Attached files

| file | filename |

|---|---|

| EX-32.1 - FLORHAM CONSULTING CORP | v217788_ex32-1.htm |

| EX-31.2 - FLORHAM CONSULTING CORP | v217788_ex31-2.htm |

| EX-31.1 - FLORHAM CONSULTING CORP | v217788_ex31-1.htm |

| EX-32.2 - FLORHAM CONSULTING CORP | v217788_ex32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from __________ to __________

Commission File Number: 000-52634

OAK TREE EDUCATIONAL PARTNERS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

20-2329345

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification No.)

|

845 Third Avenue, 6th Floor, New York, New York 10022

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code:

(646) 290-5290

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.0001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ¨ No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer (Do not check if a smaller reporting company) ¨

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $1,358,563 as of December 31, 2010.

As of March 31, 2011, 22,938,540 shares of the registrant’s common stock, par value $.0001 per share, were issued and outstanding, of which 179,641 shares are held in escrow subject to future earnings attainment.

Documents Incorporated by Reference: None.

2010 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

|

Page

|

||

|

PART I

|

||

|

Item 1.

|

Business.

|

5

|

|

Item 1A.

|

Risk Factors.

|

27

|

|

Item 1B.

|

Unresolved Staff Comments.

|

34

|

|

Item 2.

|

Properties.

|

34

|

|

Item 3.

|

Legal Proceedings.

|

34

|

|

Item 4.

|

(Removed and Reserved).

|

35

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

35

|

|

Item 6.

|

Selected Financial Data.

|

38

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

38

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

|

|

Item 8.

|

Financial Statements and Supplementary Data.

|

46

|

|

Item 9.

|

Changes and Disagreements With Accountants on Accounting and Financial Disclosure.

|

67

|

|

Item 9A.

|

Controls and Procedures.

|

67

|

|

Item 9B.

|

Other Information.

|

68

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance.

|

69

|

|

Item 11.

|

Executive Compensation.

|

73

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

80

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence.

|

83

|

|

Item 14.

|

Principal Accounting Fees and Services.

|

88

|

|

PART IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules.

|

88

|

|

Signatures

|

92

|

- 2 -

Cautionary Statement Concerning Forward-Looking Statements

Our representatives and we may from time to time make written or oral statements that are "forward-looking," including statements contained in this Annual Report on Form 10-K and other filings with the Securities and Exchange Commission, reports to our stockholders and news releases. All statements that express expectations, estimates, forecasts or projections are forward-looking statements within the meaning of the Act. In addition, other written or oral statements which constitute forward-looking statements may be made by us or on our behalf. Words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates," "projects," "forecasts," "may," "should," variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions which are difficult to predict. These risks may relate to, without limitation:

|

|

·

|

we are subject to risks relating to enrollment of students. If we are not able to continue to successfully recruit and retain our students, we will not be able to sustain our revenue growth rate;

|

|

|

·

|

we are subject to risks relating to tuition pricing, which could have a material adverse affect on our financial results;

|

|

|

·

|

our course offerings be no longer be current;

|

|

|

·

|

our acquisition strategy may have an adverse effect on our ability to manage our business;

|

|

|

·

|

if we fail to maintain any of our state authorizations, we would lose our ability to operate in that state;

|

|

|

·

|

if any regulatory audit, investigation or other proceeding finds us not in compliance with the numerous laws and regulations applicable to the postsecondary education industry, we may not be able to successfully challenge such finding and our business could suffer;

|

|

|

·

|

if regulators do not approve our acquisitions, the acquired schools’ state licenses, accreditation, and ability to participate in Title IV programs (if applicable) may be impaired;

|

|

|

·

|

state licenses and accreditation requirements may adversely impact our ability to effect a sale of our company or any of our operating businesses;

|

|

|

·

|

we are dependent on the continued services of certain key executives;

|

|

|

·

|

government regulations relating to the Internet could increase our cost of doing business, affect our ability to grow or otherwise have a material adverse effect on our business, financial condition, results of operations and cash flows;

|

|

|

·

|

our financial performance depends, in part, on our ability to keep pace with changing market needs and technology; if we fail to keep pace or fail in implementing or adapting to new technologies, our business may be adversely affected;

|

|

|

·

|

we are subject to risks relating to our information technology, system applications and security systems, which could have a material adverse affect on our financial results;

|

|

|

·

|

our success depends on attracting and retaining qualified personnel;

|

|

|

·

|

we may not be able to adequately protect our intellectual property, and we may be exposed to infringement claims by third parties;

|

|

|

·

|

we may be subject to infringement and misappropriation claims in the future, which may cause us to incur significant expenses, pay substantial damages and be prevented from providing our services;

|

|

|

·

|

our limited operating history and the unproven long-term potential of our business model make evaluating our business and prospects difficult;

|

|

|

·

|

we may need additional capital and may not be able to obtain such capital on acceptable terms;

|

|

|

·

|

we are subject to the risk of being in default under our outstanding secured indebtedness;

|

|

|

·

|

we are subject to the risk of being in default under our outstanding secured obligations;

|

|

|

·

|

Our business may be adversely affected by a further economic slowdown in the U.S. or abroad or by an economic recovery in the U.S.;

|

|

|

·

|

we may not be able to sustain our recent growth rate or profitability, and we may not be able to manage future growth effectively;

|

|

|

·

|

insiders have substantial control over us, and they could delay or prevent a change in our corporate control even if our other stockholders wanted it to occur;

|

|

|

·

|

there may not be sufficient liquidity in the market for our common stock;

|

|

|

·

|

the market price of our common stock may be volatile;

|

|

|

·

|

our outstanding options and warrants may adversely affect us in the future and cause substantial dilution to existing shareholders;

|

|

|

·

|

our common stock may be considered a “penny stock” and may be difficult to sell;

|

|

|

·

|

the market for penny stocks has experienced numerous frauds and abuses which could adversely impact investors in our stock; and

|

- 3 -

|

|

·

|

we have not paid dividends in the past and do not expect to pay dividends in the future, and any return on investment may be limited to the value of our stock.

|

Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in or suggested by such forward-looking statements. We undertake no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof. Readers should carefully review the factors described herein and in other documents we file from time to time with the Securities and Exchange Commission, including our Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K, and any Current Reports on Form 8-K filed by us.

- 4 -

In this report, “Oak Tree”, the “Company,” "we", "us" and "our", refer to Oak Tree Educational Partners, Inc., Educational Investors, Inc., a Delaware corporation (“EII”), Valley Anesthesia, Inc., a Delaware corporation (“Valley”), Training Direct, LLC, a Connecticut limited liability company (“Training Direct” and together with EII and Valley, the “EII Group”), Educational Training Institute, Inc., a New York corporation (“ETI”), Culinary Tech Center, LLC, a New York limited liability company (“CTC”), and Professional Culinary Academy LLC, a New York limited liability company (“PCA”, and together with ETI and CTC, the “Culinary Group”), unless the context otherwise requires. Unless otherwise indicated, the term "year," "fiscal year" or "fiscal" refers to our fiscal year ending December 31st.

