Attached files

| file | filename |

|---|---|

| EX-32.2 - Asia Carbon Industries, Inc. | ex32-2.htm |

| EX-31.2 - Asia Carbon Industries, Inc. | ex31-2.htm |

| EX-31.1 - Asia Carbon Industries, Inc. | ex31-1.htm |

| EX-32.1 - Asia Carbon Industries, Inc. | ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ___________to __________

Commission file number 333-167090

Asia Carbon Industries, Inc.

(Exact name of registrant as specified in its charter)

|

Maryland

|

26-2895795

|

|

|

State or other jurisdiction of

Incorporation or organization

|

(I.R.S. Employer

Identification No.)

|

|

110 Wall Street, 11th Floor, New York, New York

|

10005

|

|

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (646) 623-6999

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. x Yes ¨ No

|

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. x Yes ¨ No

|

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company x |

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). o Yes x No

|

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

The aggregate market value of the voting and non-voting common stock of the issuer held by non-affiliates as of December 31, 2010 was approximately $21,346,573.26 (20,928,013 shares of common stock held by non-affiliates) based upon the closing price of $1.02 per share of common stock as quoted by OTC Bulletin Board on March 29, 2011.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

¨ Yes ¨ No

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

The number of shares of common stock outstanding as of March 29, 2011 is 50,608,077.

Table of Contents

|

|

Page

|

|

|

PART I

|

||

|

Item 1.

|

2 | |

|

Item 1A.

|

19 | |

|

Item 1B.

|

31 | |

|

Item 2.

|

31 | |

|

Item 3.

|

32 | |

|

Item 4.

|

32 | |

|

PART II

|

||

|

Item 5.

|

33 | |

|

Item 6.

|

35 | |

|

Item 7.

|

36 | |

|

Item 7A.

|

41 | |

|

Item 8.

|

41 | |

|

Item 9.

|

42 | |

|

Item 9A.

|

42 | |

|

Item 9B.

|

42 | |

|

PART III

|

||

|

Item 10.

|

43 | |

|

Item 11.

|

48 | |

|

Item 12.

|

49 | |

|

Item 13.

|

50 | |

|

Item 14.

|

50 | |

|

PART IV

|

||

|

Item 15.

|

51 | |

Cautionary Statement Regarding Forward Looking Statements

The discussion contained in this Annual Report on Form 10-K contains “forward-looking statements” within the meaning of Section 27A of the United States Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the United States Securities Exchange Act of 1934, as amended, or the Exchange Act. Any statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases like “anticipate,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “target,” “expects,” “management believes,” “we believe,” “we intend,” “we may,” “we will,” “we should,” “we seek,” “we plan,” the negative of those terms, and similar words or phrases. We base these forward-looking statements on our expectations, assumptions, estimates and projections about our business and the industry in which we operate as of the date of this Form 10-K. These forward-looking statements are subject to a number of risks and uncertainties that cannot be predicted, quantified or controlled and that could cause actual results to differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. Statements in this Form 10-K describe factors, among others, that could contribute to or cause these differences. Actual results may vary materially from those anticipated, estimated, projected or expected should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect. Because the factors discussed in this Form 10-K could cause actual results or outcomes to differ materially from those expressed in any forward-looking statement made by us or on our behalf, you should not place undue reliance on any such forward-looking statement. New factors emerge from time to time, and it is not possible for us to predict which will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. Except as required by law, we undertake no obligation to publicly revise our forward-looking statements to reflect events or circumstances that arise after the date of this Form 10-K or the date of documents incorporated by reference herein that include forward-looking statements.

PART I

|

Business

|

Corporate History

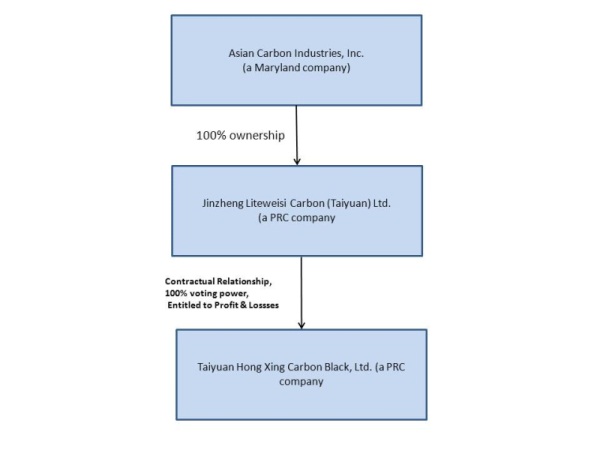

Asia Carbon Industries, Inc. (the "Company") was incorporated in the State of Maryland on June 23, 2008. Through the steps described below, we became the indirect holding company for Taiyuan Hongxing Carbon Black, Ltd. ("Hongxing"), a manufacturer of carbon black products in the People's Republic of China ("PRC"), on December 29, 2009.

On November 10, 2008, we formed Liteweisi as our wholly-owned subsidiary and a "wholly foreign-owned enterprise" in the PRC.

The laws of the PRC place certain restrictions on round trip investments, which are defined under PRC law as an acquisition of a PRC entity by an offshore special purpose vehicle owned by one or more PRC residents. To comply with these restrictions, on December 29, 2009, we, through Liteweisi, entered into a Entrusted Management Agreement, Exclusive Option Agreement, Exclusive Purchase Agreement, Pledge of Equity Agreement and Shareholders’ Voting Proxy Agreement (collectively, the “Entrusted Agreements”) with Hongxing and shareholders of Hongxing, Guoyun Yan and Chunde Meng (the “Hongxing Shareholders”). Asia Carbon issued 36,239,394 restricted shares of its common stock to Karen Prudente, nominee and trustee for the Hongxing Shareholders, for Hongxing and the Hongxing Shareholders entering into the Entrusted Agreements. Karen Prudente’s role with respect to the restricted shares held by the Hongxing Shareholders is to manage the trust of the Hongxing Shareholders. These restricted shares issued to Karen Prudente were issued in reliance upon the exemptions set forth in Section 4(2) of the Securities Act of 1933, as amended, on the basis that they were issued under circumstances not involving a public offering. As a result of the aforementioned transaction, the Hongxing Shareholders obtained control of the Company.

Generally, we provide Hongxing with technology consulting and management services pursuant to the Entrusted Agreements, the material terms are as follows:

|

·

|

Entrusted Management Agreement – pursuant to this agreement entered into by and among the Hongxing Shareholders, Hongxing, and Liteweisi, the Hongxing Shareholders and Hongxing entrust the management of Hongxing to Liteweisi until (a) the winding up of Hongxing, (b) the termination date of the agreement as determined by the parties, or (c) the date on which Liteweisi acquires Hongxing. During the term, Liteweisi is fully and exclusively responsible for the management of Hongxing. In consideration of such services, the Hongxing Shareholders and Hongxing will pay a fee to Liteweisi as set forth in the agreement.

|

|

·

|

Exclusive Option Agreement – pursuant to this agreement entered into by and among Liteweisi, the Hongxing Shareholders, and Hongxing, the Hongxing Shareholders grant Liteweisi an irrevocable exclusive purchase option to purchase all or part of the shares of Hongxing, currently owned by any of the Hongxing Shareholders. Further, Hongxing grants Liteweisi an irrevocable exclusive purchase option to purchase all or part of the assets and business of Hongxing. Liteweisi and the Hongxing Shareholders will enter into relevant agreements regarding the price of acquisition based on the circumstances of the exercise of the option, and the consideration shall be refunded to Liteweisi or Hongxing at no consideration in an appropriate manner decided by Liteweisi. Upon the exercise of the option, Liteweisi will be subject to non-competition restrictions as set forth in the agreement.

