Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

____________

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

____________

FORM 10-K

ANNUAL REPORT

PURSUANT TO SECTIONS 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

PURSUANT TO SECTIONS 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Mark one)

| XXX | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the fiscal year ended December 31, 2010 | ||

| TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

| For the transition period from __________ to __________ |

Commission File Number 0-24958

POTOMAC BANCSHARES, INC.

(Exact Name of Registrant as Specified in Its Charter)

(Exact Name of Registrant as Specified in Its Charter)

| West Virginia | 55-0732247 | |

| (State or Other Jurisdiction of | (I.R.S. Employer | |

| Incorporation or Organization) | Identification No.) | |

| 111 East Washington Street | ||

| PO Box 906, Charles Town WV | 25414-0906 | |

| (Address of Principal Executive Offices) | (Zip Code) |

| Registrant's telephone number, including area code | 304-725-8431 | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Name of Each Exchange | ||

| Title of Each Class | on Which Registered | |

| NONE | ||

| |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $1.00 Par Value

(Title of Class)

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| Yes | No |

XX

|

1

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Yes | No |

XX

|

Indicate by check mark whether the registrant: (l) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| Yes |

XX

|

No |

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

| Yes |

|

No |

|

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (§ 228.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

XX

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large Accelerated Filer

|

Accelerated Filer | Non-Accelerated Filer | Smaller Reporting Company |

XX

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| Yes | No |

XX

|

State the aggregate market value of the voting and non-voting common equity held by nonaffiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $16,931,162 as of June 30, 2010

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date.

3,390,178 as of March 12, 2011

DOCUMENTS INCORPORATED BY REFERENCE

The following lists the document that is incorporated by reference in the Form 10-K Annual Report, and the Parts and Items of the Form 10-K into which the document is incorporated.

| Part of the Form 10-K into Which | ||

| Document | the Document is Incorporated | |

| Portions of Potomac Bancshares, Inc.’s Proxy Statement for the 2011 Annual Meeting of Shareholders which proxy statement will be filed on or about April 8, 2011. | Part III, Items 10, 11, 12, 13 and 14 |

2

Potomac Bancshares, Inc.

Annual Report on Form 10-K

For the Year Ended December 31, 2010

Annual Report on Form 10-K

For the Year Ended December 31, 2010

| PART I | ||||||

| Item | 1. | Business | 4 | |||

| Item | 2. | Properties | 11 | |||

| Item | 3. | Legal Proceedings | 12 | |||

| Item | 4. | (Removed and Reserved) | 12 | |||

| PART II | ||||||

| Item | 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases | ||||

| of Equity Securities | 12 | |||||

| Item | 6. | Selected Financial Data | 15 | |||

| Item | 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 16 | |||

| Item | 7A. | Quantitative and Qualitative Disclosures About Market Risk | 28 | |||

| Item | 8. | Financial Statements and Supplementary Data | 30 | |||

| Item | 9. | Changes In and Disagreements with Accountants on Accounting and Financial Disclosure | 70 | |||

| Item | 9A. | Controls and Procedures | 70 | |||

| Item | 9B. | Other Information | 70 | |||

| PART III | ||||||

| * Item | 10. | Directors, Executive Officers and Corporate Governance | 71 | |||

| * Item | 11. | Executive Compensation | 71 | |||

| * Item | 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 71 | |||

| * Item | 13. | Certain Relationships and Related Transactions and Director Independence | 71 | |||

| * Item | 14. | Principal Accounting Fees and Services | 71 | |||

| PART IV | ||||||

| Item | 15. | Exhibits and Financial Statement Schedules | 72 | |||

* The information required by Items 10, 11, 12, 13 and 14, to the extent not included in this document, is incorporated herein by reference to the information included under the captions “Management Nominees to the Board of Potomac,” “Directors Continuing to Serve Unexpired Terms,” “Section 16(a) Beneficial Ownership Reporting Compliance,” “Executive Compensation,” “Employee Benefit Plans,” “Compensation of Directors,” “Ownership of Securities by Nominees, Directors and Officers,” “Certain Transactions with Directors, Officers and Their Associates” and “Audit Committee Report” in the registrant’s definitive proxy statement which is expected to be filed on or about April 8, 2011.

FORWARD-LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 evidences Congress’ determination that the disclosure of forward-looking information is desirable for investors and encourages such disclosure by providing a safe harbor for forward-looking statements by corporate management. This Form 10-K, including the President’s letter and the Management’s Discussion and Analysis of Financial Condition and Results of Operations, contains forward-looking statements that involve risk and uncertainty. “Forward-looking statements” are easily identified by the use of words such as “could,” “anticipate,” “estimate,” “believe,” “confident,” and similar words that refer to a future outlook. To comply with the terms of the safe harbor, the company notes that a variety of factors could cause the company’s actual results and experiences to differ materially from the anticipated results or other expectations expressed in the company’s forward-looking statements.

The risks and uncertainties that may affect the operations, performance, development and results of the company’s business include, but are not limited to, the growth of the economy, unemployment, pricing in the real estate market, interest rate movements, the impact of competitive products, services and pricing, customer business requirements, the current economic environment posing significant challenges and affecting our financial condition and results of operations, the possibility of future FDIC assessments, Congressional legislation and similar matters (including changes as a result of rules and regulations adopted under the Dodd-Frank Wall Street Reform and Consumer Protection Act). We caution readers of this report not to place undue reliance on forward-looking statements which are subject to influence by unanticipated future events. Actual results, accordingly, may differ materially from management expectations.

3

PART I

Item 1. Business.

History and Operations

The Board of Directors of Bank of Charles Town (the "bank") caused Potomac Bancshares, Inc. ("Potomac" or the “company”) to be formed on March 2, 1994, as a single-bank holding company. To date, Potomac's only activities have involved the acquisition of the bank. Potomac acquired all of the shares of the bank’s common stock on July 29, 1994.

Bank of Charles Town is a West Virginia state-chartered bank that formed and opened for business in 1871 and so is celebrating 140 years of operation in 2011. The Federal Deposit Insurance Corporation insures the bank’s deposits. The bank engages in general banking business primarily in Jefferson, Berkeley and Morgan Counties of West Virginia; Clarke, Frederick and Loudoun Counties of Virginia and Washington and Frederick Counties of Maryland. The main office is in Charles Town, West Virginia at 111 East Washington Street, with branch offices in

- Harpers Ferry, West Virginia,

- Kearneysville, West Virginia,

- Martinsburg, West Virginia and

- Hedgesville, West Virginia.

The bank provides individuals, businesses and local governments with a broad range of banking services. These services include

- Commercial credit lines, equipment loans, and construction financing,

- Real estate loans, secondary market and adjustable rate mortgages,

- Retail loan products including home equity lines of credit,

- Checking and savings accounts for businesses and individuals and

- Certificates of deposit and individual retirement accounts.

Online banking with bill pay and E-statements among other services are available through BCT NetTeller 24 hours a day, 7 days a week. ATMs located at each of the five offices and Touchline 24, an interactive voice response system available at 1-304-728-2424, are also available to customers 24/7. The bank initiated the formation of an ATM network with two banks in the community to provide customers of all three banks the use of 17 ATM locations free of charge in the eastern panhandle of West Virginia. Use of ATMs at all Sheetz (a regional convenience store franchise) locations is also free of charge. The bank’s One Financial Center encompasses the trust and financial services department and BCT Investments. The trust department provides financial management, investment and trust services. BCT Investments provides financial management, investment and brokerage services.

Lending Activities

Credit Policies

The bank offers a variety of loans for consumer and commercial purposes. Underwriting standards for all lending include

- Sound credit analysis,

- Proper documentation according to the bank's loan policy standards,

- Management of loan concentrations to a single industry or with a single class of collateral,

- Diligent maintenance of past due and nonaccrual loans and

- A risk grading system that assists us in managing deteriorating credits on a proactive basis.

The lending policies of the bank address the importance of a diversified portfolio and a balance between maximum yield and minimum risk. It is the bank’s policy to avoid concentrations of loans such as loans to one industry, loans to one borrower or guarantor or loans secured by similar collateral.

4

The bank's loan policy designates particular loan-to-value limits for real estate loans in accordance with recommendations in Section 304 of the Federal Deposit Insurance Corporation Improvement Act of 1991. As stated in the loan policy, there may be certain lending situations not subject to these loan-to-value limits and from time to time senior management of the bank may permit exceptions to the established limits. Any exceptions are sufficiently documented.

