Attached files

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

[X]

|

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

|

[ ]

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ___________ to ___________

Commission File No. 333-1258321

5BARz International Inc.

(Name of small business issuer in its charter)

|

Nevada

|

26-4343002

|

|

(State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification No.)

|

|

25910 Acero, Suite 370

Mission Viejo, California

|

92691

|

|

(Address of principal executive offices)

|

(Zip Code)

|

949-916-3261

(Registrant’s telephone number, including area code)

|

Securities registered under Section 12(b) of the Exchange Act:

|

|

|

Title of each class registered:

|

Name of each exchange on which registered:

|

|

None

|

None

|

|

Securities registered under Section 12(g) of the Exchange Act:

|

|

|

Common Stock, par value $0.001

(Title of class)

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. Yes [ ] No [X]

Check whether the issuer is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by checkmark if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III if this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

Large Accelerated Filer [ ] Accelerated Filer [ ] Non-Accelerated Filer [ ] Smaller Reporting Company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act: Yes [ ] No [X ]

State issuer's revenues for its most recent fiscal year: None.

Number of shares of the registrant’s common stock outstanding as of March 31, 2011 was 88,569,800

DOCUMENTS INCORPORATED BY REFERENCE: None

5BARz International Inc.

Form 10-K

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements. Forward-looking statements include those that address activities, developments or events that we expect or anticipate will or may occur in the future. All statements other than statements of historical facts contained in this Annual Report, including statements regarding our future financial position, business strategy, budgets, projected costs and plans and objectives of management for future operations, are forward-looking statements. These statements reflect the current views of management with respect to future events and are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from those described in the forward-looking statements. Such risks and uncertainties include those set forth under the captions "Risk Factors" beginning on page 2, "Management's Discussion and Analysis of Financial Condition and Results of Operations" beginning on page 7, and elsewhere in this Annual Report. We undertake no obligation to update or revise our forward-looking statements, whether as a result of new information, future events or otherwise. We advise you to carefully review the reports and documents we file from time to time with the Securities and Exchange Commission (the "SEC"), particularly our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K.

As used in this Annual Report, the terms "we," "us," "our," "5BARz" and the "Company" mean 5BARz International Inc. and its subsidiaries, unless otherwise indicated. All dollar amounts in this Annual Report are expressed in U.S. dollars, unless otherwise indicated.

The disclosures set forth in this report should be read in conjunction with the financial statements and notes thereto of the Company for the year ended December 31, 2010. Because of the nature of a relatively new and growing company, the reported results will not necessarily reflect the operating results that will be achieved in the future.

The 5BARz patent pending technology provides the first, plug and play, consumer electronic product that will capture cell signal, amplify it and resend that signal all within a device the size of your clock radio, giving you clear voice and data cell service throughout your home, your office or when you are mobile.

On December 30, 2010, the Registrant, 5Barz International Inc., a Nevada corporation, (“5BARz”), acquired, pursuant to an Assignment Agreement from Dollardex Group Corp., a Panamanian Corporation, all right title and interest in a set of agreements comprised of an “Amended and Restated Master Global Marketing and Distribution Agreement”, an “Asset Purchase Agreement”, a “Line of Credit Agreement” and a “Security Agreement”, collectively referred to as “The Agreements”. The Agreements, relate principally to the development of the sales and marketing of the 5BARz™ line of products and related accessories, and the acquisition of a 50% interest in the underlying intellectual property, by 5Barz International Inc.

The 5BARz business opportunity to bring this state of the art technology to market represents a significant step forward in the deployment of micro-cell technology, often referred to as ‘cellular network extenders” in the industry. A step that management believes will significantly improve the functionality of cellular networks by managing cellular signal within the vicinity of the user. This technology facilitates cellular usage in areas where structures, create “cellular shadows” or weak spots within metropolitan areas, and also serves to amplify cellular signal as users move away from cellular towers in urban areas. The market potential of the technology is far reaching.

Company History

5BARz International Inc. was incorporated on November 17, 2008 and is a Nevada Corporation. On December 30, 2010 the Company acquired the “Master Global Marketing and Distribution Agreement” for the marketing and distribution of 5BARz products throughout the world. In addition to the acquisition of the marketing and distribution rights, the Company entered into an agreement for the acquisition of a 50% interest in the underlying intellectual property comprising the 5BARz products, and hold a security interest over the balance of those assets.

Prior to December 30, 2010 the Registrant was a designated shell Company pursuant to section 12B-2 of the exchange act, and operated under the name Bio-Stuff.

Milestones

2007: A 5BARz working prototype was developed of an affordable consumer friendly single piece plug ‘n play booster with a minimum of 45dB of gain in both up and down paths.

July 22, 2008: Dollardex Group entered into an exclusive “Master Global Marketing and Distribution Agreement” (the “Distribution Agreement”) for the 5BARz products..

July 2009: First production run and FCC Certification of 5BARz Road Warrior

August 2009: Field testing and final modification of 5BARz Road Warrior

January 2010: 5BARz Road Warrior Selected as CES Innovations 2010 Design and Engineering Award. Marketing commenced in the US.

January 2011: 5BARz International Inc. acquires the “Master Global Marketing and Distribution Agreement” for the marketing and distribution of 5BARz products throughout the world, and enters into agreement for the acquisition of a 50% interest in the underlying intellectual property.

The Market Opportunity

The market opportunity for the 5Barz technology represents some 4.8 billion cell phone subscribers worldwide and is growing as a result of the following factors;

|

·

|

Dead zones, weak signals, and dropped calls are the biggest problems in the industry. Now, by adding internet and video, the quality issue is increasing exponentially.

|

|

·

|

76% of cellular subscribers use their mobile phone as the primary phone

|

|

·

|

More consumers are using mobile phones for web browsing, up and down- loading photos, videos and music

|

|

·

|

More mobile phones are operating at higher frequencies which have less ability to penetrate buildings

|

|

·

|

Weak signals make internet applications inaccessible and slow and increase the drain on cell phone batteries.

|

|

·

|

Forty percent of all mobile phone users report inadequate service in their homes or office and we estimate that 60% of the 4 billion mobile phone users worldwide consider continuous connectivity to be very important.

|

Intellectual property

5BARz technology is based on achieving unique isolation between antennas, without oscillation greatly improving signal gain for individual, home and office coverage.

|

Title

|

Patent Application

|

|

Cell Phone Signal Booster

|

11/625331

|

|

Dual Cancellation Loop Wireless Repeater

|

12/106468

|

|

Wireless Repeater Management Systems

|

12/328076

|

|

Dual Loop Active and Passive Repeater Antenna Isolation Improvement

|

12/425615

|

|

5BARz Trademark

|

78/866260

|

|

Multi-Band Wireless Repeater

|

12/235313

|

|

Antenna Docking Station

|

61/118103

Provisional

|

|

Control Beacon Transmission for Base Station Repeaters

|

61/140171

Provisional

|

Competition

Traditional Solutions

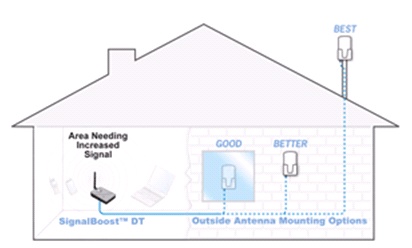

The cell phone booster industry started about a decade ago as a cottage industry for select users. That industry was estimated to be approximately a $150 million/year industry. The solution was a three step solution comprised of a power booster, external antenna which required installation outside of ones residence or office, 15 to 100 feet of cable and an inside antennae sending the signal. The cost of the unit installed ranged from $4000 to $2,500, and operated on either single or multiple carriers.

