Attached files

| file | filename |

|---|---|

| EX-23 - CONSENT OF BDO CANADA LLP - Gentor Resources, Inc. | bdoconsent01.htm |

| EX-32 - SECTION 906 CERTIFICATION OF CEO - Gentor Resources, Inc. | certification906ceo.htm |

| EX-31 - SECTION 302 CERTIFICATION OF CFO - Gentor Resources, Inc. | certification302cfo.htm |

| EX-32 - SECTION 906 CERTIFICATION OF CFO - Gentor Resources, Inc. | certification906cfo.htm |

| EX-31 - SECTION 302 CERTIFICATION OF CEO - Gentor Resources, Inc. | certification302ceo.htm |

| EX-10 - EMPLOYMENT AGREEMENT FOR PETER RUXTON - Gentor Resources, Inc. | ruxtonemploymentagreement.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

or

o

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period form ____________________ to ____________________.

Commission file number 333-130386

GENTOR RESOURCES, INC.

---------------------------------------------------------------------

(Exact name of registrant as specified in its charter)

Florida -------------------- | 20-2679777 -------------------------- |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

1 First Canadian Place, Suite 7070

100 King Street West

Toronto, Ontario M5X 1E3

Canada

-------------------------------------------

(Address of principal executive offices)(Zip Code)

(416) 366-2221

-----------------------

(Registrant=s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each Class | Name of each exchange on which registered |

None | N/A |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES o NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES o NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES o NO o

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (Section 229.405) is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of Alarger accelerated filer,@ Aaccelerated filer@ and Asmaller reporting company@ in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer o |

Non-accelerated filed o | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES o NO x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2010, was $ 25,048,367 (based upon the last reported sale price of $1.77 per Share of Common Stock as quoted on the OTC Bulletin Board on June 30, 2010).

As of the date hereof, there were 59,368,340 shares of the registrant's $0.0001 par value Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None

1

TABLE OF CONTENTS

PART I.

Item 1.

Business.

Item 1A.

Risk Factors.

Item 1B.

Unresolved Staff Comments.

Item 2.

Properties.

Item 3.

Legal Proceedings.

PART II.

Item 5.

Market for Registrant=s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities.

Item 6.

Selected Financial Data.

Item 7.

Management's Discussion and Analysis of Financial Condition and Results of Operations.

Item 7A.

Quantitative and Qualitative Disclosure About Market Risk.

Item 8.

Financial Statements and Supplementary Data.

Item 9.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

Item 9A.

Controls and Procedures.

Item 9B.

Other Information.

PART III.

Item 10.

Directors, Executive Officers, and Corporate Governance.

Item 11.

Executive Compensation.

Item 12.

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

Item 13.

Certain Relationships and Related Transactions, and Director Independence.

Item 14

Principal Accountant Fees and Services.

Item 15.

Exhibits, Financial Statements Schedules.

Cautionary Statement Regarding Forward-Looking Statements

The information provided in this Form 10-K Annual Report (the AReport@) may contain Aforward looking@ statements or statements which arguably imply or suggest certain things about our future. Statements, which express that we Abelieve@, Aanticipate@, Aexpect@, Aintend to@ or Aplan to@, as well as, other similar expressions and/or statements which are not historical fact, are forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on assumptions that we believe are reasonable, but a number of factors and/or risks could cause our actual results to differ materially from those expressed or implied by these statements, including, but not limited to:

$

risks related to our properties being in the exploration stage

$

risks related to mineral exploration and development activities

$

risks related to our title and rights in and to our mineral properties

$

risks related our mineral operations being subject to government regulation

$

risks related to the competitive industry of mineral exploration

$

risks related to our ability to obtain additional capital to develop our resources, if any

$

risks related to the fluctuation of prices for precious and base metals

$

risks related the possible dilution of our common stock from additional financing activities

$

risks related to our subsidiary activities

$

risks related to our shares of common stock

The foregoing list is not exhaustive of the factors that may affect our forward-looking statements and new risk factors may emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this Report. These forward-looking statements are based on our current expectations and are subject to a number of risks and uncertainties, including those set forth above. Although we believe that the expectations reflected in these forward-looking statements are reasonable, our actual results could differ materially from those expressed in these forward-looking statements, and any events anticipated in the forward-looking statements may not actually occur. Except as required by law, we undertake no duty to update any forward-looking statements after the date of this report to conform those statements to actual results or to reflect the occurrence of unanticipated events. Furthermore, any discussion of our financial condition and results of operation should be read in conjunction with the financial statements and the notes to the financial statements included elsewhere in this Report.

PART I.

Item 1.

Business.

In this Report, references to Awe,@ Aus,@ Aour@ and/or the ACompany@ refer to Gentor Resources, Inc., a Florida corporation.

Background

We are a Florida corporation formed under the name of Gentor Resources, Inc. on March 24, 2005.

As of the date of this Report, we have the three (3) subsidiaries, which are as follows: (1) Gentor Idaho, Inc., an Idaho corporation (AGentor Idaho@), (ii) Gentor Resources Limited, a British Virgin Islands registered company (“Gentor BVI”) and (iii) APM Mining, LLC, an Omani limited liability company (“Gentor Oman”).

Gentor Idaho was formed on June 28, 2007 and is a wholly owned subsidiary of the Company.

Gentor BVI, which was formerly known as APM Mining Ltd (“APM Mining”) was formed on November 19, 2009 and is a wholly owned subsidiary of the Company.

Gentor Oman was formed on February 23, 2010 and is a majority owned subsidiary of Gentor BVI. Even though Gentor BVI owns 70% of the share capital of Gentor Oman, pursuant to the constitutive contract for Gentor Oman, Gentor BVI is entitled to 99.99% of the profits and losses of Gentor Oman. Gentor Oman is in the process of changing its legal name to “Gentor Resources, LLC” which the Company believes will become effective around April 5, 2011.

We are an exploration stage company (as such term is defined in Securities Act Industry Guide 7(a)(4)(i)) which means that we are engaged in the search for mineral deposits (reserves) which are not either in the development or production stage. Our corporate strategy is to create shareholder value by acquiring and developing highly prospective mineral properties.

Since our inception, we have acquired rights to mineral properties in (i) the state of Montana (the AMontana Project@), (ii) the state of Idaho (the AIdaho Project@), (iii) the Nunavut Territory (the ANunavut Project@) and (iv) the Sultanate of Oman (the “Oman Project”). As of the date of this Report, we have terminated our rights to explore the Montana Project and the Nunavut Project, but we still maintain our rights to explore (1) the Idaho Project, which is a molybdenum-tungsten project located in East-Central Idaho and (2) the Oman Project, which is a copper and gold project located in the Batinah Coastal Region of the Sultanate of Oman. For a more detailed description of the Idaho Project and the Oman Project, please see the information contained in Part I, Item 2 of this Report in the section entitled AProperties.@

Stock Split

On February 26, 2007, the board of director (the ABoard of Directors@) of the Company executed a written action by unanimous written consent of the directors in lieu of a special meeting of the directors (the AStock Split Director Action@) which authorized the Company to amend and restate its Articles of Incorporation to effectuate a 25 for 1 forward split (the AMarch 2007 Split@) of our common stock and increase the authorized shares of common stock from 1,500,000 to 37,500,000. The Stock Split Director Action was approved by the holders of a majority of our common stock at such time by a written action of the shareholders in lieu of a special meeting of the shareholders (the AStock Split Shareholder Action@) and on March 1, 2007, the Company filed its amended and restated articles of incorporation (the ARestated Articles@) which provided that upon the filing of the Restated Articles with the Secretary of State of the State of Florida, each one (1) share of the $0.0001 par value common stock of the Company outstanding as of the close of business on February 28, 2007 (the ARecord Date@) was to be divided into twenty five (25) shares of the $0.0001 par value common stock of the Company.

Amendment to The Restated Articles To Increase The Authorized Capital Stock of the Company

On August 24, 2009, the Board of Director of the Company executed a written action by unanimous written consent of the directors in lieu of a special meeting of the directors (the “Capital Stock Director Action”) which authorized the Company to amend the Restated Articles to increase the authorized capital stock of the Company.

