Attached files

| file | filename |

|---|---|

| EX-21 - Deyu Agriculture Corp. | v216965_ex21.htm |

| EX-31.1 - Deyu Agriculture Corp. | v216965_ex31-1.htm |

| EX-31.2 - Deyu Agriculture Corp. | v216965_ex31-2.htm |

| EX-32.1 - Deyu Agriculture Corp. | v216965_ex32-1.htm |

| EX-32.2 - Deyu Agriculture Corp. | v216965_ex32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934: For the Fiscal Year Ended December 31, 2010

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission File Number 333-160476

DEYU AGRICULTURE CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

80-0329825

|

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

|

incorporation or organization)

|

Identification No.)

|

Room 808, Tower A, Century Centre, 8 North Star Road

Beijing, People’s Republic of China

(Address, including zip code, of principal executive offices)

(626) 242-5292

86-13828824414

(Registrants’ telephone number, including area code)

|

Securities Registered Under Section 12(b) of the Exchange Act:

|

None

|

|

Name of exchange on which registered:

|

None (OTCQB)

|

|

Securities registered pursuant to Section 12(g) of the Act:

|

Common Stock, par value $0.001 per share

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes ¨No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

Non-accelerated filer o

|

|

Smaller Reporting Company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of the end of the issuer’s most recently completed second fiscal quarter, the issuer’s public float was $26,520,648. As of the end of the issuer’s fiscal year ended December 31, 2010, its net revenue was $89,175,633.

The number of outstanding shares of the registrant’s Common Stock on March 29, 2011 was 10,499,774.

Documents Incorporated By Reference

NONE

DEYU AGRICULTURE CORP.

FORM 10-K

INDEX

|

Page

|

|||

|

PART I

|

|||

|

Item 1.

|

Business.

|

3 | |

|

Item 1A.

|

Risk Factors.

|

18 | |

|

Item 1B.

|

Unresolved Staff Comments.

|

18 | |

|

Item 2.

|

Properties.

|

18 | |

|

Item 3.

|

Legal Proceedings.

|

19 | |

|

Item 4.

|

(Removed and Reserved)

|

19 | |

|

PART II

|

|||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

20 | |

|

Item 6.

|

Selected Financial Data.

|

22 | |

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

22 | |

|

Item 7A.

|

Quantitative and Qualitative Disclosures about Market Risk.

|

32 | |

|

Item 8.

|

Financial Statements.

|

32 | |

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

|

33 | |

|

Item 9A.

|

Controls and Procedures.

|

33 | |

|

PART III

|

|||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance.

|

35 | |

|

Item 11.

|

Executive Compensation.

|

41 | |

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

45 | |

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence.

|

47 | |

|

Item 14.

|

Principal Accountant Fees and Services.

|

48 | |

|

Part IV

|

|||

|

Item 15.

|

Exhibits and Financial Statement Schedules.

|

49 | |

|

SIGNATURES

|

52 | ||

2

DEYU AGRICULTURE CORP.

PART I

ITEM 1. Business

In this Annual Report on Form 10-K, unless otherwise indicated, the words “we”, “us” and “our” refer to Deyu Agriculture Corp. and all entities owned or controlled by Deyu Agriculture Corp. All references to “Deyu” or the “Company” in this Annual Report mean Deyu Agriculture Corp., a Nevada corporation, and all entities owned or controlled by Deyu Agriculture Corp., except where it is made clear that the term only means the parent or a subsidiary company. References in this Annual Report to the “PRC” or “China” are to the People’s Republic of China.

Overview

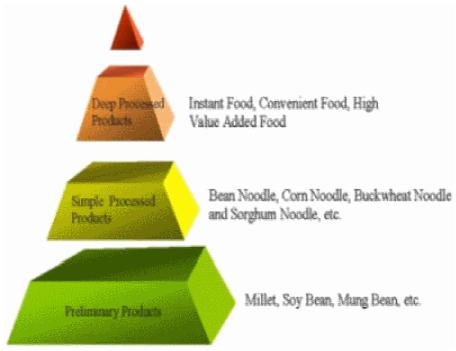

We are a Beijing, China-based producer and seller of organic and non-organic, ready-to-eat and ready-to-drink “simple processed” and “deep processed” grain consumer products which are sold in approximately 10,000 supermarkets and convenient stores throughout China. We are also one of the dominant organic and non-organic agricultural product distributors in Shanxi Province engaged in procuring, processing, marketing and distributing various grain and corn products and byproducts.

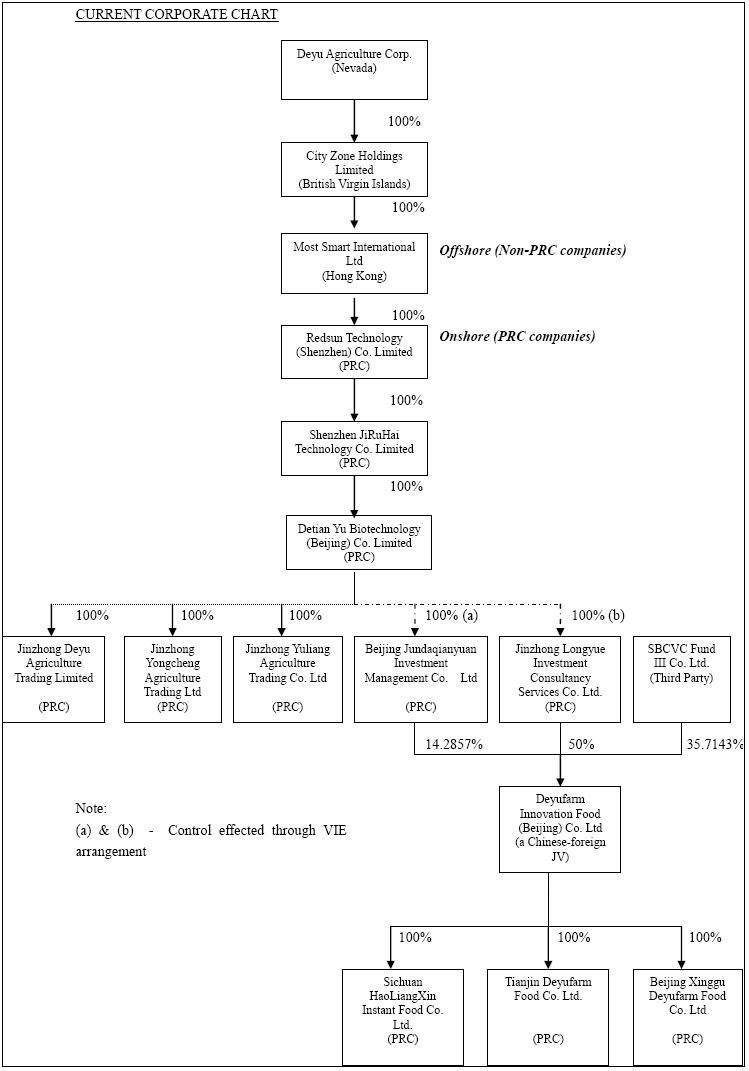

Our farming operations are conducted through our wholly-owned PRC subsidiaries, Jinzhong Deyu Agriculture Trading Co. Limited (“Jinzhong Deyu”), Jinzhong Yongcheng Agriculture Trading Co. Limited (“Yongcheng”), and Jinzhong Yuliang Agriculture Trading Co. Limited (“Yuliang”). Jinzhong Deyu focuses on processing and distributing “simple processed” grain products, while Yongcheng and Yuliang focus on the distribution of corn and corn byproducts. Our “deep processed” grain product operations are conducted through our variable interest entities (a) Beijing Jundaqianyuan Investment Management Co., Ltd. (“Junda”), a PRC company and 14.2857% equity interest holder in Deyufarm Innovation Food (Beijing) Co., Ltd., a PRC company (“Deyufarm”) and (b) Jinzhong Longyue Investment Consultancy Services Co., Ltd. (“Longyue”), a PRC company and the 50% equity interest holder in Deyufarm. Together, Junda and Longyue owned 100% of Deyufarm on December 31, 2010 prior to the finalization of funding from SBCVC Fund III Co. Ltd., an unrelated third party, and each derive 100% of their income from the profits generated by Deyufarm through its wholly-owned subsidiary, Sichuan Haoliangxin Instant Food Co., Ltd., a PRC company (“Haoliangxin”).

