Attached files

| file | filename |

|---|---|

| EX-32.2 - Pinpoint Advance CORP | v216653_ex32-2.htm |

| EX-31.1 - Pinpoint Advance CORP | v216653_ex31-1.htm |

| EX-31.2 - Pinpoint Advance CORP | v216653_ex31-2.htm |

| EX-32.1 - Pinpoint Advance CORP | v216653_ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For The fiscal year ended December 31, 2010

or

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission file number: 000-52562

PINPOINT ADVANCE CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

|

33-1144642

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.) |

|

4 Maskit Street

|

|

|

Herzeliya, Israel

|

46700

|

|

(Address of principal executive offices)

|

(Zip Code)

|

972 9-9500245

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Title of each Class

Common Stock, $.0001 par value per share

Warrants to purchase shares of Common Stock

Units, each consisting of one share of Common Stock and one Warrant

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

||

|

Non-accelerated filer o

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes x No o.

The aggregate market value of the outstanding common stock, other than shares held by persons who may be deemed affiliates of the registrant, computed by reference to the closing sales price for the Registrant’s Common Stock on June 30, 2010, as reported on the OTC Bulletin Board, was approximately $0.

As of March 21, 2011, there were 3,484,402 shares of common stock, par value $.0001 per share, of the registrant outstanding.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

TABLE OF CONTENTS

|

PART I

|

||||

|

Item 1.

|

Business

|

2 | ||

|

Item 1A.

|

Risk Factors

|

5 | ||

|

Item 1B.

|

Unresolved Staff Comments

|

12 | ||

|

Item 2.

|

Properties

|

12 | ||

|

Item 3.

|

Legal Proceedings

|

12 | ||

|

Item 4.

|

(Removed and Reserved)

|

13 | ||

|

PART II

|

||||

|

Item 5.

|

Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

13 | ||

|

Item 6.

|

Selected Financial Data

|

14 | ||

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

14 | ||

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

18 | ||

|

Item 8.

|

Financial Statements and Supplementary Data

|

18 | ||

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

18 | ||

|

Item 9A.

|

Controls and Procedures

|

18 | ||

|

Item 9B.

|

Other Information

|

19 | ||

|

PART III

|

||||

|

Item 10.

|

Directors and Executive Officers and Corporate Governance

|

19 | ||

|

Item 11.

|

Executive Compensation

|

21 | ||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

22 | ||

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

23 | ||

|

Item 14.

|

Principal Accounting Fees and Services

|

24 | ||

|

PART IV

|

||||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

25 | ||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (“Annual Report”) includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements can be identified by the use of forward-looking terminology, including the words “believes,” “estimates,” “anticipates,” “expects,” “intends,” “plans,” “may,” “will,” “potential,” “projects,” “predicts,” “continue,” or “should,” or, in each case, their negative or other variations or comparable terminology. Such statements include, but are not limited to, any statements relating to our ability to consummate any acquisition or other business combination and any other statements that are not statements of current or historical facts. These statements are based on management’s current expectations, but actual results may differ materially due to various factors, including, but not limited to, our:

|

|

·

|

being a development stage company with no operating history;

|

|

|

·

|

dependence on key personnel, some of whom may join us following an initial transaction, if any;

|

|

|

·

|

personnel allocating their time to other businesses and potentially having conflicts of interest with our business;

|

|

|

·

|

potentially being unable to obtain financing to complete an initial transaction, if any;

|

|

|

·

|

limited pool of prospective target businesses;

|

|

|

·

|

potential change in control if we acquire one or more target businesses for stock;

|

|

|

·

|

delisting of our securities from the OTC Bulletin Board or our inability to have our securities quoted on the OTC Bulletin Board or any exchange following a business combination;

|

|

|

·

|

financial performance following an initial transaction, if any; or

|

|

|

·

|

those other risks and uncertainties detailed in the Registrant’s filings with the Securities and Exchange Commission.

|

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and developments in the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in this Annual Report on Form 10-K. In addition, even if our results of operations, financial condition and liquidity, and developments in the industry in which we operate are consistent with the forward-looking statements contained in this Annual Report on Form 10-K, those results or developments may not be indicative of results or developments in subsequent periods.

These forward-looking statements are subject to numerous risks, uncertainties and assumptions about us described in our filings with the Securities and Exchange Commission. The forward-looking events we discuss in this Annual Report on Form 10-K speak only as of the date of such statement and might not occur in light of these risks, uncertainties and assumptions. Except as required by applicable law, we undertake no obligation and disclaim any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

1

PART I

|

Item 1.

|

Business

|

Overview

Pinpoint Advance Corp. (the “Company”, “we”, or “us”) is a blank check company. We were organized under the laws of the State of Delaware on September 6, 2006. We were formed for the purpose of acquiring, merging with, engaging in a capital stock exchange with, purchasing all or substantially all of the assets of, or engaging in any other similar business combination with a business that has operations or facilities located in Israel or which is a company operating outside of Israel, specifically in Europe, which management believes would benefit from establishing operations or facilities in Israel, preferably in the technology sector (“Business Combination”). On May 18, 2009, our Second Amended and Restated Certificate of Incorporation became effective, to (i) effectuate the redemption of shares (“IPO Shares”) issued in the Company’s initial public offering (“IPO”) for cash from the trust account (“Trust Account”) in the amount per share of $9.91 (the “Redemption”), and in connection with the Redemption, distribute to holders of the IPO Shares one new share of common stock (“New Common Stock”) for every eight IPO Shares redeemed; (ii) create a new class of common stock called Class A Common Stock and exchange each share of common stock issued by the Company prior to its IPO (“Founder Shares”) for five shares of Class A Common Stock; and (iii) eliminate the blank check company restrictions by amending Article THIRD and deleting Article SIXTH in its entirety to allow for the continuation of our corporate existence.

On May 19, 2009, we (i) completed the distribution of cash from our Trust Account in the aggregate amount of $28,491,250 to holders of 2,875,000 IPO Shares, which IPO Shares were redeemed and then cancelled, and (ii) issued an aggregate of 359,402 shares of New Common Stock in connection with the Redemption. Holders of the New Common Stock currently own approximately 10% of the Company’s aggregate outstanding common equity. All units issued in the IPO were split into their respective common stock and warrants, with the common stock being redeemed as described above. The Company’s warrants remain outstanding in accordance with the terms of the Warrant Agreement, dated April 19, 2007 and expire on April 19, 2011. The warrant shares issuable upon exercise of the warrant were decreased in proportion to the decrease in the Company’s outstanding shares of capital stock and the exercise price was increased to $7.5336 per share.

On May 19, 2009, we issued an aggregate of 3,125,000 shares of Class A Common Stock in exchange for surrender and cancellation of 625,000 Founder Shares. The Class A Common Stock has the same rights, preferences and privileges as the New Common Stock. Holders of the New Common Stock and Class A Common Stock will vote together as one class on all matters (including the election of directors) submitted to a vote of the stockholders. Our management has operated the Company since its formation and has over 100 years of combined experience in operating public companies. Our management has agreed not to accept compensation until consummation of a business combination.