Carrier Solution

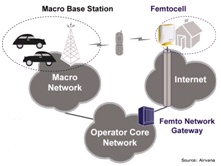

The Solution that was selected more recently by AT&T (microcell), Sprint (Airave) T-Mobile no longer selling one, and Verizon (network extender), is a solution referred to as FEMTO Cell technology. This again is a three step solution which utilizes a high speed internet link to bring your cell signal into your home or office which in itself is an issue. The solution is a carrier only solution, it degrades your internet signal for other uses, is limited by the requirement for phone lines or other lines, costs $150 to $300 to purchase with ongoing monthly cost.

Femtocell

5BARz Technology

The 5Barz technology is a one step, easy to use solution which is a truly a consumer product. There are no external antennas or installation required, it operates on all carriers and for a multitude of cellular devices including 3G and 4G devices. Most importantly this highly engineered device is transparent to carrier networks, which is becoming an increasingly critical factor.

For signal boosters to maintain network transparency, at a minimum, two key elements are essential; 1) maintain stability, and 2) maintain signal fidelity.

Stability

In the industry, there have been concerns with the stability of signal boosters both from a design and installation standpoint. It is important to eliminate sources of instability in the design, and have detection capability and algorithms in place to squelch any oscillations that could occur from poor installation. CelLynx designs meet both these requirements. CelLynx is conservative in design, and in continuous monitoring.

By Design

The main concerns for design related stability issues are inherent gain stage stability and controlling bi-directional loop gain.

Stage-by-Stage Design

In addition to basic in-band matching, the paper design of each gain stage contains a stability analysis over a wide operating frequency range ensuring the device is stable up to the point where its gain is negligible. This is done for each stage in the amplifier. During prototype testing, these stability results are confirmed. In addition to room temperature, testing includes temperature extremes. This combination of analysis and prototype testing provides great confidence that the inherent amplifier stages are stable.

Signal Fidelity

The CelLynx booster signal fidelity is excellent, and the output spectrum is well within the FCC requirements.

Summary

CelLynx designed 5BARz technology to guarantee stability, then added proper firmware to eliminate set-up and environmental problems. CelLynx products substantiate that a cell signal booster can be installed in real-world field applications and remain stable with linear operation. CelLynx products are network compatible by design.

Comparative Analysis

|

5BARz

|

Femtocell

|

Traditional Repeaters

|

|

|

Options for Consumer

|

· Plug and play solutions that significantly improve wireless service

|

· Carrier-specific box that connects to the internet through the broadband service at the home and acts like a short-range network tower site

|

· Bi-directional amplifier and external antennasInstallation of antennas required with minimum spacing of 35 feet or more between the antennas

|

|

Easy to Understand

|

· Simply place the unit where there is some or marginal wireless service, turn on the unit and the voice and data wireless service is improved for everyone

|

· Connect the unit to your broadband service where your router is located and the voice only wireless service should be improved throughout the home

|

· Need to determine what the two pieces of equipment, cables, and multiple power cords are for

· Complex manual … Determine the ideal location for both antennas, outdoor network antenna and indoor coverage antenna, then determine ideal location for the bi-directional amplifier for proper cable routing to the antennas

|

|

Cost

|

· One-time equipment charge only$299 5BARz Road Warrior

|

· Equipment charge $250 for each carrier, 2 carrier house equals $500 equipment charge Equipment won’t work if you change carriers Possible monthly fee Requires use of broadband service

|

· Equipment charge starting at $350 for dual band Professional installation starting at $200Higher performance antennas starting at $100

|

|

Setup

|

· Plug ‘n play No adjustments One part works for all carriers

|

· Carrier-specific set up May require ISP support Currently Voice Only

|

· Go on roof to measure signal level; outdoor network antenna placement based on testing for 2 bars or more signal strength Antennas need to be spaced 35 feet or more apart

|

|

Reliability

|

· Designed by engineers and brought to production by managers trained in the Six Sigma quality process Self contained, fewest cables/connectors

· Oscillation suppression circuitry

|

· Broadband vulnerable: Degraded broadband throughput Power outage Depends

on carrier down/power down on carrier command Intermittent handoffs with macro

network

|

· External antennas less reliable Connectors Outdoor mounting Oscillation prone

|

|

Installation

|

· None; Plug ‘n play

|

· Needs to be collocated with broadband service GPS antenna may need to be installed near a window with a cable going to the femtocell

|

· Professional installation recommended

|

Marketing Strategy

5Barz International Inc. will be deploying a multi–faceted marketing strategy. The US market is clearly dominated by cellular service providers which makes available to the Company their primary source for market penetration. To that end the Company are developing a growing group of professional, seasoned marketing executives, that are capable of introducing and deploying a sophisticated marketing strategy working with the highest levels of executive within the cellular service providers and integrating the 5Barz solutions into their marketing infrastructure.

In addition, a number of specific target markets exist throughout the US based upon factors such as specific needs (US Coast Guard and Homeland Security, trucking industry, recreational vehicles and boats) as well as geographic parameters such as dead zones in inner cities, and most all rural areas. These specific target markets will be penetrated by sales representatives working in a dual capacity whereby they will make direct sales calls on initial recognized target markets and develop in the long term to become the Company’s customer service representatives, dealing with all customers within specific geographic areas.

Once initial market penetration has been established, the Company will expand its marketing focus to national and local retailers, and employ more broad based marketing programs such as television infomercials to vastly expand its market reach. Further, the Company has a view to OEM integration of its technology in the future.

Variations of this roll out will be implemented in other countries based upon the maturity of the industry in that country, profile of the industry leaders such as cellular providers, the general economy in these countries and consumers purchasing capability. A key factor with respect to the timing of opening in new countries is the price sensitivity in that new country, recognizing that the Company will experience substantive reduction in production costs as volume increases and efficiencies of production are achieved. In addition, as the frequency at which cell phones operate vary in different regions of the world, marketing will be aligned with production capability at those variable frequencies.

Need For Additional Financing

The Company has very limited funds, and such funds may not be adequate to take advantage of current and planned business opportunities. Even if the Company's funds prove to be sufficient to acquire an interest in, or complete upon transactions contemplated, the Company may not have enough capital to fully develop the opportunity. The ultimate success of the Company may depend upon its ability to raise additional capital. As additional capital is needed, there is no assurance that funds will be available from any source or, if available, that they can be obtained on terms acceptable to the Company. If not available, the Company's operations will be limited and may be

Ability to continue as a going concern.

