Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DUCOMMUN INC /DE/ | d8k.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - DUCOMMUN INC /DE/ | dex21.htm |

| EX-99.2 - TRANSCRIPT OF CONFERENCE CALL - DUCOMMUN INC /DE/ | dex992.htm |

| EX-10.2 - VOTING AGREEMENT - DUCOMMUN INC /DE/ | dex102.htm |

| EX-99.1 - PRESS RELEASE - DUCOMMUN INC /DE/ | dex991.htm |

| EX-10.1 - COMMITMENT LETTER - DUCOMMUN INC /DE/ | dex101.htm |

Ducommun

Acquisition of LaBarge

April 4, 2011

Exhibit 99.3 |

1

Forward-Looking Statements/Additional

Information

Forward-Looking Statements

Certain statements contained in this press release regard matters that are not historical

facts and are forward-looking statements within the meaning of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995, as amended, and the rules

promulgated pursuant to the Securities Act of 1933, as amended, and the Securities

Exchange Act of 1934, as amended. Such statements include statements regarding the proposed acquisition of LaBarge, including but not limited to statements

regarding benefits of the acquisition, as well as statements regarding the proposed financing

of the acquisition. Because such forward-looking statements contain risks and

uncertainties, actual results may differ materially from those expressed in or implied by such forward-looking statements. Factors that could cause actual results to

differ materially include, but are not limited to: (1) the occurrence of any event,

change or other circumstances that could give rise to the termination of the merger

agreement or voting agreement; (2) the outcome of any legal proceedings that have been or may

be instituted against LaBarge and/or Ducommun and others following announcement of the

merger agreement; (3) the inability to complete the merger due to the failure to obtain stockholder approval or the failure to satisfy other

conditions to the completion of the merger, including the expiration of the waiting period

under the Hart-Scott-Rodino Antitrust Improvements Act 1976, as amended; (4)

the failure to obtain the necessary debt financing arrangements set forth in commitment

letters received in connection with the merger; (5) the interest rate on any borrowings

incurred to finance the acquisition and operations of Ducommun and its subsidiaries following the acquisition; (6) risks that the proposed transaction disrupts

current plans and operations and the potential difficulties in employee retention as a result

of the merger; (7) difficulties integrating LaBarge’s business, operations and

employees into Ducommun’s business and operations; (8) the inability to recognize the

benefits of the merger, including any potential synergies, growth, cost savings or

accretive value; (9) the method of accounting for the acquisition; (10) the inability to

maintain current customer and supplier relationships following the merger; (11) the

amount of the costs, fees, expenses and charges related to the merger and the actual terms of

certain financings that will be obtained for the merger; and (12) the impact of the

indebtedness incurred to finance the consummation of the merger. The businesses of Ducommun and LaBarge are also subject to a number of risks as described in

the SEC filings of Ducommun and LaBarge, copies of which may be obtained by contacting the

investor relations departments of each company via their websites www.ducommun.com and

www.labarge.com. Many of the factors that will determine the outcome of the subject matter of this press release are beyond Ducommun’s

or LaBarge’s ability to control or predict. Ducommun undertakes no obligation to

release publicly the results of any revisions to these forward-looking statements that

may be made to reflect events or circumstances after the date hereof or to reflect the

occurrence of unanticipated events. Additional Information

In connection with the proposed merger, LaBarge will file a proxy statement with the SEC. When

completed, a definitive proxy statement and a form of proxy will be mailed to the

stockholders of LaBarge. LABARGE’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT WHEN IT BECOMES AVAILABLE BECAUSE IT WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. LaBarge’s stockholders will be able

to obtain, without charge, a copy of the proxy statement (when available) and other

relevant documents filed by LaBarge with the SEC from the SEC’s website at www.sec.gov or the investor relations section of LaBarge’s website at

www.labarge.com, or by written request to LaBarge, Inc., c/o Corporate Secretary, 9900 Clayton

Road, St. Louis, MO 63124. Ducommun and LaBarge and their respective directors and executive officers may be deemed to be

participants in the solicitation of proxies from LaBarge’s stockholders with

respect to the proposed merger. Information about Ducommun’s directors and executive officers is set forth in Ducommun’s 2011 proxy statement on Schedule 14A

filed with the SEC on March 29, 2011 and its Annual Report on Form 10-K for the year ended