Business

All activity from inception (September 6, 2006) through May 19, 2009 was related to the Company’s formation and capital raising activities and seeking a suitable Business Combination. Following the approval of our stockholders to continue our existence at a meeting of stockholders held on May 15, 2009, our objective is to achieve long-term growth potential through one or more combinations with operating companies or businesses. We will not restrict our search for potential candidates to companies engaged in any specific business, industry or geographical location and, thus, may acquire any type of business. We also will continue to pursue certain claims of the Company against a third party, as described below.

Our executive offices are located at 4 Maskit Street, Herzeliya, Israel 46700 and our telephone number at that location is 972-9-9500245. We currently have a website at www.pinpointac.com and consequently we make available on the Internet materials that we file with or furnish to the Securities and Exchange Commission. We will still provide electronic or paper copies of such materials free of charge upon request.

2

On October 27, 2008, the Company announced it had executed a letter of intent to effectuate a Business Combination with a privately-held company with its headquarters in Israel (the “LOI”). All parties to the LOI negotiated the terms of a definitive agreement and in fact, a definitive agreement (the “Agreement”) was executed by all parties to the LOI. However, one of the parties (the “Objecting Party”) to the Agreement claimed it never released its signature thereto and has since indicated that it no longer wished to pursue the proposed business combination.

The Company believes a binding, definitive agreement was executed by all parties. However, because one of the parties had indicated its position that no binding agreement existed and that it did not wish to continue with negotiations, the Company determined to liquidate the Trust Account established by the Company for the benefit of its public stockholders, and return funds to the holders of shares of the Company’s common stock issued in the Offering, in accordance with its Offering prospectus and the terms of its amended and restated certificate of incorporation.

The Company’s Amended and Restated Certificate of Incorporation provided for mandatory liquidation of the Company in the event that the Company did not consummate a Business Combination within 18 months from the date of the consummation of its Offering, or 24 months from the consummation of the Offering if certain extension criteria had been satisfied. In October 2008 the Company announced its termination of a letter of intent for potential business combination plans as well as its plan to distribute the amount held in the Trust Fund to its stockholders and to adopt a plan for continued corporate existence.

At a special meeting held on May 15, 2009, a majority of the Company’s stockholders voted in favor of the proposal to remove the blank check company restrictions from the Company’s charter, thereby allowing the Company to continue its corporate existence. In accordance with stockholder approval of the Company’s proposals, on May 19, 2009 the Company effectuated the Redemption in the amount of $9.91 per share from the Trust Account, and distributed one share of New Common Stock for every eight IPO Shares redeemed, for an aggregate of 359,402 shares of New Common Stock. The stockholders also approved the creation of the Class A Stock and the exchange of each share of common stock owned by the Company’s founder for five shares of Class A Stock, for an aggregate of 3,125,000 shares of Class A Stock.

On December 8, 2009, the Company and others, filed a lawsuit against the Objecting Party, Elbit Systems Holdings Ltd. ("Elbit") and others, in the Petah Tikva District Court of Israel (“Court”), for damages in the amount of NIS 37.7 million (USD $10 million) (the "Lawsuit"). The Lawsuit is based on the following factual background:

|

a.

|

That following a period of extensive negotiations between inter alia, the Company and Elbit, a July 2008 Letter of Intent was signed, which contemplated inter alia, the Company purchase from Elbit of 31% of Kinetics, Ltd., i.e. 18,716 Ordinary Shares of Kinetics Ltd. (the "Kinetics Shares"), for a price of $26 million. Following said purchase, a merger between the Company and Kinetics was to be effectuated;

|

|

b.

|

That the Company, as a blank check company and in order to fulfill its duty to obtain timely stockholders' approval, was compelled to finalize a Business Combination by October 18, 2008;

|

|

c.

|

That based on the Letter of Intent, and a belief at the time of Elbit's good faith, the Company continued negotiating a definitive agreement with all parties involved in the transaction;

|

|

d.

|

That after lengthy negotiations, a definitive agreement was finalized and signed in early October 2008;

|

|

e.

|

That Elbit's signature on the definitive agreement was withheld based on Elbit's claim that it had "just received" information about a new order that would raise the forecast of Kinetics' profits in 2009; and

|

3

|

f.

|

That Elbeit’s remained a shareholder of Kinetics Shares after October 18, 2008.

|

The Lawsuit is in preliminary stages. The Lawsuit seeks reparation for damages caused to plaintiffs as a result of defendants' lack of good faith in negotiations, and requests that the Court hold that defendants materially breached the definitive agreement, that defendants are estopped from denying that the definitive agreement was finalized, and that defendants acted with fraud, and alternatively, with recklessness and without good faith (based inter alia, on representations made during negotiations). The Lawsuit also alleges that Elbit was unjustly enriched by its conduct, and that any enrichment as a result of Elbit's retention of the Kinetics Shares belongs to Pinpoint.

On February 22, 2010, the defendants filed a Statement of Defense. Pursuant to Court suggestion, the parties have submitted their dispute to non-binding mediation, before Professor Nily Cohen. The mediation is currently ongoing.

The Company continues to review new business opportunities for a potential business combination. The analysis of new business opportunities has and will be undertaken by or under the supervision of our officers and directors. We have unrestricted flexibility in seeking, analyzing and participating in potential business opportunities. In our efforts to analyze potential target companies or businesses, we will consider, among others, the following factors:

|

(i)

|

Potential for growth, indicated by new technology, anticipated market expansion or new products;

|

|

(ii)

|

Competitive position as compared to other firms of similar size and experience within the relevant industry segment as well as within the industry as a whole;

|

|

(iii)

|

Strength and diversity of management, either in place or scheduled for recruitment;

|

|

(iv)

|

Capital requirements and anticipated availability of required funds, to be provided by us or from operations, through the sale of additional securities, through joint ventures or similar arrangements or from other sources;

|

|

(v)

|

The cost of participation by us as compared to the perceived tangible and intangible values;

|

|

(vi)

|

The extent to which the business opportunities can be advanced;

|

|

(vii)

|

The accessibility of required management expertise, personnel, raw materials, services, professional assistance and other required items; and

|

|

(viii)

|

Other relevant factors that we identify.

|

In applying the foregoing criteria, no one of which will be controlling, management will attempt to analyze all factors and circumstances and make a determination based upon reasonable investigative measures and available data. Potentially available business opportunities may occur in many different industries, and at various stages of development, all of which will make the task of comparative investigation and analysis of such business opportunities extremely difficult and complex. Due to our limited capital we may not discover or adequately evaluate adverse facts about any opportunity evaluated or, ultimately, any transaction consummated.

Form of Acquisition

The manner in which we participate in an opportunity will depend upon the nature of the opportunity, our respective needs and desires and the promoters of the opportunity, and our relative negotiating strength and that of such promoters.