On August 25, 2009, the Capital Stock Director Action was approved by a the holders of a majority of our common stock by a written action of the shareholders in lieu of a special meeting of the shareholders (the “Capital Stock Shareholder Action”) and on September 1, 2009, the Company filed the amendment (the “Amendment”) to the Restated Articles with the Secretary of State of the State of Florida. The Amendment was deemed to be effective upon its filing with the Secretary of State of the State of Florida.

Prior to effectiveness of the Amendment, the authorized capital stock of the Company consisted of fifty million (50,000,000) shares, of which (i) thirty seven million five hundred thousand (37,500,000) shares (each with a par value of $0.0001) were designated as common stock and (ii) twelve million five hundred thousand (12,500,000) shares (each with a par value of $0.0001) were designated as preferred stock. After the effectiveness of the Amendment, which was on September 1, 2009, the authorized capital stock of the Company was increased such that the authorized capital stock of the Company now consists of one hundred fifty million (150,000,000) shares, of which (i) one hundred million (100,000,000) shares (each with a par value of $0.0001) is a class designated as common stock and (ii) fifty million (50,000,000) shares (each with a par value of $0.0001) is a class designated as preferred stock.

Acquisition of Gentor Resources Limited

On February 23, 2010, the Company entered into that certain Stock Exchange Agreement (the “Exchange Agreement”) to acquire all of the issued and outstanding equity securities of APM Mining Ltd., a British Virgin Islands registered company. On March 8, 2010, the Company closed on the Exchange Agreement, and as a result thereof, APM Mining (now known as Gentor Resources Limited) became a wholly owned subsidiary of the Company. In connection with the closing of the Exchange Agreement, the Company exchanged 10,362,000 shares of restricted common stock of the Company with the sole shareholder of APM Mining for all of the issued and outstanding equity stock of APM Mining. With the acquisition of APM Mining, the Company acquired the exploration rights in and to the Oman Project.

Our Business

We are an exploration stage company (as such term is defined in Securities Act Industry Guide 7(a)(4)(i)) which means that we are engaged in the search for mineral deposits (resources and reserves) which are not either in the development or production stage.

Mineral exploration is a research and development activity that does not produce a specific product. Successful exploration often results in increased project value that can be realized through the optioning or selling of the project to larger companies. As such, we aim to acquire properties which we believe have potential to host economic concentrations of minerals, particularly copper, gold, molybdenum and nickel. These acquisitions have and may take the form of unpatented mining claims on federal land, or leasing claims, or private property owned by others.

The Idaho Project and the Oman Project (each a “Project” and collectively the “Projects”), the Company=s only current mineral properties, are without known reserves and all of our exploration activities with respect to these Projects to date have been exploratory in nature. There is no assurance that a “commercially viable” mineral deposit (that is, that the potential quantity of a mineral deposit and its market value would, after consideration of the costs and expenses that would be required to explore, develop and/or extract any such mineral deposit (if any), would justify a decision to do so) exists at either of the Projects and further exploration beyond the scope of our planned exploration activities will be required before a final evaluation as to the economic feasibility of the mining of the Projects can be determined. Moreover, there is no assurance that further exploration will result in a final evaluation that a commercially viable mineral deposit exists at Projects.

Since the Company has recently completed a private placement relating to the sale of our equity securities, we believe that we have adequate working capital to enable us, in the near future, to continue our exploration activities of our Projects for so long as the results of the geological exploration that we complete indicate that further exploration of either and/or both Projects are recommended. There are no assurances that we will continue to have adequate working capital to enable us to continue our exploration activities, and to the extent that we do not have sufficient financing to undertake the continued exploration of the Projects, then we intend to raise additional capital and/or seek a joint venture partner to finance the further exploration of the Projects.

All exploration activities at our Projects that have been completed to date are preliminary exploration activities. Advanced exploration activities, including the completion of comprehensive drilling programs, will be necessary before we are able to complete any feasibility studies on either Project. If our exploration activities result in an indication that either of the Projects contains potentially commercial exploitable quantities of minerals, then we would attempt to complete feasibility studies on such property to assess whether commercial exploitation of the property would be commercially feasible. There is no assurance that commercial exploitation of either Project would be commercially feasible even if our initial exploration programs show evidence of significant mineralization.

If we determine not to proceed with further exploration of the Idaho Project and/or the Oman Project due to results from geological exploration that indicate that further exploration is not recommended, then we will attempt to acquire additional interests in new mineral resource properties. There is no assurance that we will be able to acquire an interest in a new property that merits further exploration. If we were to acquire an interest in a new property, then our plan would be to conduct resource exploration of the new property, to the extent that we have available resources to conduct such exploration. In any event, we anticipate that our acquisition of a new property and any exploration activities that we would undertake will be subject to our ability to secure additional financing, of which there is no assurance.

From December 31, 2008 to the date of this Report, the Company has not undertaken any substantive exploration activities at the Idaho Project. As of the date of this Report, we intend to devote substantially all of our resources to the exploration activities at the Oman Project.

Competition

There is aggressive competition within the mineral exploration industry in connection with the discovery, acquisition and development of properties considered to have commercial potential. As a young mineral exploration stage company with a five (5) year operating history, we compete with other startup and established mineral resource exploration companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, our competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on the exploration of their mineral properties and on the development of their mineral properties. In addition, our competitors may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in our competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact on our ability to achieve the financing necessary for us to conduct further exploration of our Projects and/or other mineral properties which we may otherwise acquire.

We also compete with other startup and established mineral exploration companies for financing from a limited number of investors that are prepared to make investments in mineral exploration companies. The presence of these competing mineral exploration companies may adversely impact on our ability to raise additional capital in order to fund our exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors.

In addition to the fact that there is aggressive competition within the mineral exploration industry, the mining industry, in general, is a speculative venture involving substantial risk that relies on numerous untested assumptions and variables. Many exploration programs do not result in the discovery of mineralization, and any mineralization discovered may not be of sufficient quantity or quality to be profitably mined. We are unable to provide any assurance that a ready market will exist for the sale of any mineralization which might otherwise be discovered and/or extracted from our Projects and/or any other mineral properties which we might otherwise acquire. Furthermore, similar to other mineral exploration companies, including our competitors, we are also subject to many unforeseen risks and expenses incident to exploring and developing mineral properties such as delays in governmental or environmental permitting, changes in the legislation governing the mining industry that might alter our ability to conduct our operations as planned, the availability of reasonably priced insurance products, unexpected construction costs necessary to create and maintain a production facility, and normal fluctuations in the general markets for the minerals and/or metals to be produced. These risks and expenses, while beyond our control, can materially adversely affect our business and cause our business to fail. Moreover, the search for valuable minerals involves numerous hazards and risks, such as cave-ins, environmental pollution liability, and personal injuries. We currently have no insurance against the risks of mineral exploration, and we do not expect to obtain any such insurance in the foreseeable future, other than the liability insurance which we might otherwise be contractually required to maintain. If we were to incur such a hazard or risk, the costs of overcoming same may exceed our ability to do so, in which event we could be required to liquidate all our assets and cease our business operations.

Government Regulations

Sultanate of Oman — the Oman Project

Any and all operations at Oman Project will be subject to various laws and regulations in the Sultanate of Oman (“Oman”) which govern prospecting, development, mining, production, exports, taxes, environmental protection and other related matters. We will be required to obtain those licenses, permits or other authorizations currently required to conduct exploration and other programs. The primary regulatory framework governing the mining industry in the Oman is set forth in The Petroleum and Minerals Law of 1974, as amended by the Mining Law of 2003 (also known as Royal Decree No. 27/2003). The general provisions of these laws are that natural minerals that occur in Oman belong to the “State” (the Government of Oman) and the Ministry of Commerce and Industry (the “Ministry”), through the Directorate General for Minerals (the “DGM”), is charged with developing and issuing associated regulations and rules regarding the granting of exploration, prospecting, and mining rights in the Oman. The DGM is primarily responsible for implementing the mining legislative framework and the safety regulations for the mining industry and carries out basic geological studies and prospects for metallic and non-metallic minerals. The DGM is also responsible for issuing prospecting and exploration permits for minerals. A number of other departments are also required to endorse the issuing of mining permits and renewals.

