Attached files

| file | filename |

|---|---|

| EX-99.2 - AVERAGE SELLING PRICE PER TONNE FOR MURIATE OF POTASH CROP NUTRIENTS - MOSAIC CO | dex992.htm |

| 8-K - FORM 8-K - MOSAIC CO | d8k.htm |

The Mosaic Company

Jim Prokopanko, President and Chief Executive Officer

Larry Stranghoener, Executive VP and Chief Financial Officer

Christine Battist, Director Investor Relations

Earnings

Conference

Call

-

3

Quarter

Fiscal

2011

Thursday, March 31, 2011

rd

Exhibit 99.1 |

Mosaic

Named

to

Corporate

Responsibility

Magazine

12th

Annual

100

Best

Corporate

Citizens

List

Slide 2

The 100 Best Corporate Citizens List is based on over 360 data points of

publicly- available

information

in

seven

categories:

Environment,

Climate

Change,

Human

Rights,

Philanthropy, Employee Relations, Financial Performance, and Governance.

The 100 Best Corporate Citizens are selected from among the large-cap

Russell 1000 companies |

Safe Harbor Statement

Slide 3

This presentation contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. Such statements include, but are not limited to, statements

about future strategic plans and other statements about future financial and operating results,

including statements about the proposed split-off by Cargill, Incorporated of its equity interest in The Mosaic Company and related

transactions (the “Split-Off”), the terms and effects of the proposed Split-Off, the

nature and impact of the proposed Split-Off and benefits of the proposed

Split-Off. Such statements are based upon the current beliefs and expectations of The Mosaic Company’s management and

are subject to significant risks and uncertainties. These risks and uncertainties include but are not

limited to risks and uncertainties arising from the predictability and volatility of, and

customer expectations about, agriculture, fertilizer, raw material, energy and transportation

markets that are subject to competitive and other pressures and economic and credit market conditions;

the level of inventories in the distribution channels for crop nutrients; changes in foreign

currency and exchange rates; international trade risks; changes in government policy; changes

in environmental and other governmental regulation, including greenhouse gas regulation and implementation of the U.S.

Environmental Protection Agency’s numeric water quality standards for the discharge of nutrients

into Florida lakes and streams; further developments in the lawsuit involving the federal

wetlands permit for the extension of the Company’s South Fort Meade, Florida, mine into

Hardee County, including orders, rulings, injunctions or other actions by the court or actions by the

plaintiffs, the Army Corps of Engineers or others in relation to the lawsuit, or any actions

the Company may identify and implement in an effort to mitigate the effects of the lawsuit;

other difficulties or delays in receiving, or increased costs of, or revocation of, necessary

governmental permits or approvals; the effectiveness of the Company’s processes for

managing its strategic priorities; adverse weather conditions affecting operations in Central

Florida or the Gulf Coast of the United States, including potential hurricanes or excess rainfall;

actual costs of various items differing from management’s current estimates, including,

among others, asset retirement, environmental remediation, reclamation or other environmental

obligations, or Canadian resource taxes and royalties; accidents and other disruptions involving Mosaic’s operations,

including brine inflows at its Esterhazy, Saskatchewan, potash mine and other potential mine fires,

floods, explosions, seismic events or releases of hazardous or volatile chemicals; the

possibility that the expected timeline for the proposed Split-Off may be delayed or the

proposed Split-Off may not occur, or that there may be difficulties with realizing the benefits of

the proposed Split-Off; and other risks and uncertainties reported from time to time in The

Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results

may differ from those set forth in the forward-looking statements. |

Important Information

Slide 4

In

connection

with

the

proposed

split-off

transaction,

GNS

II

(U.S.)

Corp.

(“M

Holdings”)

has

filed

with

the

SEC

a

Registration

Statement

on

Form

S-4

that

includes

a

proxy

statement

of

Mosaic

that

also

constitutes

a

prospectus

of

M

Holdings.

Mosaic

will

deliver

the

final

proxy

statement/prospectus

to

its

stockholders.

Investors

and

holders

of

Mosaic

securities

are

strongly

encouraged

to

read

the

proxy

statement/prospectus

(and

any

other

relevant

documents

filed

with

the

SEC)

when

it

becomes

available

because

it

will

contain

important

information

relating

to

the

proposed

transaction.

You

may

obtain

a

free

copy

of

the

proxy

statement/prospectus

(when

available)

and

other

related

documents

filed

by

Mosaic

and

M

Holdings

with

the

SEC,

without

charge,

at

the

SEC’s

website

at

www.sec.gov.