Real Estate Lending

Loans secured by real estate are made to individuals and businesses for

- The purchase of raw land and land development,

- Commercial, multi-family and other non-residential construction,

- Purchase of improved property,

- Purchase of owner occupied one to four family residential property,

- Lines of credit and

- Home equity loans.

Approximately 93% of the bank's loans are secured by real estate. These loans had an average delinquency rate of 2.53% and a loss rate of 0.85% during 2010. The average delinquency rate and loss rate are based on comparisons to 2010 average total loans.

As of December 31, 2010, aggregate dollar amounts (in thousands) in loan categories secured by real estate are as follows:

|

$ | 24 174 | |

|

792 | ||

|

97 537 | ||

|

1 976 | ||

|

79 615 | ||

| $ | 204 094 | ||

Commercial Lending

Commercial loans not secured by real estate with an aggregate balance of $7.9 million at December 31, 2010 make up approximately 3.6% of the total loan portfolio. The bank’s loan policy for commercial loans including those commercial loans secured by real estate is to

- Grant loans on a sound and collectible basis,

- Invest the bank’s funds profitably for the benefit of shareholders and the protection of depositors and

- Serve the legitimate credit needs of the community in which the bank is located.

Average delinquency and the loss rate for commercial loans not secured by real estate were less than 1% during 2010 compared to 2010 average total loans.

Consumer Lending

Retail loans to individuals for personal expenditures are approximately 3.1% of the bank's total loans at December 31, 2010. The aggregate balance of these loans was $6.8 million at December 31, 2010. The majority of these loans are installment loans.

There is some risk in every retail loan transaction. The bank accepts moderate levels of risk while minimizing retail loan losses through careful investigation into the character of each borrower, determining the source of repayment before closing each loan, collateralizing most loans, exercising care in documentation procedures, administering an aggressive retail loan collection program, and following the retail loan policies. Loans to individuals for personal expenditures had an average delinquency rate of 0.07% and a loss rate of 0.04% in 2010 (based on comparisons to 2010 average total loans).

All other loans total $436 thousand (0.20% of total loans) at December 31, 2010. These loans had no delinquency rate and no average loss rate in 2010 compared to 2010 average total loans.

5

Investment Activities

The bank's investment policy governs its investment activities. The policy states that excess daily funds are to be invested in federal funds sold and securities purchased under agreements to resell. The daily funds are used to cover deposit draw downs by customers, to fund loan commitments and to help maintain the bank's asset/liability mix.

According to the policy, funds in excess of those invested in federal funds sold and securities purchased under agreements to resell are to be invested in (1) U.S. Treasury bills, notes or bonds, (2) obligations of U.S. Government agencies or (3) obligations of the State of West Virginia and political subdivisions thereof with a rating of not less than A or fully insured bonds or (4) obligations of states other than West Virginia and political subdivisions thereof with a rating of not less than A or fully insured bonds.

The policy governs various other factors including maturities, the closeness of purchase price to par, amounts that may be purchased and percentages of the various types of investments that may be held.

Deposit Activities

The bank offers noninterest-bearing and interest-bearing checking accounts and savings accounts. The bank offers automatically renewable certificates of deposit in various terms from 91 days to five years. The bank is also a participant in the CDARS program. The CDARS program offers certificates of deposit in various terms from four weeks to five years. Individual retirement accounts in the form of certificates of deposit are also available.

To open a deposit account, the depositor must meet the following requirements for low risk individuals:

- Present a valid identification,

- Have a social security number,

- Must be a U.S. citizen or possess evidence of legal alien status, and

- Must be at least 18 years of age or share an account with a person at least 18 years of age.

When depositors are considered medium or high risk (i.e. out-of-state driver’s license and/or resident), additional verification requirements apply.

Competition

As of March 4, 2010, there were 63 bank holding companies (including multi-bank and one bank holding companies) operating in the State of West Virginia. These holding companies are headquartered in various West Virginia cities and control banks throughout the State of West Virginia, including banks that compete with the bank in its market area.

The bank's market area is generally defined as Jefferson County and Berkeley County, West Virginia. As of June 30, 2010, there were six banks in Jefferson County with 16 banking offices. The total deposits of these commercial banks as of June 30, 2010 were $671 million, and the bank ranked number one in total deposits with $211 million or 31.41% of the total deposits in the market at that time. The bank has two branch offices in Berkeley County. Opening in July 2001 and June 2003, these branches have 4.94% of the market share of deposits in Berkeley County where there are 11 banks with 31 banking offices.

For most of the services that the bank performs, there is also competition from financial institutions other than commercial banks. For instance, credit unions, some insurance companies, and issuers of commercial paper and money market funds actively compete for funds and for various types of loans. In addition, personal and corporate trust and investment counseling services are offered by insurance companies, investment counseling firms and other business firms and individuals. Due to the geographic location of the bank's primary market area, the existence of larger financial institutions in Maryland, Virginia and Washington, D.C. influences the competition in the market area. Larger regional and national corporations continue to be increasingly visible in offering a broad range of financial services to all types of commercial and consumer customers. The principal competitive factors in the markets for deposits and loans are interest rates, either paid or charged. The chartering of numerous new banks in West Virginia and the opening of numerous federally chartered savings and loan associations has increased competition for the bank. The 1986 legislation passed by the West Virginia Legislature allowing statewide branch banking provided increased opportunities for the bank, but it also increased competition for the bank in its service area. With the beginning of reciprocal interstate banking in 1988, bank holding companies (such as Potomac Bancshares, Inc.) also face additional competition in efforts to acquire other subsidiaries throughout West Virginia.

6

In 1994, Congress passed the Riegle-Neal Interstate Banking and Branching Efficiency Act. Under this Act, bank holding companies are permitted to acquire banks located in states other than the bank holding company’s home state without regard to whether the transaction is permitted under state law. Commencing on June 1, 1997, the Act allowed national banks and state banks with different home states to merge across state lines, unless the home state of a participating bank enacted legislation prior to May 31, 1997, that expressly prohibits interstate mergers. Additionally, the Act allows banks to branch across state lines, unless the state where the new branch will be located enacted legislation restricting or prohibiting de novo interstate branching on or before May 31, 1997. West Virginia adopted legislation, effective May 31, 1997, that allowed for interstate branch banking by merger across state lines and allowed for de novo branching and branching by purchase and assumption on a reciprocal basis with the home state of the bank in question. The effect of this legislation has been increased competition for West Virginia banks, including the bank.

Employees

Potomac currently has no employees.

As of March 1, 2011, the bank had 89 full-time employees and 11 part-time employees.

Supervision and Regulation

Introduction. Potomac is a bank holding company within the provisions of the Bank Holding Company Act of 1956, is registered as such, and is subject to supervision by the Board of Governors of the Federal Reserve System ("Board of Governors"). The Bank Holding Company Act requires Potomac to secure the prior approval of the Board of Governors before Potomac acquires ownership or control of more than five percent (5%) of the voting shares or substantially all of the assets of any institution, including another bank.

As a bank holding company, Potomac is required to file with the Board of Governors annual reports and such additional information as the Board of Governors may require pursuant to the Bank Holding Company Act. The Board of Governors may also make examinations of Potomac and its banking subsidiaries. Furthermore, under Section 106 of the 1970 Amendments to the Bank Holding Company Act and the regulations of the Board of Governors, a bank holding company and its subsidiaries are prohibited from engaging in certain tie-in arrangements in connection with any extension of credit or any provision of credit, sale or lease of property or furnishing of services.

Potomac’s depository institution subsidiary is subject to affiliate transaction restrictions under federal law that limit the transfer of funds by the subsidiary bank to its respective parent and any nonbanking subsidiaries, whether in the form of loans, extensions of credit, investments or asset purchases. Such transfers by any subsidiary bank to its parent corporation or any nonbanking subsidiary are limited in an amount to 10% of the institution's capital and surplus and, with respect to such parent and all such nonbanking subsidiaries, to an aggregate of 20% of any such institution's capital and surplus.

Potomac is required to register annually with the Commissioner of Banking of West Virginia ("Commissioner") and to pay a registration fee to the Commissioner based on the total amount of bank deposits in banks with respect to which it is a bank holding company. Although legislation allows the Commissioner to prescribe the registration fee, it limits the fee to ten dollars per million dollars of deposits rounded off to the nearest million dollars. Potomac is also subject to regulation and supervision by the Commissioner.