Other than general permit matters, there are no current orders relating to us and/or the Oman Project with respect to the foregoing laws and regulations. If we escalate our exploration activities at the Oman Project, it is reasonable to expect that compliance with various regulations will increase our costs. Such compliance may include feasibility studies on the impact of our proposed operations to land, water and biological resources, costs associated with minimizing surface impact, water treatment and protection, reclamation activities, including rehabilitation of various sites, on-going efforts at alleviating the mining impact on wildlife and permits or bonds as may be required to ensure our compliance with applicable regulations. It is unlikely that the costs and delays associated with such compliance could become so prohibitive that we may decide to not proceed with exploration, development, or mining operations on the Oman Project. We are not presently aware of any specific material environmental constraints affecting our Oman Project that would preclude the economic development or operation of the Oman Project.

United States of America — the Idaho Project.

General:

Any and all operations at Idaho Project will be subject to various federal and state laws and regulations in the United States which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. We will be required to obtain those licenses, permits or other authorizations currently required to conduct exploration and other programs. There are no current orders relating to us and/or the Idaho Project with respect to the foregoing laws and regulations. If we escalate our exploration activities at the Idaho Project, it is reasonable to expect that compliance with various regulations will increase our costs. Such compliance may include feasibility studies on the impact of our proposed operations to land, water and biological resources, costs associated with minimizing surface impact, water treatment and protection, reclamation activities, including rehabilitation of various sites, on-going efforts at alleviating the mining impact on wildlife and permits or bonds as may be required to ensure our compliance with applicable regulations. It is possible that the costs and delays associated with such compliance could become so prohibitive that we may decide to not proceed with exploration, development, or mining operations on the Idaho Project. We are not presently aware of any specific material environmental constraints affecting our Idaho Project that would preclude the economic development or operation of the Idaho Project.

U.S. Federal Environmental Laws:

The U.S. Forest Service (the AUSFS@) and the U.S. Bureau of Land Management (the AUSBLM@) require that mining operations on lands subject to their respective regulations obtain an approved plan of operations that is subject to the Federal Land Policy Management Act, the Code of Federal Regulations and a review of environmental impacts under the National Environmental Policy Act. Any significant modifications to an approved plan of operations would require the submission of amendments and the completion of an Environmental Assessment or an Environmental Impact Statement prior to the approval of any such modification to a plan of operations. Generally, mining companies must post a bond or other surety to guarantee the cost of post mining reclamation. These requirements could add significant additional cost and delays to any mining project undertaken by us.

The U.S. Environmental Protection Agency administers the Clean Water Act. Any discharge of industrial waters or pollutants into any waters of the United States must be permitted under a National Pollution Discharge Elimination System (the ANPDES@) permit. Mining companies seeking to discharge mine or mineral process water into waters of the United States must first obtain an NPDES permit, which may contain stipulations regarding water treatment and monitoring. These requirements could add significant additional cost and delays to any mining project undertaken by us.

Under the U.S. Resource Conservation and Recovery Act (the “RCRA”), mining companies may incur costs for generating, transporting, treating, storing, or disposing of hazardous waste, as well as for closure and post-closure maintenance once they have completed mining activities on a property. The Bevill exclusion to the RCRA excludes solid waste from the extraction, beneficiation, and processing of ores and minerals from regulation as hazardous waste under Subtitle C of the RCRA Any future mining operations at the Idaho Project may produce air emissions, including fugitive dust and other air pollutants, from stationary equipment, storage facilities, and the use of mobile sources such as trucks and heavy construction equipment which are subject to review, monitoring and/or control requirements under the Federal Clean Air Act and state air quality laws. Permitting rules may impose limitations on our production levels or create additional capital expenditures for pollution control in order to comply with the rules.

The U.S. Comprehensive Environmental Response Compensation and Liability Act of 1980, as amended, (ACERCLA@) also imposes strict joint and several liability on parties associated with releases or threats of releases of hazardous substances. Those liable groups include, among others, the current owners and operators of facilities which release hazardous substances into the environment and past owners and operators of properties who owned such properties at the time the disposal of the hazardous substances occurred. This liability could include the cost of removal or remediation of the release and damages for injury to the surrounding property. We cannot predict the potential for future CERCLA liability with respect to the Idaho Project or their respective surrounding areas.

Idaho Laws:

Mining in the State of Idaho is subject to federal, state and local law. Three types of laws of particular importance to the Idaho Project are those affecting land ownership and mining rights, those regulating mining operations, and those dealing with environmental protection. Mineral exploration activities on private grounds are not regulated by the State of Idaho. As such, we may conduct exploration activities on private properties without approval by any state government agency. However, activities that may impact streams or stream beds or banks are regulated by the Idaho Department of Environmental Quality. Therefore, in order to expand our exploration activities at the Idaho Project onto Federal land or across Patterson creek, we will be required to secure permits for bridging Patterson creek if the banks of the creek are to be disturbed, maintain approval to work on such Federal Lands from the USBLM, and secure and/or maintain any other authorizations required to conduct our exploration program.

Anticipated Costs and Effects of Compliance With Government Regulations

The Oman Project

As of the date of this Report, all of our activities with respect to the Oman Project are exploratory in nature and haven been confined to government owned lands as more specifically described below in Part I, Item 2 of this Report. Exploration activities are subject to maintaining an Exploration License, a Water License for drilling and certain other Oman Government approvals where legislation so requires. Based on current currency exchange rates (as of the date of this Report, 1 Rial (the currency of the Oman) equals approximately 2.6 United States Dollars), we anticipate that our near term costs of compliance with the forgoing government regulations will be approximately $97,750 per year, with no other substantive regulatory costs. The bulk of these costs are derived from a mandatory tenement rental fee (the “Rental Fee”) payable to the Oman Government at the rate of 50 Rial per square kilometer of exploration in years one, and at a rate of 25 Rial per square kilometer of exploration for each year thereafter. Our current exploration area is approximately 1,468 square kilometers. If, in the future, we determine to expand the exploration areas of the Oman Project beyond the Block 5 site and the Block 6 site as currently being explored, our costs of compliance with government regulations would increase as our Rental Fee would increase as the size of the exploration area increased.

Furthermore, in order to maintain our Exploration Licenses, and pursuant to Royal Decree No. 27/2003, we will be required, among other things, to (i) appoint and train Omani nationals according to the conditions specified in accordance with the Oman’s Ominisation Policy; (ii) immediately implement any environmental safety and protection measures as instructed by the DGM in conjunction with the Ministry of Environment with respect to our licensed operations; (iii) inform the DGM in advance of any intentions to perform or cease any relevant activity of the licensed operations; (iv) notify the DGM, within a maximum of thirty (30) days, about any economically valuable minerals discovered in the mining area, and within one year of this notification (if at all), we must carry out feasibility studies to assess the commercial exploitation of the discovered minerals and inform the Ministry accordingly; (v) must not transfer any mineral from an exploration zone without obtaining the DGM’s prior written approval except for the purposes of analysis, evaluation, or testing according to the conditions stipulated by the implementing regulations; (vi) allow persons authorized by the Ministry of the DGM to have access to its books and records, at any time, in accordance with the provisions of the implementing regulations, and upon request, to forward, free of charge, copies of such books and records and to forward to the DGM, every six (6) months, copies of the information registered in the records by the implementing regulations; (vii) provide the DGM, within three (3) months after the end of the fiscal year, with a copy of the financial statements of the mining operations as audited by a reputable accounting firm; and (viii) rehabilitate the mining area after completion of the operations. While we must comply with these rules and regulations to maintain our Exploration Licenses, we do not anticipate incurring any substantive costs to comply with said rules and regulations.