December 31, 2010, filed with the SEC on February 22, 2011. Information about

LaBarge’s directors and executive officers, including their ownership of LaBarge Common Stock, is set forth in LaBarge’s 2010 proxy statement on Schedule 14A,

filed with the SEC on October 18, 2010. Investors may obtain additional information

regarding the interests of the participants in the proposed merger, which may be

different than those of LaBarge’s stockholders generally, by reading the proxy statement

and other relevant documents regarding the proposed merger, when filed with the SEC.

|

2

Acquiring LaBarge: A Transformational Event

Strengthens Ducommun’s market position as a significant Tier 2 supplier for

both structural and electronic assemblies

Creates platform for Ducommun Technologies as a leading global A&D provider

of Electronics Manufacturing Services (EMS) for low volume/high mix

applications

Excellent strategic fit that broadens Ducommun’s customer base and brings

market diversification

Bolsters growth profile and long-term operating margins

Acquisition of a premier franchise, adding substantial technical

capabilities in

highly-compatible corporate culture with an excellent management team and

outstanding workforce

Transaction expected to be accretive to earnings in full year 2012 while

maintaining financial flexibility |

3

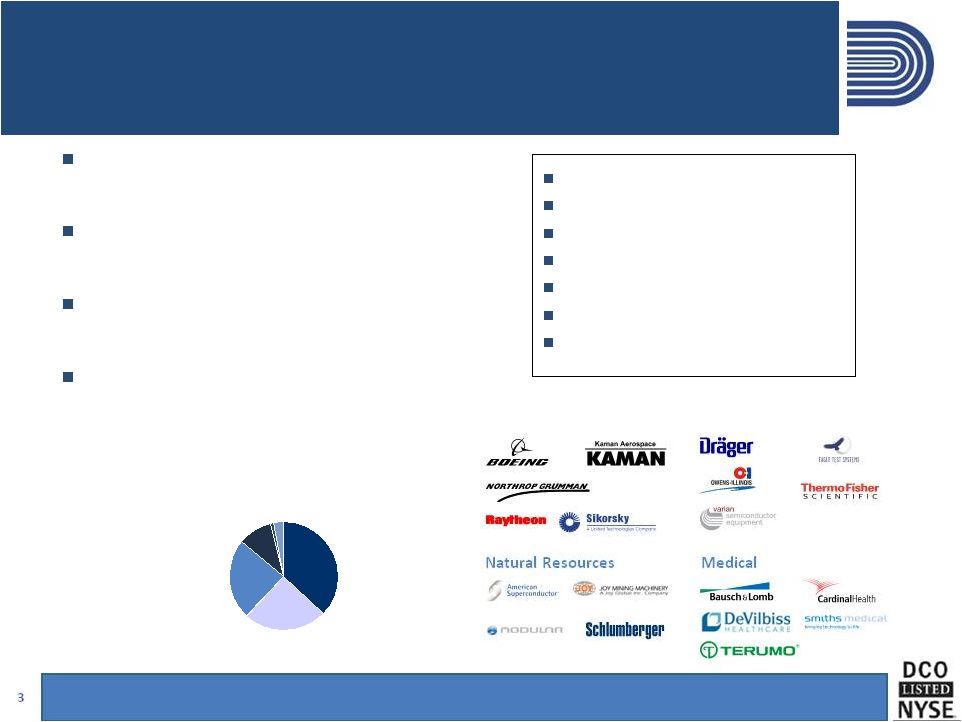

LaBarge

at a Glance

A proven leader in electronics manufacturing

services to customers in a diverse group of

markets

Expertise in high-mix, low-volume manufacture of

custom, complex, high-reliability, mission-critical

products

Broad range of capabilities in electronics and

interconnects to electro-mechanical and high-end

final assemblies

Extensive value-added services, such as

engineering and design, program management

and aftermarket support

LTM End Market Revenue Mix

Source:

LaBarge

public filings as of 1/2/11

Headquarters —

St. Louis, MO

Founded in 1953

Employees —

Approximately 1,600

FYE —

June 30, based on 52-week fiscal year

LTM

Revenue

(1/2/11)

