Attached files

| file | filename |

|---|---|

| EX-10.16 - ABSTRACT FOR THE LEASE - Clavis Technologies International Co., Ltd. | clavis_10k-ex1016.htm |

| EX-31.1 - CERTIFICATION - Clavis Technologies International Co., Ltd. | clavis_10k-ex3101.htm |

| EX-32.1 - CERTIFICATION - Clavis Technologies International Co., Ltd. | clavis_10k-ex3201.htm |

| EX-31.2 - CERTIFICATION - Clavis Technologies International Co., Ltd. | clavis_10k-ex3102.htm |

| EX-32.2 - CERTIFICATION - Clavis Technologies International Co., Ltd. | clavis_10k-ex3202.htm |

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended

|

December 31, 2010

|

OR

|

o

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from __________________ to __________________

Commission File Number 000-54055

CLAVIS TECHNOLOGIES INTERNATIONAL CO., LTDC.

(Name of small business issuer in its Charter)

|

Nevada

|

27-1505309

|

|

(State of Other Jurisdiction of

Incorporation or Organization)

|

(IRS Employer

Identification No.)

|

#1564-1, Seojin Bldg., 3rd Floor, Seocho3-Dong, Seocho-Gu, Seoul, Korea 137-874

(Address of Principal Executive Offices and Zip Code)

(011) 82-2-3471-9340

(Registrant’s telephone number, including area code)

Securities registered under Section 12 (b) of the Act: None

Securities registered under Section 12 (g) of the Act:

Common Stock, $0.001 par value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

Yes o

|

No x

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

Yes o

|

No x

|

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a small reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o |

| Non-accelerated filer o (Do not check if smaller reporting company) | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of June 30, 2010, the aggregate market value of voting common stock held by non-affiliates of the Registrant (49,475,200 shares) was approximately $263,703. The aggregate market value was computed by reference to the last sale price of such common equity as of that date.

As of April 15, 2011, the issuer had 62,375,200 shares of Common Stock outstanding.

Documents Incorporated by Reference: None

INDEX

|

Page

|

||

|

PART I

|

||

|

Item 1.

|

Business

|

1

|

|

Item 1A.

|

Risk factors

|

20

|

|

Item 1B.

|

Unresolved Staff Comments

|

20

|

|

Item 2.

|

Properties

|

20

|

|

Item 3.

|

Legal Proceedings

|

20

|

|

Item 4.

|

[Reserved]

|

20

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

21

|

|

Item 6.

|

Selected Financial Data

|

21

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

21

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

29

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

F-1 |

|

Item 9.

|

Changes In and Disagreements With Accountants on Accounting and Financial Disclosure

|

30 |

|

Item 9A.

|

Controls and Procedures

|

30

|

|

Item 9B.

|

Other Information

|

30

|

| 31 | ||

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

32

|

|

Item 11.

|

Executive Compensation

|

33

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

34

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

35

|

|

Item 14.

|

Principal Accounting fees and Services

|

|

|

PART IV

|

|

|

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

35

|

|

|

||

|

SIGNATURES

|

37

|

|

|

CERTIFICATIONS

|

|

i

PART I

This Form 10-K contains forward-looking statements. For this purpose, any statements contained in this Form 10-K that are not statements of historical fact may be deemed to be forward-looking statements. You can identify forward-looking statements by those that are not historical in nature, particularly those that use terminology such as “may,” “will,” “should,” “could,” “expects,” “anticipates,” “contemplates,” “estimates,” “believes,” “plans,” “projected,” “predicts,” “potential,” or “continue” or the negative of these similar terms. In evaluating these forward-looking statements, you should consider various factors, including those listed in the “Risk Factors” section of our registration statement on Form S-1 (SEC File No. 333-164589). The Company’s actual results may differ significantly from the results projected in the forward-looking statements. The Company assumes no obligation to update forward-looking statements.

As used in this Form 10-K, references to the “Company,” the “Registrant,” “we,” “our,” or “us” refer to Clavis Technologies International Co., Ltd. unless the context otherwise indicates.

ITEM 1. BUSINESS

Clavis Technologies International Co., Ltd., a Nevada corporation ("the Company"), was incorporated in Nevada on September 10, 2009. On December 1, 2009, the Company entered into a definitive Share Exchange Agreement with Clavis Technologies Co., Ltd., a Korean corporation (“Clavis Technologies” or “Clavis Korea”), and the shareholders of Clavis Korea. Pursuant to the agreement, the Company acquired 100% of the issued and outstanding capital stock of Clavis Korea in exchange for 45,000,000 shares of the Company’s common stock, representing approximately 75% of the issued and outstanding stock of the Company. Clavis Korea was incorporated under the laws of Republic of Korea on January 28, 2003. Clavis Korea is located in Seoul, Korea, and has been engaged in the development of global Electronic Product Code (EPC) network software. The Company’s goal is to be a global player in ubiquitous computing solutions using its proprietary Radio Frequency Identification (“RFID”) middleware which is based on the Electronic Product Code Network and mobile financial solutions.

Clavis Technologies has been providing RFID-enabled solutions, including business processes, based on the EPCglobal standard s to various industrial markets as a vendor of RFID technology since 2003. EPCglobal is a joint venture between GS1 (formerly known as EAN International) and GS1US (formerly known as Uniform Code Council, Inc.). GS1 is an international not-for-profit association dedicated to the development and implementation of global standards for supply and demand chains. GS1US is the U.S. member of GS1. According to Wikipedia, the GS1 System of standards, including EPCglobal Gen 2, is the most widely-used supply-chain standards system in the world. On its web site, GS1 states that its global system is used by over one million companies doing business across 145 countries.

As Clavis Technologies combines its products, expertise, partnerships and integration capability into solutions for a wide range of device computing applications, Clavis Technologies enables its clients to tap into the wealth of data captured by networked devices such as RFID readers or handheld devices to extend the quality of valuable information to any device where companies or their customers need.

Historically, Clavis Technologies has concentrated on the RFID business as a provider that sold only RFID middleware. As the RFID market has experienced significant growth recently, Clavis Technologies has launched its framework-based product packages, which has been developed since 2003, including added-value RFID applications that can be customized for a broad range of industries. Because our RFID middleware is based on the open standards by EPCglobal, we do not maintain any copyright protection for our RFID middleware. In addition, we currently do not have any patent or other intellectual property protection for any of our products and services. See the section entitled “Our Intellectual Property” on page 35 of this prospectus.

Currently, our results are heavily dependent upon sales to the retail and business to business markets. Our customers are dependent upon retail sales, which are susceptible to economic cycles and seasonal fluctuations. Furthermore, as approximately two-thirds of our revenues and operations are located outside the U.S., fluctuations in foreign currency exchange rates have a significant impact on reported results. Our primary geographic markets are the Republic of Korea, where almost all of our revenue has been earned, and Thailand, where we have not yet earned any revenue but we are actively seeking business in this country. For the year ended December 31, 2010, the two largests largest customers accounted for 81% of sales and for the year ended December 31, 2009, the three largest customers accounted for 66% of sales. In 2010, the Korean Ministry of Unification (52%) and Shinsegae I&C (29%) accounted for approximately 81% of sales. In 2009 Korea Pallet Pool Co., Ltd. (35.28 %), The Korean Ministry of Unification (15.2%) and KTNetworks (15.44%) accounted for approximately 66% of sales.

1

We believe that some markets we serve are slowing as a result of the global recession. In response to the current global market conditions, we are moving forward with initiatives to improve working capital to mitigate the effects of the economy on our business. We believe that the strength of our core business and our ability to generate positive cash flow will sustain Clavis Technologies International through this challenging period.

