Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - AVISTAR COMMUNICATIONS CORP | exh_32.htm |

| EX-23.1 - EX-23.1 - AVISTAR COMMUNICATIONS CORP | exh_23-1.htm |

| EX-21.1 - EX-21.1 - AVISTAR COMMUNICATIONS CORP | exh_21-1.htm |

| EX-31.1 - EX-31.1 - AVISTAR COMMUNICATIONS CORP | exh_31-1.htm |

| EX-31.2 - EX-31.2 - AVISTAR COMMUNICATIONS CORP | exh_31-2.htm |

| EX-10.42 - EX-10.42 - AVISTAR COMMUNICATIONS CORP | exh_10-42.htm |

| EX-10.44 - EX-10.44 - AVISTAR COMMUNICATIONS CORP | exh_10-44.htm |

| EX-10.43 - EX-10.43 - AVISTAR COMMUNICATIONS CORP | exh_10-43.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

———————————————

FORM 10-K

——————————————————

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

OR

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OF 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to .

Commission File Number: 000-31121

——————————————————

AVISTAR COMMUNICATIONS CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

|

88-0463156

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification Number)

|

|

|

1875 South Grant Street, 10th Floor, San Mateo California

|

94402

|

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (650) 525-3300

Securities registered pursuant to Section 12(b) of the Act: None

Securities Registered pursuant to Section 12(g) of the Act:

|

Title of each class

|

||

|

Common Stock, $0.001 par value

|

||

—————————————————

Indicate by check mark if the registrant is a well known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file the reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a small reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o

Non-accelerated filer o(Do not check if a smaller reporting company) Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the closing price of $0.53 per share for shares of the Registrant’s Common Stock on June 30, 2010 (the last business day of the Registrant’s most recently completed second fiscal quarter as reported by the OTC Market) was $7,160,496. Shares of Common Stock held by each executive officer and director and by each person who owns 10% or more of the outstanding Common Stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes. The Registrant’s Common Stock is currently quoted and traded on the OTC Market, an over-the-counter securities market.

As of March 3, 2011, the registrant had outstanding 39,273,370 shares of Common Stock.

DOCUMENTS INCORPORATED BY REFERENCE

The Registrant incorporates by reference into Part III of this Annual Report on Form 10-K specific portions of its Proxy Statement for its 2011 Annual Meeting of Stockholders.

AVISTAR COMMUNICATIONS CORPORATION

ANNUAL REPORT ON FORM 10-K

YEAR ENDED DECEMBER 31, 2010

|

TABLE OF CONTENTS

|

Page

|

||||

|

PART I

|

|||||

|

Item 1. Business

|

3

|

||||

|

Item 1A. Risk Factors

|

16

|

||||

|

Item 1B. Unresolved Staff Comments

|

24

|

||||

|

Item 2. Properties

|

24

|

||||

|

Item 3. Legal Proceedings

|

24

|

||||

|

Item 4. [Removed and Reserved]

|

24

|

||||

|

PART II

|

|||||

|

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

25

|

||||

|

Item 6. Omitted

|

25

|

||||

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

25

|

||||

|

Item 7A. Omitted

|

35

|

||||

|

Item 8. Financial Statements and Supplementary Data

|

35

|

||||

|

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

35

|

||||

|

Item 9A. Controls and Procedures

|

35

|

||||

|

Item 9B. Other Information

|

36

|

||||

|

PART III

|

|||||

|

Item 10. Directors, Executive Officers and Corporate Governance

|

37

|

||||

|

Item 11. Executive Compensation

|

37

|

||||

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

37

|

||||

|

Item 13. Certain Relationships and Related Transactions and Director Independence

|

38

|

||||

|

Item 14. Principal Accountant Fees and Services

|

38

|

||||

|

PART IV

|

|||||

|

Item 15. Exhibits, Financial Statement Schedules

|

39

|

||||

|

Signatures

|

43

|

||||

|

Index to Financial Statements

|

F-1

|

||||

2

|

Forward Looking Statements

|

This Annual Report on Form 10-K, the exhibits hereto and the information incorporated by reference herein contain “forward looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and such forward looking statements involve risks and uncertainties. When used in this Annual Report, the words “expects,” “anticipates,” “believes,” “plans,” “intends” and “estimates” and similar expressions are intended to identify forward looking statements. These forward looking statements include predictions, among others, regarding our future revenues and profits, income from settlement and patent licensing, customer concentration, customer buying patterns, research and development expenses, sales and marketing expenses, general and administrative expenses, litigation and legal fees, income tax provision and effective tax rate, realization of deferred tax assets, liquidity and sufficiency of existing cash, cash equivalents, and investments for near-term requirements, sufficiency of leased facilities, purchase commitments, product development and transitions, expansion and licensing of our patent portfolio, competition and competing technologies, and financial condition and results of operations as a result of recent accounting pronouncements. Such statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include those discussed below and those discussed in “Item 1a. Risk Factors” as well as others incorporated by reference herein. Avistar Communications Corporation (the “Company,” “we,” or “us”) undertakes no obligation to publicly release any revisions to these forward looking statements to reflect events or circumstances after the date this Annual Report is filed with the Securities and Exchange Commission or to reflect the occurrence of unanticipated events.

|

Item 1. Business

|

Avistar Communications Corporation (“Avistar”, the “Company”, “us”, “our”, or “we”) was founded as a Nevada limited partnership in 1993. We filed our articles of incorporation in Nevada in December 1997 under the name Avistar Systems Corporation. We reincorporated in Delaware in March 2000 and changed our name to Avistar Communications Corporation in April 2000. The operating assets and liabilities of the business were then contributed to our wholly owned subsidiary, Avistar Systems Corporation, a Delaware corporation. In July 2001, our Board of Directors and the Board of Directors of Avistar Systems approved the merger of Avistar Systems with and into Avistar Communications Corporation. The merger was completed in July 2001. In October 2007, we merged Collaboration Properties, Inc., the Company's wholly-owned subsidiary, with and into the Company, with Avistar being the surviving corporation. Avistar has one wholly-owned subsidiary, Avistar Systems U.K. Limited (ASUK).

Our principal executive offices are located at 1875 South Grant Street, 10th Floor, San Mateo, California, 94402. Our telephone number is (650) 525-3300. Our trademarks include Avistar and the Avistar logo, AvistarVOS, Shareboard, vBrief and The Enterprise Video Company. This Annual Report on Form 10-K also includes Avistar and other organizations’ product names, trade names and trademarks. Our corporate website is www.avistar.com.

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are available free of charge on our website when such reports are available on the U.S. Securities and Exchange Commission (“SEC”) website (see “Company—Investor Relations—SEC Information”). The public may read and copy any materials filed by Avistar with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at http://www.sec.gov. The contents of these websites are not incorporated into this filing.

|

Overview

|

Avistar is a technology company defined by its customers’ need to see the people they interact with. Organizations ranging from smaller companies to the largest global enterprises use desktop videoconferencing to improve collaboration among their employees, and to connect more effectively with customers and suppliers.

