Attached files

| file | filename |

|---|---|

| EX-31.2 - SEQUENTIAL BRANDS GROUP, INC. | ex31-2d.htm |

| EX-10.36 - SEQUENTIAL BRANDS GROUP, INC. | ex10-36.htm |

| EX-32.1 - SEQUENTIAL BRANDS GROUP, INC. | ex32-1d.htm |

| EX-10.35 - SEQUENTIAL BRANDS GROUP, INC. | ex10-35.htm |

| EX-10.31 - SEQUENTIAL BRANDS GROUP, INC. | ex10-31.htm |

| EX-10.30 - SEQUENTIAL BRANDS GROUP, INC. | ex10-30.htm |

| EX-10.32 - SEQUENTIAL BRANDS GROUP, INC. | ex10-32.htm |

| EX-10.33 - SEQUENTIAL BRANDS GROUP, INC. | ex10-33.htm |

| EX-31.1 - SEQUENTIAL BRANDS GROUP, INC. | ex31-1d.htm |

| EX-23.1 - SEQUENTIAL BRANDS GROUP, INC. | ex23-1d.htm |

| EX-10.34 - SEQUENTIAL BRANDS GROUP, INC. | ex10-34.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

|

(Mark One)

|

[X] Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2010

[_] Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from __________________ to ______________________.

Commission file number 0-16075

PEOPLE’S LIBERATION, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or Other Jurisdiction of Incorporation or Organization)

|

86-0449546

(I.R.S. Employer Identification No.)

|

1212 S. Flower Street, 5th Floor

Los Angeles, CA 90015

(Address of Principal Executive Offices)(Zip Code)

(213) 745-2123

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

Yes o

|

No x

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

Yes o

|

No x

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

Yes x

|

No o

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

Yes o

|

No x

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o

(Do not check if smaller reporting company)

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.)

|

Yes o

|

No x

|

The aggregate market value of the registrant's common stock held by non-affiliates of the registrant on June 30, 2010, the last business day of the registrant's most recently completed second fiscal quarter was $1,511,823 (based on the closing sales price of the registrant's common stock on that date).

At March 31, 2011, the registrant had 36,002,563 shares of Common Stock, $0.001 par value, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

PEOPLE’S LIBERATION, INC.

INDEX TO FORM 10-K

|

PART I

|

Page

|

||

|

Item 1.

|

Business

|

3

|

|

|

Item 1A.

|

Risk Factors

|

10

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

16

|

|

|

Item 2.

|

Properties

|

16

|

|

|

Item 3.

|

Legal Proceedings

|

16

|

|

|

Item 4.

|

(Removed and Reserved)

|

17

|

|

|

PART II

|

|||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

17

|

|

|

Item 6.

|

Selected Financial Data

|

18

|

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

18

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures about Market Risk

|

31

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

32

|

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

69

|

|

|

Item 9A.

|

Controls and Procedures

|

69

|

|

|

Item 9B.

|

Other Information

|

70

|

|

|

PART III

|

|||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

70

|

|

|

Item 11.

|

Executive Compensation

|

72

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

80

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

82

|

|

|

Item 14.

|

Principal Accounting Fees and Services

|

84

|

|

|

PART IV

|

|||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

85

|

1

PART I

This 2010 Annual Report on Form 10-K, including the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” contains “forward-looking statements” that include information relating to future events, future financial performance, strategies, expectations, competitive environment, regulation and availability of resources. These forward-looking statements include, without limitation, statements regarding: proposed new products, regulatory developments or other matters; statements concerning projections, predictions, expectations, estimates or forecasts for our business, financial and operating results and future economic performance; statements of management’s goals and objectives; and other similar expressions concerning matters that are not historical facts. Words such as “may,” “will,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes” and “estimates,” and similar expressions, as well as statements in future tense, identify forward-looking statements.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by which, that performance or those results will be achieved. Forward-looking statements are based on information available at the time they are made and/or management’s good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause these differences include, but are not limited to:

|

|

·

|

our failure to implement our business plan within the time period we originally planned to accomplish;

|

|

|

·

|

the risks of expanding the number of products we offer, as well as the number of brands we market and distribute;

|

|

|

·

|

our ability to locate manufacturers who can timely manufacture our products;

|

|

|

·

|

our ability to enter into distribution agreements both in the United States and internationally;

|

|

|

·

|

the demand for high-end jeans, sportswear and other casual apparel in the United States and internationally;

|

|

|

·

|

the outcome of legal proceedings and related costs of legal counsel;

|

|

|

·

|

a decline in the retail sales environment;

|

|

|

·

|

a decrease in the availability of financial resources at favorable terms;

|

|

|

·

|

industry competition;

|

|

|

·

|

general economic conditions; and

|

|

|

·

|

other factors discussed under the headings “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.”

|

Forward-looking statements speak only as of the date they are made. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. If we do update one or

2

more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

Item 1. Business

Corporate Overview

We design, market and sell high-end casual apparel under the brand names “People’s Liberation,” “William Rast” and, in the United States, “J. Lindeberg.” The majority of the merchandise we offer consists of premium denim, knits, wovens, leather goods, golf wear and outerwear for men and women. In the United States, we distribute our William Rast and J. Lindeberg branded merchandise to better specialty stores, boutiques and department stores, such as Nordstrom, Saks Fifth Avenue and Neiman Marcus, as well as online at various websites including williamrast.com, jlindebergusa.com and Zappos.com. We also market and sell our J. Lindeberg branded collection and golf apparel through our retail stores in New York City, Los Angeles and Miami, and J. Lindeberg golf wear to green grass golf stores and boutiques in the United States. William Rast products are also sold in our four retail stores located in Los Angeles, San Jose and Cabazon, California, and Miami, Florida. Internationally, in select countries, we sell our William Rast branded apparel products directly and through distributors to better department stores and boutiques.

We commenced our William Rast clothing line in May 2005 and our People’s Liberation business in July 2004. Our William Rast clothing line is a collaboration with Justin Timberlake.

We began distributing J. Lindeberg branded apparel products in the United States on an exclusive basis beginning July 2008 in collaboration with J. Lindeberg AB of Sweden. In addition to being sold in the United States through our subsidiary, J. Lindeberg USA, LLC, J. Lindeberg branded high-end men’s fashion and premium golf apparel is marketed and sold by J. Lindeberg AB worldwide.

We are headquartered in Los Angeles, California, and maintain showrooms in New York, Los Angeles and Atlanta.