Our business plan is to generate sustained revenue growth through selected investments in product development and marketing. Revenue growth may also be generated by acquisitions of other companies that we may identify to expand our product offerings and/or customer base. We currently do not have any acquisitions targeted during 2011.

What is RFID

Radio frequency identification (RFID) is hardly a new technology. The concept was first developed over 50 years ago as a method of identifying friendly aircraft during World War II. In the past ten years, however, the technology has received great attention due to a confluence of events, including technology advancement, heightened security concerns and a greater emphasis on cost control.

In general terms, RFID is a means of identifying a person or object using a radio frequency transmission. In fact, the word transponder is a combination of transmit and respond. In basic terms, a transponder will identify itself when it detects a signal from a compatible device, known as a reader or interrogator, in an RFID system.

In a typical RFID system, transponders, often called tags, are attached to objects. Each tag carries with its information: a serial number, model number, color, place of assembly or any other imaginable data. When these tags pass through a field generated by a compatible reader, they transmit this information back to the reader, thereby identifying the object.

Tag technology generally dictates the operating parameters of an RFID system. Operating frequencies and tag power source are two of the many factors influencing performance. Some systems can only read tags one-by-one as they pass a reader on a conveyor belt, while others can identify 50 tags as a forklift exits a loading dock door. No single combination is best suited for all applications, despite some manufacturers’ contentions.

Critical performance variables in an RFID system involve the range at which communication can be maintained, the size of the information space contained on the tag, the rate at which the communication with the tag can take place, the physical size of the tag, the ability of the system to "simultaneously" communication with multiple tags, and the robustness of the communication with respect to interference due to material in the path between the reader and the tag. Several factors determine the level of performance that can be achieved in these variables. The factors include the legal/regulatory emission levels allowed in the country of use, whether or not a battery is included in the tag to assist its communication back to the reader, and the frequency of the RF carrier used to transport the information between the tag and the reader.

According to a 2007 market report by IDTechEx Ltd. entitled “RFID Forecasts, Players and Opportunities 2007 (“IDTechEx RFID Market Report”), the number of items that will have RFID tags that identify each individual unit, case or pallet will increase significantly by 2017. The IDTechEx RFID Market Report projects approximately 18.54 billion RFID tags will be sold in 2010 and that such number will increase to approximately 669.75 billion tags by 2017. Add to this capacity the ability, through wireless, to track tagged items in real-time and what emerges is a smart network of connected items each item tagged, tracked, and connected. IDTechEx is a consulting firm that provides independent research, analysis and advisory services regarding printed and thin film electronics, RFID and smart packaging.

RFID employs Radio Frequency Communications to exchange data between a portable memory device and a host computer or PLC. An RFID system typically consists of a "Tag/Label/Printed Circuit Board (PCB)" containing data storage, an Antenna to communicate with the Tag, and a Controller to manage the communication between the Antenna and the PC or PLC; the terms Reader or Reader/Writer are used when the Antenna and Controller are combined in a single housing.

The Tag/Label/PCB is commonly attached to a product carrier, tote or even the product itself, providing a remote database that travels with the product.

What is the Difference between Auto-ID and RFID

Automatic identification, or Auto ID for short, is the broad term given to technologies that are used to help machines identify objects. There are a host of technologies that fall under the Auto-ID umbrella, including bar codes, smart cards, voice recognition and similar technologies. Radio frequency identification (RFID) is one type of Auto-ID technology. It uses radio waves to automatically identify individual items.

2

What is the significant advantage of RFID systems?

The significant advantage of all types of RFID systems is the non-contact, non-line-of-sight nature of the technology. Tags can be read through a variety of substances such as snow, fog, ice, paint, crusted grime, and other visually and environmentally challenging conditions where barcodes or other optically read technologies would be useless. RFID tags can also be read in challenging circumstances at remarkable speeds, in most cases responding in less than 100 milliseconds. The read/write capability of an active RFID system is also a significant advantage in interactive applications such as work-in-process or maintenance tracking. Though it is a costlier technology (compared with barcode), RFID has become indispensable for a wide range of automated data collection and identification applications that would not be possible otherwise.

Primary Components of an RFID system

RFID systems are comprised of three main components:

|

●

|

Tags/Labels/PCBs;

|

|

|

●

|

Antennas; and

|

|

●

|

Controllers (transceiver with decoder)

|

[A simple Read/Write RFID system]

Tag/Label/PCB

An RFID Tag/Label/PCB contains a coil, a programmed silicon chip and in Active Read/Write systems, a battery.

Tags

Tags come in a variety of sizes, memory capacities, temperature survivability and ranges. Tags can be small enough to inject into animals or large enough to cover an entire desktop. Nearly all tags are encapsulated for durability against shock, chemicals, moisture and dirt. While tags are immune to most environmental factors, their Read/Write ranges may be affected by close proximity to metal and electromagnetic radiation.

Tags can be powered by an internal battery (often called an "Active Tag") or by inductive coupling ("Passive Tag"). Passive Tags have zero maintenance requirements and virtually an unlimited life span. The life span of an Active Tag can be limited by the battery life, although some Tags offer replaceable batteries or extremely large capacity batteries.

Labels

Labels have printed, punched, etched or deposited RF coils on a paper/polyester substrate with a memory chip. Although less resistant to environmental conditions than the encapsulated tags, the labels provide distinct, low-cost benefits in open-loop (or disposable) applications. If the label is involved in an open-loop system, it is affixed onto the product itself and is shipped throughout the complete supply chain. The reference to disposability in this application is the fact that when the item is eventually purchased by the consumer (e.g. a PC), it is taken out of the supply chain loop. This is in contrast to reusable Tag applications such as pallet tracking in which the Tag will remain in the supply chain indefinitely. The low cost makes Labels extremely attractive for high-volume applications.

PCBs (Printed Circuit Boards)

PCBs (Printed Circuit Boards) are meant to be embedded into a product or carrier. Although impervious to high temperatures, such as is found in plastic pallet manufacturing, the PCB requires some encapsulation if it is to have direct contact with outside environmental conditions (e.g. rain, excessive moisture, etc.). The benefits of RFID PCBs are the low cost and the ability to endure environments in which Labels would not survive. Plastic pallet manufacturing provides a good example of applying an RFID PCB. The PCB is placed inside the plastic pallet prior to the ultrasonically welding phase of the plastic pallet manufacturing cycle. The PCB converts the pallet to a "Smart Pallet," and data can be read and written to the pallet throughout the complete supply chain.

3

Antennas

An antenna is a device that uses radio waves to read and write data to the Tags/Labels/PCBs. Some systems use separate antennas and controllers, while other systems integrate the antenna and controller into a single reader or reader/writer. Antennas can be found in all shapes and sizes, including antennas which can fit into very tight spaces and larger antennas for greater read/write ranges. In addition, the antennas provide unique solution features. One such example is the submersible antennas used for media disc drive applications. The antenna is mounted under de-ionized water to read/write data to the tags while submerged. Other examples include antennas that offer portals around conveyors or even dock doors. These portals (also called tunnels and gates) read or write to Tags/Labels/PCBs as they pass through.

Controllers

The controller manages the communication interface between an antenna and a PC, PLC, Server or Network Interface Module. The host system interfaces with the controller and directs the interrogation of the tag via parallel, serial or bus communications. RFID controllers can also be programmed to perform process control directly from the data in the tag memory. Some controllers even feature direct I/O points that can be activated by the controller, making it possible to lessen the work load of the host system.

Types of RFID

Our software products can be adopted for use with any type of RFID tag system Read Only, Read/Write (Reusable) and/or Read/Write (Disposable), as described below. Consequently, the type of RFID is not a barrier to use of our RFID software products.

