Attached files

| file | filename |

|---|---|

| EX-21.1 - TIENS BIOTECH GROUP USA INC | v216077_ex21-1.htm |

| EX-31.1 - TIENS BIOTECH GROUP USA INC | v216077_ex31-1.htm |

| EX-32.1 - TIENS BIOTECH GROUP USA INC | v216077_ex32-1.htm |

| EX-10.48 - TIENS BIOTECH GROUP USA INC | v216077_ex10-48.htm |

| EX-10.49 - TIENS BIOTECH GROUP USA INC | v216077_ex10-49.htm |

| EX-10.46 - TIENS BIOTECH GROUP USA INC | v216077_ex10-46.htm |

| EX-10.51 - TIENS BIOTECH GROUP USA INC | v216077_ex10-51.htm |

| EX-10.47 - TIENS BIOTECH GROUP USA INC | v216077_ex10-47.htm |

| EX-10.50 - TIENS BIOTECH GROUP USA INC | v216077_ex10-50.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to_____

Commission File Number: 001-32477

TIENS BIOTECH GROUP (USA), INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

75-2926439

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

No. 17, Xinyuan Rd.

Wuqing New Tech Industrial Park

Tianjin, China 301700

(Address of principal executive offices) (Zip Code)

Registrant’s Telephone Number, including area code: (011) 86-22-8213-7914

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of Each Class

|

Name of Each Exchange on which Registered

|

|

|

Common Stock, par value $0.001

|

|

NYSE Amex

|

Securities registered pursuant to Section 12(g) of the Exchange Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨

(Do not check if a smaller reporting company)

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Based upon the closing sale price of $1.84 per share of Common Stock on NYSE Amex on June 30, 2010, the aggregate market value of the 3,503,586 shares of voting stock held by non-affiliates of the registrant was approximately $6,446,598.

There were 71,333,586 shares of the registrant’s common stock outstanding on March 29, 2011.

DOCUMENTS INCORPORATED BY REFERENCE – None.

FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These statements relate to future events or our future financial performance. We have attempted to identify forward-looking statements by terminology including “anticipates”, “believes”, “expects”, “can”, “continue”, “could”, “estimates”, “expects”, “intends”, “may”, “plans”, “potential”, “predict”, “should” or “will” or the negative of these terms or other comparable terminology. These statements are only predictions; uncertainties and other factors may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels or activity, performance or achievements expressed or implied by these forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Our expectations are as of the date this Form 10-K is filed, and we do not intend to update any of the forward-looking statements after the date this Annual Report on Form 10-K is filed to confirm these statements to actual results, unless required by law.

ITEM 1. BUSINESS.

In this Annual Report on Form 10-K, references to “dollars” and “$” are to United States Dollars and references to “RMB” and “renminbi” are to Chinese Renminbi (RMB). References to “we”, “us”, “our”, the “Company” or “Tiens USA” include Tiens Biotech Group (USA), Inc. and its subsidiaries.

Overview

Tiens USA researches, develops, manufactures, and markets nutrition supplement products, including wellness products and dietary supplement products. Our operations are conducted from our headquarters in Tianjin, People’s Republic of China (“China” or the “PRC”) through our 80% owned subsidiary, Tianjin Tianshi Biological Development Co., Ltd. (“Biological”), and our wholly-owned subsidiary, Tianjin Tiens Life Resources Co., Ltd. (“Life Resources”). We sell our products for distribution in China to an affiliated company that in turn sells the products to consumers through its chain store and its Chinese affiliated companies. Outside of China, we sell our products to overseas affiliated companies located in 45 countries that in turn sell them to independent direct sales distributors.

Corporate History and Organization

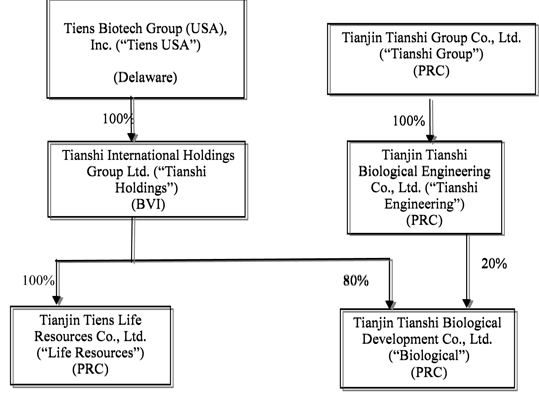

Tiens USA is a Delaware corporation. We own 100% of Tianshi International Holdings Group Ltd., a British Virgin Islands company (“Tianshi Holdings”) which owns all of the registered share capital of Tianjin Tiens Life Resources Co., Ltd., a Chinese Foreign Investment Enterprise (“Life Resources”) and 80% of Biological’s outstanding shares. Biological is a Chinese-foreign equity joint venture company established under Chinese laws on March 27, 1998, subject to the Law on Sino Foreign Equity Joint Ventures.

Tianjin Tianshi Biological Engineering Co., Ltd. (“Tianshi Engineering”), a Chinese company, owns the remaining 20% of Biological. Tianshi Engineering is 100% owned by Tianjin Tianshi Group Co., Ltd. (“Tianshi Group”), a Chinese company. Tianshi Group is 90% owned by Jinyuan Li, our Chairman, Chief Executive Officer, Acting Chief Financial Officer and President and owner of 95.1% of our outstanding stock, and 10% owned by Baolan Li, Jinyuan Li’s daughter, who is a member of our Board of Directors.

Life Resources is currently constructing research and development, manufacturing and logistic facilities, as well as administrative offices in Tianjin, China totaling approximately 420,000 square meters. We moved our administrative offices to the newly constructed Industrial Park on October 16, 2010. We expect to complete the move of our other facilities at the end of 2011.

The following chart shows the ownership interests in our operating subsidiaries.

Products and Manufacturing

We have developed and produce 37 nutrition supplement products, which include wellness products and dietary supplements.

Each of our wellness products includes at least one health function and has been issued a Certificate of Domestic Wellness Product by the State Food and Drug Administration (SFDA). This SFDA certificate is required for the production and sale of wellness products in China. Dietary supplements, which do not include any health functions, are considered to be “ordinary food,” and do not require a SFDA certificate. Each of our products has been issued a Product Standard Code by the Bureau of Technical Supervision.

We put great emphasis on product quality assurance. In 2002, we were awarded a Quality System Certificate for compliance with the standard “ISO9001: 2000” in the area of Design and Development, Production and Service of Food and Health Care Food in China. In addition, many of our products have received a certificate of Hazard Analysis Critical Control Point (“HACCP”). HACCP identifies and assesses hazards and risks associated with the manufacture, distribution and use of food-handling establishments. In 2009 and 2010, four of our products received a kosher certificate from the Kosher Supervision of America (“KSA”), which is recognized by rabbinical societies throughout the world. These products bear the KSA symbol, which tells consumers that the products are in compliance with kosher standards.

Our products are manufactured by Life Resources and Biological at our facilities in Tianjin, China. The manufacturing processes of our nutrition supplement products are categorized into six types depending on the different forms of the finished products: Powder, Tea, Capsules, Tablets, Granules and Soft Gel Capsules. All of our manufacturing complies with the product standards approved by the Bureau of Technical Supervision in China.