Introduction

We own and operate vocational training and technical schools. Through our acquisition of EII, we have acquired schools that provide vocational education for the potential employees in the heath care and medical industries. We have also recently acquired additional affiliated schools that provide educational skills and vocational training in commercial cooking, catering, hotel operations and customer service.

Our Schools

Our for-profit schools operate in two markets: vocational training and test preparation. The Culinary Group currently maintains six teaching locations in New York State (Albany, Yonkers, Buffalo, Poughkeepsie, Monticello and Queens, New York), and Training Direct maintains a teaching location in Bridgeport, Connecticut.

The Reverse Merger and Acquisition of Training Direct

The Reverse Merger

On December 16, 2009, we executed an agreement and plan of merger with EII Acquisition Corp. (a newly formed acquisition subsidiary of Oak Tree), Educational Investors, Inc., a Delaware corporation (“EII”) and its security holders, Sanjo Squared, LLC, Kinder Investments, LP, Joseph Bianco and Anil Narang (collectively, the “EII Securityholders”). Under the terms of the merger agreement, Mergerco was merged with and into EII, with EII as the surviving corporation of the merger, as a result of which EII became a wholly-owned subsidiary of our company. In connection with the merger, the EII Securityholders received (i) an aggregate of 6,000,000 shares of our common stock, (ii) options to acquire 2,558,968 additional shares of our common stock, 50% of which have an initial exercise price of $0.41 per share and 50% of which have an initial exercise price of $0.228 per share, subject to certain performance targets set forth in the merger agreement, and (iii) 250,000 shares of our Series A Preferred Stock, with each share of Series A Preferred Stock automatically convertible into 49.11333 shares of common stock upon the filing by us of an amendment to our certificate of incorporation which increases the authorized shares of our common stock to at least 50,000,000. As described below, on October 13, 2010, we amended and restated our certificate of incorporation to increase the number of our authorized common stock to 50,000,000 and accordingly, 12,278,333 shares of common stock were issued upon automatic conversion of the Series A Preferred Stock.

Our Board of Directors, by written consent dated as of December 23, 2009, approved the reverse merger and the consummation of the transactions contemplated in the merger agreement. Prior to the consummation of the reverse merger, on December 23, 2009, David Stahler, our former sole officer and director, solicited consents from a majority of the then stockholders via electronic mail, facsimile and telephone seeking approval of the reverse merger and the consummation of the transactions contemplated in the merger agreement. However, as set forth below, shareholder approval of the reverse merger consummated in December 2009 was not required under the laws of the State of Delaware as a precondition to consummation of such transaction.

The reverse merger was structured as a “reverse triangular merger” in which we, as a public shell company, formed a wholly-owned merger subsidiary in the State of Delaware on December 16, 2010 named EII Acquisition Corp. (“Mergerco”). Pursuant to the merger agreement, Mergerco was merged with and into EII, with EII as the surviving corporation of the reverse merger. Each of EII and Mergerco were the “constituent corporations” (as defined in the Delaware General Corporation Law) to the reverse merger. Pursuant to the merger agreement, we issued the merger consideration (its common stock and preferred stock) to the stockholders of EII in the reverse merger. As a result of such merger, EII (as the surviving entity of the constituent corporations) became our wholly-owned subsidiary. On December 28, 2009, a Certificate of Merger of Domestic Corporations was filed with the Secretary of State of the State of Delaware, effective as of December 31, 2009.

- 5 -

Although as set forth above we elected to obtain consents to the merger from holders of a majority of our then outstanding shares, neither such consents nor any other shareholder approvals were required as a pre-condition to the valid consummation of the reverse merger in December 2009. We were not a constituent corporation to the reverse merger and neither our existence, certificate of incorporation, or authorized common stock was affected by the reverse merger of Mergerco with and into EII. Pursuant to well settled Delaware law, the approval of a corporation’s shareholders would not be required as a condition to the valid consummation of a reverse triangular merger, so long as the shares of common stock and preferred stock issued by us as consideration for the acquisition of the target company (EII, in our case) had been previously authorized under our certificate of incorporation. As we had a sufficient number of authorized shares of common stock and preferred stock to issue to the EII stockholders in order to consummate the reverse triangular merger transaction between EII and Mergerco, our directors had both the statutory and certificate of incorporation authority to issue such shares for any permissible corporate purpose, such as the EII acquisition. In substance, Delaware treats reverse triangular merger transactions in the same manner as though we had issued from our authorized and previously unissued common stock, additional shares directly to the stockholders of EII in exchange for 100% of the EII shares.

Approval of the reverse merger by the stockholders of EII was required and was obtained. In addition, shareholder approval was required from the sole stockholder of Mergerco, which in this case was our company. In such connection, on December 23, 2009, our board of directors approved of the reverse merger and the consummation of the transactions contemplated thereby by unanimous written consent. Based upon the foregoing, since approval of the Company’s shareholders was not required for the reverse merger, it was permissible for the reverse merger to be consummated and effective on December 31, 2009.

The closing of the transactions contemplated by the merger agreement was subject to a number of conditions including, without limitation, completion of due diligence, approval of the merger agreement by the boards of directors of EII and our company and the prior or simultaneous closing of the acquisition of Training Direct, LLC (as discussed below). Accordingly, on December 31, 2009, the parties to the merger agreement deemed all closing conditions to be satisfied and accordingly, the reverse merger was consummated. As a result of the reverse merger, we believe we are no longer a shell corporation as that term is defined in Rule 405 of the Securities Act of 1933, as amended, and Rule 12b-2 of the Securities Exchange Act of 1934, as amended.

On December 23, 2009 and May 19, 2010 our board of directors, and on May 19, 2010 Kinder Investments, L.P. and Sanjo Squared, LLC, which were shareholders owning 89.5% of our outstanding shares of common stock on May 19, 2010, approved by written consent: (i) our corporate name change; (ii) the increase in our authorized shares of common stock; and (iii) our 2009 Stock Incentive Plan for key employees, directors, consultants and others providing services to us, pursuant to which up to 1,500,000 shares of common stock shall be authorized for issuance thereunder. The General Partner of Kinder Investments, L.P. is Nesher, LLC. The person having voting, dispositive or investment powers over Nesher is Dov Perlysky, Managing Member. Mr. Perlysky is a member of the Company’s board of directors and therefore, Kinder is a beneficial owner and affiliate of our company. The persons sharing voting, dispositive or investment powers over Sanjo Squared, LLC (50% each) are Joseph J. Bianco and Anil Narang, Managers. Mr. Bianco is the Chief Executive Officer and Chairman of the board of directors of our company and Mr. Narang is the President, Chief Operating Officer and a member of the board of directors of our company. Accordingly, Sanjo is a beneficial owner and affiliate of the Company. Kinder and Sanjo proposed to execute, and on May 19, 2010 entered into, shareholder consents approving the name change, share capital increase and 2009 Plan and such consents did not constitute a solicitation on behalf of our company.

The determination by our existing board of directors and majority shareholders (Kinder and Sanjo) in May 2010 to approve our name change to Oak Tree Educational Partners, Inc., as well as the share capital increase and the 2009 Plan, was made independently of the merger agreement and recently completed transaction with Culinary Tech Center, LLC and Professional Culinary Academy LLC and its affiliates (the “Culinary Group Acquisition”), and was in no way related to such Culinary Group Acquisition. In addition, consummation of such Culinary Group Acquisition was subject to certain conditions, including our obtaining external financing and the approval of the New York State Department of Education. Our completed Culinary Group Acquisition is described below.