We have three go-to-market strategies. Product and Technology Sales involves direct and channel sales of video and unified communications and collaboration solutions and associated support services to the Global 5000. Partner and Technology Licensing involves co-marketing, sales and development, embedding, integration and interoperability to enterprises. IP Licensing involves the prosecution, maintenance, support and generation of licensing revenue through either license or sale of the intellectual property that we have developed, some of which is used in our products.

3

Using visual communications is smart

No one would argue about the benefit of unified, visual communication to business. It reduces the need for travel, with its cost and lost time, and enables a global hallway conversation. Organizations that use visual communications benefit from greater productivity, reduced expenses, increased margins and overall better work – life balance, all while improving the world we live in. The average 20% reduction in business travel shrinks our carbon footprint and makes the planet greener for everyone.

Avistar made it smarter

When we started in 1994, a relative handful of companies delivered desktop videoconferencing solutions. The promise of visual communications was obvious, but at the time these companies delivered solutions that were expensive, inconvenient, and unreliable. Avistar has invested over a million man-hours to deliver what organizations need: a desktop videoconferencing experience that is reliable, easy to use, economical, and looks great. Under the hood, we took what we believe was a smarter approach: software-only technology combined with the most efficient bandwidth management techniques that we refined over years of experience through solving the challenges of delivering high quality video to and from large numbers of desktops across an organization and over business critical networks. And our results are visible – a superior desktop videoconferencing experience that gets used more fully throughout the enterprise than any other videoconferencing offerings.

Leading Unified Communications (UC) providers easily integrate Avistar technology

Our customers, across many industries, need the interoperability, scalability, and bandwidth / policy management that are built into Avistar videoconferencing. Our partners, who include some of the world’s leading technology firms, integrate or resell Avistar videoconferencing with their own software applications. Technology leaders like IBM, Logitech, and LifeSize deploy our solutions within theirs, to offer their customers video-enabled applications and business processes because we license Avistar videoconferencing to them as components. They are able to quickly integrate our flexible, cost-effective, high-definition videoconferencing with their own solutions.

Our product line is logically organized to meet the needs of a variety of organizations, big and small, including financial institutions, manufacturers, original equipment manufacturers (OEM) or resellers. End users and enterprise customers prefer the option of just paying for the capabilities they require. We have built a platform that enables such choices. In addition, information technology (IT) groups want to understand the optional capabilities which we provide like multiparty calling and how they work in heterogeneous environments, to ensure that end users will use the infrastructure efficiently and productively.

Avistar desktop videoconferencing gets used more fully

Avistar deployments a few years ago have resulted in steadily increased usage in minutes per day of active utilization because our desktop videoconferencing works, and it works well. We offer network administrators and technology partners a completely scalable solution for managing bandwidth, protecting calls in progress, setting and administering policy with priority user classes, and central control so that one person can keep everyone’s video calls running smoothly. Our customers demand that their videoconferencing plays well with all others, and we believe that Avistar has the experience and tools to ensure that it will.

We believe our software-only approach is advantageous for both end user populations and our OEMs and resellers because it facilitates quick deployment, lower cost, and right-sized buying. Over the years, our services and support team have seen virtually every problem that relates to videoconferencing. Their accumulated knowledge is cycled back into our solutions, which are continually refined and improved. Furthermore, because Avistar is software-only, a simple update brings powerful new features to thousands of desktops immediately, with no hardware changes.

Whether an IT director or an OEM, videoconferencing is all about the end user, the individual who wants to click on a name or photo from their contact list, and be connected immediately, no matter if the other person is around the globe or behind the firewall of another company. Next, they want to single-click to add more people. Then, they want to see and hear everyone with no jitters and shaking. We solve the underlying challenges to make the people in that global conversation forget they are running multiparty, interoperable visual communications. Since our solutions are also available as components, our technology partners and OEMs can easily add the richest video experience available to their software offerings, boosting their market appeal.

|

Industry Background

|

Globalization, supported by the near ubiquity of communications networks such as the Internet, has allowed companies to lower costs, reach new markets, change business processes (e.g., eBusiness) and distribute and outsource operations. It also has meant increased competition, a faster business pace and less differentiation. These factors, coupled with the difficulty and cost of travel, increased risks due to socio-political uncertainties and pandemic concerns and the desire to reduce carbon emissions and environmental impact, are causing businesses to look for new tools that will help them increase productivity, reduce budgetary expenses, take advantage of revenue opportunities, and minimize business continuity risks. Enterprises of all sizes stand to benefit from new and advanced communication and collaboration tools that enable their employees, partners, suppliers and customers to collaborate more effectively and form tighter relationships within and across buildings and over disparate geographies and time zones. Communications tools that speed decision-making, build trust-based relationships, especially across cultures, and are software-presence-aware are becoming even more critical in today’s increasingly complex business environment.

4

The emergence of the Internet has accelerated the adoption of network-based collaboration applications including email, instant messaging, and web conferencing. The increasing availability and affordability of bandwidth on communication networks is further driving businesses to utilize new communication tools, such as voice and video over IP, and are enabling users to connect from more places, including home offices and WiFi hot spots such as airports and hotels. This is enabling more distributed, mobile and global operations while maintaining communications.

|

Limitations of Current Means of Communication and Collaboration

|

As technology advances become more affordable and modes of communication expand, enterprises are seeking widely deployable and cost effective technology to replicate, at the desktop, the impact of visual communication and collaboration that occurs in a face-to-face meeting. Individuals generally prefer face-to-face encounters to less personal forms of communication because they can see one another and benefit from the non-verbal cues that speed communication and deepen understanding. This is particularly true for more complex interactions such as negotiations, sales, product development, project and crises management and decision making across geography/functions/cultures. However, in today’s globalized, fast-paced business environment, face-to-face interactions are often forgone due to the difficulty and time required for travel, and the need to act quickly. These time and distance challenges become increasingly difficult to deal with as the number of potential participants increase. Beyond traditional teleconferencing, attempts to conduct virtual meetings as an alternative to face-to-face meetings have generally been limited to conference room-based video conferencing and web-based data teleconferences.

To address the growing need for collaboration across distance and time, organizations have resorted to using a patchwork of discrete technologies, including video conferencing and teleconferencing, fax, email, instant messaging, Internet audio and video delivery and data sharing applications. Many of these technologies have been widely adopted, and collectively indicate the need for collaboration tools including visual unified communications solutions. However, these discrete technologies are not good substitutes by themselves for face-to-face meetings and presentations because they do not provide an integrated communications solution that fosters team interaction and delivers critical, time-sensitive information quickly and reliably. By providing face-to-face collaboration in an integrated communications solution, video can speed problem resolution and motivate action, trust and understanding. Additionally, users want to leverage knowledge and expertise by being able to create and publish video content from their desktop, either spontaneously, as with email or voicemail, or in a more formal manner for broader distribution through the Internet or corporate data network.