The

proxy

statement/prospectus

(when

it

is

available)

and

the

other

documents

may

also

be

obtained

for

free

by

accessing

Mosaic’s

website

at

www.mosaicco.com

under

the

tab

“Investors”.

This

communication

shall

not

constitute

an

offer

to

sell

or

the

solicitation

of

an

offer

to

buy

securities,

nor

shall

there

be

any

sale

of

securities

in

any

jurisdiction

in

which

such

solicitation

or

sale

would

be

unlawful

prior

to

registration

or

qualification

under

the

securities

laws

of

such

jurisdiction.

Such

an

offer

may

be

made

solely

by

a

prospectus

meeting

the

requirements

of

Section

10

of

the

U.S.

Securities

Act

of

1933,

as

amended.

Accordingly,

the

proxy

solicitation

for

the

merger

described

in

this

communication

has

not

commenced.

The

distribution

of

this

communication

may,

in

some

countries,

be

restricted

by

law

or

regulation.

Accordingly,

persons

who

come

into

possession

of

this

document

should

inform

themselves

of

and

observe

these

restrictions.

Participants in this Transaction

Mosaic

and

M

Holdings

and

their

respective

directors,

executive

officers

and

certain

other

members

of

management

and

employees

may

be

deemed,

under

SEC

rules,

to

be

participants

in

the

solicitation

of

proxies

from

Mosaic’s

stockholders

with

respect

to

the

proposed

transaction.

Information

regarding

the

persons

who

may,

under

the

rules

of

the

SEC,

be

considered

participants

in

the

solicitation

of

the

Mosaic

stockholders

in

connection

with

the

proposed

transaction

is

set

forth

in

the

proxy

statement/prospectus

filed

with

the

SEC.

You

can

find

information

about

the

executive

officers

and

directors

of

Mosaic

in

its

Annual

Report

on

Form

10-K

for

the

fiscal

year

ended

May

31,

2010

filed

with

the

SEC

on

July

23,

2010

and

in

its

definitive

proxy

statement

filed

with

the

SEC

on

August

24,

2010.

You

can

obtain

free

copies

of

these

documents

from

Mosaic

using

the

website

information

above.

