Attached files

The Savannah Bancorp, Inc. and Subsidiaries

Financial Statement Section

Index

Page

Number

|

Index to Financial Statement Section

|

F-1

|

|

Report of Independent Registered Public Accounting Firm

|

F-2

|

|

Consolidated Balance Sheets

|

|

|

December 31, 2010 and 2009

|

F-3

|

|

Consolidated Statements of Operations for the Years

|

|

|

Ended December 31, 2010, 2009 and 2008

|

F-4

|

|

Consolidated Statements of Changes in Shareholders'

|

|

|

Equity for the Years Ended December 31, 2010, 2009 and 2008

|

F-5

|

|

Consolidated Statements of Cash Flows for the Years

|

|

|

Ended December 31, 2010, 2009 and 2008

|

F-6

|

|

Notes to Consolidated Financial Statements

|

F-7

|

|

Management’s Discussion and Analysis of Financial

|

|

|

Condition and Results of Operations

|

F-33

|

|

Selected Five-Year Financial Data – 2006-2010

|

|

|

Selected Financial Condition Highlights

|

F-33

|

|

Selected Operating Highlights

|

F-34

|

|

Selected Quarterly Data

|

F-35

|

|

Market for Registrant's Common Equity and

|

|

|

Related Shareholder Matters

|

F-35

|

|

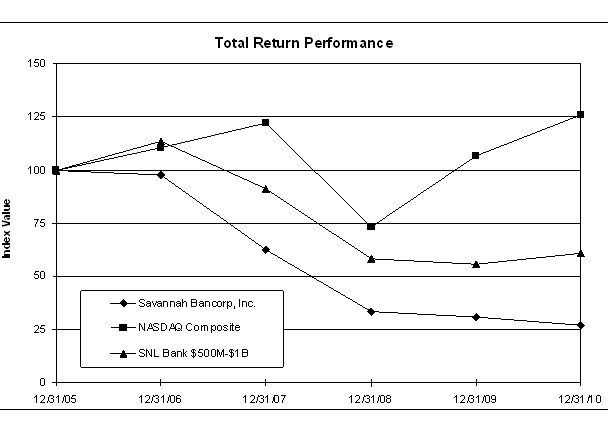

Stock Performance Graph

|

F-36

|

|

Introduction

|

F-37

|

|

Critical Accounting Estimates

|

F-38

|

|

Results of Operations

|

|

|

2010 Compared with 2009

|

F-42

|

|

2009 Compared with 2008

|

F-43

|

|

Financial Condition and Capital Resources

|

F-44

|

| Loan Concentrations | F-44 |

| Liquidity and Interest Rate Sensitivity Management | F-46 |

| Off-Balance Sheet Arrangements | F-46 |

| Forward Looking Statements | F-47 |

| Cash Flow/Maturity Gap and Repricing Data | F-48 |

| Average Balance Sheet and Rate/Volume Analysis – 2010 and 2009 | F-49 |

| Average Balance Sheet and Rate/Volume Analysis – 2009 and 2008 | F-50 |

F-1

The Savannah Bancorp, Inc. – 2010 Annual Report

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders

of The Savannah Bancorp, Inc.:

We have audited the accompanying consolidated balance sheets of The Savannah Bancorp, Inc. and subsidiaries as of December 31, 2010 and 2009 and the related consolidated statements of operations, changes in shareholders’ equity and cash flows for each of the three years in the period ended December 31, 2010. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of The Savannah Bancorp, Inc. and its subsidiaries as of December 31, 2010 and 2009 and the results of its operations and its cash flows for each of the three years in the period ended December 31, 2010, in conformity with accounting principles generally accepted in the United States of America.

/s/ Mauldin & Jenkins, LLC

Albany, Georgia

March 25, 2011

F-2

The Savannah Bancorp, Inc. – 2010 Annual Report

The Savannah Bancorp, Inc. and Subsidiaries

Consolidated Balance Sheets

($ in thousands, except share data)

|

December 31,

|

|||

|

2010

|

2009

|

||

|

Assets

|

|||

|

Cash and due from banks

|

$ 17,990

|

$ 19,253

|

|

|

Federal funds sold

|

110

|

8,575

|

|

|

Interest-bearing deposits in banks

|

40,836

|

12,707

|

|

|

Cash and cash equivalents

|

58,936

|

40,535

|

|

|

Securities available for sale, at fair value (amortized

|

|||

|

cost of $136,980 and $86,596)

|

138,099

|

87,919

|

|

|

Loans, net of allowance for loan losses of $20,350

and $17,678

|

806,212

|

866,208

|

|

|

Premises and equipment, net

|

15,056

|

15,574

|

|

|

Other real estate owned

|

13,199

|

8,329

|

|

|

Bank-owned life insurance

|

6,309

|

6,434

|

|

|

Goodwill and other intangible assets, net

|

3,786

|

2,498

|

|

|

Other assets

|

25,333

|

23,011

|

|

|

Total assets

|

$ 1,066,930

|

$ 1,050,508

|

|

|

Liabilities

|

|||

|

Deposits:

|

|||

|

Noninterest-bearing

|

$ 95,725

|

$ 82,557

|

|

|

Interest-bearing demand

|

140,531

|

143,559

|

|

|

Savings

|

20,117

|

16,893

|

|

|

Money market

|

265,840

|

228,124

|

|

|

Time deposits

|

401,532

|

413,436

|

|

|

Total deposits

|

923,745

|

884,569

|

|

|

Short-term borrowings

|

15,075

|

23,553

|

|

|

Other borrowings

|

10,536

|

15,988

|

|

|

Federal Home Loan Bank advances

|

17,658

|

31,664

|

|

|

Subordinated debt to nonconsolidated subsidiaries

|

10,310

|

10,310

|

|

|

Other liabilities

|

3,803

|

5,398

|

|

|

Total liabilities

|

981,127

|

971,482

|

|

|

Commitments and contingencies (Notes 17 and 20)

|

|||

|

Shareholders' equity

|

|||

|

Preferred stock, par value $1 per share:

|

|||

|

authorized 10,000,000 shares, none issued

|

-

|

-

|

|

|

Common stock, par value $1 per share: shares authorized

|

|||

|

20,000,000, issued 7,201,346 and 5,933,789

|

7,201

|

5,934

|

|

|

Additional paid-in capital

|

48,634

|

38,605

|

|

|

Retained earnings

|

29,275

|

33,383

|

|

|

Treasury stock, at cost, 2,483 and 1,443 shares

|

(1)

|

(4)

|

|

|

Accumulated other comprehensive income, net

|

694

|

1,108

|

|

|

Total shareholders' equity

|

85,803

|

79,026

|

|

|

Total liabilities and shareholders' equity

|

$ 1,066,930

|

$ 1,050,508

|

|

The accompanying notes are an integral part of these consolidated financial statements.