The following table lists our products.

|

Wellness Products *

|

Dietary Supplement Products *

|

|

|

Bone Treasure Tablets (b)

|

Tianshi Barley Green Tablets (b)

|

|

|

Chewable Calcium Tablets (b)

|

Tianshi Breast Beauty Capsules

|

|

|

Chewable Calcium Tablets with multi-flavor (b)

|

Tianshi Calcium-Treasure Tablets (b)

|

|

|

Grape Extract Capsules (a) (b)

|

Tianshi Double-cellulose Tablets (a) (b)

|

|

|

Tianshi Beauty Face Capsules (b) (c)

|

Tianshi Eel Oil Capsules

|

|

|

Tianshi Cell Rejuvenation Capsules (a) (b)

|

Tianshi Hemp Seed Oil Softgels

|

|

|

Tianshi Chitosan Capsules (a) (b)

|

Tianshi Lycopene Tablets (a) (b)

|

|

|

Tianshi Cordyceps Capsules (a) (b)

|

Tianshi Multi-Vit-Mine Coffee (b)

|

|

|

Tianshi Lipid Metabolic Management Tea (a) (b) (c)

|

Tianshi Natto Capsules (b)

|

|

|

Tianshi Metabolic Balance Capsules (a) (b) (c)

|

Tianshi Perilla Oil Softgels (b)

|

|

|

Tianshi Nutrient Super Calcium Powder (a) (b)

|

Tianshi Pine Pollen Powder Capsules

|

|

|

Tianshi Pressure Care Tea (b)

|

Tianshi Propeptide Polypeptide Albumen Powder (b)

|

|

|

Tianshi Slimming Tea (a) (b) (c)

|

Tianshi Rich Selenium Green Tea

|

|

|

Tianshi Spirulina Capsules (a) (b)

|

Tianshi Sea Buckthorn Oil Softgels (a) (b)

|

|

|

Tianshi Super Calcium Powder with Metabolic Factors (a) (b)

|

Tianshi Super Calcium Milk Powder (b)

|

|

|

Tianshi Super Calcium Powder for Children (a) (b)

|

Tianshi Tibet-Garlic Capsules (b)

|

|

|

Tianshi Super Calcium Capsules with Lecithin (a) (b)

|

||

|

Tianshi Sweet Dreams Granules (a) (b)

|

||

|

Tianshi Vitality Softgels (a) (b)

|

||

|

Tianshi Throat Care Granules (b)

|

||

|

Tianshi Zinc Capsules (a) (b)

|

|

|

*

|

These products are not intended to diagnose, treat, cure or prevent any disease.

|

|

(a)

|

This product has received Halal Approval, which certifies that our manufacturing processes comply with the requirements of Islamic dietary law.

|

|

(b)

|

This product has received an HACCP Certificate.

|

|

(c)

|

This product has received KSA Kosher Certificate.

|

For the years ended December 31, 2010 and 2009, almost all of our revenue was generated from related party customers. See note 17 to our consolidated financial statements, for a breakdown of domestic and international revenue, and revenue by product group, for the last two fiscal years. In 2010 and 2009, our Tianshi Cordyceps Capsules accounted for 17.4% and 10.6% of our revenue, respectively, and our Tianshi Nutrient Super Calcium Powder accounted for 15.7% and 19.0% of our revenue, respectively.

Trademarks and Patents

We consider the “Tiens” logo important to our business and have registered our products under the logo “Tiens” with the State Administration of Industry and Commerce in China. The registration is valid for a period of ten years from May 21, 2002 and can be renewed for further ten-year periods multiple times. We have conducted extensive research and developed Tianshi Super Calcium Powder with Metabolic Factors and Tianshi Super Calcium Powder for Children, which have each been awarded a patent from the State Intellectual Properties Office in China with respective patent numbers of ZL97115067.2 and ZL97115068.0. These two patents are effective for 20 years, commencing on January 13, 2001.

Suppliers

We have established long-term relationships with most of our suppliers. We believe that the raw materials required for manufacturing our products are relatively easy to find and alternative suppliers are convenient to locate. The following table lists our principal suppliers:

|

SUPPLIER

|

PRODUCT

|

|

|

Tianjin Xinhengyang Import and Export Trade Co.,Ltd

|

Whole and de-fatted milk powder, Polydextrose

|

|

|

Tianjin Xingsheng Import and Export Trade Co.,Ltd

|

Cordyceps mycelium powder

|

|

|

Shanghai Guangdeli Capsule Co.,Ltd

|

Capsules

|

|

|

Qinghai Kangpu Biological Technology Development Co.,Ltd

|

Seabuckthorn seed oil

|

|

|

Tianjin Tangchao Food Industry Co.,Ltd

|

Extraction of grape seed, yolk lecithin

|

|

|

Tianjin Xindayutong Trade Co., Ltd

|

Gelatin, Vitamin E powder

|

|

|

Shanxi Guangsheng Capsule Co., Ltd

|

Capsules

|

|

|

Baolingbao Biological Co., Ltd

|

Isomaltooligosaccharide, Anhydrous glucose

|

|

|

Hebei Jinmu Pharmaceutical Group Co.,Ltd

|

Folium nelumbinis, Herba gynostemma pentaphyllum

|

|

|

Shandong Aokang Biological Technology Co.,Ltd

|

|

Chitosan

|

Research and Development

We incurred research and development expenses of $1.8 million and $1.3 million in 2010 and 2009, respectively. As of December 31, 2010, we employed 91 staff members in research and development, which accounts for an increase of 12 employees in our research and development team during 2010.

Marketing and Distribution

In China, we sell our products to Tianshi Engineering, an affiliated Chinese company, through our subsidiaries Biological and Life Resources. Tianshi Engineering, in turn, sells the products to customers through its branches and affiliated companies and at chain stores, which are owned by individual distributors, who are not affiliates of the Company. During 2010 Tianshi Engineering closed five of its less profitable branches in China. As of December 31, 2010, Tianshi Engineering had 87 branches in China. Prior to 2006, Biological sold all of its products to Tianshi Engineering as finished products at a price equal to 25% of the Chinese market price for the products. This 25% figure was negotiated between the parties in 2003, before we acquired Tianshi Holdings, and we believe that it is a reasonable sales price for us to receive. We used this pricing formula in 2010, and currently continue to use the same pricing formula.

At the beginning of 2006, Biological also began selling semi-finished products to Tianshi Engineering. To qualify for a direct selling license in China, Tianshi Engineering is required to produce a part of the products that it sells in China. As a result, Biological began to sell semi-finished products to Tianshi Engineering, which jointly shares with us licenses to produce, manufacture and sell the products. The price of semi-finished goods sold to Tianshi Engineering was originally set at the beginning of 2006 to provide us with a 75% gross profit margin. However, based on fluctuations in the cost of raw materials and quantities produced, this percentage varied during the year. This 75% figure was negotiated between the parties, and we believe that it is reasonable. The goal of this new pricing policy was to try to maintain our gross margins on semi-finished goods at a similar level to historical gross margins for finished goods.

As of June 2008, Life Resources replaced Biological in the production of semi-finished products and began to produce and sell semi-finished products to Tianshi Engineering on the same pricing terms as Biological’s previous sales. In October 2009, Life Resources transferred part of its production and sale of semi-finished products to Biological.

Internationally, our strategy is to develop a strong direct sales force through our international affiliated companies. We sell our products to overseas affiliated companies located in 45 countries who in turn re-package the products to meet the needs of the local markets and sell them to independent direct sales distributors. Currently, the United States is not a significant part of our business. During 2010, we decreased the number of countries where we sell directly to overseas affiliates from 54 to 45. Our CEO, Jinyuan Li, owns or controls these overseas related companies. Due to the common ownership, there are no formal sales or administrative agreements among us and those overseas related parties. The business operations among these related entities have historically been, and continue to be, regulated through internal policies. In 2010 our highest sales outside of China were to the following eleven countries, in descending order: Russia, South Africa, Kazakhstan, Roumania, Ukraine, Lagos, India, Bengal, Ghana, Uganda and Columbia.