In the event the Company enters into a definitive agreement to acquire an operating company, the acquisition may not require stockholder approval, even if it constituted a change in control of the Company, provided the Company’s common stock is not then listed on a national exchange and the acquisition is structured so as not to require a stockholder vote under the Delaware code. Accordingly, stockholders may not be entitled to vote on any future acquisitions by the Company.

4

It is likely that we will acquire our participation in a business opportunity through the issuance of our common stock or other securities. Although the terms of any such transaction cannot be predicted, it should be noted that in certain circumstances the criteria for determining whether or not an acquisition is a so-called “tax free” reorganization under Section 368(a)(l) of the Internal Revenue Code of 1986, as amended (the “Code”), depends upon whether the owners of the acquired business own 80% or more of the voting stock of the surviving entity. If a transaction were structured to take advantage of these provisions rather than other “tax free” provisions provided under the Code, our then-existing stockholders would, in such circumstances retain 20% or less of the total issued and outstanding shares of the surviving entity. Under other circumstances, depending upon the relative negotiating strength of the parties, our then-existing stockholders may retain substantially less than 20% of the total issued and outstanding shares of the surviving entity. This will result in substantial additional dilution to the equity of our then-existing stockholders.

If we were to pursue a “tax-free” reorganization as described above, our then-existing stockholders would not have control of a majority of our voting shares following a reorganization transaction. As part of such a transaction, all or a majority of our directors may resign and new directors may be appointed without any vote by our stockholders.

In the case of an acquisition of stock or assets not involving a statutory merger or consolidation directly involving us, the transaction may be accomplished upon the sole determination of management without any vote or approval by our stockholders. In the case of a statutory merger or consolidation directly involving us, it will likely be necessary to call a stockholders’ meeting and obtain the approval of the holders of a majority of our outstanding shares. The necessity to obtain such stockholder approval may result in delay and additional expense in the consummation of any proposed transaction and will also give rise to certain appraisal rights to dissenting stockholders. Most likely, management will seek to structure any such transaction so that no stockholder approval is required.

It is anticipated that the investigation of specific business opportunities and the negotiation, drafting and execution of relevant agreements, disclosure documents and other instruments will require substantial management time and attention and substantial costs for third party professionals, accountants, attorneys and others. If a decision is made not to participate in a specific business opportunity, these costs theretofore incurred in the related investigation would not be recoverable. Furthermore, even if an agreement is reached for the participation in a specific business opportunity, the failure to consummate that transaction may result in our loss of the related costs incurred.

We presently have no employees apart from the officers named elsewhere herein. Our officers and directors are engaged in outside business activities and anticipate that they will devote very limited time to our business until a business opportunity has been identified. We expect no significant changes in the number of our employees other than such changes, if any, incident to a business combination.

|

Item 1A.

|

Risk Factors

|

Statements in this Annual Report that are not strictly historical in nature and are forward-looking statements. These statements may include, but are not limited to, statements about the timing of the commencement, enrollment, and completion of our clinical trials for our product candidates; the progress or success of our product development programs; the status of regulatory approvals for our product candidates; the timing of product launches; our ability to protect our intellectual property, if any and operate our business without infringing upon the intellectual property rights of others; and our estimates for future performance, anticipated operating losses, future revenues, capital requirements, and our needs for additional financing. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would,” “goal,” or other variations of these terms (including their use in the negative) or by discussions of strategies, plans or intentions. These statements are only predictions based on current information and expectations and involve a number of risks and uncertainties. The underlying information and expectations are likely to change over time.

5

Factors that could cause actual results to differ materially from what is expressed or forecasted in our forward-looking statements include, but are not limited to, the following:

Risks Associated With Our Business

Our business is difficult to evaluate because we have no operating history.

As we have no operating history or revenue and only minimal assets following the liquidation of our Trust Account, there is a risk that we will be unable to continue as a going concern and consummate a business combination. We have had no recent operating history nor any revenues or earnings from operations since inception. Following the distribution of the Trust Account, we have had no significant assets or financial resources. We will, in all likelihood, sustain operating expenses without corresponding revenues, at least until the consummation of a business combination. We cannot assure you that we can identify a suitable business opportunity and consummate a business combination and, therefore, our net operating losses may increase significantly. The report of our independent registered public accountants on our financial statements includes an explanatory paragraph stating that our ability to continue as a going concern is dependent on the consummation of the business combination or raising substantial additional funds.

Our business will have no revenues unless and until we execute a business combination with an operating company or business.

We are a development stage shell company and have had no revenues from operations. We may not realize any revenues unless and until we successfully execute a business combination with an operating company or business.

There is competition for those private companies suitable for a business combination of the type contemplated by management.

We are in a highly competitive market for a small number of business opportunities which could reduce the likelihood of consummating a successful business combination. We are and will continue to be an insignificant participant in the business of seeking business combinations with small private and public entities. A large number of established and well-financed entities, including small public companies and venture capital firms, are active in mergers and acquisitions of companies that may be desirable target candidates for us. Nearly all these entities have significantly greater financial resources, technical expertise and managerial capabilities than we do; consequently, we will be at a competitive disadvantage in identifying possible business opportunities and successfully completing a business combination. These competitive factors may reduce the likelihood of our identifying and consummating a successful business combination.

There are relatively low barriers to becoming a blank check company or shell company, thereby increasing the competitive market for a small number of business opportunities.

There are relatively low barriers to becoming a blank check company or shell company. A newly incorporated company with a single stockholder and sole officer and director may become a blank check company or shell company by voluntarily subjecting itself to the SEC reporting requirements by filing and seeking effectiveness of a Form 10 with the SEC, thereby registering its common stock pursuant to Section 12(g) of the Exchange Act. Assuming no comments to the Form 10 have been received from the SEC, the registration statement is automatically deemed effective 60 days after filing the Form 10 with the SEC. The relative ease and low cost with which a company can become a blank check or shell company can increase the already highly competitive market for a limited number of private businesses that seek to consummate a business combination with a public company.

6

Because a majority of our management's prior business experience has been limited to segments of the technology industry, they may lack the necessary experience to consummate an acquisition with a business in other segments or an alternative industry.

A significant portion of our management’s prior business experience has been limited to certain segments of the technology industry, notably software, telecommunication, media services, IT services, Internet and consumer products. If we locate an attractive business combination unrelated to these segments of the technology industry, our management may not have the necessary experience to adequately assess the merits or risks of the industries or segments in which the business operates.

We have no existing agreement for a business combination or other transaction.

We have no arrangement, agreement or understanding with respect to engaging in a business combination with a private or public entity. No assurances can be given that we will successfully identify and evaluate suitable business opportunities or that we will conclude a business combination. Management has not identified any particular industry or specific business within an industry for evaluation. We cannot guarantee that we will be able to negotiate a business combination on favorable terms, and there is consequently a risk that funds allocated to the purchase of our shares will not be invested in a company with active business operations.

The time and cost of preparing the target to prepare financial statements necessary to consummate a business combination with us may preclude us from entering into a business combination with the most attractive target companies.