|

|

·

|

Exclusive Purchase Agreement – pursuant to this agreement entered into by and among Liteweisi and Hongxing, Hongxing grants to Liteweisi the sole and exclusive right of purchasing all the products produced and manufactured by Hongxing at a price which is equal to the total cost of the products subject to adjustments by the parties’ mutual written agreement.

|

|

·

|

Pledge of Equity Agreement –pursuant to this agreement entered into by and among the Hongxing Shareholders (as Pledgors), and Liteweisi (as Pledgee), the equity interest of the Hongxing Shareholders is pledged to guarantee all of the rights and interest Liteweisi is entitled to under the Entrusted Management Agreement, the Exclusive Option Agreement, and the Shareholders’ Voting Proxy Agreement. The Hongxing Shareholders pledge, by way of a first priority pledge, all of its rights, title and interest in (i) 100% of the equity interest in Hongxing, (ii) 100% of the registered capital of Hongxing, (iii) all investment certificates and other documents in respect of the registered capital of Hongxing, (iv) all money, dividends, interest and benefits at any time arising in respect of all the equity interest and registered capital of Hongxing, and (v) all voting rights and all other rights and benefits attaching to or accruing to the equity interst of the registered capital of Hongxing to Liteweisi.

|

|

·

|

Shareholders’ Voting Proxy Agreement – pursuant to this agreement entered into by and among the Hongxing Shareholders and Liteweisi, the Hongxing Shareholders irrevocably appoint the persons designated by Liteweisi with the exclusive right to exercise, on their behalf, all of their voting rights of Hongxing. The persons designated by Liteweisi shall be the full board of directors of Liteweisi.

|

When we sell our equity or borrow funds we expect the proceeds will be forwarded to Hongxing and accounted for as a loan to Hongxing and eliminated during consolidation. We may also use the proceeds to repurchase our capital stock or for our corporate overhead expenses. If we borrow funds we expect to be the primary obligor on any debt. For example, in April 2010 we raised $1,368,464, and in May 2010, we raised $1,667,984 in two private placements from certain non-affiliated accredited investors in a private placement of our common stock. Net proceeds after our expenses were provided to Hongxing through Liteweisi.

The Entrusted Agreements empowered Asia Carbon, through Liteweisi, the ability to substantially influence Hongxing’s daily operations and financial affairs, appoint its senior executives and approve all matters requiring shareholders’ approval. As a result of these Entrusted Agreements, which obligates Asia Carbon to absorb a majority of the risk of loss from Hongxing’s activities and enable Asia Carbon to receive a majority of its expected residual returns, Asia Carbon, through its wholly-owned subsidiaries, accounts for Hongxing as its Variable Interest Entity (“VIE”) under ASC 810-10. Accordingly, Asia Carbon consolidates Hongxing’s operating results, assets and liabilities.

By causing our subsidiary Liteweisi to enter into the Entrusted Agreements, we obtained substantially the same result as a direct share exchange, which is to permit us to consolidate the financial results of Hongxing as our VIE.

The following diagram sets forth the current corporate structure of the Company:

Neither Asia Carbon nor Liteweisi has any operations or plans to have any operations in the future other than acting as a holding and management company for Hongxing and raising capital for its operations. However, we reserve the right to change our operating plans regarding Asia Carbon and Liteweisi.

History of Hongxing

Hongxing, the primary entity through which we operate our business, was formed on December 4, 2003 as a limited liability company under the laws of the PRC, under the approval of Shanxi Development and Reform Commission. In December 2009, Hongxing and Liteweisi, a wholly-owned subsidiary of Asia Carbon, entered into a number of contractual agreements by which Liteweisi was entrusted to manage and operate Hongxing. These contractual agreements, described in further detail above, also provide for the consolidation of the financial statements of Asia Carbon, Liteweisi, and Hongxing.

Business of Hongxing

We are a holding company that, through our wholly-owned subsidiary Liteweisi and our variable interest entity ("VIE") Hongxing, manufactures in the PRC a series of high quality carbon black products under the brand name “Great Double Star.”

According to Company research, we are one of the top ten carbon black producers in Shanxi Province in China and have relationships with a high-profile customer base. Revenue and net income have grown consistently since inception, and in the fiscal year ended December 31, 2010, we reported revenues of $29.7 million, a 44% increase over the year 2009, and $3.27 million in net income, a 10% increase compared to 2009.

Carbon black is a deep black powder with a number of applications. Derived from the controlled combustion of coal tar or residual oil feedstock, carbon black’s desirable chemical properties make it a critical raw material for many industries. It is widely used within the rubber industry as reinforcing filler; the paint and coating industry use carbon black as coloring agent and it is used in batteries as a conductive agent. Carbon black is used predominately by the automotive tire industry, where it can improve rubber’s strength, wear resistance, and life span, and thus lower the overall cost of tire products.

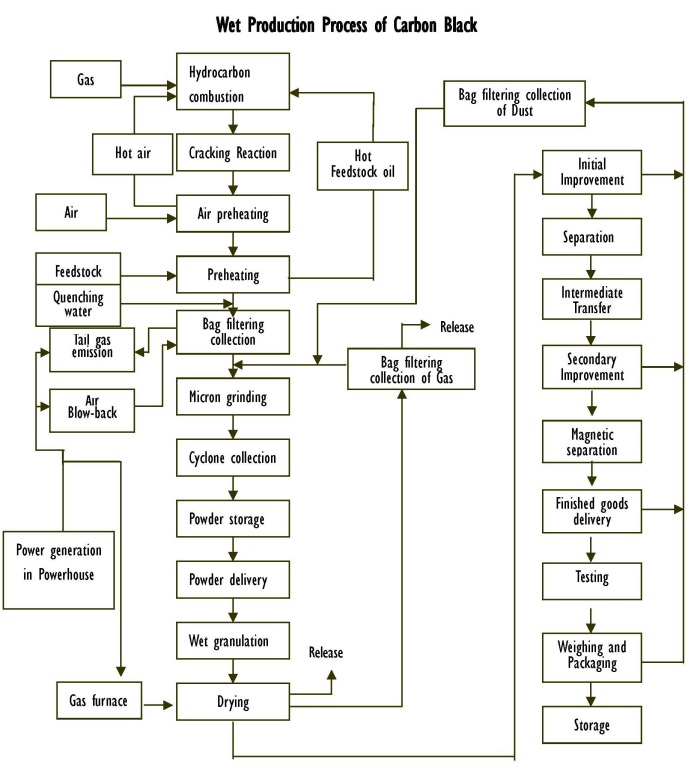

Hongxing manufactures carbon black through a combination of dry method and wet method production. In 2010, the Company directed resources to converting one of its existing lines into a wet method production line to produce better quality, lower cost, and more environmentally friendly carbon black. The new wet line commenced full operation in the fourth quarter of 2010.

Industry Overview

According to the Carbon Black World Data Book 2008, the latest available industry report, issued by Notch Consulting Group that is published annually to provide an overview of the carbon black industry, demand in the carbon black industry is forecast to rise 4.2 % per year through 2010 to nearly 11 million metric tons per year. While growth in worldwide demand may slow, it is anticipated that China’s domestic demand will continue to bolster a healthy rubber market.

China is the world’s second largest producer of carbon black. According to the latest available report, a 2008 report by Dong Fang Securities, a national and comprehensive securities company in China that provides services like security underwriting, brokerage, investment consulting, and financial advising, the rubber industry accounts for 89.5% of worldwide carbon black consumption, 67.5% of which is used for tire manufacturing and 9.5% is for other rubber car parts (such as fan belts, bumpers, etc.). Other rubber industries account for 12.5%. The remaining 10.5% is used in other non-rubber industries like ink, coating, plastic, etc.

