Attached files

| file | filename |

|---|---|

| EX-21 - American Smooth Wave Ventures, Inc. | v216590_ex21.htm |

| EX-14.1 - American Smooth Wave Ventures, Inc. | v216590_14-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

CURRENT REPORT

(Amendment No. 2)

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 21, 2011

AMERICAN SMOOTH WAVE VENTURES, INC.

(Exact name of registrant as specified in its charter)

IOWA

(State or other jurisdiction of incorporation)

|

001-34715

|

26-3036101

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

Jiangtou Industrial Zone, Chendai Town

Jinjiang City, Fujian Province 362211 People’s Republic of China

(Address of principal executive offices and zip code)

+86 0595-85196329

(Registrant’s telephone number, including area code)

73726 Alessandro Dr. Suite 103

Palm Desert, CA 92260

(Registrant’s former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b))

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

TABLE OF CONTENTS

|

PART I

|

3

|

|

|

Item 1

|

Business

|

3

|

|

Item 1A.

|

Risk Factors

|

16

|

|

Item 1B.

|

Unresolved Staff Comments

|

33

|

|

Item 2

|

Properties

|

33

|

|

Item 3

|

Legal Proceedings

|

33

|

|

Item 4

|

Removed and Reserved

|

34 |

|

PART II

|

34

|

|

|

Item 5

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

34

|

|

Item 6

|

Selected Financial Data

|

35

|

|

Item 7

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

35

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures about Market Risk | 44 |

|

Item 8

|

Financial Statements and Supplementary Financial Data

|

44

|

|

Item 9

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

44

|

|

Item 9A.

|

Controls and Procedures

|

45

|

|

Item 9B.

|

Other Information

|

45

|

|

PART III

|

46

|

|

|

Item 10

|

Directors, Executive Officers and Corporate Governance

|

46

|

|

Item 11

|

Executive Compensation

|

48

|

|

Item 12

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

49

|

|

Item 13

|

Certain Relationships and Related Transactions and Director Independence

|

51

|

|

Item 14

|

Principal Accounting Fees and Services

|

52

|

|

PART IV

|

53

|

|

|

Item 15

|

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

|

53

|

i

Item 9.01 Financial Statements and Exhibits.

Explanatory Note

On January 21, 2011, American Smooth Wave Ventures, Inc. (“ASWV”) acquired all of the equity interests of Ailibao International Investment Limited, a British Virgin Islands corporation (“Ailibao”) and filed a Current Report on Form 8-K (the “Original 8-K”) to report the acquisition. The Original 8-K contained audited financial information of Ailibao as of December 31, 2009 and 2008 and for each of the years in the three year period ended December 31, 2009. This Amendment No. 1 to the Original 8-K includes (i) as Exhibit 99.1 the audited consolidated financial statements of Ailibao as of December 31, 2010 and 2009, and for each of the years in the three year period ended December 31, 2010, and the related notes thereto and (ii) other information that would be disclosed by Ailibao as if it were filing an Annual Report on Form 10-K with the Securities and Exchange Commission (the “SEC”) with respect to its fiscal year ended December 31, 2010.

Introductory Note

Except as otherwise indicated by the context, references in this Current Report on 8-K/A (this “Form 8-K/A”) to the “Company,” “Ailibao,” “we,” “us” or “our” are references to the combined business of Ailibao International Investment Limited and its consolidated subsidiaries. References to “China” or “PRC” are references to the People’s Republic of China. References to “RMB” are to Renminbi, the legal currency of the PRC, and all references to “$” and dollar are to the U.S. dollar, the legal currency of the United States.

Special Note Regarding Forward-Looking Statements

This report contains forward-looking statements and information relating to Ailibao that are based on the beliefs of our management as well as assumptions made by and information currently available to us. Such statements should not be unduly relied upon. When used in this report, forward-looking statements include, but are not limited to, the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan” and similar expressions, as well as statements regarding new and existing products, technologies and opportunities, statements regarding market and industry segment growth and demand and acceptance of new and existing products, any projections of sales, earnings, revenue, margins or other financial items, any statements of the plans, strategies and objectives of management for future operations, any statements regarding future economic conditions or performance, uncertainties related to conducting business in the PRC, any statements of belief or intention, and any statements or assumptions underlying any of the foregoing. These statements reflect our current view concerning future events and are subject to risks, uncertainties and assumptions. There are important factors that could cause actual results to vary materially from those described in this report as anticipated, estimated or expected, including, but not limited to: competition in the industry in which we operate and the impact of such competition on pricing, revenues and margins, volatility in the securities market due to the general economic downturn; SEC regulations which affect trading in the securities of “penny stocks,” and other risks and uncertainties. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward- looking statements, even if new information becomes available in the future. Depending on the market for our stock and other conditional tests, a specific safe harbor under the Private Securities Litigation Reform Act of 1995 may be available. Notwithstanding the above, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Exchange Act expressly state that the safe harbor for forward-looking statements does not apply to companies that issue penny stock. Because we may from time to time be considered to be an issuer of penny stock, the safe harbor for forward-looking statements may not apply to us at certain times.

2

PART I

|

ITEM 1.

|

BUSINESS.

|

Description of Business

We design, manufacture and sell “Ailibao” branded footwear and design related apparel in the PRC. Ailibao Shoes was formed in 1983 as a “collective-owned enterprise” under the name Jinjiang Chendai Jiangtou Leather Factory and reorganized into a limited liability company in 1998 under the name Ailibao Shoes based in Jinjiang city, Fujian province, PRC. Our Ailibao footwear line is focused on athletic shoes for casual dress and sporting activities including basketball, soccer, tennis, skateboarding, running, and hiking. Ailibao-branded apparel products include Ailibao sports suits, shirts, caps, athletic bags and related accessories.

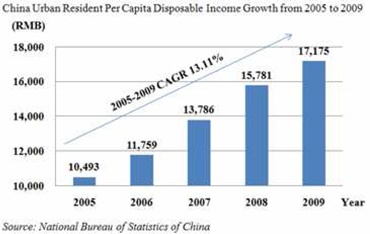

Our business strategy is to offer a wide range of Ailibao-branded products at prices that are competitive in our market. While China has become the second largest global economy, 2009 annual urban disposable income per capita was just Renminbi (“RMB”) 17,175 (National Bureau of Statistics of China). We sell at lower prices than international brands, while offering several comparable models as well as various unique styles. In 2010, the average retail price for a pair of our shoes was RMB 180.

We currently offer a wide line of sports footwear and sports-related apparel, which consisted of 80% and 20% of our sales in 2010, respectively. Our brand is focused on teens and young adults and our brand’s slogan is “street-fashion-life.” Our most popular style is “hip hop,” which accounted for over 73% of our footwear sales in 2010. We sell our products to regional distributors that currently supply 1,237 retail stores, 337 of which are Ailibao-branded franchise retailers. We do not receive franchise fees from these retailers.

We seek to increase our sales primarily by developing appealing new Ailibao products and by helping our distributors to attract new retailers in their territories. We also offer start-up incentives and store design support to retailers that open Ailibao-branded franchise stores. Such stores use Ailibao signage and carry our products exclusively. In addition to focusing solely on our products, Ailibao branded franchise stores provide us with “built-in” advertising and brand promotion in local neighborhoods.

From January 2007 through December 31, 2010, we have grown our sales at an annual average rate of over 25%. From January 2006 to December 31, 2010, the number of franchise locations grew from 544 stores to 1,237 stores. Our current manufacturing facilities have three production lines with an annual production capacity of approximately 3.5 million pairs of shoes. For 2010 shoe production, we manufactured approximately 3,561,566 million pairs in-house and used subcontract manufacturers for approximately 6,004,538 million pairs. All of our apparel is produced using subcontract manufacturers.

Company Background

Our History and Corporate Structure

Prior to January 21, 2011, we were a privately-held company. On January 21, 2011, pursuant to an agreement and plan of reorganization (the “Exchange Agreement”) by and among ASWV, Ailibao and the holders of all outstanding shares of Ailibao (the “Ailibao Shareholders”), ASWV acquired all of the outstanding shares of Ailibao (the “Ailibao Shares”) from the Ailibao Shareholders, and the Ailibao Shareholders transferred all of the Ailibao Shares to ASWV. In exchange, ASWV issued to the Ailibao Shareholders, 317,409,000 shares of common stock of and to the introducing party, 6,826,000 shares of common stock, totaling 95% of the shares of common stock of ASWV issued and outstanding after January 21, 2011 (the “Share Exchange”).

3

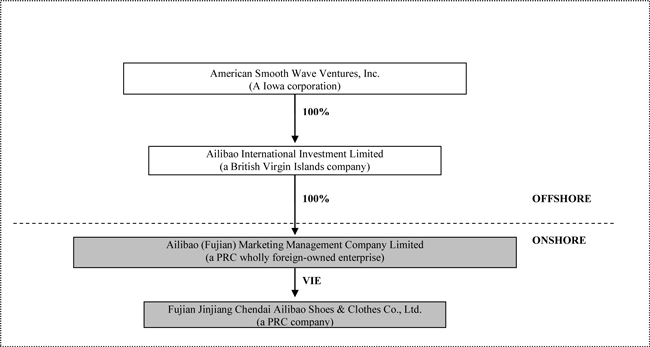

Ailibao is a British Virgin Islands company that was incorporated on June 8, 2010 and acts as a holding company and its sole asset is the shares of Ailibao (Fujian) Marketing Management Company Limited, (“Ailibao Marketing”), a wholly foreign-owned enterprise in the PRC. Ailibao Marketing has series of control agreements with Fujian Jinjiang Chendai Ailibao Shoes & Clothes Co., Ltd., a PRC company (“Ailibao Shoes”) that was formed in 1998. Ailibao Shoes is principally engaged in the design, production and sale of Ailibao-branded shoes and sportswear. As Ailibao Marketing has contractual control of Ailibao Shoes as well all rights to the economic benefit (including any profits and dividends) of Ailibao Shoes, Ailibao Shoes is considered a Variable Interest Entity (“VIE”) under applicable accounting principles. In this report, the terms “we,” “us,” and the “Company” are used interchangeably and refer to our US corporate parent company, all of our subsidiaries and the VIE company on a combined basis.

Our wholly owned subsidiary, Ailibao Marketing, has entered into a series of contractual arrangements with Ailibao Shoes and their respective shareholders, which enable us to:

|

·

|

exercise effective control over the business management and shareholder voting rights of Ailibao Shoes;

|

|

·

|

receive substantially all of the economic benefits of Ailibao Shoes through service fees in consideration for the business consulting services provided by Ailibao Marketing; and

|

|

·

|

have an exclusive option to purchase all of the equity interests in Ailibao Shoes and when and to the extent permitted under PRC laws.

|

We do not have an equity interest in Ailibao Shoes. However, as a result of these contractual arrangements, we are considered the primary economic beneficiary of Ailibao Shoes and we treat it as our consolidated affiliated entity under the generally accepted accounting principles in the United States, or U.S. GAAP. We have consolidated the financial results of its company in our consolidated financial statements in accordance with U.S. GAAP for the three years ended December 31, 2008, 2009 and 2010. For a description of these contractual arrangements, see “Corporate Structure.”

The following is a summary of the currently effective contracts among our subsidiary Ailibao Marketing, our consolidated affiliated entities Ailibao Shoes and the respective shareholders of Ailibao Shoes.

Business Operations Agreement

Pursuant to the business operations agreement dated November 18, 2010 among Ailibao Marketing, Ailibao Shoes and Baojian Ding, Baofu Ding and Changming Ding, the shareholders of Ailibao Shoes (the “Business Operations Agreement”), Ailibao Shoes must appoint the persons designated by Ailibao Marketing to be its executive director or directors, general manager, chief financial officer and any other senior officers. Ailibao Shoes agrees to accept the proposals provided by Ailibao Marketing from time to time relating to employment decisions, daily business operations and financial management. Without Ailibao Marketing’s prior written consent, Ailibao Shoes shall not conduct any transaction which may materially affect its assets, obligations, rights or operations, including but not limited to, incurrence or assumption of any indebtedness, sale or purchase of any assets or rights, incurrence of any encumbrance on any of its assets or intellectual property rights in favor of a third party, or transfer of any rights or obligations under this agreements to a third party. The term of this agreement shall survive until Ailibao Marketing is dissolved according the laws of the PRC. Ailibao Marketing may terminate the agreement at any time by providing 30 days’ advance written notice to Ailibao Shoes and to each of its shareholders. Neither Ailibao Shoes nor any of its shareholders may terminate this agreement.

Share Pledge Agreement

Pursuant to the share pledge agreement dated November 18, 2010 among Ailibao Marketing and Baojian Ding, Baofu Ding and Changming Ding, the shareholders of Ailibao Shoes (the “Share Pledge Agreement”), the shareholders of Ailibao Shoes pledge all of their equity interest in Ailibao Shoes to Ailibao Marketing, to guarantee Ailibao Shoes and its shareholders’ performance of their obligations under, where applicable, the Exclusive Business Consultation and Services Agreement (defined below), the Business Operation Agreement, the Option Agreements (defined below) and the Intellectual Property License Agreement (defined below). If Ailibao Shoes and/or any of its shareholders breach their contractual obligations under these agreements, Ailibao Marketing, as pledgee, will be entitled to certain rights, including the right to sell the pledged equity interests. Without Ailibao Marketing’s prior written consent, the shareholders of Ailibao Shoes may not transfer or assign the pledged equity interests, or create or allow any encumbrance that would prejudice Ailibao Marketing’s interests. During the term of the Share Pledge Agreement, Ailibao Marketing is entitled to receive all of the dividends and profits paid on the pledged equity interests. The equity interest pledge expires on the earlier of (i) the date on which Ailibao Shoes and its shareholders have fully performed their obligations under the Exclusive Business Consultation and Services Agreement, the Business Operation Agreement, the Option Agreement and Intellectual Property License Agreement; or (ii) Ailibao Marketing enforces the pledge pursuant to the terms and conditions under this agreement, to fully satisfy its rights under such agreements.

4

Power of Attorney

Pursuant to a power of attorney dated November 18, 2010 (the “Power of Attorney”), each of Baojian Ding, Baofu Ding and Changming Ding, the shareholders of Ailibao Shoes, irrevocably appointed, Mrs. Lam Mei Ying, the person designated by Ailibao Marketing, as their attorney-in-fact to vote on their behalf on all matters of Ailibao Shoes requiring shareholder approval under PRC laws and regulations. The Power of Attorney is valid so long as the principals are shareholders of Ailibao Shoes.

Exclusive Business and Consulting Services Agreement

Pursuant to the exclusive business and consulting services agreement dated November 18, 2010 between Ailibao Marketing and Ailibao Shoes (the “Exclusive Business and Consulting Services Agreement”), Ailibao Marketing has exclusive right to provide consulting services relating to, among other things, marketing and brand building activities, business development strategy and financing strategy, and certain other business areas to Ailibao Shoes. Pursuant to the Exclusive Business and Consulting Services Agreement, Ailibao Shoes agreed to pay a service fee to Ailibao Marketing equal to 100% of the net profits of Ailibao Shoes, and Ailibao Marketing agreed not engage any third party for any of the consulting services provided under the agreement. In addition, Ailibao Marketing exclusively owns all intellectual property rights resulting from the performance of this agreement. The initial term of the agreement is ten years and is extendable indefinitely by Ailibao Marketing. Ailibao Marketing can terminate the agreement at any time by providing 30 days’ prior written notice, while Ailibao Shoes is not permitted to unilaterally terminate the agreement.

Intellectual Properties License Agreement

Pursuant to the intellectual properties license agreement dated November 18, 2010 between Ailibao Marketing and Ailibao Shoes (the “Intellectual Properties License Agreement”), Ailibao Shoes grants Ailibao Marketing a royalty-free right to use its intellectual property. The term of the Intellectual Properties License Agreement is ten years with automatic renewal for another ten years, unless Ailibao Marketing gives three months’ prior written notice of non-renewal. Ailibao Marketing may terminate the agreement at any time by providing 30 days’ prior written notice.

Option Agreement

Pursuant to the option agreement dated November 18, 2010 among Ailibao Marketing and Baojian Ding, Baofu Ding and Changming Ding, the shareholders of Ailibao Shoes, the shareholders of Ailibao Shoes granted Ailibao Marketing or its designees an exclusive option to purchase, to the extent permitted under PRC law, all or part of their equity interest in Ailibao Shoes. Ailibao Marketing or its designees have sole discretion to decide when to exercise the option, either in part or in full, and they are entitled to exercise the option an unlimited number of times until all of the equity interests have been acquired, and can freely transfer the option, in whole or in part to any third party. Without Ailibao Marketing’s consent, the shareholders of Ailibao Shoes may not transfer, donate, pledge, or otherwise dispose of their equity interest in Ailibao Shoes. The equity option agreement will remain in full force and effect until the earlier of the date on which all of the equity interest in Ailibao Shoes has been acquired by Ailibao Marketing or its designated representatives.

5

Our current corporate structure is set forth below:

The PRC’s Economic Outlook

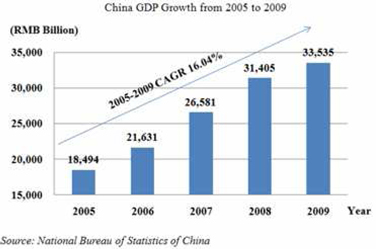

The PRC has experienced stable and strong economic growth in recent years. The PRC’s GDP has increased from RMB 18,493.7 billion to RMB 33,535.3 billion from 2005-2009, at a compound annual growth rate of approximately 16.04% (National Bureau of Statistics of China). Both GDP and GDP per capita between 2005 and 2009 are shown below:

The PRC’s economic growth has led to the increase in urbanization. As a result, the PRC’s urban population has increased from 562 million in 2005 to 622 million in 2009.

6

PRC Urban Population

|

Year

|

2005

|

2006

|

2007

|

2008

|

2009

|

|||||||||||||||

|

Urban Population (in millions)

|

562

|

577

|

594

|

607

|

622

|

|||||||||||||||

|

Total Population (in millions)

|

1,308

|

1,314

|

1,321

|

1,328

|

1,335

|

|||||||||||||||

|

Urbanization Rate (%)

|

43.0

|

43.9

|

44.9

|

45.7

|

46.6

|

|||||||||||||||

Source: National Bureau of Statistics of China

The disposable income per capita for urban residents in the PRC has increased also from RMB 10,493 in 2005 to RMB 17,175 in 2009, representing a compound annual growth rate of approximately 13.11%.

Rising incomes in the PRC have fueled the increase in the purchase of consumer goods. From 2005 to 2009, consumption of retail products in the PRC increased from RMB 6.72 trillion to RMB 12.53 trillion, representing a compound annual growth rate, or CAGR, of 16.85% (National Bureau of Statistics of China).

The PRC Sportswear Market

The PRC’s urbanization and increasing disposable incomes are key contributing factors to the growth of the PRC’s sportswear market. From 2004 to 2008, the PRC’s sportswear market increased from approximately USD $3.3 billion (RMB 27.4 billion) to USD $9.8 billion (RMB 68.3 billion), accounting for a compound annual growth rate of 31.3% (Frost & Sullivan, as reported by CIMB Research). The PRC’s sportswear market is expected to reach RMB 200 billion by 2010 and RMB 297 billion in 2020, representing a CAGR of 15.7% (UBS Global Equity Research).

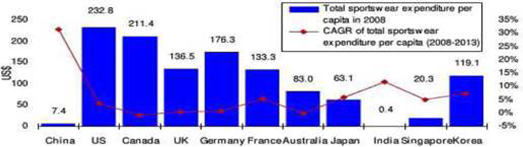

The PRC has the world’s largest population with approximately 1.3 billion people, yet its sportswear expenditure lags behind many developed nations. The PRC’s 2008 sportswear expenditure per capita was only USD $7.4, whereas the United States’ was USD $232.8 (Frost & Sullivan, as reported by CIMB Research).

Total Sportswear Expenditure per Capita in 2008

7

Source: Frost & Sullivan, as reported by CIMB Research

Market Participants

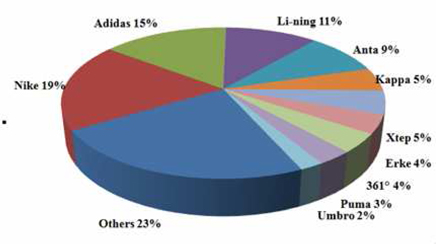

China’s sportswear market consists of international and domestic brands. Nike and Adidas are the international leading brands, accounting for 18.8% and 14.9% respectively of China’s sportswear market in 2008 (Frost & Sullivan). China’s domestic brands can be divided into two different markets: premium brands such as Li Ning and mass market brands such as Anta, Erke, Xtep, 361° and Peak.

Competitive Strengths

Brand focused on Teens and Young Adults

We focus on developing in-demand styles for teenagers and young adults. We send our product designers to industry-recognized shoe fashion centers, and our designers observe market trends in the footwear industry to inspire our new product designs. Our specialization in design allows us to produce product styles that are in high demand, which we believe allow us to capture a larger market share of mainstream Chinese teenagers and adults.

Affordable Pricing

Our products are typically priced lower than international and Chinese high-end brand names, while offering unique styling and comparable quality. Our pricing strategy is thus well suited for our core customer demographics in the PRC.

Strong Retail Sales Network

We have been able to expand our sales network coverage to 20 PRC provinces. The franchise store network includes street-level retail stores, in-mall retail stores, and in-department store sales booths and mixed sportswear retail stores.

Extensive Industry Experience

Our experience in the sports footwear industry has allowed us to manage our costs and to build strong distributor relationships. We have an experienced senior management team with an average of 17 years industry experience. In addition to production expertise and cost control, our team is experienced at developing new designs and bringing them to finished products in a short time span.

Business Strategies

We have several strategies to continue growing our business.

Increase Ailibao-Branded Franchise Stores

We plan to continuously strengthen our sales network by expanding our retail presence to new areas within the PRC. Based on feedback from distributors and our own market research, we have identified areas in northeastern and southwestern China as ideal markets for our products. We plan to build our sales network in these regions, including lower- and middle-income areas of major cities such as Beijing, Shanghai, Guangzhou, and Shenzhen. To accelerate such expansion, we intend to incentivize distributors and retailers by paying for a certain percentage of store construction expenses.

Promote our Brand Image through Company-Owned Retail Stores

We plan to open approximately 20 company-owned retail stores ourselves, which will generally serve to promote new products and unify our brand image. These retail stores will be larger than our typical-sized franchise stores and will carry more products. We also expect to generate higher profit margins on products sold at these store locations. The actual number of company stores and their timing will depend on future fund raising.

8

New Product Development

We plan to dedicate more financial resources to new product development. Expenditures will include both hiring more personnel to focus on shoe design and shoe fabric design, in addition to increasing the frequency of trips to worldwide shoe fashion centers.

Music, Film and TV star sponsorships

We plan to hire highly recognized and popular Chinese entertainers to sponsor and act as spokespersons for our products. We believe this marketing strategy will help strengthen our brand recognition on a national level, which can substantially improve our product acceptance, both at the distribution and retailing level. We believe our brand’s positioning as a lifestyle fashion brand gives us an advantage as music, film and TV stars cost much less to hire as shoe product sponsors than professional athletes. The timing and extent of these sponsorships will depend on our future fund raising.

Products

Footwear

We have produced footwear since 1998. In 2003, we transitioned from being a manufacturer of jogging shoes to our present position as a lifestyle footwear and apparel company. Our footwear sales accounted for 80% of our sales for the fiscal year ended December 31, 2010 and approximately 16% of our shoe sales were in our “hip hop” category during that time. Our products are marketed using the “Ailibao” brand name and logo, as well as various related derivatives, and in August 25, 2006 our “ “ trademark was recognized as “China’s Well-Known Trademark” by the Jiangxi Province Jiujiang City Court Intermediate People’s Court. Our product line is represented by our promotional slogan “Street Fashion Life.” This slogan represents the categories of our footwear designs: street, fashion, and life.

“ trademark was recognized as “China’s Well-Known Trademark” by the Jiangxi Province Jiujiang City Court Intermediate People’s Court. Our product line is represented by our promotional slogan “Street Fashion Life.” This slogan represents the categories of our footwear designs: street, fashion, and life.

“ trademark was recognized as “China’s Well-Known Trademark” by the Jiangxi Province Jiujiang City Court Intermediate People’s Court. Our product line is represented by our promotional slogan “Street Fashion Life.” This slogan represents the categories of our footwear designs: street, fashion, and life.

“ trademark was recognized as “China’s Well-Known Trademark” by the Jiangxi Province Jiujiang City Court Intermediate People’s Court. Our product line is represented by our promotional slogan “Street Fashion Life.” This slogan represents the categories of our footwear designs: street, fashion, and life.|

|

·

|

Street refers to hip-hop and skateboard style

|

|

|

·

|

Fashion refers to metropolitan, fashion forward style; and

|

|

|

·

|

Life refers to leisure and sports style

|

Apparel and Accessories

Our apparel and accessories products accounted for approximately 20% of our sales for the 2010 fiscal year. Our apparel and accessories includes T-shirts, sweaters, sports suits, jackets, bags, hats, and athletic accessories.

Product Development

Our product development team places great emphasis on the comfort and functionality of our products. We focus on two key categories to meet our customers’ high expectations: (i) new product styles and (ii) quality and value.

We spend significant time and energy making sure we have stylish product offerings that suit contemporary tastes for mainstream Chinese teens and young adults. We also strive to make sure our shoes are durable and comfortable, so we work hard to shape our shoes to fit our average customers’ foot dimensions. We perform vigorous product testing to test our footwear’s ability to withstand everyday uses, while continuing to provide its users high comfort.

9

Production

Our production facility has three production lines, with a current annual production capacity of approximately 3.5 million pairs of footwear. We are planning to develop a new plant on land adjacent to our current production facility with an anticipated combined area of 19,050 square meters. This new facility would add approximately 3.5 million pairs to our current capacity per year. We also use outsourced manufacturers. All of our apparel is made using outsource manufacturers.

Production Process:

Our production uses several steps that take place in sequential fashion:

|

|

1.

|

Raw materials procurement: We procure raw materials from long-standing suppliers. Our raw materials are comprised of natural and synthetic leather, nylon, rubber and plastics.

|

|

|

2.

|

Preparation and processing of raw materials: Our quality control department inspects and tests the raw materials for processing. The quality control department also instructs and tests product parts supplied by our subcontractors.

|

|

|

3.

|

Sewing and stitching: Our footwear production department sews and stitches the walls of the shoe. These walls will be combined during assembly to create the shape of shoe.

|

|

|

4.

|

Shaping and assembly of soles: Our footwear production department produces the upper-soles and mid-soles of the footwear and assembles them together.

|

|

|

5.

|

Assembly: Our footwear production department assembles all unfinished footwear parts. The assembly process includes gluing the soles to the body of the shoe and pressing and drying the products.

|

|

|

6.

|

Quality Control: We put our finished footwear under quality control tests,that include visual inspections as well as testing and bending the products.

|

|

|

7.

|

Packaging: Our footwear is packaged according to customers’ orders and will be stored for a short period of time until shipped.

|

The order of our production process is depicted in the chart below:

10

Procurement of Raw Materials

In 2010, we purchased raw materials for our products from 130 different suppliers. We use high quality raw materials that meet our quality specifications and styles for our footwear. The raw materials we procure include: natural and synthetic leather, nylon, rubber and plastics. These products are the fundamental building blocks of our shoes. Based on our current product designs, we will choose new and different styles of materials to procure for the manufacturing of our footwear. We purchase raw materials based on the order quantities we receive from our distributors. We only purchase raw materials for in-house production. For outsourced production, we select the raw materials for our subcontractors to purchase. We typically pay our vendors within 90 days after delivery.

Outsourcing

We outsourced approximately 64% of our footwear production in 2010 and all of our apparel and accessory production. We use ten different subcontractors. Our top five shoe subcontractors are Fujian Jinjian Wanlilai Shoes and Clothing Co., Ltd., Jinjian Haodeli Shoes and Clothing Development Co., Ltd., Quanzhou Sanle Sports Co., Ltd., Jinjiang Hui Kai Shoes Co., Ltd. and Quanzhou Xinhao Shoes and Clothing Co., Ltd. , who are all located in Jinjiang, Fujian Province. Our subcontractors purchase their own raw materials, and we inspect the raw materials before production. We subcontract all of our apparel and accessory products.

11

Quality Control and Management

Our quality control efforts include testing on raw materials, R&D stage quality control, production process quality control and final goods quality control. Our main objective is to control the quality throughout all phases of production for both our own facilities and the OEM subcontractors. Our management team has over 15 years of shoe manufacturing industry experience, which allows them to effectively control the quality of the goods we produce. On August 9, 2008, we received ISO9001:2000, a certificate for quality management system certification issued by Guangdong Audit and Certification Centre of Quality System.

Raw Materials Quality Control

We select raw materials for specific product designs and use a machine to test for anti-yellowing, folding, abrasion, temperature resistance and stretch proof ability. We also choose the same specific materials for our subcontractors to use for manufacturing. We also test the materials our subcontractors use for production to confirm that they meet our quality standards.

Design Prototypes Quality Control

During the design phase, we place great emphasis on material quality, especially the shoe soles. The sole material tests include folding, abrasion, cold-resistance and stretch-proofing.

Production Process Quality Control

We observe our staff during the assembly process to confirm they are properly assembling the footwear to our standards and address assembly problems on a case-by-case basis.

Finished Products Quality Control

We randomly select finished goods for quality control testing. Tests that we apply include but are not limited to the following: thermo stability test, anti-yellowing test, abrasion resistance test, hard fold test and stretch test.

Distributors

We sell our products to 11 regional distributors, who, in turn, supply retail outlets around the country. As of December 31, 2010, our top four distributors were located in Chengdu, Chongqing, Wuhan and Zhengzhou. As of December 31, 2010, our distributors currently supply 1,237 retail outlets, in 20 provinces the PRC. As of December 31, 2010, the highest retail store concentration is in Sichuan Province and Chongqing, where 473 retail stores carry our products. We set sales targets for our distributors to increase sales on an annual basis. If our distributors meet our sales targets, we give them a percentage discount on the total order.

We assess the suitability of our distributors based on the following criteria:

|

|

·

|

relevant experience in the management and operation of sportswear retail stores;

|

|

|

·

|

creditworthiness, including a review of the latest three-month bank statements, cash flow and credit record;

|

|

|

·

|

ability to develop and operate a network of retail stores in its designated sales region;

|

|

|

·

|

ability to meet our sales targets; and

|

|

|

·

|

suitability of warehouse location and size.

|

Our distribution agreements are generally for a term of up to five years. Our distributors seek to promote and develop more Ailibao franchise stores in their territories. To assist our distributors to increase the number of Ailibao franchise stores in their territory, we may provide certain funding assistance for decoration and store set-up costs for retailers that are interested to sell Ailibao on an exclusive basis. The amount of decoration compensation is dependent on the location and size of the retail store.

While we may provide the Ailibao franchise store with design and merchandising support, we sell and ship to the distributors, who warehouse the product and supply the retail stores in their territory. The distributor has the direct financial and contractual relationship with the retail store.

Our distributor agreements do not prevent us from opening our own retail stores in any territory. We have plans to open our own Ailibao flagship retail stores in China, to improve general Ailibao brand presence and to increase interest in Ailibao-Branded Franchise stores in neighboring areas (see “–Ailibao-Branded Franchise Stores” below).

12

Distributor Arrangements

Term and Exclusivity

|

|

·

|

Our typical distributor agreement has a 5-year term and requires that Ailibao is the only shoe brand our distributors carry.

|

Geographical

|

|

·

|

Our distributors are positioned in select geographical regions and are restricted to distribute our products within their designated areas.

|

Pricing

|

|

·

|

Our distributors should use our suggested price guidelines and are only allowed to discount a certain percentage based on level of consumption.

|

Support

|

|

·

|

We provide financial support to retail stores for in-store decorations. All retail stores must have a uniform decorative style. The amount of decoration funds granted is determined by the location of the retail stores and the square meters of sales area.

|

All of our distributors undergo an intensive credit examination. We provide credit to our distributors on case-by-case basis based on each distributors financial conditions. Distributors typically pay 30% in advance of orders and pay the balance 30 days after delivery of finished product. According to each distributor’s credit record and financial condition, we may extend credit terms up to 90 days. We sometimes buy back unsold inventory from our distributors for a 20-60% discount.

Ailibao-Branded Franchise Stores

We approve the use of our name and logo to selected retailers that are willing to sell our shoes on an exclusive basis. We send management to candidate retail store locations to confirm that retail stores conform to our store layouts and general guidelines. All new store locations are pre-approved by us. We also will provide staff training on selling our products and give initial assistance on store operation guidelines.

To maintain consistency with our brand image for our retail stores we provide the following:

|

|

·

|

Blueprints and store design guidelines

|

|

|

·

|

Product and window display advertisements

|

|

|

·

|

General guidelines on store operation

|

As of December 31, 2010, 149 of our 1,237 franchise stores are owned and operated by our distributors, while 1,088 are owned and operated by unrelated third-party owners and none are owned by us. All franchise stores are supplied with Ailibao merchandise by the distributor that serves their respective region. We periodically send marketing staff to retail stores to perform market research and on-site inspections. We also work with our distributors to monitor which models are trending well and which are not. Based on market feedback, we make adjustments to our product range and segmentation.

Sales Fairs

We hold sales fairs to showcase prototype products to our distributors. We hold three sales fairs each year, in March, June and September. Typically these sales fairs take place for 5 days, near our factory in Jinjiang city, Fujian province. We launch and sell our new collection of products for each season at these sales fairs. Distributors place orders for the products at these sales fairs, which constitute approximately 80% of our annual revenue, with the remaining 20% coming from in season re-orders.

Defects and Overstock

We have defective product return policies with our distributors. We agree with our distributors that a 1% defective product rate for products is acceptable. If the defective product rate exceeds 1%, distributors have the right for a refund for the defective products. To date, we have experienced a defective product rate below 1%. We also agree to buy back overstock from our distributors, at a 20-60% discount that depends on the amount of time since they originally bought the product.

13

Promotion and Marketing

We typically promote and market our products through sponsoring events, advertisement billboards and other types of advertisements such as Internet marketing and hosting sales fairs. We plan to increase our advertising expenditures to enhance the awareness of Ailibao brand as well as attract new distributors.

Before we market in new areas, we send our marketing staff to perform onsite research. Marketing managers will consider factors of target market as follows: the population of target market, income level, consuming habit, main consuming groups and other major players.

Pricing

We set our pricing according to a variety of factors including: cost of raw materials and production, market conditions and competitors’ pricing. We set suggested retail prices on our products for our distributors. Our distributors are allowed to extend certain discounts to our retail outlets depending on their regional location.

Competition

The footwear and accessories industry is highly competitive and fragmented in the PRC. Our Chinese competitors include Anta, Lining, China Hongxing, China Eratat, China Sports, Exceed and Xtep. Our principal regional competitors are Qiaodan, Deerway, Jinlaike and Qiuzhi. The major foreign competitors offering sports shoes in China is Nike, Adidas, and Puma.

The chart below depicts the sportswear companies’ market share of the PRC’s sportswear market as of 2008.

Competition is determined by the following: performance style and quality, new product development, price, product identity through marketing and promotion, and support to distributors and customer service. Our current market share consists of less than 1% of the total market. We seek to compete with a wide product line that compares favorably in style, while having lower price points.

Employment Breakdown

As of December 31, 2010, we had approximately 1,210 full-time employees. Over 90% of employees are experienced production people. Our production staff works 11 hours each day, 6 days a week. The chart below provides details of our employees by function.

14

|

Department

|

Number of Employees

|

|||

|

Footwear production department

|

1,038 | |||

|

Quality control department

|

51 | |||

|

Product development

|

18 | |||

|

Sales and marketing center

|

30 | |||

|

Administration department

|

59 | |||

|

Finance department

|

11 | |||

|

Senior management

|

3 | |||

|

Total Employees

|

1,210 | |||

Intellectual Property Rights

As of December 31, 2010, we have registered seven trademarks, and two pending trademark applications. We also have our website cnailibao.com registered until June 14, 2013. In August 25, 2006 our “Ailibao” trademark was recognized as one of “China’s Well-Known Trademarks” by virtue of the judgment made by the Intermediate People’s Court in Jinjiang City of Jiangxi Province.

According to the Well-known Trademark Recognition and Protection guideline issued by State Administration For Industry and Commerce (SAIC) on April 17, 2003, “Well-Known Trademark of China” is defined as those well-known trademarks in China which are widely known and enjoy a high reputation in the market place. The Trademark Law only provides certain factors that need to be considered when recognizing a trademark as the “well-known trademark,” which include the public recognition of trademark and time of use of such trademark. The registration term of trademark, including well-known trademark, is ten years, which could be extended for another ten years upon application of the trademark’s owner within 6 months before expiration of the original term. Our Ailibao brand has also been recognized as a “Fujian Famous Brand” by the Fujian Provincial Peoples’ Government in December 2008.

Environment Protection

Our manufacturing operations are subject to PRC environmental laws and regulations on air emission, solid waste emission, sewage and waste water, discharge of waste and pollutants, and noise pollution. These laws and regulations include Law of the PRC on Environmental Protection, Law of the PRC on the Prevention and Control of Water Pollution, Law of the PRC on the Prevention and Control of Atmospheric Pollution, Law of the PRC on the Prevention and Control of Pollution from Environmental Noise, and Law of the PRC on the Prevention and Control of Environmental Pollution of Solid Waste. We are also subject to periodic monitoring by relevant local government environmental protection authorities.

According to these environmental laws and regulations, all business operations that may cause environmental pollution and other public hazards are required to incorporate environmental protection measures into their operations and establish a reliable system for environmental protection. Such a system must adopt effective measures to prevent and control pollution levels and harm caused to the environment in the form of waste gas, waste water and solid waste, dust, malodorous gas, radioactive substance, noise, vibration, and electromagnetic radiation generated in the course of production, construction or other activities.

Companies in the PRC are also required to carry out an environment impact assessment before commencing construction of production facilities and the installation of pollution treatment facilities that meet the relevant environmental standards and treat pollutants before discharge. On October 21, 2010, Jinjiang Environmental Protection Bureau issued a certificate letter, verifying that the construction of our new factory and supporting facilities complies with the environment protection requirements, that the relevant acceptance inspection is being processed and that our passing the acceptance inspection is without material obstacle. The main environmental impact from our operations is the generation of wastewater and noise pollution from the operation of production machinery. On October 29, 2010, we received a Provisional Certificate of Sewage Discharge Permission issued by Jinjiang Environmental Protection Bureau.

15

Health and Safety Matters

The PRC Production Safety Law (the “Production Safety Law”) requires that we maintain safe working conditions under the Production Safety Law and other relevant laws, administrative regulations, national standards and industrial standards. We are required to offer education and training programs to our employees regarding production safety. The design, manufacture, installation, use and maintenance of our safety equipment are required to conform with applicable national and industrial standards. In addition, we are required to provide employees with safety and protective equipment that meet national and industrial standards and to supervise and educate them to wear or use such equipment according to the prescribed rules.

As required under the Regulation of Insurance for Labor Injury, Provisional Insurance Measures for Maternity of Employees, Interim Regulation on the Collection and Payment of Social Insurance Premiums, and Interim Provisions on Registration of Social Insurance, we provide our employees in the PRC with welfare schemes covering pension insurance, unemployment insurance, maternity insurance, injury insurance and medical insurance.

Insurance

We do not maintain general product liability insurance for any of our products. Nevertheless, we believe that our practice is in line with the general industry practice in the PRC as product liability insurance is not required under PRC law. In past 4 years, we did not receive any material claims from customers or consumers relating to our products.

Research and Development

We have spent approximately RMB10 million and RMB7.89 million during the years ended December 31, 2010 and 2009, respectively.

Corporate Information

Our principal executive offices are located at Jiangtou Industrial Zone, Chendai Town, Jinjiang City, Fujian Province 362211 PRC, Tel: +86 0595-8519-6329, Fax: +86 0595-8519-2329.

Reports to Securityholders

ASWV delivers annual reports on Form 10-K, which include ASWV’s financial statements to ASWV’s stockholders. ASWV files annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and proxy and information statements and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Exchange Act. The public may read and copy these materials at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549, on official business days during the hours of 10:00 am to 3:00 pm. The public may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding us and other companies that file materials with the SEC electronically.

Item 1A. Risk Factors.

In addition to the other information in this Form 8-K/A, readers should carefully consider the following important factors. These factors, among others, in some cases have affected, and in the future could affect, our financial condition and results of operations and could cause our future results to differ materially from those expressed or implied in any forward-looking statements that appear in this on Form 8-K/A or that we have made or will make elsewhere.

16

Risks Relating to Our Business

We distribute our products through Ailibao branded-franchise stores operated by independent third-party operators over which we have limited control.

Our distributors wholesale some of our products to third-party retail store operators. We have limited control over the retail stores as they are operated by third-party retail operators, and we have no contract with them as they are supplied by the distributor, including those that use our name in their branding. We have contractual relationships only with our distributors and not with authorized third party retail store operators. There can be no assurance that these current distribution arrangements provide us with sufficient control to ensure the Ailibao branded-franchise stores sell our products on an exclusive basis or to prevent our Ailibao brand from being associated with any negative image relating to quality or customer service. Such association could damage our brand image and reputation and could have a material adverse effect on our business, results of operations and financial condition. Further, if distributors experience financial difficulties, they may unilaterally attempt to liquidate their inventory build-up through discounts at their Ailibao branded-franchise stores without our approval, which may damage the image and the value of our “Ailibao” brand.

Adverse changes in the business and creditworthiness of our distributors could materially adversely affect our financial condition and results of operations.

We derive all of our revenue from sales to distributors. If our distributors perform poorly or if we fail to maintain good relationships with our distributors, our sales, financial condition and operating results may be adversely affected.

We rely on our distributors for the expansion of our retail sales network, but they may not be willing to accommodate the needs of our business plans.

Our distributor-led retail network consists of 1,237 Ailibao-branded outlets covering 20 provinces and municipalities in the PRC. We rely on our existing and new distributors to assist us in exploring new markets for our products and identifying potential locations for new stores. There can be no assurance that our distributors will choose the most ideal locations for new retail outlets and that their retail expansion would be timely or sufficient in scope to satisfy the needs of our business.

We rely on several large distributors for a significant portion of our sales.

We derive a significant portion of our sales from several large distributors. For the 2008, 2009 and 2010 fiscal years, sales to our top five distributors accounted for approximately 43.3%, 42.0% and 52%, respectively, of our total revenue. For the 2008, 2009 and 2010 fiscal years, sales to our single largest distributor accounted for approximately 10.2%, 9.1% and 13.4%, respectively, of our total revenue. We generally enter into distributorship agreements with our distributors for up to a term of 60 months. The duration of our contractual relationships with each of our top five distributors has been for more than 6 years. We do not manufacture our products on a made-to-order basis; rather, we take orders for our prototype products at sales fairs before entering into sale contracts with our distributors to manufacture our products. Our purchase orders at sales fairs constitute approximately 80% of our revenue. There can be no assurance that our top distributors will renew their distributorship agreements with us on commercially acceptable terms or at all.

Under our agreements with our distributors, we appoint only one distributor instead of multiple competing distributors for one designated geographical area or region. This enables us to manage and monitor the distributor and the Ailibao retail outlets in the designated region more effectively. While we may rely on a sole distributor in a designated region to sell our products, we believe that we would be able to appoint a replacement distributor in the designated region if the need arises. However, to the extent that any distributor for any particular market ceases to cooperate with us for any reason and we are not able to find a suitable replacement distributor for that market in a timely manner, we will likely lose significant business in that market, as there can be no assurance that we would be able to obtain orders from other distributors to replace any such lost sales. Any substantial reduction in purchases from our top distributors, or any failure to renew their agreements with us, may result in a significant loss of sales and our business, financial condition and results of operation may be materially adversely affected.

17

We are subject to market fluctuations, which can impact the price that we sell our products to our distributors. In addition, distributors’ sales of our products at a discount, rather than the suggested retail price, to end customers could have an adverse effect on our business and brand name.

The prices at which we sell our products are affected by supply and demand fluctuations inherent in the market for our products. Under our current business model, we sell our products to distributors and do not sell directly to consumers. We do not have any agreements with our distributors that provide for a minimum purchase price at which the distributors buy our products. We do, however, provide suggested retail prices. As such, the wholesale prices we offer for our products to our distributors must match the distributors’ expectations for the retail sale of our products to consumers. If distributors believe that our suggested retail prices do not justify the wholesale prices at which we are offering them, they may require us to lower our wholesale prices. If the wholesale prices of our products should decrease, our growth targets, financial condition, and results of operations may be materially adversely affected.

Our sales to distributors may not directly correlate to the demand for our products by end consumers, which could adversely affect our ability to accurately track market trends and preferences of end consumers for our products and respond to such changing market dynamics.

We sell our products to distributors and do not sell directly to end consumers. Our distributors do not provide us with any sales reports or inventory reports. These reports would enable us to identify whether our products are gaining consumer acceptance at the Ailibao retail outlets. Therefore, we rely on our distributors to monitor inventory levels and overall sales performance of authorized third party retail store operators. If we are unable to track end-consumer sales accurately, we may not be able to assess market trends and preferences, which ultimately could have a material adverse effect on our revenue.

We face increasing labor costs and other costs of production in the PRC, which could materially adversely affect our profitability.

The footwear manufacturing industry is labor intensive. Labor costs in China have been increasing in recent years and our labor costs in the PRC could continue to increase in the future. If labor costs in the PRC continue to increase, our production costs, including both our own manufacturing and outsourcing costs, will likely increase. This may in turn affect the selling prices of our products, which may then affect the demand of such products and thereby adversely affect our sales, financial condition and results of operations. Moreover, increases in costs of product parts required for production of our products, such as natural and synthetic leather, and semi-finished rubber soles, increases in electricity costs and other increases in production costs, may cause similar adverse effects, particularly if we are unable to identify and employ other appropriate means to reduce our costs of production. Furthermore, we may not be able to pass on these increased costs to consumers by increasing the selling prices of our products in light of competitive pressure in the markets where we operate. In such circumstances, our profit margin may decrease and our financial results may be adversely affected.

Interruptions in our supply of raw materials and product parts could adversely affect our business, financial condition and results of operations.

Our supply agreements were signed based on orders received. For the 2008, 2009 and 2010 fiscal years, we purchased raw materials for our products from 54, 42 and 60 suppliers, respectively, most of which are located in Jinjiang. For the 2008, 2009 and 2010 fiscal years, our top five raw-material suppliers and subcontractors accounted for approximately 34.9% 35.6% and 56.8%, respectively, of our total purchases from raw-material suppliers and subcontractors. During the same periods, our single largest supplier accounted for approximately 10.3%, 10.7% and 14.6%, respectively, of our total purchases. We purchase a large portion of our raw materials and product parts from a small number of suppliers. There can be no assurance that our top suppliers will continue to deliver raw materials or product parts to us in a timely manner or at acceptable prices and quality, or at all. Any disruption in supply of raw materials or product parts from our suppliers may adversely affect our business, financial condition and results of operations.

18

Our profitability may decrease if we are unable to pass on increased cost of raw materials and product parts to our customers.

Our manufacturing operations depend on adequate supplies of raw materials and product parts. We purchase all of our raw materials on an order-by-order basis with suppliers. The prices of certain of our key raw materials, such as synthetic leather, are subject to factors beyond our control, such as fluctuations in crude oil prices. We may also experience difficulty in obtaining other acceptable quality materials on a timely basis and the prices that we pay for such materials may increase due to increased demand or other factors. We may not be able to pass on the increased cost to our customers by increasing the selling prices due to competitive pressure in the markets. In such circumstances, our business, financial condition and results of operations may be adversely affected.

We rely on third party contract manufacturers for a portion of our footwear production and all of our apparel and accessories production and failure of such parties to provide products in a timely fashion could adversely affect our business, financial condition and results of operations.

During the 2008, 2009 and 2010 fiscal years, we outsourced a portion of our footwear production to five contract manufacturers and all of our apparel production to four contract manufacturers. For 2008, 2009, and 2010, our single largest contract manufacturer of footwear accounted for approximately 18.7%, 18.3% and 34.0%, respectively, of our total purchases of footwear, and the term of our agreement with this manufacturer expires on October 24, 2011. For 2008, 2009 and 2010, our single largest contract manufacturer for apparel accounted for approximately 36.4%, 35.3% and 27.0%, respectively, of our total purchases of apparel, and our agreement with this manufacturer expires May 31, 2011.

We can give can be no assurance that we can renew these contracts upon expiry, on commercially acceptable terms, or at all. Contract manufacturers may unilaterally terminate our supply contracts or they may seek to increase the prices that they charge. As a result, we are not assured of an uninterrupted supply of footwear, apparel and accessories of acceptable quality or at acceptable prices from our contract manufacturers. We may not be able to offset any interruption or decrease in supply of our products by increasing production at our own production facilities due to capacity constraints, and we may not be able to substitute suitable alternative contract manufacturers in a timely manner at commercially acceptable terms. Any disruption in our supply of products from contract manufacturers may adversely affect our business and could result in loss of sales and increase in production costs, which would adversely affect our business and results of operations.

We may be involved in legal proceedings arising from violation of relevant laws, rules or regulations particularly in respect of labor and environmental protection by third party contract manufacturers and suffer from damage to our reputation.

We contract with third-party contract manufacturers and raw material suppliers. In order to protect the reputation of our brand, we strive to adhere to all relevant laws, rules and regulations, particularly in respect of labor and environmental protection. However, we do not exercise any control over the operations of our contract manufacturers or suppliers and are therefore not able to ensure their compliance with applicable laws and regulations. Therefore, there can be no assurance that our contract manufacturers or suppliers are in compliance with, or will comply with, all applicable labor and environmental laws, rules and regulations with respect to their manufacturing operations. In the event that our contract manufacturers or suppliers violate any of these laws, rules or regulations, any resulting negative publicity may damage our brand and defeat our brand-building efforts. In the event that we are named as a defendant in a lawsuit or any other proceeding arising from violations by our contract manufacturers or suppliers of any applicable laws, rules or regulations with respect to their manufacturing operations, we will incur costs and resources in defending ourselves in such a lawsuit or proceeding. As a result of the foregoing factors, our business, profitability and results of operations may be adversely affected.

Failure to effectively promote or maintain the Ailibao brand may affect our performance and sales and cause us to incur significant costs.

The image of the Ailibao brand is an important factor in influencing consumer preferences and building brand loyalty. Promoting and maintaining the Ailibao brand is therefore crucial to our success and growth within the PRC footwear market. We have a sales department that helps arrange media sponsorships and other endorsement activities. We use a variety of media, such as the Internet and outdoor billboard displays to build both regional and national brand recognition. If we are unsuccessful in promoting our Ailibao brand among its targeted consumer groups, the goodwill and consumer acceptance of our Ailibao brand may be eroded, and our business, financial condition, results of operations and prospects may be adversely affected. Any negative publicity, whether in the PRC or abroad, in relation to our brand or our brand representatives could have an adverse effect on the public’s perception of our brands, which could have a negative impact on our business and results of operations.

19

In addition, we have incurred and expect to continue to incur significant costs and expenses arising out of our brand-building activities, including sponsorships and increased advertising in regional and national Internet, television and billboard displays. These activities may not be successful in building the goodwill and profile of our brand, which could have a negative effect on our sales and results of operations.

Our sales may be affected by seasonality, weather conditions and a number of other factors.

We operate our business in the PRC and derive all of our revenue from these operations. Generally, PRC consumers’ spending behavior is stable year-on-year but varies seasonally, particularly during the Chinese Spring Festival, which falls in our first fiscal quarter.

However, the mix of product sales may vary considerably from time to time as a result of changes in seasonal and geographic demand for particular types of footwear, apparel and accessories. In addition, unexpected and abnormal changes in climate may affect sales of our products that are timed for release during a particular season.

Fluctuations in our sales may also result from a number of other factors including:

|

|

·

|

the timing of international and domestic sports events;

|

|

|

·

|

consumer acceptance of our new and existing products;

|

|

|

·

|

changes in the overall sportswear industry growth rates;

|

|

|

·

|

economic and demographic conditions that affect consumer spending and retail sales;

|

|

|

·

|

the mix of products ordered by our distributors;

|

|

|

·

|

the timing of the placement and delivery of distributor orders; and

|

|

|

·

|

variation in the expenditure necessary to support our business.

|

As a result, we believe that comparisons of our operating results between any interim periods may not be meaningful and that these comparisons may not be an accurate indicator of our future performance.

Our manufacturing operations may be disrupted for reasons beyond our control, which could impact our financial condition and/or results of operations.

Our manufacturing operations could be disrupted for reasons beyond our control. The causes of disruptions may include extreme weather conditions, landslides, earthquakes, fires, natural catastrophes, raw material supply disruptions, equipment and system failures, labor force shortages, energy shortages, workforce actions or environmental issues. Any significant disruption to our operations could adversely affect our ability to make and sell products.

In addition, the occurrence of any of these events could have a material adverse effect on the productivity and profitability of any of our manufacturing facilities and on our business, financial condition or results of operations, and/or the operations of our distributors.

We have a limited operating history and our historical results of operations of our apparel business may not be indicative of our future performance.

We have a limited history of operation and the historical financial information in this Form 8-K/A may not necessarily reflect our future results of operation. There also may not be a sufficient basis to evaluate our future prospects. We have outsourced all of our apparel production to contract manufacturers. We have a limited operating history in the sale and marketing of apparel and do not have any experience in manufacturing apparel. As a result, the historical operating results of our apparel business may not provide a meaningful basis for evaluating the performance of our apparel business going forward and may not be indicative of our future performance.

20

If we are unable to increase our production capacity due to our internal production constraints or our inability to locate suitable contract manufacturers with sufficient production capacity of their own, our operating results may be adversely affected.

We manufacture a portion of our footwear at our production facility in Jinjiang, Fujian province. We outsource the manufacturing of a portion of our footwear and all of our apparel and accessories to contract manufacturers. Although we produce a portion of our footwear products in house, we expect to continue to rely on contract manufacturers for the production of a portion of our footwear and all of our apparel and accessories. Therefore, our ability to continue to increase our sales depends on the successful expansion of our footwear production capacity at our production facility and the availability of contract manufacturers with sufficient production capacity of their own. If we are unable to continue to increase our internal production capacity or engage suitable contract manufacturers, our operating results may be adversely affected.

We may not be able to manage our growth effectively and our growth may slow down in the future.

We have been expanding our business rapidly and intend to continue to do so either through organic growth or through acquisitions and investments in related businesses as we deem appropriate. Such expansion may place a significant strain on our managerial, operational and financial resources. Further, we have no prior experience in engaging in the management and operation of retail stores or retail business. We will need to manage our growth effectively, which may entail devising and implementing business plans, training and managing our growing workforce, managing costs and implementing adequate control and reporting systems in a timely manner. There can be no assurance that our personnel, procedures and controls will be managed effectively to support our future growth adequately. Failure to manage our expansion effectively may affect our success in executing our business plan and adversely affect our business, financial condition and results of operation. In addition, our growth in percentage terms may slow in the future. Accordingly, you should not rely on our historic growth rate as an indicator for our future growth rate.

We may not be successful in our future expansion plans and may be unable to secure sufficient funding for such plans to further grow our business.

Our business expansion plans will require us to increase investments in, and devote significant resources to, our brand promotion efforts, internal production capacities, research and design capabilities and the Ailibao sales distribution network operated by our distributors. If we fail to implement our future expansion plans, we may not achieve our growth target. Furthermore, our ability to obtain adequate funds to finance our expansion plans depends on our financial condition and results of operations, as well as other factors that may be outside our control, such as general market conditions, the performance of the PRC sportswear industry, and political and economic conditions in the PRC. If additional capital is unavailable, we may be forced to abandon some or all of our expansion plans, as a result of which our business, financial condition and results of operations could be adversely affected.

Loss of any key executive personnel or any failure to attract such personnel in the future will adversely impact our business and growth prospects.

Our future success will depend on the continued service of our senior management. In particular, Mr. Ding Baofu chief executive officer, has over 18 years’ experience in the sportswear industry and is responsible for our overall corporate strategies, planning and business development. His experience and leadership is critical to our operations and financial performance. We do not maintain any “key-man” insurance policies. If we lose the services of any of our key executive personnel and cannot replace them in a timely manner, such loss may reduce our competitiveness, and may adversely affect our financial condition, operating results and future prospects. In addition, our success depends significantly on other personnel and, in particular, our team of designers. Other international and domestic competitors that operate in the PRC may be able to offer more favorable compensation packages to recruit personnel whom we consider desirable. Our continued success will depend on our ability to attract and retain qualified personnel in order to manage our existing operations as well as our future growth. We may not be able to attract, assimilate or retain the personnel whom we need. Our staff expenses in relation thereto may increase significantly. This may adversely affect our ability to expand our business effectively.

21

While design and aesthetics of our products are important factors for consumer acceptance of our products, technical innovation in the design of footwear, apparel, and sports equipment is also essential to the commercial success of our products. Research and development plays a key role in technical innovation. Our failure to introduce technical innovation in our products could result in a decline in consumer demand for our products.

We may be involved in litigation on intellectual property infringement or other litigation or regulatory proceedings, which could adversely affect our reputation, financial condition and results of operations.

We may design products with elements that may inadvertently infringe copyright or other intellectual property rights, as a result of which other parties may initiate litigation or other proceedings against us. Responding to and defending these proceedings may require substantial costs and diversion of resources, and the result of these proceedings may be uncertain. Furthermore, our reputation may be adversely affected.

We may be subject to other lawsuits and regulatory actions relating to the business from time to time. Due to the inherent uncertainties of litigation and regulatory proceedings, we cannot accurately predict the ultimate outcome of any such proceedings. An unfavorable outcome could have an adverse impact on our business, financial condition and results of operations. In addition, any significant litigation in the future, regardless of its merits, could divert management’s attention from our operations and result in substantial legal fees.

If we are unable to protect adequately our intellectual property, we may be involved in legal proceedings, which could be expensive and time consuming, and consumers may shift their preference away from our products.

We believe that our trademarks, patents, and other intellectual property rights are important to our brand, success and competitive position. We consider the Ailibao brand name and our trademarks to be among our most valuable assets. There may be products that are counterfeit reproductions of our products or that otherwise infringe on our intellectual property rights. We may pursue litigation in the future to enforce our intellectual property rights. Any such litigation could result in substantial costs and a diversion of our resources. If we are unsuccessful in challenging a party’s products based on trademark or design or utility patent infringement, continued sales of these products could adversely affect our sales and our brand and result in the shift of consumer preference away from our products. The actions we take to establish and protect trademarks, patents, and other intellectual property rights may not be adequate to prevent imitation of our products by others or to prevent others from seeking to block sales of our products on grounds of violations of proprietary rights.