At the closing of the reverse merger, our sole officer resigned and Joseph Bianco was appointed as our Chief Executive Officer, Anil Narang was appointed as our President and Chief Operating Officer, and Kellis Veach was appointed as our Chief Financial Officer and Secretary. In addition, our sole director resigned and Joseph Bianco, Anil Narang, Dov Perlysky, Howard Spindel and David Cohen were appointed as our directors, with such resignation and appointments effective on January 22, 2010, representing the tenth day after mailing our Schedule 14f-1 Information Statement to our shareholders of record.

- 6 -

We filed an Information Statement on Schedule 14C under the Exchange Act, and upon the effectiveness of such Information Statement, we amended and restated our certificate of incorporation on October 13, 2010 to, among other things:

|

·

|

increase our authorized common stock to 50,000,000 shares; and

|

|

·

|

change our corporate name to “Oak Tree Educational Partners, Inc.”.

|

Acquisition of Training Direct

On December 16, 2009, EII entered into an interest purchase agreement with the members of Training Direct, and our company, pursuant to which EII acquired all outstanding membership interests, on a fully diluted basis, of Training Direct in exchange for (a) $200,000 cash, (b) shares of our common stock having a deemed value of $600,000 (the “Acquisition Shares”), with such number of Acquisition Shares to be determined by dividing $600,000 by the “Discounted VWAP” (as defined below) for the 20 “Trading Days” (as defined below) immediately following the consummation of the reverse merger, and (c) shares of our common stock having a deemed value of $300,000 (the “Escrow Shares”), with such number of Escrow Shares to be determined by dividing $300,000 by the Discounted VWAP for the 20 Trading Days immediately following the consummation of the reverse merger. The Escrow Shares will be held in escrow and released therefrom as provided in the purchase agreement. “Discounted VWAP” is defined in the purchase agreement as 70% of the “VWAP” of our common stock, but in no event less than $0.40 per share. “VWAP” is defined in the purchase agreement as a fraction, the numerator of which is the sum of the product of (i) the closing trading price for our common stock on the applicable national securities exchange on each Trading Day of the 20 Trading Days following the consummation of the reverse merger, and (ii) the volume of our common stock on the applicable national securities exchange for each such day and the denominator of which is the total volume of our common stock on the applicable national securities exchange during such twenty day period, each as reported by Bloomberg Reporting Service or other recognized market price reporting service. “Trading Day” is defined in the purchase agreement as any day on which the New York Stock Exchange or other national securities exchange on which our common stock trades is open for trading. The Discounted VWAP for the twenty Trading Days after the effective date of the reverse merger is $1.67. Accordingly, on March 3, 2010 we issued an aggregate of 359,281 Acquisition Shares, effective December 31, 2009, and 179,641 Escrow Shares.

The closing of the purchase agreement was subject to a number of conditions including, without limitation, approval of the change of ownership of Training Direct by the Connecticut Department of Higher Education, the consummation of the reverse merger, and execution of a certain employment agreement and consulting agreement. On December 31, 2009, the parties to the purchase agreement deemed all closing conditions to be satisfied and accordingly, the purchase and sale of the Training Direct membership interests was consummated simultaneous with the reverse merger.

ETI and the Culinary Group Acquisition

On May 27, 2010, effective May 21, 2010, we entered into agreements to acquire 100% of the equity interests of Educational Training Institute, Inc., Culinary Tech Center, LLC and Professional Culinary Academy LLC; the latter two of which are licensed by the New York State Department of Education. The Culinary Group provides vocational training in commercial cooking, catering, hotel operations and customer service.

As further described below, on December 1, 2010, we and the Culinary Group satisfied all conditions to closing, including, without limitation, obtaining approval of the acquisition from the New York State Department of Education, and accordingly, the parties consummated the acquisition of the Culinary Group pursuant to amended and restated agreements. The cash portion of the purchase price for the Culinary Group was financed by us through a $10 million senior secured debt facility (the “Loan”) provided by Deerpath Funding, LP (“Deerpath”), a NYC-based provider of financing to middle market companies.

- 7 -

On December 1, 2010 (the “Closing Date”), we consummated the acquisition of ETI pursuant to an amended and restated agreement and plan of merger dated as of November 30, 2010 (the “Merger Agreement”) by and among the Company, ETI Acquisition Corp. (a newly formed acquisition subsidiary of the Company) (“Mergerco”), ETI and its stockholders being Messrs. Joseph Monaco, Harold Kaplan and their wives and daughters (collectively, the “ETI Stockholders”) pursuant to which Mergerco was merged with and into ETI, with ETI as the surviving corporation of the merger (the “Merger”). Upon consummation of the Merger, ETI became our wholly-owned subsidiary. Under the terms of the Merger Agreement, the ETI Stockholders were issued an aggregate of 1,200,000 shares of our common stock (the “Merger Shares”), representing $3.0 million of our common stock valued at $2.50 per share. In addition, under the Merger Agreement, the ETI Stockholders are entitled to receive contingent merger consideration in the form of $500,000 of additional shares of our common stock, based upon the Culinary Group reaching a certain cumulative EBITDA level in 2011. The contingent merger consideration is valued based on the volume weighted average price of our common stock for the 20 trading days prior to determination of the applicable EBITDA of the Culinary Group in fiscal 201l.

The Amended and Restated Membership Interest Purchase Agreement

Immediately following consummation of the Merger referred to above, we consummated the acquisition of CTC and PCA pursuant to an amended and restated membership interest purchase agreement (the “Purchase Agreement”) with the Culinary Group and Messrs. Monaco and Kaplan, the sole members of CTC and PCA. Under the terms of the Purchase Agreement, ETI (now a wholly-owned subsidiary of the Company) purchased from Messrs. Monaco and Kaplan 100% of the membership interests of each of CTC and PCA. The purchase price for such equity membership interests paid at closing was $1.5 million, in cash, in equal amounts to Messrs. Monaco and Kaplan or their designee(s).

On the Closing Date, Messrs. Monaco and Kaplan entered into employment agreements (the “Employment Agreements”) with us expiring December 31, 2013, pursuant to which they shall serve as Executive Vice Presidents of the Company and the President and Chief Operating Officer, respectively, of the Culinary Group. Such executives shall each receive base salaries of $150,000 in 2010, increasing to $200,000 in 2011 and $250,000 in each of 2012 and 2013; provided, that, in the event that the cumulative pre-tax income of the Culinary Group in 2011 does not equal or exceed the cumulative pre-tax income in 2010, then the base salaries for 2012 and 2013 shall remain at $200,000. In addition, Messrs. Monaco and Kaplan shall be entitled to discretionary bonuses, as determined by our board of directors.

