Attached files

| file | filename |

|---|---|

| 10-K - NEDAK ETHANOL, LLC | form10k_032911.htm |

| EX-31.1 - 302 CERTIFICATION/FAGERLAND - NEDAK ETHANOL, LLC | form10kexh311_032911.htm |

| EX-31.2 - 302 CERTIFICATION/BORER - NEDAK ETHANOL, LLC | form10kexh312_032911.htm |

| EX-32.1 - 1350 CERTIFICATION/FAGERLAND - NEDAK ETHANOL, LLC | form10kexh321_032911.htm |

| EX-10.(I).36 - SUPPLEMENT FOREBEARANCE AGREEMENT - NEDAK ETHANOL, LLC | form10kex10i36_032911.htm |

| EX-32.2 - 1350 CERTIFICATION/BORER - NEDAK ETHANOL, LLC | form10kex322_032911.htm |

Exhibit 13.1

Fiscal Year 2010 Annual Report

March 31, 2011

A letter from the President and General Manager

Dear NEDAK Investor: This is my second annual report to you as President of an operating company, and as I write to you, I’m looking back at the most remarkable of a remarkable six years. This second year of operations has brought us to a steady level of production that we only hoped to achieve a year ago. Our expectations include continued improvements that should bring production levels up to the maximum amount allowed under our environmental permits.

Last year, I told you that “the challenges and possibilities of the days to come are different from the past”, and this statement is even more true today. Ahead, the word “improvement” dominates our thinking—process improvement, equipment improvement and upgrade, training and skill improvement, improvement of feedstock, improvement of steady throughput, and in all of these, improvement of quality. We like to say that we have set our foot on the road of “Continuous Quality Improvement.”

One of the most challenging aspects of business at NEDAK this year has been the weakened financial condition that remained after the volatile experiences of the 5 year development and start-up phases. This, combined with volatile commodities markets, corn and natural gas procurement under negative working capital conditions, and a very slow start to recovery in the larger economy across the world were the main challenges in 2010. We continue to explore options to remedy our negative working capital and improve our lending arrangements. Those options may include obtaining additional equity capital, as well as changing our marketing and procurement arrangements in a way that reduces the levels of risk and reward in our business.

Our goals are to protect as much of the value of this successfully operating production facility for the benefit of the existing membership and to keep control of the company. Although the market values for ethanol plants sold during the last 12-24 months spanned a wide range, non-operating ethanol plants have generally sold at a significant discount. Therefore, considering our existing debt load and the value others have received in the sale of ethanol plants in recent months, we believe the best way to add member value is to maintain a continually operated facility into what we hope is a more prosperous future in the industry.

On a brighter note, we have experienced improvement in the local wet distillers grains market, which fueled a profitable fourth quarter in 2010 and we have continued to see a stable demand for this product in our area.

This Annual Report containing our fiscal 2010 financial statements includes discussion of many challenges in the past two years. My message to you in this letter continues to look forward with our plans and expectations for the future grounded in our prior experience. Overall, I have three main goals:

|

·

|

Protect Unit holder value in our efforts to recapitalize the company, seeking additional resources and strategic changes in marketing and operation partners.

|

|

·

|

Continue to stabilize Unit holder value by continuous improvement of efficiencies while controlling expenses and maximizing revenues.

|

|

·

|

Continue to review opportunities to increase revenues through product research and development.

|

Another significant initiative we’ve started in recent months and plan to pursue into the future is targeted capital investments in equipment to improve even more our production efficiencies. Investments in new, upgraded or modified equipment is critical to establish us as a low-cost producer. As additional working capital becomes available, the Directors and Management will actively pursue any capital project that can bring immediate process or productivity improvements with cash flow and payback in the short term.

Looking forward, we are ready to capture the upside potential of our commodity markets when the opportunities arise and our capital resources allow. As we all know, today’s environment is much different than when we were organized. However, we intend to continue in our efforts to develop our business into a valuable and productive enterprise that will provide returns to you in the future.

Jerome Fagerland,

President and General Manager

2010 Annual Report

|

Content

|

Page

|

|

Forward-Looking and Cautionary Statements

|

1

|

|

Company Overview

|

2

|

|

Management’s Discussion & Analysis of Financial Condition and Results of Operation

|

5

|

|

Overview

|

5

|

|

2010 and 2009 Production Levels

|

7

|

|

2010 and 2009 Net Income

|

8

|

|

Revenues, Cost of Goods Sold, General & Administrative Expenses

|

9

|

|

Liquidity and Capital Resources

|

10

|

|

Market Risk

|

12

|

|

Application of Critical Accounting Estimates

|

13

|

|

Off-Balance Sheet Arrangements

|

14

|

|

Our Directors and Officers

|

14

|

|

Changes in and Disagreements with Accountants

|

14

|

|

Market Price and Dividends

|

14

|

|

Management’s Responsibility for Financial Information

|

15

|

|

Management’s Report on Internal Control over Financial Reporting

|

15

|

|

Annual Report on Form 10-K

|

16

|

|

Audited Financial Statements for the Years ended December 31, 2010 and 2009

|

|

|

Report of Independent Registered Public Accounting Firm

|

F-1

|

|

Balance Sheets

|

F-2

|

|

Statements of Operations

|

F-3

|

|

Statements of Changes in Members’ Equity

|

F-4

|

|

Statements of Cash Flows

|

F-5

|

|

Notes to Financial Statements

|

F-6

|

Forward-Looking and Cautionary Statements

Certain statements contained in this 2010 Annual Report may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve a number of risks, uncertainties and other factors that could cause actual results to be materially different, as discussed more fully elsewhere in this Annual Report and in the company’s filings with the Securities and Exchange Commission (“SEC”), including the company’s 2010 Form 10-K filed on March 31, 2011.

1

Company Overview

General

NEDAK Ethanol, LLC, a Nebraska limited liability company (the “Company,” “we” or “us”) was formed in 2003 to construct and operate our ethanol plant near Atkinson, Nebraska. We began producing ethanol and distiller’s grains at the plant in December 2008, but did not commence full production until June of 2009. Our ethanol plant consumes approximately 17 million bushels of locally grown corn annually, and produces approximately 44 million gallons of denatured fuel-grade ethanol and approximately 340,000 tons of wet distiller’s grains for feed cattle annually.

Strategy

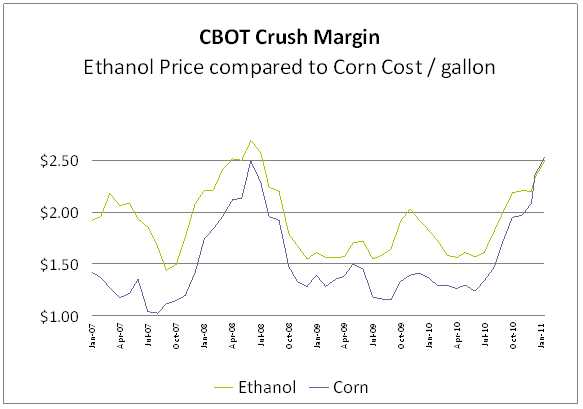

In the past few years, U. S. ethanol production capacity has grown to over 13 billion gallons annually, and significant portions of that capacity are owned by the largest players in the U. S. fossil fuel markets. In that marketplace, we produce barely 1/3 of 1% of that domestic capacity, which leaves us with strategic challenges. Furthermore, the economic realities leave us with unique financial challenges as compared to most other producers. With approximately half of our assets leveraged with debt and as a newer plant in an industry in which approximately a third of all plants are nearly fully depreciated and a significant number of plants recently out of bankruptcy, we have a high interest burden requiring cash as well as a large non-cash depreciation burden to cover. The marketplace is also experiencing dramatic swings in profitability. In 2010, the “Crush Margin” (the difference between the market prices of ethanol and corn per gallon of ethanol produced) swung from a low of $0.02 to a high of $0.53. This compared to lows and highs in 2009 of $0.18 and $0.61 per gallon, respectively. Our combined interest and depreciation alone will be more than $0.18 per gallon in 2011.