F-3

The Savannah Bancorp, Inc. – 2010 Annual Report

The Savannah Bancorp, Inc. and Subsidiaries

Consolidated Statements of Operations

($ in thousands, except per share data)

|

For the Years Ended December 31,

|

|||||

|

2010

|

2009

|

2008

|

|||

|

Interest and dividend income

|

|||||

|

Loans, including fees

|

$ 45,001

|

$ 47,081

|

$ 53,259

|

||

|

Loans held for sale

|

-

|

-

|

60

|

||

|

Investment securities:

|

|||||

|

Taxable

|

2,401

|

3,220

|

2,803

|

||

|

Tax-exempt

|

313

|

154

|

87

|

||

|

Dividends

|

47

|

45

|

191

|

||

|

Deposits with banks

|

147

|

45

|

149

|

||

|

Federal funds sold

|

20

|

18

|

133

|

||

|

Total interest and dividend income

|

47,929

|

50,563

|

56,682

|

||

|

Interest expense

|

|||||

|

Deposits

|

12,460

|

16,454

|

21,842

|

||

|

Short-term and other borrowings

|

1,138

|

1,045

|

596

|

||

|

Federal Home Loan Bank advances

|

458

|

397

|

1,359

|

||

|

Subordinated debt

|

306

|

362

|

642

|

||

|

Total interest expense

|

14,362

|

18,258

|

24,439

|

||

|

Net interest income

|

33,567

|

32,305

|

32,243

|

||

|

Provision for loan losses

|

21,020

|

13,065

|

6,000

|

||

|

Net interest income after provision for loan losses

|

12,547

|

19,240

|

26,243

|

||

|

Noninterest income

|

|||||

|

Trust and asset management fees

|

2,599

|

2,351

|

2,832

|

||

|

Service charges on deposit accounts

|

1,788

|

1,809

|

1,881

|

||

|

Mortgage related income, net

|

398

|

432

|

295

|

||

|

Gain on sale of securities

|

608

|

2,119

|

163

|

||

|

Gain on hedges

|

2

|

873

|

1,288

|

||

|

Other operating income

|

1,916

|

1,238

|

1,216

|

||

|

Total noninterest income

|

7,311

|

8,822

|

7,675

|

||

|

Noninterest expense

|

|||||

|

Salaries and employee benefits

|

11,948

|

12,146

|

13,584

|

||

|

Occupancy and equipment

|

3,945

|

3,716

|

3,884

|

||

|

Information technology

|

2,101

|

1,810

|

1,633

|

||

|

FDIC deposit insurance

|

1,688

|

1,886

|

653

|

||

|

Amortization of intangibles

|

171

|

144

|

144

|

||

|

Loss on sale and write-downs of foreclosed assets

|

2,472

|

2,566

|

228

|

||

|

Other operating expense

|

4,652

|

4,710

|

4,616

|

||

|

Total noninterest expense

|

26,977

|

26,978

|

24,742

|

||

|

Income (loss) before income taxes

|

(7,119)

|

1,084

|

9,176

|

||

|

Income tax expense (benefit)

|

(3,130)

|

155

|

3,170

|

||

|

Net income (loss)

|

$ (3,989)

|

$ 929

|

$ 6,006

|

||

|

Net income (loss) per share:

|

|||||

|

Basic

|

$ (0.60)

|

$ 0.16

|

$ 1.01

|

||

|

Diluted

|

$ (0.60)

|

$ 0.16

|

$ 1.01

|

||

|

Dividends per share

|

$ 0.02

|

$ 0.185

|

$ 0.50

|

||

|

Average basic shares (000s)

|

6,625

|

5,933

|

5,930

|

||

|

Average diluted shares (000s)

|

6,625

|

5,936

|

5,947

|

||

|

The accompanying notes are an integral part of these consolidated financial statements.

|

F-4

The Savannah Bancorp, Inc. – 2010 Annual Report

The Savannah Bancorp, Inc. and Subsidiaries

Consolidated Statements of Changes in Shareholders' Equity

($ in thousands, except share data)

|

For the Years Ended December 31,

|

|||

|

2010

|

2009

|

2008

|

|

|

Common shares issued

|

|||

|

Shares, beginning of year

|

5,933,789

|

5,933,789

|

5,923,797

|

|

Common stock issued

|

1,267,557

|

-

|

6,211

|

|

Exercise of options

|

-

|

-

|

3,781

|

|

Shares, end of year

|

7,201,346

|

5,933,789

|

5,933,789

|

|

Treasury shares owned

|

|||

|

Shares, beginning of year

|

1,443

|

318

|

318

|

|

Treasury stock issued

|

(943)

|

-

|

-

|

|

Unredeemed common stock

|

36

|

-

|

-

|

|

Unvested restricted stock

|

1,947

|

1,125

|

-

|

|

Shares, end of year

|

2,483

|

1,443

|

318

|

|

Common stock

|

|||

|

Balance, beginning of year

|

$ 5,934

|

$ 5,934

|

$ 5,924

|

|

Common stock issued

|

1,267

|

-

|

6

|

|

Exercise of options

|

-

|

-

|

4

|

|

Balance, end of year

|

7,201

|

5,934

|

5,934

|

|

Additional paid-in capital

|

|||

|

Balance, beginning of year

|

38,605

|

38,516

|

38,279

|

|

Common stock issued, net of issuance costs

|

9,980

|

-

|

68

|

|

Stock-based compensation expense, net

|

49

|

89

|

137

|

|

Exercise of options

|

-

|

-

|

32

|

|

Balance, end of year

|

48,634

|

38,605

|

38,516

|

|

Retained earnings

|

|||

|

Balance, beginning of year

|

33,383

|

33,552

|

30,512

|

|

Net income (loss)

|

(3,989)

|

929

|

6,006

|

|

Dividends paid

|

(119)

|

(1,098)

|

(2,966)

|

|

Balance, end of year

|

29,275

|

33,383

|

33,552

|

|

Treasury stock

|

|||

|

Balance, beginning of year

|

(4)

|

(4)

|

(4)

|

|

Treasury stock issued

|

3

|

-

|

-

|

|

Balance, end of year

|

(1)

|

(4)

|

(4)

|

|

Accumulated other comprehensive income, net

|

|||

|

Balance, beginning of year

|

1,108

|

2,934

|

1,561

|

|

Change in unrealized gains/losses on securities

|

|||

|

available for sale, net of reclassification adjustment

|

(127)

|

(531)

|

842

|

|

Change in fair value and gains on termination of

|

|||

|

derivative instruments, net of tax

|

(287)

|

(1,295)

|

531

|

|

Balance, end of year

|

694

|

1,108

|

2,934

|

|

Total shareholders' equity

|

$ 85,803

|

$ 79,026

|

$ 80,932

|

The accompanying notes are an integral part of these consolidated financial statements.

See Note 1 for other comprehensive income disclosures.