Although IP communications technologies are already in use at many enterprises, businesses and other organizations require increasingly comprehensive, integrated and scalable visual unified communication capabilities. For example, video conferencing is often limited to scheduled point-to-point communication from designated rooms or through the use of “roll-about” products, where call set-up procedures, lack of networking, bandwidth requirements and room availability greatly constrain functionality, spontaneity, usability, reliability and efficiency. Most individuals do not have immediate access to these video technologies, and the reservation and set-up time make them unlikely to be used on a spontaneous basis. Few of these video solutions are deployed widely to individuals to support them where and how they normally work—at their desks, integrated into the business applications they use. Usage and adoption of these systems is thus often limited.

Elements of a Complete Communications and Collaboration Solution

To become a critical tool in the enterprise, a communications solution must first and foremost provide application functionality that boosts worker productivity. It also has to be “self service” and provide high quality at scale, high reliability, low total cost of ownership, and be available to people where and when they do most of their work, which typically means at their desks, but increasingly means from home or while traveling. It must also effectively utilize existing and evolving network infrastructure. We believe a complete communications and collaboration solution must provide the following:

|

|

Applications and Functionality

|

|

|

·

|

Support or integrate into the applications people use, in the way they use them, to deliver real-time and non-real-time self service personnel for collaboration and visual communication;

|

|

|

·

|

Do so in an intuitive, “easy” manner in order to foster expanding usage;

|

|

|

Quality

|

|

|

·

|

Approximate the video and audio quality of television for natural and easy interaction;

|

|

|

·

|

Make interactions as realistic as possible by minimizing visual artifacts when transmitting and receiving video calls such as latency, jitter, freeze-frame, stutter and small frame size;

|

|

|

·

|

Seamlessly integrate all forms of audio, video and data communications;

|

5

|

|

Scalability

|

|

|

·

|

Like the Internet and public telephone networks, the communications solution must be designed for size independence and should scale cost-effectively to support a very large numbers of users;

|

|

|

Virtualization

|

|

|

·

|

As cloud and virtual desktop infrastructures (VDI) are being more universally deployed and adopted, unified visual communication solutions need to operate effectively within these new computing environments;

|

|

|

·

|

Users will expect the same visual communications experience within the virtualized environment as they’ve experienced within their more traditional computing environment, and IT administrators will expect that their networks and server infrastructure will not be adversely affected by the virtualized desktop videoconferencing solution itself;

|

|

|

Reliability

|

|

|

·

|

Operate dependably and reliably to avoid user frustration, while minimizing support costs;

|

|

|

·

|

Provide visual unified communications with the ease of use, speed, quality, functionality, flexibility and global access of the telephone, while easily supporting more complex applications and situations;

|

|

|

Adaptability

|

|

|

·

|

Offer an upgradeable architecture that can evolve as bandwidth availability, protocols, standards and compression technologies change;

|

|

|

·

|

Include powerful software to manage an integrated suite of collaborative applications, relying on networked infrastructure;

|

|

|

·

|

Leverage current and future business investments in local and wide area networks, Internet protocol and standards-based infrastructures;

|

|

|

·

|

Reduce reliance on hardware components through a shift to software-based integrated communications functionality;

|

|

|

Affordability

|

|

|

·

|

Operate and scale cost effectively;

|

|

|

·

|

Utilize standard, low cost and widely available hardware components, such as “web-cams”;

|

|

|

·

|

Be cost-effective compared to other pervasive forms of enterprise communication, such as email; and

|

|

|

·

|

Deliver cost savings through innovations in support, network and resource management.

|

We believe high quality visual unified communications allow businesses to improve collaboration and thereby offer them the opportunity to increase productivity, enhance customer service and revenue generation, and facilitate business-to-business interactions that reduce costs, all on an accelerated basis. We also believe that, just as every organization now relies on a telephone network, and most businesses increasingly rely on the Internet, a market is emerging in which businesses and other organizations will choose to rely on fully integrated video, audio and data collaboration, regardless of networks, to make their business applications more effective.

|

The Avistar C3™ Platform and Solutions

|

Avistar delivers a suite of video, audio and collaboration solutions which are designed to support users in the office, via the conference room or on-the-go. It is through an intelligent coupling of various forms of communication and collaboration into daily work processes that we believe the benefits described above can be realized. To fulfill this, we deliver a communication and collaboration platform known as Avistar C3™. The Avistar C3™ platform provides a comprehensive and integrated suite of video, audio and collaboration applications that include on-demand access to interactive video calling and conferencing, content creation and publishing, broadcast origination and video distribution, and video-on-demand, as well as data sharing, presence-based directory services and network management. Our Avistar C3™ platform architecture is open and flexible in order to embrace continued technological innovation and standardization. It is designed to use existing and emerging communication and video standards such as session initiation protocol, or SIP. It also provides customers choice and flexibility in designing and implementing network topologies to best deliver high-quality video, audio and collaboration applications to desktops, conference rooms and individuals on-the-go.

6

Interactive video calling. Our system allows users to participate in spontaneous interactive video collaborations from their desktops. Users can simultaneously see multiple participants in windows on their workstations or an external monitor. Additionally, our system provides full duplex audio, which allows multiple users to speak and hear each other clearly at the same time. The Avistar C3™ solution provides a stunning high-definition experience between desktops and also delivers continuous presence multiparty videoconferencing between end users, room solutions and other devices, all without requiring advance reservations or complicated conferencing services. Each participant has the full ability to utilize all the call functions of the system, such as adding or removing participants, focusing the view on one participant, putting anyone or the entire call on hold, and transferring the call. Advanced telephony features such as Caller ID, Do Not Disturb, Leave Message and Multiline Calling are also provided. All user features are designed to be simple to operate, intuitive and intelligent. By doing this, Avistar can ensure that its clients can setup calls quickly and participate on the call, without the need for additional and costly communications support staff.

Integrated collaboration & data sharing. In addition to communicating via desktop videoconferencing, users can simultaneously create and annotate a shared document using text or drawing tools color-coded specifically for each user. Our desktop sharing technology is based on the latest SIP dual video standards which support sharing the entire desktop or individual applications, based on end user selection.

Leading Unified Communication (UC) Platforms. Although industry leading UC platforms such as IBM Lotus Sametime, Microsoft OCS and Lync provide comprehensive presence, instant-messaging, email and telephony integration, the desktop videoconferencing features within these solutions often lack a feature rich videoconferencing experience, interoperability with both SIP and H.323 based room systems, continuous multiparty videoconferencing and advanced bandwidth management features. Avistar has recognized these UC solution shortcomings and has delivered the Avistar C3 Unified family of solutions that are specifically designed to close the UC videoconferencing gap and allow end users to experience a truly unified visual communications experience.