—

$324

million

LTM

EBITDA

(1/2/11)

—

$39

million

LTM

EBITDA

Margin

(1/2/11)

—

12%

Customer Overview

37%

Natural

Resources

24%

Industrial

25%

Medical

10%

Other

3%

Aerospace & Defense

Industrial

Defense

Commercial

Aerospace

1% |

4

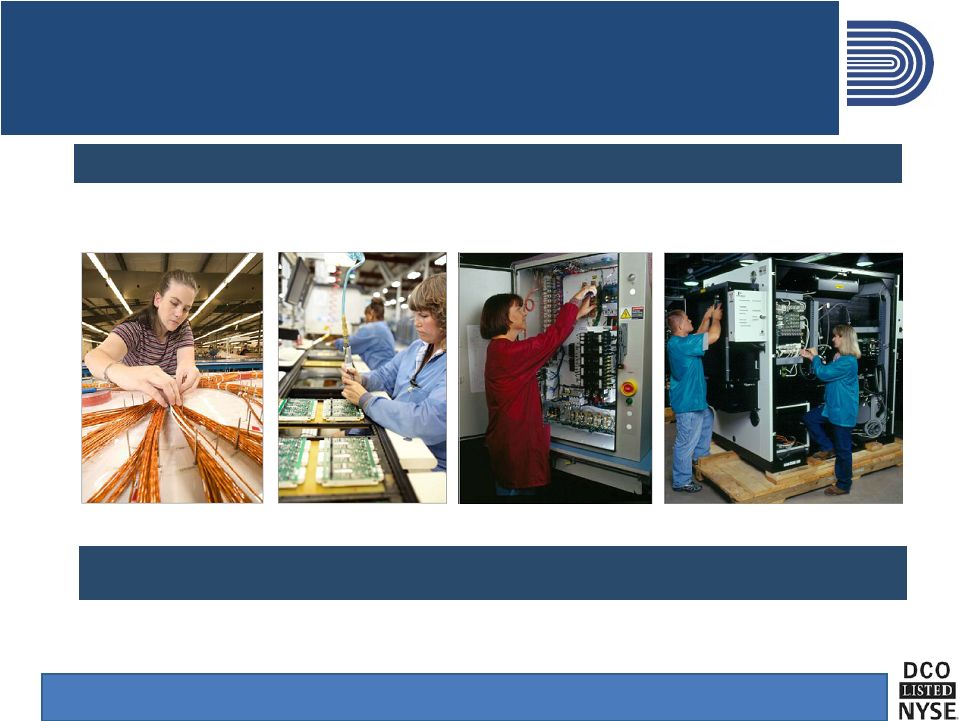

A Full Service EMS Provider

Broad Based Specialized Capabilities

Leading Provider of Niche Electronics Manufacturing Services (EMS)