F-5

The Savannah Bancorp, Inc. – 2010 Annual Report

The Savannah Bancorp, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

|

For the Years Ended December 31,

|

|||

|

($ in thousands)

|

2010

|

2009

|

2008

|

|

Operating activities

|

|||

|

Net income (loss)

|

$ (3,989)

|

$ 929

|

$ 6,006

|

|

Adjustments to reconcile net income (loss) to cash

|

|||

|

provided by operating activities:

|

|||

|

Provision for loan losses

|

21,020

|

13,065

|

6,000

|

|

Loans originated for sale

|

-

|

-

|

(10,255)

|

|

Proceeds from sale of loans originated for sale

|

-

|

291

|

10,202

|

|

Net amortization (accretion) of securities

|

1,922

|

432

|

(95)

|

|

Depreciation and amortization

|

1,454

|

1,513

|

1,383

|

|

Accretion of gain on termination of derivatives

|

(453)

|

(1,962)

|

(2,670)

|

|

Proceeds from termination of derivatives

|

-

|

1,299

|

3,225

|

|

Non cash stock-based compensation expense

|

79

|

144

|

221

|

|

(Increase) decrease in deferred income taxes, net

|

(1,759)

|

(1,748)

|

621

|

|

Gain on sale of loans and securities, net

|

(608)

|

(2,119)

|

(221)

|

|

Loss on sale and write-downs of foreclosed assets

|

2,472

|

2,566

|

228

|

|

Equity in net loss (income) of nonconsolidated subsidiary

|

50

|

(43)

|

(94)

|

|

Gain on sale of partnership interest

|

(255)

|

-

|

-

|

|

Increase in CSV of bank-owned life insurance policies

|

(183)

|

(218)

|

(231)

|

|

Decrease (increase) in prepaid FDIC deposit insurance assessment

|

1,545

|

(5,037)

|

-

|

|

(Increase) decrease in income taxes receivable/payable

|

(3,758)

|

1,068

|

59

|

|

Change in other assets and other liabilities, net

|

(1,965)

|

(673)

|

1,150

|

|

Net cash provided by operating activities

|

15,572

|

9,507

|

15,529

|

|

Investing activities

|

|||

|

Activity in available for sale securities

|

|||

|

Purchases

|

(100,897)

|

(88,741)

|

(44,616)

|

|

Sales

|

52,483

|

62,076

|

5,248

|

|

Maturities, calls and paydowns

|

22,547

|

21,203

|

20,420

|

|

Loan originations and principal collections, net

|

22,644

|

(35,442)

|

(71,955)

|

|

Proceeds from sale of foreclosed assets

|

9,120

|

5,048

|

3,852

|

|

Disposition of premises and equipment

|

-

|

305

|

-

|

|

Proceeds from life insurance and sale of partnership interest

|

1,002

|

-

|

-

|

|

Distribution from nonconsolidated subsidiary

|

-

|

-

|

350

|

|

Additions to premises and equipment

|

(765)

|

(6,141)

|

(5,516)

|

|

Net cash received from FDIC-assisted transaction

|

190,253

|

-

|

-

|

|

Net cash provided by (used in) investing activities

|

196,387

|

(41,692)

|

(92,217)

|

|

Financing activities

|

|||

|

Net increase (decrease) in noninterest-bearing deposits

|

4,837

|

(166)

|

(5,780)

|

|

Net (decrease) increase in interest-bearing deposits

|

(166,516)

|

52,720

|

73,577

|

|

Net (decrease) increase in short-term borrowings

|

(8,478)

|

(10,083)

|

13,037

|

|

Net (decrease) increase in other borrowings

|

(5,452)

|

3,837

|

12,151

|

|

Net decrease in FHLB advances

|

(29,006)

|

(505)

|

(20,804)

|

|

Payment on note payable

|

(74)

|

(86)

|

(1,840)

|

|

Dividends paid

|

(119)

|

(1,098)

|

(2,966)

|

|

Issuance of common stock, treasury stock and exercise of options

|

11,250

|

-

|

110

|

|

Net cash (used in) provided by financing activities

|

(193,558)

|

44,619

|

67,485

|

|

Increase (decrease) in cash and cash equivalents

|

18,401

|

12,434

|

(9,203)

|

|

Cash and cash equivalents, beginning of year

|

40,535

|

28,101

|

37,304

|

|

Cash and cash equivalents, end of year

|

$ 58,936

|

$ 40,535

|

$ 28,101

|

|

Supplemental disclosures of cash flow information

|

|||

|

Cash paid during the year for:

|

|||

|

Interest on deposits and other borrowings

|

$ 14,881

|

$ 18,826

|

$ 25,920

|

|

Income taxes

|

-

|

550

|

2,595

|

|

Non cash investing activity:

|

|||

|

Transfer to other real estate owned from loans

|

(16,462)

|

(7,843)

|

(10,068)

|

The accompanying notes are an integral part of these consolidated financial statements.

F - 6

The Savannah Bancorp, Inc. – 2010 Annual Report

Notes to Consolidated Financial Statements

________________________________________________________________________________________________________________

Note 1 - Organization and Summary of Significant Accounting Policies

Principles of Consolidation - The consolidated financial statements include the accounts of The Savannah Bancorp, Inc. (“the Company”) and its wholly-owned subsidiaries, The Savannah Bank, N.A. (“Savannah”), Bryan Bank & Trust (“Bryan”), and Minis & Co., Inc. (“Minis”), a registered investment advisory firm. The Company formed a new subsidiary, SAVB Holdings, LLC (“SAVB Holdings”), in the third quarter 2008 for the purpose of holding problems loans and other real estate. The two bank subsidiaries, together, are referred to as the “Subsidiary Banks”. All significant intercompany balances and transactions have been eliminated in consolidation. Certain prior year balances have been reclassified to conform to the current year presentation.

Nature of Operations - The Company is a bank holding company headquartered in Savannah, Georgia that owns two banks and a registered investment advisory firm. The Company has eleven banking offices and thirteen ATMs in Savannah, Garden City, Skidaway Island, Whitemarsh Island, Tybee Island, Pooler, and Richmond Hill, Georgia and Hilton Head Island and Bluffton, South Carolina. The Company also has mortgage lending offices in Savannah, Richmond Hill and Hilton Head Island and an investment management office in Savannah. Through the subsidiaries, the Company offers a full range of lending, deposit, residential mortgage origination, fiduciary, trust and investment advisory products. The primary service areas of the Company are Chatham County and Bryan County, Georgia and southern Beaufort County in South Carolina. In 2005, the Company formed a nonconsolidated subsidiary, SAVB Properties, LLC, which purchased a 50 percent interest in two real estate partnerships that own the Company’s headquarters building and the adjacent parking lot. This investment is accounted for using the equity method of accounting. The Company’s sold its interest in the parking lot in 2010.

Use of Estimates - In preparing consolidated financial statements in conformity with generally accepted accounting principles (“GAAP”) in the United States, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the balance sheet and reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Material estimates that are particularly susceptible to significant change in the near term relate to the determination of the allowance for loan losses, the valuation of other real estate owned, fair value of financial instruments, other-than-temporary impairment analysis and the evaluation of the realization of deferred tax assets.

Cash and Cash Equivalents - For purposes of the consolidated statements of cash flows, cash and cash equivalents include cash and balances due from banks, federal funds sold and interest-bearing deposits in banks, all of which mature within ninety days.

Securities Available for Sale - Management has classified the entire investment securities portfolio as available for sale. Securities available for sale are carried at estimated fair value with unrealized gains and losses, net of deferred income taxes, recorded as a separate component of shareholders' equity. Purchase premiums and discounts are recognized in interest income using the interest method over the life of the securities. Gains and losses on the sale of securities are recorded on the trade date and are determined using the specific identification method.

A decline in the fair value of any available for sale security below cost, that is deemed other-than-temporary, results in a charge to earnings for the excess of cost over fair value which is attributed to credit quality. A new cost basis for the security is established upon recognition of other-than-temporary impairment.

