Attached files

| file | filename |

|---|---|

| EX-31.1 - CHINA LOGISTICS INC | ex31_1.htm |

| EX-14.1 - CHINA LOGISTICS INC | ex14_1.htm |

| EX-32.1 - CHINA LOGISTICS INC | ex32_1.htm |

U.S. Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-K

| [X] | Annual Report Under Section 13 or 15(d) of The Securities Exchange Act of 1934 for the Fiscal Year Ended December 31, 2010 |

| [ ] | Transition Report Under Section 13 or 15(d) of The Securities Exchange Act of 1934 for the Transition Period from _______ to _______ |

Commission File Number: 001-10559

HUTECH21 CO. LTD.

(F/K/A CHINA LOGISTICS, INC.)

| British Virgin Islands | N/A |

| (State or other jurisdiction of | (IRS Employer identification No.) |

| incorporation or organization) |

#201 Daerungtechnotown III

Gasan-Dong

Geumcheon-Gu, Seoul

Korea 153-772

(Address of principal executive offices)

+82 2 2107 7200

(Issuer's telephone number)

Securities Registered Pursuant to Section 12(b) of the Act:

Common Stock

Par Value: 0.0001

Indicate by check mark if the registrant is a well-know seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [x]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [x]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [x] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 if Regulation S-K (229.405 of this Chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy of information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K.

Yes [ ] No [x]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ |

| Non-accelerated filer | ¨(Do not check if a smaller reporting company) |

| Accelerated filer | ¨ |

| Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in rule 12b-2 of the exchange act).

Yes [ ] No [x]

The Registrant’s revenues for its fiscal year ended December 31, 2009 was $8,139,485.

The aggregate market value of the voting stock on April 15, 2011 (consisting of Common Stock, $0.0001 par value per share) held by non-affiliates was approximately $229,606 based upon the most recent sales price ($1.90) for such Common Stock on said date, April 15, 2011. On April 15, 2011, there were 551,265 shares of our Common Stock issued and outstanding, of which approximately 120,845 shares were held by non-affiliates.

Number of shares of preferred stock outstanding as of April 15, 2011: 32,950

Number of shares of common stock outstanding as of April 15, 2011: 551,265

DOCUMENTS INCORPORATED BY REFERENCE

None

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING INFORMATION

The discussion contained in this 10-K under the Securities Exchange Act of 1934, as amended, contains forward-looking statements that involve risks and uncertainties. The issuer's actual results could differ significantly from those discussed herein. These include statements about our expectations, beliefs, intentions or strategies for the future, which we indicate by words or phrases such as "anticipate," "expect," "intend," "plan," "will," "we believe," "the Company believes," "management believes" and similar language, including those set forth in the discussions under "Notes to Financial Statements" and "Management's Discussion and Analysis or Plan of Operation" as well as those discussed elsewhere in this Form 10-K. We base our forward-looking statements on information currently available to us, and we assume no obligation to update them. Statements contained in this Form 10-K that are not historical facts are forward-looking statements that are subject to the "safe harbor" created by the Private Securities Litigation Reform Act of 1995.

| (1) |

| (2) |

HISTORY

Hutech21 Co. Ltd. (the “Company” or “CLGZF”) was converted from the State of Nevada to British Virgin Island in 2011. The Company was originally incorporated in the State of Nevada on December 23, 1988, formerly known as China Logistics Inc., China International Tourism Holdings, Ltd., Dark Dynamite, Inc., NCI Holdings, Inc., Vector Holding, Inc., and prior to June 26, 2002, Vector Aeromotive Corporation.

On February 17, 2009, the Company entered into a transfer & change of control agreement with Ms. Wanwen Su (“Ms. Su”) and Mr. Ming Lei (“Mr. Lei”), pursuant to which, Ms. Su acquired from Mr. Lei 26,360 shares of preferred stock of the Company and received a “controlling interest” in the Company.

On February 18, 2009, our Board of Directors adopted a resolution approving a two hundred to one reverse split of our issued and outstanding Common Stock. The reverse split combined our outstanding Common Stock on the basis of 200 outstanding shares being changed to 1 outstanding share. Each shareholder’s percentage ownership in the Company (and relative voting power) remained essentially unchanged as a result of the reverse split. The reverse split was effective on April 3, 2009.

On February 18, 2009, a Plan of Exchange (the “Exchange”) was executed between and among the Company, Chengkai Logistics Co Ltd., a corporation organized under the laws of the Peoples’ Republic of China (“Chengkai”), and the shareholders of Chengkai (“Chengkai Shareholders”). The Exchange was consummated on May 19, 2009, pursuant to which 50,000,000 (after taking into account the Reverse Split) shares of the Company’s common stock were issued to the stockholder of Chengkai. Thereafter, Chengkai became the Company’s wholly-owned subsidiary.

On April 23, 2009, China Logistics, Inc. (F/K/A China International Tourism Holdings, Ltd.), entered into an Agreement (the “Agreement”) between and among the Registrant, Shanxi Kai Da Lv You Gu Wen Xian Gong Si, a corporation organized under the laws of the Peoples’ Republic of China (“Kai Da”), and Mr. Lei Ming, an individual (“Buyer”).

Pursuant to the terms of the Agreement, the Buyer acquired 100% of the total assets of $407,616 and total liabilities of $481,275 (collectively “Kai Da Assets and Liabilities) from the Registrant for the payment of good and valuable consideration of $100.00 (the “Purchase Price”). As a result of the transactions consummated at the closing, the purchase and issuance gave the former president a 'controlling interest' in Kai Da, and Kai Da was no longer a wholly-owned subsidiary of the Company.

On August 10, 2009, the Company changed its corporate name from China International Tourism Holdings, Ltd. to China Logistics Inc. to provide a more accurate description of the Company’s current operations and marketing efforts in the logistic industry. Accordingly, the ticker symbol of the Company’s Common Stock was changed to “CLGZ” and then to "CLGZF" upon completion of our conversion to a British Virgin Islands company.

BUSINESS DESCRIPTION OF THE ISSUER

Since the reverse merger with Chengkai was consummated, we have continued operations of Chengkai, a logistic company specializing in logistical services for car manufacturers, car components, food assortments, chemicals, paper, and machinery in China. Chengkai was incorporated in the PRC on October 19, 2004 as a limited liability company, with registered capital of approximately $1,000,000 as of December 31, 2010. Chengkai is located in Guangzhou City, one of the largest commercial bases in China, and a booming transportation hub with easy access to railroad, highway, and rivers. Chengkai has two logistic centers located in Baiyun Airport and the Huangpu Xingang Port in Guangzhou City, Guangdong Province, China.

CLGZF and our wholly-owned subsidiary Chengkai are hereafter referred to as the “Company” or “we”.

The Company specializes in logistical services for car manufacturers, car components, food assortments, chemicals, paper, and machinery in China. The services cover various aspects of transportation management, including logistical planning, import and export management, electronic customs declaration systems, supply chain planning, transporting products from ports to warehouses or vice versa, organization of transportation, and storage and distribution of products.