Interconnect Systems

Printed Circuit Card

Assemblies

Higher-Level Assemblies

Systems Integration |

5

LaBarge Market Diversification

Defense

Medical

Natural Resources

Industrial

Missile systems

Radar systems

Aircraft applications

Shipboard systems

Glass container

manufacturing systems

Electronic test equipment

Semiconductor capital

equipment

Wind power generation

systems

Oilfield services equipment

Mine automation

Agricultural applications

Surgical systems

Patient monitoring and

therapy devices

Respiratory care devices

Biodecontamination

equipment |

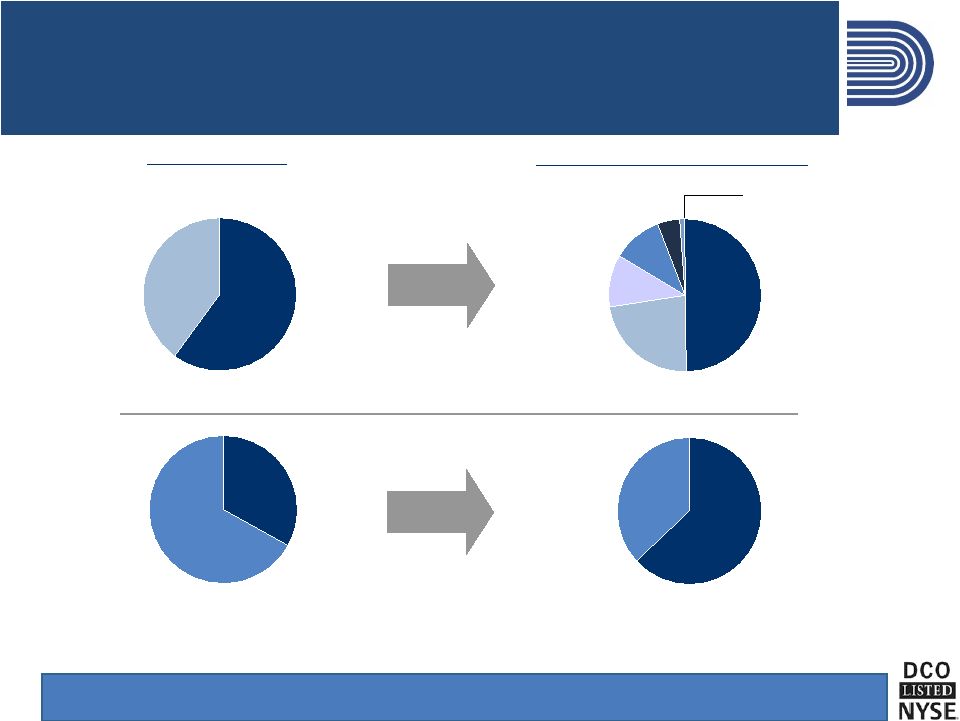

6

Defense &

Space

60%

Commercial

Aerospace

40%

Broadens Industry Focus and Product Portfolio

Defense &

Space

50%

Commercial

Aerospace

23%

Industrial

11%

Natural

Resources

11%

Medical

5%

Other

1%

Source:

Ducommun and LaBarge public filings

Ducommun Revenue

Ducommun/LaBarge Pro Forma Revenue

Ducommun-

LaBarge

Technologies

63%

Ducommun

Aerostructures

37%

Ducommun

Technologies

33%

Ducommun

Aerostructures

67%

CY 2010 Sales =

$732mm

CY 2010 EBITDA =

$83mm

CY 2010 Margin =

11.3%

CY 2010 Sales =

$408mm

CY 2010 EBITDA =

$44mm

CY 2010 Margin =

10.7% |

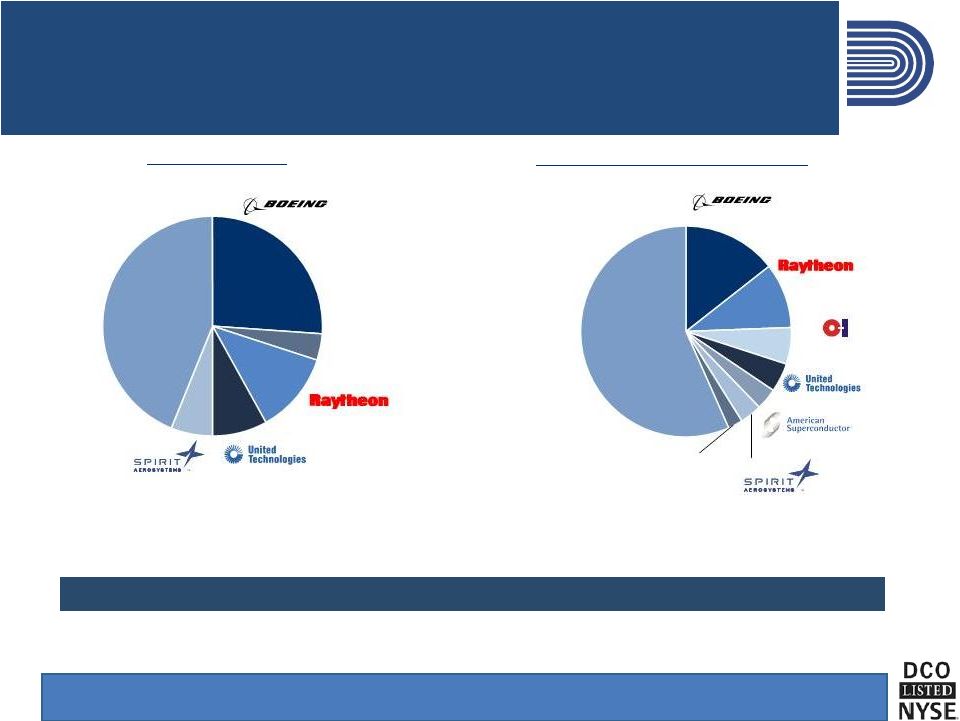

7

Diversified, Blue-Chip Customer Base

CY 2010 Sales:

$408 million

CY 2010 PF Sales:

$732 million

Significant Customer Cross-Selling Opportunities

Ducommun Revenue

1

1

1

Ducommun/LaBarge Pro Forma Revenue

26%

US Government

4%

12%

8%

6%

Other

44%

15%

10%

6%

4%

3%

3%

US Government

2%

Other

57%

Source:

Ducommun public investor presentation and LaBarge public filings

Note:

1 Based on LaBarge FY 2010 revenue

Owens-Illinois |

8

Acquisition Builds DCO’s Technology Products

Interconnect Systems

Integrated Electronic Assemblies

Display Systems / EMS Assemblies

Advanced Microwave Switches

High Performance Motors & Resolvers

Wiring Harness

Temperature

Control

Interconnect

Systems

PCB Assemblies

Higher Level Assemblies

Systems Integration

Multi-Branched Harness

High-Flexibility Molded Gimbal Cable

Display Panels

Resolver

Stepper Motors

Raytheon AESA Radar Rack

Microwave Transfer Switch

Microwave Multi Position Switch

Military Radar Systems

Factory Automation

RF & Digital Assembly

Complex Wired Chassis

Quality Systems

Testing Capabilities

High Synergy Potential |

9

UH-60 Black Hawk

Increased Content on Growing A&D Platforms

Expansion of Current Platforms

F-35 Joint Striker Fighter

Overhead panel assemblies

Circuit card assemblies and coaxial cables

Cockpit and airframe harnesses

Firewalls

Window assemblies

Hellfire rack

Door assemblies

Erosion shields /leading

edge for rotary wings

Exhaust ducts

Cable harnesses

Circuit card assemblies

Power supplies

Engine ducts |

10

Transaction Overview

Ducommun’s purchase price per LaBarge share: $19.25

Total enterprise value paid for business: ~$340 million, excluding transaction and

financing fees

Total purchase price multiple for business: enterprise value/CY 2010 EBITDA of 8.7x

Anticipate generation of annual pre-tax savings and synergies of approximately 2% of

LaBarge run-rate revenue

Total cost of transaction, including all transaction and financing fees, ~$370 million

Transaction

is

expected

to

be

accretive

to

earnings

in

full

year

2012

Acquisition is forecast to increase Ducommun’s:

–

EBITDA Margins

–

Cash flow from operations

Closing expected 2Q 2011 |

11

Sources and Uses

Sources

Uses

Committed Financing Structure in Place to Support the Transaction

Notes:

1 Reflects balance sheets as of 12/31/2010 for Ducommun and 1/2/2011 for LaBarge

2 Ducommun will have access to a $40 million revolving credit facility upon closing

3 Represents transaction and financing fees for Ducommun and LaBarge

($mm)

Purchase of 100% of LaBarge Equity

310.3

Refinance Ducommun and LaBarge Debt

33.5

New Cash on

Balance Sheet

14.7

Transaction and Financing Fees

31.5

Total

Uses

390.0

($mm)

Senior Secured Term Loan

190.0

Senior Notes

200.0

Total

Sources

390.0 |

12

In Summary: A Great Strategic Fit

End-Market

Diversification & A&D

Platform Expansion

Creates a full service EMS provider with highly specialized capabilities

Expands existing A&D platforms and adds access to new high growth programs

Diversification of customer base and expands growth opportunities

Expansion of

Ducommun’s Existing

Technology Product

Portfolio

Creates platform for Ducommun Technologies as the largest non-OEM A&D EMS provider

for radar rack solutions

High level of commonality between products

Increases Overall

Electronics

Manufacturing Service

Nature of Portfolio

Creates a leading provider of low-volume/high-mix custom, complex, high

reliability mission-critical services and products to the A&D industry

Expands Ducommun’s value-added service offerings including engineering and design,