Target companies that fail to comply with SEC reporting requirements may delay or preclude a business combination. Sections 13 and 15(d) of the Exchange Act require reporting companies to provide certain information about significant acquisitions, including certified financial statements for the acquired company, covering one, two, or three years, depending on the relative size of the acquisition. The time and additional costs that may be incurred by some target entities to prepare such statements may significantly delay or essentially preclude consummation of a business combination. Otherwise suitable prospects that do not have or are unable to obtain the required audited statements may be inappropriate for a business combination so long as the reporting requirements of the Exchange Act are applicable.

Any potential business combination with a foreign company may subject us to additional risks.

If we enter into a business combination with a foreign concern, we will be subject to risks inherent in business operations outside of the United States. These risks include, for example, currency fluctuations, regulatory problems, punitive tariffs, unstable local tax policies, trade embargoes, risks related to shipment of raw materials and finished goods across national borders and cultural and language differences. Foreign economies may differ favorably or unfavorably from the United States economy in growth of gross national product, rate of inflation, market development, rate of savings, and capital investment, resource self-sufficiency and balance of payments positions, and in other respects.

Our stockholders may be held liable for claims by third parties against us to the extent of distributions received by them.

Under the Delaware General Corporation Law, stockholders may be held liable for claims by third parties against a corporation to the extent of distributions received by them in the distribution of the Trust Account. If the corporation complies with certain procedures set forth in Section 280 of the Delaware General Corporation Law intended to ensure that it makes reasonable provision for all claims against it, including a 60-day notice period during which any third-party claims can be brought against the corporation, a 90-day period during which the corporation may reject any claims brought, and an additional 150-day waiting period before any liquidating distributions are made to stockholders, any liability of stockholders with respect to a liquidating distribution is limited to the lesser of such stockholder’s pro rata share of the claim or the amount distributed to the stockholder, and any liability of the stockholder would be barred after the third anniversary of the dissolution. We did not comply with those procedures in the liquidation and distribution of the Trust Account. Because we did not comply with Section 280, we obtained stockholder approval to comply with Section 281(b) of the Delaware General Corporation Law, requiring us to adopt a plan of dissolution that will provide for our payment, based on facts known to us at such time, of (i) all existing claims, (ii) all pending claims and (iii) all claims that may be potentially brought against us within the subsequent 10 years. Because we are a blank check company, the claims that could be made against us are significantly limited and the likelihood that any claim that would result in any liability extending to the trust is minimal. However, because we did not comply with Section 280, our public stockholders could potentially be liable for any claims to the extent of distributions received by them in the Trust Account liquidation and any such liability of our stockholders will likely extend beyond the third anniversary of such dissolution. Accordingly, we cannot assure you that third parties will not seek to recover from our public stockholders amounts owed to them by us.

7

We may choose to redeem our outstanding warrants at a time that is disadvantageous to our warrant holders.

Subject to there being a current prospectus under the Securities Act of 1933 with respect to the shares of common stock issuable upon exercise of the warrants, we may redeem the warrants issued as a part of our Units at any time after the warrants become exercisable in whole and not in part, at a price of $.01 per warrant, upon a minimum of 30 days’ prior written notice of redemption, if and only if, the last sales price of our common stock equals or exceeds $14.25 per share for any 20 trading days within a 30 trading day period ending three business days before we send the notice of redemption. Redemption of the warrants could force the warrant holders (i) to exercise the warrants and pay the exercise price thereafter at a time when it may be disadvantageous for the holders to do so, (ii) to sell the warrants at the then current market price when they might otherwise wish to hold the warrants, or (iii) to accept the nominal redemption price which, at the time the warrants are called for redemption, is likely to be substantially less than the market value of the warrants. The foregoing does not apply to the 1,500,000 insider warrants purchased by certain of our officers and directors prior to our IPO, as such warrants are not subject to redemption while held by the initial holder or any permitted transferee of such initial holder.

Although we are required to use our best efforts to have an effective registration statement covering the issuance of the shares underlying the warrants at the time that our warrant holders exercise their warrants, we cannot guarantee that a registration statement will be effective, in which case our warrant holders may not be able to exercise our warrants.

Holders of our warrants will be able to exercise the warrant only if (i) a current registration statement under the Securities Act of 1933 relating to the shares of our common stock underlying the warrants is then effective and (ii) such shares are qualified for sale or exempt from qualification under the applicable securities law of the states in which the various holders of warrants reside. Although we have undertaken in the warrant agreement, and therefore have a contractual obligation, to use our best efforts to maintain a current registration statement covering the shares underlying the warrants following completion of our IPO to the extent required by federal securities law, and we intend to comply with such undertaking, we cannot assure you that we will be able to do so. In addition, we have agreed to use our reasonable efforts to register the shares underlying the warrants under the blue sky laws of the states of residence of the exercising warrant holders, to the extent an exemption is not available. The value of the warrants may be greatly reduced if a registration statement covering the shares issuable upon the exercise of the warrants is not kept current or if the securities are not qualified, or exempt from qualification, in the states in which the holders of warrants reside. Holders of warrants who reside in jurisdictions in which the shares underlying the warrants are not qualified and in which there is no exemption will be unable to exercise their warrants and would either have to sell their warrants in the open market or allow them to expire unexercised. If and when the warrants become redeemable by us, we may exercise our redemption right even if we are unable to qualify the underlying securities for sale under all applicable state securities laws.

Because the warrants sold in the private placement were originally issued pursuant to an exemption from the registration requirements under the federal securities laws, holders of such warrants will be able to exercise their warrants even if, at the time of exercise, a prospectus relating to the common stock issuable upon exercise of such warrants is not current. As a result, the holders of the warrants purchased in the private placement will not have any restrictions with respect to the exercise of their warrants. As described above, the holders of the warrants purchased in our IPO will not be able to exercise them unless we have a current registration statement covering the shares issuable upon their exercise.

We may issue shares of our capital stock or debt securities to complete an acquisition, which would reduce the equity interest of our stockholders and likely cause a change in control of our ownership.

Our Second Amended and Restated Certificate of Incorporation authorizes the issuance of up to 15,000,000 shares of common stock, par value $.0001 per share, 5,000,000 shares of Class A Stock, par value $.0001 per share, and 1,000,000 shares of preferred stock, par value $.0001 per share. As of December 31, 2010, there were 14,640,598 authorized but unissued shares of our common stock available for issuance, 1,875,000 shares of Class A Stock and all of the 1,000,000 shares of preferred stock available for issuance. The issuance of additional shares of our common stock, Class A Stock or any number of shares of our preferred stock:

|

·

|

may significantly reduce the equity interest of our stockholders;

|

8

|

·

|

will likely cause a change in control if a substantial number of our shares of common stock are issued, which may affect, among other things, our ability to use our net operating loss carry forwards, if any, and most likely also result in the resignation or removal of our present officers and directors; and

|

|

·

|

may adversely affect prevailing market prices for our common stock.

|

Additionally, if we finance the purchase of assets or operations through the issuance of debt securities, it could result in:

|

·

|

default and foreclosure on our assets if our operating revenues after an acquisition were insufficient to pay our debt obligations;

|

|

·

|

acceleration of our obligations to repay the indebtedness even if we have made all principal and interest payments when due if the debt security contained covenants that required the maintenance of certain financial ratios or reserves and any such covenant were breached without a waiver or renegotiation of that covenant;

|

|

·

|

our immediate payment of all principal and accrued interest, if any, if the debt security was payable on demand; and

|

|

·

|

our inability to obtain additional financing, if necessary, if the debt security contained covenants restricting our ability to obtain additional financing while such security was outstanding.

|

We may have insufficient resources to cover our operating expenses and the expenses of consummating an acquisition.

