Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - Dutch Gold Resources Inc | ex31_2.htm |

| EX-4.1 - EXHIBIT 4.1 - Dutch Gold Resources Inc | ex4_1.htm |

| EX-21.1 - EXHIBIT 21.1 - Dutch Gold Resources Inc | ex21_1.htm |

| EX-32.1 - EXHIBIT 32.1 - Dutch Gold Resources Inc | ex32_1.htm |

| EX-32.2 - EXHIBIT 32.2 - Dutch Gold Resources Inc | ex32_2.htm |

| EX-31.1 - EXHIBIT 31.1 - Dutch Gold Resources Inc | ex31_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010.

Commission file number: 333-72163

|

DUTCH GOLD RESOURCES, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

58-2550089

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification Number)

|

|

3500 Lenox Road, Suite 1500, Atlanta, Georgia

|

30326

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(404) 419-2440

(Issuer's Telephone Number, Including Area Code)

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: Common Stock, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months ( or for such shorter period that the registrant was required to submit and post such files.

|

Yes o

|

No o (Not required by smaller reporting companies)

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o

|

Smaller reporting Company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes Nox

As of March 31, 2011 the aggregate market value of the shares of the Registrant’s common stock held by non-affiliates (based upon the closing price of such shares as reported on the OTCQB) was approximately $6,814,195.

As of March 31, 2011, there were 447,365,069 shares of the Registrant’s common stock issued and outstanding and 2 million shares of Series A Convertible preferred stock issued and outstanding.

TABLE OF CONTENTS

|

PART I

|

|||

|

|

|

|

|

|

ITEM 1.

|

|

9

|

|

|

ITEM 1A.

|

|

12

|

|

|

ITEM 1B

|

17

|

||

|

ITEM 2.

|

|

17

|

|

|

ITEM 3.

|

|

25

|

|

|

ITEM 4.

|

|

25

|

|

|

|

|

|

|

|

PART II

|

|||

|

|

|||

|

ITEM 5.

|

|

26

|

|

|

ITEM 6.

|

|

27

|

|

|

ITEM 7.

|

|

27

|

|

|

ITEM 7A.

|

|

30

|

|

|

ITEM 8

|

|

30

|

|

|

ITEM 9.

|

|

53

|

|

|

ITEM 9.A(T)

|

|

53

|

|

|

ITEM 9B.

|

|

55

|

|

|

|

|

|

|

|

PART III

|

|||

|

|

|

|

|

|

ITEM 10.

|

|

55

|

|

|

ITEM 11.

|

|

56

|

|

|

ITEM 12.

|

|

57

|

|

|

ITEM 13.

|

|

57

|

|

|

ITEM 14.

|

|

58

|

|

|

ITEM 15.

|

|

58

|

|

|

|

|

||

|

61

|

|||

|

|

|

||

|

CERTIFICATIONS

|

|

||

2

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and the information incorporated by reference may include "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended. Various statements, estimates, predictions, and projections stated under "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business," and elsewhere in this Annual Report are "forward-looking statements" within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These statements appear in a number of places in this Annual Report and include statements regarding the intent, belief or current expectations of Dutch Gold Resources, Inc. or our officers with respect to, among other things, the ability to successfully implement our operating and acquisition strategies, including trends affecting our business, financial condition and results of operations. While these forward-looking statements and the related assumptions are made in good faith and reflect our current judgment regarding the direction of the related business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions, or other future performance suggested herein. These statements are based upon a number of assumptions and estimates, which are inherently subject to significant uncertainties and contingencies, many of which are beyond our control and reflect future business decisions which are subject to change. Some of these assumptions inevitably will not materialize, and unanticipated events will occur which will affect our results. Some important factors (but not necessarily all factors) that could affect our revenues, growth strategies, future profitability and operating results, or that otherwise could cause actual results to differ materially from those expressed in or implied by any forward-looking statement, include the following:

These statements include, but are not limited to, comments regarding:

|

The establishment and estimates of mineral reserves and resources;

|

|

·

|

Grade;

|

|

·

|

Expenditures;

|

|

·

|

Exploration;

|

|

·

|

Permits;

|

|

·

|

Closure costs;

|

|

·

|

Future financing;

|

|

·

|

Liquidity;

|

|

·

|

Estimates of environmental liabilities;

|

|

·

|

Our ability to obtain financing to fund our estimated expenditure and capital requirements;

|

|

·

|

Factors impacting our results of operations;

|

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect,” “is expected,” “anticipates” or “does not anticipate,” “plans,” “estimates” or “intends,” or stating that certain actions, events or results “may,” “could,” “would,” “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

|

·

|

Unexpected changes in business and economic conditions;

|

|

·

|

Significant increases or decreases in gold prices;

|

|

·

|

Unanticipated grade changes;

|

|

·

|

Metallurgy, processing, access, availability of materials, equipment, supplies and water;

|

|

·

|

Determination of reserves;

|

|

·

|

Results of current and future exploration activities;

|

|

·

|

Results of pending and future feasibility studies;

|

|

·

|

Joint venture relationships;

|

|

·

|

Local and community impacts and issues;

|

|

·

|

Timing of receipt of government approvals;

|

|

·

|

Accidents and labor disputes;

|

|

·

|

Environmental costs and risks;

|

|

·

|

Competitive factors, including competition for property acquisitions;

|

|

·

|

Availability of external financing at reasonable rates or at all; and

|

|

·

|

The factors discussed in this Annual Report on Form 10-K under the heading “Risk Factors.”

|

This list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the sections titled “Risk Factors and Uncertainties,” “Description of the Business” and “Management’s Discussion and Analysis” of this Annual Report. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events, except as required by law.

Stockholders and other users of this Annual Report on Form 10-K are urged to carefully consider these factors in connection with the forward-looking statements. We do not intend to publicly release any revisions to any forward-looking statements contained herein to reflect events or circumstances occurring after the date hereof or to reflect the occurrence of unanticipated events.

CAUTIONARY NOTE TO UNITED STATES INVESTORS

The United States Securities and Exchange Commission (SEC) Commission permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms on this website (or press release), such as “measured,” “indicated,” “inferred,” and “resources,” which the SEC guidelines strictly prohibit U.S. registered companies from including in their filings with the SEC. U.S. Investors are urged to consider closely the disclosure in our Form 10-K which may be secured from us, or from the SEC’s website at http://www.sec.gov/edgar.shtml

We also note that drilling results are not indicative of mineralized material in other areas where we have mining interests. Furthermore, mineralized material identified on our properties does not and may never have demonstrated economic or legal viability.