The Company has accrued net losses of $53,230 for the period from inception November 14, 2008, to December 31, 2010. The Company has earned no revenues to date. Consequently the Company’s future is dependent upon their ability to obtain financing and to execute upon their business plan and to create future profitable operations for the business. These factors raise substantial doubt that the Company will be able to continue as a going concern. In the event that the Company cannot raise further debt or equity capital, or achieve profitable operations, the Company may have to liquidate their business interests and investors may lose their investment.

Lack of profitable operating history

The Company faces all of the risks of a new business and the special risks inherent in the investigation, acquisition, and involvement in a new business opportunity. The Company must be regarded as a new or "start-up" venture with all of the unforeseen costs, expenses, problems, and difficulties to which such ventures are subject, and consequently has a high risk or failure.

Dependance upon a sole director and limited management and consultants

The Company currently has only one individuals serving as its officer and director, and few employees and consultants. The Company will be heavily dependent upon their skills, talents, and abilities to implement its business plan, and secure additional personnel and may, from time to time, find that the inability of the officers and directors to fully meet the needs of the business of the Company results in a delay in progress toward implementing its business plan.

We may conduct further offerings in the future in which case investors' shareholdings may be diluted.

Since our inception, we have relied on sales of our common stock to fund our operations. We may conduct further equity offerings in the future to finance our current operations. If common stock is issued in return for additional funds, the price per share could be lower than that paid by our current stockholders. We anticipate continuing to rely on equity sales of our common stock in order to fund our business operations. If we issue additional stock, investors' percentage interests in us will be diluted. The result of this could reduce the value of current investors' stock.

Regulation of Penny Stocks.

The Company's securities, are subject to a Securities and Exchange Commission rule that imposes special sales practice requirements upon broker-dealers who sell such securities to persons other than established customers or accredited investors. For purposes of the rule, the phrase "accredited investors" means, in general terms, institutions with assets in excess of $5,000,000, or individuals having a net worth in excess of $1,000,000 or having an annual income that exceeds $200,000 (or that, when combined with a spouse's income, exceeds $300,000). For transactions covered by the rule, the broker-dealer must make a special suitability determination for the purchaser and receive the purchaser's written agreement to the transaction prior to the sale. Consequently, the rule may affect the ability of broker- dealers to sell the Company's securities and also may affect the ability of purchasers in this offering to sell their securities in any market that might develop therefore.

In addition, the Securities and Exchange Commission has adopted a number of rules to regulate "penny stocks." Such rules include Rules 3a51-1, 15g-1, 15g-2, 15g-3, 15g-4, 15g-5, 15g-6, 15g-7, and 15g-9 under the Securities Exchange Act of 1934, as amended. Because the securities of the Company may constitute "penny stocks" within the meaning of the rules, the rules would apply to the Company and to its securities. The rules may further

affect the ability of owners of Shares to sell the securities of the Company in any market that might develop for them.

Shareholders should be aware that, according to Securities and Exchange Commission, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (i) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (ii) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (iii) "boiler room" practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (iv) excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and (v) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. The Company's management is aware of the abuses that have occurred historically in the penny stock market. Although the Company does not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to the Company's securities.

Our common stock is not listed on a national exchange and as a public market develops in the future, it may be limited and highly volatile, which may generally affect any future price of our common stock.

Our common stock currently is listed only in the over-the-counter market on the OTCBB, which is a reporting service and not a securities exchange. We cannot assure investors that in the future our common stock would ever qualify for inclusion on any of the NASDAQ markets for our common stock, The American Stock Exchange or any other national exchange or that more than a limited market will ever develop for our common stock. The lack of an orderly market for our common stock may negatively impact the volume of trading and market price for our common stock.

Any future prices for our common stock will be determined in the marketplace and may be influenced by many factors, including the following:

|

·

|

the depth and liquidity of the markets for our common stock;

|

|

·

|

investor perception of 5BARz International Inc. and the industry in which we participate;

|

|

·

|

general economic and market conditions;

|

|

·

|

statements or changes in opinions, ratings or earnings estimates made by brokerage firms or industry analysts relating to the market in which we do business or relating to us specifically, as has occurred in the past;

|

|

·

|

quarterly variations in our results of operations;

|

|

·

|

general market conditions or market conditions specific to technology industries; and

|

|

·

|

domestic and international macroeconomic factors.

|

In addition, the stock market has recently experienced extreme price and volume fluctuations. These fluctuations are often unrelated to the operating performance of the specific companies. As a result of the factors identified above, a stockholder (due to personal circumstances) may be required to sell his shares of our common stock at a time when our stock price is depressed due to random fluctuations, possibly based on factors beyond our control.

Impracticability of Exhaustive Investigation.

The Company's limited funds and the lack of full-time management will likely make it impracticable to conduct a complete and exhaustive investigation and analysis of its chosen business opportunity before the Company commits its capital or other resources thereto. Management decisions, therefore, will likely be made without detailed feasibility studies, independent analysis, market surveys and the like which, if the Company had more funds available to it, would be desirable.

Other Regulation.

The Company may be subject to regulation or licensing by federal, state, or local authorities. Compliance with such regulations and licensing can be expected to be a time-consuming, expensive process and may limit other investment opportunities of the Company.

Failure to Perform

The Company may be unable to comply with the payment terms of certain agreements providing the Company with the exclusive sales marketing and distribution rights to 5BARz product. In the event that the Company defaults on such agreements, the Company may be unable to maintain operations as a going concern.

Reliance on Third parties

The Company has entered into certain agreements related to the exclusive sales marketing and distribution rights. In the event that the production Company is unable or unwilling for any reason to supply product under the terms of such agreement, the Company may not be able distribute product or may have business interrupted as they secure alternative production facilities.

Competitive Technologies

The Companies technology relates to a market that is highly competitive and a much sought after solution by cellular networks. The Company expects to be at a disadvantage when competing with firms that have substantially greater financial and management resources and capabilities than the Company. The Company is subject to technological obsolescence should other technologies be developed which are superior to the Companies technology.

Item 1B. Unresolved Staff Comments

None.

Item 2. Description of Properties

Our property consists of office space located at 25910 Acero, Suite 370, Mission Viejo, California, 92691. Currently, this space is sufficient to meet our needs; however, as we expand our business and continue to hire employees, we will have to find a larger space for our offices and also other locations to meet market growth in other geographic locations.

Item 3. Legal Proceedings

Management is not aware of any legal proceedings contemplated by any governmental authority or any other party involving us or our properties. As of the date of this Quarterly Report, no director, officer or affiliate is (i) a party adverse to us in any legal proceeding, or (ii) has an adverse interest to us in any legal proceedings. Management is not aware of any other legal proceedings pending or that have been threatened against us or our properties.

Item 4. Submission of Matters to a Vote of Security Holders

None.

Item 5. Market for Registrants Common Equity; Related Stockholder Matters and Issuer Purchase of Equity Securities

Our common stock trades on the OTC Bulletin Board system under the symbol “BARZ”. The stock commenced trading in October 2010.