Following the distribution of the Trust Account, we are in need of additional financing to fund our operating expenses. If we do not have sufficient funds available to fund our expenses, we may be forced to obtain additional financing, either from our management or the existing stockholders or from third parties. We may not be able to obtain additional financing and our existing stockholders and management are not obligated to provide any additional financing. If we do not have sufficient proceeds and cannot find additional financing, we may be forced to dissolve and liquidate prior to consummating a business combination.

We may be unable to obtain additional financing, if required, to complete a business combination or to fund the operations and growth of the target business, which could compel us to restructure the transaction or abandon a particular business combination.

To the extent that additional financing proves to be unavailable when and if needed to consummate a particular business combination, we would be compelled to restructure the transaction or abandon that particular business combination and seek an alternative target business candidate. In addition, if we consummate a business combination, we may require additional financing to fund the operations or growth of the target business. The failure to secure additional financing could have a material adverse effect on the continued development or growth of the target business. None of our officers, directors or stockholders is required to provide any financing to us prior to, in connection with or after a business combination.

Our ability to effect a business combination and to execute any potential business plan afterwards will be dependent upon the efforts of our key personnel, some of whom may join us following a business combination and whom we would have only a limited ability to evaluate.

Our ability to effect a business combination will be totally dependent upon the efforts of our key personnel. The future role of our key personnel following an acquisition, however, cannot presently be fully ascertained. Although we expect most of our management and other key personnel to remain associated with us following an acquisition, we may employ other personnel following the business combination. While we intend to closely scrutinize any additional individuals we engage after a business combination, we cannot assure you that our assessment of these individuals will prove to be correct. Moreover, our current management will only be able to remain with the combined company after the consummation of a business combination if they are able to negotiate terms with the combined company as part of any such combination. If we acquired a target business in an all-cash transaction, it would be more likely that current members of management would remain with us if they chose to do so. If a business combination were structured as a merger whereby the stockholders of the target company were to control the combined company following a business combination, it may be less likely that management would remain with the combined company unless it was negotiated as part of the transaction via the acquisition agreement, an employment or consulting agreement or other arrangement. The determination to remain as officers of the resulting business will be made prior to the completion of the transaction and will depend upon the appropriateness or necessity of current management to remain. In making the determination as to whether current management should remain with us following the business combination, management will analyze the experience and skill set of the target business’ management and negotiate as part of the business combination that certain members of current management remain if it is believed that it is in the best interests of the combined company post-business combination. If management negotiates to be retained post-business combination as a condition to any potential business combination, such negotiations may result in a conflict of interest.

9

An acquisition of an operating company may not require the approval of our stockholders, so you may not be entitled to vote on such a business combination.

In the event the Company enters into a definitive agreement to acquire an operating company, the acquisition may not require stockholder approval, even if it constitutes a change in control of the Company, provided the Company’s common stock is not then listed on a national exchange and the acquisition is structured so as not to require a stockholder vote under the Delaware code. Accordingly, stockholders may not be entitled to vote on any future acquisition by, or of, the Company.

Other than their relationship with us, none of our officers or directors has ever been associated with a blank check company which could adversely affect our ability to consummate a business combination.

Other than their relationship with us, none of our officers or directors has ever been associated with a blank check company. Accordingly, you may not have sufficient information with which to evaluate the ability of our management team to identify and complete a business combination. Our management’s limited experience in operating a blank check company could adversely affect our ability to consummate a business combination and force us to dissolve and liquidate.

Our officers and directors may allocate their time to other businesses thereby causing conflicts of interest in their determination as to how much time to devote to our affairs. This could have a negative impact on our ability to consummate a business combination.

Our officers and directors are not required to commit their full time to our affairs, which may result in a conflict of interest in allocating their time between our operations and other businesses. We do not intend to have any full time employees prior to the consummation of a business combination. Each of our officers are engaged in several other business endeavors and are not obligated to contribute any specific number of hours per week to our affairs. If our officers’ other business affairs require them to devote more substantial amounts of time to such affairs, it could limit their ability to devote time to our affairs and could have a negative impact on our ability to consummate a business combination. We cannot assure you that these conflicts will be resolved in our favor.

Because our common stock is considered a penny stock and is subject to the SEC’s penny stock rules broker-dealers may experience difficulty in completing customer transactions and trading activity in our securities may be adversely affected.

After the distribution of the Trust Account, our net tangible assets were less than $5,000,000 and our common stock has had a market price per share of less than $5.00, thus transactions in our common stock were and continue to be subject to the “penny stock” rules promulgated under the Securities Exchange Act of 1934, as amended. Under these rules, broker-dealers who recommend such securities to persons other than institutional accredited investors must:

|

·

|

make a special written suitability determination for the purchaser;

|

|

·

|

receive the purchaser’s written agreement to a transaction prior to sale;

|

10

|

·

|

provide the purchaser with risk disclosure documents which identify certain risks associated with investing in “penny stocks” and which describe the market for these “penny stocks” as well as a purchaser’s legal remedies; and

|

|

·

|

obtain a signed and dated acknowledgment from the purchaser demonstrating that the purchaser has actually received the required risk disclosure document before a transaction in a “penny stock” can be completed.

|

Broker-dealers in our common stock may find it difficult to effectuate customer transactions and trading activity in our securities may be adversely affected. As a result, the market price of our securities may be depressed, and you may find it more difficult to sell our securities.

Our officers and directors currently own shares of our Class A Stock and thus may influence certain actions requiring a stockholder vote.

Our officers and directors collectively hold approximately 80% of our voting power by virtue of their ownership of Class A Stock. This ownership interest, together with any other acquisitions of our shares of common stock (or warrants which are subsequently exercised), could allow our officers or directors to influence the outcome of matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions after completion of our initial business combination. The interests of our officers or directors and your interests may not always align and taking actions which require approval of a majority of our stockholders, such as selling our company, may be more difficult to accomplish.

If our existing stockholders (including those officers and directors who have purchased warrants in the private placement) exercise their registration rights, it may have an adverse effect on the market price of our common stock and the existence of these rights may make it more difficult to effect a business combination.