It is management’s belief based on industry experience that modern carbon black products are an adaption of early "lamp blacks," first produced in China over 3,500 years ago, when printers used the soot generated from burning oil in lamps to make ink. The technology did not change much until advances in the twentieth century facilitated cost-effective mass production. Today, carbon black is primarily produced from "sour" gas (natural gas that contains hydrogen sulfide or sulfur) and coal tar (one of the by-products formed when coal is carbonized to make coke or gasified to make coal gas).

It is also our belief based on industry experience that the majority of existing production lines use a traditional “dry” granulation method to produce carbon black. While this method is efficient, it has drawbacks. In its initial form, carbon black is a fluffy, black powder, which is difficult to handle and easily released into the atmosphere where it can be breathed in by workers. Without proper ventilation and worker protection, this can be a health hazard. Carbon black dust can also get into small, even closed spaces, such as electrical boxes, making it difficult to keep the work area clean.

It is also our belief based on industry experience that carbon black supplies were initially produced largely in the United States ("US"), predominately in oil producing areas such as Texas. However, as environmental and employee health concerns grew, production in the US decreased substantially. The shortfall was made up for in countries like China, where regulations are less stringent and labor is more accessible and less expensive. Today, these countries account for the majority of global production.

Over time, efforts to improve the overall manufacturing process resulted in the development of a “wet” granulation production method. This wet process virtually eliminates the carbon dust and provides additional benefits. Wet manufacturing lowers the cost of producing carbon black, leaves a smaller environmental footprint, and yields a final product that is denser and more durable. As a result, longer lasting end products are produced. The Company is in the process of converting one of its existing lines from dry granulation to the wet production method.

Carbon Black Industry in China

A report from China’s Carbon Black Association (Fourth Issue, 2009), the only national organization in the carbon black industry in China whose mandate is to assist the government to supervise the industry, conduct industry research and statistics, and to publish such research findings, and whose data are widely used and regarded as authoritative, of which Hongxing is a member, indicated that in 2007, the aggregate net revenue for its 39 members was $485 million, a 55.87% increase as compared to 2006. Sales volume for 2007 was 1.78 million tons, an increase of 31.17% compared to 2006. As a whole, China’s carbon black production capacity continues to grow; in 2008, the total output of carbon black in China reached 2.43 million tons, a 5.65% increase of 2.3 million tons from the total output in 2007. In 2009, the total output of carbon black reached 2.83 million tons. The projected total output of carbon black in 2010 is 3.25 million tons. The statistic for 2010 will be released by the Carbon Black Association in April of 2011.

There are several factors affecting China’s carbon black market. The following is an overview of the key issues.

Today, there are more than 40 carbon black varieties for rubber production, of which the China market currently produces approximately 30 according to the Handbook of Rubber Industry (Revised, 2002), Second Subset, published by Chemical Industry Press, a science and technology publisher with publications on subjects like chemistry, chemical technology, materials, environment, energy, biotechnology, and pharmacy. The total output of carbon black is in surplus, but the availability of high-quality and wet-granulation carbon black varieties for radial tire production is still insufficient to meet demand. As this continues to improve, and the quality, price and performance of China’s product can satisfy the requirements in the international market, China’s exports will continue to rise.

In China, tire manufacturing accounts for more than 80% of total carbon black consumption. According to the China Association of Automobile Manufacturers, a self-regulatory and non-profit organization for auto manufacturers, spare part manufacturers and related industries approved by the Ministry of Civil Affairs of China, auto sales in 2009 were 13.64 million vehicles, an increase of 46% over 2008. The sales for 2010 were 18 million units, making China the largest auto market in the world. In the next few years, it is also expected that more and more global tire manufacturers will shift their production base to China. Overseas and domestic market demands will stimulate tire industry growth, which, in turn, increases the demand within the carbon black industry.

In order to accelerate the industrial restructuring, and to prevent redundant low-level construction and environmental pollution, the PRC strengthened their regulation over the carbon black industry in June 2002, issuing "The Directory of the Elimination of Outdated Production Capacity, Processes and Products." According to the Directory, any dry granulation device with annual production capacity of less than or equal to 10,000 tons of carbon black was to be eliminated. This decree resulted in more than 70 small-scale carbon black manufacturing companies withdrawing from the market due to outdated technology. As the market of carbon black intensifies, small-scale and poor performing enterprises will be eliminated. The China market favors large enterprises with great production capacity and modern technology.

It is management’s belief based on industry experience that China’s Tenth Five-year Plan with respect to the carbon black industry targets the development and production of high-quality and high-grade varieties for radial tires, especially for "green" high performance tires and tires with low rolling-resistance. As demand for conventional carbon black varieties for bias tires and other downstream sectors eventually decreases, the Five-Year Plan encourages the carbon black sector should make greater efforts in technical innovation and product development to satisfy the demand in the tire market.

While benefiting companies such as Hongxing, with the capability and resources to heed these government initiatives, such directives also serve as barriers to entry for new firms who must secure construction and environmental permits; many new projects have been rejected due to deviation from environmental protection standards. In recent years, China’s carbon black companies have made great strides to achieve energy conservation and emission reduction.

Properties of Carbon Black

The main three properties of carbon black are:

Particle Size

The diameter of spheric particles is the fundamental property which largely affects blackness and dispersibility when carbon black is mixed with resins or other vehicles. In general, the smaller the particle size is, the higher the blackness of carbon black becomes. Dispersion, however, becomes difficult due to an increase in coagulation force.

Structure

Like particle size, the size of the structure also affects the blackness and dispersibility of carbon black. Generally, the increase of structure size improves dispersibility but lowers blackness. Carbon black with a larger structure in particular shows an excellent conductive property.

Surface Chemistry

Various functional groups exist on carbon black’s surface. The affinity of carbon black with inks or paint varnishes changes depending on the type and amount of the functional groups.

Carbon black, with a large amount of hydroxyl group given with oxidation treatment, has a greatly enhanced affinity to print inks or varnishes, showing an excellent dispersibility.

Production of Carbon Black

Carbon black is produced with the thermal decomposition method or the partial combustion method using hydrocarbons such as oil or natural gas as raw material.

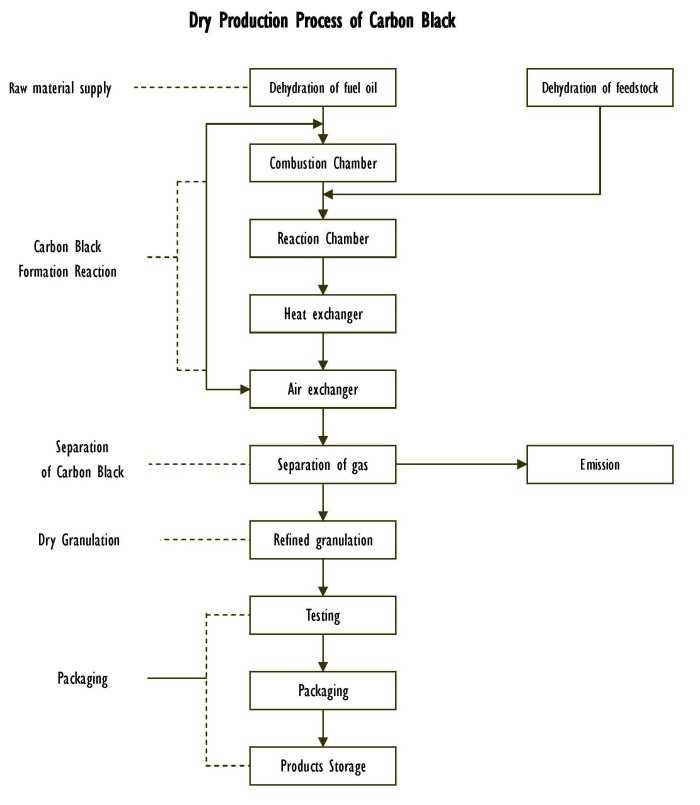

The characteristics of carbon black vary depending on manufacturing process, and therefore carbon black is classified by manufacturing process. Carbon black produced with the furnace or “dry” process, which is the most commonly used method now, is called or “furnace black,” distinguishing it from carbon black, which is manufactured with other processes.

The Company’s three production lines use the dry granulation method to produce carbon black. This method forms carbon black by blowing petroleum oil or coal oil as raw material (feedstock oil) into high-temperature gases to combust them partially. This method is suitable for mass production due to its high yield, and allows wide control over its properties such as particle size or structure. This is currently the most common method used for manufacturing carbon black for various applications from rubber reinforcement to coloring.

While this is efficient, a significant amount of carbon dust is generated. It is this dust which causes health and environmental concerns. The “wet” granulation lines that Hongxing completed and run into operation on October 26, 2010, provide a number of significant benefits, including gas comprehensive utilization, lowering black carbon production cost, reducing environmental pollution, increasing black carbon product quality, and increased varieties of black carbon. The new wet line has an annual capacity of 25,000 tons of carbon black.

Products

The Company currently manufactures one “soft” and two “hard” carbon black products, called N660, N330, and N220, respectively. The Company’s main product N660, is a soft carbon black which has the flexibility necessary for the production of automobile tire inner tubes and hoses. The Company also produces N220 and N330 hard carbon black. N220 hard carbon black, which has good strength and elongation properties, is mainly used in the manufacturing of automobile tires. The N330 hard carbon black has a lower production cost and is mainly used in manufacturing sides of automobile tires.

The price of hard carbon black is slightly higher than that of soft carbon black. Although the cost of hard carbon black is a little higher than that of soft carbon black, the demand for hard carbon black is significantly higher than the demand for the soft.

As of December 2010, the market price of dry N220 hard carbon black was $1,036 per ton, of wet N220 hard carbon black was $1,139 per ton, of N330 hard carbon black was $984 per ton, and of N660 soft carbon black was $984 per ton. In terms of profitability, N660 is the most profitable product (the cost of producing N660 is the lowest among the three products). Producing a ton of N660 soft carbon black requires roughly 1.7 tons -1.8 tons of coal tar, and the profit margin is about 30%; while producing a ton of N220 or N330 hard carbon black requires about 1.9 tons of coal tar, and the profit margin is only 23% -24%.

Manufacturing

The dry production of carbon black includes five processes: the supply of raw materials process, carbon black cracking process and use of waste heat process, separation of carbon black process, dry granulation, and packaging process, as illustrated in the following diagram. Each of the Company’s production lines typically runs for 11 months of the year, leaving one month for repair and maintenance.

The wet production of carbon black is more complex in terms of technology and procedures, as illustrated in the following diagram.

Uses for Carbon Black

Practically all rubber products which require good tensile and abrasion wear properties use carbon black, thus they are black in color. Where physical properties are important but colors other than black are desired, such as white tennis shoes, precipitated or fused silica is typically substituted. The most common use of carbon black has been as a reinforcing agent in tires. Today, because of its unique properties, the uses of carbon black have expanded to include pigmentation, ultraviolet (UV) stabilization and conductive agents in a variety of everyday and specialty high performance products, including:

Tires and Industrial Rubber Products

Carbon black is added to rubber as both a filler and as a strengthening or reinforcing agent. For various types of tires, it is used in inner liners, carcasses, sidewalls and treads utilizing different types based on specific performance requirements. Carbon black is also used in many molded and extruded industrial rubber products, such as belts, hoses, gaskets, chassis bumpers, and multiple types of pads, boots, wiper blades, fascia, conveyor wheels, and grommets. A typical car tire contains approximately 3.63 kg of carbon black.

Coloring Agent for Ink and Paints

Carbon black has higher tinting strength compared to iron black or organic pigments, and is widely used for newspaper inks, printing inks, India inks, and paints. Carbon black is also used as black pigment for inkjet ink or toners. Carbon blacks enhance formulations and deliver broad flexibility in meeting specific color requirements.

Resin and Film Coloring Agents

Carbon black has high tinting strength and is thermally stable, and therefore it is widely used for general coloring for resins and films. Carbon black is also excellent for absorbing ultraviolet light, providing both a superb resistance against ultraviolet rays and a coloring effect when just a small amount is mixed with resins. Carbon black based resins are used in automobile bumpers, wire coverings and steel pipe linings which require weather resistance in particular.

Electric Conductive Agent

Carbon black particles have a graphite-like crystalline structure, providing excellent electric conductivity. Therefore, carbon black is widely used as conductive filler, mixed in plastics, elastomers, paints, adhesives, films, and pastes. For example, fuel caps and fuel-introducing pipes for automobiles are required to provide electric conductivity for preventing static and carbon black is an excellent antistatic agent.

Electrostatic Discharge (ESD) Compounds:

Carbon blacks can be designed to transform electrical characteristics from insulating to conductive in products such as electronics packaging, safety applications, and automotive parts.

Plastics

Carbon blacks are widely used for conductive packaging, films, fibers, moldings, pipes and semi-conductive cable compounds in products such as refuse sacks, industrial bags, photographic containers, agriculture mulch film, stretch wrap, and thermoplastic molding applications for automotive, electrical/electronics, household appliances and blow-molded containers.

High Performance Coatings:

Carbon blacks provide pigmentation, conductivity, and UV protection for a number of coating applications including automotive (primer basecoats and clearcoats), marine, aerospace, decorative, wood, and industrial coatings.

Raw Materials and Equipment

The principal raw material used in our manufacture of carbon black is the residual heavy oils derived from the distillation of coal tars. Raw material costs generally are influenced by the availability of various types of carbon black feedstock and natural gas, and related transportation costs.

Shanxi Province, where Hongxing’s facilities are located, is rich in coal tar resources, giving the Company an ample supply of raw materials. Even under serious competition for coal tar supply, Hongxing’s management believes that it would be able to stabilize its supply chain. Additionally, as Hongxing expands its operations, it anticipates that it will garner greater purchasing power, which in turn will bring the company greater leverage in pricing.

We have entered into long term contracts with a number of suppliers. Such long term contracts in our industry are typically for only one year terms due to the fluctuating prices of the raw materials. We believe these contracts help us maintain regular production capacity even when supply experiences a shortage. During the year, the contracts guarantee the supply of specified amount of the raw material from the supplier, but the exact purchase price is determined by market condition at that time when purchase occurs. We keep good relationships with our suppliers, and we believe that they grant us priority in purchase of the raw material at a competitive price. Because the price of raw materials fluctuates in accordance with supply and demand, the price of our end products will reflect the price fluctuation of the raw materials.

Production equipment includes the following: burning furnace, reaction furnace, heat collecting furnace, air heater, dyer, industrial blender, air blower, industrial vacuum, oil pre heater, pressuring air generator, oil pump, water pump, air filter, lifter, storage container, packaging machine, DCS controller etc. Production equipment is manufactured according to our specifications in accordance with national safety standards.

Suppliers

For the last three fiscal years, Hongxing’s top 8 suppliers were as follows:

Suppliers and purchase amounts in 2008-2010

|

Name

|

Value (USD)

|

Percentage of Purchases (%)

2008

|

Percentage of Purchases (%)

2009

|

Percentage of Purchases (%)

2010

|

||||||||||||

|

Taiyuan Coal GasificationCo.,Ltd

|

10,812,740 | 21.99 | 19.08 | 16 | ||||||||||||

|

Taiyuan Gengyang Industries Co.,Ltd

|

10,575,565 | 20.18 | 19.23 | 16.6 | ||||||||||||

|

Taiyuan Dongsheng Coking & Gas Co.,Ltd

|

10,506,062 | 19.9 | 19.22 | 16.53 | ||||||||||||

|

Shanxi Changyuan Coking Co.,Ltd

|

9,346,852 | 16.16 | 17.79 | 15.50 | ||||||||||||

|

Shanxi Yinyan Energy Development Co.,Ltd

|

8,431,612 | 13.28 | 16.91 | 14.46 | ||||||||||||

|

Xiaoyi Jinhui Cold & Coking Co.,Ltd

|

5,909,088 | 8.49 | 7.77 | 13.63 | ||||||||||||

|

Shanxi Tianxing Coal Gasification Co.,Ltd

|

841,453 | - | - | 3.7 | ||||||||||||

|

Shanxi Donghui Coal Chemical Co.,Ltd

|

756,880 | - | - | 3 | ||||||||||||

|

Total Purchases

|

18,710,177 | 15,733,121 | 22,736,954 | |||||||||||||

Customers

Hongxing currently sells to 13 customers, three of which account for approximately 66% of sales: Xuzhou Xulun Tire Co., Ltd, Shandong Shifeng Group and Shandong Double Star Tire Industry Co., Ltd. The following table illustrates the percentage of sales to each of our 13 customers in the last three fiscal years.

Major customers and sales amounts in 2008-2010

|

Company Name

|

Percentage of 2008

|

Percentage of 2009

|

Percentage of 2010

|

||||||||||||

| 1 |

Xuzhou Xulun Rubber Co., Ltd.

|

32

|

%

|

31

|

%

|

30

|

%

|

||||||||

| 2 |

Shifeng Juxing Tire Co., Ltd.

|

25

|

%

|

22

|

%

|

20

|

%

|

||||||||

| 3 |

Shandong Luhe Group Co., Ltd.

|

9

|

%

|

21

|

%

|

16

|

%

|

||||||||

| 4 |

Company D

|

7

|

%

|

8

|

%

|

6

|

%

|

||||||||

| 5 |

Company E

|

8

|

%

|

6

|

%

|

5

|

%

|

||||||||

| 6 |

Company F

|

7

|

%

|

7

|

%

|

6 |

%

|

||||||||

| 7 |

Company G

|

3

|

%

|

- | 4 |

%

|

|||||||||

| 8 |

Company H

|

4

|

%

|

5

|

%

|

6 |

%

|

||||||||

| 9 |

Company I

|

2

|

%

|

- | 4 |

%

|

|||||||||

| 10 |

Company J

|

1

|

%

|

- | - | ||||||||||

| 11 |

Company K

|

1

|

%

|

- | - | ||||||||||

| 12 |

Company L

|

1

|

%

|

- | - | ||||||||||

| 13 |

Company M

|

- | - | 3 |

%

|

||||||||||

| Total Sales | 100 | % | 100 | % | 100 | % | |||||||||

Sales and Marketing

Because carbon black is essentially a commodity and there are relatively few large end users, the industry is relationship and price-driven rather than directed by marketing efforts. To that end, Hongxing’s sales team focuses on spending time with existing and potential customers. Hongxing has assigned an exclusive sales person for each major market, and each of its target customers is visited frequently. Currently, the majority of sales occur in Shandong, Jiangsu and Guangdong Provinces.

Hongxing’s target market is large rubber companies and tire producers, and the Company’s management believes it has strong relationships with existing customers. With its effective, dedicated sales network, high quality product, reasonable price and strong after-sale service, management believes that as much as 90% of Chinese tire manufacturers are familiar with its products.

Currently our production falls short of market demand. In spite of this, we are seeking to expand our business presence and distribution channels in China. We have already established an office in Qingdao, Shandong province, with plans to expand our business into areas where major tire manufacturers are located.

We plan to promote our products and increase our brand awareness through our relationships with several trade companies in the bonded area of Qingdao. Enterprises situated within the bonded area enjoy preferential policies such as tax rebates for exports and tax-free trading within the bonded area. Meanwhile, we will continue to cultivate good relations with additional rubber and plastic companies.

Growth Strategy

We have established a multi-prong growth strategy, with the objective of establishing the Company as a leading manufacturer and marketer in China’s growing carbon black sector, with a particular emphasis in the tire and automotive industries.

To execute this strategy, we intend to implement the following plan:

Complete conversion of existing production facilities. The primary component of this strategy is the addition of wet processing capabilities, which will provide the Company and its customers with several benefits, as discussed below. The capacity of the first completed wet line is approximately 25,000 tons.

Low-carbon and clean production. To pave the way to low-carbon and clean production, we are seeking to use natural gas to enhance its production process for energy conservation and emission reduction. Once completed, both dry and wet production line could use natural gas to operate, which will increase the quality of our products. Secondly, we are planning to build a power plant to recycle the tail gas produced in the manufacturing process to generate electricity needed in the production.

Development of superior end product. Wet carbon black products are more stable than dry carbon black products in quality and performance. In the next five years, we believe that our clients will require their carbon black to be denser and of higher quality to satisfy these three properties: lower rolling resistance, higher wet skid resistance, and stronger wear resistance. This denser, higher quality carbon black can only be produced through wet processing means.

Improved Margins. After adopting the wet granulation method, the quality of our carbon black products will be dramatically improved and we estimate the sales margin for the new products will be around 30 percent. While the raw materials expense is the same, the process is more expensive; however the higher quality end product enables the Company to charge a premium for wet process carbon black.

While demand for wet carbon black will gradually replace dry carbon black as an important raw material in the rubber tire industry, we anticipate that dry carbon black will still be in demand as many factories still utilize it for lower cost products.

Expansion of the distribution network. Management believes the domestic market represents a substantial opportunity, particularly as China’s rural economy is modernized. The nation’s growing “middle class” continues to increase demand for automobiles. To this end, we will continue to add to our dedicated sales force within existing markets, in addition to expanding into new geographic areas.

Expansion of production capacity. We will continue to expand our current production capacity in the future. We intend to add new wet granulation production lines. We have the option of building a new wet line with 40,000 tons of capacity, or acquiring a target company with wet production capacity. We will continue to evaluate alternatives to add production capacity to our carbon black operation by analyzing the cost benefits of acquisition versus build out.

Investment in recyclable energy. In conjunction with the addition of these new production lines, subject to the availability of financing, the Company intends to construct a thermal power plant within its facility campus that would use the tail gas generated from the manufacturing of the carbon black to generate electricity. There are no specific plans for construction of a thermal plant at this time.

Continue to Develop and Market New Products. As China continues the shift from an agricultural market to a “controlled” capitalist environment, the demand for other carbon black related products, such as toner, high performance paints, electric materials, etc. is expected to expand as well. Management will be opportunistic in its approach to new product development. Line extensions are expected to come as a result of thorough internal research and development, customer requests, and acquisitions. In conjunction with the expansion of production capacity, we plan to continue to target and cater to the needs of both our new and existing customers.

Quality Control

Carbon black dust spreads easily in the air through virtually any air current or movement. Additionally, because carbon black is a pigment, it can stain exposed surfaces. We remain concerned with the effects of our operations on our employees and the environment, and to that end, management has instituted specific procedures that minimize the production of dust and optimize working conditions. These specific procedures entail strengthening the Company’s previous measures and standards, including upgrading the granulator, installing the dust-absorption to equipments by section and classification, and upgrading previously manual operations to a numerically controlled automatic packing system.

It is management’s belief based on industry experience that generally, there are no negative clinical health effects to the manufacture of carbon black. However, our facilities are subject to regular inspection to ensure that they comply with health, safety and environmental regulation. This includes regular maintenance of equipment, training of employees with regard to handling of carbon black, and regular review of emergency response to conditions associated with the use of carbon black.

Hongxing’s advanced technology and scientific means of detection have met the PRC’s environmental protection and safety requirements. Our carbon black products have been verified by the ISO9000 quality system certification, and were identified by the Industrial Technology Research Institute. Our products are fully in compliance with national standards. To meet the environmental protection and safety standards, we are monitored by the local Environmental Protection Monitoring Station. These inspections are carried out in three aspects: (i) air surveillance, using a TH0150C large air sampler and TG328B analysis libra, and measuring against the national air pollutant emission standard, (ii) noise surveillance, using a HS6288D noise analysis instrument and measuring against the national industrial enterprise factory boundary noise emission standard and (iii) water surveillance, using a series of analysis instruments such as TG328B analysis Libra and measuring against the national standard for general wastewater discharge.

We have been awarded the “Orange Company Prize” by Shanxi Environment Protection Administration in 2008. The Orange Company Prize is awarded by the provincial environmental government to indicate our environment protection standards meet the required standards. The Bureau of Environmental Protection of Taiyuan classifies the local companies into 5 categories by different environment protection level being achieved. Among them, the red and blue awards are the top two levels, while red and black levels mean that the company has failed to meet environmental protection standards. The Orange award means the Company meets all the required standards.

Competition

According to a research report issued by Orient Securities Co., Ltd. in 2008, although the $8.8 billion carbon black market represents a substantial opportunity, the industry is competitive, and concentrated. The top three transnational corporations, Cabot Corporation, Degussa AG, and Columbian Chemicals Company, account for approximately 47% of the world's overall capacity of carbon black. Each of these firms has production facilities in China, where production is also concentrated.

The projected total output of carbon black in China for 2010 is 3.25 million tons. In 2009, the total output of carbon black reached 2.83 million tons, while the top 15 manufacturing enterprises reached 1.87 million tons, accounting for 66 percent of total output. The following table illustrates the top 15 carbon black manufacturers in China.

Top 15 Carbon Black Companies in China

|

No.

|

Company Name

|

Output in 2009(Ton)

|

Output in 2008(Ton)

|

Growth Rate

(±%)

|

|||||||||||

| 1 |

Jiangxi Black Cat

|

328,228 | 258,000 | 27.2 | |||||||||||

| 2 |

Cabot Chemical

|

320,000 | 250,000 | 28 | |||||||||||

| 3 |

Longxing Chemical Group

|

182,779 | 146,347 | 24.8 | |||||||||||

| 4 |

Suzhou Baohua Carbon Black

|

147,637 | 113,846 | 29.7 | |||||||||||

| 5 |

Huadong Rubber Material

|

136,190 | 111,007 | 22.7 | |||||||||||

| 6 |

Zhongxiang Chemical Industry

|

128,911 | 138,373 | -6.8 | |||||||||||

| 7 |

Shijiazhuang Xinxing

|

94,883 | 87,012 | 9 | |||||||||||

| 8 |

Dashiqiao liaoBin

|

84,021 | 75,077 | 11.9 | |||||||||||

| 9 |

Hebei Daguangming Industry Group

|

79,865 | 85,158 | -6.2 | |||||||||||

| 10 |

Shanxi Shuidong

|

67,913 | 41,666 | 63 | |||||||||||

| 11 |

Qingdao Yingchuang Chemical

|

67,000 | 66,000 | 1.5 | |||||||||||

| 12 |

Qingzhou Bo’ao

|

63,762 | 49,650 | 28.4 | |||||||||||

| 13 |

Shandong Beisite Chemical

|

61,231 | 51,972 | 17.8 | |||||||||||

| 14 |

Hangzhou Fuchuanjiang

|

57,723 | 57,607 | 0.2 | |||||||||||

| 15 |

Maoming Huanxing

|

49,286 | 50,088 | -1.6 | |||||||||||

|

Others

|

961,841 | 846,197 | 13.7 | ||||||||||||

|

Total

|

2,831,270 | 2,428,000 | 16.6 | ||||||||||||

Source: China’s Carbon Black Association

Since new participants must undergo a long period of production before they are capable of satisfying large quantity orders, management believes our primary competition lies in current market participants. Currently carbon black manufactures are expanding their facilities through the use of new technologies and acquisition, new participants will find it very difficult to gain market share. The entry requirements for entering the industry have become tougher.

One of the largest barriers to entry is developing solid long-term clients. We believe that we already have long-term relationships with several of our important customers, like Xuzhou Xulun Rubber Co., Ltd, Shifeng Juxing Tire Co., Ltd and Shandong Luhe Group Co., Ltd.

Intellectual Property

Our trademark “Great Double Star” has been registered with the State Administration for Industry and Commerce, Trademark Office, and is valid from February 14, 2008 to February 13, 2018. It is registered for use with Commodity (Type 1), namely industrial carbon black, chemical rubber enhancer, industrial chemicals, activated carbon, accelerants, fixative, gas purifying agent, rubber preservatives, and chemicals for industrial usage.

Government Regulation

Environmental Regulation

Hongxing’s operation and facilities are subject to environmental laws and regulations stipulated by the national and the local environment protection bureaus in China. Relevant laws and regulations include provisions governing construction of production lines, air emissions, water discharges and the management and disposal of hazardous substances and wastes, more particularly, the laws on environment protection, water and air pollution, air pollutant emission standards, general wastewater discharge standards and industrial enterprise factory boundary noise emission standards.

On November 15, 2004, Hongxing obtained a construction commencement approval for its construction of one production line with production capacity of 12,000 tons of carbon black per year from the Taiyuan Municipal Environmental Protection Bureau. Failure to obtain the necessary environmental approvals for construction of our production lines and pollution emission permits may subject us to fines and, in some cases, may even result in the mandated cessation of production. However, Hongxing is not aware of any investigations, prosecutions, disputes, claims or other proceedings in respect of environmental protection, nor has it been subject to any action made by any environmental administration authorities of the PRC.

Regarding the cost of compliance, our annual investment in environmental protection equipment totals 7.9 million RMB. That includes 5.4 million RMB ($800,000) on bag-filtering deduster, 1.6 million RMB ($240,000) on wastewater treatment equipment, and 900,000 RMB ($130,000) for the change of filtering bag and related materials.

Hongxing maintains controls at its production facilities to facilitate compliance with environmental rules and regulations. Hongxing is not aware of any investigations, prosecutions, disputes, claims or other proceedings in respect of environmental protection, nor has it been subject to any action made by any environmental administration authorities of the PRC. To management's knowledge, Hongxing’s operation meets or exceeds the existing requirements of the PRC.

Employees

As of March 21, 2011, Hongxing had 222 full time employees, of which five are in senior management, two are administrators, two are in human resources, three are in supplies, six are in sales and transportation, four are in finance, four are in the technology department, three are in the safety and environmental protection department, six are in logistics, twelve are in the testing center, five in storage and 160 employees in the production of carbon black.

Hongxing maintains good relations with its employees. All of its employees belong to the Labor Union committee of Taiyuan Hongxing Carbon Black Co., Ltd., it is a self-operated organization but governed by the General Labor Union of Xigu Village, Qingxu County.

Hongxing is required to contribute a portion of its employees' total salaries to the Chinese government's social insurance funds, including medical insurance and unemployment insurance and to purchase job injuries insurance for employees, in accordance with relevant regulations. The government's social insurance funds account for 10% of employees' total salaries, while job injuries insurance premiums are about RMB 50 ($8) per person per year. Hongxing expects the amount of its contribution to the government's social insurance funds and the cost related to job injuries insurance to increase in the future as it expands its workforce and operations.

Executive Offices

Our executive office in China for Hongxing is located at Qingxu County, Taiyuan, Shanxi Province, Tel: 86-351-5966868, and Fax: 86-351-5966308. Our company website address is: www.asiacarbonindustries.com

Risk of Loss and Product Liability Insurance

The Company doesn’t have any product liability insurance for its products.

|

Risk Factors

|

The reader should carefully consider each of the risks described below. If any of the following risks described below should occur, our business, financial condition or results of operations could be materially adversely affected and the trading price of our common stock could decline significantly.

Risks Related to Our Business and Industry

Below are some Risk Factors that may be pertinent to the Company:

Negative or uncertain worldwide economic conditions may adversely impact our business.

Our operations and performance are materially affected by worldwide economic conditions, which deteriorated significantly during fiscal 2009. Although 2010 performance shows a return to positive growth trends, the possible market turmoil and tightened credit availability in the future will generally reduce consumer confidence, increase difficulty in collecting accounts receivable, increase pricing pressure on products and services, and lead to widespread reduction of global business activity. If such events occur, weakness in worldwide economic conditions could have a material adverse effect on our financial condition and cash flows.

Changes in supply-demand balance in the regions and the industries in which we operate may adversely affect our financial results.

Our key customers continue to shift their manufacturing capacity from mature markets such as North America and Western Europe to emerging regions such as Asia, South America and Eastern Europe. Although we are responding to meet these market demand conditions, we cannot be certain that we will be successful in expanding capacity in emerging regions (which depends in part on economic and political conditions in these regions and, in some cases, on our ability to acquire or form strategic business alliances) or in reducing capacity in mature regions commensurate with industry demand. Similarly, demand for our customers’ products and our competitors’ reactions to market conditions could affect our financial results.

In addition, our products are sensitive to changes in industry capacity utilization. As a result, pricing tends to decrease when capacity utilization in these businesses decreases, which could affect our financial performance.

Our cost saving initiatives may not achieve the results we anticipate.

We have undertaken and will continue to undertake cost reduction initiatives to optimize our asset base, improve operating efficiencies and generate cost savings. The success of these activities is not predictable and we cannot be certain that we will be able to complete these initiatives as planned or that the estimated operating efficiencies or cost savings from such activities will be fully realized or maintained over time.

Volatility in the price of raw materials or their reduced availability could decrease our margins.

Our manufacturing processes consume significant amounts of energy and raw materials, the costs of which are subject to worldwide supply and demand as well as other factors beyond our control. Dramatic increases in such costs or decreases in the availability of raw materials at acceptable costs could have an adverse effect on our results of operations. For example, the key raw materials required for carbon black production is coal tar. Any increase in the price of these raw materials will affect the price at which we can sell our product. If we are not able to raise our prices to pass on increased costs, we would be unable to maintain our margins.

Similarly, movements in the market price for crude oil typically affect carbon black feedstock costs. Significant movements in the market price for crude oil tend to create volatility in our carbon black feedstock costs, which can affect our working capital and results of operations. Although some of our annual carbon black supply contracts provide a price adjustment to account for changes in feedstock costs, there is a lag between the time when we incur feedstock costs and the time when prices are adjusted under some of these contracts. Accordingly, we may not be able to pass increased costs along to our customers when they occur, which can have a significant negative impact on results of operations and cash flows in a given quarter. We have reduced the time lag in many of our long-term contracts as they have come up for renewal, but we may not be successful in reducing the time lag in some or all of the remainder of these contracts as they come up for renewal in the future. In addition, it is possible that a supply contract with a price adjustment mechanism could expire by its terms before we are able to recapture fully our raw material cost increases. We attempt to offset the effects of increases in raw material costs through selling price increases in our non-contract sales, productivity improvements and cost reduction efforts. Success in offsetting increased raw material costs with price increases is largely influenced by competitive and economic conditions and could vary significantly depending on the segment served. Such increases may not be accepted by our customers, may not be sufficient to compensate for increased raw material and energy costs or may decrease demand for our products and our volume of sales. If we are not able to fully offset the effects of increased raw material or energy costs, it could have a significant impact on our financial results.

We depend on a group of key customers for a significant portion of our sales. A significant adverse change in a customer relationship or in a customer’s performance or financial position could harm our business and financial condition.

Our success in strengthening relationships and growing business with our largest customers and retaining their business over extended time periods could affect our future results. We have 13 customers in China, virtually all in the tire industry that together represent a significant portion of our total net sales and operating revenues. In fiscal 2010, sales to our three largest customers accounted for approximately 66% of our consolidated revenues. If one or more of our major customers were to become unable or unwilling to continue purchasing its products in the scale of their recent purchases, our revenue and competitive position could be harmed. Moreover, the loss of any of our important customers, or a reduction in volumes sold to them because of a work stoppage or other disruption, could adversely affect our results of operations until such business is replaced or the disruption ends. Any deterioration of the financial condition of any of our customers or the industries they serve that impairs our customers’ ability to make payments to us also could increase our uncollectible receivables and could affect our future results and financial condition.

Our operations involve the handling of hazardous and, in some instances, radioactive materials, and we are subject to extensive safety, health and environmental requirements, which could increase our costs and/or reduce our revenues.

Our ongoing operations are subject to extensive federal, state, local and foreign laws, regulations, rules and ordinances relating to safety, health and environmental matters (“SH&E Requirements”), many of which provide for substantial monetary fines and criminal sanctions for violations. These SH&E Requirements include requirements to obtain and comply with various environmental-related permits including achievement of construction commencement approvals and completion examination approvals for each of our production lines, and pollution emission permit for the disposal of waste gases, waste water, waste dust and other waste materials. We have not obtained all necessary construction commencement approvals and completion examination approvals for our production lines, but we are now in the process of obtaining such requisite environmental approvals. Failure to obtain such environmental-related approvals may subject us to fines or disrupt our operations and construction, which may materially and adversely affect our business, results of operations and financial condition. Moreover, future SH&E Requirements may be enacted to create more severe liabilities under the SH&E Requirements with respect to our other facilities, operations, or products.

Although we have not suffered from material environmental, health or safety fines or other sanctions from the relevant governmental authorities in the past, the failure to comply with any present or future regulations could result in the assessment of damages or imposition of fines against us, suspension of production, and cessation of our operations or even criminal sanctions. The suspension of production and cessation of our operations could affect our earnings in a materially adverse manner. The enacting of new regulations could also require us to acquire costly equipment which may incur other significant expenses.

In addition, the operation of a chemical manufacturing business as well as the sale and distribution of chemical products involves safety, health and environmental risks. For example, the production and/or processing of carbon black, fumed metal oxides, tantalum, niobium, aerogel and other chemicals involve the handling, transportation, manufacture or use of certain substances or components that may be considered toxic or hazardous within the meaning of applicable SH&E Requirements. The processing of tantalum ore also involves radioactive substances. The transportation of chemical products and other activities associated with the manufacturing process have the potential to cause environmental or other damage as well as injury or death to employees or third parties. We could incur significant expenditures in connection with such operational risks.

Plant capacity expansions may be delayed and not achieve the expected benefits.

Our ability to complete capacity expansions as planned may be delayed or interrupted by the need to obtain environmental and other regulatory approvals, availability of labor and materials, unforeseen hazards such as weather conditions, and other risks customarily associated with construction projects. Moreover, capacity expansion in our Rubber Blacks, Performance Products and Fumed Metal Oxides Businesses could have a negative impact on the financial performance of these businesses until capacity utilization is sufficient to absorb the incremental costs associated with the expansion.

We may be required to write off certain assets if our assumptions about future sales and profitability prove incorrect.

In our analysis of the recoverability of certain assets, namely inventory, property, plant and equipment, investments, intangible assets and deferred tax assets, we have made assumptions about future sales (pricing, volume and region of sale), costs, cash generation and the ultimate profitability of the business and/or tax jurisdiction. These assumptions were based on management’s best estimates and if the actual results differ significantly from these assumptions due to market conditions, we may not be able to realize the value of the assets recorded as of December 31, 2010, which could lead to a write-off of certain of these assets in the future.

Regulations requiring a reduction of greenhouse gas emissions will impact the carbon black industry, including us.

Carbon dioxide is emitted in the carbon black manufacturing process. Currently, there are no PRC laws or regulations regarding Carbon dioxide emission. According to the Aire Prevention and Treatment Law of PRC and other emission standards of air pollutants, emission of sulfur dioxide is strictly controlled. The PRC joins international treaties to control Carbon dioxide emission.

Currently, there are no requirements under PRC law to purchase emission credits for carbon dioxide emission. Instead, the Company is required to apply for pollution emission permits, which do not contain requirements for Carbon dioxide. There may be future requirements under PRC law to purchase emission credits, and there are also ongoing discussions in other regions and countries, including the United States, Canada, China and Brazil regarding greenhouse gas emission reporting and reduction programs, but those programs have not yet been defined and their potential impact on our manufacturing operations or financial results cannot be estimated at this time.

We may be subject to information technology system failures, network disruptions and breaches in data security.

Information technology system failures, network disruptions and breaches of data security could disrupt our operations by impeding our processing of transactions, our ability to protect customer or Company information and our financial reporting. Our computer systems, including our back-up systems, could be damaged or interrupted by power outages, computer and telecommunications failures, computer viruses, internal or external security breaches, catastrophic events such as fires, earthquakes, tornadoes and hurricanes, and/or errors by our employees. Although we have taken steps to address these concerns by implementing sophisticated network security and internal control measures, there can be no assurance that a system failure or data security breach will not have a material adverse effect on our financial condition and results of operations.

The trend towards environmental protection, energy efficiency and low carbon emissions could result in a large expenditure on our part.

The trend towards a “greener” environment and greater environmental protection may compel us to expend more money in equipment and processes to reduce pollution and emissions into the environment, especially if this is regulated by the PRC authorities.

Hongxing’s operating history may not serve as an adequate basis to judge Hongxing’s future prospects and results of operations.

Hongxing commenced its current line of business in 2003 but as the Company only commenced operations in 2008, the Company's history may not provide a meaningful basis on which to evaluate its business. As such, Hongxing’s operating history may not provide a meaningful basis on which to evaluate its business. We cannot assure that Hongxing will maintain its profitability or that we will not incur net losses in the future. We expect that Hongxing’s operating expenses will increase as it expands. Any significant failure to realize anticipated revenue growth could result in significant operating losses. We will continue to encounter risks and difficulties frequently experienced by companies at a similar stage of development, including our potential failure to:

|

·

|

Raise adequate capital for expansion and operations;

|

|

·

|

Implement Hongxing’s business model and strategy and adapt and modify them as needed;

|

|

·

|

Increase awareness of Hongxing’s brands, protect its reputation and develop customer loyalty;

|

|

·

|

Manage Hongxing’s expanding operations and service offerings, including the integration of any future acquisitions;

|

|

·

|

Maintain adequate control of Shanxi Hongxing’s expenses;

|

|

·

|

Anticipate and adapt to changing conditions in the carbon black market in which Hongxing operates or the automotive tire industry and other markets in which Hongxing sells its products, as well as the impact of any changes in government regulations, mergers and acquisitions involving Hongxing’s competitors, technological developments and other significant competitive and market dynamics.

|

If we are not successful in addressing any or all of these risks, Hongxing’s business may be materially and adversely affected.

Because we may require additional financing to expand our operations, our failure to obtain necessary financing may slow our expansions.

At December 31, 2010 we had working capital of $7,845,000. Our capital requirements in connection with the development of our business are significant. During the year ended December 31, 2010, we spent $23,786,000 for the purchase of raw materials and $2,433,000 to purchase equipment.

To the extent we require financing, the absence of an active public market for our common stock may make it difficult for us to raise additional equity capital if required for our present business or for any planned expansion. We cannot assure you that we will be able to get additional financing on any terms, and, if we are able to raise funds, it may be necessary for us to sell our securities at a price which is at a significant discount from the market price, if there is one, and on other terms which may be disadvantageous to us. In connection with any such financing, we may be required to provide registration rights to the investors and pay damages to the investor in the event that the registration statement is not filed or declared effective by specified dates. The price and terms of any financing which would be available to us could result in both the issuance of a significant number of shares and significant downward pressure on our stock price.

The terms of any future financing may adversely affect your interest as stockholders.

If we require additional financing in the future, we may be required to incur indebtedness or issue equity securities, the terms of which may adversely affect your interests in us. For example, the issuance of additional indebtedness may be senior in right of payment to your shares upon our liquidation. In addition, indebtedness may be under terms that make the operation of Hongxing's business more difficult because the lender's consent could be required before we take certain actions. Similarly the terms of any equity securities we issue may be senior in right of payment of dividends to your common stock and may contain superior rights and other rights as compared to your common stock. Further, any such issuance of equity securities may dilute your interest in us.

Our failure to compete effectively may adversely affect our ability to generate revenue.

We compete with other companies, many of whom are developing or can be expected to develop products similar to us. Many of our competitors are more established, and have significantly greater financial, technical, marketing and other resources than it presently possess. Some of our competitors have international name recognition and a larger customer base. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements and may be able to undertake more extensive promotional activities, offer more attractive terms to customers, and adopt more aggressive pricing policies. We cannot assure you that we will be able to compete effectively with current or future competitors or that the competitive pressures we face will not harm our business.

Our business and operations are experiencing rapid growth. If we fail to effectively manage our growth, our business and operating results could be harmed.

We have experienced, and continue to experience, rapid growth in our operations, which have placed, and will continue to place, significant demands on our management, operational and financial infrastructure. If we do not effectively manage our growth, the quality of our products and services could suffer, which could negatively affect our operating results. To effectively manage this growth, we will need to continue to improve our operational, financial and management controls and our reporting systems and procedures. These systems enhancements and improvements may require significant capital expenditures and management resources. Failure to implement these improvements could hurt our ability to manage our growth and our financial position.

We may engage in future acquisitions that could dilute the ownership interests of our stockholders, cause us to incur debt and assume contingent liabilities.

We, through our subsidiary Liteweisi or our VIE entity, Hongxing, may review acquisition and strategic investment prospects that we believe would complement the current product offerings of Hongxing, augment its market coverage or enhance its technical capabilities, or otherwise offer growth opportunities. From time to time we may review investments in new businesses and we, through our subsidiary Liteweisi or Hongxing, may make investments in, and to acquire, businesses, products, or technologies in the future. We expect that when we raise funds from investors for any of these purposes we will be either the issuer or the primary obligor while the proceeds will be forwarded to Hongxing and accounted for as a loan to Hongxing and eliminated during consolidation. In the event of any future acquisitions, we could:

|

•

|

issue equity securities which would dilute current stockholders’ percentage ownership;

|

|

•

|

incur substantial debt;

|

|

•

|

assume contingent liabilities; or

|

|

•

|

expend significant cash.

|

These actions could have a material adverse effect on our operating results or the price of our common stock. Moreover, even if, through our subsidiary Liteweisi or Hongxing, we do obtain benefits in the form of increased sales and earnings, there may be a lag between the time when the expenses associated with an acquisition are incurred and the time when we recognize such benefits. Acquisitions and investment activities also entail numerous risks, including:

|

•

|

difficulties in the assimilation of acquired operations, technologies and/or products;

|

|

•

|

unanticipated costs associated with the acquisition or investment transaction;

|

|

•

|

the diversion of management’s attention from other business concerns;

|

|

•

|

adverse effects on existing business relationships with suppliers and customers;

|

|

•

|

risks associated with entering markets in which Hongxing has no or limited prior experience;

|

|

•

|

the potential loss of key employees of acquired organizations; and

|

|

•

|