Loans and Loan Fees - The Subsidiary Banks underwrite mortgage, commercial and consumer loans to customers. A substantial portion of the loan portfolio consists of real estate secured loans throughout the coastal Georgia and South Carolina areas. Loans that management has the intent and ability to hold for the foreseeable future or until maturity or pay-off are generally reported at their outstanding unpaid principal balances adjusted for charge-offs, the allowance for loan losses, and any deferred fees or origination costs. Interest income is accrued on the unpaid principal balance. Loan origination fees, net of certain direct origination costs, are deferred and recognized as an adjustment of the related loan yield on a straight-line basis, which approximates the interest method.

The accrual of interest on mortgage and commercial loans is discontinued at the time the loan is 90 days past due unless the credit is well-secured and in process of collection. Revolving credit loans and other personal loans are typically charged-off when payments are 120 days past due. Past due status is based on the contractual terms of the

F-7

The Savannah Bancorp, Inc. – 2010 Annual Report

Notes to Consolidated Financial Statements

________________________________________________________________________________________________________________

Note 1 - Organization and Summary of Significant Accounting Policies (continued)

loan. Loans are placed on nonaccrual status or charged-off at an earlier date if collection of principal or interest in full becomes doubtful. All interest accrued in the current year but not collected for loans that are placed on nonaccrual status or charged-off is reversed against interest income. The interest on these loans is accounted for on the cash-basis or cost-recovery method until qualifying for return to accrual. Loans are returned to accrual status when all the principal and interest amounts contractually due are brought current and future payments are reasonably assured.

A loan is considered impaired when, based on current information and events, it is probable that the Company will be unable to collect the scheduled payments of principal or interest when due according to the contractual terms of the loan agreement. Factors considered by management in determining impairment include payment status, collateral value, and the probability of collecting scheduled principal and interest payments when due. Loans that experience insignificant payment delays and payment shortfalls generally are not classified as impaired. Management determines the significance of payment delays and payment shortfalls on a case-by-case basis, taking into consideration all of the circumstances surrounding the loan and the borrower, including the length of the delay, the reasons for the delay, the borrower’s prior payment record, and the amount of the shortfall in relation to the principal and interest owed. Impairment is measured on a loan by loan basis by either the present value of expected future cash flows discounted at the loan’s effective interest rate, the loan’s obtainable market price, or the fair value of the collateral if the loan is collateral dependent. Management charges down the loan or establishes a valuation allowance when management determines the value is less than the carrying amount.

Allowance for Loan Losses - The allowance for loan losses is established through a provision for loan losses charged to earnings resulting from measurements of inherent credit risk in the loan portfolio and estimates of probable losses or impairments of individual loans. The adequacy of the allowance is based on management's continuing evaluation of the loan portfolio considering current economic conditions, underlying collateral value securing loans and other relevant qualitative and quantitative factors that deserve recognition in estimating loan losses. Actual future losses may be different from estimates due to unforeseen events. Loans that are determined to be uncollectible are charged-off against the allowance and subsequent recoveries, if any, are credited to the allowance.

The adequacy of the allowance for loan losses is evaluated on a regular basis by management and reported to and approved by the Audit Committee of the Board of Directors (“Board”) quarterly. The evaluation is based upon management’s periodic review of the collectability of specific loans, adverse situations that may affect specific borrowers’ ability to repay, the estimated value of any underlying collateral, the composition and size of the loan portfolio, emerging credit trends, regulatory guidance and prevailing economic conditions. In addition, on a regular basis, management and the Board review loan ratios. These ratios include the allowance for loan losses as a percentage of total loans, net charge-offs as a percentage of average loans, nonperforming loans as a percentage of total loans and the allowance coverage on nonperforming loans. Also, management reviews past due ratios by officer, Subsidiary Bank and the Company as a whole. This evaluation is inherently subjective as it requires estimates that are susceptible to significant revision as more information becomes available.

The Company has a number of documented loan policies and procedures that set forth the approval and monitoring process of the lending function. Adherence to these policies and procedures is monitored by management and the Board. A number of committees and an underwriting staff oversee the lending operations of the Company. These include the Board Loan Committee and Problem Asset Committee. Credit administration personnel monitor and, if necessary, adjust the grades assigned to loans through periodic examination. In addition, the Company contracts with an independent third party for loan review which reports to the Audit Committee of the Board.

In compliance with loan policy, the lending staff is given lending limits based on their knowledge and experience. Loan quality or “risk-rating” grades are assigned to each loan based upon certain factors. This information is used to assist management in monitoring the credit quality of the portfolio. Loan requests of amounts greater than an officer’s lending limits are reviewed by senior credit officers, in-house loan committees or the Board.

F - 8

The Savannah Bancorp, Inc. – 2010 Annual Report

Notes to Consolidated Financial Statements

________________________________________________________________________________________________________________

Note 1 - Organization and Summary of Significant Accounting Policies (continued)

Credit quality, adherence to policies and loss mitigation are major concerns of credit administration. Credit administration reviews and approves third-party appraisals obtained by the Company on real estate collateral and monitors loan maturities to ensure updated appraisals are obtained.

Our allowance for loan losses consists of two components, a general reserve and a specific reserve. For the general component, risk-rating grades are assigned by lending or credit administration, based on an analysis of the financial and collateral strength and other credit attributes underlying each loan. Loan grades range from 1 to 8, with 1 being loans with the least credit risk. Allowance factors established by management are applied to the total balance of loans in each grade to determine the amount needed in the allowance for loan losses. The allowance factors are established based on historical loss ratios experienced by the Company for these loan types, as well as the credit quality criteria underlying each grade, adjusted for trends and expectations about losses inherent in our existing portfolios. In making these adjustments to the allowance factors, management takes into consideration factors which it believes are causing, or are likely in the future to cause, losses within our loan portfolio but which may not be fully reflected in our historical loss ratios. Allowance factors established by management are then multiplied by loan balances for each grade or homogeneous portfolio of loans to determine the amount needed in the allowance for loan losses. The specific component relates to loans that are deemed to be impaired. Impairment is measured on a loan-by-loan basis for loans above a minimum dollar amount. For such loans that are classified as impaired, an allowance is established or the loan is charged-down when the discounted cash flows (or value of related collateral or observable market price) of the impaired loan is lower than the carrying value of that loan. Large groups of smaller balance homogeneous loans are evaluated collectively for impairment.

Premises and Equipment - Buildings, furniture, banking equipment and leasehold improvements are stated at cost less accumulated depreciation and amortization. Depreciation and amortization of these assets are computed using the straight-line method over the estimated useful lives or estimated lease terms including expected lease renewals, ranging from three to fifty years, of the respective assets for financial reporting purposes and accelerated methods for income tax purposes. Additions and major improvements are capitalized, while routine maintenance and repairs and gain or loss on dispositions are recognized currently.

Other Real Estate Owned - Assets acquired through loan foreclosure are held for sale and are initially recorded at fair value less estimated disposal costs at the date of foreclosure, establishing a new cost basis. Subsequent to foreclosure, valuations are periodically performed by management and the assets are carried at the lower of carrying amount or fair value less estimated disposal costs. Valuation allowances are established or the asset is written-down when subsequent valuations are less than current carrying amounts. Expenses from operations, changes in the valuation allowance, write-downs and net expenses from holding these assets are included in noninterest expense.

Bank-Owned Life Insurance - Bank-owned life insurance policies are recorded at the net realizable value of the underlying insurance contracts. The change in contract value during the year represents the contract earnings during the period less the mortality costs and administrative costs of the underlying life insurance contracts. The increase in cash surrender value from bank-owned life insurance contracts is included as a component of other operating income and the mortality costs and administrative fees are recorded as noninterest expense.

Intangible Assets - Intangible assets include goodwill and other identifiable assets, such as customer lists and deposits. Customer list and deposit premium intangibles are amortized on a straight-line basis over estimated useful lives of ten and five years, respectively, and evaluated for impairment whenever events or changes in circumstances indicate the carrying amount of the assets may not be recoverable. Goodwill is not amortized but tested annually for impairment or at any time an event occurs or circumstances change that may trigger a decline in the value of the reporting unit. Examples of such events or circumstances include an adverse change in operations, legal factors, business climate, unanticipated competition, change in regulatory environment, or loss of key personnel. The goodwill and customer list intangible assets were evaluated for impairment as of August 31, 2010 and based on that evaluation it was determined that there was no impairment.

F-9

The Savannah Bancorp, Inc. – 2010 Annual Report

Notes to Consolidated Financial Statements

________________________________________________________________________________________________________________

Note 1 - Organization and Summary of Significant Accounting Policies (continued)

Income Taxes - The income tax accounting guidance results in two components of income tax expense: current and deferred. Current income tax expense reflects taxes to be paid or refunded for the current period by applying the provisions of the enacted tax law to the taxable income or excess of deductions over revenues. The Company determines deferred income taxes using the liability (or balance sheet) method. Under this method, the net deferred tax asset or liability is based on the tax effects of the differences between the book and tax bases of assets and liabilities, and enacted changes in tax rates and laws are recognized in the period in which they occur.

Deferred income tax expense results from changes in deferred tax assets and liabilities between periods. Deferred tax assets are recognized if it is more likely than not, based on the technical merits, that the tax position will be realized or sustained upon examination. The term more likely than not means a likelihood of more than 50 percent; the terms examined and upon examination also include resolution of the related appeals or litigation processes, if any. A tax position that meets the more-likely-than-not recognition threshold is initially and subsequently measured as the largest amount of tax benefit that has a greater than 50 percent likelihood of being realized upon settlement with a taxing authority that has full knowledge of all relevant information. The determination of whether or not a tax position has met the more-likely-than-not recognition threshold considers the facts, circumstances, and information available at the reporting date and is subject to management’s judgment. Deferred tax assets may be reduced by deferred tax liabilities and a valuation allowance if, based on the weight of evidence available, it is more likely than not that some portion or all of a deferred tax asset will not be realized.

Earnings (Loss) Per Share - Basic earnings (loss) per share represent net income (loss) divided by the weighted average number of common shares outstanding during the period. Diluted earnings (loss) per share reflect additional common shares that would have been outstanding if dilutive potential common shares had been issued, as well as any adjustment to income that would result from the assumed issuance. Potential common shares that may be issued by the Company relate solely to outstanding stock options, and are determined using the treasury stock method. Earnings (loss) per common share have been computed based on the following:

|

(amounts in thousands)

|

|||

|

Years Ended December 31,

|

2010

|

2009

|

2008

|

|

Average number of common shares outstanding - basic

|

6,625

|

5,933

|

5,930

|

|

Effect of dilutive options

|

-

|

3

|

17

|

|

Average number of common shares outstanding - diluted

|

6,625

|

5,936

|

5,947

|

Stock option shares in the amount of 174,328, 194,814 and 192,022 for the years ended 2010, 2009 and 2008, respectively, were excluded from the diluted earnings per share calculation due to their anti-dilutive effect.

Derivative Instruments and Hedging Activities - Accounting principles provide the disclosure requirements for derivatives and hedging activities with the intent to provide users of financial statements with an enhanced understanding of: (a) how and why an entity uses derivative instruments, (b) how derivative instruments and related hedged items are accounted for, and (c) how derivative instruments and related hedged items affect an entity’s financial position, financial performance, and cash flows. Accounting principles require qualitative disclosures about objectives and strategies for using derivatives, quantitative disclosures about the fair value of and gains and losses on derivative instruments, and disclosures about credit-risk-related contingent features in derivative instruments.

As required by accounting principles, the Company records all derivatives on the balance sheet at fair value. The accounting for changes in the fair value of derivatives depends on the intended use of the derivative, whether the Company has elected to designate a derivative in a hedging relationship and apply hedge accounting and whether the hedging relationship has satisfied the criteria necessary to apply hedge accounting. Derivatives designated and qualifying as a hedge of the exposure to changes in the fair value of an asset, liability, or firm commitment attributable to a particular risk, such as interest rate risk, are considered fair value hedges. Derivatives designated and qualifying as a hedge of the exposure to variability in expected future cash flows, or other types of forecasted transactions, are considered cash flow hedges. Hedge accounting generally provides for the matching of the timing

F-10

The Savannah Bancorp, Inc. - 2010 Annual Report

Notes to Consolidated Financial Statements

________________________________________________________________________________________________________________

Note 1 - Organization and Summary of Significant Accounting Policies (continued)

of gain or loss recognition on the hedging instrument with the recognition of the changes in the fair value of the hedged asset or liability that are attributable to the hedged risk in a fair value hedge or the earnings effect of the hedged forecasted transactions in a cash flow hedge. The Company may enter into derivative contracts that are intended to economically hedge certain of its risk, even though hedge accounting does not apply or the Company elects not to apply hedge accounting.

Other Comprehensive Income (Loss) - Comprehensive income (loss) is the change in the Company’s equity during the period from transactions and other events and circumstances from non-owner sources.

|

($ in thousands)

|

2010

|

2009

|

2008

|

|

Net income (loss)

|

$ (3,989)

|

$ 929

|

$ 6,006

|

|

Change in unrealized gains/losses on securities

|

|||

|

available for sale, net of reclassification adjustment

|

(127)

|

(531)

|

842

|

|

Change in fair value and gains on termination of

|

|||

|

derivative instruments, net of tax

|

(287)

|

(1,295)

|

531

|

|

Other comprehensive income (loss)

|

$ (4,403)

|

$ (897)

|

$ 7,379

|

Accounting for Stock-Based Compensation - Accounting principles require that the compensation cost relating to share-based payment transactions be recognized in financial statements. That cost will be measured based on the grant date fair value of the equity or liability instruments issued. The stock compensation accounting guidance covers a wide range of share-based compensation arrangements including stock options, restricted share plans, performance-based awards, share appreciation rights, and employee share purchase plans.

The stock compensation accounting guidance requires that compensation cost for all stock awards be calculated and recognized over the employees’ service period, generally defined as the vesting period. For awards with graded-vesting, compensation cost is recognized on a straight-line basis over the requisite service period for the entire award. A Black-Scholes model is used to estimate the fair value of stock options, while the market price of the Company’s common stock at the date of grant is used for restricted stock awards and stock grants.

The 1995 Incentive Stock Option Plan (“1995 Plan”) authorized the Company to issue both incentive and non-qualified stock options to certain key officers for the purchase of shares at the fair market value of the stock at the date of grant. In 2000, the shareholders authorized additional option shares under the 1995 Plan. All authorized shares have been awarded from the 1995 Plan.

In 2005, shareholders approved the 2005 Omnibus Stock Ownership and Long-Term Incentive Plan (“2005 Omnibus Plan”) and authorized 250,000 option or restricted shares to be available for issuance. The total number of remaining options or awards available for issuance at December 31, 2010 under the 2005 Omnibus Plan was 147,249 shares of common stock. Options granted under both plans have a term of ten years and generally become fully vested over periods ranging from three to ten years. Performance based options granted to directors vest over three quarters from the date of grant.

The following table summarizes compensation costs related to the Company’s stock-based compensation plans for the years ended December 31:

|

($ in thousands)

|

2010

|

2009

|

2008

|

|

Salaries and employee benefits

|

$ 52

|

$ 94

|

$ 189

|

|

Directors' stock-based compensation

|

27

|

50

|

32

|

|

Pre-tax stock-based compensation expense

|

79

|

144

|

221

|

|

Income tax benefit

|

(30)

|

(55)

|

(84)

|

|

Total stock-based compensation expense, net of tax

|

$ 49

|

$ 89

|

$ 137

|

F - 11

The Savannah Bancorp, Inc. – 2010 Annual Report

Notes to Consolidated Financial Statements

________________________________________________________________________________________________________________

Note 1 - Organization and Summary of Significant Accounting Policies (continued)

During 2010, 2009 and 2008 no income tax benefits were realized on stock option exercises.

The Company recognizes stock-based compensation expense using the graded vesting attribution method. The remaining unrecognized compensation cost related to unvested incentive stock option and restricted share awards at December 31, 2010 is approximately $122,000. The weighted-average period of time over which this cost will be recognized is approximately 5.3 years. This amount does not include the cost of any additional options that may be granted in future periods nor any reduction in cost for potential forfeitures.

The fair value of each option grant is estimated on the date of grant using the Black-Scholes option pricing model with the following assumptions.

|

2010

|

2009

|

2008

|

|

|

Weighted average fair value of options granted

|

$ 3.41

|

$ 1.87

|

$ 4.29

|

|

Expected volatility

|

45%

|

39.1%

|

31.4%

|

|

Dividend yield

|

1.47%

|

2.67%

|

2.87%

|

|

Risk-free interest rate

|

2.43%

|

1.82%

|

2.48%

|

|

Expected life

|

6.0 years

|

6.0 years

|

6.0 years

|

Risks and Uncertainties - In the normal course of its business, the Company encounters two significant types of risk: economic and regulatory. There are three main components of economic risk: interest rate risk, credit risk and market risk. The Company is subject to interest rate risk to the degree that our interest-bearing liabilities mature or reprice at different speeds, or on different indexes, than our interest-earning assets. Credit risk is the risk of default on the loan portfolio that results from borrowers’ inability or unwillingness to make contractually required payments. Market risk reflects changes in the value of collateral underlying loans receivable and the valuation of other real estate owned, investment securities available for sale and mortgage servicing rights.

The Company is subject to the regulations of various government agencies. These regulations can and do change significantly from period to period. The Company also undergoes periodic examinations by the regulatory agencies, which may subject the Company to further changes with respect to asset valuations, amounts of required loss allowances and operating restrictions resulting from the regulators’ judgments on information available to them at the time of their examination.

Recent Accounting Pronouncements

In June 2009, the Financial Accounting Standards Board (“FASB”) amended its guidance on accounting for transfers of financial assets. The amended guidance eliminates the concept of qualifying special-purpose entities and requires that these entities be evaluated for consolidation under applicable accounting guidance, and it also removes the exception that permitted sale accounting for certain mortgage securitizations when control over the transferred assets had not been surrendered. Based on this new standard, many types of transferred financial assets that would previously have been derecognized will now remain on the transferor’s financial statements. The guidance also requires enhanced disclosures about transfers of financial assets and the transferor’s continuing involvement with those assets and related risk exposure. The new guidance was effective for the Company beginning in 2010. Adoption of this new guidance did not have a significant impact on the Company’s financial condition or results of operations.

Also in June 2009, the FASB issued amended guidance on accounting for variable interest entities (“VIE”). This guidance replaces the quantitative-based risks and rewards calculation for determining which enterprise might have a controlling financial interest in a VIE. The new, more qualitative evaluation focuses on who has the power to direct the significant economic activities of the VIE and also has the obligation to absorb losses or rights to receive benefits from the VIE. It also requires an ongoing reassessment of whether an enterprise is the primary beneficiary of a VIE and calls for certain expanded disclosures about an enterprise’s involvement with VIEs. The new guidance was effective for the Company’s 2010 fiscal year and did not have a significant impact on its financial condition or results of operations.

F - 12

The Savannah Bancorp, Inc. – 2010 Annual Report

Notes to Consolidated Financial Statements

________________________________________________________________________________________________________________

Note 1 - Organization and Summary of Significant Accounting Policies (continued)

In January 2010, the FASB issued amended guidance on the disclosure of fair value measurements that added new disclosures and clarified certain existing disclosure requirements. The amended guidance requires disclosure of the amount of and the reason for any significant transfers between Level 1 and Level 2 of the fair value hierarchy as well as the policy for determining when transfers between levels are recognized. The guidance also requires a more detailed breakdown of the information presented in the reconciliation of the beginning and ending balance of Level 3 fair value measurements, including separate information on purchases, sales, issuances, settlements and transfers in or out. The FASB clarified the requirement to disclose valuation techniques and inputs for recurring and nonrecurring fair value measurements as well the guidance on how assets and liabilities should be disaggregated for the fair value measurement disclosures. Most of this amended guidance is effective for the Company beginning in 2010, except the more detailed reconciliation of Level 3 measurements which is effective for 2011. The adoption of this new guidance is not expected to have a material effect on the Company’s consolidated financial position or results of operations.

In February 2010, the FASB amended its guidance to certain recognition and disclosure requirements. The amended guidance requires Securities and Exchange Commission (“SEC”) filers to evaluate subsequent events through the date the financial statements are issued and removes the requirement for SEC filers to disclose the date through which subsequent events have been evaluated. The FASB believes these amendments alleviate potential conflicts with the SEC’s requirements. The amended guidance was effective upon issuance for the Company. The adoption of this amended guidance did not have a material effect on the Company’s consolidated financial position or results of operations.

In July 2010, the FASB issued guidance on the disclosures about the credit quality of financing receivables and the allowance for loan losses. The guidance requires additional disclosure to facilitate financial statement users’ evaluation of the following: (1) the nature of credit risk inherent in the entity’s loan portfolio, (2) how that risk is analyzed and assessed in arriving at the allowance for loan losses, and (3) the changes and reasons for those changes in the allowance for loan losses. For public companies, increased disclosures as of the end of a reporting period are effective for periods ending on or after December 15, 2010. Increased disclosures about activity that occurs during a reporting period are effective for interim and annual reporting periods beginning on or after December 15, 2010. The adoption of this guidance resulted in the inclusion of additional disclosures in the Company’s consolidated financial statements.

In January 2011, the FASB issued guidance deferring the effective date of disclosures about troubled debt restructurings for public entities. The delay is intended to allow the FASB time to complete its deliberations on what constitutes a troubled debt restructuring. The effective date of the new disclosures about troubled debt restructurings for public entities and the guidance for determining what constitutes a troubled debt restructuring will then be coordinated. Currently, that guidance is anticipated to be effective for interim and annual periods ending after June 15, 2011. The adoption of this guidance is not expected to have a material impact on the Company’s consolidated financial position or results of operations.

The FASB issued guidance on when to perform step 2 of the goodwill impairment test for reporting units with zero or negative carrying amounts. The guidance modifies Step 1 of the goodwill impairment test for reporting units with zero or negative carrying amounts. For those reporting units, an entity is required to perform Step 2 of the goodwill impairment test if it is more likely than not that a goodwill impairment exists. In determining whether it is more likely than not that a goodwill impairment exists, an entity should consider whether there are any adverse qualitative factors indicating that an impairment may exist such as if an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying amount. The guidance will be effective for the Company on January 1, 2011 and is not expected have a material impact on the Company’s financial statements.

F - 13

The Savannah Bancorp, Inc. – 2010 Annual Report

Notes to Consolidated Financial Statements

________________________________________________________________________________________________________________

Note 2 - Acquisitions

On June 25, 2010, Savannah entered into an agreement with the FDIC to purchase substantially all deposits and certain liabilities and assets of First National Bank, Savannah (“First National”). Savannah acquired approximately $42 million in assets and assumed $216 million in liabilities, including $201 million in customer deposits. The assets primarily include cash and due from accounts and investment securities. Savannah acquired the local, non-brokered deposits of approximately $105 million at a premium of 0.11 percent, or approximately $116,000. In connection with the closing, Savannah received a cash payment from the FDIC totaling $174 million, based on the differential between liabilities assumed and assets acquired, taking into account the deposit premium.

The following table summarizes the estimated fair values of the assets acquired and liabilities assumed at the date of the acquisition.

|

($ in thousands)

|

June 25, 2010

|

|

Assets acquired

|

|

|

Cash and due from banks

|

$ 7,330

|

|

Interest-bearing deposits in banks

|

8,851

|

|

Securities available for sale

|

25,937

|

|

Loans

|

131

|

|

Premises and equipment

|

11

|

|

Deposit premium intangible

|

387

|

|

Other assets

|

128

|

|

Total assets acquired

|

42,775

|

|

Liabilities assumed

|

|

|

Deposits

|

200,843

|

|

Federal Home Loan Bank advances

|

15,271

|

|

Due to the FDIC

|

266

|

|

Accrued interest and other liabilities

|

432

|

|

Total liabilities assumed

|

216,812

|

|

Net liabilities assumed

|

$ (174,037)

|

The only loans assumed by Savannah were deposit-secured loans which are not subject to FDIC loss-share. In its assumption of the deposit liabilities, the Company believes that the customer relationships associated with the local deposits have intangible value. In addition, the Company determined that the recorded amount of the deposits approximates fair value primarily due to the fact that the Company can re-price all customer deposits to current market rates.

Note 3 - Restrictions on Cash and Demand Balances Due from Banks and Interest-Bearing Bank Balances

The Subsidiary Banks are required by the Federal Reserve Bank (“FRB”) to maintain minimum cash reserves based upon reserve requirements calculated on their deposit balances. Cash reserves of $581,000 and $339,000 are required as of December 31, 2010 and 2009, respectively. At times, the Company pledges interest-bearing cash balances at the Federal Home Loan Bank of Atlanta (“FHLB”) in addition to investment securities to secure public fund deposits and securities sold under repurchase agreements. The Company did not have any cash pledged at the FHLB at December 31, 2010. Pledged cash balances were $11,500,000 at December 31, 2009.

F - 14

The Savannah Bancorp, Inc. – 2010 Annual Report

Notes to Consolidated Financial Statements

________________________________________________________________________________________________________________

Note 4 - Securities Available for Sale

The aggregate amortized cost and fair value of securities available for sale as of December 31, 2010 and 2009 are as follows:

| 2010 | ||||

|

($ in thousands)

|

Amortized

|

Unrealized

|

Unrealized

|

Fair

|

|

Cost

|

Gains

|

Losses

|

Value

|

|

|

Investment securities:

|

||||

|

U.S. government-sponsored enterprises (“GSE”)

|

$ 1,821

|

$ 4

|

$ -

|

$ 1,825

|

|

Mortgage-backed securities - GSE

|

120,998

|

1,628

|

(435)

|

122,191

|

|

State and municipal securities

|

10,285

|

76

|

(154)

|

10,207

|

|

Restricted equity securities

|

3,876

|

-

|

-

|

3,876

|

|

Total investment securities

|

$ 136,980

|

$ 1,708

|

$ (589)

|

$ 138,099

|

| 2009 | ||||

|

($ in thousands)

|

Amortized

|

Unrealized

|

Unrealized

|

Fair

|

|

Cost

|

Gains

|

Losses

|

Value

|

|

|

Investment securities:

|

||||

|

U.S. government-sponsored enterprises

|

$ 1,727

|

$ 136

|

$ -

|

$ 1,863

|

|

Mortgage-backed securities - GSE

|

73,203

|

1,205

|

(120)

|

74,288

|

|

State and municipal securities

|

7,906

|

108

|

(6)

|

8,008

|

|

Restricted equity securities

|

3,760

|

-

|

-

|

3,760

|

|

Total investment securities

|

$ 86,596

|

$ 1,449

|

$ (126)

|

$ 87,919

|

The distribution of securities by contractual maturity at December 31, 2010 is shown below. Actual maturities may differ from contractual maturities because issuers may have the right to call or prepay obligations with or without call or prepayment penalties.

|

($ in thousands)

|

Amortized

Cost

|

Fair Value

|

|

Securities available for sale:

|

||

|

Due in one year or less

|

$ 100

|

$ 102

|

|

Due after one year through five years

|

2,331

|

2,357

|

|

Due after five years through ten years

|

3,625

|

3,548

|

|

Due after ten years

|

6,050

|

6,025

|

|

Mortgage-backed securities - GSE

|

120,998

|

122,191

|

|

Restricted equity securities

|

3,876

|

3,876

|

|

Total investment securities

|

$ 136,980

|

$ 138,099

|

At December 31, 2010 and 2009, investment securities with a carrying value of $61,728,000 and $60,260,000, respectively, are pledged as collateral to secure public funds, securities sold under repurchase agreements and FHLB borrowings.