The High/Low price at which the stock traded during the three months period ended December 31, 2010 are as follows;

High - $0.08 Low - $0.008

The prices provided above reflect the share trading price after adjusting for the retroactive adjustment for an 18 for 1 forward stock split which occurred on November 15, 2010.

Holders of Record

As of March 30, 2011, the last sale price of our common stock on the OTCBB was $1.49 per share. As of March 30, 2011, there were approximately 55 stockholders of record holding 88,569,800 shares.

Dividend Policy

We have neither paid nor declared dividends on our common stock since our inception and do not plan to pay dividends in the foreseeable future. Any earnings that we may realize will be retained to finance our growth

Forward Stock Split

On November 15, 2010, the Company approved a forward split of its common stock, par value $0.001, at a ratio of 18-for-1 (the "Forward Split"), at which time each share of common stock was automatically reclassified as and converted into 18 shares of common stock. Each stockholder’s percentage ownership in the Company and proportional voting power remained unchanged by the Forward Split. In connection with the Forward Split, an amendment to the Company’s Articles of Incorporation was approved increasing the number of authorized shares of common stock from 100,000,000 to 250,000,000. For comparability purposes, all references to BARz stock within this document have been adjusted to reflect the effects of the Forward Split, unless otherwise indicated.

Stock Cancellation

On December 30, 2010, the Company cancelled eighty-seven million eight hundred thousand shares (87,800,000) of its issued and outstanding common stock (the “Common Stock”) held by Daniel Bland, the sole officer and director of the Company. Immediately following the cancellation, the Company had seventy-one million nine hundred sixty-nine thousand eight hundred (71,969,800) shares of issued and outstanding Common Stock.

Private Placement

On March 30, 2011 the Company completed a private placement of 1,000,000 common shares to an accredited investor for aggregate proceeds of $1,000,000. The Company issued the securities pursuant to a Regulation “S” exemption from registration.

Equity Compensation Plans

The Company has no equity compensation plans nor any other form of commitments which would require issuance of the Company’s common stock.

Item 6. Selected Financial Data

Not applicable for smaller reporting company.

Item 7. Management’s Discussion and Analysis of Financial Condition and Result of Operations

You should read the following discussion together with our consolidated financial statements and the related notes and other financial information included elsewhere in this report. The discussion in this report contains forward-looking statements that involve risks and uncertainties, such as statements of our plans, objectives, expectations and intentions. The cautionary statements made in this report should be read as applying to all related forward-looking statements wherever they appear in this report. Our actual results could differ materially from those discussed here.

Overview

5BARz International is the exclusive distributor of a proprietary line of Cellular Network Extenders developed by CelLynx under the 5BARz brand. These highly engineered products are state of the art consumer electronics that manage cell signal within the proximity of the user. The devices are plug and play, without the need for extensive set up, and are carrier agnostic. The first product brought to market is the 5BARz Road Warrior, a plug and play device designed for users on the go. As the acquisition of the assets comprising this area of business occurred on December 30, 2010, the Company has just commenced the development of the financing, sales and marketing activities required to launch this business globally.

The financial and business analysis below provides information we believe is relevant to an assessment and understanding of our financial position, results of operations and cash flows. This financial and business analysis should be read in conjunction with the financial statements and related notes included in this form 10-K.

Going Concern

The registrant has an accumulated deficit through December 31, 2010 totaling $53,230 and recurring losses and negative cash flows from operations. Because of these conditions, the registrant will require additional working capital to develop its business operations. The registrant's success will depend on its ability to raise money through debt and the sale of stock to meet its cash flow requirements. The ability to execute its strategic plan is contingent upon raising the necessary cash to

1) Complete the acquisition of the intellectual property from Cellynx for proceeds of $1,239,556.

2) Comply with the commitment to provide to Cellynx a line of credit of $2,500,000; and,

3) Settle the liability to Dollardex Group Corp. for the assignment of the Global Sales and Marketing agreement et all in the amount of $370,000 and

4) Raise the necessary working capital to launch the global sales and marketing activities for the Company.

Management believes that the market sector that it is developing remains buoyant despite the general economic down turn. Further, the efforts the Company has made to promote its business has received favorable support to date and we expect that to will continue for the foreseeable future. If the Company’s capital raising efforts do not continue to be successful, the registrant's ability to continue as a going concern will be in question.. The financial statements do not include any adjustments relating to the recoverability and classification of asset carrying amounts or the amount and classification of liabilities that might be necessary should the registrant be unable to continue as a going concern.

Results of Operations

The total operating expenses for the year ended December 31, 2010 were $29,099 (2009 - $16,421). Legal and professional fees for the year ended December 31, 2010 were $24,856 (2009 – $12,091). This is the result of the activities related to the listing of the Company’s securities to trade on the OTCBB during the quarter as well as the costs associated with the acquisition of assets comprising the business of the Company.

We generated no revenue and recorded no bad debt expense during the year ended December 31, 2010. For the year ended December 31, 2010, other expense of $4,068 (2009 - $4,097) were incurred as general operating expenses as the Company maintained its listing activities and commenced the organization of it’s pending sales and marketing development. The Company incurred amortization of organizational costs of $175 which with an expensingof an additional $718 wrote off that item from the balance sheet of the Company. Net loss for the year ended December 31, 2010 totaled $29,122 (2009 - $19,220). For the period from inception, November 17, 2008 through December 31, 2010, net loss for the Company was $53,230 total operating expenses for the corresponding period was $50,357. Professional fees for the period November 17, 2008 (Inception) through December 31, 2010 were $41,697. We generated no revenue and recorded no bad debt expense during the period November 17, 2008 (Inception) through December 31, 2010. Other income (expense) was $$2,873 during the period November 17, 2008 (Inception) through December 31, 2010. Income tax expense (benefit) during the period November 17, 2008 (Inception) through December 31, 2010 was $0.

Critical Accounting Policies and Estimates

Our Management’s Discussion and Analysis of Financial Condition and Results of Operations section discusses our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results may differ from these estimates.

Liquidity and Capital Resources

As at December 31, 2010

As at the year ended December 31, 2010, our current assets were $0 and our current liabilities were $1,898,385, which resulted in a working capital deficiency of ($1,898,385). As at the year ended December 31, 2010, current liabilities were comprised of: (i) $15,220 in accounts payable and accrued expenses; and (ii) $8,602 in advances from shareholders (iii) $1,439,566 due to Cellynx for intellectual property and (iv) $434,997 due to a related party.

As at the year ended December 31, 2010, our total assets were $1,883,650 comprised of: (i) $0 in current assets; and (ii) $1,883,650 comprised of the cost of a 50% interest in the 5BARz intellectual property.

As at the year ended December 31, 2010, our total liabilities were $1,898,385 (2009 - $1,430) consisting entirely of current liabilities. This increase in liabilities over 2009 represents the cost of the 5BARz intellectual property acquired.

Stockholders’ equity decreased from $737 for fiscal year ended December 31, 2009 to stockholders’ deficit of $14,735 for the year ended December 31, 2010.