The Company’s customers include international companies and domestic enterprises in China from various industries. Their clients from the automobile industry include Rolls Royce Automobile Accessories, Mercedes Benz Automobile Accessories, Peugeot Automobile Accessories, BMW Automobile Accessories, and Nissan Automobile Accessories. Their electronic industries clients include IBM Electronics and Creator Corporation China. The Company’s chemical industries clients include Korean LG Chemical Engineering Company, French Rhodia Chemical Company, Spanish Caster Rubber Company, and Korean Dongsung Chemical Co., Ltd. The Company’s customer base has been increasing at a rapid pace, especially within the Food Industry, Paper Industry, Mechanical Industry, Garment Industry, Furniture Industry and Daily Commodity Industry.

| (3) |

SERVICES

International Trade and Import & Export Management

Import & export trade, domestic distribution and purchasing solutions are provided by the Company to reach a win-win business solution. Through several years of practice of commercial trading in China, the Company has accumulated resourceful working experiences and gained close partnerships with financial institutions. These financial institutions help us combine our business procedures and financial status to provide value-added and win-win business solutions for our clients.

| * | Purchasing process |

| * | Services orienting towards foreign purchasers |

| * | Services for domestic manufacturing purchasers |

| * | Distribution process |

| * | Efficient import & export customs declaration |

| * | Supply-chain financing service |

Some international purchasers, who need to purchase their commodities and balance the account among several districts within the country, will more or less be restricted by the local policies such as the leverage of foreign exchange, value-added tax, and import & export trading rights. In order to solve such inadequacies, the Company strives to improve their clients’ working efficiency, and help minimize costs. We minimize costs by integrating manufacturing resources such as purchasing, R&D and manufacturers. We center on a specific or diversified products that highlight core business. We also incorporate management of materials, information and financing. We commit to a more reliable and efficient supply-chain partnership with manufacturers and transnational purchasers.

Customs Declaration

The Company provides customs affairs trusteeship, consultations, and software application solutions on customs network supervision.

Customs affairs have become very complicated in China given the supervision on processing trade, factors concerning China’s policies, and the local implementation and the conflicts that might occur within enterprises. We, as the third party that gets involved in between the government and enterprises, strive to keep sound relationships with governmental departments. With the support of some relevant departments, and our experiences and specialty in dealing with customs affairs, we can provide a comprehensive backup service for our clients.

Specialties:

In regards to the supervision policies on processing trade, we provide declaration management strategies and computerized system for enterprises engaged in processing trade, so as to improve their management level, optimize their declaration procedures, and control their declaration risks.

| * | We automatically collect data in the manufacturing management database. |

| * | We safely connect the manufacturing management system and accounting management system of the enterprises. |

| * | We develop customized planning that corresponds to each enterprise. |

| * | We monitors and analyzes capital flow. |

Warehousing and Transportation

The Company provides diversified logistics solutions.

In order to construct an efficient logistics system, the Company has established solutions with our co-partners, based on the needs of our clients. Through effective integration of logistics, we provide various logistics solution for our clients. Our experienced consultants diagnose and analyze elements that make up of the whole supply-chain to help customize a logistic system that shortens the time of order to the time of delivery.

| (4) |

Specialties:

| * | Production Logistics |

| * | Sales Logistics |

| * | International Logistics |

Production Logistics

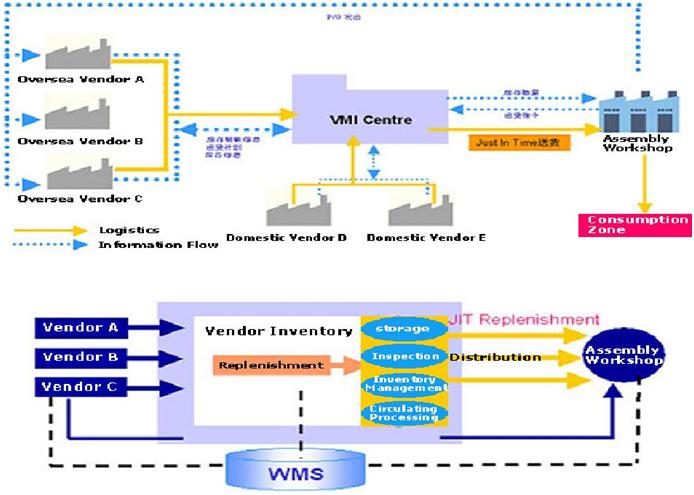

Our client’s competitiveness is measured through the enterprise’s capacity to improve its production efficiency, lower its comprehensive cost and practice expenditures, all of which are realized through the optimization and improvement of production logistics system. In-time supply and keeping appropriate inventory are of the most concerned by manufacturers. We, together with other enterprises, have worked for many years in establishing an efficient logistics system in line with our client’s needs.

| * | Production accessories and raw material supply |

| * | Vendor managed inventory (VMI :Vendor Managed Inventory) |

| * | Land transportation |

| * | In-factory logistics |

Sales Logistics

The Company provides managerial operations as well as delivery service for product agents, dealers, and department stores.

| * | National network transportation |

| * | Management and operation in the logistics center |

| * | 3C digital product logistics |

| * | Quality inspection of clothing and textile goods |

International Logistics

Through the Company’s talented staff and reliable partnerships, the Company provides international cargo transportation that supports business expansion efforts of clients.

| * | International Logistics Business |

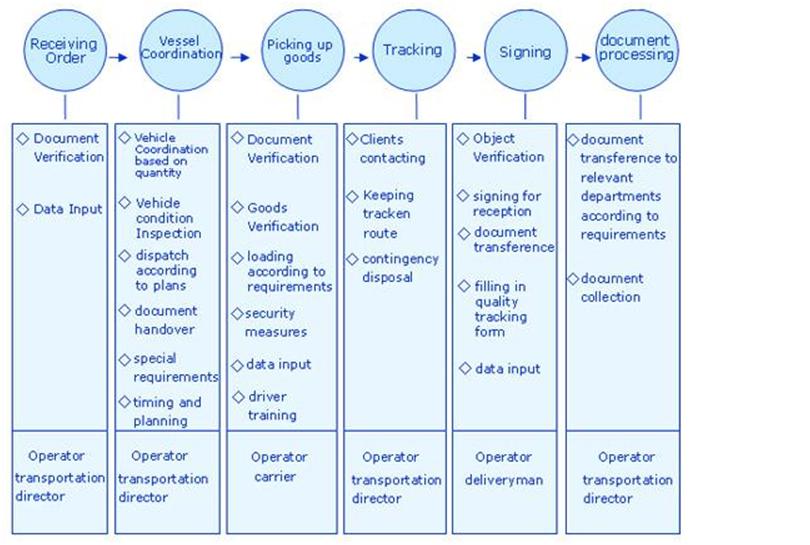

Below are illustrations of our logistics procedures:

| (5) |

There are many factors that affect our business, operating results and financial conditions, many of which are beyond its control. The following is a description of the most significant factors that might cause the actual results of operations in future periods to differ materially from those currently expected or desired.

Business Risk Factors

Our auditors have expressed doubt about our ability to continue as a going concern. If we do not generate substantial revenue from our new relationships and are also unable to obtain capital from other resources, we will significantly curtail our operations or halt them entirely.

Historically, we have been dependent on financings to fund our development and working capital needs. For the year ended December 31, 2010, we had net loss of $46,648, resulting in our accumulated deficit of $1,114,708 as of December 31, 2010. Accordingly, if we do not develop any new projects, we would have to continue to severely diminish our operations or halt them entirely. The opinion of our auditors contains an explanatory paragraph regarding our ability to continue as a going concern.

Competitors could copy our business model and erode our market share, brand recognition and profitability.