Read-Only

Read accuracy is often a critical factor in choosing RFID. With fixed position barcode readers, achieving a first-pass read accuracy of 95% to 98% is quite respectable. Depending on environmental conditions and maintenance, barcode read rates often decline to less than 90% over time. In most environments, RFID can achieve 99.5% to 100% first-pass read rates, according to a white paper issued by Nokia Inc. in April 2006 entitled “Radio Frequency Identification Technology”. Further, with no moving parts or optical components, maintenance is not an issue.

Read accuracy is often a critical factor in choosing RFID. With fixed position barcode readers, achieving a first-pass read accuracy of 95% to 98% is quite respectable. Depending on environmental conditions and maintenance, barcode read rates often decline to less than 90% over time. In most environments, RFID can achieve 99.5% to 100% first-pass read rates. Further, with no moving parts or optical components, maintenance is not an issue.

The demands of industrial environments also favor RFID. Some environments require data collection systems to operate while immersed in fluids, chemicals, dirt and heat. Examples include applications where tags and antennas transfer data while completely submerged in water, or even cases where tags pass through paint ovens at 240°C.

The value of RFID is further realized when considering line-of-sight requirements. With RFID, the tag does not have to be visible to the face of the reader. With the ability to penetrate most non-metallic materials (assuming the proper frequency is used), RFID tags can be embedded in totes, containers or even products. Moreover, these containers and products can be sealed in over-pack materials without any adverse effects on the data capture results.

Read/Write (Reusable)

In a more advanced system (read/write), RFID can be used as a dynamic electronic manifest, allowing users to reduce traffic on networks, link remote production stations and to backup host PCs or PLCs. As an example of this electronic manifest, in automotive engine manufacturing, the tag is attached to an engine carrier. Routing and build instructions are written to the tag. As the engine and carrier approach the first station, the tag is interrogated by a reader/writer to determine whether or not the engine should be at the station. If affirmative, the build information is read off the tag and transferred to the local processor, there decisions are made on how to instruct the automated equipment. After the operations are performed, key quality data and/or production results are stored on the tag. This allows users to later investigate any quality issues across varying lots. In the case where the operation is unsuccessful, this failure is also written to the tag. Then, prior to reaching the next station, the engine is removed from the line and transferred to a remote rework station. At the rework station, the tag is read to determine how the engine must be repaired.

In the electronic industry, several companies are taking the electronic manifests even further, enabling production operations to continue even if the central server or host fails. Since a tag can combine with a local processor at a given station to communicate all build instructions to that station, operations can be conducted without any dependency on the network.

4

Read/Write (Disposable)

In an even more advanced state, disposable labels are applied to products during manufacturing and utilized throughout the entire supply chain (from manufacturing through retail and out to the customers). In essence, the RFID labels are used to create "smart products" that can communicate with their surroundings.

Applying RFID labels directly to television sets illustrates the value of creating "smart products." During production, RFID labels are applied to the inside of the televisions' housings. After utilizing the labels during production (as explained above), the labels accompany the "smart products" into the warehouse. In the warehouse, the labels are used for either locating given model or routing different models to intended storage locations. Further, with the ability of reader/writers to communicate with multiple labels in the same field, all televisions can be read or written to as they exit the warehouse, regardless of whether the televisions are stacked on pallets or transported separately. This enables users to write destination information to the "smart products" and to record what has been shipped, providing the trigger for electronic billing. Upon reaching the retail warehouse, the "smart products" are read upon entering the building, providing instant receipt into inventory and automatic payment clearance for suppliers. The "smart products" are then tracked into the retail outlet where the label is used for anti-theft and real-time inventory. Finally, as the televisions leave the outlet, key customer and product configuration information is written to the RFID labels. If a customer returns a given television set to the Service Center (or affiliated Service Center), the product's complete record is pulled up on a computer monitor prior to the customer reaching the service counter, bringing service to a new level.

The example reveals how "smart products" not only save money throughout the supply chain, but also add value for the customer. This value-added feature is being used by manufacturers (and retailers) to distinguish their products against competitive offerings, enabling the manufacturers to increase sales and/or margins.

EPC Network (Auto-ID)

The concept of EPC Network comes from Auto-ID and these words are used interchangeably.

Automatic identification, or Auto-ID for short, is the broad term given to a host of technologies that are used to help machines identify objects. Auto identification is often coupled with automatic data capture. That is, companies want to identify items, capture information about them and somehow get the data into a computer without having employees type it in.

The aim of most Auto-ID systems is to increase efficiency, reduce data entry errors, and free up staff to perform more value-added functions. There are a host of technologies that fall under the Auto-ID umbrella. These include bar codes, smart cards, voice recognition, some biometric technologies (retinal scans, for instance), optical character recognition, radio frequency identification (RFID) and others.

The EPC Network (Auto-ID) is comprised of five fundamental elements:

EPC- The Electronic Product Code (EPC) is the next generation of product identification. Like the U.P.C. (Universal Product Code) or bar code, the EPC is divided into numbers that identify the manufacturer, product, version and serial number. But, the EPC uses an extra set of digits to identify unique items. The EPC is the only information stored on the EPC tag. This keeps the cost of the tag down and provides flexibility, since an infinite amount of dynamic data can be associated with the serial number in the database.

EPC Tags and Readers - The EPC Network is an RFID-based system that uses radio frequency to communicate between readers and tags. The EPC (a number for uniquely identifying an item) is stored on a special tag. These tags will be applied during the manufacturing process. In turn, using radio waves, the tags will “communicate” their EPCs to readers, which will then pass the information along to a computer or local application system.

Object Name Service (ONS) - The vision of an open, global network for tracking goods requires some special network architecture. Since only the EPC is stored on the tag, computers need some way of matching the EPC to information about the associated item. That’s the role of the Object Name Service (ONS), an automated networking service similar to the Domain Name Service (DNS) that points computers to sites on the World Wide Web.

Physical Markup Language (PML) - The Physical Markup Language (PML) is a new standard “language” for describing physical objects. When finalized, it will be based on the widely accepted extensible Markup Language (XML). Together with the EPC and ONS, PML completes the fundamental components needed to automatically link information with physical products. The EPC identifies the product; the PML describes the product; and the ONS links them together. Standardizing these components will provide “universal connectivity” between objects in the physical world.

5

ALE (Application Level Events) - ALE is software technology designed to manage and move information in a way that does not overload existing corporate and public networks. ALE uses a distributed architecture, meaning it runs on different computers distributed through an organization, rather than from one central computer. ALEs are organized in a hierarchy and act as the nervous system of the new EPC Network, managing the flow of information.

With this new EPC network, computers will be able to “see” physical objects, allowing manufacturers to be able to track and trace items automatically throughout the supply chain. This technology will revolutionize the way companies manufacture, sell and buy products.

RFID Market

Background

In recent years, the most RFID markets have experienced considerable growth in the size of orders experienced by companies in this market segment. For example, there was a 900 million China ID card commitment delivered in 2008, which is more than ten times anything that came before. In 2007, UPM Raflatac landed an order to supply 30 million RFID tickets a months to Moscow transport system. In August 2006, Confidex secured an order in China for 125 million smart tickets. Prior to that order, the largest single orders worldwide for such tickets were 50 million and 20 million units in 2005 and 2004, respectively. In March 2006, Savi Technology won a $25 million order from the US Military for RFID systems; the previous largest order for military RFID systems was $111 million. In August 2006, RF Code secured an order from SYMX in the U.S. for $30 million real-time monitoring software (“RTLS”), which was much larger than any previous orders for RTLS.