A brief description of our products is set forth below, by division:

|

●

|

Corn Products Division –Yongcheng and Yuliang process and distribute corn and corn byproducts. Yongcheng and Yuliang acquire unprocessed corn and perform value-added processes such as cleaning, drying and packaging. Consumers range from corn oil/corn starch manufacturing companies, livestock feed companies and governmental procurement agencies in China.

|

|

●

|

“Simple Processed” Grain Product Division – Jinzhong Deyu procures and distributes with Detian Yu grain products including millet, green beans, soy beans, black rice, whole wheat flour and may other variety of grains traditionally grown and consumed in China. Jinzhong Deyu acquires unprocessed grains and performs simple value-added processes to the grains such as peeling, cleaning, grinding and packaging. The majority of our finished products are then sold directly to supermarkets and grain wholesalers. One other type of product is packed dried noodles consisting of grains or grains mixed with wheat.

|

|

●

|

“Deep Processed” Grain Products Division –Haoliangxin and Deyufarm have developed deep processed grain products for years and owns various consumer packed products, including non-fry organic instant noodles made of grains. Haoliangxing has also developed instant drink grain soups and buckwheat teas and continues to develop new products. Haoliangxin has grown rapidly due to the increased demand of more organic products in the PRC made of grains and instant daily food products, particularly in urban cities with a growing middle class and high-income consumers who tend to have less time to cook and eat. Our expansion of our sales networks and brand name promotions have resulted in our brand name recognition which we believe have triggered strong sales for this division of our business.

|

Operating revenue for the year ended December 31, 2010 was $89,175,633, representing a 119% increase from $40,732,447 for the year ended December 31, 2009. Our net income for the year ended December 31, 2010 was $11,502,252, representing a 60% increase from $7,181,132 for the year ended December 31, 2009.

3

Our principal office is located at Tower A, Century Centre, Room 808, 8 North Star Road, Beijing, PRC. Our telephone number is (626) 242-5292 and (86)-13828824414. Our fax number is (86)-10-62668413, and our corporate website is www.deyuagri.com (information on our website is not made a part of this Annual Report).

Corporate History

2010 Share Exchange and Financings

On April 27, 2010, Deyu (then known as Eco Building International, Inc.) completed the acquisition of City Zone Holdings Limited, an emerging organic and non-organic agricultural products distributor in the Chinese Province of Shanxi, engaged in procuring, processing, marketing and distributing various grain and corn products (“City Zone”), by means of a share exchange (the “Exchange”). As a result of the Exchange, City Zone became a wholly-owned subsidiary of Deyu.

Simultaneously with the acquisition, we completed a private placement offering in the gross amount of $8,211,166 of the sale of securities to accredited investors at $4.40 per unit, with each “Unit” consisting of one share of our Series A convertible preferred stock and one warrant to purchase 0.4 shares of our common stock with an exercise price of $5.06 per share.

On May 10, 2010, we closed on the second and final round of the private placement offering as disclosed in our Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”) on May 3, 2010 through the sale of 589,689 Units comprised of 589,689 shares of our Series A Convertible Preferred Stock and 235,882 five year warrants with an exercise price of $5.06 per share, to certain accredited investors for total gross proceeds of $2,594,607. We raised an aggregate amount of $10,805,750 in the two rounds of offerings.

In connection with the financing transaction, we entered into (i) a Registration Rights Agreement, (ii) a Lock-Up Agreement and (iii) a Securities Escrow Agreement for a make good arrangement with our management (together with the Securities Purchase Agreement, these agreements shall be referred to as the “Financing Documents”).

The private placement closed simultaneously with the signing of the Financing Documents and our issuing of 2,455,863 shares of Series A convertible preferred stock and warrants exercisable into 982,362 shares of common stock to certain investors (collectively, the “Investors”). Pursuant to its terms, the Series A convertible preferred stock receive cumulative dividends at a rate of 5% per annum and can be converted into common stock on a 1:1 basis, subject to applicable adjustments. Pursuant to its terms, the warrants can be converted into 982,362 shares of common stock at an exercise price of $5.06 per share (the "Warrants"). The Warrants will expire on April 27, 2015.

In connection with the private placement and as part of the Financing Documents, we also entered into a Registration Rights Agreement, whereby, we agreed to file a registration statement on Form S-1 (or other applicable Form) within 60 days of the close of such financing. If the registration statement was not timely filed or was not declared effective within 180 days from the closing, we could have been liable for damages in the amount of 0.5% of the purchase price per month until the default is cured. We filed a Registration Statement on Form S-1 with the SEC on June 15, 2010, and on October 21, 2010, the SEC declared the Form S-1 effective.

We also entered into a Lock-Up Agreement with the Investors, pursuant to which the common stock owned by the management of City Zone will be locked-up until six (6) months after the Registration Statement is declared effective.

Lastly, our majority shareholder (Expert Venture Limited) entered into a Securities Escrow Agreement whereby such majority shareholder pledged 2,455,863 shares of common stock of the Company as security that we reach certain earnings thresholds for fiscal years ended 2010 and 2011 (the “Make Good Shares”). One half (or 1,227,932 shares) of the Make Good Shares shall be allocated to the 2010 earnings requirement and the other half (1,227,931 shares) of the Make Good Shares shall be allocated to the 2011 earnings requirement. If we meet these thresholds, the Make Good Shares will be released from escrow and returned to our majority shareholder. Alternatively, if we fail to meet the earnings requirements, the Make Good Shares will be released to the Investors in accordance with the terms of the Securities Escrow Agreement. For the fiscal year 2010, pursuant to the Make Good Agreement, we have to report net income of $11,000,000. For fiscal year 2011, pursuant to the Make Good Agreement, we have to report net income of $15,000,000. We will not be issuing any additional shares if the earnings threshold is not met. The Make Good Shares are already issued to our majority shareholder and it will be transferring his shares to the Investors if the earnings threshold is not met. Therefore, this will not dilute any shareholders.

4

The Make Good Shares shall be released from escrow based on the following terms and conditions:

For Fiscal Year ended 2010, the 1,227,932 shares being held in escrow for fiscal year 2010 shall be disbursed as follows:

|

–

|

If we achieve net income of at least 95% of $11,000,000, then 1,227,932 shares shall be returned to the majority shareholder.

|

|

–

|

If we achieve net income of less than 50% of $11,000,000 (or $5,500,000), then 1,227,932 shares shall be released to the investors on a pro rata basis (based on the amount of each Investors investment).

|

|

–

|

If we achieve net income of between 50% and less than 95% of $11,000,000, then a portion of the 1,227,932 shares held in escrow shall be disbursed to the Investors (the remaining shares will be returned to the majority shareholder. The number of shares released to the Investors shall be determined by doubling the percentage missed between the actual net income as compared to the make good target and then multiplying that by the 1,227,932 escrow shares.

|

We had achieved the 2010 performance threshold. Additionally, as a result of the Share Exchange, we changed our fiscal year end to December 31.

On May 19, 2010, we filed with the Secretary of State for the State of Nevada a Certificate of Amendment to our Articles of Incorporation changing our name from “Eco Building International, Inc.” to “Deyu Agriculture Corp.” FINRA declared the name change effective on June 2, 2010.

2010 VIE Control Agreements (Deyufarm and Haoliangxin)

On November 16, 2010, our wholly-owned PRC subsidiary Detian Yu entered into a series of control agreements (collectively, the “Control Agreements”) with each of Junda and Longyue pursuant to which Detian Yu shall provide management and consulting services and business cooperation opportunities services to each of Junda and Longyue in exchange for service fees from each of Junda and Longyue equal to 100% (in the aggregate) of the net income after tax of each of Junda and Longyue. Together, Junda and Longyue owned 100% of Deyufarm as of December 31, 2010 prior to the finalization of funding from SBCVC Fund III Co., Ltd., an unrelated third party, and each derive 100% of their income from the profits generated by Deyufarm through its wholly-owned subsidiary, Haoliangxin.