We cannot assure you that our competitors will not attempt to copy our business model, or portions thereof, and that this will not erode our market share and brand recognition and impair our growth rate and profitability. In response to any such competitors, we may be required to decrease our fees, which may reduce our operating margins and profitability.

Because our officers and directors reside outside of the United States, it may be difficult for you to enforce your rights against them or enforce United States court judgments against them in China.

Our directors and our executive officers reside in the PRC and all of our assets are located in China. It may therefore be difficult for United States investors to enforce their legal rights, to effect service of process upon our directors or officers or to enforce judgments of United States courts predicated upon civil liabilities and criminal penalties of our directors and officers under federal securities laws. Further, it is unclear if extradition treaties now in effect between the United States and China would permit effective enforcement of criminal penalties of the federal securities laws.

Because we may not be able to obtain business insurance in the PRC, we may not be protected from risks that are customarily covered by insurance in the United States.

Business insurance is not readily available in China. To the extent that we suffer a loss of a type which would normally be covered by insurance in the United States, such as product liability and general liability insurance, we would incur significant expenses in both defending any action and in paying any claims that result from a settlement or judgment.

Because our funds are held in banks which do not provide insurance, the failure of any bank in which we deposit our funds could affect our ability to continue in business.

Banks and other financial institutions in the PRC do not provide insurance for funds held on deposit. As a result, in the event of a bank failure, we may not have access to funds on deposit. Depending upon the amount of money we maintain in a bank that fails, our inability to have access to our cash could impair our operations, and, if we are not able to access funds to pay our suppliers, employees and other creditors, we may be unable to continue in business.

Failure to comply with the United States Foreign Corrupt Practices Act could subject us to penalties and other adverse consequences.

We are subject to the United States Foreign Corrupt Practices Act, which generally prohibits United States companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some that may compete with us, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in China. We can make no assurance, however, that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations.

Failure to achieve and maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act could have a material adverse effect on our business and operating results and stockholders could lose confidence in our financial reporting.

Internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. If we cannot provide reliable financial reports or prevent fraud, our operating results could be harmed. Under the current SEC regulations, we will be required to include an auditor’s report on internal controls over financial reporting for the year ended December 31, 2009. Failure to achieve and maintain an effective internal control environment, regardless of whether we are required to maintain such controls, could also cause investors to lose confidence in our reported financial information, which could have a material adverse effect on our stock price. Although we are not aware of anything that would impact our ability to maintain effective internal controls, we have not obtained an independent audit of our internal controls, and, as a result, we are not aware of any deficiencies which would result from such an audit. Further, at such time as we are required to comply with the internal controls requirements of Sarbanes Oxley, we may incur significant expenses in having our internal controls audited and in implementing any changes which are required.

Declining economic conditions could negatively impact our business

Our operations are affected by local, national and worldwide economic conditions. Markets in the United States and elsewhere have been experiencing extreme volatility and disruption for more than 12 months, due in part to the financial stresses affecting the liquidity of the banking system and the financial markets generally. This volatility and disruption has reached unprecedented levels. The consequences of a potential or prolonged recession may include a lower level of economic activity and uncertainty regarding energy prices and the capital and commodity markets. While the ultimate outcome and impact of the current economic conditions cannot be predicted, a lower level of economic activity might result in a decline in overall sales. Instability in the financial markets, as a result of recession or otherwise, also may affect the cost of capital and our ability to raise capital.

| (6) |

Material Disruptions At Our Facilities Could Negatively Impact Our Financial Results.

We operate our facilities in compliance with applicable rules and regulations and take measures to minimize the risks of disruption at our facilities. A material disruption at one of our facilities could prevent us from meeting customer demand, reduce our sales and/or negatively impact our financial results. Any of our facilities, or any of our machines within an otherwise operational facility, could cease operations unexpectedly due to a number of events, including:

*unscheduled maintenance outages;

*prolonged power failures;

*an equipment failure;

*a chemical spill or release;

*explosion of a boiler;

*the effect of a drought or reduced rainfall on its water supply;

*labor difficulties;

*disruptions in the transportation infrastructure, including roads, bridges, railroad tracks and tunnels;

*fires, floods, earthquakes, hurricanes or other catastrophes;

*terrorism or threats of terrorism;

*domestic and international laws and regulations applicable to our Company and our business partners, including joint venture partners, around the world; and

*other operational problems.

Any such downtime or facility damage could prevent us from meeting customer demand for our services and/or require us to make unplanned capital expenditures. If one of these facilities were to incur significant downtime, our ability to satisfy customer requirements could be impaired, resulting in lower sales and having a negative effect on our financial results.

China Logistics’ business plan is based, in part, on estimates and assumptions which may prove to be inaccurate and accordingly their business plan may not succeed.

The discussion of the business incorporates management’s current best estimate and analysis of the potential market, opportunities and difficulties that China Logistics faces. There can be no assurances that the underlying assumptions accurately reflect opportunities and potential for success. Competitive and economic forces on marketing, distribution and pricing of products make forecasting of sales, revenues and costs extremely difficult and unpredictable.

Adverse changes in economic policies of the People’s Republic of China (“PRC”) government could have a material adverse effect on the overall economic growth of the PRC, which could reduce the demand for China Logistics’ services and materially adversely affect its business.

All of China Logistics’ assets are located in and all of its revenue is sourced from the PRC. Accordingly, China Logistics’ business, financial condition, results of operations and prospects will be influenced to a significant degree by political, economic and social conditions in the PRC generally and by continued economic growth in the PRC as a whole.

The PRC economy differs from the economies of most developed countries in many respects, including the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. Although the PRC government has implemented measures since the late 1970s emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of improved corporate governance in business enterprises, a substantial portion of productive assets in the PRC is still owned by the PRC government. In addition, the PRC government continues to play a significant role in regulating industry development by imposing industrial policies. The PRC government also exercises significant control over the PRC’s economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies.

While the PRC economy has experienced significant growth over the past decade, growth has been uneven, both geographically and among various sectors of the economy. The PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures benefit the overall PRC economy, but may also have a negative effect on China Logistics. For example, China Logistics’ operating results and financial condition may be adversely affected by government control over capital investments or changes in tax regulations that are applicable to it.

| (7) |

Fluctuations in exchange rates could adversely affect our business and the value of our securities.

The value of our common stock will be indirectly affected by the foreign exchange rate between U.S. dollars and RMB and between those currencies and other currencies in which our sales may be denominated. Because substantially all of our earnings and cash assets are denominated in RMB fluctuations in the exchange rate between the U.S. dollar and the RMB will affect the relative purchasing power of our monies, our balance sheet and our earnings per share in U.S. dollars. In addition, appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue that will be exchanged into U.S. dollars as well as earnings from, and the value of, any U.S. dollar-denominated investments we make in the future.

Since July 2005, the RMB has no longer been pegged to the U.S. dollar. Although the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in the RMB exchange rate and lessen intervention in the foreign exchange market.

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions. While we may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and we may not be able to successfully hedge our exposure at all. In addition, our foreign currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currencies.

Industry Risk Factors

High fuel prices may increase carrier prices and volatility in fuel prices may make it more difficult to pass through this cost to our clients, which may impair our operating results.

Fuel prices recently reached historically high levels and continue to be volatile and difficult to predict. In the event fuel prices rise, carriers can be expected to charge higher prices to cover higher operating expenses, and our gross profits and income from operations may decrease if we are unable to continue to pass through to our clients the full amount of these higher costs. Higher fuel costs could also cause material shifts in the percentage of our revenue by transportation mode, as our clients may elect to utilize alternative transportation modes, such as inter-modal. In addition, increased volatility in fuel prices may affect our gross profits and income from operations if we are not able to pass through to our clients any higher costs associated with such volatility. Any material shifts to transportation modes with respect to which we realize lower gross profit margins could impair our operating results.