program management

Ability to offer complete system integration services to a broader customer base

Creates Significant

Synergy Opportunities

Corporate cost synergies

Supply chain and operational improvements

Complements Ducommun Technologies’ existing integrated

electronics assembly product offerings |

13

Appendix |

14

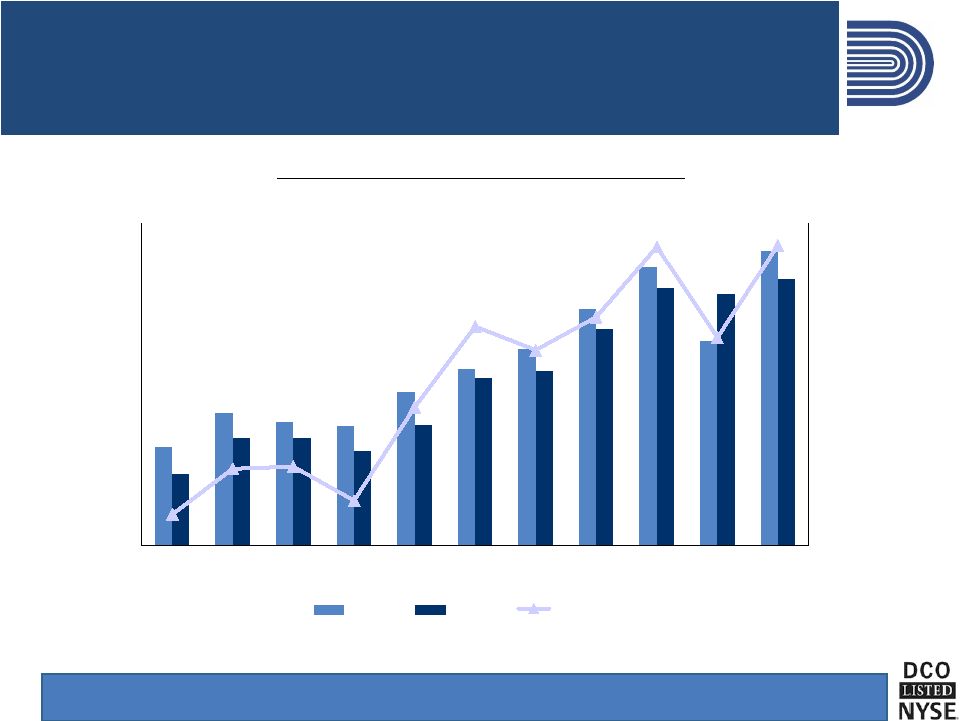

LaBarge: A Decade of Solid Growth

Bookings, Sales & Earnings –

Last 10 Years

(dollars in millions)