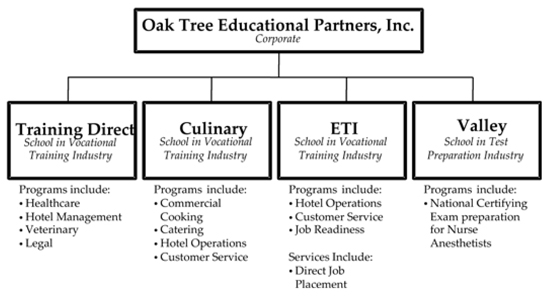

The following diagram sets forth our corporate structure, after giving effect to consummation of the transactions contemplated by the Merger Agreements and the Purchase Agreements described below.

- 8 -

The Loan Agreement

On the Closing Date, we completed the Loan with Deerpath pursuant to a Loan Agreement dated November 30, 2010 by and among the Company and its subsidiaries and Deerpath (the “Loan Agreement”), and received gross proceeds of $3,000,000 as an initial drawdown (the “Initial Loan”), a portion of which was used to fund the acquisition of CTC and PCA. We paid an aggregate amount of $185,000 to Deerpath at the closing, consisting of structuring and closing fees and expenses. Deerpath may, at its sole discretion, make additional Loans up to an aggregate amount equal to $7,000,000 (the “Additional Loans”).

In exchange for the Initial Loan, we issued to Deerpath (i) a senior secured initial term promissory note in the principal amount of $3,000,000 (the “Note”); (ii) a warrant (the “Warrant”) initially exercisable to purchase 628,857 shares of our common stock, representing 2.5% of our fully diluted common stock as of the Closing Date, at an exercise price of $0.50 per share; and (iii) 1,886,571 shares of our common stock (the “Deerpath Shares”), representing 7.5% of our fully diluted common stock as of the Closing Date. The number of shares of our common stock issuable upon exercise of the Deerpath Warrant is subject to customary anti-dilution adjustments.

Under the terms of the Loan Agreement, the principal amount of the Loan and Additional Loans (collectively, the “Principal Debt”) shall bear interest at a rate equal to the lesser of (i) 13.50% per annum; and (ii) the maximum rate of interest Deerpath may receive under applicable law. The principal amount and all accrued and unpaid interest under the Loan and Additional Loans shall be repaid by us on or prior to November 30, 2015 (the “Maturity Date”). Commencing on January 1, 2011 and continuing until the Principal Debt is paid in full (a) accrued and unpaid interest shall be paid by us in arrears on the first day of each month; and (b) we shall make payments of Principal Debt on a quarterly basis in an amount equal to $75,000 per quarter. In addition, we may elect to prepay any or all of the Principal Debt upon 2 business day’s prior written notice to Deerpath in a minimum amount of $100,000 and in minimum increments of $10,000 for any amounts in excess of $100,000. We shall pay a cash prepayment premium of 3%, 2% or 1% of the Principal Debt being prepaid if such prepayment occurs on or prior to the first, second or third anniversaries of the Closing Date, respectively.

The Loan and Additional Loans are secured by a first priority lien and security interest on all of the assets of the Company and its subsidiaries pursuant to a security agreement (the “Security Agreement”) dated as of November 30, 2010, among the Company, each of its subsidiaries and Deerpath, as well as by a pledge of all of the equity that the Company and certain of its subsidiaries owns in each of their respective subsidiaries pursuant to a pledge agreement (the “Pledge Agreement”) dated as of November 30, 2010, among the Company, certain of its subsidiaries and Deerpath. Due to the entry by the Company into the Security Agreement with Deerpath, Valley Anesthesia, Inc. (“Valley”), the Company’s wholly owned subsidiary, entered into a Subordination and Intercreditor Agreement (the “Subordination Agreement”) and Amended and Restated Security Agreement (the “Valley Security Agreement”) with Valley Anesthesia Educational Programs, Inc. (“VAEP”), pursuant to which VAEP agreed to subordinate its security interest in all of Valley’s assets, as well as repayment, covering a 6-year installment promissory note in the principal amount of $2,000,000 (the “VAEP Note”) previously issued by Valley to VAEP in connection with Valley’s August 2009 purchase of a majority of the equity of VAEP, in favor of Deerpath’s priority first lien and security interest.

In consideration for its execution of the Subordination Agreement, Oak Tree and each of its subsidiaries guaranteed the VAEP Note and, pursuant to an amended and restated security agreement, Oak Tree and its subsidiaries granted VAEP a lien, subordinated to the Deerpath lien and any other senior secured indebtedness (including acquisition indebtedness), on the assets and properties of Oak Tree and its subsidiaries. In addition, Oak Tree’s principal shareholders, Kinder Investments, LP, Joseph J. Bianco and Anil Narang agreed to guaranty, under certain circumstances, the payment when due of up to nine monthly installments, totaling a maximum of approximately $319,500, of the VAEP Note.

Our History

Prior to the reverse merger, we were an Internet professional services firm. We provided our clients with an integrated set of strategic, creative and technology services that enabled them to effect and maximize their Internet business. Our services included advising clients on developing business models for their Internet activities, identifying opportunities to improve operational efficiencies through online opportunities and planning for the operations and organization necessary to support an online business. Our services also included developing graphic designs and web sites for our clients. We also recommended and installed appropriate hardware and software networks to enable online sales, support and communication, and managed the hosting of clients' websites in certain cases.

In 2006, we entered into our first Internet consulting agreement and since then completed web design and project work for another five clients located in New York. For the year ended December 31, 2009, we had consulting revenues of $16,252, as compared to $14,025 for the year ended December 31, 2008. The decrease in the 2009 period was due to fewer projects completed for new and existing clients.

- 9 -

In 2009, our sole officer and director determined that there was inadequate demand for our consulting services and sought to redirect our focus to acquiring a growing operating business. On December 31, 2009, we consummated the reverse merger with EII simultaneous with EII’s acquisition of Training Direct. As a result of the reverse merger, we will carry out the business and operations of the EII Group, and we discontinued our consulting operations.

On December 1, 2010, we consummated the acquisition of the Culinary Group, which are affiliated schools that provide educational skills and vocational training in commercial cooking, catering, hotel operations and customer service.

Our Current Businesses

EII

EII was incorporated in the State of Delaware on July 20, 2009 for the purpose of acquiring vocational, training and technical schools, with an initial emphasis on the health care and medical industries. EII’s wholly-owned subsidiary, Valley Anesthesia, Inc., was incorporated on July 15, 2009 in the State of Delaware. Effective August 20, 2009, Valley Anesthesia, Inc. purchased certain assets and assumed certain liabilities and operations of Valley Anesthesia Educational Programs, Inc., which was incorporated in the State of Iowa on March 10, 1993, for an aggregate purchase price of $3,838,215, plus certain contingent payments which are subject to the achievement of predetermined operating milestones.

Valley

Through Valley, we provide comprehensive review and update courses and study materials that aid Student Registered Nurse Anesthetists (“SRNA”) and Graduate Registered Nurse Anesthetists (“GRNA”) in preparation for the National Certifying Exam (“NCE”) throughout the continental United States.

Valley’s principal service is a three-day comprehensive review and update course designed to prepare SRNAs for the NCE. Valley also offers a 600-page basic manual. Additionally, Valley offers MemoryMasterTM, which is a collection of approximately 4,000 questions and answers designed to further assist its students in preparation for the NCE. Valley presented 10 courses in 2007, 11 courses in 2008, 12 courses in 2009 and 13 courses in 2010. In addition, Valley has 14 courses scheduled for 2011.