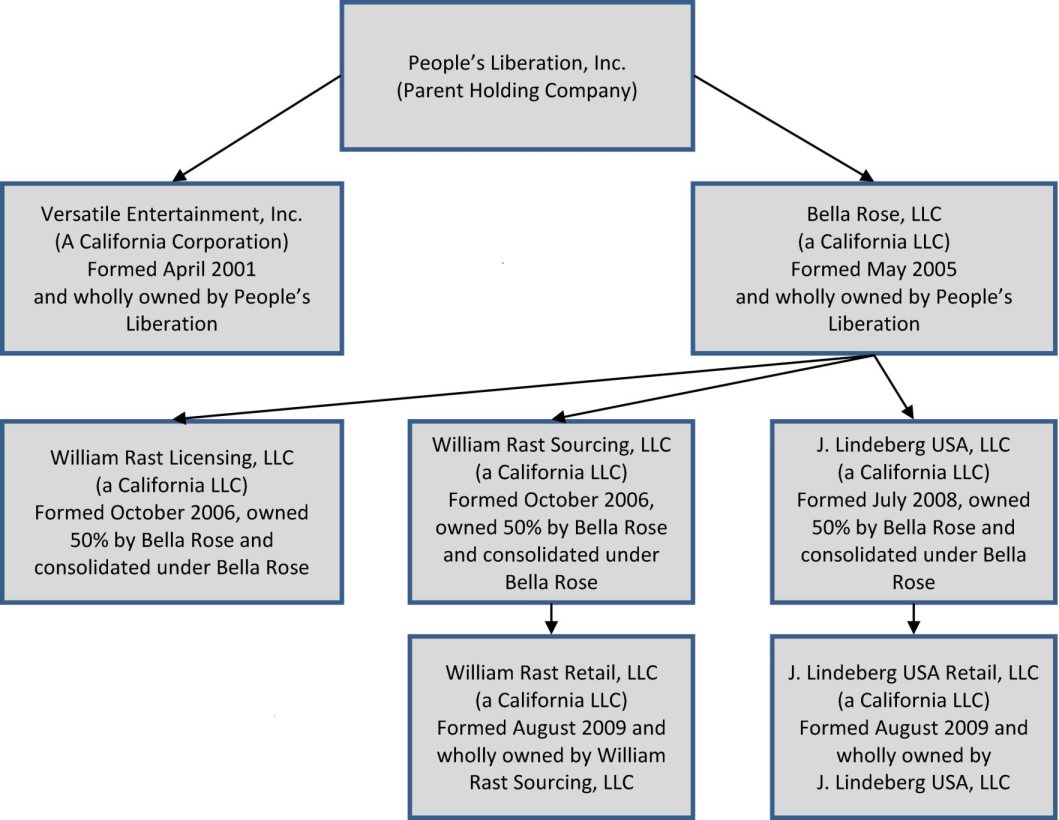

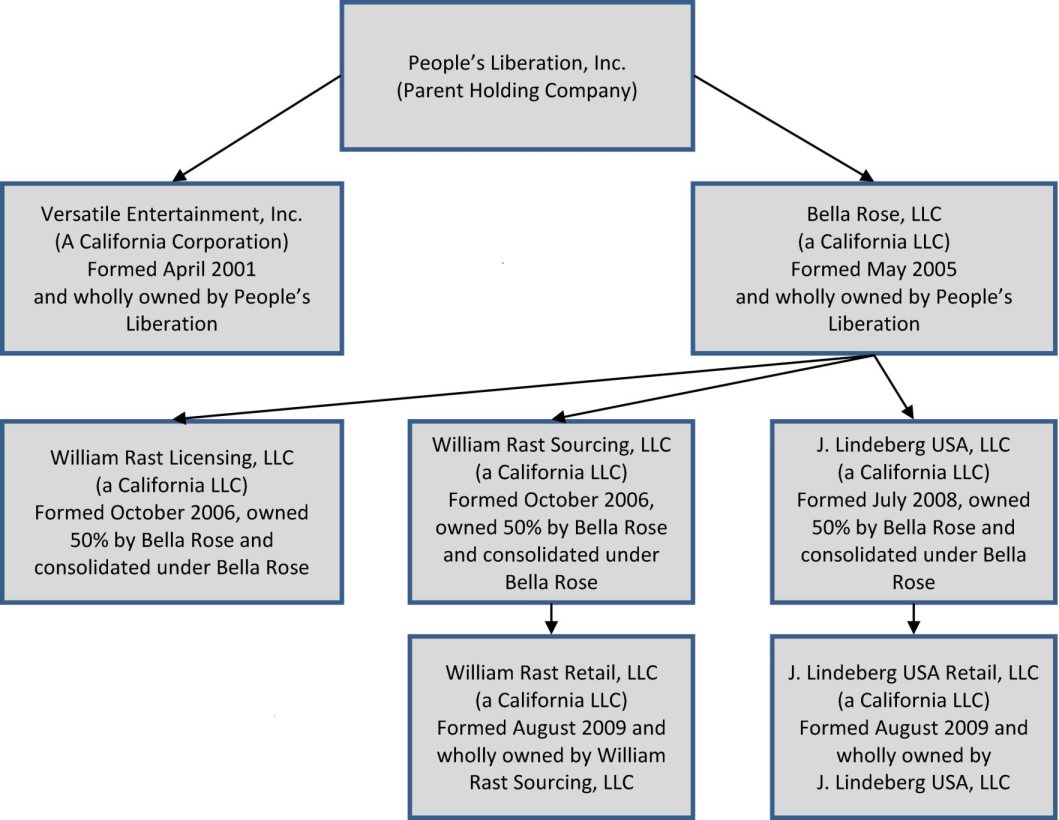

Structure of Operations

Our wholly-owned subsidiary Versatile Entertainment, Inc. conducts our People’s Liberation brand business. Our William Rast brand business is conducted through our wholly-owned subsidiary Bella Rose, LLC. William Rast Sourcing, LLC and William Rast Licensing, LLC are consolidated under Bella Rose and are each owned 50% by Bella Rose and 50% by Tennman WR-T, Inc., an entity owned in part by Justin Timberlake. William Rast Retail, LLC, a California limited liability company, was formed on August 26, 2009 and is a wholly-owned subsidiary of William Rast Sourcing. William Rast Retail was formed to operate our William Rast retail stores. Our J. Lindeberg brand business is conducted through Bella Rose. J. Lindeberg USA, LLC is consolidated under Bella Rose and is owned 50% by Bella Rose and 50% by J. Lindeberg USA Corp. an entity owned by J. Lindeberg AB, a Swedish corporation. J. Lindeberg USA Retail, LLC, a California limited liability company, was formed on August 21, 2009 and is a wholly-owned subsidiary of J. Lindeberg USA. J. Lindeberg Retail was formed to operate our J. Lindeberg retail stores.

3

Illustrated below is summary of our corporate structure by legal entity:

Apparel Industry Background

We operate in the premium contemporary segment of the apparel industry, which is characterized by lower volume sales of higher margin products. Our future success depends in part on the continued demand by consumers for high-end casual apparel, which in recent years has contributed to a proliferation of brands such as True Religion, Seven For All Mankind, Diesel, Guess, J Brand and Joe’s Jeans. We anticipate that the premium contemporary segment of the apparel industry will become increasingly competitive because of the consumer demand for apparel in this segment, as well as the high retail prices consumers are willing to spend for such goods. An increase in the number of brands competing in the premium contemporary segment of the apparel industry could result in reduced shelf space for our brands at better department stores and boutiques, our primary customers.

Customers

We market our products to better department stores and boutiques that cater to fashion forward clientele. Our products are sold to a limited number of better department stores and boutiques to maintain our premium brand status. In the United States, our William Rast and J. Lindeberg products are sold in a number of Nordstrom and Neiman Marcus store locations. We plan to continue to develop our existing relationships with our customers, and expand our domestic sales and distribution to better department stores. Currently, in addition to Nordstrom and Neiman Marcus, we sell to Saks Fifth Avenue, as well as hundreds of other boutiques and specialty retailers. We also sell our William Rast and J. Lindeberg brands online at various websites including williamrast.com, jlindebergusa.com and Zappos.com. We market and sell our J. Lindeberg branded collection and golf apparel through our retail stores in New York City and Los Angeles, and we sell J. Lindeberg golf wear to green grass golf stores and boutiques in the United States. William Rast products are sold in four William Rast branded retail stores located in Los Angeles, San Jose and Cabazon, California, and Miami, Florida. Internationally, in select countries, we sell our William Rast products directly and through distributors to better department stores and boutiques. We intend to expand our international distribution of our William Rast brand into additional territories and increase our brand penetration in the countries in which our apparel is currently being sold.