We believe we can satisfy our cash requirements for the next twelve months with equity financing or loans. Subsequent to December 31, 2010 the Company has raised equity capital by way of Private Placements of $1,000,000 at a price of $1.00 per share, completed on March 30, 2011.

We anticipate that our operational and general and administrative expenses for the next 12 months will total approximately $7,000,000. Which includes the balance due for the intellectual property acquisitions and line of credit aggregating $3,940,000 made available to Cellynx. When sufficient financing is received, we will add additional management and sales personnel. However, we do not intend to increase our staff until such time as we can raise the capital or generate revenues to support the additional costs. At this time we have not entered into any agreements or negotiations with a sales and marketing entity to undertake marketing for us. The foregoing represents our best estimate of our cash needs based on current planning and business conditions. The exact allocation, purposes and timing of any monies raised in subsequent private financings may vary significantly depending upon the exact amount of funds raised and our progress with the execution of our business plan.

Limited Operating History

We have a limited operating history and consequently we cannot guarantee that the expansion efforts described in this report will be successful. Our business is subject to risks inherent in growing an enterprise, including limited capital resources and possible rejection of our new products and/or sales methods.

Inventory

We currently do not have any inventories.

Revenue Recognition

We have not earned any revenue to date.

Going Concern

The independent auditors' report accompanying our financial statements contains an explanatory paragraph expressing substantial doubt about our ability to continue as a going concern. The financial statements have been prepared "assuming that we will continue as a going concern," which contemplates that we will realize our assets and satisfy our liabilities and commitments in the ordinary course of business.

Management believes that actions presently being taken to obtain additional funding and implement its strategic plans provide the opportunity for us to continue as a going concern.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

Market risk is the risk of loss from adverse changes in market prices and interest rates. We do not have substantial operations at this time so they are not susceptible to these market risks. If, however, they begin to generate substantial revenue, their operations will be materially impacted by interest rates and market prices.

5BARZ INTERNATIONAL, INC.

Formerly BIO-STUFF

Index to Financial Statements

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

F-1

|

|

|

Balance Sheet:

December 31, 2010 and 2009

|

F-2

|

|

|

Statements of Operations:

For the year ended December 31, 2010 and 2009

|

F-3

|

|

|

Statements of Stockholders' Deficit:

For the year ended December 31, 2010 and 2009

|

F-4

|

|

|

Statements of Cash Flows:

For the year ended December 31, 2010 and 2009

|

F-5

|

|

|

Notes to Financial Statements:

December 31, 2010

|

F-6

|

THOMAS J. HARRIS

CERTIFIED PUBLIC ACCOUNTANT

3901 STONE WAY N., SUITE 202 SEATTLE, WA 98103 206.547.6050

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors

5BARZ INTERNATIONAL, INC.

Blaine, WA

We have audited the balance sheets of 5BARZ INTERNATIONAL, INC. a development stage company, as at DECEMBER 31, 2009 and 2008, the statements of earnings and deficit, stockholders’ deficiency and cash flows for the periods from inception November 14, 2008 to DECEMBER 31, 2010 and 2009. Theses financial statements are the responsibility of the company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that I plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for my opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of 5BARZ INTERNATIONAL, INC. a development stage company, as of December 31, 2010 and the results of its operations and its cash flows for the period then ended in conformity with generally accepted accounting principles accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the company will continue as a going concern. As discussed in Note 2, the company’s significant operating losses, working capital deficiency and need for new capital raise substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Thomas J Harris, CPA

March 30, 2011

F-1

| 5BARZ INTERNATIONAL, INC. | ||||||||

| Formerly BIO-STUFF | ||||||||

| (A Development Stage Enterprise | ) | |||||||

| Balance Sheet | ||||||||

|

December 31,

|

December 31,

|

|||||||

|

2010

|

2009

|

|||||||

|

ASSETS

|

||||||||

|

Current assets:

|

||||||||

|

Cash

|

$ | - | $ | 1,274 | ||||

|

Accounts receivable

|

- | - | ||||||

|

Inventory

|

- | - | ||||||

|

Total current assets

|

- | 1,274 | ||||||

|

Fixed Assets

|

||||||||

|

Furniture and Equipment

|

- | - | ||||||

|

Computer Equipment

|

||||||||

|

Leasehold Improvements

|

||||||||

|

Total Fixed Assets

|

- | - | ||||||

|

Less Accumulated Depreciation

|

||||||||

|

Net Fixed Assets

|

- | - | ||||||

|

Other Assets

|

||||||||

|

Organizational expenses

|

- | 893 | ||||||

|

Intellectual property

|

1,883,650 | |||||||

|

Total Other Assets

|

1,883,650 | 893 | ||||||

|

Total assets

|

$ | 1,883,650 | $ | 2,167 | ||||

|

LIABILITIES

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable and accrued expenses

|

$ | 15,220 | $ | 250 | ||||

|

Advances from shareholder

|

8,602 | 1,180 | ||||||

|

Related party loans

|

434,997 | |||||||

|

Note Payable

|

1,439,566 | |||||||

|

Total current liabilities

|

1,898,385 | 1,430 | ||||||

|

Total liabilities

|

1,898,385 | 1,430 | ||||||

|

STOCKHOLDERS' EQUITY

|

||||||||

|

Common stock, $.001 par value, 250,000,000 (100,000,000 in 2009),

|

||||||||

|

authorized and 87,569,800 (8,876,100 in 2009) shares issued and outstanding

|

87,570 | 8,876 | ||||||

|

Capital in excess of par value

|

(49,075 | ) | 15,969 | |||||

|

Stock subscription receivable

|

- | - | ||||||

|

Deficit accumulated during the development stage

|

(53,230 | ) | (24,108 | ) | ||||

|

Total stockholders' equity

|

(14,735 | ) | 737 | |||||

|

Total liabilities and stockholders' equity

|

$ | 1,883,650 | $ | 2,167 | ||||

F-2

| 5BARZ INTERNATIONAL, INC. | ||||||||||||

| Formerly BIO-STUFF | ||||||||||||

| (A Development Stage Enterprise | ) | |||||||||||

| Statements of Operations | ||||||||||||

|

Cumulative,

|

||||||||||||

|

Inception,

|

||||||||||||

|

November 17,

|

||||||||||||

|

2008 Through

|

Year-ended

|

Year-ended

|

||||||||||

|

December 31,

|

December 31,

|

December 31,

|

||||||||||

|

2010

|

2010

|

2009

|

||||||||||

|

Sales

|

$ | - | $ | - | $ | - | ||||||

|

Cost of Sales

|

- | - | - | |||||||||

|

Cost of Sales

|

- | - | - | |||||||||

|

General and administrative expenses:

|

||||||||||||

|

Salaries

|

- | |||||||||||

|

Depreciation and Amortization

|

447 | 175 | 233 | |||||||||

|

Legal and professional fees

|

41,697 | 24,856 | 12,091 | |||||||||

|

Demo Expense

|

3,000 | 3,000 | ||||||||||

|

Filing fees and investor expenses

|

3,783 | 3,783 | ||||||||||

|

Other general and administrative

|

1,430 | 285 | 1,097 | |||||||||

|

Total operating expenses

|

50,357 | 29,099 | 16,421 | |||||||||

|

(Loss) from operations

|

(50,357 | ) | (29,099 | ) | (16,421 | ) | ||||||

|

Other income (expense):