Accordingly, our near-term strategy is to minimize losses and to team up with a strategic commodities marketer that can assist with risk management. We are also currently working to reorganize our financial structure with the objectives of providing working capital and restructuring our debt. After risk-management, our strategic initiatives include improving production efficiencies, maximizing throughput, controlling expenses, and increasing revenues in an innovative way.

Snapshot of our Business

Below are three presentations of key economic drivers of our business: where we sell our product, Chicago Board of Trade (“CBOT”) crush margins, and a trend of reformulated blendstock for oxygenate blending (“RBOB”) pricing compared to ethanol pricing.

Where we sell our product

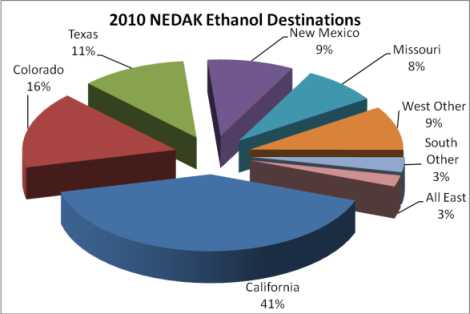

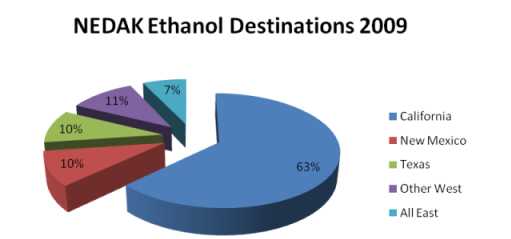

We believe that we have an advantage due to our location and the geography of other plant locations across the country. Our westernmost location provides us with a transportation cost advantage when shipping to our western customers. The large population in California is evident in the proportion of our sales delivered into that market, with New Mexico and Texas drawing effectively equal portions of our product as all the rest of the western states. Only 3% of our product was shipped into the eastern U. S. in 2010.

2

Crush margin & RBOB

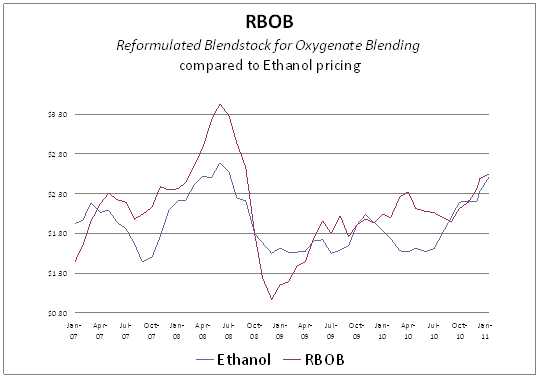

The relationship between the cost of corn and the price of ethanol is shown in the following graph. This correlation is clearly primary in our marketplace. The relationship between the cost of gasoline and ethanol is less direct, as shown in the RBOB graph. Several times in the last three years, ethanol has actually been priced above the market price of RBOB, which is the unleaded gasoline base for the E10 product that is the dominant product in which ethanol is consumed.

3

4

Management’s Discussion & Analysis of Financial Condition

and Results of Operation

Overview

We completed full startup of our ethanol plant in June 2009, and have the capacity to annually process approximately 17 million bushels of corn, through a dry milling process, into approximately 44 million gallons of ethanol per year. We also produce approximately 340,000 tons of wet distiller’s grains (“WDG”) annually. We are currently operating at approximately 112% capacity.

Our plant needs approximately 47,000 bushels per day as the feedstock for its dry milling process. The grain supply for our plant is obtained primarily from local markets. The price and availability of corn are subject to significant fluctuations depending upon a number of factors that affect commodity prices in general, including crop conditions, weather, governmental programs and foreign purchases.

As a commodity processor, our profitability is primarily driven by the relationship between the cost of corn and the price at which we can sell our end-products, ethanol and WDG. Since we have been operational, the price of ethanol has usually tracked closely with the cost of corn. Although the corn-ethanol Crush Margin—the difference between the cost of corn in each gallon and the price of ethanol—has varied from time to time, revenues from sales of ethanol have usually covered our variable costs of operations, leaving our fixed costs to be covered by our WDG revenues. As of March 4, 2011, corn for May 2011 delivery was $7.28 per bushel and the corresponding ethanol sales prices is $2.61 per gallon on the CBOT, resulting in a negative gross Crush Margin of $0.04 per gallon.

Because of the way our costs have been covered during our first year and a half of operations, our profitability has tended to improve with higher corn costs. Cattle feeders compare our WDG prices to the price they would otherwise pay for feed corn, which means that generally speaking throughout our operations, higher corn prices have tended to increase our WDG revenues. So long as the price of ethanol covers our variable costs with a sufficient Crush Margin and our fixed costs are covered by WDG prices, higher corn costs support higher WDG prices and increase our profitability. Since these commodity price relationships are complex and not necessarily correlated, these trends could change at any time, and our profitability could be hindered by higher corn prices. At some point, increased corn costs will decrease the Crush Margin to the point where WDG prices cannot compensate and our profitability would correspondingly decrease.

As described below under “Liquidity and Capital Resources—Credit Facility,” we have been actively working with our lenders to resolve defaults under our credit agreements, change the way we manage our commodity risk and identify sources of additional capital to meet our working capital needs. In connection with that process, we have modified or terminated several of our pre-existing contracts for the sale of ethanol and WDG and the purchase of corn and natural gas. Currently, we are considering entering into a substitute marketing agreement or toll processing agreement, which we believe will allow us to more effectively manage risk and will reduce our working capital needs. While those discussions are on-going, we have established a relationship with Tenaska Biofuels, LLC (“Tenaska”). Although we have not entered into any long-term agreement with Tenaska, we are working closely with Tenaska for the purchase of corn and have been selling all of our ethanol through Tenaska. We have also entered into a master netting agreement to facilitate payments with Tenaska and more efficiently use our working capital. The agreement is terminable by either party at will.

WDG Revenues

As noted above, WDG sales are a key revenue stream driving our profitability. Generally, because distiller’s grains compete with other protein-based animal feed products, the price of distiller’s grains may decrease when the prices of competing feed products decrease. Downward pressure on commodity prices, such as soybeans and corn, will generally cause the price of competing animal feed products to decline, resulting in downward pressure on the price of WDG, which will decrease our revenues.

Our WDG-derived profits improved in 2010 over 2009, in part due to improvements in supply and demand throughout 2010. During the startup of our plant in 2009, our WDG was favored in the marketplace because of its better quality when compared to the

5

modified and dry product that had been available in the local market previously. However, late in 2009 and through the summer of 2010, a large local ethanol facility increased the amount of WDG available in the marketplace. Additionally, a local feedlot closed, which decreased local demand for distiller’s grains. Then, in the fall of 2010, the local feedlot resumed operations and our competitor’s WDG production was converted to dried distiller’s grain production for the export market. This resulted in increased WDG sales and a decrease in our losses in the fourth quarter of 2010.

In addition to an improvement of local WDG supply and demand factors in 2010, we undertook a WDG pricing strategy that improved our results for 2010. During the winter of 2009 – 2010, because we expected a reduction in WDG demand during the summer of 2010, we offered our large volume consumers a deeper discount in return for their commitment to continue to take the same volume of WDG throughout the summer at the same price. These marketing agreements allowed us to earn higher WDG prices over the summer of 2010 than we received in 2009.