More

detailed

information

regarding

the

identity

of

potential

participants,

and

their

direct

or

indirect

interests,

by

securities

holdings

or

otherwise,

will

be

set

forth

in

the

final

proxy

statement/prospectus

and

other

material

to

be

filed

with

the

SEC

in

connection

with

the

proposed

transaction. |

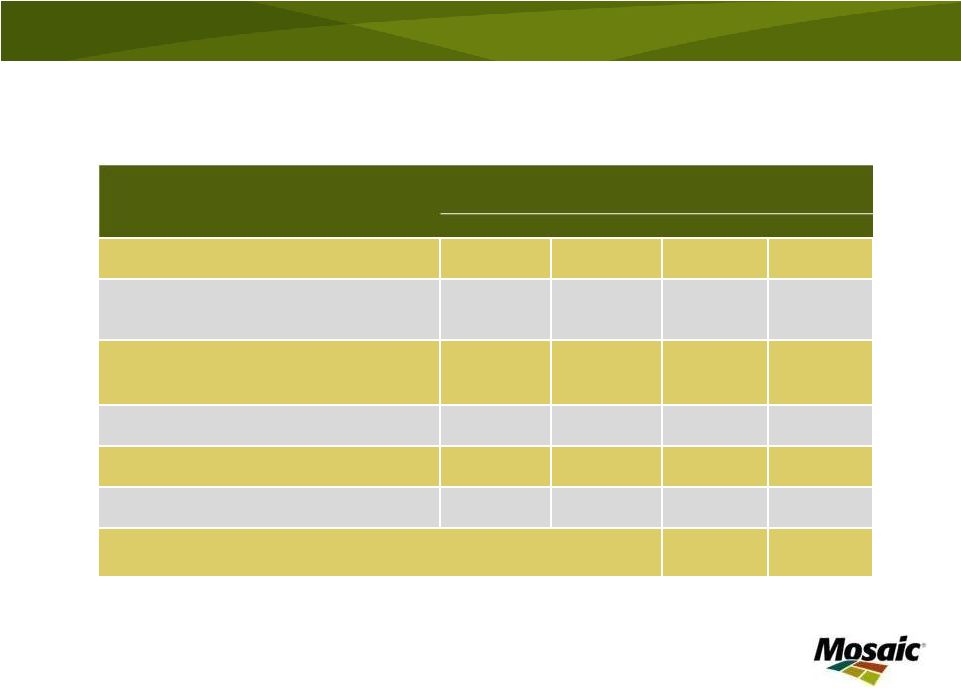

Net Sales

$2,214.3

$1,731.9

$7,077.4

$4,898.8

Gross Margin

$853.6

$476.5

$2,126.6

$1,005.7

% of net sales

39%

28%

30%

21%

Net Earnings

$542.1

$222.6

$1,865.4

$431.0

% of net sales

24%

13%

26%

9%

Diluted EPS

$1.21

$0.50

$4.17

(a)

$0.97

Effective Tax Rate

24%

35%

23%

32%

Cash Flow Provided by Operations

$365.9

$476.7

$1,453.8

$823.9

Cash and Cash Equivalents as of Feb 28, 2011 & Feb 29, 2010

$3,352.1

$2,291.8

Financial Results

Slide 5

(a)

Includes an after tax gain of $570 million, or $1.27 per share, on the sale of our

interest in Fosfertil S.A. Three Months Ended

Nine Months Ended

In millions, except per share amounts

2/28/2011

2/29/2010

2/28/2011

2/29/2010 |

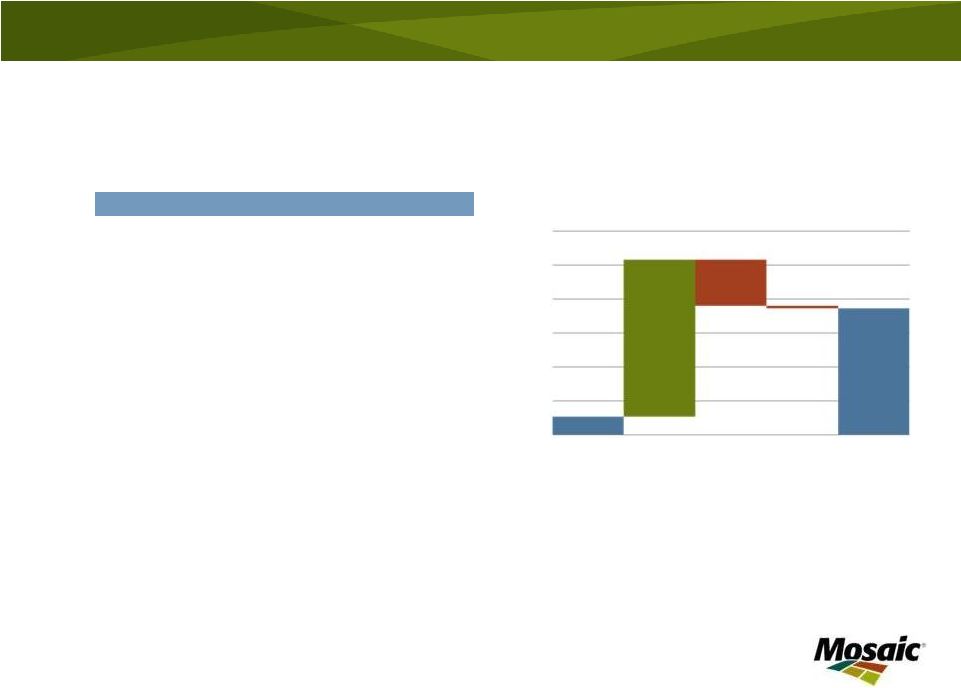

Phosphates Segment Highlights

Slide 6

Q3 FY11

Q2 FY11

Q3 FY10

IN MILLIONS, EXCEPT DAP PRICE

Net sales

$1,458.0

$1,974.0

$1,020.7

Gross Margin

$454.2

$476.3

$114.0

% of net sales

31%

24%

11%

Operating earnings

$371.8

$402.3

$52.9

Sales volumes

2.4

3.7

2.5

NA production volume

(a)

2.0

2.1

1.9

Avg DAP selling price

$543

$461

$336

Third quarter year over year highlights:

•

Higher selling prices, partially offset by higher raw material costs

•

Finished product operating rate of 83% vs. 75% a year ago

•

Exceptional mining performance

(a)