|

||||||||||||

|

Interest Income

|

- | - | ||||||||||

|

Currency Income/(losses)

|

(2,155 | ) | 695 | (2,799 | ) | |||||||

|

Other expenses

|

(718 | ) | (718 | ) | ||||||||

|

(Loss) before taxes

|

(53,230 | ) | (29,122 | ) | (19,220 | ) | ||||||

|

Provision (credit) for taxes on income

|

- | - | ||||||||||

|

Net (loss)

|

$ | (53,230 | ) | $ | (29,122 | ) | $ | (19,220 | ) | |||

|

|

||||||||||||

|

Basic earnings (loss) per common share

|

$ | (0.0033 | ) | $ | (0.0022 | ) | ||||||

|

Weighted average number of shares outstanding

|

8,876,100 | 8,876,000 | ||||||||||

F-3

| 5BARZ INTERNATIONAL, INC. | ||||||||||||||||||||||||

| Formerly BIO-STUFF | ||||||||||||||||||||||||

| (A Development Stage Enterprise | ) | |||||||||||||||||||||||

| Statements of Stockholders' Equity | ||||||||||||||||||||||||

|

Deficit

|

||||||||||||||||||||||||

|

Accumulated

|

||||||||||||||||||||||||

|

Capital in

|

Stock

|

During the

|

||||||||||||||||||||||

|

Common Stock

|

Excess of

|

Subscription

|

Development

|

|||||||||||||||||||||

|

Shares

|

Amount

|

Par Value

|

Receivable

|

Stage

|

Total

|

|||||||||||||||||||

|

Inception, November 17, 2008

|

||||||||||||||||||||||||

|

Founder Shares Issued

|

7,100,000 | $ | 7,100 | $ | - | $ | - | $ | - | $ | 7,100 | |||||||||||||

|

Shares Issued

|

1,776,100 | 1,776 | 15,969 | 17,745 | ||||||||||||||||||||

|

Stock subscription receivable

|

(425 | ) | (425 | ) | ||||||||||||||||||||

|

Development state net loss

|

(4,888 | ) | (4,888 | ) | ||||||||||||||||||||

|

Balances, December 31, 2008 (audited)

|

8,876,100 | 8,876 | 15,969 | (425 | ) | (4,888 | ) | 19,532 | ||||||||||||||||

|

Subscription receivable received

|

425 | 425 | ||||||||||||||||||||||

|

Development stage net loss

|

(19,220 | ) | (19,220 | ) | ||||||||||||||||||||

|

Balances, December 31, 2009 (audited)

|

8,876,100 | 8,876 | 15,969 | - | (24,108 | ) | 737 | |||||||||||||||||

|

Initiated 18:1 stock split, November 2010

|

150,893,700 | 150,894 | (150,894 | ) | - | |||||||||||||||||||

|

Shares cancelled, December 2010

|

(87,800,000 | ) | (87,800 | ) | 87,800 | - | ||||||||||||||||||

|

Shares issued

|

15,600,000 | 15,600 | (1,950 | ) | 13,650 | |||||||||||||||||||

|

Development stage net loss

|

(29,122 | ) | (29,122 | ) | ||||||||||||||||||||

|

Balances, December 31, 2010

|

87,569,800 | $ | 87,570 | $ | (49,075 | ) | $ | - | $ | (53,230 | ) | $ | (14,735 | ) | ||||||||||

F-4

| 5BARZ INTERNATIONAL, INC. | ||||||||||||

| Formerly BIO-STUFF | ||||||||||||

| (A Development Stage Enterprise | ) | |||||||||||

| Statements of Cash Flows | ||||||||||||

|

Cumulative,

|

||||||||||||

|

Inception,

|

||||||||||||

|

November 17,

|

|

|||||||||||

|

2008 Through

|

||||||||||||

|

December 31,

|

December 31,

|

December 31,

|

||||||||||

|

2010

|

2010

|

2009

|

||||||||||

|

Cash flows from operating activities:

|

||||||||||||

|

Net (loss)

|

$ | (53,230 | ) | $ | (29,122 | ) | $ | (19,220 | ) | |||

|

Adjustments to reconcile net (loss) to cash

|

||||||||||||

|

provided (used) by developmental stage activities:

|

||||||||||||

|

Depreciation and Amortization

|

- | 233 | ||||||||||

|

Change in current assets and liabilities:

|

||||||||||||

|

Inventory

|

- | - | ||||||||||

|

Deposits

|

- | - | ||||||||||

|

Accounts payable and accrued expenses

|

15,220 | 14,970 | (4,500 | ) | ||||||||

|

Net cash flows from operating activities

|

(38,010 | ) | (14,152 | ) | (23,487 | ) | ||||||

|

Cash flows from investing activities:

|

||||||||||||

|

(Purchase)/abandonment of other assets

|

- | 893 | - | |||||||||

|

Purchase of intellectual property

|

(1,883,650 | ) | (1,883,650 | ) | ||||||||

|

Net cash flows from investing activities

|

(1,883,650 | ) | (1,882,757 | ) | - | |||||||

|

Cash flows from financing activities:

|

||||||||||||

|

Proceeds from sale of common stock

|

38,495 | 13,650 | 425 | |||||||||

|

Advances from shareholder

|

8,602 | 7,422 | - | |||||||||

|

Related party loans

|

1,874,563 | 1,874,563 | ||||||||||

|

Net cash flows from financing activities

|

1,921,660 | 1,895,635 | 425 | |||||||||

|

Net cash flows

|

- | (1,274 | ) | (23,062 | ) | |||||||

|

Cash and equivalents, beginning of period

|

- | 1,274 | 24,336 | |||||||||

|

Cash and equivalents, end of period

|

$ | - | $ | - | $ | 1,274 | ||||||

|

Supplemental cash flow disclosures:

|

||||||||||||

|

Cash paid for interest

|

$ | - | $ | - | $ | - | ||||||

|

Cash paid for income taxes

|

- | - | - | |||||||||

F-5

5BARZ INTERNATIONAL INC.

(Formely Bio-Stuff)

(A development stage enterprise)

Notes to Financial Statements

December 31, 2010

Note 1 - Organization and summary of significant accounting policies:

Following is a summary of the Company’s organization and significant accounting policies:

Organization and nature of business – 5BARz International Inc. (formerly Bio-Stuff), (“We,” or “the Company”) is a Nevada corporation incorporated on November 17, 2008.

The Company has acquired an interest in certain intellectual property and has entered into a global sales and distribution agreement on December 30, 2010 which provides for the global sales and marketing of products produced under the 5BARz brand. The 5BARz technology and products are comprised of a highly engineered microcell technology often referred to as “cellular network extenders.”