We currently anticipate a continued increase in revenues from the sale of WDG in 2011 over 2010 because of increasing corn prices, which topped $7.00 per bushel on February 25, 2011 on the Chicago Mercantile Exchange ending the day at $7.12 per bushel. Our first quarter 2011 WDG pricing has been based on the December 2010 cost of corn under our verbal agreements with local cattle feeders, and we expect it to fluctuate throughout 2011. Furthermore, we believe our WDG revenues will increase in 2011 as plant productivity continues to increase through improved operating processes, systems and formulation.

Ethanol Market Factors

The price of ethanol is largely driven by supply and demand on the national markets, as well as regulatory requirements born by fuel blenders. Annual U.S. ethanol production capacity grew continually from 1980 through the middle of 2009. According to the Renewable Fuels Association (“RFA”), in 2002, annual U.S. ethanol production surpassed two billion gallons, by 2007, production further increased to 6.5 billion gallons, and in 2009 it topped ten billion gallons. Due to general economic difficulties and commodity prices in the last half of 2008, approximately two billion gallons of additional capacity that was planned or already under construction was put on hold, but the RFA indicates that total U.S. ethanol production capacity is now approximately 13 billion gallons.

The Renewable Fuels Standard (“RFS”), which was created by the Energy Policy Act of 2005 (the “2005 Act”), established the RFS2 standard for blending renewable fuels into automobile fuel in 2011 at 13.95 billion gallons, of which 2.56 billion gallons must come from non-corn based ethanol, leaving a maximum requirement of 11.4 billion gallons of corn based ethanol to be blended in 2011. As of December 2010, the RFA reported that nation-wide there were 191 operating ethanol refineries with a nameplate capacity of 13.1 billion gallons, another 21 non-operating facilities with 654 million gallons of capacity and 11 more plants under construction with additional capacity of 840 million gallons. Total capacity from these 223 facilities would be 14.6 billion gallons at nameplate, and at 110% of nameplate could produce over 16 billion gallons of ethanol per year. This means that compared to the RFS2 standard for 2011, there is nearly five billion gallons of potential corn based ethanol oversupply in the U.S. Therefore, the ethanol industry must continue to generate demand for ethanol beyond the minimum floor set by the RFS in order to support current ethanol prices.

In response to a request by Growth Energy, an ethanol industry trade association, under section 211(f)(4) of the Clean Air Act, the Environmental Protection Agency (“EPA”) has granted a partial waiver to allow fuel and fuel additive manufacturers to introduce gasoline that contains more than 10 volume percent (vol%) ethanol and up to 15 vol% ethanol (“E15”) for use in model year (“MY”) 2001 and newer light-duty motor vehicles, subject to several conditions. On October 13, 2010, the EPA granted a partial waiver for E15 for use in MY2007 and newer “light-duty vehicles.” “Light-duty vehicles” include cars, light-duty trucks and medium-duty passenger vehicles. On January 21, 2011, the EPA granted a partial waiver for E15 for use in MY2001-2006 “light-duty vehicles.” These decisions were based on test results provided by the U.S. Department of Energy (“DOE”) and other information regarding the potential effect of E15 on vehicle emissions. Taken together, the two actions allow, but do not require, E15 to be introduced into commerce for use in MY2001 and newer light-duty vehicles if conditions for mitigating, misfueling and ensuring fuel quality are met. The EPA is in the process of completing work on regulations that would provide a more practical means of meeting the conditions.

As shown in the graph above under “Company Overview—Shapshot of our Business—Crush Margin & RBOB,” throughout the last four years, with a very high correlation, ethanol and corn prices rose and fell together with a high level of correlation. We have no reason to expect this to change in the foreseeable future. On a macro basis, we also believe that both product delivery infrastructure and demand for ethanol must increase in order to increase ethanol profit margins over both the near and long term.

We believe that since the beginning of the global recession in mid 2009, the fluctuating U.S. demand for ethanol has been primarily driven by two variables: (1) the level of on-hand inventory of ethanol in the domestic blender pipeline and storage, and to a lesser extent, (2) the sale of ethanol to South America as the weather and economies affect the sugar crop and the production of sugar-based ethanol there. The Crush Margin tends to increase in the short term (week to week) when shortages in blender inventories cause

6

immediate demand pressure. Less dramatically, we believe that the net export of U.S. ethanol to Brazil as a result of the Brazilian sugar crop shortages caused longer term (month to month) increases in the 2010 average Crush Margins.

We believe these short and medium term fluctuations in the Crush Margin will continue to cover our variable ethanol production costs, and until the domestic ethanol distribution infrastructure grows and domestic demand for ethanol increases, the Crush Margin will have a muted impact on our profitability.

Risk Management

Because our financial performance is primarily based on commodity prices, one of the most important facets of our industry is risk management, focused on maintaining balance in the sale of ethanol and the purchase of corn. Historically, and to the extent we had available working capital, we have used commodity forward-contract marketing. The preferred position is to purchase corn and sell a matching amount of ethanol for future delivery when the margins are profitable. When corn is forward-contracted and ethanol cannot be sold to balance, we face the risk that corn prices will fall, followed by ethanol, leaving the plant with excessive expenses in corn purchases, pushing the cost of ethanol above the market price. Even if the decision is made to shut down the plant, rather than operate at a loss, the purchase and resale of that corn will also result in a loss. Alternatively, we sometimes purchase corn for future delivery and buy corn futures contracts as a hedge against adverse price changes, but this requires us to pay margin calls on the futures contracts. However, our ability to hedge has been limited because of our working capital and liquidity. As a result we have been limited to using nearby spot purchases of corn and sales of ethanol for prompt delivery. We are continuing to explore other marketing arrangements and possibly a toll processing agreement to reduce our exposure to commodity price risk and more efficiently manage our working capital.

Production Matters

In the beginning of 2010, we were forced to run the plant at reduced rates due to poor quality corn and increased foreign material in the corn fines. The plant production staff closely monitored the beer column (part of the ethanol manufacturing process) and made adjustments to the process, which minimized the impact on production rates. We reduced the solids content in the mash going to the beer column, adjusted the beer column temperature, and retuned process controllers for temperature and level control. Throughout 2010, we gradually increased the steady-state rates up to and past 100% of our plant’s name-plate capacity. By year end, the plant was frequently topping daily production rates above 110% of nameplate, and since have often increased to 113% of nameplate. Our goals for 2011 include stabilizing production rates and continuing to improve equipment and processes until we achieve daily production rates that require an application to the Nebraska Department of Environmental Quality to increase our Air Quality Permit production limit beyond our current 117% of nameplate.

We expect to spend at least the next 12 months focused on plant operations, including three primary functions: (i) managing cost-effective purchases of inputs for our production process, (ii) optimizing the production process to reduce manufacturing costs, and (iii) monitoring and evaluating the performance of our marketing agents to ensure effective marketing of our ethanol and distiller’s grains.

2010 and 2009 Production Levels

We began ethanol and distiller’s grains production in January 2009, and full production commenced in June 2009 as our plant constructor, Delta-T Corporation (“Delta-T”) turned the plant over to us. 2009 began with limited production, no production in May, and gradual improvements into winter when severe weather and startup equipment, along with infrastructure problems, resulted in down time. 2010 was a year of proving our plant capabilities and operational competence. Our operational team performed well in 2010, with excellent performance at the end of the year.

Monthly summary of 2010 and 2009 operations:

|

Ethanol Gallons

|

Corn Bushels

|

Denatured Yield

|

Tons of Wet DGs

|

Tons of Dry DGs

|

||||||||||||

| Produced (000’s) |

Nameplate

|

Ground (000’s) | (000’s) |

Sold (000’s)

|

Sold (000’s)

|

|||||||||||

| 2010 | 2009 | % 2010 | 2010 | 2009 | 2010 | 2009 | 2010 | 2009 | 2010 | 2009 | ||||||

| January | 3,446 | 2,817 | 88% | 1,240 | 1,051 | 2.78 | 2.68 | 25 | 22 | 0.4 | 0.0 | |||||

| February | 3,563 | 2,347 | 101% | 1,278 | 839 | 2.79 | 2.80 | 26 | 22 | 0.1 |

0.0

|

|||||

|

March

|

4,125 | 2,428 |

106%

|

1,490

|

943 | 2.77 | 2.57 |

26

|

20

|

2.1 | 0.0 | |||||

| April | 3,475 | 2,961 | 90% | 1,240 |

1,141

|

2.80

|

2.60

|

26 |

20

|

2.5

|

0.0

|

|||||

| May | 4,254 | - | 109% | 1,542 | - | 2.76 | - | 25 |

-

|

1.6

|

0.1 | |||||

| June | 4,174 |

3,099

|

111%

|

1,484

|

1,238 | 2.81 | 2.50 | 19 |

10

|

2.5 | 3.2 | |||||

|

July

|

3,900

|

3,340

|

100%

|

1,412

|

1,177

|

2.76

|

2.84

|

22

|

19 |

3.8

|

2.5 | |||||

| August | 4,167 | 3,753 | 107% | 1,490 | 1,416 | 2.80 | 2.65 | 21 |

21

|

4.6

|

4.8

|

|||||

| September | 4,070 |

3,643

|

108%

|

1,462

|

1,274

|

2.78

|

2.86

|

29

|

22

|

1.7

|

4.0

|

|||||

| October |

3,659

|

3,222

|

94%

|

1,338

|

1,181

|

2.73

|

2.73

|

31

|

25

|

0.0 |

1.0

|

|||||

| November |

3,893

|

3,733 |

103%

|

1,418

|

1,376

|

2.75 |

2.71

|

34

|

23

|

0.5

|

1.0

|

|||||

| December | 4,356 |

3,011

|

112% |

1,542

|

1,114

|

2.82

|

2.70 |

35

|

24

|

0.1

|

2.0

|

|||||

|

Total

|

47,082 | 34,354 | 107% |

16,936

|

12,750 |

2.78

|

2.69

|

319

|

228

|

19.9

|

18.6

|

7

Quarterly summary of 2010 and 2009 operations:

|

Ethanol Gallons

|

Corn Bushels

|

Denatured Yield

|

Tons of Wet DGs

|

Tons of Dry DGs

|

Net Income (Loss)

|

||||||||||||||||||

|

Produced (000’s)

|

Ground (000’s)

|

(000’s)

|

Sold (000’s)

|

Sold (000’s)

|

(000’s)

|

||||||||||||||||||

|

2010 2009

|

2010 2009

|

2010 2009

|

2010 2009

|

2010 2009

|

2010 2009

|

||||||||||||||||||

|

Quarter 1

|

11,134

|

7,592

|

4,008

|

2,833

|

2.78

|

2.68

|

77

|

64

|

2.6

|

0.0

|

$1,727

|

($3,843)

|

|||||||||||

|

Quarter 2

|

11,903

|

6,060

|

4,266

|

2,379

|

2.79

|

2.55

|

70

|

30

|

6.6

|

3.3

|

(3,218)

|

(4,423)

|

|||||||||||

|

Quarter 3

|

12,137

|

10,736

|

4,364

|

3,867

|

2.78

|

2.78

|

72

|

62

|

10.1

|

11.3

|

(2,125)

|

(3,019)

|

|||||||||||

|

Quarter 4

|

11,908

|

9,966

|

4,298

|

3,671

|

2.77

|

2.71

|

100

|

72

|

0.6

|

4.0

|

1,529

|

2,050

|

|||||||||||

|

Total

|

47,082

|

34,354

|

16,936

|

12,750

|

2.78

|

2.69

|

319

|

228

|

19.9

|

18.6

|

($2,087)

|

($9,235)

|

|||||||||||

Our production dramatically improved in 2010. First, our production in the first half of 2009 was restricted by the failure and reconstruction of one of the three fermenters. Second, our operational improvements due to post-startup expertise in 2010 allowed improved throughput and steady-state production in the second half of 2010 as compared to 2009. As the table above illustrates, our third quarter production volumes in 2010 were the best of both years. The third quarter volumes resulted from bringing the third fermenter on line in our new plant in June of 2009, and from continuing the efforts to further maximize throughput and improve steady-state production in 2010. Fourth quarter 2009 production volumes were hampered by the establishment of maintenance and cleaning processes as well as severe winter weather causing breakdowns and power failures. While winter weather caused reduced throughput in the fourth over the third quarter in both years, we still increased production in the fourth quarter of 2010 because of our throughput and steady-state production.

2010 and 2009 Net Income

Comparison of our fourth quarter 2010 and 2009 Statement of Operations Items:

|

Fourth Quarter

2010

|

Fourth Quarter 2010

Percentage

|

Fourth Quarter 2009

|

Fourth Quarter 2009

Percentage

|

|||||||

|

Revenues

|

$

|

27,955,531

|

100%

|

$

|

21,924,243

|

100%

|

||||

|

Cost of Goods Sold

|

25,225,020

|

90%

|

22,341,201

|

102%

|

||||||

|

Gross Profit (Loss)

|

2,730,511

|

10%

|

(416,958)

|

2%

|

||||||

|

General & Admin. Expenses

|

624,176

|

2%

|

387,089

|

2%

|

||||||

|

Operating Income (Loss)

|

2,106,335

|

8%

|

(804,047)

|

(4%)

|

||||||

|

Other Income (Expense) net

|

(576,726)

|

(2%)

|

2,855,001

|

13%

|

||||||

|

Net Income

|

$

|

1,529,609

|

6%

|

$

|

2,050,954

|

9%

|

||||

Summary of 2010 and 2009 Income Statement Items:

|

2010

|

2010 Percentage

|

2009

|

2009

Percentage

|

|||||||

|

Revenues

|

$

|

94,777,441

|

100%

|

$

|

67,536,108

|

100%

|

||||

|

Cost of Goods Sold

|

94,338,221

|

99%

|

74,528,307

|

110%

|

||||||

|

Gross Profit (Loss)

|

439,220

|

0%

|

(6,992,199)

|

(10%)

|

||||||

|

General & Admin. Expenses

|

2,424,432

|

2%

|

2,596,682

|

4%

|

||||||

|

Operating Income (Loss)

|

(1,985,213)

|

(2%)

|

(9,588,881)

|

(14%)

|

||||||

|

Other Income (Expense) net

|

(101,374)

|

0%

|

353,633

|

1%

|

||||||

|

Net Loss

|

$

|

(2,086,586)

|

(2%)

|

$

|

(9,235,248)

|

(14%)

|

||||

In both the fourth quarter and the year as a whole, our financial results improved in 2010 over 2009. We received a benefit of approximately $3,000,000 from our settlement with Delta-T in both years. In 2009, we received that payment in the fourth quarter and in 2010 we received it in the first quarter. Thus, while fourth quarter 2010 net income was approximately $521,000 lower than the same quarter of 2009, our operating income improved approximately $2,910,000 in 2010 over 2009 before accounting for Other Income (Expense) items.

8

Operating Income (Loss) improvement in 2010 over 2009 was approximately $7,600,000. This is a result of three primary factors. First, our total throughput increased in every month of 2010 as compared to 2009, but most dramatically in the first half because 2009 production was restricted with only two operational fermenters through April and no production in May. Second, although not apparent in the raw numbers, yield was improved in 2010 over 2009 as a result of our improved processes and methods—despite the fact that the quality of the corn we used in 2010 was worse than used in 2009. Third, our improvements in operational methods and infrastructure resulted in a significant reduction in down time and stop/start incidents in 2010 as compared to 2009.

Revenues, Cost of Goods Sold, General & Administrative Expenses

Revenues

Our revenues from operations come from two primary sources: sales of ethanol and distiller’s grains. For the year ended December 31, 2010 and 2009, without freight reimbursements, we received $79,085,330 (about 83%) and $53,785,224 (about 80%) of our revenue from the sale of ethanol, respectively, and $12,004,033 (about 13%) and $8,006,646 (about 12%) of our revenue from the sale of distiller’s grains, respectively. The average selling price for ethanol was $1.73 and $1.56 per gallon in 2010 and 2009, respectively; the average selling price for WDG was $30.34 and $27.05 per ton in 2010 and 2009, respectively; and the average selling price for dry distiller’s grains was $98.75 and $84.47 per ton in 2010 and 2009, respectively. We sold approximately 46.0 and 34.3 million gallons of ethanol in 2010 and 2009, respectively; we sold approximately 319,000 and 228,000 tons of WDG in 2010 and 2009, respectively; and we sold approximately 19,900 and 18,600 tons of dried distiller’s grains in 2010 and 2009, respectively.

As we have previously reported, there are two price/cost relationships that must improve for us to be profitable: the Crush Margin, and the price of distiller’s grains compared to the costs that remain uncovered by the Crush Margin. These two relationships are inherent in the largest numbers in our statement of operations, which in descending order are ethanol sales, corn purchases, and distiller’s grains revenue.

We expect the Crush Margin to increase above its year end 2010 level. As of December 31, 2010, the CBOT price of corn was $6.29 per bushel while CBOT ethanol was $2.38 per gallon, resulting in a $0.16 Crush Margin (assuming a 2.83 bushel to gallon conversion rate); while the average Crush Margin for all of 2010 was $0.37. The Crush Margin continued to deteriorate in January 2011 until it was actually negative in mid month. The negative Gross Crush Margin continued throughout February and remained so until the middle of March, 2011, when it became positive. For all of 2010, our ethanol revenue was 122% of the cost of corn, but in the fourth quarter that ratio was the lowest of the year at 115%, while first, second and third quarters it was 125%, 123% and 130% respectively. We believe this ratio will be driven higher with improvement in the U.S. economy, which should increase demand for ethanol, and those higher prices will be supported by continued political support for ethanol and the RFS.

Sales of distiller’s grains only accounted for 13% and 12% of our revenues in 2010 and 2009, respectively, when both ethanol and distiller’s grains revenues were depressed. As discussed above, we increased our 2010 summer WDG volume over 2009 in return for reduced prices, resulting in an overall increase in WDG revenue in 2010 over 2009. Finally, we expect the price of distiller’s grains to improve as feedlot operators recognize the benefits of WDG over corn.

Cost of Goods Sold

Our cost of goods sold as a percentage of revenues was 99% and 110% in 2010 and 2009, respectively, which includes a fourth quarter improvement of 90% in 2010 from 102% in 2009. The improvement in the fourth quarter resulted from both a better Crush Margin and better distiller’s grains prices. Our two primary costs of producing ethanol and distiller’s grains are corn and natural gas. As of December 31, 2010, we had forward purchase contracts for delivery of 2,100,000 bushels of corn through July 2011, for a total commitment of approximately $11,487,000. We expect continued volatility in the price of corn, which could significantly impact our cost of goods sold. The following chart provides more detail on our cost of goods sold, and a comparison between the periods.

|

Cost of Goods Sold Items

|

2010

|

2010 Percentage

|

2009

|

2009

Percentage

|

|||||||

|

Revenues

|

$

|

94,777,441

|

100%

|

$

|

67,536,108

|

100%

|

|||||

|

Costs:

|

|||||||||||

|

Corn

|

62,590,549

|

67%

|

43,874,327

|

65%

|

|||||||

|

Denaturant & Chemicals

|

5,888,114

|

6%

|

4,255,093

|

6%

|

|||||||

|

Ethanol Freight Costs

|

6,800,521

|

7%

|

8,013,611

|

12%

|

|||||||

|

Natural Gas and Electricity

|

8,217,478

|

9%

|

8,259,391

|

12%

|

|||||||

|

Production Labor

|

2,551,832

|

3%

|

2,298,954

|

3%

|

|||||||

|

Supplies and Maintenance

|

1,221,811

|

1%

|

631,858

|

1%

|

|||||||

|

Property Tax

|

971,496

|

1%

|

1,108,134

|

2%

|

|||||||

|

Depreciation

|

6,096,420

|

6%

|

6,086,939

|

9%

|

|||||||

|

Total Cost of Goods Sold

|

$

|

94,338,221

|

99%

|

$

|

74,528,307

|

110%

|

9

Corn is the largest component of our cost structure. Our cost of corn was higher in 2010 than in 2009. Our average cost of corn per gallon of ethanol produced was $1.36 and $1.26 in 2010 and 2009, respectively, with the monthly minimum average of $1.18 and $1.11 per gallon in 2010 and 2009, respectively, and a monthly maximum of $1.88 and $1.48 in 2010 and 2009, respectively. Our average cost per bushel of corn was $3.85 and $3.46 in 2010 and 2009, respectively, with a monthly minimum average of $3.30 and $3.13 in 2010 and 2009, respectively, and a monthly maximum average of $5.15 and $3.94 in 2010 and 2009, respectively.

General and Administrative Expenses

Our general and administrative expense as a percentage of revenues for 2010 and 2009 was 2% and 4%, respectively. The improvement was primarily due to increasing revenues and productivity. General and administrative expenses include salaries and benefits of administrative employees, insurance, professional fees and other general administrative costs. The following chart provides more detail on our general and administrative expenses, and a comparison between the periods.

|

General and Administrative

Expense Items

|

2010

|

2010 Percentage

|

2009

|

2009

Percentage

|

|||||||

|

Revenues

|

$

|

94,777,441

|

100%

|

$

|

67,536,108

|

100%

|

|||||

|

Costs:

|

|||||||||||

|

Administrative People Costs

|

997,364

|

1%

|

961,856

|

1%

|

|||||||

|

Professional Fees

|

861,759

|

1%

|

1,089,277

|

2%

|

|||||||

|

Insurance

|

337,097

|

0%

|

361,880

|

1%

|

|||||||

|

Other

|

228,212

|

0%

|

183,669

|

0%

|

|||||||

|

Total General and Administrative Expenses

|

$

|

2,424,432

|

2%

|

$

|

2,596,682

|

4%

|

|||||

Environmental Compliance

Our operations are subject to environmental laws and regulations adopted by various governmental entities in the jurisdiction in which we operate. These laws require us to investigate and remediate the effects of the release or disposal of materials. We are in compliance with all environmental regulations and respond promptly to all requests and suggestions from the state and federal regulating bodies when they are received.

Construction Contract

The Company entered into an Engineering, Procurement and Construction Services Fixed Price Contract dated August 9, 2006 (the “Delta-T Contract”) with Delta-T. Following a dispute, the parties amended the Delta-T Contract on September 1, 2009, which provided that, among other things: (i) Delta-T relinquished letter of credit proceeds of $3,995,000 held by Lender, and (ii) a $5,000,000 promissory note in Delta-T’s favor was extinguished. The extinguishment of the $5,000,000 promissory note and other contract liabilities were recorded as reductions to property and equipment. The relinquishment of the $3,995,000 letter of credit proceeds, less $228,431 for costs expected to be incurred, was recognized as gain in other income during the fourth quarter of 2009.

On March 19, 2010, we entered into a Settlement Agreement and Mutual Release (the “Settlement Agreement”) with Delta-T, Delta-T’s parent, Bateman Litwin NV (“Bateman”) and Bateman Engineering Inc. (“Bateman Engineering”) under which, among other things, (i) Delta-T and Bateman authorized us to draw $3,000,000 from a letter of credit, and (ii) we released Delta-T and Bateman from all warranties and other claims under the Delta-T Contract. The Settlement Agreement resolved all outstanding disputes among us, Bateman and Delta-T relating to the Delta-T Contract and construction of our ethanol plant. The receipt of the $3,000,000 was recognized as a gain in other income in the first quarter of 2010.

Liquidity and Capital Resources

Net cash provided by operating activities was $4,766,368 for the year ended December 31, 2010 compared to net cash used in operating activities of $4,941,283 for the year ended December 31, 2009. In addition to the ordinary and generally anticipated draws and additions to working capital in increasing accounts payable, inventory and receivables that come with the commencement of operations of a business, we received significant benefits from the Settlement Agreement. In 2010, we received $3,000,000 related to the settlement. In 2009, the settlement increased our working capital, with a reduction of retainage and sales tax payable of

10

$1,700,000 and $400,000, respectively, as well as relinquishment of letter of credit proceeds of $3,995,000. Other non-working capital benefits derived from this settlement were used to reduce our long term asset value through forgoing warranty repairs worth approximately $230,000 and the (non-cash) extinguishment of a $5,000,000 note payable to Delta-T.

We had expected that our original equity offerings and debt financing would have been sufficient to cover all costs associated with the initial stage of production. However, as of December 31, 2010, we had negative working capital of ($4,644,148), prior to classification of $38.6 million of our debt to current liabilities. We may continue operating at negative margins, depending on commodity prices. If we are unable to generate sufficient cash flows from operations or obtain additional debt or equity financing, our ability to continue operations may be materially hindered, including our ability to enter into derivative positions, and we may be forced to continue to purchase our corn and market our ethanol at spot prices, which would further expose us to market volatility and associated risks. The financial statements included within this Annual Report have been prepared assuming that we will continue as a going concern. Until we are able to obtain additional working capital from operations or outside sources and modify our Credit Agreement covenants or refinance our construction loan, there is substantial doubt as to whether we can continue to operate as a going concern.

As we have reported in the past, we continue to work with our lenders and others to identify the means by which we can improve our capital position. Improved capitalization would better enable us to hedge and better manage our market risk in the commodity markets, among other things. Improving our capitalization will likely involve restructuring our debt so that both our debt level and the associated covenants are more compatible with current market conditions, and may also involve our issuing equity in one or more private placements on terms which we cannot predict at this time.

Credit Facility

We entered into the following agreements with AgCountry Farm Credit Services, FLCA (“Lender”) regarding our senior secured credit facility (“Facility”) for the provision of construction and permanent debt financing for our ethanol plant: a Master Credit Agreement dated February 14, 2007 (the “Master Agreement”), and several supplements including the Seventh Supplement and Forbearance agreement to the Master Credit Agreement effective February 1, 2011 (the “Seventh Supplement” and together with the Master Agreement, the “Loan Agreements”). As of December 31, 2010, we had $38,026,321 outstanding under the Facility.

Under the Loan Agreements, we made certain customary representations and are subject to customary affirmative and negative covenants, including restrictions on our ability to incur debt, create liens, dispose of assets, pay distributions and to make capital expenditures, and customary events of default (including payment defaults, covenant defaults, cross defaults, construction-related defaults and bankruptcy defaults).

Affirmative financial covenants under the Loan Agreements require us to maintain minimum working capital of $6,000,000, a minimum current ratio of 1.20:1.00, minimum tangible net worth of $41,000,000, minimum owners’ equity ratio of 50%, and a minimum fixed charge coverage ratio of 1.25:1.00. As of December 31, 2010, we did not meet those covenants, as follows: our working capital was negative ($4,644,148) (not including current liabilities for term debt previously classified as long term), our current ratio was 0:72 to 1.00 (not including current liabilities for term debt previously classified as long term), our tangible net worth was $40,399,378, our owners' equity ratio was 71%, and our fixed charge coverage ratio was 0.79: 1.00. This resulted in all debt under the Loan Agreement being classified as current liabilities.

In addition, we have also agreed to the following with the Lender under the Loan Agreements, among other things:

|

|

·

|

We must obtain Lender’s consent to make any capital expenditures in excess of $500,000.

|

|

|

·

|

We must make annual payments to Lender of 40% of our Net Available Cash (as defined in the Loan Agreements).

|

|

|

·

|

We must make monthly payments of principal and interest.

|

We are actively negotiating with the Lender to convert the construction financing to operating lines and to modify the loan covenants to reflect current industry economics. We cannot predict whether the Lender will agree to modify any of those covenants. To the extent we are unable to modify those covenants, it may not be possible to meet them unless the commodities markets we operate in move in favorable directions. Until we are able to comply with the covenants under the Loan Agreements, the Lender may take a variety of actions, including immediately accelerating the repayment of all outstanding debt under the Loan Agreements. Such acceleration could entitle the Lender to liquidate all of our assets, and would likely lead to our bankruptcy, reorganization or winding up of our affairs.

11

TIF Note

In June 2007, the City of Atkinson, Nebraska (“City”) issued a tax increment financing Note (the “TIF Note”), the net proceeds of which in the amount of $4,939,925 were paid to us to reimburse us for certain infrastructure improvements relating to our plant. Repayment of the TIF Note is guaranteed by us, but was originally expected to be retired from incremental property tax revenue we pay the City, which are based on the added value of our land and buildings. The TIF Note serves as collateral for a loan with an outstanding balance of $6,579,000 (the “Loan”) as of December 31, 2010. We received the net proceeds of the Loan under a Loan Agreement with the lead lending agent, Arbor Bank (“TIF Lender”), under which we loaned the proceeds to the City in exchange for the TIF Note. This liability has been classified as a current liability, and will remain so until the resolution of the TIF Lawsuit described below.

On August 12, 2010, the TIF Lender filed a lawsuit (the “TIF Lawsuit”) against us in the District Court of Douglas County, Nebraska alleging that we failed to make certain payments due under the TIF Note and failed to maintain the required debt service reserve fund. In addition, the lawsuit states that the TIF Lender has accelerated the maturity of the TIF Note. The TIF Lawsuit provides that as of August 9, 2010, the amount due and owing under the TIF Note was $7,039,126, and the TIF Lender seeks payment of that amount, plus such additional amounts as become due and owing under the TIF Note, with interest accruing after August 9, 2010 at the rate of 9.5% until the judgment is paid. It is uncertain when or how the court will rule on the several pending motions. Discovery is ongoing and no trial date has been set.

Market Risk

We are exposed to the impact of market fluctuations associated with commodity prices. We may use derivative financial instruments as part of an overall strategy to manage market risk, assuming we have sufficient working capital and liquidity to manage such a strategy, or we may transfer risk management to Tenaska under a long term arrangement. If we do not transfer risk management to Tenaska, then subject to available working capital, we may, when able, use cash, futures and option contracts to hedge changes to the commodity prices of corn, natural gas and gasoline. We will not enter into these derivative financial instruments for trading or speculative purposes, nor will we designate these contracts as cash flow or fair value hedges for accounting. However, our ability to undertake any hedging activities has been limited due to our limited working capital. We cannot presently predict if or when we may modify our risk management profile through an arrangement with Tenaska or any other party.

Commodity Price Risk

We are exposed to market risk with respect to the price of ethanol, our principal product, and the price and availability of corn, the principal commodity we use to produce ethanol. Our other primary product is distiller’s grains, and we are also subject to market risk with respect to its price. In general, rising ethanol and distiller’s grains prices should result in higher profit margins, and therefore represent favorable market conditions. Ethanol and distiller’s grains prices are, however, influenced by various factors beyond the control of our management, including the supply and demand for gasoline, the availability of substitutes and the effects of laws and regulations.

Ethanol revenues are based on its market price, which is largely driven by the supply and demand in the national marketplace. Our risk management team meets weekly and assesses the balance of forward purchases of corn with forward sales of ethanol and the risks associated with the trends in the marketplace. Throughout the majority of the last year and a half, the price of ethanol has closely followed the market price of corn. The price of unleaded gasoline is also a primary concern in that if the price of ethanol rises above the RBOB price, then the economies do not allow favorable margins for the discretionary blenders and demand for ethanol falls.

Distiller’s grains are primarily sold into the local cattle feed market. Historically, the summer months bring the lowest seasonal demand for this product. As previously reported, we endured an extraordinarily long period of startup irregularities and our ability to market distiller’s grains in 2009 was affected by these complications, as well as a deeper seasonal reduction in 2009 than was expected. Consistent production volumes and quality are required to maximize the pricing potential of our favorable geography near a large number of cattle feeders. We continue to work to establish a reputation and relationships with those cattle feeders that will help mitigate the seasonal variability in future years, though ultimately demand for distiller’s grains is not in our control.

Ethanol, corn and energy markets have demonstrated a complex relationship in the past 24 months. Generally speaking, we believe that the price of energy provides a ceiling value for ethanol, particularly in the price of crude oil as driven into the price of unleaded gasoline, otherwise known in the markets as RBOB. However, except when affected by that upward limit, we believe that the price of ethanol follows the price of corn with a high degree of correlation, with the Crush Margin dictated by the market relationships of supply and demand. As discussed above, that Crush Margin has been squeezed in recent months by the oversupply of ethanol capacity, but can be significantly affected by any of several factors, including the relationship of distribution infrastructure and

12

its limits to handle the volume of ethanol that could be produced by the existing capacity while limited by the EPA to 10% blends for regular unleaded gasoline. The price of oil also affects the Crush Margin. In mid 2008, when oil was above $140 a barrel, the cost of RBOB allowed profitable blending of ethanol with a favorable Crush Margin, even when corn costs were above $6 and $7 a bushel.

The availability and price of corn is subject to wide fluctuations due to various unpredictable factors which are beyond our control, including weather conditions, farmer planting decisions, governmental policies with respect to agriculture and local, regional, national and international trade, demand and supply. In 2010, our corn cost as a percentage of ethanol sales was 75%, and was 66% of gross sales.

We expect the annual impact on our results of operations due to a $0.30 per bushel fluctuation in market prices for corn to be approximately $4,890,000, or $0.11 per gallon, assuming our plant continues to operate at 100% name plate capacity (production of 44,000,000 gallons of ethanol annually). We also expect a $0.20 per gallon fluctuation in ethanol market prices to impact annual net income by approximately $8,800,000, a $0.20 per gallon fluctuation in denaturant market prices to impact annual net income by approximately $180,000, and a $0.50 per BTU fluctuation in natural gas market prices to impact annual net income by approximately $630,000.

We seek to minimize the risks from fluctuations in the prices of corn and ethanol through the use of derivative instruments, provided we have sufficient working capital to enter into such instruments and cover any margin requirements necessary to maintain such positions. In practice, as markets move, we will seek to actively manage our risk and adjust hedging strategies as appropriate, provided we have sufficient working capital for such strategies. Although we believe our hedge positions accomplish an economic hedge against our future purchases, they are not designated as such for hedge accounting purposes, which would match the gain or loss on our hedge positions to the specific commodity purchase being hedged. We mark to market our hedge positions, which means as the current market price of our hedge positions changes, the gains and losses are immediately recognized in our cost of goods sold. The immediate recognition of hedging gains and losses can cause net income to be volatile from quarter to quarter due to the timing of the change in the value of the derivative instruments relative to the cost and use of the commodity being hedged. We have recorded gains (losses) on derivative instruments of approximately ($335,600) and $4,700 for 2010 and 2009, respectively.

In the event we do not have sufficient working capital to enter into hedging strategies to manage our risks, we may be forced to purchase our corn and market our ethanol at spot prices and as a result, we could be further exposed to market volatility and risk. However, as discussed above, we may also determine to transfer much of our risk management to Tenaska.

Application of Critical Accounting Estimates

Management uses estimates and assumptions in preparing these financial statements in accordance with Generally Accepted Accounting Principles (“GAAP”). Those estimates and assumptions affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenues and expenses. We use estimates and assumptions in accounting for the following significant matters, among others: the allowance for doubtful accounts, useful lives of property and equipment, the valuation of inventory, and inventory purchase commitments, and long-lived asset impairments including the assumptions used to estimate future cash flows, the ability to raise capital, and the ability to comply with certain provisions within the Loan Agreements. Actual results may differ from previously estimated amounts, and such differences may be material to our financial statements. We periodically review estimates and assumptions, and the effects of revisions are reflected in the period in which the revision is made.

Long-lived assets, such as property and equipment, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. In accordance with the our policy for evaluating impairment of long-lived assets, we have estimated that the projected future undiscounted cash flows from operations of these facilities exceed their carrying value at December 31, 2010; therefore no impairment loss was recognized. In determining the projected future undiscounted cash flows, we made significant assumptions concerning the future viability of the ethanol industry, the future price of corn in relation to the future price of ethanol and the overall demand for ethanol in relation to production and supply capacity. Changes in the estimated future prices of corn and ethanol used within the analysis can have a significant effect on the determination of impairment given the sensitivity of the analysis. In addition to the impairment analysis performed, we believe that the following factors also indicate that no impairment of long-lived assets has occurred. First, our short time in operation under distress from construction delays, equipment failures and startup complications provides inadequate cost history to assess with reasonable levels of certainty what the cost structure will be going forward. Second, the economic structure of the distiller’s grain markets has been excessively volatile throughout initial plant operations. The cash flow to be generated from sales of distiller’s grains is a critical requirement for us to generate future profitability. Third, the economic recession in the U.S. during the entire startup and operation of the plant further complicated the measurement of our ability to generate future cash flows that are required to document material impairment to the carrying value of our plant assets. In the impairment analysis, we assumed (i) future distiller’s grain revenue will be 17% of gross

13

revenue, (ii) future corn costs will be 87% of ethanol revenue, and (iii) these relationships drive EBITDA estimates for 2011 of 8% of gross revenues. If we fail to realize these economic improvements, it is likely in the future, that asset values will need to be adjusted to reflect impaired value because we would be unable to forecast future cash flows sufficient to carry those values.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonable likely to have a current or future material effect on our financial condition, results of operations or liquidity.

Our Directors and Officers

Below is certain information about our Directors and officers. Additional information about our Directors and officers will be provided in our proxy statement for our 2011 Annual Members’ Meeting.

|

|

●

|

Jeff Lieswald, a Director, is a principal of Agland Electric Motor (a retail electric motor reseller) and has worked as an electrician for 23 years.

|

|

|

●

|

Todd Shane, a Director, is a farmer and rancher with HBK Land & Cattle Co.

|

|

|

●

|

Kirk Shane, a Director, is a farmer and rancher.

|

|

|

●

|

Gerald Winings, a Director, is the manager of Atkinson Fertilizer, Inc., a blender and distributor of agricultural fertilizers.

|

|

|

●

|

Everett Vogel, Vice President, a Director and Chairman of the Board, is President and a Director of Stuart Fertilizer and Grain, Inc., a blender and distributor of agricultural fertilizers.

|

|

|

●

|

Paul Seger, a Director, is the owner of Seger Farms.

|

|

|

●

|

Kenneth Osborne, a Director, is the President and a Director of Osborne Construction, Inc.

|

|

|

●

|

Robin Olson, a Director, is a Director of Olson Industries, Inc., a manufacturer of airport light bases, irrigation systems, commercial trash containers, electric utility poles and other galvanized products, and is a Principal of Alpha Galvanizing.

|

|

|

●

|

Clayton Goeke, a Director, is a farmer and rancher.

|

|

|

●

|

Jerome Fagerland is the Company’s President, General Manager and a Director.

|

|

|

●

|

Steve Dennis, a Director, is the owner and manager of O’Neill Grain Co., a grain elevator.

|

|

|

●

|

Paul Corkle, a Director, is a farmer and rancher and owner of Corkle Insurance Agency.

|

|

|

●

|

Timothy Borer, the Secretary, Treasurer and a Director, is a farmer.

|

|

|

●

|

Richard Bilstein, a Director and Vice President of the Board, is a Farm Manager for Don Oppliger Farms.

|

Changes in and Disagreements with Accountants.

We have not had any disagreements with our accountants in our two most recent fiscal years or any subsequent interim period.

On June 24, 2009, we changed independent registered public accountants from Boulay, Heutmaker, Zibell & Co., PLLP to McGladrey & Pullen, LLP. McGladrey & Pullen, LLP performed the audits as of and for the years ended December 31, 2010 and 2009.

Market Price and Dividends

There is no public trading market for our Membership Units, and our Third Amended and Restated Operating Agreement dated March 4, 2009 (the “Operating Agreement”) contains significant restrictions on the transfer of our Units to ensure that we are not

14

deemed a “publicly traded partnership” and thus taxed as a corporation. Additionally, pursuant to the Operating Agreement, the Board has developed a Unit Transfer Policy which imposes conditions on the transfer of Membership Units.

Subject to the provisions of the Nebraska Limited Liability Company Act (the “Act”), distributions are payable at the discretion of our Board of Directors as provided in our Operating Agreement. The Board has no obligation to distribute profits, if any, to Members. We have not declared or paid any distributions on our Membership Units to date, and distributions on our Common Units are first subject to preferential distributions on our Class A Preferred Units. We anticipate distributing a portion of our net cash flow to our Members in proportion to the Membership Units held and in accordance with our Operating Agreement and any loan covenants to which we may then be subject. By net cash flow, we mean our gross cash proceeds received less any portion, as determined by our Directors in their sole discretion, used to pay or establish reserves for our expenses, debt payments, capital improvements, replacements and contingencies. If our financial performance and loan covenants permit, our Board of Directors will consider cash distributions at times and in amounts that will permit Unit holders to make income tax payments. However, the Board may elect to retain future profits to provide operational financing for the plant, debt retirement and possible plant expansion.

Management’s Responsibility for Financial Information

It is the responsibility of management to prepare and present the financial statements in this Annual Report with integrity and objectivity. These financial statements have been prepared in accordance with GAAP. As required, management applies certain estimates and judgments in the preparation of these financial statements.

Wagner and Associates, an independent accounting and management consulting firm, was retained to assist management in their assessment of the effectiveness of our internal controls over financial reporting. That firm is responsible to management to document our internal control structure and to test the structure’s effectiveness, reporting to management any recommendations for improvement as well as providing assurances through testing of the system’s effectiveness. McGladrey & Pullen, LLP, an independent registered public accounting firm, is retained to audit our financial statements.

The Audit Committee of the Board of Directors and is responsible for selection and supervision of accounting management and the independent registered public accounting firm. The Audit Committee meets periodically and privately with the independent registered public accounting firm as well as management to review accounting, auditing, internal control structure and financial reporting matters.

Management’s Report on Internal Control over Financial Reporting

Management is also responsible for establishing and maintaining adequate internal control over financial reporting. Our internal control over financial reporting is a process designed by, or under the supervision of, our CEO and CFO, and effected by our Board of Directors, management and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements in accordance with GAAP and includes policies and procedures that:

|

(i)

|

Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect our financial transactions, | |

|

(ii)

|

Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with GAAP, and that our revenues and expenditures are being made only in accordance with authorizations of our management and directors, and

|

|

|

(iii)

|

Provide reasonable assurance regarding the prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on our financial statements.

|

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with policies or procedures may deteriorate.

Management assessed our internal control over financial reporting as of December 31, 2010. Management based its assessment on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”). Management’s assessment included an evaluation of such elements as the design and operating effectiveness of key financial reporting controls, process documentation, accounting policies and our overall control environment.

Based on this assessment, management concluded that our internal control over financial reporting was effective as of December 31, 2010. This annual report is not required to include an attestation report of our independent registered public accounting firm regarding our internal control over financial reporting.

15

Annual Report on Form 10-K

You may request, orally or in writing, a copy of our annual report on Form 10-K, which will be provided to you at no cost, by contacting Lisa Fix, P. O. Box 391, Atkinson, NE 68713, Office Phone 402 925-5570.

16

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Members

NEDAK Ethanol, LLC

We have audited the accompanying balance sheets of NEDAK Ethanol, LLC as of December 31, 2010 and 2009, and the related statements of operations, changes in members’ equity, and cash flows for the years then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of NEDAK Ethanol, LLC as of December 31, 2010 and 2009, and the results of its operations and its cash flows for the years then ended in conformity with U.S. generally accepted accounting principles.

The financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, there is uncertainty as to the Company’s ability to cure credit agreement defaults and, therefore, to secure additional funds needed to fund ongoing operations. This raises substantial doubt about the Company's ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 2 to the financial statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ McGladrey & Pullen, LLP

Sioux Falls, South Dakota

March 31, 2011

F-1

|

NEDAK ETHANOL, LLC

|

|||

|

Balance Sheets

|

|||

|

December 31,

|

|||

|

2010

|

2009

|

||

|

ASSETS (Note 8)

|

|||

|

Current Assets

|

|||

|

Cash and cash equivalents

|

$ 1,618,244

|

$ 1,853,959

|

|

|

Restricted short term investment (Note 7)

|

1,163,581

|

1,153,708

|

|

|

Restricted cash (Notes 8, 9 and 11)

|

1,043,173

|

997,656

|

|

|

Accounts receivable

|

2,813,133

|

1,149,804

|

|

|

Commodity broker receivable

|

-

|

94,391

|

|

|

Inventory (Note 3)

|

5,267,330

|

2,971,319

|

|

|

Derivative financial instruments (Notes 4 and 10)

|

-

|

5,325

|

|

|

Prepaid expenses and other

|

208,190

|

622,443

|

|

|

Total current assets

|

12,113,651

|

8,848,605

|

|

|

Property and equipment, net (Note 5)

|

75,160,322

|

81,150,620

|

|

|

Deposits

|

550,000

|

300,000

|

|

|

Debt issuance costs, net of accumulated amortization of $696,175

|

|||

|

and $419,256 as of December 31, 2010 and 2009, respectively

|

1,065,060

|

1,341,979

|

|

|

Total other assets

|

1,615,060

|

1,641,979

|

|

|

Total Assets

|

$ 88,889,033

|

$ 91,641,204

|

|

|

LIABILITIES AND MEMBERS' EQUITY

|

|||

|

Current Liabilities

|

|||

|

Current maturities of long-term debt (Note 2, 8 and 9)

|

$ 6,025,417

|

$ 3,205,471

|

|

|

Accounts payable

|

|||

|

Trade

|

1,244,868

|

1,834,787

|

|

|

Corn

|

5,322,868

|

2,688,561

|

|

|

Accrued liabilities (Note 2)

|

4,164,646

|

2,401,015

|

|

|

Reclassification of long-term debt to current (Notes 2, 8 and 9)

|

38,579,904

|

45,873,529

|

|

|

Total current liabilities

|

55,337,703

|

56,003,363

|

|

|

Long-Term Debt, net of Current Maturities (Notes 2, 8 and 9)

|

18,750

|

18,750

|

|

|

Commitments and Contingencies (Notes 2, 6, 7, 11 and 12)

|

|||

|

Members’ Equity (Note 6)

|

|||

|

Preferred Units, 185.45 and 185.44 units issued and outstanding as of December 31, 2010 and 2009, respectively

|

1,854,503

|

1,854,428

|

|

|

Common Units, net of offering costs, 5,233 units issued and outstanding

|

49,839,281

|

49,839,281

|

|

|

Accumulated deficit

|

(18,161,204)

|

(16,074,618)

|

|

|

Total members' equity

|

33,532,580

|

35,619,091

|

|

|

Total Liabilities and Members’ Equity

|

$ 88,889,033

|

$ 91,641,204

|

|

|