As of November 16, 2010, Detian Yu controls Deyufarm, a PRC joint venture entity by virtue of a Joint Venture Contract executed on September 25, 2010 by and among Junda, Longyue and SBCVC Fund III Company Limited, a company organized under the laws of Hong Kong and the 35.7143% equity interest holder in Deyufarm as of February 25, 2011. According to the agreement of “investments and related matters” on September 15, 2010 by and among Junda, Longyue, SBCVC and Deyufarm, within two years after SBCVC contributes the capital, SBCVC has rights to request Deyufarm to buy back some or all shares owned by Junda or Longyue but transferred to SBCVC; and within 48 months, all parties will start and complete the eligible IPO. Deyufarm, through its subsidiary, Haoliangxin, is engaged in the research & development and production of instant grain foods and has production facilities in Chengdu, Sichuan Province, PRC. Set forth below is a brief summary of each of the Control Agreements.

Pursuant to an Exclusive Management and Consulting Service Agreement, Detian Yu shall provide to each of Junda and Longyue management and consulting services in relation to the business of Junda and Longyue in exchange for 35% of the net income after taxes of Junda and Longyue every fiscal year for a term of 10 years. Such services include, without limitation, design system solutions, professional consulting, personnel training, market research, planning and development, operation planning and business strategies, market development of products and services, promotional and public relations activities, customer management and development, accounting and financial management, and consulting services to raw material suppliers. Furthermore, each of Junda and Longyue have irrevocably guaranteed to Detian Yu that it will not apply to any judicial authority, arbitration authority, government or any other authority or individual for the revocation of the agreement for any reason.

5

Pursuant to a Business Cooperation Agreement, Detian Yu shall provide business cooperation opportunities services including clients, cooperation partners and market information in the fields of grain processing, sales and financing to each of Junda and Longyue in exchange for cooperation fees and commissions from each of Junda and Longyue equal to 65% of the net income after tax of each of Junda and Longyue in every fiscal year for a term of 10 years. Furthermore, each of Junda and Longyue have irrevocably guaranteed to Detian Yu that it will not apply to any judicial authority, arbitration authority, government or any other authority or individual for the revocation of the agreement for any reason.

Detian Yu has entered into Business Operations Agreements with each of (i) Junda and its shareholders and (ii) Longyue and its shareholders pursuant to which such shareholders warrant that Junda or Longyue (as the case may be) shall not engage in any transactions which may have a material effect on the capital, business, personnel, obligations, rights or operations of Junda or Longyue (as the case may be) without the prior written consent of Detian Yu or a third party designated by Detian Yu. Furthermore, the shareholders shall elect the directors of Junda or Longyue (as the case may be), cause such directors to elect the person designated by Detian Yu as chairman of the board, and appoint the persons designated by Detian Yu as general manager, chief finance auditor and other senior operating officers in compliance with the procedures stipulated by relevant laws, regulations and each company’s articles of association. The shareholders have also agreed to unconditionally pay or freely transfer all dividends and any other income or rights (if any) acquired from Junda or Longyue (as the case may be) as the shareholders thereof and provide all the documents or take all the actions needed to satisfy such payment and transfer in compliance with the requirements of Detian Yu. Detian Yu shall guarantee the performance of the obligations of Junda and Longyue under all contracts executed by Junda and Longyue for the term of these Control Agreements and the shareholders have agreed to pledge all of their respective equity interests in Junda or Longyue (as the case may be) for a counter-guarantee of the performance of Detian Yu’s guarantees and other relevant obligations assumed by Detian Yu. The term of these Control Agreements is 10 years.

As security for the performance of all of the obligations or debts under the Exclusive Management and Consulting Service Agreements and Business Cooperation Agreements assumed by Junda and Longyue, and under a counter-guarantee to all the payments made by Detian Yu for the performance of the guarantees assumed by Detian Yu under the Business Operation Agreements, the shareholders of Junda and the shareholders of Longyue entered into Share Pledge Agreements with Detian Yu pursuant to which they agreed to pledge all of their respective interests to Detian Yu. The term for each pledge shall continue until the date that all of the Control Agreements summarized above have been terminated. Each of the shareholders of Junda has also executed a Power of Attorney which grant to a designee of Detian Yu all the voting rights as a shareholder of Junda and each of the shareholders of Longyue has also executed a Power of Attorney which grant to a designatee of Detian Yu all the voting rights as a shareholder of Junda and Longyue.

Detian Yu has also entered into Equity Acquisition Option Agreements with the shareholders of Junda and the shareholders of Longyue pursuant to which the shareholders have granted to Detian Yu an irrevocable and unconditional right to purchase, or cause a designated party of Detian Yu to purchase, part or all of the equity interests in Junda and Longyue from such shareholders, when and to the extent that, applicable PRC laws permit. The consideration for the equity acquisition option for Junda is RMB 80,000,000 and the consideration for the equity option for Longyue is RMB 120,000,000.

The Control Agreements executed by the following shareholders of Junda may be considered related person transactions by virtue of each shareholder’s stated relationship with the Registrant (a) Jianming Hao, the Chairman and CEO of the Registrant, owns 33% of Junda, (b) Wenjun Tian, the Presdient and a Director of the Registrant, owns 34% of Junda, (c) Jianbin Zhou, the Chief Operating Officer of the Registrant, owns 10% of Junda, (d) Li Ren, Vice President of Branding and Marketing of the Registrant, owns 5% of Junda, (e) Yongqing Ren, Vice President of the Corn Division of the Registrant, owns 3% of Junda and (f) Junde Zhang, Vice President of the Grains Division of the Registrant, owns 3% of Junda. All of the Control Agreements have been reviewed, analyzed, and approved by the Company’s independent board members.

6

Corporate Structure

The Company’s current corporate structure is set forth below:

7

With the exception of our four registered trademarks: “Deyu”, “Deyufarm”, “Haoliangxin” and “Shitie”, we do not own any patents, trademarks, licenses or franchises on our products or processes. We produce processed foods and therefore patents, trademarks and licenses are not necessary for our business operations. We also own the rights to the domain name www.deyuagri.com, which is currently in good standing.

Competitive Landscape

There are several smaller companies in our simple processed grain landscape, which are local in focus, have little brand recognition and limited distribution networks. The competitors are:

|

–

|

Shanxi Qinzhou Huang Millet Group Limited Company - This company’s main products are high quality millets grown in the city of Qinzhou, in Shanxi Province.

|

|

–

|

Shanxi Jin Wei Yuan Grains Company Limited - This Company mainly produces and sells high quality grains as well as deep processed grain products, including millets, corn powder, and soy beans.

|

|

–

|

Heshun Province Xin Ma Millets Development Company Limited - This company produces and sells grains as well as deep processed products, including beans and flour.

|

Our main competitors in the deep processed grain market are:

|

–

|

Ting Tsin International Group – They are a market leader in instant noodles, ready-to-drink teas and bottled water; best known for their "Master Kong" brand in China.

|

|

–

|

White Elephant Group – Henan-based food company with “White Elephant” branded instant noodles.

|

|

–

|

Hualong Group – Hebei-based food company with “White Elephant” branded instant noodles.

|

|

–

|

Wu Gu Dao Chang Company – COFCO subsidiary with “Wu Gu Dao Chang” branded instant noodles.

|

Seasonality of Raw Materials

The growing season for our corn and grain in the Shanxi Province is 135+ days, which requires only one planting per year of the farmland. With our storage facilities being built, it has increased our storage capacity by 70,000+ tons to more than 120,000+ tons, with turnover capacity of 600,000+ tons. We believe that an increase in storage capacity, combined with its ability to increase its farmer’s cooperative network and farmer’s agents, as well as the ability to expand its purchasing into other geographical areas in Shanxi Province, reduces the risk which may be attributable to raw material seasonality.