Our existing stockholders, including our officers and directors who have purchased warrants in the private placement, are entitled to require us to register the resale of such warrants as well as their shares of common stock at any time after the date on which their shares are released from escrow. If such existing stockholders exercise their registration rights with respect to all of their shares of common stock (including those 1,500,000 shares of common stock issuable upon exercise of warrants included as part of the insider warrants), then there will be an additional 2,125,000 shares of common stock eligible for trading in the public market and we will bear the costs of registering such securities. The presence of this additional number of shares of common stock eligible for trading in the public market may have an adverse effect on the market price of our common stock. In addition, the existence of these rights may make it more difficult to effectuate a business combination or increase the cost of the target business, as the stockholders of the target business may be discouraged from entering into a business combination with us or will request a higher price for their securities as a result of these registration rights and the potential future effect their exercise may have on the trading market for our common stock.

There has been a very limited public trading market for our securities, and the market for our securities may continue to be limited and may be sporadic and highly volatile.

Prior to May 19, 2009, there was a limited public market for our common stock, which was quoted on the Over the Counter Bulletin Board (“OTCBB”). Following the liquidation of our Trust Account, there has not been any public trading in the common stock. We cannot assure you that an active market for our shares will be established or maintained in the future. If we are unable to establish a public market for our common stock, holders will have no or limited liquidity. Holders of our common stock may have to bear a complete loss of the value of their investment in us.

If we are able to establish a public market, the market price of our common stock may be volatile, which could cause the value of our common stock to decline. Securities markets experience significant price and volume fluctuations. This market volatility, as well as general economic conditions, could cause the market price of our common stock to fluctuate substantially. Many factors beyond our control may significantly affect the market price of our shares. These factors include:

|

·

|

price and volume fluctuations in the stock markets;

|

11

|

·

|

changes in our earnings or variations in operating results;

|

|

·

|

any shortfall in revenue or increase in losses from levels expected by securities analysts;

|

|

·

|

changes in regulatory policies or law;

|

|

·

|

operating performance of companies comparable to us; and

|

|

·

|

general economic trends and other external factors.

|

Even if an active market for our common stock is established, stockholders may have to sell their shares at prices substantially lower than the price they paid for the shares or might otherwise receive than if an active public market existed.

|

Item 1B.

|

Unresolved Staff Comments.

|

Not applicable.

|

Item 2.

|

Properties.

|

Until October 25, 2008, the 18 month anniversary of the completion of our IPO, we leased office space at which we maintain our executive offices at 4 Maskit Street, Herzeliya, Israel. The costs for this space was included in the $7,500 per-month fee New Pole Ltd., an affiliate of Ronen Zadok, our Chief Financial Officer, charged us for general and administrative services. After October 25, 2008 and until December 31, 2010, New Pole Ltd. continued to permit our use of such space, and to provide us with general and administrative services, upon the same terms and conditions. Currently, New Pole Ltd. permits our continued use of this space and provides general and administrative services free of charge. We consider our current office space adequate for our current operations.

|

Item 3.

|

Legal Proceedings.

|

On December 8, 2009, the Company and others, filed a lawsuit against the Objecting Party, Elbit Systems Holdings Ltd. ("Elbit") and others, in the Petah Tikva District Court of Israel (“Court”), for damages in the amount of NIS 37.7 million (USD $10 million) (the "Lawsuit"). The Lawsuit is based on the following factual background:

|

a.

|

That following a period of extensive negotiations between inter alia, the Company and Elbit, a July 2008 Letter of Intent was signed, which contemplated inter alia, the Company purchase from Elbit of 31% of Kinetics, Ltd., i.e. 18,716 Ordinary Shares of Kinetics Ltd. (the "Kinetics Shares"), for a price of $26 million. Following said purchase, a merger between the Company and Kinetics was to be effectuated;

|

|

b.

|

That the Company, as a blank check company and in order to fulfill its duty to obtain timely stockholders' approval, was compelled to finalize a Business Combination by October 18, 2008;

|

|

c.

|

That based on the Letter of Intent, and a belief at the time of Elbit's good faith, the Company continued negotiating a definitive agreement with all parties involved in the transaction;

|

|

d.

|

That after lengthy negotiations, a definitive agreement was finalized and signed in early October 2008;

|

|

e.

|

That Elbit's signature on the definitive agreement was withheld based on Elbit's claim that it had "just received" information about a new order that would raise the forecast of Kinetics' profits in 2009; and

|

12

|

f.

|

That Elbeit’s remained a shareholder of Kinetics Shares after October 18, 2008.

|

The Lawsuit is in preliminary stages. The Lawsuit seeks reparation for damages caused to plaintiffs as a result of defendants' lack of good faith in negotiations, and requests that the Court hold that defendants materially breached the definitive agreement, that defendants are estopped from denying that the definitive agreement was finalized, and that defendants acted with fraud, and alternatively, with recklessness and without good faith (based inter alia, on representations made during negotiations). The Lawsuit also alleges that Elbit was unjustly enriched by its conduct, and that any enrichment as a result of Elbit's retention of the Kinetics Shares belongs to Pinpoint.

On February 22, 2010, the defendants filed a Statement of Defense. Pursuant to Court suggestion, the parties have submitted their dispute to non-binding mediation, before Professor Nily Cohen. The mediation is currently ongoing.

|

Item 4.

|

(Removed and Reserved)

|

PART II

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

Market Information

Our warrants are traded on the OTCBB under the symbols PPACW. On May 19, 2009, all Units were split into their respective warrant and common stock components. On May 19, 2009, holders of the Company’s common stock had their stock exchanged eight for one for shares of New Common Stock. On May 19, 2009, holders of our founder stock were issued Class A Stock in exchange for such founder stock. As of May 19, 2009, there was no public market for our New Common Stock and Class A Stock. Our warrants commenced public trading on June 1, 2007. Following the distribution of the Trust Account on May 19, 2009, there has been no market for our warrants due to the sporadic and limited trading in such warrants.

|

OTC Bulletin Board

|

||||||||||||||||||||||||

|

Pinpoint Advance

Corp.

Common Stock

|

Pinpoint Advance

Corp. Warrants

|

Pinpoint Advance

Corp. Units

|

||||||||||||||||||||||

|

High

|

Low

|

High

|

Low

|

High

|

Low

|

|||||||||||||||||||

|

Quarter ended September 30, 2009

|

$

|

9.85

|

$

|

9.68

|

$

|

—

|

$

|

—

|

$

|

—

|

$

|

—

|

||||||||||||

|

Quarter ended June 30, 2009

|

$

|

9.99

|

$

|

9.80

|

$

|

—

|

$

|

—

|

$

|

—

|

$

|

—

|

||||||||||||

|

Quarter ended December 31, 2008

|

$

|

9.76

|

$

|

9.28

|

$

|

0.16

|

$

|

0.0005

|

$

|

10.105

|

$

|

9.49

|

||||||||||||

Holders

On March 21, 2011, there were 6 holders of record of our common stock, including the Class A Stock, and five holders of record of our warrants.

Dividends

We have not paid any dividends on our common stock to date and do not intend to pay dividends prior to the completion of a business combination. The payment of dividends in the future will be contingent upon our revenues and earnings, if any, capital requirements and general financial condition subsequent to completion of a business combination. The payment of any dividends subsequent to a business combination will be within the discretion of the board of directors. It is the present intention of our board of directors to retain all earnings, if any, for use in our business operations and, accordingly, our board does not anticipate declaring any dividends in the foreseeable future.

13

Recent Sales of Unregistered Equity Securities

None.

Securities Authorized for Issuance Under Equity Compensation Plans

None.

Repurchases of Equity Securities

None.

|

Item 6.

|

Selected Financial Data

|

Not applicable.

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

Caution Regarding Forward-Looking Information

Certain statements contained in this annual filing, including, without limitation, statements containing the words "believes", "anticipates", "expects" and words of similar import, constitute forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Such factors include, among others, the following: international, national and local general economic and market conditions: our ability to successfully make and integrate acquisitions; existing government regulations and changes in, or the failure to comply with, government regulations; adverse publicity; competition; fluctuations and difficulty in forecasting operating results; changes in business strategy or development plans; business disruptions; the ability to attract and retain qualified personnel; and other factors referenced in this and previous filings.

Given these uncertainties, readers of this Form 10-K and investors are cautioned not to place undue reliance on such forward-looking statements. The Company disclaims any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements contained herein to reflect future events or developments.

The following discussion should be read in conjunction with the Company’s Financial Statements and footnotes thereto contained in this report.

Overview

We were formed as a blank check company on September 6, 2006 for the purpose of acquiring, merging with, engaging in a capital stock exchange with, purchasing all or substantially all of the assets of, or engaging in any other similar business combination with a business that has operations or facilities located in Israel or which is a company operating outside of Israel, which management believes would benefit from establishing operations or facilities in Israel, preferably in the technology sector. From inception to October 2008, our principal business activities related to our formation, capital raising and seeking a Business Combination target.

14

The Company’s principal activities from inception through May 19, 2009 were related to the Company’s formation, capital raising activities and the Business Combination.

In the Offering, the Company sold to the public 2,875,000 Units at a price of $10.00 per Unit. Each Unit consisted of one share and one warrant. Each warrant entitled the holder to purchase one share of the Company's common stock at a price of $7.50. Proceeds from the Offering and the Private Placement totaled approximately $28.5 million, which was net of approximately $1.6 million in underwriting fees and other expenses paid at closing. The Company also sold to the underwriters for $100 an option to purchase up to 125,000 Units.

The Company had agreed that $28.37 million or $9.91 per Unit sold in the Offering was to be held in the Trust Account, of which $0.30 per Unit of the compensation to underwriters was deferred until consummation of the Business Combination. The deferred compensation to underwriters was forfeited due to the Company’s inability to consummate a Business Combination within the time allotted in its Amended and Restated Certificate of Incorporation.

On October 27, 2008, the Company announced it had executed an LOI to effectuate a Business Combination with Elbit. All parties to the LOI negotiated the terms of a definitive agreement and in fact, a definitive agreement was executed by all parties to the LOI. However, Elbit claimed it never released its signature thereto and indicated it no longer wished to pursue the proposed Business Combination.

The Company believes a binding, definitive agreement was executed by all parties. However, Elbit indicated its position that no binding agreement existed and that it did not wish to continue with negotiations, and therefore, the Company was unable to consummate the Business Combination.

On December 8, 2009, the Company and others, filed the Lawsuit in the Petah Tikva District Court of Israel, for damages in the amount of NIS 37.7 million (USD $10 million).

The Lawsuit is in preliminary stages. The Lawsuit seeks reparation for damages caused to plaintiffs as a result of defendants' lack of good faith in negotiations, and requests that the Court hold that defendants materially breached the definitive agreement, that defendants are estopped from denying that the definitive agreement was finalized, and that defendants acted with fraud, and alternatively, with recklessness and without good faith (based inter alia, on representations made during negotiations). The Lawsuit also alleges that Elbit was unjustly enriched by its conduct, and that any enrichment as a result of Elbit's retention of the Kinetics Shares belongs to Pinpoint.

On February 22, 2010 the defendants filed a Statement of Defense. Pursuant to Court suggestion, the parties have submitted their dispute to non-binding mediation, before Professor Nily Cohen. The mediation is currently ongoing.

On May 19, 2009 the Company effectuated the redemption of the shares of common stock issued in the Offering in the amount of $9.91 per share from the Trust Account and distributed one share of New Common Stock for every eight common shares then held for an aggregate of 359,402 shares of New Common Stock. The stockholders also approved the creation of a new class of common stock called Class A Stock. The founders of the Company exchanged each share of common stock held by them for five shares of Class A Stock, for an aggregate of 3,125,000 shares of Class A Stock.

Results of Operations

Net income (Loss) of $(72,323) and $(45,682) reported for the years ended December 31, 2010 and 2009 respectively, consists for each year primarily of $67,264 and $221,804 of expenses for administrative services; $393 and $22,290 for franchise taxes; and $0 and $204,596 for federal income taxes, respectively. Interest income from the Trust Account was $0 and $5,953 for the years ended December 31, 2010 and 2009 respectively. The change in interest income resulted from the Company’s distribution of cash held in the Trust Account.

15

Gross proceeds from the IPO were $30,250,000 (including the over-allotment option and warrants sold privately). We paid a total of $1,349,900 in underwriting discounts and commissions, and approximately $449,000 was paid for costs and expenses related to the IPO. After deducting the underwriting discounts and commissions and the offering expenses, the total net proceeds to us from the IPO were approximately $28,451,000, of which $28,366,000 was deposited into the Trust Account. The remaining proceeds were used for business, legal and accounting due diligence on prospective acquisitions and general and administrative expenses prior to the redemption of the common stock.

Commencing on April 19, 2007 and terminating at the eighteen month anniversary of our IPO in October 2008, we began incurring a fee from New Pole Ltd., an affiliate of Ronen Zadok, our chief financial officer, of $7,500 per month for providing us with office space and certain general and administrative services. Currently, New Pole Ltd. permits our continued use of the office space free of charge. In addition, Mr. Zadok advanced $151,210 to us for payment on our behalf of IPO expenses. This amount was repaid following the IPO from the net proceeds of the IPO.

On May 19, 2009, the Company effectuated the redemption of the shares of common stock issued in the Offering in the amount of $9.91 per share from the Trust Account.

Liquidity and Capital Resources

At December 31, 2010, the Company had $15,636 in cash, current liabilities of $156,416 and a working capital deficit of $136,505. Further, the Company has incurred, and expects to continue to incur, costs. The Company did not hold any cash equivalents as of December 31, 2010. These factors, among others, indicate that the Company may be unable to continue operations as a going concern unless the Company is able to obtain further financing. The directors of the Company have in the past loaned money to the Company to finance its operations. They may but are not obligated to provide additional funds to the company. As of the date of this Report, there were no commitments from any of the directors to provide such funds. If the Company is unable to obtain financing on favorable terms, or at all, it will not be able to continue operating with its current resources. Management has no current plans to raise additional capital.