4

Beginning in June 2009, we exclusively sold our People’s Liberation branded apparel and apparel accessories to Charlotte Russe in North America and Central America. We were in litigation with Charlotte Russe in relation to our distribution agreement which litigation was settled in February 2011. Following the settlement, we are exploring options for the marketing and distribution of People’s Liberation branded apparel and apparel accessories both in North America and internationally. For further information on our litigation with Charlotte Russe and the litigation settlement, see the discussion under Note 10 to the financial statements as well as the discussion below under Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations --- Recent Developments.”

In December 2009, we signed a binding term sheet for a new multi-year licensing agreement with Viva International Group to design, produce and globally distribute William Rast Eyewear and William Rast Racing Eyewear focusing on styles for both the premium and sportswear categories for men and women. Viva is a worldwide leading eyewear company, representing premium and luxury brands including, GUESS, SKECHERS®, Tommy Hilfiger, Escada and Ermenegildo Zegna. The William Rast branded eyewear collections, which will include sunglasses and prescription eyewear, will debut in 2011 and will be available in William Rast’s branded stores and in upscale department stores and specialty retailers worldwide.

Our Products

Our principal products consist of high-end casual apparel under the brand names “William Rast,” “People’s Liberation” and, in the United States, “J. Lindeberg.” The majority of the merchandise we offer consists of premium denim, knits, wovens, leather goods, golf wear and outerwear for men and women. Our principal products are designed, manufactured, marketed, and distributed under our “William Rast” and “People’s Liberation” labels and we market and distribute under the J. Lindeberg label in the United States, products that are designed and manufactured by J. Lindeberg AB of Sweden. Our William Rast brand is a collection of denim, knits, wovens, leather goods and outerwear for both men and women and our J. Lindeberg brand primarily consists of golf wear and collection apparel for men. Our People’s Liberation brand primarily includes denim and knits for women. As a result of the fit, quality, styles and the marketing and branding of our products, we believe that our products will continue to command premium prices in the marketplace.

Our denim is made from high quality fabrics milled primarily in the United States, Japan, Italy, Turkey and Mexico, and processed with various treatments, washes and finishes, including light, medium, dark, and destroyed washes, some of which include studs, stones, and embroidered pockets as embellishments. We introduce new versions of our major styles each season in different colors, washes and finishes.

Our knits and woven products consist of men’s and women’s tops and bottoms. We sell knit and woven products which consist primarily of cotton and silk fabrications. Similar to our denim products, we introduce new versions, bodies, styles, colors and graphics of our knit and woven products each season. We anticipate expanding our products and fabrications to include other fashion forward materials.

5

Our leather goods consist primarily of men’s and women’s jackets and outerwear. These goods are manufactured using high-quality leather and occasionally include studs, stones and other embellishments.

An in-house team of designers is responsible for the design and development of our People’s Liberation and William Rast denim product lines. We do not currently have a formal research and development effort. Our design team and consultants, together with our in-house sales team and our J. Lindeberg outside sales contractors, shop stores, travel and speak to market and trend setters to help generate new product ideas.

Sales and Distribution

US Wholesale Sales and Distribution

We sell our products through our own sales force based in Los Angeles, New York and Atlanta. Additionally, we operate showrooms in Los Angeles, New York and Atlanta with dedicated salaried and commissioned sales staff. We also employ customer service representatives who are assigned to key customers and provide in-house customer service support. We ship products to and invoice our United States customers directly from warehouse facilities located in or around Los Angeles, California. Under agreements with third-party warehouses, we outsource all of our finished good shipping, receiving and warehouse functions.

Currently, our William Rast and J. Lindeberg branded products are sold in the United States to department stores and boutiques and following the settlement of our litigation with Charlotte Russe, we are exploring options for the marketing and distribution of People’s Liberation branded apparel and apparel accessories in North America. While we do not depend on any individual department store to sell our products, for the year ended December 31, 2010, approximately 15.8% of our sales were to one customer. Sales to this customer were part of a one-time program and we do not anticipate that this will be a recurring program in the future. For the year ended December 31, 2009, approximately 36.6% of our sales were to two customers.

International Wholesale Sales and Distribution

Our William Rast branded apparel products are also sold internationally in select countries directly and through agents and distributors to better department stores and boutiques. Our distributors purchase products at a discount for resale in their respective territories and market, sell, warehouse and ship William Rast branded apparel products at their expense. Our agents are paid a commission on net sales of our William Rast products. We anticipate growing our international distribution channels across new territories.

Through our subsidiary, William Rast Europe, we sold and marketed William Rast apparel and accessories to European customers and distributors. We ceased operations in our William Rast Europe subsidiary, and as a result, all sales to European and other international customers and distributors are currently sold through our wholesale division.

Retail Sales

Our William Rast branded apparel and accessories are sold through our three full-price William Rast brand retail stores and also through our William Rast brand outlet store. Our J. Lindeberg branded apparel and accessories are sold through our three full-price J. Lindeberg brand retail stores.

In November 2009, we launched our retail expansion plan with the opening of two new full-price William Rast brand retail stores at the Westfield Century City Shopping Mall in Los Angeles, California, and the Westfield Valley Fair Shopping Mall in San Jose, California. Additionally, we opened our first William Rast brand outlet store at the Desert Hills Premium Outlets in Cabazon, California, near Palm Springs. To further our retail expansion plan, we opened an additional J. Lindeberg retail store in April 2010 and a William Rast store in August 2010, both located in the Aventura Mall in Miami, Florida. These store openings are part of our retail expansion plan which includes the roll-out of retail stores in major metropolitan locations over the next several years. We continue to revise our expansion plan as retail market conditions change in response to economic conditions. We believe that the retail stores will enhance our net sales and gross profit and the outlet store will allow us to sell our overstock or slow moving items at higher profit margins.

6

As of March 31, 2011, we had the following retail store locations:

|

Brand

|

Location

|

Opening or Acquisition Date

|

||

|

William Rast

|

Miami, Florida

|

August 2010

|

||

|

J. Lindeberg

|

Miami, Florida

|

April 2010

|

||

|

William Rast

|

Century City, California

|

November 2009

|

||

|

William Rast

|

San Jose, California

|

November 2009

|

||

|

William Rast Outlet

|

Cabazon, California

|

November 2009

|

||

|

J. Lindeberg

|

Los Angeles, California

|

May 2009

|

||

|

J. Lindeberg

|

New York, New York

|

July 2008

|

||

Brand Development

Our brands have acquired consumer recognition in the high-end fashion denim, knits, golf wear and casual wear markets. We plan to continue building and expanding this recognition by target marketing our products to fashion conscious consumers who want to wear and be seen in the latest, trendiest jeans and other apparel. To facilitate this objective, we plan to continue to limit distribution to exclusive boutiques, major retailers and our own retail stores. We also plan to use celebrities as a marketing catalyst to continue to bring attention and credibility to our brands. Currently, we leverage the popular public images of Justin Timberlake in the promotion of our William Rast apparel line and Camilo Villegas to promote our J. Lindeberg apparel line.

We anticipate that our internal growth will be driven by (1) expansion of our product lines by introducing new styles and categories of apparel products, (2) entering into license agreements for the manufacture and distribution of new apparel categories, accessories, fragrances and other products similar to our agreement with Viva International Group, (3) expansion of our wholesale distribution, both domestically and internationally through high-end retailers, and (4) expansion of our retail store penetration. We employ a multi-brand strategy which diversifies the fashion and other risks associated with reliance on any single brand.

Manufacturing and Supply

During 2010, we used third party contract manufacturers and full package suppliers to produce our William Rast denim finished goods from facilities located primarily in Mexico, Columbia and Los Angeles, California. In 2011, we began sourcing our denim products exclusively from domestic third party contract manufacturers located in or around Los Angeles, California. Our denim is made from high quality fabrics milled primarily in the United States, Japan, Italy, Turkey and Mexico. For the majority of our William Rast knits and other non-denim products, we currently source these goods from international suppliers primarily in Asia. We currently purchase all of our J. Lindeberg branded apparel products from J. Lindeberg AB in Sweden, the beneficial owner of 50% of our subsidiary, J. Lindeberg USA, LLC.