If we fail to maintain and upgrade our information technology systems to meet the demands of our customers and protect our information technology systems against risks that we cannot control, our business may be adversely affected.

We compete for customers based in part on the flexibility and sophistication of our information technology systems. The failure of the hardware or software that supports these systems, the loss of data contained in the systems or the inability to access or interact with our website or connect with our customers electronically, could significantly disrupt our operations, prevent customers from placing orders with us or cause us to lose freight, orders or customers. If our information technology systems are unable to handle additional volume as our business and scope of services grow, our service levels and operating efficiency will likely decline. In addition, we expect that our customers will continue to demand increasingly sophisticated information technology systems from us. If we fail to hire or retain qualified persons to implement, maintain and protect our information technology systems, or if we fail to upgrade or replace our information technology systems to handle increased volumes and levels of complexity and meet the increased demands of our customers, our business may be adversely affected.

Our information technology systems are dependent upon global communications providers, web browsers, telephone systems and other aspects of the Internet infrastructure that have experienced significant system failures and electrical outages in the past. Our systems are also susceptible to outages due to fire, floods, power loss, telecommunications failures and similar events. Although we have implemented network security measures, our servers are vulnerable to computer viruses, break-ins and similar disruptions from unauthorized tampering. The occurrence of any of these events could disrupt or damage our information technology systems and adversely affect our internal operations, our ability to provide services to our customers and the ability of our customers to access our information technology systems.

| (8) |

Stock Risk Factors

Certain shareholders control a majority voting right.

Our chief executive officer owns 100% of the outstanding shares of our preferred stock, each share of which constitutes twenty-five (25) Common Share votes (subject to adjustment for stock splits, stock dividends, combinations, and the like upon occurrence of such event, if any) in all matters, representing 59.91% of total voting right. Accordingly, he will be able to influence the election of our directors and thereby influence or direct our policies.

No dividends have been paid on our preferred stock and common stock

To date, we have not paid any cash dividends on our preferred stock and common stock. We do not expect to declare or pay dividends on the preferred and common stock in the foreseeable future. In addition, the payment of cash dividends may be limited or prohibited by the terms of any future loan agreements.

We may need to issue more stock, which could dilute your stock.

If China Logistics does not have enough capital to meet future capital requirements, they may need to conduct additional capital-raising in order to continue operations. To the extent that additional capital is raised through the sale of equity and/or convertible debt securities, the issuance of such securities could result in dilution to shareholders and/or increased debt service commitments. Accordingly, if China Logistics issues additional stock, it could reduce the value of your stock.

Our stock may be subject to substantial price and volume fluctuations due to a number of factors, many of which will be beyond our control and may prevent our stockholders from reselling our common stock at a profit.

The securities markets have experienced significant price and volume fluctuations in the past. This market volatility, as well as general economic, market or political conditions, could reduce the market price of our common stock in spite of our operating performance. In addition, our operating results could be below the expectations of public market analysts and investors, and in response the market price of our common stock could decrease significantly. Investors may be unable to resell their shares of our common stock for a profit. The decline in the market price of our common stock and market conditions generally could adversely affect our ability to raise additional capital, to complete future acquisitions of or investments in other businesses and to attract and retain qualified technical and sales and marketing personnel.

There is no trading market for our shares of common stock and you may be unable to sell your shares.

There has never been a public trading market in our common stock and no such trading market is expected to develop in the immediate future. We are relying on certain exemptions from registration under the Securities Act of 1933, which will result in certain restrictions on the resale of our shares. We are not obligated to repurchase any shares at the request of any holder thereof. Further, we are not obligated to register our common stock under the Securities Act of 1933 or to otherwise contact market makers to create and maintain a market in our shares. Our common stock is not a suitable investment for investors who require liquidity. There can be no assurance that a significant public market for our securities will develop or be sustained following this offering. Thus, there is a risk that you may never be able to sell your shares.

Because we may be subject to the “penny stock” rules, you may have difficulty in selling our common stock.

Because our stock price is less than $5.00 per share, our stock may be subject to the SEC’s penny stock rules, which impose additional sales practice requirements and restrictions on broker-dealers that sell our stock to persons other than established customers and institutional accredited investors. The application of these rules may affect the ability of broker-dealers to sell our common stock and may affect your ability to sell any common stock you may own.

| (9) |

According to the SEC, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include:

| * | Control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; | |

| * | Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; | |

| * | “Boiler room” practices involving high pressure sales tactics and unrealistic price projections by inexperienced sales persons; | |

| * | Excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and | |

| * | The wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses. |

As an issuer of “penny stock” the protection provided by the federal securities laws relating to forward looking statements does not apply to us.

Although the federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks. As a result, if we are a penny stock, we will not have the benefit of this safe harbor protection in the event of any claim that the material provided by us contained a material misstatement of fact or was misleading in any material respect because of our failure to include any statements necessary to make the statements not misleading.

The application of the "penny stock" rules could adversely affect the market price of our common stock and increase your transaction costs to sell those shares.

As long as the trading price of our common shares is below $5 per share, the open-market trading of our common shares will be subject to the "penny stock" rules. The "penny stock" rules impose additional sales practice requirements on broker-dealers who sell securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 together with their spouse). For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of securities and have received the purchaser's written consent to the transaction before the purchase. Additionally, for any transaction involving a penny stock, unless exempt, the broker-dealer must deliver, before the transaction, a disclosure schedule prescribed by the Securities and Exchange Commission relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements must be sent disclosing recent price information on the limited market in penny stocks. These additional burdens imposed on broker-dealers may restrict the ability or decrease the willingness of broker-dealers to sell our common shares, and may result in decreased liquidity for our common shares and increased transaction costs for sales and purchases of our common shares as compared to other securities.

| (10) |

ITEM 1B. Unresolved Staff Comments

Not applicable.

Our main office is located at Suite 910, Yi An Plaza, 33 Jian She Liu Road, Guangzhou, People’s Republic of China, which has a total area of 750 square feet. Our office is under a two-year lease agreement with annual rental payment of approximately $8,700. This space is adequate for our present operations. No other businesses operate from this office.

We may be subject to, from time to time, various legal proceedings relating to claims arising out of our operations in the ordinary course of our business. We are not currently a party to any legal proceedings, the adverse outcome of which, individually or in the aggregate, would have a material adverse effect on the business, financial condition, or results of operations of the Company.