Valley’s revenue is currently generated from three sources: (i) seminars, (ii) manuals, and (iii) MemoryMasterTM. In addition, Valley anticipates that there will be a fourth revenue source beginning in 2011, which is from on-line practice examinations that management expects to launch in the second quarter of 2011.

Training Direct

EII’s wholly-owned subsidiary, Training Direct, LLC, was organized as a limited liability company in the State of Connecticut on January 7, 2004. Training Direct provides “distance learning” and “residential training” educational programs for students to become eligible for entry-level employment in a variety of fields and industries. Training Direct strives to assist those who may not have realized their full potential in the workplace by finding such individuals a new career direction and assisting in progressing their learning skills necessary to reach their earning and personal development possibilities and goals. Training Direct maintains licenses from the Connecticut Commissioner of Higher Education, the Connecticut Department of Health Services and the National Health Career Association, and is an Eligible Training Provider under the Workforce Investment Act. Such licenses require that Training Direct have a competent faculty, offer educationally sound and up-to-date courses and course materials, and be subject to inspections and approvals by outside examining committees.

The Culinary Group

Culinary Tech Center and Professional Culinary Academy were each formed in the State of New York on June 13, 2008 and July 18, 2008, respectively. CTC and PCA offer training programs that prepare students for entry level employment in the culinary field. Courses include comprehensive six and nine-month programs in both commercial cooking and catering. All programs require students to complete an externship that provides experience working in a foodservice establishment. Graduates prepare for careers in restaurants, bakeries, corporate and other food service departments, as well as catering and take-out prepared foods. Some CTC locations also offer courses in hotel operations and customer service that prepare students for entry level positions in such fields. CTC and PCA maintain licenses from the New York State Department of Education.

- 10 -

Educational Training Institute

Educational Training Institute was formed in the State of New York on December 28, 1992. ETI provides customized training courses for “at risk” high school students on behalf of school districts. Courses include hotel operations, customer service and job readiness. ETI also provides a non-training direct placement service that helps vocational rehabilitation clients find jobs.

Our Offices and Other Corporate Information

EII’s and Valley’s principal executive offices are located at 845 Third Avenue, 6th Floor, New York, New York 10022, and its telephone number is (646) 290-5290. Valley’s principal operating office is located at 1995 Country Club Blvd, Clive, Iowa 50325 and its telephone number is (515) 221-2590. Valley maintains a website at www.valleyanesthesia.com. Training Direct’s principal executive offices are located at 3885 Main Street, 2nd Floor, Bridgeport, Connecticut 06606 and its telephone number is (203) 372-8842. Training Direct maintains a website at www.trainingdirectusa.org. The Culinary Group principal executive offices are located at 424 West 33rd Street, New York, New York 10001 and its telephone number is (212) 243-5081. The Culinary Group maintains a website at www.traininginstitute.ny.com. The contents of such websites are not part of this report.

Valley’s Program Offerings

Seminars

Each review and update course includes 26 hours over a three-day time period. The courses are located throughout the United States in areas with high concentrations of nursing programs. Seminars are typically held in hotel conference rooms located close to airports to minimize logistical issues for traveling students.

Registration for the seminars can be completed online, by mail or by telephone. Registration for courses for the following year occurs at the end of August. Once the registration period has commenced, there is significant enrollment in the seminars within a couple days. Seminars in Cleveland and Philadelphia have traditionally had the highest student enrollments with two courses in Cleveland that included 217 and 216 students, respectively, and 215 students in Philadelphia in 2007. In 2008, the seminars had enrollments for two courses in Philadelphia of 224 and 220 students, respectively and in Cleveland for two courses of 219 and 216 students, respectively. In 2009, the seminars had enrollments for two courses in Cleveland of 211 and 209 students, respectively, a course in Philadelphia with enrollment of 218 students and a course in Dallas with enrollment of 217 students. In 2010, the seminars had enrollments for a course in Orlando with 226 enrollments a course in Philadelphia with 215 enrollments, a course in Cleveland with 214 enrollments and a course in Dallas with 200 enrollments.

Manuals

Valley publishes a course manual which is purchased by students enrolled in the seminars and others. The course manual consists of over 600 pages and is printed by a third party. While the volume is fairly substantial, the complexity of the printing is not excessive and the manuals are not bound. Production costs were approximately $175,000 in 2007, $186,000 in 2008, $182,000 in 2009 and $177,000 in 2010. The manuals are ordered from the printers each fall after registration has begun for the following year’s courses and correspondingly, the majority of the printing costs are incurred in the fourth quarter. Since the per unit cost to print 100 manuals is the same as the cost to print one, Valley only orders enough books to meet its known demand. As Valley receives additional orders, it places orders with its vendor to print the required quantity to meet the additional demand.

MemoryMasterTM

Valley offers its MemoryMasterTM study guide collection of approximately 4,000 questions and answers to aid its students in preparation for the NCE by facilitating the memorization and understanding of a large body of anesthesia-related facts, concepts and issues. MemoryMasterTM content is categorized according to the outline provided by the Council on Certification of Nurse Anesthesia, which includes:

|

|

·

|

basic and related clinical sciences;

|

- 11 -

|

|

·

|

equipment, instrumentation and technology;

|

|

|

·

|

basic principles of anesthesia;

|

|

|

·

|

advanced principles of anesthesia; and

|

|

|

·

|

professional issues.

|

MemoryMasterTM is offered in two forms: (i) a bound, soft covered book, and (ii) flash cards. The book provides the entire MemoryMasterTM content in a side-by-side format, with questions appearing on the left side of each page and the corresponding answers on the right side.

MemoryMasterTM is printed by the same third party source as the course manuals. MemoryMasterTM can also be ordered from the printers on an as needed basis. Management estimates that MemoryMasterTM accounted for approximately $340,000 and $353,000 of revenue in 2009 and 2010, respectively. Historically, the fourth quarter includes the greatest amount of MemoryMasterTM shipments and related revenue.

On-Line Practice Examinations

Valley anticipates that there will be a fourth revenue source beginning in 2011, which is from on-line practice examinations that management expects to launch in the second quarter of 2011. Valley’s on-line practice examinations will be a test assessment program where students can visit a mock testing center on-line. Practice examinations and subject-specific quizzes will be available for student practice purposes. Valley believes that this will be a popular addition to its offerings, and that most students who take its courses, and others who do not, will avail themselves of the new test assessment center.

Training Direct’s Program Offerings

Distance Learning Programs

Distance learning programs provide an additional opportunity to individuals who may not have acquired all of the education they need and are unable to take advantage of residential training educational opportunities. Distance learning is defined as enrollment and study with an educational institution that provides lesson materials prepared in a sequential and logical order for study by students on their own, allowing students to acquire new professional skills while studying at home at their own pace. In order to help each student in their field of study, Training Direct provides counseling and lesson assistance by telephone and through mail.