7

We may be able to realize additional cost savings in product manufacturing due to our strong relationships with a diverse group of U.S. and international manufacturers established by our management team. We do not rely on any one manufacturer and manufacturing capacity is readily available to meet our current and planned needs. We do not currently have any long-term agreements in place for the supply of fabric, thread or other raw materials. Fabric, thread and other raw materials are available from a large number of suppliers worldwide. Although we do not depend on any one supplier, for the year ended December 31, 2010, three suppliers provided for 71.3% of our total combined purchases for the year. For the year ended December 31, 2009, three suppliers provided for 59.4% of our total combined purchases for the year.

Competition

The premium denim, knits and golf wear industries are intensely competitive and fragmented, and will continue to become more competitive and fragmented as a result of the high margins that are achievable in the industries. Our competitors include other small companies like ours, as well as companies that are much larger, with superior economic, marketing, distribution, and manufacturing capabilities. Our competitors in the denim and knit markets include brands such as True Religion, Seven For All Mankind, Diesel, Guess, J Brand and Joe’s Jeans, as well as other premium denim brands.

We compete in our ability to create innovative concepts and designs, develop products with extraordinary fit, and produce high quality fabrics and finishes, treatments and embellishments. At a retail price point of $150 to $280 for denim jeans, $20 to $125 for knits and other apparel items, and $60 to $1,000 for collection products, we believe that we offer competitively priced products in our target markets.

8

Trademarks and other Intellectual Property

We have filed trademark applications for the following marks in the following territories:

|

Name of Mark

|

Territory

|

|

People’s Liberation

|

USA, European Community, Japan, Mexico, Hong Kong, Israel, Russia, Taiwan, Singapore, Turkey, Australia and Canada.

|

|

William Rast

|

USA, European Community, Japan, Mexico, People’s Republic of China, Hong Kong, Israel, Russia, Taiwan, Singapore, Turkey, Canada, Australia, Republic of Korea, Croatia and United Arab Emirates, Brazil, India, South Africa.

|

|

William Rast & Design

|

USA, European Community and Japan.

|

|

Rising Star

|

USA, European Community, Japan, Mexico, Republic of Korea, Hong Kong, Israel, Russia, Taiwan, Singapore, Turkey, Australia and Canada.

|

|

Star Pocket

|

USA, Japan, Mexico, Republic of Korea, Israel, Russia, Singapore, Turkey, Australia and Canada.

|

|

The Dub

|

USA, European Community, Japan, Mexico, People’s Republic of China, Republic of Korea, Russia, Canada, Croatia and United Arab Emirates, Australia, Brazil, Hong Kong, Singapore, Taiwan.

|

|

Mummy Star

|

USA, Mexico, Canada.

|

|

People’s Liberation & Design (Mummy Star)

|

USA, Mexico, Canada, Japan.

|

We plan to continue to expand our brand names and our proprietary trademarks and designs worldwide.

Government Regulation and Supervision

Our operations are subject to the effects of international treaties and regulations such as the North American Free Trade Agreement (NAFTA). We are also subject to the effects of international trade agreements and embargoes by entities such as the World Trade Organization. Generally, these international trade agreements benefit our business rather than burden it because they tend to reduce trade quotas, duties, taxes and similar impositions. However, these trade agreements may also impose restrictions that could have an adverse impact on our business, by limiting the countries from whom we can purchase our fabric or other component materials, or limiting the countries where we might market and sell our products.

Labeling and advertising of our products is subject to regulation by the Federal Trade Commission. We believe that we are in compliance with these regulations.

9

Employees

We have a total of 49 full time employees. Our full time employees consist of two officers, Colin Dyne, our Chief Executive Officer and Chief Financial Officer, and Andrea Sobel, Executive Vice President of Branding and Licensing. Our production and design teams include 8 employees consisting of production managers as well as pattern makers, technical designers and product designers. Our production and design teams are responsible for the design, development, and preparation of sample products. Additionally, we have 39 full time employees who handle retail and wholesale sales, marketing, customer service, accounting and administration functions, and 32 part time retail store employees.

Item 1A. Risk Factors

Several of the matters discussed in this document contain forward-looking statements that involve risks and uncertainties. Factors associated with the forward-looking statements that could cause actual results to differ materially from those projected or forecast are included in the statements below. In addition to other information contained in this report, readers should carefully consider the following cautionary statements.

Risks Related To Our Business

Our J. Lindeberg clothing line is a collaboration with J. Lindeberg USA Corp, a wholly-owned subsidiary of J. Lindeberg AB. Should our relationship with our partner deteriorate, our profitability may be negatively impacted.

J. Lindeberg USA, LLC, an entity that we manage and is 50% owned by our wholly-owned subsidiary, Bella Rose, and 50% owned by J. Lindeberg USA Corp, a wholly-owned subsidiary of J. Lindeberg AB, has the exclusive rights to source, market, and distribute J. Lindeberg™ branded apparel in the United States on an exclusive basis. J. Lindeberg AB is required to make available to J. Lindeberg USA for purchase all new collections of J. Lindeberg™ branded apparel, and provide for the factory-direct purchase by J. Lindeberg USA of J. Lindeberg™ branded apparel on terms no less favorable to J. Lindeberg USA then terms received by J. Lindeberg AB or its affiliates for the same or substantially the same merchandise. In addition, the agreements establishing the relationship between the parties provide for a license from J. Lindeberg AB to J. Lindeberg USA of the J. Lindeberg™ mark and other related marks for use in the United States on an exclusive basis for a period of 25 years. In the event that our relationship with J. Lindeberg AB deteriorates or if the business operations of J. Lindeberg AB deteriorate, J. Lindeberg AB may be unable to fulfill its contractual obligation to us, including providing us with design, sourcing and timely product delivery, which could adversely impact our sales and profitability.

Our J. Lindeberg USA operating agreement contains buy-out provisions for its members.

The operating agreement of our 50% owned subsidiary, J. Lindeberg USA, LLC provides that the other 50% owner, J. Lindeberg USA Corp., has the option to purchase our 50% share of J. Lindeberg USA, LLC at a negotiated purchase price. In accordance with the operating agreement, J. Lindeberg has two call option periods, the first of which ends on June 30, 2011 and provides for a purchase price of four times a negotiated amount, and the second call option which continues for the duration of the operating agreement, and provides for a purchase price of two times a negotiate amount. If J. Lindeberg USA Corp. purchases our 50% interest in J. Lindeberg USA, LLC pursuant to the terms of the operating agreement or otherwise, our sales and future projected growth may be adversely impacted.

10

We may require additional capital in the future.

We may not be able to fund our future retail growth or react to competitive pressures if we lack sufficient funds. We are currently evaluating various financing strategies to be used to expand our retail business and fund future growth, including the opening of new retail stores. We believe that our existing cash and cash equivalents, anticipated cash flows from our operating activities and pursuant to our factoring arrangements, and the net proceeds from the settlement of our Charlotte Russe litigation will be sufficient to fund our minimum working capital and capital expenditure needs for the next twelve months. The extent of our future capital requirements will depend on many factors, including our results of operations. We may also need to raise additional capital if our working capital requirements or capital expenditures are greater than we expect, or if we expand our business by acquiring or investing in additional brands. There can be no assurance that additional debt or equity financing will be available on acceptable terms or at all. In addition, any additional funding may result in significant dilution to existing shareholders.