Note: Fiscal year ends on June 30

$-

$50.0

$100.0

$150.0

$200.0

$250.0

$300.0

$350.0

FY 00

FY 01

FY 02

FY 03

FY 04

FY 05

FY 06

FY 07

FY 08

FY 09

FY 10

$-

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

$16.0

Bookings

Net Sales

Net Earnings |

15

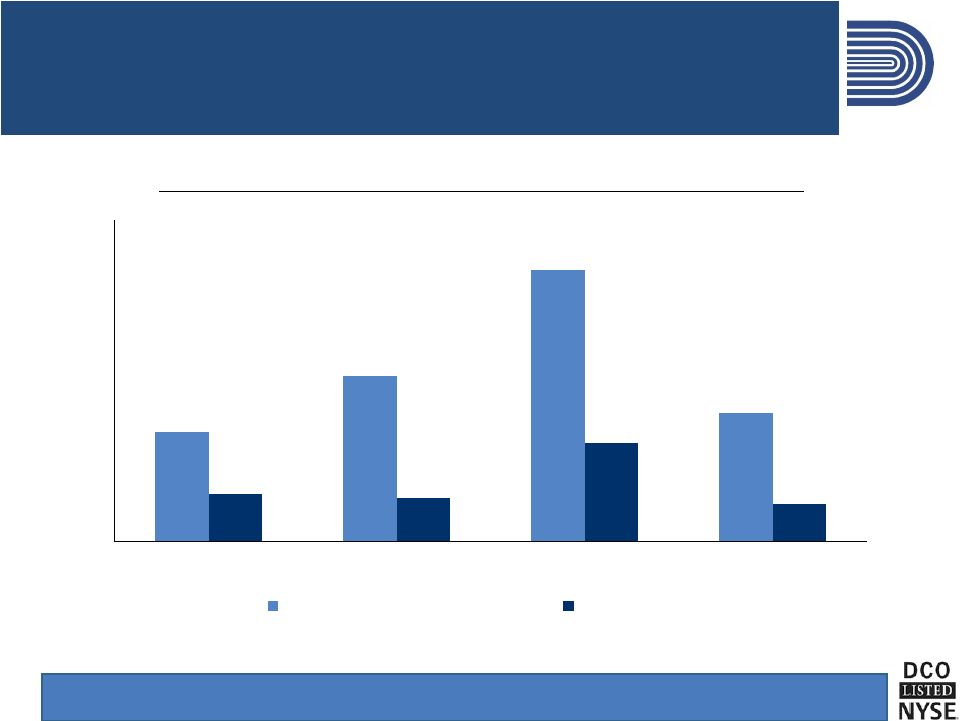

LaBarge Cash Flow Averages $18M Annually

Net Cash Provided by Operating Activities vs. Capital Expenditures

$12.0

$18.0

$29.6

$14.0

$5.2

$4.8

$10.8

$4.2

$0

$5

$10

$15

$20

$25

$30

$35

FY 07

FY 08

FY 09

FY 10

Net Cash Provided by Operating Activities

Capital Expenditures

Note: Fiscal year ends on June 30; net

cash provided by operating activities averaged $18 million from FY07 through FY10 |

16

$269.0

$479.0

$0.0

$100.0

$200.0

$300.0

$400.0

$500.0

$600.0

2009

2014E

$2.8

$4.4

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

2006

2011E

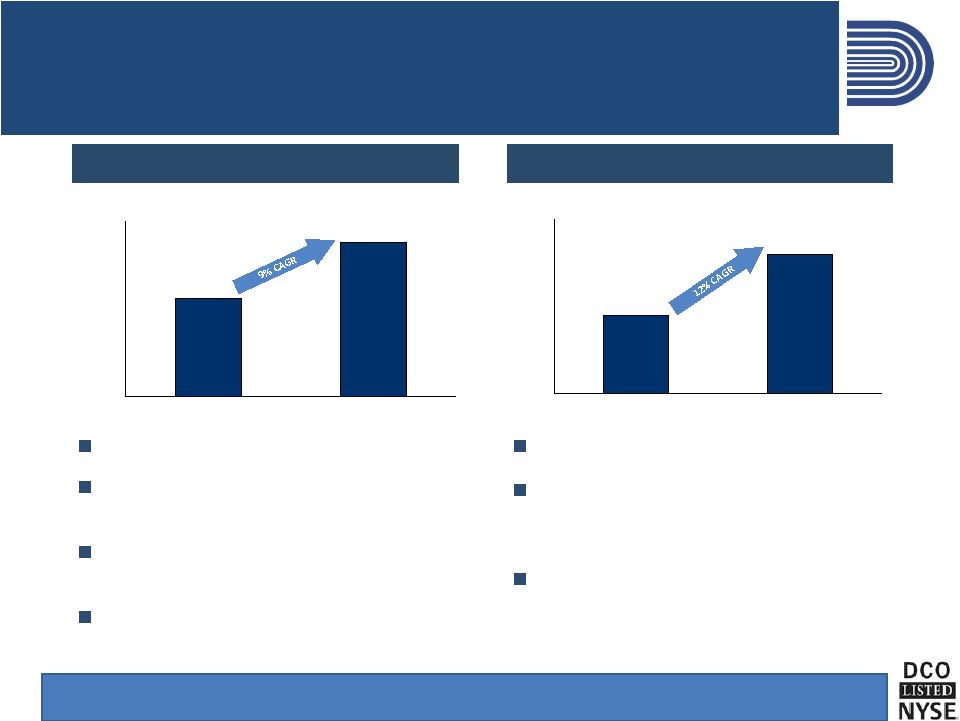

Overall Growth in EMS

$2.8bn in 2006 to $4.4bn by 2011

Significant opportunity to penetrate sector

not historically served well by EMS providers

Reduces total manufacturing costs in

increasingly complex systems

Enables primes to focus on core systems

expertise

$269bn in 2009 to $479bn by 2014

OEMs are becoming increasingly

comfortable using EMS partners for

complete system manufacturing

Outsourcing will continue to drive market

growth

Defense EMS Growth (2006–2011E)