Training Direct’s distance learning offerings include educational programs in the following fields and industries:

|

|

·

|

medical office assistance;

|

|

|

·

|

medical billing and coding;

|

|

|

·

|

hotel-motel front office;

|

|

|

·

|

veterinary assistant;

|

|

|

·

|

paralegal; and

|

|

|

·

|

pharmacy technician.

|

All of Training Direct’s courses are priced at $1,295 to $1,600 per program. Students may pay via cash, credit card, money order or check.

When each lesson is completed, the student mails the assigned work to the school for correcting, grading, comment and subject matter guidance by qualified instructors. Corrected assignments are rapidly returned to the student, providing a personalized student-teacher relationship.

Medical Office Assistant Program

Training Direct’s medical office assistant curriculum prepares the student for a wide range of entry-level office positions in different areas of the health industry. The curriculum prepares a student for potential employment in medical offices, clinics, public health departments and hospitals. The student acquires a basic understanding of medical terminology, records management, financial administration and administrative procedures which relate to the functioning of a medical office. An outline of the medical office assistant curriculum includes the following, without limitation:

|

|

·

|

introduction to medical office assistance;

|

- 12 -

|

|

·

|

introduction to medical terminology;

|

|

|

·

|

advanced medical terminology and pharmacology;

|

|

|

·

|

administrative medical assistance;

|

|

|

·

|

medical, legal and ethical responsibilities;

|

|

|

·

|

computers and information processing;

|

|

|

·

|

patients' medical records;

|

|

|

·

|

drug and prescription records;

|

|

|

·

|

office maintenance and management;

|

|

|

·

|

fees, credit and collection;

|

|

|

·

|

health insurance systems;

|

|

|

·

|

bookkeeping;

|

|

|

·

|

payroll procedures; and

|

|

|

·

|

job search techniques.

|

A high school diploma or general education degree is required for applicants to become eligible for the program. Upon successful completion of the program, the student receives a diploma.

Medical Billing and Coding Program

Training Direct’s medical insurance billing and coding curriculum prepares the student for entry-level employment to process insurance claims for a medical office. There are multiple roles that the student can fulfill with this curriculum, such as patient and administration contact, working with computers, and accounting tasks. Specific potential career duties consist of: (i) data collection from patients, hospitals, laboratories and physicians; (ii) diagnostic and procedure coding; (iii) timely generation of claims to maximize cash flow for the medical practice; (iv) keeping up to date on insurance plans, rules and regulations; (v) bookkeeping transactions; and (vi) follow-up on claims.

An outline of the medical billing and coding curriculum includes the following, without limitation:

|

|

·

|

introduction to medical terminology;

|

|

|

·

|

advanced medical terminology and pharmacology;

|

|

|

·

|

fundamentals of health insurance coverage;

|

|

|

·

|

source documents and the insurance claim cycle;

|

|

|

·

|

coding diagnosis;

|

|

|

·

|

coding procedures;

|

|

|

·

|

the health insurance claim form;

|

|

|

·

|

fees: private insurance and managed care, the Medicaid program;

|

|

|

·

|

the Medicare program;

|

|

|

·

|

workers’ compensation coverage and other disability programs; and

|

|

|

·

|

patient billing: credit and collection practices.

|

In this program, the student acquires an understanding of basic medical terminology, anatomy and physiology, procedural and diagnostic coding, types of medical insurance programs, insurance claims completion and submission, payment and follow-up procedures, relevant office skills and the role of computers in the medical office. Upon successful completion of the program, the student receives a diploma. In addition, this course offers students an optional opportunity to become nationally certified by the National Healthcare Association.

Hotel-Motel Program

Training Direct’s hotel-motel career training curriculum prepares the student for entry-level employment in the Hospitality industry. The student learns about the typical organizational structure of the industry, how each department functions, what the staffing requirements are for each department, as well as the character traits necessary for successful employment for each part of the organization. At the completion of the curriculum, the student is ready to apply for employment in any number of hospitality functions such as front desk operations, catering, housekeeping, sales and promotions, maintenance, purchasing and convention organization. Considerable attention is also given to personnel selection, organization and management. This is an employee intensive industry where human relations are an important component to successful career advancement.

- 13 -

|

|

·

|

the Hospitality industry;

|

|

|

·

|

personnel requirements;

|

|

|

·

|

the General Manager and Assistant Manager;

|

|

|

·

|

front desk operations;

|

|

|

·

|

the desk clerk;

|

|

|

·

|

uniformed services;

|

|

|

·

|

guest relations;

|

|

|

·

|

the sales department;

|

|

|

·

|

conventions and meetings;

|

|

|

·

|

accounting procedures;

|

|

|

·

|

cleaning and maintenance personnel;

|

|

|

·

|

food and beverage management team;

|

|

|

·

|

inventories and control; and

|

|

|

·

|

career guidance.

|

Upon successful completion of the program, the student receives a diploma.

Veterinary Assistant Program

Training Direct’s veterinary assistant curriculum prepares the student for entry-level employment under the supervision of veterinarians to diagnose and treat animals for injuries, illness and routine veterinary needs such as standard inoculations and periodic check ups. Veterinary assistants perform many tasks ranging from soothing and quieting animals under treatment to drawing blood, inserting catheters and conducting laboratory tests.

An outline of the veterinary assistant curriculum includes the following, without limitation:

|

|

·

|

introduction to medical terminology;

|

|

|

·

|

advanced medical terminology and pharmacology;

|

|

|

·

|

introduction to small animal care;

|

|

|

·

|

animal rights and welfare;

|

|

|

·

|

nutrition and digestive system;

|

|

|

·

|

animal studies, including dogs, cats, rabbits, hamsters, amphibians, reptiles, birds, fish and others;

|

|

|

·

|

introduction to veterinary practice;

|

|

|

·

|

care and maintenance of a veterinary facility;

|

|

|

·

|

administrative duties;

|

|

|

·

|

ethics; and

|

|

|

·

|

fee collection procedures, billing and payroll.

|

In this program, the student acquires an understanding of basic medical terminology, the history, breeds and types of animal groups, feeding, handling, care, housing and diseases of animals, key terms, organizational structure and functions of the veterinary clinic, and interacting with professional aspects of veterinary practices. Upon successful completion of the program, the student receives a diploma.

Paralegal Program

Training Direct’s paralegal course prepares students for entry-level employment positions to assist lawyers. The student gains an understanding of the scope of law that is practiced in law offices, corporations and government agencies.

This is an intensive course requiring extensive reading including cases in many areas of the law. In addition to understanding the breadth of the paralegal profession, students begin by learning legal terminology and then study the judicial system, civil and criminal law, the anatomy of a trial as well as pretrial procedures and research. Students also study different areas of law including Bankruptcy, Estate Planning, Family Law, Real Estate, Contracts, Torts, Immigration and Naturalization and Collections.

An outline of the paralegal curriculum includes the following, without limitation:

|

|

·

|

the paralegal profession;

|

- 14 -

|

|

·

|

law seminars covering roots of American law, organization of the American legal system, sources of law, the trial, and legal terminology;

|

|

|

·

|

legal research tools;

|

|

|

·

|

cause of action in a civil case, pre-trial discovery, admissibility and use of evidence, and trial preparation;

|

|

|

·

|

contracts;

|

|

|

·

|

Federal bankruptcy;

|

|

|

·

|

criminal law;

|

|

|

·

|

estate planning;

|

|

|

·

|

family law;

|

|

|

·

|

real estate;

|

|

|

·

|

torts;

|

|

|

·

|

immigration and naturalization; and

|

|

|

·

|

collections.

|

The duration of this course is six months on a part-time basis. Upon successful completion of the program, the student receives a diploma.