The Company's restricted cash and cash equivalents were held in the Trust Account until May 19, 2009 and were invested in a money market fund. The Company recognized interest income of $1,359,678 from inception (September 6, 2006) to May 19, 2009. The Company distributed all cash from its Trust Account as part of the Redemption.

The cash and cash equivalent held in the Trust Account prior to May 19, 2009 was generated by the proceeds from the Offering of approximately $28,750,000, the proceeds of the sale of founder securities of $1,500,000, and $1,365,361 of interest earned on such funds.

The warrants issued in the Offering are currently outstanding in accordance with their terms and will become exercisable upon the consummation of a business combination.

In connection with the IPO, our underwriter agreed to defer payment of the remaining three percent (3%) of the gross proceeds ($862,500) until completion of a Business Combination. Due to the inability of the Company to consummate a Business Combination within the allotted time, the 3% deferred fee was forfeited by the underwriter and was returned to our public stockholders from the Trust Account upon the distribution of the Trust Account.

Following the distribution of the Trust Account, we are in need of additional financing to fund our operating expenses. If we do not have sufficient funds available to fund our expenses, we may be forced to obtain additional financing, either from our management or from third parties. We may not be able to obtain additional financing and our existing stockholders and management are not obligated to provide any additional financing. If we do not have sufficient proceeds and cannot find additional financing, we may be forced to dissolve and liquidate prior to consummating a business combination.

16

We may need additional financing to complete a business combination. We cannot assure you that such financing would be available on acceptable terms, if at all. To the extent additional financing proves to be unavailable when needed to consummate a particular business combination, we would be compelled to restructure the transaction or abandon that particular business combination and seek an alternative target business candidate. In addition, if we consummate a business combination, we may require additional financing to fund the operations or growth of the target business.

Other than contractual obligations incurred in the ordinary course of business, we do not have any other long-term contractual obligations.

Critical Accounting Policies

Our financial statements have been prepared in accordance with accounting principles generally accepted in the United States. These generally accepted accounting principles require management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Our significant accounting policies are described in the notes to the consolidated financial statements included in this report. Judgments and estimates of uncertainties are required in applying our accounting policies in many areas. Management has discussed the development and selection of these policies with the Company’s Board of Directors and the Board of Directors has reviewed the Company’s disclosures of these policies. There have been no material changes to the critical accounting policies or estimates reported in the Management’s Discussion and Analysis section of the audited financial statements for the year ended December 31, 2008 as filed with the Securities and Exchange Commission.

Recent Accounting Pronouncements

The Company does not believe any recently issued, but not yet effective, accounting standards if currently adopted would have a material effect on the accompanying financial statements.

Off-Balance Sheet Arrangements

None.

Contractual Obligations

We do not have any long term debt, capital lease obligations, operating lease obligations, purchase obligations or other long term liabilities. We entered into a Service Agreement with New Pole Ltd., requiring us to pay $7,500 per month. The agreement terminated on the eighteen month anniversary of our IPO in October 2008. However, New Pole Ltd. continued to permit our use of our office space and provided general and administrative services upon the same terms and conditions until December 2008. Currently, New Pole Ltd. permits our continued use of this space free of charge.

17

Other than contractual obligations incurred in the ordinary course of business, we do not have any other long-term contractual obligations.

|

Item 7A.

|

Quantitative and Qualitative Disclosure about Market Risk

|

Not applicable.

|

Item 8.

|

Financial Statements and Supplementary Data

|

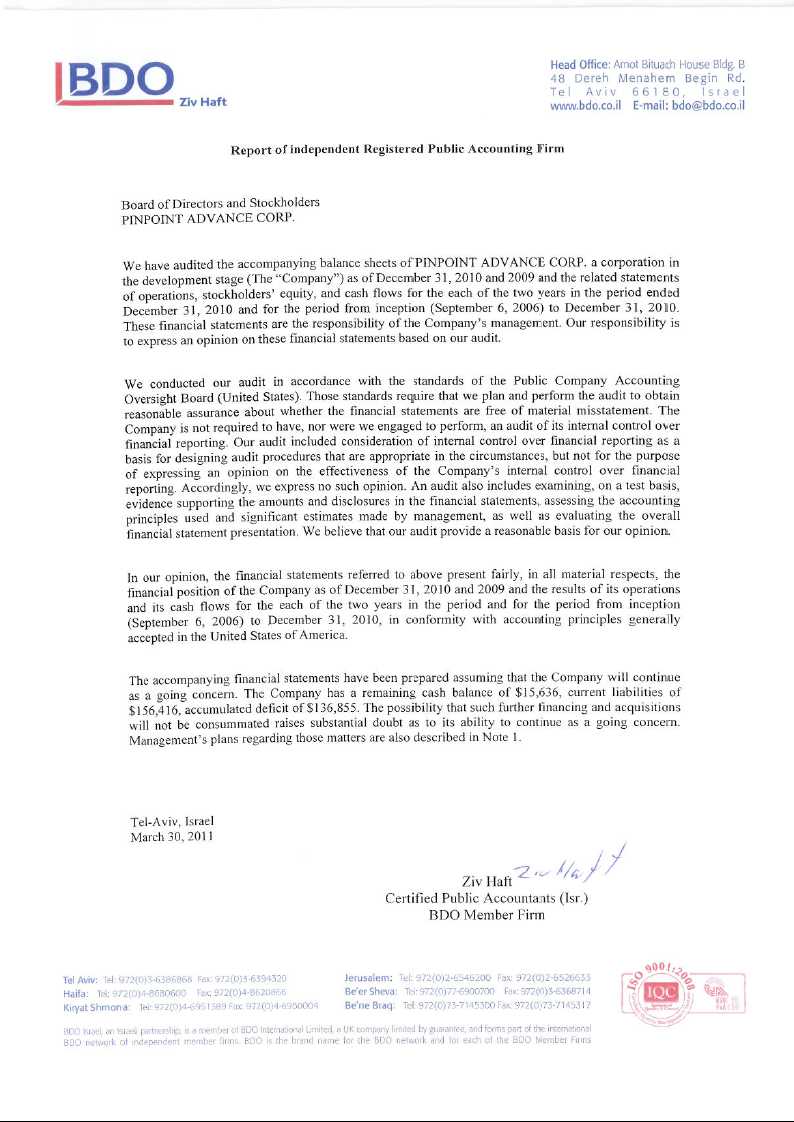

Reference is made to our financial statements beginning on page F-1 of this report.

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

|

None.

|

Item 9A.

|

Controls and Procedures

|

Disclosure Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Under the supervision and with the participation of our management, including our Chief Executive Officer and our Chief Financial Officer, (together, the “Certifying Officers”), we carried out an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Based on the foregoing, our Certifying Officers concluded that our disclosure controls and procedures were effective as of the end of the period covered by this Annual Report.