ITEM 4. (Removed and Reserved)

| (11) |

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is quoted on the Electronic Over-the-Counter Bulletin Board under the symbol, “CLGZF”. Trading in the common stock in the over-the-counter market has been limited and sporadic and the quotations set forth below are not necessarily indicative of actual market conditions. Furthermore, these prices reflect inter-dealer prices without retail mark-up, mark-down, or commission, and may not necessarily reflect actual transactions. The high and low bid prices for the common stock for each quarter of the years ended December 31, 2010 and 2009 are as follows:

| Interim Period | Low | High | ||||||

| Interim Period ended March 31, 2011 | $ | 2.10 | $ | 2.10 | ||||

| Fiscal 2010 | ||||||||

| Quarter ended March 31, 2010 | $ | 22.00 | $ | 22.00 | ||||

| Quarter ended June 30, 2010 | $ | 8.00 | $ | 8.00 | ||||

| Quarter ended September 30, 2010 | $ | 2.40 | $ | 2.40 | ||||

| Quarter ended December 31, 2010 | $ | 2.00 | $ | 2.00 | ||||

| Fiscal 2009 | ||||||||

| Quarter ended March 31, 2009 | $ | 40.00 | $ | 40.00 | ||||

| Quarter ended June 30, 2009 | $ | 27.00 | $ | 27.00 | ||||

| Quarter ended September 30, 2009 | $ | 15.00 | $ | 15.00 | ||||

| Quarter ended December 31, 2009 | $ | 7.00 | $ | 7.00 |

Record Holders

We are authorized to issue 250,000,000 shares of common stock, par value $.0001, and 5,000,000 shares of preferred stock, par value $.01. There are currently 4,502 record holders of our common stock and 1 record holder of our preferred stock.

The holders of the Common Stock are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders. Holders of the Common Stock have no preemptive rights and no right to convert their Common Stock into any other securities. There are no redemption or sinking fund provisions applicable to the Common Stock.

The holders of the Preferred Stock shall vote with the holders of Common Stock except that each Preferred Share shall constitute twenty-five (25) Common Share votes (subject to adjustment for stock splits, stock dividends, combinations, and the like upon occurrence of such event, if any) in all matters voted on by the members of the Company and shall be further entitled to such voting rights as may be expressly required by law.

Dividends

We have not declared any dividends since our inception and do not anticipate paying any dividends in the foreseeable future. The payment of dividends is within the discretion of the Board of Directors, and will depend on our earnings, capital requirements, financial condition, and other relevant factors. There are no restrictions that currently limit our ability to pay dividends on our Common Stock, other than those generally imposed by applicable state law.

The holders of Preferred Stock shall be entitled to receive, when and as declared by the Board of Directors out of any funds legally available therefore, a dividend per share equal to any dividends per share declared on the Common Shares. The right to such dividends on Preferred Shares shall not be cumulative, and no right shall accrue to the holders of such preferred shares by reason of the Board’s failure to pay or declare and set apart dividends thereon.

Liquidation Preference

In the event of any liquidation, dissolution or winding up of the affairs of the Company, whether voluntary or involuntary, the holders of Preferred Stock shall be entitled to be paid first out of the assets of the Company available for distribution to holders of the Company’s shares of all classes an amount equal to US$25 per Preferred Share, and no more, before any distribution of assets. If the assets of the Company shall be insufficient to permit the payment in full to the holders of the Preferred Stock of the amounts thus distributable, then the entire assets of the Company available for such distribution shall be distributed ratably among the holders of the Preferred Stock in proportion to the full preferential amount each such holder is otherwise entitled to receive.

Securities Authorized for Issuance Under Equity Compensation Plans

As of the date of this Report, we have not authorized any equity compensation plan, nor has our Board of Directors authorized the reservation or issuance of any securities under any equity compensation plan.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

None.

| (12) |

Purchases of Equity Securities by the Small Business Issuer and Affiliated Purchasers

None.

Transfer Agent

Our transfer agent is Guardian Registrar & Transfer, Inc. located at 7951 SW 6th Street, Suite 216, Plantation, Florida 33324.

ITEM 6. SELECTED FINANCIAL DATA

If the registrant qualifies as a smaller reporting company as defined by Rule 229.10(f)(1), it is not required to provide the information required by this Item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

Forward Looking Statements

Certain statements in this report, including statements of our expectations, intentions, plans and beliefs, including those contained in or implied by "Management's Discussion and Analysis" and the Notes to Consolidated Financial Statements, are "forward-looking statements", within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), that are subject to certain events, risks and uncertainties that may be outside our control. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “will”, and similar expressions identify forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We undertake no obligation to update or revise any forward-looking statements. These forward-looking statements include statements of management's plans and objectives for our future operations and statements of future economic performance, information regarding our expansion and possible results from expansion, our expected growth, our capital budget and future capital requirements, the availability of funds and our ability to meet future capital needs, the realization of our deferred tax assets, and the assumptions described in this report underlying such forward-looking statements. Actual results and developments could differ materially from those expressed in or implied by such statements due to a number of factors, including, without limitation, those described in the context of such forward-looking statements, our expansion strategy, our ability to achieve operating efficiencies, our dependence on distributors, capacity, suppliers, industry pricing and industry trends, evolving industry standards, domestic and international regulatory matters, general economic and business conditions, the strength and financial resources of our competitors, our ability to find and retain skilled personnel, the political and economic climate in which we conduct operations and the risk factors described from time to time in our other documents and reports filed with the Securities and Exchange Commission (the "Commission"). Additional factors that could cause actual results to differ materially from the forward-looking statements include, but are not limited to: 1) our ability to successfully develop our services; 2) our ability to compete effectively with other companies in the same industry; 3) our ability to raise sufficient capital in order to effectuate our business plan; and 4) our ability to retain our key executives.

RESULTS OF OPERATIONS FOR THE YEARS ENDED DECEMBER 31, 2010 AND 2009

Sales

We had sales of $8,139,485 for the year ended December 31, 2010, of which $6,949,343 from sales of products and $1,190,142 from services rendered, decreasing by $3,852,775 compared to revenues of $11,992,260 for the year ended December 31, 2009, of which $11,334,256 from sales of products and $658,004 from services rendered. We generated our revenues from import and export trading, services charge on logistics and custom clearance agency. We heavily relied on couple major customers with respect to import and export trading business. The decrease in sales to one major customer caused our total revenues to decline.

| (13) |

Cost of Sales

We had $7,511,514 and $11,344,960 in cost of sales, or 92.28% and 94.60% of sales revenues, during the years ended December 31, 2010 and 2009, respectively. Cost of sales as a percentage of sales was high in general determined by our business model as a logistic services provider for import/export business. The intensive competition in logistic industry as a result of globalization restricts the growth in our gross margin. The relatively low cost of sales as a percentage of sales in 2010 was due primarily to the increase in our revenues with respect to service charge, which includes cargo fees and agent fees. Compared to import/export business, service charge bears relatively low cost.

Income / Loss

We had net loss of $46,648 and $1,061,366 for the years ended December 31, 2010 and 2009, respectively. The decrease in net loss during the year ended December 31, 2010 was due to the increase in gross profit from services charge. In addition, the selling general and administrative expense decreased by $841,821 compared to selling general and administrative expense of $1,540,081 in 2009.

During the year ended December 31, 2009, we had loss of $126,220 on extinguishment of convertible debt, as a result of the issuance of 7,420 shares of common stock to settle the loan from shareholder of $58,120 and the loan from a third party of $16,000. The shares were valued at the fair value of our common stock on the grant date, or $27 per share. The difference between the fair market value and the conversion price of $10 per share was recognized as loss on extinguishment of convertible debt. No such loss in 2010 was another reason for decrease in net loss in 2010.

Expenses

We had operating expenses of $698,260 and $1,540,081 for the years ended December 31, 2010 and 2009, respectively. The decrease in operating expenses in 2010 was due to no non-cash consulting expense incurred in connection with stock issuance in 2010. During the year ended December 31, 2009, we had non-cash consulting expenses of $1,026,000 as a result of the issuance of 38,000 shares of common stock for the services rendered. The shares were not issued until the third quarter of 2009, using the fair value of our common stock on the grant date, at a market quoted price of $27.