Our William Rast business is a collaboration with Tennman WR-T, Inc., an entity owned in part by Justin Timberlake. Should our relationship with our partner deteriorate, our sales and profitability may be negatively impacted.

Certain of our consolidated subsidiaries that we manage have the exclusive rights to manufacture clothing and accessories under the William Rast tradename. We share ownership of these subsidiaries with Tennman WR-T, Inc., an entity controlled by Justin Timberlake. In the event that our relationships with Tennman and Justin Timberlake deteriorate, our sales and profitability may be negatively impacted.

Failure to manage our growth and expansion could impair our business.

We believe that we are poised for growth in 2011. but no assurance can be given that we will be successful in maintaining or increasing our sales in the future. Any future growth in sales will require additional working capital and may place a significant strain on our management, management information systems, inventory management, sourcing capability, distribution facilities and receivables credit management. Any disruption in our order processing, sourcing or distribution systems could cause orders to be shipped late, and under industry practices, retailers generally can cancel orders or refuse to accept goods due to late shipment. Such cancellations and returns would result in a reduction in revenue, increased administrative and shipping costs, further burden on our distribution facilities and also adversely impact our relations with retailers.

Increasing the number of branded company-operated stores will require us to develop new capabilities and increase our expenditures.

Our growth strategy is dependent in part on our ability to open and operate new retail stores and the availability of suitable store locations on acceptable terms. Although we operated seven branded retail stores as of December 31, 2010, we historically have been primarily a wholesaler. In the second and third quarters of 2010, we opened a J. Lindeberg full price retail store and a William Rast full price retail store in Miami, Florida. These store openings are part of our retail expansion plan which contemplates the roll-out of additional retail stores in major metropolitan locations over the next several years. The success of this strategy is dependent upon, among other factors, the identification of suitable markets and sites for new store locations, the negotiation of acceptable lease terms, the hiring, training and retention of competent sales personnel, and extent of capital expenditures, if any, for these stores. We must also appropriately manage retail inventory levels, install and operate effective retail systems, execute effective pricing strategies and integrate our stores into our overall business mix. An increase in the number of branded company-operated stores will place increased demands on our operational, managerial and administrative resources and require us to further develop our retailing skills and capabilities. These increased demands could cause us to operate our business less effectively, which in turn could cause deterioration in the financial performance of our existing stores and in our more established wholesale

11

businesses. The commitments associated with our expansion will increase our operating expenses and may be costly to terminate. In addition, these investments may be difficult to recapture if we decide to close a store or change our strategy.

We operate in a seasonal business, and our failure to timely deliver products to market will negatively impact our profitability.

The apparel industry is a seasonal business in which our financial success is largely determined by seasonal events such as the commencement of the school year and holiday seasons. In the event that we are unable to supply our products to the marketplace in a timely manner as a consequence of manufacturing delays, shipping delays, or other operational delays, our sales and profitability will be negatively impacted.

Our operating results may fluctuate significantly.

Management expects that we will experience substantial variations in our net sales and operating results from quarter to quarter. We believe that the factors which influence this variability of quarterly results include:

|

|

-

|

the timing of our introduction of new product lines and our ability to respond quickly to new trends;

|

|

|

-

|

the level of consumer acceptance of each new product line;

|

|

|

-

|

general economic and industry conditions that affect consumer spending and retailer purchasing;

|

|

|

-

|

the availability of manufacturing capacity;

|

|

|

-

|

the timing of trade shows;

|

|

|

-

|

the product mix of customer orders;

|

|

|

-

|

the return of defective merchandise;

|

|

|

-

|

the timing of the placement or cancellation of customer orders;

|

|

|

-

|

transportation delays;

|

|

|

-

|

quotas and other regulatory matters;

|

|

|

-

|

the lack of credit approval of our customers from our factors;

|

|

|

-

|

the occurrence of charge backs in excess of reserves; and

|

|

|

-

|

the timing of expenditures in anticipation of increased sales and actions of competitors.

|

As a result of fluctuations in our revenue and operating expenses that may occur, management believes that period-to-period comparisons of our results of operations are not a good indication of our future performance. It is possible that in some future quarter or quarters, our operating results will be below the expectations of securities analysts or investors. In that case, our stock price could fluctuate significantly or decline.

The financial condition of our customers could affect our results of operations.

Certain retailers, including some of our customers, have experienced in the past, and may experience in the future, financial difficulties, which increase the risk of extending credit to such retailers and the risk that financial failure will eliminate a customer entirely. These retailers have attempted to improve their own operating efficiencies by concentrating their purchasing power among a narrowing group of vendors. There can be no assurance that we will remain a preferred vendor for our existing customers. A decrease in business from or loss of a major customer, such as one customer that accounted for 15.8% of our net sales for the year ended December 31, 2010, and the two customers that accounted for approximately 36.6% of our net sales for the year ended December 31, 2009, one of which was Charlotte Russe, could have a material adverse effect on the results of our operations. There can be no assurance that our factors will approve the extension of credit to certain retail customers in the future. If a customer’s credit is not approved by our factors or sales to a customer exceed the related factor’s imposed limits, we could assume the collection risk on sales to the customer.

12

Our dependence on independent manufacturers and suppliers of raw materials reduces our ability to control the manufacturing process, which could harm our sales, reputation and overall profitability.

We depend on full package suppliers, independent contract manufacturers and suppliers of raw materials to secure a sufficient supply of raw materials and maintain sufficient manufacturing and shipping capacity in an environment characterized by declining prices, labor shortage, continuing cost pressures and increased demands for product innovation and speed-to-market. This dependence could subject us to difficulty in obtaining timely delivery of products of acceptable quality. In addition, a contractor’s failure to ship products to us in a timely manner or failure to meet the required quality standards could cause us to miss the delivery date requirements of our customers. The failure to make timely deliveries may cause our customers to cancel orders, refuse to accept deliveries, impose non-compliance charges through invoice deductions or other charge-backs, demand reduced prices or reduce future orders, any of which could harm our sales, reputation and overall profitability.

For the year ended December 31, 2010, three suppliers accounted for approximately 71% of our consolidated purchases. For the year ended December 31, 2009, three suppliers accounted for approximately 59% of our purchases. We do not have long-term contracts with any of our suppliers, and any of these suppliers may unilaterally terminate their relationship with us at any time. While management believes that there exists an adequate amount of suppliers to provide products and services to us, to the extent that we are not able to secure or maintain relationships with suppliers that are able to fulfill our requirements, our business would be harmed.

We do not control our suppliers or their labor practices. The violation of federal, state or foreign labor laws by one of our suppliers could subject us to fines and result in our goods that are manufactured in violation of such laws being seized or their sale in interstate commerce being prohibited. To date, we have not been subject to any sanctions that, individually or in the aggregate, have had a material adverse effect on our business, and we are not aware of any facts on which any such sanctions could be based. There can be no assurance, however, that in the future we will not be subject to sanctions as a result of violations of applicable labor laws by our suppliers, or that such sanctions will not have a material adverse effect on our business and results of operations.

We may not be able to adequately protect our intellectual property rights.

The loss of or inability to enforce the trademarks “William Rast” and “People’s Liberation” and our other proprietary designs, know-how and trade secrets could adversely affect our business. If any third party independently develops similar products to ours or manufactures knock-offs of our products, it may be costly to enforce our rights and we would not be able to compete as effectively. Additionally, the laws of foreign countries may provide inadequate protection of intellectual property rights, making it difficult to enforce such rights in those countries.

We may need to bring legal claims to enforce or protect our intellectual property rights. Any litigation, whether successful or unsuccessful, could result in substantial costs and diversions of resources. In addition, notwithstanding the rights we have secured in our intellectual property, third parties may bring claims against us alleging that we have infringed on their intellectual property rights or that our intellectual property rights are not valid. Any claims against us, with or without merit, could be time consuming and costly to defend or litigate and therefore could have an adverse affect on our business.