According to the IDTechEx RFID Market Report, the usage of RFID is expected to migrate to East Asia as the dominant manufacturing territory. As the manufacture of RFID hardware and software moves to East Asia, it is expect that the execution of services such as system integration will move there as well. China already has 85% of the world’s manufacturing capacity, for products of all sorts and it will tag exports to Western requirements. China is already executing the largest RFID order by value (over one billion national identification cards for adults equal to six billion dollars (including systems)). The IDTechEx RFID Market Report indicates that China has a policy of making its own requirements throughout the RFID value chain as soon as possible. RFID is leapfrogging technologies such as magnetic stripes and barcodes, according to the IDTechEx RFID Market Report.

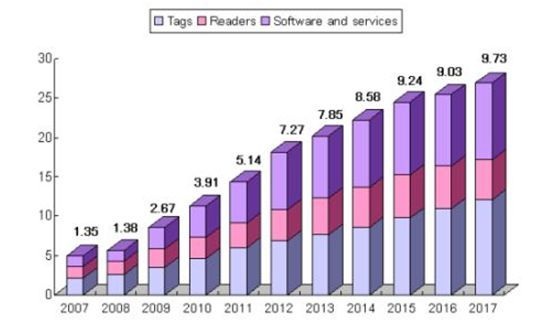

RFID Market size

In 2009 the value of the entire RFID market was expected to be $5.56 billion, up from $5.25 billion in 2008. This includes tags, readers and software/services for RFID cards, labels, fobs and all other form factors. By far the biggest segment of this is RFID cards, and $2.57 billion of the total $5.56 billion being spent on all other forms of RFID - from RFID labels to active tags. In the Korean and Thai markets, we are still a small player, in terms of size and revenue. However, we have been in the RFID software industry since 2003. We also offer a total solution to our customers, including RFID hardware at competitive prices as we expect to earn little profit from hardware sales; our focus is on profit margins from sales of our software and our expertise in integrating our software with RFID systems. When our projects involve hardware, we integrate our software into the hardware prior to delivery to our customers. As a smaller company with seven years experience in the RFID middleware industry, we are able to respond quickly and flexibly to the needs of our customers. In addition, because we have a seven year history of projects in the RFID industry in our current target markets of Korea and Thailand, we believe that we have a stable but growing competitive position as we use our experience in these markets as a marketing tool to attract new business.

6

$ Billions

Source: RFID Forecasts 2007-2017, IDTechEx, 2007

The tagging of pallets and cases as demanded by retailers (mostly in the U.S.) will use approximately 225 million RFID labels in 2009. RFID in the form of tickets used for transit will require 350 million RFID tags in 2009. The tagging of animals (such as pigs and sheep) is now substantial as it becomes a legal requirement in many more territories, with 105 million RFID tags being used for this sector in 2009. In total, 2.35 billion tags will be sold in 2009 versus 1.97 billion in 2008.

As a summary from the latest research by IDTechEx, by 2017, the market value will be over five times the size of the market compared to 2007, but the number of tags supplied will be over 350 times that of 2007, driven by the development of lower cost tags and installed infrastructure which will enable high volumes of articles to be tagged.

7

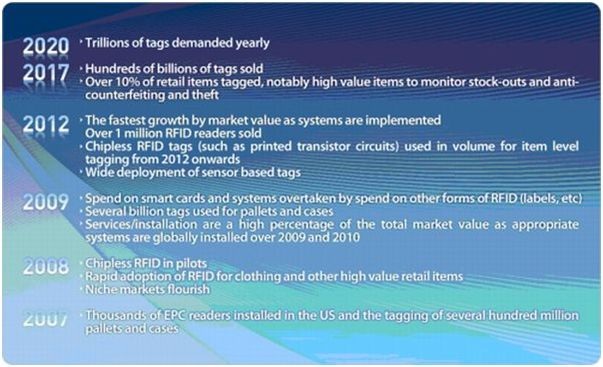

Source: RFID Forecasts 2007-2017, IDTechEx, 2007

Opportunities in the RFID Market

We expect the future emphasis for RFID products to shift towards process based solutions. End user processes are highly diverse and require RFID systems to integrate with their existing AIDC infrastructure. Such process-centric solutions need to have high levels of flexibility incorporated into the design to ensure that customized requirements are taken care of. Even within manufacturing sectors, there is a higher focus towards monitoring work-in-progress (WIP). High process efficiency levels have a direct impact on the overall productivity and profitability of the enterprise. Whatever be the vertical / application market opportunity, end-users are likely to exhibit faster adoption rates when there is a clear convergence of RFID technology and existing business processes in place.

8

Source: RFID Opportunities in 2008, Frost & Sullivan, 2007

The pharmaceutical industry is expected to emerge as an important vertical industry for RFID by 2017, in which going from sales of $90 million in 2007 to $2.05 billion, according to the IDTechEx RFID Market Report. The regulatory environment requiring compliance with various state e-pedigree laws is among the biggest drivers for the vertical market. Large distributors are leading the way in terms of deployment and utilizing RFID data to drive their internal processes forward. Early adopters and pharmaceutical manufacturers are continuing their RFID projects and this is likely to further increase traction within the vertical market.

Healthcare distribution chains are another area of opportunity and which is project to be the largest use of RFID tags in the healthcare area through 2017, according to the IDTechEx RFID Market Report. Innovative uses of the technology include hospitals deploying RFID-enabled refrigerators for consignment of high value drugs that are extremely sensitive to temperature changes. The appliances enable constant monitoring of the drug’s quality. Combining RFID / RTLS systems with existing Wi-Fi networks and hospital infrastructure systems is also expected to continue adoption rates in 2010. Patient tracking applications are likely to present a good opportunity for products that integrate both RFID and barcodes (2D technology).

The retail supply chain will continue to incite interest and large suppliers are expected to see most of the deployments through 2017, according to the IDTechEx RFID Market Report. RFID vendors are likely to witness greater success by targeting suppliers who work with mandated retailers or retailers that have adopted the technology at the store level. Tagging at the manufacturing / supplier facility alone will not result in true value since the downstream benefit is not there when retailers have not invested in RFID. High value categories such as apparel, footwear and media are likely to have higher adoption rates of RFID technology. The opportunity in the vertical lies in delivering RFID solutions that can be integrated and scaled up with the existing retail network in place.

In-store and point-of sale (POS) applications are emerging as key areas of interest for RFID deployments. Retailers are evaluating RFID applications that enhance the overall shopping experience for the customer. The momentum is particularly strong in Europe and Asia where there is a higher emphasis on item level tagging. For example, by 2007 the British retailer Marks & Spencer had RFID tags on its apparel in 120 stores. By tagging individual items at the store level, RFID-enabled mirrors and electronic displays enable the customer to view, select, and locate related / different items within the store.

9

The decision by Airbus in July 2009 to implement RFID systems based on its earlier pilot program is a positive driver for the overall adoption within the vertical market. Airport baggage handling applications are another volume-driven RFID opportunity that is expected to witness pilot programs and deployments in coming years. Projects in the past few years in Milan, Italy, Argentina, UK, Australia and Thailand reflect the technology’s gaining popularity outside North America. Sales of RFID systems for the air industry is projected to reach $755 million by 2017, according to the IDTechEx RFID Market Report.

The strong need for track and trace capabilities in chemical and petroleum industries is expected to increase the demand for RFID within these markets. Oil & Gas RFID Solution Group (“OGR”) was established several years ago as an alliance of subject-matter experts, academic researchers and technology providers and a handful of leading petroleum companies. The OGR members have been engaged in identifying and defining a plan for the development and deployment of RFID technology within the petroleum and chemical industry. Most petroleum products need to be certified, according to the American Petroleum Institute, which requires manufacturers to provide a documented history of the product. Efforts by the Chemical Industry Data Exchange (CIDX) in aligning itself closely with EPCglobal are expected to support chemical companies in furthering their RFID deployments.