When and if we determine the feasibility of mining of the Oman Project, before we can commence any mining activities at the Oman Project, we will be required to secure a Mining Permit and an Environmental Permit, and we anticipate that we would incur a refundable cost estimated at $20,000 in the form of a bond as well as annual permit fees. Furthermore, if we deem it appropriate to construct a Copper Concentrator, we would undertake such a construction project on leased land from the Oman Government and would be required to pay for a land lease at then prevailing rates, which we anticipate will be approximately US$2.60 per square kilometer.

With respect to all of our activities, we intend to consult with any nearby local village and local government and /or authorities as a courtesy with respect to any activities at the Oman Project, but we are not required to pay any fees to said local authorities and/or subject to any local rules/regulations.

The Idaho Project

If we continue with our exploration activities at the Idaho Project, we anticipate that our primary near term cost of compliance with applicable environmental laws is likely to be less than $25,000. A bond in the amount of $10,000 is currently obligated for reclamation of exploration disturbances on the lands of the USBLM. These costs will be primarily the costs of reclamation of disturbances on Federal Lands administered by the USBLM to ensure that the reclamation is done to the satisfaction of the USBLM.

As of the date of this Report, our exploration activities with respect to the Idaho Project have been confined to private lands occupied by us under a lease/option to purchase agreement, as more specifically described below in Part I, Item 2 of this Report in the section entitled AProperties.@ Since out exploration activities have been confined to private lands, our operations do not require USBLM or USFS permits and are not governed by their regulations. In the event we expand our exploration activities, we have obtained approval to drill additional holes on USBLM land on both sides of Patterson creek, but we have not yet accessed those sites. Access to these lands does require trespass on a USBLM administered public road. Permission by the USBLM to use this road has already been received by us. Our use of this road could result in a much higher than normal level of traffic. Higher levels of traffic could increase the potential for accidents, and could result in increased sediment being generated and possibly entering the adjacent Patterson Creek. To preclude these possibilities, the USBLM has granted us permission to conduct routine maintenance on this road, consisting of improving sight distances, constructing a cross fall away from the creek and surfacing the road where possible with rock to minimize erosion and filter sediment.

We anticipate a future need to discharge mine water to ground water on land controlled by us. Discharging mine water to groundwater requires compliance with the State of Idaho Ground Water Quality Rule which is administered by the Idaho Department of Environmental Quality. The rule does not in and of itself create a permit requirement, but it does stipulate required water quality standards which must be met. The U.S. Environmental Protection Agency (the “EPA”) does not regulate discharges to ground water but may require a demonstration that the discharge does not have a direct connection to surface water. A permit may be required from Lemhi County for the same. The U.S. Army Corps of Engineers has indicated that their approval for the project is not required. In order to meet the water quality standards established by the State of Idaho, a water treatment facility will have to be designed, constructed and operated in accordance with the instructions from the consulting engineers hired by us for these purposes.

Intellectual Property

We have not filed for any protection of our trademark for Gentor Resources. We own the copyright of all of the contents of our website, www.gentorresources.com, which we are currently developing.

Employees

We currently have eight (8) full-time employees and four (4) part time employees. In addition, Donat Madilo (the Treasurer and Chief Financial Officer of the Company) and Arnold T. Kondrat (a director and executive Vice President of the Company) provide various services on an as needed basis and are compensated for their respective services at standard industry rates.

Item 1A.

Risk Factors.

Since the Company is a Asmaller reporting company@ as defined by Rule 12b-2 of the Exchange Act, we are not required to provide the information required under this item.

Item 1B.

Unresolved Staff Comments.

None.

Item 2.

Properties.

Oman Project

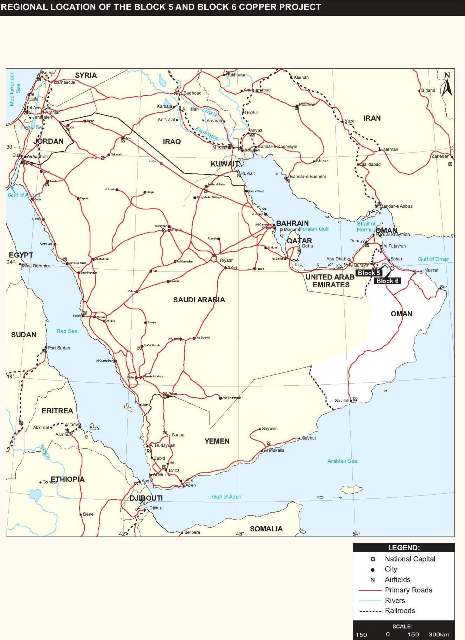

The Oman Project is a copper project located in the Semail Ophiolite Belt of the South Batinah Coastal Region of the northern part of the Sultanate of Oman. As of the date of this Report, the Oman Project consists of the Block 5 prospect area (“Block 5”) and the Block 6 prospect area (“Block 6”) which are adjacent to one another.

Copper is a ductile metal with very high thermal and electrical conductivity, and for this reason, copper is widely used as a thermal conductor, an electrical conductor, a building material, and a constituent of various metal alloys. Since copper is ductile and a good conductor of electricity and heat, its main use is in the manufacture of appliances where there is a need for a good conductor of heat and electricity such as generators, household and car electrical wiring, as well as electronic appliances. Presently, copper is used mainly in power generation and transmission; however, it is also used in the manufacture of electronic products, building construction, and the production of industrial machinery and transportation vehicles. Moreover, the excellent alloying properties of copper have made it indispensable when combined with other metals, such as zinc (to form brass), tin (to form bronze), or nickel.

Copper is also an internationally traded commodity, and its prices are determined by the major metals exchanges – New York Mercantile Exchange (COMEX), the London Metals Exchange (LME) and the Shanghai Futures Exchange (SHFE). Prices on these exchanges generally reflect the worldwide balance of copper supply and demand and can be volatile and cyclical. During 2010, LME spot copper prices averaged $3.42 per pound and ranged from $2.76 per pound to $4.42 per pound. In general, demand for copper reflects the rate of underlying world economic growth, particularly in industrial production and construction.

Location and Access

The Block 5 and Block 6 prospect sites are located approximately 150km northwest of Muscat, the capital city of the Sultanate of Oman, and approximately 30km to the south of the regional port city of Sohar in the South Batinah Coastal Region. Block 5 and Block 6 are regionally well placed in relation to existing infrastructure (i.e., power, water and communications ) and serviced by a national highway between Muscat and Dubai in the United Arab Emirates (UAE), which supports a number of secondary tarred and gravel roads which cross the project areas. Access to the area is primarily by a well maintained tarred road and secondary gravel roads which are connected to the main national highway between Muscat and Dubai. The regional port, located in the city of Sohar, lies approximately 40km north of the center of Block 5 and approximately 80km north of the center Block 6.

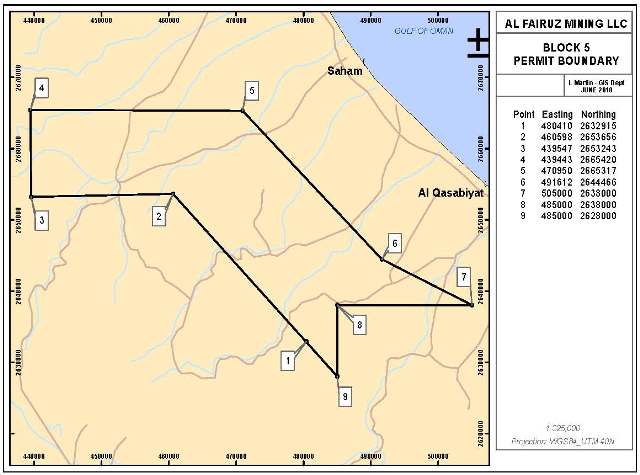

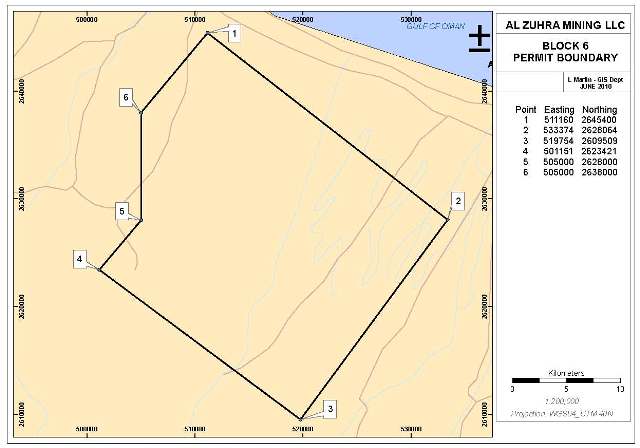

Block 5 covers approximately 858.60 square kilometers and Block 6 covers approximately 609.63 square kilometers. The property boundaries for Block 5 and Block 6 have not been surveyed by a registered surveyor or physically demarcated. Boundary coordinates have been provided for by the Government of Oman on issue of the exploration permits and have not been verified by the Company. As such, the Company intends to engage the services of a registered surveyor to survey the property boundaries. Nevertheless, the exploration team of the Company has checked the property boundaries by means of hand-held GPS devices and has confirmed there are no material errors.