Includes crop nutrient dry concentrates and animal feed ingredients

OPERATING EARNINGS BRIDGE

$ IN MILLIONS

0

100

200

300

400

500

600

Q3 FY10 OE

Selling price

Raw materials

Other

Q3 FY11 OE |

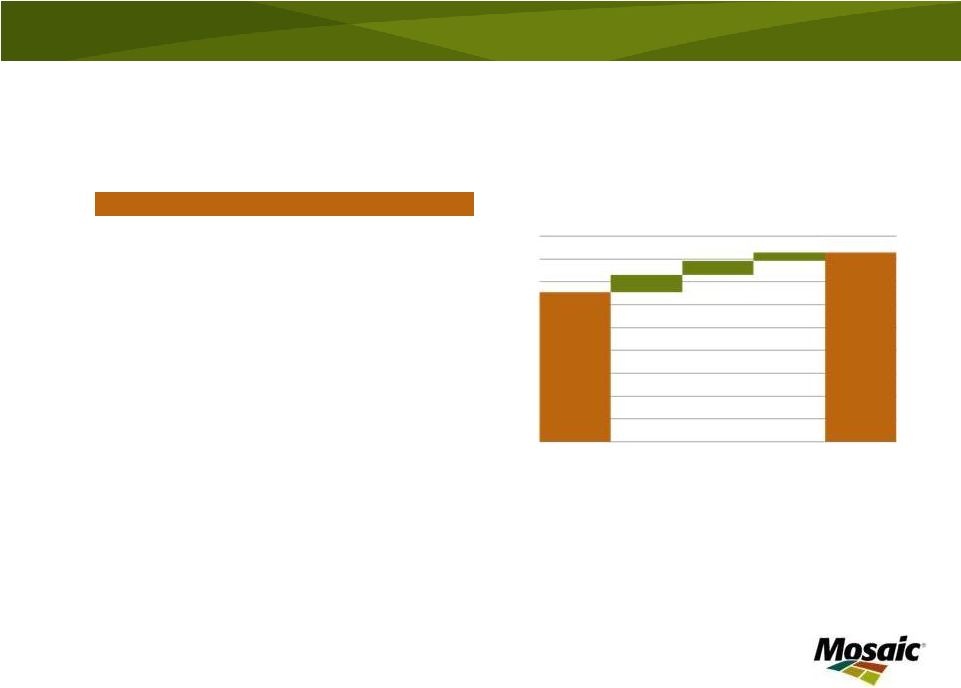

Potash Segment

Highlights Slide 7

Q3 FY11

Q2 FY11

Q3 FY10

IN MILLIONS, EXCEPT MOP PRICE

Net sales

$757.7

$699.0

$730.0

Gross Margin

$411.6

$285.2

$352.0

% of net sales

54%

41%

48%

Operating earnings

$413.9

$251.5

$326.0

Sales volumes

1.9

1.8

1.9

Production volume

2.0

1.7

1.3

Avg MOP selling price

$358

$331

$356

Third quarter year over year highlights:

•

Operating

earnings

improvement

due

to

favorable

effect

of

higher

production

volume,

increased

selling

prices

and insurance recoveries

•

Operating rate 90% vs. 59% a year ago

•

Lean producer inventories

(a) Includes insurance recoveries of $38.2 million

OPERATING EARNINGS BRIDGE

$ IN MILLIONS

0

50

100

150

200

250

300

350

400

450

Q3 FY10 OE

Production costs

Sales price

Other(a)

Q3 FY11 OE |

Category

Guidance

Phosphates

Record demand in 2011

Higher sulfur and ammonia costs

Q4

Sales

volume

2.5

–

2.9

million

tonnes

Q4

DAP

selling

price

$560

-

$590

per

tonne

Q4 Operating rate above 85%

Potash

Record demand in 2011

North American producer inventories to remain low

Q4

Sales

volume

1.9

–

2.2

million

tonnes

Q4

MOP

selling

price

$385

-

$415

per

tonne

Q4 Operating rate above 90%

Capital Expenditures

$1.2

-

$1.4

billion

Canadian Resource Taxes and Royalties

$250

–

$300

million

SG&A

$360

–

$380

million

Effective Tax Rate

(a)

Mid to upper 20 percent range

Financial Guidance –

Fiscal 2011

Slide 8

(a)

Effective tax rate excludes items related to the Fosfertil sale.

|

The Mosaic Company

Earnings

Conference

Call

-

3

rd

Quarter

Fiscal

2011

Thursday, March 31, 2011 |

Factors We Are Watching

•

Commodity prices

–

Outstanding underlying fundamentals

–

Sensitive to weather and geopolitical developments

–

Tight stock to use ratios

•

Weather and North American planting conditions

•

Supply uncertainties

–

Ma’aden timing

–

Raw material uncertainty

–

China export duties

–

Political unrest

–

South Fort Meade litigation

–

Timing of potash brownfield projects

Slide 10 |

Have We Been Here Before?