Our Current Products

Our products include (a) corn products, (b) simple processed grain products and (c) deep processed grain products. Our corn products are principally sold to large food and oil processing companies and feed material production companies. Our simple processed grain products have been packaged under our registered trademarks “Deyu” and “Shitie” for retail distribution in supermarkets. We plan to increase the number of grain food product offerings by developing processed grain foods and higher value-added products. Our current grain products include the following:

|

Item

|

Weight

|

Unit

|

|

Fine millet

|

400g

|

bag

|

|

Fine millet

|

2,400g

|

bag

|

|

Fine millet

|

5kg

|

bag

|

|

Gift box millet

|

400g

|

bag

|

|

Green bean

|

400g

|

bag

|

|

Green bean noodle

|

800g

|

bag

|

|

Green bean

|

800g

|

bag

|

|

Corn grits

|

400g

|

bag

|

|

Corn flour

|

800g

|

bag

|

|

Soybean

|

400g

|

bag

|

|

Whole wheat flour

|

5kg

|

bag

|

|

Whole wheat flour

|

25kg

|

bag

|

|

Black rice

|

400kg

|

bag

|

|

Buckwheat noodle

|

800g

|

bag

|

|

Sorghum flour

|

800g

|

bag

|

|

Gift box grains

|

2,400g

|

bag

|

|

Combo bean flour

|

2,400g

|

bag

|

|

Combo red flour

|

2,400g

|

bag

|

|

Health congee

|

936g

|

bag

|

8

Our current deep processed products are sold in famous chained supermarkets and convenient stores across Beijing and are expanding throughout China via our strong local sales forces. Products under the name of “Deyufarm” include the following:

Product Characteristics

Our farmland is located in the center of Shanxi Province, which has a relatively dry climate and which is ideal for grain cultivation. Grain crop growth relies principally on the climate and rainfall, and is not dependent on the application of chemical fertilizers or pesticides. Our simple and deep value-added processing of grains maintain the grain’s original nutritional components. A portion of Jinzhong Deyu’s grain products are certified as “Organic” by the Beijing Zhonglu Huaxia Organic Food Certification Centre, the chief organic food certification organization accredited and approved by the Certification and Accreditation Administration of the PRC (CNCA).

We provide technological guidance and support to our farmers regarding seed dissemination, cultivation methods, ecological fertilizer, irrigation, cultivation, weeding and harvesting. Working closely with our farmers helps ensure that we receive high quality raw materials for production. We also utilize an advanced product control system to help ensure high-quality finished products.

9

Key Customers

The Company did not have any customers who accounted for 10% or more of total sales of our products or 10% or more of total trade receivables during the fiscal years ended December 31, 2010 and 2009. However, the following tables set forth our three major customers for each division for fiscal years ended December 31, 2010 and 2009, respectively:

Corn Division:

|

% of Gross Sales for the Years Ended December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Corn Division:

|

||||||||

|

Shanghai Yihai Trading Co., Ltd., Shanxi Office

|

23.8

|

%

|

48.6

|

%

|

||||

|

Sichuan Guangyuanhexi Provincial Grain Reserve

|

4.3

|

%

|

3.3

|

%

|

||||

|

Chengdu Zhengda Co., Ltd.

|

3.7

|

%

|

2.2

|

%

|

||||

|

Top Three Customers as % of Total Gross Sales:

|

31.8

|

%

|

54.1

|

%

|

||||

For corn division, due to the efforts of diversifying our customer base, the top three and top one customer percentages of gross sales in 2010 have decreased substantially. At the same time, the portion of revenues derived from new or small customers has increased and the overall number of customers also increased.

Simple Processed Grain Division:

|

% of Gross Sales for the Years Ended December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Simple-Processed Grain Division:

|

||||||||

|

Tianjin Yimingda Grain Division

|

5.2

|

%

|

-

|

%

|

||||

|

Beijing Guanfu Food Products Co., Ltd.

|

5.1

|

%

|

-

|

%

|

||||

|

Beijing Qiheyuan Food Technology Co., Ltd.

|

3.1

|

%

|

-

|

%

|

||||

|

Top Three Customers as % of Total Gross Sales

|

13.4

|

%

|

-

|

%

|

||||

We changed our strategy from selling both corn and grain to one key customer to focusing on selling simple processed grains through retail stores for direct consumers for their day to day use, at the same time to match with deep processed grain products sold in the same stores.

Deep Processed Grain Division:

|

% of Gross Sales for the Years Ended December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Deep-Processed Grain Division:

|

||||||||

|

Xinkeyuan

|

2.1

|

%

|

-

|

%

|

||||

|

Beijing Huanqiu Jindan E-Commerce Co., Ltd.

|

2.1

|

%

|

-

|

%

|

||||

|

Tiajin Hongfuyongsheng Business Trading Co., Ltd.

|

1.1

|

%

|

-

|

%

|

||||

|

Top Three Customers as % of Total Gross Sales:

|

5.3

|

%

|

-

|

%

|

||||

10

As it is a newly created division in 2010, there is no data available for 2009. Two of the top three customers are all wholesalers distributing through their channels of numerous retail stores regionally or nationally, while the other one is an e-commerce retailer. We also directly sell through retail chain stores.

For the corn division, top three customers’ accounts receivable represents 10% within the division and 9% overall in 2010. For the simple-processed grain division, top three customers’ accounts receivable represents 17% within the division and 1% overall in 2010. For the deep-processed grain division, top three customers’ accounts receivable represents 7% within the division and less than 1% overall in 2010.

Key Suppliers of Raw Materials

The Company does not have any suppliers who accounted for 10% or more of total purchases of raw materials or 10% or more of total trade payables during the fiscal years ended December 31, 2010 and 2009.

Market Opportunity

Grain Products (Simple and Deep Processed)

Grain products contain high levels of vitamin B1, dietary fiber and trace elements. Coarse grains are believed to be beneficial to people with diabetes or high blood pressure. The Chinese Nutrition Society, commissioned by the Ministry of Health in 2007 to formulate Dietary Guidelines, recommends consumption of 250-400 grams per day of processed grain foods for adults. They also recommended that adults consume 50-100 grams per day of coarse grains and whole grain foods. 72% of adults in China, amounting to 607 million people, are urban residents. Based on these guidelines, the demand for grain products by people in urban cities could reach 7.66 million tons.

As a result of the economic growth and improved living standards in China, the dietary components of the Chinese population have changed dramatically. In general, the population pays more attention to diet and nutrition. Management believes that the increased awareness of the value and benefits of grain products has resulted in an increased demand for our organic grain products.

Corn and Corn Byproducts

The demand for corn has increased significantly, with annual growth of 3.26% for 2006 through 2009 and growth of 2.88% expected for 2010 through 2015. According to estimates by United States Department of Agriculture (“USDA”), the global demand for corn has substantially exceeded supply from 2007 through 2010.

|

Year

|

Beginning Balance

|

Supply

|

Demand

|

Supply Demand Gap

|

Closing Balance

|

|

2006/2007

|

125,110

|

713,130

|

728,080

|

-14,950

|

110,160

|

|

2007/2008

|

110,160

|

789,810

|

778,880

|

10,930

|

121,090

|

|

2008/2009

|

130,350

|

787,830

|

778,600

|

9,230

|

1,395.8

|

|

2009/2010

|

139,580

|

785,140

|

796,520

|

-11,380

|

1,281.9

|

(Units: ‘000 tons)

(Source: USDA)

Corn as Feed Material

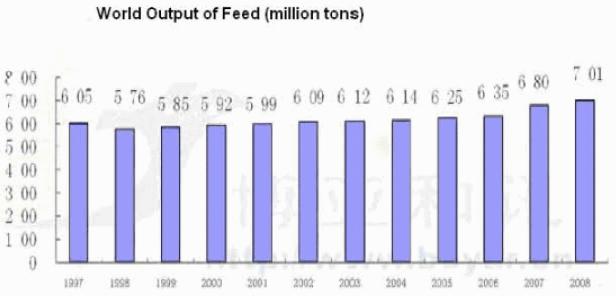

Since 1997, feed production has maintained steady growth. China is now the second largest feed producer, second only to the United States. Corn is the main raw feed material for pigs, cattle, chickens and other livestock. Corn byproducts, including corn stalks, are also used as an important source of feed.