Overall Market Size and Growth

Source: Technology Forecasters

Source: IPC Market Research

($ in billions)

($ in billions) |

17

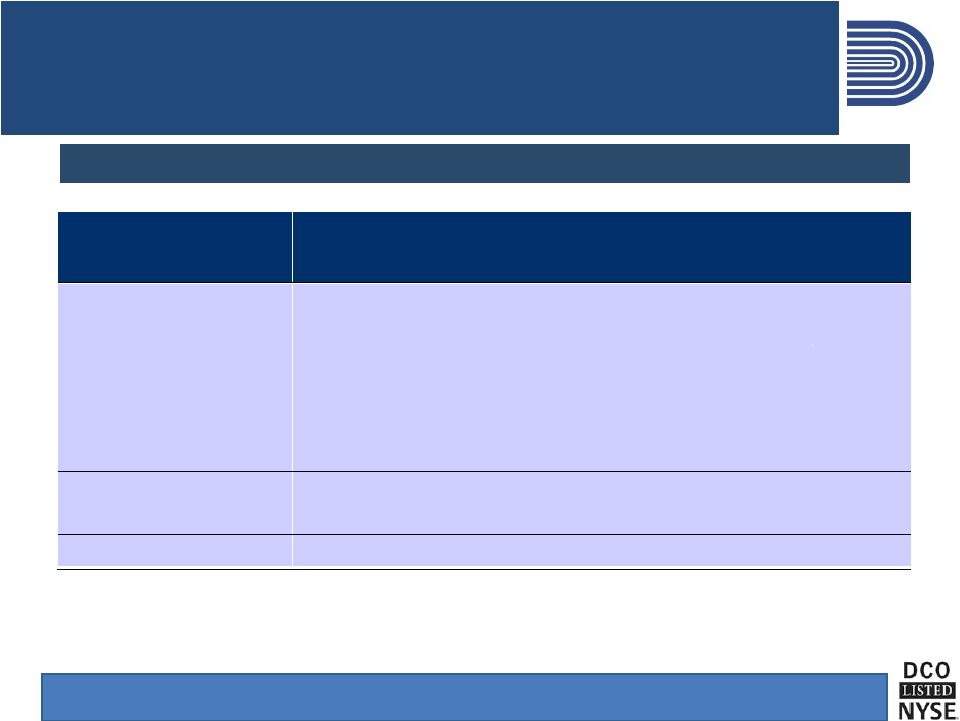

Acquisition Pro Forma Capitalization

Actual and Pro Forma Capitalization as of 12/31/10

Notes:

1

Upon close of the transaction, Ducommun will have a new revolving credit facility of

$40mm 2

Related to the acquisition of DynaBil Industries

3

Pro forma 12/31/2010 EBITDA including year-one synergies and adjusted for start-up

costs in new product development programs ($mm, unless noted)

Ducommun

(12/31/10)

Capitalization

(%)

Adjusted Cum.

EBITDA

Multiple

(x)

Adjusted

Pro Forma

(12/31/10)

Capitalization

(%)

Adjusted Cum.

EBITDA

Multiple

(x)

Cash

10.3

27.4

Revolving

Credit

Facility

1

–

–

–

–

–

–

Promissory Notes

3.3

1.3

0.1

–

–

–

New Senior Secured Term Loan

–

–

0.1

190.0

29.7

2.1

New Senior Notes

–

–

0.1

200.0

31.3

4.3

Net Debt

(7.0)

–

Net Cash

362.6

–

4.0

Total Book Equity

254.2

98.7

249.4

39.0

Total Book Cap

257.5

100.0

639.4

100.0

3

2 |

Established

1849 |