As operation costs vary from country to country, international market prices vary accordingly. We sell our products to overseas affiliates at the FOB (destination port) price, which consists of 25% of the Chinese retail price for similar products in Chinese market, including customs duty, value-added tax and other miscellaneous transportation cost. The overseas affiliates mark up the products to cover their expenses and realize profits of approximately 10%.

Competition

Internationally, we engage in the direct selling industry and compete with other direct selling organizations. Some of them have a longer operating history and higher visibility, name recognition and financial resources than we do. The leading direct selling companies in our existing markets are Avon and Alticor (Amway). Some of our competitors, including Avon and Alticor (Amway), have been granted a direct selling business license in certain parts of China pursuant to China’s regulations governing direct selling. In other cites and/or provinces of China, the selling models of Avon and Alticor (Amway) are similar to the model utilized by our company; therefore, Avon and Alticor (Amway) are our main competitors in our Chinese operations. The direct selling regulations require Tianshi Engineering, our affiliate who sells our products in China, to apply for approval to conduct a direct selling enterprise in China. On March 11, 2011, Tianshi Engineering received a direct selling license in Tianjin.

Regulatory Framework

Product Regulation

The central governing authority in China for wellness products is the SFDA, which is under the jurisdiction of the State Council. SFDA issues administrative rules. Provincial, city and town authorities implement the rules of the SFDA. Other than the SFDA, other ministries and administrations also have certain responsibility for the management of wellness or nutrition supplement products, such as the State Administration for Industry and Commerce.

We develop and manufacture products that are classified as nutrition supplement products, which include wellness products and dietary supplement products. Wellness products may not be sold in China without a wellness products certificate. The governmental approval process in China for a newly developed wellness product is as follows:

|

|

·

|

An application for a product certificate is filed with SFDA, which directs the applicant to send product samples to one of the government appointed research institutes;

|

|

|

·

|

The appointed research institute conducts clinical trials, stability tests, function tests and toxicity tests on the product, makes a report and sends the report back to SFDA within 6 months; and

|

|

|

·

|

The Expert Committee of SFDA makes a final decision on the application and issues a “wellness products certificate” or a refusal notice to the applicant.

|

This certificate authorizes the sales and marketing of the product in China. The certificate does not expire and does not require renewal. The approval process generally takes nine to twelve months. Dietary supplement products are not subject to SFDA regulation.

Sales and Marketing Regulations

In most countries, our products are usually considered general commodities, which do not require specific selling permits and are not subject to the strict regulations applied to drugs and medicine. In some countries, direct selling (or multi-level marketing) is highly regulated or prohibited. Since we sell our products to our affiliated companies for sale internationally, the local approval issues with respect to sales and distribution are addressed by our affiliates.

In China, we aim to expand our market share through the branches, chain stores, and affiliated companies of Tianshi Engineering, our affiliate that sells our products in China. The regulatory environment with respect to direct selling in this market remains fluid and the process for obtaining the necessary governmental approvals has been interpreted differently by different governmental authorities.

Tianshi Engineering has applied for a direct selling license in a number of provinces and must obtain a series of approvals from the Departments of Commerce in such provinces, as well as the Departments of Commerce in each city and district in which we plan to operate. Tianshi Engineering is also required to obtain the approval of the State Ministry of Commerce, which is the national government authority overseeing direct selling.

Tianshi Engineering has found that it is taking more time than anticipated to work through the approval process with the Chinese authorities. These authorities have broad discretion in interpreting the regulations and granting necessary approvals. A delay in obtaining approvals at one level can delay its ability to obtain approvals at the next level. The complexity of the approval process as well as the government’s continued cautious approach as direct selling develops in China makes it difficult to predict a timeline for obtaining these approvals.

Environmental Compliance

We are subject to China’s National Environmental Protection Law, as well as a number of other national and local laws and regulations regulating air, water and noise pollution and setting pollutant discharge standards. We believe that all our manufacturing operations are in material compliance with all applicable environmental laws. During 2010, we did not incur any costs to comply with environmental laws.

Employees

As of December 31, 2010, we had 1,380 full-time employees. We have no part-time employees. We believe that our relations with our employees are satisfactory.

Available Information

This Annual Report on Form 10-K for the fiscal year ended December 31, 2010 is available on our website at http://www.tiens-bio.com. The Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2010, excluding exhibits, and the Company’s complete audited financial statements for the fiscal year ended December 31, 2010, will be mailed without charge to any stockholder, upon written request to Secretary of the Company, c/o Tiens Biotech Group (USA), Inc., No. 17, Xinyuan Road, Wuqing New-Tech Industrial Park, Tianjin, People’s Republic of China 301700.

We file annual and quarterly reports, proxy statements and other information with the SEC. Stockholders may read and copy any reports, statements or other information that we file at the SEC’s public reference room in Washington, D.C. Please call the SEC at 1-800-SEC-0330 for further information about the public reference room. Our public filings are also available from commercial document retrieval services and at the Internet Web site maintained by the SEC at www.sec.gov.

Not applicable.

Not applicable.

We conduct our main business activities in Tianjin, China. Our primary facilities are located at No. 17, Xinyuan Road, Wuqing New-tech Industrial Park, Tianjin, PRC.

On January 1, 2009, Biological entered into an office and facilities lease agreement with Tianshi Group. Under the terms of the agreement, Biological’s annual rent is equal to 1% of its gross revenues. In addition, Biological is obligated to pay insurance, maintenance and other expenses related to the premises. This agreement expired on December 31, 2009. On January 1, 2010, Biological and Life Resources each entered an office and facilities lease agreement with Tianshi Group on the same terms as Biological’s lease agreement with Tianshi Group in 2009. These two leases cover the following real properties:

|

|

·

|

one office buildings with an area of 1,350 square meters; and

|

|

|

·

|

one dormitory with an area of 2,365 square meters.

|

The Company paid rent under these leases in the amount of $500,361 and $458,382 for the year ended December 31, 2010 and 2009, respectively.

On January 1, 2009, each of Biological and Life Resources entered a Lease Agreement with Tianshi Group pursuant to which Biological and Life Resources will have the right to use and occupy the workshop and warehouse spaces being transferred under the 2007 Transfer Agreement and the 2008 Transfer Agreement. The lease agreements cover the following workshop and warehouse spaces:

|

|

·

|

four workshops with an area of 8,549 square meters; and

|

|

|

·

|

one warehouse with an area of 3,870 square meters.

|

The leases are rent-free, except that, Biological and Life Resources are required to pay Tianshi Group for utility charges and maintenance costs on the buildings. The leases continue until the earlier of the date Biological and Life Resources acquire use of alternate facilities or the land use rights on the underlying property expire. For the year ended December 31, 2010, Biological and Life Resources recorded $330,708 of the rent expense, which is not paid to Tianshi Group, but recorded as paid in capital based upon market price.

Life Resources Property

Life Resources is currently constructing research and development, manufacturing and logistic facilities, as well as administrative offices totaling approximately 420,000 square meters. The facilities are located in our current headquarters in Tianjin, China.

As of December 31, 2010, the office buildings, dormitories, power center, boiler room, warehouse for wellness products had been transferred from construction in progress to fixed assets. The product exhibition center, quality control center and wash house were undergoing interior decoration and expect to be completed at the end of June 2011. The interior decoration of work plants and other warehouses has been nearly completed and these facilities will be put into use once the equipment is installed. We expect the equipment to be installed at the end of 2011. As of the end of 2010, the cost of the completed work of construction in progress and other facilities was $204,854,576 (based on an exchange rate of $1 = RMB 6.6120 as of December 31, 2010), which includes amounts paid for the underlying land use right. The office buildings, dormitories, power center, boiler room and warehouse for wellness products had been put into use from October 2010. We expect that other construction work and equipment installation will be completed in 2011.

We are not a party to any material pending legal proceedings.

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASERS OF EQUITY SECURITIES.

Market Prices of Common Stock

Our common stock is listed on NYSE Amex under the symbol “TBV”. The following table sets forth the range of high and low sales prices for our common stock reported by NYSE Amex in each fiscal quarter from January 1, 2009 to December 31, 2010.

|

High

|

Low

|

|||||||

|

2010

|

||||||||

|

Quarter Ended December 31

|

$ | 1.75 | $ | 1.25 | ||||

|

Quarter Ended September 30

|

$ | 1.85 | $ | 1.33 | ||||

|

Quarter Ended June 30

|

$ | 2.62 | $ | 1.75 | ||||

|

Quarter Ended March 31

|

$ | 3.10 | $ | 2.16 | ||||

|

2009

|

||||||||

|

Quarter Ended December 31

|

$ | 5.35 | $ | 2.45 | ||||

|

Quarter Ended September 30

|

$ | 5.57 | $ | 2.26 | ||||

|

Quarter Ended June 30

|

$ | 3.02 | $ | 1.67 | ||||

|

Quarter Ended March 31

|

$ | 4.45 | $ | 1.11 | ||||

Stockholders

As of March 29, 2011, there were a total of 71,333,586 shares of our common stock outstanding, held by approximately 930 stockholders of record.

Dividend Policy

We have not declared any dividends on our common stock since inception and do not intend to pay dividends on our common stock in the foreseeable future. If we ever determine to pay a dividend, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency from the PRC for the payment of such dividends from the profits of Biological and Life Resources. Please see additional discussion under Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Financial Condition, Liquidity and Capital Resources.”

Securities Authorized for Issuance Under Equity Compensation Plans

None.

Not applicable.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

FORWARD-LOOKING STATEMENTS:

The following discussion of the financial condition and results of operations should be read in conjunction with the consolidated financial statements and related notes thereto. The words or phrases “would be,” “will allow,” “expect to”, “intends to,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” or similar expressions are intended to identify “forward-looking statements”. Such statements include those concerning our expected financial performance, our corporate strategy and operational plans. Actual results could differ materially from those projected in the forward-looking statements as a result of a number of risks and uncertainties, including: (a) those risks and uncertainties related to general economic conditions in China, including regulatory factors that may affect such economic conditions; (b) whether we are able to manage our planned growth efficiently and operate profitable operations, including whether our management will be able to identify, hire, train, retain, motivate and manage required personnel or that management will be able to successfully manage and exploit existing and potential market opportunities; (c) whether we are able to generate sufficient revenues or obtain financing to sustain and grow our operations; (d) whether we are able to successfully fulfill our primary requirements for cash, which are explained below under “Liquidity and Capital Resources”; and (e) whether Tianshi Engineering, our affiliate who sells our products in China, obtains a direct selling license in China. Statements made herein are as of the date of the filing of this Form 10-K with the Securities and Exchange Commission and should not be relied upon as of any subsequent date.

Unless otherwise required by applicable law, we do not undertake, and we specifically disclaim any obligation, to update any forward-looking statements to reflect occurrences, developments, unanticipated events or circumstances after the date of such statement.

Overview

Tiens USA researches, develops, manufactures, and markets 37 nutrition supplement products, including wellness products and dietary supplement products. Our operations are conducted from our headquarters in Tianjin, China through our 80% owned subsidiary, Biological, and our wholly-owned subsidiary, Life Resources. We sell our products to affiliated companies in China and internationally.

We develop our products at our product research and development center, which employs highly qualified professionals in the fields of pharmacology, biology, chemistry and fine chemistry.

In China, we sell our products to Tianshi Engineering, an affiliated company. Tianshi Engineering, in turn, sells the products to customers through its branches and affiliated companies and at chain stores, which are owned by individual distributors. Internationally, we sell our products to overseas affiliates who in turn re-package the products to meet the needs of the local markets and sell to independent distributors who use the products themselves and/or resell them to other distributors or consumers.

Results of Operations

Year Ended December 31, 2010 Compared to Year Ended December 31, 2009

|

Year ended December 31,

|

||||||||||||

|

2010

|

2009

|

Change

|

||||||||||

|

REVENUE - RELATED PARTIES

|

$ | 41,021,135 | $ | 60,032,968 | -33.3 | % | ||||||

|

REVENUE - THIRD PARTIES

|

323,585 | 1,943,101 | ||||||||||

|

COST OF SALES-RELATED PARTIES

|

14,850,739 | 18,754,680 | -25.6 | % | ||||||||

|

COST OF SALES-THIRD PARTIES

|

158,638 | 1,412,812 | ||||||||||

|

GROSS PROFIT

|

26,335,343 | 41,808,577 | -37.0 | % | ||||||||

|

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

|

19,530,501 | 16,009,382 | 22.0 | % | ||||||||

|

INCOME FROM OPERATIONS

|

6,804,842 | 25,799,195 | -73.6 | % | ||||||||

|

OTHER (EXPENSE) INCOME, NET

|

(176,578 | ) | (61,591 | ) | 186.7 | % | ||||||

|

INCOME BEFORE PROVISION FOR INCOME TAXES

|

6,628,264 | 25,737,604 | -74.2 | % | ||||||||

|

PROVISION FOR INCOME TAXES

|

1,469,548 | 930,703 | 57.9 | % | ||||||||

|

NET INCOME

|

5,158,716 | 24,806,901 | -79.2 | % | ||||||||

|

LESS: Net income attributable to the noncontrolling interest

|

(323,101 | ) | (965,557 | ) | -66.5 | % | ||||||

|

NET INCOME ATTRIBUTABLE TO TIENS BIOTECH GROUP

|

$ | 4,835,615 | $ | 23,841,344 | -79.7 | % | ||||||

|

WEIGHTED AVERAGE NUMBER OF SHARES, BASIC AND DILUTED

|

71,333,586 | 71,333,586 | ||||||||||

|

EARNINGS PER SHARE, BASIC AND DILUTED

|

$ | 0.07 | $ | 0.33 | ||||||||

Revenue. In 2010 revenue was $41.3 million, compared to $62.0 million in 2009, a decrease of 33.3%. The breakdown of revenue between Chinese and international sales is as follows:

Chinese and International Revenue

|

Revenue

|

Year 2010

|

Year 2009

|

% Change

|

|||||||||

|

China

|

$ | 24,894,472 | $ | 27,241,333 | -8.6 | % | ||||||

|

International

|

$ | 16,450,248 | $ | 34,734,736 | -52.6 | % | ||||||

For 2010, revenue in China was $24.9 million, a decrease of 8.6% compared to $27.2 million for 2009.

The decrease in revenue for the year of 2010 was mainly due to the decrease in international sales. For the year of 2010, international revenue was $16.5 million, a decrease of 52.6% compared to $34.7 million for the year of 2009. The reasons for the decrease in international revenue include, but are not limited to the following: (1) During 2008, China’s Administration of Quality Supervision, Inspection and Quarantine (“AQSIQ”) carried out a national campaign against unsafe food and substandard products, which brought on a general slow-down and backlog of export clearances for Chinese food products. Upon the lifting of the regulations, overseas affiliated companies began to purchase more products, thereby increasing sales of 2009; (2) Our Indonesia affiliated company has not purchased from us during the year of 2010, given they purchased more products in 2009 after the 2008 product scarcity for the reason noted above. During the first half of 2009, our Indonesia affiliated company purchased $9.2 million of finished and semi-finished product from us, which was 2.7 times their purchases for the first half of 2008. In addition, local Original Equipment Manufacturers (“OEM”) in Indonesia have been producing healthcare products with our semi-finished goods, which have a profit margin that is much lower than the profit margin of finished goods. The sales decline in Indonesia accounts for 43.56% of that in overseas. (3) The lasting global economic recession has generally reduced customers' buying power. During the early stages of the recession, the direct selling business is generally benefited with the new sales force joined by the unemployed population. This positive effect has been fading away during the later stages of the recession; (4) Our affiliated companies in many regions have made certain adjustments to their marketing programs and reorganizations at their branch and higher levels, which is expected to boost sales performance over the long-run but negatively affect sales in the short-run.

Cost of sales. Cost of sales were $15.0 million in 2010 compared to $20.2 million in 2009, a decrease of 25.6%. This decrease was primarily due to the corresponding decrease in sales. Cost of sales decreased at a lower rate than revenue, primarily due to fixed costs, which do not increase or decrease in line with sales.

Gross profit. Gross profit decreased by 37.0% to $26.3 million in 2010, compared to $41.8million in 2009. The gross profit margin for 2010 was 63.7% compared to 67.5% in 2009.

Selling, general and administrative expenses. Selling, general and administrative expenses increased by 22.0% to $19.5 million in 2010, compared to $16.0million in 2009. The increase was primarily due to increases in allowance for bad debt ($1.9 million), salaries expenses ($0.7 million) and Research & Development Expenses ($0.6 million).

Other (expense) income, net. Other income, net was $0.2 million of expense in 2010, compared to expense of $0.06 million in 2009. This was mainly due to the decrease in interest income and the increase in interest expense of 2010 compared to 2009. In the second half of 2010, the Company obtained a $9.1million loan from Tianshi Engineering with an interest rate of 5.31% per year and a $3.0 million loan from Construction Bank with the benchmark interest rate of one-year loan (The interest rate is 5.56% from October 20, 2010 to December 25, 2010 and 5.81% from December 26, 2010 to December 31, 2010.), which contributed to the increase of interest expense.

Provision for income tax. Provision for income tax increased by 57.9% to $1.5 million in 2010, compared to $0.9 million in 2009. The main reason of this increase was that Life Resources began to pay income tax at the rate of 12.5% from January 1, 2010.

Net income. For the above stated reasons, net income in 2010 was $4.8 million compared to $23.8 million in 2009, a decrease of 79.7%.

Financial Condition, Liquidity and Capital Resources

We have historically met our working capital and capital expenditure requirements, including funding for expansion of operations, through net cash flow provided by operating activities. Our principal source of liquidity is our operating cash flow. From the forth quarter of 2010, due to the large amount of cash required for construction in progress and materials purchase of Life Resources, we obtained bank loans.

On October 9, 2010, Life Resources entered into a loan agreement with Agricultural Bank of China (Agricultural Bank), pursuant to which Agricultural Bank loaned RMB200,000,000 (or US$30,248,000) with the benchmark interest rate of The People’s Bank of China to fund Life Resources’ construction in progress under the guarantee of Tiens Group. Under the agreement, Life Resources is permitted the full amount before October 8, 2011, and repay it before October 8, 2013. As of December 31, 2010, Life Resources has drawn RMB122,000,000 (or US$18,451,280) of the loan.

On October 20, 2010, we obtained a loan of RMB20,000,000 (US $3,024,800) from Construction Bank of China for purchasing raw materials and other auxiliary materials at the term of one year. The weighted-average interest rate of the short-term debt is the one-year benchmark lending rate (The interest rate is 5.56% from October 20, 2010 to December 25, and 5.81% from December 26, 2010 to December 31.).

Net cash provided by operating activities was $60.4 million in 2010, compared to $43.9million in 2009. Our net income in the year of 2010 was $5.2 million, a 79.2% decrease from 2009.

As of December 31, 2010, we had negative working capital of $10.3 million. Cash was $10.2 million as of December 31, 2010, compared to $1.8 million as of December 31, 2009.

Net cash used in investing activities was $73.2 million in 2010 compared to $83.0 million in 2009. In 2010, Life Resources paid $54.5 million on construction in progress.

Accounts receivable-related parties decreased to $10.0 million as of December 31, 2010 from $15.4 million as of December 31, 2009, which was mainly due to the decrease in sales in the year of 2010 compared to those of 2009. Other receivables-related parties decreased to $17.4 million as of December 31, 2010 from $44.6 million as of December 31, 2009, which was mainly due to our collection of a receivable from Tianshi Investment for the sale of Tiens Yihai Co., Ltd. (“Tiens Yihai”).

Going forward, our primary requirements for cash consist of:

|

|

·

|

completion of construction by Life Resources of new research and development, manufacturing and logistic facilities, and administrative offices;

|

|

|

·

|

the continued production of existing products and general overhead and personnel related expenses to support these activities;

|

|

|

·

|

the development costs of new products; and

|

|

|

·

|

expansion of production scale to meet the demands of our markets.

|

The Wholly Foreign Owned Enterprise Law (1986), as amended, and The Wholly Foreign Owned Enterprise Law Implementing Rules (1990), as amended, contain the principal regulations governing dividend distributions by wholly foreign owned enterprises. Under these regulations, wholly foreign owned enterprises, such as Life Resources, may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. Additionally, Life Resources are required to set aside a certain amount of any accumulated profits each year (a minimum of 10%, and up to an aggregate amount equal to half of its registered capital), to fund certain reserve funds. These reserves are not distributable as cash dividends, except in the event of liquidation, and cannot be used for working capital purposes. The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. We have not declared any dividends on our common stock since inception and do not intend to pay dividends on our common stock in the foreseeable future. If we ever determine to pay a dividend, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of such dividends from the profits of Biological and Life Resources.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements.

Critical Accounting Estimates

Management’s discussion and analysis of its financial condition and results of operations is based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). Our financial statements reflect the selection and application of accounting policies which require management to make significant estimates and judgments. See note 2 to our consolidated financial statements, “Summary of Significant Accounting Policies.” Management bases its estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances. Actual results may differ from these estimates under different assumptions or conditions. We believe that the following reflect the more critical accounting policies that currently affect our financial condition and results of operations.

Revenue Recognition

During 2010, we sold both semi-finished products and finished products to Tianshi Engineering domestically. Revenue from semi-finished products was recognized at delivery point. Revenue from finished products was recognized only when the related party Chinese distributors recognized sales of our products to unaffiliated third parties. Revenues in both cases are net of taxes.

For overseas sales, we sell finished products. We recognize revenue from international sales (non-Chinese) to affiliated parties, net of taxes, as goods are shipped and clear review by the customs department of the Chinese government.

We are generally not contractually obligated to accept returns. However, on a case by case negotiated basis, we permit customers to return products. Revenue is recorded net of an allowance for estimated returns. Such reserves are based upon management’s evaluation of historical experience and estimated costs. The amount of the reserves ultimately required could differ materially in the near term from amounts included in the accompanying consolidated financial statements. As of December 31, 2010, Tianshi Engineering, an affiliated company, owned all of the related party distributors that sell our products in China.

Allowance for Doubtful Accounts

Our trade accounts receivables are mainly due from related companies. We have made full provision for accounts receivable-related parties aging over one year and a general allowance for doubtful debts of 0.5% of the remaining accounts receivable-related parties. Management reviews its accounts receivable on a regular basis to determine if the bad debt allowance is adequate at each year-end, paying particular attention to the age of receivables outstanding.