Impact of Inflation

We believe that inflation has had a negligible effect on operations during this period. We believe that we can offset inflationary increases in the cost of sales by increasing sales and improving operating efficiencies.

Liquidity and Capital Resources

We had cash flows of $72,817 used in operating activities during the year ended December 31, 2010, compared to cash flows of $1,235,684 provided by operating activities for the year ended December 31, 2009. Negative cash flows from operation in 2010 were due primarily to the increase in other receivables by $941,274, plus decrease in accounts payable by $7,521,861, partially offset by the collection in accounts receivable by $3,455,889, the decrease in inventory by $3,543,137, and the increase in tax payable and other payable in the amount of $468,498 and $422,037, respectively. Positive cash flows from operations during the year ended December 31, 2009 were primarily due to effective collection in accounts receivable in the amount of $3,464,878, plus the increase in accounts payable by $1,083,483, and the increase in others by $321,808, partially offset by the increase in inventory and other receivable, which were $3,136,582 and $133,949, respectively, and the decrease in tax payable by $587,694.

Cash flows used in investing activities were $29,983 and $25,399 for the years ended December 31, 2010 and 2009, respectively, due primarily to the purchase of property and equipment in both years.

We had cash flows of $18,762 and $517,659 used in financing activities for the years ended December 31, 2010 and 2009, respectively, due to the repayments to a shareholder loan in both years.

Overall, we have funded our cash needs from inception through December 31, 2010 with a series of debt and equity transactions, primarily with related parties. If we are unable to receive additional cash from our related parties, we may need to rely on financing from outside sources through debt or equity transactions. Our related parties are under no legal obligation to provide us with capital infusions. Failure to obtain such financing could have a material adverse effect on operations and financial condition.

We had cash of $1,137,529 on hand and working capital of $1,189,716 as of December 31, 2010. Currently, we have enough cash to fund our operations for about nine months. This is based on current working capital and projected revenues. However, if the projected revenues fall short of needed capital we may not be able to sustain our capital needs. We will then need to obtain additional capital through equity or debt financing to sustain operations for an additional year. Our current level of operations would require capital of approximately $700,000 per year starting in 2010. Modifications to our business plans may require additional capital for us to operate. For example, if we are unable to raise additional capital in the future we may need to curtail our number of product offers or limit our marketing efforts to the most profitable geographical areas. This may result in lower revenues and market share for us. In addition, there can be no assurance that additional capital will be available to us when needed or available on terms favorable to us.

On a long-term basis, liquidity is dependent on continuation and expansion of operations, receipt of revenues, additional infusions of capital and debt financing. However, there can be no assurance that we will be able to obtain additional equity or debt financing in the future, if at all. If we are unable to raise additional capital, our growth potential will be adversely affected. Additionally, we will have to significantly modify our business plan.

Off-Balance Sheet Arrangements

We have not entered into any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources and would be considered material to investors. Certain officers and directors of the Company have provided personal guarantees to our various lenders as required for the extension of credit to the Company

| (14) |

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We do not use derivative financial instruments in our investment portfolio and has no foreign exchange contracts. Our financial instruments consist of cash and cash equivalents, trade accounts receivable, accounts payable and long-term obligations. We consider investments in highly liquid instruments purchased with a remaining maturity of 90 days or less at the date of purchase to be cash equivalents. However, in order to manage the foreign exchange risks, we may engage in hedging activities to manage our financial exposure related to currency exchange fluctuation. In these hedging activities, we might use fixed-price, forward, futures, financial swaps and option contracts traded in the over-the-counter markets or on exchanges, as well as long-term structured transactions when feasible.

Foreign Exchange Rates

All of our sales are denominated in Renminbi (“RMB”). As a result, changes in the relative values of U.S. Dollars and RMB affect our reported levels of revenues and profitability as the results are translated into U.S. Dollars for reporting purposes. Fluctuations in exchange rates between the U.S. dollar and RMB affect our gross and net profit margins and could result in foreign exchange and operating losses.

Our results of operations and cash flow are translated at average exchange rates during the period, and assets and liabilities are translated at the unified exchange rate as quoted by the People’s Bank of China at the end of the period. Translation adjustments resulting from this process are included in accumulated other comprehensive income in our statement of shareholders’ equity. We recorded net foreign currency gains of $39,723 in 2010 and $4,053 in 2009. We have not used any forward contracts, currency options or borrowings to hedge our exposure to foreign currency exchange risk. We cannot predict the impact of future exchange rate fluctuations on our results of operations and may incur net foreign currency losses in the future.

Our financial statements are expressed in U.S. dollars but the functional currency of our operating subsidiary is RMB. The value of your investment in our stock will be affected by the foreign exchange rate between U.S. dollars and RMB. To the extent we hold assets denominated in U.S. dollars, including the net proceeds to us from this offering, any appreciation of the RMB against the U.S. dollar could result in a change to our statement of operations and a reduction in the value of our U.S. dollar denominated assets. On the other hand, a decline in the value of RMB against the U.S. dollar could reduce the U.S. dollar equivalent amounts of our financial results, the value of your investment in our company and the dividends we may pay in the future, if any, all of which may have a material adverse effect on the price of our stock.

The exchange rates used to translate amounts in RMB into U.S. Dollars for the purposes of preparing the financial statements or otherwise stated in this MD&A were as follows:

| 2010 | 2009 | |||

| Balance sheet items, except for the registered and paid-up capital as of December 31, 2010 and 2009 |

USD 0.151:RMB 1 |

USD 0.146:RMB 1 |

||

| Amounts included in the statement of operations, statement of changes in stockholders’ equity and statement of cash flows for the years ended December 31, 2010 and 2009 |

USD 0.148:RMB 1 |

USD 0.146:RMB 1 |

| (15) |

Financial Summary Information

Because this is only a financial summary, it does not contain all the financial information that may be important to you. It should be read in conjunction with the consolidated financial statements and related notes presented in this section.

Audited Financial Summary Information for the Years Ended December 31, 2010 and 2009

| For the year ended December 31, | ||||||||

| Statements of Operations | 2010 | 2009 | ||||||

| Sales | $ | 8,139,485 | $ | 11,992,260 | ||||

| Cost of Sales | $ | 7,511,514 | $ | 11,344,960 | ||||

| Gross profit | $ | 627,971 | $ | 647,300 | ||||

| Operating expenses | $ | 698,260 | $ | 1,540,081 | ||||

| (Loss) from operations | $ | (70,289 | ) | $ | (892,781) | |||

| Other income (expenses) | $ | 33,192 | $ | (160,780) | ||||

| Net (loss) | $ | (46,648 | ) | $ | (1,061,366) | |||

| Net loss per common share | $ | 0.01 | 2.02 | |||||

| Balance Sheet |

As of December 31, 2010 |

|||

| Cash | $ | 1,137,529 | ||

| Total current assets | $ | 3,657,461 | ||

| Fixed assets, net | $ | 60,051 | ||

| Total Assets | $ | 3,717,512 | ||

| Current liabilities | $ | 2,467,745 | ||

| Commitments and Contingencies | $ | 330 | ||

| Stockholders’ equity | $ | 1,249,437 | ||

| Total liabilities and stockholders’ equity | $ | 3,717,512 | ||

| (16) |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and

Stockholders of China Logistics, Inc.

