingly, the permits we need for our mining and gas operations may not be issued, or, if issued, may not be issued in a timely fashion. Permits we need may involve requirements that may be changed or interpreted in a manner that restricts our ability to conduct our mining operations or to do so profitably. Future legislation and administrative regulations may increasingly emphasize the protection of the environment, health and safety and, as a consequence, our activities may be more closely regulated. Such legislation and regulations, as well as future interpretations of existing laws, may require substantial increases in equipment and operating costs, delays, interruptions or a termination of operations, the extent of which cannot be predicted.

While it is not possible to quantify the expenditures we incur to maintain compliance with all applicable federal and state laws, those costs have been and are expected to continue to be significant. We post surety performance bonds or letters of credit pursuant to federal and state mining laws and regulations for the estimated costs of reclamation and mine closing, often including the cost of treating mine water discharge when necessary. Compliance with these laws has substantially increased the cost of coal mining for all domestic coal producers. We endeavor to conduct our mining operations in compliance with all applicable federal, state, and local laws and regulations. However, even with our substantial efforts to comply with extensive and comprehensive regulatory requirements, violations during mining operations occur from time to time.

Mine Safety and Health

Stringent health and safety standards have been in effect since Congress enacted the Federal Coal Mine Health and Safety Act of 1969. The Federal Coal Mine Safety and Health Act of 1977 significantly expanded the enforcement of safety and health standards and imposed safety and health standards on all aspects of mining operations. A further expansion occurred in June 2006 with the enactment of the Mine Improvement and New Emergency Response Act of 2006 (“MINER Act”).

The MINER Act and related Mine Safety and Health Administration (“MSHA”) regulatory actions require, among other things, improved emergency response capability, increased availability of emergency breathable air, enhanced communication and tracking systems, more available mine rescue teams, increased mine seal strength and monitoring of sealed areas in underground mines, and larger penalties by MSHA for noncompliance by mine operators. Coal producing states, including West Virginia and Kentucky, have passed similar legislation.

In 2008, MSHA published final rules implementing Section 4 of the MINER Act that addressed mine rescue, sealing of abandoned areas, refuge alternatives, fire prevention and detection, use of air from the belt entry and civil penalty assessments. MSHA also provided guidance on wireless communication and electronic tracking systems and new requirements for the plugging of coal bed methane wells with horizontal branches in coal seams. Two additional regulations were also published related to measures to achieve alcohol and drug free mines and the use of coal mine dust personal monitors. In February 2009, the United States Court of Appeals for the District of Columbia Circuit held that the 2008 rules were not sufficient to satisfy the requirements of the MINER Act in certain respects, and remanded those portions of the rules to MSHA for reconsideration. New rules issued by the MSHA will likely contain more stringent provisions regarding training of rescue teams.

8

On October 19, 2010, MSHA issued a proposed rule, 75 Fed. Reg. 64412 (“PR1”), which would lower the current two milligram dust standard to one milligram gradually over a two-year period, mandate the use of continuous personal dust monitors, address extended work shifts, redefine normal production shifts, require additional medical surveillance examinations for miners, and provide for the use of a single, full-shift sample to determine compliance.

The current respirable coal mine dust exposure standard would be reduced as follows:

|

|

●

|

The current limit would be lowered to 1.7 mg/m3 six months after the final rule's effective date.

|

|

|

●

|

The limit would be lowered to 1.5 mg/m3 12 months after the final rule's effective date.

|

|

|

●

|

The limit would be lowered to 1.0 mg/m3 24 months after the final rule's effective date.

|

|

|

●

|

The limit for miners who show evidence of developing pneumoconiosis would be reduced to 0.5 mg/m3 six months after the final rule's effective date.

|

|

|

●

|

Additionally, the limit for intake air at underground mines would be reduced to 0.5 mg/m3 six months after the final rule's effective date.

|

The PR1 would phase in the required use of the Continuous Personal Dust Monitor (“CPDM”). The CPDMs would electronically store all respirable dust sampling data collected during a shift and would be sent to MSHA electronically. The CPDMs would be optional for surface coal mines and for non-production areas of underground coal mines (such as outby areas).

Other changes include: requiring sampling of extended work shifts to account for occupational exposures of greater than eight hours per shift; requiring sampling when production is equivalent to or greater than the level of average production level over the last 30 production shifts; requiring spirometry testing, occupational history and symptom assessment to be implemented, in addition to the chest x-ray exam currently required for underground coal miners and medical surveillance; and finally, a single, full-shift sample collected by MSHA or the mine operator would be used to determine compliance rather than averaging multiple dust samples of different miners’ exposures per the current requirements.