Potomac is required to secure the approval of the West Virginia Board of Banking before acquiring ownership or control of more than five percent of the voting shares or substantially all of the assets of any institution, including another bank. West Virginia banking law prohibits any West Virginia or non-West Virginia bank or bank holding company from acquiring shares of a bank if the acquisition would cause the combined deposits of all banks in the State of West Virginia, with respect to which it is a bank holding company, to exceed 25% of the total deposits of all depository institutions in the State of West Virginia.

Depository Institution Subsidiary. The bank is subject to FDIC deposit insurance assessments. In addition to the normal FDIC insurance rates, during 2009, the FDIC imposed a 7 basis point special assessment based on June 30, 2009 deposits due on or before September 30, 2009, which amounted to $138,090 for Bank of Charles Town. In November of 2009, the FDIC required all banks to prepay premiums for the next three years, which was due on or before December 30, 2009. As a result, Bank of Charles Town has prepaid the FDIC insurance premiums of $1,661,631 for the years of 2010, 2011, and 2012. It is possible that the FDIC will impose additional assessments in the future, and the amount of these assessments could be material.

7

Capital Requirements. The Federal Reserve Board has issued risk-based capital guidelines for bank holding companies, such as Potomac. The guidelines establish a systematic analytical framework that makes regulatory capital requirements more sensitive to differences in risk profiles among banking organizations, takes off-balance sheet exposures into explicit account in assessing capital adequacy, and minimizes disincentives to holding liquid, low-risk assets. Under the guidelines and related policies, bank holding companies must maintain capital sufficient to meet both a risk-based asset ratio test and leverage ratio test on a consolidated basis. The risk-based ratio is determined by allocating assets and specified off-balance sheet commitments into four weighted categories, with higher levels of capital being required for categories perceived as representing greater risk. The leverage ratio is determined by relating core capital (as described below) to total assets adjusted as specified in the guidelines. The bank is subject to substantially similar capital requirements adopted by applicable regulatory agencies.

Generally, under the applicable guidelines, the financial institution's capital is divided into two tiers. "Tier 1", or core capital, includes common equity, noncumulative perpetual preferred stock (excluding auction rate issues) and minority interests in equity accounts or consolidated subsidiaries, less goodwill. Bank holding companies, however, may include cumulative perpetual preferred stock in their Tier 1 capital, up to a limit of 25% of such Tier 1 capital. "Tier 2", or supplementary capital, includes, among other things, cumulative and limited-life preferred stock, hybrid capital instruments, mandatory convertible securities, qualifying subordinated debt, and the allowance for loan losses, subject to certain limitations, less required deductions. "Total capital" is the sum of Tier 1 and Tier 2 capital.

Financial institutions are required to maintain a risk-based ratio of 8%, of which 4% must be Tier 1 capital. The appropriate regulatory authority may set higher capital requirements when an institution's particular circumstances warrant.

Financial institutions that meet certain specified criteria, including excellent asset quality, high liquidity, low interest rate exposure and the highest regulatory rating, are required to maintain a minimum leverage ratio of 3%. Financial institutions not meeting these criteria are required to maintain a leverage ratio which exceeds 3% by a cushion of at least 100 to 200 basis points, and, therefore, the ratio of Tier 1 capital to total assets should not be less than 4%.

The guidelines also provide that financial institutions experiencing internal growth or making acquisitions will be expected to maintain strong capital positions substantially above the minimum supervisory levels, without significant reliance on intangible assets. Furthermore, the Federal Reserve Board's guidelines indicate that the Federal Reserve Board will continue to consider a "tangible Tier 1 leverage ratio" in evaluating proposals for expansion or new activities. The tangible Tier 1 leverage is the ratio of an institution's Tier 1 capital, less all intangibles, to total assets, less all intangibles.

Failure to meet applicable capital guidelines could subject the financial institution to a variety of enforcement remedies available to the federal regulatory authorities, including limitations on the ability to pay dividends, the issuance by the regulatory authority of a capital directive to increase capital and the termination of deposit insurance by the FDIC, as well as to the measures described in the "Federal Deposit Insurance Corporation Improvement Act of 1991" as applicable to undercapitalized institutions.

The Federal Reserve Board, as well as the FDIC, has adopted changes to their risk-based and leverage ratio requirements that require that all intangible assets, with certain exceptions, be deducted from Tier 1 capital. Under the Federal Reserve Board's rules, the only types of intangible assets that may be included in (i.e., not deducted from) a bank holding company's capital are readily marketable purchased mortgage servicing rights ("PMSRs") and purchased credit card relationships ("PCCRs"), provided that, in the aggregate, the total amount of PMSRs and PCCRs included in capital does not exceed 50% of Tier 1 capital. PCCRs are subject to a separate limit of 25% of Tier 1 capital. The amount of PMSRs and PCCRs that a bank holding company may include in its capital is limited to the lesser of (i) 90% of such assets' fair market value (as determined under the guidelines), or (ii) 100% of such assets' book value, each determined quarterly. Identifiable intangible assets (i.e., intangible assets other than goodwill) other than PMSRs and PCCRs, including core deposit intangibles, acquired on or before February 19, 1992 (the date the Federal Reserve Board issued its original proposal for public comment), generally will not be deducted from capital for supervisory purposes, although they will continue to be deducted for purposes of evaluating applications filed by bank holding companies.

8

As of December 31, 2010, Potomac had capital in excess of all applicable requirements as shown below:

| Actual | Required | Excess | |||||||

| (in thousands) | |||||||||

| Tier 1 capital: | |||||||||

| Common stock | $ | 3 672 | |||||||

| Surplus | 3 932 | ||||||||

| Retained earnings | 23 725 | ||||||||

| 31 329 | |||||||||

| Less: | |||||||||

| Cost of shares acquired for the treasury | 2 866 | ||||||||

| Disallowed deferred tax asset | 398 | ||||||||

| Total tier 1 capital | $ | 28 065 | $ | 8 653 | $ | 19 412 | |||

| Tier 2 capital: | |||||||||

| Allowance for loan losses (1) | 2 733 | ||||||||

| Total risk-based capital | $ | 30 798 | $ | 17 306 | $ | 13 492 | |||

| Risk-weighted assets | $ | 216 322 | |||||||

| Tier 1 capital | $ | 28 065 | $ | 11 992 | $ | 16 073 | |||

| Average total assets (2) | $ | 299 802 | |||||||

| Capital ratios: | |||||||||

|

Tier 1 risk-based capital ratio

|

12.97% | 4.00% | 8.97% | ||||||

|

Total risk-based capital ratio

|

14.24% | 8.00% | 6.24% | ||||||

|

Tier 1 capital to average total assets (leverage)

|

9.36% | 4.00% | 5.36% | ||||||

|

(1) Limited to 1.25% of gross risk-weighted assets.

(2) Net of disallowed deferred tax asset. |

|||||||||

Gramm-Leach-Bliley Act of 1999. On November 4, 1999, Congress adopted the Gramm-Leach-Bliley Act of 1999. This Act, also known as the Financial Modernization Law, repealed a number of federal limitations on the powers of banks and bank holding companies originally adopted in the 1930’s. Under the Act, banks, insurance companies, securities firms and other service providers may now affiliate. In addition to broadening the powers of banks, the Act created a new form of entity, called a financial holding company, which may engage in any activity that is financial in nature or incidental or complementary to financial activities.

The Federal Reserve Board provides the principal regulatory supervision of financial services permitted under the Act. However, the Securities and Exchange Commission and state insurance and securities regulators also assume substantial supervisory powers and responsibilities.

The Act addresses a variety of other matters, including customer privacy issues. The obtaining of certain types of information by false or fraudulent pretenses is a crime. Banks and other financial institutions must notify their customers about their policies on sharing information with certain third parties. In some instances, customers may refuse to permit their information to be shared. The Act also requires disclosures of certain automatic teller machine fees and contains certain amendments to the federal Community Reinvestment Act.

Permitted Non-Banking Activities. Under the Gramm-Leach-Bliley Act, bank holding companies may become financial holding companies and engage in certain non-banking activities. Potomac has not yet filed to become a financial holding company and presently does not engage in, nor does it have any immediate plans to engage in, any such non-banking activities.