We have audited the accompanying consolidated balance sheets of China Logistics, Inc. and Subsidiary (the “Company”) as of December 31, 2010 and 2009 and related statements of consolidated operations, stockholders’ deficit, comprehensive income and cash flows for the years ending December 31, 2010 and 2009. These financial statements are the responsibility of the company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of China Logistics, Inc. and Subsidiary as of December 31, 2010 and 2009 and the results of its operations and its cash flows for years ended December 31, 2010 and 2009 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 13, the Company has suffered recurring losses and accumulated deficit that raises substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Lake & Associates, CPA’s LLC

Lake & Associates, CPA’s LLC

Schaumburg, Illinois

April 15, 2011

| China Logistics, Inc and Subsidiary | ||||||||

| Audited Condensed Consolidated Balance Sheets | ||||||||

As of December 31, 2010 and 2009

| ASSETS | ||||||||

| December 31, 2010 | December 31, 2009 | |||||||

| CURRENT ASSETS | ||||||||

| Cash and cash equivalents | $ | 1,137,529 | $ | 1,223,829 | ||||

| Accounts receivable,trade | 1,022,740 | 4,418,594 | ||||||

| Other receivables | 1,113,337 | 146,524 | ||||||

| Inventory | 341,797 | 3,844,655 | ||||||

| Prepaid expenses | 23,817 | 290,903 | ||||||

| Prepaid VAT tax | 18,241 | 483,068 | ||||||

| TOTAL CURRNET ASSETS | 3,657,461 | 10,407,573 | ||||||

| FIXED ASSETS | ||||||||

| Property, plant, and equipment | 79,440 | 47,319 | ||||||

| Accumulated depreciation | (19,389 | ) | (12,082 | ) | ||||

| NET FIXED ASSETS | 60,051 | 35,237 | ||||||

| TOTAL ASSETS | $ | 3,717,512 | $ | 10,442,810 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable | $ | 1,270,497 | $ | 8,690,450 | ||||

| Other payables | 547,584 | 114,355 | ||||||

| Other payables-related party | 18,778 | 36,816 | ||||||

| Received in advance | 622,042 | 335,076 | ||||||

| Tax payable | 8,844 | 9,422 | ||||||

| TOTAL CURRENT LIABILITIES | 2,467,745 | 9,186,119 | ||||||

| TOTAL LIABILITIES | 2,467,745 | 9,186,119 | ||||||

| COMMITMENTS AND CONTINGENCIES | ||||||||

| Redeemable preferred stock (par value $.01, 5,000,000 Shares authorized, | 330 | 330 | ||||||

| 32,950 shares issued and outstanding as of December 31, 2010 and 2009 | ||||||||

| STOCKHOLDERS' EQUITY | ||||||||

| Common stock (par value $.0001, 250,000,000 shares authorized, | 55 | 55 | ||||||

| 547,868 shares issued and outstanding as of December 31, 2010 and 2009 | ||||||||

| Additional paid in capital | 2,184,304 | 2,184,304 | ||||||

| Statutory reserves | 850 | 850 | ||||||

| Accumulated other comprehensive income | 178,936 | 139,213 | ||||||

| Retained earnings (deficit) | (1,114,708 | ) | (1,068,060 | ) | ||||

| TOTAL STOCKHOLDERS' EQUITY | 1,249,437 | 1,256,362 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 3,717,512 | $ | 10,442,810 | ||||

The accompanying notes are an integral part of these financial statements.

| (17) |

China Logistics, Inc and Subsidiary

Audited Condensed Consolidated Statements of Operation

For the Years ended December 31, 2010 and 2009

| For the year ended | ||||||||

| December 31, 2010 | December 31, 2009 | |||||||

| Revenues | ||||||||

| Product | $ | 6,949,343 | $ | 11,334,256 | ||||

| Services | 1,190,142 | 658,004 | ||||||

| 8,139,485 | 11,992,260 | |||||||

| Cost of revenues | ||||||||

| Product | 6,953,667 | 11,014,269 | ||||||

| Services | 557,847 | 330,691 | ||||||

| 7,511,514 | 11,344,960 | |||||||

| Gross profits | 627,971 | 647,300 | ||||||

| Operating expenses | ||||||||

| Selling general and administrative | $ | 698,260 | $ | 1,540,081 | ||||

| (Loss) from operations | (70,289 | ) | (892,781 | ) | ||||

| Other income (expense) | ||||||||

| Finance income (expense) | 33,134 | (35,409 | ) | |||||

| (Loss) on extinguishment of convertible debt | — | (126,220 | ) | |||||

| Non-operating income (expense) | 58 | 849 | ||||||

| Total other income (expense) | 33,192 | (160,780 | ) | |||||

| Income (Loss) before income taxes | (37,097 | ) | (1,053,561 | ) | ||||

| Income taxes | 9,551 | 7,805 | ||||||

| Net (Loss) | (46,648 | ) | (1,061,366 | ) | ||||

| Other comprehensive income | ||||||||

| Foreign currency translation gain | 39,723 | 4,053 | ||||||

| Comprehensive income (loss) | $ | (6,925 | ) | $ | (1,057,313 | ) | ||

| Weighted average common shares outstanding | ||||||||

| Basic | 547,868 | 524,025 | ||||||

| (Loss) per common share | ||||||||

| Basic | $ | (0.01 | ) | $ | (2.02 | ) | ||

The accompanying notes are an integral part of these financial statements.

| (18) |

China Logistic, Inc. and Subsidiary

Audited Consolidated Statements of Cash Flows

For the years ended December 31, 2010 and 2009

| For the year ended | ||||||||

| 2010 | 2009 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net income (loss) | $ | (46,649 | ) | $ | (1,061,366 | ) | ||

| Adjustments to reconcile net income (loss) to | ||||||||

| net cash (used in) operating activities: | ||||||||

| Depreciation | 6,781 | 3,731 | ||||||

| Stock issuance for service & loan settlement | $ | 1,226,340 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable ,trade | 3,455,889 | 3,464,878 | ||||||

| Other receivable | (941,274 | ) | (133,949 | ) | ||||

| Prepaid expense | 270,090 | 23,043 | ||||||

| Inventory | 3,543,137 | (3,136,582 | ) | |||||

| Accounts payable | (7,521,861 | ) | 1,083,483 | |||||

| Tax payable | 468,498 | (587,694 | ) | |||||

| Other payable | 422,037 | 31,991 | ||||||

| Others | 270,535 | 321,808 | ||||||

| NET CASH PROVIDED BY OPERATING ACTIVITIES | (72,817 | ) | 1,235,684 | |||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Purchase of property, plant, and equipment | (29,983 | ) | (25,399 | ) | ||||

| NET CASH (USED IN) INVESTING ACTIVITIES | (29,983 | ) | (25,399 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| (Decrease) of due to shareholders' | (18,762 | ) | (517,659 | ) | ||||

| NET CASH (USED IN) FINANCING ACTIVITIES | (18,762 | ) | (517,659 | ) | ||||

| FOREIGN CURRENCY TRANSLATION ADJUSTMENT | 35,262 | (94 | ) | |||||

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | (86,300 | ) | 692,532 | |||||

| CASH AND CASH EQUIVALENTS: | ||||||||

| Beginning of period | 1,223,829 | 531,297 | ||||||

| End of period | $ | 1,137,529 | $ | 1,223,829 | ||||

The accompanying notes are an integral part of these financial statements.