GLOSSARY OF MINING TERMS

We estimate and report our resources and we will estimate and report our reserves according to the definitions set forth in NI 43-101. The definitions for each reporting standard are presented below with supplementary explanations and descriptions of the parallels and differences.

|

NI 43-101 Definitions

|

|

|

|

Indicated mineral resource

|

|

The term “indicated mineral resource” refers to that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be established with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

|

|

|

|

|

|

Inferred mineral resource

|

|

The term “inferred mineral resource” refers to that part of a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

|

|

|

|

|

|

Measured mineral resource

|

|

The term “measured mineral resource” refers to that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

|

|

|

|

|

|

Mineral reserve

|

|

The term “mineral reserve” refers to the economically mineable part of a measured or indicated mineral resource demonstrated by at least a preliminary feasibility study. The study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting materials and allowances for losses that might occur when the material is mined.

|

|

|

|

|

|

Mineral resource

|

|

The term “mineral resource” refers to a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge.

|

|

|

|

|

|

Opt

|

|

Troy ounce per ton

|

|

|

|

|

|

Probable mineral reserve

|

|

The term “probable mineral reserve” refers to the economically mineable part of an indicated, and in some circumstances a measured mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

|

|

Proven mineral reserve1

|

|

The term “proven mineral reserve” refers to the economically mineable part of a measured mineral resource demonstrated by at least a preliminary feasibility study.

|

|

|

|

|

|

Qualified person2

|

|

The term “qualified person” refers to an individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development, production activities and project assessment, or any combination thereof, including experience relevant to the subject matter of the project or report and is a member in good standing of a self-regulating organization.

|

|

|

|

|

|

SEC Industry Guide 7 Definitions

|

|

U.S. reporting guidelines that apply to registrants engaged or to be engaged in significant mining operations.

|

|

|

|

|

|

Exploration stage

|

|

An “exploration stage” prospect is one, which is not in either the development or production stage.

|

|

|

|

|

|

Development stage

|

|

A “development stage” project is one which is undergoing preparation of an established commercially mineable deposit for its extraction but which is not yet in production. This stage occurs after completion of a feasibility study.

|

|

|

|

|

|

Mineralized material

|

|

The term “mineralized material” refers to material that is not included in the reserve, as it does not meet all of the criteria for adequate demonstration for economic or legal extraction.

|

|

|

|

|

|

Probable reserve

|

|

The term “probable reserve” refers to reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

|

|

|

|

|

|

Production stage

|

|

A “production stage” project is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product.

|

|

|

|

|

|

Proven reserve

|

|

The term “proven reserve” refers to reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established.

|

|

|

|

|

|

Reserve

|

|

The term “reserve” refers to that part of a mineral deposit, which could be economically and legally extracted or produced at the time of the reserve determination. Reserves must be supported by a feasibility study done to bankable standards that demonstrates the economic extraction. (“Bankable standards” implies that the confidence attached to the costs and achievements developed in the study is sufficient for the project to be eligible for external debt financing.) A reserve includes adjustments to the in-situ tonnes and grade to include diluting materials and allowances for losses that might occur when the material is mined.

|

1 For Industry Guide 7 purposes this study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

2 Industry Guide 7 does not require designation of a qualified person.

Additional definitions for terms used in this Annual Report filed on Form 10-K.

|

Argillite:

|

Low grade metamorphic clay rich sedimentary rock (shale, mudstone, siltstone).

|

|

Block model:

|

The representation of geologic units using three-dimensional blocks of predetermined sizes.

|

|

Breccia:

|

A rock in which angular fragments are surrounded by a mass of fine-grained minerals.

|

|

CIM:

|

Canadian Institute of Mining and Metallurgy.

|

|

Cut off or cut-off grade:

|

When determining economically viable mineral reserves, the lowest grade of mineralized material that qualifies as ore, i.e. that can be mined at a profit.

|

|

Diatreme:

|

Brecciated rock formed by volcanic or hydrothermal eruptive activity, generally in a pipe or funnel like orientation.

|

|

EM:

|

An instrument that measures the change in electro-magnetic conductivity of different geological units below the surface of the earth.

|

|

Fault:

|

A rock fracture along which there has been displacement

|

|

Feasibility study:

|

Group of reports that determine the economic viability of a given mineral occurrence.

|

|

Formation:

|

A distinct layer of sedimentary or volcanic rock of similar composition.

|

|

|

|

|

G/t or gpt:

|

Grams per metric tonne.

|

|

Geophysicist:

|

One who studies the earth; in particular the physics of the solid earth, the atmosphere and the earth’s magnetosphere.

|

|

Geotechnical work:

|

Tasks that provide representative data of the geological rock quality in a known volume.

|

|

Grade:

|

Quantity of metal per unit weight of host rock.

|

|

Host rock:

|

The rock containing a mineral or an ore body.

|

|

Mapping or geologic mapping:

|

The recording of geologic information such as the distribution and nature of rock units and the occurrence of structural features, mineral deposits, and fossil localities.

|

|

Mineral:

|

A naturally formed chemical element or compound having a definite chemical composition and, usually, a characteristic crystal form.

|

|

Mineralization:

|

A natural occurrence in rocks or soil of one or more metal yielding minerals.

|

|

Mining:

|

The process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. Exploration continues during the mining process and, in many cases, mineral reserves are expanded during the life of the mine operations as the exploration potential of the deposit is realized.

|

|

National Instrument 43-101:

|

Canadian standards of disclosure for mineral projects.

|

|

Open pit:

|

Surface mining in which the ore is extracted from a pit or quarry, the geometry of the pit may vary with the characteristics of the ore body.

|

|

Ore:

|

Mineral bearing rock that can be mined and treated profitably under current or immediately foreseeable economic conditions.

|

|

Ore body:

|

A mostly solid and fairly continuous mass of mineralization estimated to be economically mineable.

|

|

Outcrop:

|

That part of a geologic formation or structure that appears at the surface of the earth.

|

|

Porphyry:

|

An igneous rock characterized by visible crystals in a fine–grained matrix.

|

|

Quartz:

|

A mineral composed of silicon dioxide, SiO2 (silica).

|

|

Reclamation:

|

The process by which lands disturbed as a result of mining activity are modified to support beneficial land use . Reclamation activity may include the removal of buildings, equipment, machinery and other physical remnants of mining, closure of tailings storage facilities, leach pads and other mine features, and contouring, covering and re-vegetation of waste rock and other disturbed areas.

|

|

SEC Industry Guide 7:

|

U.S. reporting guidelines that apply to registrants engaged or to be engaged in significant mining operations.

|

|

Sedimentary rock:

|

Rock formed at the earth’s surface from solid particles, whether mineral or organic, which have been moved from their position of origin and re-deposited, or chemically precipitated.

|

|

Strike:

|

The direction, or bearing from true north, of a vein or rock formation measured on a horizontal surface.

|

|

|

|

|

Strip:

|

To remove overburden in order to expose ore.

|

|

Vein:

|

A thin, sheet like crosscutting body of hydrothermal mineralization, principally quartz.

|

In this report, “opt” represents troy ounces per short ton, “gpt” represents grams per metric tonne, “ft.” represents feet, “m” represents meters, “km” represents kilometer, and “sq.” represents square. All of our financial information is reported in U.S. dollars.