The climate in the Oman is hot and dry in the interior and hot and humid along the coast. Summer temperatures in the capital of Muscat and other coastal locations often climb to approximately 109°F, with high humidity. Winters are generally mild, with lows averaging about 63°F. Temperatures are similar in the interior, although they are more moderate at higher elevations. Rainfall throughout the Oman is minimal, averaging only about four inches (100mm) per year, however, run-off water in the mountains can be heavy causing short term flooding. Due to the historical favorable weather conditions in the Oman, we anticipate that as a result of the weather conditions, we believe that we will be able to undertake our exploration activities for the entire length of the year, with revised schedules for periods of extreme temperatures as needed.

Nature and Extent of the Company=s Rights to the Oman Project

Block 5

The rights to explore the land which constitutes Block 5 is controlled by Al Fairuz Mining Company, LLC, a company incorporated under the laws of the Sultanate of Oman (“Al Fairuz”). Any and all exploration to be carried out by Al Fairuz is conducted under Exploration Permit No. WTS/T/10/2010 (the “Block 5 Exploration Permit”), which was originally granted to Al Fairuz on June 30, 2009. The Block 5 Exploration Permit is valid for twelve months and is renewable annually for an extended period of twelve (12) months provided that the extension application is submitted three (3) months from the time of expiry. As of the date of this Report, the Block 5 Exploration Permit is in good standing will expire on June 29, 2011 unless the same is renewed for another twelve (12) month period.

On or about October 27, 2009, African Precious Minerals Limited, a company incorporated under the laws of the British Virgin Islands (“APM”), Al Fairuz and the Al Fairuz shareholders entered in that certain earn-in agreement (the “Block 5 Agreement”) which outlines the terms and conditions of the joint venture (the “Block 5 Joint Venture”) between the parties with respect to the exploration, development and mining of Block 5. The Block 5 Agreement provides APM with the right to earn up to a 50% participating interest in and to the Block 5 prospect site as well as a 50% interest in the share capital of Al Fairuz, subject to the terms and conditions contained in the Block 5 Agreement.

On January 20, 2010, APM, APM Mining, Al Fairuz and the Al Fairuz shareholders entered into that certain Novation Agreement (the “Novation Agreement) whereby Al Fairuz Mining and the AFM Shareholders agreed to allow APM to transfer and assign all of its rights, obligations, liabilities, duties and responsibilities under the Block 5 Agreement to APM Mining, an affiliate of APM.

On February 28, 2010, and in connection with the acquisition by the Company of all the issued and outstanding equities of APM Mining, APM Mining Al Fairuz and the Al Fairuz shareholders entered into that certain letter agreement (the “Letter Agreement”) which amended the Block 5 Agreement (as amended by the Novation Agreement) to provide that (i) the Company was permitted to acquire APM Mining, and thus the rights in and to the Block 5 Agreement and (ii) in exchange for the Company issuing 2,500,000 shares of common stock to Yasser Al Fairuz (a shareholder of Al Fairuz), the Company now has the right to earn up to a 65% participating interest in and to the Block 5 prospect site as well as a 65% interest in and to the share capital in Al Fairuz, subject to the terms and conditions contained in the Block 5 Agreement.

On March 8, 2010, the Company concluded its acquisition of APM Mining, and as of said date, acquired all of the rights, obligations, liabilities, duties and responsibilities of APM Mining under the Block 5 Agreement. The Block 5 Agreement, as amended by the Novation Agreement and the Letter Agreement (collectively referred to herein as the “Block 5 Agreement”) provides that after (i) Gentor BVI pays to Al Fairuz approximately 30,000 Rial for the reimbursement of various initial exploration expenditures (the “Initial Expenditure Expenses”) and (ii) Gentor BVI completes a Joint Ore Reserves Committee (“JORC”) compliant bankable feasibility study (the “Bankable Feasibility Study”), to be prepared by an internationally recognized consulting firm, reflecting the feasibility, financial viability and proposed plan for mining a prospective ore body or deposit of minerals and other minerals within Block 5, which study shall include such information that may be required to enable a banking or other financial institution or investor to determine whether or not to advance funds in order to establish a mine at the Block 5 prospect site, then Gentor BVI will be granted a 65% participating interest in and to Block 5 as well as a 65% interest in and to the share capital in Al Fairuz.

Until such time as Gentor BVI has acquired a 65% interest in and to the share capital in Al Fairuz, Gentor BVI has been appointed to serve as the project manager of the Block 5 Joint Venture to oversee all technical operations and exploration activities, until the Management Committee (as defined herein) determines otherwise. As the project manager for the Block 5 Joint Venture, Gentor BVI in responsible to, with such assistance from the Al Fairuz shareholders as may reasonably be required, obtain and maintain all permits, consents, approvals or other authorizations necessary or desirable for the performance of the exploration activities at the Block 5 prospect site, and any and all costs associated with the obtaining or maintaining of such permits, consents, approvals or other authorizations shall be borne solely by Gentor BVI. Under the terms of the Block 5 Agreement, there is no definitive date on which Gentor BVI must complete the Bankable Feasibility Study referenced above. As the project manager of the Block 5 Joint Venture, Gentor BVI must prepare an annual exploration program and budget for its proposed exploration activities that must be approved by a management committee of Al Fairuz (the “Management Committee”) which is comprised of four (4) representatives, two (2) of whom are appointed by Al Fairuz and two (2) of whom are appointed by Gentor BVI. All decisions to be undertaken by the Management Committee shall be decided upon by a majority vote, and in the event of a deadlock, the deadlock shall be settled by mediation and/or arbitration in accordance with the Rules of Arbitration of the International Chamber of Commerce.

Despite the fact that, as of the date of this Report, Gentor BVI has not completed the Bankable Feasibility Study, in light of the good working relationship between the parties, and in light of the fact that the Company has paid the Initial Expenditure Expenses to AL Fairuz on or about January 24, 2011, Al Fairuz provided Gentor BVI with a 40% interest in and to the share capital of Al Fairuz. The acquisition of the foregoing 40% in and to the share capital of Al Fairuz does not impair and/or limit the right of Gentor BVI to earn up to a 65% participating interest in and to the Block 5 prospect site as well as a 65% interest in and to the share capital in Al Fairuz upon completion of the Bankable Feasibility Study.