| (19) |

China Logistic, Inc. and Subsidiary

Audited Consolidated Statement of Stockholders' Equity

For the years ended December 31, 2010 and 2009

| Additional | Accumulated | |||||||||||||||||||||||||||

| Common Stock | paid-in | Statutory | Other | Retained | ||||||||||||||||||||||||

| Shares | Amount | Capital | Reserve | Comprehensive | Earnings | |||||||||||||||||||||||

| Income (loss) | Total | |||||||||||||||||||||||||||

| Balances, January 1, 2009 | 502,448 | $ | 50 | $ | 957,969 | $ | 850 | $ | 135,160 | $ | (6,694 | ) | $ | 1,087,335 | ||||||||||||||

| Stock issued for service | 38,000 | 4 | 1,025,996 | 1,026,000 | ||||||||||||||||||||||||

| Stock issued for loan settlement | 7,420 | 1 | 200,339 | 200,340 | ||||||||||||||||||||||||

| Net Income(Loss) for the period | (1,061,366 | ) | (1,061,366 | ) | ||||||||||||||||||||||||

| Other comprehensive income | 4,053 | 4,053 | ||||||||||||||||||||||||||

| Balances, December 31, 2009 | 547,868 | $ | 55 | $ | 2,184,304 | $ | 850 | $ | 139,213 | $ | (1,068,060 | ) | $ | 1,256,362 | ||||||||||||||

| Net Income(Loss) for the period | (46,648 | ) | (46,648 | ) | ||||||||||||||||||||||||

| Other comprehensive income | 39,723 | 39,723 | ||||||||||||||||||||||||||

| Balances, December 31, 2010 | 547,868 | $ | 55 | $ | 2,184,304 | $ | 850 | $ | 178,936 | $ | (1,114,708 | ) | $ | 1,249,437 | ||||||||||||||

*The stockholder’s equity has been retrospectively restated in connection with redomestication (note14)

The accompanying notes are an integral part of these financial statements.

| (20) |

CHINA LOGISTICS, INC. AND SUBSIDIARY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2010

| 1. | ORGANIZATION AND BUSINESS BACKGROUND |

China Logistics Inc. (the “Company” or “CLGZ”) was incorporated in the State of Nevada on December 23, 1988, formerly known as China International Tourism Holdings, Limited, Dark Dynamite, Inc., NCI Holdings, Inc., Vector Holding, Inc., and prior to June 26, 2002, Vector Aeromotive Corporation. The name change from China International Tourism Holdings, Limited to China Logistics Inc. took effective on August 10, 2009.

On February 18, 2009, a Plan of Exchange (the “Exchange”) was executed between and among the Company, Chengkai Logistics Co Ltd., a corporation organized under the laws of the Peoples’ Republic of China (“Chengkai”), and the shareholders of Chengkai (“Chengkai Shareholders”). The Exchange was consummated on May 19, 2009, pursuant to which 500,000 (after taking into account the Reverse Split) shares of the Company’s common stock were issued to the stockholder of Chengkai. Thereafter, Chengkai became the Company’s wholly-owned subsidiary.

Simultaneously, pursuant to a Purchase Agreement, the former president of the Company tendered a cash purchase price of $100 and assumed certain liabilities in exchange for all outstanding shares of Shaanxi Kai Da Lv You Gu Wen You Xian Gong Si, the Company’s wholly-owned subsidiary organized under the laws of the Peoples’ Republic of China ("Kai Da"). As a result of the transactions consummated at the closing, the purchase gave the former president a 'controlling interest' in Kai Da, and Kai Da was no longer a wholly-owned subsidiary of the Company.

The Exchange between the Company and Chengkai have been respectively accounted for as reverse acquisition and recapitalization of the Company and Chengkai whereby Chengkai is deemed to be the accounting acquirer (legal acquiree) and the Company to be the accounting acquiree (legal acquirer) under the Exchange. The condensed consolidated financial statements are in substance those of Chengkai, with the assets and liabilities, and revenues and expenses, of the Company being included effective from the respective consummation dates of the Exchange.

CLGZ and its wholly-owned subsidiary Chengkai are hereafter referred to as (the “Company”).

The Company is a logistic company specializing in logistical services for car manufacturers, car components, food assortments, chemicals, paper, and machinery in China. The services cover various aspects of transportation management, including logistical planning, import and export management, electronic customs declaration systems, supply chain planning, transporting products from ports to warehouses or vice versa, organization of transportation, and storage and distribution of products.

The Company’s customers include international companies and domestic enterprises in China from various industries. The Company’s customer base has been increasing at a rapid pace, especially within the Food Industry, Paper Industry, Mechanical Industry, Garment Industry, Furniture Industry and Daily Commodity Industry.

| (21) |

CHINA LOGISTICS, INC. AND SUBSIDIARY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2010

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Basis of Presentation

The accompanying consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America.

Management’s Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of financial statements and the reported amounts of revenues and expenses during the reporting period. Such estimates include but are not limited to depreciation, taxes, and contingencies. Actual results could differ from those estimates. The financial statements above reflect all of the costs of doing business.

Principles of Consolidation

The consolidated financial statements include the financial statements of the Company and its subsidiary, Chengkai.

All significant inter-company balances and transactions within the Company have been eliminated upon consolidation.

Cash and cash equivalents

Cash and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

Allowance for doubtful accounts

The Company establishes an allowance for doubtful accounts based on management’s assessment of the collectibility of trade receivables. A considerable amount of judgment is required in assessing the amount of the allowance. The Company considers the historical level of credit losses and applies percentages to aged receivables categories. The Company makes judgments about the creditworthiness of each customer based on ongoing credit evaluations, and monitors current economic trends that might impact the level of credit losses in the future. If the financial condition of the customers were to deteriorate, resulting in their inability to make payments, a larger allowance may be required.

Based on the above assessment, during the reporting periods, the management establishes the general provisioning policy to make allowance equivalent to 0.5% of gross amount of trade receivables due less than 1 year, 5% of gross amount of trade receivables due from 1 to 2 years, 10% of gross amount of trade receivables due from 2 to 3 years. The management completely writes off the gross amount of trade receivables due over 3 years. Additional specific provision is made against trade receivables to the extent which they are considered to be doubtful.

Bad debts are written off when identified. The Company does not accrue interest on trade receivables.

| (22) |

CHINA LOGISTICS, INC. AND SUBSIDIARY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2010

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

Allowance for doubtful accounts (cont’d)

Historically, losses from uncollectible accounts have not significantly deviated from the general allowance estimated by the management and no significant additional bad debts have been written off directly to the profit and loss. This general provisioning policy has not changed in the past since establishment and the management considers that the aforementioned general provisioning policy is adequate and not too excessive and does not expect to change this established policy in the near future.

Inventories

Inventories are stated at the lower of cost or market. Cost is determined on a first in first out basis and includes all expenditures incurred in bringing the goods to the point of sale and putting them in a saleable condition. In case of manufacturing inventories, cost includes an appropriate share of production overheads based on normal operating capacity. In assessing the ultimate realization of inventories, the management makes judgments as to future demand requirements compared to current or committed inventory levels. The Company estimates the demand requirements based on market conditions, forecasts prepared by its customers, sales contracts and orders in hand.

In addition, the Company estimates net realizable value based on intended use, current market value and inventory ageing analyses. The Company writes down the inventories for estimated obsolescence or unmarketable inventories equal to the difference between the cost of inventories and the estimated market value based upon assumptions about future demand and market conditions.

Property, plant and equipment