Prior thereto, the Company was a designated “shell Company” holding certain technology related to biodegradable product.

The Company has been in the development stage since its formation and has not yet realized any revenues from its planned operations.

Basis of presentation – Our accounting and reporting policies conform to U.S. generally accepted accounting principles applicable to development stage enterprises. Changes in classification of 2010 amounts have been made to conform to current presentations.

Use of estimates -The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Cash and cash equivalents -For purposes of the statement of cash flows, we consider all cash in banks, money market funds, and certificates of deposit with a maturity of less than three months to be cash equivalents.

Property and Equipment – The Company values its investment in property and equipment at cost less accumulated depreciation. Depreciation is computed primarily by the straight line method over the estimated useful lives of the assets ranging from five to thirty-nine years.

Fair value of financial instruments and derivative financial instruments – We have adopted Accounting Standards Codification regarding Disclosure About Derivative Financial Instruments and Fair Value of Financial Instruments. The carrying amounts of cash, accounts payable, accrued expenses, and other current liabilities approximate fair value because of the short maturity of these items. These fair value estimates are subjective in nature and involve uncertainties and matters of significant judgment, and, therefore, cannot be determined with precision. Changes in assumptions could significantly affect these estimates. We do not hold or issue financial instruments for trading purposes, nor do we utilize derivative instruments in the management of foreign exchange, commodity price or interest rate market risks.

Federal income taxes - Deferred income taxes are reported for timing differences between items of income or expense reported in the financial statements and those reported for income tax purposes in accordance with Accounting Standards Codification regarding Accounting for Income Taxes, which requires the use of the asset/liability method of accounting for income taxes. Deferred income taxes and tax benefits are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases, and for tax loss and credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Deferred taxes are provided for the estimated future tax effects attributable to temporary differences and carryforwards when realization is more likely than not.

F-6

5BARZ INTERNATIONAL INC.

(Formely Bio-Stuff)

(A development stage enterprise)

Notes to Financial Statements

December 31, 2010

Net income per share of common stock – We have adopted Accounting Standards Codification regarding Earnings per Share, which requires presentation of basic and diluted EPS on the face of the income statement for all entities with complex capital structures and requires a reconciliation of the numerator and denominator of the basic EPS computation to the numerator and denominator of the diluted EPS computation. In the accompanying financial statements, basic earnings per share of common stock is computed by dividing net income by the weighted average number of shares of common stock outstanding during the period. We do not have a complex capital structure requiring the computation of diluted earnings per share.

Note 2 - Uncertainty, going concern:

At December 31, 2010, the Company was engaged in a business and had suffered losses from development stage activities to date. In addition, the Company has minimal operating funds. Although management is currently attempting to identify business opportunities and is seeking additional sources of equity or debt financing, there is no assurance these activities will be successful. Accordingly, we must rely on our officers to perform essential functions without compensation until a business operation can be commenced. No amounts have been recorded in the accompanying financial statements for the value of officers’ services, as it is not considered material.

These factors raise substantial doubt about the ability of the Company to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Note 3 - Federal income tax:

We follow Accounting Standards Codification regarding Accounting for Income Taxes. Deferred income taxes reflect the net effect of (a) temporary difference between carrying amounts of assets and liabilities for financial purposes and the amounts used for income tax reporting purposes, and (b) net operating loss carryforwards. No net provision for refundable Federal income tax has been made in the accompanying statement of loss because no recoverable taxes were paid previously. Similarly, no deferred tax asset attributable to the net operating loss carryforward has been recognized, as it is not deemed likely to be realized.

The provision for refundable Federal income tax consists of the following:

|

2010

|

2009

|

|||||||

|

Refundable Federal income tax attributable to:

|

||||||||

|

Current operations

|

$ | (29,122 | ) | $ | (19,220 | ) | ||

|

Less, Nondeductible expenses

|

-0- | -0- | ||||||

|

-Less, Change in valuation allowance

|

29,122 | 19,220 | ||||||

|

Net refundable amount

|

- | |||||||

F-7

5BARZ INTERNATIONAL INC.

(Formely Bio-Stuff)

(A development stage enterprise)

Notes to Financial Statements

December 31, 2010

The cumulative tax effect at the expected rate of 35% of significant items comprising our net deferred tax amount are as follows:

|

2010

|

2009

|

|||||||

|

Deferred tax asset attributable to:

|

||||||||

|

Net operating loss carryover

|

$ | 9,901 | $ | 2,883 | ||||

|

Less, Valuation allowance

|

(9,901 | ) | (2,883 | ) | ||||

|

Net deferred tax asset

|

- | - | ||||||

At December 31, 2010, an unused net operating loss carryover approximating $53,230 is available to offset future taxable income; those losses start to expire in 2028.

Note 4 – Cumulative sales of stock:

Since its inception, we have issued shares of common stock as follows:

On November 17, 2008, our Directors authorized the issuance of 7,100,000 founder shares at par value of $0.001. These shares are restricted under rule 144 of the Securities Exchange Commission.

On various days in December 2008, our Directors authorized the issuance of 1,776,100 shares of common stock at a price of $0.01 per share as fully paid and non-assessable to the subscriber. These shares are not restricted and are free trading.

On November 15, 2010, the Company’s majority shareholder approved a forward stock split of 18:1 and increased the authorized shares from 100,000,000 to 250,000,000

On December 30, 2010, the Company cancelled 87,800,000 shares of common stock.

On December 31, 2010, the Directors issued 15,600,000 shares in conjunction with the acquisition of certain assets, more fully described in Note 5

Note 5 – Asset acquisition Agreement:

On December 31, 2010, the Company acquired the assignment of four agreements providing the right title and interest in;

(i) An “Amended and Restated Master Global Marketing and Distribution Agreement.”

(ii) An asset purchase agreement

(iii) A line of credit agreement

(iv) A security agreement

The agreements relate principally to the development of the sales and marketing of the 5BARz line of products and related accessories.

F-8

5BARZ INTERNATIONAL INC.

(Formely Bio-Stuff)

(A development stage enterprise)

Notes to Financial Statements

December 31, 2010

The purchase of this assignment agreement was made for proceeds of $383,650, which is comprised of a note payable of $370,000 and the issuance of 15,600,000 shares of common stock. The note payable bears no interest and has no specific terms of repayment.

Pursuant to the terms of the asset purchase agreement, the Company is obligated to a series of payments for a ½ interest in the 5BARz intellectual property for aggregate payments of $1,500,000. Payable as follows;

(a) $200,000 which shall be credited from the advance by the Buyer to the Seller pursuant to the Line of Credit Agreement, and which shall be paid on or before February 28, 2011;

(b) $300,000 to be paid on or before March 31, 2011; and

(c) $1,000,000 to be paid on or before April 30, 2011.

All payments required under this agreement are current.

The agreement was assigned by a Company, the Director of which is a Director of the reporting enterprise. This is a related party transaction.