Our system has the following key features necessary to make integrated video collaboration effective, scalable and economical:

|

|

·

|

All Software Solution. Our client and server solutions are delivered using all software components requiring no proprietary hardware. This allows our clients to reuse excess desktop and server capacity in addition to right-sizing their purchases. This means that Avistar clients can scale their Avistar solution as demand sales, unlike Avistar “hardware based” competitors who force their clients to pay ahead of demand.

|

|

|

·

|

Easy to use interface. Our applications combine the rich interaction of a face-to-face meeting with a self-service interface that’s intuitive and easy to use.

|

|

|

·

|

Click-to-connect simplicity. To initiate calls or add another user to a call already underway, a user simply clicks on either a name in the directory, or a predefined contact in a “buddy list”. Standard telephone-like features such as hold, hang-up, forward, “leave message” or “begin another call” are all completed with the click of a mouse, or keyboard shortcuts. Additionally, anyone on a network can initiate a video call to the desktop of colleagues, customers, suppliers and others on alternate networks.

|

|

|

·

|

“Find Me, Follow Me.” Avistar video calling is built on directories and SIP features referred to as “Find Me, Follow Me.” Using this feature, our system is able to determine the location of any user at any time. To call a user it is not necessary to know their number or current location. As long as the Avistar user is logged into his or her Avistar application, the “Find Me, Follow Me” application automatically registers where that user is logged in, regardless of site or geography, and routes all calls to the user’s location. Using this “Find Me, Follow Me” technology, Avistar’s system makes video calling a one-click process and enables what we call “Video Instant Messaging”, all based on a simple SIP URI.

|

|

|

·

|

Network Bandwidth Management. Avistar C3 Command™ provides system administrators with the ability to flexibly and proactively manage each of the various components of the network. Within our system, the most costly and complex equipment and software applications are shared as networked resources. This arrangement allows for redundancy and dynamic allocation of these resources to users who need them, and ensures that users experience the best video quality possible at the highest reliability and lowest cost of use. Servers and switches can be maintained, installed and repaired centrally, and many network support functions can be performed remotely over the data network, assisted by Avistar C3 Call Control™, thereby limiting the disruption of service to an individual user. Similarly, additional desktops and meeting rooms can be easily and inexpensively added to the Avistar platform, with those new users concurrently added to the Avistar directory. Additionally, our software makes call routing decisions to minimize communications costs and control bandwidth utilization. This functionality is protected under certain patents held by Avistar. Lastly, Avistar C3 Command™ supports network topology modeling in addition to allowing network and application administrators to setup bandwidth consumptions policies based on network link, class of user and or threshold limits.

|

|

|

·

|

Virtualization. We believe that only Avistar provides desktop videoconferencing support for VDI applications and thin terminals. The Avistar C3 Integrator™ solution allows our clients to experience a feature rich desktop videoconferencing experience on VDI solutions such as Citrix XenDesktop and XenApp, in addition to industry leading thin terminals from Dell, HP and Wyse. We believe that the Avistar architecture is perfectly suited to deliver desktop videoconferencing in these virtualized environments as it ensures that all application functionality is being executed within the server environment, while encoding and decoding takes place next to the webcam through an automated Avistar plug in. This approach is unique in our industry and further exemplifies Avistar’s commitment to lowering the cost and complexity of desktop videoconferencing within the enterprise.

|

7

We believe our solution includes the following benefits to our customers:

|

|

·

|

Speed business processes. We provide a fully integrated Internet protocol-based video collaboration solution that allows individuals to seamlessly make video calls to anyone within their business, out to clients and to business partners, which can speed business processes by enhancing collaboration and communication.

|

|

|

·

|

Increased availability of knowledge within the enterprise. At many businesses, individuals who possess valuable knowledge often cannot effectively distribute their knowledge to the rest of the organization. Our system enables these businesses to access these individuals and disseminate their knowledge more efficiently and effectively by offering them the ability to call, broadcast or record from their desktops, and offering other users the ability to receive this information real-time, or access video recordings at a convenient time and location. The ability to spontaneously add additional participants to a call encourages personal communications between individuals who otherwise might not enjoy this access. In addition, our system gives every desktop the ability to create and publish valuable visual content, which can be distributed inside and outside the organization to support employee and customer needs worldwide.

|

|

|

·

|

Improved productivity and revenue generation. Our system helps companies increase the productivity of their employees and accelerate time critical decision-making. By creating a network of Avistar users, our customers can have face-to-face meetings within the enterprise and with customers and partners, without the costs and time delays of travel. Negotiations, crises management, sales, advisory services, decision-making and other persuasive communications are more effective when done face-to-face. Our solution allows interactions to happen in real-time, speeding up the manner in which business is done, freeing up time for employees, enhancing business-to-business communications, and potentially increasing revenue generation.

|

|

|

·

|

Enhanced customer and partner relationships. Our system helps companies to be more responsive to and develop stronger business relationships with their customers, partners and suppliers. An Avistar call is generally as easy and reliable as a telephone call or “instant message”, while being more personal. One of our customers has provided Avistar networks to their clients and business partners, including offshore outsource partners, in order to facilitate interactions and improve relationships.

|

|

|

·

|

Opportunity to leverage existing and future communication infrastructures. We provide an open architecture that uses existing standards and is designed to take advantage of emerging standards. Our system integrates into our customers’ existing network communications infrastructure, and supports the protocols a company may choose to use for video broadcasts, data sharing and the transport of information. However, video quality varies depending on the protocol selected. Our system utilizes existing data networks for transporting video, and is designed to support real time digital networking and video transmission. We have designed our system to continue to work with Internet protocol-based technologies as standards evolve and quality of service improves. We expect this flexibility, together with simplified software and hardware at the desktop, to allow companies to make effective use of their existing local area and wide area networks, as well as their next generation networks.

|

|

|

·

|

Better communication to face new business challenges such as globalization, business continuity planning, and distributed locations. Within global corporations, professionals collaborate daily with customers, partners and associates who are often located in different offices and/or different time zones. This has increasingly become the case as firms, due to economic and security concerns, have restricted travel, begun decentralizing their personnel across a more distributed set of locations, taking advantage of lower costs of real estate and increased business resiliency through distributed operations, and shifted more operations to outsourcing providers. In this context, critical information must be delivered on a timely basis and without confusion, as smoothly as if colleagues were working together in person. Avistar’s video product suite enables companies that are reducing travel and/or distributing their operations to easily and quickly connect small, remote offices as well as at-home workers to the central organization and still benefit from face-to-face interaction. Based on our experience in helping existing customers choose their optimal configurations, we are able to advise new customers on setups and configurations that will be most effective for a large central office, a small branch office, an outsourcing provider, or other remote locations.

|

|

System Architecture and Technology

|

Our visual unified communications solutions are based on our 10th major release of our open architecture, which enables users to communicate using various networking protocols and transport media, including IP networks and the Internet. We developed our architecture to address the necessary elements of a complete video-enabled collaboration solution.