13

The loss of Chief Executive Officer and Chief Financial Officer, Colin Dyne, could have an adverse effect on our future development and could significantly impair our ability to achieve our business objectives.

Our success is largely dependent upon the expertise and knowledge of our Chief Executive Officer and Chief Financial Officer, Colin Dyne, whom we rely upon to formulate our business strategy. As a result of the unique skill set and responsibilities of Mr. Dyne, the loss of Mr. Dyne could have a material adverse effect on our business, development, financial condition, and operating results. We do not maintain “key person” life insurance on any of our management, including Mr. Dyne.

Our failure to comply with the requirements of the Sarbanes-Oxley Act, including section 404, could have a material adverse affect on our business and stock price.

Effective internal control over financial reporting is necessary for us to provide reliable financial reports and effectively prevent fraud. Section 404 of the Sarbanes-Oxley Act of 2002 requires us to evaluate and report on our internal control over financial reporting. We have prepared for compliance with Section 404 by strengthening, assessing and testing our system of internal control over financial reporting to provide the basis for our report. The process of strengthening our internal control over financial reporting and complying with Section 404 was expensive and time consuming, and required significant management attention. We cannot be certain that the measures we have undertaken will ensure that we will maintain adequate controls over our financial processes and reporting in the future. Furthermore, if we are able to rapidly grow our business, the internal control over financial reporting that we will need will become more complex, and significantly more resources will be required to ensure our internal control over financial reporting remains effective. Failure to implement required controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations. If we or our auditors discover a material weakness in our internal control over financial reporting, the disclosure of that fact, even if the weakness is quickly remedied, could diminish investors’ confidence in our financial statements and harm our stock price. In addition, non-compliance with Section 404 could subject us to a variety of administrative sanctions, including the suspension of trading, ineligibility for listing on one of the Nasdaq Stock Markets or national securities exchanges, and the inability of registered broker-dealers to make a market in our common stock, which would further reduce our stock price.

Risks Related to Our Industry

Our business may be negatively impacted by general economic conditions and the current weakness in the global economy.

Our performance is subject to worldwide economic conditions and their impact on levels of consumer spending that affect not only the ultimate consumer, but also retailers and distributors, our largest direct customers. Consumer spending has deteriorated significantly and may remain depressed, or be subject to further deterioration for the foreseeable future. The worldwide apparel industry is heavily influenced by general economic cycles. Purchases of high-end fashion apparel and accessories tend to decline in periods of recession or uncertainty regarding future economic prospects, as disposable income declines. Many factors affect the level of consumer spending in the apparel industries, including, among others: prevailing economic conditions, levels of employment, salaries and wage rates, the availability of consumer credit, taxation and consumer confidence in future economic conditions. During periods of recession or economic uncertainty, we may not be able to maintain or increase our sales to existing customers, make sales to new customers, open or operate new retail stores or maintain sales levels at existing stores, or maintain or increase our international operations on a profitable basis. As a result, our operating results may be adversely and materially affected by downward trends in the United States or global economy, including the current downturn in the United States.

14

We operate in a highly competitive industry and the success of our business depends on our ability to overcome a variety of competitive challenges.

We operate our business in the premium contemporary segment of the apparel industry. Currently, our competitors include companies and brands such as True Religion, Seven For All Mankind, Diesel, Guess, J Brand and Joe’s Jeans. We face a variety of competitive challenges including:

|

|

-

|

anticipating and quickly responding to changing consumer demands that are dictated in part by fashion and season;

|

|

|

-

|

developing innovative, high-quality products in sizes and styles that appeal to consumers;

|

|

|

-

|

competitively pricing our products and achieving customer perception of value; and

|

|

|

-

|

the need to provide strong and effective marketing support to maintain the image of our brands.

|

Our ability to anticipate and effectively respond to these competitive challenges depends in part on our ability to attract and retain key personnel in our design, merchandising and marketing staff. Competition for these personnel is intense, and we cannot be sure that we will be able to attract and retain a sufficient number of qualified personnel in future periods. In addition, our competitors may have greater financial resources than we do which could limit our ability to respond quickly to market demands. In the event that we are not successful in addressing the competitive challenges we face, we could lose market share to our competitors and consequently our stock price could be negatively impacted.

Risks Related to Our Common Stock

Since trading on the OTC Bulletin Board may be sporadic, you may have difficulty reselling your shares of our common stock.

In the past, our trading price has fluctuated as the result of many factors that may have little to do with our operations or business prospects. In addition, because the trading of securities on the OTC Bulletin Board is often more sporadic than the trading of securities listed on an exchange, you may have difficulty reselling any of our common shares.

We have a limited trading volume and shares eligible for future sale by our current stockholders may adversely affect our stock price.

To date, we have had a very limited trading volume in our common stock. For instance, for the year ended December 31, 2010, approximately 1.6 million shares of our common stock were traded and for the year ended December 31, 2009, approximately 4.9 million shares of our common stock were traded. As long as this condition continues, the sale of a significant number of shares of common stock at any particular time could be difficult to achieve at the market prices prevailing immediately before such shares are offered.

Our common stock price is highly volatile.

The market price of our common stock is likely to be highly volatile as the stock market in general has been highly volatile.

Factors that could cause such volatility in our common stock may include, among other things:

|

|

-

|

actual or anticipated fluctuations in our quarterly operating results;

|

|

|

-

|

changes in financial estimates by securities analysts;

|

|

|

-

|

conditions or trends in our industry or in the economy in general; and

|

|

|

-

|

changes in the market valuations of other comparable companies.

|

15

We do not foresee paying dividends in the near future.

We have not paid dividends on our common stock and do not anticipate paying such dividends in the foreseeable future.

Our officers and directors own a significant portion of our common stock, which could limit our stockholders’ ability to influence the outcome of key transactions.

Our officers and directors and their affiliates beneficially own approximately 28.2% of our outstanding voting shares as of March 17, 2011. In addition, Gerard Guez owns approximately 29.7% of our outstanding voting shares. As a result, our officers and directors, and Mr. Guez, are able to exert influence over the outcome of any matters submitted to a vote of the holders of our common stock, including the election of our Board of Directors. The voting power of these stockholders could also discourage others from seeking to acquire control of us through the purchase of our common stock, which might depress the price of our common stock.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 2. Properties

We lease our principal executive office space under a lease agreement that expires in March 2012. The facility is approximately 13,000 square feet, and is located in Los Angeles, California. It is from this facility that we conduct all of our design, executive and administrative functions. Our finished goods are shipped from third-party warehouses in Ontario and Los Angeles, California. Our internet products are shipped from a third-party warehouse in Long Beach, California. We have showrooms located in Los Angeles, New York City and Atlanta. Our New York City showroom lease expires in January 2013, our two Los Angeles showroom leases expire in April and May 2013 and our Atlanta showroom lease expires in June 2011. We have four William Rast retail stores located in Los Angeles, San Jose and Cabazon, California, and Miami, Florida. Our William Rast retail store leases expire on various dates beginning April 2011 through January 2020. We have three J. Lindeberg retail stores located in New York City, Los Angeles and Miami, Florida. Our J. Lindeberg retail store leases expire on various dates beginning June 2014 through March 2017. We believe that the facilities we utilize are well maintained, in good operating condition, and adequate to meet our current and foreseeable needs.