Our Products

Our software products can be adopted for use with any type of RFID tag system Read Only, Read/Write (Reusable) and/or Read/Write (Disposable), as described below. Consequently, the type of RFID is not a barrier to use of our RFID software products.

Our software product development is done by employees. We have not used any consultants or otherwise outsource our software product development to third parties. We spent a limited amount on research and development in 2009, which was primarily on salaries for our software development employees, and because we expended large amounts on research and development spent in 2007 and 2008. We expect to increase our research and development in 2010.

For the year ended December 31, 2010, approximately $15,050, or 8.3% of total sales, was attributable to sales of our URISware; approximately $16,900, or 9.4% of total sales, was from the sales of RFID hardware; approximately $11,300, or 6.3% of our total sales, was attributable to sales of URISwis; and approximately $4,700, or 2.6% of total sales, was attributable to sales of URISpagent. These amounts do not include the revenue attributable to the integration of the software products into the client’s systems. We had total sales of all of our software products in 2010, net of integration revenue, of $30,900, or approximately 17.1% of total revenue in 2010. The balance of our total revenue in 2010 consisted of (a) $140,614 attributable to the integration of the software products into the client’s systems and (b) $40,111 which was attributable to hardware sales (which does not include the software which we integrate into such hardware). A description of these and other products is set forth below.

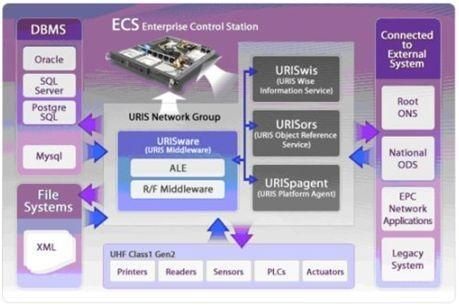

URIS Network Group - Total system of EPCglobal Network

Clavis Technologies URIS Network Group is a RFID integrated solution for customizing RFID data into enterprise applications by progressively collecting and managing RFID data stream. Clavis Technologies RFID Framework is a proprietary framework from Clavis Technologies that integrates and manages a whole system, and complies with EPCglobal standards. Therefore, because URIS Network Group is built upon the Clavis Technologies RFID framework, it ensures performance enhancement and system monitoring, diagnosis, and recovery.

10

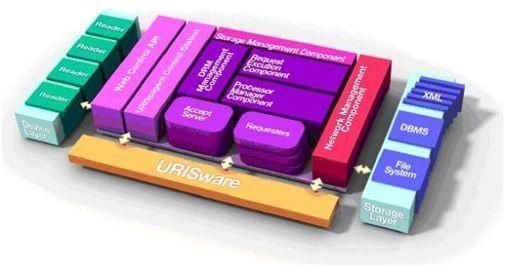

URISware

URISware is ALE (Application Level Event)-compliant RFID Middleware software solution. It transforms RFID data into user readable information which are then translated, filtered, and grouped by data patterns. Finally, URISware combines refined data sets and broadcasts them upon entry of corresponding reporting and event triggering conditions.

The architecture of URISware

The advantages of our URISware are:

|

Stability

|

●

|

Uses Clavis Technologies own URIS Framework to realize the optimized RFID middleware

|

|

●

|

Reliable stability by using lightweight system that minimizes use of resource

|

|

|

●

|

Maximizes convenience of operators and administers and system stability by auto-monitoring, diagnosis and recovery

|

|

|

●

|

Transaction circumstance for multi-tier under the distributed system structure

|

|

|

●

|

Efficiently manage the process by PTM (Process Transaction Manager)

|

|

|

Compatibility

|

●

|

Supports varied codes (64bit/96bit/128bit etc.)

|

|

●

|

Provides interfaces to connect with varied solutions (ERP, WMS, Legacy system etc.)

|

|

|

●

|

Provides varied communications protocols (TCP/IP, HTTP, TCP, SMTP etc.)

|

11

|

Scalability

|

●

|

Supports integration of EPC Global Architecture-based products and URIS products by Plug-in

|

|

●

|

Applies user-defined business models

|

|

|

Standards

|

●

|

EPCglobal Network ALE Specifications

|

|

Compliance

|

●

|

EPCglobal TDS(Tag Data Standard) Specifications

|

|

●

|

EPCglobal TDT(Tag Data Translation) Specifications

|

|

|

●

|

ISO and Mobile RFID Specifications

|

URIS Network Group has gradually specialized in these industries.

Logistics, Manufacturing, and Retail

We developed a single window-based integrated solution to track moving quantities of products globally and to provide Discovery Services, tracking products’ histories per each domain in logistics, manufacturing, and retail industry that should be tied to show whole flow of Supply Chain Management (SCM).

Aerospace

We have focused on Ultra High Frequency (UHF) RFID system to handle passengers’ baggage accurately and promptly as well as provide passengers with convenient services such as a carousel indicator system, showing a passenger’s seat number, when his or her baggage arrives on a carousel and specialized EPCIS, showing the tracking information of baggage in real time for aviation.

Casino

Unlike prior RFID-based casino solutions which focused on HF RFID, we have developed the UHF RFID casino solution to apply various applications without considering a read rage in RFID system. In additions, we have developed RFID-based casino hardware with Alien Technology Asia (ATA) to operate with our UHF RFID casino solution. This system will change manual works (e.g. reports of rolling game, betting management) into automated works.

Education

We have provided efficient turnkey RFID solutions, including other technologies that universities and institutes require, to build u-Lab or u-practical room with real demo programs that are based on our various implementation cases.

Asset Management (For All Industries)

We have developed RFID-based asset management solutions which are integrated with R3 and ERP of SAP to be implemented system wide. This solution can accept barcode system simultaneously so companies can use this system with flexibility.

URISpagent

URISpagent is a hardware device interface software system. It controls RFID Readers and sensors, collects tag and sensory information to build RFID data set and then reports a list of formatted RFID message to data consuming servers.

The architecture of URISpagent

12

The advantages of our URISpagent are:

|

Stability

|

●

|

Uses Clavis Technologies own URIS Framework to realize the optimized RFID system

|

|

●

|

Reliable stability by using lightweight system that minimizes use of resource

|

|

|

●

|

Maximizes convenience of operators and administers and system stability by auto-monitoring, diagnosis and recovery

|

|

|

●

|

Transaction circumstance for multi-tier under the distributed system structure

|

|

|

●

|

Efficiently manages the process by PTM (Process Transaction Manager)

|

|

|

Compatibility

|

●

|

Supports varied vendors’ RFID devices (Alien, Symbol, LS Industrial Systems etc.)

|

|

●

|

Supports varied codes (64bit/96bit/128bit etc.)

|

|

|

●

|

Provides varied communications protocols (TCP/IP, HTTP, TCP etc.)

|

|

|

Scalability

|

●

|

Supports integration of EPC Global Architecture-based products and URIS products by Plug-in

|

|

●

|

Applies user-defined business models

|

|

|

Standards

|

●

|

EPCglobal Network ALE Specifications

|

|

Compliance

|

●

|

EPCglobal TDS (Tag Data Standard) Specifications

|

|

●

|

EPCglobal TDT (Tag Data Translation) Specifications

|

|

|

●

|

ISO and Mobile RFID Specifications

|

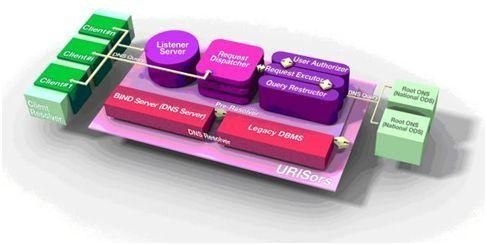

URISors

URISors is an object name service software solution. It points an Electronic Product Code (EPC) querier to network addresses where information on the EPC is stored. Also it defines and manages corresponding EPC information of RFID tags to support the automated networking service.