A notice of proposed non-banking activities must be furnished to the Federal Reserve and the Banking Board before Potomac engages in such activities, and an application must be made to the Federal Reserve and Banking Board concerning acquisitions by Potomac of corporations engaging in those activities. In addition, the Federal Reserve may, by order issued on a case-by-case basis, approve additional non-banking activities.

The Bank. The bank is a state-chartered bank that is not a member of the Federal Reserve System and is subject to regulation and supervision by the FDIC and the Commissioner.

Compliance with Environmental Laws. The costs and effects of compliance with federal, state and local environmental laws will not have a material effect or impact on Potomac or the bank.

9

International Money Laundering Abatement and Anti-Terrorist Financing Act of 2001 (USA Patriot Act). The International Money Laundering Abatement and Anti-Terrorist Financing Act of 2001 (the “Patriot Act”) was adopted in response to the September 11, 2001 terrorist attacks. The Patriot Act provides law enforcement with greater powers to investigate terrorism and prevent future terrorist acts. Among the broad-reaching provisions contained in the Patriot Act are several designed to deter terrorists’ ability to launder money in the United States and provide law enforcement with additional powers to investigate how terrorists and terrorist organizations are financed. The Patriot Act creates additional requirements for banks, which were already subject to similar regulations. The Patriot Act authorizes the Secretary of the Treasury to require financial institutions to take certain “special measures” when the Secretary suspects that certain transactions or accounts are related to money laundering. These special measures may be ordered when the Secretary suspects that a jurisdiction outside of the United States, a financial institution operating outside of the United States, a class of transactions involving a jurisdiction outside of the United States or certain types of accounts are of “primary money laundering concern.” The special measures include the following: (a) require financial institutions to keep records and report on the transactions or accounts at issue; (b) require financial institutions to obtain and retain information related to the beneficial ownership of any account opened or maintained by foreign persons; (c) require financial institutions to identify each customer who is permitted to use a payable-through or correspondent account and obtain certain information from each customer permitted to use the account; and (d) prohibit or impose conditions on the opening or maintaining of correspondent or payable-through accounts.

Sarbanes-Oxley Act of 2002. On July 30, 2002, the Senate and the House of Representatives of the United States enacted the Sarbanes-Oxley Act of 2002, a law that addresses, among other issues, corporate governance, auditing and accounting, executive compensation, and enhanced and timely disclosure of corporate information.

Effective August 29, 2002, as directed by Section 302(a) of Sarbanes-Oxley, Potomac’s chief executive officer and chief financial officer are each required to certify that Potomac’s Quarterly and Annual Reports do not contain any untrue statement of a material fact. The rules have several requirements, including having these officers certify that: they are responsible for establishing, maintaining and regularly evaluating the effectiveness of Potomac’s internal controls; they have made certain disclosures to Potomac’s auditors and the audit committee of the Board of Directors about Potomac’s internal controls; and they have included information in Potomac’s Quarterly and Annual Reports about their evaluation and whether there have been significant changes in Potomac’s internal controls or in other factors that could significantly affect internal controls subsequent to the evaluation.

Troubled Asset Relief Program – Capital Purchase Program. On October 3, 2008, the Federal government enacted the Emergency Economic Stabilization Act of 2008 (“EESA”). EESA was enacted to provide liquidity to the U.S. financial system and lessen the impact of looming economic problems. The EESA included broad authority. The centerpiece of the EESA is the Troubled Asset Relief Program (“TARP”). EESA’s broad authority was interpreted to allow the U.S. Treasury to purchase equity interests in both healthy and troubled financial institutions. The equity purchase program is commonly referred to as the Capital Purchase Program (“CPP”). Management and our Board of Directors did a thorough evaluation of both the positive and negative aspects of the CPP. In the end, we came to the conclusion that, based on our strong capital position, earnings capacity, and the fact that it would dilute the earnings of existing shareholders, we would not participate in the CPP.

American Recovery and Reinvestment Act of 2009. On February 17, 2009, President Obama signed into law the American Recovery and Reinvestment Act of 2009 (“ARRA”), more commonly known as the economic stimulus or economic recovery package. ARRA includes a wide variety of programs intended to stimulate the economy and provide for extensive infrastructure, energy, health, and education needs. In addition, ARRA imposes certain new executive compensation and corporate expenditure limits on all current and future TARP recipients that are in addition to those previously announced by the U.S. Treasury, until the institution has repaid the U.S. Treasury, which is now permitted under ARRA without penalty and without the need to raise new capital, subject to the U.S. Treasury’s consultation with the recipient’s appropriate regulatory agency.

10

Dodd-Frank Act. On July 21, 2010, sweeping financial regulatory reform legislation entitled the “Dodd-Frank Wall Street Reform and Consumer Protection Act” (the “Dodd-Frank Act”) was signed into law. Generally, the Dodd-Frank Act is effective the day after it was signed into law, but different effective dates apply to specific sections of the law. The Dodd-Frank Act implements far-reaching changes across the financial regulatory landscape, including provisions that, among other things, will:

- Centralize responsibility for consumer financial protection by creating a new agency, the Consumer Financial Protection Bureau, which will have rulemaking authority for a wide range of consumer protection laws that would apply to all banks and have broad powers to supervise and enforce consumer protection laws;

- After a three-year phase-in period which begins January 1, 2013, removes trust preferred securities as a permitted component of a holding company’s tier 1 capital;

- Requires financial holding companies to be well-capitalized and well-managed as of July 21, 2011. Bank holding companies and banks must also be both well-capitalized and well-managed in order to acquire banks located outside their domiciled state;

- Provides for an increase in the FDIC assessment for depository institutions with assets of $10 billion or more, increases in the minimum reserve ratio for the deposit insurance fund from 1.15% to 1.35% and changes in the basis for determining FDIC premiums from deposits to assets;

- Provides for new disclosure and other requirements relating to executive compensation and corporate governance. These disclosures and requirements apply to all public companies, not just financial institutions;

- Permanently increases the limit for federal deposit insurance, increases the cash limit of Securities Investor Protection Corporation protection from $100,000 to $250,000 and provides unlimited federal deposit insurance until January 1, 2013 for non-interest bearing demand transaction accounts at all insured depository institutions;

- Repeals the federal prohibitions on the payment of interest on demand deposits; and

- Amends the Electronic Fund Transfer Act (EFTA) to, among other things, give the Federal Reserve the authority to establish rules regarding interchange fees charged for electronic debit transactions by payment card issuers having assets over $10 billion and to enforce a new statutory requirement that such fees be reasonable and proportional to the actual cost of a transaction to the issuer.

Uncertainty remains as to the ultimate impact of the Act, which could have a material adverse impact either on the financial services industry as a whole, or on Potomac’s business, results of operations and financial condition.

Available Information. The company files annual, quarterly and current reports, proxy statements and other information with the SEC. The company’s SEC filings are filed electronically and are available to the public through the Internet at the SEC’s website at http://www.sec.gov. In addition, any document filed by the company with the SEC can be read and copied at the SEC’s public reference facilities at 100 F Street, NE, Washington, DC 20549. Copies of documents can be obtained at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Copies of documents can also be obtained free of charge by any shareholder by writing to Gayle Marshall Johnson, Sr. Vice President and Chief Financial Officer, Potomac Bancshares, Inc., PO Box 906, Charles Town, WV 25414.

Item 2. Properties.

The bank owns the land and buildings of the main office and the branch office facilities in Harpers Ferry, Kearneysville, Martinsburg and Hedgesville. The bank also owns a lot at the corner of Route 340 and Washington Street in Bolivar that will probably be sold.

The main office property is located at 111 East Washington Street, Charles Town, West Virginia. This property consists of two separate two story buildings located side by side with adjoining corridors. During 2000, the construction of the newer of these two buildings was completed. The first floor of the new building houses the bank’s One Financial Center (trust and financial services). The second floor of the new building houses certain administrative and loan offices. Both of these floors open into the older bank premises, constructed in 1967. In July of 2006, the bank completed the purchase of a property adjacent to the main office for future expansion. In early 2008, construction began on an addition to the main office facilities which was completed in 2009. The new addition houses a new drive through with five lanes (one ATM/night deposit lane and four transaction lanes), the call center, the Information Technology and Deposit Operations departments and certain administrative offices. Renovations to the existing two buildings were completed along with the addition. In September 2009, the Finance Department relocated from the leased space in Burr Industrial Park to a part of the renovated main office building.

11

In October 2005 to provide additional office and storage areas, the bank leased space in Burr Industrial Park in Kearneysville, West Virginia. Currently, the leased space provides record storage facilities and a business recovery site for the bank.