Pharmacy Technician Program

Training Direct’s pharmacy technician curriculum prepares the student for entry-level employment positions to work under the supervision of pharmacists, to help prepare medications for dispensing to patients, label of medications, perform inventories and order supplies, prepare intravenous solutions, help maintain records, and perform other duties as directed by pharmacists.

An outline of the pharmacy technician curriculum includes the following, without limitation:

|

|

·

|

introduction to pharmacy technicians;

|

|

|

·

|

introduction to medical terminology;

|

|

|

·

|

advanced medical terminology and pharmacology;

|

|

|

·

|

home and long term health care;

|

|

|

·

|

regulatory standards in pharmacy practice;

|

|

|

·

|

computer applications;

|

|

|

·

|

medication errors;

|

|

|

·

|

pharmaceutical dosage forms;

|

|

|

·

|

pharmaceutical calculations;

|

|

|

·

|

drug distribution systems; and

|

|

|

·

|

customer care.

|

In this course, the student acquires a basic understanding of medical terminology, pharmacological terms, organizational structure and function of the pharmacy, regulatory standards in the practice of pharmacy, drug-use control and information services, administrative aspects of pharmacy technology and professional aspects of pharmacy technology. The duration of this course is six months on a part-time basis. The completion of this program provides the student with the knowledge necessary to pass the national Pharmacy Technician Certification Board exam. A high school diploma or general education degree is required for applicants to become eligible for this program. Upon successful completion of the program, the student receives a diploma.

Residential Training Program

Training Direct offers a comprehensive Certified Nurse's Aide Program to assist its students with developing the skills and knowledge necessary to obtain an entry-level position as a Nurse's Aide in a health care facility. The training program provides the student with both basic knowledge and practical experience in the terminology, procedures, and techniques required of a Nurse's Aide. This training program meets the Connecticut Department of Health Services guidelines for eligibility to take the State certification exam for Nurse's Aides. Training Direct also offers residential training programs in medical billing and coding and recently started programs in pharmacy technology and phlebotomy.

- 15 -

Student Services

The student services office is available to assist students with a wide range of administrative, advisory, referral and employment assistance matters.

In particular, every program at the school includes career preparation lessons to review hiring procedures, to help students write resumes and to improve employment interview skills. Student Services matches students with potential employers who contact Training Direct throughout the year to fill openings.

Educational Training Institute’s Program Offerings

ETI provides vocational training to “at risk” high school students that would benefit from training to ease the transition from high school into the job market. The creative and flexible teaching methods of ETI’s instructors assist students in achieving success and reaching their goals by meeting students’ individual learning needs. All students have been referred by city, state or federal agencies, as well as city school districts. ETI also offers a direct-job placement service for vocational rehabilitation clients.

ETI focuses on following training programs to school districts and high school students:

|

·

|

hotel operations;

|

|

·

|

customer service; and

|

|

·

|

job readiness.

|

In connection with our hotel operations program, we place our students in an internship position in the hospitality industry which may include, without limitation, housekeeping, security, maintenance and hosting. With respect to customer service training, we place our students in an internship position working as a call center representative, a customer service representative, reservation agent or guest service representative.

In our job readiness training program, we seek to assist our students in developing the following skills: (i) communication; (ii) job seeking; (iii) job application completion; (iii) resume writing and interviewing skills; (iv) industry literacy; and (v) time management. We also conduct mock job interviews with our students to help them learn interviewing skills, and to put such skills into practice. We also seek to place students in an externship position in each student’s area of interest.

Our direct job placement program assists vocational rehabilitation clients with finding employment opportunities.

ETI does not have any dedicated facilities because its classes are held in high schools.

The Culinary Group’s Program Offerings

CTC and PCA offer culinary training in classroom, kitchen and industry environments. The program includes an externship that will offer students hands-on experience that best suits their abilities and career goals while expanding their knowledge of the culinary field. CTC and PCA also offer performance-based professional and employment skills that are imperative to succeed in today’s culinary marketplace.

Our training emphasizes “learning by doing” with special attention given to the practical side of commercial food preparation. Graduates prepare for careers in restaurants, bakeries, corporate and other food service departments, as well as the expanding fields of catering and take-out prepared foods. Entry level positions that may be obtained upon successful completion of our courses include, without limitation, sous chef, garde manger, pantry person, and short-order or line cook.

CTC and PCA offer the following culinary courses to its students:

|

·

|

commercial cooking plus externship;

|

|

·

|

commercial cooking and catering plus externship;

|

|

·

|

customer service; and

|

|

·

|

hotel operations.

|

In order to qualify for enrollment at CTC and PCA, a prospective student must provide a referral from a city, state or federal agency or proof of high school graduation or equivalency. In addition, a prospective student must visit the school for a tour and personal interview and complete and sign an enrollment agreement. Each school has its own admissions staff to handle information requests, student screening, interviews and the enrollment process.

- 16 -

CTC has three locations in New York (Albany, Yonkers and Queens). PCA has three locations in New York (Buffalo, Poughkeepsie and Monticello).

Commercial Cooking Plus Externship Course

CTC’s and PCA’s commercial cooking plus externship course covers a period of 6 months or 600 hours, which includes (i) skills development (100 hours); (ii) food preparation (100 hours); (iii) catering (75 hours); (iv) quantity food production (100 hours); (v) food sanitation (25 hours); and (vi) externship (200 hours).

The skills development portion of this course is an introduction to commercial cooking that covers all of the basics, from measuring and knife skills, to a wide variety of cooking techniques. Our food preparation curriculum covers the basics of the commercial kitchen, including equipment and procedures used in professional food establishments. Here, we also seek to teach our students to master the practical skills of food selection, handling and cooking, as well as displaying and serving prepared foods in an attractive and appetizing manner. Our catering and quantity food production curriculum deal with planning, preparing, presenting and serving foods for catered affairs such as parties, receptions and business conferences and for other large numbers of people while controlling food quality and quantity. In these portions of the course, our students will learn to work as a team member in a busy commercial kitchen. With respect to food sanitation, our students will learn to maintain proper health and sanitation standards in a food service establishment.

The final portion of our commercial cooking plus externship course is obtaining on-the-job, practical experience in a working foodservice establishment through our externship program. The externship is a continuation of the in-school learning process, giving students the opportunity to sharpen and expand their cooking skills in a real-world environment.

Commercial Cooking and Catering Plus Externship Course

Our commercial cooking and catering plus externship course covers a period of 9 months or 900 hours. Specific curriculum includes (i) skills development (100 hours); (ii) food preparation (100 hours); (iii) baking and cake decoration (100 hours); catering (100 hours); (iv) restaurant management, consisting of food sanitation, food purchasing and restaurant operations (100 hours); (v) quantity food production (100 hours); and (vi) externship (300 hours).