Gains and losses on sales of securities available for sale consist of the following for the years ended December 31:

|

($ in thousands)

|

2010

|

2009

|

2008

|

|

Gross gains

|

$ 684

|

$ 2,170

|

$ 163

|

|

Gross losses

|

(76)

|

(51)

|

-

|

|

Net realized gains

|

$ 608

|

$ 2,119

|

$ 163

|

F - 15

The Savannah Bancorp, Inc. – 2010 Annual Report

Notes to Consolidated Financial Statements

________________________________________________________________________________________________________________

Note 4 - Securities Available for Sale (continued)

The restricted equity securities consist of the following at December 31:

|

($ in thousands)

|

2010

|

2009

|

|

FHLB stock

|

$ 3,054

|

$ 3,205

|

|

FRB stock

|

822

|

555

|

|

Total

|

$ 3,876

|

$ 3,760

|

The following table shows the gross unrealized losses and fair value of the Company’s investments with unrealized losses that are not deemed to be other-than-temporarily impaired, aggregated by investment category and length of time that individual securities have been in a continuous unrealized loss position at December 31, 2010. At December 31, 2009, the unrealized loss was not material to the financial statements. Available for sale securities that have been in a continuous unrealized loss position are as follows:

|

Less Than 12 Months

|

12 Months or More

|

Total

|

||||

|

Fair

|

Unrealized

|

Fair

|

Unrealized

|

Fair

|

Unrealized

|

|

|

($ in thousands)

|

Value

|

Losses

|

Value

|

Losses

|

Value

|

Losses

|

|

Mortgage-backed securities - GSE

|

$ 37,606

|

$ (435)

|

$ -

|

$ -

|

$ 37,606

|

$ (435)

|

|

State and municipal securities

|

3,853

|

(154)

|

-

|

-

|

3,853

|

(154)

|

|

Total temporarily impaired securities

|

$ 41,459

|

$ (589)

|

$ -

|

$ -

|

$ 41,459

|

$ (589)

|

The unrealized losses on the Company’s investment in GSE mortgage-backed securities were caused by interest rate increases. The Company purchased those investments at a premium relative to their face amount, and the contractual cash flows of those investments are guaranteed by an agency of the U.S. Government. Accordingly, it is expected that the securities would not be settled at a price less than the amortized cost bases of the Company’s investments. The Company also has municipal securities with unrealized losses caused by interest rate increases. Management has reviewed these bonds and all are rated AAA or Aa1. Because the decline in market value is attributable to changes in interest rates and not credit quality, and because the Company does not intend to sell the investments and it is not more likely than not that the Company will be required to sell the investments before recovery of their amortized cost bases, which may be maturity, the Company does not consider those investments to be other-than-temporarily impaired at December 31, 2010.

Note 5 - Loans

The composition of the loan portfolio at December 31, 2010 and 2009 is presented below:

|

($ in thousands)

|

Percent

|

Percent

|

||

|

2010

|

of Total

|

2009

|

of Total

|

|

|

Commercial real estate

|

||||

|

Construction and development

|

$ 20,819

|

2.5%

|

$ 61,476

|

7.0%

|

|

Owner-occupied

|

120,797

|

14.6

|

102,942

|

11.6

|

|

Non owner-occupied

|

231,641

|

28.0

|

233,767

|

26.5

|

|

Residential real estate - mortgage

|

363,390

|

44.0

|

381,350

|

43.1

|

|

Commercial

|

74,889

|

9.1

|

89,380

|

10.1

|

|

Installment and other consumer

|

15,026

|

1.8

|

14,971

|

1.7

|

|

Gross loans

|

826,562

|

100.0%

|

883,886

|

100.0%

|

|

Allowance for loan losses

|

(20,350)

|

(17,678)

|

||

|

Net loans

|

$ 806,212

|

$ 866,208

|

F - 16

The Savannah Bancorp, Inc. – 2010 Annual Report

Notes to Consolidated Financial Statements

________________________________________________________________________________________________________________

Note 5 - Loans (continued)

For purposes of the disclosures required pursuant to accounting standards, the loan portfolio was disaggregated into segments and then further disaggregated into classes for certain disclosures. A portfolio segment is defined as the level at which an entity develops and documents a systematic method for determining its allowance for loan losses. There are four loan portfolio segments that include commercial real estate, residential real estate-mortgage, commercial and installment and other consumer. Commercial real estate has three classes including construction and development, owner-occupied and non owner-occupied. The construction and development class includes residential and commercial construction and development loans. Land and lot development loans are included in the non owner-occupied commercial real estate class or residential real estate segment depending on the property type.

Changes in the allowance for loan losses are summarized as follows:

|

($ in thousands)

|

2010

|

2009

|

2008

|

|

Balance, beginning of year

|

$ 17,678

|

$ 13,300

|

$ 12,864

|

|

Provision for loan losses

|

21,020

|

13,065

|

6,000

|

|

Charge-offs

|

(18,765)

|

(8,893)

|

(5,714)

|

|

Recoveries

|

417

|

206

|

150

|

|

Balance, end of year

|

$ 20,350

|

$ 17,678

|

$ 13,300

|

The following table details the change in the allowance for loan losses from December 31, 2009 to December 31, 2010 by loan segment:

|

($ in thousands)

|

Commercial Real Estate

|

Residential Real Estate

|

Commercial

|

Consumer

|

Unallocated

|

Total

|

|

Allowance for loan losses

|

||||||

|

Beginning balance

|

$ 5,740

|

$ 10,690

|

$ 977

|

$ 227

|

$ 44

|

$ 17,678

|

|

Charge-offs

|

(5,840)

|

(11,729)

|

(1,080)

|

(116)

|

-

|

(18,765)

|

|

Recoveries

|

20

|

352

|

17

|

28

|

-

|

417

|

|

Provision

|

4,802

|

14,269

|

1,614

|

379

|

(44)

|

21,020

|

|

Ending balance

|

$ 4,722

|

$ 13,582

|

$ 1,528

|

$ 518

|

$ -

|

$ 20,350

|

|

Ending balance: individually

evaluated for impairment

|

$ 285

|

$ 4,055

|

$ 540

|

$ 257

|

$ -

|

$ 5,137

|

|

Loans

|

||||||

|

Ending balance

|

$ 373,257

|

$ 363,390

|

$ 74,889

|

$ 15,026

|

$ -

|

$ 826,562

|

|

Ending balance: individually

evaluated for impairment

|

$ 3,865

|

$ 25,669

|

$ 596

|

$ 257

|

$ -

|

$ 30,387

|

A loan is considered impaired, in accordance with the impairment accounting guidance, when based on current information and events, it is probable that the Company will be unable to collect all amounts due from the borrower in accordance with the contractual term of the loan. Impaired loans include loans modified in troubled debt restructurings where concessions have been granted to borrowers experiencing financial difficulties. These concessions could include a reduction in the interest rate on the loan, payment extensions, forgiveness of principal, forbearance or other actions intended to maximize collection.

F - 17

The Savannah Bancorp, Inc. – 2010 Annual Report

Notes to Consolidated Financial Statements

________________________________________________________________________________________________________________

Note 5 - Loans (continued)

The following is a summary of information pertaining to impaired loans as of and for the year ended December 31, 2010:

|

($ in thousands)

|

Recorded

Investment

|

Unpaid Principal Balance

|

Related

Allowance

|

|

Impaired loans without a valuation allowance

|

|||

|

Commercial real estate

|

|||

|

Construction and development

|

$ 152

|

$ 177

|

$ -

|

|

Owner-occupied

|

1,075

|

1,374

|

-

|

|

Non owner-occupied

|