In the event that Gentor BVI no longer desires to devote its time and resources to the exploration, development and/or mining of Block 5, then Gentor BVI has the right to withdrawal from the Block 5 Joint Venture as follows: (i) If Gentor BVI desires to withdrawal from the Block 5 Joint Venture before the completion of the Bankable Feasibility Study, then Gentor BVI may do so at any time and for any reason so long as Gentor BVI provides at least ninety (90) days written notice to Al Fairuz and the Al Fairuz shareholders of its intent to the withdrawal from the project; moreover, Gentor BVI shall have no obligation whatsoever to pay any monies to Al Fairuz and/or the Al Fairuz shareholders in connection with said withdrawal. However, since Gentor BVI does own a 40% in and to the share capital of Al Fairuz, said interest is subject to buy-sell provisions agreed to between the parties; and (ii) If Gentor BVI desires to withdrawal from the Block 5 Joint Venture after the completion of the Bankable Feasibility Study, then Gentor BVI may do so at any time and for any reason so long as Gentor BVI provides at least thirty (30) days written notice to Al Fairuz and the Al Fairuz shareholders of its intent to the withdrawal from the Block 5 Joint Venture; moreover, Gentor BVI shall have no obligation whatsoever to pay any monies to Al Fairuz and/or the Al Fairuz shareholders in connection with said withdrawal. However, in this instance, Gentor BVI will be entitled to receive a Net Smelter Royalty (defined as a 2% of the gross revenues received by Al Fairuz Mining from the sale of end products produced from mining activities over that part of the Block 5 prospect site after deduction of agreed upon expenses) until such time as the aggregate amount of Net Smelter Royalty paid to Gentor BVI equals to the aggregate amount of means those costs incurred by Gentor BVI in respect of its exploration activities which have been approved in the reports submitted by Gentor BVI to the Management Committee. Again, since Gentor BVI does own a 40% in and to the share capital of Al Fairuz, said interest is subject to buy-sell provisions agreed to between the parties.

Block 6

The rights to explore the land which constitutes Block 6 is controlled by Al Zuhra Mining Company, LLC, a company incorporated under the laws of the Sultanate of Oman (“Al Zuhra”). Any and all exploration to be carried out by Al Zuhra is conducted under Exploration Permit No. MOCI/C/5-10/10/2010 (the “Block 6 Exploration Permit”), which was originally granted to Al Zahra on February 17, 2010. The Block 6 Exploration Permit is valid for twelve months and is renewable annually for an extended period of twelve (12) months provided that the extension application is submitted three (3) months from the time of expiry. As of the date of this Report, the Block 6 Exploration Permit is in good standing will expire on February 16, 2012 unless the same is renewed for another twelve (12) month period.

On or about January 29, 2010, APM Mining, Al Zuhra, Sheikh Ahmed Farid bin Mohammed al Awalaki and Qannas bin Ahmed Farid Al Awalaki entered in that certain agreement (the “Block 6 Agreement”) which outlines the terms and conditions between the parties with respect to the exploration, development and mining of Block 6. The Block 6 Agreement provides APM with the right to earn up to a 70% participating interest in the share capital of Al Zuhra, subject the terms and conditions contained in the Block 6 Agreement. Concurrently with the execution of the Block 6 Agreement, APM Mining had the right to acquired a 20% participating interest in the share capital of Al Zuhra, and the Company anticipates that is will formally acquire said 20% interest within the next few weeks.

On March 8, 2010, the Company concluded its acquisition of APM Mining, and as of said date, acquired all of the rights, obligations, liabilities, duties and responsibilities of APM under the Block 6 Agreement and the right to acquire the 20% participating interest in the share capital of Al Zuhra.

The Block 6 Agreement provides that (i) within thirty (30) days after the completion of the airborne and pilot drilling activities, and provided that the results of the pilot drilling are positive and Gentor BVI proceeds with the exploration activities at the Block 6 prospect site, then Gentor BVI will be entitled to acquire an additional 40% participating interest in the share capital of Al Zuhra and (ii) after Gentor BVI completes a JORC compliant bankable feasibility study (the “Bankable Feasibility Study”), to be prepared by an internationally recognized consulting firm, reflecting the feasibility, financial viability and proposed plan for mining a prospective ore body or deposit of minerals and other minerals within Block 6, which study shall include such information that may be required to enable a banking or other financial institution or investor to determine whether or not to advance funds in order to establish a mine at the Block 6 prospect site, then Gentor BVI will be granted a 70% participating interest in and to the share capital in Al Zuhra.

Until such time as Gentor BVI has acquired a 70% participating interest in and to the share capital in Al Zuhra, Gentor BVI has been appointed to serve as the project manager of the Block 6 exploration activities to oversee all technical operations and exploration activities related thereto, until the Management Committee (as defined herein) determines otherwise. As the project manager for the Block 6 prospect site, Gentor BVI in responsible to, with such assistance from the Al Zuhra shareholders as may reasonably be required, obtain and maintain all permits, consents, approvals or other authorizations necessary or desirable for the performance of the exploration activities at the Block 6 prospect site, and any and all costs associated with the obtaining or maintaining of such permits, consents, approvals or other authorizations shall be borne solely by Gentor BVI. While Gentor BVI shall use its commercially reasonable efforts to oversee and manage the exploration activities at the Block 6 prospect site, there is no definitive date on which Gentor BVI must complete the Bankable Feasibility Study referenced above. As the project manager of the Block 6 prospect site, Gentor BVI must prepare an annual exploration program and budget for its proposed exploration activities that must be approved by a management committee of Al Zuhra (the “Management Committee”) which is comprised of four (4) representatives, two (2) of whom are appointed by Al Zuhra and two (2) of whom are appointed by Gentor BVI. All decisions to be undertaken by the Management Committee shall be decided upon by a majority vote, and in the event of a deadlock, the deadlock shall be settled by mediation and/or arbitration in accordance with the Rules of Arbitration of the International Chamber of Commerce.

In the event that Gentor BVI no longer desires to devote its time and resources to the exploration, development and or mining of Block 6, then Gentor BVI has the right to withdrawal from Al Zuhra as follows: (i) If Gentor BVI desires to withdrawal from Al Zuhra before the completion of the Bankable Feasibility Study, then Gentor BVI may do so at any time so long as Gentor BVI written notice to Al Zuhra that the Block 6 prospect site does not warrant any further work; moreover, Gentor BVI shall have no obligation whatsoever to pay any monies to Al Zuhra and/or the Al Zuhra shareholders in connection with said withdrawal. However, if Gentor BVI withdrawals prior to the completion of the airborne and pilot drilling activities, Gentor BVI will be required to sell back its 20% participating interest in the share capital of Al Zuhra for nominal consideration; and (ii) If Gentor BVI desires to withdrawal from Al Zuhra after the completion of the Bankable Feasibility Study, then Gentor BVI may do so at any time and for any reason; moreover, Gentor BVI shall have no obligation whatsoever to pay any monies to Al Zuhra and/or the Al Zuhra shareholders in connection with said withdrawal. However, in this instance, Gentor BVI will be entitled to receive a Net Smelter Royalty (defined as a 2% of the gross revenues received by Al Zuhra from the sale of end products produced from mining activities over that part of the Block 6 prospect site after deduction of agreed upon expenses) until such time as the aggregate amount of Net Smelter Royalty paid to Gentor BVI equals to the aggregate amount of means those costs incurred by Gentor BVI in respect of its exploration activities which have been approved in the reports submitted by Gentor BVI to the Management Committee. In either event, and subject to the foregoing, since Gentor BVI does own a participating interest in and to the share capital of Al Zuhra, said interest is subject to buy-sell provisions agreed to between the parties.

Map

Below is a map of the location of the Block 5 prospect site and the Block 6 prospect site within the Middle East region.

Below is a boundary map of the location of the Block 5 prospect site.

Below is a boundary map of the location of the Block 6 prospect site.

History of Operations in the Region

The Oman Mountains region in northern Oman was known as a major producer of copper during the Mesopotamian era. The exploitation and smelting of copper continued up to around 940AD, which is evident from great slag piles, ancient smelters and excavations on and near present day outcropping copper deposits.

Modern copper exploration and mining activities on or near Block 5 and Block 6 started around 1974 when Prospection Ltd, a Canadian exploration company, obtained the rights to conduct copper and chrome exploration across the entire extent of the Semail Ophiolite Belt.

In 1978, Prospection Ltd identified and explored 352 target areas which yielded economic copper deposits such as Aarja, Bayda, Lasail and Rakah. In the area covered by the Block 5 and Block 6, a total of 46 targets were identified and explored by techniques such as geochemistry, geophysical methods including airborne electromagnetics, ground electromagnetic surveys, gravity surveys, induced polarization (IP) surveys and diamond drilling.