11

Source: Nongbo Interactive Commerce (www.aweb.com.cn)

Corn Food Products

The development of corn processing has led to a revolution in corn consumption habits. In many developed countries, corn is generally regarded as a “health food”. In the United States, it is believed that over one tenth of health foods are made with corn or corn byproducts. In recent years, demand for corn in international markets has grown. Corn oil squeezed from corn germ contains over 10 types of fatty acids, more than 50% of which are acids rich in vitamins A and E. Corn oil is low in cholesterol and is believed to have positive effects on high blood pressure and heart disease. Corn oil is also widely used in the pharmaceutical and chemical industries.

Sales Network

Grain Products (Preliminary, Simple and Deep Processed)

We established a marketing center in Beijing focused on promoting our products throughout China. In addition, we plan to expand our sales network to include offices in the cities of Shenzhen, Hangzhou, Chengdu, Tianjin and Congqing. Our main sales channels are as follows:

|

●

|

Supermarkets: At present, our sales network covers approximately 10,000 supermarkets and convenience stores with distribution to over 29 Provinces in China, including the cities of Shanxi, Beijing, Tianjin, Jinan, Fuzhou, Chengdu and Shijiazhuang. Supermarkets include Hualian, RT-Mart Supermarket, Wal-Mart, Tiankelong, Yung-hui, China Resources Vanguard, Aoshi Kai, Sinopec Convenience Stores, Supermarkets, Tian Jia, the Tianhe supermarket chains and Sen Tian supermarket.

|

|

●

|

Sales channels of unpackaged products: We also sell unpackaged products of various kinds of grains in some supermarkets in Beijing open and loosely in baskets where customers can scoop the grains into plastic bags to determine the volume they want, and such sales strategy targets large use consumers.

|

Corn Products

Corn is used extensively in feeds, edible food and highly processed products. Global energy shortages make corn an attractive alternative energy source. We have strategic partnerships with large customers such as Yihai Group, New Hope Group, Zhenda Feeds and provincial Grain Reserves. We have entered into a two year purchase agreement with Yihai Group for the sale of corn products. According to the master agreement, Yihai will purchase from us 250,000 tons of corn in 2010 and 500,000 tons in 2011.

12

Product Development

At present, our grain products are mostly simple processed products. “Simple process” refers to products which are processed from raw materials to become ready-to-cook grains, whereas “deep process” refers to simple processed products which are further processed to become instant, ready-to-eat or drink beverages or foods. Over the next two to three years, we plan on focusing on the development of “simple processed” grain food products, with the goal of becoming the top producer of these products in China. Our existing grain products are natural foods that maintain their original nutritious properties and we believe such products will meet the demand of consumers seeking healthy diets. We also plan to continue to develop deep processed foods, such as instant foods and other high value-added grain foods, based on consumer demand. These types of food products are easy to store, convenient to prepare, and maintain their nutritional characteristics. This is especially suitable for consumer groups who have little time to prepare meals, but are concerned with maintaining a healthy diet.

Processing and Warehousing Capacities

General

Our facilities have site coverage of 11,667 square meters and constructed area of 6,752 square meters. The plant also includes a 3,000 square meter drying area surrounded by villages and farmland in Shanzhuang Tou Village of Shitie County.

Production Capacity

We are equipped with three fully automatic production lines for millet, grain and flour. These lines include various kinds of rice milling machines, filtering machines, elevators, color selection machines, exhaust fans, automatic packing machines and other equipment.

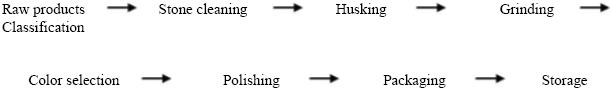

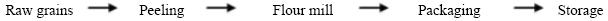

Grains production flow chart:

13

Flour (corn flour, millet flour) production flow chart:

To ensure high quality we installed fully automated production equipment in our facilities. Characteristics of our production equipment are as follows:

|

■

|

Production equipment is fully automated. Raw materials are moved through the production process via the elevator. The production process is fully enclosed for protection against any pollution or contamination.

|

|

|

■

|

We installed equipment with advanced color selection technology for grains. The device is stable and reliable, and features automatic temperature control, automatic removal of dust and impurities, automatic air pressure detection, self injection and light testing.

|

|

|

■

|

We have a cooling system that helps millet maintain its nutritious components, color and appearance.

|

|

|

■

|

Selective application of the polishing process helps maintain nutritional components.

|

Our modern equipment and technology, combined with advanced processing techniques, helps ensure that grain production is high-quality, natural, green and ecological. Additionally, a portion of our grains can be categorized as organic. The careful management of breeding, cultivation, production, packaging and storage also leads to high quality products.

We implemented strict quality control on each process in purchasing, storage, processing, packaging, and distribution. We keep any items that are examined in the course of quality control inspections for one year in accordance with National Technology Quality Supervision Bureau requirements. We cooperate fully with the Bureau during their random testing and examination of our products.

Packaging Capacity

Our 400 square-meter packaging facility is dust proof, moisture proof, anti-static, anti-rodent and air ventilated and is isolated from the rest of the plant. Products are transported by a hoisting machine to the packaging facility, which has four production lines: automated vacuum packaging, automated granular packaging, automated Hatta hybrid packaging and automated powder packaging. All processes in the packaging facility are enclosed to avoid contamination.

The vacuum packaging line automates measuring, bag making, filling, cutting, bag shaping, vacuum sealing, coding, counting and transmission. It accommodates 70 to 500 grams of product and packages at the speed 100 to 120 bags per minute. The granular packaging line also automates measuring, bag making, filling, cutting, bag shaping, coding, counting and transmission. It accommodates 75 to 1,000 grams of product at the speed of 90 to 120 bags per minute. The Hatta hybrid packaging line is used for packing the healthy congee and colored grains. It automates measuring, bag making, filling, cutting, bag shaping, coding, counting and transmission, and accommodates 50 to 500 grams of product at the speed of 120 to 150 bags per minute. The powder packing line is used for packaging grain flour products and automates measuring, bag making, filling, cutting, bag shaping, coding, counting and transmission, and accommodates 5 to 5,000 grams of product at the speed of 80 to 90 bags per minute.

Our product labeling complies with the Interim Measures for Labeling of Food Products of Enterprises in the Shanxi Province and the GB7718-1994 Standards for Food Products Labeling. We obtained the registration certificate (Record number SB/1407000-009-01).

14

Warehousing and Logistics Capacity

We rent two large warehouses for storage of raw materials (mainly corn): the Yuci Warehouse and the Shanxi 661 Warehouse. The total capacity of our warehouse space is greater than 50,000 tons and annual turnover is approximately 250,000 tons. In 2010, the construction of a new storage center was still in progress, which is situated on 70 mu (approximately 46,690 square meters) of land for storage of more than 70,000 tons of food products and annual turnover of greater than 350,000 tons. This warehouse will allow us to have storage capacity of more than 120,000 tons of food products and annual turnover of greater than 600,000 tons.

The cave type warehouses that we use are fully enclosed and have thermostatic and moisture proof characteristics. Each of the cave type warehouses is built with 1.5 meter thick walls and moisture proof layers. They maintain a temperature of 10 degrees Celsius throughout the year, perfectly suited for food storage. Since no air conditioning is required, the operating costs of the warehouses are low. The warehouses are equipped with infrared sensors that can accurately detect temperature changes and the presence of rodents, insects, and other pests.