PART I

|

ITEM 1.

|

BUSINESS HISTORY AND ORGANIZATION

|

Dutch Gold Resources, Inc. (the “Company” or “Registrant” or “Dutch Gold”) is a precious metals exploration stage company engaged in the business of acquiring, exploring and developing mineral properties in North America. Dutch Gold Resources, Inc. (the “Company” or “Registrant” or “Dutch Gold” or “DGRI”) was incorporated in Colorado on October 13, 1989 as Ogden, McDonald & Company. On July 22, 1996, Ogden, McDonald & Company completed a transaction pursuant to which the shareholders of Worldwide PetroMoly Corporation, a Texas corporation, acquired approximately 90.6% of the shares outstanding in Ogden, McDonald & Company. On October 11, 1996, Ogden, McDonald & Company changed its name to Worldwide PetroMoly, Inc.

On June 1, 2001, Small Town Radio, Inc., a Georgia corporation ("Small Town Georgia"), was merged into a subsidiary of our Company. In connection with our acquisition of Small Town Georgia, on June 7, 2001, we sold all of the share capital of Worldwide PetroMoly to Mr. Gilbert Gertner, our former Chairman of the Board.

On May 23, 2002, Small Town Georgia was renamed "Small Town Radio of Georgia" in preparation for our reincorporation as a Nevada corporation. On May 28, 2002, Worldwide PetroMoly, Inc. was merged with and into Small Town Radio, Inc., a newly created Nevada corporation, in an incorporation merger.

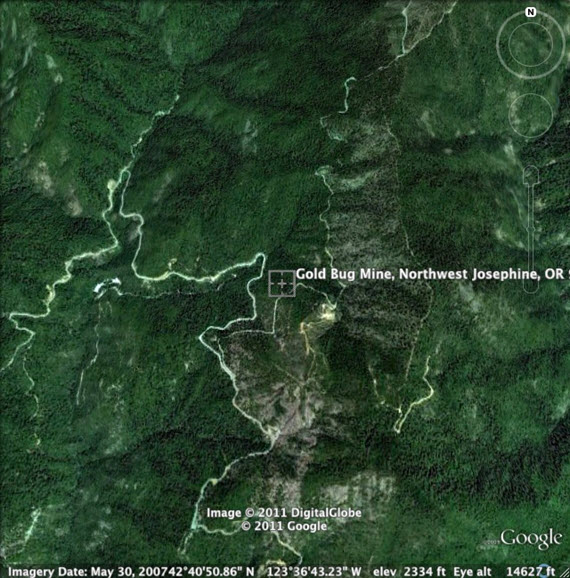

The Company changed its name to Tombstone Western Resources, Inc. on May 1, 2006 and refocused to become a natural resources company. On December 7, 2006, the Company changed its name to Dutch Gold Resources, Inc. On January 16, 2007, the Registrant, Dutch Gold Resources, Inc. consummated the terms of its Share Exchange Agreement (the “Agreement”) with Dutch Mining, LLC (“Dutch Mining”) whereby the Registrant issued 24,000,000 shares of its Common Stock to the Dutch Mining equity holders and their designees in exchange for all of the issued and outstanding equity interests of Dutch Mining (the “Exchange”). Following the Exchange, Dutch Mining became a wholly-owned subsidiary of the Registrant and the Registrant had a total of 30,256,144 shares of Common Stock issued and outstanding. We presently hold an interest in properties in Nevada, Montana and Oregon. We are currently in the exploration stage and have not generated revenue from operations since 2008.

In January 2010, we acquired the assets of Aultra Gold, Inc, (AGDI) , now known as Shamika 2 Gold, Inc., significantly increasing our land position. The assets of Aultra Gold, Inc. included a portfolio of properties in Nevada and Montana. Subsequently, Aultra Gold, Inc., completed a reverse merger with Shamika 2 Gold, Inc., whereby Shamika Resources, Inc. became the controlling shareholder and Dutch Gold ceased to be an affiliate of Shamika 2 Gold, Inc.

On March 26, 2010, AGDI entered into an Agreement and Plan of Share Exchange (the “Agreement”) with Shamika2 Gold Inc., a Canadian Corporation (“Shamika”) and the shareholders of Shamika (the “Shamika Holders”). Pursuant to the Agreement, AGDI acquired all of the outstanding shares (the “Shamika Shares”) from the Shamika Holders in exchange for the aggregate of 50,000,000 shares of the AGDI’s common stock, par value $0.001 per share (the “Common Stock”) (the “Exchange”).

The Company currently operates in one segment exploring mineral properties.

Overview of Business and Properties

Our objective is to increase the value of our shares through the exploration, development and extraction of gold, silver and other valuable minerals. We generally conduct our business as sole operator, but we may enter into arrangements with other companies through joint venture or similar agreements in an effort to achieve our strategic objectives. We own or lease our mineral interests and properties and operate our business through various subsidiary companies, each of which is owned entirely, directly or indirectly, by us.