Item 3. Legal Proceedings

On October 27, 2009, People’s Liberation, Inc. and our wholly-owned subsidiary, Versatile Entertainment, Inc., filed a complaint for damages and equitable relief against Charlotte Russe Holding, Inc. and its wholly-owned subsidiary, Charlotte Russe Merchandising, Inc. (collectively, “Charlotte Russe”) in the Superior Court of the State of California, County of Los Angeles, Central District (Versatile Entertainment, Inc. v. Charlotte Russe Merchandising, Inc., BC424674) (the “Charlotte Russe Action”). On that same day, we also filed suit against Advent International Corporation and certain of its subsidiaries, and David Mussafer and Jenny J. Ming (collectively, the “Advent Defendants”) in the Superior Court of the State of California, County of Los Angeles, Central District (Versatile Entertainment, Inc. v. Advent International Corporation, BC424675) (the “Advent Action”). Advent International Corporation, through its subsidiaries, acquired Charlotte Russe in October 2009.

On February 3, 2011, People's Liberation, Versatile Entertainment, Colin Dyne, ECA Holdings II, LLC and New Media Retail Concepts entered into a Settlement Agreement and Mutual Release with Charlotte Russe Holding, Inc. and Charlotte Russe Merchandising, Inc., Advent International Corporation, Advent CR Holdings, Inc., David Mussafer, and Jenny Ming. The agreement was entered into to settle all disputes among the parties relating to:

16

|

|

·

|

that certain action in the Los Angeles County Superior Court entitled Charlotte Russe Holding, Inc. et al. v. Versatile Entertainment, Inc. et al., Case No. BC 424734; and

|

|

|

·

|

that certain action entitled Versatile Entertainment, Inc. et al. v. David Mussafer, et al., originally brought in the Los Angeles County Superior Court, Case No. BC 424675.

|

On August 13, 2010, we entered into an asset purchase agreement with two related parties pursuant to which we sold 50% of the net proceeds, after contingent legal fees and expenses, that may be received by us as a result of our litigation with Charlotte Russe. In connection with the asset purchase agreement, we also entered into a promissory note in the amount of $750,000 with the same related parties on August 13, 2010.

Pursuant to the settlement agreement, on February 3, 2011 we received $3.5 million, after the distribution of amounts owed under the terms of the asset purchase agreement, as described above, and the payment of legal fees and expenses. We will record the settlement gain in the first quarter of 2011. We also received $750,000 in the third quarter of 2010 relating to the litigation in connection with the asset purchase agreement, for total proceeds of $4.3 million. The settlement included the dismissal with prejudice of all claims pending between the parties as well as mutual releases, without any admission of liability or wrongdoing by any of the parties to the actions.

We are subject to certain other legal proceedings and claims arising in connection with our business. In the opinion of management, there are currently no claims that could have a material adverse effect on our consolidated financial position, results of operations or cash flows.

Item 4. Removed and Reserved

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Common Stock

Our common stock is quoted on the OTCQB Over-The-Counter market under the symbol “PPLB.” The following table sets forth, for the periods indicated, the high and low bid information for the common stock, as determined from quotations on the Over-the-Counter market, as well as the total number of shares of common stock traded during the periods indicated. The following quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

|

High

|

Low

|

Volume

|

||||||||||

|

Year Ended December 31, 2010

|

||||||||||||

|

First Quarter

|

$ | 0.40 | $ | 0.12 | 407,720 | |||||||

|

Second Quarter

|

$ | 0.23 | $ | 0.11 | 339,905 | |||||||

|

Third Quarter

|

$ | 0.14 | $ | 0.05 | 406,344 | |||||||

|

Fourth Quarter

|

$ | 0.25 | $ | 0.05 | 440,820 | |||||||

|

Year Ended December 31, 2009

|

||||||||||||

|

First Quarter

|

$ | 0.33 | $ | 0.10 | 1,325,515 | |||||||

|

Second Quarter

|

$ | 0.35 | $ | 0.08 | 2,323,127 | |||||||

|

Third Quarter

|

$ | 0.48 | $ | 0.15 | 627,420 | |||||||

|

Fourth Quarter

|

$ | 0.41 | $ | 0.16 | 669,010 | |||||||

17

On March 30, 2011, the closing sales price of our common stock as reported on the Over-The-Counter Bulletin Board was $0.14 per share. As of March 17, 2011, there were approximately 456 record holders of our common stock. Our transfer agent is Stalt, Inc., Menlo Park, CA.

Dividends

Since January 1, 2006, we have not paid or declared cash distributions or dividends on our common stock. We do not intend to pay cash dividends on our common stock in the near future. We currently intend to retain all earnings, if and when generated, to finance our operations. The declaration of cash dividends in the future will be determined by the board of directors based upon our earnings, financial condition, capital requirements and other relevant factors.

Item 6. Selected Financial Data

Not applicable.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read together with the Consolidated Financial Statements of People’s Liberation, Inc. and the “Notes to Consolidated Financial Statements” included elsewhere in this report. This discussion summarizes the significant factors affecting the consolidated operating results, financial condition and liquidity and cash flows of People’s Liberation, Inc. for the fiscal years ended December 31, 2010 and 2009. Except for historical information, the matters discussed in this Management’s Discussion and Analysis of Financial Condition and Results of Operations are forward-looking statements that involve risks and uncertainties and are based upon judgments concerning various factors that are beyond our control.

Overview

We design, market and sell high-end casual apparel under the brand names “People’s Liberation,” “William Rast” and, in the United States, “J. Lindeberg.” The majority of the merchandise we offer consists of premium denim, knits, wovens, leather goods, golf wear and outerwear for men and women. In the United States, we distribute our William Rast and J. Lindeberg branded merchandise to better specialty stores, boutiques and department stores, such as Nordstrom, Saks Fifth Avenue and Neiman Marcus, as well as online at various websites including williamrast.com, jlindebergusa.com and Zappos.com. We also market and sell our J. Lindeberg branded collection and golf apparel through our retail stores in New York City, Los Angeles and Miami, and J. Lindeberg golf wear to green grass golf stores and boutiques in the United States. William Rast products are also sold in our four retail stores located in Los Angeles, San Jose and Cabazon, California, and Miami, Florida. Internationally, in select countries, we sell our William Rast branded apparel products directly and through distributors to better department stores and boutiques. Following the settlement of our litigation with Charlotte Russe which is described elsewhere in this report, we are currently exploring options for the marketing and distribution of People’s Liberation branded apparel and apparel accessories both in North America and internationally.

We commenced our William Rast clothing line in May 2005 and our People’s Liberation business in July 2004. Our William Rast clothing line is a collaboration with Justin Timberlake.

We began distributing J. Lindeberg branded apparel products in the United States on an exclusive basis beginning July 2008 in collaboration with J. Lindeberg AB of Sweden. In addition to being sold in the United States through our subsidiary, J. Lindeberg USA, LLC, J. Lindeberg branded high-end men’s fashion and premium golf apparel is marketed and sold by J. Lindeberg AB worldwide.

We are headquartered in Los Angeles, California, maintain showrooms in New York, Los Angeles and Atlanta.

18

Structure of Operations

Our wholly-owned subsidiary Versatile Entertainment, Inc. conducts our People’s Liberation brand business. Our William Rast brand business is conducted through our wholly-owned subsidiary Bella Rose, LLC. William Rast Sourcing, LLC and William Rast Licensing, LLC are consolidated under Bella Rose and are each owned 50% by Bella Rose and 50% by Tennman WR-T, Inc., an entity owned in part by Justin Timberlake. William Rast Retail, LLC, a California limited liability company, was formed on August 26, 2009 and is a wholly-owned subsidiary of William Rast Sourcing. William Rast Retail was formed to operate our William Rast retail stores. Our J. Lindeberg brand business is conducted through Bella Rose. J. Lindeberg USA, LLC is consolidated under Bella Rose and is owned 50% by Bella Rose and 50% by J. Lindeberg USA Corp. an entity owned by J. Lindeberg AB, a Swedish corporation. J. Lindeberg USA Retail, LLC, a California limited liability company, was formed on August 21, 2009 and is a wholly-owned subsidiary of J. Lindeberg USA. J. Lindeberg Retail was formed to operate our J. Lindeberg retail stores.