The skills development, food preparation, catering, quantity food production, food sanitation and externship portions of this course cover similar areas of the culinary arts that we teach in our commercial cooking plus externship course. Our baking and cake decorating curriculum teaches our students how to effectively bake bread, rolls, cakes, pies and pastries in quantity. Here, we also develop the art of decorating cakes with color and form to create a professional product. With respect to restaurant management, we teach our students techniques for maintaining, ordering, receiving and storing inventory for food service establishments according to the specific needs of such establishments. In addition, our students will learn the fundamentals in operating a food service establishment.

Customer Service Course

Our customer service course covers a period of 6 months or 600 hours, which includes (i) effective oral communication (100 hours); (ii) literacy for the workplace (90 hours); (iii) career development (60 hours); (iv) introduction to customer service (30 hours); (v) effective customer relations (100 hours); (vi) office practices (90 hours); (vii) salesmanship (30 hours); and (viii) internship (100 hours).

In our effective oral communication curriculum, the student will be able to define factors influencing effectiveness of speech, voice and body language, and principles of active listening. We also teach our students to define various verbal units, and will provide them with a written selection containing inaccurate word selection and help them to identify verbal fault. Finally, we teach principles of general telephone etiquette and ways of projecting an appropriate telephone personality.

With respect to literacy for the workplace, students will study the principles of grammar and punctuation, vocabulary development, and basic principles of effective reading and writing skills. In a skills development laboratory, students will create written critiques of both fiction and non-fiction works, as well as newspaper and magazine articles. In the career development portion of our customer service course, students will develop cover letter and resume writing skills, job search skills and successful interview techniques. We will also present ethical and legal considerations for the workplace and how our students can get ahead on the job. Students will role-play in mock interviews both as interviewees and employers.

- 17 -

The introduction to customer service and effective customer relations curriculums cover the basics of customer service with a wide range of job assignments that will be vital to the customer service specialist, including, basic technology and understanding the use of computers and other office machinery. Students will be able to define the fundamentals of customer service interaction with problem solving and conflict resolution scenarios. During an interaction skill building laboratory, the student will role play situations involving customer inquiries, problems and complaints while being recorded for subsequent review and analysis. In the office practices and salesmanship portions of this course, students will familiarize themselves with front desk procedures, records and file management, basic supply management and the handling of mail, e-mail documents and other confidential correspondence. In addition, our students will gain an understanding of the behavior and mentality that is crucial to becoming an effective salesman.

The final portion of this course is internship placement, which is a continuation of the in-school learning process, and provides the student the opportunity to sharpen and expand his/her skills in a real-world environment.

Hotel Operations Course

Our hotel operations course covers a period of 6 months or 600 hours. Specific curriculum includes (i) effective oral communication (100 hours); (ii) literacy for the workplace (90 hours); (iii) career development (60 hours); (iv) introduction to the hospitality industry (30 hours); (v) front desk operations (100 hours); (vi) hospitality law and security (60 hours); (vii) housekeeping and facilities management (60 hours); and (viii) internship (100 hours).

The effective oral communication, literacy for the workplace, career development and internship portions of this course are similar to what we teach in our customer service course; however, here we focus on the hospitality industry. In introduction to the hospital industry, students will learn different sectors of the hospitality industry, including, without limitation, hotel organizations, staffing and operational functions of each department, and basic technologies utilized by a hotel. With respect to front desk operations, students will understand reservation functions, rooms, bedding and rates, guest procedures and effective guest relations. Students will also become familiar with common front desk reports, controls and their management functions.

The hospitality law and security curriculum covers procedures and equipment for fire safety, accident and crime prevention, and dealing with medical emergencies. In housekeeping and facilities management, students will learn staffing responsibilities, and the organization of the housekeeping and engineering departments.

Our Industries

General

The domestic non-traditional education sector is a significant and growing component of the postsecondary degree-granting education industry, which was estimated to be a $386 billion industry in 2007, according to the Digest of Education Statistics published in 2009 by the U.S. Department of Education’s National Center for Education Statistics. According to the same study, in 2007, over 6.9 million, or 38%, of all students enrolled in higher education programs were over the age of 24, and enrollment in degree-granting institutions between 2008 and 2017 is expected to increase 19% for students over age 25. These students would not be classified as traditional (i.e., 18 to 24 years of age, living on campus, supported by parents, and not working full-time). The nontraditional students typically are looking to improve their skills and enhance their earnings potential within the context of their careers. Although it may be expected that the recession of 2008 and 2009 may have temporarily reduced domestic enrollment, we believe that the demand for non-traditional education will continue to increase, reflecting the knowledge-based economy in the U.S and economic dislocations resulting from the recent recession.

Many working learners seek accredited degree programs that provide flexibility to accommodate the fixed schedules and time commitments associated with their professional and personal obligations. The education formats offered by our institutions enable working learners to attend classes and complete coursework on a more convenient schedule than traditional universities offer. Although more colleges and universities are beginning to address some of the needs of working learners, many universities and institutions do not effectively address the needs of working learners for the following reasons:

|

|

·

|

Traditional universities and colleges were designed to fulfill the educational needs of conventional, full-time students ages 18 to 24, and that industry sector remains the primary focus of these universities and institutions. This focus has resulted in a capital-intensive teaching/learning model that may be characterized by: (i) a high percentage of full-time, tenured faculty; (ii) physical classrooms, library facilities and related full-time staff; (iii) dormitories, student unions, and other significant physical assets to support the needs of younger students; and (iv) an emphasis on research and related laboratories, staff, and other facilities.

|

- 18 -

|

|

·

|

The majority of accredited colleges and universities continue to provide the bulk of their educational programming on an agrarian calendar with time off for traditional breaks. The traditional academic year runs from September to mid-December and from mid-January to May. As a result, most fulltime faculty members only teach during that limited period of time. While this structure may serve the needs of the full-time, resident, 18 to 24 year old student, it limits the educational opportunities for working learners who must delay their education for up to four months during these traditional breaks.

|

|

|

·

|

Traditional universities and colleges may also be limited in their ability to provide the necessary customer service for working learners because they lack the necessary administrative and enrollment infrastructure.

|

|

|

·

|

Diminishing financial support for public colleges and universities has required them to focus more tightly on their existing student populations and missions, which has reduced access to education.

|

Valley

According to the American Association of Nurse Anesthetists (“AANA”), in the United States there were 118 accredited nurse anesthesia programs in 2010. This number grew from 108 programs in 2006, 2007, 2008 and 2009, and from 95 programs in 2005. Most SRNAs are registered with the AANA. As set forth in the table below, the number of SRNAs registered with the AANA has increased substantially over the past eleven years. Valley has developed strategic relationships with accredited nurse anesthesia programs and with the AANA. Many of the programs have requested that Valley provide courses specifically for their programs, however, Valley currently provides courses for only one school located in Tennessee.

|

SRNAs Registered with AANA

|

||||

|

Year

|

Registered SRNAs

|

|||

|

1999

|

2,372 | |||

|

2005

|

4,300 | |||

|

2006

|

4,800 | |||

|

2007

|

5,042 | |||

|

2008

|

5,317 | |||

|

2009

|

5,610 | |||

|

2010

|

5,717 | |||

Source: AANA