Slide 11

Key differences between 2008 and

now:

Less

raw

material

price

pressure

Lean

distribution

pipeline,

cautious

buying

behavior

Relative

cost

of

nutrients

well

within

historic

norms

Crop Nutrient Price Index: NPK weighting based on US nutrient use from

2005/06 through 2007/08, indexed to average prices in 2000 = 100 Crop Price

Index: Crop price weighting based on US Corn/Wheat/Soybean acreage in 2007, indexed to average prices in 2000 = 100

Source: Mosaic

CROP NUTRIENT AFFORDABILITY IN THE U.S.

CROP NUTRIENT PRICE INDEX/CROP PRICE INDEX

0.5

1.0

1.5

2.0

2.5

2000

2002

2004

2006

2008

2010

CALENDAR YEAR |

Mosaic: An Agricultural

Leader

Successful execution of our strategic

priorities is paying off:

•

•

Strong

cash

flow

and

balance

sheet

•

Potash:

–

Growing volume through expansions

•

Phosphates:

–

Operational excellence

–

Global scale and reach

–

Premium products

Slide 12

Phosphate

and

Potash

Balanced

portfolio

– |

The Mosaic Company

Earnings

Conference

Call

-

3

rd

Quarter

Fiscal

2011

Thursday, March 31, 2011 |

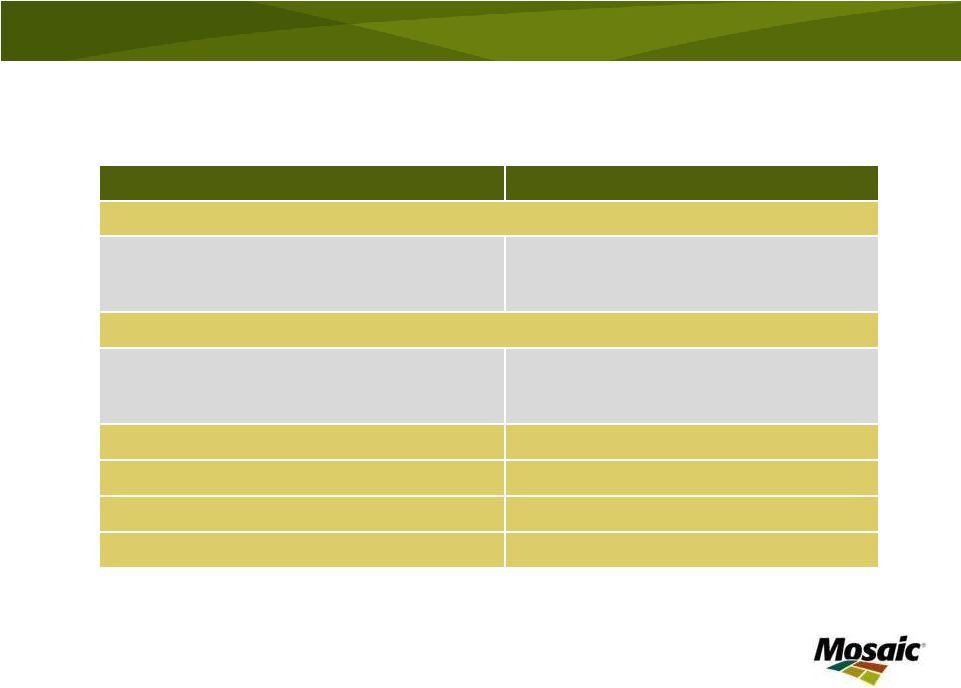

Appendix

Change

Estimated Change in

Pre-Tax Earnings

($ in millions)

Estimated

Change in Annual

EPS

MOP Price ($/tonne)

$50

$381

$0.61

Potash Volume (000 tonnes)

500

$124

$0.20

DAP Price ($/tonne)

$50

$417

$0.67

Phosphates Volume (000 tonnes)

500

$114

$0.18

Sulfur ($/lt)

$25

$90

$0.15

Ammonia ($/tonne)

$25

$45

$0.07

Natural Gas ($/mmbtu)

$0.25

$9

$0.01

(a)

These factors do not change in isolation; actual results could vary from the above

estimates Earnings Sensitivity to Key Drivers

(a)

Slide 14 |