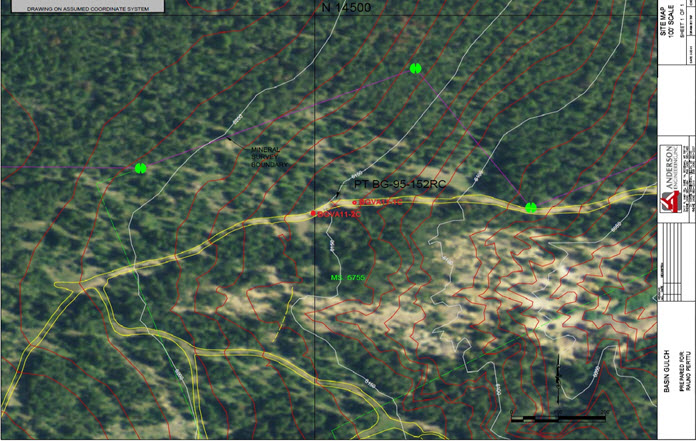

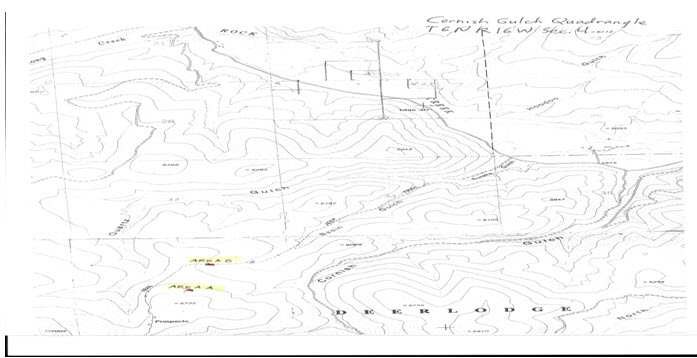

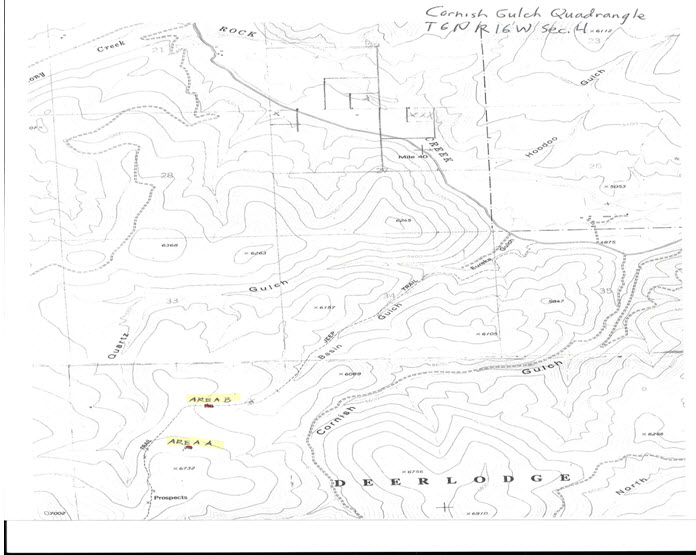

We own a leasehold interest in a property near Philipsburg, Montana which is of 217 acres of patented land and approximately 900 acres of Bureau of Land Management (BLM) land, referred to as Basin Gulch. We acquired the property in 2010 and commenced a regional exploration program in 2010. Over the next two years, we estimate we will spend approximately $4 million on exploration and development at the Basin Gulch Project, which will mainly consist of drilling and test mining.

The Jungo gold exploration project is located approximately 50 miles northwest of the town of Winnemucca in Humboldt County, Nevada. It is accessed by excellent county-maintained gravel roads west from Winnemucca, then north from Jungo junction. The last three miles to the property are accessed by poor quality dirt roads. The property is situated on the eastern margin of the Jackson Mountains.

The property is on BLM land and is held by 95 unpatented lode mining claims. Twenty five of the claims have a two percent net smelter return royalty to William (Bill) Hansen. The other 70 claims are owned by DGRI.

The property was acquired by DGRI by the transaction with Aultra Gold in January 2010. Mr. Hansen originally showed the property to Aultra Gold, which acquired it and staked additional claims.

Principal Executive Offices

Our principal executive office is located at 3500 Lenox Road, Suite 1500, Atlanta, Georgia 30326. Our phone number is 404-419-2440. Our website is www.DutchGold.com. We currently lease office space for our corporate office and operations under a one-year renewable contract with monthly rental charges approximately $2,500 per month. We believe that these offices adequately meet the current needs of the Company. We make available periodic reports and press releases on our website. Our common shares trade on the Over the Counter market under the symbol "DGRI."

General Government Regulations

United States

Mining in the State of Nevada and in the State of Montana is subject to Federal, state and local law. Three types of laws are of particular importance to our U.S. mineral properties: those affecting land ownership and mining rights; those regulating mining operations; and those dealing with the environment.

Land Ownership and Mining Rights

The Jungo Project in Nevada is situated on lands owned by the United States (Federal Lands). On Federal Lands, mining rights are governed by the General Mining Law of 1872 (General Mining Law) as amended, 30 U.S.C. §§ 21-161 (various sections), which allows the location of mining claims on certain Federal Lands upon the discovery of a valuable mineral deposit and proper compliance with claim location requirements. A valid mining claim provides the holder with the right to conduct mining operations for the removal of locatable minerals, subject to compliance with the General Mining Law and Nevada state law governing the staking and registration of mining claims, as well as compliance with various federal, state and local operating and environmental laws, regulations and ordinances. As the owner or lessee of the unpatented mining claims, we have the right to conduct mining operations on the lands subject to the prior procurement of required operating permits and approvals, compliance with the terms and conditions of any applicable mining lease, and compliance with applicable Federal, state, and local laws, regulations and ordinances.

Mining Operations

The exploration of mining properties and development and operation of mines is governed by both Federal and state laws. The Jungo property is administered by the United States Department of the Interior, Bureau of Land Management, which we refer to as the BLM. In general, the Federal laws that govern mining claim location and maintenance and mining operations on Federal Lands, including the Tonkin Springs property, are administered by the BLM. Additional Federal laws, such as those governing the purchase, transport or storage of explosives and those governing mine safety and health, also apply.

The State of Nevada, likewise, requires various permits and approvals before mining operations can begin, although the state and Federal regulatory agencies usually cooperate to minimize duplication of permitting efforts. Among other things, a detailed reclamation plan must be prepared and approved, with bonding in the amount of projected reclamation costs. The bond is used to ensure that proper reclamation takes place, and the bond will not be released until this is completed. The Nevada Department of Environmental Protection, which we refer to as the NDEP, is the state agency that administers the reclamation permits, mine permits and related closure plans on our Nevada property. Local jurisdictions (such as Humboldt County) may also impose permitting requirements (such as conditional use permits or zoning approvals).

Environmental Law

The development, operation, closure and reclamation of mining projects in the United States requires numerous notifications, permits, authorizations and public agency decisions. Compliance with environmental and related laws and regulations requires us to obtain permits issued by regulatory agencies, and to file various reports and keep records of our operations. Certain of these permits require periodic renewal or review of their conditions and may be subject to a public review process during which opposition to our proposed operations may be encountered. We are currently operating under various permits for activities connected to mineral exploration, reclamation and environmental considerations. Unless and until a mineral resource is proved, it is unlikely our operations will move beyond the exploration stage. If in the future we decide to proceed beyond exploration, there will be numerous notifications, permit applications and other decisions to be addressed at that time.

The State of Montana likewise requires various permits and approvals before mining operations can begin, although the state and Federal regulatory agencies usually cooperate to minimize duplication of permitting efforts. Among other things, a detailed reclamation plan must be prepared and approved, with bonding in the amount of projected reclamation costs. The bond is used to ensure that proper reclamation takes place, and the bond will not be released until this is completed. The Montana Department of Environmental Quality, which we refer to as the MDEQ, is the state agency that administers the reclamation permits, mine permits and related closure plans on our Montana property. Local jurisdictions (such as Humboldt County) may also impose permitting requirements (such as conditional use permits or zoning approvals).

Gold Uses

Gold is generally used for fabrication or investment. Fabricated gold has a variety of end uses including jewelry, electronics, dentistry, industrial and decorative uses, medals, medallions and official coins. Gold investors buy gold bullion, official coins and jewelry.

Gold Supply

A combination of current mine production and draw-down of existing gold stocks held by governments, financial institutions, industrial organizations and private individuals make up the annual gold supply. Based on public information available for the years 2008 through 2010, on average, current mine production has accounted for approximately 61% of the annual gold supply.

On February 18, 2011, the afternoon fixing gold price on the London Bullion Market was $1,384 per ounce and the spot market gold price on the New York Commodity Exchange was $1,388 per ounce.

Gold Price History

The price of gold is volatile and is affected by numerous factors all of which are beyond our control such as the sale or purchase of gold by various central banks and financial institutions, inflation, recession, fluctuation in the relative values of the US dollar and foreign currencies, changes in global and regional gold demand, and the political and economic conditions of major gold-producing countries throughout the world.

The following table presents the high, low and average afternoon fixed prices in U.S. dollars for gold per ounce on the London Bullion Market over the past nine years:

|

Year

|

|

High

|

|

|

Low

|

|

|

Average

|

|

|||

|

2002

|

349

|

278

|

310

|

|||||||||

|

2003

|

416

|

320

|

363

|

|||||||||

|

2004

|

|

|

454

|

|

|

|

375

|

|

|

|

410

|

|

|

2005

|

|

|

537

|

|

|

|

411

|

|

|

|

445

|

|

|

2006

|

|

|

725

|

|

|

|

525

|

|

|

|

603

|

|

|

2007

|

|

|

841

|

|

|

|

608

|

|

|

|

695

|

|

|

2008

|

|

|

1,011

|

|

|

|

713

|

|

|

|

872

|

|

|

2009

|

|

|

1,146

|

|

|

|

810

|

|

|

|

978

|

|

|

2010

|

1,421

|

1058

|

1225

|

|||||||||

Seasonality

Seasonality is not a material factor to the Company for its projects. Certain surface exploration work may need to be conducted when there is no snow but it is not a significant issue for the Company.

Competition

We compete with major mining companies and other natural mineral resource companies in the acquisition, exploration, financing and development of new projects. Many of these companies have greater resources and are better capitalized than the Company. There is significant competition for the limited number of gold acquisition and exploration opportunities. Our competitive position depends upon our ability to successfully and economically explore, acquire and develop new and existing mineral prospects. Factors that allow producers to remain competitive over the long-term include the quality and size of ore bodies, costs of operation, and the acquisition and retention of qualified employees. The Company competes with mining companies for skilled mining engineers, mine and processing plant operators and mechanics, geologists, geophysicists and other technical personnel. This competition could result in higher employee turnover and may result in higher labor costs.

Employees

As of March 30, 2011, we had 5 employees. Our employees in the U.S. include geologists, environmentalists, information technologists and office administrators. The Company believes we have good relations with our employees. We also engage independent contractors in connection with the exploration of our properties, such as drillers, geophysicists, geologists and other technical disciplines.

|

ITEM 1A.

|

RISK FACTORS

|

This report, including Management's Discussion and Analysis of Financial Condition and Results of Operations, contains forward-looking statements that may be affected by several risk factors. The following information summarizes all material risks known to us as of the date of filing this report:

Our independent auditors have expressed doubt about our ability to continue as a going concern.

Our independent registered public accountants have expressed doubt about our ability to continue as a going concern in their report on our December 31, 2010 and December 31, 2009 financial statements. Our independent registered public accountants have advised us that our continuance as a going concern is dependent upon our ability to raise capital. There is no assurance that we will be able to raise adequate capital or generate sufficient cash from operations to continue as a going concern.

Because of our limited operations and the fact that we are not currently generating revenue, we may be unable to service our debt obligations.

We currently have total debt of approximately $3,206,046 pursuant to notes issued by us. The Company is presently unable to meet related interest obligations in the amount of $337,443. Our ability to satisfy our current debt service obligations and any additional obligations we might incur will depend upon our future financial and operating performance which, in turn, is subject to prevailing economic conditions and financial, business, competitive, legislative and regulatory factors, many of which are beyond our control. If our cash flow and capital resources continue to be insufficient to fund debt service and general obligations, we may be forced to reduce or delay planned acquisitions, expansion and capital expenditures, sell assets, obtain additional equity capital or restructure debt. We cannot provide assurance that our operating results, cash flow and capital resources will be sufficient for payment of debt service and other future obligations.

Because our common stock is quoted on the "OTC Pink Sheets," your ability to sell your shares in the secondary trading market may be limited.

Our common stock is currently quoted on the OTC Pink Sheets. Consequently, the liquidity of our common stock is impaired, not only in the number of shares that are bought and sold, but also through delays in the timing of transactions and coverage by security analysts and the news media, if any, of our company. As a result, prices for shares of our common stock may be lower than might otherwise prevail if our common stock was quoted and traded on NASDAQ or a national securities exchange.

Because our shares are "penny stocks," you may have difficulty selling them in the secondary trading market.

Federal regulations under the Securities Exchange Act of 1934 regulate the trading of so-called "penny stocks," which are generally defined as any security not listed on a national securities exchange or NASDAQ, priced at less than $5.00 per share and offered by an issuer with limited net tangible assets and revenues. Since our common stock currently is quoted on the Pink Sheets at less than $5.00 per share, our shares are "penny stocks" and may not be quoted unless a disclosure schedule explaining the penny stock market and the risks associated therewith is delivered to a potential purchaser prior to any trade.

In addition, because our common stock is not listed on NASDAQ or any national securities exchange and currently is quoted at and trades at less than $5.00 per share, trading in our common stock is subject to Rule 15g-9 under the Securities Exchange Act. Under this rule, broker-dealers must take certain steps prior to selling a "penny stock," which steps include:

|

|

•

|

Obtaining financial and investment information from the investor;

|

|

|

•

|

Obtaining a written suitability questionnaire and purchase agreement signed by the investor; and

|

|

|

•

|

Providing the investor a written identification of the shares being offered and the quantity of the shares.

|

If these penny stock rules are not followed by the broker-dealer, the investor has no obligation to purchase the shares. The application of these comprehensive rules will make it more difficult for broker-dealers to sell our common stock and our shareholders, therefore, may have difficulty in selling their shares in the secondary trading market.

Existing shareholders may face dilution from our financing efforts.

We are dependent on raising capital from external sources to execute our business plan. We plan to issue debt securities, capital stock or a combination of these securities. We may not be able to sell these securities, particularly under the current market conditions. Even if we are successful in finding buyers for our securities, the buyers could demand high interest rates or require us to agree to onerous operating covenants, which could in turn harm our ability to operate our business by reducing cash flow and restricting operating activities. If we were to sell our capital stock, we might be forced to sell shares at a depressed market price, which could result in substantial dilution to existing shareholders. In addition, shares of newly issued capital stock may have rights, privileges and preferences superior to those of our common shareholders.

Our future earnings may be adversely affected because of charges resulting from acquisitions, or an acquisition could reduce shareholder value.

The Company may be required to amortize, over a period of years, certain identifiable intangible assets. The resulting amortization expense could reduce overall net income and earnings per share. Changes in future markets or technologies may require us to accelerate the amortization of intangible assets in such a way that our overall financial condition or operating results are harmed. If changes in economic and/or business conditions cause impairment of goodwill and other intangibles acquired by acquisition, it is likely that a significant non – cash charge against our earnings would result. If economic and/or business conditions did not improve, we could incur additional impairment charges against any earnings we might have in the future. An acquired business could reduce shareholder value if it should generate a net loss or require invested capital.

Risks Relating to Our Company

We have incurred substantial losses since our inception and may never be profitable. Since our inception, we have never been profitable and we have not generated revenue from operations since 2008. As of December 31, 2010, our accumulated deficit was $21,246,160. To become profitable, we must identify additional mineralization and establish economic reserves on our properties and then develop our properties or locate and enter into agreements with third party operators. It could be years before we receive any revenues from production, if ever. We may suffer significant additional losses in the future and may never be profitable. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. We expect to incur losses unless and until such time as one or more of our properties enters into commercial production and generates sufficient revenue to fund our continuing operations.

The feasibility of mining any of our properties has not been established, meaning that we have not completed sufficient exploration or other work necessary to determine if it is commercially feasible to develop any of our properties. We are currently an exploration stage company. We have no proven or probable reserves on our properties as defined by Securities and Exchange Commission, except for the mineral properties acquired and fair and fair valued related to the Aultra Gold asset acquisition. A "reserve," as defined by regulation of the SEC, is that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. A reserve requires a feasibility study demonstrating with reasonable certainty that the deposit can be economically extracted and produced.

The mineralized material identified on our properties, except for the aforementioned mineral properties acquired and fair valued related to the Aultra Gold asset acquisition, do not and may never demonstrate economic viability. Substantial expenditures are required to establish reserves through drilling and additional study and there is no assurance that reserves will be established. Whether a mineral deposit can be commercially viable depends upon a number of factors, including the particular attributes of the deposit including size, grade and proximity to infrastructure; metal prices, which can be highly variable; and government regulations, including environmental and reclamation obligations. If we are unable to establish some or all of our mineralized material as proven or probable reserves in sufficient quantities to justify commercial operations, we may not be able to raise sufficient capital to develop a mine, even if one is warranted. If we are unable to establish such reserves, the market value of our securities may suffer and you may lose some or all of your investment.

We note that we are filed with the Canadian investor’s estimates of mineralized material in accordance with NI 43-101. These standards are substantially different from the standards generally permitted to report reserve and other estimates in reports and other materials filed with the SEC. Under NI 43-101, we report measured, indicated and inferred resources, measurements which are generally not permitted in filings made with the SEC. U.S. investors are cautioned not to assume that all or any part of measured or indicated resources reporting in our Canadian filings will ever be converted into reserves.

The figures for our estimated mineralized material are based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.Unless otherwise indicated, mineralization figures presented in our filings with securities regulatory authorities including the SEC, press releases and other public statements that may be made from time to time are based upon estimates made by independent geologists and our internal geologists. When making determinations about whether to advance any of our projects to development, we must rely upon such estimated calculations as to the mineralized material and grades of mineralization on our properties. Until ore is actually mined and processed, mineralized material and grades of mineralization must be considered as estimates only.

These estimates are imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot assure you that:

|

|

•

|

Estimates will be accurate; mineralization estimates will be accurate; or this mineralization can be mined or processed profitably.

|

|

|

•

|

Any material changes in mineral estimates and grades of mineralization will affect the economic viability of placing a property into production and such property's return on capital. There can be no assurance that minerals recovered in small scale tests will be recovered in large-scale tests under on-site conditions or in production scale.

|

The estimates contained in our public filings have been determined and valued based on assumed future prices, cut-off grades and operating costs that may prove to be inaccurate. Extended declines in market prices for gold and/or silver may render portions of our mineralization estimates uneconomic and result in reduced reported mineralization or adversely affect the commercial viability of one or more of our properties. Any material reductions in estimates of mineralization, or of our ability to extract this mineralization, could have a material adverse effect on our results of operations or financial condition.

If we decide to put one or more of our properties into production, we will require significant amounts of capital and our ability to obtain this necessary funding will depend on a number of factors, including the status of the national and worldwide economy and the price of gold, silver and other precious metals. Fluctuations in production costs, material changes in the mineral estimates and grades of mineralization or changes in the political conditions or regulations in Montana or Nevada may make placing these properties into production uneconomic. Further, we may also be unable to obtain the necessary permits in a timely manner, on reasonable terms or on terms that provide us sufficient resources to develop our properties. These and other factors may cause us to delay production at the Basin Gulch Project and the Jungo Project beyond 2014, if at all.

We will require significant additional capital to continue our exploration activities and, if warranted, to develop mining operations. Substantial expenditures will be required to determine if proven and probable mineral reserves exist at any of our properties, to develop metallurgical processes to extract metal, to develop the mining and processing facilities and infrastructure at any of our properties or mine sites and, in certain circumstances, to acquire additional property rights. We have spent and will be required to continue to expend significant amounts of capital for drilling, geological and geochemical analysis, assaying and, when warranted, feasibility studies with regard to the results of our exploration. We may not benefit from these investments if we are unable to identify commercially exploitable mineralized material. If we decide to put one or more of our properties into production, we will require significant amounts of capital to develop and construct the mining and processing facilities and infrastructure required for mining operations. Our ability to obtain necessary funding for these purposes, in turn, depends upon a number of factors including the status of the national and worldwide economy and the price of gold, silver and other precious metals. We may not be successful in obtaining the required financing or, if we can obtain such financing, such financing may not be on terms that are favorable to us. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration or development and the possible, partial or total loss of our potential interest in certain properties. Any such delay could have a material adverse effect on our results of operations or financial condition.

We may acquire additional exploration stage properties and we may face negative reactions if reserves are not located on acquired properties. There can be no assurance that we will be able to identify and complete the acquisition of such properties at reasonable prices or on favorable terms and that reserves will be identified on any properties that we acquire. We may also experience negative reactions from the financial markets if we are unable to successfully complete acquisitions of additional properties or if reserves are not located on acquired properties. These factors may adversely affect the trading price of our common stock or our financial condition or results of operations.

Our industry is highly competitive. Attractive mineral lands are scarce and we may not be able to obtain quality properties. We compete with many companies in the mining industry including large, established mining companies with substantial capabilities, personnel and financial resources. There is a limited supply of desirable mineral lands available for claim staking, lease or acquisition in the U.S. and other areas where we may conduct exploration activities. We may be at a competitive disadvantage in acquiring mineral properties since we compete with these individuals and companies, many of which have greater financial resources and larger technical staffs than we do. Competition in the industry is not limited to the acquisition of mineral properties but also extends to the technical expertise to find, advance and operate such properties; the labor to operate the properties; and the capital for the purpose of funding such properties. Many competitors not only explore for and mine precious metals, but conduct refining and marketing operations on a world-wide basis. Such competition may result in our company being unable not only to acquire desired properties, but to recruit or retain qualified employees or to acquire the capital necessary to fund our operation and advance our properties. Our inability to compete with other companies for these resources would have a material adverse effect on our results of operation, financial condition and cash flows.

Fluctuating gold and silver prices could negatively impact our business. The potential for profitability of our gold and silver mining operations and the value of our mining properties are directly related to the market price of gold and silver. The price of gold and silver may also have a significant influence on the market price of our common stock. The market price of gold and silver historically has fluctuated significantly and is affected by numerous factors beyond our control. These factors include supply and demand fundamentals, expectations with respect to the rate of inflation, the relative strength of the U.S. dollar and other currencies, interest rates, gold and silver sales and loans by central banks, forward sales by metal producers, accumulation and divestiture by exchange traded funds, global or regional political, economic or banking crises and a number of other factors. The market price of silver is also affected by industrial demand. The selection of a property for exploration or development, the determination to construct a mine and place it into production and the dedication of funds necessary to achieve such purposes are decisions that must be made long before the first revenues, if any, from production will be received. Price fluctuations between the time that such decisions are made and the commencement of production can have a material adverse effect on the economics of a mine.

The volatility of mineral prices represents a substantial risk that no amount of planning or technical expertise can fully eliminate. In the event gold and silver prices decline and remain low for prolonged periods of time, we might be unable to develop our properties, which may adversely affect our results of operations, financial performance and cash flows. Title to mineral properties can be uncertain, and we are at risk of loss of ownership of one or more of our properties. Our ability to explore and operate our properties depends on the validity of our title to that property. Our mineral properties consist of leases of unpatented mining claims, as well as unpatented mining and millsite claims that we control directly. Unpatented mining claims provide only possessory title and their validity is often subject to contest by third parties or the Federal government, which makes the validity of unpatented mining claims uncertain and generally more risky. These uncertainties relate to such things as the sufficiency of mineral discovery, proper posting and marking of boundaries, assessment work and possible conflicts with other claims not determinable from public record. Since a substantial portion of all mineral exploration, development and mining in the United States now occurs on unpatented mining claims, this uncertainty is inherent in the mining industry. We have not obtained title opinions covering our entire property, with the attendant risk that title to some claims, particularly title to undeveloped property, may be defective. There may be valid challenges to the title to our property which, if successful, could impair development and/or operations.

We remain at risk in that the mining claims may be forfeited either to the United States or to rival private claimants due to failure to comply with statutory requirements as to location and maintenance of the claims or challenges to whether a discovery of a valuable mineral exists on every claim.

Our continuing reclamation obligations at the Basin Gulch and our other properties could require significant additional expenditures. We are responsible for the reclamation obligations related to disturbances located on all of our properties, including the Basin Gulch project and the Jungo project. We have posted a bond in the amount of the estimated reclamation obligation at the Jungo and Basin Gulch. There is a risk that any cash bond, even if increased based on the analysis and work performed to update the reclamation obligations, could be inadequate to cover the actual costs of reclamation when carried out. The satisfaction of bonding requirements and continuing reclamation obligations will require a significant amount of capital. There is a risk that we will be unable to fund these additional bonding requirements and, further, that the regulatory authorities may increase reclamation and bonding requirements to such a degree that it would not be commercially reasonable to continue exploration activities, which may adversely affect our results of operations, financial performance and cash flows.

Our ongoing operations and past mining activities are subject to environmental risks, which could expose us to significant liability and delay, suspension or termination of our operations. All phases of our operations are subject to Federal, state and local environmental regulation. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for us and our officers, directors and employees. Future changes in environmental regulation, if any, may adversely affect our operations, make our operations prohibitively expensive or prohibit them altogether. Environmental hazards may exist on our properties that are unknown to us at the present and that have been caused by us, or previous owners or operators, or that may have occurred naturally. Mining properties from the companies we have acquired may cause us to be liable for remediating any damage that those companies may have caused. The liability could include response costs for removing or remediating the release and damage to natural resources including ground water, as well as the payment of fines and penalties.

Failure to comply with applicable environmental laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities, causing operations to cease or be curtailed and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions.

Our operations are subject to permitting requirements that could require us to delay, suspend or terminate our operations on our mining properties. Our operations, including ongoing exploration drilling programs, require permits from the state and Federal governments, including permits for the use of water and for drilling wells for water. We may be unable to obtain these permits in a timely manner, on reasonable terms or on terms that provide us sufficient resources to develop our properties, or at all. Even if we are able to obtain such permits, the time required by the permitting process can be significant. If we cannot obtain or maintain the necessary permits, or if there is a delay in receiving these permits, our timetable and business plan for exploration of our properties maybe adversely affected, which may in turn adversely affect our results of operations, financial condition and cash flows.

Legislation has been proposed that would significantly affect the mining industry. Periodically, members of the U.S. Congress have introduced bills which would supplant or alter the provisions of the General Mining Law of 1872 which governs the unpatented claims that we control with respect to our U.S. properties. One such amendment has become law and has imposed a moratorium on the patenting of mining claims, which reduced the security of title provided by unpatented claims such as those on our U.S. properties. If additional legislation is enacted, it could substantially increase the cost of holding unpatented mining claims by requiring payment of royalties, and could significantly impair our ability to develop mineral estimates on unpatented mining claims. Such bills have proposed, among other things, to make permanent the patent moratorium, to impose a Federal royalty on production from unpatented mining claims and to declare certain lands as unsuitable for mining. Although it is impossible to predict at this time what royalties may be imposed in the future, the imposition of such royalties could adversely affect the potential for development of such mining claims, and the economics of existing operating mines on Federal unpatented mining claims. Passage of such legislation could adversely affect our business.

In March 2010, the State of Nevada enacted Assembly Bill No. 6 ("AB6") which sought to balance the state budget by reducing expenditures and increasing certain fees. Among those fee increases was a one-time fee payable in conjunction with the annual filing of an affidavit of the intent to hold a mining claim, with a tiered fee structure applied for holders of 11 or more claims. The fee ranges from $70 per claim for holders of 11 to 199 claims up to $195 per mining claim for holders of 1,300 or more claims as of the date of filing. We filed our annual affidavits of our intent to hold a mining claim on November 1, 2010 and based on the number of claims held by our subsidiaries at that time, we estimate we will have to pay certain amounts due to this fee on or before June 1, 2011. We remain at risk that Nevada may impose additional fees or other levies affecting the mining industry in the future.

We are currently in the exploration stage and our management has limited experience in developing and operating a mine. We are currently working towards developing our Basin Gulch Project in Montana and our Jungo Project in Nevada. Our ability to manage our growth, if any, will require us to improve and expand our management and our operational and financial systems and controls. If our management is unable to manage growth effectively, our business and financial condition may be materially harmed. In addition, if rapid growth occurs, it may strain our operational, managerial and financial resources.

We are subject to litigation risks. All industries, including the mining industry, are subject to legal claims, with and without merit. Defense and settlement costs can be substantial, even with respect to claims that have no merit. Due to the inherent uncertainty of the litigation process, the resolution of any particular legal proceeding could have a material adverse effect on our financial position and results of operations.

The nature of mineral exploration and production activities involves a high degree of risk and the possibility of uninsured losses that could materially and adversely affect our operations.

Exploration for minerals is highly speculative and involves greater risk than many other businesses. Many exploration programs do not result in the discovery of mineralization, and any mineralization discovered may not be of sufficient quantity or quality to be profitably mined. Few properties that are explored are ultimately advanced to production. Our current exploration efforts are, and any future development or mining operations we may elect to conduct will be, subject to all of the operating hazards and risks normally incident to exploring for and developing mineral properties, such as, but not limited to: economically insufficient mineralized material; fluctuations in production costs that may make mining uneconomical; availability of labor, power, transportation and infrastructure; labor disputes; potential delays related to social and community issues; unanticipated variations in grade and other geologic problems; environmental hazards; water conditions; difficult surface or underground conditions; industrial accidents; metallurgical and other processing problems; mechanical and equipment performance problems; failure of pit walls or dams; unusual or unexpected rock formations; personal injury, fire, flooding, cave-ins and landslides; decrease in reserves due to a lower silver price; and decrease in reserves due to a lower gold price.

Any of these risks can materially and adversely affect the development of properties, production quantities and rates, expenditures, potential revenues and production dates. We have no insurance to guard against any of these risks. If we determine that capitalized costs associated with any of our mineral interests are not likely to be recovered, we would incur a write-down of our investment in these interests. All of these factors may result in losses in relation to amounts spent that are not recoverable.

We do not insure against all risks to which we may be subject in our planned operations. We may also be unable to obtain insurance to cover other risks at economically feasible premiums or at all. Insurance coverage may not continue to be available or may not be adequate to cover liabilities. We might also become subject to liability for environmental, pollution or other hazards associated with mineral exploration and production which may not be insured against, which may exceed the limits of our insurance coverage or which we may elect not to insure against because of premium costs or other reasons. Losses from these events may cause us to incur significant costs that could materially adversely affect our financial condition and our ability to fund activities on our property. A significant loss could force us to reduce or terminate our operations.

We depend on a limited number of personnel and the loss of any of these individuals could adversely affect our business. Our company is dependent on key management, namely our Chairman and Chief Executive Officer, our Vice President and Chief Operating Officer, and our Chief Financial Officer. Daniel Hollis, our Chairman and Chief Executive Officer, is responsible for strategic direction and the oversight of our business. Rauno Perttu, our Vice President and Chief operating Officer, is responsible for the oversight of technical information development, corporate and project development and management. Steven Keaveney, our Chief Financial Officer, is responsible for treasury management, all accounting activity, reporting and compliance with the Securities and Exchange Commission. We rely heavily on these individuals for the conduct of our business. The loss of any of these officers would significantly and adversely affect our business. In that event, we would be forced to identify and retain an individual to replace the departed officer. We may not be able to replace one or more of these individuals on terms acceptable to us. We have no life insurance on the life of any officer.

Some of our directors may have conflicts of interest as a result of their involvement with other natural resource companies. Some of our directors are directors or officers of other natural resource or mining-related companies or may be involved in related pursuits that could present conflicts of interest with their roles at Dutch Gold. These associations may give rise to conflicts of interest from time to time. In the event that any such conflict of interest arises, a director who has such a conflict is required to disclose the conflict to a meeting of the directors of the company in question and to abstain from voting for or against approval of any matter in which such director may have a conflict. In appropriate cases, we will establish a special committee of independent directors to review a matter in which several directors or management, may have a conflict.

Risks Relating to Our Common Stock

Our stock price has historically been volatile and, as a result, you could lose all or part of your investment.

The market price of our common stock has fluctuated significantly and may decline in the fiscal year ended December 31, 2011. The fluctuation of the market price of our common stock has been affected by many factors that are beyond our control including: changes in the worldwide price for gold and/or silver, results from our exploration or development efforts and the other risk factors discussed herein.

|

UNRESOLVED STAFF COMMENTS

|

Not required for smaller reporting companies.

|

ITEM 2.

|

PROPERTIES

|

We generally hold mineral interests through patented and unpatented mining and mill site claims, leases of patented and unpatented mining claims and joint venture and other agreements. Patented and Unpatented mining claims are held subject to paramount title in the United States. In order to retain these claims, we must pay annual maintenance fees to the BLM and to the counties within which the claims are located. Rates for these jurisdictions vary and may change over time. Other obligations which must be met include obtaining and maintaining necessary regulatory permits and lease and option payments to claim owners.

For purposes of organizing and describing our exploration efforts in the United States, we have grouped our properties into two complexes, the Basin Gulch Complex and the Jungo Complex. Mineral properties outside these areas and where we to date have performed limited exploration work are grouped as "Other United States Properties." Certain properties are subject to certain royalty and earn-in rights.

Jungo Project The Jungo gold exploration project is located approximately 50 miles northwest of the town of Winnemucca, in Humboldt County, Nevada. It is accessed by excellent county-maintained gravel roads west from Winnemucca then north from Jungo junction. The last three miles to the property are by poor quality dirt roads. The property is situated on the eastern margin of the Jackson Mountains.

Geologic Setting:

The Jungo property is underlain by Pretertiary metasedimentary and metadiorite rocks that have locally been covered and intruded by younger, possibly Miocene, volcanic units. These units are largely covered by unconsolidated gravels from the adjacent mountainside, and by Pleistocene lake beds. A series of range-front normal faults offsets these units and is probably associated with mineralization on the property. A key player in mineralization is likely an apparent volcanic vent that was intersected in trenching and drilling, and appears associated with the range-front faulting.

Property:

The property is on BLM land and is held by 95 unpatented lode mining claims. Twenty five of the claims have a two percent net smelter return royalty to William (Bill) Hansen. The other 70 claims are owned by DGRI.

The property was acquired by DGRI by the transaction with Aultra Gold in January 2010. Mr. Hansen originally showed the property to Aultra Gold (“AGI”), which acquired it and staked additional claims.

Work on the Property:

AGI Exploration:

Mr. Hansen told AGI that he had several years earlier drilled three holes on the property, but the earlier records were lost. AGI surface sampled the property and completed two trenches in 2007. AGI’s sampling and trenching produced encouraging results. Among the promising results was a twenty-foot interval in the first of two trenches that assayed 0.042 opt gold and more than 0.5 opt silver. A select sample of trench rock assayed 0.6 opt gold and 4.44 opt silver.

An isolated pit to bedrock almost 2,000 feet to the northwest assayed 0.11 opt gold and 3.80 opt silver.

2010 Trenching Program by Dutch