Note 6 – Related Party Transactions:

On December 30, 2010 the Company acquired by way of an assignment agreement all right title and interest in a set of agreements from a Company of which the Director is also the Director of the reporting Company, more fully described in Note 5 above. The proceeds to be paid for that assignment agreement is comprised of a note payable in the amount of $370,000, and the issuance of 15,600,000 shares of common stock. The note payable bears no interest and has no specific terms of repayment.

On December 31, 2010 the Company had an additional amount due to a shareholder of the Company of $8,602 (2009 - $1,180). The loan is non interest bearing and has no fixed terms of repayment.

NOTE 7 – Commitments:

On December 30, 2010 the Company entered into a commitment to provide to the co-owner of the Company’s intellectual property a revolving line of credit in the amount of $2.5 million dollars payable as follows;

| (i) | $200,000 on or before February 17, 2011 |

|

(ii)

|

$1,300,000 on or before March 31, 2011; and

|

|

(iii)

|

$1,000,000 on or before April 30, 2011;

|

F-9

5BARZ INTERNATIONAL INC.

(Formely Bio-Stuff)

(A development stage enterprise)

Notes to Financial Statements

December 31, 2010

NOTE 8 – Subsequent events

On January 7, 2011 the Company entered into a stock purchase agreement from two shareholders of Cellynx Group, Inc. to acquire in aggregate 63,412,638 shares of the capital stock of Cellynx Group, Inc. a Company that owns a ½ interest in the intellectual property comprising the 5BARz technology. That acquisition represents a 34% equity interest in Cellynx Group, Inc. and is made for total proceeds of $634,126. To date the Company has paid $100,000 on January 7, 2011 and a further $70,000 on March 9, 2011. The final payment of $464,126 is due by April 7, 2011 to complete the acquisition.

On March 30, 2011 the Company completed a private placement of 1,000,000 common shares to an accredited investor for aggregate proceeds of $1,000,000. The Company issued the securities pursuant to a Regulation “S” exemption from registration.

Note 9 - New accounting pronouncements:

In May 2008, the Accounting Standards Codification issued 944.20.15, “Accounting for Financial Guarantee Insurance Contracts-and interpretation of Accounting Standards Codification 944.20.05”. Accounting Standards Codification 944.20.15 clarifies how Accounting Standards Codification 944.20.05 applies to financial guarantee insurance contracts, including the recognition and measurement of premium revenue and claims liabilities. This statement also requires expanded disclosures about financial guarantee insurance contracts. Accounting Standards Codification 944.20.15 is effective for fiscal years beginning on or after December 15, 2008, and interim periods within those years. Accounting Standards Codification 944.20.15 has no effect on the Company’s financial position, statements of operations, or cash flows at this time.

In March 2008, the Accounting Standards Codification issued 815.10.15, Disclosures about Derivative Instruments and Hedging Activities—an amendment of Accounting Standards Codification 815.10.05. This standard requires companies to provide enhanced disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative instruments and related hedged items are accounted for under 815.10.15 and its related interpretations, and (c) how derivative instruments and related hedged items affect an entity’s financial position, financial performance, and cash flows. This Statement is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008, with early application encouraged. The Company has not yet adopted the provisions of Accounting Standards Codification 815.10.15, but does not expect it to have a material impact on its consolidated financial position, results of operations or cash flows.

In December 2007, the Accounting Standards Codification 815.10.65, Noncontrolling Interests in Consolidated Financial Statements—an amendment of Accounting Standards Codification 810.10.65. This statement amends Accounting Standards Codification 810.10.65 to establish accounting and reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. It clarifies that a noncontrolling interest in a subsidiary is an ownership interest in the consolidated entity that should be reported as equity in the consolidated financial statements. Before this statement was issued, limited guidance existed for reporting noncontrolling interests. As a result, considerable diversity in practice existed. So-called minority interests were reported in the consolidated statement of financial position as liabilities or in the mezzanine section between liabilities and equity. This statement improves comparability by eliminating that diversity. This statement is effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008 (that is, January 1, 2009, for entities with calendar year-ends). Earlier adoption is prohibited. The effective date of this statement is the same as that of the related Accounting Standards Codification 805.10.10 (revised 2007). The Company will adopt this Statement beginning March 1, 2009. It is not believed that this will have an impact on the Company’s consolidated financial position, results of operations or cash flows.

F-10

5BARZ INTERNATIONAL INC.

(Formely Bio-Stuff)

(A development stage enterprise)

Notes to Financial Statements

December 31, 2010

In February 2007, the Accounting Standards Codification, issued Accounting Standards Codification 810.10.65, The Fair Value Option for Financial Assets and Liabilities—Including an Amendment of Accounting Standards Codification 320.10.05. This standard permits an entity to choose to measure many financial instruments and certain other items at fair value. This option is available to all entities. Most of the provisions in Accounting Standards Codification 810.10.65 are elective; however, an amendment to Accounting Standards Codification

320.10.05 Accounting for Certain Investments in Debt and Equity Securities applies to all entities with available for sale or trading securities. Some requirements apply differently to entities that do not report net income. Accounting Standards Codification 810.10.65 is effective as of the beginning of an entities first fiscal year that begins after November 15, 2007. Early adoption is permitted as of the beginning of the previous fiscal year provided that the entity makes that choice in the first 120 days of that fiscal year and also elects to apply the provisions of SFAS No. 157 Fair Value Measurements. The Company will adopt Accounting Standards Codification 810.10.65 beginning March 1, 2008 and is currently evaluating the potential impact the adoption of this pronouncement will have on its consolidated financial statements.

In September 2006, the Accounting Standards Codification issued Accounting Standards Codification 820.10.05, Fair Value Measurements This statement defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles (GAAP), and expands disclosures about fair value measurements. This statement applies under other accounting pronouncements that require or permit fair value measurements, the Board having previously concluded in those accounting pronouncements that fair value is the relevant measurement attribute. Accordingly, this statement does not require any new fair value measurements. However, for some entities, the application of this statement will change current practice. This statement is effective for financial statements issued for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. Earlier application is encouraged, provided that the reporting entity has not yet issued financial statements for that fiscal year, including financial statements for an interim period within that fiscal year. The Company will adopt this statement March 1, 2008, and it is not believed that this will have an impact on the Company’s consolidated financial position, results of operations or cash flows.

F-11

Item 9. Changes in and Disagreements with Accountants on Accounting and Financing Disclosure

Our accountants are Thomas J Harris CPA, independent certified public accountants. We do not presently intend to change accountants. At no time have there been any disagreements with such accountants regarding any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure.

Item 9A. Controls and Procedures

Evaluation of disclosure controls and procedures

Under the supervision and with the participation of our management, including our principal executive officer and principal financial officer, we conducted an evaluation of our disclosure controls and procedures, as such term is defined under Rule 13a-15(e) and Rule 15d-15(e) promulgated under the Securities Exchange Act of 1934, as amended (Exchange Act), as of December 31, 2009. Based on this evaluation, our principal executive officer and principal financial officers have concluded that our disclosure controls and procedures are effective to ensure that information required to be disclosed by us in the reports we file or submit under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms and that our disclosure and controls are designed to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is accumulated and communicated to our management, including our principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING