Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

[ X ] ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

OR

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________to_________

Commission File No. 000-53343

ASIA GREEN AGRICULTURE CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada | 26-2809270 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| Shuinan Industrial Area, Songxi County, | |

|

Fujian Province 353500, China |

353500 |

|

(Address of principal executive offices) |

(Zip Code) |

(+86) 0599-2335520

Registrant's telephone

number

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of Each Class | Name of Each Exchange on Which |

| None | Registered |

| None |

Securities registered pursuant to Section 12(g) of the

Exchange Act:

Common Stock, Par Value $0.001 per Share

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [ X ]

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.

Yes [ ] No [ X ]

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes [ ] No [ X ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes [ ] No [ ]

Indicate by check mark if disclosure of delinquent filers

pursuant to Item 405 of Regulation S-K is not contained herein, and will not be

contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K.

[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ]

(Do not check if a smaller company) |

Smaller reporting company [ X ] |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [ X ]

The aggregate market value of the shares of common stock held by non-affiliates of the registrant (based upon the $ 0.04 closing price of the common stock as of the last business day of the registrant's most recently completed second fiscal quarter as reported on the OTC Bulletin Board), was approximately $0.1 million. Shares of common stock held by each executive officer and director and by each person who owned 10% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 24, 2011, there were 36,823,626 shares of the registrant's common stock outstanding. The common stock is the registrant's only class of stock currently outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive Proxy Statement to be filed with the Securities and Exchange Commission within 120 days after registrant's fiscal year end December 31, 2010 are incorporated by reference into Part III of this report.

-1-

-2-

USE OF TERMS; CONVENTIONS

Except where the context otherwise requires and for the purposes of this report only:

-

“We,” “us,” “our company,” and “our,” refer to the combined business of Asia Green Agriculture Corporation (formerly known as SMSA Palestine Acquisition Corp.). and its consolidated subsidiaries;

-

“Sino Oriental” refers to Sino Oriental Group Limited, our direct, wholly-owned subsidiary, a BVI corporation;

-

“Misaky” refers Misaky Industrial Limited, our indirect, wholly-owned subsidiary, a Hong Kong corporation;

-

“Fujian Yada” refers to Fujian YADA Group Co., Ltd, our indirect, wholly-owned subsidiary, a Chinese corporation;

-

“China,” “Chinese” and “PRC,” refer to the People’s Republic of China;

-

“Renminbi” and “RMB” refer to the legal currency of China; and

-

“U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States.

Our functional currency is the RMB; however, our financial information is expressed in U.S. Dollars. Assets and liabilities are translated into U.S. Dollars at the closing exchange rates on the balance sheet date, and revenues and expenses are translated at the average exchange rate. The closing exchange rates were RMB 6.612 to $1 as at December 31, 2010 and RMB 6.817 to $1 as at December 31, 2009. The average exchange rates were RMB 6.759 to $1 for year ended December 31, 2010 and the rate of RMB 6.821 to $1 for the year ended December 31, 2009.

STOCK SPLIT AND NAME CHANGE

On January 18, 2011, we filed amended and restated Articles of Incorporation with the Nevada Secretary of State to give effect to (i) a 2.5 for 1 forward stock split and (ii) an increase in our authorized common stock from 100 million shares to 200 million shares and (iii) a name change from SMSA Palestine Acquisition Corporation to Asia Green Agriculture Corporation. The information in this report has been adjusted to give effect to the stock split, increase in authorized capital and name change.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, or the "Securities Act," and Section 21E of the Securities Exchange Act of 1934 or the "Exchange Act." These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or anticipated results. In some cases, you can identify forward looking statements by terms such as "may," "intend," "might," "will," "should," "could," "would," "expect," "believe," "anticipate," "estimate," "predict," "potential," or the negative of these terms. These terms and similar expressions are intended to identify forward-looking statements. Statements in this report regarding the following are forward looking statements:

-

our expected future business, financial condition and results of operations;

-

anticipated market demand for and timing of introduction of our products;

-

expectations regarding the growth of the organic food products and organic food processing industries in China;

-

expectations regarding trends in PRC governmental policies and regulations relating to the organic food based products and organic food processing industries; and

-

general economic and business conditions in China.

The forward-looking statements in this report are based upon management's current expectations and beliefs, which management believes are reasonable. However, these forward-looking statements involve various risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may turn out to be incorrect. Our actual results could be materially different from our expectations. Important risks and factors that could cause our actual results to be materially different from our expectations are generally set forth in the “Risk Factors,” and other sections in this report. You are cautioned not to place undue reliance on any forward-looking statements.

These statements represent our estimates and assumptions only as of the date of this report. Except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

-3-

PART I

ITEM 1. BUSINESS

Overview

We are a green and organic food producer headquartered in Fujian Province, China. We are one of the leading producers of organic bamboo shoot products in China and are a provider of fresh fruits and vegetables and processed fruits and vegetables. We grow, process and distribute over 100 varieties of fresh and processed agricultural products. Our product offerings generally fall into three main categories:

-

Bamboo shoot products

-

Fresh vegetable and fruit

-

Processed vegetable

We are vertically integrated with operations that include the planting, harvesting, processing, packaging and selling of final products. Through our vertically integrated model, we offer direct and strict control over our fresh agricultural products, which we believe allows us to generate high margins and provide stronger guarantees for product quality relative to providers that are not vertically integrated.

Our Industry

The Bamboo shoot industry

Bamboo is a group of perennial evergreen plants and is one of the fastest growing woody plants in the world. Bamboo shoots are new bamboo culms that come out of the ground. They are edible and widely used in a number of Asian dishes and broths. Bamboo shoots are low in saturated fat, cholesterol and sodium; yet they are a good source of protein, vitamin E, niacin, iron, and dietary fiber. Bamboo shoots have similar nutritional elements as asparagus and are widely recognized as a healthy, green, organic food source. (Source: www.wikipedia.com and www.nutritiondata.com) China has over 10 million total acres (40,468 square kilometers) of bamboo forest, placing it first in the world (Source: China Bamboo Shoot Association). China is also the largest producer of bamboo shoot products with over 90% of global market share (Source: China Bamboo Shoot Association). The overall Chinese bamboo shoot industry is highly fragmented; there are currently over 2,000 bamboo shoot companies in China.

Organic food products industry

The global organic food market has experienced over 30% growth in the past few years. China is one of the world's fastest growing markets for organic food products both in terms of consumer demand and commercial production. Sales of organic food products reached $900 million in China in 2007, and accounted for only 1.5% of the global market share.( Source: www.ofcc.org.cn). The Organic Food Certificate Center estimates that China will account for more than 5% of the global organic food industry within the next ten years. (Source: www.ofcc.org.cn)

China's approach to organic food is somewhat unique as compared to other countries, in that the organic food space is segmented into Certified Organic and Green Food. "Green Food" refers to safe, fine quality and nutritious food produced and processed under the principles of sustainable development and certified by the China Green Food Development Center based on specified standards. Food products that meet these standards are permitted to be sold with a green food logo. The certified green food can be divided into two groups: Grade A (allowing the use of a certain amount of chemical materials) and Grade AA (another name for organic food). (Source: "Enhancing Sustainable Development Through Developing Green Food: China's Option" presented by Liu Lijuan, First Secretary, Mission of China to the United Nations in Geneva, July, 30 2003.) Organic food production requires that no chemical be used in the process. The objectives of Green Food are low environmental impact, good food safety and social efficiency. China has adopted the Green Food certifications as an alternative to full Organic certification, enabling the production of nutritious and safe foods, without the typical drop in agricultural production output that full Organic certification could cause. (Source: Wikipedia: Organic Food; Organic Food Certification) According to our communication with the China Green Food Development Center, the average length of time required to obtain a Green Food certification is about one year. We sell products that are certified as Green Food, as well as products that are certified as Organic Food under the JAS (Japanese Agriculture Standard). We have also obtained Organic Food certifications for our bamboo shoots products from the China Organic Food Certification Center.

China has a strong and growing organic and green food industry. The rising popularity of organic and green foods is driven by a number of factors. First and foremost is the increasing concern of China's rising middle class with food safety. The concerns on food safety relate to both the short term purity and nutrition of the food, as well as to longer term concerns on the potential health impact of chemicals that are used in the production of the food. There is also increasing concern with the impact of agricultural production on the environment and the residual effects of agricultural chemicals on the ecosystem.

Our Operations

We operate a vertically integrated process, from the planting of the proceeds to their processings. As a result we can ensure our products have high quality, meet applicable certification guidelines and are delivered to customers in a timely fashion. We produce fresh agricultural products on our own planting bases for two main purposes. The first purpose is to develop food products for sale directly for consumer consumption. The second purpose is to develop food products as raw material to be used for future processing. Fresh agricultural products are harvested, sorted, packaged and delivered directly to distributors and end-users. The remaining fresh agricultural products are delivered to production facilities for processing. The table below summarizes our planting bases as of December 31, 2010 and our anticipated expansion for 2011.

| 2010 | 2011E | |

| Bamboo forest | 30,500 acres (123.43 square kilometers) | 43,700 acres (176.85 square kilometers) |

| Vegetables & Fruits (including mushrooms) | 12,500 acres (50.59 square kilometers) | 12,500 acres (50.59 square kilometers) |

-4-

We strategically manage our planting bases to optimize operating efficiencies, to offer a broader product offering, and to support our year-round sales and processing. The following chart illustrates the planting cycle for most of our fresh produce on a 12-month basis.

| Product | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

| Winter Bamboo Shoot | ||||||||||||

| Spring Bamboo Shoot | ||||||||||||

| Fuki | ||||||||||||

| Corn | ||||||||||||

| Mushroom | ||||||||||||

| Cucumber | ||||||||||||

| Grape | ||||||||||||

| Grapefruit | ||||||||||||

| Taro | ||||||||||||

| Ginger | ||||||||||||

| Radish |

Bamboo forest

As of December 31, 2010, we had the right to use approximately 30,500 acres (123.43 square kilometers)] of bamboo forest. We purchase land use rights to bamboo forest, or enter into lease agreements with the local rural village cooperatives and pay rent for the use of the land. Generally, the terms of our leases are for a period of 20 to 30 years. We are currently in the first to sixth year of each of our lease terms for bamboo forest.

We utilize our experience in bamboo growing to improve bamboo shoot yields by timely weeding and strategic clearing of older bamboo, thus ensuring adequate light and resources to maintain optimal capacity. Bamboo shoots are harvested from December to April. During the harvest season, we hire additional temporary workers. Currently, we use no fertilizers or pesticides in growing our bamboo shoots.

We plan to expand our bamboo forest to an aggregate of 43,700 acres (176.85 square kilometers) by the end of 2011. We expect to be able to harvest bamboo shoots produced by the new forest in December 2011. We do not expect this bamboo forest expansion to be a significant contributor to our 2011 revenue. However, we do expect the expansion to positively impact 2012 revenues.

Vegetable and fruit planting base

As of December 31, 2010, we had the right to use approximately 12,500 acres (50.59 square kilometers) of vegetable and fruit planting bases through long-term lease contracts. Our leases are held under 20-year terms. We are currently in the first to sixth year of each of our lease terms for our vegetable and fruit planting basis.

We adopt an integrated approach in managing vegetable and fruit planting processes. Before planting, we receive sales indications from our customers on anticipated amounts and product specifications. After analyzing these indications, we formulate a planting schedule by taking into account order sizes, market dynamics, and land requirements. The lead time for agricultural production varies depending on the type of vegetable or fruit, and on average, takes three to four months. This customer-driven process is intended to improve production efficiency and eliminate over/under production of products.

Farmers conduct the entire planting process for our vegetables and fruits according to our standardized planting procedures using designated seeds, fertilizer, and pesticides. For each batch of products, we execute field tests for pesticide residuals and product quality 10 days before harvesting.

Our Products

We currently provide over 100 kinds of fresh and processed products that can be grouped into the following three categories: organic bamboo shoot products, fresh vegetables and fruits and processed vegetables.

Organic bamboo shoot products

We sell fresh bamboo shoots and processed bamboo shoot products. We have developed strong brand equity for bamboo shoot products in China. In 2010, our bamboo shoot revenue accounted for 52% of our total revenue. In a letter dated March 12, 2010 from the Chinese Bamboo Industry Association to the Trademark Office of State Administration of Industry and Commerce of China, the Chinese Bamboo Industry Association recommended the "Yada" trademark of our Fujian Yada subsidiary as a “Famous Trademark of China”, and stated in the letter that “Fujian Yada Group Co., Ltd. is one of the largest producers of boiled bamboo shoots products and dried vegetables in China”.

Our bamboo shoot products are all organic. We grow our bamboo shoot requirements to satisfy all the requirements necessary for certification as complying with the Japanese Agricultural Standard, or JAS, (the highest agricultural quality standard used by the Overseas Merchandise Inspection Company). However, we do not seek JAS certification for all our products, since we only export some of our products to Japan. The JAS program is based on the ongoing evaluation of internal procedures and the management competence of respective certified operators. An operator must have standard operational procedures in written form regarding all JAS relevant details of production, quality and labeling, and must prove the existence of a documented internal verification that each specific lot of products was produced in compliance with the JAS standards and the operator’s standard operational procedures. To apply for the JAS certification, an operator must submit its application to an accredited certifier of JAS certification.

Fresh bamboo shoots are harvested from December to April. According to Chinese custom, bamboo shoots which are harvested before March are known as "winter bamboo shoots," and those harvested starting from March are referred to as "spring bamboo shoots." Winter bamboo shoots are lower in output and higher in price compared with spring bamboo shoots. We sell most of our winter bamboo shoots and a portion of our spring bamboo shoots as fresh products, and use the rest of spring bamboo shoots as raw material to produce processed bamboo shoot products in accordance with specific customer requests.

Fresh bamboo shoots are delivered directly to customers after sorting, weighing and packaging. Processed bamboo shoots are boiled in water immediately after harvesting, and are then preserved in 18 liter metal cans. Processed bamboo shoots can be stored for up to three years before being turned into final product. We can process water boiled bamboo shoots into various forms, such as block, slice, strip or crumb, based upon customer requirements. All final products are packaged in vacuumed plastic bags.

-5-

We recently launched a new processed bamboo shoot product called the high PH bamboo shoot. It is produced from fresh spring bamboo shoots using our own proprietary process. High PH bamboo shoots keep a fresh appearance, taste and flavor over time by maintaining a similar PH value level to that of fresh bamboo shoots. These attributes significantly differentiate this product from traditional processed bamboo shoots. By having high PH bamboo shoots, our customers are able to enjoy fresh tasting bamboo shoots during the off-season which we designate to be during the months of May to December. Because high PH bamboo shoots are produced from low cost spring bamboo shoots and can be sold at premium off-season prices, the product is generating higher gross profit margin than fresh bamboo shoots and traditional processed bamboo shoots. While it is still early, we have experienced strong demand for high PH bamboo shoots since launching in April 2010, and believe this product has great market potential. We believe we are the sole supplier of this product in the world. We have applied for patent protection on the processing procedures and formulation for high PH bamboo shoots. That application is pending.

In December 2010, we launched a seasoned bamboo shoot product that is ready-to-eat and like a snack. To date, revenue from this product has not been material.

Bamboo wood

In order to maintain an optimal density of bamboo forests for production of bamboo shoots, we cut and harvest a proportion of older bamboo and sell it for wood products. In 2010, approximately 13% of our total revenue was derived from selling mature bamboo for use in wood products.

Fresh vegetables and fruits

Fresh fruits and vegetables accounted for approximately 28% of our total revenue in 2010. We grow and sell different varieties of vegetables and fruits, including mushrooms, corn, taro, radishes, cucumbers, ginger, and grapefruits. We harvest fresh vegetables and fruits, sort, weigh, pack and deliver these fresh vegetables and fruits to customers. Different varieties have different harvest seasons. Currently, we supply all of our fresh vegetables and fruits from our own planting bases and ship them to customers in season.

The China Green Food Development Center has established certification procedures that require an applicant wishing to apply for Green Food certification for its products to submit an application to the provincial green food office, which will conduct a document review and an onsite inspection, designate a product inspection agency to conduct a product inspection, and, if necessary, designate a environmental monitoring station to collect and inspect samples of the relevant product. After receiving reports from the provincial green food office, the production inspect agency and the environmental monitoring station, the China Green Food Development Center will send the information it has collected to the Green Food Certification and Review Committee for its review. If the Committee decides that the product meets the Green Food standards, the Center will grant a Green Food Certification for the product to the applicant.

Our fresh vegetables and fruits are grown to meet the standards for Green Food Certification. Some of our vegetables and fruits have received the Green Food Certification. However, we do not seek Green Food certification for all our products that we believe satisfy the requirements for the certification. Based on our discussions with the China Green Food Development Center, the average length of time required to obtain a Green Food certification is about one year.

Organic off-season fresh vegetables will be pre-processed by washing, sorting, and packaging in plastic trays before being delivered to the market. We expect off-season vegetables to become an additional avenue of growth.

Processed vegetables

Our processed vegetables are typically harvested, boiled and then dehydrated or brined. Processed vegetables include water boiled fuki, water boiled corn, brined ginger, water boiled mushrooms, dehydrated mushrooms and water boiled warabi. We supply most of the raw materials for our processed vegetables from our own planting bases. We also purchase pre-processed vegetables which are either not available in Fujian Province or which we are unable to produce in sufficient quantity. Processed vegetables contributed 7% of our total revenue in 2010.

Operations

We currently process our products through two subsidiary entities, Fujian Yada and Fujian Yaxin. We operate state-of-art processing workshops in the full-closed mode and employ advanced processing and testing equipment, some of which is imported from Japan, and the rest of which is from China. Our production lines can be used to produce both processed bamboo shoots and other processed products, which might have slight difference in details but share the same basic processing procedure.

Processing

The production process for processed products generally involves three steps. Using processed bamboo shoot and an example, the steps are as follows:

Step-1 Pre-processing

Pre-processing includes boiling, peeling and washing operations for fresh bamboo shoots. This process is labor intensive and done by our workers almost entirely by hand. We hire temporary workers to operate during peak harvesting season which is normally March and April every year. However, in case of labor shortages, we can outsource pre-processing to third party contractors.

Step-2 Semi-product processing

Semi-product processing includes sorting, cutting, sterilization, canning and storage. After being cut into standardized size, all semi-products are sterilized with high temperature. Then these semi-products are stored in sealed 18 liter cans and stored under normal temperature until they are needed for final product processing.

Step-3 Final-product processing

We take semi-products as raw material and further transform them into different forms such as block, flake, slice, strip and crumb according to different customer requirements. Then we pack products with seal plastic package and perform quality control for each batch of product.

-6-

Storage

As of December 31, 2010, we had 6,000 metric tons of cold storage capacity, and 10,000 square meters of room temperature warehouse space. Cold storage is used to temporarily store fresh produce before preliminary processing or delivery to customers, as well as to store semi-processed high PH bamboo shoots. Room temperature warehouses are used to store semi-processed products (except for semi-processed high PH bamboo shoots) and finished products.

In order to meet our growth requirements, we plan to add an additional 5,500 metric tons of cold storage capacity by the end of 2011. We are on target to meet that goal. As of December 31, 2010, the construction plan of the new storage has been finalized and the construction work is underway. The primary purposes of building the new cold storage facility are to:

-

Provide the necessary storage for fresh raw materials which are later used for processed products

-

Satisfy the storage needs for our high PH bamboo shoot production

-

Improve fresh produce delivery flexibility as market conditions change

Procurement

Our planting bases are in China. We contract with local farmers to supervise the planting, growing and harvesting in accordance with our specifications. We then purchase the products from the farmers at prevailing market prices. We also purchase raw materials from other suppliers including seeds, fertilizers, fresh agricultural products, semi-processed vegetables, and packaging materials.

We purchased some fresh and semi-processed bamboo shoots in 2010 in order to meet demand that exceeded our planting base. In addition, we purchased semi-processed species of bamboo shoots that do not grow in Fujian Province, such as semi-processed bitter bamboo shoots from Sichuan Province and semi-processed slender bamboo shoots from Zhejiang Province.

We also purchased some fresh and semi-processed vegetables which do not grow in Fujian Province or which we do not adequately produce from our own planting bases. In the future, we expect to continue to procure fresh and semi-processed vegetables from third party suppliers when it makes strategic sense.

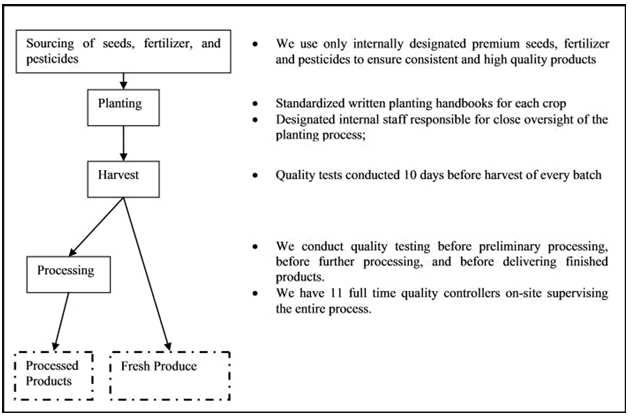

Quality Control & Certifications

Product quality is a core focus. We have an established and traceable quality control system in place from planting to finished products. We conduct quality control in the following procedures:

-7-

We have obtained the following certificates for certain of our products and planting bases:

-

Japanese Agricultural Standard (the highest agricultural quality standard issued by Overseas Merchandise Inspection Company)

-

ISO 9001: 2008 and ISO 9001:2000 by China Quality Certification Center (中国质量认证中心)

-

Hazard Analysis and Critical Control Points by China Quality Certification center (中国质量认证中心); and

-

Green Food by China Green Food Development Center (中国绿色食品发展中心)

-

Organic Food Certificate by China Organic Food Certification Center (中绿华夏有机食品认证中心).

-

Organic Certificate by The Institute for Marketecology (IMO)

The JAS certificates were granted to our production process of organic bamboo shoot products as well as 437 acres of bamboo forests (divided into 15 testing sites). We selected only a portion of our bamboo forests for certification to reduce costs, and view this as a sample testing to demonstrate that our bamboo forests meet the JAS certification standard since we believe most of our bamboo forests are substantially identical in quality.

ISO 9000 is a family of standards for quality management systems. ISO9001:2008 is the most current ISO standard and include requirements on quality management, resource management, product measurement, measurement, analysis and improvement. (source: Wikipedia). Our Fujian Yada subsidiary has been awarded the certificate for its quality management system's compliance with the standard ISO9001: 2008 GB/T 19001-2008. The quality management system applies in the following area: production of boiled bamboo shoots soft pack can, boiled fuki soft pack can, boiled mixed vegetables soft pack can (including lotus root, osmunda japonica thunb and pteridium aquitinum ), boiled edible fungi soft pack can, boiled corn soft pack can and 18-Liter boiled bamboo shoots can. Our Fujian Yaxin subsidiary has been awarded the certificate for its quality management system's compliance with the standard ISO9001:2000 GB/T 19001-2000 for its production of boiled bamboo shoots soft pack can, boiled edible fungi soft pack can, boiled wild vegetables soft pack can, boiled fuki soft pack can, 18-Liter boiled bamboo shoots can and boiled fuki can.

Hazard Analysis Critical Control Point (HACCP) is a systematic preventive approach to food safety and pharmaceutical safety that addresses physical, chemical, and biological hazards as a means of prevention rather than finished product inspection. It requires the operators to conduct a hazard analysis, identify critical control points, establish critical limits and monitoring for each critical control point, and establish corrective actions. (source: Wikipedia). We been awarded the certificate of HACCP for the production of boiled bamboo shoots, boiled fuki, boiled mixed vegetables (including lotus root, osmunda japonica thunb, and pteridium aquitinum), boiled edible fungus, and boiled corn soft pack can. We have also been awarded the HACCP certificate for the production of boiled bamboo shoots soft pack can, boiled edible fungi soft pack can, boiled wild vegetables soft pack can, boiled fuki soft pack can, 18-Liter boiled bamboo shoots can and 18-Liter boiled fuki can.

We have been awarded certificates of Organic Food for our 18-Liter canned boiled bamboo shoots, boiled bamboo shoots, sliced boiled bamboo shoots, and dried bamboo shoots. We have been awarded certificates of Green Food for our fresh bamboo shoots, winter bamboo shoots, sweet tangelo and sweet corn.

The Institute for Marketecology (IMO) is one of the first and most renowned international agencies for inspection, certification and quality assurance of eco-friendly products. Its world-wide activities are accredited by the Swiss Accreditation Service (SAS) according to EN 45011 (ISO 65), which is the international standard for certification. IMO offers certification for organic production and handling according the EU Regulation (EC) No. 834/2007 and (EC) No. 889/2008. Also it has been accredited by USDA for organic certification according to the American National Organic Program (NOP). (source: http://www.imo.ch/). We have been awarded a certificate by IMO for our organic wild collection, processing and marketing of organic products, bamboo shoots and boiled bamboo shoots.

Intellectual Property

We have obtained trademark registrations of "幸福仁佳", "亚利达", "亚达飘香", "茶坪", "白熊" (“white bear” in Chinese), "小孩儿" (“little children” in Chinese), "维多嘉", "圣达" (“Shengda” in Chinese) under application No. 7526764, "利好", "早上好" (“good morning” in Chinese), "大眼晶", "亚达工夫" (“Yada Kong Fu” in Chinese), "亚达" (composed of a rectangle image and the Chinese characters of “Yada”) under application No. 7748481 and "亚达" (composed of an image with two circles and the Chinese characters of “Yada”) under application No. 7526798, No. 7528872 and No. 7662856 with the Trademark Bureau of PRC State Administration of Industry and Commerce. The duration of the trademark protection in the PRC is 10 years from the effective registration date.

We have filed a patent application covering our high PH bamboo shoot product with the State Intellectual Property Office of PRC. That application is pending.

Research & Development

General

Our research and development efforts are intended to achieve the following objectives:

-

Achieve superior product safety and quality

-

Reduce production costs

-

Improve planting technology in order to increase crop yields

-

Develop new, high value-added products

In 2009 and 2010, we incurred only nominal research and development expenses. Some of our activities were carried out in-house by our own staff, which did not incur material expenses. Other activities were done in conjunction with professors and researchers from research institutes and universities with which we have relationships. Under those programs we provide the professors and researchers with nominal compensation in addition to reimbursement of expenses.

-8-

We are constantly looking to improve our profitability through product portfolio management. We intend to launch a number of new high margin products every year. We have formed a research and development team which consists of ten members, including both our management and professors from such institutes and universities. Current projects include experiments for the use of fuki in medicinal functions and the analysis of waste usage for bamboo shoot shells.

We augment our direct research and development efforts through relationships with several research institutes and universities, specifically Fujian Agriculture and Forestry University, Wuyi University, and Fuzhou University:

-

Under our agreement with Fujian Agriculture and Forestry University, the university is responsible for developing “high-quality bamboo shoot product processing technologies”, and we are responsible for providing financial support for the research and commercialization of the research results. Our company and Fujian Agriculture and Forestry University will jointly own the intellectual property rights in any research results developed under this project. If we wish to commercialize the research results in mass production, we will be required to enter into a separate intellectual property transfer or license agreement. We believe that Fujian Agriculture and Forestry University will transfer or license any rights in the research results on commercially reasonable terms. However, we cannot assure you that Fujian Agriculture and Forestry University will do so and if it does not, our access to valuable technology may be impeded or made more costly than we expect, which could adversely impact our business.

-

Under our agreement with Wuyi University, we provide intern positions for students from the Tourism and Management Department of Wuyi University. In return, Wuyi University trains its students in the Tourism and Management Department in knowledge areas relevant to us, such as corporate management and green food. Under the agreement with Fuzhou University, the Food Science and Technology Research Institute of the university helps us to develop polysaccharose bamboo shoot products and we pay $22,300 as research funds to the Food Science and Technology Research Institute, and provide raw materials and testing sites for the research.

-

The Food Science and Technology Research Institute of Fuzhou University has the right to apply for patents on patentable research results, and we can jointly file such applications with it. If we jointly apply for patent protection with the Food Science and Technology Research Institute of Fuzhou University, we will share all rights over the technologies covered by such patent. If we do not jointly apply for a patent, the Food Science and Technology Research Institute of Fuzhou University will owns the underlying technologies covered by such patent, and we will be entitled to a non-exclusive, royalty-free license to use such patents.

High PH bamboo shoots

In April 2010 we launched a new product—our high PH bamboo shoots. The processing procedure and formulation for high PH bamboo shoots are totally different than that of traditional processed products. Whereas traditionally processed bamboo shoots have a sour or acidic flavor, high PH bamboo shoots have the same appearance as fresh bamboo shoots, and very closely emulate the taste and crispness of fresh bamboo shoots.

We are able to purchase fresh bamboo shoots as raw materials for our high PH bamboo shoots in March and April, during the peak growing season, when supply is high and prices are at their lowest. After processing, we are able to sell the high PH bamboo shoots in the off-season when prices are higher. We experienced gross margins for this product of approximately 73% for the period from inception of sales through 2010, compared to 20% to 30% for typical fresh and processed bamboo shoot products. We are positioning our high PH bamboo shoot products for sale to premium markets such as supermarkets, high-end restaurants and hotels and experienced strong sales momentum in the first three months after introduction. The following table compares features of fresh bamboo shoots, processed bamboo shoots and high PH bamboo shoot products.

| High PH bamboo shoot | Fresh bamboo shoot | Traditional processed | |

| Shelf life | 12 months | 2~3 days | 12 months |

| Taste | Same as fresh products | Delicious and crispy | Sour |

| PH value | 5.6~6.0 | 6.3~6.5 | 4.2~4.6 |

| Sale period | Year-round | Dec to next April | Year-round |

| Gross margin | 73% | 20~30% | 20~25% |

Sales and Distribution

Domestic market

In 2010, approximately 94% of our revenues were derived from sales of products into the domestic Chinese market. We sell products in China through our own sales force as well as more than 100 distributors. All of our processed products are sold in China under the Fujian Yada brand.

Our products are sold to:

-

Farmer's markets

-

Local supermarkets in Fujian Province, including Carrefour, Wal-Mart, NDH-Mart, and Yonghui

-

Other supermarkets in Eastern China

-

Hotels, food courts and chain restaurants, such as Little Sheep

-

Specialty stores

-

Food manufacturers

-

The high speed train originating from the Fuzhou station

-9-

We currently have sales offices in Shanghai and Fuzhou. Our domestic sales network covers 10 provinces and cities including Shanghai, Beijing, Tianjin, Shandong, Jiangsu, Zhejiang, Fujian, Hubei, Henan, and Guangdong. Our sales teams are responsible for pursuing direct sales to customers including new businesses in the Eastern China market. We sell direct to supermarkets such as Shanghai Yimaide, Kangda-mart, Hui Jin stores, and Hualian marts in Shanghai. We sell to other major supermarkets such as Carrefour, Jiadeli, RT-Mart, Tesco and Wal-mart through distributors. We now sell directly and indirectly to over 700 stores of such major supermarkets. Sales to major supermarkets, directly or through distributors, accounted for about 15% of our total net sales for the year ended December 31, 2010. We are also in discussions to establish sales to several major retailers, such as Lianhua Mart in Shanghai and Shandong province, Yingzuo Mall in Shandong province, Wu Mart in Beijing, Huarun Supermarket in Jiangsu province, and a few local retailers in Hubei province. Our ongoing negotiations with these retailers focus on the domestic market in China, and we do not expect such negotiations will result in expansion of our business beyond China and Japan in the near future.

In the future, we plan to expand our sales channels through three core initiatives:

-

We plan to increase both direct sales to end users and also the number of our distributors.

-

We expect to continue to expand our customer base to include additional branded chain supermarkets, food courts, hotels and restaurants in the Eastern China region, especially in Shanghai.

-

We plan to continue to open new distribution locations that are exclusive to the Yada brand. We have opened five locations. These locations are dedicated to selling green and organic agricultural products under the Yada brand and focus on bulk orders to local hotels, restaurants and stores, with a small retail component for gift packages. We intend to employ a franchise model for a majority of the distribution locations, which will allow us to create a group of new customers, maintain quality and inventory control, while reducing our working capital requirements and ongoing responsibilities for operating costs of the locations.

Japan market

In 2010, sales from the Japanese market accounted for approximately 6% of our total revenue. We sell semi-finished and final processed products to Japan. We do not currently sell fresh agricultural goods to Japan. At present, we perform all export business through one subsidiary, Shengda. We sell products in Japan through more than 20 overseas distributors. Our Japanese customers primarily consist of convenience stores and food manufacturers. In addition, we are a raw material supplier to Yamazaki, a bread manufacturer in Japan.

All of the products we sell to Japan are sold under an original equipment manufacturer, or OEM, arrangement, whereby we manufacture the products and they are labeled under a third party's brand name. However, the product package credits Fujian Yada as the raw material provider. We anticipate stable growth in the Japanese market for at least the near term.

Brand strategy

We seek to expand our customer base and enhance brand recognition by:

-

Continuing to penetrate well-known supermarkets to promote organic and green food products;

-

Attending various green food exhibitions and organizing nutrition training sessions for distributors to promote food containing crude fiber, such as bamboo shoot products and fuki and green agricultural food; and

-

Launching our exclusive Yada-branded distribution locations in major cities.

Competition

At present, there are thousands of bamboo shoot producers in China. The market is competitive and highly fragmented. We believe that competition in our markets is based principally on price, product quality, brand recognition, stable and timely supply of products, innovation, and breadth of sales network. We believe that we compete favorably with regard to most of these factors, as follows:

-

Pricing. Based on communications with our customers and retailers, we believe that the prices of our products are roughly average, with some of our products being less expensive and others more expensive than our competitor's products. We anticipate that we will not be a low price leader. Rather our pricing strategy will be to provide quality products at prices that are near our competitors.

-

Product taste and quality. Based on customers’ comments during communications with our sales personnel, we believe Chinese consumers generally recognize our products as having superior quality, taste and freshness. We place significant emphasis on food quality and safety and have a well-established, traceable and strict quality control system for all stages of our business, including planting, raw material sourcing, processing, packaging, storage and transportation. We apply internal quality controls which we believe are stricter than the national standard. As a result, we have received a number of product quality certifications. See “Operations—Quality Control and Certifications” above. In 2010, we grew and supplied a majority of our raw materials from our own planting bases and processed our processed vegetables in our own processing facilities.

-

Brand recognition. In a letter dated March 12, 2010 from the Chinese Bamboo Industry Association to the Trademark Office of State Administration of Industry and Commerce of China, the Chinese Bamboo Industry Association recommended the “Yada” trademark of Fujian Yada as a “Famous Trademark of China”, and stated in the letter that “Fujian Yada Group Co., Ltd. is one of the largest producers of boiled bamboo shoots products and dried vegetables in China”. Based on the information in this letter, we believe we are one of the largest producers of bamboo shoot food products in China.

-10-

-

Stable timely supply of products. Our planting bases and processing facilities are strategically located near the borders of Fujian Province, Jiangxi Province and Zhejiang Province, as well as within close proximity to the city of Shanghai. This arrangement not only affords us access to those three provinces and the city of Shanghai, but also facilitates low logistics costs, which in turn enables us to deliver fresh agricultural products on time. In addition, Fujian Province is widely recognized as the #1 growing area for bamboo globally. This provides us with access to a large potential planting base. We believe our vertically integrated business model provides us with enhanced production efficiency, stable supply of products and better control over costs as compared to those competitors that rely on third party suppliers. We also sell over 100 varieties of fresh and processed agricultural products. That product diversity allows us to meet the demands of a variety of customers and mitigate seasonality risks.

-

Product Innovation. We place high emphasis on product development and innovation. Since 2005, we have introduced more than 30 products. We intend to launch one or two significant new products every year and continue to improve our product portfolio with high margin and high value-added products. In 2010, we launched high PH bamboo shoots. This product is generating strong sales in the first year after introduction and is currently under patent application in the domestic China market. We also recently launched a seasoned, ready to eat bamboo shoot product.

-

Sales network. We sell all fresh agricultural products and a portion of our processed products in China through an extensive nationwide sales and distribution network, covering 10 provinces and cities. This network was comprised of more than 100 distributors and about 40 direct sales employees of our sales offices in Shanghai and Fuzhou. We sell our products to farmers markets and supermarkets in Fujian and in Shanghai (including but not limited to Carrefour, Wal-Mart and Yonghui), and various food manufacturers, chain restaurants and retailers in China. We are also opening exclusive, Yada-branded distribution locations in Shanghai, and in Guangdong, Zhejiang and Fujian provinces.

Growth strategy

As a vertically integrated green and organic agricultural product producer in China with strong brand recognition, we believe we are well positioned to capitalize on future industry growth. We are focused on leveraging industry opportunities and our competitive strengths to become China's leading brand for green and organic food products through the following initiatives:

-

Expand our planting base. Out of a total of 30,500 acres of bamboo forests, our 17,300 acres of bamboo forest produced approximately 27,000 metric tons of bamboo shoots in 2010, while the remaining were newly added and did not commence production in 2010. Out of a total of 12,500 acres of vegetable and fruit planting bases, our 10,400 acres of vegetable and fruit planting bases collectively produced approximately 54,000 metric tons of vegetables and fruits in 2010, while the remaining were newly added and did not commence production in 2010. In order to satisfy increasing market demand, we plan to expand our bamboo forest by an additional 13,200 acres of bamboo forest by the end of 2011.

-

Improve our profitability by continuously introducing new high value added products. We constantly evaluate our products and adapt to changes in market conditions by updating our products to reflect new trends in consumer preferences. In 2010 we launched our high PH bamboo shoots and our seasoned bamboo which is ready to eat as a snack. Through our own research and development and cooperation with academic institutions, we plan to introduce at least 1 or 2 new products each year, which are higher value added than existing products and are able to improve our profitability.

-

Further expand our domestic sales and distribution network and enter new markets. We are focused on expanding our sales and distribution channels in the domestic China market, and maintaining existing customers in Japan. We currently sell through distributors and members of our own sales force to farmers' markets, supermarkets, food manufacturers, restaurants and retailers in China. To support our future growth, we intend to further expand our domestic sales and distribution channels in our covered geographic areas and explore new markets by increasing Fujian Yada's brand presence in additional supermarkets.

-

Increase our cold storage capacity. Currently, we have 6,000 metric ton cold storage facility for storing fresh and semi-finished products. We plan to build a new cold storage facility to increase the capacity by an additional 5,500 metric tons, in order to meet the requirements of our existing products and the anticipated need for recent new product launches. We are on target to meet that goal. As of December 31, 2010, the construction plan has been finalized and the construction work has commenced.

-

Further enhance our brand recognition. We have been gaining brand recognition in China, especially in Fujian Province. We expect to further enhance our branding through branded counters in supermarkets. We also began opening exclusive Yada-branded distribution locations in select locations in China.

Regulation

The food industry, of which vegetable and fruit based products form a part, is subject to extensive regulation in China. The following summarizes the most significant PRC regulations governing our business in China.

Food Hygiene and Safety Laws and Regulations

As a producer of food products in China, we are subject to a number of PRC laws and regulations governing food safety and hygiene, including:

-

The PRC Product Quality Law

-

The PRC Food Safety Law

-

The PRC Food Hygiene Law

-

The Implementation Rules on the Administration and Supervision of Quality and Safety in Food Producing and Processing Enterprises

-11-

-

The Regulation on the Administration of Production Licenses for Industrial Products

-

The Provisional Rules on the Release of Food Advertisement

-

The Provisions on the Administration of Hygiene Registration of Export Food Producing Enterprises

-

The General Measure on Food Quality Safety Market Access Examination

-

The General Standards for the Labeling of Prepackaged Foods

-

The Standardization Law

-

The Special Rules on Strengthening Safety and Supervision of Food and other Products

-

The Regulation on Hygiene Administration of Food Additive

-

The Regulation of Administration of Bar Code Merchandise

-

The PRC Metrology Law

These laws and regulations set out safety and hygiene standards and requirements for various aspects of food production, such as the production, packaging, handling, labeling and storage of food for the use of facilities and equipment that make food, as well as for the use of food additives. Failure to comply with these laws and regulations may result in confiscation and destruction of our products and inventory, confiscation of proceeds from the sale of non-compliant products, fines, suspension of production and operations, product recalls, revocation of licenses, and, in extreme cases, criminal liability. We believe that we comply in all material respects to the PRC Food Hygiene and Safety laws and regulations applicable to us or our business; however, China’s regulatory environment is still developing and subject to the rapid introduction of new requirements or standards.

Environmental Regulations

We are subject to various governmental regulations related to environmental protection. The major environmental regulations applicable to us include:

-

The Environmental Protection Law of the PRC

-

The Law of PRC on the Prevention and Control of Water Pollution

-

Implementation Rules of the Law of PRC on the Prevention and Control of Water Pollution

-

The Law of PRC on the Prevention and Control of Air Pollution

-

Implementation Rules of the Law of PRC on the Prevention and Control of Air Pollution

-

The Law of PRC on the Prevention and Control of Solid Waste Pollution

-

The Law of PRC on the Prevention and Control of Noise Pollution

Our manufacturing facilities are subject to various pollution control regulations with respect to water, air and noise pollution as well as the disposal of waste and hazardous materials. We are also subject to periodic inspections by local environmental protection authorities. Our operating subsidiaries have received certifications from the relevant PRC government agencies in charge of environmental protection indicating that their business operations are in material compliance with the relevant PRC environmental laws and regulations. We are not currently subject to any pending actions alleging any violations of applicable PRC environmental laws.

PRC Foreign Investment Laws

Our operating subsidiaries are generally subject to PRC laws and regulations applicable to foreign investments in China, including those described below. Since the PRC legal system continues to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involve uncertainties.

-

Provisions Regarding Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (M&A Rule). Under the M&A Rule, it is difficult for a foreign company to acquire a PRC company. Our wholly foreign owned subsidiary Fujian Yada was acquired by Misaky. Fujian Yada and Misaky then became wholly owned subsidiaries of Sino Oriental, which in turn was acquired by Asia Green Agriculture Corporation. A PRC governmental authority may challenge the effect of some or all of these prior acquisitions. Such governmental authority could regard the transactions as affiliated acquisitions and return investment for which approval of MOFCOM and/or CSRC would be required. See “Risk Factors--If the China Securities Regulatory Commission, or CSRC, or another PRC regulatory agency determines that CSRC or other approval is required in connection with the reverse acquisition of Sino Oriental, the reverse acquisition may be unwound, or we may become subject to penalties.”

-

PRC Foreign-funded Enterprises Law The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership as well as exerts substantial influence over the manner in which we must conduct our business activities through its regulations regarding land use rights, property and other matters. Our ability to operate in China may be harmed by changes in its laws and regulations, including with respect to land use rights, property and other matters. For example, government actions in the future could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

-12-

-

Regulations of PRC on Foreign Exchange Administration All our sales revenue and expenses are denominated in RMB. Restrictions on currency exchange may limit our ability to receive and use our sales revenue effectively although, currently, our PRC operating subsidiaries may purchase foreign currencies for settlement of current account transactions without the approval of SAFE in accordance with certain procedural requirements assuming SAFE has approved their current levels of registered capital and total investment. Since substantially all of our revenues are earned by our PRC subsidiaries, developments under PRC law that impact our PRC subsidiaries’ ability to make dividends and other distributions or repatriate profits could adversely affect our ability to grow, make investments or complete acquisitions that could benefit our business, pay dividends to you , and otherwise fund and conduct our business.

PRC Land Law

Under the PRC laws, land in urban districts shall be owned by the State, land in the rural areas and suburban areas, except otherwise provided for by the State, shall be collectively owned by farmers including land for building houses land and hills allowed to be retained by farmers.

The procedures and practice for issuing title certificates for farmer-collectively-owned land are not well established. Despite the fact that PRC authorities have issued several legal directives and rules to regulate the process of issuing Collectively-owned Land Title Certificates (集体土地所有证) (for farmland) and Forest Title Certificates (林权证) (for forest land) to evidence the ownership of the farmers to the farmer-collectively-owned land, in practice, not many areas in the PRC have implemented such a system due to difficulties in identifying the proper owners for such farmer-collectively-owned lands, amongst other reasons.

Under the PRC laws, farmers of a rural cooperative or other individuals or organizations desiring to cultivate lands are required to enter into Contracted Farming Agreements (承包合同) with the Villagers' Committees (村委会) or Rural Collective Economic Organizations (村集体经济组织) in order to legally obtain a Rural Land Contracted Operation Right (农村土地承包经营权) for use in crop farming, forestry, animal husbandry and fisheries production under a term of 30 years. They should sign a contract with the (correspondents contractor) which can be a Villagers' Committee (村委会) or a Rural Collective Economic Organization (村集体经济组织), to define each other's rights and obligations. Farmers who have contracted land for operation are obliged to use the land rationally according to the purposes agreed upon in the contracts. The right of operation of land contracted by contractors shall be protected by law. Within the validity term of a contract, the adjustment of land contracted by individual contractors should get the consent from over two-thirds majority vote of the villagers' congress of a Rural Collective Economic Organization (村集体经济组织) or over two-thirds of villagers' representatives of a Villagers' Committee (村委会) and then be submitted to land administrative departments of the township (town) people's government and county level people's government for approval.

Because of the lack of a well-developed central filing and registration system of administration and supervision in the PRC rural areas, not many Villagers' Committees or Rural Collective Economic Organizations (村集体经济组织) in practice would formally sign Contracted Farming Agreements (承包合同) when granting Rural Land Contracted Operation Right (土地承包经营权) to farmer-households.

Preferential Policies for the Agriculture Industry

As part of the agricultural industry in China we enjoy certain preferential policies. Currently earnings from certain products that we produce and sell are exempt from China's value added tax and enterprise income tax. We have been exempt from the value added tax and enterprise income tax for the past four years. This exemption is reviewed on an annual basis and can be eliminated at any time. Elimination of this exemption would increase our tax expenses and impact our profitability.

Under a preferential policy related to agricultural product development, the Ministry of Agriculture and the Agriculture Department of Fujian Province subsidizes a portion of the interest payments on our outstanding commercial loans. In addition, the provincial government in Fujian Province subsidizes certain utility costs, including water.

Our Employees

As of December 31, 2010, we employed total of 317 full-time employees in the following functions:

| Department | Number of Employees |

| Senior Management | 5 |

| Human Resource & Administration | 22 |

| Production & Procurement | 206 |

| Sales & Marketing | 56 |

| Accounting | 28 |

| Total | 317 |

Our employees are not represented by a labor organization or covered by a collective bargaining agreement. We have not experienced any work stoppages.

We are required under PRC law to make contributions to employee benefit plans at specified percentages of our after-tax profit. In addition, we are required by PRC law to cover employees in China with various types of social insurance. Implementation of social insurance laws has changed in recent years. We have attempted to pay all of our social insurance payments for our past employees but disparities in records and implementation have made this difficult. See “Risk Factors—We may face claims and/or administrative penalties for non-execution of labor contracts or nonpayment and/or under payment of social insurance and housing fund obligations in respect of our temporary workers and our full-time employees.” We believe that we are in material compliance with the relevant PRC employment laws for our current employees.

Seasonality

As is typical in the food and food processing industry, we experience seasonality in our business. Our bamboo shoots business operates primarily in the first and fourth fiscal quarters every year. Our fresh fruit and vegetable business varies according to the seasonality of each type of vegetable and fruit. Our fruit and vegetable processing lines are mainly carried out year-round because our primary source fruits are harvested during different periods and must be processed right away. As a result of seasonality, our personnel, working capital requirements, cash flow and inventories vary throughout the year.

-13-

In fiscal 2010, sales during the first and fourth fiscal quarters accounted for approximately 61% of our total sales. We are looking to expand our products into additional categories of vegetables that, in part, will extend the season and provide increase revenues during our current "off peak" seasons.

Insurance

We have property insurance for all of our facilities. We believe our insurance coverage is customary and standard for companies of comparable size in comparable industries in China. We do not have any business liability, interruption or litigation insurance coverage for our operations in China. Insurance companies in China offer limited business insurance products. While business interruption insurance is available to a limited extent in China, we have determined that the risks of interruption, cost of such insurance and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. Therefore, we are subject to business and product liability exposure.

Legal Proceedings

From time to time, we may be involved in litigation relating to claims arising out of our operations in the normal course of business, including claims of alleged infringement, misuse or misappropriation of intellectual property rights of third parties. As of the date of this report, we are not a party to any such litigation which we believe would have a material adverse effect on us.

Our Corporate Structure

We are a Nevada holding company and conduct substantially all of our business through our operating subsidiary Fujian Yada in China. We own all of the equity in Fujian Yada through Sino Oriental and Sino Oriental’s wholly owned subsidiary Misaky. Both Sino Oriental and Misaky are intermediate holding companies and have no other significant assets and operations of its own. Fujian Yada is incorporated in China in 2001. Subsequently, in a series of transactions in 2010, Misaki acquired 100% ownership of Fujian Yada.

The following chart reflects our organizational structure as of the date of this report.

Our Corporate History

We were originally incorporated in the State of Nevada on May 31, 2008 to effect the reincorporation of Senior Management Services of Palestine, Inc., a Texas corporation. On January 17, 2007 Senior Management Services of Palestine, Inc. and its affiliated companies (collectively "SMS Companies"), filed a petition for reorganization under Chapter 11 of the United States Bankruptcy Code. On August 1, 2007, the bankruptcy court confirmed the First Amended, Modified Chapter 11 Plan (the "Plan"), as presented by SMS Companies and their creditors. The effective date of the Plan was August 10, 2007.

Halter Financial Group, Inc., participated with SMS Companies and their creditors in structuring the Plan. As part of the Plan, Halter Financial Group, Inc. provided $115,000 to be used to pay professional fees associated with the Plan confirmation process. Halter Financial Group, Inc. was granted an option to be repaid through the issuance of equity securities in 23 of the SMS Companies, including Senior Management Services of Palestine, Inc. Halter Financial Group, Inc. exercised the option, and as provided in the Plan, 80% of our outstanding common stock, or 1,000,000 shares, was issued to Halter Financial Group, Inc. in satisfaction of Halter Financial Group, Inc.’s administrative claims. The remaining 20% of our outstanding common stock, or 250,010 shares, was issued to 449 holders of unsecured debt. The 1,250,010 shares, or Plan Shares, were issued pursuant to Section 1145 of the Bankruptcy Code. As further consideration for the issuance of the 1,000,000 Plan Shares to Halter Financial Group, Inc., the Plan required Halter Financial Group, Inc. to assist us in identifying a potential merger or acquisition candidate, to provide for the payment of our ongoing operating expenses and to provide us, at no cost, with consulting services, including assisting us with formulating the structure of any proposed merger or acquisition. Additionally, Halter Financial Group, Inc. was responsible for paying our legal and accounting expenses related to this registration statement and our expenses incurred in consummating a merger or acquisition.

-14-

On November 4, 2009, we entered into a share purchase agreement with Yang Yongjie, a resident of China, pursuant to which Yang Yongjie acquired 11.25 million shares of our common stock for $4,500 or, $0.0004 per share. At that time, our business plan was to develop the Chinese restaurant concept currently undertaken by Legend Restaurant Management, a Samoa corporation in which Yang Yongjie owns an interest. In connection with the share purchase agreement Yang Yongjie was appointed to be our sole director and executive officer. After giving effect to this transaction, 12,500,010 shares of our common stock were issued and outstanding.

On April 13, 2010, Zhan Youdai and Liufeng Zhou, Zhan Youdai's spouse, entered into an agreement with Misaky, a limited liability company incorporated in Hong Kong, pursuant to which Misaky agreed to acquire 100% of the equity interest in Fujian Yada for cash consideration of RMB31,157,000. The transaction was completed on May 26, 2010. Beginning shortly after completion of Misaky’s acquisition of Fujian Yada and prior to the acquisition by Sino Oriental as described below, Cai Yangbo held 100% of the equity interest in Misaky on behalf of Zhan Youdai who was the sole beneficial owner with full power to direct the voting and disposition of such equity interest and the sole director of Misaky. Misaky is an investment holding company without any other business activities and only holds the 100% equity interest in Fujian Yada.

On July 2, 2010, Cai Yangbo, the holder of 100% of the shares of Misaky, which owned 100% of the equity interest of Fujian Yada at that time, entered into an agreement with Sino Oriental, a limited company incorporated in the British Virgin Islands, pursuant to which Sino Oriental agreed to acquire 100% of the equity interest in Misaky for cash consideration of HK$3,001, equivalent to the issued and paid up share capital of Misaky.

Before the acquisition by the Company completed on August 20, 2010 as described below, Cai Yangbo held approximately 76.91% of the equity interest in Sino Oriental. Under the terms of a trust agreement, Cai Yangbo held that position on behalf of Mr. Zhan Youdai and conferred upon Mr. Zhan Youdai the sole beneficial ownership with full power to direct the voting and disposition of such equity interest. Mr. Zhan Youdai was also the sole director of Sino Oriental. Sino Oriental is an investment holding company without any other business activities and only holds 100% equity interest in Misaky. On August 20, 2010, we entered into a share cancellation agreement with Yang Yongjie pursuant to which Yang Yongjie surrendered for cancellation 9,738,180 shares of our outstanding common stock that were previously issued to him pursuant to the securities purchase agreement dated November 4, 2009. The consideration for the cancellation was inducement of the share exchange between Sino Oriental and the Company.

On August 20, 2010, we entered into an exchange agreement with Sino Oriental Agriculture Group Ltd. and the shareholders of Sino Oriental Agriculture Group Ltd, pursuant to which all of the shareholders of Sino Oriental Agriculture Group Ltd. transferred all of the issued and outstanding stock of Sino Oriental Agriculture Group Ltd. to us, and in exchange we issued to such shareholders 29,214,043 newly issued shares of our common stock. In connection with the exchange agreement Yang Yongjie agreed to resign as a director and as an officer. Zhan Youdai and Zhang He were appointed to be our directors and Zhan Youdai and Tsang Yin Chiu Stanley were appointed as our executive officers. Prior to the execution of the exchange agreement on August 20, 2010, Fujian Yada had reorganized its corporate structure and acquired Fujian Yaxin Food Co., Ltd., Fujian Shengda Import and Export Trading Co., Ltd. and Fujian Xinda Food Co., Ltd., all companies registered under the laws of the PRC and previously jointly owned by Mr. Zhan and his spouse, Liufeng Zhou. Upon completion of this reorganization, Fujian Yaxin Food Co., Ltd., Fujian Shengda Import and Export Trading Co., Ltd. and Fujian Xinda Food Co., Ltd. became the wholly owned subsidiaries of Fujian Yada.

Immediately prior to completion of the exchange pursuant to the exchange agreement, on August 20, 2010, the trust agreement was terminated and Cai Yangbo, the majority shareholder of Sino Oriental prior to the exchange, and Zhan Youdai entered into an Option Agreement, pursuant to which Zhan Youdai has an option to purchase all the equity interest in the Company held by Cai Yangbo at any time during the period commencing on the 180th day following the signing date of the Option Agreement and ending on the second anniversary of the signing date of the Option Agreement, at an aggregate exercise price of US$84,981,327. Under its terms, the option was not exercisable for a period of six months, so for a period of four months Mr. Zhan did not beneficially own the shares of Asia Green Agriculture Corporation. However, because he became the Company's Chairman and Chief Executive Officer after the exchange, he had control of the Company from and after the time he assumed such duties.

Also on August 20, 2010 we closed the transactions under a securities purchase agreement dated July 23, 2010 with certain institutional investors, pursuant to which we sold 1,939,407 units for an aggregate purchase price of approximately $15.3 million. Each unit consisted of 2.5 newly issued shares of our common stock and a warrant to purchase 0.5 shares of our common stock. The warrants are exercisable at $3.78 per share and have a term of three years. The total number of shares of common stock issuable upon exercise of the warrants issued to the investors was 969,717. We also issued warrants to purchase 339,396 shares of common stock to certain placement agents and financial advisors, including William Blair & Company, L.L.C and Halter Financial Securities, Inc., on the same terms as those sold to the investors. In connection with that transaction, we agreed to register the shares of our common stock within a pre-defined period.

On February 10, 2011, we issued a five year warrant to purchase 50,000 shares of our common stock at an exercise price of $4.00 per share to CCG Investor Relations Partners LLC in connection with a consulting agreement.

As a result of these transactions, we currently have 36,823,626 shares of common stock outstanding. We have 1,309,113 shares of common stock underlying three year warrants to purchase common stock at $3.78 per share and 50,000 shares of common stock underlying a five year warrant to purchase common stock at $4.00 per share. We also have outstanding options to purchase 3,093,258 shares of common stock which have been issued to employees.

-15-

ITEM 1A. RISK FACTORS

This report includes forward-looking statements about our business and results of operations that are subject to risks and uncertainties. See "Forward-Looking Statements," above. Factors that could cause or contribute to such differences include those discussed below. In addition to the risk factors discussed below, we are also subject to additional risks and uncertainties not presently known to us or that we currently deem immaterial. If any of these known or unknown risks or uncertainties actually occur, our business could be harmed substantially.

Risks Related to Our Business

Any ill effects, product liability claims, recalls, adverse publicity or negative public perception regarding particular foods we use as raw materials, our products or our industry in general could harm our sales and cause consumers to avoid our products.

The food industry is subject to risks posed by food spoilage and contamination, product tampering, product recall, and consumer product liability claims. Our operations could be impacted by both genuine and fictitious claims regarding our products and our competitors' products. In the event of product contamination or tampering, we could be compelled to recall some of our products. A widespread product recall could result in significant loss due to the cost of conducting a product recall including destruction of inventory and the loss of sales resulting from the unavailability of the product for a period of time.

In addition, any adverse publicity or negative public perception regarding particular fruits we use as raw materials, our products, our actions relating to our products, or our industry in general could result in a substantial drop in demand for our products. This negative public perception may include publicity regarding the safety or quality of particular fruits we use as raw materials or products in general, of other companies or of our products specifically. Negative public perception may also arise from regulatory investigations or product liability claims, regardless of whether those investigations involve us or whether any product liability claim is successful against us. We could also suffer losses from a significant product liability judgment against us. Either a significant product recall or a product liability judgment, involving either our company or our competitors, could also result in a loss of consumer confidence in our products or the food category, and an actual or perceived loss of value of our brands, materially impacting consumer demand.