Inventories

Inventories are stated at the lower of cost or market using the moving average basis. Management reviews inventory annually for possible obsolete goods or to determine if any reserves are necessary for potential obsolescence.

Recent accounting pronouncements

In October 2009, the FASB issued Accounting Standards Update (ASU) 2009-13, Multiple-Deliverable Revenue Arrangements (ASU 2009-13) (formerly EITF 08-1, Revenue Arrangements with Multiple Deliverables) which amends ASC 605, Revenue Recognition. This accounting update establishes a hierarchy for determining the value of each element within a multiple deliverable arrangement. The amendments in this update are effective for revenue arrangement entered into or materially modified in fiscal years beginning on or after June 15, 2010. The adoption of ASU 2009-13 did not have an impact on the Company’s consolidated financial statements.

In January 2010, the FASB issued ASU 2010-02 — Consolidation (Topic 810): Accounting and Reporting for Decreases in Ownership of a Subsidiary. This update amends Subtopic 810-10 and related guidance to clarify that the scope of the decrease in ownership provisions of the Subtopic and related guidance applies to (i) a subsidiary or group of assets that is a business or nonprofit activity; (ii) a subsidiary that is a business or nonprofit activity that is transferred to an equity method investee or joint venture; and (iii) an exchange of a group of assets that constitutes a business or nonprofit activity for a noncontrolling interest in an entity, but does not apply to: (i) sales of in substance real estate; and (ii) conveyances of oil and gas mineral rights. The amendments in this update are effective beginning in the period that an entity adopts FAS 160 (now included in Subtopic 810-10). The adoption of the provisions in ASU 2010-02 did not have an impact on the Company’s consolidated financial statements.

The FASB has issued ASU 2010-06, Fair Value Measurements and Disclosures (Topic 820): Improving Disclosures about Fair Value Measurements. This ASU requires some new disclosures and clarifies some existing disclosure requirements about fair value measurement as set forth in Codification Subtopic 820-10. ASU 2010-06 amends Codification Subtopic 820-10 and now requires a reporting entity to use judgment in determining the appropriate classes of assets and liabilities and to provide disclosures about the valuation techniques and inputs used to measure fair value for both recurring and nonrecurring fair value measurements. ASU 2010-06 was effective for interim and annual reporting periods beginning after December 15, 2009. As this standard relates specifically to disclosures, the adoption did not have an impact on the Company’s consolidated financial position and results of operations.

In February 2010, the FASB issued ASU 2010-10, "Consolidation (Topic 810)." The amendments to the consolidation requirements of ASC Topic 810 resulting from the issuance of Statement 167 are deferred for a reporting entity's interest in an entity (1) that has all the attributes of an investment company or (2) for which it is industry practice to apply measurement principles for financial reporting purposes that are consistent with those followed by investment companies. An entity that qualifies for the deferral will continue to be assessed under the overall guidance on the consolidation of variable interest entities in ASC Subtopic 810-10 (before the Statement 167 amendments) or other applicable consolidation guidance, such as the guidance for the consolidation of partnerships in ASC Subtopic 810-20. The deferral is primarily the result of differing consolidation conclusions reached by the International Accounting Standards Board ("IASB") for certain investment funds when compared with the conclusions reached under Statement 167. The deferral is effective as of the beginning of a reporting entity's first annual period that begins after November 15, 2009, and for interim periods within that first annual reporting period, which coincides with the effective date of Statement 167. Early application is not permitted. The provisions of ASU 2010-10 are effective for the Company beginning in 2010. The adoption of ASU 2010-10 did not have an impact on the financial position, results of operations or cash flows of the Company.

In February 2010, the FASB issued an accounting standard that amended certain recognition and disclosure requirements related to subsequent events. The accounting standard requires an entity that is an SEC filer to evaluate subsequent events through the date that the financial statements are issued and removes the requirement that an SEC filer disclose the date through which subsequent events have been evaluated. This guidance was effective upon issuance. The adoption of this standard had no effect on the Company’s consolidated financial position or results of operations.

In May 2010, the FASB issued ASU 2010-19, “Foreign Currency (Topic 830): Foreign Currency Issues: Multiple Foreign Currency Exchange Rates”. The amendments in this ASU are effective as of the announcement date of March 18, 2010. The adoption of this update did not have an impact on the Company’s financial statements.

In July 2010, the FASB issued ASU 2010-20, Disclosures about the Credit Quality of Financing Receivables and the Allowance for Credit Losses, which amends ASC 310, Receivables. This ASU requires disclosures related to financing receivables and the allowance for credit losses by portfolio segment. The ASU also requires disclosures of information regarding the credit quality, aging, nonaccrual status and impairments by class of receivable. A portfolio segment is the level at which a creditor develops a systematic methodology for determining its credit allowance. A receivable class is a subdivision of a portfolio segment with similar measurement attributes, risk characteristics and common methods to monitor and assess credit risk. Trade accounts receivable with maturities of one year or less are excluded from the disclosure requirements. The effective date for disclosures as of the end of the reporting period is the first quarter of fiscal year 2011. The effective date for disclosures for activity during the reporting period is the second quarter of fiscal year 2011. The adoption will not have a material effect on the Company’s consolidated financial statements.

Other accounting standards that have been issued or proposed by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a material impact on the Company’s consolidated financial statements upon adoption.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Not applicable.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

The financial statements required by this item can be found following the signature page of this Annual Report.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

None.

Disclosure Controls and Procedures

Our management, with the participation of our principal executive officer and principal financial officer, evaluated the effectiveness, as of the end of the period covered by this report, of our disclosure controls and procedures, as such term is defined in Exchange Act Rule 13a-15(e). Based on this evaluation, our principal executive officer and principal financial officer concluded that, as of such date, the Company’s disclosure controls and procedures were effective.

Disclosure controls and procedures are designed to ensure that information required to be disclosed by us in our Exchange Act reports is recorded, processed, summarized, and reported, within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and communicated to our management, including our principal executive officer and principal financial officer, as appropriate to allow timely decisions regarding required disclosure.

Management’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rule 13a-15(f).Our management conducted an evaluation of the effectiveness of our internal control over financial reporting based on the framework in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission and concluded that as of the end of the period covered by this report, our internal controls over financial reporting were effective.

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Our management’s report was not subject to attestation by our registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit us to provide only our management’s report in this annual report.

Changes in Internal Control over Financial Reporting

There has been no change in our internal control over financial reporting during the fourth quarter of 2010 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

Not applicable.

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

Set forth below are the names of our directors and executive officers as of March 29, 2011. Jinyuan Li has served on the Board since September 2003. Baolan Li was appointed to the Board in October 2010. All other directors have served on the Board since January 2004. Directors are elected annually by our shareholders at the annual meeting. Each director holds his or her office until his or her successor is elected and qualified or his or her earlier resignation or removal. Mr. Li’s and Ms. Li’s statutory employment agreements provide for an indefinite period.

|

NAME

|

AGE

|

POSITION

|

||

|

Jinyuan Li

|

53

|

Chairman, Chief Executive Officer, President and Acting Chief Financial Officer

|

||

|

Yupeng Yan

|

48

|

Executive Vice President and Director

|

||

|

Baolan Li

|

28

|

Director

|

||

|

Socorro Quintero

|

59

|

Director

|

||

|

Gilbert Raker

|

67

|

Director

|

None of our directors and officers was selected pursuant to any agreement or understanding with any other person. There is no family relationship between any director or executive officer and any other director or executive officer, except that Ms. Baolan Li is the daughter of Mr. Jinyuan Li.