Prospection Ltd identified 26 target areas at the Block 5 prospect site. These copper and chromite targets were identified from aerial spotting of gossans by helicopter and later by means of the results of a regional Airborne Electromagnetic Survey. During 1974 Prospection Ltd covered the entire Semail Ophiolite Belt with an airborne Electromagnetic Survey on 330m line spacing. All 26 target areas were subjected to initial field investigations which included basic mapping, geochemistry, varying from grab sampling to soil- and stream sediment sampling; and various geophysical investigations. In areas covered by younger rocks the emphasis was placed on geophysical techniques such as ground electromagnetic surveys, gravity surveys and Induced Polarization (IP) surveys. The targets at Hara Kilab, Mahab 2, Mahab 3 and Mahab 4 returned positive exploration results and were recommended for drilling. A total of 2,452.92m were completed in 35 diamond drill holes on the Hara Kilab, Mahab 2, Mahab 3 and Mahab 4 occurrences in Block 5. Results from these exploration programs were sourced from historic reports with drill collars cited on local grids. The exact collar positions, intersected lithologies and assay results could not be verified without the drill collar beacons and drill core.

Around 1983, the Government of Oman through the Oman Mining Company (“OMCO”), a Government owned company, obtained the mineral rights from Prospection Ltd and the exploitation of the Aarja, Bayda and Lasail deposits, to the north of Block 5, commenced following the construction of a copper concentrator, smelter and refinery complex near Lasail.

In order to maintain a steady supply of ore, the Government of Oman engaged Bishimetal Exploration Co., Ltd., a Japanese consultancy on contract (“Bishimetal”) to conduct further exploration around the Lasail complex area. From 1984 to 1987 Bishimetal identified copper mineralization in various places around the known deposits. The exploration area included the northern half of Block 5 were Bishimetal conducted 1: 50 000 scale detailed mapping.

In 1988 the Government of Oman requested the government of Japan to evaluate the possibility of developing the copper deposits at Rakah and Hayl as Safil. As such, a Cooperative Mineral Exploration Program, through the Japanese International Cooperation Agency (the “JICA”) and the Metal Mining Agency of Japan (the “MMAJ”) followed whereby exploration and development studies were carried out in the Block 5 and Block 6 prospect areas, amongst others. By 1995 the focus of the Cooperative Mineral Exploration Program shifted to the central and southern Batinah Coastal region. By 2000 JICA delineated three massive sulphide ore bodies at neighboring Ghuzayn and evaluated a number of prospects located in the Block 5 and Block 6 prospect areas. OMCO continued its exploration, development and mining activities until 2009 until such time as the exploration rights to Block 5 and Block 6 were granted to Al Fairuz and Al Zuhra, who then in turn turned over the management of said exploration activities to Gentor BVI.

Work Completed by the Company at the Oman Project

All of the work undertaken by the Company with respect to the Oman Project is exploratory in nature. Around April 2010, the Company commissioned and completed a 7,227km line of a Versatile Time Domain Electro-Magnetic Survey (“VTEM”) covering both Blocks 5 and 6. The airborne helicopter VTEM survey identified approximately fifty-six (56) geophysical anomalies. Ground truthing and geological mapping followed. Twenty four (24) holes totaling 2,861m of fence line target drilling commenced in June 2010. Five of the 56 anomalies identified by the VTEM were tested and two (2) new volcanogenic massive sulfide (‘VMS”) ore deposits were identified.

The Company has also been reviewing, collecting and analyzing all available information regarding the Oman Project which the Company intends to use for Geographic Information System (GIS) and geological modeling purposes.

Company=s Proposed Plan of Exploration and/or Development of the Oman Project

The Block 5 prospect site is without known reserves and our proposed exploration program is exploratory in nature. We are currently working with various consultants to review the available data relating to the Oman Project and we intend to continue to work with said consultants to refine a formal exploration program.

Based on the information available to us, we intend to continue to refine our exploration program continue our exploration activities, which includes testing of identified anomalies, exploration drilling and resource drilling. As such, we intend to undertake the following work at the Oman Project during the calendar year 2011, which we estimate, based on information available to us, will cost approximately $5,300,000:

•

Further data gathering and geological compilation of new data and existing GIS database.

•

Utilizing remote sensing techniques to identify alteration associated with mineralization.

•

Trial ground geophysics using IP and EM.

•

9,700m resource drilling at Maqail South and Mahab 4.

•

4,000m exploration drilling over known untested targets.

We cannot provide any assurance that the exploration, development and/or extraction of any copper at the Oman Project to be ACommercially Viable@, that is, that the potential quantity of copper and their market value would, after consideration of the costs and expenses that would be required to explore, develop and/or extract any such copper deposits (if any), would justify a decision to do so. Moreover, we believe that further exploration beyond the scope of our planned exploration activities will be required before a final evaluation as to the economic feasibility of the Oman Project can be determined, and until we reviewed and analyzed the results of our current planned exploration activities, we cannot estimate the scope and/or cost of any further exploration activities at this time.

Plant and Equipment

Since our inception, we have purchased a number of property and equipment assets such as diamond saw for core cutting, four (4) all-terrain-vehicles for off road transport, downhole cameras, and other associated exploration equipment, tools and software.

Geology and Mineralization

The Oman is geologically significant as it is the host to substantial Paleozoic and Mesozoic oil and gas resources in shelf carbonates and sediments onto which the Semail Ophiolite Complex was thrusted. The desert conditions mean that exposure is almost 100% and the extensive scientific literature on the oil and gas industry provides an excellent framework to assess the ophiolites. The regional geological history of the Semail Ophiolite Complex places the formation of the belt in the Mid-Cretaceous era, which implies that the belt formed during the wider Tethyan Orogen.

The Semail Belt is believed to have formed in a proto-ocean located approximately where The Persian Gulf and The Gulf of Oman are today. This proto-ocean formed in the Mid-Cretaceous but closed again in the Late Cretaceous. As the proto-ocean closed, the oceanic crust which had formed as the continental crust drifted apart was pushed up onto the Arabian Plate to the west to form the Semail Ophiolite. In detail, the formation of the Semail Ophiolite Belt took place in a number of discrete but related thrusting episodes.

Locally, the Semail Ophiolite is a 600km long, 100-150km wide and 5-10km thick nappe located along the Gulf of Oman. The belt consists of a large thrust slice including 5-6km of upper mantle peridotites and 4-5km of oceanic crustal rocks. Most of this mantle sequence consists of tectonised harzburgite.

Originally, mantle diapirs were the feeders for the ridge segment and magma chambers. Tholeiitic picritic melts generated the crustal sequence, which includes as much as 4km of layered mafic and ultramafic rocks of a cumulate sequence overlain by isotropic gabbros, diorites and trondjhemites. The upper part of the ophiolite includes 2km of pillow lavas which, in northern Oman, have been divided into five main lava units. The Semail Ophiolite is covered by a 2.5km thick blanket of pelagic sediments which include metalliferous material.

The copper mineralisation is hosted within numerous VMS deposits within the ophiolite belt. More than 150 VMS deposits have been identified within the 600km strike length of the Semail Ophiolite Belt; most cluster in groups, each within a 25-50km radius. The Geotimes Unit is a sequence of basaltic pillow lavas up to 1.5km thick and forms the footwall to many of the main massive sulphide deposits, as well as abundant iron and manganese rich sediments. The morphology, ore types, mineralogy and geochemistry of the deposits are similar to the deposits of Cyprus. However, a few of the deposits have mineralogical and geochemical characteristics more similar to massive sulphides currently forming in immature back-arc rifts.