Before corn can be stored in warehouses, it must undergo drying and water removal treatments. We have three sets of drying equipment allowing us to process up to 350,000 tons annually. The new storage center will be equipped with the most advanced equipment for corn drying allowing it to process 500,000 tons annually. After the drying process, the corn is packaged in bags and moved to warehouses. There, the products undergo insecticide and anti-bacterial treatments. After being sealed for 15 days and air ventilated for another 7 days, the products are then stored in enclosed warehouses.

We have an exclusive lease agreement with three railway lines for freight transportation: (a) Shanxi Cereal & Oil Group, Mingli Reservation Depot; (b) Shanxi Yuci Cereal Reservation Depot; and (c) Yuci Dongzhao Railway Freight Station. These exclusive agreements help us ensure speedy delivery of our products at a low cost (compared to truck transportation).

Research and Development

We hire a number of agricultural experts as the consultants in sectors including food processing, breeding, cultivation, nutrition and disease prevention. We, together with the Shanxi Agricultural Sciences Institute, Shanxi Agricultural University and their Institute of Seeds and Planting, established a joint laboratory for research breeding and cultivation. This laboratory also provides quality testing of our products and provides suggestions for the improvement of our products. We have also established an agricultural product research center in Beijing. Specifically, we have entered into two Agricultural Technology Cooperative Agreements. One agreement is with Sorghum Institute, Shanxi Academy of Agricultural Science for the cooperative use of technology in the cultivation and planting of grains. The other agreement is with Millet Research Institute, Shanxi Academy of Agricultural Science for the cooperation of species improvement and green planting technologies.

Our R&D team and laboratory uses a hybridization technique for breeding rather than a genetically modified approach. They have special characteristics such as strong drought resistance and resistance to pests. None of the seeds are cultivated using pesticides or chemical fertilizers. This not only reduces costs, but also increases the output and, most importantly, allows us to ensure that a portion of our crops are organic.

Research and development expenses were $73,860 and $98,087 for the years ended December 31, 2010 and 2009, respectively. We reduced our R&D expenditures in 2010 due to the fact that we discontinued a research project focused on one particular type of grain which we decided not to pursue. None of these expenditures were directly borne or reimbursed by our customers. For 2011, we expect to spend $300,000 on R&D for further product researches and improvements and new product developments.

Target Market

We focus on promoting the concept of “healthy and green”. Target customers include urban city residents who pursue healthy diets. Management believes health-oriented food products are also important to families in tier 1 and tier 2 cities in China. Beijing, Shanghai and Guangzhou are considered tier 1 cities in China because they were the first to be opened up to competitive economic development and are the most populous, affluent and competitive. Tier 2 cities, such as Tianjin, Suzhou, Dalian, Qingdao and Hangzhou, have a smaller population and are not as developed as tier 1 cities.

15

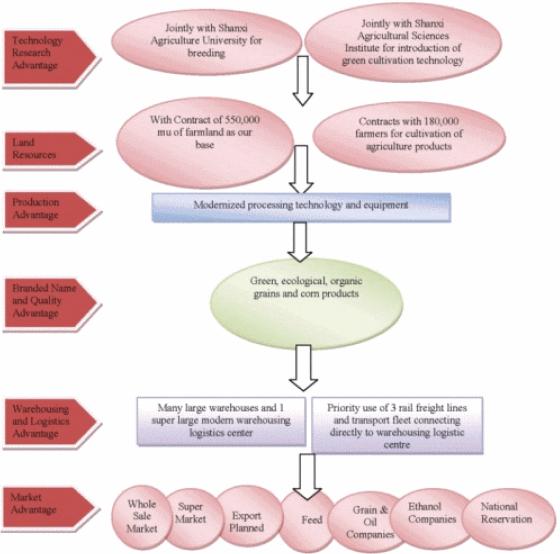

Operating Mode

We have established a large scale plantation adopting the mode of “Company + Farmers + Base”. Shanxi Province offers high quality land that supports organic growing of grains and corn. Our operating model is illustrated by the chart below:

Government Regulation

Grain Production and Sales Business

Our production, purchases and sales of grain food products are subject to the following rules and regulations in the People’s Republic of China:

|

1.

|

“The Food Safety Law of the People’s Republic of China” (the “Food Safety Law”)

|

|

2.

|

“Regulations on the Implementation of the Food Safety Law of the People’s Republic of China” (the “Regulations”)

|

|

3.

|

“Law of the People’s Republic of China on Quality and Safety of Agricultural Products” and the Food Distribution Management Ordinance.

|

16

We are engaged in the sale of packaged grain products. The supervising authority for such products is the Beijing Bureau of the Industry and Commerce. Pursuant to Regulation 29 of the Food Safety Laws, entities engaging in food production, food distribution and food service, must obtain a Food Production Permit, Food Distribution Permit and Food Service Permit. Those who have obtained the Food Production Permit are authorized to operate a food production business and are not required to apply for a Food Distribution Permit. However we have also obtained the Food Distribution Permit from the Beijing Bureau of Industry and Commerce.

We are also engaged in the production and sale of grain foods. The supervising authority for such production is the Technology Quality Supervision Bureau of Shanxi Province. Pursuant to Food Safety Laws and ancillary regulations, the nation’s Head Office of the Technology Quality Supervision Bureau supervises technology quality of enterprises which are engaged in food production. The Bureau issues Food Production Permits, undertakes mandatory examinations of technology quality for entry into the industry and is responsible for investigation of incidents regarding food safety. Pursuant to Regulation 29 of the Food Safety Laws, entities engaging in food production, food distribution and food service, must obtain the Food Production Permit, Food Distribution Permit and Food Service Permit. Those who have obtained the Food Production Permit are authorized to operate food production businesses and are not required to apply for a Food Distribution Permit. Deyu has also obtained the nation’s Industrial Production Permit from the Technology Quality Supervision Bureau (Cereals: QS140701040051 and Flour: QS140701016210). Our food labeling complies with the Interim Measures for Labeling of Food Products of Enterprises in Shanxi Province and GB7718-1994 Standards for Food Products Labeling and has obtained the relevant registration certificate (Record number SB/1407000-009-01).

Corn Purchase and Sale Business

Yuliang is engaged in the purchase and sale of raw corn products. The supervising authority for the purchase and sale of raw corn products is the State Administration of Grain. Pursuant to Regulation 6 of the Food Distribution Management Regulations announced by the State Council of PRC, the State Council Development and Reform Department and the National Food Administration Departments (the commissions National Food Authority) are responsible for the mid and long-term planning of the nation’s overall balance of foods, regulation, restructuring of important food species and food distribution. The National Food Administration Department is responsible for food distribution, guidance to the industry, oversight of the food distribution laws, regulations, policies and implementation of rules and regulations. Pursuant to Regulation 9, food operators must obtain permits and register pursuant to relevant registration regulations. We obtained the necessary Food Products Purchase Permit and operate in compliance with the relevant standards of food quality, storage, logistics and facilities.

Competitive Advantages

Unique Cultivation Environment

Shanxi Province is located on the Loess Plateau in the western part of China. The city of Jinzhong is located in the center of Shanxi Province. The topography of the regions creates optimal conditions for growing grains. Favorable weather conditions, combined with our unique and advantageous geographical conditions lead to high-quality products. There has been no serious flood or drought in the region in the past 100 years. The recent drought occurred in Northern China does not affect Company due to once a year planting season starting from April. The temperature difference between day and night is greater than 10 degrees Celsius. The weather is dry and cold. There are about 158 days without frost during the year and the growing period is longer than 135 days. The weather conditions are especially favorable for growing corn and grains. Grains are highly drought resistant. Growing grains is reliant on natural rainfall, no irrigation is required throughout the year, and no application of chemical fertilizer or pesticides is needed. Irrigation by underground water is only required in exceptional circumstances.

The northern and southern parts of Shanxi Provicne are rich in coal mines, however, there are no large coal mines or other large polluting industries in the central part of Shanxi Province, where Jinzhong is located. Jinzhong’s economy relies heavily on agriculture. Jinzhong’s cultivation lands are located in Jinzhong City.

17

Scale Production Advantage

Agricultural land for large scale farming of grains is becoming rare in China. With the support of our local government, we have adopted the operation mode of Company + Farmers + Base on a large scale. In the past three years, we signed agricultural co-operative agreements with governments of the counties and villages of Jinzhong for exclusive farming rights to approximately 90,000 acres of farmland for 20 years. Local governments arrange for farmers to grow crops on the farming land and we place orders with the farmers each year. The farmers plant according to the size of the orders and we acquire the crops after they are harvested. We do not own title to this land nor do we own the right to use this land.

Technical Support

To improve the technology in farming, breeding and cultivation, and processing, we hired 6 professors as consultants. With Shanxi Agricultural Sciences Institute and Shanxi Agriculture University and their breeding and cultivation center, we established joint laboratories for the research and development of corn and grain breeding and cultivation.

Employees

We currently have approximately 781 full time employees and various numbers of part-time employees working on a seasonal basis.

ITEM 1A. Risk Factors

This information not required for smaller reporting companies such as Deyu.

ITEM 1B. Unresolved Staff Comments

None.

ITEM 2. Properties

We rent two large warehouses for storage of raw materials (mainly corn): the Yuci Warehouse and the Shanxi 661 Warehouse. The total capacity of our warehouse space was greater than 50,000 tons and annual turnover is about 250,000 tons. In 2010, the construction of a new storage center was still in progress, which is situated on 70 mu (approximately 46,690 square meters) of land for storage of more than 70,000 tons of food products and annual turnover of greater than 350,000 tons. This warehouse allows us to have storage capacity of more than 120,000 tons of food products and annual turnover of greater than 600,000 tons.

The cave type warehouses are natural warehouses with enclosed, thermostatic and moisture proof characteristics. Each of the cave type warehouses is built with a 1.5 meter thick covering and moisture proof layers and maintains a temperature of 10 degrees Celsius throughout the year, ideal for food storage. Because no air conditioning is required, the operating costs of the warehouses are low. The warehouses are equipped with infrared detection and temperatures sensing devices which are able to accurately detect rodents, insects and temperature changes.

The standardized warehouses, new storage facilities, and cave type warehouses are located at the Yongcheng Logistics Center, Liyan County, Yuci District, Jinzhong City, PRC.

Land

We owned close to 2,000 acres of land in the Shanxi Province. The land is used for research and development; specifically, experimental breeding of seeds for potential use by the farmers we ultimately purchase corn and grain from.

On September 30, 2010 and December 20, 2010, we entered into Farmland Transfer Agreements with Shanxi Jinbei Plant Technology Co., Ltd. for the transfer of certain land use rights consisting of 53,000 mu (equivalent to 8,731 acres) and 52,337 mu (equivalent to 8,615 acres), respectively. We paid RMB19,415,000 (approximately $2,900,000) and RMB27,221,000 (approximately $4,066.000) in September 30, 2010 and December 20, 2010, respectively. Pursuant to the agreement and the terms of the land use certificates, the land use rights continue for 43 years (on average). The land will be used for agricultural planting of corn and grains.

18

ITEM 3. Legal Proceedings

We are currently not involved in any litigation that we believe could have a material adverse effect on our financial condition or results of operations. To our knowledge, there is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of our executive officers or any of our subsidiaries, threatened against or affecting our company, our common stock, any of our subsidiaries or any of our companies or our companies’ subsidiaries’ officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect.

ITEM 4. (Removed and Reserved)

19

PART II

|

ITEM 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

Market Information

Our common stock is quoted on the OTCQB under the symbol “DEYU”. There can be no assurance that a liquid market for our securities will ever develop. Transfer of our common stock may also be restricted under the securities or blue sky laws of various states and foreign jurisdictions. Consequently, investors may not be able to liquidate their investments and should be prepared to hold the common stock for an indefinite period of time.

The following table summarizes the high and low closing sales prices per share of the common stock for the periods indicated as reported on the OTCQB:

|

Closing Bid Prices

|

||||||||

|

Fiscal Year Ended December 31, 2010

|

||||||||

| High ($) | Low ($) | |||||||

|

1st Quarter (January 4 – March 31):

|

NONE

|

NONE

|

||||||

|

2rd Quarter (April 1 – June 30):

|

7.10

|

5.00

|

||||||

|

3nd Quarter (July 1 – September 30):

|

7.75

|

6.00

|

||||||

|

4th Quarter (October 1 – December 31):

|

7.00

|

3.00

|

||||||

The following table presents certain information with respect to our equity compensation plan as of December 31, 2010:

|

Number of

|

||||||||||||

|

securities remaining

|

||||||||||||

|

Number of securities

|

available for future

|

|||||||||||

|

to be issued

|

Weighted-average

|

issuance under equity

|

||||||||||

|

upon exercise of

|

exercise price of

|

compensation plans

|

||||||||||

|

outstanding options,

|

outstanding options,

|

(excluding securities

|

||||||||||

|

warrants and rights

|

warrants and rights

|

reflected in column (a))

|

||||||||||

|

Plan Category

|

(a)

|

(b)

|

(c)

|

|||||||||

|

Equity compensation plans

|

||||||||||||

|

approved by security holders

|

--

|

$

|

--

|

--

|

||||||||

|

Equity compensation plans

|

||||||||||||

|

not approved by security holders(1)

|

971,000

|

4.40

|

29,000

|

|||||||||

|

Total

|

971,000

|

$

|

4.40

|

29,000

|

||||||||

(1) On November 4, 2010, the Company’s Board of Directors approved the Company’s 2010 Share Incentive Plan. Under the Plan, 1,000,000 shares of the Company’s common stock shall be allocated to and authorized for use pursuant to the terms of the Plan. On November 8, 2010, a total of 931,000 non-qualified incentive stock options were approved by our Board of Directors and granted under the Plan to executives, key employees, independent directors, and consultants at an exercise price of $4.40 per share and on December 15, 2010, 40,000 non-qualified incentive stock shares were approved by our Board of Directors and granted under the Plan to a consultant at an exercise price of $4.40 per share, of which shall vest as follows:

33 1/3% of the option grants vested one (1) month after the date of grant;

33 1/3% of the option grants will vest twelve (12) months after the date of grant; and

33 1/3% of the option grants will vest twenty-four (24) months after the date of grant.

20

On November 5, 2011, we filed a Registration Statement with the SEC on Form S-8 covering the shares underlying the options set forth above. As of March 25, 2011, none of the options issued pursuant to the Plan have been exercised.

Performance Graph

We are a “smaller reporting company” and, as such, are not required to provide this information.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

In connection with the Share Exchange, on April 27, 2010, we issued an aggregate of 8,736,932 shares of our common stock to the shareholders of City Zone. We received in exchange from the City Zone shareholders 100% of the shares of City Zone, which exchange resulted in City Zone becoming our wholly owned subsidiary. The issuance of such securities was exempt from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under the Securities Act of 1933, as amended.

Simultaneous with the closing the Share Exchange, we entered into the Purchase Agreement with certain accredited Investors for the issuance and sale in a private placement of Units, consisting of, 2,455,863 shares of our Series A convertible preferred stock, par value $0.001 per share and Series A warrants to purchase up to 982,362 shares of our Common Stock, for aggregate gross proceeds of approximately $10,805,750. The issuances of the aforementioned securities were exempt from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under the Securities Act of 1933, as amended.

On November 4, 2010, the Company’s Board of Directors approved the Company’s 2010 Share Incentive Plan (the “Plan”). Under the Plan, 1,000,000 shares of the Company’s common stock shall be allocated to and authorized for use pursuant to the terms of the Plan. On November 8, 2010, a total of 931,000 non-qualified incentive stock options were approved by our Board of Directors and granted under the Plan to executives, key employees, independent directors, and consultants at an exercise price of $4.40 per share and on December 15, 2010, 40,000 non-qualified incentive stock shares were approved by our Board of Directors and granted under the Plan to a consultant at an exercise price of $4.40 per share, of which shall vest as follows:

33 1/3% of the option grants vested one (1) month after the date of grant;

33 1/3% of the option grants will vest twelve (12) months after the date of grant; and

33 1/3% of the option grants will vest twenty-four (24) months after the date of grant.

On November 5, 2011, we filed a Registration Statement with the SEC on Form S-8 covering the shares underlying the options set forth above. As of March 25, 2011, none of the options issued pursuant to the Plan have been exercised.

Holders of Common Equity

On March 29, 2011, we had 10,499,774 shares of common stock issued and outstanding to 14 holders of record, and the closing price of our common stock as quoted on the OTCQB was $2.90 per share. The number of record holders does not include beneficial owners of common stock whose shares are held in the names of banks, brokers, nominees or other fiduciaries.

Dividends

We have not paid cash dividends on any class of common equity since formation.

In connection with our private placement in May 2010, we issued 2,455,863 shares of our Series A convertible preferred shares and warrants exercisable into 982,362 shares of common stock to certain Investors. Pursuant to the terms of our Series A convertible preferred share designations, the holders of our Series A convertible preferred shares are entitled to receive cumulative dividends at a rate of 5% per annum, and such shares of Series A convertible preferred stock are convertible into shares of our common stock on a 1:1 basis, subject to applicable adjustments. On July 22, 2010, we distributed a cumulative Series A convertible preferred share dividend of $96,051 in aggregate, to such holders of Series A convertible preferred stock on a pro rata basis and on January 27, 2011, we issued a second Series A convertible preferred share dividend equal to $231,670, in the aggregate, to such holders of Series A convertible preferred stock on a pro rata basis.

21

ITEM 6. Selected Financial Data

We are a “smaller reporting company” and, as such, are not required to provide this information.

ITEM 7. Management‘s Discussion and Analysis of Financial Condition and Results of Operations

Forward Looking Statements

The following is management’s discussion and analysis of certain significant factors which have affected our financial position and operating results during the periods included in the accompanying consolidated financial statements, as well as information relating to the plans of our current management. This Annual Report includes forward-looking statements. Generally, the words “believes ”, “anticipates”, “ may ”, “ will ”, “ should ”, “ expect ”, “ intend ”, “estimate”, “continue” and similar expressions or the negative thereof or comparable terminology are intended to identify forward-looking statements. Such statements are subject to certain risks and uncertainties, including the matters set forth in this Annual Report or other reports or documents we file with the SEC from time to time, which could cause actual results or outcomes to differ materially from those projected. Undue reliance should not be place on these forward-looking statements which speak only as of the date hereof. We undertake no obligation to update these forward-looking statements.

The following discussion and analysis should be read in conjunction with our consolidated financial statements and the related notes thereto and other financial information contained elsewhere in this Annual Report.

Summary of our Business

We are a Beijing, China-based producer and seller of organic and non-organic, ready-to-eat and ready-to-drink “simple processed” and “deep processed” grain consumer products which are sold in approximately 10,000 supermarkets and convenient stores throughout China. We are also one of the dominant organic and non-organic agricultural product distributors in Shanxi Province engaged in procuring, processing, marketing and distributing various grain and corn products and byproducts.

We have experienced high growth in both revenue and net income. Operating revenue for the year ended December 31, 2010 was $89,175,633, representing a 119% increase from $40,732,447 for the year ended December 31, 2009. Our net income for the year ended December 31, 2010 was $11,502,252, representing a 60% increase from $7,181,132 for the year ended December 31, 2009.

Our continuous growth relies on our ability to meet the increasing demand for our current products and our expanded product lines. Management has developed strategies and taken actions to keep up with demands and foreseeable ones. Such actions include working with farmers to increase current yields, focusing on our ability to enter into new cooperative agreements, signing contracts with new farmer agents, and expanding geographically in Shanxi Province, land acquisitions, building production sites and warehouses, or even consider mergers and acquisitions of suppliers of some of our products (although we are currently not a party to any such negotiations or agreements), vendors, or competitors if considered necessary or bargain purchase.

As a result of our recent Control Agreements whereby we now control Deyufarm, our deep processed grain products are higher margin products than our rough processed corn. As such, we have increased our efforts to enter into supermarkets in tier 1 and tier 2 cities in China. Additionally, based upon our perceived and historical growing demand for our deep processed grain products, the changing dietary demands, and the increase in health and nutrition consciousness of the Chinese people, we believe we have a unique opportunity to substantially increase our revenues, net income and gross margins. Management has also begun an initial evaluation of the viability of exporting our deep processed grain products to other countries, such as Japan and the United States.

22

We believe significant factors that could affect our operating results are the (a) cost of raw materials, (b) prices and margins of our products to our retailers and their markup to the end users, (c) consumer acceptance of our deep processed grain products, (d) general economic conditions in China, and (e) the changing dietary habits of the people of China towards our quality organic food.

Our goal for 2011 is to develop the business model comprised of three major pieces: corn division, simple and deep processed grain divisions, and non-processed and unpacked grains sold in retail stores. Together that would result in significant growth. We will shift some capital from corn division to unpacked grain business. At the same time, we rely on our strengths, competitive edges and support to our corn customers to keep up the revenues. On the other hand, all of increased distribution channels and brand name recognition out of sales and marketing initiatives and momentum we gain from simple and deep processed grain products would help tremendously on this unpacked grain business. In addition, the ERP system we implemented to strength and better our procurement capability and accuracy, particularly for retail side of business, would boost up our flexibility and accuracy to eventually increase our business and quality of accounting and internal control. Meanwhile, the B2B and B2C E-Commerce we built will further enhance our selling capability which should attract especially our current or new wholesale customers who can register as members by paying membership fees to attain lower pricing. This initiative would help encourage them to order high volume and help our cash flows at the same time.

Plan of Operation

With the corn business being matured and stable and yet increasing demand yearly, we have acquired two pieces of farmland of approximately 17,300 acres of ownership rights between 40 to 47 years at the end of 2010 for a total of approximately $7 million to secure the supply and quality of crops for both grains and corn. The growing season for these parcels commences in April 2011. As a result, we believe we have achieved economies of scale through exclusive rights of use to over 109,000 acres of some of China’s most fertile agricultural land, including ownership rights to approximately 19,000 acres. Since demand of both simple processed and deep processed grain products is increasing through our expanding sales network and brand name recognition, we are increasing the land coverage of our growing base and also our production base for deep processed products. To achieve that, we are constructing warehouses in Shanxi Province and a new plant in the outskirts of Beijing.

In the coming year 2011, for sales and marketing strategy, instead of rapidly increasing the number of stores selling our products across Beijing and China as a whole, we have shifted our focus on promoting our name brand and products regionally, and increasing customer purchases on a per store basis.

Since we have been successful of promoting and selling our products through all of our distribution channels and networks, including B2B and B2C E-Commerce, and our brand names are becoming widely known, to support this growth, the Company has carefully planned to build more warehouses and plants and to acquire companies in the future that either fit in or expand Deyu product lines. It also helps ease requests by many of our wholesalers and retail stores for providing other non-existing Deyu product lines. Thus, we plan to make a few strategic acquisitions per year vertically or horizontally to sell either under our own brands name or theirs through our distribution networks.

Critical Accounting Policies and Estimates

This discussion and analysis of financial condition and results of operations has been prepared by management based on our consolidated financial statements, which have been prepared in accordance with US GAAP. The preparation of these financial statements requires management to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues, and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, management evaluates our critical accounting policies and estimates, including those related to revenue recognition, valuation of accounts receivable, property and equipment, long-lived assets, intangible assets, derivative liabilities and contingencies. Estimates are based on historical experience and on various assumptions believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. These judgments and estimates affect the reported amounts of assets and liabilities and the reported amounts of revenue and expenses during the reporting periods.

23

We consider the following accounting policies important in understanding our operating results and financial condition:

Use of Estimates

The preparation of the consolidated financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Management makes its estimates based on historical experience and various other assumptions and information that are available and believed to be reasonable at the time the estimates are made. Therefore, actual results could differ from those estimates under different assumptions and conditions.

Long-Lived Assets