Jinyuan Li

Jinyuan Li has served as the Chairman of the Board and a Director since September 2003. In June 2010, Jinyuan Li was appointed as Acting Chief Financial Officer. Jinyuan Li is also the President and founder of Tianshi Group and has held the position of President since 1995. Mr. Li has 14 years of experience in the petroleum and plastics industries. He holds a number of leadership positions in government and social associations, including as Standing Committee Member of Tianjin Political Consultative Conference; Vice-chairman of China Enterprise Confederation & China Enterprise; Executive of All-China Federation of Industry & Commerce; Vice Chairman of China Association for the Promotion of Industrial Development; and Vice President of Chinese Healthcare Association, etc. Mr. Li was elected as one of the Top Ten Most Outstanding Talents in the Greater China Area; one of the Ten Most Popular Personages Among the High-Ranking, by China Economic Forum; Excellent Entrepreneur, by the Organization Committee of the Second Chinese Entrepreneur Forum in 2003, and as the Most Creative Chinese Businessman of Asia in 2004. Mr. Li holds an MBA from Nankai University.

Yupeng Yan

Mr. Yan has served as our Executive Vice-President since September 2003. Mr. Yan has also served as Vice-President of Tianshi Group since March 1997, acting as general manager of its Global Information Technology Center from July 2007 to January 2009 and as head of its Global Marketing Center from June 2004 to June 2007. Since November 2008 Mr. Yan has served as the Vice General Manager of Global Marketing Center and Vice President of Tianshi Group’s China Region. Mr. Yan currently holds a number of leadership positions including Vice-Dean of Tianshi College (formerly Tianshi Occupational Technique Institute), and Vice-Chairman of Tianshi Science and Technique Association. Mr. Yan was elected as one of the Chinese Ten Outstanding Professional Managers in 2004. Mr. Yan received an Executive MBA from Nankai University in July 2004.

Baolan Li

On October 20, 2010, Baolan Li joined the Board of Directors of the Company. Ms. Li is the daughter of Jinyuan Li, the Chairman, Chief Executive Officer, President and Acting Chief Financial Officer of the Company. From August 2008 to October 2010, Ms. Li served as the Assistant of the Chief Financial Officer of the Company and as the Assistant of the Vice President – Marketing. Prior to her appointment to the Company, Ms Li attended the Royal Holloway University of London, London, UK and received a Bachelor’s Degree with Honors in Industrial and Financial Economics in 2006 and a Master’s Degree in Economics in 2008. Ms. Baolan Li held a short-term internship position with ICEA Investment Banking Division (Hong Kong) from September 2006 to November 2006.

Socorro Quintero

Dr. Socorro Quintero serves as our director since January 2004. She is Associate Professor of Finance at Oklahoma City University’s Meinders School of Business (“OCU”) where she has organized and managed the Corporate Directors Institute (“CDI”) in 2007 and 2009. The CDI brings together directors and governance professionals to share the latest issues and best practices in corporate board governance. In February 2011, Dr. Quintero joined the board of directors and became the chairperson of the audit committee of the board of directors of Joway Health Industries Group (GTVI.OB). Prior to joining OCU in 1993, she was an Assistant Professor of Finance at the University of South Florida in Tampa. Her teaching and research expertise covers varied areas in finance, including, but not limited to, investments, asset pricing, capital budgeting, and financial derivatives. She obtained her PhD in Finance from the University of Texas at Austin in 1989. Before her career in finance, her earlier work experiences were in various industrial engineering and management capacities while working for Abbott Laboratories, Atlantic Steel Company and Levi Strauss & Company. Dr. Quintero obtained a Bachelor of Science in Physics from the University of the Philippines in 1972, and Master of Science in Industrial Engineering from the Georgia Institute of Technology in Atlanta in 1977.

Gilbert Raker

Mr. Raker serves as our director since January 2004. Since February 2010 Mr. Raker has been the President of Wyngate Management Corporation,, a private consulting company that works in association with several IR / PR, investment and merchant banking firms in New York City that specialize in assisting middle market firms. From February 2010 to February 2011 he was also the Vice Chairman and a director of Electro-Comp Services, Inc., a private company engaged in the testing, verification and brokering of electronic components. From January 2009 to February 2010 he worked with a niche investment bank in New York that focused on financing middle market companies. From November 1988 to January 2009 he was the President, Chief Executive Officer and Chairman of the Board of SEMX Corporation, a multi-national company that manufactured materials and components used in microelectronic circuitry on a worldwide basis for the automotive, consumer electronics, defense, medical and aerospace industries. Prior to November 1988, Mr. Raker worked at two private equity investment firms, was employed as the Chief Financial Officer and in one case as the Chief Operating Officer of two New York Stock Exchange listed companies and served in a variety of capacities in numerous private and public companies. He began his career as a Management Consultant for Touche Ross. Mr. Raker received his B.S. in Chemistry from Eastern University, his MBA in Production Management from Syracuse University and completed all of the course work for a PhD in Finance and Economics at Syracuse University. Early in his career he taught Accounting and Production Management at Eastern University and Syracuse University, respectively.

Board Leadership Structure

The Board of Directors believes that Mr. Li’s service as both Chairman of the Board, Chief Executive Officer, President and Active Chief Financial Officer is in the best interest of the Company and its stockholders. Mr. Li possesses detailed and in-depth knowledge of the issues, opportunities and challenges facing the Company and its business and is thus best positioned to develop agendas that ensure that the Board’s time and attention are focused on the most critical matters. His combined role enables decisive leadership, ensures clear accountability, and enhances the Company’s ability to communicate its message and strategy clearly and consistently to the Company’s shareholders, employees and customers.

Each of the directors other than Jinyuan Li, Yupeng Yan and Baolan Li is independent (see “Director Independence” below), and the Board of Directors believes that the independent directors provide effective oversight of management. The Board of Directors has not designated a lead director. Our independent directors call and plan their executive sessions collaboratively and, between Board of Directors meetings, communicate with management and one another directly. In the circumstances, the directors believe that formalizing in a lead director functions in which they all participate might detract from rather than enhance performance of their responsibilities as directors.

Board’s Role In Risk Oversight

The Board of Directors is responsible for the overall risk oversight of the Company. The Board discusses, and receives updates from senior management on the identification, assessment, management and mitigation of the critical risks facing the Company. The Audit Committee requires the Company’s management to update the Audit Committee about the Company’s major financial risk exposure and the steps that management has taken to monitor and control such exposure and oversee the risks related to financial issues. The Audit Committee monitors risks associated with financial reporting and internal controls, receives annual reports on risk assessment from the Company’s auditors and regularly discusses financial and economic risks as well as financial implications of certain regulatory or legal risks with the Company’s Chief Executive Officer, Acting Chief Financial Officer, other members of senior management and outside counsel or consultants.

Director Qualifications

We seek directors with established strong professional reputations and experience in areas relevant to the strategy and operations of our businesses. We seek directors who possess the qualities of integrity and candor, who have strong analytical skills and who are willing to engage management and each other in a constructive and collaborative fashion. We also seek directors who have the ability and commitment to devote significant time and energy to service on the Board and its committees. We believe that all of our directors meet the foregoing qualifications.

The Board of Directors believes that the leadership skills and other experiences of its Board members, as described below, provide the Company with a range of perspectives and judgment necessary to guide our strategies and monitor their execution.

Jinyuan Li: Jinyuan Li has extensive PRC business experience and being a founder of the Company has enabled him to lead the Board throughout the development of the Company.