8

We believe that the following technical factors will transform and consolidate the existing video collaboration applications marketplace, creating a strong need for a software platform that will support this consolidation and evolution:

|

|

·

|

Improved compression technologies;

|

|

|

·

|

The widespread adoption of virtualized technologies;

|

|

|

·

|

Increased proliferation of broadband infrastructure (with enhanced tools to optimize bandwidth for video transmission (QOS; quality of service));

|

|

|

·

|

Developing availability of converged audio, video and data networks;

|

|

|

·

|

Improved computer processing speeds; and

|

|

|

·

|

Adoption of critical digital video and multimedia standards.

|

Our Avistar C3™ platform supports this consolidation and evolution by integrating industry standards for audio, video and data transport, but separating them from application functionality and system management. This allows our software application platform to manage the interoperation and transcoding of various standards to seamlessly integrate video, audio and data into complex applications, and not be limited by the functionality built into one particular, application-specific standard. It also allows the system to accommodate new and evolving standards with minimal disruption. Current industry and widely accepted proprietary standards supported include H.263, H.264, H.320, H.323, SIP, NTSC, PAL, MPEG, Microsoft Windows Media Video and Real Networks RealMedia. Our system uses TCP/IP, the standard Internet protocol, for providing video and audio calls, scheduling and starting broadcast presentations, and managing the creation of materials. In addition, we use TCP/IP for overall systems and network management throughout our Avistar C3™ software platform. This approach allows us to deliver connectivity throughout an enterprise and allows us to leverage existing Internet infrastructure. For delivery of high-quality video streams in the local area network, including wireless, we primarily utilize video over IP technology but offer a choice of IP or traditional circuit switched technologies, including the ability to mix and match network types. Thus, Avistar customers can successfully deploy desktop video across the enterprise, even if portions of their network, in older buildings for example, are not capable of supporting real-time video on their data networks. We use our gateways to translate between the various network technologies used in our system. These gateways are managed and controlled by our systems software with TCP/IP-based protocols.

We believe our video software platform positions us to lead the transformation described above. Further, we provide a suite of collaboration applications that seamlessly operate with the standards based systems allowing users to access this functionality in an easy and intuitive manner. We expect to make this platform more accessible to developers and to allow integration with other applications and network hardware.

Because of the intelligent integration of various video network components, all Avistar products are controlled by the Avistar C3™ platform, our architecture has the following key features:

|

|

·

|

Network management: Avistar C3™ utilizes open protocols for call set-up, call control and directory services. It also complies with standards and interfaces and connects with video networks through shared Avistar gateways, which are further connected via private or public telephony or TCP/IP networks. Servers communicate through our signaling system for video protocol, SSV, which is based on TCP/IP, the standard Internet protocol. Through this signaling system, servers exchange configuration information and allocate call resources during call set-up, and exchange network status information. The signaling system selects the optimal route for all video calls, helping to minimize call costs and performance demands on wide area network resources. Most videoconferencing equipment using industry standard compression technologies also can communicate with an Avistar network.

|

|

|

·

|

Transport standard independence: Our system selects the appropriate transport standards for transmitting information over networks to help deliver the highest quality video possible and full duplex audio in the most efficient manner. For example, the Avistar C3™ software automatically exchanges information among servers and switches to determine the best network route for video calls. For the transport of video over a local area network, our system uses either data networks with our IP endpoints, or existing spare Ethernet wires for our legacy product to deliver standards-compliant high quality signals. This allows customers to choose the transport type to best fit their network capabilities in the local area. In a wide area network, we use industry video compression standards across a customer’s private IP network, VPN’s, the Internet, or the public telephony network. Recent product releases have enhanced our ability to support mobile and home workers who may have lower bandwidth connections. For the transmission of recorded content on corporate data networks or via the Internet, our system uses standard digital storage formats and transport technologies.

|

|

Avistar C3™ Infrastructure, Solutions, Product and Editions

|

The Avistar C3™ platform is comprised of the following solutions and bundled editions:

9

Avistar C3™ - Endpoints

|

·

|

Avistar C3 Media Engine™

|

The Avistar C3 Media Engine™ solution is Avistar’s all-software visual communications plug in for 3rd party applications. The Avistar C3 Media Engine™ solution is designed to enable rich and robust visual communications to any desktop application.

The Avistar C3 Media Engine™ is available as a Standalone, Avistar C3™ Pro, Avistar C3™ Business and Avistar C3™ Business Pro Editions.

|

·

|

Avistar C3 Communicator™

|

The Avistar C3 Communicator™ - Standalone Edition is Avistar’s feature rich, HD capable desktop visual communication software application. The Avistar C3 Communicator™ solution can be used as a standalone desktop or integrated as part of a complete communications offering.

|

·

|

Avistar C3 Unified™ for Microsoft OCS

|

The Avistar C3 Unified™ for Microsoft OCS solution is Avistar’s next generation desktop visual communication application for the Microsoft OCS platform. The Avistar C3 Unified™ for Microsoft OCS solution is designed as an integrated client plug in for Microsoft OCS. The Avistar C3 Unified™ for Microsoft OCS solution can be used in conjunction with certain other separately licensed Avistar C3™ solutions.

|

·

|

Avistar C3 Unified™ for Microsoft Lync

|

The Avistar C3 Unified™ for Microsoft Lync solution is Avistar’s next generation desktop visual communication application for the Microsoft Lync platform. The Avistar C3 Unified™ for Microsoft Lync solution is designed as an integrated client plug in for Microsoft Lync. The Avistar C3 Unified™ for Microsoft Lync solution can be used in conjunction with certain other separately licensed Avistar C3™ solutions.

|

·

|

Avistar C3 Unified™ for IBM Lotus Sametime

|

The Avistar C3 Unified™ for IBM Lotus Sametime solution is Avistar’s next generation desktop visual communication application for the IBM Lotus Sametime platform. The Avistar C3 Unified™ for IBM Lotus Sametime solution is designed as an integrated client plug in for IBM Lotus Sametime. The Avistar C3 Unified™ for IBM Lotus Sametime solution can be used in conjunction with certain other separately licensed Avistar C3™ solutions.

Avistar C3™ - Virtual Desktop Infrastructure (VDI) Support

|

·

|

Avistar C3 Integrator™ for Citrix

|

The Avistar C3 Integrator™ for Citrix solution is Avistar’s integration answer to enable the Avistar C3™ platform to operate with the Citrix HDX protocol and thin client environment. The Avistar C3 Integrator™ for Citrix solution is available with the Avistar C3 Unified™ and Avistar C3 Communicator™ solutions.

|

·

|

Avistar C3 Integrator™ for HP

|

The Avistar C3 Integrator™ for HP solution is Avistar’s integration answer to enable the Avistar C3™ platform to operate with the HP RGS protocol and thin client environment. The Avistar C3 Integrator™ for HP solution is available with the Avistar C3 Unified™ and Avistar C3 Communicator™ solutions.

Avistar C3™ - Infrastructure Solutions

|

·

|

Avistar C3 Conference™

|

The Avistar C3 Conference™ solution is an all-software multiparty control unit (MCU) designed to deliver scalable, reliable and economical multiparty conferencing. The Avistar C3 Conference™ solution is packaged as part of the Avistar C3™ Business and Avistar C3™ Business Pro Editions and may be licensed on a standalone basis for use with other applications.

|

·

|

Avistar C3 Conference™ for IBM Lotus Sametime

|

The Avistar C3 Conference™ for IBM Lotus Sametime solution is an all-software MCU designed to operate seamlessly with the IBM Lotus Sametime solution via the IBM Lotus Sametime TCSPI interface. This solution delivers a scalable, reliable and economical continuous- presence, multiparty conferencing experience to IBM Lotus Sametime users. The Avistar C3 Conference™ for IBM Lotus Sametime solution is sold on a standalone basis for use with the IBM Lotus Sametime platform.

|

·

|

Avistar C3 Tunnel™

|

The Avistar C3 Tunnel™ solution is Avistar’s firewall traversal software designed to support videoconferencing over firewalls and networks. The Avistar C3 Tunnel™ solution is comprised of the following firewall traversal features, specifically the tunnel server, tunnel client and tunnel SDK and packaged as part of the Avistar C3™ Pro, Avistar C3™ Business and Avistar C3™ Business Pro Editions or may be licensed on a standalone basis for use with other applications.

10

|

·

|

Avistar C3 Connect™

|

The Avistar C3 Connect™ solution is Avistar’s all-software SIP-H.323 interoperability gateway. The Avistar C3 Connect™ solution is designed to operate as an integrated part of the Avistar C3 Call Control™ solution or may be licensed on a standalone basis for use with other applications.

|

·

|

Avistar C3 Command™

|

The Avistar C3 Command™ solution is Avistar’s all-software dynamic bandwidth management solution. The Avistar C3 Command™ solution is designed to operate as an integrated part of the Avistar C3™ platform or may be licensed on a standalone basis for use with other applications.

|

·

|

Avistar C3 Call Control™

|

The Avistar C3 Call Control™ solution is a general purpose SIP based communications server that provides centralized endpoint and infrastructure registration, management, reporting and configuration. The Avistar C3 Call Control™ solution seamlessly integrates the following software solutions:

|

o

|

Avistar C3 Command™ (as part of the Avistar C3™ Pro, Avistar C3™ Business and Avistar C3™ Business Pro Editions)

|

|

o

|

Avistar C3 Connect™ (as part of Avistar C3™ Pro and Avistar C3™ Business Editions)

|

Avistar C3™ Editions

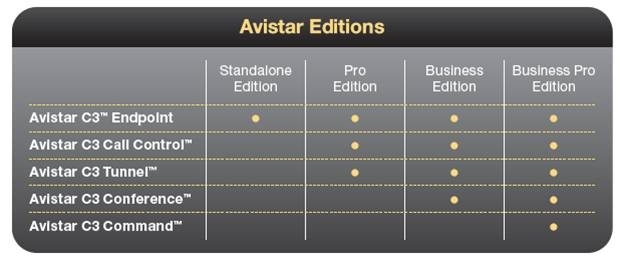

The Avistar C3™ solutions described above are available on an individual (standalone) basis, or can be purchased as Editions which are predetermined endpoint and infrastructure bundles of our solutions. This allows our clients to purchase Avistar solutions based on current needs, with a clear and economical upgrade path. This also allows our clients to avoid over provisioning, ahead of demand, which occurs often within the videoconferencing industry. By packaging our solutions and providing an economical upgrade path, Avistar has further differentiated itself from its competitors, while being responsive to its customers’ needs.

The table below depicts how Avistar clients can choose from any of the Avistar C3™ endpoints listed above, alongside three Edition bundles. Each Edition fills a specific need and builds on the feature set of the previous Edition. As feature sets increase, so does cost. Clients can upgrade from one Edition to the next by paying an uplift charge (essentially the difference in price between the Editions being upgraded):

|

Patent Licensing

|

Historically, we have derived a significant portion of our annual revenues by licensing our broad portfolio of patents covering, among other areas, video and rich media collaboration technologies, networked real-time text and non-text communications and desktop workstation echo cancellation. This broad suite of patents enables much of the functionality of the Avistar C3™ platform. Licenses to third parties cover part of or all of our patent portfolio. End-to-end rich media collaborative application companies that have licensed Avistar patents include Polycom, Inc., Tandberg ASA, Sony Corporation and Sony Computer Entertainment Inc. (SCEI), Emblaze-VCON Ltd., Radvision, LifeSize Communications, Inc., Logitech, and International Business Machines Corp. (IBM).

11

On December 18, 2009, we entered into a definitive agreement to sell substantially all of our patent portfolio and associated patent applications to Intellectual Ventures Fund 61 LLC, pending the fulfillment of certain requirements for closing. As of December 31, 2009, we had 99 U.S. and foreign patents covering various aspects of our technology, with expiration dates ranging from 2013 to 2018, and 26 pending patent applications.

On January 19, 2010, and prior to completing the Intellectual Ventures transaction, we concluded an agreement with Springboard Group S.A.R.L. granting to Skype a non-exclusive license to Avistar’s patent portfolio under Avistar’s standard terms and conditions. Then on January 21, 2010, we completed and closed the patent purchase transaction with Intellectual Ventures referenced above. As a result, associated rights, obligations, risks and costs for the sold patents and patent applications, including the patents in reexamination related to Microsoft petitions, are now the responsibility of Intellectual Ventures. As part of the transaction with Intellectual Ventures, we received a license-back to the transferred patents and patent applications for our current and future products covered by the portfolio.

Following this transaction, we retained a small forward-looking patent portfolio comprising one Canadian patent, one European application and four U.S. applications. We also retained continuing royalty income from existing patent licenses. We continue an active program to grow, license, and protect our intellectual property portfolio, primarily through the filing of patent applications. As of December 31, 2010, we held 1 issued U.S. patent and 1 issued Canadian patent, as well as 18 U.S. patent applications and 1 European patent application.

|

Segment Information

|

We operate through two segments:

|

|

·

|

Our products division engages in the design, development, manufacture, sale and marketing of networked video communications products.

|

|

|

·

|

Our intellectual property division engages in the development, prosecution, maintenance, support and generation of licensing revenue through license or sale of our intellectual property and technology, some of which is used in our video communications system.

|

Financial information regarding these segments is provided in Note 10 to our consolidated financial statements included in this Annual Report on Form 10-K. Financial information relating to revenues and other operating income, net loss, operating expenses and total assets for the three years ended December 31, 2010, can be found in our Consolidated Financial Statements attached hereto.

|

Customers

|

|

|

Video Communications Products

|

As of December 31, 2010, we have licensed and recognized revenue with respect to over 35,000 end-users at over 400 customer sites in approximately 151 cities in over 40 countries. Because many of our customers operate on a decentralized basis, decisions to purchase our systems are often made independently by individual business units. As such, a single company may represent several separate accounts, and multiple customer sites may relate to the same company.

For the year ended December 31, 2010, Intellectual Ventures, SKYPE, and Deutsche Bank AG and its affiliates accounted for 56%, 15%, and 12% of our total revenues, respectively. For the year ended December 31, 2009, IBM, City Information Services and Deutsche Bank AG and its affiliates accounted for 35%, 19% and 14% of our total revenues, respectively. For the year ended December 31, 2008, Deutsche Bank AG and its affiliates, UBS Warburg LLC and its affiliates, IBM and Sony Corporation accounted for 40%, 19%, 18% and 11% of our total revenues, respectively. No other customer accounted for more than 10% of our total revenues in 2010, 2009 or 2008. The level of sales to any customer may vary from quarter to quarter, and while we continue to expand our indirect sales channel, we expect that significant customer concentration will continue for the foreseeable future. The loss of, or a decrease in the level of sales to, or a change in the ordering pattern of, any one of these customers could have a material adverse impact on our financial condition or results of operations. The nature and general terms of our product, maintenance and service sales/offerings, as well as the material terms of our agreements with Intellectual Ventures, SKYPE, IBM and Sony Corporation, are described in Note 2 to our consolidated financial statements under “Revenue Recognition and Deferred Revenue” included in this Annual Report on Form 10-K. The material terms of our arrangements with Deutsche Bank, City Information Services and UBS were consistent with the general terms and conditions of our standard product, maintenance and service sales/ offerings to our customers.

International revenue, which consists of sales to customers with operations principally in Western Europe and Asia comprised 33%, 44%, and 51% of total revenue for 2010, 2009, and 2008, respectively. For 2010, 2009, and 2008, revenues to customers in the United Kingdom accounted for 12%, 34%, and 22% of total revenue, respectively.

12

|

Licensing Activities

|

We derived approximately 77% or $15.1 million, 10% or $853,000, and 11% or $954,000, of our annual revenues in 2010, 2009, and 2008, respectively, by licensing or selling our broad portfolio of patents to third parties covering video and rich media collaboration technologies, networked real-time text and non-text communications and desktop workstation echo cancellation. Our license revenue in 2010 was primarily generated by the sale of substantially all of our patents to Intellectual Ventures for a one-time cash payment of $11.0 million and the licensing of our patents to SKYPE for an upfront license fee of $3.0 million in January 2010. Our license revenue in 2009 and 2008 was primarily royalties generated from licenses granted to Sony Corporation and its subsidiaries.

|

Sales and Marketing

|

Direct Sales. We have a direct sales force in the United States and Europe consisting of sales managers located in New York and London. Sales managers have direct responsibility for selling and account management of our technology at customer sites.

Indirect Sales. Through our partnership organization, we have established a set of relationships with strategic partners and value added resellers, in order to establish and expand an indirect channel of sales for our products.

Marketing. Our marketing efforts are directed towards Global 5000 companies with targeted solutions for the small and medium-size business (SMB) and Enterprise markets, focused on the specific collaboration needs of each. We also work with our existing customers to demonstrate how our solutions can further satisfy their needs, thereby growing our footprint within our installed base. We emphasize initiatives to develop market awareness of our solutions and services, as well as increase usage of our installed systems.

We also use marketing programs to build recognition of our corporate brand, foster partnerships, and promote our technology in regards to licensing opportunities.

|

Installation, Maintenance, Training and Support Services

|

We provide a wide variety of services for the implementation and support of our video communications products. These services range from product training, deployment assistance, custom product enhancements to custom onsite support. We generally install our systems for new customers. In an increasing number of cases, our customers’ information technology group or services partner install follow-on orders. In the future, we expect our customers or their services partners will increasingly perform the installation process.

The installation that we offer to our customers as a separately-priced service relates to the set up and configuration of desktop and infrastructure components of our solution. To accomplish this activity, our staff frequently interfaces with the customer’s internal IT staff and external suppliers, in order to provide for connectivity to the customer’s local and wide area networks, and for the connections between the various components purchased. The effective operation of software is checked by our staff during this installation process. Although the “work time” of this activity at a single location may be only one or two days, the coordination necessary for accommodating the equipment and establishing connectivity frequently creates cycle times of between two and six weeks at the customer’s site.

Our maintenance and support services ensure that customers benefit from the latest networked video technology through software upgrades and expedited repair services. Our customer support center provides voice and video call assistance to Avistar users and administrators throughout the world. On-site support is also available for a separate fee as is training on-site at a customer facility or at an Avistar location.

|

Backlog

|

We do not believe that backlog is a meaningful indicator of future business prospects. Therefore, we believe that backlog information is not material to an understanding of our overall business.

|

Research and Development

|

We believe that strong system development capabilities are essential to our strategy. Our research and development efforts focus on enhancing our core technology, developing additional applications, addressing emerging technologies, standards and protocols, and engaging in patent generation activities. Our system development team consists of engineers and software developers with experience in video and data networking, voice communications, video and data compression, email, collaboration and Internet technologies. We believe that our diverse technical expertise contributes to the highly integrated functionality of our system. We devote a significant amount of our resources to research and development as this is core to our business strategy and ongoing success. Our research and development expense for the years ended December 31, 2010, 2009, and 2008 was $6.6 million, $3.9 million, and $5.2 million, respectively.

13

|

Intellectual Property and Proprietary Rights

|

Our ability to compete and continue our long history of fundamental innovation depends substantially upon internally developed technology. We rely on a combination of patent, copyright, trademark and trade secret laws, as well as licensing, non-disclosure and other agreements with our consultants, suppliers, customers, and employees to protect our internally developed technology.

We typically enter into confidentiality, license and nondisclosure agreements with our employees, consultants, prospective customers, licensees, and partners which seek to limit the use and distribution of our proprietary materials and prohibit reverse-engineering of our proprietary technologies. In addition, we control access to and distribution of our software, documentation and other proprietary information. Several of our license agreements with our customers require us to place our software source code into escrow. In such cases, these agreements provide that these customers may be entitled to retain copies of the software, and have a limited non-exclusive right to use and/or reproduce, maintain, update, enhance and produce derivative works of the software source code under the terms of the agreements if we fail to cure a contractual breach by us on a timely basis, or if we become the subject of a bankruptcy or similar proceeding. Additionally, we maintain a strong working relationship with vendors whom we identify as key suppliers, and assign preferred provider status to these vendors under agreements that secure ordering and extended warranty rights for us.

We have pursued registration of our key trademarks and service marks in the United States, the United Kingdom and certain other European countries, and intend to pursue additional registrations in more countries where we plan to establish a significant business presence. We own several United States, Canadian and United Kingdom trademarks, including Avistar and the Avistar logo, Avistar C3™, Avistar C3 Unified™, Avistar C3 Integrator™, Avistar C3 Conference™, Avistar C3 Desktop™, Shareboard and vBrief.

|

Competition

|

The market for video collaboration products and solutions is highly competitive. As a result of advances in technology, increases in communications capability and reductions in communications costs in the past several years, the market is now characterized by many competitors, rapidly changing technology, evolving user needs, developing industry standards and protocols and the frequent introduction of new products and services. Within the market for video collaboration products and solutions, we compete primarily with Polycom, Inc., Cisco Systems, Inc., Radvision, Ltd., and Emblaze-VCON Ltd.

With increasing interest in the power of video collaboration, unified communications and the establishment of communities of users, we face increasing competition from alternative communications solutions that employ new technologies or new combinations of technologies from companies such as Cisco Systems, Inc., Avaya, Inc., Nortel Networks Corporation, Microsoft Corporation, and IBM Corporation that enable web-based or network-based video and unified communications with low-cost digital camera systems.

We believe that the principal factors affecting competition in our markets include:

|

|

·

|

Product features, functionality and scalability;

|

|

|

·

|

Product quality and performance;

|

|

|

·

|

Product reliability and ease of use;

|

|

|

·

|

Use of open standards;

|

|

|

·

|

Quality of service and support;

|

|

|

·

|

Company reputation, size and financial stability;

|

|

|

·

|

Price and overall cost of ownership;

|

|

|

·

|

Integration with other desktop collaboration products; and

|

|

|

·

|

Document sharing, including internet-based collaboration.

|

Currently, our principal competitors are companies that provide products and services in specific areas where we offer our integrated system, such as:

|

|

·

|

Room-based point-to-point and multi-point video communications products;

|

|

|

·

|

Desktop video communications products;

|

|

|

·

|

Broadcast video products;

|

|

|

·

|

Video retrieval and viewing products;

|

14

|

|

·

|

Desktop content creation products; and

|

|

|

·

|

Web-based data collaboration products.

|

While a number of companies have marketed applications that enable users to use individual features similar to our solutions, we do not believe that any single competitor currently offers as comprehensive a set of functionality as our solution provides. We believe these companies in many cases can also represent complementary opportunities to extend the reach of our solutions by potentially expanding the market for video and unified communications and collaboration.

We expect competition to increase significantly in the future from existing providers of specialized video and unified communications products, VOIP solution providers and other companies as they enter our existing or future markets, possibly including major telephone companies or communications equipment providers. These companies may develop similar or substitute solutions, which may be less costly or provide better performance or functionality than our systems. A number of our existing and potential competitors have longer operating histories, significantly greater financial, marketing, service, support, technical and other resources, significantly greater name recognition and a larger installed base of customers than we do. In addition, many of our current or potential competitors have well-established relationships with our current and potential customers, and have extensive knowledge of our industry. It is possible that new competitors or alliances among competitors may emerge and acquire significant market share. To be successful, we must continue to respond promptly and effectively to the challenges of developing customer requirements, technological change and competitors’ innovations. Accordingly, we cannot predict what our relative competitive position will be as the market evolves for video collaboration and unified communications products and services.

|

Employees

|

As of December 31, 2010, we had 51 employees, including personnel dedicated to research and development, customer service, including installation and support services, sales and marketing, and finance and administration. Our future performance depends in significant part upon the continued service of our key technical, sales and marketing, and senior management personnel, most of whom are not obligated to remain with us by an employment agreement. The loss of the services of one or more of our key employees could harm our business.

|

Executive Officers of the Registrant

|

Our officers and their ages as of December 31, 2010 were as follows:

|

Name

|

Age

|

Position

|

||||||

|

Robert F. Kirk

|

55

|

Chief Executive Officer

|

||||||

|

Elias A. MurrayMetzger

|

40

|

Chief Financial Officer, Chief Administrative Officer and Corporate Secretary

|

||||||

|

J. Chris Lauwers

|

50

|

Chief Technology and Product Officer

|

||||||

|

Anton F. Rodde

|

68

|

President, Intellectual Property Division

|

||||||

|

Stephen M. Epstein

|

45

|

Chief Marketing Officer

|

||||||

|

Stephen W. Westmoreland

|

55

|

Chief Information Officer

|

||||||

|

Michael J. Dignen

|

56

|

Senior Vice President, Sales

|

||||||

|

Bryan M. Kennedy

|

55

|

Vice President, Business Development

|

||||||

Robert F. Kirk joined Avistar in July 2009 as our Chief Executive Officer. He previously served as Chief Executive Officer of ChoicePay, Inc., a payment services company, from August 2008 to its sale to Tier Technologies, Inc. in January 2009. Mr. Kirk served as Chief Executive Officer of VICOR, Inc., a provider of image-enabled receivables processing and management solutions, from August 2005 to its sale to Metavante Corporation in August 2007. Prior to his appointment as Chief Executive Officer of VICOR, Inc., in August 2005, Mr. Kirk served continuously in various management positions at VICOR, Inc. beginning in January 1999. Mr. Kirk holds a Master's and Bachelor's degree in Business Administration from West Virginia University.

Elias A. MurrayMetzger was promoted to the position of Chief Financial Officer, Chief Administrative Officer and Corporate Secretary in January 2010, after serving as our Chief Financial Officer and Corporate Secretary from April 2009 to January 2010 and Acting Chief Financial Officer and Corporate Secretary from January to April 2009. From January 2006 to January 2009, Mr. MurrayMetzger served as our worldwide Corporate Controller, playing a key role in the Company’s financial reporting and compliance functions. From April 2004 to January 2006, Mr. MurrayMetzger served as Assistant Controller of Centra Software, Inc., a provider of software solutions for online business communication, collaboration and learning. During his tenure at Centra, Mr. MurrayMetzger successfully navigated Centra’s Sarbanes-Oxley compliance effort and SEC reporting functions. Mr. MurrayMetzger worked in the technology audit practice of PricewaterhouseCoopers from February 2000 to March 2004. He is a Certified Public Accountant (inactive) and has a Bachelors of Science in Agribusiness with a concentration in finance from California Polytechnic State University, San Luis Obispo.

15

J. Chris Lauwers has been our Chief Technology and Product Officer since August 2005. He served as Chief Technology Officer from March 2001 to August 2005. He was our Vice President of Engineering from 1996 to 2001 and Director of Engineering from 1994 to 1996. He previously served as Principal Software Architect at VICOR, Inc. from 1990 to 1994, and as a research associate at Olivetti Research Center from 1987 to 1990. Dr. Lauwers holds a B.S. in electrical engineering from the Katholieke Universiteit Leuven of Belgium. Dr. Lauwers also holds an M.S. and a Ph.D. in electrical engineering and computer science from Stanford University.

Anton F. Rodde has been the President of the Intellectual Properties Division since December 2003. Prior to joining Avistar, he served as President and CEO of Western Data Systems, an ERP software company, from 1991 to 2002, as Group Vice President at Manugistics from 2002 to 2003, the company which acquired Western Data Systems, as President and General Manager of several subsidiaries of Teknekron Corporation, a technology incubator, from 1984 to 1991, as founder and President of Control Automation, a robotics company, from 1980 to 1984, and held a variety of technical and management positions at AT&T from 1970 to 1980. Dr. Rodde holds a B.S. in physics from Benedictine University and an M.S. and Ph.D. in physics from the Illinois Institute of Technology.

Stephen M. Epstein joined Avistar in January 2008. Prior to Avistar he was Vice President, Head of Product Management at Mantas, Inc. from July 2003 to January 2008, where he was responsible for global product strategy, managing product requirements, defining go to market plans and marketing strategy, while evaluating the financial services market. Prior to joining Mantas, Mr. Epstein was Head of Product & Business Development at Bang Networks from May 2002 to July 2003 where he spearheaded product and business development efforts, focusing on delivering real-time information distribution products. Mr. Epstein held senior-level management and product development positions including Head of Global Foreign Exchange Sales Technology and Group CTO at Deutsche Bank from March 1995 to May 2002.

Stephen W. Westmoreland joined Avistar as Chief Information Officer in October 2009 and he is responsible for our development, quality assurance, information technology and customer support functions. From December 2003 to October 2009, he was Senior Vice President of Support Operations for VICOR, Inc., where he helped to significantly grow the company and played a leading role as part of Metavante’s successful acquisition of VICOR, Inc. Prior to that, Mr. Westmoreland held Chief Information Officer positions at Damage Studios and VALinux Systems. Mr. Westmoreland holds a BS degree in Computer Science from Louisiana Tech University.