The Harpers Ferry branch office is located at 1366 W. Washington Street, Bolivar, West Virginia. The office is a one story brick building constructed in 1975 and renovated in 2005. There is another building on this property that existed at the time of the bank's purchase. This separate building is rented to an outside party by the bank.

The branch facility at 5480 Charles Town Road, Kearneysville, West Virginia was erected in 1985. This one story brick building opened for business in April of 1985. During 1993, an addition was constructed, doubling the size of this facility. Renovation of these facilities was completed in 2006.

The branch facility at 119 Cowardly Lion Drive, Hedgesville, West Virginia was erected in 2003. This one story brick building opened for business in June of 2003.

The branch office at 9738 Tuscarora Pike in Martinsburg, West Virginia opened for business in July of 2001. Originally housed in a leased facility on the property, the one story brick building was completed in January 2005.

There are no encumbrances on any of these properties. In the opinion of management, these properties are adequately covered by insurance.

Item 3. Legal Proceedings.

Currently, Potomac is involved in no legal proceedings.

The bank is involved in various legal proceedings arising in the normal course of business, and in the opinion of the bank, the ultimate resolution of these proceedings will not have a material effect on the financial position or operations of the bank.

Item 4. (Removed and Reserved).

PART II

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

The following information reflects comparative per share data for the periods indicated for Potomac common stock for (a) trading values and (b) dividends. As of March 11, 2011, there were approximately 1,100 shareholders.

Trading of Potomac Bancshares, Inc. common stock is not extensive and cannot be described as a public trading market. Potomac Bancshares, Inc. is on the OTC Bulletin Board Market. To gather information about Potomac in this market use Potomac’s symbol PTBS.OB. Scott and Stringfellow, Inc., and Koonce Securities Inc. are market makers for Potomac’s stock. Market makers are firms that maintain a firm bid and ask price for a given number of shares at a given point in time in a given security by standing ready to buy or sell at publicly quoted prices. Information about sales of Potomac’s stock is available on the Internet through many of the stock information services using Potomac’s symbol. Shares of Potomac common stock are occasionally bought and sold by private individuals, firms or corporations, and, in most instances, Potomac does not have knowledge of the purchase price or the terms of the purchase. The trading values for 2009 and 2010 are based on information available through the Internet. No attempt was made by Potomac to verify or determine the accuracy of the representations made to Potomac or gathered on the Internet.

| Price Range | Cash Dividends | ||||||||||

| High | Low | Paid per Share | |||||||||

| 2009 | First Quarter | $ | 10.10 | $ | 7.50 | $ | .1175 | ||||

| Second Quarter | 9.50 | 6.60 | .1175 | ||||||||

| Third Quarter | 8.00 | 5.35 | .0300 | ||||||||

| Fourth Quarter | 6.34 | 5.75 | .0000 | ||||||||

| 2010 | First Quarter | $ | 6.10 | $ | 4.63 | $ | .0000 | ||||

| Second Quarter | 6.34 | 4.50 | .0000 | ||||||||

| Third Quarter | 5.84 | 4.30 | .0000 | ||||||||

| Fourth Quarter | 5.25 | 4.30 | .0000 | ||||||||

12

The primary source of funds for dividends paid by Potomac is the dividend income received from the bank. The bank's ability to pay dividends is subject to restrictions under federal and state law, and under certain cases, approval by the FDIC and the Commissioner could be required. Dividends will only be paid when and as declared by the board of directors.

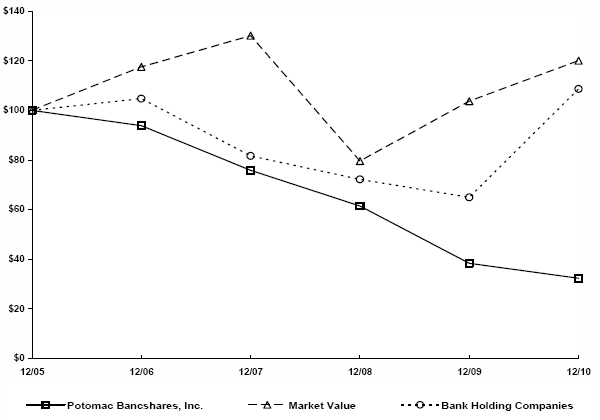

Performance Graph

The following graph compares the yearly percentage change in Potomac’s cumulative total shareholder return on common stock for the five-year period ending December 31, 2010, with the cumulative total return of the Bank Holding Companies Index (SIC Code 6712) and the Market Value Index. Shareholders may obtain a copy of the index by calling Research Data Group, Inc. at telephone number (415) 643-6018. There is no assurance that Potomac’s stock performance will continue in the future with the same or similar trends as depicted in the graph.

The graph shall not be deemed incorporated by reference by any general statement into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that Potomac specifically incorporates this graph by reference, and shall not otherwise be filed under such Acts.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Potomac Bancshares, Inc., the Market Value Index

and Bank Holding Companies Index

Among Potomac Bancshares, Inc., the Market Value Index

and Bank Holding Companies Index

ASSUMES $100 WAS INVESTED ON JANUARY 1, 2006 AND ASSUMES DIVIDENDS WERE

REINVESTED THROUGH FISCAL YEAR ENDING DECEMBER 31, 2010

REINVESTED THROUGH FISCAL YEAR ENDING DECEMBER 31, 2010

13

ISSUER PURCHASES OF EQUITY SECURITIES

| (c) Total Number | |||||||||

| of Shares | |||||||||

| (a) Total | Purchased as | (d) Maximum Number | |||||||

| Number of | (b) Average | Part of Publicly | of Shares that May | ||||||

| Shares | Price Paid | Announced | Yet be Purchased | ||||||

| Period | Purchased | Per Share | Programs | Under the Program | |||||

| October 1 through October 31 | NONE | $ | - - | 283 553 | 62 515 | ||||

| November 1 through November 30 | NONE | - - | 283 553 | 62 515 | |||||

| December 1 through December 31 | NONE | - - | 283 553 | 62 515 | |||||

On February 12, 2002, the company’s Board of Directors originally authorized the repurchase program. The program authorized the repurchase of up to 10% of the company’s stock over the next twelve months. The stock may be purchased in the open market and/or in privately negotiated transactions as management and the board of directors determine prudent. The program has been extended on an annual basis.

Summary of Equity Compensation Plans

| Equity Compensation Plan Information | |||||||

| Number of | |||||||

| Securities to be | Number of Securities | ||||||

| Issued Upon | Weighted Average | Remaining Available for | |||||

| Exercise of | Exercise Price of | Future Issuance Under | |||||

| Outstanding | Outstanding | Equity Compensation | |||||

| Plan Category | Options | Options | Plan | ||||

| Equity compensation plans approved by Stockholders | 120,974 | $ | 14.76 | 310,586 | |||

| Equity compensation plans not approved by Stockholders | - | $ | - | - | |||

| 120,974 | $ | 14.76 | 310,586 | ||||

The 2003 Stock Incentive Plan was approved by stockholders on May 13, 2003, which authorized up to 183,600 shares of common stock to be used in the granting of incentive and non-qualified options to employees and directors. On April 24, 2007, the stockholders approved an additional 250,000 shares of common stock to be used in the granting of incentive and non-qualified options to employees and directors. This is the first and only stock incentive plan adopted by the company. Under the plan, the option price cannot be less than the fair market value of the stock on the date granted. An option’s maximum term is ten years from the date of grant. Employee options granted under the plan are subject to a five year graded vesting schedule. Director options immediately vest.

For additional information regarding our equity compensation plans, refer to the discussion in Note 10 to the audited consolidated financial statements included in Item 15 of this Annual Report on Form 10-K.

14

Item 6. Selected Financial Data.