Yupeng Yan: Yupeng Yan has extensive experience in management and marketing which enables him to guide the Board through related decisions.

Baolan Li: Baolan Li has a strong academic background that enables her to be an effective director.

Socorro Quintero: Socorro Quintero has strong academic background and extensive experience in reviewing financial results of companies which enables her to effectively serve as the chairman of our Audit Committee since the Company’s listing in the United States.

Gilbert Raker: Gilbert Raker has extensive experience in finance and management, and his leadership experience gained while serving on the board of a multi-national company enable him to effectively serve as a member of our Audit Committee and Compensation Committee.

Board Practices

Our business and affairs are managed under the direction of our Board of Directors. The primary responsibilities of our Board of Directors are to provide oversight, strategic guidance, counseling and direction to our management.

The Board has an Audit Committee and does not have a Nominating Committee. The entire Board assumes the duties that would be delegated to a Nominating Committee. The Company believes that this practice focuses the attention of each director on the important task of selecting nominees, and a separate committee is unnecessary.

Nominations by Stockholders

There have been no changes to the procedures by which the stockholders of our company may recommend nominees to the Board of Directors since the filing of the Company’s Definitive Proxy Statement on April 29, 2010 for its Annual Meeting of Stockholders, which was held on May 28, 2010.

Audit Committee

The Board of Directors has established an audit committee in accordance with Section 3(a)(58)(A) of the Exchange Act. The members of the Audit Committee during the fiscal year ended December 31, 2010 were Socorro Quintero, Chairperson, Howard Balloch and Gilbert Raker, each of whom was independent as defined under Section 121(A) of NYSE Amex listing standards currently in effect. During the fiscal year ended December 31, 2010, none of the Audit Committee members was a current officer or employee of our company or any of its affiliates.

The Board of Directors has determined that Socorro Quintero and Gilbert Raker each qualifies as an “audit committee financial expert” under Item 407(d) of Regulation S-K.

Code of Ethics

The Board has adopted a Code of Ethics to promote its commitment to the legal and ethical conduct of our company’s business. The Chief Executive Officer, Chief Financial Officer, and other senior officers are required to abide by the Code of Ethics, which provides the foundation for compliance with all corporate policies and procedures, and best business practices.

The Code of Ethics was filed as an exhibit to our Annual Report on Form 10-KSB for the year ended December 31, 2004. A written copy of the Code of Ethics can be found on our website at www.tiens-bio.com and will be provided upon request at no charge by writing to Secretary, Tiens Biotech Group (USA), Inc., No. 17, Xinyuan Road, Wuqing New-Tech Industrial Park, Tianjin, China 301700.

Section 16(a) Beneficial Ownership Reporting Compliance

Based solely upon a review of Forms 3, 4 and 5 and amendments to these forms furnished to us, all parties subject to the reporting requirements of Section 16(a) of the Exchange Act filed all such required reports during and with respect to 2010 except that Ms. Li did not timely file one Form 3.

Compensation Discussion and Analysis

All compensation decisions for our executive officers, including the salary of our Chief Executive Officer, Acting Chief Financial Officer and President, Jinyuan Li, are made by Jinyuan Li. Because Jinyuan Li owns more than 50% of our voting stock, we are a “controlled company” pursuant to Rule 801(a) of NYSE Amex Rules (“NYSE Amex Rules”). Therefore, we are exempt from NYSE Amex Rule 805(a), which requires that the compensation of a CEO and all other executive officers be determined, or recommended to the Board for determination, by a compensation committee composed of independent directors, or the majority of independent directors on the Board.

The objectives of our compensation programs.

We seek to attract and retain executive officers of the highest caliber and motivate them to maximize the success of our business.

What our compensation program is designed to reward.

Our CEO believes that he is incentivized by his large equity ownership in our company. Therefore, he believes that a long-term employment contract providing a base salary is appropriate compensation for him. With respect to the other executive officers’ base salaries, our CEO bases his recommendations on past salary levels with our company and his perception of the quality of their respective performances and attempts to match their salaries with his perception of compensation levels at a small number of companies he considers comparable. The CEO also takes in to consideration the relatively low salaries provided to executive officers by companies in China compared to public companies in the United States. Our CEO assesses the normal responsibilities of each position, as well as the extra responsibilities and additional work related to special projects which such executive officers may be expected to perform. No relative weight was assigned to any of the foregoing factors.

Elements of compensation.

Each executive officer receives cash compensation as a base salary. Base salary for our executive officers is fixed by their respective employment agreements, as described under “Employment Agreements.” Jinyuan Li’s salary for 2010 was fixed pursuant to employment agreements with Tianjin Tianshi Biological Development Co. Ltd. (“Biological”) entered into in 2005. Manbo He was our principal financial officer from June 1, 2009 to June 1, 2010, and his salary for 2010 was fixed pursuant to an employment agreement with Biological, dated June 1, 2009. Their base salaries were based on our CEO’s subjective perceptions of salaries paid by comparable companies for comparable positions. Our executive officers did not receive any bonuses for 2010. Due to the fact that we do not currently and did not in 2010 give bonuses to any of our named executive officers, Jinyuan Li did not identify any individual or corporate goals when setting the remuneration of Mr. He for 2010.

Our strategy is to maintain compensation for employees at levels that are equal to or in excess of those offered by companies of comparable size, consistent with the individual employees’ capabilities and responsibilities. We do not currently have a stock option plan, but may consider adopting one in the future to further incentivize its employees.

Why we chose to pay each element.

We have entered into long-term employment agreements with Mr. Li, providing for his base salary.

The employment agreements with Mr. Li and Ms. Li provide for payments upon termination for specified reasons. These payments are required by local Chinese employment regulations. Additional information regarding applicable payments under such agreements is provided under the heading “Potential Payments Upon Termination or Change of Control.”

How we determine the amount for each element of pay.

With respect to the executive officers’ base salaries, our CEO bases his recommendations on past salary levels and his perception of the quality of the executive officers’ respective performances and attempts to match their salaries with his perception of compensation levels at a small number of companies he considers comparable, although not necessarily included in the NYSE Amex Composite Index or NASDAQ Biotechnology Index. Our CEO assesses the normal responsibilities of each position, as well as the extra responsibilities and additional work related to special projects which such executive officers may be expected to perform. Our CEO also takes in to consideration the relatively low salaries provided to executive officers by companies in China compared to public companies in the United States.

Compensation Committee Interlocks and Insider Participation

During 2010, the members of the Compensation Committee were Gilbert Raker and Yupeng Yan. The Compensation Committee did not deliberate on executive compensation for fiscal 2010. Yupeng Yan was an employee and officer of our company during 2010. No member of the Compensation Committee has a relationship that would constitute an interlocking relationship with Executive Officers or Directors of our company or another entity.

Compensation Committee Report

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K of the Exchange Act with management and the full Board. Based on that review and discussion, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in our Annual Report on Form 10-K for 2010 .

The Compensation Committee

Gilbert Raker, Chairman

Yupeng Yan

Summary Compensation Table

The table below summarizes the total compensation paid or earned by each of the named executive officers for the fiscal years ended December 31, 2010 and 2009.

|

Name and

Principal Position (1)

|

Year

|

Salary

($)

|

Total

($)

|

|||||||

|

Jinyuan Li

|

2010

|

$

|

166,660

|

$

|

166,660

|

|||||

|

Chairman, Chief Executive

|

2009

|

$

|

166,660

|

$

|

166,660

|

|||||

|

Manbo He

|

2010

|

$

|

21,778

|

$

|

21,778

|

|||||

|