Recent Developments

Target Corporation

In May 2010, our subsidiary, William Rast Sourcing, LLC, entered into a design and licensing agreement with Target Corporation and in December 2010, we launched an exclusive collection of William Rast products for a limited time in Target stores throughout the United States. The exclusive collection included William Rast men’s and women’s denim and knits designed specifically for Target. During the year ended December 31, 2010, we received design and product revenues over the term of the agreement. In addition to product revenue, Target released commercials and other advertising media during the launch of the exclusive collection.

Charlotte Russe Litigation

In June 2009, we began to exclusively sell our People’s Liberation branded apparel and apparel accessories to Charlotte Russe in North America and Central America and provided Charlotte Russe with marketing and branding support for our People’s Liberation branded apparel. As discussed under Note 10 to the Consolidated Financial Statements, we were in litigation with Charlotte Russe and its affiliates in relation to our exclusive distribution agreement, which Charlotte Russe purported to terminate on October 26, 2009. As a result of the litigation, there have been no significant sales of People’s Liberation branded apparel to Charlotte Russe subsequent to October 2009.

On February 3, 2011, People's Liberation, Versatile Entertainment, Colin Dyne, ECA Holdings II, LLC and New Media Retail Concepts entered into a Settlement Agreement and Mutual Release with Charlotte Russe Holding, Inc. and Charlotte Russe Merchandising, Inc., Advent International Corporation, Advent CR Holdings, Inc., David Mussafer, and Jenny Ming. The agreement was entered into to settle all disputes among the parties relating to:

|

|

·

|

that certain action in the Los Angeles County Superior Court entitled Charlotte Russe Holding, Inc. et al. v. Versatile Entertainment, Inc. et al., Case No. BC 424734; and

|

|

|

·

|

that certain action entitled Versatile Entertainment, Inc. et al. v. David Mussafer, et al., originally brought in the Los Angeles County Superior Court, Case No. BC 424675.

|

On August 13, 2010, we entered into an asset purchase agreement with two related parties pursuant to which we sold 50% of the net proceeds, after contingent legal fees and expenses, that may be received by us as a result of our litigation with Charlotte Russe. The $750,000 cash proceeds received from the asset purchase agreement were recorded as other income in our consolidated statement of operations during the year ended December 31, 2010. In connection with the asset purchase agreement, we also entered into a promissory note in the amount of $750,000 with the same related parties on August 13, 2010.

19

Pursuant to the settlement agreement, on February 3, 2011 we received $3.5 million, after the distribution of amounts owed under the terms of the asset purchase agreement, as described above, and the payment of legal fees and expenses. We will record the settlement gain in the first quarter of 2011. We also received $750,000 in the third quarter of 2010 relating to the litigation in connection with the asset purchase agreement, for total proceeds of $4.3 million. The settlement included the dismissal with prejudice of all claims pending between the parties as well as mutual releases, without any admission of liability or wrongdoing by any of the parties to the actions.

During the year ended December 31, 2010, we wrote off approximately $588,000 of accounts receivable due from Charlotte Russe and recorded an inventory reserve of approximately $76,000 for inventory on hand related to purchase orders received from Charlotte Russe.

Retail Sales

Our William Rast branded apparel and accessories are sold through our three full-price William Rast brand retail stores and also through our William Rast brand outlet store. Our J. Lindeberg branded apparel and accessories are sold through our three full-price J. Lindeberg brand retail stores.

In November 2009, we launched our retail expansion plan with the opening of two new full-price William Rast brand retail stores at the Westfield Century City Shopping Mall in Los Angeles, California, and the Westfield Valley Fair Shopping Mall in San Jose, California. Additionally, we opened our first William Rast brand outlet store at the Desert Hills Premium Outlets in Cabazon, California, near Palm Springs. To further our retail expansion plan, we opened an additional J. Lindeberg retail store in April 2010 and a William Rast store in August 2010, both located in the Aventura Mall in Miami, Florida.

As of March 31, 2011 we had the following retail store locations:

|

Brand

|

Location

|

Opening or Acquisition Date

|

||

|

William Rast

|

Miami, Florida

|

August 2010

|

||

|

J. Lindeberg

|

Miami, Florida

|

April 2010

|

||

|

William Rast

|

Century City, California

|

November 2009

|

||

|

William Rast

|

San Jose, California

|

November 2009

|

||

|

William Rast Outlet

|

Cabazon, California

|

November 2009

|

||

|

J. Lindeberg

|

Los Angeles, California

|

May 2009

|

||

|

J. Lindeberg

|

New York, New York

|

July 2008

|

||

These store openings are part of our retail expansion plan which includes the roll-out of retail stores in major metropolitan locations over the next several years. We continue to revise our expansion plan as retail market conditions change in response to economic conditions. We believe that the retail stores will enhance our net sales and gross profit and the outlet store will allow us to sell our overstock or slow moving items at higher profit margins.

Critical Accounting Policies, Judgments and Estimates

Our discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates, including those related to our valuation of inventories and our allowance for uncollectible house accounts receivable, recourse factored accounts receivable and chargebacks, and contingent assets and liabilities. We base our estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. We believe the following critical accounting policies affect our more significant judgments and estimates used in the preparation of our consolidated financial statements:

20

Inventories. Inventories are evaluated on a continual basis and reserve adjustments, if any, are made based on management’s estimate of future sales value of specific inventory items. Reserve adjustments are made for the difference between the cost of the inventory and the estimated market value, if lower, and charged to operations in the period in which the facts that give rise to the adjustments become known. Inventories, consisting of piece goods and trim, work-in-process and finished goods, are stated at the lower of cost (first-in, first-out method) or market.

Accounts Receivable. Factored accounts receivable balances with recourse, chargeback and other receivables are evaluated on a continual basis and allowances are provided for potentially uncollectible accounts based on management’s estimate of the collectability of customer accounts. Factored accounts receivable without recourse are also evaluated on a continual basis and allowances are provided for anticipated returns, discounts and chargebacks based on management’s estimate of the collectability of customer accounts and historical return, discount and other chargeback rates. If the financial condition of a customer were to deteriorate, resulting in an impairment of its ability to make payments, an additional allowance may be required. Allowance adjustments are charged to operations in the period in which the facts that give rise to the adjustments become known.

Intangible Assets. Intangible assets are evaluated on a continual basis and impairment adjustments are made based on management’s reassessment of the useful lives related to intangible assets with definite useful lives. Intangible assets with indefinite lives are evaluated on a continual basis and impairment adjustments are made based on management’s comparison of the carrying amount of an asset to future undiscounted net cash flows expected to be generated by the asset. Impairment adjustments are made for the difference between the carrying value of the intangible asset and the estimated valuation and charged to operations in the period in which the facts that give rise to the adjustments become known.

Revenue Recognition. Wholesale revenue is recognized when merchandise is shipped to a customer, at which point title transfers to the customer, and when collection is reasonably assured. Customers are not given extended terms or dating or return rights without proper prior authorization. Revenue is recorded net of estimated returns, charge backs and markdowns based upon management’s estimates and historical experience. Website revenue is recognized when merchandise is shipped to a customer and when collection is reasonably assured. Retail revenue is recognized on the date of purchase from our retail stores. Advertising revenue received under sponsorship agreements is recorded in the period in which the event to which the advertising rights were granted occurred. Design revenue received under design and license agreements is recorded in the period in which the design services are provided to the licensee.