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||

| (Dollars in Thousands Except Per Share Data) | ||||||||||||||||

| Summary of Operations | ||||||||||||||||

| Interest income | $ | 13 904 | $ | 14 913 | $ | 17 358 | $ | 19 691 | $ | 19 099 | ||||||

| Interest expense | 4 143 | 5 121 | 6 477 | 8 161 | 6 932 | |||||||||||

| Net interest income | 9 761 | 9 792 | 10 881 | 11 530 | 12 167 | |||||||||||

| Provision for loan losses | 1 599 | 6 690 | 2 934 | 678 | 331 | |||||||||||

| Net interest income after provision | ||||||||||||||||

| for loan losses | 8 162 | 3 102 | 7 947 | 10 852 | 11 836 | |||||||||||

| Noninterest income | 4 076 | 4 281 | 4 355 | 4 379 | 3 766 | |||||||||||

| Noninterest expense | 9 764 | 11 059 | 9 587 | 9 703 | 9 261 | |||||||||||

| Income (loss) before income taxes | 2 474 | (3 676 | ) | 2 715 | 5 528 | 6 341 | ||||||||||

| Income tax expense (benefit) | 680 | (1 436 | ) | 853 | 1 998 | 2 306 | ||||||||||

| Net income (loss) | $ | 1 794 | $ | (2 240 | ) | $ | 1 862 | $ | 3 530 | $ | 4 035 | |||||

| Per Share Data | ||||||||||||||||

| Net income (loss), basic | $ | .53 | $ | (.66 | ) | $ | .55 | $ | 1.03 | $ | 1.17 | |||||

| Net income (loss), diluted | .53 | (.66 | ) | .55 | 1.03 | 1.16 | ||||||||||

| Cash dividends declared | .00 | .27 | .46 | .42 | .38 | |||||||||||

| Book value at period end | 7.90 | 7.54 | 8.19 | 8.52 | 7.78 | |||||||||||

| Weighted-average shares outstanding, basic | 3 390 178 | 3 390 516 | 3 401 717 | 3 423 239 | 3 454 961 | |||||||||||

| Weighted-average shares outstanding, diluted | 3 390 178 | 3 390 516 | 3 403 265 | 3 430 764 | 3 467 918 | |||||||||||

| Average Balance Sheet Summary | ||||||||||||||||

| Assets | $ | 303 998 | $ | 304 739 | $ | 303 749 | $ | 297 716 | $ | 289 303 | ||||||

| Loans | 227 113 | 239 175 | 232 894 | 226 773 | 220 895 | |||||||||||

| Securities | 39 388 | 32 841 | 34 178 | 42 040 | 48 891 | |||||||||||

| Deposits | 263 534 | 261 233 | 259 536 | 252 908 | 243 833 | |||||||||||

| Stockholders’ equity | 26 780 | 26 266 | 30 118 | 28 207 | 26 632 | |||||||||||

| Performance Ratios | ||||||||||||||||

| Return (loss) on average assets | 0.59% | (0.74)% | 0.61% | 1.19% | 1.39% | |||||||||||

| Return (loss) on average equity | 6.70% | (8.53)% | 6.18% | 12.51% | 15.15% | |||||||||||

| Dividend payout ratio | 0.00% | (40.91)% | 83.64% | 40.78% | 32.48% | |||||||||||

| Capital Ratios | ||||||||||||||||

| Leverage ratio | 9.36% | 8.75% | 9.85% | 9.99% | 9.34% | |||||||||||

| Risk-based capital ratios | ||||||||||||||||

| Tier 1 capital | 12.97% | 11.65% | 12.37% | 13.01% | 12.71% | |||||||||||

| Total capital | 14.24% | 12.92% | 13.63% | 14.23% | 13.82% | |||||||||||

15

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

AVERAGE BALANCES, INCOME/EXPENSE AND AVERAGE YIELD/RATE

This schedule is a comparison of interest earning assets and interest-bearing liabilities showing average yields or rates derived from average balances and actual income and expenses. Income and rates on tax exempt loans and securities are computed on a tax equivalent basis using a federal tax rate of 34%. Loans placed on nonaccrual status are reflected in the balances.

| 2010 | 2009 | 2008 | |||||||||||||||||||||||

| Average | Income/ | Average | Average | Income/ | Average | Average | Income/ | Average | |||||||||||||||||

| Balances | Expense | Yield/Rate | Balances | Expense | Yield/Rate | Balances | Expense | Yield/Rate | |||||||||||||||||

| (in thousands) | (in thousands) | (in thousands) | |||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||

| Loans | |||||||||||||||||||||||||

| Taxable | $ | 226 169 | $ | 12 875 | 5.69% | $ | 238 493 | $ | 13 759 | 5.77% | $ | 232 124 | $ | 15 151 | 6.53% | ||||||||||

| Tax exempt | 944 | 73 | 7.73% | 682 | 64 | 9.38% | 770 | 73 | 9.48% | ||||||||||||||||

| Total loans | 227 113 | 12 948 | 5.70% | 239 175 | 13 823 | 5.78% | 232 894 | 15 224 | 6.54% | ||||||||||||||||

| Taxable securities | 34 372 | 755 | 2.20% | 29 084 | 933 | 3.21% | 31 286 | 1 415 | 4.52% | ||||||||||||||||

| Nontaxable securities | 5 016 | 306 | 6.10% | 3 757 | 224 | 5.96% | 2 892 | 167 | 5.77% | ||||||||||||||||

| Federal funds sold | 3 291 | 3 | 0.09% | 4 049 | 7 | 0.17% | 10 712 | 249 | 2.32% | ||||||||||||||||

| Other earning assets | 7 935 | 21 | 0.26% | 3 125 | 24 | 0.77% | 7 765 | 383 | 4.93% | ||||||||||||||||

| Total earning assets | 277 727 | $ | 14 033 | 5.05% | 279 190 | $ | 15 011 | 5.38% | 285 549 | $ | 17 438 | 6.11% | |||||||||||||

| Allowance for loan losses | (5 335 | ) | (4 776 | ) | (2 940 | ) | |||||||||||||||||||

| Cash and due from banks | 4 655 | 6 850 | 4 396 | ||||||||||||||||||||||

| Premises and equipment, net | 8 510 | 8 650 | 6 934 | ||||||||||||||||||||||

| Other assets | 18 441 | 14 825 | 9 810 | ||||||||||||||||||||||

| Total assets | $ | 303 998 | $ | 304 739 | $ | 303 749 | |||||||||||||||||||

| LIABILITIES AND | |||||||||||||||||||||||||

| STOCKHOLDERS’ EQUITY | |||||||||||||||||||||||||

| Deposits | |||||||||||||||||||||||||

| Savings and interest- | |||||||||||||||||||||||||

| bearing demand deposits | $ | 126 035 | $ | 838 | 0.66% | $ | 119 504 | $ | 1 016 | 0.85% | $ | 120 853 | $ | 1 615 | 1.34% | ||||||||||

| Time deposits | 109 902 | 3 134 | 2.85% | 115 239 | 3 756 | 3.26% | 111 574 | 4 547 | 4.08% | ||||||||||||||||

| Total interest- | |||||||||||||||||||||||||

| bearing deposits | 235 937 | 3 972 | 1.68% | 234 743 | 4 772 | 2.03% | 232 427 | 6 162 | 2.65% | ||||||||||||||||

| Securities sold under agreements | |||||||||||||||||||||||||

| to repurchase and federal | |||||||||||||||||||||||||

| funds purchased | 8 372 | 84 | 1.00% | 9 212 | 148 | 1.61% | 9 963 | 255 | 2.56% | ||||||||||||||||

| Advances from FHLB and FRB | 3 333 | 87 | 2.61% | 4 336 | 201 | 4.64% | 1 381 | 60 | 4.34% | ||||||||||||||||

| Total interest | |||||||||||||||||||||||||

| bearing liabilities | 247 642 | $ | 4 143 | 1.67% | 248 291 | $ | 5 121 | 2.06% | 243 771 | $ | 6 477 | 2.66% | |||||||||||||

| Noninterest-bearing demand | |||||||||||||||||||||||||

| deposits | 27 597 | 26 490 | 27 109 | ||||||||||||||||||||||

| Other liabilities | 1 979 | 3 692 | 2 751 | ||||||||||||||||||||||

| Stockholders’ equity | 26 780 | 26 266 | 30 118 | ||||||||||||||||||||||

| Total liabilities and | |||||||||||||||||||||||||

| stockholders’ equity | $ | 303 998 | $ | 304 739 | $ | 303 749 | |||||||||||||||||||

| Net interest income | $ | 9 890 | $ | 9 890 | $ | 10 961 | |||||||||||||||||||

| Net interest spread | 3.38% | 3.32% | 3.45% | ||||||||||||||||||||||

| Interest expense as a | |||||||||||||||||||||||||

| percent of average earning assets | 1.49% | 1.83% | 2.27% | ||||||||||||||||||||||

| Net interest margin | 3.56% | 3.54% | 3.84% | ||||||||||||||||||||||

16

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS

OF OPERATIONS

OF OPERATIONS

CRITICAL ACCOUNTING POLICIES

GENERAL

The company’s financial statements are prepared in accordance with U. S. generally accepted accounting principles. The financial information contained within our statements is, to a significant extent, financial information that is based on measures of the financial effects of transactions and events that have already occurred. A variety of factors could affect the ultimate value that is obtained either when earning income, recognizing an expense, recovering an asset or relieving a liability. We use historical loss factors as one factor in determining the inherent loss that may be present in our loan portfolio. Actual losses could differ significantly from the historical factors that we use. In addition, U. S. generally accepted accounting principles may change from one previously acceptable method to another method. Although the economics of our transactions would be the same, the timing of events that would impact our transactions could change.

ALLOWANCE FOR LOAN LOSSES

The allowance for loan losses is an estimate of the losses that may be sustained in our loan portfolio. The allowance is based on two basic principles of accounting: (1) losses be accrued when they are probable of occurring and are capable of estimation and (2) losses be accrued based on the differences between the value of collateral, present value of future cash flows or values that are observable in the secondary market and the loan balance.

The allowance consists of specific, general and unallocated components. The specific component relates to loans that are classified as doubtful or substandard. For such loans that are also classified as impaired, an allowance is established when the discounted cash flows (or collateral value or observable market price) of the impaired loan is lower than the carrying value of that loan. The general component covers non-classified loans and is based on historical loss experience adjusted for qualitative factors. An unallocated component is maintained to cover uncertainties that could affect management’s estimate of probable losses. The unallocated component of the allowance reflects that margin of imprecision inherent in the underlying assumptions used in the methodologies for estimating specific and general losses in the portfolio.

RECENT LEGISLATION IMPACTING THE FINANCIAL SERVICES INDUSTRY

On July 21, 2010, sweeping financial regulatory reform legislation entitled the “Dodd-Frank Wall Street Reform and Consumer Protection Act” (the “Dodd-Frank Act”) was signed into law. Generally, the Dodd-Frank Act is effective the day after it was signed into law, but different effective dates apply to specific sections of the law. The Dodd-Frank Act implements far-reaching changes across the financial regulatory landscape, including provisions that, among other things, will:

- Centralize responsibility for consumer financial protection by creating a new agency, the Consumer Financial Protection Bureau, which will have rulemaking authority for a wide range of consumer protection laws that would apply to all banks and have broad powers to supervise and enforce consumer protection laws;

- After a three-year phase-in period which begins January 1, 2013, removes trust preferred securities as a permitted component of a holding company’s tier 1 capital;

- Requires financial holding companies to be well-capitalized and well-managed as of July 21, 2011. Bank holding companies and banks must also be both well-capitalized and well-managed in order to acquire banks located outside their domiciled state;

- Provides for an increase in the FDIC assessment for depository institutions with assets of $10 billion or more, increases in the minimum reserve ratio for the deposit insurance fund from 1.15% to 1.35% and changes in the basis for determining FDIC premiums from deposits to assets;

- Provides for new disclosure and other requirements relating to executive compensation and corporate governance. These disclosures and requirements apply to all public companies, not just financial institutions;

17

- Permanently increases the $250 thousand limit for federal deposit insurance and increases the cash limit of Securities Investor Protection Corporation protection from $100 thousand to $250 thousand and provides unlimited federal deposit insurance until January 1, 2013 for non-interest bearing demand transaction accounts at all insured depository institutions;

- Repeals the federal prohibitions on the payment of interest on demand deposits; and

- Amends the Electronic Fund Transfer Act (EFTA) to, among other things, give the Federal Reserve the authority to establish rules regarding interchange fees charged for electronic debit transactions by payment card issuers having assets over $10 billion and to enforce a new statutory requirement that such fees be reasonable and proportional to the actual cost of a transaction to the issuer.

Uncertainty remains as to the ultimate impact of the Act, which could have a material adverse impact either on the financial services industry as a whole, or on our business. Provisions in the legislation that affect deposit insurance assessments, payment of interest on demand deposits and interchange fees could increase the costs associated with deposits as well as place limitations on certain revenues those deposits may generate. Provisions in the legislation that revoke the Tier 1 capital treatment of trust preferred securities and otherwise require revisions to the capital requirements of the Company and the Bank could require the Company and the Bank to seek other sources of capital in the future.

GENERAL

The year 2010 was a combination of challenges and opportunities. The challenges came in the form of increased regulation, poor loan demand, unemployment concerns and very little change in the real estate market. Opportunities have presented themselves through commercial growth in the market area, a bank consolidation and a diverse customer base.

The challenges the bank faces today are similar to the concerns we had at the end of 2009. Real estate has long been the driving force for the local economy. The real estate industry is still reeling from foreclosures and the effects of unemployment in the region. Although we believe the harshest realities of the real estate collapse are behind us, management is confident the recovery will be much slower than the collapse. Regulation has been and will continue to be a challenge to the bank’s operations. Increased reporting requirements and possible limitations on some fee income items are some of the issues that we deal with in the current regulatory environment. However, there are opportunities to grow the bank and its customer base.

The opportunities have come mostly in the form of an emerging local economy. Several commercial facilities are either in development or planned over the next five years. Although these facilities are not being funded by the bank, they represent opportunities for employment in the market area. Inquiries into our loan products have picked up over the last several months. We are hopeful that is a sign that the local economy is turning around. One of our competitors was purchased by a larger regional bank. We believe this opens up the opportunity to provide services to customers that do not want to bank with a larger institution. One of the most exciting opportunities is the diverse customer base we are building. We have “traditional” customers that have banked with us for most of their lives and enjoy visiting our locations and interacting with our customer friendly employees. However, we are seeing increasing numbers of customers that want to bank from their business, their home or where ever they happen to be located when the need arises. Technology has given us the opportunity to reach these customers in increasing numbers. We look forward to meeting the needs of all of our customers through a combination of the best customer service and the latest technology.

18

The following table sets forth selected quarterly results (with dollars in thousands) of the company for 2010 and 2009.

| 2010 | 2009 | ||||||||||||||||||||||||||

| Three Months Ended | Three Months Ended | ||||||||||||||||||||||||||

| Dec 31 | Sept 30 | June 30 | Mar 31 | Dec 31 | Sept 30 | June 30 | Mar 31 | ||||||||||||||||||||

| Interest income | $ | 3 380 | $ | 3 459 | $ | 3 539 | $ | 3 526 | $ | 3 594 | $ | 3 704 | $ | 3 805 | $ | 3 810 | |||||||||||

| Interest expense | 948 | 993 | 1 058 | 1 144 | 1 208 | 1 228 | 1 300 | 1 385 | |||||||||||||||||||

| Net interest income | 2 432 | 2 466 | 2 481 | 2 382 | 2 386 | 2 476 | 2 505 | 2 425 | |||||||||||||||||||

| Provision for loan losses | 615 | 213 | 461 | 310 | 13 | 3 540 | 1 560 | 1 577 | |||||||||||||||||||

| Net interest income (loss) after | |||||||||||||||||||||||||||

| provision for loan losses | 1 817 | 2 253 | 2 020 | 2 072 | 2 373 | (1 064 | ) | 945 | 848 | ||||||||||||||||||

| Noninterest income | 884 | 1 047 | 1 093 | 1 052 | 1 619 | 1 369 | 1 047 | 1 022 | |||||||||||||||||||

| Noninterest expense | 2 263 | 2 531 | 2 461 | 2 509 | 2 973 | 3 102 | 3 134 | 2 626 | |||||||||||||||||||

| Income (loss) before taxes | 438 | 769 | 652 | 615 | 1 019 | (2 797 | ) | (1 142 | ) | (756 | ) | ||||||||||||||||

| Income tax expense (benefit) | 32 | 241 | 214 | 193 | 614 | (1 204 | ) | (508 | ) | (338 | ) | ||||||||||||||||

| Net income (loss) | $ | 406 | $ | 528 | $ | 438 | $ | 422 | $ | 405 | $ | (1 593 | ) | $ | (634 | ) | $ | (418 | ) | ||||||||

| Earnings (loss) per share, basic | |||||||||||||||||||||||||||

| and diluted | $ | .12 | $ | .16 | $ | .13 | $ | .12 | $ | .12 | $ | (.47 | ) | $ | (.19 | ) | $ | (.12 | ) | ||||||||

NET INTEREST INCOME

Overall, interest and dividend income was 7% lower in 2010 when compared with 2009 results. The particular reasons for the reduction in interest income are (1) an approximately 5% decrease in average loan balances and an eight basis point reduction in the average loan rate in 2010 compared to 2009 and (2) an 83 basis point reduction in average yield on debt securities in 2010 compared to 2009 even with an almost 20% increase in averages balances in these securities during the same period since many securities with higher yields were called. Other earning assets have changed by varying degrees but have not significantly affected interest income.

Interest expense decreased 19% in 2010 compared to 2009. The decrease between 2009 and 2008 was 21%. The decreased expense in these years results from lower interest rates as balances in deposit accounts have not changed materially during the last three years. Average rates for these years are 1.68% in 2010, 2.03% in 2009 and 2.65% in 2008. The continuance of low rates is precipitated by the rates enacted by the Federal Reserve during the period.

Fiscal year 2010 has proven to be as challenging as 2009. The economy does show signs of recovery but expectations continue to be cautiously optimistic. The housing market and unemployment continue to be a drag on the local economy. However, there are developments in the local economy that point toward some relief in unemployment. Macy’s is building a procurement center in Martinsburg, WV. The U.S. Customs and border patrol center in Harpers Ferry, WV continues to provide construction employment as its facilities grow. The addition of tables games at the Charles Town Races and Slots has also provided employment. Interest rates are expected to remain at current levels throughout most of 2011. Management is hopeful that interest rates and the volume of affordable housing will entice buyers back into the loan market during 2011.

19

VOLUME AND RATE ANALYSIS

This schedule analyzes the change in net interest income attributable to changes in volume of the various portfolios and changes in interest rates. The change due to both rate and volume variances has been allocated between rate and volume based on the percentage relationship of such variances to each other.

| 2010 Compared to 2009 | 2009 Compared to 2008 | |||||||||||||||||||||||

| (in thousands) | (in thousands) | |||||||||||||||||||||||

| Change in | Change in | |||||||||||||||||||||||

| Income/ | Volume | Rate | Income/ | Volume | Rate | |||||||||||||||||||

| Expense | Effect | Effect | Expense | Effect | Effect | |||||||||||||||||||

| INTEREST INCOME | ||||||||||||||||||||||||

| Taxable loans | $ | (884 | ) | $ | (697 | ) | $ | (187 | ) | $ | (1 392 | ) | $ | 430 | $ | (1 822 | ) | |||||||

| Tax exempt loans | 9 | 16 | (7 | ) | (9 | ) | (8 | ) | (1 | ) | ||||||||||||||

| Taxable securities | (178 | ) | 244 | (422 | ) | (482 | ) | (95 | ) | (387 | ) | |||||||||||||

| Nontaxable securities | 82 | 77 | 5 | 57 | 52 | 5 | ||||||||||||||||||

| Federal funds sold | (4 | ) | (1 | ) | (3 | ) | (242 | ) | (97 | ) | (145 | ) | ||||||||||||

| Other earning assets | (3 | ) | (5 | ) | 2 | (359 | ) | (149 | ) | (210 | ) | |||||||||||||

| TOTAL | $ | (978 | ) | $ | (366 | ) | $ | (612 | ) | $ | (2 427 | ) | $ | 133 | $ | (2 560 | ) | |||||||

| INTEREST EXPENSE | ||||||||||||||||||||||||

| Savings and interest-bearing | ||||||||||||||||||||||||

| demand deposits | $ | (178 | ) | $ | 58 | $ | (236 | ) | $ | (599 | ) | $ | (18 | ) | $ | (581 | ) | |||||||

| Time deposits | (622 | ) | (168 | ) | (454 | ) | (791 | ) | 155 | (946 | ) | |||||||||||||

| Securities sold under agreements | ||||||||||||||||||||||||

| to repurchase and federal | ||||||||||||||||||||||||

| funds purchased | (64 | ) | (13 | ) | (51 | ) | (107 | ) | (18 | ) | (89 | ) | ||||||||||||

| Advances from FHLB and FRB | (114 | ) | (40 | ) | (74 | ) | 141 | 137 | 4 | |||||||||||||||

| TOTAL | $ | (978 | ) | $ | (163 | ) | $ | (815 | ) | $ | (1 356 | ) | $ | 256 | $ | (1 612 | ) | |||||||

| NET INTEREST INCOME | $ | - - | $ | (203 | ) | $ | 203 | $ | (1 071 | ) | $ | (123 | ) | $ | (948 | ) | ||||||||

NONINTEREST INCOME AND EXPENSE

Fees generated through the bank’s overdraft protection plan continue to be the largest single contributor to the bank’s noninterest income. These fees are included in the service charges on deposit accounts category which totaled $1.9 million for 2010, $2.2 million for 2009 and $2.3 million for 2008. Trust and financial services income, generally the second largest single contributor to noninterest income, increased in 2010 compared to 2009 due to an increase in market values which are the basis for fees. VISA/MC fees, typically the third largest single contributor to noninterest income, increased 20% in 2010 compared to 2009 due to continuing consumer comfort with electronic transactions and an increase in consumer spending throughout 2010. All other non-interest income changed to varying degrees, but no significant changes occurred in any one particular income category.

Salaries and employee benefits of $4.7 million are about 48% of the total noninterest expense for 2010, a percentage of about 3% more when compared to 2009. This increase in salaries and benefits as a percentage of total noninterest expense is due to the decrease in total noninterest expense as shown by double digit decreases in almost every major noninterest expense category. During the past few years, full utilization of personnel has continued to allow the bank to hold down salaries and benefit costs by holding down the increase in personnel. As expected, pension expense decreased 90% (about $450 thousand) in 2010 compared to 2009 with freezing of the pension plan as of October 31, 2009. Also, as expected, the expense for the 401(k) plan increased 92% (about $103 thousand) in 2010 compared to 2009 since the employer match was increased in conjunction with the freezing of the pension plan. During 2011, salaries and employee benefits are expected to increase slightly. The increase involves the addition of one executive officer and the replacement of another executive officer due to retirement.

20

Expenses related to premises have increased and expenses related to furniture and equipment have decreased. The increase in occupancy expense of premises is attributable to a full year of depreciation on the Donald S. Smith Financial Center addition to the main branch facility and an increase in grounds maintenance related to poor weather conditions. The reduction in furniture and equipment expense is due to the disposal and full depreciation of aging assets. During 2010, advertising and marketing expense and printing, stationery and supplies expense decreased 22.2% and 12.1%, respectively. The decrease is in line with management’s effort to control costs. The FDIC assessment decreased since there was no special assessment in 2010 and due to some reduction in the deposit base at the time of the assessments. Foreclosed property expense decreased significantly in 2010 as a result of the reduction in the costs to prepare properties for sale.

The other noninterest expense category is the total of approximately 60 separate expense accounts. None of the account balances in this category exceed 1% of gross revenue of the company for any of the three years presented. Increases are due to the growth in the bank’s customer base and some inflationary increases.

INTEREST RATE SENSITIVITY

The table below shows the opportunities the company will have to reprice interest earning assets and interest-bearing liabilities as of December 31, 2010 (in thousands).

| Mature or Reprice | |||||||||||||||||

| After Three | |||||||||||||||||

| Months | After One Year | ||||||||||||||||

| Within | But Within | But Within | After | ||||||||||||||

| Three Months | Twelve Months | Five Years | Five Years | Nonsensitive | |||||||||||||

| Interest Earning Assets: | |||||||||||||||||

| Loans | $ | 27 792 | $ | 29 367 | $ | 78 111 | $ | 83 980 | $ | - - | |||||||

| Securities | 2 012 | 3 191 | 32 372 | 4 237 | 878 | ||||||||||||

| Federal funds sold | 2 725 | - - | - - | - - | - - | ||||||||||||

| Other earning assets | 6 511 | - - | - - | - - | - - | ||||||||||||

| Total | $ | 39 040 | $ | 32 558 | $ | 110 483 | $ | 88 217 | $ | 878 | |||||||

| Interest-Bearing Liabilities: | |||||||||||||||||

| Time deposits $100,000 and over | $ | 1 901 | $ | 24 707 | $ | 18 439 | $ | - - | $ | - - | |||||||

| Other time deposits | 9 723 | 24 810 | 23 730 | - - | - - | ||||||||||||