The PR1 is out for comment until May 2, 2011.

On September 23, 2010, MSHA promulgated an Emergency Temporary Standard (“ETS”) requiring that the total incombustible content (“TIC”) of the combined coal, rock and other dusts in underground coal mines be at least 80%. 75 Fed. Reg. 57849 (Sept. 23, 2010). In addition, the ETS requires that where methane is present in any ventilating current, the TIC of such combined dust shall be increased 0.4% for each 0.1% of methane. The ETS revised the existing standard, 30 C.F.R. § 75.403, which permitted TIC of combined dusts to be 65% in areas of a mine other than return air courses.

The ETS serves as an emergency temporary final rule with immediate effect and provides for an opportunity for notice and comment, after which MSHA will issue a new final standard. The new final standard must be issued within nine months of the promulgation of the ETS and may differ from the ETS.

On February 2, 2011, MSHA published proposed changes to 30 C.F.R. Part 104 regarding the Pattern of Violations (“POV”) program (“PR2”). Under the PR2, MSHA will consider all significant and substantial (“S&S”) citations and orders issued, including non-final citations and orders, when determining POV status. The existing initial screening criteria found at 30 C.F.R. § 104.2 will be eliminated. Additionally, the PR2 removes the potential POV notice and instead will post the pattern criteria online so that operators can track their status. MSHA will also post compliance data that the agency will use on its website and provide access to mine operators in a searchable form. Finally, mines will be reviewed at least twice annually for POV status under the PR2. The new POV status will utilize similar criteria as to what is currently set forth in 30 C.F.R. § 104.3, including the history of S&S violations, § 104(b) failure to abate orders for S&S violations, § 104(d) citations and orders for an unwarrantable failure to comply, § 107(a) imminent danger orders, § 104(g) orders for untrained miner withdrawal orders, and other information “that demonstrates a serious safety or health management problem at the mine, such as accident, injury and illness records.” Mitigating circumstances will also be considered, including changes in ownership, however, it is unclear at what point in the process the mine operator may offer such information to MSHA.

9

The PR2 is out for comment until April 4, 2011.

On December 27, 2010, MSHA issued a proposed rule, 75 Fed. Reg. 81165 (“PR3”), to revise the requirements for pre-shift, supplemental, on-shift and weekly examinations of underground coal mines. The PR3 would add the requirement that operators identify violations of mandatory health or safety standards and would also require the mine operator to record and correct these violations, note the actions taken to correct the conditions and review with mine examiners (e.g., the mine foreman, assistant mine foreman or other certified persons) on a quarterly basis all citations and orders issued in areas where pre-shift, supplemental, on-shift and weekly examinations are required.

The PR3 is out for comment until February 25, 2011.

Kentucky, the state in which we operate, has state programs for mine safety and health regulation and enforcement. Collectively, federal and state safety and health regulation in the coal mining industry is perhaps the most comprehensive and pervasive system for protection of employee health and safety affecting any segment of industry in the United States. While regulation has a significant effect on our operating costs, our United States competitors are subject to the same regulation.

Safety performance is measured in a variety of different ways, including through accident and violation experience expressed in terms of Non-Fatal Days Lost (NFDL) injury incident rates, Total Reported Incident Rates (TRIR) and Violations per Inspection Day (VPID). The NFDL incident rate represents the number of non-fatal injuries that result in days away from work, statutory days charged, or days of restricted work activity annually per 100 employees. The TRIR represents the number of NFDL injuries, injuries requiring medical treatment and fatalities occurring annually per 100 employees. The VPID measure represents the average number of violations issued by MSHA per inspection day (each day constitutes 5 on-site inspection hours).

We have hired White Star Mining as our operator to conduct all of our mining operations. This third party operator hires its own employees for the mining operations. Our third party contractor keeps their own records regarding the safety performance of their company and their employees. We cannot provide the NFDL and TRIR information for that of our third party contractor.

In addition, our third party operator is responsible for any and all violations issued by MSHA or other regulatory agencies regarding their mining operations. We do not have access to the records of our third party contractor for their VPIP statistics.

Black Lung. Under federal black lung benefits legislation, each coal mine operator is required to make payments of black lung benefits or contributions to: (i) current and former coal miners totally disabled from black lung disease; and (ii) certain survivors of a miner who dies from black lung disease. The Black Lung Disability Trust Fund, to which we must make certain tax payments based on tonnage sold, provides for the payment of medical expenses to claimants whose last mine employment was before January 1, 1970 and to claimants employed after such date, where no responsible coal mine operator has been identified for claims or where the responsible coal mine operator has defaulted on the payment of such benefits. In addition to federal acts, we are also liable under various state statutes for black lung claims. Federal benefits are offset by any state benefits paid.

Coal Industry Retiree Health Benefit Act of 1992 and Tax Relief and Retiree Health Care Act of 2006. The Coal Industry Retiree Health Benefit Act of 1992 (“Coal Act”) provides for the funding of health benefits for certain UMWA retirees. The Coal Act established the Combined Benefit Fund (“CBF”) into which “signatory operators” and “related persons” are obligated to pay annual premiums for covered beneficiaries. The Coal Act also created a second benefit fund, the 1992 Benefit Plan, for miners who retired between July 21, 1992 and September 30, 1994 and whose former employers are no longer in business. On December 20, 2006, President Bush signed the Tax Relief and Retiree Health Care Act of 2006. This legislation includes important changes to the Coal Act that impacts all companies required to contribute to the CBF. Effective October 1, 2007, the SSA revoked all beneficiary assignments made to companies that did not sign a 1988 UMWA contract (“reachback companies”), but phased-in their premium relief. Effective October 1, 2007, reachback companies will pay only 55% of their plan year 2008 assessed premiums, 40% of their plan year 2009 assessed premiums, and 15% of their plan year 2010 assessed premiums. General United States Treasury money will be transferred to the CBF to make up the difference. After 2010, reachback companies will have no further obligations to the CBF, and transfers from the United States Treasury will cover all of the health care costs for retirees and dependents previously assigned to reachback companies.

10

Environmental Laws

Surface Mining Control and Reclamation Act. The Surface Mining Control and Reclamation Act, (“SMCRA”), which is administered by the Office of Surface Mining Reclamation and Enforcement (“OSM”), establishes mining, environmental protection, and reclamation standards for all aspects of surface mining as well as many aspects of deep mining. The SMCRA and similar state statutes require, among other things, the restoration of mined property in accordance with specified standards and an approved reclamation plan. In addition, the Abandoned Mine Land Fund, which is part of the SMCRA, imposes a fee on all current mining operations, the proceeds of which are used to restore mines closed before 1977. The maximum tax is $0.315 per ton on surface-mined coal and $0.135 per ton on deep-mined coal. A mine operator must submit a bond or otherwise secure the performance of its reclamation obligations. Mine operators must receive permits and permit renewals for surface mining operations from the OSM or, where state regulatory agencies have adopted federally approved state programs under the act, the appropriate state regulatory authority. We accrue for reclamation and mine-closing liabilities in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 410-20, “Asset Retirement and Environmental Obligations” (“ASC 410-20”).

Clean Water Act. Section 301 of the Clean Water Act prohibits the discharge of a pollutant from a point source into navigable waters of the United States except in accordance with a permit issued under either Section 402 or Section 404 of the Clean Water Act. Navigable waters are broadly defined to include streams, even those that are not navigable in fact, and may include wetlands. All mining operations in Appalachia generate excess material, which are typically placed in fills in adjacent valleys and hollows. Likewise, coal refuse disposal areas and coal processing slurry impoundments are located in valleys and hollows. These areas frequently contain intermittent or perennial streams, which are considered navigable waters under the Clean Water Act. An operator must secure a Clean Water Act permit before filling such streams. For approximately the past twenty-five years, operators have secured Section 404 fill permits that authorize the filling of navigable waters with material from various forms of coal mining. Operators have also obtained permits under Section 404 for the construction of slurry impoundments. Discharges from these structures require permits under Section 402 of the Clean Water Act. Section 402 discharge permits are generally not suitable for authorizing the construction of fills in navigable waters.

Clean Air Act. Coal contains impurities, including sulfur, mercury, chlorine, nitrogen oxide and other elements or compounds, many of which are released into the air when coal is burned. The Clean Air Act and corresponding state laws extensively regulate emissions into the air of particulate matter and other substances, including sulfur dioxide, nitrogen oxide and mercury. Although these regulations apply directly to impose certain requirements for the permitting and operation of our mining facilities, by far their greatest impact on us and the coal industry generally is the effect of emission limitations on utilities and other customers. Owners of coal-fired power plants and industrial boilers have been required to expend considerable resources to comply with these air pollution standards. The United States Environmental Protection Agency (“EPA”) has imposed or attempted to impose tighter emission restrictions in a number of areas, some of which are currently subject to litigation. The general effect of such tighter restrictions could be to reduce demand for coal. This in turn may result in decreased production and a corresponding decrease in revenue and profits.

National Ambient Air Quality Standards. Ozone is produced by a combination of two precursor pollutants: volatile organic compounds and nitrogen oxide, a by-product of coal combustion. Particulate matter is emitted by sources burning coal as fuel, including coal fired power plants. States are required to submit to EPA revisions to their State Implementation Plans (“SIPs”) that demonstrate the manner in which the states will attain National Ambient Air Quality Standards (“NAAQS”) every time a NAAQS is revised by EPA. In 2006, EPA adopted a new NAAQS for fine particulate matter, which a number of states and environmental advocacy groups challenged as not sufficiently stringent to satisfy Clean Air Act requirements. In February 2009, the United States Court of Appeals for the District of Columbia Circuit agreed that EPA had inadequately explained its decision regarding several aspects of the NAAQS and remanded those to EPA for reconsideration, a process that could lead to more stringent NAAQS for fine particulate matter. EPA also adopted a more stringent ozone NAAQS on March 27, 2008. Revised SIPs for both ozone and fine particulates could require electric power generators to further reduce particulate, nitrogen oxide, and sulfur dioxide emissions. In addition to the SIP process, the Clean Air Act permits states to assert claims against sources in other “upwind” states alleging that emission sources including coal fired power plants in the upwind states are preventing the “downwind” states from attaining a NAAQS. The new NAAQS for ozone and fine particulates, as well as claims by affected states, could result in additional controls being required of coal fired power plants and we are unable to predict the effect on markets for our coal.

11

Acid Rain Control Provisions. The acid rain control provisions promulgated as part of the Clean Air Act Amendments of 1990 in Title IV of the Clean Air Act (“Acid Rain program”) required reductions of sulfur dioxide emissions from power plants. The Acid Rain program is now a mature program and we believe that any market impacts of the required controls have likely been factored into the price of coal in the national coal market.

Regional Haze Program. EPA promulgated a regional haze program designed to protect and to improve visibility at and around so-called Class I Areas, which are generally National Parks, National Wilderness Areas and International Parks. This program may restrict the construction of new coal-fired power plants whose operation may impair visibility at and around the Class I Areas. Moreover, the program requires certain existing coal-fired power plants to install additional control measures designed to limit haze-causing emissions, such as sulfur dioxide, nitrogen oxide and particulate matter. States were required to submit Regional Haze SIPs to EPA by December 17, 2007. Many states did not meet the December 17, 2007, deadline and we are unable to predict the impact on the coal market of the failure to submit Regional Haze SIPs by the deadline or of any subsequent submissions deadlines.

New Source Review Program. Under the Clean Air Act, new and modified sources of air pollution must meet certain new source standards (“New Source Review Program”). In the late 1990s, EPA filed lawsuits against many coal-fired plants in the eastern United States alleging that the owners performed non-routine maintenance, causing increased emissions that should have triggered the application of these new source standards. Some of these lawsuits have been settled, with the owners agreeing to install additional pollution control devices in their coal-fired plants. The remaining litigation and the uncertainty around the New Source Review Program rules could adversely impact utilities’ demand for coal in general or coal with certain specifications, including the coal we produce.

Multi-Pollutant Strategies. In March 2005, EPA issued two closely related rules designed to significantly reduce levels of sulfur dioxide, nitrogen oxide and mercury: the Clean Air Interstate Rule (“CAIR”) and the Clean Air Mercury Rule (“CAMR”). CAIR sets a “cap-and-trade” program in 28 states and the District of Columbia to establish emissions limits for sulfur dioxide and nitrogen oxide, by allowing utilities to buy and sell credits to assist in achieving compliance with the NAAQS for 8-hour ozone and fine particulates. CAMR as promulgated will cut mercury emissions nearly 70% by 2018 through a “cap-and-trade” program. Both rules were challenged in numerous lawsuits and the United States Court of Appeals for the District of Columbia Circuit vacated CAMR and remanded it to EPA for reconsideration on February 8, 2008. In February 2009, EPA announced its intention to develop a technology-based standard under Section 112 of the Clean Air Act to address mercury emissions rather than pursue the “cap-and-trade” approach of CAMR. The same court vacated the CAIR on July 11, 2008, but subsequently revised its remedy to a remand to EPA for reconsideration on December 23, 2008. EPA is preparing its response to the remand, but the court did not impose a response date. Regardless of the outcome of litigation on either rule, stricter controls on emissions of SO2, NOX and mercury are likely in some form. Any such controls may have an impact on the demand for our coal.

Global Climate Change

The United States has not implemented the 1992 Framework Convention on Global Climate Change (“Kyoto Protocol”), which became effective for many countries on February 16, 2005. The Kyoto Protocol was intended to limit or reduce emissions of greenhouse gases, such as carbon dioxide. The United States has not ratified the emission targets of the Kyoto Protocol or any other greenhouse gas agreement among parties.

Nevertheless, global climate change continues to attract considerable public and scientific attention and a considerable amount of legislative attention in the United States is being paid to global climate change and the reduction of greenhouse gas emissions, particularly from coal combustion by power plants. Enactment of laws and passage of regulations regarding greenhouse gas emissions by the United States or some of its states, or other actions to limit carbon dioxide emissions, could result in electric generators switching from coal to other fuel sources.

12

Comprehensive Environmental Response, Compensation and Liability Act

The Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), and similar state laws affect coal mining operations by, among other things, imposing cleanup requirements for threatened or actual releases of hazardous substances that may endanger public health or welfare or the environment. Under CERCLA and similar state laws, joint and several liability may be imposed on waste generators, site owners and lessees and others regardless of fault or the legality of the original disposal activity. Although EPA excludes most wastes generated by coal mining and processing operations from the hazardous waste laws, such wastes can, in certain circumstances, constitute hazardous substances for the purposes of CERCLA. In addition, the disposal, release, or spilling of some products used by coal companies in operations, such as chemicals, could implicate the liability provisions of the statute. Under EPA’s Toxic Release Inventory process, companies are required annually to report the use, manufacture, or processing of listed toxic materials that exceed defined thresholds, including chemicals used in equipment maintenance, reclamation, water treatment and ash received for mine placement from power generation customers. Our current and former coal mining operations incur, and will continue to incur, expenditures associated with the investigation and remediation of facilities and environmental conditions under CERCLA.

Endangered Species Act

The federal Endangered Species Act and counterpart state legislation protect species threatened with possible extinction. Protection of endangered species may have the effect of prohibiting or delaying us from obtaining mining permits and may include restrictions on timber harvesting, road building, and other mining or agricultural activities in areas containing the affected species. Based on the species that have been identified on our properties to date and the current application of applicable laws and regulations, we do not believe there are any species protected under the Endangered Species Act that would materially and adversely affect our ability to mine coal from our properties in accordance with current mining plans.

Operations - Permitting; Compliance. We have obtained all the permits required for its current operations under the SMCRA, the Clean Water Act, the Clean Air Act, and corresponding state laws. We are currently, and intend to remain in compliance in all material respects with such permits and intend to routinely correct in a timely fashion violations of which it receives notice in the normal course of operations. The expiration dates of the permits are largely immaterial as the law provides for a right of successive renewal. The cost of obtaining surface mining, clean water, and air permits can vary widely depending on the scientific and technical demonstrations that must be made to obtain the permits. However, the cost of obtaining a permit is rarely more than $500,000 and of obtaining a renewal is rarely more than $5,000. It is impossible to predict the full impact of future judicial, legislative, or regulatory developments on our operations because the standards to be met, as well as the technology and length of time available to meet those standards, continue to develop and change.

The imposition of more stringent requirements under environmental laws or regulations, new developments or changes regarding site cleanup costs or the allocation of such costs among potentially responsible parties, or a determination that we are potentially responsible for the release of hazardous substances at sites other than those currently identified, could result in additional expenditures or the provision of additional accruals in expectation of such expenditures.

Coal Reserves

We estimate that, as of December 31, 2010, we have total reserves of approximately 9.8 million tons, of proven/probable reserves. “Reserves” are defined by Securities and Exchange Commission Industry Guide 7 as that part of a mineral deposit, which could be economically and legally extracted or produced at the time of the reserve determination. “Recoverable” reserves mean coal that is economically recoverable using existing equipment and methods under federal and state laws currently in effect. “Proven (Measured) Reserves” are defined by Securities and Exchange Commission Industry Guide 7 as reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. “Probable reserves” are defined by Securities and Exchange Commission Industry Guide 7 as reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. At this time, we cannot readily define the difference of assurance between “proven” and “probable” reserves.

13

The table below summarizes our reserves for each of our mines:

|

SEAM

|

TONS

|

CLASS

|

GRADE*

|

OWNED

|

LEASED

|

|

Winifede

|

214,650

|

Proven/Probable

|

STEAM

|

0

|

214,650

|

|

Taylor

|

1,783,500

|

Proven/Probable

|

STEAM

|

0

|

1,783,650

|

|

Cedar Grove

|

3,702,600

|

Proven/Probable

|

STEAM/NEAR MET

|

0

|

3,702,600

|

|

Pond Creek

|

4,027,762

|

Proven/Probable

|

STEAM/NEAR MET

|

0

|

4,027,762

|

|

TOTALS

|

9,728,512

|

Information about our reserves consists of estimates based on engineering, economic, and geological data assembled and analyzed by its contracted engineers, geologists, and finance associates. Reserve estimates are updated as deemed necessary by management using geologic data taken from drill holes, adjacent mine workings, outcrop prospect openings and other sources. Coal tonnages are categorized according to coal quality, seam thickness, mineability, and location relative to existing mines and infrastructure. In accordance with applicable industry standards, proven reserves are those for which reliable data points are spaced no more than 2,700 feet apart. Probable reserves are those for which reliable data points are spaced 2,700 feet to 7,900 feet apart. Further scrutiny is applied using geological criteria and other factors related to profitable extraction of the coal. These criteria include seam height, roof and floor conditions, yield, and marketability.

As with most coal-producing companies in Central Appalachia, all of our coal reserves are controlled pursuant to leases from third party landowners. These leases convey mining rights to the coal producer in exchange for a royalty payment to the lessor based on either a fixed amount per ton of coal mined or a percentage of gross sales price of coal mined. All of our leases have automatic renewal provisions. The royalties for coal reserves to landowners from our producing properties was approximately $303,467 for the year ended December 31, 2010 and $110,000 for the year ended December 31, 2009.

So long as the leases are maintained, we intend to mine all of the coal on the properties covering the leases, in large part due to the automatic renewal provisions. Should we receive a significant capital infusion allowing us to run full time continuous mining operations for all properties, we would expect to complete mining production in approximately 10 years. However, if we are unable to maintain our leases, we would be unable to maintain this production schedule. As of the date of this report, we have no mines open and are conducting no mining operations. Accordingly, we have no current scheduled production. Upon receipt of additional requisite funding, we plan to resume mining operations.

Our wholly-owned subsidiary, Gwenco, Inc., obtained Title Reports from an established law firm with offices in Kentucky and West Virginia with respect to the title to the real property subject to the Company’s leases and the rights described therein. Furthermore, we have obtained supplemental title reports from Appalachian Title Research, Inc. with respect to the title to real property subject to certain of our leases and the rights described therein.

14

The categorization of the “quality” (i.e., sulfur content, Btu, coal type, etc.) of coal reserves is as follows as of December 31, 2010:

|

Recoverable Reserves (1)

Sulfur Content |

||||||||||||||||||||

|

Seam

|

Recoverable

Reserves

|

+1% (2) |

-1% (2)

|

Compliance

(2)

|

Avg. Btu

as

Received (3)

|

|||||||||||||||

|

Winifrede

|

214,650 | 0 | 100 | % | 100 | % | 12,000-12,500 | |||||||||||||

|

Taylor

|

1,783,650 | 0 | 100 | % | 100 | % | 12,000-12,500 | |||||||||||||

|

Cedar Grove

|

3,702,600 | 0 | 100 | % | 100 | % | 12,000-12,500 | |||||||||||||

|

Pond Creek

|

4,027,762 | 0 | 100 | % | 100 | % | 12,000-12,500 | |||||||||||||

[Missing Graphic Reference]

|

(1)

|

The reserve numbers of each Seam contain a moisture factor specific to the particular reserves of that Seam. The moisture factor represents the average moisture present in our delivered coal.

|

|

(2)

|

+1% or -1% refers to sulfur content as a percentage in coal by weight. Compliance coal is less than 1% sulfur content by weight and is included in the -1% column.

|

|

(3)

|

Represents an estimate of the average Btu per pound present in our coal, as it is received by the customer.

|

Compliance compared to non-compliance coal

Coals are sometimes characterized as compliance or non-compliance coal. The phrase compliance coal, as it is commonly used in the coal industry, refers to compliance only with sulfur dioxide emissions standards imposed by Title IV of the Clean Air Act and indicates that when burned, the coal will produce emissions that will meet the current standard without further cleanup. A coal that is considered a compliance coal for meeting sulfur dioxide standards may not meet an emission standard for a different pollutant such as mercury. Moreover, the term compliance coal is always used with reference to the then current regulatory limit. Clean air regulations that further restrict sulfur dioxide emissions will likely reduce significantly the amount of coal that can be labeled compliance. Currently, coal classified as compliance coal will meet the power plant emission standard of 1.2 pounds of sulfur dioxide per million Btu’s of fuel consumed. At December 31, 2010, all of our coal reserves met the current standard as compliance coal.

Attached below is a table showing production results for the last three years for the Slater’s Branch location on our Pond Creek seam. We have done any drilling on the Cedar Grove, Winifrede or Taylor seams and as such we have no production rates for each of those seams.

|

Year

|

Clean Tons Severed

|

Clean tons sold

|

Weighted Average

Price per ton ($)(1)

|

|

2010

|

32,898

|

32,898

|

73

|

|

2009

|

24,222.15

|

24,222.15

|

66.57

|

|

2008

|

7,686.68

|

7,686.68

|

97.15

|

|

(1)

|

The weighted average calculation is the sum of the daily tonnage sold multiplied by the average daily vender price per ton divided by annual tonnage results.

|

15

Our Slater’s Branch location at Pond Creek has road access and can be reached on trucks. The minable coal thickness is 29” to 49”. We run a continuous mining operation using shuttle cars, conveyer belts and continuous miners. We have contracted White Star Mining to conduct all mining operations at this location. This mine is currently closed. We intend to reopen upon receiving the requisite additional funds.

Employees

We currently employ one person, our President, Eugene Chiaramonte, Jr. All other personnel who provide services for us, whether in administration or in mining operations, either work on an independent contractor basis or work for White Star Mining under a contract mining arrangement. None of our employees are represented by a labor union, and we have not entered into a collective bargaining agreement with any union. We have not experienced any work stoppages and believe that it has good relations with its employees.

Business Development of Kentucky

Quest Minerals (Nevada), was organized on November 19, 2003 to acquire and operate privately held coal mining companies in the southeast United States.

Reverse Merger. We were incorporated on November 21, 1985 in the State of Utah under the name “Sabre, Inc.” It subsequently changed its name to Tillman International, Inc., or Tillman. On February 9, 2004, Quest Minerals (Nevada) completed a “reverse merger” with Tillman. On April 8, 2004, Tillman changed its name to “Quest Minerals & Mining Corp.”

Gwenco Acquisition. Effective April 28, 2004, Quest Minerals (Nevada) acquired 100% of the outstanding capital stock of Gwenco in exchange for 1,386,275 shares of Series B preferred stock of Quest Minerals (Nevada) and the assumption of up to $1,700,000 in debt. Each share of Series B preferred stock carries a liquidation preference of $2.50 per share and is convertible into shares of Quest’s common stock.

16

Item 1A. RISK FACTORS AND CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

An investment in our common stock involves a high degree of risk. You should carefully consider the following risk factors and the other information in this report before investing in our common stock. Our business and results of operations could be seriously harmed by any of the following risks. The trading price of our common stock could decline due to any of these risks, and you may lose part or all of your investment.

We have received a notice from our secured lender under our exit facility alleging defaults thereunder who could seek liquidation of our assets. On June 14, 2010, our secured lender under the exit facility, delivered a notice of default relating to that certain Loan and Security Agreement dated March 8, 2010. Under the notice, our alleged an Event of Default under the Loan Agreement occurred and was continuing pursuant to Section 8.21 thereunder as they allegedly deemed itself “insecure” under the Loan Agreement. We have denied our secured allegation of an Event of Default under the Loan Agreement and contend that no such Event of Default under the Loan Agreement has occurred or is continuing. On June 17, 2010, Gwenco and our secured lender entered into an agreement pursuant to which, among other things, our secured lender agreed to forbear under the Loan Agreement for a period of 90 days. On November 4, 2010, our secured lender delivered another notice of default relating to the Loan and Security Agreement, realleging that an Event of Default under Loan Agreement occurred and was continuing. We deny the allegations under all notices of an Event of Default under the Loan Agreement and contend that no such Event of Default under the Loan Agreement has occurred or is continuing. We continue to contend that no default under the exit facility has occurred. To date, our secured lender has not commenced any legal proceedings against us. However, if our secured lender were to commence litigation and was successful proving a default thereunder, they could seek to liquidate our assets.

Our wholly owned subsidiary, Gwenco, Inc., is emerging from bankruptcy protection; however, it is still possible that its assets may be liquidated in the future. On March 2, 2007, our wholly owned subsidiary, Gwenco, Inc., filed a voluntary petition for reorganization under Chapter 11 of the U.S. Bankruptcy Code with the United States Bankruptcy Court for the Eastern District of Kentucky. Prior to October 12, 2009, Gwenco oversaw its operations as a debtor in possession, subject to court approval of matters outside the ordinary course of business. In 2007, the Bankruptcy Court approved Gwenco’s request for debtor-in-possession financing in an amount of up to $2,000,000 from holders of Gwenco’s existing debt obligations in order to fund operating expenses. Under Chapter 11, all claims against Gwenco in existence prior to the filing of the petitions for reorganization relief under the federal bankruptcy laws were stayed while Gwenco was in bankruptcy. On September 30, 2009, the Bankruptcy Court confirmed Gwenco’s Plan of Reorganization (the “Plan”). Secured and non-priority unsecured classes of creditors voted to approve the Plan, with over 80% of the unsecured claims in dollar amount voting for the plan, and over 90% of responding lessors supporting it. The Plan became effective on October 12, 2009.

Even though the Bankruptcy Court has confirmed the Plan, it is still possible that the Bankruptcy Court could convert Gwenco’s case to Chapter 7 and liquidate all of Gwenco’s assets if the Court determines that Gwenco is unable to perform under the Plan. The Court could make such a determination upon motion of any creditor, other party to the action, or on its own motion. In the case of a Chapter 7 conversion, the Company would be materially impacted and could lose all of its working assets and have only unpaid liabilities. In addition, the Company might be forced to file for protection under Chapter 11 as it is the primary guarantor on a number of Gwenco’s contracts.

Equipment breakdowns and a shortage of supplies have caused significant work stoppages. Unless we receive significant additional working capital, it is likely that these breakdowns and shortages will continue. During the past two fiscal years, we have been forced to suspend its mining operations for approximately two out of five days, on average, due to either breakdowns in equipment or a lack of necessary supplies. We require significant additional working capital to maintain, repair, or replace its equipment and to maintain adequate inventories of supplies in order to significantly reduce these work stoppages. It is possible that we may not be able to obtain such additional working capital in the amounts necessary to reduce these work stoppages. If we are unable to obtain such working capital, significant work stoppages are to likely to continue.

We have issued a substantial number of securities convertible into shares of our common stock which will result in substantial dilution to the ownership interests of our existing stockholders. As of April 12, 2011, approximately 45,589,707,032 shares of our common stock were required for issuance upon exercise or conversion of the following securities (without regard to any limitations on conversion): (i) 45,307,529,032 shares representing shares of common stock issuable upon conversion in full of our outstanding convertible promissory notes or claims with conversion options (without regard to any limitations on conversion); (ii) 32,178,000 shares of common stock issuable upon conversion of our Series A Preferred (without regard to any limitations on conversion) and (iii) 250,000,000 shares were reserved for exercise of outstanding options. The exercise or conversion of these securities will result in a significant increase in the number of outstanding shares and substantially dilute the ownership interests of our existing shareholders. In addition, any decrease in our stock price will result in additional shares of common stock required for issuance upon exercise or conversion of the securities set forth above. Furthermore, the conversion prices set in many of our convertible securities do not adjust in the event of a stock split or reverse stock split.

17

The issuance of shares upon conversion of our convertible securities may cause immediate and substantial dilution to our existing stockholders. The issuance of shares upon conversion of our outstanding convertible notes or Series A Preferred Stock may result in substantial dilution to the interests of other stockholders since the selling stockholders may ultimately convert and sell the full amount issuable on conversion. Although the selling stockholders may not convert their convertible notes if such conversion would cause them to own more than 4.99% of our outstanding common stock, this restriction does not prevent the selling stockholders from converting some of their holdings and then converting the rest of their holdings. In this way, the selling stockholders could sell more than this limit while never holding more than this limit. There only upper limit on the number of shares that may be issued is the number of shares of common stock authorized for issuance under our articles of incorporation. The issuance of shares upon conversion of the convertible notes will have the effect of further diluting the proportionate equity interest and voting power of holders of our common stock. Furthermore, the conversion prices set in many of our convertible securities do not adjust in the event of a stock split or reverse stock split.

The issuance of shares of common stock to consultants may cause immediate and substantial dilution to our existing stockholders. We have established, and my establish in the future additional, stock incentive plans under which we may issue various types of awards, including common stock awards. We currently pay certain consultants and are likely to continue to pay consultants in the future with stock awards under these plans. The issuance of stock awards to consultants will have the effect of further diluting the proportionate equity interest and voting power of holders of our common stock.