The architecture of URISors

The advantages of our URISors are:

|

Stability

|

●

|

Uses Clavis Technologies own URIS Framework to realize the optimized RFID ONS (Object Name Service)

|

|

●

|

Reliable stability by using lightweight system that minimizes use of resource

|

|

|

●

|

Maximizes convenience of operators and administers and system stability by auto-monitoring, diagnosis and recovery

|

|

|

●

|

Transaction circumstance for multi-tier under the distributed system structure

|

|

|

●

|

Efficiently manages the process by PTM (Process Transaction Manager)

|

|

|

Compatibility

|

●

|

Supports varied codes (EPC, ISO, UCODE, GS, IATA, mobile code etc.)

|

|

●

|

Provides varied communications protocols (HTTP, TCP, UDP etc.)

|

|

|

Scalability

|

●

|

Supports integration of EPC Global Architecture-based products and URIS products by Plug-in

|

|

●

|

Applies user-defined business models

|

|

|

Standards

|

●

|

EPCglobal Network ONS

|

|

Compliance

|

●

|

EPCglobal TDS (Tag Data Standard) Specifications

|

|

●

|

NIDA (National Internet Development Agency of Korea) ODS

|

13

URISwis

URISwis is an information service solution. It consists of EPC information server and an interface for accessing EPC-related information. The information server contains EPC-related information and business data such as date of manufacture, date of expiration, and price. The interface is EPCIS-compliant and consists of a Query and Capture Interface to extract and provide EPC and business information.

The architecture of URISwis

The advantages of our URISwis are:

|

Stability

|

●

|

RFID EPCIS uses Clavis Technologies own URIS Framework to realize the optimized RFID system

|

|

●

|

Reliable stability by using lightweight system that minimizes use of resource

|

|

|

●

|

Maximizes convenience of operators and administers by the web-based management console

|

|

|

Compatibility

|

●

|

Has independent Capture/Query Interface for any kinds of languages

|

|

●

|

Provides Web Service interfaces to connect with varied solutions (ERP, WMS, Legacy system etc.)

|

|

|

●

|

Provides varied communications protocols (HTTP, SOAP etc.)

|

|

|

Scalability

|

●

|

Supports expansion attributes for event types

|

|

●

|

Supports Capture Interfaces of standards and user-defined master data

|

|

|

●

|

Queries event and master data by varied parameters

|

|

|

Standards

|

●

|

EPCglobal Network EPCIS Specifications

|

|

Compliance

|

●

|

HTTP POST for the Capture Interface

|

|

●

|

SOAP standard for the web service binding

|

URIS RTLS Solution

URIS RTLS Solution is real-time monitoring software that tracks a location and condition of each active RFID tag, alerts based on non-approval situations, backs up data of tracking histories of active RFID tags, and records other movements or changes after office hours. We have focused our URIS RTLS solutions on hospitals’ services such as patient monitoring systems and company security systems for visitor tracking systems that restrict access to facilities and information.

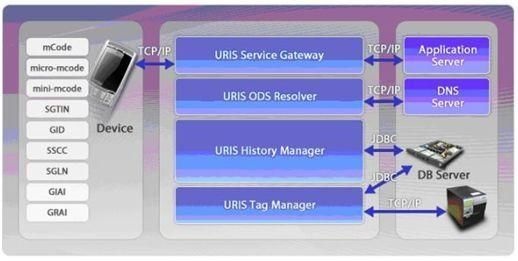

URIS Mobile RFID Platform

Clavis Technologies’ URIS Mobile RFID Platform is a mobile RFID integration software solution to accommodate a various kind of code systems such as EPC and mCode. A RFID-Equipped cell phone reads and transforms a RFID tag code by its corresponding coding scheme. Our URIS platform consists of Service Gateway, ODS Resolver, History Manager and Tag Manager. We have developed our URIS Mobile RFID platform to provide the mobile search services by mobile phone attached a RFID Reader that can catch up data around users to search information in real time. We will also provide Mobile RFID Gateway to integrate with the mobile internet easily and rapidly.

14

The architecture of URIS Mobile RFID Platform

URIS Service Gateway

Service gateway detects and translates code information from tags as well as authenticates who is user. There are three components, (1) Event Detection, which detects information, such as EPC, mCode, micro-mCode, and mini-mCode, from terminals, (2) Code Translator, which translates code information (EPC, mCode, micro-mCode, and mini-mCode) into URN/FQDN form and (3) User Authentication, which checks the user authentication based on user information which came from terminals.

URIS ODS Resolver

ODS Resolver searches for location of server which has object/service information related with Tag code. It has DNS Controller which can provide URL list of object/service information which is equivalent to RFID tag codes in DNS and directory service that manages object/service /URL information.

URIS History Manager

History Manager manages code/history information recorded in RFID tags and generates serial numbers. There are 4 components: (1) Event Processor for receiving/ recording/ inquiring issued/ sensed events which came from Tag Manager and terminals, (2) Serial Generator that generates and manages serial numbers, (3) Object Information for collecting/ saving/ inquiring information of RFID tag codes, and (4) Tracking Information for providing history information service to see integrated history information which is distributed.

URIS Tag Manager

Each code system (EPC, mCode, micro-mCode and mini-mCode) is managed by Tag Manager (registration, issuing, and disusing). Tag Manager has a Code Generator that generates code which is compatible with each code system (EPC, mCode, micro-mCode and mini-mCode), Tag Register (which can generate and disuse codes as well as manages the code system), and Tag Printing that prints managed codes with a tag printer.

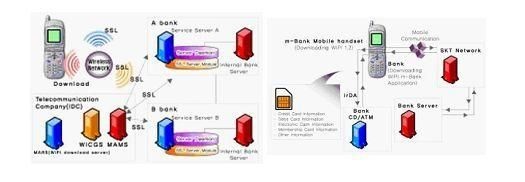

u-Financial Solutions

Our u-Financial Solution has focused on u-Financial Portal system that provides m-Banking and m-Stock by mobile phone, PDA and other portable devices in retail market. In the business to business market, we have developed u-Voucher, authenticated by RFID or 2D barcode that can be used to provide payment services of public institutions.

m-Banking Solution

Clavis Technologies released the m-banking solution based on two different platforms, each providing the same services – such as inquiring view of accounts, accounts transaction history, view of checks and exchange rates; transferring service; credit card service; and other typical banking services.

15

The system overview of m-Banking Solution

m-Stock Solution

Clavis Technologies released the m-stock solution based on WIPI (Wireless Internet Platform For Interoperability), the Korean Wireless Internet Standard, providing such services as Quotes, Pre-Order, ECN (Electronic Communication Network) and Account services.

Product Upgrades and Diversification

URIS Network Group

Following the Latest Updated World Specification

The first version of URIS is made by C# and based on.NET. Clavis Technologies has prepared the new version URIS based on JAVA to support UNIX and Linux platforms to provide extensible services for all kind commercialized operation systems and platforms. Clavis Technologies plans to upgrade the URIS core transaction engine supporting EPC Network specification Version 1.1 to be the global RFID solution. We will perform this update annually during the third and fourth quarters.

Expanding Enterprise Application Interfaces

Clavis Technologies expects to upgrade the business logics of URIS Network Group for each step of the enterprise RFID section supporting applications of industries of Government, CPG, Heath Care, Logistics, Manufacturing, and Retail based on customers’ needs as well as Clavis Technologies’ knowledge accumulated since 2003. Considering various Database Management System (DBMS) and backend systems, these interfaces will be modulized to integrate easily and rapidly with minimizing errors. We are in the process of securing a partnership with SAP Korea, which we expect will be finalized in the second quarter of 2011. We also expect that after we have the partnership with SAP Korea in place, we will perform this upgrade during the third quarter of 2011.