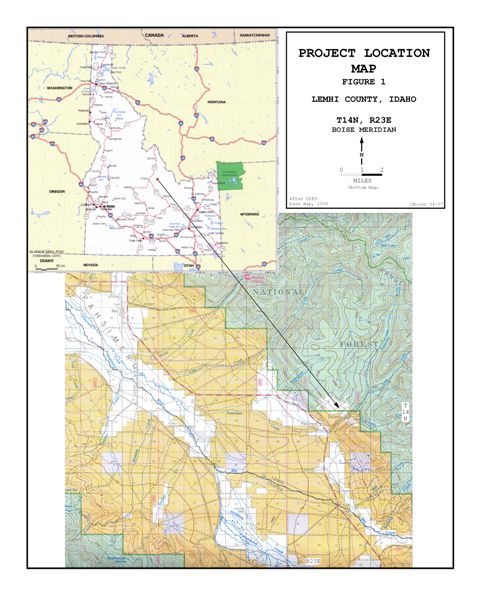

Idaho Project

The Idaho Project is a molybdenum-tungsten project located in East-Central Idaho and is sometimes referred to herein as the AIMA Mine.@

Molybdenum is a refractory metal with very unique properties. Molybdenum, when added to plain carbon and low alloy steels, increases strength, corrosion resistance and high temperature properties of the alloy. The major applications of molybdenum containing plain and low alloy steels are automotive body panels, construction steel and oil and gas pipelines. When added to stainless steels, molybdenum imparts specialized corrosion resistance in severe corrosive environments while improving strength. The major applications of stainless steels are in industrial chemical process plants, desalinization plants, nuclear reactor cooling systems and environmental pollution abatement. When added to super alloy steels, molybdenum dramatically improves high temperature strength, creep resistance and resistance to oxidation in such applications as advanced aerospace engine critical components. The effects of molybdenum additions to steels are not readily duplicated by other elements and as such are not significantly impacted by substitution of other materials; as such, Molybdenum has few substitutes. Other uses for Molybdenum include fuel desulfurization catalysts, lubricants and alloy element in gas turbine engine components. Furthermore, Molybdenum, as a high-purity metal, is also used in electronics such as flat-panel displays and in super alloys used in aerospace.

Location and Access

The IMA Mine is located on the western edge of Lemhi County in east Central Idaho, which is near the major communities of Salmon and Challis. U.S. Highway 93 runs between Salmon and Challis. Access to the IMA mine is obtained from Highway 93 as follows: At Mile Post 264 (which is approximately 18 miles North East of Challis), turn south on the paved Pahsimeroi Road (a.k.a. AFarm to Market Road@), then proceed southerly 24 miles to the Hamlet of Patterson, then turn East on the Patterson Creek Road (a 4x4 access road) and proceed for 1 mile to the IMA Mine.

Nature and Extent of the Company=s Rights to the Idaho Project

Effective as of March 1, 2007, Bardswich LLC, an Idaho limited liability company (ABardswich LLC@), an entity that is owned and controlled by Lloyd J. Bardswich, the former president, treasurer, chief financial officer of the Company, and IMA-1, LLC, a Montana limited liability company (the AIdaho Claim Owner@) entered into that certain Mineral Lease Agreement and Option to Purchase (the AIdaho Option Agreement@) which relates to twenty one (21) patented mining claims (the AIMA Mine@) located over approximately 376 acres of real property and four other parcels of approximately 216 acres in Lemhi County, Idaho (collectively, the AOptioned Properties@). In accordance with the terms of the Idaho Option Agreement, concurrently with the execution of the Idaho Option Agreement, Bardswich LLC paid the Idaho Claim Owner $40,000 in cash as the first Advanced Minimum Royalty Payment (as such term is defined herein). On July 23, 2007, Bardswich LLC and Gentor Idaho entered into that certain assignment agreement (the AAssignment Agreement@) whereby Bardswich LLC assigned all of its rights, title and interest in and to the Idaho Option Agreement in exchange for $40,000 in cash and 500,000 shares of the Company=s common stock. The Idaho Option Agreement grants the Company (through Gentor Idaho) the exclusive right (the AExploration and Mineral Right@) to enter the Optioned Properties (and thus the IMA Mine) for the purpose of exploring and developing the Optioned Properties (and thus the IMA Mine), as well as, removing and selling for our own account any and all minerals, mineral substances, metals ore bearing materials and rocks of any kind. The Idaho Option Agreement also grants the Company an option (the AOption Right@) to purchase the Idaho Claim Owner=s rights to the Optioned Properties, including but not limited to the IMA Mine, for a total purchase price of $5,000,000 (the APurchase Price@), excluding therefrom the right of the Idaho Claim Owner to receive a three percent (3%) royalty on net revenue generated from the sale of any molybdenum, copper, lead, and zinc recovered from the IMA Mine and a five percent (5%) royalty on the net revenue generated from the sale of all other ores, minerals, or other products recovered from the Optioned Properties (collectively, the ANet Smelter Return Royalties@). The duration of the Idaho Option Agreement is indefinite so long as the Company makes the necessary scheduled payments of advanced minimum royalty payments (each an AAdvanced Minimum Royalty Payment@) under the Idaho Option Agreement. Bardswich LLC made an initial payment of $40,000 in cash to the Idaho Claim Owner upon execution of the Idaho Option Agreement and the Company made an additional payment of $60,000 to the Idaho Claim Owner on the six month anniversary date of the signing of the original Option Agreement as well as another additional payment of $100,000 during the month of March 2008. According to the terms of the Idaho Option Agreement, additional payments of: (i) $100,000 in cash was due on or before the second anniversary of the Idaho Option Agreement (March 1, 2009), (ii) $100,000 in cash is due on or before the third anniversary of the Idaho Option Agreement (March 1, 2010), (iii) $200,000 in cash is due on or before the fourth anniversary date of the Idaho Option Agreement (March 1, 2011), and (iv) $200,000 in cash is due on or before each subsequent anniversary date of the Idaho Option Agreement thereafter until the Purchase Price is paid or the Idaho Option Agreement is terminated or cancelled. On March 1, 2009, the Idaho Claim Owner agreed to accept four equal payments of $25,000 each on each of March 1, May 1, July 1, and September 1, 2009 in lieu of the $100,000 payment that was due in full on March 1, 2009 (the second anniversary date of the Idaho Option Agreement). The $25,000 payments that were due, respectively, on March 1, 2009, May 1, 2009, July 1, 2009 and September 1, 2009 have been paid to the Idaho Claim Owner. On February 14, 2010, the Idaho Claim Owner agreed to accept four equal payments of $25,000 each on each of March 1, May 1, July 1, and September 1, 2010 in lieu of the $100,000 payment that would be due in full on March 1, 2010 (the third anniversary date of the Idaho Option Agreement). The $25,000 payments that were due, respectively, on March 1, 2010, May 1, 2010, July 1, 2010 and September 1, 2010 have been paid to the Idaho Claim Owner. On March 8, 2011, the Idaho Claim Owner agreed to accept a payment of $100,000 in lieu of the $200,000 payment that was due in full on March 1, 2011 (the fourth anniversary date of the Idaho Option Agreement). The foregoing agreed upon $100,000 payment has been paid to the Idaho Claim Owner. All payments that become due to the Idaho Claim Owner subsequent to March 2011 remain as stipulated in the original Idaho Option Agreement (i.e. $200,000 per annum). To the extent that the Company makes any Advanced Minimum Royalty Payments, the Company is entitled to receive a corresponding credit against any required Net Smelter Returns Royalties that are otherwise required to be paid to the Idaho Claim Owner under the Idaho Option Agreement. Moreover, the Company is also entitled to receive a credit equal to all Advanced Minimum Royalty Payments and payments of Net Smelter Return Royalties against the Purchase Price. In the event the Idaho Claim Owner notifies the Company that the Company has breached a term, condition or covenant of the Idaho Option Agreement (other than the payment of monies due and payable under the Idaho Option Agreement), then the Company has at least sixty (60) days (twenty (20) days for any monetary payment obligation) to cure any such breach. If the Company cannot cure, or begin to cure, any such breach within the cure period, then the Idaho Claim Owner can terminate the Idaho Option Agreement. The Company also has (i) the right to terminate the Idaho Option Agreement at any time and (ii) the right to assign all or any portion of the Idaho Option Agreement to any third party.