Enhancing Voluminous Transaction Capability

Because of the voluminous transactions that we expect will be appearing in the specific industrial area (i.e., distribution, logistics, etc.) in near future, Clavis Technologies has enhanced the transaction capability to develop an advanced RFID application platform to deploy in any industry stably and immediately.

URIS RTLS Solution

Handling an extensive scale of Active RFID tags’ data

Based on customers’ requirement, Clavis Technologies expects to upgrade the data processing to provide data storage of a large scale of active RFID tags’ data as well as various monitoring and reporting functions especially in small areas or limited areas where consumer security is a high priority. Such updates will be made each year and are dependent on the requirements of any given projects in such year.

16

Ultra-Wideband (UWB) Application

Clavis Technologies will gradually focus on this application as UWB becomes more widely used. UWB allows for high data throughput with low power consumption for distances of less than 10 meters, or about 30 feet, which is very applicable to the digital home requirements. We expect to have a UWB application by the end of 2011 for anticipated project at Korean steelmaker.

URIS Mobile RFID Platform

Developing the Mobile RFID Middleware

Clavis Technologies expects to develop the new version RFID middleware that can be embedded in mobile or PDA, as a personal device (as opposed to PDAs and hand-held devices used for industrial purposes), that can provide people with the unique and individual RFID services comparing with enterprise services in near future. We expect to develop this mobile middleware by the third or fourth quarter of 2011, provided we finalize our partnership with Innoace (a Korean mobile solutions provider).

u-Financial Solution

Developing the m-Payment Platform

Clavis Technologies expects to develop various m-Payment platforms (i.e., Transportation card, Credit card, Debit card, Point card, Cashback Credit card, e-Purse, Micro-payment etc.) to provide unlimited payment ways by a mobile handset (using a short-range wireless connectivity technology commonly referred to as Near Field Communication (NFC) services). We expect to develop this mobile payment platform the end of the second quarter of 2011. We are currently with Bizmodeline to negotiate NFC-based services with one of the major Korean credit card companies.

Developing u-Voucher Solution

Clavis Technologies expects to develop u-voucher solution based on 2D bar codes by mobile internet and RFID tags by mobile RFID system to provide fast and easy payment service to users. The Korean Ministry of Health and Welfare wants a u-Voucher system developed. During 2010, we were a consultant to the Korean Ministry of Health on the u-Voucher. Based on the results of our consultancy, we expect to complete the main functions of u-Voucher by the end of the second quarter of 2011 and complete the development of the u-Voucher solution by the end of the third quarter of 2011.

Developing the m-Financial Portal Service Platform

Clavis Technologies will upgrade m-banking solution depending on mobile system applications that banks plan to deploy in their works firstly and then develop the m-Financial portal service platform, especially enhanced for m-Payment ways, integrated Clavis Technologies m-banking service platforms with other companies’ m-stock service platforms. We expect to develop this platform by the end of 2012.

Strategic Relationships

EPCglobal

The EPCglobal consortium develops industry standards for the use of RFID technology in supply chains. EPCglobal is the organization entrusted by industry to establish and support the EPCglobal Network™. The EPCglobal consortium also is involved in the development of EPCglobal Standards via EPCglobal’s Action & Working Groups and the EPCglobal Certification and Accreditation Program testing. Clavis Technologies joined EPCglobal as a member in 2004. A member of EPCglobal is called a “subscriber.” EPCglobal classifies subscribers into two general categories: end-users and solution providers. End-users include manufactures, retailers, wholesalers, carriers and government organizations. Solution providers are organizations that help end users move goods through the supply chain. Solution providers include hardware and software companies, consultants, systems integrators, and training companies (such as Clavis Technologies). As a solution subscriber, we participate in EPCglobal’s various EPCglobal Action and Working Groups which address standard specifications, business issues, software issues and other matters.

IBM Korea

We developed SCM based on Auto-ID System for Sales of IBM Korea in Korea. Our RFID middleware is customized for IBM platforms such as DB2 and Websphere, In 2004, we commenced a two year contractual partnership with IBM Korea in which we analyzed IBM RFID software for IBM as well as prepare seminar materials to introduce IBM RFID solutions. Although our contractual partnership ceased in 2006, we still maintain personal relationships with IBM Korea’s staff from which we exchange advice and analysis on RFID business issues.

17

Bizmodeline

In 2010 we entered into a memorandum of understanding with Bizmodeline to jointly develop with them RFID-enabled Near Field Communications (NFC) business. Bizmodeline holds 2,700 patents and provides m-Financial, Authentication and Radio communication solutions. We will development RFID-enabled NFC application based on service models developed by Bizmodeline, using Bizmodeline’s patents for financial, billing, RFID and NFC. We will also supply the required hardware for the NFC solutions.

UbizValley

In 2010 we entered into a memorandum of understanding with UbizValley for jointly developing RFID mobile service systems. UbizValley develops solutions for Fixed Mobile Convergence (FMC) environment for public and private entities. FMC is the seamless connectivity between fixed and wireless telecommunication networks. In working with UbizValley, we will develop the RFID system with various applications in the mobile business area. UbizValley will develop the mobile and Internet part of the RFID system. We expect that UbizValley will play an important role for us in the mobile internet development to provide mobile services to credit card companies.

RFID Systems and Mobile RFID System

We have provided RFID middleware and hardware and consulting on RFID systems with many major Korean corporations. We are also developing with Korea’s major telecommunication companies, SK Telecom and KTF, new mobile Internet business. In addition, we have completed projects with major Korean financial institutions towards developing mobile banking capabilities.

Our Intellectual Property

Because our RFID middleware is based on the open standards by EPCglobal, we do not maintain any copyright protection for our RFID middleware. However, in the future, we expect to submit patents for unique applications of our RFID middleware.

Legal and Regulatory Requirements

In general, we do not have to comply with any special legal or regulatory requirements to conduct our business. In Korea, in order to bid on government projects, we have to register with the Korean Public Procurement Service. If we seek government projects in our countries, we expect would have to register with a government agency to submit a bid on any such government project. In addition, in the third quarter of 2011, we expect to submit an application for certification of our URISware software by EPCglobal. We expect to submit applications for certification of our other software products by EPCglobal during the fourth quarter of 2011. Generally, it takes six to eight weeks to get software certified by EPCglobal. While this certification is not a legal or regulatory requirement to conduct business, it will make it easier for us to conduct our business because it will be a comfort to potential customers that our products comply with the EPCglobal Gen 2 standard.

The EPCglobal certification program is composed of two testing at EPCglobal certified testing facilities; such a certified facility is located in Seoul, Korea. The first phase of testing is the “conformance testing” which is used to verify that the EPC hardware and EPC software (such as our RFID middleware) complies with the EPCglobal standards. The second test is the “interoperability test”, which is used to determine the ability of difference compliance certified products with other compliance certified products. EPCglobal created a new mark that it has started providing to solution providers who have had their hardware and/or software certified by EPCglobal. Products carrying the new mark represent that the eligible product has successfully demonstrated all applicable mandatory testing for both conformance and interoperability requirements. After we get our software products certified by EPCglobal, we will be permitted to put the EPCglobal Certification Mark on our website and marketing materials.

Suppliers

While we develop our own software, we have four main hardware suppliers: Alien Technology (a provider of RFID hardware manufacturer), NextID (a reseller of AeroScout Wi-Fi based Active RFID products), Onnuri Electronics (a reseller of ATID Company hardware for mobile RFID) and LG Industrial System (a Korean manufacturer of RFID equipment). We are not dependent on any one supplier for our RFID hardware, and we could replace any such supplier in a reasonably quick time frame.

18

Competitors

Some of our main competitors are Reva Systems, GlobeRanger, OATSystems and RedPrairie. Some of these competitors have substantially greater financial and personnel resources than we do.

Reva systems

Reva Systems develops radio-frequency identification (RFID) network infrastructure products that enable customers to rapidly deploy scalable solutions in any environment. Reva's standards-based Tag Acquisition Processor (TAP) appliances facilitate improved system performance, manageability and security while significantly lessening implementation time and complexity. Reva products are delivered by a global network of partners and deployed worldwide across a range of innovative applications spanning industries such as Aerospace, Contract Manufacturing, Discrete Manufacturing, Consumer Packaged Goods, Retail, Consumer Electronics, Logistics, and Healthcare/Life Sciences. Reva was founded in 2004, and is headquartered in Chelmsford, Mass.

GlobeRanger

GlobeRanger is a provider of RFID and mobility software solutions. GlobeRanger owns an innovative platform, iMotion, which provides the critical software infrastructure that transforms real-time data, from the edge of the enterprise, into actionable information. iMotion serves as the foundation for GlobeRanger and its partners to rapidly develop, deploy, and manage RFID and mobile applications. Founded in 1999, GlobeRanger is headquartered in Richardson, Texas.

OATSystems

OATSystems, Inc. founded in 2001, is the developer of deployed standards-based RFID solutions. OATSystems has worked closely with MIT's Auto-ID Center, to develop many of the key standards and technologies that make commercial deployments of RFID possible. OATSystems' Senseware - the company's flagship product - provides a complete and powerful standards-based RFID solution for companies in the retail, CPG, manufacturing, pharmaceutical, and logistics markets. Checkpoint Systems, Inc. (NYSE: CKP), a leading manufacturer and marketer of identification, tracking, security and merchandising solutions for the retail industry and its supply chain, acquired OATSystems in June 2009, and OATSystems is operating as a division of Checkpoint.

RedPrairie

RedPrairie, founded in 2003, developed RFID-enabled suite of supply chain execution solutions and applications for international trade logistics, mobile resource management, supply chain security and inventory optimization to address the broader needs for global supply chain management and security. RFID technology is an integral part of RedPrairie’s supply chain suite. RedPrairie has also created RFID Igniter™ and RFID Accelerator™. These applications can be easily integrated (“bolted on”) with any ERP or distribution system.

Marketing

To market our products and services, we plan to leverage our relationships with RFID organizations, primarily EPCglobal, as well as our prior customers and major RFID hardware vendors. We have a good working relationship with a number of Korean companies, such as LG Electronics and SK Telecom, from which we hope to leverage additional business both within Korea and in Southeast Asia.

We expect to sell our products and services through three channels:

|

1.

|

Direct to end user through our own sales force;

|

|

2.

|

Through a third party that will purchase our products on an ad hoc basis; and/or

|

|

3.

|

In conjunction with our number of strategic partners.

|

Our objective is to generate approximately 30% of our sales from direct selling efforts and approximately 70% of sales to be generated through third parties (such as existing and prior customers as well as vendors and strategic partners).

Our Research and Development

URIS Network Group

As a main product in our company, we have prepared URIS Network Group to specialize in the EPC Interface based on global standards to apply them to real industrial fields more efficiently and to get the certification from EPCglobal. In additions, we plan to provide URIS duplex Monitoring System (MTS) that monitors RFID hardware and EPCglobal Network servers as well as notices the system administrator to check up when an error is happened.

19

URIS RTLS Solution

We plan to develop a RTLS Data Hub system that can accept both technologies, Active RFID and UWB, to process the collected data from various RTLS hardware simultaneously. The user interface of the monitoring system program will be improved by using Flex and Flash to improve the legibility of the user data. Such technology show efficient results when large-scale tags are used in a specific space.

Mobile RFID Platform

We are interested in mobile RFID client software that can be embedded in a mobile phone to process RFID tags data with integrating a mobile software platform. This is a critical technology of Mobile RFID system and takes part as a significant mechanism. We plan to engraft the integrated technology between EPCIS and Discovery Service to realize mobile search services integrated with RFID tags and objects’ information.

u-Financial Solution

The technological development strategy of u-Financial Solution accepts a mobile payment mechanism using the biological information of the user in order to promote the security of the original u-Financial Portal. We plan to accept a mobile payment technology that allows financial payment less than US$30 using credit card information inserted in a portable device’s chip and contains biological identification mechanisms (e.g., fingerprint or iris) to strengthen the security level.

Employees

As of December 31, 2010, we had 7 full-time employees, three of whom are involved primarily in financial management and administration of our company.

|

ITEM 1A.

|

RISK FACTORS

|

Not applicable.

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

Not applicable.

|

ITEM 2.

|

PROPERTIES

|

We lease approximately 2,665 square feet for our executive offices located at #1564-1, Seojin Bldg., 3rd Fl., Seocho3-Dong, Seocho-Gu, Seoul, Korea 137-874. We have extended our lease until January 31, 2013. Our monthly rent is approximately $4,598. We believe this space is suitable for our present operations and adequate for foreseeable expansion of our business.

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

We are not currently a party in any legal proceedings.

|

ITEM 4.

|

[RESERVED]

|

20

PART II

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

Market Information

On November 2, 2010, the Financial Regulatory Authority declared our common stock eligible for quotation on the OTC Electronic Bulletin Board under the symbol “CTLH.” Since that date, no shares of our common stock has traded on the OTC Bulletin Board.

Our Transfer Agent

We have appointed Olde Monmouth Stock Transfer Company, with offices at 200 Memorial Parkway, Atlantic Highlands, New Jersey 07716, phone number 732-872-2727, as transfer agent for our shares of common stock. The transfer agent is responsible for all record-keeping and administrative functions in connection with our shares of common stock.

Dividend Policy

We have never declared or paid any cash dividends on our shares of common stock nor do we anticipate paying any in the foreseeable future. Furthermore, we expect to retain any future earnings to finance our operations and expansion. The payment of cash dividends in the future will be at the discretion of our Board of Directors and will depend upon our earnings levels, capital requirements, any restrictive loan covenants and other factors the Board considers relevant.

Holders of Common Stock

As of April 15, 2011, the shareholders' list of our shares of common stock showed 64 registered shareholders and 62,375,200 shares issued and outstanding.

Securities authorized for issuance under equity compensation plans

We currently do not have any equity compensation plans.

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

Not applicable.

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

Statements used in this Form 10-K, in filings by the Company with the Securities and Exchange Commission (the "SEC"), in the Company's press releases or other public or stockholder communications, or made orally with the approval of an authorized executive officer of the Company that utilize the words or phrases "would be," "will allow," "intends to," "will likely result," "are expected to," "will continue," "is anticipated," "estimate," "project," or similar expressions speaking to anticipated actions, results or projections in the future speak only as of the date made, are based on certain assumptions and expectations which may or may not be valid or actually occur, and which involve various risks and uncertainties, such as those set forth in the “Risk Factors” section of our registration statement on Form S-1 (SEC File No. 333-164589). The Company cautions readers not to place undue reliance on any such statements and that the Company's actual results for future periods could differ materially from those anticipated or projected.

Unless otherwise required by applicable law, the Company does not undertake, and specifically disclaims any obligation, to update any forward-looking statements to reflect occurrences, developments, unanticipated events or circumstances after the date of such statement.

The following discussion should be read in conjunction with our consolidated financial statements and related notes included as part of this report.

21

Overview